-

Hulu Out-Executing Comcast in On-Demand Programming?

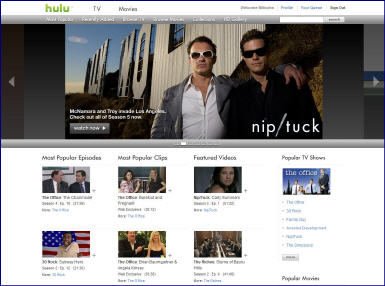

The crew over at Hulu must be gleefully fist-bumping each other this week as Hulu scored a key strategic and public relations coup in adding to its lineup two of Comedy Central's most popular programs, "The Daily Show with Jon Stewart" and "The Colbert Report." Though officially positioned as a test, Hulu still deserves big-time kudos as the deal is an endorsement of its value proposition.

The deal and Hulu's execution illustrate a larger point that I've been making for a while: one of broadband's three key disruptions is that it enables new aggregators to gain an edge on larger incumbents by changing the dynamics of competition. To be more specific, in this case, I think that Hulu has out-executed Comcast, America's #1 cable operator by delivering new value to consumers and gaining important PR momentum. Here's why:

Fancast, which is Comcast's online portal (in beta), actually announced a deal with Comedy Central back on May 19th for access to these same programs and others. Yet go to Fancast and search for "Daily Show" and, as shown below, you won't find any Daily Show full episodes available, just an assortment of short clips and times when it's on TV. A Comcast spokesperson told me that Comcast's implementation is imminent, but its delay in getting the programs up and running is accentuated when you consider that Comedy Central must have done its distribution deal with Fancast BEFORE its deal with Hulu.

Second, and more concerning is that, as a Comcast digital subscriber, when I tried to find The Daily Show and Colbert in Comcast's VOD menu, all that is available are five older Colbert clips and 1 older Daily Show clip. My guess is these haven't been updated in a while. No full-length Daily Show or Colbert programs are available at all in VOD.

While the Comcast spokesperson told me that the company works closely with its programming partners like Viacom to figure out the optimal mix of programming to make available on VOD, I think an unavoidable conclusion here is that Comcast (and other cable operators) is constrained by its inability to monetize VOD programming with advertising (what this week's "Project Canoe" is meant to address) and to easily add new programming on the VOD menu. These programming gaps create opportunities for upstarts like Hulu to capitalize on.

It may be unfair to zero in so narrowly on Comcast's execution with Daily Show/Colbert, yet things weren't much different when I searched for MTV's popular "The Hills" on Hulu, Fancast and Comcast's VOD. While Hulu doesn't appear to have a deal for full episodes of "The Hills" it masks this cleverly by providing thumbail images and easy navigation back to MTV's site where the video lives, for over 50 episodes (this is tactic Hulu uses for ABC's shows as well). On the other hand, Fancast displays just 5 full episodes, 2 from this season and 3 from last. And on VOD there are also just 5 episodes, though all from this season.

I think it's pretty significant that Hulu, a site that only went live 3 months ago can not only gain access to hit Comedy Central programs like Daily Show/Colbert, but can execute quickly. Hulu is using its advantages - flexible technologies, interactive features (clipping, embedding, sharing), monetization capability, savvy PR and startup pluck to compete with far-larger incumbents like Comcast.

Of course Comcast racks up billions of VOD views each year and has vast resources, making it an important player in on-demand programming. Yet Hulu has managed to make Comcast's advantages look a little less intimidating. I asked the Comcast spokesperson about this. She acknowledged Hulu's progress, but maintained that Comcast believes its mulit-platform approach is stronger.

In the big picture that's true, but when it comes to winning consumers' hearts and minds, it's often execution, not broad strategy that carries the day. And don't forget, when Hulu is unshackled from the PC - with its content freely riding Comcast's broadband pipes all the way to the TV - execution will matter even more.

This week Hulu provided a textbook example of how broadband-only aggregators can gain a foothold against well-established incumbents. Comcast and other incumbents should be taking notice and getting their game on.

What do think? Post a comment and let everyone know!

Categories: Advertising, Aggregators, Cable Networks, Cable TV Operators

Topics: Comcast, Comedy Central, Fancast, Hulu, The Colbert Report, The Daily Show, Viacom

-

The NewsMarket Finds a Profitable Corner of the Broadband Video Market

While much attention in the broadband video industry has been focused on consumer-oriented companies, The NewsMarket is showing that there are other profitable niches for those with deep domain knowledge and creative business models. When I was in NYC last week I caught up with Romina Rosado, its Global Head of Marketing over lunch to learn more.

The NewsMarket's fundamental insight was recognizing that broadband would be a great platform for news video to be disseminated and that broadband's growth would eventually change both the roles of public relations/corporate communications professionals and the media's coverage of news.

On the one hand, PR people would need to offer up more video assets to augment their traditional text and images-based materials. And on the other hand, as consumer penetration of broadband increased, the news media would need improved access to video assets to help them cover stories online in a way that met changing consumer expectations. As its name implies, The NewsMarket's vision was to serve these two worlds, helping marry PR and news reporting to broadband in an efficient, cost-effective manner.

But executing on this vision has been turbulent. Founded in the dot com heyday, The NewsMarket clung to life in the early 2000's waiting for the market to stabilize and catch up. The good news is that not only has this happened, but The NewsMarket is now using its core competencies and relationships to expand its services.

The way The NewsMarket works is that companies, government agencies and other providers pay a fee to upload and have their videos (e.g. product demos, executive interviews, etc.) hosted at a secure site, where pre-approved media outlets are then able to download and edit. There are now 17,000 media outlets in 193 countries accessing video. Broadband's progress is evident, as Romina explained that a year ago NewsMarket videos were used in the same proportion by traditional broadcasters and online news outlets. Now the latter account for 80% of usage, including many newspaper sites as heavy users.

About a year ago The NewsMarket addressed bloggers by making a portion of its total videos available in a product called VideoCafe. But in response to the blurring demarcations of media and bloggers' displeasure at the limited quantity, The NewsMarket is shifting course to give bloggers access to the full library. It's also adding lots of HD video as sources are increasing their video quality.The NewsMarket has also expanded its portfolio by providing white label "broadcast newsroom" services for others' sites. About 70 customers have signed up for this. Microsoft is one example (not login needed). The NewsMarket has taken the next logical step by introducing its BrandTV product, whereby brands and others can set up their own channels in custom environments. YouTube is an obvious alternative for companies considering a quick and cheap alternative. But its unmanaged environment poses obvious issues, particularly for the growing list of companies getting more serious about using video to deliver their messages.

The NewsMarket's lessons are not only to be persistent in the face of adversity, but also to be creative in thinking about what kinds of macro changes broadband forces and how inventive business models can take advantage of them.

Categories: Aggregators

Topics: The NewsMarket

-

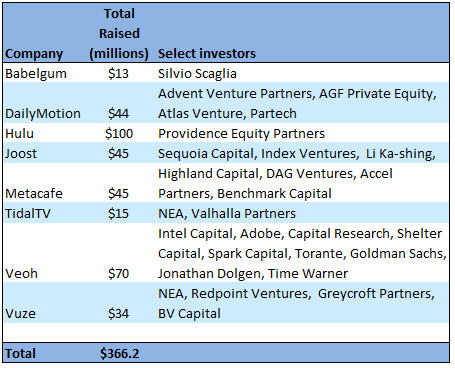

Video Aggregators Have Raised $366+ Million to Date

With this week's news that Veoh has garnered another $30 million in financing, by my count the total amount raised by the top broadband video aggregators now exceeds $366 million. The breakdown is below, according to publicly available data I've pulled together.

While definitions of who should be included in this category are admittedly fuzzy, I consider broadband aggregators to be companies that are providing a broad-based destination site that focuses mainly on professionally-created video. Often these sites include broadcast network and cable TV programming, but they don't have to. I'm sure plenty of readers have their own definitions and that I've overlooked some, so feel free to post a comment to add others to the list.

Savvy investors seem to have an enormous appetite for these kinds of companies. Veoh, with 28 million monthly unique visitors, and others have demonstrated their ability to attract lots of eyeballs. Yet all of these companies are solely reliant on advertising, and that of course makes begs the question how well these companies can convert their traffic to real revenue and therefore become profitable, sustainable businesses?

Since all of these companies are private it is hard to assess their momentum. Yet in a recent panel I moderated at Streaming Media East, Mike Henry, SVP of Ad Sales for Veoh explained the range of current challenges. Chief among them is getting traditional TV media buyers to clearly understand the broadband medium, how to buy into it and how to measure its performance. These are crucial matters since the biggest source of broadband ad dollars will no doubt come from brands shifting their TV spending to broadband.

Of course, to the extent that these companies can continue raising big money, they're buying themselves more runway. Complicating matters is that all of these sites live in the long shadow of YouTube, which alone still accounts for around 40% of all video views per month. Then there are big players like Yahoo, MSN and AOL and recent entrants like Adobe which are vying for their share of the video pie. But at some point these companies will have to show they can make money and survive.

With all these crosscurrents, it will be interesting to see how these companies' stories unfold.

Categories: Advertising, Aggregators, Deals & Financings

-

May '08 VideoNuze Recap - 3 Key Topics

Looking back over two dozen posts in May and countless industry news items, I have synthesized 3 key topics below. I'll have more on all of these in the coming months.

1. Broadband-delivered movies inch forward - breakthroughs still far out

In May there was incremental progress in the holy grail-like pursuit of broadband-delivered movies. Apple established day-and-date deals with the major studios for iTunes. Netlix and Roku announced a new lightweight box for delivering Netlix's "Watch Now" catalog of 10,000 titles to TVs. Bell Canada launched its Bell Video Store, complete with day-and-date Paramount releases, with others to come soon. And Starz announced a deal with Verizon to market "Starz Play" a newly branded version of its Vongo broadband subscription and video-on-demand service.

Taken together, these deals suggest that studios are warming to the broadband opportunity. This is certainly influenced by slowing DVD sales. Yet as I explained in "iTunes Film Deals Not a Game Changer" and "Online Move Delivery Advances, Big Hurdles Still Loom" broadband movies are still bedeviled by a lack of mass PC-TV connectivity, no real portability, well-defined consumer behavior around DVDs and the studios' well-entrenched, window-driven business model. Despite May's progress, major breakthroughs in the broadband movie business are still way out on the horizon.

2. Broadcast TV networks are embracing broadband delivery - but leading to what?

Unlike the film studios, the broadcast TV networks are plowing headlong into broadband delivery, yet it's not at all clear where this leads. In "Does Broadband Video Help or Hurt Broadcast TV Networks" and "Fox's 'Remote-Free TV': Broadband's First Adverse Impact on Networks?" I laid out an initial analysis about broadband's pluses and minuses for networks. I'll have more on this in the coming weeks, including more in-depth financial analysis.

On the plus side, in "2009 Super Bowl Ads to Hit $3 Million, Broadband's Role Must Grow," "Sunday Morning Talk Shows Need Broadband Refresh" and "Today Show Interview with McClellan Showcases Broadband's Power," I illustrated some opportunities broadband is creating. On the other hand, "Bebo Pursues Distinctive Original Programming Model" and "More Questions than Answers at Digital Hollywood" explained how exciting new programming approaches are taking hold, challenging traditional TV production models. Broadcasters are in the eye of the broadband storm.

3. Advertising's evolution fueled by innovation and resources

Last, but hardly least, I continued on one of my favorite topics: the impact broadband video is having on the advertising industry. Over the last 10 years the Internet, with its targetability, interactivity and measurability has caused major shifts in marketers' thinking. With broadband further extending these capabilities to video, the traditional TV ad business is now ripe for budget-shifting. We'll be exploring a lot of this at a panel I'm moderating at Advertising 2.0 this Thursday.

In "Tremor, Adap.tv Introduce New Ad Platforms" and "All Eyes on Cable Industry's 'Project Canoe'" (from Mugs Buckley), key players' innovations were described along with how the cable industry plans to compete. Content providers are being presented with more and more options for monetizing their video, a trend which will only accelerate. Yet as I wrote in "Key Themes from My 2 Panel Discussions Last Week," many issues remain, and with so many content start-ups reliant on ads, there may be some disappointment looming when people realize the ad market is not as mature as they had hoped.

That's it for May. Lots more coming in June. Please stay tuned.

Categories: Advertising, Aggregators, Broadcasters, Cable TV Operators, Devices, Downloads, FIlms, Studios, Video Sharing

Topics: Adap.TV, Apple, Bell Canada, Canoe, iTunes, Netflix, Paramount, Roku, Starz, Tremor, Verizon, Vongo

-

Online Movie Delivery Advances, Big Hurdles Still Loom

Online movie delivery is back in the news, but dramatic change is still well down the road in this space as usability, rights issues and incumbent business models/consumer behaviors pose formidable hurdles.

Yesterday Netflix announced a $99 appliance with Roku, enabling the company's "Watch Instantly" streaming service on TVs. That news follows Apple's deals with a number of big studios in early May obtaining "day-and-date" access to current titles. And today brings news that Bell Canada, that country's largest telco, is formally launching its Bell Video Store, also providing day-and-date delivery, of Paramount titles to start (and soon others), plus portable viewing on Archos devices.

Netflix, which I last wrote about here, took a shot across the bow of Apple TV and Vudu by introducing the

Roku box, the lowest-priced broadband movies appliance yet. Apples-to-apples comparisons aren't fair as the stripped-down Netflix/Roku box doesn't have a hard-drive or equivalent processing. That inevitably means lower quality delivery vs. locally-stored content with the others, plus uncertainty about HD-delivery. Netflix/Roku's big advantage is that it's a value-add service for current Netflix subscribers, meaning no new fees as with the Apple TV/Vudu approaches.

Roku box, the lowest-priced broadband movies appliance yet. Apples-to-apples comparisons aren't fair as the stripped-down Netflix/Roku box doesn't have a hard-drive or equivalent processing. That inevitably means lower quality delivery vs. locally-stored content with the others, plus uncertainty about HD-delivery. Netflix/Roku's big advantage is that it's a value-add service for current Netflix subscribers, meaning no new fees as with the Apple TV/Vudu approaches.However, Watch Instantly has older titles and amounts to less than 10% of Netflix's total catalog. I don't see that changing much; Watch Instantly runs smack into studios' incumbent windowing approach and deals with HBO, Showtime and Starz for premium TV. Netflix's model is built on the home video window, so new online delivery rights must be obtained which will be a tough road. However, with Paramount, MGM, Lionsgate and others splintering from Showtime recently to set up their own premium channel, it's possible that some studios' rights may loosen up, but of course at a price.

Still, I don't see the Netflix/Roku box breaking 10% penetration of Netflix's sub base any time soon, barring a box giveaway. Enlarging the value proposition by licensing the Roku technology for inclusion in other devices (e.g. Blu-ray) could also help drive adoption.

Meanwhile, today Bell Canada is announcing the formal launch of its Bell Video Store. In beta since late '07,

it offers 1,500 titles, now including day-and-date delivery from Paramount (and others soon according to Michael Freeman, Bell's director of product management who I spoke to yesterday). This is noteworthy, as it appears to be the first time a service provider has received day-and-date online access from any studio. If other providers follow suit we may finally witness some internal competition with sacrosanct-to-date Video on Demand initiatives.

it offers 1,500 titles, now including day-and-date delivery from Paramount (and others soon according to Michael Freeman, Bell's director of product management who I spoke to yesterday). This is noteworthy, as it appears to be the first time a service provider has received day-and-date online access from any studio. If other providers follow suit we may finally witness some internal competition with sacrosanct-to-date Video on Demand initiatives.By using ExtendMedia's platform, Bell is also enabling downloads-to-own directly to Archos portable devices. With a couple million satellite homes and fiber IPTV fiber-based deployments continuing, there are multiple three screen options looming for Bell. Yet for now these are limited. Michael confirmed Bell has no plans to offer a branded movie appliance a la Netflix/Roku, meaning it will dependent on XBoxes and other PC-TV bridge devices.

Renewed progress and experimentation are welcome in this space, but lots of hard work remains for online movie delivery to become mainstream.

What do you think of the online movie delivery space? Post a comment now!

Categories: Aggregators, Cable Networks, Devices, Downloads, FIlms, Studios

Topics: Apple, Bell Canada, HBO, Netflix, Paramount, Roku, Showtime, Starz, VUDU

-

HBO Wakes Up to Broadband

HBO's deal with Apple to include its programs in the iTunes store has received widespread coverage in the last couple of days, particularly because it includes differentiated pricing for the first time.

Indeed, while it's a big story that Apple's Steve Jobs has finally consented to deviate from his "one price for all" approach - which NBC couldn't attain last fall - there is another angle on this announcement: the possibility that, at long last, HBO has woken up to broadband video's potential.

HBO's absence from the broadband scene has been noticeable. As the most profitable and acclaimed TV

network, I've long thought that HBO had significant upside in pursuing broadband initiatives. Instead it has badly lagged Showtime and Starz, its two principal rivals in the premium network space, as well as other networks.

network, I've long thought that HBO had significant upside in pursuing broadband initiatives. Instead it has badly lagged Showtime and Starz, its two principal rivals in the premium network space, as well as other networks. Showtime in particular has been quite innovative in both creating broadband-only extras for its programs, plus enticing user-involvement opportunities. For its part, Starz has been aggressive in pursuing Vongo, its broadband-subscription service, which continues to make inroads with numerous device partnerships.

Yet HBO has seemed contentedly disinterested in broadband. Between its hefty subscription fees and healthy DVD business, broadband has likely been seen as just a gnat buzzing about. HBO's lack of broadband interest is evident on its web site which has just a smattering of video clips and highlights, and it is fairly static, with little-to-nothing enticing for the broadband user.

In reality, broadband could have likely been adding real value to HBO's business. With the proper incentives, HBO's creative production partners could have easily come up with broadband extras that would have appealed to the diehard fans of its programs. In addition to their sheer programming value, these would have helped drive more fan loyalty and stickiness between seasons. That would help address HBO's churn rate during its off-season periods.

While HBO's iTunes relationship is a step forward, it's a small one. Contrast its approach to soon-to-be-corporate-sibling Bebo's programming model (which I wrote about yesterday), with its intense focus on community engagement and the different philosophies are evident. Of course HBO is a programming powerhouse and there's no arguing with its success. But for it to fully embrace broadband's opportunities, it would benefit from looking at what Bebo and others are currently doing.

Categories: Aggregators, Cable Networks, Indie Video, Video Sharing

Topics: Apple, HBO, iTunes, Showtime, Starz, Vongo

-

iTunes Film Deals Not a Game-Changer

In the last few days there's been a lot of attention paid to Apple's deals with Disney, Fox, Warner Bros, Paramount, Universal, Sony, Lionsgate, Imagine and First Look Studios giving iTunes day-and-date access to these studios' current films.

As an advocate of the broadband medium, naturally I'm delighted to see studios put broadband distribution

on a par with DVD release. The deals should rightly be interpreted as another step in the maturation of the broadband medium.

on a par with DVD release. The deals should rightly be interpreted as another step in the maturation of the broadband medium. However, these deals, in and of themselves, do not constitute a game-changing event for paid downloads of feature films. That's because until there's mass connectivity between PCs and TVs and much-improved portability, consumers' willingness to buy is going to be significantly muted. Consumers' inability to easily watch a feature film on their widescreen TV or easily grab-these- movies-to-go (as with DVDs) are a huge drag on the download value proposition, easily swamping its new convenience benefits.

I believe that lack of mass connectivity between PCs and TVs is the last major hurdle to unlocking broadband video's ultimate potential. It is also the firewall that's preserving a lot of incumbents' business models (cable operators, broadcasters, etc.). No question, Apple and iTunes are powerful marketing partners for the studios, and their download revenue will certainly increase from its current modest base. But not even Apple's mighty brand (and certainly not its anemic AppleTV device) is enough to compensate for broadband's current deficiency.

The good news is that there's a frenzy of energy directed at solving the PC-to-TV connectivity issue. Though no approach has yet broken through, I'm still betting it's only a matter of time until one does. When that happens, studios will reap the major benefits. Until then, these deals represent progress, but not game-changing events.

Categories: Aggregators, Downloads, FIlms, Studios

Topics: Apple, Disney, FOX, iTunes, Lionsgate, New Line, Paramount, Sony Pictures, Universal, Warner Bros.

-

Hulu's Kilar at NAB, My Reactions

One of the best hours I spent at NAB was the one listening to Hulu's CEO Jason Kilar. Too bad it was scheduled for 5pm on Day 3, resulting in a desultory crowd of only a 100 or so. Broadcasters and others could learn a lot from Kilar and Hulu's early experience.

Hulu, which was derisively referred to as "Clown Co" prior to its launch, is anything but. In my previous review of its beta, I gave it a B+. One month since its official launch, I now move it up a notch to A minus, and as I'll explain later, an A is within reach.

Hulu is as well-thought out a broadband video enterprise as currently exists, for at least three reasons:

Clarity of purpose - While Hulu evokes Google with its lofty goal, "to help people find and enjoy the world's premium content, when, where and how they want to," it has provided discipline to keep Kilar and his team focused on meaningfully supportive differentiators.

Relentless user-focus - Hulu is Apple-esque in its devotion to what Kilar called an "atypically strong user experience." The team has sweated over and uses every design and technology lever available to make Hulu easy and enjoyable and accessible to the mainstream market.

Organizational capability - Hulu has a startup mentality where every decision is do-or-die. It may feel intangible if you've never worked in a startup, but personal ownership is an incredibly important advantage. Inculcating this ethos despite a $100 million investment and $1 billion valuation is no mean feat.

Several recent spins through Hulu showed how these come together. Hulu now has 50+ content partners, but is uncluttered by UGC. This is a place for only high-quality programming. Finding and playing video is a snap. Graphics and fonts are simple and clear. As Kilar said the site's 16:9 graphics, differentiated from standard square thumbnails, suggest this place is different from the rest (no "Tokyo at night" orientation here). Here you can also easily clip and share favorite scenes, which Kilar says has been done 100k+ times on 12K sites since launch.

And how about this - do a search for "Lost" - the popular ABC program which is NOT available on Hulu - and you'll get results pointing you offsite to ABC.com. Talk about putting the user first!

Hulu's real lesson to broadcasters and others is that if you create a high-quality user environment, you open up real opportunities and options. These include getting above average CPMs from advertisers (through effective units like the 7 second introductory "brand slate"), wringing value out of programs no longer on-air (example "Arrested Development" was #1 or #2 most popular on Hulu), pre-empting non-revenue producing/non-branded environments like file-sharing sites and YouTube, allowing new programs to be easily sampled and last but not least, re-capturing users who prefer online over the traditional on-air model.

Hulu still has major challenges ahead: massively building out its content library, proving its syndication value to content partners who could as easily go direct to distributors, making its overall economics work, and of course, navigating the treacherous political waters of its big media backers. If it does all of these, it gets an A. Hulu's impressive progress to date gives me every reason to believe it will.

What do you think of Hulu? Post a comment!

Categories: Aggregators, Broadcasters, Startups

Topics: Hulu

-

News from NAB

The press releases began flying today, timed with NAB's kickoff. Here are a few that caught my eye:

Move Networks Raises $46 Million

Move continues its fund-raising prowess, raising a large C round. As more content providers push the HD quality bar, Move's content delivery services have increased appeal.

Signiant Powers Hulu's Distribution Efforts

Hulu, the NBC-Fox aggregator is using Signiant's media management platform to ingest content from the various content partners it works with.

Widevine Provides Content Security for Microsoft's Silverlight

For the first time Microsoft has used a third-party content security system to add a layer of protection for content providers using the company's new rich media plug-in.

EveryZing Introduced "RAMP," Signs Up Cox Radio

Building on its recent launch of EZSearch and EZSEO to enable video discovery, EveryZing has introduced a management console for the products for which Cox Radio will be the first customer.

Live Streaming Quality Bar Raised Via Mogulus-Kulabyte Partnership

Live streaming gains further traction as Mogulus and Kulabyte announce deal to bring high-quality live Flash streaming to producers.

No doubt there will be plenty more over the next couple of days.

Categories: Aggregators, Broadcasters, CDNs, HD, Mobile Video, Technology

Topics: EveryZing, Hulu, Kulabyte, Microsoft, Mogulus, Move Networks, Signiant, Silverlight, Widevine

-

Sony Launches C-Spot Comedy Series

The stampede into broadband-only comedy shorts continued yesterday with Sony launching "C-Spot". The six short series will run on Sony's Crackle.com, YouTube, AOL Video, Hulu, Verizon Wireless' VCAST and others likely to come.

Comedy has been such a popular genre online because it is cheap to produce, easy to digest in short bursts and doesn't require story narratives to be compelling. What we've seen to date largely appeals to the young male demo which can't seem to get enough of the gross-out or sophomoric skits or hot ladies delivering goofy laugh lines.

I sampled a few of C-Spot's new programs and while I won't pretend to be a professional reviewer, I did find them to be a cut above some of the average comedic fare I've found elsewhere. Plus I think Sony's onto something by serializing these shorts and releasing new episodes on specific days of the week.

Though broadband is truly an on-demand medium, I continue to believe that audience-building requires habituation that is only driven by regularly-scheduled new releases. Prom Queen (though not a comedy) met with success by serializing, and I've been surprised there haven't been more imitators to date.

Regardless of format, I'm expecting comedy will remain the broadband medium's hottest genre, attracting indies and established players alike.

Categories: Aggregators, Studios

-

YouTube: "Over-the-Top's" Best Friend

The announcement a couple of weeks ago that YouTube was partnering with TiVo got me to thinking that YouTube is probably the best friend that so called "over-the-top" or "cable bypass" aspirants could have.

As a quick refresher, "over-the-top" and "cable bypass" refer to the emerging category of devices and service providers seeking to bring broadband video to the consumer's TV, but without the involvement of existing video providers such as cable and satellite. Some of these efforts (Apple TV, Vudu and Internet-enabled TVs) are positioned as augmenting incumbent providers, while some (Building B, others) are meant to compete directly.

Today's players share the common trait of being closed, "walled gardens," offering only certain content that they select. This contrasts with the open Internet/broadband model, where users are able to access any content they choose. Many of you know that I have been a strong proponent that open is the winning competitive path for aspiring over-the-top players.

If the over-the-top crowd adopts the open approach, YouTube is their perfect ally; it is the best-known brand name in broadband video, has the largest library of both user-generated and increasingly premium

video and has huge loyalty. Positioned properly it could be a killer value proposition for over-the-top players. I've previously argued that Apple missed the boat by not adopting this positioning for Apple TV.

video and has huge loyalty. Positioned properly it could be a killer value proposition for over-the-top players. I've previously argued that Apple missed the boat by not adopting this positioning for Apple TV.I talked last week with David Eun, VP of content partnerships at Google and Chris Maxcy, head of biz dev for YouTube, and they both made clear that the goal is to morph YouTube from a consumer destination site to a full-fledged video platform distributing video everywhere - devices, mobile, web sites, others. To this end, YouTube recently published an expanded set of APIs to allow 3rd parties to gain easier access to YouTube's content. This of course is great news for over-the-top devices, who should have considerable flexibility for how to incorporate YouTube into their offering. For now TiVo is leading the way in offering YouTube, albeit to a very small audience.

If you were wondering whether YouTube or Google itself will enter the device business, that seems unlikely. David and Chris were clear in saying that devices are not their core competency, and they'll leave it to others to decide how to implement the YouTube APIs and create and test various user experiences. Meanwhile with more premium content flowing into YouTube, its value as an over-the-top partner only increases.

What do you think? Post a comment!

Categories: Aggregators, Devices

Topics: Apple, Apple TV, Google, TiVo, VUDU, YouTube

-

Welcome to the "Syndicated Video Economy"

I am ever mindful of the old adage about "missing the forest for the trees" as I try daily to understand the often minor feature differences between competing vendors or the nuances of startups' market positioning. As we all know, when you get too close to something, it's quite easy to lose the larger perspective. So periodically I think it's essential to take a huge step back to try to identify the larger patterns or trends that crystallize from the daily frenzy of deals and announcements.

As a result, I've come to believe that recent industry activity points to an emerging and significant trend: the early formation of what I would term the "syndicated video economy." By this I mean to suggest that I'm

seeing more and more industry participants' strategies - in both media and technology - start from the proposition that the broadband video industry will only succeed if video assets are widely dispersed and revenue creatively apportioned.

seeing more and more industry participants' strategies - in both media and technology - start from the proposition that the broadband video industry will only succeed if video assets are widely dispersed and revenue creatively apportioned. For content providers the notion of widespread video syndication big change in their business approach. In the past year I think we've observed content providers of all stripes transition from "aggregating eyeballs", to "accessing eyeballs," wherever they may live now or in the future: portals, social networks, portable devices, game consoles, etc. Underlying this shift is the realization that advertising-based revenues are going to fuel the broadband video industry for the foreseeable future. The ad model requires scale and syndication is the best way to deliver it.

This shift by content providers has been accompanied by a loosening of traditional tightly-controlled, scarcity-driven distribution strategies, an acknowledgement that fighting newly-empowered consumers is a futile exercise. The evidence of this shift abounds. Consider the broadcasters like CBS, NBC and Fox, which through their affiliates (Hulu, CBS Audience Network) are syndicating programming to many portals/aggregators (e.g. Yahoo, MSN, AOL, YouTube), social networks (e.g. Facebook, MySpace, Bebo) and others. And Disney's Stage 9 digital studio, which premiered with YouTube and explicitly plans to tap into broadband video hubs. And cable networks like MTV Networks, which is pursuing a plethora of distribution deals. And traditional news-gatherers like local TV stations, newspapers and news services (e.g. Reuters, AP) which have stepped up their activity to scatter their video clips to the Internet's nooks and crannies. And the list goes on and on.

Taking their cue from the media companies' strategy shift, technology entrepreneurs and investors have ramped up their focus on this market opportunity. The prospect of the syndicated video economy blossoming drives news/information distributors such as Voxant, ClipSyndicate, Mochilla, TheNewsMarket and RedLasso, an ad manager such as FreeWheel, and a content accelerator such as Signiant, plus many others. Then there are more established companies guiding areas of their product development process by the prospect of the syndicated video economy's growth: Google, WorldNow, Akamai, thePlatform, Anystream, Maven Networks, Brightcove, PermissionTV and plenty of others (apologies to those I've left out!)

All of this suggests that the eventual "value chain" of the broadband video industry will look quite different than the traditional one (for more on this, I've posted some my slides from late '07 here.) As with all economies, in the nascent syndicated video economy there is vast interdependence among the various players, not to mention shifting market positions and degrees of pricing power and negotiating leverage. It is far too early to gauge who will emerge as the syndicated video economy's winners and losers. But make no mistake, lots of energy and investment will be expended trying to nurture its growth and exploit its opportunities.

Do you see the syndicated video economy forming as well? Post a comment and let us all know!

Categories: Advertising, Aggregators, Broadcasters, Cable Networks, Newspapers, Portals, Startups, Syndicated Video Economy

Topics: Akamai, Anystream, ClipSyndicate, FreeWheel, Google, Mochilla, RedLasso, Signiant, TheNewsMarket, thePlatform, Voxant, WorldNow

-

Fueling Over-the-Top Broadband Video

Today I'm very pleased to introduce Michael Greeson as a contributor to VideoNuze. Michael is the founding partner and Principal Analyst at The Diffusion Group, a leading analytics and advisory firm helping

companies in the connected home and broadband media markets. VideoNuze has partnered with TDG to bring key highlights of its research and opinions to VideoNuze readers on a regular basis. I'm confident that you'll find them valuable and, as always, look forward to your feedback.A Simple Way to Fuel Diffusion of Over-the-Top Broadband Videoby Michael Greeson

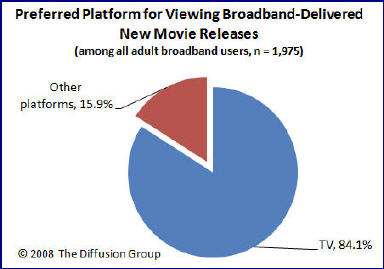

companies in the connected home and broadband media markets. VideoNuze has partnered with TDG to bring key highlights of its research and opinions to VideoNuze readers on a regular basis. I'm confident that you'll find them valuable and, as always, look forward to your feedback.A Simple Way to Fuel Diffusion of Over-the-Top Broadband Videoby Michael GreesonWith the web becoming more about media and entertainment, the rationale to get a broadband conduit into the living room is irrefutable - after all, that's where most consumers have their high-definition TV and their best sound system, it's the home's most comfortable media setting and remains the preferred platform for watching video. Not that a laptop PC in the den, a second TV and stereo in the master bedroom, or even an iPhone are not interesting as video consumption points; of course they are, but not as the primary or preferred setting. As noted below, when asked to choose between TVs, desktop PCs, notebook PCs, or mobile video platforms, close to nine in ten consumers prefer to watch movies on their living room TV.

Then why are those companies which are pushing a "three screen" video consumption strategy spending most of their energy and resources on the two "new" spaces (that is, PC-based or portable/mobile video consumption) and forgetting about the living room TV altogether? It seems as if open broadband to the TV is not sexy or cool enough for Silicon Valley; too mundane for such "cutting edge" companies.

Then why are those companies which are pushing a "three screen" video consumption strategy spending most of their energy and resources on the two "new" spaces (that is, PC-based or portable/mobile video consumption) and forgetting about the living room TV altogether? It seems as if open broadband to the TV is not sexy or cool enough for Silicon Valley; too mundane for such "cutting edge" companies.I've got news for them: watching video on the TV is not going away anytime soon, meaning that emerging new video models (the other two screens) will serve as supplements to the living room TV, not as replacements. Those pointing to TV's demise (a dubitable and specious position to hold) must know that, even if this happens, it will come about very, very slowly. The TV has proven an incredibly resilient and flexible viewing platform, one whose primacy will be reinforced by new media, not compromised.

For these reasons, I advocate a very simple strategy to help push broadband connectivity into the living room and broadband video into its rightful place. Forget about earmarking Internet connectivity as a "premium" feature reserved only for high-end CE, game consoles, or novel "new media" platforms like Apple TV. Think beyond adding Internet connectivity to a TV (which has a replacement cycle of six to eight years) or a high-def DVD player (a higher-end platform seen as unnecessary to most consumers).

Instead, add Internet connectivity to mainstream consumer electronic devices that are widely diffused, dependable, and which enjoy a more rapid replacement cycle - devices such as low-to-mid-range DVD players. Yes, it would increase the cost of the DVD player, but only slightly, and if there is legitimate value in delivering web-based media to the living room, the cost increase will be seen as tolerable. In the end, there is no better way to accomplish widespread, rapid diffusion than to tie a compelling new application to a trusted (existing) platform that's several hundred dollars cheaper than similarly-enabled platforms.

The argument I've presented above is relatively commonsensical: it is inherently easier to enhance incrementally the features and capabilities of a stable, widely diffused, well-loved platform (like a DVD player) than to try to sell consumers a completely new "black box" that enables a specific set of benefits that, while convincing, may not by themselves be sufficiently compelling to generate a purchase. Moreover, "new media" can benefit immensely by serving "traditional environments." While it is interesting to envision a future where anytime/anywhere video consumption is possible, at this point simply enhancing the primary video experience may be the most practical for "three screen" broadband video players. While not as "hot" or "cool," it will likely prove the most lucrative.

Categories: Aggregators, Devices

Topics: The Diffusion Group

-

TidalTV: Another Well-Funded Aggregator Goes For It

(Note: This is the first of a series of posts with companies participating in the 2008 Media Summit, a premier industry event which will be held next week in NYC. VideoNuze has partnered with Digital Hollywood, the Media Summit's producer, to provide select news and analysis coverage.)

Investors continue to show lots of optimism about the broadband video aggregator category. The latest data point is TidalTV, a new entrant that announced last week it has raised $15 million from NEA and Valhalla Partners. This comes on top of a crowd of well-funded startups: Joost ($45M+), Veoh ($40M+ to date), Building B ($17.5M), Vuze ($32M+), Hulu ($100M) and many others who are attacking this space in one way or another.

To better understand how TidalTV will distinguish itself from the pack, yesterday I had a lengthy briefing with CEO Mollie Spilman. She provided her first extensive remarks about TidalTV's game plan since last week's announcement. (Thanks to my old friend Tom MacIsaac, former CEO of Lightningcast, for facilitating the introduction. Tom recently launched Cove Street Partners and is as smart a player in the broadband video ad space as anyone around.)

The first thing to know about TidalTV is that it is pursuing mainstream users, not early adopters. This targeting pervades all its decision-making: site design is clean and approachable (Mollie said Apple is their role model), content is professional/well-branded only (no UGC), user experience incorporates a traditional linear programming sensibility combined with full on-demand access and advertising mimics traditional pods, while also integrating new broadband-only formats.

In short, TidalTV's making a bet that given how nascent broadband video adoption is among mainstream users, there is ample room to become the brand/destination of choice by providing an experience that feels more similar to traditional TV than to online. Though Mollie says that Apple is TidalTV's heaviest influence, I see clear parallels to AOL from the mid-late '90s. Recall that AOL's pervasive consumer-friendly UI, content and marketing (the Steve Case mantra) enabled it to crush all the dial-up ISPs which had more techie, complicated orientations. Watching AOL's rise made me a big believer that consumer-friendliness can indeed be a meaningful competitive differentiator if executed really well.

AOL is an interesting point of comparison because TidalTV's founder Scott Ferber was a co-founder of Advertising.com, which was sold to AOL in 2004, albeit after the Case era ended at AOL. Mollie was at Ad.com for 6 years as well. Other TidalTV executives come from Ad.com, Joost and Fox. The Ad.com lineage helps explain why TidalTV has chosen to invest significantly in optimizing its advertising capabilities rather than building a lot of its own publishing or delivery features (note TidalTV is all Flash-based streaming with no downloads and no P2P).

TidalTV has some interesting challenges ahead. First is content. It sounds like the company has made substantial progress in deals to obtain content from the "top 50 brands" which includes not only broadcast and cable network fare, but also print, online publishers and others who produce professional video. Yet Mollie concedes that "90% of TidalTV's content at launch could probably be found somewhere on-air or online," as content providers increasingly pursue widespread syndication. TidalTV's opportunity is to pull the content together in a neat, intuitive manner that mainstream users appreciate.

TidalTV will do so by using a "faux linear" presentation, which entails it becoming a "digital programmer," assembling its partners' shows into their own channelized formats (e.g. "The CSI Channel"), with traditional linear air times. For example, if you come to the site at 4pm, you'd see "what's on now" on multiple channels. At launch Mollie anticipates offering 10-15 channels, all on a revenue share basis with providers. This presentation approach is meant to appeal to mainstream users by providing a tangible link to a TV-oriented experience. If a user clicks to start watching, a linear "feed" will start playing, including ad breaks. However, TidalTV will also offer all programs on a full, on-demand basis as well.

But to illustrate how complicated the content acquisition terrain is for 3rd parties like TidalTV, consider Hulu, the NBC/FOX JV. It has insisted that prospective syndication partners take the Hulu player if they're to gain access to popular shows like "Heroes" and "24." Doing so could break TidalTV's user-friendly design. Mollie acknowledged this challenge, but felt confident that in examples like these, there should be adequate incentives to work out an arrangement. Then there's ABC, which to date has not pursued syndication aggressively. If it maintains its ABC.com centric approach, simply not making its programs available to 3rd parties, that leaves aggregators with obvious holes in their offerings. This would be especially challenging for a site like TidalTV, which appeals directly to mainstream users. Speaking generically, Mollie said that TidalTV's neutral "Switzerland" approach (i.e. no investments from media companies) should help in all of its content negotiations.

Driving traffic is another key issue. With other players in the market already, they've had a chance to build their traffic, though not necessarily in TidalTV's core target audience. For instance, Veoh alone says it's getting 20M+ unique visitors per month. To jumpstart traffic, Mollie said that TidalTV is prepared to fund an aggressive marketing plan, testing direct marketing, search, offline ads, outdoor, SEO, viral, PR and other tactics.

TidalTV expects to offer a geo-based limited beta in the Maryland, Virginia and DC area in late March, expanding to a national beta in mid-April. I'll be getting a peek at the beta product next week, so I'll have more to say then. Though it's still far too early to make a definitive assessment of TidalTV's chances of success, I like the fact that Mollie repeatedly uses the word "experimental" in her comments. That's a recognition of how early-stage this market space is and suggests TidalTV will stay flexible and open to all approaches to find success.

What do you think of TidalTV's chances? Post a comment and let everyone know!

Categories: Aggregators, Startups

Topics: ABC, AOL, Building B, FOX, Joost, NBC, New Enterprise Associates, TidalTV, Valhalla Partners, Veoh

-

HBO, Showtime, Starz: 3 Different Broadband Strategies

The unveiling of HBO's broadband video strategy provides fresh evidence that the 3 major premium cable channels - HBO, Showtime and Starz - are pursuing 3 very different paths in navigating the broadband world.

These 3 channels have traditionally been tight-knit partners with cable operators who leveraged these channels' brands and programming relentlessly in marketing campaigns to gain new revenues and subscribers. But operators' high margin digital services (e.g broadband access, phone, HD, VOD DVR) have lately become the primary focus of cable marketers' finite promotional power. Somewhat mitigating this shift has been powerful original programming, especially from HBO (The Sopranos, Sex and the City, etc.) that has often made these "must have" channels for audiences, helping build powerful consumer brands in the process.

Broadband delivery further scrambles the relationship between these 3 premium channels and their cable operator brethren. For the first time, the premium channels can promote their services, and even deliver them directly to consumers, all without cable operators' involvement. This newfound flexibility has led to 3 very different strategies that I would categorize as "Be bold" (Starz), "Be incremental" (Showtime) and "Be aligned" (HBO).

"Be bold" - Starz has pursued the boldest broadband strategy, launching Vongo, a pure broadband-delivered subscription service several years ago. Starz has invested heavily in making Vongo a top-notch user experience, including hundreds of hours of additional content specifically for the service. Starz has marketed Vongo

directly to consumers and through non-cable industry distribution partnerships (e.g. HP, AT&T, Microsoft, Toshiba, Samsung, others). Starz is very clearly trying to grow the market for its programming.

directly to consumers and through non-cable industry distribution partnerships (e.g. HP, AT&T, Microsoft, Toshiba, Samsung, others). Starz is very clearly trying to grow the market for its programming.Starz has sought cable operator partnerships as well, I believe correctly arguing that Vongo can be priced and packaged in a way that provides new value for subscribers as well as cable operators. These efforts have been stymied to date as reluctant operators perceive Vongo as possibly opening the door for Starz and others to gain direct access to subscribers, while also creating possible confusion around operators' budding VOD services.

"Be incremental" - Showtime has focused its broadband efforts on new revenue opportunities such as selling episodes through aggregators like iTunes, and also offering innovative new programming and features that capitalize on broadband's ability to directly interface with audiences. Two perfect examples of the latter are the "Dexter" parallel webisode series and season finale producers' video I have previously written about.

Showtime's goal is to create valuable exposure for its programming to non-subscribers on the bet that actual sampling is the best way to drive new subscriptions (in the past sampling was limited to cable operators' offering "preview weekends"). Showtime's "be incremental" approach studiously avoids creating conflicts with its cable operator partners, while not limiting the network's ability to harness broadband's potential.

"Be aligned" - HBO's belated entry into the broadband world is intended to support its cable partners by offering access to HBO Broadband to only those viewers who are both existing HBO subscribers AND cable broadband subscribers. This "value add" positioning is comparable in some ways to Netflix's "Watch Instantly" approach. They are both focused on giving existing subscribers more, not creating a distinct

service, a la Vongo, aimed at expanding the market. Further, by limiting HBO Broadband's geographic rollout, HBO is taking an additionally cautious approach compared with the others. The HBO message is clear: we're staying strongly aligned with our traditional cable industry partners.

service, a la Vongo, aimed at expanding the market. Further, by limiting HBO Broadband's geographic rollout, HBO is taking an additionally cautious approach compared with the others. The HBO message is clear: we're staying strongly aligned with our traditional cable industry partners. Three premium channels, three distinct broadband strategies. Further evidence that we currently live in a world of vast experimentation, with market participants focused on different goals and different ways of achieving them. I expect plenty more of this to come, as all players gather data about what works and what doesn't.

What do you think? Post a comment and let us all know!

Categories: Aggregators, Cable Networks, Cable TV Operators

Topics: HBO, Showtime, Starz, Vongo

-

Apple TV Improves, Vudu is In its Crosshairs

As widely expected, yesterday Apple launched movie rentals in iTunes, with titles from all the major studios. Steve Jobs also announced price cuts and a number of key enhancements to Apple TV, squarely repositioning the device as a "broadband movies appliance" (my term). Apple TV now allows direct ordering (no computer needed) and a much improved UI prominently featuring movies. The message from Apple is

clear: the primary value proposition for Apple TV's prospective buyers is convenient movie rentals through iTunes.

clear: the primary value proposition for Apple TV's prospective buyers is convenient movie rentals through iTunes. In the last few weeks there has been much buzzing about which companies might feel the most competitive pressure from Apple's launch of movie rentals. Here's how I see it: when rentals are combined with Apple TV's new features, the company that has to be waking up this morning most nervous about Apple's news yesterday is Vudu, because it has the most obviously similar value proposition.

Some of you may not be familiar with Vudu. It is a recently launched combination online movie/TV on demand service and companion box that has gained a lot of favorable early reviews. The company is backed by Benchmark and Greylock, two huge and highly regarded venture firms. While any startup faces long odds of success, with Vudu now going up against the Apple branding and marketing juggernaut, Vudu's odds

seem even more daunting. In fact, one wonders how the folks at Benchmark and Greylock, when considering their original Vudu investment, weighed the very question of Apple's entry into this market, as it was somewhat inevitable.

seem even more daunting. In fact, one wonders how the folks at Benchmark and Greylock, when considering their original Vudu investment, weighed the very question of Apple's entry into this market, as it was somewhat inevitable.To step back for a moment, as many of you know, I'm skeptical about all appliances meant to bridge the broadband and TV worlds, as I think they have only narrow consumer appeal and create new inconveniences. Apple TV and Vudu are even more specifically-directed at people who are focused on premium movie and TV content, not gaining access to the wider world of broadband video (note Apple TV does provide some access to YouTube videos and podcasts). In effect, purchasers of either of these products value the instant viewing gratification they offer more than the selection, portability, unlimited viewing windows and "extras" that DVDs provide. And of course there are a broad array of choices and models for accessing DVDs (e.g. Netflix, Blockbuster, Wal-Mart, etc.).

However, for interested buyers, my sense is that both Apple TV and Vudu do an admirable job at delivering online movies and TV programs. The issue is that, if I was considering a purchase, and was obviously only going to buy one, I'd be hard-pressed to see why I'd pick Vudu over Apple TV. Consider: Apple TV is cheaper ($329 vs $399 for Vudu, albeit with smaller storage space), provides access to your music library and podcasts already configured in iTunes, allows easy display of your photos, has a familiar iPod/iTunes UI and enables transfers to these devices for portable viewing. Apple TV is also backed by a strong and well-known brand, giving additional comfort that the company will be around for a long time to come, which is always a nagging question when buying anything from a startup.

The whole category of broadband movie appliances is going to remain pretty small until the key limitations are resolved (small selection, 24 hour playback, 30-day expiration, no portability, no "extras", etc.). When these are fully addressed, online delivery of movies and TV programs will happen in a big way, no question.

So for now, given these limitations, what we're really seeing is a skirmish for positioning and branding, with an eye toward the long-term win. This dynamic in particular gives Apple, as a multi-billion dollar diversified company, yet another a big advantage over a single product startup. I've learned never to count out plucky startups, but given Apple TV's new positioning plus rentals, the mountain Vudu is trying to climb just got a whole lot more treacherous.

What do you think? Post a comment and let everyone know!

Categories: Aggregators, Devices, FIlms

Topics: Apple, Apple TV, iTunes, VUDU

-

Netflix-Apple Battle is Illusory

Netflix announced this morning that it was removing the usage cap on its "Instant Watching" feature for unlimited plan subscribers. This feature allows subscribers to choose from 6,000 titles (and growing) to stream and view on their PCs. Up until now subscribers received an allocation of streaming hours based on their monthly subscription level (e.g. 17 hours if subscribing at $17/mo). Now the hours will be unlimited. It's a smart move for Netflix and a great value proposition for Netflix subscribers.

AP first reported the change yesterday and is depicting it as a preemptive move against Apple, which is anticipated to announce tomorrow that movie rental downloads will be available in iTunes. The price point is expected to be $3.99/download. This is a major departure for Apple's iTunes, which has, of course, stuck religiously to its purchase download model for both music and videos.

Others have also depicted Apple's move as a direct strike at Netflix, but I think this battle is illusory. Rather, I view Apple's introduction of rentals as clear competition for the likes of Movielink, CinemaNow, Amazon

Unbox, XBox LIVE and other rental stores, but not a blow to Netflix. The value propositions are very different. That's because Netflix very wisely has made the Instant Watching feature a value add for its subscribers, not an incremental fee.

Unbox, XBox LIVE and other rental stores, but not a blow to Netflix. The value propositions are very different. That's because Netflix very wisely has made the Instant Watching feature a value add for its subscribers, not an incremental fee. As a $16.99/mo subscriber myself, I love the fact that Netflix is unmetering Instant Watching, and am hard-pressed to see why anyone would drop their subscription in favor of Apple's rental model, unless they envision consuming a lot of movies on their iPods (now there's a slim segment of the population!).

From an economic standpoint alone, the breakeven is only 4+ movies, which is likely well below the monthly consumption of most of Netflix's full unlimited subscribers. And with Apple's rental model, users are still subjected to all the same online movie limitations all the other services have suffered from: no easy playback on TVs, lack of portability, viewing window limits, etc. Granted iTunes downloads enable watching on-the-go (vs. Netflix's streams), but I don't see that as a big differentiator. With Netflix you get the best of DVDs' advantages and now unlimited online delivery.

Now, if Apple were to pursue subscriptions, that would be a direct attack on Netflix. Yet even this approach might not be that successful. The fact is, Netflix has spent heavily on marketing over the years, and its strong brand awareness and 7 million subscriber base are quite meaningful advantages.

Online movie delivery, whether rental or owned, still has a long way to go to achieve mainstream success. Apple will certainly nudge the category forward, but not dramatically. Still, Netflix needs to remain aggressively on offensive to retain its leadership mantle. This is a category with lots of moves yet to be made.

Am I missing something? Post a comment and let everyone know!

Categories: Aggregators, Devices, FIlms

-

CES 2008 Broadband Video-Related News Wrap-up

CES 2008 broadband video-related news wrap-up:

Panasonic and Comcast Announce Products With tru2way™ Technology

Panasonic And Comcast Debut AnyPlay™ Portable DVR

NETGEAR® Joins BitTorrent™ Device PartnersD-Link Joins BitTorrent™ Device Partners

Vudu Expand High Definition Content Available Through On-Demand Service

Sling Media Unveils Top-of-Line Slingbox PRO-HD

Open Internet Television: A Letter to the Consumer Electronics Industry

Paid downloads a thing of the past

Samsung, Vongo Partner To Offer Movie Downloads For P2 Portable Player

Comcast Interactive Media Launches Fancast.com

New Year Brings Hot New Shows and Longtime Favorites to FLO TV

P2Ps and ISPs team to tame file-sharing traffic

ClipBlast Releases OpenSocial API

Categories: Advertising, Aggregators, Broadband ISPs, Broadcasters, Cable Networks, Cable TV Operators, Devices, Downloads, FIlms, Games, HD, Mobile Video, P2P, Partnerships, Sports, Technology, UGC, Video Search, Video Sharing

Topics: ABC, BitTorrent, BT, Comcast, D-Link, Disney, Google, HP, Microsoft, NBC, Netgear, Panasonic, Samsung, Sony, TiVo, XBox, YouTube

-

Microsoft Flexes Broadband Muscles at CES

Microsoft grabbed the early PR spotlight at the Consumer Electronics Show (CES), now underway in Las Vegas, announcing a variety of deals across the broadband video spectrum. The deals, announced by Bill Gates in his traditional night 1 keynote, reinforce Microsoft's intentions to play multiple roles in what Gates calls the "first true Digital Decade."

Here's a look at Microsoft's deals and why they matter:

NBCU 2008 Olympics on MSN, using Silverlight

Microsoft and NBC, which has the broadcast rights to the '08 Summer Games from Beijing, announced that MSN would be the exclusive partner for NBCOlympics.com including thousands of hours of live video

coverage, and that Silverlight, which is Microsoft's "Flash-killer", would be used. As I mentioned in my "6 Predictions for 2008", the '08 games are going to be the biggest broadband video event yet. The deal gains MSN lots of traffic and Silverlight lots of exposure and downloads, not to mention serious validation as a live streaming platform if it executes well.

coverage, and that Silverlight, which is Microsoft's "Flash-killer", would be used. As I mentioned in my "6 Predictions for 2008", the '08 games are going to be the biggest broadband video event yet. The deal gains MSN lots of traffic and Silverlight lots of exposure and downloads, not to mention serious validation as a live streaming platform if it executes well.ABC/Disney and MGM content on XBox LIVE

In a further move to bolster the premium-quality content available in XBox LIVE (the content offering that accompanies XBox 360), Microsoft announced that both ABC/Disney and MGM would now be providing both SD and HD content. These moves bring XBox LIVE's catalog closer to parity with iTunes, while

keeping up the competition with Amazon Unbox and other stores. Separately, Microsoft said that XBox racked up 17.7 million units sold during the '07 holiday season.(correction, Microsoft press release misstated this number. Holiday sales were actually 4.3 million units, bringing cumulative units sold to date to 17.7 million, thx Karl)

keeping up the competition with Amazon Unbox and other stores. Separately, Microsoft said that XBox racked up 17.7 million units sold during the '07 holiday season.(correction, Microsoft press release misstated this number. Holiday sales were actually 4.3 million units, bringing cumulative units sold to date to 17.7 million, thx Karl)XBox users have been remarkable active purchasers and downloaders using XBox LIVE, and previous briefings I've conducted with XBox executives suggest that the initiative has been particularly successful with HD. Since Xbox is purchased primarily as a gaming platform, it serves as a great Trojan horse opportunity for Microsoft to gain broadband access to the TV.

Meanwhile, XBox LIVE has served as the deal unit for Zune's library as well, so these moves are important to watch as they benefit Microsoft's efforts to dislodge iPod from its perch as the leading digital media player. Only disappointment here is no ad-supported counterpart was announced for ABC programs, leaving AOL as ABC's only announced broadband syndication partner, as best I can tell.

Meanwhile, XBox LIVE has served as the deal unit for Zune's library as well, so these moves are important to watch as they benefit Microsoft's efforts to dislodge iPod from its perch as the leading digital media player. Only disappointment here is no ad-supported counterpart was announced for ABC programs, leaving AOL as ABC's only announced broadband syndication partner, as best I can tell.BT and XBox 360 Integration

Microsoft leveraged Xbox 360 for another convergence play, announcing with BT that the company's "BT Vision" IPTV service would be available for XBox 360 owners as an integrated service offering. This means that no separate set-top box would be required for BT Vision subs. Though the box won't roll out until mid '08, this concept has compelling upside for both sides and could be a nice blueprint for future IPTV deals. It eliminates set-top capex for BT, while providing strong marketing benefits to both parties, helping drive broadband/TV convergence on the back of the popular XBox gaming console.

Showtime, TNT and CNN with new apps on Mediaroom, Samsung supporting Extender

Elsewhere, Microsoft announced that Showtime, TNT and CNN would be creating new apps for Microsoft's Mediaroom IPTV platform, which it says is now installed on 1M set-tops globally. And lastly, that Samsung will support Extender for Windows Media Center, which means that HD content can be sent over wired or wireless-N networks from PC to TV. Extender hasn't caught on yet, but Microsoft is continuing to push it as a bridge device. I've yet to test it, but have that on my list of to-do's.

Taken together, these announcements from Microsoft show the company's vast resources allow it to play a role in all aspects of the broadband era - software, devices, services, content, gaming, etc. Less pronounced in these deals was the company's recently added online advertising prowess, which will soon be applied to broadband video as well. Stay tuned for news on this front as '08 unfolds.

Categories: Aggregators, Broadcasters, Cable Networks, Downloads, FIlms, Games, HD, International, IPTV, Partnerships, Sports

Topics: ABC, BT, CNN, Disney, MGM, Microsoft, NBC, Olympics, Samsung, Showtime, TNT, Xbox 360, Xbox LIVE

-

Netflix-LG Set-top Box is Another Misstep

Yesterday's announcement by Netflix and LG Electronics that they are partnering to develop a new set-top box generated a lot of coverage. For me the deal shows at least 2 things. First, there is an endless reservoir of optimism concerning consumers' willingness to adopt standalone devices for broadband-delivered video.

And second, that Netflix, which has been all over the board in the last couple years in trying to define a broadband delivery strategy, has seemingly made yet another misstep in this critical area.

And second, that Netflix, which has been all over the board in the last couple years in trying to define a broadband delivery strategy, has seemingly made yet another misstep in this critical area. Regarding the optimism about standalone devices, as many of you know, I recently wrote about this in a post entitled "Broadband Video on TVs is a Mirage" in which I concluded that these broadband appliances are unlikely to gain widespread market appeal. Though little information was revealed about the Netflix-LG box, for now, I don't see any reason to believe that this new box will be an exception to the logic I laid out in that post. At best I view standalone broadband appliances (e.g. AppleTV, Vudu, Moviebeam, Akimbo, etc.) as appealing to only a small sliver of consumers.

My logic applies to Netflix-LG as follows: how many people are realistically going to shell out $400 (assumed price) for a new box, plus spend the time involved to install it, when the principal benefit is to be able to watch a small subset (6K out of Netflix's current 90K catalog) of content Netflix already makes easily available on the robust DVD format? I'd say maybe 10% of Netflix's current base of 7 million, max. That would be 700K boxes TOTAL - hardly the kind of numbers that make a CE executive's eyes pop.

A greater issue is that this new box seems to represent just the latest in a pattern of dubious moves by Netflix, coupled with poor communications, regarding how it intends to gracefully migrate from its current DVDs-through-the-mail approach to succeed in the broadband era.

For the last two years Netflix has publicly appeared to jump from one broadband approach to the next. For example, yesterday's box announcement was accompanied by news that Anthony Wood, whom Netflix brought on board just 8 months ago as its V.P. of Internet TV, would be departing from the company, reversing Netflix's previous plan of developing its own box (which itself was an ill-considered idea).

The LG box approach continues Netflix's pattern of cloudy planning and communications. On a day that should have been all about articulating why this new co-developed LG box is, at last, the correct approach, Reed Hastings, Netflix's CEO seemed to veer completely off message in his remarks to the NY Times, stating that "We want to be integrated on every Internet-connected device, game system, high-definition DVD player and dedicated Internet set-top box. Eventually, as TVs have wireless connectivity built into them, we'll integrate right into the television."

Huh? If this "Netflix-everywhere" approach is instead the real strategy, then why put out the LG press release at all, much less specifically say in the first sentence that Netflix is "joining forces to develop a set-top box." If the company is really interested in an "everywhere" approach, then it should have announced a group of partnerships to validate Mr. Hastings's aspiration and stayed away from the notion that it would co-develop any particular model. A Netflix investor is left wondering, yet again, what is Netflix's real game plan, how it will allocate its finite resources and how it will leverage its brand equity to succeed in the broadband world?

My sense is that Netflix seems to have a bias that it needs to be intimately involved in hardware development, rather than partnering widely and relying on the market to sort things out. Netflix should follow TiVo's recent (and correct, I believe) approach in trying to "piggyback" on top of devices as they're deployed and gain market traction. Starz is yet another example of a content provider staying agnostic, correctly forming partnerships with various device manufacturers for its Vongo service, while steering clear of embracing any particular approach. While Mr. Hastings hints that Netflix wants to do exactly this in his remarks, the LG announcement undermines this strategy, if it can even be called that.

Netflix has assiduously built one of the best brands in subscription entertainment. Its task now is to leverage that brand in the broadband era. Regrettably, yesterday's LG announcement provides little evidence that the company has finally formed a winning plan. With competitors all around it, Netflix needs to get this right sooner rather than later.

Agree or disagree with my assessment? Post a comment and let everyone know!

Categories: Aggregators, Devices, Partnerships