-

Comparing iTunes and Hulu Monthly TV-Related Revenues - For Now, It's No Contest

Last week Apple announced that it has sold 200 million TV episodes to date and also that all four of the major broadcast networks are now providing HD versions of their prime-time shows. These periodic updates are always welcome as Apple is notoriously parsimonious with its iTunes numbers, making it hard for analysts to get a real handle on how the store is doing.

This latest total got me to thinking about the relative sizes of online aggregators of prime-time TV shows. Below I've made some calculations comparing the revenues of iTunes, the largest paid download store, with the revenues of Hulu, likely the largest free, ad-supported streaming site for TV programs. The conclusion is clear: for now at least, iTunes is a far larger business, demonstrating that despite the obvious appeal of free video, a segment of consumers are still plenty willing to buy and collect individual episodes.

iTunes calculations

I estimate iTunes is currently generating about 10 million TV program downloads/month. TV program

downloads officially began just about 3 years ago with ABC's initial iTunes partnership. There's obviously been a ramp over the years, so if you assume 50% of the volume came in the first 3 years combined, and 50% in the 10 months of '08 alone, that produces 100 million TV program downloads year to date or about 10 million downloads/month. (that actually synchs with the fact that Apple last disclosed 150 million total TV program downloads in May, '08, 5 months ago).

downloads officially began just about 3 years ago with ABC's initial iTunes partnership. There's obviously been a ramp over the years, so if you assume 50% of the volume came in the first 3 years combined, and 50% in the 10 months of '08 alone, that produces 100 million TV program downloads year to date or about 10 million downloads/month. (that actually synchs with the fact that Apple last disclosed 150 million total TV program downloads in May, '08, 5 months ago).To grossly simplify, let's say the download price is $2/episode. I know that doesn't take account of the $3 HD downloads iTunes launched last month (of which it says it sold a million) or the varying prices of international downloads. At $2/episode iTunes does $20 million/month in gross download revenues from TV programs.

Hulu calculations

comScore said Hulu delivered about 119 million video streams in July '08. Since there's a ton of content at Hulu, estimating how many of those streams were full-length TV programs is anyone's best guess. But let's

say it's 10%, and that ALL of these streams were watched in their entirety, which is obviously optimistic. That would yield just under 12 million full episodes watched/month. That feels high to me, but let's stay with it for now.

say it's 10%, and that ALL of these streams were watched in their entirety, which is obviously optimistic. That would yield just under 12 million full episodes watched/month. That feels high to me, but let's stay with it for now.Recently, in "Broadcast Networks' Use of Broadband is Accelerating Demise of Their Business Model," I estimated that given Hulu's extremely light ad load and an assumed $60 CPM for its ads, it may be generating $.18 of revenue/viewer/episode. Feedback I've received suggests that probably an overstatement, so let's bump it down just a bit to $.15. With 12 million episodes/mo, that would translate to about $1.8 million/month in gross advertising revenues from TV programs alone.

Conclusions

Though the above numbers need to be taken with a grain of salt, they suggest there's a huge gap in TV program-related revenues between iTunes and Hulu. Now of course iTunes has been around a lot longer than Hulu, and of course it benefits from the massive popularity of the iPod, and more recently the iPhone. We also can't forget there are lots of places to watch free TV episodes online while there are comparably fewer online stores to purchase and download high-quality episodes. So it might actually be fairer to compare the monthly revenues of ALL the online aggregators (and the networks' own sites too) to iTunes to get a clearer comparison.

Still, I think comparing iTunes and Hulu does show how nascent the streaming TV market is today. In the long-run, I'm a believer that free, ad-supported trumps a la carte paid downloading. But for now, when it comes to real revenues - which for many is the only metric that really matters - it's no contest.

What do you think? Post a comment now!

Categories: Aggregators, Broadcasters

-

At Last, Google Flexes YouTube's Strategic Muscles

In the two years since Google acquired YouTube, I've often wondered about two things: (1) was there really a strategic rationale behind the deal? and, (2) if there was indeed a strategic rationale, when might we see it borne out in actual business initiatives?

For sure YouTube's organic growth has continued unabated during these two years and from a traffic

perspective, it is more dominant now than ever. Yet the dearth of initiatives that are tangibly strategic (or meaningfully revenue-producing for that matter) to Google, or that even minimally strengthen either company's underlying value proposition, has led me to conclude that the deal had more to do with the Google guys wanting to acquire YouTube for its "coolness" factor - simply because they could - than anything else.

perspective, it is more dominant now than ever. Yet the dearth of initiatives that are tangibly strategic (or meaningfully revenue-producing for that matter) to Google, or that even minimally strengthen either company's underlying value proposition, has led me to conclude that the deal had more to do with the Google guys wanting to acquire YouTube for its "coolness" factor - simply because they could - than anything else. I don't mean to sound unfair to the YouTubers who work diligently to make YouTube an incredible experience, which of course it truly is. Yet it is hard to deny the obvious: exactly what has YouTube done differently during the last two years that it couldn't have done had it remained independent (and saying "afforded its monthly CDN bills" doesn't count!), and how exactly have either YouTube or Google benefited from being together during this time?

However, I think things are finally changing. In fact, with little fanfare or proactive PR, Google at last seems to be strategically flexing YouTube's muscles. While some of what they're doing is experimental, other moves have significant market potential and could be highly disruptive to other broadband oriented media and technology companies.

At the top of my "highest potential" list is Google Content Network, especially as it's envisioned as "spokes" tied to YouTube's "hub." I wrote at length about GCN a month ago in "Google Content Network Has Lots of Potential, Implications" so I won't rehash my arguments here. But note yesterday's news about "Poptub" as the second video series to get the GCN/YouTube treatment; I expect a steady drumbeat of these types of deals in the months to come. GCN has the potential to become a key driver of the Syndicated Video Economy.

Another high-potential activity is YouTube's plan to start streaming full episodes. The first deal with CBS is no doubt a signal of many more to come. Full episode streaming is strategic on a number of levels. It enhances YouTube's and Google's access to big brands' ad dollars. While Google has thrived in the self-service, "long tail of advertising" world, it needs more cred among big brands, especially as it pursues its Google TV initiative (see latest deal with NBCU) and other eventual broadband-to-the-TV activities. Full episodes are also a winner from a user standpoint: a unified video experience across premium, indie, long tail and UGC video is very compelling and also squeezes competitors with narrower offerings.

Yet another high-potential activity is the implementation of search ads on YouTube. When the deal was originally done, my first reaction was to think it was a no-brainer to simply start displaying ads against every YouTube search (example - you search for "West Wing" in YouTube and the results page shows an ad to buy the DVD set). If there's one thing Google knows cold, it's the search ad business. YouTube searches represent billions of incremental opportunities each year to extend its core franchise.

Lastly - and this is admittedly more of a "Will Richmond thing" than anything Google or YouTube are yet pursuing: I think it's practically inevitable that the company will start investing in independent broadband video companies at some point. I touched on this in yesterday's piece about NBCU-60Frames and MSN-Stage 9. As time marches on and some of the above activities bear fruit, it's going to become very tempting for Google/YouTube to lever its strengths more directly into content ownership. I know what Google's always maintained about being a technology company, committed to neutrality in way that even Switzerland would appreciate. But as Google's ad business matures and it inevitably is pressured for growth, content is going to be a very alluring opportunity.

Lastly - and this is admittedly more of a "Will Richmond thing" than anything Google or YouTube are yet pursuing: I think it's practically inevitable that the company will start investing in independent broadband video companies at some point. I touched on this in yesterday's piece about NBCU-60Frames and MSN-Stage 9. As time marches on and some of the above activities bear fruit, it's going to become very tempting for Google/YouTube to lever its strengths more directly into content ownership. I know what Google's always maintained about being a technology company, committed to neutrality in way that even Switzerland would appreciate. But as Google's ad business matures and it inevitably is pressured for growth, content is going to be a very alluring opportunity. Regardless of what happens on this last point, YouTube now seems to have a full plate of strategic activities underway. It's great to finally see this happening.

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Broadcasters, Indie Video, Syndicated Video Economy

Topics: 60Frames, CBS, Disney, Google, Google Content Network, MSN, NBCU, YouTube

-

Lessons from Two Recent Deals: NBCU-60Frames and Microsoft/MSN Video-Disney/Stage 9

I always hesitate to conclude too much from just a couple data points, but two deals in the last week - between NBCU and 60Frames and between Microsoft/MSN Video and Disney/Stage 9 - feel to me like leading indicators of more deals of this kind to come.

In case you missed the news, last Tuesday, NBCU and 60Frames, an independent broadband-only studio I've written about, announced a comprehensive content development and ad sales deal. Critically, NBCU will take original broadband-only shows from 60Frames to brands/agencies with which it has relationships to pursue both upfront sponsorships and possible brand integration.

Then this past Monday, Disney and Microsoft announced at MIPCOM that Stage 9, Disney's in-house broadband-only studio which I've also written about, would begin syndicating its shows to MSN Video for European viewers. While smaller in scope, the Disney-MS deal is no less noteworthy.

I see at least three underlying threads to these deals that suggest broader market implications. First, the

deals are further evidence that the broadband-only video model is still nascent and in need of market validation and financial support. If these deals are in fact harbingers, this support will come from established players like NBCU and Microsoft who have significant reach and access to ad dollars. Somewhat ironically these are also companies that have financial stakes (either through direct ownership of or important customer/strategic relationships with) the very incumbent media properties that the broadband-only crowd is trying to grab eyeballs away from.

deals are further evidence that the broadband-only video model is still nascent and in need of market validation and financial support. If these deals are in fact harbingers, this support will come from established players like NBCU and Microsoft who have significant reach and access to ad dollars. Somewhat ironically these are also companies that have financial stakes (either through direct ownership of or important customer/strategic relationships with) the very incumbent media properties that the broadband-only crowd is trying to grab eyeballs away from.Second, the down economy is a catalyst for more of these types of deals. Last week, in "5 Conclusions About the Bad Economy's Effect on Broadband Video," I asserted that the broadband-only studios would tighten their belts a bit to conserve resources in this uncertain climate. One way to mitigate their financial risk and uncertainty is through these linkups with deep pocketed partners. NBCU's backing of the 60Frames slate appears to be the most extensive of these types of deals to date. That Stage 9 - owned by well-funded Disney - is also hunting down big distribution partners which have brand relationships is still further evidence that risk mitigation is a key priority.

Third, the deals point to an acceleration of the trend toward broadband video syndication. In a presentation I give periodically to industry executives, I have a slide titled "Syndicated Video Economy Accelerates" which lists the reasons as: (1) Ongoing video explosion causes heightened need to break through to audiences, (2) Device proliferation causes even more audience fragmentation, (3) Ad model firms up, improving ROI for free, widely distributed video and (4) Social media use means surging user-driven syndication. That slide needs to be updated for a new #1 reason motivating syndication: "In a down economy, syndication could mean the difference between success and failure for broadband-only studios and even big media backed broadband initiatives."

Third, the deals point to an acceleration of the trend toward broadband video syndication. In a presentation I give periodically to industry executives, I have a slide titled "Syndicated Video Economy Accelerates" which lists the reasons as: (1) Ongoing video explosion causes heightened need to break through to audiences, (2) Device proliferation causes even more audience fragmentation, (3) Ad model firms up, improving ROI for free, widely distributed video and (4) Social media use means surging user-driven syndication. That slide needs to be updated for a new #1 reason motivating syndication: "In a down economy, syndication could mean the difference between success and failure for broadband-only studios and even big media backed broadband initiatives."Here's something else to consider: what role might YouTube, the market's undisputed 800 pound gorilla, play as an emerging distributor and financial backer of broadband-only video? Despite its much-avowed

disinterest in being a content provider, YouTube, with Google's abundant balance sheet, is in a Warren Buffet-like position to become the go-to resource for financial backing and key distribution. (Readers who are cable industry veterans will also see a potential parallel to the M.O. of TCI back in the 1980's and 90's.) Couple Google's billions with YouTube's massive reach, desire to move up the quality ladder from its UGC roots, pursuit of new ad models and commerce models and its budding GCN initiative, and the company really is superbly positioned to play a role in the development of broadband-only programming.

disinterest in being a content provider, YouTube, with Google's abundant balance sheet, is in a Warren Buffet-like position to become the go-to resource for financial backing and key distribution. (Readers who are cable industry veterans will also see a potential parallel to the M.O. of TCI back in the 1980's and 90's.) Couple Google's billions with YouTube's massive reach, desire to move up the quality ladder from its UGC roots, pursuit of new ad models and commerce models and its budding GCN initiative, and the company really is superbly positioned to play a role in the development of broadband-only programming. Anyway, I digress. For now, it's fair to say that these two deals do not yet make a trend. But still, I think it's extremely likely that we'll see many more of these kinds of linkups in the months to come. We're living in a hunker down time, when starry-eyed creatives enticed by broadband's no-rules freedom will be tempered by business executives' no-nonsense pursuit of financial viability.

What do you think? Post a comment now.

(Btw, for a deeper dive into how broadband-only studios ride out the economic storm, join me for the Broadband Video Leadership Breakfast Panel in Boston on Nov 10th. One of our panelists will be Fred Seibert, creative director and co-founder of Next New Networks, arguably the granddaddy of the broadband-only crowd, having raised over $23 million to date. Early bird pricing ends on Friday.)

Categories: Advertising, Aggregators, Broadcasters, International, Portals, Syndicated Video Economy

Topics: 60Frames, Disney, Google, Microsoft, MSN Video, NBCU, Stage 9, YouTube

-

5 Updates to Note: Brightcove 3, Silverlight 2, Google-YouTube-MacFarlane, NBC-SNL-Tina Fey, Joost-Hulu

With so much going on in the broadband video world, I rarely get an opportunity to follow up on previously discussed items. So today, an attempt to catch up on some news that's worth paying attention to:

Brightcove 3 is released - Back in June I wrote about the beta release of Brightcove 3, the company's updated video platform. Today Brightcove is officially releasing the product. I got another good look at it a couple weeks ago in a briefing with Adam Berrey, Brightcove's SVP of Marketing. I like what I saw. Much more intuitive publishing/workflow. Improved ability to mix and match video and non-video assets in the way content is actually consumed. New emphasis on high-quality delivery to keep up with ever-escalating quality bar. Flexibility around video player design and implementation. And so on.

The broadband video publishing/management platform is incredibly crowded, and only getting more competitive. Brightcove 3 ups the ante further.

Silverlight 2 is released - Speaking of releases, Microsoft officially unveiled Silverlight 2 yesterday, making it available for download today. I was on a call yesterday with Scott Guthrie, corporate VP of the .NET developer Division, who elaborated on the details. NBC's recent Olympics was Silverlight 2 beta's big public event, and as I wrote in August, the user experience was seamless and offered up exciting new features (PIP, concurrent live streams, zero-buffer rewinds, etc.).

A pitched battle between Microsoft and Adobe is underway for the hearts and minds of developers, content providers and consumers. Silverlight has a lot of catching up to do, but as is evident from the release, it intends to devote a lot of resources. Can you say Netscape-IE or Real-WMP? This will be a battle worth watching.

Google and Seth MacFarlane are hitting a home run with "Cavalcade of Comedy" - A month since its debut, Google/YouTube and Seth MacFarlane seem to have hit on a winning formula at the intersection of video syndication, audience growth and brand sponsorship. On YouTube alone, the 10 short episodes have generated over 12.7 million views according to my calculations, while this TV Week piece quotes 14 million + when all views are tallied.

Last month, in "Google Content Network Has Lots of Potential, Implications" I wrote at length about how powerful GCN and YouTube could be for the budding Syndicated Video Economy, yet noted that the jury is still out on whether Google's really committed to GCN. "Cavalcade's" early success surely gives GCN some tailwind. (Btw, for more on Google/YouTube's myriad video initiatives, join me on Nov. 10th for the Broadband Video Leadership Breakfast Panel, which David Eun, the company's VP of Content Partnerships will be a panelist)

NBC/SNL and Tina Fey set a new standard for viral success - Tina Fey's Sarah Palin skits are hilarious and unlike anything yet seen in viral video. Usage is through the roof: a new study by IMMI suggests that twice as many people watched the skits online and on DVR than did on-air, while Visible Measures's data (as of 3 weeks ago!), shows over 11 million video views. SNL is smack in the middle of the cultural zeitgeist once again, with Thursday night specials and reports of a new dedicated web site in the mix.

To put in perspective how disruptive viral video can be to the uninitiated, several weeks ago I heard a pundit on CNN's AC360 dismiss the potential impact of the Fey skits on the election with a wave of his hand and a remark to the effect of "come on, how many people stay up that late to watch SNL really?" How's that for being out of touch with the way today's world really works? Political pros and other taste-makers should take heed - viral video can be a cultural tour de force.

Joost Flash version is here, finally - Remember Joost? Originally the super-secret "Venice Project" from the team that made a killing on KaZaA and Skype (the latter of which was acquired by eBay, permanently undermining former eBay CEO Meg Whitman's M&A acumen), Joost today is announcing its Flash-based video service. You might ask what took the company so long given this is where the market's been for several years already? I have no idea.

But here's one key takeaway from Joost's story: because of its lineage, the company was once regaled as the "it" player of the broadband video landscape. Conversely, Hulu, because of its big media NBC and Fox parentage, was dismissed by many right from the start. Now look at how their fortunes have turned. When your mom used to tell you "don't judge a book by its cover," she was right.

What do you think? Post a comment.

Categories: Aggregators, Broadcasters, Politics, Syndicated Video Economy, Technology

Topics: Brightcove, Google, Hulu, Joost, Microsoft, NBC, Saturday Night Live, Seth MacFarlane, Silverlight, YouTube

-

Cutting the Cord on Cable: For Most of Us It's Not Happening Any Time Soon

Two questions I like to ask when I speak to industry groups are, "Raise your hand if you'd be interested in 'cutting the cord' on your cable TV/satellite/telco video service and instead get your TV via broadband only?" and then, "Do you intend to actually cut your cord any time soon?" Invariably, lots of hands go up to the first question and virtually none to the second. (As an experiment, ask yourself these two questions.)

I thought of these questions over the weekend when I was catching up on some news items recently posted to VideoNuze. One, from the WSJ, "Turn On, Tune Out, Click Here" from Oct 3rd, offered a couple examples of individuals who have indeed cut the cord on cable and how their TV viewing has changed. My guess is that it wasn't easy to find actual cord-cutters to be profiled.

There are 2 key reasons for this. First it's very difficult to watch broadband video on your TV. There are special purpose boxes (e.g. AppleTV, Vudu, Roku, etc.), but these mainly give access to walled gardens of pre-selected content, that is always for pay. Other devices like Internet-enabled TVs, Xbox 360s and others offer more selection, but are not really mass adoption solutions. Some day most of us will have broadband to the TV; there are just too many companies, with far too much incentive, working on this. But in the short term, this number will remain small.

The second reason is programming availability. Potential cord-cutters must explicitly know that if they cut their cord they'll still be able to easily access their favorite programs. Broadcasters have wholeheartedly embraced online distribution, giving online access to nearly all their prime-time programs. While that's a positive step, the real issue is that cord-cutters would get only a smattering of their favorite cable programs. Since cable viewing is now at least 50% of all TV viewing (and becoming higher quality all the time, as evidenced by cable's recent Emmy success), this is a real problem.

To be sure, many of the biggest ad-supported cable networks (MTV, USA, Lifetime, Discovery) are now making full episodes of some of their programs available on their own web sites. But these sites are often a hodgepodge of programming, and there's no explanation offered for why some programs are available while others are not. For example, if you cut the cord and could no longer get Discovery Channel via cable/satellite/telco, you'd only find one program, "Smash Lab" available at Discovery.com. Not an appealing prospect for Discovery fans.

Then there's the problem of navigation and ease of access. Cutting the cord doesn't mean viewers don't want some type of aggregator to bring their favorite programming together in an easy-to-use experience. Yet full streaming episodes are almost never licensed to today's broadband aggregators. Cable networks are rightfully being cautious about offering full episodes online to aggregators not willing to pay standard carriage fees.

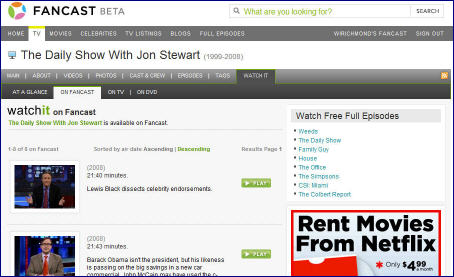

For example, even at Hulu, arguably the best aggregator of premium programming around, you can find Comedy Central's "The Daily Show" and "Colbert Report." But aside from a few current episodes from FX, SciFi and Fuel plus a couple delayed episodes from USA like "Monk" and "Psych," there's no top cable programming to be found.

As another data point, I checked the last few weeks of Nielsen's 20 top-rated cable programs and little of this programming is available online either. A key gap for cord-cutters would be sports. At a minimum, they'd be saying goodbye to the baseball playoffs (on TBS) and Monday Night football (on ESPN). In reality, sports is the strongest long-term firewall against broadband-only viewing as the economics of big league coverage all but mandate carriage fees from today's distributors to make sense.

Add it all up and while many may think it's attractive to go broadband only, I see this as a viable option for only a small percentage of mainstream viewers. Only when open broadband to the TV happens big time and if/when cable networks offer more selection will this change.

What do you think? Post a comment now.

Categories: Aggregators, Broadcasters, Cable Networks, Cable TV Operators, Devices, Telcos

Topics: AppleTV, Comedy Central, Discovery, ESPN, FX, Hulu, Lifetime, Roku, SciFi, TBS, USA, VUDU, Xbox360

-

Hulu to Stream Tonight's Presidential Debate; Reaction to NYTimes.com Coverage?

There are reports today that Hulu intends to stream tonight's second presidential debate along with the third debate planned for Oct. 15th. VideoNuze readers will recall that I observed two weeks ago that NYTimes.com

streamed the first debate on its home page. I regarded this as a noteworthy incursion of a print publisher onto broadcast/cable's traditional turf and asserted that the debates give the NYTimes a plum opportunity to use video to expand its audience appeal and ad revenue potential.

streamed the first debate on its home page. I regarded this as a noteworthy incursion of a print publisher onto broadcast/cable's traditional turf and asserted that the debates give the NYTimes a plum opportunity to use video to expand its audience appeal and ad revenue potential. Cause and effect that Hulu, backed by two broadcasters Fox and NBC, is now planning to stream the remaining debates? Hard to say. But no question, if Hulu hadn't done this, it would have been leaving the door open, again, for NYTimes to be a prime destination for live streaming of the debate. For broadcasters fighting for every eyeball out there, that would have been a mistake. More evidence of how broadband is creating competition between previously disparate media worlds.

Categories: Aggregators, Newspapers, Politics

Topics: FOX, Hulu, NBC, NYTimes.com

-

Inside the Netflix-Starz Play Licensing Deal

This past Wednesday, Starz, the Liberty Media-owned premium cable network, licensed its "Starz Play" broadband service to Netflix. The three year deal makes all of Starz's 2,500 movies, TV shows and concerts available to Netflix subscribers using its Watch Instantly streaming video feature. Very coincidentally I happened to be at Starz yesterday for an unrelated Liberty meeting, and had a chance to speak to Starz CEO Bob Clasen, who I've known for a while, to learn more.

On the surface the deal is an eye-opener as it gives a non-cable/telco/satellite operator access to Starz's

trove of prime content. As I've written in the past, cable channels, which rely on their traditional distributors for monthly service fees, have been super-sensitive to not antagonizing their best customers when trying to take advantage of new distribution platforms. This deal, which uses broadband-only distribution to reach into the home, no doubt triggers "over-the-top" or "cable bypass" alarm bells with incumbent distributors.

trove of prime content. As I've written in the past, cable channels, which rely on their traditional distributors for monthly service fees, have been super-sensitive to not antagonizing their best customers when trying to take advantage of new distribution platforms. This deal, which uses broadband-only distribution to reach into the home, no doubt triggers "over-the-top" or "cable bypass" alarm bells with incumbent distributors. Then there is the value-add/no extra cost nature of Netflix's Watch Instantly feature. That there is no extra charge to subscribers for Starz's premium content (as there typically is when subscribing to Starz through cable for example) raises the question of whether Starz might have given better pricing to Netflix to get this deal done than it has to its other distributors.

But Bob is quick to point out that in reality, the Netflix deal is a continuation of Starz's ongoing push into broadband delivery begun several years ago with its original RealNetworks deal and continued recently with Vongo. To Starz, Netflix is another "affiliate" or distributor, which, given its tiny current online footprint does not pose meaningful competition to incumbent distributors. With only about 17 million out of a total 100 million+ U.S. homes subscribing to Starz, broadband partnerships are seen as a sizable growth opportunity by the company.

Further, Starz has been aggressively pitching online deals to cable operators and telcos for a while now, though only the latter has bit so far (Verizon's FiOS is an announced customer). Cable operators seem interested in the online rights, but have been reluctant to pay extra for them as Starz requires.

Bob also noted that Starz's wholesale pricing was protected in its Netflix deal, and that for obvious reasons of not hurting its own profitability, Starz has strong incentives to preserve incumbent deal terms in all of its new platform deals.

To me, all of this adds up to at least a few things. First is that Netflix must be paying up in a big way to

license Starz Play. I assume this is an obvious recognition by Netflix that it needed more content to make Watch Instantly more compelling (see also Netflix's recent Disney Channel and CBS deals). Since it's not charging subscribers extra, Netflix is making a bet that over time - and aided by its Roku and other broadband-to-the-TV devices - Watch Instantly will succeed and as a result, will drive down its costs by reducing the number of DVDs the company needs to buy and ship. That seems like a smart long-term bet as the broadband era unfolds.

license Starz Play. I assume this is an obvious recognition by Netflix that it needed more content to make Watch Instantly more compelling (see also Netflix's recent Disney Channel and CBS deals). Since it's not charging subscribers extra, Netflix is making a bet that over time - and aided by its Roku and other broadband-to-the-TV devices - Watch Instantly will succeed and as a result, will drive down its costs by reducing the number of DVDs the company needs to buy and ship. That seems like a smart long-term bet as the broadband era unfolds.And while I agree that Starz Play on Netflix doesn't represent real competition to cable, telco and satellite outlets today, it's hard not to see it as a signal that traditional distributors are losing their hegemony in premium video distribution. (for another example of this, see Comedy Central's licensing of Daily Show and Colbert to Hulu). As I've said for a while, over the long term, the inevitability of broadband all the way to the TV portends significant disruption to current distribution models. I see Netflix at the forefront of this disruptive process.

What do you think? Post a comment now.

Categories: Aggregators, Cable Networks, Cable TV Operators, Devices, Telcos

Topics: CBS, Comedy Central, Disney, Liberty Media, Netflix, Starz, Verizon

-

Comcast's Fancast Becomes Hub for Premieres; But Where's Project Infinity?

Here's a clever move from Comcast's Fancast broadband portal to create new value for users and generate excitement in the broadband market: this week it is running "Premiere Week," an aggregation of 168 premiere TV episodes. The episodes span series premieres ("Desperate Housewives," "Dexter," "The Office"), season premieres ("Fringe," "Sons of Anarchy," "Crash") and classic pilots ("Dynasty," "The A-Team," "Miami Vice"). It's great fun and a visitor could get lost on the site for hours, as I nearly did.

These are the kinds of promotions that Comcast should be all over. Given its extensive reach and programming muscle, the company has definite - though not insurmountable - advantages over other aggregators to pull this kind of promotion together.

The competition for aggregating premium programming continues to intensify. Business models are all over the board as are approaches for getting video all the way to the TV. For example, last week Amazon launched its pay-per-use VOD initiative which includes a page of info for how to watch using TiVo, Sony Bravia Internet Video Link, Xbox 360, etc. Then yesterday, Netflix announced that it will incorporate about 2,500 of Starz's movies, TV shows and concerts in its Watch Instantly feature, along with a feed of its linear channel. Still other moves are forthcoming.

Comcast's real lever though is unifying its currently siloed worlds of digital TV, broadband Internet access and Fancast. When converged they're a blockbuster; companies like Netflix, Amazon and others cannot replicate this combination. In particular, Comcast, and other cable operators are ideally positioned to bridge broadband all the way to the TV. That's the last big hurdle to unlock broadband's ultimate value. Whether they'll do so is an open question.

Earlier this year Comcast CEO Brian Roberts unveiled the company's "Project Infinity" which suggested Comcast was looking to unify its various video offerings and bring broadband to its subscribers' TV. It seemed like a promising move, though there was no timeline disclosed. Now, nearly 9 months later I can't find any updates on the status of Project Infinity. It would be great for the company to publicly release a progress report or sense of upcoming milestones.

Promotions like "Premiere Week" are a positive step from Comcast, but real competitive advantage for the company lies in launching services which are truly impossible for others to match.

What do you think? Post a comment.

Categories: Aggregators, Cable TV Operators, Portals

Topics: Amazon, Comcast, Fancast, Netflix, Starz, TiVo

-

September '08 VideoNuze Recap - 3 Key Themes

Welcome to October. Recapping another busy month, here are 3 key themes from September:

1. When established video providers use broadband, it must be to create new value

Broadband simultaneously threatens incumbent video businesses, while also opening up new opportunities. It's crucial that incumbents moving into broadband do so carefully and in ways that create distinct new value. However, in September I wrote several posts highlighting instances where broadband may either be hurting existing video franchises, or adding little new value.

Despite my admiration for Hulu, in these 2 posts, here and here, I questioned its current advertising implementations and asserted that these policies are hurting parent company NBC's on-air ad business. Worse yet, In "CNN is Undermining Its Own Advertisers with New AC360 Live Webcasts" I found an example where a network is using broadband to directly draw eyeballs away from its own on-air advertising. Lastly in "Palin Interview: ABC News Misses Many Broadband Opportunities" I described how the premier interview of the political season produced little more than an online VOD episode for ABC, leaving lots of new potential value untapped.

Meanwhile new entrants are innovating furiously, attempting to invade incumbents' turf. Earlier this week in "Presidential Debate Video on NYTimes.com is Classic Broadband Disruption," I explained how the Times's debate coverage positions it to steal prime audiences from the networks. And at the beginning of this month in "Taste of Home Forges New Model for Magazine Video," I outlined how a plucky UGC-oriented magazine is using new technology to elbow its way into space dominated by larger incumbents.

New entrants are using broadband to target incumbents' audiences; these companies need to bring A-game thinking to their broadband initiatives.

2. Purpose-driven user-generated video is YouTube 2.0

In September I further advanced a concept I've been developing for some time: that "purpose-driven" user-generated video can generate real business value. I think of these as YouTube 2.0 businesses. Exhibit A was a company called Unigo that's trying to disrupt the college guidebook industry through student-submitted video, photos and comments. While still early, I envision more purpose-driven UGV startups cropping up in the near future.

Meanwhile, brand marketers are also tapping the UGV phenomenon with ongoing contests. This trend marked a new milestone with Doritos new Super Bowl ad contest, which I explained in "Doritos Ups UGV Ante with $1 Million Price for Top-Rated 2009 Super Bowl Ad." There I also cataloged about 15 brand-sponsored UGV contests I've found in the last year. This is a growing trend and I expect much more to come.

3. Syndication is all around us

Just in case you weren't sick of hearing me talk about syndication, I'll make one more mention of it before September closes out. Syndication is the uber-trend of the broadband video market, and several announcements underscored its growing importance.

For example, in "Google Content Network Has Lots of Potential, Implications" I described how well-positioned Google is in syndication, as it ties AdSense to YouTube with its new Seth MacFarlane "Cavalcade of Cartoon Comedy" partnership. The month also marked the first syndication-driven merger, between Anystream and Voxant, a combination that threatens to upend the competitive dynamics in the broadband video platform space. Two other syndication milestones of note were AP's deal with thePlatform to power its 2,000+ private syndication network, and MTV's comprehensive deal with Visible Measure to track and analyze its 350+ sites' video efforts.

I know I'm a broken record on this, but regardless of what part of the market you're playing in, if you're not developing a syndication plan, you're going to be out of step in the very near future.

That's it for September, lots more planned in October. Stay tuned.

What do you think? Post a comment!

Categories: Aggregators, Analytics, Brand Marketing, Broadcasters, Magazines, Partnerships, Syndicated Video Economy, UGC

Topics: ABC, Anystream, AP, CNN, Doritos, Google, Hulu, MTV, NY Times, Taste of Home, thePlatform, Unigo, Visible Measu, Voxant, YouTube

-

Google Content Network Has Lots of Potential, Implications

Many of you know that Google has recently begun distributing short animated videos from Seth MacFarlane (creator of TV's "Family Guy") to a wide network of sites that previously only received ads from Google, through their participation in AdSense. The company dubs this the "Google Content Network" (GCN for short), and from my vantage point, it has a lot of potential and implications for other players in the video distribution value chain. Yesterday, I spoke to Alexandra Levy, Google's Director of Branded Entertainment, and the point person for driving this initiative.

The first thing that resonates for me about GCN is that Google's vision for it harmonizes perfectly with my concept of the "Syndicated Video Economy." VideoNuze readers know that last March I introduced the SVE concept to capture a trend that I was noticing: an ecosystem was forming to distribute broadband video widely across the Internet, in contrast to the traditional, narrower distribution model.

Alex echoed the SVE, saying that in her many conversations with content producers, finding an audience is their top challenge. Great content, unwatched, is like the proverbial tree that falls in the forest when nobody is around to hear it.

So enter GCN, which Google rightly sees as a "media distribution platform." To understand its implications fully, you have to evaluate its potential to all relevant constituencies: Users get great updated content served to them at the sites they already visit. Those sites benefit from offering premium content, while also receiving a revenue share on the accompanying ads. The content provider benefits from leveraging Google's vast AdSense network to have video "pushed" to relevant audiences, increasing viewership and engagement. And advertisers' brands benefit from adjacency to premium content that is sought after and compelling.

Of course, last but not least, Google benefits from being the intermediary in this whole process. We all know from Google's massive success in web search that being the intermediary in a model where all constituent interests are neatly aligned creates near-infinite economic value. While Alex concedes the MacFarlane video (which is sponsored by Burger King and was brokered by Media Rights Capital) is still an "experiment," GCN sure does seem to bear a lot of resemblance to Google's traditional search model in the alignment of constituent interests.

Another twist here is that users who click for more video are driven back to MacFarlane's YouTube channel (already the 69th most subscribed channel, with almost 70K subscribers), which drives habituation, a key lever for ongoing video success as any network TV executive will admit. In this light, GCN gives Google a way of finally tying its powerful AdSense engine to YouTube. I'm not suggesting that Google is sweating the ROI on its $1.6 billion YouTube acquisition, but GCN surely looks like a way to move YouTube far beyond its roots as everyone's favorite UGC aggregator.

Alex is quick to point out that GCN does not budge Google from its often-stated position that it is not a content creator. Rather, it's using GCN to connect brands, content producers and users. If that connecting process drives audiences and generates revenues for content producers - and admittedly the proof is not yet in - that would give Google a lot of disruptive capital to help shape the video landscape. Just so nobody gets carried away, Google announced a similar experiment 2 years ago with MTV that fizzled out. So the company has yet to prove its experiment works and that it is fully committed to the GCN model.

Still, I continue to believe that video syndication - and the accompanying benefits to all - is a key, key driver of how the broadband video landscape is going to unfold. As a small teaser, there will be more interesting news on the syndication front early next week. Stay tuned.

(And note that the syndicated video economy will be one of the main topics of discussion at the Broadband Video Leadership Breakfast "How to Profit from Broadband Video's Disruptive Impact" with our A-list group of panelists, including Google's David Eun, on November 10th. Click here to learn more and register for special early bird rate.)

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Indie Video, Syndicated Video Economy

Topics: Google, Google Content Network, Seth MacFarlane, YouTube

-

Digging in Further on Broadcast Networks and Broadband

Yesterday's post, "Broadcast Networks' Use of Broadband Video is Accelerating Demise of their Business Model" spurred some great comments on the site, and as usual, a flurry of private emails to me from folks who don't want to comment publicly (this is a recurring VideoNuze phenomenon I've mentioned before...).

Since there's substantial interest in this topic and I thought some of my comments from yesterday needed some clarification, I want to dig in a little further today.

First I want to address the numbers I outlined, especially the benchmark of $1 of ad revenue per viewer per episode that I asserted NBC derives from "Heroes" on-air. I've had some push back that this number is too high and that it more likely is 50-75 cents/viewer/episode. As I refined my assumptions further, I do think I was probably a bit too optimistic, particularly regarding the actual number of ad units NBC sells. I do think all of these numbers are somewhere in the ballpark, but what they actually are on a show-by-show basis is obviously only known only to NBC itself.

That all said, the gap between today's "analog dollars" and the revenue being derived from online

distribution (the so-called "digital pennies") may still be pretty close to what I suggested yesterday. That's because I also had push back on my assumption that Hulu is generating an effective CPM of $60 (note, I had characterized that as "generous"). According to some folks, it's possible their eCPM could in fact be closer to $30 - or less. This is all private data, so again, it's really hard to pin this down.

distribution (the so-called "digital pennies") may still be pretty close to what I suggested yesterday. That's because I also had push back on my assumption that Hulu is generating an effective CPM of $60 (note, I had characterized that as "generous"). According to some folks, it's possible their eCPM could in fact be closer to $30 - or less. This is all private data, so again, it's really hard to pin this down. One point I'd like to make again, so nobody's left with any misimpressions: I don't believe networks have been wrong in pursuing online distribution of their shows. I applaud their proactivity. Rather, my problem is that I think the way they've chose to monetize broadband delivery - with such a paucity of ads - is not only under-monetizing and undervaluing their product, but also creating a set of consumer expectations about the online medium that are going to be hard to reverse.

For Hulu to put the equivalent of 1 1/2 minutes of advertising against "Heroes," when NBC can command premium on-air rates for about 20 minutes of ads, strikes me as seriously out of whack. At the risk of sounding anti-consumer, I think Hulu is hurting its parent company's financial interests by over-emphasizing its user experience. The consequences of Hulu's "limited commercial interruptions" policy are really the thesis of yesterday's post: I believe the networks own use of broadband is accelerating the demise of their traditional ad model.

To be clear, I'm not suggesting Heroes on Hulu should carry 20 minutes of ads, but I do think it can carry more than 1 1/2 minutes. As important, its ad model needs to quickly evolve to include better targeting, more engagement, more creative units, etc, to break from a purely CPM-based paradigm. I know that many folks are hard at work on these items.

Net, net, these are incredibly complicated times for networks. As the Portfolio piece says, NBC's Zucker is "unsparingly harsh about the prospects for broadcast television..." And NBC's issues don't end with broadband; as commenters to yesterday's post noted, it's also being buffeted by the effects of DVRs, VOD and fragmentation driven by social networks, mobile and other shifting consumer behaviors.

I love Zucker's sense of honesty and urgency about the network business. I thought NBC's hardheaded approach to obtaining variable pricing from iTunes was terrific. And as many of you know, I think Hulu's site execution has been world-class. But Hulu, NBC, and the other networks must recognize that their current approach to ad-supported broadband delivery is undervaluing their own product and hastening the demise of their traditional P&L.

What do you think? Post a comment now!

Categories: Advertising, Aggregators, Broadcasters

-

Broadcast Networks' Use of Broadband is Accelerating Demise of their Business Model

Last weekend I finally got a chance to read "Zuckervision," the splashy cover page piece about NBCU's CEO and president Jeff Zucker in the September issue of Conde Nast's Portfolio magazine. It's a pretty candid expose of the challenges that Zucker faces turning around the flagship NBC brand. More broadly though, it describes the challenges that all network executives have in trying to profitably navigate the digital era.

Zucker says, "Predicting what the media world is gonna look like in eight years is incredibly daunting. I defy

anybody to that." He's right, and I'm not going to take him up on his offer. What's more salient though is to focus on the here and now - on what networks are doing with ad-supported broadband distribution today. From this perspective I think it's fair to conclude that broadcast networks' current use of broadband is accelerating the demise of their business model.

anybody to that." He's right, and I'm not going to take him up on his offer. What's more salient though is to focus on the here and now - on what networks are doing with ad-supported broadband distribution today. From this perspective I think it's fair to conclude that broadcast networks' current use of broadband is accelerating the demise of their business model. That's right. For all of Zucker's and his compatriots' lament about "analog dollars being turned into digital pennies," as best I can tell, the networks themselves are actually the ones most responsible for turning this fear into a reality. I touched on this in a previous post, but here are the numbers explaining why.

When each of us, watches an episode of NBC's "Heroes," for example, on-air, NBC generates approximately $1.00 of advertising revenue (assuming NBC sells 75% of the 22 minutes of ads at a CPM of $30). That $1/viewer/episode figure obviously varies by program, but it's a good benchmark to use. (Note: per the following post, I think these assumptions are a little high, a more accurate range for NBC's revenue/viewer/episode is probably $.50 - $1.00.)

Now consider what happens when we watch "Heroes" on Hulu, NBC and Fox's well-respected aggregator. There are 5 ad breaks with just one 15 second ad in each break. There's also a 7 second "brand slate" at the beginning of each episode ("The following program is brought to you by....") and a display ad at the conclusion. Rounding up, let's say that totals three 30 second ads. Assuming Hulu sells all the ads at a generous $60 CPM (note that's 2x the on-air rate), the revenue/viewer/episode is 18 cents. That means that when you watch Heroes on Hulu, NBC is generating less than 20% of its customary revenue (hence the "digital pennies" fear).

Hulu's ad implementation is not unique - if you look at the other network sites, their ad models are roughly comparable. I don't know who came up with this ad approach, but I would contend that in their zeal to move prime time programs online, the networks have all gone too far in emphasizing a user-friendly experience over sound business discipline.

Hulu's ad implementation is not unique - if you look at the other network sites, their ad models are roughly comparable. I don't know who came up with this ad approach, but I would contend that in their zeal to move prime time programs online, the networks have all gone too far in emphasizing a user-friendly experience over sound business discipline. Of course, as consumers this new ad model is great. We get high-quality, free content at our fingertips, with minimal interruptions. For the vast majority of consumers, this value proposition beats buying and downloading an episode at iTunes any day (all the more so as popular shows like Heroes are bound to cost even more under NBC's new variable pricing relationship with Apple).

With the current model, NBC needs for Hulu to get more 5x its current CPM (which would be more than 10x NBC's current on-air CPM) just to stay even with its traditional ad model. That's a pipe dream. It doesn't matter how much interactivity or exclusivity Hulu can give an advertiser (and by the way Nissan already had full exclusivity in the Heroes episode I watched) no advertiser is going to pay 10x on-air rates. Simply put, Hulu's and others' minimal quantity of ads cannot be compensated for using higher prices.

Now that the genie is out of the bottle with the networks' online ad model, it's going to be awfully hard to make major modifications to it. As eyeballs inexorably shift from on-air to online, NBC and the other networks' top line ad revenues is going to get pinched. Also poised to bear the brunt is the whole Hollywood community accustomed to benefiting from on-air economics (Zucker's aggressive attempts to reduce expenses are also discussed in the Portfolio piece).

Bottom line: the way NBC and other networks have implemented broadband accelerates the vast change that is buffeting the broadcast business.

What do you think? Post a comment!

Categories: Advertising, Aggregators, Broadcasters

-

Fancast Gets a Facelift

Comcast's Fancast broadband portal has received a much-needed facelift, adding new features and content to compete with other well-funded players in this space. (Note: before you conclude that VideoNuze has become obsessed with covering Comcast - since just yesterday I dug into its ISP policies - rest assured, tomorrow I'll move on!)

Fancast is by far the most ambitious portal effort among the major cable operators. In fact, while other operators' portals target just their own ISP customers, Comcast's goal is to have Fancast compete for ANY broadband user's attention. That means that Fancast goes head to head with ad-based broadband aggregators like Hulu, Veoh, Joost, Metacafe, etc. And now with Fancast's new video download store, it also butts up against folks like iTunes, Amazon Unbox, Xbox LIVE Marketplace, etc. Then of course there's YouTube, the 800 pound gorilla of the broadband video world, which all aggregators, compete with on one level or another.

With such a formidable array of competitors, Fancast has a high bar to succeed. Still, I've maintained for a while that Comcast, with its 14 million+ broadband subscribers and 22 million+ cable subscribers is extremely well-positioned and needed to play aggressively in broadband video distribution. To date though I've been underwhelmed by Fancast, which seemed to have a solid vision, but sub-par execution. (For more on this, see 2 previous posts, here and here, comparing Hulu and Fancast.)

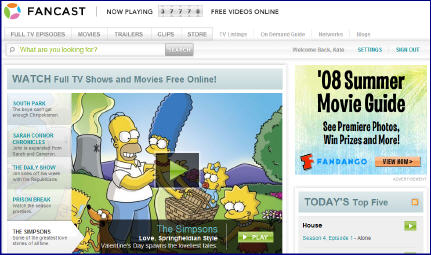

Now, with Fancast's facelift, the portal is getting some mojo. Fancast's director of communications Kate Noel recently took me on a spin through what's new. First up is a new home page (see below) that nicely showcases premium content that is curated by an in-house editorial team. Clicking on a selection reveals an oversize video player (which can be further enlarged to full screen). New features include embedding and sharing, along with a handy tool to be notified when a new episode is offered.

There's also a noticeable improvement in content selection, which Kate says now includes over 37,500 video assets; 320+ individual TV programs, 250+ movies and countless trailers and clips from over 100 content partners. Fancast is also putting a heavy emphasis on editorial differentiation, and has created sections such as "Today's Top 5," "Daily Buzz (blog)" and "Discover All Your Favorites." to help orient users on the site and provide editorial perspective.

This all plays to what Kate says is Fancast's larger mission to not just "offer TV online," but rather to "use Fancast as a cross-platform hub" that draws value from and drives value to Comcast's other offerings - digital cable, VOD and DVR service in particular.

With Comcast's huge cable subscriber base, that sounds right in theory. But how exactly Fancast fully executes on that potential still feels squishy. For example, doing a search for a current episode of "Mad Men" reveals a nice option to watch on VOD (since it's not currently on Fancast - that's a whole other story...), but is this really a game-changer? A much more significant lever at Comcast's disposal would be getting Fancast onto their digital cable boxes, so all that great Fancast content could be consumed in the living room (maybe along with YouTube, Funnyordie, NYTimes.com and other video?). The nagging question remains: will that day ever come?

One last thing that struck me about Fancast was its seemingly murky relationship with Hulu, which supplies many of Fancast's movies, and some of its TV programs. Is Hulu a Fancast competitor, a partner, both? Kate says Hulu is not competitive. Yet at the end of the day, aren't both Hulu and Fancast competing for the same ad dollars, and eyeballs? Here's another question: with Comcast's vast programming arm, why can't it procure movies directly from studios, instead of cutting Hulu in on the action? I must say, it's all very confusing.

Still, to the average user, the new Fancast is an improvement, and there is more progress yet to come.

What do you think? Post a comment now!

Categories: Aggregators, Cable TV Operators, Portals

Topics: Comcast, Fancast, Hulu

-

1Cast: A Legit Redlasso Successor Has Tall Mountain to Climb

Personalized online news is as old as the web itself. But personalized online video news is a nut that has yet to be fully cracked - although by all rights it should be. This was Redlasso's goal, until broadcasters, which hadn't given permission for their content to be ingested and shared, put an end to the young company last month.

Now comes 1Cast, a company seeking to be a legitimate Redlasso successor. Today it is announcing first round funding from wireless king Craig McCaw's Eagle River Holdings. Yesterday I got more details from 1Cast CEO Anthony Bontrager.

Anthony has correctly realized that gaining deals with video news partners is an absolute prerequisite to

success. To that end he says the company will have "no shortage" of content, and also has a particular focus on "repatriating international content." Though for now he's not disclosing any details, based on conversations I've had with broadcasters, my sense is that credible companies, even when early stage, can get deals done.

success. To that end he says the company will have "no shortage" of content, and also has a particular focus on "repatriating international content." Though for now he's not disclosing any details, based on conversations I've had with broadcasters, my sense is that credible companies, even when early stage, can get deals done.Yet there are other key success factors for a personalized news aggregator like 1Cast to succeed. Three that are high on my list are user experience, audience growth and revenue generation. Miss on any of these three and I think the model fails.

From a user experience standpoint, Anthony says creating a new personalized "micro-cast" is a simple three step process. That sounds promising, though since the beta won't open till later month (with full launch late in '08), I can't judge the specifics yet. And the wildcard is how content providers will ultimately react to having their videos mashed together with competitors' videos in a single micro-cast.

Growing an audience is a more daunting. As we all know, the web is incredibly noisy, and users have well-entrenched news-gathering habits. Yet there is white space in personalized video news. Anthony said that while 1Cast will be a central hub, he's focused on "channel partners" as well, and portals in particular, to grow traffic. Deals with majors like Yahoo, AOL, MSN, and others would be a huge win, but are notoriously hard to clinch for startups.

Last, but not least is revenue. Even assuming an audience can be built, optimally monetizing it is a challenge. Anthony said they're working with an undisclosed ad network and will also build their own sales team. Direct sales are important as living primarily off an ad network's splits will not produce sufficient revenue for 1Cast.

Yet even a direct sales team isn't a panacea; Anthony mentioned that some content providers want to sell any new impressions 1Cast generates. That's consistent with how I understand other Syndicated Video Economy deals like these work as well. But like other aggregators, that leaves 1Cast with a swiss cheese inventory situation that is complex to sell. Then factor in that some inventory will be essentially local in nature (i.e. generated from local video news) - which really requires a local sales orientation to fully monetize - and complexity grows still further.

Add it all up and 1Cast has a tall mountain to climb to succeed. Not insurmountable, but definitely challenging. From a consumer standpoint, personalized video news is very compelling; I just wonder whether a 6-person startup has the necessary mojo or if it requires a larger player with deep resources and content relationships. Meanwhile broadcasters are pursuing their own video initiatives and others like Voxant, WorldNow and Critical Media have been circling these waters for a while. 1Cast has an ambitious story; how it unfolds will be worth watching.

What do you think? Post a comment!

Categories: Aggregators, Startups, Syndicated Video Economy

Topics: 1Cast, Critical Media, RedLasso, Voxant, WorldNow

-

New Magid Survey: Short-Form Dominates Online Video Consumption and Hurts TV Viewership

Survey results being released this morning by Frank N. Magid Associates, a research consultancy, and video aggregator Metacafe provide fresh evidence that short-form video dominates online video consumption. Notably, the survey also goes a step further, finding that 28% of respondents who watch online video report watching less TV as a result.

Meanwhile though, on the same day earlier this week that I was talking to Mike Vorhaus, managing director at Magid, and Erick Hachenburg, CEO of Metacafe about this new survey, Mediaweek was reporting a separate Magid survey, commissioned by CBS, which found that "35% of the nearly 50,000 streamers surveyed...reported that they are more likely to view shows on the network as a result of having been exposed to content on the web."

As I learned from Mike, there's no actual contradiction in these 2 surveys' findings, but you do have to squint your eyes a bit to make sure you're understanding the data accurately.

First, the findings on short-form's domination. The Metacafe survey asked respondents about the most commonly viewed types of video and presented them with category choices. The top 5 selected were all short-form oriented: Comedy/jokes/bloopers (37%), music videos (36%), videos shot and uploaded by consumers (33%), news stories (31%) and movie previews (28%). TV shows comes in at #6 (25%), followed by more short-form categories of weather, TV clips and sports clips.

First, the findings on short-form's domination. The Metacafe survey asked respondents about the most commonly viewed types of video and presented them with category choices. The top 5 selected were all short-form oriented: Comedy/jokes/bloopers (37%), music videos (36%), videos shot and uploaded by consumers (33%), news stories (31%) and movie previews (28%). TV shows comes in at #6 (25%), followed by more short-form categories of weather, TV clips and sports clips. That short-form, snackable video dominates is not really a huge surprise, given YouTube's market share and the preponderance of virally shared clips. Yet Mike emphasized that short-form does not equal UGC, a point that Erick also highlights. Rather, Mike sees short-form as a legitimate alternative entertainment format that creatives are embracing and audiences are adopting. It is causing further audience fragmentation resulting in the TV audience erosion that the survey also uncovered.

Which of course begs how Magid's CBS survey data squares up. Mike explained that the key here is that the

CBS survey is based solely on users of CBS.com. These people naturally have a greater affinity for CBS programming and their likelihood of watching CBS shows on TV will be far higher than randomly-selected audiences (such as in the Metacafe survey). Here's the CBS press release for more details.

CBS survey is based solely on users of CBS.com. These people naturally have a greater affinity for CBS programming and their likelihood of watching CBS shows on TV will be far higher than randomly-selected audiences (such as in the Metacafe survey). Here's the CBS press release for more details.So the CBS data suggests that networks should be encouraged that streaming their shows builds loyalty and broadcast viewership, and therefore that they should keep on doing it. Nevertheless they need to be mindful that their shows now compete in a far larger universe of video choices, and that short-form - as a new genre - is something they too should be looking to exploit. Appropriately, all the networks, and many studios, are doing exactly that.

There is no shortage of research concerning consumer media behavior floating around these days. As the two Magid surveys show, superficially data may appear to be conflicting, though in reality it is not. Observers need to make sure they're digging in, and taking away the right lessons.

What do you think? Post a comment now!

Categories: Aggregators, Broadcasters

Topics: CBS, Magid, MetaCafe, YouTube

-

Metacafe's New Wikicafe Refines Metadata Process

Metacafe, the short-form video aggregator with 30 million monthly visitors, has unveiled a new feature called "Wikicafe" which addresses the daunting and ongoing problem of how to find exactly the video you're looking for and gain high-quality recommendations.

Now in beta and available to its registered users only, Wikicafe is philisophically similar to Wikipedia, which involves users in building the knowledge base around specific content. Similarly, Wikicafe's goal is to involve users in continually refining the metadata for specific videos. This in turn will yield improved search and discovery for subsequent users.

Wikicafe is an intriguing spin on video search which I have discussed a number of times. Last week I spoke to Eyal Hertzog, Metacafe's co-founder and now chief creative officer, who's leading the charge on Wikicafe. This was the first briefing Metacafe has given on the new Wikicafe feature.

Eyal notes that there are really two ways to tackle content navigation. One is through super-sophisticated algorithms and distributed hardware, an approach epitomized by Google. The other is community-based collaboration, an approach epitomized by Wikipedia. He is biased toward the latter because he believes that the likelihood that the original metadata assigned by the video's creator (and even subsequent metadata that may be produced by technology-based approaches) will never be as accurate as that which is produced by other humans with specific domain knowledge.

Thus the idea behind Wikicafe: if given the right tools, Metacafe's users will create and maintain the most accurate metadata for Metacafe's vast collection of videos. It's a classic "wisdom of crowds" approach. Of course, it also requires that users act appropriately or things could spin out of control very quickly.

Wikicafe is very straightforward to use. Once logged in, you simply click on "Editing Options" in the upper right corner of each video. Then you can start editing the video's title, tags, description and then save your changes. You can track your changes (and those that others add), be notified about subsequent changes and start a discussion about your changes. You can even translate your changes into other languages. As Eyal explains it, this "collaborative taxonomy" allows redirection between related terms ("PS3" and "Playstation3"), clarifies ambiguous words, resolves hierarchical terms and connects different languages.

In a sense, Wikicafe is a natural evolution for Metacafe, which has always emphasized community involvement in filtering which content gets added and promoted on the site. With a group of active, passionate users and Wikipedia as a model, it seems likely that Wikicafe will gain traction in the community.

What then becomes especially intriguing is the potential for carrying the Wikicafe approach outside of Metacafe's borders for the larger universe of broadband video. Could users eventually become an augment or even replacement to top-down driven video guides, the norm in today's cable and satellite offerings? It's an interesting vision to contemplate. First let's see how Wikicafe evolves in the Metacafe community.

What do you think? Post a comment now!

Categories: Aggregators, Technology, Video Search

Topics: Google, MetaCafe, Wikipedia

-

June '08 VideoNuze Recap - 3 Key Topics

Wrapping up a busy June, I'd like to quickly recap 3 key topics covered in VideoNuze:

1. Execution matters as much as strategy

I've been mindful since the launch of VideoNuze to not just focus on big strategic shifts in the industry, but also on the important role of execution. I'm not planning to get too far into the tactical weeds, but I do intend to show examples where possible of how successful execution can make a difference. This month, in 2 posts comparing and contrasting Hulu and Fancast (here and here) I tried to constructively show how a nimble upstart can get a toehold against an entrenched incumbent by getting things right.

While great execution is a key to successful online businesses, it may sometimes feel pretty mundane. For example, in "Jacob's Pillow Uses Video to Enhance Customer Experience" I shared an example of an arts organization has begun including video samples of upcoming performances on its web site, improving the user experience and no doubt enhancing ticket sales. A small touch with a big reward. And in this post about the analytics firm Visible Measures, I tried to explain how rigorous tracking can enhance programming and product decisions. I'll continue to find examples of where execution has had an impact, whether positive or negative.

2. Cable TV industry impacted by broadband

As many of you know, I believe the cable TV industry is a crucial element of the broadband video industry. Cable operators now provide tens of millions of consumer broadband connections. And cable networks have become active in delivering their programs and clips via broadband. Yet the broadband's relationships with operators and networks are complex, presenting a range of opportunities and challenges.

On the opportunities side, in "Cable's Subscriber Fees Matter, A Lot," I explained how the monthly sub fees that networks collect put them on a firm financial footing for weathering broadband's changes and an advantageous position compared to broadband content startups which must survive solely on ads. Further, syndication is offering new distribution opportunities, as evidenced by Scripps Networks syndication deal with AOL in May and Comedy Central's syndication of Daily Show and Colbert Report to Hulu and Adobe. Yet cable networks are challenged to exploit broadband's new opportunities while not antagonizing their traditional distributors.

For operators, though broadband access provides billions in monthly revenues, broadband is ultimately going to challenge their traditional video subscription business. In "Video Aggregators Have Raised $366+ Million to Date," I itemized the torrent of money that's flowed into the broadband aggregation space, with players ultimately vying for a piece of cable's aggregation revenue. These and other companies are working hard to change the video industry's value chain. There will be a lot more news from them yet to come.

3. Video publishing/management platforms continue to evolve

Lastly, I continued covering the all-important video content publishing/management platform space this month, with product updates from PermissionTV, Brightcove and Entriq/Dayport. Yesterday, in introducing Delve Networks, another new player, I included a chart of all the companies in this space. I put a significant emphasis on this area because it is a key building block to making the broadband video industry work.

These companies are jostling with each other to provide the tools that content providers need to deliver and optimize the broadband experience. The competitive dynamic between these companies is very blurry though, with each emphasizing different features and capabilities. Nonetheless, each seems to be winning a share of the expanding market. I'll continue covering this segment of the industry as it evolves.

That's it for June; I have lots more good stuff planned for July!

Categories: Aggregators, Cable Networks, Cable TV Operators, Technology

Topics: AOL, Brightcove, Comedy Central, Delve, Entriq, Fancast, Hulu, Jacobs Pillow, PermissionTV, Scripps, Visible Measures

-

The Incredibly Growing YouTube

Closing out the week, I missed this blurb from Information Week yesterday reporting YouTube's staggering dominance of broadband video traffic. New numbers out from Hitwise show that in May '08 YouTube garnered 75% of the 10 million visits to 63 video sites that Hitwise is tracking. That's 9 times the traffic of #2 MySpaceTV and more than 20 times that of the #3 site which is Google's other video property (remember it?)

According to Hitwise YouTube's share rose 26% from a year ago compared with drops by all the others in the top 5 sites except Veoh, which rose by 32% from a year ago.

It's just mind-boggling to think that one site could have such market share, particularly when a lot of the

networks' programs cannot be found there. I think it speaks to how strong users' appetites are for UGC and viral content remain, how YouTube has become a de facto video platform for lots of smaller players in the industry (and consumers) and how the company is likely beginning to enjoy some early success with its partners' channels.

networks' programs cannot be found there. I think it speaks to how strong users' appetites are for UGC and viral content remain, how YouTube has become a de facto video platform for lots of smaller players in the industry (and consumers) and how the company is likely beginning to enjoy some early success with its partners' channels. A few months ago, in "YouTube: Over-the-Top's Best Friend" I wrote that YouTube is quickly becoming the perfect ally for all those makers of new broadband-to-the-TV devices. These companies desperately need content and credible brands to help pull through consumer demand. YouTube offers both. In this sense, YouTube has huge value yet to be tapped (of course demonstrating that it can monetize its massive audience wouldn't hurt its partnership value...)

However, looked at another way, YouTube's success should be very encouraging to other players. To start with, YouTube is doing a marvelous job educating the world about the virtues of broadband video. And while YouTube is the market's 800 pound gorilla, it is still leaving key opportunities open for other players to differentiate themselves. Potential areas include high-quality delivery, ad-based and paid monetization and offering content that YouTube simply doesn't have (examples: Comedy Central programs like "The Daily Show" and "Colbert Report")

Volumes are yet to be written about YouTube. Whether it turns its market-leading traffic into a financially-explosive franchise or forever remains a red-ink spewing blip on Google's P&L is yet to be seen. Either way, when the history of broadband video is written, YouTube will be featured prominently.

Categories: Aggregators, UGC, Video Sharing

Topics: Comedy Central, Hitwise, MySpaceTV, Veoh, YouTube

-

Comcast/Fancast, Hulu and the Role of Great Execution, Part 2

A couple of weeks ago in "Hulu Out-Executing Comcast in On-Demand Programming?" I took Comcast's Fancast to task because Hulu was first to implement its deal with Comedy Central for full episodes of "The Daily Show" and "Colbert Report." It was a missed opportunity for Fancast, which had previously announced a deal with Comedy Central for these shows. Hulu gained a bonanza of favorable press attention, likely spiking its usage.

Well fair is fair and so I'm now happy to report that Fancast has also posted these programs. But at the risk of sounding like a Fancast scourge (which I'm really not trying to be) Hulu continues to distinguish itself with a superior user experience. For those looking to succeed in broadband video the execution differences between these two sites provide key lessons.

First, after searching for The Daily Show on Hulu, the site automatically displays the most recent episodes first (beginning with last night's episode). When starting the player, Hulu's quick 7 second "brand slate" runs and then the program starts. This emphasis on a quick payoff no doubt reflects lessons Hulu's CEO Jason Kilar learned from his years at Amazon, which, like all great e-commerce sites knows that a distraction-free checkout process results in more completed transactions.

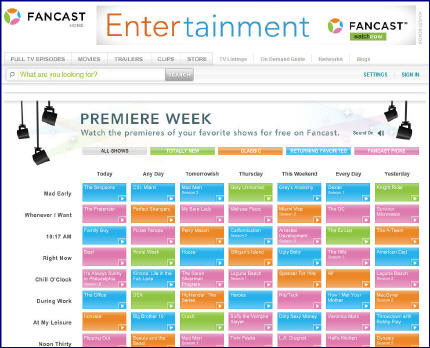

Conversely, at Fancast, after doing a search for Daily Show, the results are "Sorted by air date Ascending | Descending." Ascending is pre-selected, and the first episode shown is from April 9th, with Lewis Black. Huh - why such an old episode being shown first by default? And is the average user really going to be familiar with these sorting terms? Why not just offer choices like "Newest" and "Oldest" with "Newest" as the default?