-

Amazon VOD Now On Roku; Battle with Apple Looms Ahead

Amazon and Roku announced yesterday that Amazon's VOD service will soon be available on Roku's $99 Digital Video Player. The deal starts to make good on Roku CEO Anthony Woods's intentions about "opening up the platform to anyone who wants to put their video service on this box."

With Amazon VOD's 40,000+ TV programs and movies added to the 12,000 titles already available to Netflix subscribers via its Watch Instantly service (plus more content deals yet to come), little Roku is starting to look like a potentially important link in the evolving "over-the-top" video distribution value chain.

More interesting though, is that I think we're starting to see the battle lines drawn for supremacy in the download-to-own/download-to-rent premium video category between Amazon on one side and Apple on the other. Though Apple dominates this market today, having sold 200 million TV programs alone, there are ample reasons to believe competition is going to stiffen.

Apple is of course in the video download business for the same reasons it was in the music download business: to drive sales of the iPod and more recently - and to a lesser extent - the iPhone. According to the latest info I could find, iTunes now has 32,000+ TV programs and movies, including a growing number in

HD. For now that's slightly less than Amazon VOD, but my guess is that over time the two libraries will be virtually identical.

HD. For now that's slightly less than Amazon VOD, but my guess is that over time the two libraries will be virtually identical. While Apple has a near monopoly on portable viewing via the iPod and iPhone, it is a laggard in bridging broadband-to-the-TV. Its Apple TV device, introduced in January, 2007, and meant to give iTunes access on the TV, has been an underperformer. Certainly a detractor has been price, with the 40GB lower-end model still running $229. But more importantly, as an iTunes-only box, Apple TV perpetuates a closed, "walled-garden" paradigm that consumers are increasingly rejecting (as companies like Roku astutely understand).

For Amazon, the world's largest online retailer, video downloads are a rich growth market. The company brings significant advantages to the table, starting with tens of millions of existing customer relationships with credit cards or other payment options just waiting to be charged for video downloads. Amazon has strong brand name recognition and trust. And of course, it has a near-limitless ability to cross-promote downloads with DVDs and other products.

Determined not to be left behind in the great race to get broadband delivered video all the way to the TV, it has been integrating its VOD service with 3rd party devices like TiVo, Sony's Bravia Internet Video Link, Xbox 360 and Windows Media Center PCs. Its latest deal with Roku is far from its last.

Amazon VOD's adoption will benefit from the fact that there are many non-Amazon reasons that people will be buying these devices. For example, consider Roku, TiVo and Xbox 360. With Roku, Netflix is fueling sales. As Netflix subscribers realize that new releases are generally not available in Watch Instantly, but are through Amazon VOD on Roku, they'll be prone to give Amazon VOD a try (the Netflix limitation is course due to Hollywood's windowing, and another reason why I believe it's crucial for Netflix to make deals with broadcast networks for online distribution of their hit programs). For TiVo and Xbox 360, each has a well-defined value proposition for consumers to purchase. Amazon VOD's availability is a pure bonus for buyers.

Amazon VOD's adoption will benefit from the fact that there are many non-Amazon reasons that people will be buying these devices. For example, consider Roku, TiVo and Xbox 360. With Roku, Netflix is fueling sales. As Netflix subscribers realize that new releases are generally not available in Watch Instantly, but are through Amazon VOD on Roku, they'll be prone to give Amazon VOD a try (the Netflix limitation is course due to Hollywood's windowing, and another reason why I believe it's crucial for Netflix to make deals with broadcast networks for online distribution of their hit programs). For TiVo and Xbox 360, each has a well-defined value proposition for consumers to purchase. Amazon VOD's availability is a pure bonus for buyers.Still, Amazon VOD's Achilles heel that it is missing a portable playback companion on a par with the iPod and iPhone. Users clearly value portability and Amazon needs to solve this problem (hmm, can you say "Kindle for Video?"). Yet another issue is that despite its various 3rd party device deals, the user experience will always be governed by these devices' strengths and weaknesses. In this respect, Apple's ownership of the whole hardware/software/services ecosystem gives it significant user experience advantages (which of course it has masterfully exploited with iTunes/iPod).

Apple and Amazon hardly have the market to themselves though. Others like Microsoft Xbox LIVE, Vudu and Sezmi are vying for a place in the market. And then of course there are the VOD offerings from the cable/satellite/telco video service providers, who have big-time incumbency advantages. Not to be forgotten in all of this is consumer inertia around the robust DVD market, which to a large extent all of these video download options seek to supplant.

In the middle of all this are Joe and Jane Consumer - soon to be overwhelmed by a barrage of competing and confusing offers for how to get on-demand TV program and movie downloads in better, faster and cheaper ways. In this market, I believe simplicity, content choices, brand and especially price will determine the eventual winners and losers. These are front and center considerations for Amazon, Apple and all the others going forward.

What do you think? Post a comment now.

Categories: Aggregators, Devices, Downloads, FIlms, HD

Topics: Amazon, Apple, iTunes, Roku, SezMi, TiVo, VUDU, XBox

-

Netflix and LG Go Over-the-Top with New "Broadband HDTVs"

Happy New Year and welcome to 2009.

The new year is picking up right where the old year left off - with Netflix adding yet another way for its subscribers to use its Watch Instantly streaming service on their TVs. Today's announcement that its WI software will be embedded in a select number of new LG "Broadband HDTVs" is more evidence of how content providers and consumer electronics companies are aiming to go "over the top" of cable/satellite/telco, driving high quality broadband video all the way to the TV.

The new LG Broadband HDTVs joins XBox 360, TiVo, Samsung and LG Blu-ray players and Roku as options

for Netflix subscribers looking to watch WI on their TVs. The differentiator here is that this is the first "boxless" approach, so it offers a potentially simpler (though not less expensive) solution for consumers. No doubt it is the first of many deals Netflix will announce with TV manufacturers in '09.

for Netflix subscribers looking to watch WI on their TVs. The differentiator here is that this is the first "boxless" approach, so it offers a potentially simpler (though not less expensive) solution for consumers. No doubt it is the first of many deals Netflix will announce with TV manufacturers in '09.Still, my bet is that the group of box-based solutions will matter more to WI usage for a long time to come. That's because, even though LG is the #3 HDTV manufacturer, TV set replacement cycles are getting longer with the down economy, the new Broadband HDTVs will likely have a several hundred dollar price premium, and importantly, a solid portion of the existing Netflix subscriber target audience for these broadband sets may have long since been using one of the box-based alternatives and not see a lot of incremental benefit in buying one of the LG Broadband HDTVs.

Nevertheless, I think an interesting target market for these sets are non-Netflix subscribers, who are open to a "cord-cutting" proposition. Netflix is laying the groundwork for becoming a genuine alternative to today's multichannel subscription video services. As I've said before, to make itself more viable as an alternative, the most important thing Netflix can do is beef-up WI's broadcast network programming library.

When top-tier broadcast network programming is combined with its movie catalog, Netflix could become very appealing for consumers who don't care much about cable network programs or sports. For $17/month for Netflix vs. $60/month or more for a typical digital TV package from cable/satellite/telco, the math on paying the premium for the Netflix-enabled LG TV becomes much more interesting. Importantly, the retailer has a much stronger hook to sell the LG Broadband HDTVs, especially if, as an added incentive, Netflix perhaps threw in a 3-4 month trial subscription.

When top-tier broadcast network programming is combined with its movie catalog, Netflix could become very appealing for consumers who don't care much about cable network programs or sports. For $17/month for Netflix vs. $60/month or more for a typical digital TV package from cable/satellite/telco, the math on paying the premium for the Netflix-enabled LG TV becomes much more interesting. Importantly, the retailer has a much stronger hook to sell the LG Broadband HDTVs, especially if, as an added incentive, Netflix perhaps threw in a 3-4 month trial subscription.The bottom line here is that Netflix continues to do the right thing by building out the portfolio of devices that play its WI streaming programming. The bigger the addressable audience is, the more that content providers of all stripes will take notice and want to do deals (Netflix's expansion of its promotional deal with Showtime is a useful data point on this subject). No other non-cable/satellite/telco subscription video service is close to Netflix in terms of number of subscribers, compatible streaming devices, library or brand name. In '09, Netflix is poised to build on these advantages as it morphs itself into an over-the-top broadband powerhouse.

What do you think? Post a comment now.

Categories: Aggregators, Devices

-

Recapping 5 Broadband Video Predictions for 2009

For those who weren't up for reading 700-1,000 words each day last week, today I offer a quick recap my 5 broadband video projections for 2009.

1. The Syndicated Video Economy Accelerates

This one is easily my least controversial prediction, since I've been writing about this trend for most of 2008. The "SVE" as I call it, is an ecosystem of video content providers, distributors and the technology companies who facilitate their relationships. In '08 video content providers increasingly realized that widespread distribution to the sites that users already frequent would improve on the "one central destination site" approach. That's a big change in the traditional media mentality. In '09 the SVE will only accelerate, as the technology building blocks for distributing, monetizing and measuring syndicated video continues to improve. To be sure, the SVE is still nascent, but many companies across the broadband landscape have begun embracing it in earnest.

2. Mobile Video Takes Off, Finally

In '08 VideoNuze has been mainly focused on wired broadband delivery of video to homes and businesses. But as the year has progressed, powerful new mobile devices have mutated the definition of broadband to also include wireless delivery. The huge success of the iPhone and other newer video-capable devices, coupled with 3G, and soon 4G networks, have contributed to mobile delivery finally realizing some of its long-held promise. Still, as some of you commented, obstacles remain. iPhones don't support Flash, the most popular video format. Wireless carriers are careful with doling out too much bandwidth for video apps. And so on. Still, '08 was a big year for video delivery to mobile devices, and I think '09 will be even bigger.

3. Net Neutrality Remains Dormant

Proponents of "net neutrality" legislation, which would codify the Internet's level playing field, expected that under an Obama administration they would finally be granted their wish, particularly since he supported the concept on the campaign trail. But I'm predicting that net neutrality will be dormant for yet another year. Mr. Obama has been emphatic about basing policy decisions on facts and data, and this is an area where net neutrality advocates continue to come up short as there's yet to be any sustained and proven ISP misbehavior. With Mr. Obama and his team having urgent fires to address all around them, there are only two scenarios I can see that move net neutrality up the prioritization list: a startling new pattern of ISP misbehavior or some kind of deal ISPs agree to in exchange for infrastructure buildout subsidies from the stimulus package.

4. Ad-Supported Premium Video Aggregators Shakeout

One of the best-funded categories of the broadband landscape has been aggregators of premium-quality video - TV programs, movies and other well-produced video. These companies have been thought of as potential long-term online competitors to today's video distributors (cable/satellite/telco). However, it's proving very difficult for these sites to differentiate themselves. Content is commonly available, user experience advantages are hard to maintain, user acquisition is not straightforward, audiences are fragmented and ad dollars are under pressure. All of this means that '09 will see a shakeout among the many players in this category, though it's hard to predict at this point who will be left standing (though at a minimum I expect Hulu and Fancast to be in this group).

5. Microsoft Will Acquire Netflix

My long-ball prediction was that at some point in '09 Microsoft will acquire Netflix. Though many of you emailed me offering kudos for boldness, not many are buying into my prediction. Fair enough, I'll either be flat-out wrong on this one or I'll get a gold star for prescience. I provided my rationale, which starts with the assumption that Apple and Google (Microsoft's two fiercest rivals in the consumer space) are best-positioned for success in the battle for the biggest consumer prize of the next 10 years: delivering broadband video services directly to the TV.

I think Microsoft needs to directly play in this space, and Netflix is a perfect vehicle. It has a great brand, a large and loyal subscriber base and excellent back-end fulfillment systems. In 2008 Netflix great strides in broadband, building out its "Watch Instantly" feature. Yet to grow WI's catalog from its current 12K titles to anything approaching the 100K+ available by DVD will require deep financial resources to deal with a recalcitrant Hollywood, and also shelter from quarter-to-quarter earnings pressures. Netflix's measured approach to broadband is consistent with its historical overall operating style. While that style has worked exceedingly well in the past, the broadband-to-the-TV service landscape is wide open right now, and Netflix should be pursuing in a thoughtful, yet ultra-aggressive way. Combined with Microsoft it would be poised to become the broadband video category leader over the next 10 years.

OK, there's the summary. I'll be checking back in on these as the year progresses.

What do you think? Post a comment now.

Categories: Aggregators, Broadband ISPs, Deals & Financings, Mobile Video, Predictions, Syndicated Video Economy

Topics: Apple, Fancast, Google, Hulu, Microsoft, Net Neutrality, Netflix

-

2009 Prediction #5: Microsoft Will Acquire Netflix

As I promised, I've tried to make my 2009 broadband predictions bolder as the week has progressed. So to cap off the week, I'm offering up a doozy: my 2009 prediction #5 is that Microsoft will acquire Netflix sometime next year.

Before I get into my rationale, I want to be perfectly clear that I have absolutely no insider information, nor have I talked to anyone at either company about this prediction, which is solely my own personal opinion. I don't directly own stock in either company, though I may have some in various mutual funds I own. This prediction doesn't constitute advice to purchase stock in either company. I'm an industry analyst who happens to believe that this deal would make a lot of strategic sense for both companies based on my assumptions about broadband video's future.

First, it's important to understand that the single biggest consumer market opportunity in the next 10 years will be delivering premium-quality video (mainly hit TV programs and movies) over broadband Internet connections to TVs. Broadband is poised to disrupt the current providers of multichannel video (cable/satellite/telco) which generate about $80-100 billion of annual revenue in the U.S. alone. Rich potential rewards await successful new broadband-only or "over the top" entrants.

While Microsoft has an impressive portfolio of consumer-facing products (e.g. Xbox, Silverlight, WMP, IE,

MSN, etc.), the reality is that today it lacks a well-branded service offering with sufficient consumer traction to credibly vie for a piece of the multichannel video market that will be up for grabs. It is unimaginable to me that Microsoft will continue to content itself with focusing only on the enablers like those listed above, along with its Mediaroom IPTV software platform, while others launch new broadband video services to consumers. Further, since the race is actually already well underway, the classic "build vs. buy" analysis tilts heavily toward "buy," especially if a jewel like Netflix is possibly available.

MSN, etc.), the reality is that today it lacks a well-branded service offering with sufficient consumer traction to credibly vie for a piece of the multichannel video market that will be up for grabs. It is unimaginable to me that Microsoft will continue to content itself with focusing only on the enablers like those listed above, along with its Mediaroom IPTV software platform, while others launch new broadband video services to consumers. Further, since the race is actually already well underway, the classic "build vs. buy" analysis tilts heavily toward "buy," especially if a jewel like Netflix is possibly available. Another Microsoft motivator is that its two keenest competitors in the consumer space, Apple and Google, also happen to be the two best-positioned companies to deliver premium video to the TV using broadband. In iTunes, Apple has by far the most successful consumer-paid download store which is already highly relevant to studios and networks (witness NBC's decision to return to iTunes earlier this fall), not to mention the most successful devices (iPod and iPhone). iTunes is Apple's springboard into disrupting the traditional multichannel video model, though exactly how the company will do so is yet to be determined. Its initial foray with Apple TV is hardly the company's final word. And with Steve Jobs' personal stake in Disney, Apple has a lot of insight and leverage to get things done in Hollywood.

Meanwhile Google, when combined with YouTube, has the highest potential for delivering an ad-supported premium broadband video service. I recognize that the operative word in that sentence is "potential." YouTube still has lots of monetization challenges. And though it has made great strides adding premium video to its site in '08, I doubt many users yet associate YouTube with premium video the way they do with Hulu for example, or any of the network sites for that matter. Further, YouTube has made little progress in articulating a strategy for getting to the TV. In a post I did earlier this year, "YouTube: Over-the-Top's Best Friend" I suggested that it would be an appealing partner for all of the over-the-top device makers, who desperately need content and a brand to penetrate the market.

Despite these shortcomings, when you consider the upside of Google Content Network and the reality that YouTube dominates video usage with 40% share of all monthly streams, its potential from an ad-supported standpoint is impressive.

Meanwhile Netflix, with over 8 million subscribers, is the most successful video subscription service outside

of the cable/satellite/telco industry. Nobody else is even close. Netflix's big opportunity is to morph its DVD-by-mail business into an online delivery model. If it succeeds it could pose significant new on-demand competition to today's multichannel providers (something that cable operators now well appreciate according to several people I've spoken to).

of the cable/satellite/telco industry. Nobody else is even close. Netflix's big opportunity is to morph its DVD-by-mail business into an online delivery model. If it succeeds it could pose significant new on-demand competition to today's multichannel providers (something that cable operators now well appreciate according to several people I've spoken to).2008 has been a very good year for Netflix in broadband. It has beefed up its WI catalog to 12,000 titles by doing deals with Starz, CBS and Disney. It has gained a toehold in the home with its Roku box, and by integrating with Xbox 360 and LG and Samsung Blu-ray players. By offering WI as a value add instead of an extra charge, it has further strengthened its customer relationships and begun collecting valuable data about what impact WI can have on future subscriber acquisition costs and retention tactics.

As I've pointed out previously, Netflix's problem is that growing its WI catalog, so that it can be perceived as a bona fide replacement for DVDs-by-mail, is a tough challenge. In most of its content deals, Netflix has DVD-based subscription rights, but not electronic or online subscription rights. That's why it only offers 12,000 titles on WI out of its total catalog of 100,000+ titles on DVD.

The major pay TV channels (HBO, Showtime and Starz) have paid billions of dollars for these exclusive electronic rights. Though Netflix was able to do a content deal with Starz, I think similar deals with HBO or Showtime are highly unlikely. Neither network is nearly as committed to online, and both no doubt view Netflix as an eventual competitor.

Reviewing Netflix's recent "Investor Day" presentation, it is clear that the company is taking a concerted, yet gradual approach to online distribution, at one point stating that the evolution to full streaming will happen over 20 years. Since Netflix is a public company and has to manage Wall Street's expectations and its quarter-to-quarter earnings, it must emphasize gradual, not disruptive, change. One look at the gorgeous hockey stick graphs of Netflix's historical revenue and earnings growth over the years attests to its "steady-Eddie" approach.

Indeed, while that approach is admirable, I think broadband represents a game-changing opportunity for Netflix. As such, rather than easing into it as the company appears to be doing, it should instead be pursuing it full bore, capitalizing on the opening competitors like Apple and Google have currently created. However, doing so will require vastly more resources, as well as insulation from public market pressures. So here are some of the appealing points of a Microsoft acquisition:

- Microsoft would instantly give Netflix new economic clout in Hollywood to compete with the pay TV networks' studio deals as they come up for renewal, scrambling the traditional "windowing" paradigm and clearing a path to a far stronger future WI catalog.

- Microsoft would also allow Netflix to build a business model where it pays broadcast networks a fee for their programs. Over time these payments could become an important adjunct to broadcasters' traditional advertising model (much like cable networks' rely on both affiliate fees and advertising). If successful, Netflix could possibly even gain preferred terms relative to broadcasters' distribution to ad-supported online aggregators.

- As the WI model takes shape, Netflix would also be in a totally new position to approach certain cable networks - who are among the most reluctant to embrace broadband delivery for their full episodes - with financial incentives that could rival what they currently collect from their cable/satellite/telco affiliates. Deals with cable networks would give potential "cord cutters" more comfort in doing so, while also pressuring the close ties between cable networks and operators.

- Just as Google has given YouTube financial cover for its spiraling bandwidth/delivery costs, Microsoft could do the same for Netflix, as it encourages its subscribers to use WI more heavily.

- Last but not least, there's Microsoft's MSN, which not only represents a solid intra-company promotional platform for Netflix's subscriber acquisition, but also the possibility of a new Netflix ad-supported service. This isn't something the company has ever pursued, but is an intriguing as a possible competitor to the likes of Hulu and others. It would give Netflix a unique hybrid paid/free model.

So that's the strategic rationale. Then there's a lot of other existing inter-company stuff that lays nice groundwork for a deal: Netflix CEO Reed Hastings is on Microsoft's board, Netflix is now using Silverlight for WI, XBox has recently integrated WI in it NXE release, etc. In short, these are two companies that already know each other well. And on the financial front, with a current market cap of $1.6B, even with an acquisition premium, Netflix would be a relatively small bite for Microsoft (particularly compared with $45B, which Microsoft was prepared to shell out for Yahoo!).

Successful as Netflix is, it is still a relative minnow swimming in a sea of whales that will be competing for the biggest consumer prize of the next 10 years. Netflix has an impressive track record and it could very well succeed by remaining independent. But it (and its stock price) will be under continuous scrutiny as everyone from Apple to Google to Comcast to Amazon to Hulu to countless others launch broadband initiatives that pressure Netflix's model.

Meanwhile, Microsoft has significant financial resources, but it lacks the ability to be a credible competitor in the broadband-to-the-TV race. Together, I believe they could turn Netflix into the single-most potent broadband competitor to today's multichannel video providers. My bet is that in '09 the two companies will come to the same conclusion.

What do you think? Post a comment now.

2009 Prediction #1: The Syndicated Video Economy Accelerates

2009 Prediction #2: Mobile Video Takes Off, Finally

2009 Prediction #3: Net Neutrality Remains Dormant

2009 Prediction #4: Ad-Supported Premium Video Aggregators Shakeout

Categories: Aggregators, Deals & Financings

-

2009 Prediction #4: Ad-Supported Premium Video Aggregators Shakeout

"Look to your left, look to your right. One of you won't be here next year."

- Professor Charles Kingsfield, The Paper Chase

Professor Kingsfield's famous admonition to incoming Harvard Law School students applies equally well in 2009 to the ad-supported aggregators of premium video. My prediction #4 for the new year is that a shakeout is coming to this space.

As I wrote last summer in "Video Aggregators Have Raised $366+ Million to Date," there has been a lot of enthusiasm around broadband-only aggregators, especially those that focus on premium-quality video. Part of the excitement is based on the idea that they could eventually snatch a chunk of the $100 billion/year that today's cable, satellite and telco video distributors generate. This vision is enhanced by the inevitability of broadband connecting seamlessly to millions of consumers' TVs, enabling a pure on-demand, a-la-carte experience. The result has been many well-funded startups (e.g. Joost, Veoh, Vuze, etc.) as well as offensive/defensive initiatives backed by large media companies (e.g. Hulu, Fancast, portal sites, etc.).

However, ad-supported video aggregators face multiple challenges. First and most is that as their ranks have grown, the audience they're commonly targeting fragments. Not only does this make it hard to achieve scale, it makes it hard to identify meaningful audience differences that advertisers seek when allocating their budgets. The recent economic collapse and ad spending slowdown only exacerbate these audience-related issues.

The next big problem is that it is very difficult for aggregators to differentiate themselves. As with most web sites, there are really two main drivers of differentiation: content and user experience. On the content side, there is a finite amount of premium video available for ad-supported online distribution and there's no such thing as exclusivity (except to some extent with Hulu and its rights to NBC and Fox shows).

Increasingly broadcast programs are available in lots of places online, (starting with the broadcasters' own sites), while cable programs are in short supply (more on why that's the case and why it will stay that way in "The Cable Industry Closes Ranks"). Though there is lots of other quality video being produced, the reality is that once you get away from hit TV shows and recently-released movies (which themselves are not available except as paid downloads), little else has the same audience-driving appeal.

User experience is certainly a bona fide differentiator, and as I have spent time at all these sites, it's evident which sites are better and easier to use than others. But user experience differences are hard to maintain; it's all too easy for one site to emulate what another one does, and with cheap, open technology there are few barriers to doing so. Over time, most of the really important differences melt away (ample evidence of this is found in the ecommerce world, where checkout processes have long since gravitated to a set of best practices).

Another problem is customer acquisition and retention, which is a particular issue for the independent aggregators, who don't have incumbent advantages to leverage. With premium video only coming online relatively recently, users' video search processes are not yet well understood. Suppose someone is looking for a missed episode of Lost and don't want to pay for it. Do they start with a Google search for "Lost?" Or for "ABC?" Or do they reflexively go to ABC.com? Or maybe they're a heavy YouTube user, so they start by heading over to YouTube.com? Still others no doubt start by going to video search sites like blinkx or Truveo. Video aggregators need to insert themselves in the flow of an online user's video search process. But doing effectively is not yet anywhere close to the reasonably well-understood world of web-based optimization techniques.

I believe all of this leads to the inevitable result that not all of today's video aggregators are going to make it to the end of '09. Some will be bought or merged, others will simply close down. You're no doubt wondering which ones I think will fall into these categories. Though I have my hunches, for now I just can't offer an informed answer. There are just too many variables in play: actual performance (which only the sites themselves know), cash burn rates, strength of commitment by investors/owners, etc. What I will say though is that the list of survivors will include at least Hulu and Fancast. Both are highly strategic to their parent companies, have significant financial backing, and enjoy content or feature differentiation that is hard to replicate and/or is valued by users.

The landscape for video aggregators is still pretty wide open, so some winners will emerge. But there are just too many entrants chasing the same prize. I'll be keeping close track of the aggregator space on VideoNuze as '09 unfolds, and will keep you apprised of all developments.

What do you think? Post a comment now.

2009 Prediction #1:The Syndicated Video Economy Accelerates

2009 Prediction #2:Mobile Video Takes Off, Finally

2009 Prediction #3:Net Neutrality Remains Dormant

Tomorrow, 2009 Prediction #5

Categories: Aggregators

Topics: Fancast, FOX, Hulu, Joost, NBC, Veoh, Vuze

-

Hulu's Impressive 2008 Growth

comScore's latest video traffic rankings came out earlier this week, and it was hard to miss Hulu's big growth in 2008. As the chart below show, the site, which only launched officially in March landed in the #6 spot with 235 million video streams in October, up from 119 million in July, 88 million in May and not in comScore's top 10 in April.

While Hulu's latest stats benefited from the SNL political skits, it's worth noting that in October Hulu delivered more streams than Viacom, Disney, AOL, ESPN, Time Warner and ABC.com as recently as April (when Hulu wasn't yet in the top 10). As Todd Spangler points out, Hulu's success is also a very significant syndication data point: in October it generated "only" 5.3 million uniques on its own site with the remainder of its 24 million uniques coming from partners.

By anyone's standards Hulu's off to a pretty amazing start. Hulu's pre-launch naysayers have been proven dead wrong. A year ago I gave Hulu's beta a solid B+; it has now become one of the best out there. In '09 its key challenge is to maximize the revenue from all that traffic.

What do you think? Post a comment now.

Categories: Aggregators

Topics: Hulu

-

Reviewing My 6 Predictions for 2008

Back on December 16, 2007, I offered up 6 predictions for 2008. As the year winds down, it's fair to review them and see how my crystal ball performed. But before I do, a quick editorial note: each day next week I'm going to offer one of five predictions for the broadband video market in 2009. (You may detect the predictions getting increasingly bolder...that's by design to keep you coming back!)

Now a review of my '08 predictions:

1. Advertising business model gains further momentum

I saw '08 as a year in which the broadband ad model continued growing in importance as the paid model remained in the back seat, at least for now. I think that's pretty much been borne out. We've seen countless new video-oriented sites launch in '08. To be sure many of them are now scrambling to stay afloat in the current ad-crunched environment, and there will no doubt be a shakeout among these sites in '09. However, the basic premise, that users mainly expect free video, and that this is the way to grow adoption, is mostly conventional wisdom now.

The exception on the paid front continues to be iTunes, which announced in October that it has sold 200 million TV episode downloads to date. At $1.99 apiece, that would imply iTunes TV program downloads exceed all ad-supported video sites to date. The problem of course is once you get past iTunes things fall off quickly. Other entrants like Xbox Live, Amazon and Netflix are all making progress with paid approaches, but still the market is held back by at least 3 challenges: lack of mass broadband-to-the-TV connectivity, a robust incumbent DVD model, and limited online delivery rights. That means advertising is likely to dominate again in '09.

2. Brand marketers jump on broadband bandwagon

I expected that '08 would see more brands pursue direct-to-consumer broadband-centric campaigns. Sure enough, the year brought a variety of initiatives from a diverse range of companies like Shell, Nike, Ritz-Carlton, Lifestyles Condoms, Hellman's and many others.

What I didn't foresee was the more important emphasis that many brands would place on user-generated video contests. In '08 there were such contests from Baby Ruth, Dove, McDonald's, Klondike and many others. Coming up in early '09 is Doritos' splashy $1 million UGV Super Bowl contest, certain to put even more emphasis on these contests. I see no letup in '09.

3. Beijing Summer Olympics are a broadband blowout

I was very bullish on the opportunity for the '08 Summer Games to redefine how broadband coverage can add value to live sporting events. Anyone who experienced any of the Olympics online can certainly attest to the convenience broadband enabled (especially given the huge time zone difference to the U.S.), but without sacrificing any video quality. The staggering numbers certainly attested to their popularity.

Still, some analysts were chagrined by how little revenue the Olympics likely brought in for NBC. While I'm always in favor of optimizing revenues, I tried to take the longer view as I wrote here and here. The Olympics were a breakthrough technical and operational accomplishment which exposed millions of users to broadband's benefits. For now, that's sufficient reward.

4. 2008 is the "Year of the broadband presidential election"

With the '08 election already in full swing last December (remember the heated primaries?), broadband was already making its presence known. It only continued as the year and the election drama wore on. As I recently summarized, broadband was felt in many ways in this election cycle. President-elect Obama seems committed to continuing broadband's role with his weekly YouTube updates and behind-the-scenes clips. Still, as important as video was in the election, more important was the Internet's social media capabilities being harnessed for organizing and fundraising. Obama has set a high bar for future candidates to meet.

5. WGA Strike fuels broadband video proliferation

Here's one I overstated. Last December, I thought the WGA strike would accelerate interest in broadband as an alternative to traditional outlets. While it's fair to include initiatives like Joss Wheedon's Dr. Horrible and Strike.TV as directly resulting from the strike, the reality is that I believe there was very little embrace of broadband that can be traced directly to the strike (if I'm missing something here, please correct me). To be sure, lots of talent is dipping its toes into the broadband waters, but I think that's more attributable to the larger climate of interest, not the WGA strike specifically.

6. Broadband consumption remains on computers, but HD delivery proliferates

I suggested that "99.9% of users who start the year watching broadband video on their computers will end the year no closer to watching broadband video on their TVs." My guess is that's turned out to be right. If you totaled up all the Rokus, AppleTVs, Vudus, Xbox's accessing video and other broadband-to-the-TV devices, that would equal less than .1% of the 147 million U.S. Internet users who comScore says watched video online in October.

However, there are some positive signs of progress for '09. I've been particularly bullish on Netflix's recent moves (particularly with Xbox) and expect some other good efforts coming as well. It's unlikely that '09 will end with even 5% of the addressable broadband universe watching on their TVs, but even that would be a good start.

Meanwhile, HD had a banner year. Everyone from iTunes to Hulu to Xbox to many others embraced online HD delivery. As I mentioned here, there are times when I really do catch myself saying, "it's hard to believe this level of video quality is now available online." For sure HD will be more widely embraced in '09 and quality will get even better.

OK, that's it for '08. On Monday the focus turns to what to expect in '09.

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Brand Marketing, Devices, HD, Indie Video, Politics, Predictions, Sports, Technology, UGC

Topics: Amazon, Apple, AppleTV, Barack Obama, Hulu, iTunes, NBC, Netflix, Olympics, Roku, VUDU, XBox

-

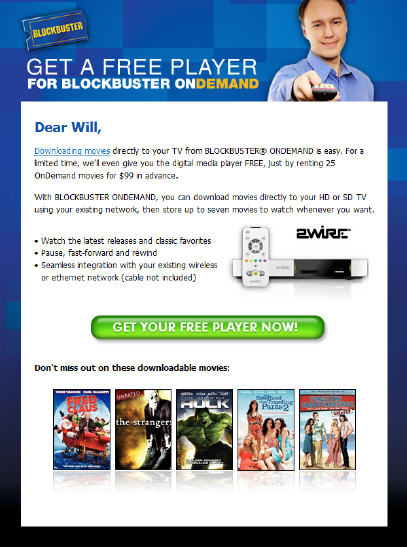

Blockbuster Online with New 2Wire MediaPoint Player Has a Tough Climb Ahead

Have you received the email pitch from Blockbuster Online yet, to rent 25 movies and get the new 2Wire MediaPoint Digital Media Player "free?" I've received a couple already this week (see below), and after reviewing the offer and its details, and comparing it to other alternatives, my conclusion is that the new service has a tough climb ahead.

The new 2Wire box itself is in the same general family as other single-purpose boxes such as AppleTV, Vudu and Netflix's Roku. There are some differences among them in hard drive size, pricing, outputs and streaming vs. downloading orientation. But they all serve the same basic purpose: connecting you via your home broadband connection to one source of "walled garden" premium-quality video content.

VideoNuze readers know I've been quite skeptical of the standalone box model, especially when box prices start in the $200-300 range. There's no question there's an upscale, early adopter audience that will buy in, but mainstream consumers will be uninterested for all kinds of reasons including: financial considerations (especially in this economy), resistance to connecting another box in already crowded consoles, perceived technical complexity, strong existing substitutes (e.g. cheap ubiquitous DVD players) and indistinct value propositions.

My judgment is based on a pretty simple set of criteria I rely on to gauge a new product or service's likelihood of success: Does it offer meaningful new value (some combination of better price, quality or speed) with minimal adoption effort required? Can a large target audience for this new value be clearly defined, served and acquired in an economically-reasonable manner? Is this new value attainable without sacrificing meaningful benefits of existing alternatives?

Miss on any one of these and the odds of success lengthen. Miss on any two and you're in long-shot territory. Miss on all three and you're dead on arrival. After evaluating the Blockbuster Online/MediaPoint current offer, my sense is that it misses on at least two and possibly all three.

Value: As explained below, for certain movies renters, the offer is valuable. It provides convenience at a relatively low financial commitment for the new device. But explaining these benefits just to the relevant target audience at an economic cost per acquisition is going to be nearly impossible. I'm dubious that even in-store promotions - which on the surface seem Blockbuster's strength - will work. First, there may be franchisee issues, as there were with previous "Total Access" promotions. And second, Blockbuster has closed so many stores in prime target neighborhoods - due to the rise of Netflix and other options eroding their business - that they'll be missing many prospects (example: in my upscale home town of Newton, MA there is not a single Blockbuster store left).

Audience: There's only one real target audience I can see for this offer, and it seems very narrow to me: low-volume renters of movies only, who are not iTunes users. Think about it - if you rent a lot of movies, you've likely been subscribing to Netflix for years (more so if you also rent TV shows). If you want to own your content instead of rent it, then you buy DVDs or maybe more recently have been buying digital version, most likely with iTunes primarily. If that's the case, then when it comes to watching on TV, you're going to buy an Apple TV (even then, few have done so to date), not a 2Wire MediaPoint. The eligible target audience left for Blockbuster/MediaPoint seems pretty slim.

Sacrificing existing benefits: Inevitably all digital distribution options need to be compared to the incumbent DVD format, which is remarkably strong (no wonder a billion units have been shipped to date). Against the DVD standard, Blockbuster/MediaPoint is inferior in a number of ways: limited viewing windows (the usual online limitations of 24 hour expiration after starting, and 30 day automatic file deletion), no portability to view rented movies on other TVs not connected to a MediaPoint, no TV shows available for rent, and at this point, smallish storage that only keeps up to 5 movies at a time.

Add it all up, and it's a pretty daunting set of issues. To be sure, much of this isn't specific to Blockbuster. To succeed, all new digital delivery options must be mindful of the above criteria as well.

What do you think? Post a comment now.

Categories: Aggregators, Devices

Topics: 2Wire, AppleTV, Blockbuster, Netflix, VUDU

-

5Min Unveils VideoSeed, a Clever Syndication Tool

5Min, one of the many well-funded entrants in the video-based how-to/knowledge space which I wrote about last Feb, has recently introduced VideoSeed, a clever syndication tool that has already helped drive its video to dozens of partner sites aggregating 110 million unique visitors per month. VideoSeed is another indicator that the Syndicated Video Economy is helping shape product development priorities throughout the broadband industry. I spoke to Ran Harnevo, 5Min's CEO/co-founder yesterday to learn more.

VideoSeed's goal is to give 5Min's partners relevant and complimentary video that can be easily inserted into

text-oriented pages with little-to-no editorial oversight. As Ran explained it, a partner signs up, specifies which pages it wants video inserted into, selects parameters of 5Min video it wants to allow and templates for how the video should appear. 5Min editors rank all of its videos 1-5 according to an internal quality scale while rigorously assigning metadata to each.

text-oriented pages with little-to-no editorial oversight. As Ran explained it, a partner signs up, specifies which pages it wants video inserted into, selects parameters of 5Min video it wants to allow and templates for how the video should appear. 5Min editors rank all of its videos 1-5 according to an internal quality scale while rigorously assigning metadata to each.VideoSeed semantically scans all of the partner-submitted pages and matches and inserts relevant 5Min video. (Examples can be seen at Answers.com and wikiHow) As new, relevant videos are added to 5Min, they automatically rotate into the partners' pages. Videos can be viewed on the site or through 5Min's "SmartPlayer" which has features like super slow motion, zooming, etc.)

5Min currently has a library of about 40K videos, of which Ran thinks 80% are sufficiently high quality to be of interest to partners. 5Min commissions some videos and aggregates others. Ran eschews terms like "premium" and "UGC" as they've found some of the best videos come from pure amateurs.

5Min sells ads across the syndication network, using its own team and third-party ad networks. It's using overlays and pre-rolls to date. Revenue is shared with the content providers and publishing partners. Advertisers benefit by reaching a targeted, engaged audience across dozens of sites while only having to make one buy decision.

Text-oriented how-to/knowledge-based sites and subject-driven specialty sites lend themselves perfectly to accepting complimentary syndicated video. But as Ran points out, shooting video, hosting/serving it and selling ads against it is a lot of effort for most text-oriented sites. This is especially true in a down economy when resources are tight. These factors have helped contribute to 5Min expanding its partner audience rapidly to 110 million uniques, with 2-3 new partners coming on board daily.

I could also see the VideoSeed technology being interesting in other categories (celebrity video comes immediately to mind), though for now Ran says 5Min's staying focused on knowledge, and also isn't looking to license VideoSeed externally. No doubt others will watch its progress and look to emulate it. But as Ran notes, to really succeed, they must first focus on assigning highly accurate metadata so the matching process works as intended and users truly get relevant, high quality video.

What do you think? Post a comment now.

Categories: Aggregators, Indie Video, Syndicated Video Economy

Topics: 5Min

-

Video is the Killer App Driving Coming Bandwidth Explosion

A short interview in Multichannel News with Rouzbeh Yassini before the Thanksgiving break last week caught my eye.

Rouzbeh's name is likely unfamiliar to many of you. But for others who have been in and around the cable and broadband industries since the '90s, he is semi-famous. In those days Rouzbeh ran a company called LANCity, which was a pioneer in designing and manufacturing cable modems. These of course are the devices that now reside in tens of millions of homes around the world, enabling broadband Internet access and the high-quality video services like YouTube, Hulu, iTunes and others that run through them.

Though it's only been about 15 years, the early-to-mid '90s seem like another age entirely. Can you remember dial-up Internet access? Busying up your phone line if you wanted to be online? Listening to all those weird tones as your creaky 56K modem connected you to Prodigy, CompuServe, AOL, or eventually this thing everyone seemed to be talking about called the "World Wide Web?"

In my opinion, Rouzbeh deserves as much credit as anyone for the transformation of the dial-up Internet era

to the broadband world we now enjoy. He played a crucial role in articulating broadband's business potential to scores of senior cable executives who barely knew what a computer was, much less this new-fangled thing called the Internet. Importantly, he was a key technical architect of modern cable networks, which today barely resemble the passive, one-way networks of old.

to the broadband world we now enjoy. He played a crucial role in articulating broadband's business potential to scores of senior cable executives who barely knew what a computer was, much less this new-fangled thing called the Internet. Importantly, he was a key technical architect of modern cable networks, which today barely resemble the passive, one-way networks of old. In short, I've learned to take notice of Rouzbeh's prognostications. Though he can be irrepressibly optimistic, he's directionally right more often than not.

All of that brings me to his Multichannel interview. Rouzbeh now envisions the era of gigabit or 1,000 megabit Internet access within a decade. To put this in perspective, today's cable modems typically deliver around 10 megabit service or 1% of a gigabit. Spurred by competitive pressures, Comcast has recently announced the rollout of 50 megabit service to certain regions, with expansion to its entire footprint by 2010. These new rollouts are part of the cable industry's "DOCSIS 3.0" standards, covering a new generation of modems and channel management techniques.

There's an axiom in the broadband industry that usage always rises to the level of bandwidth provided. Yet when we're talking 1 gigabit service, one has to rightly ask, "what in the world are people going to do with all that bandwidth?" Rouzbeh posits things like corporate networking, remote offices, medical services and the like, but only touches briefly on video delivery.

From my perspective, video is the killer application that will drive this bandwidth explosion. As I wrote recently in "Video Quality Keeps Improving - What's it All Mean?" we are on the front end of a shift toward dramatically higher video quality, with near HD delivery already becoming common (Hulu, Netflix and Vudu are among the most recent to announce HD initiatives). This shift will only accelerate going forward. And to accommodate it will require lots more bandwidth from network providers.

In reality, the trickiest part of bandwidth expansion is less the technology development and deployment and more the business models that support the investments and make the most strategic sense. Questions abound: Is the right model to charge $150/mo for 50 megabit access as Comcast plans? Or to build a content service available only to those high-powered users? Or act like a CDN and provide services so as to charge content providers themselves to deliver higher-quality video? Maybe some hybrid of these, or some other model? And of course, what impact do these models have on the incumbent multichannel subscription video offering?

While there's murkiness now, like Rouzbeh, I'm a big believer that these things will ultimately be worked out and that bandwidth expansion is inevitable. Just as we now look back on the dial-up era and wonder how we got by, eventually we'll look at the mid-to-late 2000s and wonder how we survived on so little bandwidth.

What do you think? Post a comment now.

Categories: Aggregators, Broadband ISPs, Cable TV Operators, People

Topics: Comcast, DOCSIS, Hulu, Netflix, VUDU

-

November '08 VideoNuze Recap - 3 Key Themes

Welcome to December and to the home stretch of 2008. Following are 3 key themes from VideoNuze in November:

Cable programming's online distribution narrows - Last month I concluded that cable programmers (e.g. Discovery, MTV, Lifetime) are going to become much more sparing when it comes to distributing their full programs online. As noted in "The Cable Industry Closes Ranks," after hearing from industry executives at the CTAM Summit and on the Broadband Video Leadership Breakfast, it has become apparent that the industry is going to defend its traditional multichannel video subscription model from broadband and new "over-the-top" incursions.

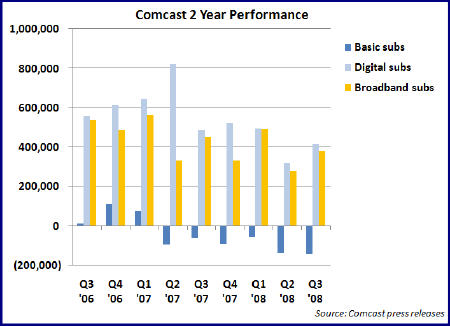

Both programmers and operators have a lot vested in this successful model, and are surely wise to see it last as long as possible. Subscription and affiliate fees are particularly precious in this economy, as the WSJ wrote on Saturday. Still, many VideoNuze readers pointed out the music industry's folly in trying to maintain its business model, only to see it turned upside down. Many predicted the cable industry is doomed to follow suit. Truth-be-told though, as I wrote in "Comcast: A Company Transformed," major cable operators are already far more diversified than they used to be. Broadband, phone and digital TV (+ add-ons like DVR, HD and VOD) have created huge new revenue streams. Surging broadband video consumption only helps them, even as "cord-cutting" looms down the road.

Netflix moves to first ranks of cord-cutting catalysts - Three posts in November highlighted the significant role that Netflix is poised to play in moving premium programming to broadband distribution. Most recently, in "New Xbox Experience with Netflix Watch Instantly: A 'Wow' Moment," I shared early reactions from a VideoNuze reader (echoed by many others) to receiving a subset of Netflix's catalog through Xbox's recently upgraded interface. Netflix CEO Reed Hastings highlighted the increasing importance of game devices in bridging broadband to the TV in his keynote at NewTeeVee Live this month (recapped here).

Still, Netflix lacks the rights to deliver many movies online, a problem unlikely to be rectified any time soon given Hollywood's stringent windowing approach. As such, in "Netflix Should be Aggressively Pursuing Broadcast Networks for Watch Instantly Service," I offered my $.02 of advice to the company that it should build on its recent deal with CBS to blow out its online library of network programs. In this ad-challenged environment, I believe networks would welcome the opportunity. Hit TV programs would help drive device sales, which is crucial for building WI's adoption. While the Roku box is a modest $99, other alternatives are still pricey, though becoming cheaper (the Samsung BD-P2500 Blu-ray player is down $100, now available at $300, I spotted the LG BD300 over the weekend for $245). A robust Netflix online package would be poised to draw subscribers away from today's cable model.

Lousy economy still looms large - Wherever you go, there it is: the lousy economy. Though the market staged a nice little rebound over the last 5 days, things are still fragile. Across the industry broadband companies are doing layoffs. This is only the most obvious of the side effects of the economic downturn. Another, more subtle one could be downward price pressure. As I wrote in "Deflation's Risks to the Broadband Video Ecosystem," economists are now growing concerned that the credit crunch could lead to collapsing prices and profits across the economy. I noted that such an occurrence would be particularly damaging for the broadband industry, where business models are still nascent, so ROIs and spending are softer.

Here's to hoping for some good economic news in December...

What do you think? Post a comment now.

Categories: Aggregators, Broadcasters, Cable Networks, Cable TV Operators, Devices, Games

Topics: CBS, Comcast, LG, Microsoft, Netflix, Roku, Samsung, XBox

-

Adconion.TV: Trying to Do Google Content Network One Better

I've been very intrigued by two recent announcements from Adconion, which bills itself as the largest independent online advertising network.

First, in early October, it announced "AMG-TV," a video content syndication network now called "Adconion.TV" as well as its first deal, to distribute Vuguru's "Back on Topps." Then last week it acquired KTV Digital Media, a production studio and syndicator, to become a wholly-owned subsidiary called RedLever. Late last week I got a briefing from Adconion CEO/founder Tyler Moebius and Reeve Collins, CEO RedLever to learn more.

My take is that Adconion.TV/RedLever is emulating the same model as Google Content Network, except with a couple of interesting twists (for more on GCN, see "Google Content Network Has Lots of Potential, Implications"). Nevertheless, both are classic Syndicated Video Economy plays, which could have a huge impact on the fundamentals of broadband video's future business model.

For those not familiar with Adconion, it says it reaches 260M unique visitors/month, second only to Google.

Traffic is about evenly split between the U.S. and the rest of the world. It has 800+ publishers in its network, including 60-70 that it represents exclusively, primarily for international sales. The company made a big splash earlier this year when it raised a monster $80M round led by Index Ventures (the lead investor in Skype among others). It has grown from 30 employees in '06 to 285 in '08.

Traffic is about evenly split between the U.S. and the rest of the world. It has 800+ publishers in its network, including 60-70 that it represents exclusively, primarily for international sales. The company made a big splash earlier this year when it raised a monster $80M round led by Index Ventures (the lead investor in Skype among others). It has grown from 30 employees in '06 to 285 in '08. The similarities between Adconion.TV and GCN are as follows: both believe their vast network of publisher web sites - which were initially built to serve ads - can now be modified to also accept high-quality syndicated video content. Each leverages the same algorithms it used to optimize which ads to insert, so that video too will only be served to the most appropriate sites. One might think of both these companies as being in the real estate business. Each has colonized vast tracts of web property and is now trying to identify, as real estate pros would say, the "highest and best use" of its inventory: ads, video or some combination of the two.

At the core of both Adconion.TV and GCN is the conviction that content should be brought to users wherever they may live, as opposed to attempting to drive them to a destination site, a la the "must-see TV" model of old. This has been a key tenet of the Syndicated Video Economy concept I've been fleshing out in '08. With the fragmentation of users over the web, social networks, mobile devices, gaming consoles, etc. the way to build a franchise is to propagate video into all of the web's nooks and crannies. Note others like Grab Networks, Syndicaster, 1Cast, Jambo and others are also heavily pursuing the syndication opportunity, each with their own competitive angle.

In both initiatives content-distribution-brand advertising are the three legs of the business model stool. Consider: in Adconion.TV's launch deal it was a package of Vuguru/Back On Topps (content) - Adconion.TV (distribution) and Skype (brand), while GCN's was Seth MacFarlane/Cavalcade of Comedy (content) - GCN (distribution) - Burger King (brand). I asked Tyler whether this three-legged stool is the model for independent broadband content (whose nascent studios have been slammed by the down economy) to be funded in the future, he emphatically replied "yes."

This highlights one key difference between GCN and Adconion.TV. Google of course has been very clear in steering away from content creation, consistently declaring it's "not a content company." Adconion, on the other hand, specifically intends to custom produce brand-infused broadband video programming. That's where the KTV acquisition comes in. Tyler explained that it is deep into talks with numerous agencies and brands about creating programs that showcase the brand sponsors. Two deals are expected to be announced soon.

Another difference is that GCN tried to drive traffic back to YouTube to incent users to subscribe to ongoing program updates and get exposed to other related programs. In my GCN post, I wrote enthusiastically that the marriage of AdSense-powered video distribution as the "spokes" with YouTube as the "hub" was formidable because it gives GCN a mechanism to build ongoing viewership beyond the first exposure at the publisher site.

Today Adconion lacks a comparable destination site. Tyler doesn't think that's important since it offers ways to subscribe, get email alerts and share within the player itself. Plus he's not hearing demand for it from brands. Still I think as this story unfolds and Adconion.TV finds itself competing with GCN for the highest-potential content, a destination site compliment will become essential. Should it agree, an acquisition would make sense to fill this hole (Metacafe? DailyMotion?).

For now though, Adconion has an aggressive plan to build Adconion.TV as an exciting new entry on the Syndicated Video Economy landscape. With its resources, reach and new production capabilities, this is clearly one to keep an eye on.

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Syndicated Video Economy

Topics: 1Cast, Adconion, Google, Google Content Network, Grab Networks, KTV Digital Media, Syndicaster, YouTube

-

New Xbox Experience with Netflix Watch Instantly: A "Wow" Moment

Wow.

That was the reaction that VideoNuze reader and digital media public relations executive Jeff Rutherford had after downloading the "New Xbox Experience" (or NXE) to his Xbox 360 and activating Netflix Watch Instantly. Jeff relayed the details to me in an email and phone call yesterday, adding that it felt comparable to his (and many others') first experience with TiVo.

Hyperbole? Maybe. I'm always mindful about how gadgeteers' early wows seem to melt away when new technology products reach the broader mass market. Still, the Xbox 360/Netflix Watch Instantly integration seems promising on at least three fronts.

First, Xbox 360 is a relatively mainstream device that has its own clear value propositions, thereby driving a sizable footprint that is only going to grow. Second, Netflix's Watch Instantly is a value-add to its subscription service, requiring no incremental fees, or special new add-on hardware to Xbox 360. And third, as Jeff reported, it was very easy to get going: he was given a code to input online and when he returned to his Xbox, his Watch Instantly queue was displayed there, awaiting his on-demand selections.

These benefits - large distribution, no extra fees, no new hardware and easy install/strong user experience - are all key to a successful broadband-to-the-TV service. But equally, if not more important is content selection and value. This is where the Xbox 360/Netflix implementation hits a speed bump, at least for now.

As I explained recently in "Netflix Should be Aggressively Pursuing Broadcast Networks for Watch Instantly Service," today's windowing model puts the company is in a serious bind with respect to getting top-flight Hollywood films. While Jeff reported seeing some strong titles like Disney's Ratatouille (and other films he noticed carrying the Starz watermark), the reality is that Watch Instantly's catalog is still a small sliver of Netflix's DVD-by-mail catalog and will remain so for some time to come.

Further portending the difficulties of what's ahead for Netflix as it navigates Hollywood's minefields is early word, courtesy of Joystiq and other blogs, that all of Sony's Columbia Pictures movies have been disabled for XBox 360 Netflix users, due to licensing issues. While we may all be rooting for Netflix to find deal terms with Sony and the others, the realist side of me says that Hollywood's overseers understand that the Xbox 360 integration (and others TBD) have real significance in the relentless push to digital delivery. So before the proverbial horse gets out of the barn, they want to ensure the right deals are in place for them to capture appropriate value.

While that drama plays itself out, Netflix would be wise to do everything else it can to bolster Watch Instantly content value and selection. As I wrote in the prior post, incorporating broadcast programs should be a top priority. Also high on the list should be well-branded, high-quality broadband-only content.

Netflix has a very interesting opportunity to accelerate the Watch Instantly adoption curve, leveraging the huge installed base of Xbox 360 users and Microsoft's UI improvements (more on NXE's new look at Engadget if you're interested). With proof of its success in hand, Netflix's negotiations with recalcitrant studios can only be helped along. Meantime, Xbox 360 is getting another strong (albeit likely temporary) value proposition to compete in the game console space. And consumers win - as Jeff pointed out - by gaining ever-better access to the content they want.

What do you think? Post a comment now.

Categories: Aggregators, Devices, Games

Topics: Microsoft, Netflix, Xbox 360

-

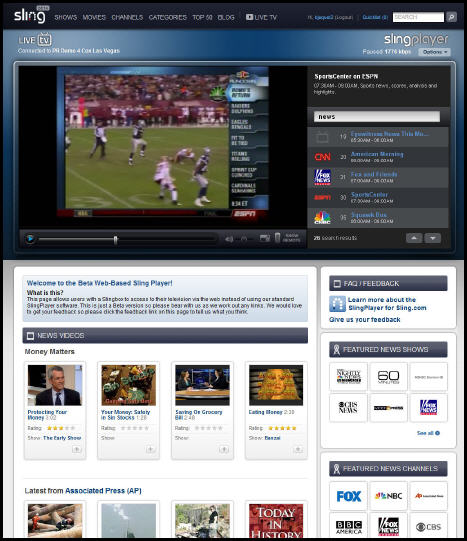

Here Comes Sling.com

Does the world need another broadband video aggregation site for premium quality video content?

The answer to that question will start to come early next week when Sling.com, the latest entrant in this already crowded space, officially launches. Recently Jason Hirschhorn, president of Sling Media's entertainment group and Brian Jaquet, Sling's Director of Public Relations came through Boston and caught me up on their plans to launch commercially on Nov. 24th.

Many of you know that Sling is the maker of the Slingbox, which connects to your TV or DVR, allowing you

to remotely watch programs on your computer. It's a very clever product, though I have to admit its use case has always been a little confounding to me. Nonetheless, just over a year ago, Sling was acquired by EchoStar in a $380 million deal. Shortly thereafter, EchoStar split itself into two parts, Dish Network, the satellite-delivered programming company, and EchoStar Corporation, which includes Sling and other technology-based businesses.

to remotely watch programs on your computer. It's a very clever product, though I have to admit its use case has always been a little confounding to me. Nonetheless, just over a year ago, Sling was acquired by EchoStar in a $380 million deal. Shortly thereafter, EchoStar split itself into two parts, Dish Network, the satellite-delivered programming company, and EchoStar Corporation, which includes Sling and other technology-based businesses.Sling.com, developed by Jason's entertainment group, is the first Sling offering not tethered to any of its devices and therefore open to all users. Acknowledging that Hulu has set a high bar on user experience, Jason explained that Sling.com is attempting to go one step further on usability, and will also differentiate itself with updated social networking capabilities and highly focused editorial content.

In particular, Sling.com offers a slew of Facebook-like features that allow users to subscribe to and favorite programs and networks, with users in turn able to follow these activities. As Jason aptly put it, the goal is to "digitize the water cooler conversation." The whole experience is geared toward engaging the user at a far deeper level than we're accustomed to in passive linear viewing, or even typical at other aggregators' sites.

The real differentiator for Sling long-term though is the integration of Sling.com with the remote viewing offered by Slingbox. Enabled by a new web-based player (instead of the prior downloadable client), users are able to seamlessly browse back and forth between watching live TV and cataloged programs, as shown below.

Taking this one step further, Sling's goal is to get its remote viewing technology embedded in others' set-top boxes as well. So for example, a Comcast STB with Sling inside would allow you to have live TV integrated into your Sling.com, without having to go buy another box.

That's an enticing prospect, but making it happen will be no small feat; the STB giants like Motorola and SA (now part of Cisco) will get on board only when their biggest customers - America's cable operators - ask for it. The prospect of these cable executives wanting to incorporate any technology controlled by Charlie Ergen, Echo's founder/CEO and the cable industry's arch-enemy, stretches my mind. However, stranger deals have been done, so who knows. In the meantime, there are a whole lot of other non-cable homes globally Sling can address first.

But much of that is down the road anyway. For now, Sling.com is going to compete head on with Hulu (which by my count supplies virtually the entire current movie catalog at Sling.com, in turn begging the question of how many different ways one relatively small ad revenue stream can get carved up?), Fancast, the portal sites, YouTube and so on. Jason readily admits that these sites will not compete on content exclusivity; ultimately they'll all have access to everything that's available.

So in this incredibly crowded space, is there room for a newcomer? On the surface, it's tempting to say "no." But history teaches us that "better mousetraps" can elbow their way into even the most crowded spaces. Remember how many search engines already existed when Google burst onto the scene? On a totally different level, I can relate to this challenge myself. A year ago I wondered whether there was room for a new broadband video-centric blog when so many others already existed; now here we are.

The reality is that newcomers succeed because they don't accept the status quo as final. Rather, they find smart ways of delivering new and better value to customers who didn't necessarily even know what they wanted, but when they got it, were delighted. That's Sling.com's challenge. Whether it can meet it remains to be seen. But in this crummy economy, their deep-pocketed backing certainly gives them a leg up on any VC-funded competitors when it comes to long-term staying power.

What do you think? Post a comment now!

Categories: Aggregators, Cable TV Operators, Devices, Satellite

Topics: Cisco, DISH Network, EchoStar, Fancast, Hulu, Motorola, SA, Sling, YouTube

-

Watching Reed Hastings at NewTeeVee Live

Yesterday I had my own positive broadband video experience, remotely watching portions of the

NewTeeVee Live conference held in SF from the comfort of my office. Om Malik and crew put together a packed agenda and I had wanted to go, but a personal conflict kept me in Boston.

NewTeeVee Live conference held in SF from the comfort of my office. Om Malik and crew put together a packed agenda and I had wanted to go, but a personal conflict kept me in Boston. I caught most of Netflix CEO Reed Hastings' keynote (until the UStream feed froze up, arghh...) and thought he offered some interesting tidbits about how he sees the broadband video market unfolding. VideoNuze readers know I've been avidly following Netflix's recent moves with Watch Instantly and I've come to think of the company as one of three key aggregators best-positioned to disrupt the cable model (the other two being YouTube and Apple).

Three noteworthy points that Hastings made:

Standards needed to interface broadband to the TV - Hastings catalogued the efforts Netflix is making to integrate with various devices like Roku, LG, TiVo, Xbox, etc, but concluded by saying that these one-off, ad hoc integrations are not scalable and are really slowing the market's evolution. Most of us would agree with this assessment. Still, he was quite pessimistic about a standards setting process's ability to move quickly enough - saying this could be a 10-30 year endeavor. Instead, if I understood him correctly, he thinks the TV approach should just be browser- based, and also that today's remotes should be scrapped in favor of pointer-driven (i.e. mouse-like) navigation.

Cable should evolve to focus on broadband delivery and de-emphasize multichannel packaging - Of course this is incredibly self-serving from Netflix's standpoint, but Hastings made the case that broadband margins for cable operators are nearly 100%, because they have no content costs, whereas on the cable side, they have high and ever-increasing programming costs. He cited Comcast's recent announcement of 50 Mbps service as evidence that cable operators should focus on winning the broadband war, and eventually letting go of the multichannel model. Nice try Reed, but I don't see that happening anytime soon. However, as I recently wrote in "Comcast: A Company Transformed," there's no question that broadband is becoming an ever greater part of its revenue and cash flow mix.(Reed emailed to clarify the above point. He didn't say cable should focus on broadband delivery over the current multichannel model; rather that cable - and satellite/telco - should focus more on web-like viewing experiences through improved navigation and VOD/DVR to be more on-demand, personalized and browser-friendly. And he added that with the shift to heavier broadband consumption, cable is a winner either way. Note - I thought I interpreted him correctly, but between UStream choking and my own scribble, it seems I was a bit off here. Thanks for correcting Reed.)Game consoles in leading position to bridge broadband to the TV - Hastings made a pretty strong case for the Wii - and to a lesser extent the PlayStation and Xbox - as the leading bridge devices. The Wii in particular could be a real broadband winner if it could support HD and Flash. As I've been thinking about broadband to the TV, I've concluded - barring anything from left field - that game devices, IP-enabled TVs and IP-enabled Blu-ray players are where the action will be concentrated for the next 3-4 years (this doesn't take account of forklift substitutes like a Sezmi or others sure to come).

NewTeeVee has a good wrap-up of Hastings' talk as well, here. The video replay isn't up yet, but when I see it, I'll post an update.

What do you think? Post a comment now!

Categories: Aggregators, Cable TV Operators, Devices

Topics: Apple, Comcast, LG, Netflix, PlayStation, Roku, TiVo, Wii, XBox, XBox, YouTube

-

The Cable Industry Closes Ranks

First, apologies for those of you getting sick of me talking about the cable TV industry and broadband video; I promise this will be my last one for a while.

After attending the CTAM Summit the last couple of days, moderating two panels, attending several others and having numerous hallway chats, I've reached a conclusion: the cable industry - including operators and networks - is closing ranks to defend its traditional business model from disruptive, broadband-centric industry outsiders.

Before I explain what I mean by this and why this is happening, it's critical to understand that the cable business model, in which large operators (Comcast, Time Warner Cable, etc.) pay monthly carriage or affiliate fees to programmers (e.g. Discovery, MTV, HGTV, etc.) and then bundle these channels into multichannel packages that you and I subscribe to is one of the most successful economic formulations of all time. The cable model has proved incredibly durable through both good times and bad. In short, cable has had a good thing going for a long, long time and industry participants are indeed wise to defend it, if they can.

It's also important to know that the industry is very well ordered and as consolidation has winnowed its ranks to about half a dozen big operators and network owners, the stakes to maintain the status quo have become ever higher. All the executives at the top of these companies have been in and around the industry for years and have close personal and professional ties. There's a high degree of transparency, with key metrics like cash flow, distribution footprint, ratings and even affiliate fees all commonly understood.

One last thing that's worth understanding is that the cable industry has very strong survival instincts, or as a long-time executive is fond of saying, "Real cable people (i.e. not recent interlopers from technology, CPG or online companies that have joined the industry) were raised in caves by wolves." The fact is that the industry started humbly and experienced many very shaky moments. Yet it has managed to survive and continually re-invent itself (for those who want to know more, I refer you to "Cable Cowboy: John Malone and the Rise of the Modern Cable Business" by Mark Robichaux, still the best book on the industry's history that I've read).

All of that brings us to broadband and its potential impact on the cable model. As I've said many times, broadband's openness makes it the single most disruptive influence on the traditional video distribution value chain. Principally that means that by new players going "over the top" of cable - using its broadband pipes to reach directly into the home - cable's model is at serious risk of breaking down, once and for all.

The cable industry now gets this, and I believe has closed ranks to frown heavily on the idea of cable programming, which operators pay those monthly affiliate fees for, showing up for free on the web, or worse in online aggregators' (e.g. Hulu, YouTube, Veoh, etc.) sites. The message is loud and clear to programmers: you'll be jeopardizing those monthly affiliate fees come renewal time if your crown jewels leak out; worse, you'll be subverting the entire cable business model.

And this message isn't being delivered just by cable operators such as Peter Stern from Time Warner who said on my Broadband Video Leadership Breakfast panel that "a move to online distribution by cable networks would directly undermine the affiliate fees that are critical to creating great content." It's also coming from the likes of Discovery CEO David Zaslav who said on a panel yesterday that "there's no economic value from online distribution," and that "great brands like Discovery's must not be undervalued by making full programs available for free online."