-

The Cable Industry Closes Ranks - Part 2

An article in Friday's WSJ "Cable Firms Look to Offer TV Programs Online" outlined a plan under which Comcast and Time Warner Cable, the nation's 2 largest cable operators, would give just their subscribers online access to cable networks' programming.

A Comcast spokesperson contacted me later Friday morning to explain that the plan, dubbed "OnDemand Online" is indeed in the works, though a release timeline is not yet set. The move is part of the company's

"Project Infinity" a wide-ranging on-demand programming vision that was unveiled at CES '08, but oddly has not been messaged much since. Meanwhile, thePlatform, Comcast's broadband video management/publishing subsidiary also called me on Friday to confirm that - unsurprisingly - it would be powering the OnDemand Online initiative (thePlatform's CEO Ian Blaine explains more in this post).

"Project Infinity" a wide-ranging on-demand programming vision that was unveiled at CES '08, but oddly has not been messaged much since. Meanwhile, thePlatform, Comcast's broadband video management/publishing subsidiary also called me on Friday to confirm that - unsurprisingly - it would be powering the OnDemand Online initiative (thePlatform's CEO Ian Blaine explains more in this post).The idea of cable operators setting up online walled gardens for their subscribers alone was first signaled by Peter Stern, Time Warner's EVP/Chief Strategy Officer on the panel I moderated at VideoNuze's Broadband Leadership Breakfast last November. As I wrote subsequently in "The Cable Industry Closes Ranks" my takeaway from his and other cable executives' recent comments was that the industry was poised to collaborate in order to defend cable's traditional - and highly profitable - business model. Under that model, cable operators currently pay somewhere between $20-25 billion per year in monthly "affiliate fees" to programmers whose networks are then packaged by operators into various consumer subscription tiers.

It should come as a surprise to nobody that both cable networks and operators are mightily incented to defend their model against the incursions of free "over the top" distribution alternatives. Indeed what's surprising to me is why it has taken the industry so long to act forcefully when the stakes are so high and the market's moving so fast? I mean cable operators themselves are the largest broadband Internet access providers in the country, and they have watched for years as their networks have been engorged by surging online viewing, courtesy of YouTube, Hulu, Netflix and others. While they've made some tepid moves to push programming online (though to be fair Comcast's Fancast portal has evolved quite a bit recently), overall their broadband video distribution activities have been underwhelming, evidence of broadband distribution's lower priority status vis-a-vis TV-based video-on-demand.

Meanwhile Friday's article triggered plenty of hackles from the blogosphere that those evil cable operators were up to their old monopolistic tricks, this time moving to control the broadband delivery market and choke off open access to premium video. While it's indeed tempting to see these plans that way, I think that would be the wrong conclusion.

Rather, I look at the Comcast/TWC moves as both welcome and likely to spur more, not less, consumer

access to broadband-delivered programming. That's because, if the cable networks are smart in their negotiations, they will gain from operators the approval to push more of their programs onto both their own web sites, and even to distribute some through others' sites. With net neutrality agitators hopeful in the wake of Barack Obama's election, Comcast and TWC need to tread carefully in these negotiations. Yet another part of the model I foresee is archived programs, which have been locked up in vaults due to programmers' concerns over operator reprisals if they leaked out online, becoming much more openly accessible.

access to broadband-delivered programming. That's because, if the cable networks are smart in their negotiations, they will gain from operators the approval to push more of their programs onto both their own web sites, and even to distribute some through others' sites. With net neutrality agitators hopeful in the wake of Barack Obama's election, Comcast and TWC need to tread carefully in these negotiations. Yet another part of the model I foresee is archived programs, which have been locked up in vaults due to programmers' concerns over operator reprisals if they leaked out online, becoming much more openly accessible. The Comcast/TWC hecklers need to remember one simple fact: to make quality programming requires solid business models. And in this economic climate, solid business models are far and few between. Despite having lost a total of over 500,000 video subscribers during the last 6 consecutive quarters, Comcast still owns one of those few sold models. And don't forget it is now investing to increase its broadband speeds, pledging 30 million, or 65% of its homes, will have 50 Mbps access by the end of '09 (a rollout which incidentally is all privately financed, without a dime of federal bailout money or other assistance).

In the utopian fantasy of some, all premium content flows freely, supported by a skimpy diet of ads alone. For some that works. Yet for cable networks accustomed to monthly affiliate fees this is completely unrealistic and uneconomic. One needs look no further than the wreakage of the American newspaper industry (including bankruptcy filings recently by the Chicago Tribune and today by the Philadelphia Inquirer) to understand the damage that occurs when business model disruption occurs in the absence of coherent, evolutionary planning.

Someday, when broadband video business models mature (as indeed they ultimately will), there will be lots of cable and other programming available for free online. For now though, getting Comcast and TWC to finally pursue an aggressive broadband distribution path is a welcome evolutionary step in unlocking this exciting new medium's ultimate potential.

What do you think? Post a comment now.

(Note: we'll be diving deep into this topic, and others, at VideoNuze's Broadband Video Leadership Evening on March 17th in NYC. More information and registration is here.)

Categories: Aggregators, Broadband ISPs, Cable Networks, Cable TV Operators

Topics: Comcast, Hulu, Netflix, Time Warner Cable, YouTube

-

Canoe and the Broadband Video Challenge

In 2008, Canoe Ventures, the JV of six large U.S. cable operators, became one of the hottest topics of conversation in the cable, programming and advertising industries. Last week, I was fortunate to get time with Vicki Lins, Canoe's Chief Marketing Officer, to learn more about the company's plans. Though Vicki has been pulling double duty between her role at Comcast Spotlight and Canoe in recent months, she had only just started full time with Canoe, so she readily admitted that she's still getting up-to-speed.

Ordinarily Canoe's advanced TV advertising mission would be off-center for VideoNuze's strictly broadband video-centric focus. But the reason it's relevant to understand is because I think long-term, the world that Canoe is trying to create on top of cable's digital set-top boxes is on a collision course with the world that broadband video is trying to create. I see both eventually competing for the same viewers, ad dollars and mind-share.

Canoe is critical to the cable industry because it recognizes that ever-better targeting, interactivity and ROIs are driving ad spending decisions. For 10+ years now, the Internet (and Google in particular) has been resetting marketers' expectations, thereby placing ever-greater pressure on TV ad executives to improve their game.

Vicki explained that first and foremost, Canoe is a service bureau, helping advertisers, programmers and

cable operators wring more value out of their ad inventory. It does not intend to sell any ads itself. Canoe's key is leveraging its access to its cable partners' digital set-top boxes. First up is what's called "Creative Versioning" or zone-based addressability - the ability to break down users into logical segments that get specific ads. Another focus is productizing the viewership data being captured by those set-tops to out-Nielsen Nielsen (while of course respecting users' privacy). A third is trying to enable user interactivity - the ability to get deeper information, zero in on a product feature in an ad, order an item, etc.

cable operators wring more value out of their ad inventory. It does not intend to sell any ads itself. Canoe's key is leveraging its access to its cable partners' digital set-top boxes. First up is what's called "Creative Versioning" or zone-based addressability - the ability to break down users into logical segments that get specific ads. Another focus is productizing the viewership data being captured by those set-tops to out-Nielsen Nielsen (while of course respecting users' privacy). A third is trying to enable user interactivity - the ability to get deeper information, zero in on a product feature in an ad, order an item, etc. All of this would benefit cable and broadcast networks seeking to more effectively monetize their ad inventory, as well as cable operators which sell a portion of cable networks' ad inventory locally. Clearly these are key constituencies, but as Vicki points out, Canoe must also address ad agencies, brands, cable technologists, local operations teams where Canoe's technology is actually deployed, cable marketers and others who have a stake in this process. It's a pretty long list, and one wonders whether a start-up is able to handle all of this at once.

But there are two even bigger issues that I see. First, I find myself wondering whether Canoe is even aiming at the right target with these initial plans. Instead, why doesn't Canoe just focus 100% of its energies on monetizing these cable operators' billions of current VOD streams? It's amazing to me that years after VOD's launch, I don't see any ads on Comcast (my cable company) VOD. My kids watch lots of Ben 10, Hannah Montana, Wizards of Waverly Place, etc on VOD yet never see a single ad for a sugared cereal or wizzy new toy. As a parent this isn't something I'm complaining about, but if I were a Comcast shareholder it would sure have me scratching my head. It seems like such a big missed opportunity...is there something I don't understand here?

As Denise Denson, MTV's EVP of Content Distribution and Marketing recently told Multichannel News, "We have over a billion VOD orders this year on Comcast alone, but we've made virtually no money in advertising in that space....With the convergence of TV and the Internet, there is a danger that the Internet's interactive content could usurp it. It's unfortunate, but programmers will have to put their content where they can actually monetize it."

And that brings us back to broadband video's challenge to Canoe. The fact is that broadband is a parallel and fast-growing VOD platform that is generating significant content provider interest because of it offers substantial control of the user experience and relatively robust monetization. As I wrote yesterday, broadband advertising innovation is being adopted by major media companies like MTV. And because broadband ad innovation is diffused over many companies (as is all innovation in the hyper-competitive Internet realm), there are rapid and continuous improvements. Conversely, by concentrating its set-top box ad efforts through just Canoe I think the cable industry is limiting the platform's vast potential.

Denise Denson hit the nail on the head: resources are finite and programming networks will focus their attention on platforms that offer the best scale and monetization opportunities. With broadband coming to TVs very soon, it will soon be a de facto competitor to cable's digital set-top box delivery. To preserve the value of its video platform, cable needs to shore up its VOD advertising and user experience and not let broadband surpass it. For my money, that seems like the most productive place for Canoe to first focus its attention.

What do you think? Post a comment now.

Categories: Advertising, Cable TV Operators

-

Sony's Internet-to-the-TV Plans Are Confusing (and the NYTimes Coverage Isn't Helping Any)

Catching up on some reading last night, I got a chance to re-read a NYTimes piece by Saul Hansell from this past Tuesday rather sensationally entitled "How Comcast Controls Sony's Internet TV Plans." When I scanned it on Tuesday before posting a link to it from VideoNuze, I had one of those "This makes absolutely no sense, I need to read this again closer" reactions. Now, upon re-reading it, I'm having one of those "This really makes no sense" reactions.

The piece - which initially concerns Sony's efforts to bring broadband video to TVs, but then veers off into a somewhat unrelated discussion of the company's negotiations with the cable industry's tru2Way and CableCard technologies - quotes Sony Electronics U.S. president Stan Glasgow as saying: "We've worked with the cable companies for five years to develop a system that would allow us and the rest of the television manufacturers to have alternative content on the TV."

Why would Sony devote five years to such an undertaking? Because, again in Mr. Glasgow's words, "If you have to ask a consumer to switch sources constantly between cable and another source, it is not the normal consumer experience...There has to be a more integrated way to have cable and Internet content on the same user interface."

I'm all for making things easy on the consumer, but let's get this right: Sony devoted five years to negotiating with the cable industry so it could avoid viewers having to push the "Source" or "Input" button on their remote controls to toggle to broadband-delivered content via Sony devices?

Hello? According to comScore's recent numbers, 142 million people in the U.S. alone watched 558 million hours of online video. But amid that massive adoption, Sony thinks it might be setting the bar too high for its potential buyers if it asked them to push a button on their remotes so that they could enjoy some of that video on their TVs instead of on their PCs?

Is it just me, or does it appear that Sony completely misjudged both its potential buyers' technical aptitude and also their strong motivation to consume broadband-delivered video on their TVs?

While you consider those questions, let's also go back to basics: why is once-mighty Sony even bothering to integrate its Internet-to-the-TV products with the cable industry in the first place? The whole point of these kinds of Internet-to-the-TV devices is to disrupt the cable (and satellite and telco) industry's hold on consumer viewing time and spending for in-home video programming. Countless companies (Netflix, Hulu, Microsoft/Xbox, Apple/AppleTV, Vudu, Netgear, Sezmi, 2Wire, Blockbuster, LG, Samsung, Neuros, etc.) get this fundamental point and are implicitly or explicitly driving toward this goal each day.

That Sony doesn't seem to understand this suggests that the correct title of Saul's piece really should have been "Comcast Benefits by Exploiting Sony's Misguided Internet TV Plans."

What's profoundly different about the broadband era is that neither Comcast nor any other incumbent controls how consumers get video on their TVs, just as neither the NYTimes nor any other single news provider has ever controlled how we've gotten our news. If would-be "over-the-top" competitors don't get this basic idea - and instead waste precious time and resources on perpetuating the traditional world order - then shame on them.

What do you think? Post a comment now.

Categories: Cable TV Operators, Devices

-

Video is the Killer App Driving Coming Bandwidth Explosion

A short interview in Multichannel News with Rouzbeh Yassini before the Thanksgiving break last week caught my eye.

Rouzbeh's name is likely unfamiliar to many of you. But for others who have been in and around the cable and broadband industries since the '90s, he is semi-famous. In those days Rouzbeh ran a company called LANCity, which was a pioneer in designing and manufacturing cable modems. These of course are the devices that now reside in tens of millions of homes around the world, enabling broadband Internet access and the high-quality video services like YouTube, Hulu, iTunes and others that run through them.

Though it's only been about 15 years, the early-to-mid '90s seem like another age entirely. Can you remember dial-up Internet access? Busying up your phone line if you wanted to be online? Listening to all those weird tones as your creaky 56K modem connected you to Prodigy, CompuServe, AOL, or eventually this thing everyone seemed to be talking about called the "World Wide Web?"

In my opinion, Rouzbeh deserves as much credit as anyone for the transformation of the dial-up Internet era

to the broadband world we now enjoy. He played a crucial role in articulating broadband's business potential to scores of senior cable executives who barely knew what a computer was, much less this new-fangled thing called the Internet. Importantly, he was a key technical architect of modern cable networks, which today barely resemble the passive, one-way networks of old.

to the broadband world we now enjoy. He played a crucial role in articulating broadband's business potential to scores of senior cable executives who barely knew what a computer was, much less this new-fangled thing called the Internet. Importantly, he was a key technical architect of modern cable networks, which today barely resemble the passive, one-way networks of old. In short, I've learned to take notice of Rouzbeh's prognostications. Though he can be irrepressibly optimistic, he's directionally right more often than not.

All of that brings me to his Multichannel interview. Rouzbeh now envisions the era of gigabit or 1,000 megabit Internet access within a decade. To put this in perspective, today's cable modems typically deliver around 10 megabit service or 1% of a gigabit. Spurred by competitive pressures, Comcast has recently announced the rollout of 50 megabit service to certain regions, with expansion to its entire footprint by 2010. These new rollouts are part of the cable industry's "DOCSIS 3.0" standards, covering a new generation of modems and channel management techniques.

There's an axiom in the broadband industry that usage always rises to the level of bandwidth provided. Yet when we're talking 1 gigabit service, one has to rightly ask, "what in the world are people going to do with all that bandwidth?" Rouzbeh posits things like corporate networking, remote offices, medical services and the like, but only touches briefly on video delivery.

From my perspective, video is the killer application that will drive this bandwidth explosion. As I wrote recently in "Video Quality Keeps Improving - What's it All Mean?" we are on the front end of a shift toward dramatically higher video quality, with near HD delivery already becoming common (Hulu, Netflix and Vudu are among the most recent to announce HD initiatives). This shift will only accelerate going forward. And to accommodate it will require lots more bandwidth from network providers.

In reality, the trickiest part of bandwidth expansion is less the technology development and deployment and more the business models that support the investments and make the most strategic sense. Questions abound: Is the right model to charge $150/mo for 50 megabit access as Comcast plans? Or to build a content service available only to those high-powered users? Or act like a CDN and provide services so as to charge content providers themselves to deliver higher-quality video? Maybe some hybrid of these, or some other model? And of course, what impact do these models have on the incumbent multichannel subscription video offering?

While there's murkiness now, like Rouzbeh, I'm a big believer that these things will ultimately be worked out and that bandwidth expansion is inevitable. Just as we now look back on the dial-up era and wonder how we got by, eventually we'll look at the mid-to-late 2000s and wonder how we survived on so little bandwidth.

What do you think? Post a comment now.

Categories: Aggregators, Broadband ISPs, Cable TV Operators, People

Topics: Comcast, DOCSIS, Hulu, Netflix, VUDU

-

Podcast with Will Richmond

Ever wonder if I actually have a real voice, in addition to the written "voice" you read each day on VideoNuze? The answer is yes, and for proof, check out a podcast interview I did with Phil Leigh of Inside Digital Media.

I discuss some of the ideas I've written about recently in "The Cable Industry Closes Ranks" and "Cutting the Cord" such as why full online episodes from cable networks aren't coming any time soon, what devices are likely to bridge broadband-to-the-TV and how important sports are to the current TV business model.

Do podcasts add value? Should I try to do more of them? Please let me know!

Categories: Cable Networks, Cable TV Operators

Topics: Inside Digital Media, Will Richmond

-

November '08 VideoNuze Recap - 3 Key Themes

Welcome to December and to the home stretch of 2008. Following are 3 key themes from VideoNuze in November:

Cable programming's online distribution narrows - Last month I concluded that cable programmers (e.g. Discovery, MTV, Lifetime) are going to become much more sparing when it comes to distributing their full programs online. As noted in "The Cable Industry Closes Ranks," after hearing from industry executives at the CTAM Summit and on the Broadband Video Leadership Breakfast, it has become apparent that the industry is going to defend its traditional multichannel video subscription model from broadband and new "over-the-top" incursions.

Both programmers and operators have a lot vested in this successful model, and are surely wise to see it last as long as possible. Subscription and affiliate fees are particularly precious in this economy, as the WSJ wrote on Saturday. Still, many VideoNuze readers pointed out the music industry's folly in trying to maintain its business model, only to see it turned upside down. Many predicted the cable industry is doomed to follow suit. Truth-be-told though, as I wrote in "Comcast: A Company Transformed," major cable operators are already far more diversified than they used to be. Broadband, phone and digital TV (+ add-ons like DVR, HD and VOD) have created huge new revenue streams. Surging broadband video consumption only helps them, even as "cord-cutting" looms down the road.

Netflix moves to first ranks of cord-cutting catalysts - Three posts in November highlighted the significant role that Netflix is poised to play in moving premium programming to broadband distribution. Most recently, in "New Xbox Experience with Netflix Watch Instantly: A 'Wow' Moment," I shared early reactions from a VideoNuze reader (echoed by many others) to receiving a subset of Netflix's catalog through Xbox's recently upgraded interface. Netflix CEO Reed Hastings highlighted the increasing importance of game devices in bridging broadband to the TV in his keynote at NewTeeVee Live this month (recapped here).

Still, Netflix lacks the rights to deliver many movies online, a problem unlikely to be rectified any time soon given Hollywood's stringent windowing approach. As such, in "Netflix Should be Aggressively Pursuing Broadcast Networks for Watch Instantly Service," I offered my $.02 of advice to the company that it should build on its recent deal with CBS to blow out its online library of network programs. In this ad-challenged environment, I believe networks would welcome the opportunity. Hit TV programs would help drive device sales, which is crucial for building WI's adoption. While the Roku box is a modest $99, other alternatives are still pricey, though becoming cheaper (the Samsung BD-P2500 Blu-ray player is down $100, now available at $300, I spotted the LG BD300 over the weekend for $245). A robust Netflix online package would be poised to draw subscribers away from today's cable model.

Lousy economy still looms large - Wherever you go, there it is: the lousy economy. Though the market staged a nice little rebound over the last 5 days, things are still fragile. Across the industry broadband companies are doing layoffs. This is only the most obvious of the side effects of the economic downturn. Another, more subtle one could be downward price pressure. As I wrote in "Deflation's Risks to the Broadband Video Ecosystem," economists are now growing concerned that the credit crunch could lead to collapsing prices and profits across the economy. I noted that such an occurrence would be particularly damaging for the broadband industry, where business models are still nascent, so ROIs and spending are softer.

Here's to hoping for some good economic news in December...

What do you think? Post a comment now.

Categories: Aggregators, Broadcasters, Cable Networks, Cable TV Operators, Devices, Games

Topics: CBS, Comcast, LG, Microsoft, Netflix, Roku, Samsung, XBox

-

Here Comes Sling.com

Does the world need another broadband video aggregation site for premium quality video content?

The answer to that question will start to come early next week when Sling.com, the latest entrant in this already crowded space, officially launches. Recently Jason Hirschhorn, president of Sling Media's entertainment group and Brian Jaquet, Sling's Director of Public Relations came through Boston and caught me up on their plans to launch commercially on Nov. 24th.

Many of you know that Sling is the maker of the Slingbox, which connects to your TV or DVR, allowing you

to remotely watch programs on your computer. It's a very clever product, though I have to admit its use case has always been a little confounding to me. Nonetheless, just over a year ago, Sling was acquired by EchoStar in a $380 million deal. Shortly thereafter, EchoStar split itself into two parts, Dish Network, the satellite-delivered programming company, and EchoStar Corporation, which includes Sling and other technology-based businesses.

to remotely watch programs on your computer. It's a very clever product, though I have to admit its use case has always been a little confounding to me. Nonetheless, just over a year ago, Sling was acquired by EchoStar in a $380 million deal. Shortly thereafter, EchoStar split itself into two parts, Dish Network, the satellite-delivered programming company, and EchoStar Corporation, which includes Sling and other technology-based businesses.Sling.com, developed by Jason's entertainment group, is the first Sling offering not tethered to any of its devices and therefore open to all users. Acknowledging that Hulu has set a high bar on user experience, Jason explained that Sling.com is attempting to go one step further on usability, and will also differentiate itself with updated social networking capabilities and highly focused editorial content.

In particular, Sling.com offers a slew of Facebook-like features that allow users to subscribe to and favorite programs and networks, with users in turn able to follow these activities. As Jason aptly put it, the goal is to "digitize the water cooler conversation." The whole experience is geared toward engaging the user at a far deeper level than we're accustomed to in passive linear viewing, or even typical at other aggregators' sites.

The real differentiator for Sling long-term though is the integration of Sling.com with the remote viewing offered by Slingbox. Enabled by a new web-based player (instead of the prior downloadable client), users are able to seamlessly browse back and forth between watching live TV and cataloged programs, as shown below.

Taking this one step further, Sling's goal is to get its remote viewing technology embedded in others' set-top boxes as well. So for example, a Comcast STB with Sling inside would allow you to have live TV integrated into your Sling.com, without having to go buy another box.

That's an enticing prospect, but making it happen will be no small feat; the STB giants like Motorola and SA (now part of Cisco) will get on board only when their biggest customers - America's cable operators - ask for it. The prospect of these cable executives wanting to incorporate any technology controlled by Charlie Ergen, Echo's founder/CEO and the cable industry's arch-enemy, stretches my mind. However, stranger deals have been done, so who knows. In the meantime, there are a whole lot of other non-cable homes globally Sling can address first.

But much of that is down the road anyway. For now, Sling.com is going to compete head on with Hulu (which by my count supplies virtually the entire current movie catalog at Sling.com, in turn begging the question of how many different ways one relatively small ad revenue stream can get carved up?), Fancast, the portal sites, YouTube and so on. Jason readily admits that these sites will not compete on content exclusivity; ultimately they'll all have access to everything that's available.

So in this incredibly crowded space, is there room for a newcomer? On the surface, it's tempting to say "no." But history teaches us that "better mousetraps" can elbow their way into even the most crowded spaces. Remember how many search engines already existed when Google burst onto the scene? On a totally different level, I can relate to this challenge myself. A year ago I wondered whether there was room for a new broadband video-centric blog when so many others already existed; now here we are.

The reality is that newcomers succeed because they don't accept the status quo as final. Rather, they find smart ways of delivering new and better value to customers who didn't necessarily even know what they wanted, but when they got it, were delighted. That's Sling.com's challenge. Whether it can meet it remains to be seen. But in this crummy economy, their deep-pocketed backing certainly gives them a leg up on any VC-funded competitors when it comes to long-term staying power.

What do you think? Post a comment now!

Categories: Aggregators, Cable TV Operators, Devices, Satellite

Topics: Cisco, DISH Network, EchoStar, Fancast, Hulu, Motorola, SA, Sling, YouTube

-

Watching Reed Hastings at NewTeeVee Live

Yesterday I had my own positive broadband video experience, remotely watching portions of the

NewTeeVee Live conference held in SF from the comfort of my office. Om Malik and crew put together a packed agenda and I had wanted to go, but a personal conflict kept me in Boston.

NewTeeVee Live conference held in SF from the comfort of my office. Om Malik and crew put together a packed agenda and I had wanted to go, but a personal conflict kept me in Boston. I caught most of Netflix CEO Reed Hastings' keynote (until the UStream feed froze up, arghh...) and thought he offered some interesting tidbits about how he sees the broadband video market unfolding. VideoNuze readers know I've been avidly following Netflix's recent moves with Watch Instantly and I've come to think of the company as one of three key aggregators best-positioned to disrupt the cable model (the other two being YouTube and Apple).

Three noteworthy points that Hastings made:

Standards needed to interface broadband to the TV - Hastings catalogued the efforts Netflix is making to integrate with various devices like Roku, LG, TiVo, Xbox, etc, but concluded by saying that these one-off, ad hoc integrations are not scalable and are really slowing the market's evolution. Most of us would agree with this assessment. Still, he was quite pessimistic about a standards setting process's ability to move quickly enough - saying this could be a 10-30 year endeavor. Instead, if I understood him correctly, he thinks the TV approach should just be browser- based, and also that today's remotes should be scrapped in favor of pointer-driven (i.e. mouse-like) navigation.

Cable should evolve to focus on broadband delivery and de-emphasize multichannel packaging - Of course this is incredibly self-serving from Netflix's standpoint, but Hastings made the case that broadband margins for cable operators are nearly 100%, because they have no content costs, whereas on the cable side, they have high and ever-increasing programming costs. He cited Comcast's recent announcement of 50 Mbps service as evidence that cable operators should focus on winning the broadband war, and eventually letting go of the multichannel model. Nice try Reed, but I don't see that happening anytime soon. However, as I recently wrote in "Comcast: A Company Transformed," there's no question that broadband is becoming an ever greater part of its revenue and cash flow mix.(Reed emailed to clarify the above point. He didn't say cable should focus on broadband delivery over the current multichannel model; rather that cable - and satellite/telco - should focus more on web-like viewing experiences through improved navigation and VOD/DVR to be more on-demand, personalized and browser-friendly. And he added that with the shift to heavier broadband consumption, cable is a winner either way. Note - I thought I interpreted him correctly, but between UStream choking and my own scribble, it seems I was a bit off here. Thanks for correcting Reed.)Game consoles in leading position to bridge broadband to the TV - Hastings made a pretty strong case for the Wii - and to a lesser extent the PlayStation and Xbox - as the leading bridge devices. The Wii in particular could be a real broadband winner if it could support HD and Flash. As I've been thinking about broadband to the TV, I've concluded - barring anything from left field - that game devices, IP-enabled TVs and IP-enabled Blu-ray players are where the action will be concentrated for the next 3-4 years (this doesn't take account of forklift substitutes like a Sezmi or others sure to come).

NewTeeVee has a good wrap-up of Hastings' talk as well, here. The video replay isn't up yet, but when I see it, I'll post an update.

What do you think? Post a comment now!

Categories: Aggregators, Cable TV Operators, Devices

Topics: Apple, Comcast, LG, Netflix, PlayStation, Roku, TiVo, Wii, XBox, XBox, YouTube

-

Sezmi Update: Technical Trial Complete, New Round Raised, Q1 Launch Planned

Sezmi, a company I wrote about enthusiastically back in May as a big potential disruptor of cable/satellite multichannel services, is making steady progress toward commercial launch. Phil Wiser, the company's co-founder/president gave me an update this week.

Most important, the company has completed technical trials in Seattle with three local broadcasters (Fisher, Tribune and Daystar), to prove in its "FlexCast" distribution model. Sezmi uses a portion of over-the-air spectrum, along with broadband connectivity, to its set-top box to bypass traditional cable infrastructure.

Phil explained that broadcasters are motivated to work with Sezmi for several reasons: incremental revenue from leasing spectrum, enhanced positioning in the Sezmi UI vs. current EPGs, and new ad-driven destination areas or "Zones," that broadcasters can use to create more customized and monetizable viewing experiences.

Phil explained that broadcasters are motivated to work with Sezmi for several reasons: incremental revenue from leasing spectrum, enhanced positioning in the Sezmi UI vs. current EPGs, and new ad-driven destination areas or "Zones," that broadcasters can use to create more customized and monetizable viewing experiences. On the cable networks side, Sezmi pulls down signals to its operational center in Melbourne, FL, processes them and uplinks them. Then, with dishes and other equipment installed at its local broadcast partners' facilities, Sezmi combines all channels for distribution to the home. That gives the viewer three ways to access programming: through traditional linear feeds, through VOD and through DVR.

Phil's confident that these technical trials validate the Sezmi delivery model as well as the feasibility of a national rollout. The next step is a beta trial, with "hundreds" of consumer homes, with a limited, geographically-based commercial rollout intended for sometime in Q1 (no doubt driven by its partners' priorities). Phil confirmed several other broadcast deals, including ones where multiple cities are covered, have been signed, and that several distribution partners are on board, including one with a national footprint (hmm, AT&T? Verizon? Someone else?)

Importantly, I also extracted from Phil that the company has closed another round of financing - greater than the earlier round of $17.5M. Sezmi has a big vision and with 3 pieces of consumer premise hardware (antenna, set top and remote), plus backend equipment and national/local delivery infrastructure to fund, this is a big dollar project for sure.

I remain optimistic about Sezmi's opportunity. As I said in the May post, I haven't seen the whole thing work at scale yet, so there are significant technology unknowns. There's also a sizable customer education mountain to climb (though hopefully mitigated by large well-branded partners' assistance). Then there's the small matter of signing up the local broadcasters, as well as the cable networks.

Still, Sezmi's core value proposition - a better viewing experience at a lower cost than today's cable/satellite incumbents - is right on the mark. The old adage about execution mattering more than strategy has rarely been truer than with Sezmi. It's going to be interesting to watch its continued progress.

What do you think? Post a comment now!

Categories: Cable Networks, Cable TV Operators, Devices, Startups

Topics: Daystar Television Network, Fisher Communications, SezMi, Tribune Broadcasting

-

The Cable Industry Closes Ranks

First, apologies for those of you getting sick of me talking about the cable TV industry and broadband video; I promise this will be my last one for a while.

After attending the CTAM Summit the last couple of days, moderating two panels, attending several others and having numerous hallway chats, I've reached a conclusion: the cable industry - including operators and networks - is closing ranks to defend its traditional business model from disruptive, broadband-centric industry outsiders.

Before I explain what I mean by this and why this is happening, it's critical to understand that the cable business model, in which large operators (Comcast, Time Warner Cable, etc.) pay monthly carriage or affiliate fees to programmers (e.g. Discovery, MTV, HGTV, etc.) and then bundle these channels into multichannel packages that you and I subscribe to is one of the most successful economic formulations of all time. The cable model has proved incredibly durable through both good times and bad. In short, cable has had a good thing going for a long, long time and industry participants are indeed wise to defend it, if they can.

It's also important to know that the industry is very well ordered and as consolidation has winnowed its ranks to about half a dozen big operators and network owners, the stakes to maintain the status quo have become ever higher. All the executives at the top of these companies have been in and around the industry for years and have close personal and professional ties. There's a high degree of transparency, with key metrics like cash flow, distribution footprint, ratings and even affiliate fees all commonly understood.

One last thing that's worth understanding is that the cable industry has very strong survival instincts, or as a long-time executive is fond of saying, "Real cable people (i.e. not recent interlopers from technology, CPG or online companies that have joined the industry) were raised in caves by wolves." The fact is that the industry started humbly and experienced many very shaky moments. Yet it has managed to survive and continually re-invent itself (for those who want to know more, I refer you to "Cable Cowboy: John Malone and the Rise of the Modern Cable Business" by Mark Robichaux, still the best book on the industry's history that I've read).

All of that brings us to broadband and its potential impact on the cable model. As I've said many times, broadband's openness makes it the single most disruptive influence on the traditional video distribution value chain. Principally that means that by new players going "over the top" of cable - using its broadband pipes to reach directly into the home - cable's model is at serious risk of breaking down, once and for all.

The cable industry now gets this, and I believe has closed ranks to frown heavily on the idea of cable programming, which operators pay those monthly affiliate fees for, showing up for free on the web, or worse in online aggregators' (e.g. Hulu, YouTube, Veoh, etc.) sites. The message is loud and clear to programmers: you'll be jeopardizing those monthly affiliate fees come renewal time if your crown jewels leak out; worse, you'll be subverting the entire cable business model.

And this message isn't being delivered just by cable operators such as Peter Stern from Time Warner who said on my Broadband Video Leadership Breakfast panel that "a move to online distribution by cable networks would directly undermine the affiliate fees that are critical to creating great content." It's also coming from the likes of Discovery CEO David Zaslav who said on a panel yesterday that "there's no economic value from online distribution," and that "great brands like Discovery's must not be undervalued by making full programs available for free online."

The issue is, as a practical matter, can the industry really control all this? If there's zero online distribution, then as Fancast's impressive new head, Karin Gilford said on my panel yesterday, "pressure builds up and another channel inevitably opens" (read that as The Piracy Channel). The problem is that if, for example, an operator does put programs up on its own site - as Fancast is doing - they're available to ALL the site's visitors, not just existing cable subscribers, unless other controls are put in place like passwords, IP address authentication, geo-targeting, etc. But these are confusing and cumbersome to users whose expectations are increasingly being set by broadcasters who are making their primetime programs seamlessly available to all comers.

So what does this closing ranks suggest? Going forward, I think we'll still see cable networks putting up plenty of clips and B-roll video from their programs, maybe the occasional online premiere, some made-for-the-web stuff, paid program downloads (iTunes, etc.) and promotional/community building contests, as Deanna Brown from Scripps described with "Rate My Space" or Zaslav discussed with "MythBusters."

But when it comes to full cable network programs going online, I think that spigot's going to dry up. That has implications for online aggregators like Hulu, who will continue to have big holes in their libraries until they're ready to pay up for these carriage rights. And it also means that broadband-to-the-TV plays are also going to be hampered by subpar lineups unless these companies too are willing to pay for cable programming.

By closing ranks the cable industry's making a bold bet that its ecosystem can withstand broadband's onslaught and the rise of the Syndicated Video Economy. In yesterday's post I noted that the music industry tried a similar approach; we know where that got them. There are plenty of reasons to think things could indeed be different for the cable industry, but there are as many other reasons to think the cable industry is massively deluding itself and could someday be grist for a chapter in the updated version of Clay Christensen's "The Innovator's Dilemma," (my personal bible for how to pursue successful disruption), right alongside the inevitable chapter about how the once mighty American auto industry spectacularly lost its way.

For my part, there are just too many moving parts for me to call this one just yet.

What do you think? Post a comment now!

Categories: Aggregators, Broadcasters, Cable Networks, Cable TV Operators, Devices, Syndicated Video Economy

Topics: Comcast, CTAM Summit, Discovery, Fancast, Scripps, Time Warner

-

Notes from Broadband Video Leadership Breakfast

Yesterday, I hosted and moderated the inaugural Broadband Video Leadership Breakfast, in association with the CTAM New England and New York chapters, here in Boston (a few pics are here). We taped the session and I'll post the link when the video is available. Here are a few of key takeaways.

My opening question to frame the discussion centered on broadband's eventual impact on the cable business model: does it ultimately upend the traditional affiliate fee-driven approach by enabling a raft of "over-the-top" competitors (e.g. Hulu, Netflix, Apple, YouTube, etc.) OR does it complement the model by creating new value and choice? As I said in my initial remarks, I believe that how this question is ultimately resolved will be the key determinant of success for many of the companies involved in today's broadband ecosystem and video industry.

I posed the question first to Peter Stern, who's in the middle of the action as Chief Strategy Officer of Time Warner Cable, the second largest cable company in the U.S. I thought his answer was intriguing: he said that it is cable networks themselves who will determine the sustainability of the model, depending on whether they choose to put their full-length programs online for free or not.

Later in the session, he put a finer point on his argument, saying that "a move to online distribution by cable networks would directly undermine the affiliate fees that are critical to creating great content" and that finding ways to offer these programs only to paying broadband Internet access subscribers was a far better model for today's cable networks and operators to pursue (for more see Todd Spangler's coverage at Multichannel News).

Peter's point echoes my recent "Cord-Cutters" post: to the extent that cable networks - which now attract over 50% of prime-time viewership, and derive a third or more of their total revenues from affiliate fees - withhold their most popular programs from online distribution, they provide a powerful firewall against cord-cutting. Speaking for myself for example, the prospect of missing AMC's "Mad Men" (not available online anywhere, at least not yet...) would be a powerful disincentive for me to yank out my Comcast boxes.

These thoughts were amplified by the other panelists, Deanna Brown, President of SN Digital, David Eun, VP of Content Partnerships for Google/YouTube, Roy Price, Director of Digital Video for Amazon and Fred Seibert, Creative Director and Co-founder of Next New Networks, who held fast to a highly consistent message that broadband should be thought of as expanding the pie, thereby creating a new medium for new kinds of video content. David, in particular cited the massive amount of user-uploaded and consumed video at YouTube (amazingly, about 13 hours of video uploaded every minute of every day) as strong evidence of the community and context that broadband fosters.

Still, our audience Q&A segment revealed some very basic cracks in the panelists' assertions that the transition to the broadband era can be orderly and managed (not to mention that afterwards, I was privately barraged by skeptical attendees). First and foremost these individuals argued the idea that the cable industry can maintain the value of its subscription service by using the control-oriented approach typified by the traditional windowing process flies in the face of valuable lessons learned by the music industry.

Of course most of us know that sorry story well by now: an assortment of entrenched, head-in-the-sand record labels forcing a margin rich, but speciously valued product (namely the full album or CD) on digitally empowered audiences, who decided to take matters into their own hands by stealing every song they could click their mouses on. Consequently, a white knight savior (Apple) offering a legitimate and consumer-friendly purchase alternative (iPod + iTunes), which would grew to be so popular that it has made the record labels beholden to it, while simultaneously hollowing out the last vestiges of the original album-oriented business model.

Does history repeat itself? Are Peter and the other brightest lights of the cable industry deluding themselves into thinking that a closed, high-margin, windowed platform like cable can ever possibly morph itself into a flexible, must-have service for today's YouTube/Facebook generation?

I've been a believer for a while that by virtue of their massive base of broadband-connected homes, high-ARPU customer relationships and programming ties, cable operators have enormous incumbent advantages to win in the broadband era. But incumbency alone does not guarantee success. Instead, what wins the day now is staying in tune with and adapting to drastically changed consumer expectations, and then executing well, day after day. One look at the now gasping-for-breadth behemoth that was once proud General Motors hammers this point home all too well.

As Fred succinctly wrapped things up, "The reason I love capitalism is that it forces all of us to keep doing things better and better." To be sure, broadband and digital delivery are unleashing the most powerful capitalistic forces the video industry has yet seen. What impact these forces ultimately have on today's market participants is a question that only time will answer.

What do you think? Post a comment now!

Categories: Aggregators, Broadband ISPs, Cable Networks, Cable TV Operators, Indie Video

Topics: Amazon, CTAM, Google, Next New Networks, Scripps, SN Digital, Time Warner Cable, YouTube

-

Comcast: A Company Transformed

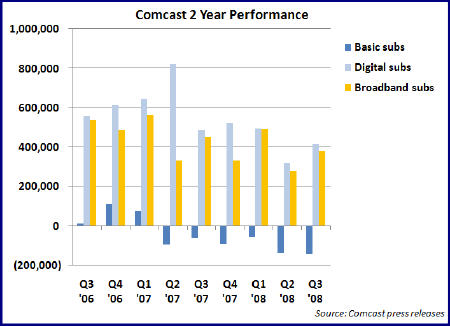

Three numbers in last week's third quarter Comcast earnings release underscored something I've believed for a while: Comcast is a company transformed, now reliant on business drivers that barely existed just ten short years ago. Comcast's transformation from a traditional, plain vanilla cable TV operator to a digital TV and broadband Internet access powerhouse is profound proof of how consumer behaviors' are changing and value is going to be created in the future.

The three numbers that caught my attention were the net additions of 382,000 broadband Internet subscribers and 417,000 digital subscribers, with the simultaneous net loss of 147,000 basic subscribers. The latter number is the largest basic sub loss the company has sustained and, based on the company's own earnings releases, the sixth straight quarter of basic sub contraction. In the pre-digital, pre-broadband days, when a key measure of cable operators' health was ever-expanding basic subscribers, this trend would have caused a DEFCON 1 situation at the company. (see graph below for 2 year performance of these three services)

That it doesn't any longer owes to the company's ability to bolster video services revenue and cash flow through ever-higher penetration of digital services into its remaining sub base (at the end of Q3 it stood at 69% or 16.8 million subs). Years after Comcast and other cable operators introduced "digital tiers," stocked with ever-more specialized channels that consumers resisted adopting, the industry has hit upon a winning formula for driving digital boxes into Americans' homes: layering on advanced services like HD, VOD and DVR that are only accessible with digital set top boxes and then bundling them with voice and broadband Internet service into "triple play" packages. Comcast has in effect gone "up-market," targeting consumers willing and able to afford a $100-$200/month bundle in order to enjoy the modern digital lifestyle.

Still, in a sense the new advanced video services represent just the latest in a continuum of improved video services. Far more impressive to me is the broadband growth that both Comcast and other cable operators have experienced. Comcast's approximately 15 million YE '08 broadband subscribers will generate almost $8 billion in annual revenue for Comcast, up dramatically from its modest days as part of @Home 10 years ago. (It's also worth noting the company now also provides phone service to over 6 million homes today vs. zero 10 years ago)

The cable industry as a whole will end 2008 with approximately 37 million broadband subs, again up from single digit millions 10 years ago. And note that the 387,000 net new broadband subs Comcast added in Q3 '08 compares with just 277,000 net broadband subs that the two largest telcos, AT&T and Verizon added in quarter, combined. As someone who was involved in the initial trials of broadband service at Continental Cablevision less than 15 years ago, observing this growth is nothing short of astounding.

While broadband's financial contribution to Comcast is unmistakable, its real impact on the company is more

keenly felt in its newfound importance in its customers' lives. Broadband Internet access has become a true utility for many, as essential in many homes as heat, water and electricity. A senior cable equipment executive told me recently that research done by cable companies themselves has shown that in broadband households, broadband service would be considered the last service to get cut back in these tough economic times. In these homes cable TV itself - long thought to be recession-resistant - would get cut ahead of broadband.

keenly felt in its newfound importance in its customers' lives. Broadband Internet access has become a true utility for many, as essential in many homes as heat, water and electricity. A senior cable equipment executive told me recently that research done by cable companies themselves has shown that in broadband households, broadband service would be considered the last service to get cut back in these tough economic times. In these homes cable TV itself - long thought to be recession-resistant - would get cut ahead of broadband.But Comcast and other cable operators must not rest on their laurels. Their next big challenge is to figure out how to take this massive base of broadband subs and start delivering profitable video services to it. If Comcast allows its broadband service to be turned into a dumb pipe, with "over the top," on demand video offerings from the likes of Hulu, YouTube, Neflix, Apple and others to ascend to dominance, that would be criminal. Not only would it devalue the broadband business, it would dampen interest in the company's advanced video services (VOD in particular) while making the company as a whole vulnerable in the coming era of alternative, high-quality wireless delivery.

Comcast is indeed a company transformed from what it was just 10 years ago. Technology, changing consumer behaviors and a little bit of "being in the right place at the right time" dumb luck have combined to allow Comcast to remake itself. Comcast itself must fully recognize these changes and aggressively build out Fancast and other initiatives to fully capitalize on its newfound opportunities.

What do you think? Post a comment now.

Categories: Aggregators, Broadband ISPs, Cable TV Operators, Telcos

Topics: Apple, AT&T, Comcast, Netflix, Verizon, Verizon, YouTube

-

October '08 VideoNuze Recap - 3 Key Themes

Welcome to November. October was a particularly crazy month with the unfolding financial crisis. Here are 3 key themes.

1. Financial crisis hurts all industries; broadband is no exception

In October the financial crisis was omnipresent. During the month I addressed its probable effects on the broadband industry here and here so I'm not going to spend much more time on it today. Suffice to say, for the foreseeable future, the key industry metrics are financing, staffing and customer spending. Conserving cash and getting to breakeven are paramount for all.

In particular, in "Thinking in Terms of a 'GOTI' Objective" I tried to provide some food for thought about why focus is so important right now. Industry CEOs' jobs have gotten a whole lot harder in the wake of the meltdown; those with the best strategic and financial skills will come through the storm, others will encounter significant challenges.

2. Broadband video is still in very early stages of development

I'm constantly trying to gauge just how developed the broadband video industry actually is. All kinds of indicators continue to suggest to me that we're still in the very early days. For example, in one post this month comparing iTunes and Hulu, it was evident that iTunes is currently far outpacing Hulu in TV episode-related revenues. Remember that Hulu is the undisputed premium ad-supported aggregator. And that the ad-supported business model itself is predicted by most to eventually be far larger than the paid model. That iTunes is so far ahead for now shows how young Hulu really is (in fact, just celebrating its first anniversary) and how much more development the ad-supported model still has ahead of it.

I think another relevant indicator of progress is how well the broadband medium is distinguishing itself from alternatives by capitalizing on its key strengths. In "Broadband Video Needs to Become More Engaging," I noted that while there have recently been positive signs of progress, overall, much of broadband's engagement potential is still untapped. That's why I'm always encouraged by compelling UGV contests like the one Fox and Metacafe unveiled this month or by technology like EveryZing's new MetaPlayer that drives more granular interactivity. To truly succeed, broadband must become more than just an online video-on-demand medium.

3. Cable operators are central to broadband video's development

As ISPs, cable operators account for the lion's share of broadband Internet access. Further, their ongoing efforts to increase bandwidth widens the universe of addressable homes for high-quality content delivery. Still, their multichannel subscription-based business model is increasingly threatened by broadband's on-demand, a la carte nature. As delivery quality escalates and consumer spending remains pinched, the notion of dropping cable in favor of online-only access become more alluring.

Yet in "Cutting the Cord on Cable: For Most of Us It's Not Happening Any Time Soon," I explained why restricted access to popular cable network programs and an inability to easily view broadband video on the TV will keep cable operators in a healthy position for some time to come. Still, it's a confusing landscape; this month I noticed Time Warner Cable itself helped foster cable bypass, when in the midst of its retransmission standoff with LIN TV, it offered an instructive video for how to watch most broadcast network programming online. Comcast also got into the act, unveiling "Premiere Week" on its Fancast portal. These kinds of initiatives remind consumers there's a lot of good stuff available for free online; all you need is a broadband connection.

Lots more to come in November, stay tuned.

Categories: Broadband ISPs, Broadcasters, Cable Networks, Cable TV Operators, Technology, UGC

Topics: Comcast, EveryZing, FOX, Hulu, iTunes, LIN TV, MetaCafe, Time Warner Cable

-

Cutting the Cord on Cable: For Most of Us It's Not Happening Any Time Soon

Two questions I like to ask when I speak to industry groups are, "Raise your hand if you'd be interested in 'cutting the cord' on your cable TV/satellite/telco video service and instead get your TV via broadband only?" and then, "Do you intend to actually cut your cord any time soon?" Invariably, lots of hands go up to the first question and virtually none to the second. (As an experiment, ask yourself these two questions.)

I thought of these questions over the weekend when I was catching up on some news items recently posted to VideoNuze. One, from the WSJ, "Turn On, Tune Out, Click Here" from Oct 3rd, offered a couple examples of individuals who have indeed cut the cord on cable and how their TV viewing has changed. My guess is that it wasn't easy to find actual cord-cutters to be profiled.

There are 2 key reasons for this. First it's very difficult to watch broadband video on your TV. There are special purpose boxes (e.g. AppleTV, Vudu, Roku, etc.), but these mainly give access to walled gardens of pre-selected content, that is always for pay. Other devices like Internet-enabled TVs, Xbox 360s and others offer more selection, but are not really mass adoption solutions. Some day most of us will have broadband to the TV; there are just too many companies, with far too much incentive, working on this. But in the short term, this number will remain small.

The second reason is programming availability. Potential cord-cutters must explicitly know that if they cut their cord they'll still be able to easily access their favorite programs. Broadcasters have wholeheartedly embraced online distribution, giving online access to nearly all their prime-time programs. While that's a positive step, the real issue is that cord-cutters would get only a smattering of their favorite cable programs. Since cable viewing is now at least 50% of all TV viewing (and becoming higher quality all the time, as evidenced by cable's recent Emmy success), this is a real problem.

To be sure, many of the biggest ad-supported cable networks (MTV, USA, Lifetime, Discovery) are now making full episodes of some of their programs available on their own web sites. But these sites are often a hodgepodge of programming, and there's no explanation offered for why some programs are available while others are not. For example, if you cut the cord and could no longer get Discovery Channel via cable/satellite/telco, you'd only find one program, "Smash Lab" available at Discovery.com. Not an appealing prospect for Discovery fans.

Then there's the problem of navigation and ease of access. Cutting the cord doesn't mean viewers don't want some type of aggregator to bring their favorite programming together in an easy-to-use experience. Yet full streaming episodes are almost never licensed to today's broadband aggregators. Cable networks are rightfully being cautious about offering full episodes online to aggregators not willing to pay standard carriage fees.

For example, even at Hulu, arguably the best aggregator of premium programming around, you can find Comedy Central's "The Daily Show" and "Colbert Report." But aside from a few current episodes from FX, SciFi and Fuel plus a couple delayed episodes from USA like "Monk" and "Psych," there's no top cable programming to be found.

As another data point, I checked the last few weeks of Nielsen's 20 top-rated cable programs and little of this programming is available online either. A key gap for cord-cutters would be sports. At a minimum, they'd be saying goodbye to the baseball playoffs (on TBS) and Monday Night football (on ESPN). In reality, sports is the strongest long-term firewall against broadband-only viewing as the economics of big league coverage all but mandate carriage fees from today's distributors to make sense.

Add it all up and while many may think it's attractive to go broadband only, I see this as a viable option for only a small percentage of mainstream viewers. Only when open broadband to the TV happens big time and if/when cable networks offer more selection will this change.

What do you think? Post a comment now.

Categories: Aggregators, Broadcasters, Cable Networks, Cable TV Operators, Devices, Telcos

Topics: AppleTV, Comedy Central, Discovery, ESPN, FX, Hulu, Lifetime, Roku, SciFi, TBS, USA, VUDU, Xbox360

-

Time Warner Cable Fostering Cable Bypass in LIN TV Retransmission Dispute?

The latest battle over "retransmission consent" is now underway between Time Warner Cable and LIN TV. These fights crop up periodically, but what's different about this one is that TW is offering instructions to its customers for how to hook their PCs to their TVs so they can view LIN's prime-time programming from the applicable network affiliate's web site.

Time Warner has set up instructional sites, such as http://www.tellthetruthwluk.com/main.phpfor residents of the Green Bay, WI area affected by the outage. Prominently displayed at the site is a 3 minute video with the step-by-step instructions for connecting a PC to a TV. (As a sidenote, the video itself is a great example of a how-to broadband video, but I'd bet that it makes the process look far easier than it is likely to be for most average consumers).

But the all-too-obvious question that I raise: once TW customers get the hookup working, how long will it take them to realize that by bypassing TW's service, some cable network programming can now also be viewed this way, and for free? TW may be inadvertently helping its own customers realize that the $40-$60/month or so they're paying TW may be avoidable.

To my knowledge, this is the first time in these regular retrans flareups involving broadcasters and cable

operators (mostly) that broadband has been injected into the mix. In these situations the warring companies usually focus on tactics like LIN offering a $50 credit to consumers to sign up for DISH satellite service or Time Warner handing out over 50,000 free antennas to its customers to receive LIN stations the pre-cable TV, over-the-air way.

operators (mostly) that broadband has been injected into the mix. In these situations the warring companies usually focus on tactics like LIN offering a $50 credit to consumers to sign up for DISH satellite service or Time Warner handing out over 50,000 free antennas to its customers to receive LIN stations the pre-cable TV, over-the-air way.But now, with broadband access to prime-time network programs rampant, cable operators have a new tactic to buttress their argument that these broadcast programs are available for free already, so they - and in turn the consumer - should not have to pay for them.

This situation underscores what I've been saying for a while: that broadcast networks' and local affiliates' strategic agendas are falling out of line, as the networks have embraced online delivery wholeheartedly and local stations are left without their historical de facto exclusivity to key prime-time programs.

Of course the root issue here is that local broadcasting is a business built on analog-determined geographic markets. With the advent of digital delivery over the Internet, the networks have increasingly realized that they can go direct to their target audiences. Sometimes they've been friendlier to their local affiliates by giving them some branding or cutting them in on the ad revenues. Yet long-term, the schism between networks and local affiliates seems inevitable. That means that these retransmission fights are bound to only get nastier in the future.

(Note: I'll have Peter Stern, Time Warner Cable's EVP of Product and Strategy on my Nov. 10th Broadband Video Leadership Panel in Boston, "How to Profit from Broadband Video's Disruptive Impact." Click here for early bird registration and information.)

What do you think? Post a comment now.

Categories: Broadcasters, Cable TV Operators

Topics: LIN TV, Time Warner Cable

-

Inside the Netflix-Starz Play Licensing Deal

This past Wednesday, Starz, the Liberty Media-owned premium cable network, licensed its "Starz Play" broadband service to Netflix. The three year deal makes all of Starz's 2,500 movies, TV shows and concerts available to Netflix subscribers using its Watch Instantly streaming video feature. Very coincidentally I happened to be at Starz yesterday for an unrelated Liberty meeting, and had a chance to speak to Starz CEO Bob Clasen, who I've known for a while, to learn more.

On the surface the deal is an eye-opener as it gives a non-cable/telco/satellite operator access to Starz's

trove of prime content. As I've written in the past, cable channels, which rely on their traditional distributors for monthly service fees, have been super-sensitive to not antagonizing their best customers when trying to take advantage of new distribution platforms. This deal, which uses broadband-only distribution to reach into the home, no doubt triggers "over-the-top" or "cable bypass" alarm bells with incumbent distributors.

trove of prime content. As I've written in the past, cable channels, which rely on their traditional distributors for monthly service fees, have been super-sensitive to not antagonizing their best customers when trying to take advantage of new distribution platforms. This deal, which uses broadband-only distribution to reach into the home, no doubt triggers "over-the-top" or "cable bypass" alarm bells with incumbent distributors. Then there is the value-add/no extra cost nature of Netflix's Watch Instantly feature. That there is no extra charge to subscribers for Starz's premium content (as there typically is when subscribing to Starz through cable for example) raises the question of whether Starz might have given better pricing to Netflix to get this deal done than it has to its other distributors.

But Bob is quick to point out that in reality, the Netflix deal is a continuation of Starz's ongoing push into broadband delivery begun several years ago with its original RealNetworks deal and continued recently with Vongo. To Starz, Netflix is another "affiliate" or distributor, which, given its tiny current online footprint does not pose meaningful competition to incumbent distributors. With only about 17 million out of a total 100 million+ U.S. homes subscribing to Starz, broadband partnerships are seen as a sizable growth opportunity by the company.

Further, Starz has been aggressively pitching online deals to cable operators and telcos for a while now, though only the latter has bit so far (Verizon's FiOS is an announced customer). Cable operators seem interested in the online rights, but have been reluctant to pay extra for them as Starz requires.

Bob also noted that Starz's wholesale pricing was protected in its Netflix deal, and that for obvious reasons of not hurting its own profitability, Starz has strong incentives to preserve incumbent deal terms in all of its new platform deals.

To me, all of this adds up to at least a few things. First is that Netflix must be paying up in a big way to

license Starz Play. I assume this is an obvious recognition by Netflix that it needed more content to make Watch Instantly more compelling (see also Netflix's recent Disney Channel and CBS deals). Since it's not charging subscribers extra, Netflix is making a bet that over time - and aided by its Roku and other broadband-to-the-TV devices - Watch Instantly will succeed and as a result, will drive down its costs by reducing the number of DVDs the company needs to buy and ship. That seems like a smart long-term bet as the broadband era unfolds.

license Starz Play. I assume this is an obvious recognition by Netflix that it needed more content to make Watch Instantly more compelling (see also Netflix's recent Disney Channel and CBS deals). Since it's not charging subscribers extra, Netflix is making a bet that over time - and aided by its Roku and other broadband-to-the-TV devices - Watch Instantly will succeed and as a result, will drive down its costs by reducing the number of DVDs the company needs to buy and ship. That seems like a smart long-term bet as the broadband era unfolds.And while I agree that Starz Play on Netflix doesn't represent real competition to cable, telco and satellite outlets today, it's hard not to see it as a signal that traditional distributors are losing their hegemony in premium video distribution. (for another example of this, see Comedy Central's licensing of Daily Show and Colbert to Hulu). As I've said for a while, over the long term, the inevitability of broadband all the way to the TV portends significant disruption to current distribution models. I see Netflix at the forefront of this disruptive process.

What do you think? Post a comment now.

Categories: Aggregators, Cable Networks, Cable TV Operators, Devices, Telcos

Topics: CBS, Comedy Central, Disney, Liberty Media, Netflix, Starz, Verizon

-

Comcast's Fancast Becomes Hub for Premieres; But Where's Project Infinity?

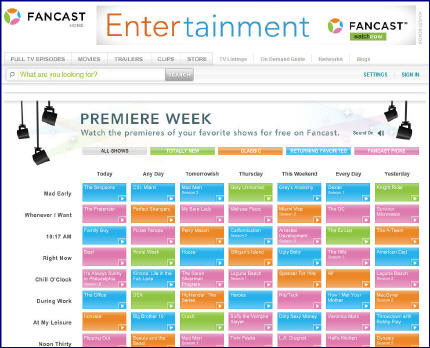

Here's a clever move from Comcast's Fancast broadband portal to create new value for users and generate excitement in the broadband market: this week it is running "Premiere Week," an aggregation of 168 premiere TV episodes. The episodes span series premieres ("Desperate Housewives," "Dexter," "The Office"), season premieres ("Fringe," "Sons of Anarchy," "Crash") and classic pilots ("Dynasty," "The A-Team," "Miami Vice"). It's great fun and a visitor could get lost on the site for hours, as I nearly did.

These are the kinds of promotions that Comcast should be all over. Given its extensive reach and programming muscle, the company has definite - though not insurmountable - advantages over other aggregators to pull this kind of promotion together.

The competition for aggregating premium programming continues to intensify. Business models are all over the board as are approaches for getting video all the way to the TV. For example, last week Amazon launched its pay-per-use VOD initiative which includes a page of info for how to watch using TiVo, Sony Bravia Internet Video Link, Xbox 360, etc. Then yesterday, Netflix announced that it will incorporate about 2,500 of Starz's movies, TV shows and concerts in its Watch Instantly feature, along with a feed of its linear channel. Still other moves are forthcoming.

Comcast's real lever though is unifying its currently siloed worlds of digital TV, broadband Internet access and Fancast. When converged they're a blockbuster; companies like Netflix, Amazon and others cannot replicate this combination. In particular, Comcast, and other cable operators are ideally positioned to bridge broadband all the way to the TV. That's the last big hurdle to unlock broadband's ultimate value. Whether they'll do so is an open question.

Earlier this year Comcast CEO Brian Roberts unveiled the company's "Project Infinity" which suggested Comcast was looking to unify its various video offerings and bring broadband to its subscribers' TV. It seemed like a promising move, though there was no timeline disclosed. Now, nearly 9 months later I can't find any updates on the status of Project Infinity. It would be great for the company to publicly release a progress report or sense of upcoming milestones.

Promotions like "Premiere Week" are a positive step from Comcast, but real competitive advantage for the company lies in launching services which are truly impossible for others to match.

What do you think? Post a comment.

Categories: Aggregators, Cable TV Operators, Portals

Topics: Amazon, Comcast, Fancast, Netflix, Starz, TiVo

-

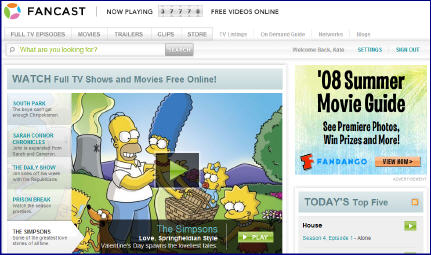

Fancast Gets a Facelift

Comcast's Fancast broadband portal has received a much-needed facelift, adding new features and content to compete with other well-funded players in this space. (Note: before you conclude that VideoNuze has become obsessed with covering Comcast - since just yesterday I dug into its ISP policies - rest assured, tomorrow I'll move on!)

Fancast is by far the most ambitious portal effort among the major cable operators. In fact, while other operators' portals target just their own ISP customers, Comcast's goal is to have Fancast compete for ANY broadband user's attention. That means that Fancast goes head to head with ad-based broadband aggregators like Hulu, Veoh, Joost, Metacafe, etc. And now with Fancast's new video download store, it also butts up against folks like iTunes, Amazon Unbox, Xbox LIVE Marketplace, etc. Then of course there's YouTube, the 800 pound gorilla of the broadband video world, which all aggregators, compete with on one level or another.

With such a formidable array of competitors, Fancast has a high bar to succeed. Still, I've maintained for a while that Comcast, with its 14 million+ broadband subscribers and 22 million+ cable subscribers is extremely well-positioned and needed to play aggressively in broadband video distribution. To date though I've been underwhelmed by Fancast, which seemed to have a solid vision, but sub-par execution. (For more on this, see 2 previous posts, here and here, comparing Hulu and Fancast.)

Now, with Fancast's facelift, the portal is getting some mojo. Fancast's director of communications Kate Noel recently took me on a spin through what's new. First up is a new home page (see below) that nicely showcases premium content that is curated by an in-house editorial team. Clicking on a selection reveals an oversize video player (which can be further enlarged to full screen). New features include embedding and sharing, along with a handy tool to be notified when a new episode is offered.

There's also a noticeable improvement in content selection, which Kate says now includes over 37,500 video assets; 320+ individual TV programs, 250+ movies and countless trailers and clips from over 100 content partners. Fancast is also putting a heavy emphasis on editorial differentiation, and has created sections such as "Today's Top 5," "Daily Buzz (blog)" and "Discover All Your Favorites." to help orient users on the site and provide editorial perspective.

This all plays to what Kate says is Fancast's larger mission to not just "offer TV online," but rather to "use Fancast as a cross-platform hub" that draws value from and drives value to Comcast's other offerings - digital cable, VOD and DVR service in particular.

With Comcast's huge cable subscriber base, that sounds right in theory. But how exactly Fancast fully executes on that potential still feels squishy. For example, doing a search for a current episode of "Mad Men" reveals a nice option to watch on VOD (since it's not currently on Fancast - that's a whole other story...), but is this really a game-changer? A much more significant lever at Comcast's disposal would be getting Fancast onto their digital cable boxes, so all that great Fancast content could be consumed in the living room (maybe along with YouTube, Funnyordie, NYTimes.com and other video?). The nagging question remains: will that day ever come?