-

June '08 VideoNuze Recap - 3 Key Topics

Wrapping up a busy June, I'd like to quickly recap 3 key topics covered in VideoNuze:

1. Execution matters as much as strategy

I've been mindful since the launch of VideoNuze to not just focus on big strategic shifts in the industry, but also on the important role of execution. I'm not planning to get too far into the tactical weeds, but I do intend to show examples where possible of how successful execution can make a difference. This month, in 2 posts comparing and contrasting Hulu and Fancast (here and here) I tried to constructively show how a nimble upstart can get a toehold against an entrenched incumbent by getting things right.

While great execution is a key to successful online businesses, it may sometimes feel pretty mundane. For example, in "Jacob's Pillow Uses Video to Enhance Customer Experience" I shared an example of an arts organization has begun including video samples of upcoming performances on its web site, improving the user experience and no doubt enhancing ticket sales. A small touch with a big reward. And in this post about the analytics firm Visible Measures, I tried to explain how rigorous tracking can enhance programming and product decisions. I'll continue to find examples of where execution has had an impact, whether positive or negative.

2. Cable TV industry impacted by broadband

As many of you know, I believe the cable TV industry is a crucial element of the broadband video industry. Cable operators now provide tens of millions of consumer broadband connections. And cable networks have become active in delivering their programs and clips via broadband. Yet the broadband's relationships with operators and networks are complex, presenting a range of opportunities and challenges.

On the opportunities side, in "Cable's Subscriber Fees Matter, A Lot," I explained how the monthly sub fees that networks collect put them on a firm financial footing for weathering broadband's changes and an advantageous position compared to broadband content startups which must survive solely on ads. Further, syndication is offering new distribution opportunities, as evidenced by Scripps Networks syndication deal with AOL in May and Comedy Central's syndication of Daily Show and Colbert Report to Hulu and Adobe. Yet cable networks are challenged to exploit broadband's new opportunities while not antagonizing their traditional distributors.

For operators, though broadband access provides billions in monthly revenues, broadband is ultimately going to challenge their traditional video subscription business. In "Video Aggregators Have Raised $366+ Million to Date," I itemized the torrent of money that's flowed into the broadband aggregation space, with players ultimately vying for a piece of cable's aggregation revenue. These and other companies are working hard to change the video industry's value chain. There will be a lot more news from them yet to come.

3. Video publishing/management platforms continue to evolve

Lastly, I continued covering the all-important video content publishing/management platform space this month, with product updates from PermissionTV, Brightcove and Entriq/Dayport. Yesterday, in introducing Delve Networks, another new player, I included a chart of all the companies in this space. I put a significant emphasis on this area because it is a key building block to making the broadband video industry work.

These companies are jostling with each other to provide the tools that content providers need to deliver and optimize the broadband experience. The competitive dynamic between these companies is very blurry though, with each emphasizing different features and capabilities. Nonetheless, each seems to be winning a share of the expanding market. I'll continue covering this segment of the industry as it evolves.

That's it for June; I have lots more good stuff planned for July!

Categories: Aggregators, Cable Networks, Cable TV Operators, Technology

Topics: AOL, Brightcove, Comedy Central, Delve, Entriq, Fancast, Hulu, Jacobs Pillow, PermissionTV, Scripps, Visible Measures

-

Comcast/Fancast, Hulu and the Role of Great Execution, Part 2

A couple of weeks ago in "Hulu Out-Executing Comcast in On-Demand Programming?" I took Comcast's Fancast to task because Hulu was first to implement its deal with Comedy Central for full episodes of "The Daily Show" and "Colbert Report." It was a missed opportunity for Fancast, which had previously announced a deal with Comedy Central for these shows. Hulu gained a bonanza of favorable press attention, likely spiking its usage.

Well fair is fair and so I'm now happy to report that Fancast has also posted these programs. But at the risk of sounding like a Fancast scourge (which I'm really not trying to be) Hulu continues to distinguish itself with a superior user experience. For those looking to succeed in broadband video the execution differences between these two sites provide key lessons.

First, after searching for The Daily Show on Hulu, the site automatically displays the most recent episodes first (beginning with last night's episode). When starting the player, Hulu's quick 7 second "brand slate" runs and then the program starts. This emphasis on a quick payoff no doubt reflects lessons Hulu's CEO Jason Kilar learned from his years at Amazon, which, like all great e-commerce sites knows that a distraction-free checkout process results in more completed transactions.

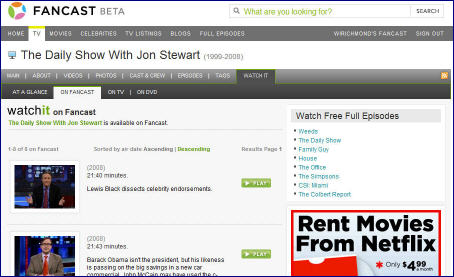

Conversely, at Fancast, after doing a search for Daily Show, the results are "Sorted by air date Ascending | Descending." Ascending is pre-selected, and the first episode shown is from April 9th, with Lewis Black. Huh - why such an old episode being shown first by default? And is the average user really going to be familiar with these sorting terms? Why not just offer choices like "Newest" and "Oldest" with "Newest" as the default?

When I tried watching several episodes I encountered more distractions and inconsistency. I alternatively saw a 30 second pre-roll, a 15 second pre-roll and once I even got back-to-back 15 second pre-rolls (of the same A1 steak sauce ad no less). Contrast this with Hulu where each time I knew to expect the voiceover intoning "The following program is brought to you...." Hulu understands that positive online experiences emphasize usability and consistency.

Separately, Hulu offers the ability to send a link to the full episode to a friend or clip just a segment, which can also be posted easily to a number of social networking sites. The features worked flawlessly and when done the video resumed playing automatically. On the other hand, an envelope icon at Fancast reveals 2 sharing options, "Beginning of Video" or "Current Scene." Yet after clicking on both they seem to reveal the same screen. So what's the difference? Worse, after finishing up sharing, the video was frozen, forcing me to close the browser and start all over again. Ugh.

Just to be clear, I don't expect perfection and I do recognize that Fancast is still in beta. To put all this in some context and explain why I'm dragging you into the weeds with this part 2 post, I've long believed that broadband's openness will allow new aggregators to emerge, attempting to compete with incumbents like cable and satellite operators. Differentiating themselves is no small feat considering, as in this case, the underlying content they have will likely be similar to what's available elsewhere.

Hulu is differentiating itself through great execution - particularly noteworthy for such a young site. My

guess is that execution and usability DNA run very deep within the Hulu team. On the other hand, Fancast has not yet demonstrated comparable execution mastery and as a result is leaving the competitive door ajar for its customers to give Hulu a try. Winning Hulu users back to Fancast will be tougher than winning them now.

guess is that execution and usability DNA run very deep within the Hulu team. On the other hand, Fancast has not yet demonstrated comparable execution mastery and as a result is leaving the competitive door ajar for its customers to give Hulu a try. Winning Hulu users back to Fancast will be tougher than winning them now. Broadband aggregation is going to be a battleground with big eventual payoffs. As a powerful incumbent, Comcast must do everything possible to preclude users from seeking out Hulu and other aggregators. (Truth be told, it is unlikely these broadband aggregators would have raised close to the $366+ million I recently reported in the first place had Comcast and other incumbents proactively seized the online aggregation space several years ago. But that's a story for another day.)

For all the time I spend talking about strategy at VideoNuze, I've always been a big believer that competition is mostly won in the trenches. That's especially true in online where great execution and usability separate winners from the rest. For Comcast, the competitive bar is far higher than it has ever been. To succeed, it must significantly improve its execution.

Categories: Aggregators, Cable Networks, Cable TV Operators

-

Hulu Out-Executing Comcast in On-Demand Programming?

The crew over at Hulu must be gleefully fist-bumping each other this week as Hulu scored a key strategic and public relations coup in adding to its lineup two of Comedy Central's most popular programs, "The Daily Show with Jon Stewart" and "The Colbert Report." Though officially positioned as a test, Hulu still deserves big-time kudos as the deal is an endorsement of its value proposition.

The deal and Hulu's execution illustrate a larger point that I've been making for a while: one of broadband's three key disruptions is that it enables new aggregators to gain an edge on larger incumbents by changing the dynamics of competition. To be more specific, in this case, I think that Hulu has out-executed Comcast, America's #1 cable operator by delivering new value to consumers and gaining important PR momentum. Here's why:

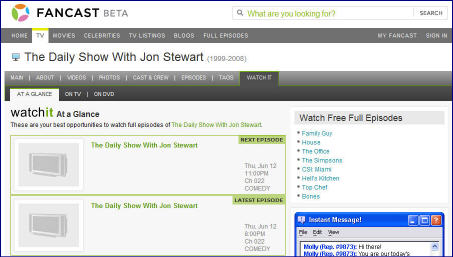

Fancast, which is Comcast's online portal (in beta), actually announced a deal with Comedy Central back on May 19th for access to these same programs and others. Yet go to Fancast and search for "Daily Show" and, as shown below, you won't find any Daily Show full episodes available, just an assortment of short clips and times when it's on TV. A Comcast spokesperson told me that Comcast's implementation is imminent, but its delay in getting the programs up and running is accentuated when you consider that Comedy Central must have done its distribution deal with Fancast BEFORE its deal with Hulu.

Second, and more concerning is that, as a Comcast digital subscriber, when I tried to find The Daily Show and Colbert in Comcast's VOD menu, all that is available are five older Colbert clips and 1 older Daily Show clip. My guess is these haven't been updated in a while. No full-length Daily Show or Colbert programs are available at all in VOD.

While the Comcast spokesperson told me that the company works closely with its programming partners like Viacom to figure out the optimal mix of programming to make available on VOD, I think an unavoidable conclusion here is that Comcast (and other cable operators) is constrained by its inability to monetize VOD programming with advertising (what this week's "Project Canoe" is meant to address) and to easily add new programming on the VOD menu. These programming gaps create opportunities for upstarts like Hulu to capitalize on.

It may be unfair to zero in so narrowly on Comcast's execution with Daily Show/Colbert, yet things weren't much different when I searched for MTV's popular "The Hills" on Hulu, Fancast and Comcast's VOD. While Hulu doesn't appear to have a deal for full episodes of "The Hills" it masks this cleverly by providing thumbail images and easy navigation back to MTV's site where the video lives, for over 50 episodes (this is tactic Hulu uses for ABC's shows as well). On the other hand, Fancast displays just 5 full episodes, 2 from this season and 3 from last. And on VOD there are also just 5 episodes, though all from this season.

I think it's pretty significant that Hulu, a site that only went live 3 months ago can not only gain access to hit Comedy Central programs like Daily Show/Colbert, but can execute quickly. Hulu is using its advantages - flexible technologies, interactive features (clipping, embedding, sharing), monetization capability, savvy PR and startup pluck to compete with far-larger incumbents like Comcast.

Of course Comcast racks up billions of VOD views each year and has vast resources, making it an important player in on-demand programming. Yet Hulu has managed to make Comcast's advantages look a little less intimidating. I asked the Comcast spokesperson about this. She acknowledged Hulu's progress, but maintained that Comcast believes its mulit-platform approach is stronger.

In the big picture that's true, but when it comes to winning consumers' hearts and minds, it's often execution, not broad strategy that carries the day. And don't forget, when Hulu is unshackled from the PC - with its content freely riding Comcast's broadband pipes all the way to the TV - execution will matter even more.

This week Hulu provided a textbook example of how broadband-only aggregators can gain a foothold against well-established incumbents. Comcast and other incumbents should be taking notice and getting their game on.

What do think? Post a comment and let everyone know!

Categories: Advertising, Aggregators, Cable Networks, Cable TV Operators

Topics: Comcast, Comedy Central, Fancast, Hulu, The Colbert Report, The Daily Show, Viacom

-

Cable's Sub Fees Matter, A Lot

In my recent post "Revisiting the Long Tail and Broadband" I explained how broadband is the next step in an evolution of video distribution systems and that now, after many years of growth, cable networks' niche, but collective audiences are exceeding those of the broadcasters.

Several readers emailed suggesting I append an important footnote to this analysis: there is a key business model difference between today's fledgling broadband video providers and cable networks. That difference is that cable networks benefit from monthly "sub fees" or "affiliate fees" that all distributors (cable TV and satellite operators, telcos, etc.) must pay to carry cable's programming. These fees are collected in addition to the advertising these networks sell. No such sub fees are available to broadband video providers (or broadcasters for that matter), at least not yet.

Having been in and around the cable industry for 20 years, I fully appreciate that sub fees matter a lot to cable networks. Since the beginning of the cable industry, they have served as a financial firewall for networks. Sub fees now range from pennies per month to over $3 for ESPN. Even on the low-end a "fully distributed" cable network (reaching approximately 80 million+ U.S. homes) reaps millions of sub fee dollars per month. And remember, that money comes in regardless of how well the network's ratings were that month. (btw, for an explanation of the genesis of sub fees, have a look at "Cable Cowboy," Mark Robichaux's biography of TCI's John Malone).

Cable networks' financial security continues to be translated into improved programming quality. Recently, in "Golden Age for TV? Yes, on Cable," the NY Times' David Carr lamented that broadcast TV seems to be on a degenerative slide to offer "all manner of contests and challenges," yet noted that cable is ascendant with Emmy and Oscar-winning talent dotting its innovative new dramas. No surprise to anyone, financial muscle translates into programming quality.

All this helps to explain why, whenever I moderate a panel including cable network executives, they fall all over themselves to declare their allegiance to their current, paying distributors. Cable networks are stepping gingerly into the broadband era, careful not to upset their enviable business model.

Conversely, broadband upstarts have no incumbent customers to consider. While this frees them to strike creative and wide-ranging distribution deals, as best I can tell, they're going to be totally dependent on advertising for a long time to come. This is why I continue urging that broadband video advertising must mature further, and fast.

While broadband upstarts scramble and broadcasters struggle, cable networks will keep chugging along, nicely fueled by their consistent sub fees.

Categories: Broadcasters, Cable Networks, Cable TV Operators, Indie Video

Topics: ESPN

-

Revisiting The Long Tail and Broadband Video

Way back in the dark ages of March, 2005, I wrote a newsletter entitled, "The Long Tail of Video is About to Get Longer - What Role Will Cable Play?" I thought of it yesterday when I read an article in Multichannel News "Cable Bests Broadcast - Basic Networks Steamroll Into Summer with Lion's Share of Audience." I continue to believe that cable TV provides a lot of lessons for those thinking about broadband video's future.

First, a quick refresher on the idea of The Long Tail. In October, 2004, Chris Anderson, editor of Wired

magazine, wrote an article which later turned into a book, asserting that once physical limitations (e.g. manufacturing, distribution, inventory, etc.) are removed - thereby allowing all products with niche appeal to be readily available to consumers - it turns out that the aggregate sales of these niche products are greater than the few "mass" products which were always available in traditional distribution channels. When this effect is plotted on an XY graph, the line depicting the tiny sales per niche unit extends indefinitely, forming a "long tail."

magazine, wrote an article which later turned into a book, asserting that once physical limitations (e.g. manufacturing, distribution, inventory, etc.) are removed - thereby allowing all products with niche appeal to be readily available to consumers - it turns out that the aggregate sales of these niche products are greater than the few "mass" products which were always available in traditional distribution channels. When this effect is plotted on an XY graph, the line depicting the tiny sales per niche unit extends indefinitely, forming a "long tail."The Long Tail was an important contribution in understanding how the world of digital economics works. Anderson cited multiple examples where the Long Tail was evident (e.g. Amazon, Rhapsody, etc.). In my March '05 piece I explained that the Long Tail concept was familiar to anyone in the cable TV business: the traditional "head" content was the broadcasters, the long tail was the constellation of niche-oriented cable TV channels.

When I wrote the piece, as a group, basic cable TV's total audience had just nudged past the collective audience of the broadcasters for the first time (i.e. The Long Tail effect was becoming evident). While each cable channel's audience was small relative to each broadcaster's, cable's total audience was now greater. It had taken 30+ years for cable audience to reach this point.

Flash forward 3+ years to the Multichannel article revealing that in May sweeps period, cable's audience share had surged to 60%, compared with 40% for the broadcasters. And it's interesting to note that a key part of cable's May win is due to cable co-opting traditional broadcast programming: in May TNT's airing of NBA playoff games accounted for 12 of the month's top 20 most-watched programs.

What does all this have to do with broadband video? As I explained back in '05, in reality, broadband distribution is essentially extending the long tail of programming. Broadband allows startups and established players (including cable and broadcast networks!) to utilize newly available broadband infrastructure to reach their audiences. The result is a massive proliferation of new programming and new viewer behaviors, further fragmenting audiences to ever-smaller niches.

Today's cable channels will eventually be seen as the "mid-tail" with broadband as the hyper-niche long tail. Given their own first-hand experience of the last 30 years, cable operators, cable networks and broadcast networks should all have a pretty clear view of the challenges and opportunities that broadband creates. How well they respond will determine who will be the winners and losers of the next 30 years.

Categories: Broadcasters, Cable Networks, Cable TV Operators

Topics: The Long Tail

-

Where's Project Canoe's New CEO?

At the recent Cable Show in New Orleans, Comcast's president Steve Burke said that Project Canoe's new CEO would be announced on June 1. However, June 1 has come and gone without any news. Project Canoe, which Mugs covered for VideoNuze recently, is the cable industry's new interactive ad system, meant to draw national advertisers to cable's VOD and other advanced video delivery platforms. A rumor has circulated widely that David Verklin, former CEO of Aegis North America (a large advertising service firm) would get the nod, but nothing has been made official. I haven't heard what is causing the delay. If you know, post a comment...

Categories: Advertising, Cable TV Operators

Topics: Comcast, Project Canoe

-

May '08 VideoNuze Recap - 3 Key Topics

Looking back over two dozen posts in May and countless industry news items, I have synthesized 3 key topics below. I'll have more on all of these in the coming months.

1. Broadband-delivered movies inch forward - breakthroughs still far out

In May there was incremental progress in the holy grail-like pursuit of broadband-delivered movies. Apple established day-and-date deals with the major studios for iTunes. Netlix and Roku announced a new lightweight box for delivering Netlix's "Watch Now" catalog of 10,000 titles to TVs. Bell Canada launched its Bell Video Store, complete with day-and-date Paramount releases, with others to come soon. And Starz announced a deal with Verizon to market "Starz Play" a newly branded version of its Vongo broadband subscription and video-on-demand service.

Taken together, these deals suggest that studios are warming to the broadband opportunity. This is certainly influenced by slowing DVD sales. Yet as I explained in "iTunes Film Deals Not a Game Changer" and "Online Move Delivery Advances, Big Hurdles Still Loom" broadband movies are still bedeviled by a lack of mass PC-TV connectivity, no real portability, well-defined consumer behavior around DVDs and the studios' well-entrenched, window-driven business model. Despite May's progress, major breakthroughs in the broadband movie business are still way out on the horizon.

2. Broadcast TV networks are embracing broadband delivery - but leading to what?

Unlike the film studios, the broadcast TV networks are plowing headlong into broadband delivery, yet it's not at all clear where this leads. In "Does Broadband Video Help or Hurt Broadcast TV Networks" and "Fox's 'Remote-Free TV': Broadband's First Adverse Impact on Networks?" I laid out an initial analysis about broadband's pluses and minuses for networks. I'll have more on this in the coming weeks, including more in-depth financial analysis.

On the plus side, in "2009 Super Bowl Ads to Hit $3 Million, Broadband's Role Must Grow," "Sunday Morning Talk Shows Need Broadband Refresh" and "Today Show Interview with McClellan Showcases Broadband's Power," I illustrated some opportunities broadband is creating. On the other hand, "Bebo Pursues Distinctive Original Programming Model" and "More Questions than Answers at Digital Hollywood" explained how exciting new programming approaches are taking hold, challenging traditional TV production models. Broadcasters are in the eye of the broadband storm.

3. Advertising's evolution fueled by innovation and resources

Last, but hardly least, I continued on one of my favorite topics: the impact broadband video is having on the advertising industry. Over the last 10 years the Internet, with its targetability, interactivity and measurability has caused major shifts in marketers' thinking. With broadband further extending these capabilities to video, the traditional TV ad business is now ripe for budget-shifting. We'll be exploring a lot of this at a panel I'm moderating at Advertising 2.0 this Thursday.

In "Tremor, Adap.tv Introduce New Ad Platforms" and "All Eyes on Cable Industry's 'Project Canoe'" (from Mugs Buckley), key players' innovations were described along with how the cable industry plans to compete. Content providers are being presented with more and more options for monetizing their video, a trend which will only accelerate. Yet as I wrote in "Key Themes from My 2 Panel Discussions Last Week," many issues remain, and with so many content start-ups reliant on ads, there may be some disappointment looming when people realize the ad market is not as mature as they had hoped.

That's it for May. Lots more coming in June. Please stay tuned.

Categories: Advertising, Aggregators, Broadcasters, Cable TV Operators, Devices, Downloads, FIlms, Studios, Video Sharing

Topics: Adap.TV, Apple, Bell Canada, Canoe, iTunes, Netflix, Paramount, Roku, Starz, Tremor, Verizon, Vongo

-

Akimbo, Vongo Expose Risks for Broadband Pioneers

The last few days' news about Akimbo and Starz's Vongo service, two of the earliest players in broadband video delivery, shows how risky the broadband video market can be for pioneers.

Akimbo - which has closed its doors after raising approximately $50 million since 2003 - demonstrates that

misjudging the key characteristics of an early market can be devastating. Akimbo's faulty assumptions included:

misjudging the key characteristics of an early market can be devastating. Akimbo's faulty assumptions included:- Anticipating that consumers would be willing to buy a broadband-only set-top box, despite overwhelming research to the contrary.

- Expecting that consumers would be willing to pay yet another monthly subscription fee, although broadband's value proposition was still in its infancy and consumers were already complaining about the high cost of cable/satellite subscription services.

- Building its initial content strategy using a pure "Long Tail" approach of aggregating lots of niche programmers, not grasping that Long Tail models only succeed when "head" content - in this case from broadcasters and cable networks - is also included.

As these misjudgments became obvious, the box was dropped, select cable programming was added to the content lineup, pricing was changed and management was overhauled. Ultimately in February '08, the whole company strategy was blown up, as Akimbo unsuccessfully tried to get a toehold in the already over-crowded white-label content management/publishing business. But once a startup is in a deep hole, it's almost impossible to climb out.

Meanwhile, Starz's announcement yesterday with Verizon, of its first "wholesale deal" for broadband delivery of its programming, shows additional risks for early players. Yesterday I caught up with Bob Greene, EVP of Advanced Services at Starz, for whom I did some consulting work several years ago on Vongo's predecessor service, Starz Ticket.

Starz launched Vongo in early '06 as a broadband-only subscription and download-to-own service, featuring programming it had under contract, plus other categories it later added. Vongo went to market direct-to-consumer and through device partners like HP, Samsung, Toshiba, Creative and Archos, but Vongo's growth has been modest as the broadband subscription category has yet to really take off.

Starz launched Vongo in early '06 as a broadband-only subscription and download-to-own service, featuring programming it had under contract, plus other categories it later added. Vongo went to market direct-to-consumer and through device partners like HP, Samsung, Toshiba, Creative and Archos, but Vongo's growth has been modest as the broadband subscription category has yet to really take off.Vongo's larger goal was getting deals done with existing service providers like cable, telco, and broadband ISPs. But this aspiration ran into the buzzsaw of incumbents' intransigence, illustrating that reliance on ecosystem partners, who often have divergent motivations, can be very risky. In this case, Vongo's would be distributors perceived Vongo as less as an opportunity to grow the market and tap new consumer behaviors, and more as a potential long-term end-run, with immediate threats to profit margins and cash flow contribution.

Cable operators have been saying "no thanks" to distributing Vongo, concluding it had more downside risk to existing Starz linear subscriptions and Video on Demand than it had upside broadband potential. The Verizon deal may reverse things; Bob says more deals are in the offing. Time will tell. In the meantime, with Vongo's direct marketing efforts set to be further de-emphasized, Starz's broadband fate is falling squarely into the hands of reluctant incumbent service providers.

Akimbo and Starz show that to succeed, it's essential to make correct fundamental assumptions about a market's early growth have a keen understanding of ecosystem partners' motivations and concerns. Missteps on any of these can have disastrous implications.

What do you think the lessons are from Akimbo and Starz's Vongo? Post a comment!

Categories: Cable Networks, Cable TV Operators, Devices, Startups, Telcos

Topics: Akimbo, Starz, Verizon

-

All Eyes on Cable Industry's "Project Canoe"

To the disappointment of many, it looks like there won't be any big news about the cable industry's "Project Canoe" at the Cable Show convention in New Orleans this week.

Project Canoe is a high-profile partnership among the nation's six largest cable companies (Comcast, Time Warner Cable, Cablevision, Cox Communications, Charter Communications and Bright House Networks) to enable national interactive advertising campaigns to be executed across the companies' cable operations. The code-name Canoe is meant to emphasize that cable operators are working together in the same boat, so to speak.

For the past nine months, the partners' Canoe leads have been meeting weekly. Once a top secret initiative, Canoe's existence was leaked in a September, 2007 Wall Street Journal article. But since then there has been no new information, leading to speculation about how much progress has been made.

Yet Canoe remains a top priority throughout the industry, and for good reason. With big advertisers like GM and Intel shifting their once big-budgeted TV ad campaigns to the Internet in significant sums, it's key that the cable operators need to figure out a way to not only protect the $5 billion or so that they generate in spot-cable advertising today, but also to increase their piece of the $70 billion dollar TV ad spend or cut into other slices of the massive US total ad spend pie. The next 3-5 years will be critical as cable advertising, the Internet and broadband video jostle for advertisers' affections.

The buzz in New Orleans suggests advertisers and agencies are excited about Canoe, though its development seems slower than they prefer. Why the slow progress that's perceived? Several operators stated that integrating the infrastructure required to execute Canoe with cable's legacy systems is hard stuff. No doubt. Then of course there are other key priorities weighing on the industry resources, such as the February 2009 digital transition.

Meanwhile, the Internet and broadband video advertising continue steaming ahead, giving advertisers and their agencies the measurement and targetability that they yearn for on TV. Cable operators have been stymied in their ability to jointly offer advertisers easy access to a nationwide or near-nationwide footprint, especially critical for Video on Demand. Canoe addresses this and other opportunities, in part by creating a set of standards for all to follow.

The only Canoe "news" at this week's Cable Show came from Comcast's Steve Burke, who stated that a CEO would be announced on June 1. Comcast is a key player in Canoe, funding between $50-70 million of the $150 million initial investment. Rumors have swirled that David Verklin, who recently stepped down as CEO of Aegis North America (a large advertising services firm) will assume the position of CEO. If true, that could be the news to break on June 1.

For those of us who have been around the interactive advertising and TV mulberry bush for many years, Canoe's potential is exciting. But we're hoping that the Canoe gets it in gear. Paddle on, gang.

What do you think of Project Canoe's prospects? Post a comment now!

Categories: Advertising, Cable TV Operators

Topics: Aegis, Bright House Networks, Cablevision, Charter Communications, Comcast, Cox Communications, Project Canoe, Time Warner Cable

-

More Questions than Answers at Digital Hollywood Spring

I'm just back from a couple days at Digital Hollywood Spring, one of the broadband industry's leading conferences. A key takeaway for me is that there are still many more outstanding questions about the broadband video industry's future - and their implications for other players in related industries - than there are concrete answers.

Here are 3 big ones worth considering:

What role will current video distributors play in an increasingly broadband-centric world?

The subscription video business, dominated by cable and satellite operators, generates approximately $80 billion/year, depending on whose data you use. The model is well-understood, and is a huge part of funding the value chain of cable networks, rights-holders and TV program producers. Bundling ever more channels (50,70,100+) into digital tiers and charging ever-higher prices for them has been a core industry revenue driver.

Yet data continues to show that out of all those channels, the average household still only watches 5-10 at the most. Couple that with the migration to broadband, DVR and on-demand consumption and one is left with the feeling that there is a significant disconnect between the way video is packaged and priced today with growing consumer expectations and behaviors. Is the current approach sustainable long term or are new players (e.g. Sezmi) going to successfully disrupt the formula? Any major disruption would have significant ripple effects.

Is the ad-supported business model for broadband video going to deliver for all the content providers relying on it?

I've been a big supporter of the ad-supported approach for a while and believe in it strongly in the long-term. Yet as I see more and more content providers, aggregators, social networks and others look to it as their primary business model, I'm growing concerned that in the short-term there isn't going to be enough money to go around to support everyone. To be sure, current growth rates are strong, yet at DH many of advertising's big hurdles to reach long-term success were mulled over: achieving scale, standardizing formats, understanding performance metrics, converting media buyers, targeting, proving interactivity's value and so on.

The efficacy of the broadband ad model online is particularly pressing for broadcasters. Though some research indicates on-air viewership is benefited from online program availability, long-term there can be no question that a substitution effect will take place as viewers decide "do I watch on-air OR online?"

Jeff Zucker, NBCU's CEO tersely captured the threat this poses in his now often-repeated question "are we trading analog dollars for digital pennies?" In other words, if someone watching an NBC show like The Office on Hulu currently brings NBC far less revenue than if they were watching it on-air, is the migration to broadband viewership actually causing a permanent down-sizing of broadcasters' ad revenue per minute viewed? A scary thought to contemplate.

What does all this mean for Hollywood?

Surely less subscription or ad revenue eventually means less money for everyone including the whole Hollywood apparatus that has been funded out of the traditional models. But how, when and to what extent does this play out?

Further, is the very nature of what's expected of Hollywood changing? Herb Scannell, CEO/founder of Next New Networks asserted in his panel that the current generation of 'auteurs' - multi-skilled and motivated people who can write, direct, produce, act and promote implies a far different role for how Hollywood creates value for itself in the future. In fact, Herb believes that technology-empowered talent is the biggest disruptive force to the traditional Hollywood equation.

The point was brought home to me in a offsite function I attended in which Bebo, the massive youth-oriented social network (recently sold to AOL for $850 million), outlined its big push into original entertainment (e.g. "KateModern," "Sofia's Diary," etc.). Their expectations of what they, creators and users will be doing to create value are starkly different from the Hollywood model.

And the questions continue. There are ample reasons to be enthusiastic about broadband video, still, we are living through transformational times impacting every corner of the traditional video value chain. For now many questions loom. Hopefully more answers will be forthcoming soon.

Do you have any answers? Post a comment and let everyone know!

Categories: Broadcasters, Cable Networks, Cable TV Operators, Devices

Topics: Bebo, Digital Hollywood, Next New Networks

-

Sezmi - Building B Portends Major Disruption to TV Industry

Builidng B, the stealthy, well-funded startup I wrote about last December, is at last pulling back the curtain today, unveiling "Sezmi" as its new name and releasing details of its end-to-end system for delivering traditional television programming and broadband video directly to the TV.

I got a preview of Sezmi (pronounced "SaysMe") at a private briefing with company executives at NAB 2 weeks ago. Upfront I want to offer a huge caveat that I only saw the system in demo mode so I cannot vouch for its performance in actual, scale situations. That said, if the system works as described, then I

would rank Sezmi as the most promising approach I've yet seen for bridging the currently separate worlds of broadband video and TV. Sezmi could well be the first bona fide broadband/on-demand competitor to cable TV and satellite operators.

would rank Sezmi as the most promising approach I've yet seen for bridging the currently separate worlds of broadband video and TV. Sezmi could well be the first bona fide broadband/on-demand competitor to cable TV and satellite operators.First things first. Sezmi should not be confused with broadband appliances seeking to bridge broadband and TV, such as AppleTV, Vudu, Akimbo and others. I am an avowed skeptic of all of these. Sezmi does not focus on delivering broadband video as an add-on to existing cable/satellite subscriptions. Rather, it is looking to replace these providers by combining the best of the traditional linear broadcast/cable network model with broadband, on-demand, digital video recording, personalization, social networking and ease-of-use that many of us now consider second nature.

Sezmi is a complete system, providing an antenna, set-top box and remote control to the consumer. One of Sezmi's key innovations is "FlexCast," which leverages multiple delivery networks to get broadcast/cable channels and broadband video into the home. In fact, the traditional channels are the bedrock of Sezmi's service offering, enabling it to be a true competitor to incumbent video providers. Sezmi leases digital broadcast space from local stations to efficiently deliver these channels, which can be watched in either familiar linear mode, or in recorded on-demand mode (note the initial set-top box comes with 1 terabyte of storage, soon to be 2 terabytes). For broadband video, it makes use of the existing broadband ISP connection.

Sezmi creates an entirely new, and exciting user experience that digital media enthusiasts will instantly recognize, and I believe, value. These include the remote control with an iPod-like scroll wheel, no numeric keypad and one-touch personalization for family members. There is also the on-screen navigation, which groups shows by episode, and presents them in personalized home page-like settings. And there's targeted contextual advertising, allowing familiar click-through options.

Sezmi creates an entirely new, and exciting user experience that digital media enthusiasts will instantly recognize, and I believe, value. These include the remote control with an iPod-like scroll wheel, no numeric keypad and one-touch personalization for family members. There is also the on-screen navigation, which groups shows by episode, and presents them in personalized home page-like settings. And there's targeted contextual advertising, allowing familiar click-through options.Recognizing that a direct-to-consumer approach would be costly and slow to scale, Sezmi has adopted a partner-centric go-to-market strategy. It is working with ISPs, telcos and others who seek entry to the video services business. Buno Pati, Sezmi's CEO/co-founder told me he expects consumer pricing would be approximately half of today's digital cable tier, including HD and DVR capability. I suggested that might imply a $35-40 per month fee. While not confirming that number, he said he wouldn't disagree with my estimate.

If Sezmi can work out its economics with partners and deliver that pricing to consumers, it would be a very compelling alternative to today's cable/satellite offerings. The key is to whom? In my briefing many types of customers were mentioned: analog subscribers, new HD TV purchasers, over-the-air households, and others. Given how ground-breaking it service is, in my opinion Sezmi needs to go after digitally savvy audiences first.

Today the company is announcing only that it is commencing trials in pilot markets and expects commercial launch with partners later this year. All eyes will be on Sezmi to see if it can execute on its bold vision. If it does this is a company that has major disruptive potential.

(Note - very coincidentally, Sezmi CEO/co-founder will be on my Digital Hollywood panel next Wed, May 6th at 10:45am)

Categories: Cable TV Operators, Devices, Startups

Topics: Building B, SezMi

-

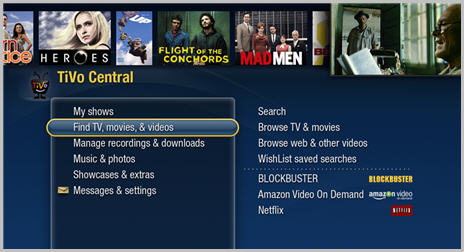

TiVo + Comcast: My Experience to Date

Yesterday TiVo and Comcast announced that their joint service offering, known as "Comcast DVR with TiVo" is now available to Greater Boston residents. The announcement comes almost 3 years since the

partnership was announced. Multichannel News recently reported that Comcast has funded $24 million of co-development work to date. I have had the service since late October as part of the beta test, but the companies had asked me to stay mum until its official launch.

partnership was announced. Multichannel News recently reported that Comcast has funded $24 million of co-development work to date. I have had the service since late October as part of the beta test, but the companies had asked me to stay mum until its official launch.  The first thing to know about this new service is that it really is familiar, lovable TiVo inside a Motorola cable set-top box. I am a long-time TiVo Series 2 owner, and as best I can tell all of the core TiVo features are available (e.g. Season Pass, Wish List, Suggestions) along with the inimitable TiVo blooping sounds effects. The box has a dual tuner so you can record one show while watching another. The navigation also incorporates all of Comcast's VOD selections, so all linear and VOD programs are considered in your searches. It's an HD-capable box, which can hold 15-20 hours of HD video. The peanut-shaped remote control is virtually unchanged.

The first thing to know about this new service is that it really is familiar, lovable TiVo inside a Motorola cable set-top box. I am a long-time TiVo Series 2 owner, and as best I can tell all of the core TiVo features are available (e.g. Season Pass, Wish List, Suggestions) along with the inimitable TiVo blooping sounds effects. The box has a dual tuner so you can record one show while watching another. The navigation also incorporates all of Comcast's VOD selections, so all linear and VOD programs are considered in your searches. It's an HD-capable box, which can hold 15-20 hours of HD video. The peanut-shaped remote control is virtually unchanged.

What's not included are all the wonderful broadband features (e.g. TiVoCast, Amazon Unbox, Rhapsody, Music Choice, Photos, Home Movies, etc.) and network features (e.g. remote scheduling, whole house service). The absence of broadband content (CNET, The Onion, NY Times, etc.) in particular will be missed. TiVo has gradually been introducing this over the last couple years. I've written a lot about broadband-to-the-TV solutions recently, and TiVo's approach has been very solid. However, Comcast obviously wanted to retain strict control over what video gets pumped into the set-top box. I have discussed this "closed" vs. "open" mindset earlier - hopefully something that will change down the road.

The service itself has mostly worked well. There were some initial hiccups requiring the Comcast service techs to return to the house and for me to call in for service. There are a few small issues that have persisted. These include periodically getting a green screen which requires me to turn the box on and off. I can't continuously lower the volume or change channels by suppressing the appropriate button on the remote control (this is possibly a TV-specific issue). I also find the service just a little less responsive than my Series 2 box - my fingers have had to adjust their muscle memory somewhat when working the familiar remote control. None of these are deal-breakers, but I do intend to have Comcast come out a take a look one of these days.

Comcast has priced the service at $2.95/mo, on top of its plain vanilla DVR service fee of $12.95/mo. I continue to believe that for consumers this proposition makes a lot of sense when compared with buying a standalone Series 3 box. It's a $3 delta over paying the monthly service charge directly to TiVo, but you avoid buying the Series 3 box (about $600 street price around $400) and potential maintenance and obsolescence issues. And it means one less box in your rack. The downside is the missing TiVo features described above.

If Comcast markets the TiVo service aggressively and correctly I think they can shift a lot of current DVR subscribers over plus add plenty of new ones down the road. It's a meaningful competitive advantage for a company caught up in a brutal battle with satellite and telco competitors. For TiVo, which has also done a deal with Cox (and others in the future presumably), it's a great shot at migrating itself out of the hardware business, into software and solutions.

Categories: Cable TV Operators, Devices, Partnerships

-

HBO, Showtime, Starz: 3 Different Broadband Strategies

The unveiling of HBO's broadband video strategy provides fresh evidence that the 3 major premium cable channels - HBO, Showtime and Starz - are pursuing 3 very different paths in navigating the broadband world.

These 3 channels have traditionally been tight-knit partners with cable operators who leveraged these channels' brands and programming relentlessly in marketing campaigns to gain new revenues and subscribers. But operators' high margin digital services (e.g broadband access, phone, HD, VOD DVR) have lately become the primary focus of cable marketers' finite promotional power. Somewhat mitigating this shift has been powerful original programming, especially from HBO (The Sopranos, Sex and the City, etc.) that has often made these "must have" channels for audiences, helping build powerful consumer brands in the process.

Broadband delivery further scrambles the relationship between these 3 premium channels and their cable operator brethren. For the first time, the premium channels can promote their services, and even deliver them directly to consumers, all without cable operators' involvement. This newfound flexibility has led to 3 very different strategies that I would categorize as "Be bold" (Starz), "Be incremental" (Showtime) and "Be aligned" (HBO).

"Be bold" - Starz has pursued the boldest broadband strategy, launching Vongo, a pure broadband-delivered subscription service several years ago. Starz has invested heavily in making Vongo a top-notch user experience, including hundreds of hours of additional content specifically for the service. Starz has marketed Vongo

directly to consumers and through non-cable industry distribution partnerships (e.g. HP, AT&T, Microsoft, Toshiba, Samsung, others). Starz is very clearly trying to grow the market for its programming.

directly to consumers and through non-cable industry distribution partnerships (e.g. HP, AT&T, Microsoft, Toshiba, Samsung, others). Starz is very clearly trying to grow the market for its programming.Starz has sought cable operator partnerships as well, I believe correctly arguing that Vongo can be priced and packaged in a way that provides new value for subscribers as well as cable operators. These efforts have been stymied to date as reluctant operators perceive Vongo as possibly opening the door for Starz and others to gain direct access to subscribers, while also creating possible confusion around operators' budding VOD services.

"Be incremental" - Showtime has focused its broadband efforts on new revenue opportunities such as selling episodes through aggregators like iTunes, and also offering innovative new programming and features that capitalize on broadband's ability to directly interface with audiences. Two perfect examples of the latter are the "Dexter" parallel webisode series and season finale producers' video I have previously written about.

Showtime's goal is to create valuable exposure for its programming to non-subscribers on the bet that actual sampling is the best way to drive new subscriptions (in the past sampling was limited to cable operators' offering "preview weekends"). Showtime's "be incremental" approach studiously avoids creating conflicts with its cable operator partners, while not limiting the network's ability to harness broadband's potential.

"Be aligned" - HBO's belated entry into the broadband world is intended to support its cable partners by offering access to HBO Broadband to only those viewers who are both existing HBO subscribers AND cable broadband subscribers. This "value add" positioning is comparable in some ways to Netflix's "Watch Instantly" approach. They are both focused on giving existing subscribers more, not creating a distinct

service, a la Vongo, aimed at expanding the market. Further, by limiting HBO Broadband's geographic rollout, HBO is taking an additionally cautious approach compared with the others. The HBO message is clear: we're staying strongly aligned with our traditional cable industry partners.

service, a la Vongo, aimed at expanding the market. Further, by limiting HBO Broadband's geographic rollout, HBO is taking an additionally cautious approach compared with the others. The HBO message is clear: we're staying strongly aligned with our traditional cable industry partners. Three premium channels, three distinct broadband strategies. Further evidence that we currently live in a world of vast experimentation, with market participants focused on different goals and different ways of achieving them. I expect plenty more of this to come, as all players gather data about what works and what doesn't.

What do you think? Post a comment and let us all know!

Categories: Aggregators, Cable Networks, Cable TV Operators

Topics: HBO, Showtime, Starz, Vongo

-

"Comcastic" or "Comcastrophe"?

Last week brought reports of a blistering letter written from Chieftain Capital Management, which owns 60 million shares of Comcast, to the company's board, requesting among other things, the ouster of Brian Roberts, Comcast's CEO for his lackluster stewardship. Playing on the company's advertising tag line, "It's Comcastic", Chieftain called Mr. Roberts's management of the company a "Comcastrophe," reciting a litany of poor financial returns shareholders have endured during Mr. Roberts's tenure.

Although other Wall Street pros fairly yawned at Chieftain's radical proposals - in fact just last week selecting him, for the 2nd year in a row, as Institutional Investor magazine's best CEO in the cable and satellite industry - the letter does provide an opportunity to consider Comcast's stature in the highly

dynamic video marketplace. But rather than looking backwards at Comcast's performance, I'd suggest looking forward and asking: how healthy is Comcast's positioning for future success? Is it closer to "Comcastic" or to "Comcastrophe"?

dynamic video marketplace. But rather than looking backwards at Comcast's performance, I'd suggest looking forward and asking: how healthy is Comcast's positioning for future success? Is it closer to "Comcastic" or to "Comcastrophe"?I'd argue that the most important factor determining Comcast's (and other cable operators') future financial success is how well they are embracing delivery of broadband video into their core business models. The adoption of broadband video by consumers, and the enthusiasm for it by content providers large and small are the most crucial fundamental marketplace changes that cable operators are now facing.

This is the case because, as I've said repeatedly over the years, broadband's open access undermines cable operators' traditional closed business model, in which only networks which have so-called "carriage deals" are available to subscribers. This closed approach contrasts with the broadband world, where all programming is accessible by everyone, all the time. Piggybacking on the Internet's own success in driving consumer choice, broadband's openness is poised to drive a stake into the heart of cable's traditional video packaging paradigm and revenue model.

Yet despite this gathering storm, Comcast and other cable operators have been woefully inattentive to explaining how they'll weave broadband video into their TV-based services. Instead, their broadband access businesses, now generating billions of dollars per year in revenues, remain almost entirely siloed from the core video side of the business.

While Comcast should be lauded for initiatives such as broadening Fancast's content, starting Ziddio, announcing an aggressive agenda for bringing more HD content to its VOD menu, and backing Tru2way, none of these directly answer the question of how Comcast will update its closed approach to content, facilitating its subscribers' access to broadband video through their set-top boxes. This would provide for a seamless and highly compelling viewing experience. Comcast's and others' silence is creating the void that is behind the frenzy of activity from technology vendors and consumers trying to kluge the broadband and TV worlds together.

Years since YouTube and others revolutionized consumers' video expectations, the answer as to how Comcast and other cable operators - who effectively "own" the living room video experience - will capitalize on these fundamental changes remains totally unaddressed. Though some investors believe they have already endured a "Comcastrophe", they'd be wise to further reset their expectations. Comcast's ongoing inability or unwillingness to chart a coherent broadband video delivery strategy suggests an even bigger "Comcastrophe" lies just ahead.

What do you think? Post a comment and let us all know!

Categories: Cable TV Operators

Topics: Comcast

-

CES 2008 Broadband Video-Related News Wrap-up

CES 2008 broadband video-related news wrap-up:

Panasonic and Comcast Announce Products With tru2way™ Technology

Panasonic And Comcast Debut AnyPlay™ Portable DVR

NETGEAR® Joins BitTorrent™ Device PartnersD-Link Joins BitTorrent™ Device Partners

Vudu Expand High Definition Content Available Through On-Demand Service

Sling Media Unveils Top-of-Line Slingbox PRO-HD

Open Internet Television: A Letter to the Consumer Electronics Industry

Paid downloads a thing of the past

Samsung, Vongo Partner To Offer Movie Downloads For P2 Portable Player

Comcast Interactive Media Launches Fancast.com

New Year Brings Hot New Shows and Longtime Favorites to FLO TV

P2Ps and ISPs team to tame file-sharing traffic

ClipBlast Releases OpenSocial API

Categories: Advertising, Aggregators, Broadband ISPs, Broadcasters, Cable Networks, Cable TV Operators, Devices, Downloads, FIlms, Games, HD, Mobile Video, P2P, Partnerships, Sports, Technology, UGC, Video Search, Video Sharing

Topics: ABC, BitTorrent, BT, Comcast, D-Link, Disney, Google, HP, Microsoft, NBC, Netgear, Panasonic, Samsung, Sony, TiVo, XBox, YouTube

-

Clueing in FCC Chairman Kevin Martin

Somebody needs to seriously clue in Kevin Martin, the chairman of the Federal Communications Commission, who has somehow gotten it into his head that America's cable TV industry needs to be burdened by all kinds of new regulations, despite the fact that competition is coming at the industry from every direction imaginable.

On the probability that you don't think too much about the FCC's actions, nor what they might mean to you, I have a reminder for you: when America's top communications regulator seeks to drive the industry that is America's #1 provider of broadband Internet service into a regulatory ditch, that's a problem for anyone who works in the media, entertainment, telecommunications and technology industries. Mr. Martin's cockeyed plans threaten to do this.

First, a quick recap. In the last several weeks Mr. Martin has sought to use hand-selected (and highly questionable) data to resurrect an arcane FCC prerogative known as the "70/70" rule. It is not worth reviewing what this rule is or whether or not it applies. What is important to know is that Mr. Martin has sought to use this rule to introduce regulations forcing cable companies to submit to federal arbitration to resolve carriage disputes with cable networks and to reduce the prices of certain leased access channels by upwards of 75%. Lingering in the background are further regulations, such as forcing "a la carte" unbundling of cable channels for unfettered consumer choice.

Last week wiser heads prevailed with the other FCC commissioners, many members of Congress and the White House intervening to check-mate Mr. Martin's plans. In fact, so perturbed by Mr. Martin's recent actions is the House Energy and Commerce Committee chairman John Dingell that has opened an investigation into Mr. Martin's handling of the FCC's affairs.

Now, in retreat, Mr. Martin has come up with a new regulation capping any one cable operator's U.S. coverage at 30%. This is particularly targeted at Comcast, which, with 27% coverage, is just a whisker away from hitting the proposed cap.

In criticizing Mr. Martin, let me make clear that I'm no cable apologist nor am I a regulatory libertarian, against all forms of government intervention. I worked in the cable industry from 1990-1998 and know the good, the bad and the ugly of the industry quite well. The government has intervened in the past to correct legitimate market failures caused by clear industry bad actors. But those days are past. Now the cable industry is fighting for its life against the triple threat of satellite, telco and broadband "over the top" competition.

So how is it possible that Mr. Martin has so completely "missed the memo" that America's consumer communications services - video, broadband Internet access and voice - are more competitive today than ever, and that re-regulation is completely wrong-headed? And that technology is enabling a wealth of new services that are causing traditionally distinct industries to compete against one another, with the ultimate winner being consumers? And that real, skilled, high-paying, American jobs which are tied to the innovative media, entertainment, technology and communications markets he oversees will certainly be adversely affected by these onerous new regulations he is proposing?

Of course, I cannot get inside Mr. Martin's head to explain his actions. All I can guess is that somehow he arrogantly believes that Washington's bureaucracy is better suited to sort out the hyper-competition and innovation sweeping these industries than are the free markets and myriad technologies being introduced. How profoundly incorrect that belief is. Last time I checked Mr. Martin's bio, he personally has exactly ZERO day-to-day business operating experience, so maybe someone can remind me what his particular expertise is in these matters? As if all this isn't enough, don't forget about how reckless it is for a regulator to mess around with one of the few remaining vibrant pockets of the American economy.

Mr. Martin's recent actions have shown him to be just another in a long line of seemingly intelligent, but ultimately clueless presidential appointees. Particularly in these tenuous economic times, America can ill-afford to have poor judgment in its chief policy-makers. For all of us who work in the media, entertainment, technology and telecom industries, let's hope the checks-and-balances system continues to work and Mr. Martin's misguided re-regulatory policies don't gain any traction.

Categories: Broadband ISPs, Cable Networks, Cable TV Operators, Regulation

Topics: Comcast, FCC, Kevin Martin

-

Building B Has Cable and Satellite in its Crosshairs

Building B is major league stealthy company with an audacious vision for how consumers will access video content in the future. If it succeeds current multichannel video service providers (namely cable and satellite providers) will feel the brunt.

Building B has a blue chip executive team and pantheon of accomplished investors and advisors. It made headlines a few months ago when it announced a $17.5M funding round led by Morgenthaler Ventures, OmniCapital and Index Ventures.

Last week I had a briefing with Buno Pati, CEO/Co-founder and Phil Wiser (Chairman/President/Co-founder). They are both highly-experienced and successful technology executives who are also quite PR savvy. They know how to stay on message and close to their stealthy script. I needed to use my "virtual crowbar" persistently to try to pry a few new morsels of information out of them. From what I learned, it's a pretty cool story. Following is what I learned about what the company.

The company's plan rests on a number of key assumptions:- TV must be the center of the consumer video experience, and today's service must be redefined

- Access to broadcast content is critical for success

- On demand, high def is in, linear, standard def is out

- Open access to robust wireless networks will be prevalent

- Advertising will be key value driver in the future

- Price of storage is going to virtually zero;

Given all this, in Buno's words, "Building B's opportunity is to unify, simplify and deliver a video experience to consumers at a more palatable price." This simple sounding statement belies an excruciatingly tall order.

The company is creating a next generation set top box of sorts that will deliver the gamut of video: TV, movies and broadband. Buno and Phil don't see their box as comparable to ones from say Akimbo, Vudu or Apple TV. These are really broadband-only augments, whereas Building B aspires to be a full-on substitute for cable or satellite. Their box will be able to access content through both wired and wireless delivery infrastructures. One engineering challenge is to match content with the optimal delivery network. So for example, one-to-many broadcast networks might be delivered over wireless while niche and interactive content would use broadband.

But Building B doesn't see a model selling the box at retail (though Phil concedes this might be a secondary outlet). Others have tried and failed at retail. Rather, its go-to-market strategy contemplates partnering with service providers like telcos and ISPs which want or need to be in the video business, but don't have the stomach or cash to upgrade their networks to do so.

Building B plans to develop a video entertainment service offering incorporating its box which can be made available turnkey to partners. These partners could include smaller telcos, particularly in rural areas, which have traditionally stapled on a satellite offering to fill out their triple play bundle. Or they could be larger telcos like AT&T or Verizon, who might augment their fiber rollouts with Building B's approach. Or they could be broadband ISPs, portals and others who aspire to be in the video business.

A key hurdle for Building B is assembling a fully competitive video lineup to what today video providers offer. This is no easy feat. Cable programmers in particular are reluctant to make advantageous deals with new distributors for fear of antagonizing existing cable and satellite affiliates. Yet Buno feels confident that Building B will gain access to major cable networks' fare, on demand, and on deal terms that are both economic to the company and non-disruptive to these networks' current arrangements. Accomplishing these deals alone would be noteworthy.

Lastly, Building B envisions delivering a personalized and easy-to-access service. Buno speaks of having a "dumbed down approach" aimed at satisfying only primary consumer needs and routines. Given its emphasis on HD, this is the part of the Building B vision that must necessitate a colossal hard drive in the box to cache content for ready access. Indeed, Buno said the company is "betting heavily that the price of storage is going to zero." If this assumption is off the bill of materials on storage alone could bust the box's budget.

Listening to Building B's vision, it's hard not to get enthusiastic about the world it seeks to create. As a consumer it would be thrilling. Yet the technology landscape is littered with ambitious would-be contenders whose aspirations foundered when faced with real-world engineering, marketing and business model challenges. Building B is simultaneously climbing tall mountains in multiple directions. If it succeeds, it will become a big-time disruptor of today's business models. It's going to be fun to watch it try.

Categories: Cable Networks, Cable TV Operators, Devices, Startups, Technology

Topics: Building B, Index Ventures, Morgenthaler Ventures, OmniCapital

-

Broadband Video vs. IPTV, The Differences Do Matter

It's funny how often I'll be talking to someone and they will casually start interchanging the terms "IPTV" and "broadband video/online video/Internet TV".

The fact that many people, including some that are actually well-informed, continue doing so is a reminder of how nascent these delivery platforms still are, and how common terms of use and understandings have yet to be established.

Yet it's important to clarify that there are differences and they do matter. While some of the backend IP transport technology is common between IPTV and broadband video, the front end technology, business models and content approaches are quite different.

In presentations I do, I distinguish that, to me at least, "IPTV" refers to the video rollouts now being pursued by large telcos (AT&T, etc.) here in the U.S. and internationally. These use IPTV-enabled set-top boxes which deliver video as IP packets right to the box, where they are converted to analog video to be visible to the viewer. IPTV set tops have more capabilities and features than traditional MPEG set-tops, and telcos are trying this as a point of differentiation.

However, at a fundamental level, receiving IPTV-based video service is akin to subscribing to traditional cable TV - there are still multi-channel tiers the consumer subscribes to. And IPTV is a closed "walled garden" paradigm - video only gets onto the box if a "carriage" deal has been signed with the service provider (AT&T, etc.). IPTV can be viewed as an evolutionary, next-gen technology upgrade to existing video distribution business models.

On the other hand, broadband video/online video/Internet TV (whatever term you prefer) is more of a revolutionary approach because it is an "open" model, just like the Internet itself. In the broadband world, there's no set-top box "control point" governing what's accessible by consumers. As with the Internet, anyone can post video, define a URL and quickly have video available to anyone with a broadband connection.

The catch is that today, displaying broadband-delivered video on a TV set is not straightforward, because most TVs are not connected to a broadband network. There are many solutions trying to solve this problem such as AppleTV, Microsoft Media Extender, Xbox, Internet-enabled TVs from Sony and others, networked TiVo boxes, etc. Each has its pros and cons, and while I believe eventually watching broadband video on your TV will be easy, that day is still some time off.

Many people ask, "Which approach will win?" My standard reply is there won't be a "winner take all" ending. Some people will always prefer the traditional multichannel subscription approach (IPTV or otherwise), while others will enjoy the flexibility and features broadband's model offers. However, for those in the traditional video world, it's important to recognize that over time broadband is certainly going to encroach on their successful models. Signs of change are all around us, and many content companies are now seizing on broadband as the next great medium.UPDATE: Mark Ellison, who is the SVP of Business Affaris and General Counsel at the NRTC (National Rural Telecommunications Cooperative, an organization which delivers telecom solutions to rural utilities) emailed to clarify that it's not just LARGE telcos that are pursuing IPTV, but many SMALLER ones as well. Point well taken Mark, it was an oversight to suggest that IPTV is solely the province of large telcos like AT&T.Categories: Cable TV Operators, IPTV, Technology, Telcos

Topics: Apple, AppleTV, Media Extender, Microsoft, Sony, TiVo, XBox

-

Black Arrow Shoots for Multiplatform Ad Success

Black Arrow has an ambitious goal of managing and serving ads across broadband video, DVR and VOD platforms. With audience fragmentation causing chaos in the advertising world, such a solution, when fully implemented, would have enormous value to content companies and service providers (cable, satellite, telco).

Black Arrow has an ambitious goal of managing and serving ads across broadband video, DVR and VOD platforms. With audience fragmentation causing chaos in the advertising world, such a solution, when fully implemented, would have enormous value to content companies and service providers (cable, satellite, telco).Black Arrow has been around for a while but went under the radar for the past few months. Now it's re-emerging, with new CEO Dean Denhart installed about 6 months ago.

Dean briefed me last week on news the company announced today, which included closing a $12M B round from existing investors Comcast, Cisco, Intel, Mayfield and Polaris and officially launching their ad platform.

The company is trying to differentiate itself from many others serving ads in the broadband video space by tackling the thorny problem of also inserting in both the DVR and VOD environments. DVR insertion today is non-existent and for VOD it's not scalable. To succeed, the company will need to integrate its servers with the service providers, which is no easy feat. As many of you know, the rap on cable operators - and I've experienced this first-hand - is that selling into them wears out early-stage companies, using up precious time and capital in long drawn-out testing, selling and negotiation cycles.

If Black Arrow survives this process and proliferates its gear into headends, it will have a formidable competitive advantage against competitors. And on the encouraging side, in the cable world at least, a nascent set of standards dubbed "DVS 629" governing digital ad insertion is now being worked on. Black Arrow is following these closely. Dean explained that the company has proven in its technology and in 2008 it will be pursuing field trials and initial rollouts with major operators. Certainly having Comcast as a lead investor can't hurt its chances.

Black Arrow's real appeal to content companies will only begin when it has significant deployments. Dean explained that while the cable sell-in process continues to unfold, it will follow a parallel track of managing ads for broadband, with the longer-term value prop of multi-platform support. And it's taking a wait-and-see approach on which business model to use to fund the capex for proliferating its servers. An analogous and interesting approach is the one Akamai has mastered - i.e. not charging ISPs. Instead it positions its gear contributing to top-line growth and opex reductions. This strategy has been a massive success for Akamai, helping it achieve widespread deployments and a huge entry barrier for competitors.

I really like this company's vision; however achieving it in full is going to take tenacity, patient and deep-pocketed investors and a few good breaks.

Categories: Advertising, Cable TV Operators, Deals & Financings, Startups

Topics: Black Arrow, Cisco, Comcast, Intel, Mayfield, Polaris

-

I Got My Official Comcast-TiVo Beta Trial Invite This Week

This week I heard from the folks at Comcast who are running the upcoming beta trial with TiVo. I'm officially on the list and should be getting a box soon. Hooray.

This week I heard from the folks at Comcast who are running the upcoming beta trial with TiVo. I'm officially on the list and should be getting a box soon. Hooray.As many of you are aware, Comcast has been on the cusp of kicking off this trial for some time now, which will let real users experience the joys of TiVo software running inside a Comcast digital set-top box. This will mark a milestone for Comcast in delivering a better user experience than the generic DVR feature that it and other cable operators rolled out a couple of years ago.

After hosting Jeff Klugman, TiVo's Senior VP, GM of its Service Provider and Advertising Engineering Division for a "fireside chat" at a cable industry conference last July, I became very bullish on the opportunity for TiVo to transform itself through these cable deals into a software and services powerhouse. In other words, long-term getting out of the high-cost, low-margin consumer device business.

Running a successful trial with Comcast is all-important to TiVo and they've been working for 2 years on this integration. Success will likely mean wide rollouts with Comcast, followed by #3 operator Cox (with whom TiVo already has a deal), and then others no doubt to follow. I'll be keeping you posted on my experience when I get the box. If it works as advertised it's going to be a killer device.

Categories: Cable TV Operators, Devices, Partnerships