-

Online-Only Originals Are Entering a Virtuous Cycle

Just last week, in "Hollywood's A-Listers Embrace Online Video, Upending the Status Quo," I noted all the various factors that are contributing to top industry talent now pursuing online-only projects. But as I've had a chance to digest last week's CES announcements, plus Hulu's news yesterday that it too is planning an aggressive originals strategy in 2012, I think it's quite likely that online-only originals are entering a "virtuous cycle." Key elements for online-only originals' success are falling into place and are poised to build on each other, combining to dramatically accelerate the growth and acceptance of this emerging class of programming.

Categories: Aggregators, Cable Networks, Indie Video

Topics: AOL, Hulu, Netflix, Yahoo, YouTube

-

Hollywood's A-Listers Embrace Online Video, Upending the Status Quo

Tom Hanks. Louis C.K. Lisa Kudrow. Kevin Spacey. David Fincher. Bill Maher. Jennifer Lopez. Judy Greer. Steven Van Zandt. Anthony Zuiker. Morgan Spurlock. Ed Begley, Jr. Heidi Klum. What do these Hollywood A-Listers (or near A-Listers) and other stars all have in common? They're all involved in original online video projects which are helping upend the Hollywood ecosystem, legitimize the online medium and further fragment audiences. Each no doubt has his/her own reasons for getting involved, and taken together they're creating momentum that is going to draw in even more talent.

Of course, the big news this week was Tom Hanks partnering with Yahoo for the animated series "Electric City." Hanks, one of Hollywood's most bankable stars, said he was drawn by the opportunity to make "ambiguous attractive" which feels like another way of saying he's searching for greater creative freedom. While creativity may be motivating Hanks, in Louis C.K.'s case, it seems more about tweaking the System and proving that when presented with a compelling offer (in this case a $5 DRM-free download of his "Live at the Beacon Theater" special), people will behave properly (i.e. pay rather than steal).

Categories: Aggregators, Devices, Indie Video

Topics: AOL, Netflix, Tom Hanks, Yahoo, YouTube

-

4 Items Worth Noting for the Oct 19th Week (FCC/Net neutrality, Cisco research, Netflix earnings, Yahoo-GroupM)

Following are 4 items worth noting from the Oct 19th week:

1. FCC kicks off net neutrality rulemaking process among flurry of input - As expected, the FCC kicked off its net neutrality rulemaking process yesterday, with all commissioners voting to explore how to set rules regulating the Internet for the first time, though Republican appointees dissented on whether new rules were in fact needed.

Leading up to the vote there was a flurry of input by stakeholders and Congress. Everyone agrees on the "motherhood and apple pie" goal that the Internet must remain open and free. The disagreement is over whether new rules are required to accomplish this, and if there are to be new rules what specifically should they be. As I argued here, the FCC is treading into very tricky waters, and law of unintended consequences looms. Already telco executives are talking about curtailing investments in network infrastructure, the opposite of what the FCC is trying to foster. The FCC will be seeking input from stakeholders as part of the process. Even though chairman Genachowski's bias to regulate is very clear, let's hope that as the data and facts are presented, the FCC is able to come to right decision, which is to leave the well-functioning Internet alone.

2. New Cisco research substantiates video, social networking usage - Speaking of the well-functioning Internet, Cisco released its Visual Networking Index study this week based on research gathered from 20 leading service providers. Cisco found that the average broadband connection consumes 4.3 gigabytes of "visual networking applications" (video, social networking and collaboration) per month, or the equivalent of 20 short videos. (Note that comScore's Aug data said of the 161 million viewers in the U.S. alone, the average number of videos viewed per month was 157.) I'm not sure what the difference is other than Cisco is measuring global traffic and comScore data is at U.S. only. Regardless, the Cisco research continues to demonstrate that users are shifting to more bandwidth-intensive applications, and the Internet is scaling up to meet their demands.

3. Netflix reports strong Q3 '09 earnings, streaming usage surges - Netflix continues to stand out as unaffected by the economy's woes, reporting its Q3 results late yesterday that included adding 510,000 net new subscribers, almost double the 261,000 from Q3 '08. The company finished the quarter with 11.1 million subs and projects to end the year with 12 to 12.3 million subs. If Netflix were a cable operator it would be the 3rd largest, just behind Time Warner Cable, which has approximately 13 million video subscribers.

Netflix CEO Reed Hastings also disclosed that 42% of Netflix's subscribers watched a TV episode or movie using the "Watch Instantly" streaming feature during the quarter, up from 22% in Q3 '08. Hastings also said in 2010 the company will begin streaming internationally, even though it has no plans to ship DVDs outside the U.S. He added that in Q4 Netflix will announce yet another CE device on which Watch Instantly will be available (just this week it also announced a partnership with Best Buy to integrate Watch Instantly with Insignia Blu-ray players). Net, net, Watch Instantly looks like it's getting great traction for Netflix and will continue to be a bigger part of the company's mix. Yet as I've mentioned in the past, a key challenge for Netflix is making more content available for streaming.

4. Yahoo's pact with GroupM for original branded entertainment raises more questions - Shifting gears, Yahoo and GroupM, the media buying powerhouse announced a deal this week to begin co-producing original branded entertainment for advertisers. The idea is to then distribute the video throughout Yahoo's News, Sports, Finance and Entertainment sections. GroupM has had some success in the past, as its "In the Motherhood" series, created for Sprint and Unilever, was picked up by ABC, though it was quickly canceled. As I pointed out in my recent post about Break Media, branded entertainment initiatives continue to grow.

Less clear to me is Yahoo's approach to video. CEO Carol Bartz said last month that "video is so crucial to our users and our advertisers..." that "there's a big emphasis inside Yahoo on our video platforms" and that "a big cornerstone of our strategy is video." OK, but these comments came just months after Yahoo closed down its Maven Networks platform, which it had only acquired in Feb '08. Having spent time at Maven, I can attest that its technology would have been well-suited to supporting the engagement and interactivity requirements of these new Yahoo-GroupM branded entertainment projects. Yahoo's video strategy, such as it is, remains very confusing to me.

Note there will be no VideoNuze email on Monday as I'll be in Denver moderating the Broadband Video Leadership Breakfast at the CTAM Summit...enjoy your weekend!

Categories: Aggregators, Branded Entertainment, Broadband ISPs, Portals, Regulation, Telcos

Topics: Cisco, FCC, GroupM, Net Neutrality, Netflix, Yahoo

-

FreeWheel is Close to Managing 1 Billion Video Ads Per Month

In a quick call yesterday with FreeWheel Co-CEO and Co-Founder Doug Knopper, who was on his way to NYC for tonight's VideoSchmooze, he told me that the company is poised to manage 1 billion video ads next month, all against premium video streams.

In addition, FreeWheel has now been integrated by AOL, MSN and Fancast, among others, with Yahoo testing currently and ready to go live soon. It looks like the major portals are being encouraged to integrate with FreeWheel's Monetization Rights Management system by the company's premium content customers.

The benefit to the content providers is better control and monetization of their ad inventory across their portal distribution deals. The portal activity comes on top of FreeWheel's recently-reported implementation with YouTube, allowing the site's premium content partners to sell and insert ads against their YouTube-initiated streams.

The benefit to the content providers is better control and monetization of their ad inventory across their portal distribution deals. The portal activity comes on top of FreeWheel's recently-reported implementation with YouTube, allowing the site's premium content partners to sell and insert ads against their YouTube-initiated streams.FreeWheel is another great example of the Syndicated Video Economy (SVE) I've frequently talked about. Doug says FreeWheel's progress is proof that the SVE is really "hitting its stride."

It is hard though to put FreeWheel's 1 billion number into perspective. One way of thinking about it is comparing it to the data that comScore reported for August '09 for the top 10 video sites. Assuming only 5-10% of YouTube's views are from its premium partners and maybe half of Fox Interactive's are (due to MySpace's user-generated videos being included in its 380M streams) the top 10 video providers would account for about 3.5B videos. If each video had an average of 2 ads (which is a decent assumption when averaging short clips vs. full programs), then the top 10 video sites would account for about 7B video ads.

Relative to the top 10 then, FreeWheel's 1B ads managed look pretty healthy. To get a fuller picture, you'd also have to consider how many premium streams are in the 12B+ video views that fall outside of comScore's top 10 video sites, and how many ads run against those. If anyone has any ideas for how to determine these numbers, I'd love to hear them.

What do you think? Post a comment now.

Categories: Advertising, Portals, Syndicated Video Economy, Technology

Topics: AOL, Fancast, FreeWheel, MSN, Yahoo, YouTube

-

Lots of News Yesterday - Adobe, Hulu, IAB, Yahoo, AEG, KIT Digital, VBrick, Limelight, Kaltura

Yesterday was one of those days when meaningful broadband video-related news and announcements just kept spilling out. While I was writing up the 5Min-Scripps Networks deal, there was a lot of other stuff happening. Here's what hit my radar, in case you missed any of it:

Adobe launches Flash 10.1 with numerous video enhancements - Adobe kicked off its MAX developer conference with news that Flash 10.1 will be available for virtually all smartphones, in connection with the Open Screen Project initiative, will support HTTP streaming for the first time, and with Flash Professional CS5, will enable developers to build Flash-based apps for the iPhone and iPod Touch. All of this is part of the battle Adobe is waging to maintain Flash's lead position on the desktop and extend it to mobile devices. The HTTP streaming piece means CDNs will be able to leverage their HTTP infrastructure as an alternative to buying Flash Media Server 3.5. Meanwhile Apple is showing no hints yet of supporting Flash streaming on the iPhone, making it the lone smartphone holdout.

Hulu gets Mediavest multi-million dollar buy - Hulu got a shot in the arm as Mediaweek reported that the Publicis agency Mediavest has committed several million dollars from 6 clients to Hulu in an upfront buy. Hulu has been flogged recently by other media executives for its lightweight ad model, so the deal is a well-timed confidence booster, though it is still just a drop in the bucket in overall ad spending.

IAB ad spending research reports mixed results - Speaking of ad spending, the IAB and PriceWaterhouseCoopers released data yesterday showing overall Internet ad spending declined by 5.3% to $10.9B in 1H '09 vs. 1H '08. Some categories were actually up though, and online video advertising turned in a solid performance, up 38% from $345M in 1H '08 to $477M in 1H '09. Though still a small part of the overall pie, online video advertising's resiliency in the face of the recession is a real positive.

Yahoo ups its commitment to original video - Yahoo is one of the players relying on advertising to support its online video initiatives, and so Variety's report that Yahoo may as much as double its proportion of originally-produced video demonstrates how strategic video is becoming for the company. Yahoo has of course been all over the map with video in recent years including the short tenure of Lloyd Braun and then the Maven acquisition, which was closed down in short order. Now though, by focusing on short-form video that augments its core content areas, Yahoo seems to have hit on a winning formula. New CEO Carol Bartz is reported to be a big proponent of video.

AEG Acquires Incited Media, KIT Digital Acquires The FeedRoom and Nunet - AEG, the sports/venue operator, ramped up its production capabilities by creating AEG Digital Media and acquiring webcasting expert Incited Media. Company executives told me late last week that when combined with AEG's venues and live production expertise, the company will be able to offer the most comprehensive event management and broadcasting services. Elsewhere, KIT Digital, the acquisitive digital media technology provider picked up two of its competitors, Nunet, a German company focused on mobile devices, and The FeedRoom, an early player in video publishing/management solutions which has recently been focused on the enterprise. KIT has made a slew of deals recently and it will be interesting to watch how they knit all the pieces together.

Product news around video delivery from VBrick, Limelight and Kaltura - Last but not least, there were 3 noteworthy product announcements yesterday. Enterprise video provider VBrick launched "VEMS" - VBrick Enterprise Media System - a hardware/software system for distributing live and on-demand video throughout the enterprise. VEMS is targeted to companies with highly distributed operations looking to use video as a core part of their internal and external communications practices.

Separate, Limelight unveiled "XD" its updated network platform that emphasizes "Adaptive Intelligence," which I interpret as its implementation of adaptive bit rate (ABR) streaming (see Limelight comment below, my bad) that is becoming increasing popular for optimizing video delivery (Adobe, Apple, Microsoft, Apple, Akamai, Move Networks and others are all active in ABR too). And Kaltura, the open source video delivery company I wrote about here, launched a new offering to support diverse video use cases by educational institutions. Education has vast potential for video, yet I'm not aware of many dedicated services. I expect this will change.

I may have missed other important news; if so please post a comment.

Categories: Advertising, Aggregators, CDNs, Deals & Financings, Enterprises, Portals, Technology

Topics: Adobe, AEG, Hulu, IAB, Kaltura, KIT Digital, Limelight, Nunet, The FeedRoom, VBrick, Yahoo

-

2 Complimentary Upcoming Webinars

I'll be participating in 2 complimentary upcoming webinars that will be of interest to VideoNuze readers.

First, this Thurs, Sept. 23rd, Colin Dixon, Senior Partner at The Diffusion Group and I will present "The Terror of Terminology: Demystifying Broadband TV." Colin is a savvy broadband analyst, with whom I often compare notes on the market. We've both been hearing similar types of questions in the market, so we've decided take on 5-6 items and address misunderstandings that linger.

We'll discuss the difference between "broadband TV" and "Internet TV," whether online video ads can support long-form premium content, why so many cable programs are available online, but so few cable programs are, what's the difference between hybrid set-top boxes and Internet set-top boxes, and why TV Everywhere is so significant. Expect a fun and educational conversation, with plenty of time for audience Q&A. Learn more and register.

Then on Wed, Sept. 30th I'll be participating in a Brightcove-sponsored webinar, "New Video Distribution Strategies - Taking Video Beyond the PC." Other speakers include Chris Little, Technology Director at Brightcove and Rich Ezekial, Director of Strategic Partnerships, Connected TV, Yahoo. Accessing online video on other devices like TVs and smartphones is one of the hottest areas of the broadband video landscape, and we'll be digging in to key trends, best practices and monetization opportunities. In particular, we'll hear specifics about Yahoo's Connected TV strategy. Learn more and register.

I look forward to seeing you on one or both of these exciting webinars!

Categories: Events

Topics: Brightcove, The Diffusion Group, Webinars, Yahoo

-

2 Complimentary Upcoming Webinars

I'll be participating in 2 complimentary upcoming webinars that will be of interest to VideoNuze readers.

First, on Thurs, Sept. 24th, Colin Dixon, Senior Partner at The Diffusion Group and I will present "The Terror of Terminology: Demystifying Broadband TV." Colin is one of the smartest broadband analysts around, and we periodically compare notes on the market. In an effort to clarify some of the confusion we continually hear around certain terminology in the market, we're going to discuss 5-6 different concepts and try to clear away the fog. Expect a fun and educational conversation, with plenty of time for audience Q&A. Learn more and register.

Then on Wed, Sept. 30th I'll be participating in a Brightcove-sponsored webinar, "New Video Distribution Strategies - Taking Video Beyond the PC." Other speakers include Chris Little, Technology Director at Brightcove and Rich Ezekial, Director of Strategic Partnerships, Connected TV, Yahoo. Accessing online video on other devices like TVs and smartphones is one of the hottest areas of the broadband video landscape, and we'll be digging in to key trends, best practices and monetization opportunities. In particular, we'll hear specifics about Yahoo's Connected TV strategy. Learn more and register.

I look forward to seeing you on one or both of these exciting webinars!

Categories: Events

Topics: Brightcove, TDG, Yahoo

-

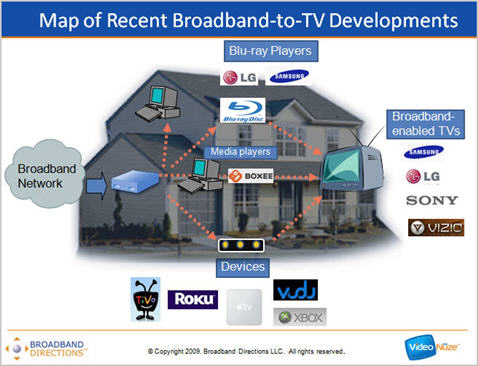

First Intel-Powered Convergence Device Being Unveiled in Europe

Convergence devices that bring broadband video and Internet applications to the TV (e.g. Roku, Xbox, Apple TV, Vudu, etc.) are a white-hot area of interest as many industry participants - including me - believe their eventual mass adoption will provide a major catalyst to broadband video usage and prompt further disruption in the value chain.

Intel has eyed a big role in this emerging market for a while, becoming a strong public proponent of the "digital home" concept. Building momentum over the past year, Intel has made announcements with Yahoo (for the "Widget Channel" framework), Adobe (to port and optimize Flash for TV viewing) and with a number of large content providers (demonstrating enhanced viewer experiences).

At the heart of Intel's early initiatives is the company's much-heralded Media Processor CE3100, the first in a family of "system on a chip" convergence-oriented processors. Next week the first CE3100-powered device, the "Mediaconnect TV" will be shown at the IBC show in Amsterdam. The box is a collaboration between a Dutch company, Metrological Media Innovations and a British interactive services provider, Miniweb (a spinoff of BSkyB). This has been previewed recently and is sure to gain more visibility next week. To learn more about Intel's convergence vision, yesterday I spoke to Wilfred Martis, the GM of Connected AV Products for Intel's Digital Home Group.

Intel sees 4 different types of home products that can be fitted with its media processor chips: set-top boxes, digital TVs, optical players (e.g. Blu-ray devices) and "connected AV" products, which are defined as standalone boxes that connect broadband to the TV, but without any guaranteed quality of service (QoS) for the video. This segmentation actually closely follows a slide I've been presenting lately which maps the various efforts for bringing broadband to the TV.

The connected AV devices are of course what "over-the-top" providers like Netflix, Amazon, iTunes, YouTube, etc. are counting on to deliver their services into the home over open broadband connections. On the one hand, Intel seems to be looking to empower these providers. As Wilfred says, Intel is trying to create a standard toolset and app environment akin to what we've seen on leading smartphones (mainly the iPhone) that helps drive creative new TV-based applications. Yet at the same time, as Wilfred notes, Intel wants to be a friend to incumbent video service providers, allowing them to deliver broadband content side-by-side with their walled-garden channels in their set-top boxes.

While Intel is clearly in this for the long haul, and has the resources to cultivate the market, other non-Intel devices continue to get a foothold. It's interesting to contrast, for example, the success that Roku is enjoying to date and ponder how the convergence device market will develop over the next several years. As I detailed a few weeks ago, Roku is successfully pursuing a classic "Crossing the Chasm" strategy, leveraging low pricing and loyalty to its content partners' brands to move lots of its product.

Still, integrating with Roku - and other current convergence devices - requires a one-off integration that assumes resources and prioritization (even when APIs exist). Some content providers will determine integrating is worthwhile, while others will not.

Intel's strategy is meant build on existing technologies and applications, making it more straightforward for content providers and applications developers to deploy on its devices (it's worth noting that Amazon, Blockbuster, Facebook and others plan to launch Widget Channel apps imminently). As Wilfred explains, when Intel's architecture is in convergence devices, incumbent software like browsers, plug-ins, drivers and the like are intended to work seamlessly. In addition, by providing abundant processing power, developers don't have to go through the arduous task of de-optimizing their apps for slower environments. And they get the performance headroom to continuously add updates.

The price for all this is of course, price. I don't know what the unit cost of the CE3100 is at volume, but my guess is that whatever it is would quickly sink any manufacturer's prospects of selling their box at anything close to a $99 price point, as Roku is. It's an age-old computing dilemma: beneficial as it is to have lots of processing power, there's a cost to it.

This raises the fundamental question of how the convergence device market will shape up over the next several years: will low-cost, "powerful-enough" devices continue to gain, or will boxes with robust processing render them obsolete at some point soon? My guess is that in the short term at least, low cost is going to lead the way. However, over the long term, it's hard to avoid the idea of significant computing power sitting next to the TV. However the business model for who pays to get it there remains in question.

What do you think? Post a comment now.

Categories: Devices, International

Topics: Adobe, Intel, Metrological Media Innovations, Miniweb, Roku, Yahoo

-

4 Items Worth Noting from the Week of August 3rd

Following are 4 items worth noting from the week of August 3rd:

1. Research, research, research - For some unknown reason, there was a flurry online video-related research and forecasts released this week. In no particular order:

eMarketer was out with a new forecast indicating 188 million online video viewers in the U.S. in 2013.

Veronis Suhler released its forecast of 2009-2013 communications industry spending, showing advertising shrinking as a percentage of total spending.

PWC's UK office released its 2009-2013 forecast, which also anticipates declines in advertising.

CBS's research head David Poltrack used detailed data to explain the company's online video strategy and buttress its argument that in a TV Everywhere world, it should be compensated for its content (slides are here, via PaidContent).

Ipsos found that Americans streamed a record amount of TV programs and movies, doubling their consumption from Sept '08 to July '09.

Yahoo and a group of research partners released data finding that 70% of online video consumption happens throughout the day and night, as opposed to traditional TV viewing which is concentrated in the prime-time window.

Last but not least, TDG released excerpts of its research on "over-the-top" video services, available for download at VideoNuze.

2. Unicorn Media launches, hires ex-Move Networks executive David Rice - It will be hard for some to believe there's room for yet another white label video publishing and management platform, but startup Unicorn Media is going to try elbowing its way into the crowded space, with a specific focus on large media companies. I spoke with Unicorn's executive team this week, led by Bill Rinehart, who was the founding CEO of Limelight.

Unicorn is positioning itself as the first "enterprise-grade" solution, staking out key differentiators such as enhanced analytics/reporting, faster/easier transcoding, improved APIs for content ingest/management and more flexible monetization/ad queuing. I have not yet seen a demo, but I'm intrigued by what I heard. The company has raised $5M to date from executives/angels and has a staff of 25. David Rice, formerly Move's VP of Marketing has come on board as Chief Strategy Officer. Given the team's industry expertise and relationships, this could be a company to watch.

3. Google acquires On2 Technologies and other encoding-related news - The blogosphere was in a flurry about Google's $106M acquisition of video compression provider On2 Technologies this week. Speculation flew about Google open-sourcing On2 new VP8 codec, which could potentially force a new standard to emerge as a challenge to H.264, today's leading codec. This is important stuff, though a little further down the stack than I usually focus, so I refer you to Dan Rayburn's analysis of the deal's implications, which is the best I've seen.

There was other news in the emerging cloud-based encoding/transcoding/delivery market this week, as Encoding.com announced a new premium service with tighter service level agreements (4 minute max wait time and 50 Gbyte/hour/customer throughput). Encoding.com's Gregg Heil and Jeff Malkin explained the company is using the new SLAs to move upmarket to service tier 1 and 2 media companies. Separate, Encoding.com's competitor mPoint's CEO Chiranjeev Bordoloi told me they're now on a $3M annualized revenue run rate as cloud-based alternatives continue to gain acceptance.

4. Don't try this at home - On a lighter note, there's been no shortage of knuckle-head stunt videos we've all seen online, but this one is near the top of my personal favorite list. Do NOT try replicating this over the weekend!Categories: Deals & Financings, Technology

Topics: CBS, eMarketer, Google, Ipsos, ON2, PWC, TDG, Unicorn Media, Veronis Suhler, Yahoo

-

R.I.P. Maven Networks

Well, it looks as though it's official: as reported by TechCrunch and others, Yahoo is discontinuing Maven Networks's third party video publishing activities though Yahoo's statement says it will use Maven technology for internal video efforts. As I've mentioned periodically, I was an early consultant to Maven, which was a pioneer in the video platform space.

Way back then (!) in 2003 most people in the media business still had a difficult time imagining why broadband video was so strategic and game-changing. Maven's team did a lot of the early spadework in evangelizing broadband's potential and building market momentum. Its reward was being acquired for $160M by Yahoo in February, 2008 in what I believe is still the largest pure play broadband deal.

However, the Yahoo acquisition was never a perfect strategic fit, even before factoring in the well-documented chaotic mess that Yahoo has become in recent years. The problem was that Yahoo is a media company, deriving the majority of its revenue from advertising. On the other hand, Maven was a technology/products company (though some in the industry always questioned the true proprietary value of Maven's technology). The most strategic deal for Maven would have been with a larger technology/products company, where it would have become part of broader suite of video products and services. Yahoo was never really well-suited to support Maven's third party video customers (and in reality it hasn't for a while now), and with all its other troubles, this move was widely expected.

For Maven's founders and investors, the company's acquisition marked a successful exit that others in the industry envy, particularly in this crummy M&A market. Still, the Yahoo-Maven deal is yet another example that when selling a company, price isn't the sole criteria for longer-term success.

Categories: Deals & Financings, Portals, Technology

-

Yahoo May Be Finally on to a Winning Original Video Strategy

The NY Times is reporting that Yahoo is ramping up its original broadband video offerings, with the impending launch of "Spotlight to Nightlight," a new series showcasing celebrity moms, hosted by former Miss USA Ali Landry and sponsored by State Farm Insurance. The new show highlights how far Yahoo has evolved from its era of failed dreams of grandeur directed by former Yahoo Media Group head Lloyd Braun. Before you say, "ugh, its Yahoo, they'll never succeed with video," I'd suggest that their new plan has some merit.

As we all know, Yahoo has suffered through all kinds of recent challenges and significant management turnover. But it is still one of the most popular online brands - the 2nd most-trafficked web site with over 146 million monthly unique visitors, the #3 search engine (now just behind YouTube) with a 21% market share and operator of the second-largest ad network behind Platform A.

Despite these strengths, I've thought Yahoo has been somewhat unimpressive in the video area. It has focused heavily on aggregating and distributing others' content in a bland, mechanical manner though still

managing to become a highly popular video streaming destination. I've sometimes wondered whether anyone really "owned" the video experience at Yahoo or whether it had been diffused over so many managers that it had been orphaned along the way. It's not been uncommon for me to see broken links, repetitious ads, 30 second pre-rolls adjacent to under 1 minute clips, and other annoyances that can quickly turn off users.

managing to become a highly popular video streaming destination. I've sometimes wondered whether anyone really "owned" the video experience at Yahoo or whether it had been diffused over so many managers that it had been orphaned along the way. It's not been uncommon for me to see broken links, repetitious ads, 30 second pre-rolls adjacent to under 1 minute clips, and other annoyances that can quickly turn off users.In the midst of this confusion, a bright spot on the original video front has been "Primetime in No Time" a short, energetic TV recap show that has gained a sizable following plus other series in specific verticals like sports and finance. On the flip side, in a sign of the mixed internal signals, it also killed "The 9" a recap show of top online content, which had both a following and a sponsor in Pepsi.

With "Spotlight to Nightlight" Yahoo seems to be further recognizing that it is sitting on mounds of data that, if properly analyzed, can reveal lots of clues about what kinds of programming would match up with its users' and advertisers' interests. Given Yahoo's size and resources, there are few online companies that should be better tuned in to what's hot and could be the strong basis for a new series.

Yahoo's opportunity is to capitalize on this information by creating short, upbeat (and humorous where possible) series that appeal to users' demonstrated interests. It should then promote the shows like crazy in appropriate vertical areas of its site (as "Spotlight to Nightlight" will be with Yahoo's "OMG"), and adjacent to relevant searches.

Recently I wrote about Demand Media, which has built a "content factory" by doing many of these same kinds of things. Yahoo could create a stable of inexpensively produced but high-quality broadband-only series that can instantly find their natural audiences. Advertisers looking for adjacency to premium video that aggregates sought-after audiences, would soon follow.

New Yahoo CEO Carol Bartz has a lot of issues on her plate to resolve, but also plenty of opportunities. Video is a big one that has been largely untapped by the company. If Yahoo builds a cohesive video strategy that relies on the significant data it has unrestricted access to, it may finally be on a winning video path.

What do you think? Post a comment now.

Categories: Portals

Topics: Yahoo

-

Clarifying Comcast's and Time Warner's Plans to Deliver Cable Programming Via Broadband to Their Subscribers

Summary:

What: Major cable operators Comcast and Time Warner intend to offer broadband access to cable programs for the first time, but they have provided few specifics to date, thereby creating a swirl of confusing interpretations. This post seeks to clarify their plans.

Important for whom: Cable networks, other content providers, cable operators, consumers

Potential benefits: Flexible access and first-time online availability of popular cable programs.

Background

Since the WSJ reported two weeks ago today that Comcast and Time Warner Cable plan to offer online access to cable TV programming to their subscribers, there has been a significant amount of confusion and misinterpretation about what these companies are actually planning to do. Absent official statements from either company, there has been an ongoing debate about whether cable operators, who want to defend their traditional model, were moving to choke off the largely open access to broadband video that users have grown accustomed to.

Things got more confusing this past Monday when AdAge ran an interview ("TV Everywhere -- As Long As You Pay For It") with Jeff Bewkes, CEO of Time Warner Inc. in which he elaborated on a company initiative dubbed "TV Everywhere" that major cable network owners such as Time Warner Inc. Viacom, NBCU, Discovery and others are said to be collaborating on. Bewkes outlined a broad online vision including the idea that cable programming could also be available on sites like Hulu, MySpace, Yahoo and YouTube as well, provided that users were paying a fee to some underlying service provider (cable/satellite/telco).

A wrinkle in the interview was exactly whom Bewkes was speaking for, since Time Warner Inc. (or "TWI" which owns the cable networks CNN, TNT, TBS, etc.) plans to spin off as an independent entity Time Warner Cable ("TWC"), which operates cable systems serving 14 million subscribers. After the split, set for next week, which of these companies would actually be sponsoring the "TV Everywhere" vision?

The NYTimes' technology reporter Saul Hansell then picked up on the interview and wrote a piece on the paper's widely-read "Bits" blog entitled "Time Warner Goes Over the Top," which provocatively began, "Just as soon as Time Warner has divested itself from the cable business, Jeff Bewkes, its chief executive, is preparing to stab the cable industry in the back. That's what I read in an interview with Mr. Bewkes in Advertising Age..."

Saul went on to describe his interpretation of one particular Bewkes comment as implying that Time Warner Inc. would offer its networks directly to consumers (or "over the top" of cable operators), thereby setting off a domino effect in which others' networks did the same, all of which would ultimately lead to the destruction of the cable industry business model.

The attention all of this received, particularly in the blogosphere, prompted a fair number of people to contact me and ask what's really going on here.

Time Warner's Plans

Yesterday I spoke with Keith Cocozza, TWI's spokesman, who said that Bewkes's comments do represent both TWI and TWC. Their mutual vision is to have cable programming offered not just at TWC's

RoadRunner portal, but also at various third-party aggregators (Hulu, etc.) so long as they subscribe to any multichannel video service (whether from TWC, Verizon, DirectTV, etc.). They do envision offering a streaming-only service for those that don't want the traditional cable subscription, but it would only be available in their geographical footprint. All of that means that there's in fact no over-the-top threat involved here at all. TWI and TWC are "agnostic" about third-party aggregator access to the cable programs, because they recognize that people want to go to whatever sites make them most comfortable. And they do not plan to charge subscribers extra for online access.

RoadRunner portal, but also at various third-party aggregators (Hulu, etc.) so long as they subscribe to any multichannel video service (whether from TWC, Verizon, DirectTV, etc.). They do envision offering a streaming-only service for those that don't want the traditional cable subscription, but it would only be available in their geographical footprint. All of that means that there's in fact no over-the-top threat involved here at all. TWI and TWC are "agnostic" about third-party aggregator access to the cable programs, because they recognize that people want to go to whatever sites make them most comfortable. And they do not plan to charge subscribers extra for online access. From a consumer standpoint, all of this is quite enlightened. But from an operational standpoint, it feels incredibly complex. For example, I asked Keith about how a remote user, seeking to watch programs at a third party aggregator's site like Hulu, would be authenticated as an actual customer of a video service provider? While acknowledging it's too early to have all the answers, he said a test TWC has conducted in Wisconsin with HBO has shown this not to be a big technical problem. I don't agree. It's hard enough for companies to do a bilateral account integration (e.g. tying a user's Amazon account to a user's TiVo account); the idea of doing multilateral account integration (the numerous combinations of potential aggregators and service providers) is fraught with complexity and seems highly daunting.

Then there are financial issues to address. With no incremental subscriber payments, online program delivery needs to be sustained through ads alone. This would be quite workable if it were just cable operators and networks involved (they could split the ad avails proportionately as they've traditionally done with linear delivery), but by allowing third-party aggregators in too, a third mouth now needs to be fed. That will trigger a whole new negotiating dynamic, as each aggregator lobbies for a different share. And it's questionable whether there's even enough ad revenue for three parties to begin with, though Keith believes there is.

Comcast's Plans

Conversely, Kate Noel, Comcast's spokeswoman, told me yesterday that while it's still early to say anything definitive about Comcast's plans for distribution through third-party aggregators, their first priority is distribution of

cable programs on their own sites (e.g. Fancast, Comcast.net) and the networks' own sites. Comcast seems to have more of a "walk, before you run" approach. It recognizes that protecting subscribers' privacy in any account integration is crucial so it plans to proceed carefully. I tried to pin Kate down on whether Comcast intends to charge for online access. Again she felt it was too early to be definitive, but it sounds like they're leaning toward a no-charge model as well. The timeline is to begin rolling out access in the 2nd half of '09.

cable programs on their own sites (e.g. Fancast, Comcast.net) and the networks' own sites. Comcast seems to have more of a "walk, before you run" approach. It recognizes that protecting subscribers' privacy in any account integration is crucial so it plans to proceed carefully. I tried to pin Kate down on whether Comcast intends to charge for online access. Again she felt it was too early to be definitive, but it sounds like they're leaning toward a no-charge model as well. The timeline is to begin rolling out access in the 2nd half of '09.Clearly there are a lot of moving pieces involved with these companies' plans. In general Time Warner has a more aggressive, yet I believe far less pragmatic, plan. They're trying to get all the way to the end zone right away, when just advancing the ball further downfield would be real progress for today's broadband users seeking improved access to premium content. Time Warner's "TV Everywhere" seems like a great vision, but it would take years to fully implement. Comcast's plan is probably achievable in a year or less. Either way, major cable operators finally seem to have the ball rolling toward broadband distribution of cable programming. As I pointed out last week, this can only be viewed as a positive.

What do you think? Post a comment now.

(btw, if you want to learn more about all this, come to the Broadband Video Leadership Evening on March 17th in NYC, where we'll dig deeply into these issues with our top-notch panel)

Categories: Cable Networks, Cable TV Operators

Topics: Comcast, Hulu, MySpace, Time Warner Cable, Yahoo, YouTube

-

January '09 VideoNuze Recap - 3 Key Themes

Following are 3 key themes from VideoNuze in January:

Broadband video marches to the TV - At CES in early January there were major announcements around connecting broadband to TVs, either directly or through intermediary devices (a recap of all the news is here). All of the major TV manufacturers have put stakes in the ground in this market and we'll be seeing their products released during the year. Technology players like Intel, Broadcom, Adobe, Macrovision, Move Networks, Yahoo and others are also now active in this space. And content aggregators like Netflix and Amazon are also scaling up their efforts.

Some of you have heard me say that as amazing as the growth in broadband video consumption has been over the last 5 years, what's even more amazing is that virtually all of it has happened outside of the traditional TV viewing environment. Consider if someone had forecasted 5 years ago that there would be this huge surge of video consumption, but by the way, practically none of it will happen on TVs. People would have said the forecaster was crazy. Now think about what will happen once widespread TV-based consumption is realized. The entire video landscape will be affected. Broadband-to-the-TV is a game-changer.

Broadband video advertising continues to evolve - The single biggest determinant of broadband video's financial success is solidifying the ad-supported model. For all the moves that Netflix, Amazon, iTunes and others have made recently in the paid space, the disproportionate amount of viewership will continue to be free and ad-supported.

This month brought encouraging research from ABC and Nielsen that online viewers are willing to accept more ads and that recall rates are high. We also saw the kickoff of "the Pool" a new ad consortium spearheaded by VivaKi and including major brands and publishers, which will conduct research around formats and standards. Three more signs of advertising's evolution this month were Panache's deal with MTV (signaling a big video provider's continued maturation of its monetization efforts), a partnership between Adap.tv and EyeWonder (further demonstrating how ecosystem partners are joining up to improve efficiencies for clients and publishers) and Cisco's investment in Digitalsmiths (a long term initiative to deliver context-based advanced advertising across multiple viewing platforms). Lastly, Canoe, the cable industry's recently formed ad consortium continued its progress toward launch.

(Note all of this and more will be grist for VideoNuze's March 17th all-star panel, "Broadband Video '09: Building the Road to Profitability" Learn more and register here)

Broadband Inauguration - Lastly, January witnessed the momentous inauguration of President Barack Obama, causing millions of broadband users to (try to) watch online, often at work. What could have been a shining moment for broadband delivery instead turned into a highly inconsistent and often frustrating experience for many.

In perspective this was not all that surprising. The Internet's capacity has not been built to handle extraordinary peak load. However on normal days, it still does a pretty good job of delivering video smoothly and consistently. As I wrote in my post mortem, hopefully the result of the inauguration snafus will be continued investment in the infrastructure and technologies needed to satisfy growing demand. That's been the hallmark of the Internet, underscored by the fact that 70 million U.S. homes now connect to the 'net via broadband vs. single digit millions just 10 years ago. I remain confident that over time supply will meet demand.

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Devices, Politics, Technology

Topics: ABC, Adap.TV, Adobe, Amazon, Broadcom, EyeWon, Intel, Macrovision, Move Networks, MTV, Netflix, Nielsen, Panache, VivaKi, Yahoo

-

Recapping CES '09 Broadband Video-Related Announcements

CES '09 is now behind us. As has become typical, this year's show saw numerous broadband video product and technology announcements. As I wrote often last week, the key theme was broadband-enabled TVs. Assuming TV manufacturers deliver on their promises, Christmas '09 should mark the start of real growth in the installed base of connected TVs.

Here are the noteworthy announcements that I caught, in no particular order (I'm sure I've missed some; if so please add a comment and include the appropriate link):

Intel and Adobe to Extend Flash Platform to TVs

Adobe and Broadcom Bring the Adobe Flash Platform to TVs

Samsung and Yahoo Bring the Best of the Web to Television

Yahoo Brings the Cinematic Internet to Life and Revolutionizes Internet-Connected Television

LG Electronics First to Unveil "Broadband HDTVs" That Instantly Stream Movies From Netflix

LG Electronics Launches Broadband HDTVs with "Netcast Entertainment Access"

Sony Debuts Integrated Networked Televisions

Vizio Announces New and Exciting "Connected HDTV" Platform with Wireless Connectivity

Netflix Announces Partnership with Vizio to Instantly Stream Movies to New High Definition TVs

MySpace Partnerships Bring Web Site to TV Set

Macrovision to Bring Instant Access to Digital Content Directly to Internet-Connected Televisions

Cisco Brings Manufacturers Together to Make Connected Home Products Simple to Set-up and Easy to Use

blip.tv and ActiveVideo Networks Sign Deal to Bring Original Online Shows Directly to Television

Hillcrest Labs and Texas Instruments Showcase RF4CE Remote Controls with Freespace Technology

Categories: Aggregators, Devices

Topics: Ac, Adobe, Amazon, Broadcom, Intel, LG, Macrovision, Move Networks, MySpace, Netflix, Netgear, Roku, Samsung, Sony, Vizio, Yahoo

-

Yahoo Gets Traction in Broadband-to-TV Market

At CES, Yahoo is making its presence felt in the budding broadband-to-the TV space with its "Yahoo Widget Engine." It has announced deals with TV manufacturers Samsung, LG, Sony and Vizio (see next post). It's an impressive list, and these Yahoo-enabled TVs are expected in the market later in '09.

Some of you may recall that the Yahoo Widget Engine debuted last summer as part of a broader alliance with Intel called the "Widget Channel". The two companies have come together to create an applications

framework running on new Intel media processing chips. An SDK allows 3rd party developers to use web-standard technologies to develop applications for TVs and other CE devices. That's a mouthful, but the news coming out of CES appears to show that Yahoo/Intel are making progress building out the ecosystem of both TV manufacturers and 3rd parties applications.

framework running on new Intel media processing chips. An SDK allows 3rd party developers to use web-standard technologies to develop applications for TVs and other CE devices. That's a mouthful, but the news coming out of CES appears to show that Yahoo/Intel are making progress building out the ecosystem of both TV manufacturers and 3rd parties applications.In addition to Yahoo content like news, weather, finance and Flickr, there's 3rd party content from USA Today, YouTube, eBay and Showtime. And there are premium movie and TV programs from Netflix, Amazon VOD and Blockbuster. The list of others involved goes on.

All of this is very positive for the budding broadband-to-the-TV space and clearly demonstrates how much emphasis the non-incumbent video service provider (cable/satellite/telco) world is placing on "over the top" services. As expected, these incumbents have a big disruptive bull's-eye on their foreheads. For the numerous 3rd parties that have never had access to the consumers' TV, broadband's openness provides their first-ever entry pass.

As exciting as all this is, the jumble of TV, content, technology and aggregation brands coming to market is prime to create mass confusion for consumers being targeted with these services. Here's the scenario: a prospective TV buyer walks into a Best Buy just looking for a new HDTV, but pretty quickly starts hearing about all these different services and brands. Within minutes the consumer's head is going to be swimming. Which service and content is free and which costs extra? How does it all connect? What if I already have Netflix, Flickr or YouTube passwords - do they automatically work? Do I need to change something that's already in my house, like my home network? And who do I call if something's not working right? One sure winner with these new broadband TVs coming out is the Geek Squad!

Still, this is exciting stuff. A whole new world of broadband on the TV content and applications is finally poised to see the light of day and with it will come all kinds of new opportunities.

What do you think? Post a comment now.

Categories: Devices

Topics: Intel, LG, Samsung, Sony, Vizio, Yahoo

-

Digital Media and Broadband Video Executives Play Musical Chairs

It's been hard not to notice the recently growing roster of digital media/broadband video executives who are either leaving their jobs or jumping to other companies.

Among the many recent changes:

- Bill Day (moved to CEO, ScanScout from Chief Media Officer, Marchex)

- Ned Desmond (leaving as President, Time, Inc Interactive)

- Tony Fadell (leaving as SVP, iPod Division, Apple)

- Karin Gilford (moved to SVP, Fancast/Comcast from VP/GM, Yahoo Entertainment)

- Bob Greene (left as EVP, Advanced Services, Starz)

- Kevin Johnson (moved to CEO, Juniper Networks from President, Platforms & Services Division, Microsoft)

- George Kliavkoff (leaving as Chief Digital Officer, NBCU)

- Michael Mathieu (moved to CEO, YuMe from President, Freedom Communications Internet Division)

- Scott Moore (leaving as SVP, Media Group, Yahoo)

- Herb Scannell (moved from CEO to Executive Chairman, Next New Networks)

- David Verklin (moved to CEO, Canoe Ventures from CEO, Aegis Media Americas)

Of course there are many more as well.

There's no blanket explanation for all of this movement. Senior executives - particularly those with strong track records in unchartered territory like digital media and broadband video - are always in demand by competitors. And established companies who can't execute or who are losing altitude in their core businesses become fertile ground for executive recruiters. Then there are always personal reasons for causing executive change (family matters, geographic restrictions, etc.).

The whole digital media and broadband space is extremely dynamic. Major incumbents continue to struggle with defining their strategies and how to organize themselves properly to execute. The financial meltdown has caused huge profit pressure, prompting operational streamlining.

Still, I'm hoping that all this executive movement doesn't slow broadband's growth. In particular, prematurely folding a digital operation into an incumbent product area can limit innovation as executives who are primarily focused on the core business and who lack detailed domain knowledge will inevitably shy away from riskier or more complex digital initiatives. I've seen this myself first hand. Broadband is still early in its evolution; hopefully executive change will foster, not hinder, its continued progress.

What do you think? Post a comment now.

Categories: People

Topics: Aegis, Apple, Canoe, Comcast, Juniper, Marchex, Microsoft, NBCU, Next New Networks, ScanScout, Starz, Time, Yahoo, YuMe

-

Modern Feed Jumps Into Video Navigation Space

With the proliferation of available broadband video comes a massive user navigation challenge. Modern Feed is launching today to address this. It is part search engine, part aggregator, with a specific focus on indexing professionally-produced programming, not user-generated video. It's also focused on actual programs, not promotional clips.

J.D. Heilprin, Modern Feed's founder/CEO told me yesterday that the company is targeting mainstream users providing the easiest way to find available, high-quality video. It employs a team of "Feeders" charged with curating the best videos to include on the site. The result is approximately 550 "networks" and 25,000 pieces of content now indexed, where "networks" is a loose term ranging from traditional broadcasters to indies new entrants like Boston Symphony or Architectural Digest.

Modern Feed is rights-holder friendly, not indexing any illegal or pirated video, and playing the video from the source's site (though sometimes with a thin Modern Feed navigation frame at the top of the screen). I played around with Modern Feed and found it to be easy-to-use and well-laid out. Modern Feed also offers an iPhone implementation that looks pretty cool, other devices are to follow.

The big challenge (and opportunity) for Modern Feed is that it's entering a very noisy space where user behavior is very undefined. There are myriad video search engines (Truveo, ClipBlast, blinkx, Veveo), portals (AOL, Yahoo, MSN), navigation sites (TV Guide, recently-launched PrimeTime Rewind) and of course the networks' own sites (and syndication efforts) offering users the ability to quickly find quality content. Then there's YouTube, the first stop for many users when it comes to video. And YouTube is increasingly moving up market by striking partnerships with premium providers.

Modern Feed's strong user experience, focus on mainstream users and device integrations are differentiators for the company. Whether these are ultimately success factors really depends on how user behavior unfolds in the nascent video navigation space. Modern Feed has raised several million dollars from angels and has 30 full-timers with aggressive growth planned.

What do you think? Post a comment and let everyone know!

See prior posts:

YouTube, C-SPAN Team Up for User-Generated, Multi-Platform Voter Project

Categories: Startups, Video Search

Topics: AOL, Blinkx, ClipBlast, Modern Feed, MSN, PrimeTime Rewind, Truveo, TV Guide, Yahoo, YouTube

-

CBS TV Stations Get Broadband Under Leess

(Note: This is the third in a series of posts with companies participating in the 2008 Media Summit, a premier industry event starting tomorrow in NYC. VideoNuze has partnered with Digital Hollywood, the Media Summit's producer, to provide select analysis and news coverage.)

A few months ago, in a post I wrote called "Broadcast TV Stations Most Threatened By Broadband/On-Demand," I asserted that broadband was bringing a perfect storm to the world of local TV stations.

These thoughts were in the background when I spoke last week with Jonathan Leess, President and GM of CBS TV Stations Digital Media Group. CBS owns 29 stations around the U.S. mostly in bigger markets. Leess has been in his role since April '04 and by all accounts has done an admirable job leading the CBS stations into the broadband era.

Most significant is the delicate balance he's tried to strike in centralizing certain online/broadband responsibilities while keeping others at the local level. This is no easy feat. Succeeding online requires scale and common technology platforms. Yet historically local stations enjoy wide autonomy in decision-making as long as they meet their numbers.

Leess explained that in broadband he's focused his corporate group on accessing and providing new non-local content, creating an internal syndication network for stations, developing technology and tools for all stations to use, focusing on national ad sales and training for local sales reps, and importantly generating new viewership by syndicating local stations' video to third parties.

A key part of executing the balancing act has been a relentless focus on work-flow and supporting technologies. Leess explained that the broadband activities at CBS TV Stations are a 24/7 operation involving hundreds of people around the country. Turning all of this into a well-oiled operation, particularly in the context of long-standing operational biases, has been an enormous operational challenge that Leess seems to have embraced.

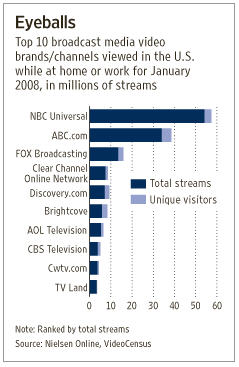

His efforts seem to be paying off. CBS TV Stations drove 89 million video views from their own sites in '07, an average of around 8 million video views/mo from their own sites, a 71% increase over '06. It's gaining an additional 10 million video views/mo through syndication partners. The primary current contributor to

syndication is Yahoo, with whom CBS TV Stations partnered in Oct '06. To put this in context, today's WSJ carried the adjacent graphic of select broadcasters' video views. Putting aside CBS TV Stations' 10 million monthly syndication streams, its '07 monthly average traffic would appear to rank it in the top 5, right around Discovery.com.

syndication is Yahoo, with whom CBS TV Stations partnered in Oct '06. To put this in context, today's WSJ carried the adjacent graphic of select broadcasters' video views. Putting aside CBS TV Stations' 10 million monthly syndication streams, its '07 monthly average traffic would appear to rank it in the top 5, right around Discovery.com. In addition, video clips are a big part of CBS TV Stations' success, as it is posting around 520/day and now offers a searchable library of 350K clips.

Meanwhile the Yahoo deal has been so successful that CBS TV Stations has clearly gotten syndication religion, with several significant announcements planned for the coming weeks. Leess explained how these syndication deals drive unprecedented consumption from out-of-market viewers while also creating valuable ad inventory. For pre-rolls, CBS is getting between $28-75 CPM, with banners fetching $8-18 CPM. Importantly, CBS TV Stations are aggressively bundling on-air/online/broadband packages, having sworn off broadband as a pure "value-add" some time ago.

While I stand by my assertion that local TV stations are most vulnerable to broadband's rise, it is also true that broadband offers stations fresh opportunities. CBS TV Stations' offensive approach shows that with the right leadership, strategy and operational plan, executing a successful transition to the broadband era is quite possible.

What do you think? Post a comment and let everyone know!

Categories: Broadcasters, Portals

Topics: CBS, CBS TV Stations Digital Media Group, Yahoo

-

Three Broadband Video Themes from February `08

At the end of each month I plan to step back and recap a few key themes from recent VideoNuze posts. Here are three from February '08:

Brand marketers embrace broadband video

One clear theme from the past 4 weeks has been brand marketers' accelerating moves into the broadband video space. This was on full display by select Super Bowl and Oscar advertisers. We are witnessing an unprecedented commitment by brands to create their own entertainment/information video content and also to induce consumers to create brand-related video through user-generated contests. As I detailed in yesterday's webinar, examples in the former category include Kraft/Tassimo, J&J, CIT Financial and GoDaddy.com, while examples in the latter category include TideToGo/MyTalkingStain.com, Heinz/Top This, Dove Cream Oil Body Wash and T-Mobile/Current TV.

Through VideoNuze I track all brands' broadband video initiatives, and it is clear that their involvement in this new medium is intensifying. Faced with splintering audiences, ad-skipping DVRs and changing media consumption habits - particularly by younger demos - brands have no choice but to get into broadband video. This results in an entirely different awareness/engagement paradigm than we're accustomed to from the world of interruptive TV advertising. Brands today increasingly recognize that a key way to create loyalty (and generate sales!) is by engaging the audience on its terms, using broadband and other technologies to accomplish this.

Monetization is the #1 challenge

Another key theme of the past month was the ongoing quest for broadband video monetization. As I also mentioned in yesterday's webinar, this is the number 1 business challenge for all broadband video industry participants - both content and technology providers. Two companies I wrote about this month, EveryZing and Veveo, are focused on improving content discovery, which leads to more consumption and revenue-generating opportunities. I also wrote about Jake Sasseville, a young entertainer who is pioneering multi-platform initiatives to forge a new revenue model.

Innovation is key in this space. Next week I'll be writing about Freewheel, an innovative startup that's just surfaced, which is providing a new approach to managing broadband video advertising. And yesterday, Magnify.net, one of my favorite early-stage companies, which focuses on enabling video content distribution, announced that it has raised an additional $1 of financing.

In addition, the big dogs of the technology and media landscape are in hot pursuit of improved video monetization as well. This month alone brought news of Yahoo's acquisition of Maven Networks, an ad-centric video platform, Google's beta rollout of AdSense for video, and the hostile bid by Microsoft for Yahoo, a deal that has vast longer-term implications for online and broadband video advertising. In short, monetization is a key focus for all large and small industry participants - cracking this nut is crucial to the long-term health of the industry.

Net neutrality re-surfaces

Lastly, this month also brought a lot of news on the regulatory front. Twice I wrote about "net neutrality," a regulatory concept its proponents believe will keep the Internet free from discrimination by broadband ISPs. While I don't agree with their viewpoint, what is clearly true is that net neutrality is being spurred by the massive adoption of broadband video, which places an unprecedented load on broadband ISPs' networks.

So that's it for this leap year month. Three themes you'll be hearing much more about going forward: brand marketers' broadband video initiatives, video monetization and net neutrality. See you on Monday for the start of a new month!

Categories: Advertising, Brand Marketing, Broadband ISPs, Regulation

Topics: EveryZing, FreeWheel, Google, Magnify.net, Maven Networks, Microsoft, Net Neutrality, Veveo, Yahoo

-

Yahoo Acquires Maven, First Hilmi Ozguc Interview

The rumor mill of the past 2 weeks proved correct, as Yahoo announced this morning that it has acquired

Maven Networks for $160M. By my count this is the biggest pure-play broadband video deal to date, and is an excellent validation of broadband video's growing importance in the media and technology landscape.

Maven Networks for $160M. By my count this is the biggest pure-play broadband video deal to date, and is an excellent validation of broadband video's growing importance in the media and technology landscape. Hilmi Ozguc, Maven's CEO and co-founder, provided me with an exclusive briefing about the deal, his first comments following the announcement this morning. (As a quick disclaimer, I did some business development and product strategy consulting work for Maven and Hilmi in the company's early days. I didn't have any current financial relationship with Maven.)

As Hilmi says below, and as I've said before (most recently in "My Rant About Super Bowl Ads"), broadband video is increasingly becoming the terrain of the big guys - the biggest brands, publishers, technology providers, networks, etc. As the broadband medium continues to mature, its ability to attract ad

dollars from incumbent media, particularly TV, is going to strengthen. This process will be accelerated by Yahoo as it seeks to drive Maven's capabilities into its customer and partner base.

dollars from incumbent media, particularly TV, is going to strengthen. This process will be accelerated by Yahoo as it seeks to drive Maven's capabilities into its customer and partner base. Following is a summary of my briefing with Hilmi:

Why did you sell the company?

Broadband video is increasingly going to be a game fought between titans because billions of dollars are at stake and the question is how do you get to the top 50 or 100 global media brands and advertisers? We've focused on building tools and technologies that these media companies need. The time to sell was excellent as was the return for our investors.

Can you describe the sale process?

We had several high profile bidders, although I can't identify them. It was gratifying to see multiple companies validate the product initiatives we put in motion 2 to 2 1/2 years ago. Yahoo has the resources to buy anyone. They took a deliberate approach and looked far and wide and concluded that Maven was the right company to buy. The whole process took several months from start to finish. The deal was for $160M, mostly in cash and it officially closed yesterday.

What group will Maven report into?

Maven will be integrated very quickly and deeply into Yahoo because video is so key to what Yahoo is doing in terms of advertising. This will not end up being a little business unit off to the side somewhere. Our engineering team will be part of Yahoo's engineering team. All Maven executives including me will be staying and have similar responsibilities to what we've been doing. A lot of work has already gone into the integration.

Who do you report into?

I'm not sure I'm at liberty to discuss that, as it would be a little too revealing of Yahoo's strategy, but I think it's in the right place to be within the company.

What does Yahoo bring to Maven?

Enormous reach, 500M visitors around the world per month. An incredible roster of advertisers and publishers who are already in their ecosystem. Interesting and complimentary engineering capabilities. A sheer ability to scale this massively. This deal is all about getting our stuff into the hands of the biggest media, publishing and advertising companies and having it exposed to a massive audience. We started as a media technology company, and evolved to mostly an advertising business. So combining with the leader in display advertising was very logical. Being plugged deeply into a company that sells close to $2B of advertising every 90 days is a huge opportunity for us. It's a massive advertising machine.

Does Yahoo-Maven portend more consolidation?

Absolutely. I just don't see how as a small startup you can have a significant enough piece of the pie when all the giants have now woken up and have video as front and center. Other big players are going to come in more aggressively.

What are the implications of Microsoft's takeover bid of Yahoo on Maven?

We need to stay focused at Maven, and as long as we do that I'm not concerned about any distractions. And I shouldn't really talk about the Microsoft deal either!

What are the 2-3 lessons you've learned about the broadband video market in 5 1/2 years since starting Maven?

When we started virtually nobody really believed in video being delivered on the Internet. We had a singular vision that said, look, once broadband is in enough homes, video is going to take off. So that was our first mission: delivery of bits, playback, HD-quality, etc. As the market evolved, the Akamais of the world solved a lot of the delivery problems, so we shifted our focus to publishing and content syndication, advertising and monetization. Basically, how does a media company generate revenue from broadband? So we evolved along with the market. We tried to stay focused on advertising, professional video and largest media companies.

This is your second successful startup - what lessons do you have for entrepreneurs?

1. Focus is the most important thing and ignoring the naysayers. It's natural to want to hedge, but you have to be bold enough to make decisions. Markets do take time to develop. We were early no question, but the market caught up and we were at right place at right time when it did. 2. Agility is also important and being analytical about what the market is saying. So the ability to shoot a direction and switch. And do it fearlessly. Trial and error is key. 3. Bet on the right people. The wrong people can steer you down the wrong path. So you essentially have to be the world's most capable talent scout, to build a team of people at all levels of the organization. A great team will figure it out.

Where's the broadband video market going from here?

Startups got this space going and created a lot of the core technology and innovation, but this is no longer a game of startups. Big media companies want to deal with big technology companies and networks. Big advertisers want to work with biggest publishers. To achieve this scale independently would be very difficult.

What are the key challenges for broadband video market?

I don't want to say the "R" word that everyone's talking about, but if it comes, I hope it's a mild one. As we know, advertisers cut back quickly in difficult economies. Though I don't think this will happen in broadband because it is so promising and it's still pretty small. Another challenge is getting ad agencies and advertisers to think of broadband as being interactive and capable of more than TV ads. You've talked about that a lot at VideoNuze. And finally the need to scale the technology and infrastructure so it's rock-solid and dependable. That's what Yahoo and Maven will focus tightly on. And I think we have all the tools between us to grab the undisputed leadership position in this, if we move fast enough.

So are you going to do startup #3?

My focus for now is on integration and marshalling all these terrific resources. Yahoo has a great team and has been chomping at the bit to have a competitive video offering to sit alongside their display offerings. They have a killer ad sales force, along with great relationships with the biggest publishers. They have mastered how to play on the media company side, and in being a partner to other media companies. We can't wait to get going.

Congrats again.

Categories: Deals & Financings, Portals, Technology