-

Finding the Needle in the Haystack: A Programmatic TV Primer

Wednesday, August 26, 2015, 3:27 PM ETPosted by:Television is facing a transformational moment in history, as viewers have more choices than ever before. Though still a fundamental pillar of marketing and a nearly $80 billion business, television has been dramatically changed by the rise of viewing devices and streaming options, and advertising buyers and sellers alike are struggling to keep up.

Based on our own data, as well as third-party data, we present three key findings:Categories: Advertising, Programmatic

-

1/3 Of Weather Company's Online Ad Revenue Now Comes From Programmatic

Last week at Adap.tv's Worldwide Publisher Conference, Curt Hecht, The Weather Company's Global Chief Revenue Officer shared an eye-opening data point: 1/3 of the company's online ad revenue now comes from programmatic, though it only started selling ads this way around 18 months ago. And contrary to lingering concerns that programmatic reduces the value of inventory, Curt also said

ads sold programmatically actually generate some of the company's best pricing, and that overall CPMs are up since programmatic was introduced.

Programmatic is one of the biggest trends in advertising today, allowing ads to be bought and sold via marketplaces using data and specific audience targeting criteria. Real-time bidding is also a feature of programmatic, though not always. Programmatic also reduces some of the back-end friction associated with the exchange of RFPs and IOs.Categories: Advertising

-

AOL Touts Data, Automation in First Programmatic Upfront

AOL held its first "Programmatic Upfront" tonight, bringing together a packed house of agencies and brands to hear multiple executives and guest speakers pound home a double message that data and automation are poised to revolutionize advertising, just as they have done on Wall Street. From a purely news standpoint, AOL announced 3 specific things:

1. Clients will be able to buy reserved premium AOL inventory programmatically through the company's AdLearn Open Platform (AOP) beginning January 1, 2014.

2. Major agencies including Accuen, Amnet, Havas Media, Horizon Media and Magna Global have all made programmatic commitments for 2014 (sizes not disclosed), with DigitasLBi, Razorfish and VivaKi considering.

3. New features in AOP including real-time bidding through private marketplaces, cross-screen inventory buying with frequency and optimization, and availability of all ad units for programmatic buying.Categories: Advertising, Technology

-

Digging Into Programmatic Video [AD SUMMIT VIDEO]

At the recent Online Video Ad Summit, MediaCrossing's CEO and founder Bill Lederer led an in-depth discussion of programmatic video with executives from Yahoo, Horizon Media and Adap.TV. For those not familiar with programmatic, it's essentially the use of technology to automate the buying and selling of media. Programmatic has become a significant factor in the online video advertising space as an augment to content providers' direct sales efforts. If you need a soup-to-nuts understanding of programmatic and its potential, this session is a great primer.

The video is below and runs 35 minutes, 22 seconds.Categories: Advertising

Topics: Adap.TV, Horizon Media, VideoNuze 2013 Online Video Advertising Summit, Yahoo

-

Brand Lift Gains Momentum As Online Video Ad Campaign Metric

Traditional ways of measuring the effectiveness of online video campaigns such as click-through and completion rates are being enhanced with brand lift metrics such as awareness and intent that are common in other forms of advertising. The latest indicator is that Adap.tv, an online video advertising marketplace, has integrated Vizu's Ad Catalyst solution, which measures brand lift, to offer this capability to its clients. Yesterday the companies released a case study which speaks to the new insights online video advertisers can gain from studying brand lift as well.

Categories: Advertising

-

Recapping All of the Product and Partnership News from ELEVATE

At the ELEVATE conference on Tuesday a number of our partners made product and partnership announcements which I mentioned were coming in a teaser last Friday. Each helps move the online video advertising market forward in different ways. A brief recap of each follows:

Categories: Advertising, Events, Technology

Topics: Adap.TV, AdoTube, Conviva, ELEVATE, EyeView, Grab Networks, Innovid, Ooyala, Panache, RAMP, Tremor Video, Undertone, YuMe

-

Online Video Advertising Industry Keeps Innovating

Speaking of online video advertising, once again there was plenty of news this week. Among the highlights, Adap.tv launched its video ad marketplace in the U.K., PointRoll added new partners to its "Included" Program and launched new mobile and in-stream Included program, Casale Media announced a new "Videobox" format transforming display ads into video ads, AdoTube released new research that in-stream ads perform 7x better than rich media ads, and blip.tv revealed that it has built a creative services group to produce ads for its clients.

The online video ad market continues to experience strong growth. I've been talking to a lot of companies in the space recently, related to the ELEVATE conference on Tues, June 7th in NYC. There is a ton of enthusiasm, but also a continued strong need for market education and best practices, which is what we'll focus on at ELEVATE (more info coming next week).Categories: Advertising

Topics: Adap.TV, AdoTube, blip.TV, Casale Media, PointRoll

-

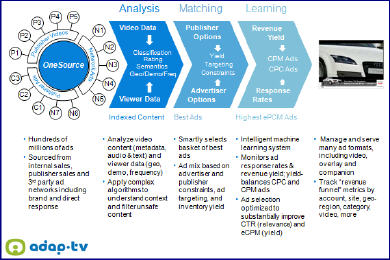

Digging into Adap.tv's New Real Time Bidding Interface for Online Video Ads

Yesterday video ad management provider Adap.tv introduced a "real-time bidding" (RTB) interface for users of its video ad marketplace, which itself was launched this past February. I'm a big believer that innovations in online video advertising, plus massive online video viewership growth and adoption of convergence devices are together causing big future shifts in brands' ad budgets. RTB is another innovation that over time will help shift budgets. To learn more I spoke to Teg Grenager, Adap.tv's founder and VP of Product last night and have also spent some time reading up on how RTB is working in the display ad sector.

advertising, plus massive online video viewership growth and adoption of convergence devices are together causing big future shifts in brands' ad budgets. RTB is another innovation that over time will help shift budgets. To learn more I spoke to Teg Grenager, Adap.tv's founder and VP of Product last night and have also spent some time reading up on how RTB is working in the display ad sector.

As background, ad exchanges give publishers the ability to expose their content and inventory to interested buyers who can use analytical tools in conjunction to allocate their budgets to better reach their targeted audiences. Exchanges are able to offer more pricing transparency to both publishers and advertisers, with the goal of improving ad performance and ROI. With exchanges, buys are placed in thousands of impressions sizes and in advance, based on anticipated targeting parameters.

As Teg explained, Adap.tv's new RTB feature improves its recently-launched marketplace by allowing ad buying at the impression level with dynamic pricing. The goal is to drive ad effectiveness even higher for advertisers, while still allowing publishers to retain control over their inventory. Teg likened RTB in the marketplace to a next-generation spot market. To use Adap.tv's RTB, the buyer (typically an agency) needs to integrate Adap.tv's API into their own trading desk technology, which as this article suggests are well underway at large firms like Publicis, Havas, The Media Kitchen and others. Once the Adap.tv API is integrated the buyer makes requests to connect with desired publishers for RTB, who in turn can accept or deny access. If accepted the buyer is then able to start bidding on available inventory, alongside other accepted buyers, creating the dynamic pricing environment.

Obviously all of the above is only worthwhile if a large number of publishers are offering inventory to the exchange in the first place and are subsequently willing to allow RTB. Teg said that 700 different properties are currently offering in-stream ad inventory to Adap.tv's marketplace, with hundreds of millions of available in-stream video impressions per month. Though this is only a fraction of the online video market, it seems like a solid start with lots of room to grow ahead. Teg noted that the buy side is in flux, with increasing pressure to be accountable to clients for targeting and ROI (things search marketing has excelled at). RTB caters to these needs.

Longer term the idea of both exchanges and RTB seem like very useful tools to further unlock online video ad spending and shift dollars over from TV. Still, with estimated total online video ad revenue around $1 billion/year, it is clearly early days for many agencies and brands. Many are still just dipping their toes into online video advertising to learn how it performs and will not yet be ready for such hands-on granular bidding. But as these brands and their agencies get more sophisticated, and for others who are already deeply immersed in the market, the idea of a robust ad exchange with RTB will likely be intriguing.

What do you think? Post a comment now (no sign-in required).Categories: Advertising, Technology

Topics: Adap.TV

-

Adap.tv Launches Player Partner Program

The ad management company Adap.tv has taken the wraps off its new "Player Partner Program" this morning. Initial partners include Brightcove, thePlatform, Mogulus, VMIX, Twistage and Kaltura. All are now integrated with Adap.tv's "OneSource" ad management system.

Yesterday, Dakota Sullivan, Adap.tv's VP of Marketing told me that though the company has been working with Brightcove and thePlatform informally to date, the new program will provide more structure to partners. Included are a central location on the Adap.tv web site for partners for promotional purposes along with other co-marketing and technology updates. No cash is changing hands with partners though, as Adap.tv tries to maintain neutrality.

These types of partnership programs are springing up all around the broadband video ecosystem, as companies continue to carve out their specific niches, and seek to benefit from partners' marketing efforts in a resource-constrained environment. I expect we'll continue to see them get rolled out.

Categories: Advertising, Partnerships

Topics: Adap.TV, Brightcove, Kaltura, Mogulus, thePlatform, Twistage, VMIX

-

Adap.tv Releases OneSource 2.0

Adap.tv is announcing its upgraded OneSource 2.0 ad management platform this morning. The Adap team explained to me on Friday what's new in this release.

OneSource 2.0 builds on the product's initial vision of improving ad optimization while reducing complexity. Adap noted that the main pain point that its customers are expressing especially given the weak economy, is

the need to spend more time focused on selling ads and less time on operationalizing the ad relationships. The need to improve their ROIs through both higher ad rates and higher fill rates is driving them to source ads from multiple sources and to want to refine those sources to find the optimal mix. All of this increases implementation and reporting complexity.

the need to spend more time focused on selling ads and less time on operationalizing the ad relationships. The need to improve their ROIs through both higher ad rates and higher fill rates is driving them to source ads from multiple sources and to want to refine those sources to find the optimal mix. All of this increases implementation and reporting complexity.OneSource 2.0's new features are meant to address these issues. The video provider can now accept ad tags from virtually any source, and do so more efficiently. In addition, through a management dashboard, the provider's ad ops manager can specify and adjust the fill order for the ad sources on a per ad basis. That means that for a specific piece of content there can be one queue for pre-rolls and another for overlays or for two pieces of content there can be two different pre-roll queues, and so on.

By sequencing multiple sources, OneSource creates a failover system so that an ad is likely always served, thereby increasing fill rates. Adap pointed to one provider who has been able to increase their fill rate from 20% to 70%.

In addition, OneSource 2.0 allows reporting by revenue source, video positions and geographic regions, which, at least in the demo screens that I saw, looked quite powerful. The ad ops manager can track performance on a daily basis and re-order sources accordingly. Lastly, there are enhanced tools for managing ads when content is syndicated, along with performance reporting.

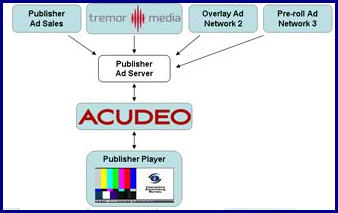

I continue to see OneSource in a competitive set with Tremor Media's Acudeo ad management system, and also to some extent with Panache and FreeWheel. All of these systems are, in one way or another trying to improve video content providers' monetization and/or syndication efforts. Adap notes that by not also operating an ad network, it can be more agnostic about ad sources and solely focused on its technology. It now has 300+ publishers on board, helping monetize "high 100s of millions" of impressions per month, which it said is a 10x increase from OneSource's launch in May '08.

What do you think? Post a comment now.

Categories: Advertising, Technology

Topics: Adap.TV, FreeWheel, Panache, Tremor Media

-

January '09 VideoNuze Recap - 3 Key Themes

Following are 3 key themes from VideoNuze in January:

Broadband video marches to the TV - At CES in early January there were major announcements around connecting broadband to TVs, either directly or through intermediary devices (a recap of all the news is here). All of the major TV manufacturers have put stakes in the ground in this market and we'll be seeing their products released during the year. Technology players like Intel, Broadcom, Adobe, Macrovision, Move Networks, Yahoo and others are also now active in this space. And content aggregators like Netflix and Amazon are also scaling up their efforts.

Some of you have heard me say that as amazing as the growth in broadband video consumption has been over the last 5 years, what's even more amazing is that virtually all of it has happened outside of the traditional TV viewing environment. Consider if someone had forecasted 5 years ago that there would be this huge surge of video consumption, but by the way, practically none of it will happen on TVs. People would have said the forecaster was crazy. Now think about what will happen once widespread TV-based consumption is realized. The entire video landscape will be affected. Broadband-to-the-TV is a game-changer.

Broadband video advertising continues to evolve - The single biggest determinant of broadband video's financial success is solidifying the ad-supported model. For all the moves that Netflix, Amazon, iTunes and others have made recently in the paid space, the disproportionate amount of viewership will continue to be free and ad-supported.

This month brought encouraging research from ABC and Nielsen that online viewers are willing to accept more ads and that recall rates are high. We also saw the kickoff of "the Pool" a new ad consortium spearheaded by VivaKi and including major brands and publishers, which will conduct research around formats and standards. Three more signs of advertising's evolution this month were Panache's deal with MTV (signaling a big video provider's continued maturation of its monetization efforts), a partnership between Adap.tv and EyeWonder (further demonstrating how ecosystem partners are joining up to improve efficiencies for clients and publishers) and Cisco's investment in Digitalsmiths (a long term initiative to deliver context-based advanced advertising across multiple viewing platforms). Lastly, Canoe, the cable industry's recently formed ad consortium continued its progress toward launch.

(Note all of this and more will be grist for VideoNuze's March 17th all-star panel, "Broadband Video '09: Building the Road to Profitability" Learn more and register here)

Broadband Inauguration - Lastly, January witnessed the momentous inauguration of President Barack Obama, causing millions of broadband users to (try to) watch online, often at work. What could have been a shining moment for broadband delivery instead turned into a highly inconsistent and often frustrating experience for many.

In perspective this was not all that surprising. The Internet's capacity has not been built to handle extraordinary peak load. However on normal days, it still does a pretty good job of delivering video smoothly and consistently. As I wrote in my post mortem, hopefully the result of the inauguration snafus will be continued investment in the infrastructure and technologies needed to satisfy growing demand. That's been the hallmark of the Internet, underscored by the fact that 70 million U.S. homes now connect to the 'net via broadband vs. single digit millions just 10 years ago. I remain confident that over time supply will meet demand.

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Devices, Politics, Technology

Topics: ABC, Adap.TV, Adobe, Amazon, Broadcom, EyeWon, Intel, Macrovision, Move Networks, MTV, Netflix, Nielsen, Panache, VivaKi, Yahoo

-

Adap.tv and EyeWonder Partner

Adap.tv and EyeWonder, two key players in the broadband video and rich media ad space are announcing a partnership today, meant to further streamline ad sales and monetization for video content providers. The partnership follows on the deal I wrote about last week between Panache and MTV also highlighting these points.

Particularly given the tough economy, video content providers are focused more than ever on maximizing the value of their inventory with the least possible amount of effort and cost. On the flip side, ad technology companies are trying to figure out how to cover more customer ground more cost-effectively. Inevitably these forces will lead to more partnerships, and likely some industry consolidation. Panache, Adap.tv, Tremor Media and others are among the companies driving the broadband ad market forward. I'll have more news on this front in the coming days.

What do you think? Post a comment now.

Categories: Advertising, Partnerships

Topics: Adap.TV, EyeWonder, MTV, Panache

-

Panache Lands MTV Networks; Ad Insertion Space Evolves

The video ad insertion and management landscape continues to evolve as Panache is announcing this morning that its platform will be deployed across MTV Networks' sites. I caught up with Steve Robinson, Panache's president yesterday to learn more.

As Steve explains it, as major media companies have grown their broadband video usage, operationalizing the business has become increasingly complex. This is no surprise and I've heard it from others as well: multiple organizations including technology development, ad operations, ad sales and programming have had to learn to work together to deploy and monetize broadband video offerings.

This is important stuff, not just because of the potential for missed revenue, but because users can quickly notice when the organization's gears are grinding. How often have you seen the same untargeted ad play repeatedly? Or not seen any ads at all? Or have had a 30 second pre-roll ad in front of short 45 second news clips you're sequentially watching? As the broadband stakes have gotten higher, large media companies have increasingly focused on how to streamline their processes in order to scale and monetize more effectively.

That's where Panache comes in. In the MTV example, Panache first integrates with MTV's standardized

video player. Once integrated, ad operations is able to use the Panache tools to create ad programs and logic, including campaigns, flights, formats, etc. This becomes the playbook for ad sales as it interfaces with customers, and can be readily modified to suit custom requests. A key benefit is that MTV's development organization doesn't need to get involved each time some part of the ad offering is changed. Improving the back-end processes helps ramp up sales, which for major media companies like MTV Networks is handled mostly by internal teams.

video player. Once integrated, ad operations is able to use the Panache tools to create ad programs and logic, including campaigns, flights, formats, etc. This becomes the playbook for ad sales as it interfaces with customers, and can be readily modified to suit custom requests. A key benefit is that MTV's development organization doesn't need to get involved each time some part of the ad offering is changed. Improving the back-end processes helps ramp up sales, which for major media companies like MTV Networks is handled mostly by internal teams.But the need for streamlining broadband video ad operations goes beyond the major media companies though, and there are other offerings with similar capabilities on the market too. For example in the past year Tremor Media has launched Acudeo, and Adap.tv has launched OneSource. Both are technology platforms for video providers that can pull ads from multiple sources (direct sales, ad networks, etc.) with an eye to maximizing fill rates and CPMs.

One key difference is business model: Panache and Adap.tv don't have ad sales organizations, whereas Tremor, as an ad network, does. For Panache or Adap.tv that means relying on some mix of licensing/platform usage fees and/or receiving a revenue share from customers, whereas for Tremor it means obtaining a chunk of the inventory to sell itself. There are no doubt feature-for-feature differences as well, but not having worked in ad ops myself, some of this is beyond my scope and would require specific due diligence.

For sure as the broadband video ad business becomes more integral to large and mid-sized content providers we'll continue to see more innovation and business process improvements in this area. Just as TV ad insertion has been refined to a science over the years, so too will broadband video.

What do you think? Post a comment now.

Categories: Advertising, Cable Networks, Technology

Topics: Adap.TV, MTV, Panache, Tremor Media

-

7 Broadband/Mobile CEOs Explain How to Raise Money in the Down Economy

Amidst all the gloomy economic news, there are actually still some earlier stage companies that are raising new money. To learn more about their how they're doing it, I emailed the CEOs of seven broadband/mobile video companies which have collectively raised nearly $80M in the last 3 months. I asked 3 basic questions:

- What are the key success factors for raising money given the difficult economic climate?

- What are the biggest challenges?

- Is there any specific advice you'd offer to those trying to raise money these days?

While there were some common themes in their answers (many of which echoed the usual fundraising maxims), there was plenty of variety and a few outliers. Space constraints don't allow for me to share all of their specific answers, so I've tried my best to summarize the common themes and highlight key nuggets of wisdom below. If you have any questions, drop me an email.

The seven CEOs who graciously took time out of their busy days to contribute their thoughts (along with the recent rounds they've raised) are:

- Amir Ashkenazi, Adap.tv ($13M Series B, 9/23/08)

- Frank Barbieri, Transpera ($8.25M Series B, 11/13/08)

- Alex Blum, KickApps ($14M Series C, 11/25/08)

- Dean Denhart, BlackArrow ($20M Series B, 10/6/08)

- Keith Kocho, ExtendMedia ($10M Series C, 12/2/08)

- Steve Rosenbaum, Magnify.net ($750K Series A1, 11/21/08)

- Ben Weinberger, Digitalsmiths ($12M Series B, 11/13/08)

1. What are the key success factors for raising money given the difficult economic climate?

The answers that dominated were all around revenue, profitability and cash flow. All the CEOs mentioned, in one way or another, that being able to demonstrate real revenue growth and momentum is essential. Some noted that in the past traffic or usage may have been sufficient, but now the "premium is on paying customers," and how get to profitability and cash flow breakeven using reasonable assumptions. Several mentioned that investors are as risk averse as ever, which of course comes as no surprise. They want to see concrete, well thought-out plans.

Investors have also become more sophisticated about the whole broadband video sector and expect entrepreneurs to be able to explain where they fit into the ecosystem and what their points of differentiation are. Importantly, they are looking for proven models (unfortunately an oxymoron for a pure startup), or at least some minimal history of success that goes "beyond PPT slideware."

A couple of CEOs noted that investors have shifted from asking "how fast can you scale?" to "how will you get through this crisis?" They no longer expect a quick exit. They are looking for a real plan which includes contingency tactics if for example, competitors do something desperate like cut their prices in half.

2. What are the biggest challenges?

The prevailing theme here was uncertainty, starting with investors' own business models. They're focused on how much of their funds to hold in reserve to shore up existing portfolio companies. They're trying to gauge their own limited partners' appetite for venture investing given the credit squeeze. Then of course they're trying to understand the impact of broadband market drivers like ad spending and user adoption. One CEO lamented the difficulty of persuading people to put new money to work on the very day the stock market's dropping by 500 points. Still another noted that all of this can lead to a "self-fulfilling prophecy" where everything freezes and missed opportunities abound.

With respect to the broadband market specifically, one CEO said the key challenge is showing how "you monetize video for your clients." Absent that, "it will not only be hard to raise money, but harder still for your client to spend money with you."

Another said that the level of scrutiny has gotten so high that it's not even worth talking to any investor which doesn't have its own track record of investing in the broadband video sector. It's just too hard to educated people in this environment. Another CEO added that your model needs to be "brilliant and bulletproof, with an A-level management team already in place." Boy, there's a steep hurdle to clear.

3. Is there any specific advice you'd offer to those trying to raise money these days?

Many of the answers to this question reflected fundraising basics: understand your business thoroughly, put a balanced team in place, seek out investors you know first, have a solid plan, and bootstrap as much as possible first.

With respect to the raising money in the current lousy market, there was a broad range of sentiment. One CEO said "Don't...the terms are going to suck..." while another said to be "incredibly realistic about how much to raise, your burn rate and valuation." On the more optimistic end of the spectrum, one said "The market's poor performance means that investors are looking for new opportunities. Ignore all the negative energy and naysayers." And another remarked that "Even during the tech disaster of 2001-2003, angel investors, VCs and tech behemoths were still putting money to work in promising sectors." Another heavily emphasized the value of loyal and supportive existing investors (if there are any) in helping making the case to new investors.

More tactically, one CEO said that the more you "minimize uncertainty that surrounds your business specifically, the better off you'll be." Another said to make the transaction as simple as possible, and to "get the big items off the table first." Still another said to demonstrate "you're indispensable to customers, helping them weather the downturn." Finally one cautioned to be ready to take a lot more meetings than usual and expect a lot deeper follow up..."it may require you to go well beyond investors in your backyard to find the right fit."

Hopefully some of this is helpful to those of you trying to raise money right now, or thinking about doing so in the near future. Broadband video remains one of the hottest sectors out there; even still, if you're not getting a lot of love right now, you're not alone...

What do you think? Post a comment now.

Categories: Deals & Financings

Topics: Adap.TV, BlackArrow, Digitalsmiths, ExtendMedia, KickApps, Magnify.net, Transpera

-

Giving Thanks and Keeping Perspective

If ever there was a year for giving thanks - and for trying to keep perspective - this is surely it. For the last several months or more, all of us have been buffeted by the economic meltdown to one extent or another. It isn't fun for anyone, and regrettably, if you believe the experts, things aren't going to turn around anytime soon.

Still, as I mentioned in last week's "Deflation's Risks to the Broadband Video's Ecosystem," for those of us who make our living focused in one way or another on broadband video, there are reasons to remain optimistic. Consumers continue to shift their behavior toward on demand, broadband-delivered alternatives. Clever entrepreneurs are introducing ever-more innovative technology-based products and services. Large pools of existing revenues are shifting around, in search of better, higher ROI ways to be allocated. And investors recognize all of this, motivating them to continue funding companies throughout the broadband ecosystem.

These are all things to be thankful for, and hopefully allow us to keep a little perspective. For those of us old enough to remember past downturns, it is also important to keep in mind that there have been difficult times in the past, and fortunately, eventually, things do correct. That doesn't relieve the current pain, but at least gives us a measure of hope for better days ahead.

Speaking of giving thanks, I want to give a shout out to the 30 companies that sponsored VideoNuze or its events in 2008. VideoNuze is just over a year old now, and I've been truly gratified by the support its received from both sponsors and the community of readers and participants.

VideoNuze is not immune from the economic meltdown, so I'd like to also mention that we're offering some great sponsorship specials going into '09. If you're interested in reaching a highly-targeted, broadband-centric group of senior decision-makers, VideoNuze is an outstanding value. I welcome your calls or emails.

Thanks to our '08 sponsors below. Happy Thanksgiving and see you on Monday.

ActiveVideo Networks, Adap.tv, Adobe, Akamai, Atlas Venture, Anystream (Grab Networks), Brightcove, ChoiceStream, Critical Media (Syndicaster), Digitalsmiths, ExtendMedia, EyeWonder, FAST Search & Transfer, Flybridge Capital Partners, Goodwin Procter, Gotuit, Jambo Media, KickApps, Kiptronic, Macrovision, Move Networks, Multicast Media, PermissionTV, Signiant, Silicon Valley Bank, thePlatform, Tremor Media, VMIX, WorldNow and Yahoo

Categories: Miscellaneous

Topics: ActiveVideo Networks, Adap.TV, Adobe, Akamai, Anystream (Grab Networks), Atlas Venture, Brightcove, ChoiceStream, D, Syndicaster

-

Looking for Economic Signals at Digital Hollywood This Week

This week I'll be at Digital Hollywood Fall in LA, the first big industry gathering I've attended since the economic crisis hit. I've been trying to keep my finger on the pulse of what the crisis means for the broadband video industry. Get-togethers like this, with lots of time for informal, off-the-record chats are great for getting a sense of what colleagues think is on the industry's horizon.

Here are 3 interrelated areas I'm most interested in learning about:

Financing

With the credit markets frozen and stock markets tumbling, the availability of financing is topic number one. This is especially relevant for the industry's many earlier stage companies, reliant on private financing from venture capitalists, angels and other private equity investors.

By my count we've seen at least 9 good-sized financings announced since around Labor Day, when the financial markets started coming unglued: Howcast ($2M), blip.tv (undisclosed), Booyah ($4.5M), BlackArrow ($20M), HealthiNation ($7.5M), Adap.tv ($13M), BitTorrent ($17M), Conviva ($20M), and Move Networks (Microsoft, undisclosed). The rumor mill tells me there are at least 2-3 additional financings underway currently. Really smart money (e.g. Warren Buffet) knows that downturns are exactly the time to invest. However, the reality can often be quite different. What's the experience of industry participants trying to raise money these days?

Staffing

In any downturn, the first expense to get cut is people. Headcount reductions are often done quietly, with word later leaking out to the public. Last week brought news of trimming at three indie video providers, Break (11 people), ManiaTV (20) and Heavy (12). More are sure to follow at other companies. As I've written before, the indies are among the most vulnerable in this environment, likely leading many to find bigger partners for both distribution and monetization. But whether layoffs will hit other industry sectors such as platforms, ad networks, CDNs, mobile video and big media is still to be determined by...

Customer spending

Central to the question of how deeply the financial crisis spirals is the interdependence of customer spending at all levels of the economy. Thinking you're safe because you're a B2B company is meaningless if your customers are B2C companies cutting back due to reductions in consumer spending. When consumers tighten their belts that leads to advertisers reducing their spending which leads to media companies scaling back which leads to technology vendors feeling the impact. The reality is we're all in this together.

In fact, the more I read about the economy's fragile condition, the clearer it is that the primary way out is rebuilding confidence and renewed spending at all levels. If a spending paralysis occurs, it could be long road ahead. While there's no reason to believe that consumers are going to slow their consumption of broadband media, the ability to monetize it and innovate around it would be dampened if spending hits a wall.

These are among the topics I'll be looking to discuss at Digital Hollywood this week. If you're attending, drop me a note so we can try to meet up and/or come by the session I'll be moderating on Wednesday at 12:30pm.

What do you think? Post a comment now!

Categories: Deals & Financings, Indie Video

Topics: Adap.TV, and Move Networks, BitTorrent, BlackArrow, blip.TV, Booyah, Conviva, HealthiNation, HowCast, Microsoft

-

More on Heavy's Spinout of Husky Media

Late last week, news broke that Heavy Media, which operates Heavy.com, one of the leading destination sites for men 18-34 was spinning off its Husky Media unit as a standalone ad management and network company. I found the deal intriguing and followed up with David Carson, co-CEO to learn more and see how it plays into larger trends I've been tracking.

Broadband ad networks already compete vigorously with each other to build out their publisher networks and cultivate brands and agencies to obtain a share of their spending. The networks are continuously enhancing their technology and trying to optimize their various ad units to demonstrate the superiority of their approach. And as I recently wrote in "Tremor, Adap.tv Introduce New Ad Platforms," some firms are now enabling ad aggregation in an effort to improve their publishers' effective CPMs.

Broadband ad networks already compete vigorously with each other to build out their publisher networks and cultivate brands and agencies to obtain a share of their spending. The networks are continuously enhancing their technology and trying to optimize their various ad units to demonstrate the superiority of their approach. And as I recently wrote in "Tremor, Adap.tv Introduce New Ad Platforms," some firms are now enabling ad aggregation in an effort to improve their publishers' effective CPMs.With this context in mind, a key question is "does the world really need another video ad management and network?" David patiently explained that they've received a lot of outside interest in their units, namely the "barn doors" that are shown before the video plays, the subsequent skin that remains on the sides while the video plays, and the playlist-like queuing of video with ads judiciously interspersed (which Heavy calls its Video Guide). Heavy has avoided pre-rolls entirely. This interest spurred them to separate Husky.

David believes that each of these units offers superior value. As compared with pre-rolls, where David said "bounce" or early termination rates can be 50% (resulting in the actual content never being seen), with Husky's approach, there's a 90% completion rate, and particularly when users come through the Husky "Video Guide", the number of videos consumed can be 3-6 times greater. David also said they're seeing click-throughs averaging 1.6%, above industry norms.

So of course the next question is, if these units perform so well, what's to stop others from introducing them as well? In fact, David would encourage this, as he believes it would help educate the market and maybe help establish these as preferred units. As long as Husky continues to get its fair share that would be a win. Husky has patents on the skin, and how it works with various video players.

David said investor meetings are underway and he anticipates the company completing its own financing. Husky will have its own separate management team. Heavy also announced last week a syndication deal for its Burly Sports show to CBSSports.com, and, no surprise, Husky will be the ad platform. To the extent that Heavy can do other syndication deals where Husky gets included, that will help it gain market share.

Clearly there continues to be a huge amount of experimentation in the broadband video ad market. The Husky deal further shows that sometimes developing technology for your a site's own use can, if successful, end up creating larger financial value.

Categories: Advertising, Deals & Financings, Indie Video

Topics: Adap.TV, CBSSports.com, Heavy.com, Husky, Tremor

-

May '08 VideoNuze Recap - 3 Key Topics

Looking back over two dozen posts in May and countless industry news items, I have synthesized 3 key topics below. I'll have more on all of these in the coming months.

1. Broadband-delivered movies inch forward - breakthroughs still far out

In May there was incremental progress in the holy grail-like pursuit of broadband-delivered movies. Apple established day-and-date deals with the major studios for iTunes. Netlix and Roku announced a new lightweight box for delivering Netlix's "Watch Now" catalog of 10,000 titles to TVs. Bell Canada launched its Bell Video Store, complete with day-and-date Paramount releases, with others to come soon. And Starz announced a deal with Verizon to market "Starz Play" a newly branded version of its Vongo broadband subscription and video-on-demand service.

Taken together, these deals suggest that studios are warming to the broadband opportunity. This is certainly influenced by slowing DVD sales. Yet as I explained in "iTunes Film Deals Not a Game Changer" and "Online Move Delivery Advances, Big Hurdles Still Loom" broadband movies are still bedeviled by a lack of mass PC-TV connectivity, no real portability, well-defined consumer behavior around DVDs and the studios' well-entrenched, window-driven business model. Despite May's progress, major breakthroughs in the broadband movie business are still way out on the horizon.

2. Broadcast TV networks are embracing broadband delivery - but leading to what?

Unlike the film studios, the broadcast TV networks are plowing headlong into broadband delivery, yet it's not at all clear where this leads. In "Does Broadband Video Help or Hurt Broadcast TV Networks" and "Fox's 'Remote-Free TV': Broadband's First Adverse Impact on Networks?" I laid out an initial analysis about broadband's pluses and minuses for networks. I'll have more on this in the coming weeks, including more in-depth financial analysis.

On the plus side, in "2009 Super Bowl Ads to Hit $3 Million, Broadband's Role Must Grow," "Sunday Morning Talk Shows Need Broadband Refresh" and "Today Show Interview with McClellan Showcases Broadband's Power," I illustrated some opportunities broadband is creating. On the other hand, "Bebo Pursues Distinctive Original Programming Model" and "More Questions than Answers at Digital Hollywood" explained how exciting new programming approaches are taking hold, challenging traditional TV production models. Broadcasters are in the eye of the broadband storm.

3. Advertising's evolution fueled by innovation and resources

Last, but hardly least, I continued on one of my favorite topics: the impact broadband video is having on the advertising industry. Over the last 10 years the Internet, with its targetability, interactivity and measurability has caused major shifts in marketers' thinking. With broadband further extending these capabilities to video, the traditional TV ad business is now ripe for budget-shifting. We'll be exploring a lot of this at a panel I'm moderating at Advertising 2.0 this Thursday.

In "Tremor, Adap.tv Introduce New Ad Platforms" and "All Eyes on Cable Industry's 'Project Canoe'" (from Mugs Buckley), key players' innovations were described along with how the cable industry plans to compete. Content providers are being presented with more and more options for monetizing their video, a trend which will only accelerate. Yet as I wrote in "Key Themes from My 2 Panel Discussions Last Week," many issues remain, and with so many content start-ups reliant on ads, there may be some disappointment looming when people realize the ad market is not as mature as they had hoped.

That's it for May. Lots more coming in June. Please stay tuned.

Categories: Advertising, Aggregators, Broadcasters, Cable TV Operators, Devices, Downloads, FIlms, Studios, Video Sharing

Topics: Adap.TV, Apple, Bell Canada, Canoe, iTunes, Netflix, Paramount, Roku, Starz, Tremor, Verizon, Vongo

-

Tremor, Adap.tv Introduce New Ad Platforms

The video ad management and networks space

, marked by competition among a group of privately-held companies, continues to evolve. In the last few weeks two key players, Tremor Media and Adap.tv have announced new solutions giving content providers more flexibility to optimally monetize their video inventory by easily accessing multiple ad sources. Given how essential the ad business is to broadband video's ultimate success, both products are welcome.Ad networks play an important role for content providers which either don't have their own ad sales team or as an augment for those that do. For the latter, ad networks help monetize their unsold inventory, particularly important during unexpected spikes in viewership. Traditionally content providers had two basic choices, each of which had disadvantages:

First, they could select one ad management/network partner. This kept things simple, but didn't necessarily optimize the inventory, because it was dependent on how well that one network's advertisers were matched to available inventory (resulting in either the inventory going unsold or users seeing the same irrelevant ad over and over again).

The second was to go with multiple ad networks. This improved optimization, but created multiple operational challenges trying to work with different ad managers, formats and reporting.

Both Tremor's new "Acudeo" platform, and Adap.tv's "OneSource" seek to resolve these problems by providing one management platform capable of handling multiple ad sources/ad networks across all ad inventory.

Jason Glickman, Tremor's CEO, explained to me that he's positioning Acudeo to do for video advertising what DoubleClick's DART did for banner advertising. Content providers can easily enable all kinds of complex ad rules around their inventory - the type of ad format to be used, their frequency and contextual targeting (with partner Digitalsmiths), their cueing and lastly, standardized reporting, so that ongoing campaign adjustments can be made. Acudeo aims to support all third party ad networks. Tremor prices Acudeo flexibly depending on whether the content provider also uses Tremor's ad network.

Adap.tv's recently introduced OneSource platform has the same goal of improving ad optimization with lower complexity. Amir Ashkenazi, Adap.tv's says OneSource differentiates itself by using Adap.tv's contextual advertising capabilities to optimize which third-party's ads to run. It does this by understanding the video content itself and then matching the optimal ads, factoring in the ad rules the content provider has preset. Amir believes that by doing so, it can raise the effective CPM delivered by 65%, from which OneSource's fee is deducted. OneSource has 40 third party ad networks currently integrated and also aims to support all ad sources.

Acudeo's and OneSource's potential is to bring more spending into the video category, which obviously would be extremely valuable. Last week, I expressed concern that with so many video content providers relying on advertising, a short-term squeeze is a real risk. Both Acudeo and OneSource are encouraging signs that the ad management and network businesses are continuing to mature, which will benefit everyone.

What do you think? Post a comment and let everyone know!

(Note: Both Tremor Media and Adap.tv are VideoNuze sponsors)

Categories: Advertising, Technology

Topics: Acudeo, Adap.TV, OneSource, Tremor Media

-

blinkx Focuses on Network and Ads

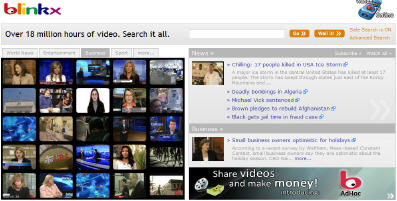

blinkx, which has been around as long as just about anyone in the video search space, is steadily building out its distribution network and advertising capabilities. I caught up with Suranga Chandratillake, CEO of blinkx, who's led the company since its spinoff from Autonomy, and successfully took the company public on London's AIM earlier this year.

Suranga said blinkx is now supporting 5 million searches/day and generating 50 million unique visitors/mo across its network. Network partners featuring a blinkx search box now include Ask.com, Real, Lycos, Infospace and scores of smaller sites that use blinkx's API. Suranga says blinkx can't distinguish between traffic coming from network partners vs. at blinkx.com itself. And the revenue splits in the business deals seem to vary widely, though typically they average out to 50-50. All deals are based on advertising, with the partner usually selling the inventory.

On the ad side, blinkx took a big step forward earlier this year, launching its "AdHoc" contextual ad program. Given the analysis blinkx is doing on video to drive search, it's a natural that the company now leverages this knowledge to improve targeting for ads. In fact, Suranga sees AdHoc as a sort of AdSense for video, dynamcially matching ads with relevant content.

With improved targeting of course comes improved CPMs. Suranga says they've seen CPMs as high as $66 through AdHoc. blinkx is relying on the scale of its 220+ content relationships and millions of impressions to make AdHoc work. Formats can vary but the one that has been most successful so far in a mid-roll banner with an invitation for user to click and engage. As I've written before, AdHoc plays in the same space as other contextual video ad companies such as ScanScout, Adap.tv, DigitalSmiths, AdBrite, YuMe and of course YouTube, plus others.

Both the contextual ad and video search spaces are growing increasingly crowded. Players recognize these are 3 interrelated Achilles heels of the current broadband video model: users finding desired content, content providers getting paid for their work and advertisers getting sufficient and well-targeted industry. blinkx seems well-positioned to address all three.

Categories: Advertising, Video Search

Topics: Adap.TV, AdBrite, Blinkx, Digitalsmiths, ScanScout, YouTube, YuMe

Posts for 'Adap.TV'

| Next