-

Kiptronic Accelerates Video Ad Insertion with DART and Atlas Integrations

Kiptronic, a dynamic ad insertion service provider for broadband-delivered video and audio has announced integrations with the two dominant ad management systems, DoubleClick's DART for Publisher and Microsoft's Atlas Ad Manager. This allows Kiptronic customers to traffic their ads from within these familiar ad management consoles beyond browser/PC-based environments.

Kiptronic plays an important role delivering ads against video that's increasingly consumed outside the

browser/PC. These days video consumption is being fragmented to widgets, smartphones, downloaded apps like Adobe Media Player, gaming devices, Internet-connected TVs and more coming as the syndicated video economy gains steam.

browser/PC. These days video consumption is being fragmented to widgets, smartphones, downloaded apps like Adobe Media Player, gaming devices, Internet-connected TVs and more coming as the syndicated video economy gains steam. While more viewership is obviously a plus for content providers, this new heterogeneity creates headaches for ad operations staff tasked with running the correct ads wherever the video is consumed. Kiptronic's secret sauce is inserting both in-browser and also in these disparate environments after recognizing their specific attributes. I'm only aware of one other company in this space, which is Volo Media, but as I understand it, they only insert in downloaded video.

Last week Bill Loewenthal, Kiptronic's President and CEO, and Jonathan Cobb, the company's founder and CTO briefed me on the new integrations as a follow up to a background call Bill and I had about a month ago. Kiptronic's customers are mainly premium content providers such as divisions of Fox, CBS, Time Warner and Sony BMG who place a high value on control and who have their own sales teams.

Kiptronic's key mantra has been enabling ad insertion to all these new environments without requiring any changes to customers' publishing processes. However, to date Kiptronic had required customers to use its proprietary management tool to insert their ads. For customers who use DART and Atlas, these new integrations now eliminate this step, likely boosting Kiptronic's appeal.

The whole concept of video consumption outside the PC/browser domain is a fascinating topic that content providers need to be mindful of. In the next couple of months Kiptronic is going to make data available showing the breakdown of all the places its ads are served. It's a pretty accurate data set given Kiptronic's role. Bill gave me a preview and it is definitely eye-opening. I'll be sharing the info as soon as it's available.

What do you think? Post a comment.

Categories: Advertising, Technology

Topics: Atlas, DoubleClick, Kiptronic, Microsoft

-

New Akamai-KickApps Partnership Stakes Out Advantages in Video Management/Publishing

More news today in the fiercely competitive video management, publishing and delivery space. KickApps, a social media platform provider and Akamai, the leading content delivery network, have announced a partnership integrating KickApps's Video Player Studio with Akamai's Stream OS video management system. On Friday I spoke to Michael Chin, KickApps's SVP of Marketing to learn more about the joint offering's benefits.

I look at this deal as a front-end/back-end marriage, bringing together the two companies' complimentary

capabilities as they seek to stake out new advantages in this market. KickApps, which has a roster of media companies, sports teams and others using its turnkey social media applications, has recently released its Video Player Studio, enabling customers to build on-demand customized video players for their sites.

capabilities as they seek to stake out new advantages in this market. KickApps, which has a roster of media companies, sports teams and others using its turnkey social media applications, has recently released its Video Player Studio, enabling customers to build on-demand customized video players for their sites. Meanwhile Akamai's Stream OS has been focused on the back-end tasks of video management and publishing, such as uploading/storing/editing video and metadata, distributing video

through managed RSS feeds, and controlling syndication through business rule creation and geo-targeting.

through managed RSS feeds, and controlling syndication through business rule creation and geo-targeting.Michael sees the joint offering's key differentiators as comprehensive out-of-the box functionality, improved flexibility/time to market and integrated social media features (rating, tagging, commenting, etc.).

KickApps is also counting on financial benefits to lure customers. It uses pay-as-you-go CPM-based pricing vs. the typical platform license fee model used by others. Large media companies usually buy out their entire KickApps-generated inventory at an agreed-upon CPM, while smaller companies stick to an ad revenue share approach. Another financial lever in the deal is that KickApps has negotiated very favorable CDN pricing from Akamai, which gives it more pricing flexibility for customers.

Michael believes that between the broader feature set and pricing advantages, the KickApps-Akamai joint offering will be well-positioned to appeal to customers of competitors like Brightcove, Maven (Yahoo) and thePlatform (Comcast), not to mention smaller players in the space who have narrower feature sets.

The KickApps-Akamai partnership continues to raise the competitive bar in this space. These are important, real differentiators the companies are using. That said, this space is very fluid, and in the coming weeks there will be at least 3 other companies which I've spoken to recently which will raise the bar in still other ways. This is a space that continues to evolve, as customer needs shift and their revenue pressures intensify. More news coming soon.

What do you think? Post a comment now.

(Note: Akamai is a current VideoNuze sponsor and KickApps is a former sponsor)

Categories: Partnerships, Technology

-

Non-Linear Presentation + Long-form Premium Video = Big Opportunity

I continue to be surprised that more long-form premium content providers have not pursued initiatives to slice and dice their programs into a non-linear user presentation. This is what "The Daily Show" has done at its site, deconstructing every episode into searchable clips. I think it's a big opportunity to drive more fan engagement, new ad inventory and provide insight about new programming ideas.

While this idea is a natural for archived sports and news programming, I think the model applies to scripted programs as well. Here's an example:

As I've written before, my wife and I were huge fans of "The West Wing" during its seven-year run on NBC.

While we now own the full DVD collection, periodically I'll talk to someone about the show and reminisce about a specific moment from years back. (In fact, TWW seems cosmically related to the current election cycle, given the show's last narrative around 2 candidates - one younger and one older - battling to succeed Bartlet.) This spurs many of those, "boy, I'd love to see that scene right now!" moments.

While we now own the full DVD collection, periodically I'll talk to someone about the show and reminisce about a specific moment from years back. (In fact, TWW seems cosmically related to the current election cycle, given the show's last narrative around 2 candidates - one younger and one older - battling to succeed Bartlet.) This spurs many of those, "boy, I'd love to see that scene right now!" moments.So wouldn't it be awesome if NBC or Warner Bros. (its producer), or whoever has the rights, were to create a site where all the episodes were archived and fully indexed for searching? This would go far beyond the show's current lame-o web site. I could type in "Bartlet speeches," "Josh meltdowns" or even "C.J.-Danny fights" and instantly see collections of relevant clips.

Before you accuse me of being geeky, stop and consider that we all have our favorite programs and love to relive memorable lines and moments. I'd argue that a really vibrant community could be built at these sites, attracting traditional advertisers eager to continue their audience relationships. Then of course there's the opportunity to embed clips into Facebook and MySpace pages, extending the community further. And think about what this ongoing loyalty would do to drive up the value of broadcast syndication rights.

The big challenge here is indexing the archive. The process must rely heavily on accurate metadata generation, but in a highly scalable, cost-effective manner. That's a mouthful of requirements, so clearly this isn't easy stuff. Various players are trying to crack this nut; two which I've previously written about are Gotuit (which is announcing a partnership with Move Networks today) and EveryZing, but there are others too. Recently I've had briefings with 2 companies that are investing in this area and will have news in the coming months.

Long-from premium providers are facing an onslaught of competition from short-form alternatives while also commonly experiencing a shortage of available inventory. Non-linear presentations of their content addresses both these issues, while delighting loyal fans. I see this as an emerging and sizable opportunity.

Am I missing something here? Post a comment now!

Categories: Advertising, Broadcasters, Technology

Topics: Daily Show, EveryZing, Gotuit, Move Networks, NBC, Warner Bros., West Wing

-

Longer-Form Live Streaming Events Get Traction

Here's another example of the multiple cross-currents in the broadband video market.

Just last week I reviewed new Magid research showing that short-form dominates broadband video consumption. Now this week I received news from Swarmcast which provides a high-quality streaming delivery platform, revealing that the average length of live streams it's serving for its customers now averages more than 75 minutes, suggesting the long-form opportunity is now firming up. An apparent contradiction? Yes. An actual contradiction? No.

What's happening is that while short-form still accounts for the vast majority of viewing instances, there are now marquee events from Swarmcast customers like MLB.com being streamed live that are generating sustained viewership. Swarmcast provides multiple examples of events that it has streamed which lead to the 75 minute average:

- July 15 - All-Star Game

- July 14 - Home Run Derby

- July 3-6 - Rothbury Music Festival

- June 28 - Nelson Mandela's 90th Birthday celebration

I think the success in live streaming events speaks to broadband's convenience. While TV is clearly the preferred viewing device, if you don't have access to one when a compelling event is on, or that content provider has chosen to stream it instead of broadcasting it, broadband is incredibly convenient.

Even so, what's traditionally held back longer-form consumption is low-quality delivery. This is the problem

Swarmcast has focused on. I've seen examples of some of their events and the quality is impressive, even at scale. So as content providers recognize that they can indeed stream high-quality long-form events, interest will build. The next key challenge of course will be monetize these streams.

Swarmcast has focused on. I've seen examples of some of their events and the quality is impressive, even at scale. So as content providers recognize that they can indeed stream high-quality long-form events, interest will build. The next key challenge of course will be monetize these streams. MLB has been a poster child for succeeding with the subscription model, leveraging its loyal fan base and exclusive games. While their brand is unique, it seems like there should also be pay-per-view opportunities for high-profile live events, akin to what has worked on cable (e.g. wrestling, boxing, music, etc.). Outside of the paid model, if audiences can be built for free events, advertisers will also take interest.

Swarmcast's customers' success in longer-form live streaming is again showing that despite the current popularity of short-form, broadband is still evolving, opening up diverse opportunities for content providers.

What do you think? Post a comment.

Categories: Technology

Topics: Swarmcast

-

Azuki Systems is Poised to Ignite Mobile Video

Azuki Systems, a Boston area startup, is poised to ignite the mobile video market with a comprehensive management, publishing and interactivity platform. Mobile video is a space with a lot of buzz, particularly with the recent iPhone launch. However, buzz has not yet translated to anything close to the activity we've seen in broadband as yet.

I spoke with Azuki's VP of Marketing and co-founder John Tremblay and Director of Marketing

Communications Laurie Klausner earlier this week to learn more. They are quick to point out the range of issues that has constrained the mobile video market to date: heterogeneous handsets/networks, constrained navigation, slow and inefficient new services creation, download application requirements, lack of interactivity/social media tools, a weak ecosystem and minimal monetization opportunities (that's quite a list...).

Communications Laurie Klausner earlier this week to learn more. They are quick to point out the range of issues that has constrained the mobile video market to date: heterogeneous handsets/networks, constrained navigation, slow and inefficient new services creation, download application requirements, lack of interactivity/social media tools, a weak ecosystem and minimal monetization opportunities (that's quite a list...). Azuki's "MashMedia Platform," a SaaS offering, addresses all of these with a browser-only requirement, meaning content and services can be delivered to 1.8 billion+ handsets immediately(Azuki's estimate). That alone significantly widens the target universe beyond the minority of handsets that today are "video-ready."

But Azuki correctly recognizes that "mobile TV' is not really the market opportunity to chase. Rather, it's the ability to deliver personalized, contextual and snackable video segments that have seamless interactive and social/sharing features. For content providers, Azuki super-charges current WAP offerings. "Facebook-on-your-phone" would be a little inaccurate to describe the experience Azuki enables for both users and content providers, but many elements of web 2.0 and social media have clearly influenced Azuki's product development vision.

John gave me a spin through a sample app created by WheelsTV, an automotive content company. Azuki ingests content from WheelsTV's CMS (or assets could come from a video CMS like thePlatform, Brightcove, etc.), then processes it into media objects. These in turn feed personalized profiles the user can build, or which can help sort content that may have been virally shared by others.

Azuki can use metadata to break down longer segments into mobile-friendly segments, also navigable through a gallery of thumbnails. Posting videos to your Facebook page is one touch away, and videos can be commented on, rated and shared with others through SMS and email. Targeted advertising completes the picture.

Azuki has a big vision which is backed by a blue-chip founding and management team, with past startup successes including ArrowPoint, SightPath, Airvana and Acopia (names very familiar to those in the Boston tech scene). The company will be rolling out beta content and services partners in the coming months, as it pushes toward commercial release later in '08. For content and service providers looking to beef up their mobile video offerings, Azuki is clearly a company to watch.

(Hat tip to Paul Roberts at The 451 Group for steering me to Azuki)

Categories: Mobile Video, Startups, Technology

Topics: Azuki Systems

-

thePlatform's New Cable Deals: Finally, an Industry Push into Broadband Video Delivery?

thePlatform, the video management/publishing company that's been a part of Comcast since early '06, had a very good day yesterday. First it jointly announced with Time Warner Cable a deal to power the #2 cable operator's Road Runner portal. And the Wall Street Journal ran a story stating that it has also signed deals with the cable industry's #3 player Cox Communications and #5 player, Cablevision Systems, which thePlatform corroborates.

Netting all this out, thePlatform will now power 4 of the top 5 cable industry's broadband portals (all except

Charter Communications), with a total reach exceeding 28 million broadband homes, according to data collected by Leichtman Research Group. That also equals approximately 44% of all broadband homes in the U.S. And it's a fair bet that thePlatform's industry penetration will further grow.

Charter Communications), with a total reach exceeding 28 million broadband homes, according to data collected by Leichtman Research Group. That also equals approximately 44% of all broadband homes in the U.S. And it's a fair bet that thePlatform's industry penetration will further grow.I caught up with Ian Blaine, thePlatform's CEO yesterday to learn a little more about the deals and whether the industry's semi-standardization around one broadband video management platform harkens a serious, and I'd argue overdue, industry push into broadband video delivery.

Ian noted that of its various customer deals, the ones with distributors like these are particularly valuable because of their potential for "network effects." This concept means that content and application providers are more likely to also adopt thePlatform if their key distributors are already using it themselves. Ian's point is very valid, as I constantly hear from content providers about the costs of complexity in dealing with multiple distributors and their varying management platforms. Yet the potential is only realized if the distributors actually build out and promote their services, offering sizable audiences to would-be content partners.

This of course has been the aching issue in the cable industry. While they've had their portal plays for years, they've been eclipsed in the hearts and minds of users by upstarts ranging from YouTube to Hulu to Metacafe to countless others, each now drawing millions of visitors each month. While solidly utilitarian, cable's portals (with the possible exception of Comcast's Fancast) are not generally regarded as go-to places for high-quality, or even UGC video. That's been a real missed opportunity.

Ian thinks the industry is experiencing an awakening of sorts, now recognizing the massive potential it's sitting on. This includes its content relationships, network ownership and huge customer reach. Of course, all of this was plainly visible in 1998 as broadband was first taking off, yet here we are 10 years later, and it somehow seems discordant to think the industry is only now grasping its strategic strengths.

Some would explain this as the cable industry being more of a "fast follower" than a true pioneer, a posture that has helped the industry avoid hyped-up and costly opportunities others have chased to their early graves. Others would offer a less charitable explanation: the industry's executives have either been asleep at the switch, overly focused on defending traditional closed video models against open broadband's incursion, or both.

In truth, and as I've mentioned repeatedly, the broadband video industry is still very early in its development, making a "fast follower" strategy still quite viable. Semi-standardization on thePlatform gives the industry a huge potential advantage in attracting content providers. It also gives the industry a more streamlined mechanism for bridging broadband video over to the TV, an area of intense interest now being pursued by juggernauts including Microsoft, Apple, Sony, Panasonic and others.

Still, cable operators' broadband video delivery potential (and the true upside of thePlatform's omnipresence) rests more on whether cable operators are finally going to embrace broadband as an eventual complement, and possibly even successor to their traditional video business model. That would be a major leap for an industry better known for cautious, incremental steps. Time will tell how this plays out.

What do you think? Post a comment!

Categories: Cable TV Operators, Devices, Technology

Topics: Apple, Cablevision, Comcast, Cox, Microsoft, Panasonic, Sony, thePlatform, Time Warner

-

VMIX: Another Entrant in Video Platform Space

Competition continues to intensify in the already-crowded video content management/platform space, with additional players continuing to hit my radar. The latest is VMIX, which contacted me after I posted my recent summary of all the companies operating in this space. I got a briefing from CEO Mike Glickenhaus, CTO/founder Greg Kostello and VP Marketing Jennifer Juckett.

VMIX has actually been around since 2005, and has built a healthy roster of customers, mainly, but not

exclusively in the local media space. Operating purely as a white-label SaaS provider, its CORE media management platform now powers over 200 sites' video and multimedia offerings, reaching 60 million+ unique visitors/mo. Examples are regional sites such as McClatchy's KansasCity.com, Lee Enterprises' StlToday.com and Landmark's HamptonRoads.com along with others such as American Cancer Society's SharingHope.tv.

exclusively in the local media space. Operating purely as a white-label SaaS provider, its CORE media management platform now powers over 200 sites' video and multimedia offerings, reaching 60 million+ unique visitors/mo. Examples are regional sites such as McClatchy's KansasCity.com, Lee Enterprises' StlToday.com and Landmark's HamptonRoads.com along with others such as American Cancer Society's SharingHope.tv.Given how crowded the space is, I'm always interested in how video platform companies articulate their points of differentiation. In this case Mike outlined several ways starting with the idea that VMIX's sale focuses on revenue generation for local media companies, rather than technology adoption. Mike has a long executive career in local media, and explained that traditionally revenue generation has been the prism through which technology decisions are made; this is no doubt truer than ever in a difficult economy.

VMIX backs up this positioning with a professional services team that helps structure sponsorship programs for its customers, also helping train them in how to sell video. Note this is a tactic that WorldNow, the leading video platform company in local media space uses as well. This angle makes sense to me - as an industry executive recently said to me, "Revenue generation never gets commoditized."

Beyond revenue, VMIX also emphasizes its UGC capabilities. UGC is scary, unmanaged terrain for most media companies and so VMIX has staffed up a human reviewing process to filter each piece of user-generated content uploaded to its customers' sites. That may seem a bit daunting, but the payoff is that these local media companies are able to broaden their news-gathering nets, at a time when newsroom headcount is shrinking (for one example of UGC is being mixed with professional video, see what CNN is doing with its iReport series). One last differentiator is VMIX's "Marketplace" where it offers third party video to its customers on an ad inventory sharing basis.

Looking beyond VMIX for a moment, there is a lot of excitement yet to come in the overall video management/platform space. In the last 2 weeks I've had briefings with other players in this space who are preparing major new initiatives and customer announcements that will up the ante for everyone.

What do you think? Post a comment now!

Categories: Technology

Topics: VMIX

-

EgoTV, Clearspring Show How Widgets Successfully Distribute Video

"Widgets" are an area that VideoNuze hasn't really touched on to date, yet they are quickly proving to be a potent way of distributing content in general and video in particular. I was pleased to get an email recently from Jimmy Hutcheson, president and founder of EgoTV, a broadband content startup, who wanted to share some details on their success distributing their "Malibu U" program through Clearspring's widget platform. In a subsequent call with Jimmy and Bill Rubacky, who leads Clearspring's marketing, I got a better handle on how the model works.

For those of you not familiar with widgets, they are small chunks of HTML code that essentially create a container into which content can be continuously pushed. Widgets have gained widespread popularity with the rise of web 2.0 social networking sites like Facebook and MySpace, as users can select different widgets for embedding in their personal pages. This allows both the user and visitors to easily view content there. A user can also embed widgets in personal content sites using PageFlakes, iGoogle or others, or can use widgets right on their desktop.

Content providers view widgets as a low-cost opportunity to dynamically distribute content to opted-in audiences. Similarly, advertisers look at widget advertising as an opportunity to reach targeted, engaged audiences.

As an example, EgoTV is now distributing "Malibu U," through Clearspring's widget and its site. Getting the widget is simple, you just click on it, find the social media platform to which you want to embed the widget and go. Jimmy explained that about 50,000-75,000 unique visitors/day can now see his widget. He's able to track video traffic across all places the widget is embedded and when he pushes a new episode, users are automatically notified. I put the widget on my rudimentary Facebook page and this is how it looks:

From an advertising standpoint, you'll notice in the upper right corner a little peel-back flap, which is one of the ways that Clearspring implements advertising. (In fact, VideoEgg's new AdFrames approach unveiled yesterday uses a similar peel-back, which in turn links to Clearspring's widget sharing capability.) Widget ads can work in all kinds of ways, including banners, pre/mid/post-rolls and overlays.

Clearspring's play is to create a "Widget Ad Network" by aggregating the content flowing through its widgets. With 4 billion pieces of content served through its widgets each month and working with many of the top 100 publishers, Bill explained that it is able to offer targeted inventory to media buyers who want to tap into the web 2.0 world.

In short, widget platforms from companies like Clearspring provide both large content providers and smaller ones like EgoTV yet another way of reaching and engaging their fragmented audiences on their terms. I fully expect more content companies, especially early stage ones looking to gain an audience toehold, to take advantage of this low-cost distribution option. Widgets will take their place as yet another distribution choice in the rapidly-evolving "syndicated video economy."

Categories: Indie Video, Technology, Video Sharing

Topics: Clearspring, EgoTV, Facebook

-

Metacafe's New Wikicafe Refines Metadata Process

Metacafe, the short-form video aggregator with 30 million monthly visitors, has unveiled a new feature called "Wikicafe" which addresses the daunting and ongoing problem of how to find exactly the video you're looking for and gain high-quality recommendations.

Now in beta and available to its registered users only, Wikicafe is philisophically similar to Wikipedia, which involves users in building the knowledge base around specific content. Similarly, Wikicafe's goal is to involve users in continually refining the metadata for specific videos. This in turn will yield improved search and discovery for subsequent users.

Wikicafe is an intriguing spin on video search which I have discussed a number of times. Last week I spoke to Eyal Hertzog, Metacafe's co-founder and now chief creative officer, who's leading the charge on Wikicafe. This was the first briefing Metacafe has given on the new Wikicafe feature.

Eyal notes that there are really two ways to tackle content navigation. One is through super-sophisticated algorithms and distributed hardware, an approach epitomized by Google. The other is community-based collaboration, an approach epitomized by Wikipedia. He is biased toward the latter because he believes that the likelihood that the original metadata assigned by the video's creator (and even subsequent metadata that may be produced by technology-based approaches) will never be as accurate as that which is produced by other humans with specific domain knowledge.

Thus the idea behind Wikicafe: if given the right tools, Metacafe's users will create and maintain the most accurate metadata for Metacafe's vast collection of videos. It's a classic "wisdom of crowds" approach. Of course, it also requires that users act appropriately or things could spin out of control very quickly.

Wikicafe is very straightforward to use. Once logged in, you simply click on "Editing Options" in the upper right corner of each video. Then you can start editing the video's title, tags, description and then save your changes. You can track your changes (and those that others add), be notified about subsequent changes and start a discussion about your changes. You can even translate your changes into other languages. As Eyal explains it, this "collaborative taxonomy" allows redirection between related terms ("PS3" and "Playstation3"), clarifies ambiguous words, resolves hierarchical terms and connects different languages.

In a sense, Wikicafe is a natural evolution for Metacafe, which has always emphasized community involvement in filtering which content gets added and promoted on the site. With a group of active, passionate users and Wikipedia as a model, it seems likely that Wikicafe will gain traction in the community.

What then becomes especially intriguing is the potential for carrying the Wikicafe approach outside of Metacafe's borders for the larger universe of broadband video. Could users eventually become an augment or even replacement to top-down driven video guides, the norm in today's cable and satellite offerings? It's an interesting vision to contemplate. First let's see how Wikicafe evolves in the Metacafe community.

What do you think? Post a comment now!

Categories: Aggregators, Technology, Video Search

Topics: Google, MetaCafe, Wikipedia

-

June '08 VideoNuze Recap - 3 Key Topics

Wrapping up a busy June, I'd like to quickly recap 3 key topics covered in VideoNuze:

1. Execution matters as much as strategy

I've been mindful since the launch of VideoNuze to not just focus on big strategic shifts in the industry, but also on the important role of execution. I'm not planning to get too far into the tactical weeds, but I do intend to show examples where possible of how successful execution can make a difference. This month, in 2 posts comparing and contrasting Hulu and Fancast (here and here) I tried to constructively show how a nimble upstart can get a toehold against an entrenched incumbent by getting things right.

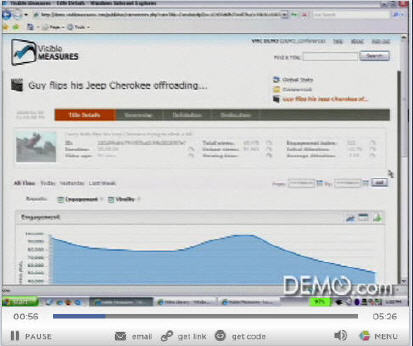

While great execution is a key to successful online businesses, it may sometimes feel pretty mundane. For example, in "Jacob's Pillow Uses Video to Enhance Customer Experience" I shared an example of an arts organization has begun including video samples of upcoming performances on its web site, improving the user experience and no doubt enhancing ticket sales. A small touch with a big reward. And in this post about the analytics firm Visible Measures, I tried to explain how rigorous tracking can enhance programming and product decisions. I'll continue to find examples of where execution has had an impact, whether positive or negative.

2. Cable TV industry impacted by broadband

As many of you know, I believe the cable TV industry is a crucial element of the broadband video industry. Cable operators now provide tens of millions of consumer broadband connections. And cable networks have become active in delivering their programs and clips via broadband. Yet the broadband's relationships with operators and networks are complex, presenting a range of opportunities and challenges.

On the opportunities side, in "Cable's Subscriber Fees Matter, A Lot," I explained how the monthly sub fees that networks collect put them on a firm financial footing for weathering broadband's changes and an advantageous position compared to broadband content startups which must survive solely on ads. Further, syndication is offering new distribution opportunities, as evidenced by Scripps Networks syndication deal with AOL in May and Comedy Central's syndication of Daily Show and Colbert Report to Hulu and Adobe. Yet cable networks are challenged to exploit broadband's new opportunities while not antagonizing their traditional distributors.

For operators, though broadband access provides billions in monthly revenues, broadband is ultimately going to challenge their traditional video subscription business. In "Video Aggregators Have Raised $366+ Million to Date," I itemized the torrent of money that's flowed into the broadband aggregation space, with players ultimately vying for a piece of cable's aggregation revenue. These and other companies are working hard to change the video industry's value chain. There will be a lot more news from them yet to come.

3. Video publishing/management platforms continue to evolve

Lastly, I continued covering the all-important video content publishing/management platform space this month, with product updates from PermissionTV, Brightcove and Entriq/Dayport. Yesterday, in introducing Delve Networks, another new player, I included a chart of all the companies in this space. I put a significant emphasis on this area because it is a key building block to making the broadband video industry work.

These companies are jostling with each other to provide the tools that content providers need to deliver and optimize the broadband experience. The competitive dynamic between these companies is very blurry though, with each emphasizing different features and capabilities. Nonetheless, each seems to be winning a share of the expanding market. I'll continue covering this segment of the industry as it evolves.

That's it for June; I have lots more good stuff planned for July!

Categories: Aggregators, Cable Networks, Cable TV Operators, Technology

Topics: AOL, Brightcove, Comedy Central, Delve, Entriq, Fancast, Hulu, Jacobs Pillow, PermissionTV, Scripps, Visible Measures

-

PermissionTV Enhances Customization, Scalability

More news today in the video publishing space as PermissionTV is making two product-related announcements with an eye toward enabling easier, faster creation of video applications by media

companies, brands and third party agencies. Specifically the company is releasing its Platform Development Kit (PDK) and "Solutions Hub." Last week Corey Halverson, PermissionTV's VP of Product Management gave me a demo and rundown of both.

companies, brands and third party agencies. Specifically the company is releasing its Platform Development Kit (PDK) and "Solutions Hub." Last week Corey Halverson, PermissionTV's VP of Product Management gave me a demo and rundown of both."Solutions Hub"

The "Solutions Hub" is a gallery of video player applications that Permission is offering developers use of to help jumpstart their video efforts. The examples are both pragmatic and inspirational, showing developers for the kinds of things that can be done with Permission's tools.

Corey explained the Solutions Hub is meant to address a phenomenon that Permission often encounters: developers who have expansive visions of the kinds of apps they'd like to build, but who still need grounding to help them get started quickly and easily. The Solutions Hub addresses this by providing a range of downloadable apps including many featuring integrations with 3rd parties (e.g. DART, Move Networks, Tremor). By anticipating developers' needs, Permission is aiming to accelerate time to market.

PDK

Targeted to agencies that need to be able to create highly customizable applications quickly but on a budget, Permission's new PDK bundles together all of its APIs, with tutorials, reference players, source code and other Flash-oriented tools. Corey characterized the PDK as allowing developers to "color outside the lines," while providing as much functionality as possible right out of the box.

While I'm not a Flash developer and therefore can't fully appreciate some of the details of the PDK, there's no question that as the market matures a blend of customization and scalability is required to succeed. In particular, as business models remain in flux and experimentation prevails, the ability to quickly and inexpensively try different approaches is key. Taken together the Solutions Hub and PDK look like solid forward progress to meeting these market objectives.

Categories: Technology

Topics: PermissionTV

-

Overview of New Brightcove 3 Beta Release

Today Brightcove is announcing the beta version of its Brightcove 3 platform. Last week CEO/Founder

Jeremy Allaire briefed me on what he called a "pretty dramatic new version of the platform." There are three new areas:

Jeremy Allaire briefed me on what he called a "pretty dramatic new version of the platform." There are three new areas:1. Contextualization - Brightcove is changing how its customers display their video from the current standalone video player/index environment to one where the player window is embedded within in an HTML page with surrounding contextual content and ads. In tests it has done, Brightcove has found that, no surprise, integrating the video window results in more video and page views. Also by surfacing video in context, it enhances search engine optimization. This is similar to EveryZing's SEO-focused approach. (see my profile). Brightcove has new APIs that work with existing content management systems to match relevant non-video content.

2. Dynamic delivery - Brightcove is upping its emphasis on high-quality long-form content by introducing a dynamic delivery feature that modulates the quality of the video delivered based on detection of the user's bandwidth. This adaptive bit rate streaming idea was pioneered by Move Networks and allows on-the-fly video file delivery adjustments. Brightcove is doing this on top of Flash with no new plug-in required by users. It will also automatically generate various encoded files for customers.

3. Producer tools overhaul - Brightcove is updating the back-end work flow tools that its customers' producers use, so they can more quickly do things like upload large video files, create tags, generate business rules, transcode files and so forth. Jeremy demo'd it for me; it's a complete drag and drop environment that looked pretty straightforward.

All-in-all these look like positive steps. Since Brightcove had invested heavily in its earlier versions, I give them credit for emphasizing continuous improvement and not sitting still. Brightcove 3 is in beta (Showtime is one site that's already using it) with wider deployment in the fall. Jeremy added that other updates are expected then too. I pried out of him that these will include monetization and distribution/syndication among others.

Categories: Technology

Topics: Brightcove, EveryZing, Move Networks, Showtime

-

Visible Measures: Ultimate Broadband Video Measurement

If you've ever hungered for insight about a specific video's performance beyond just how many views it has received, Visible Measures is a company after your heart. An independent firm that measures the reach and engagement of broadband video across the Internet, VM heralds an era of ultimate insight into how each and every video performs when it enters the Internet's fast-moving current.

By integrating its code with the video player, VM collects data on session length, drop-out points, rewind activity, click-throughs, viral distribution, geographic usage and other metrics. Think of VM as "big brother-esque" (in a positive way) in tracking a video's "true reach" as VM puts it, supplying a dizzying array of data to content providers and advertisers. The data is presented in intuitive, graphical formats that analysts can parse and sort to understand the video's ROI and what can be done to improve performance next time around. The company is already tracking over 80 million videos in its database.

I recently spent time with Matt Cutler, VM's VP of Marketing and Analytics who gave me a demo of the system and how it's being brought to market. VM is targeting established and early stage media companies, advertisers and ad agencies, all of whom have a critical stake in developing business cases for video deployments and ad campaigns. VM's tracking capabilities are especially meaningful given how pervasive the "syndicated video economy" is becoming.

None of this is to suggest that VM's data will replace programmers' and advertisers' creative instincts, but it would surely provide some real world augments to help offset the inherent guesswork involved in the creative process. (for more specifics about how VM works, see the below video from DEMO '08)

For advertisers specifically, today VM is announcing both its "VisibleCampaign" solution to measure ad campaigns' performance and also a collaboration with Dynamic Logic to track how these campaigns affect a brand's perception. Both initiatives are important in helping advertisers and agencies gain more insight about the broadband video medium and why it's important to invest. As someone who has expressed concern that the broadband ad business needs to mature quickly to support the myriad startup and established media companies relying on it, VM's will surely help decision-makers across the board gain comfort in shifting over more of their budgets.

VM is a perfect example of innovation needed to help optimize a new medium as it takes root. The company has raised $19 million through three rounds and is based in Boston. Based on what I've seen I'm quite enthusiastic about its odds of success.

Categories: Advertising, Startups, Technology

Topics: Dynamic Logic, Visible Measures

-

Understanding TakeTV/Fanfare's Demise

Late last week came news that SanDisk has discontinued its TakeTV device and companion Fanfare content aggregation web site, which were unveiled last October. TakeTV was an inexpensive USB PC-TV connector that allowed users to grab video from Fanfare, for easy playback on their TVs.

I gave TakeTV and Fanfare a moderately positive review and thought that as a low-end product it could gain some traction. I thought of it as having "stocking stuffer" appeal - a relatively cheap gadget that would find its market. I've done a little asking around to try to understand what happened.

From what I've gathered, it sounds like SanDisk ultimately recognized the reality that TakeTV was really

peripheral to their core focus of marketing memory products. Too much customer education would be required to move this product, especially in the face of quasi-competitors like AppleTV, Vudu, Xbox and others. In addition, minimums from Hollywood to gain top-notch content has continued to raise the bar for startup devices like these to succeed.

peripheral to their core focus of marketing memory products. Too much customer education would be required to move this product, especially in the face of quasi-competitors like AppleTV, Vudu, Xbox and others. In addition, minimums from Hollywood to gain top-notch content has continued to raise the bar for startup devices like these to succeed. Yet, my bet is that we haven't seen the last of SanDisk's involvement in the broadband video market. Like hard-drives, processors and PCs themselves, memory products rely on ever-larger applications to drive the consumer purchase cycle. For SanDisk, video has to be right at the top of their list in terms of the apps that will create demand for its increasingly capacious storage products. So stay on the lookout for SanDisk to resurface somewhere in the video landscape.

Categories: Devices, Technology

Topics: SanDisk

-

Entriq-DayPort Deal Broadens Product Offerings

Though I've been predicting a wave of consolidation among broadband vendors for a while, deals in the space have only been sporadic. I think that's been due to investors continuing to fund independent companies and a sufficient amount of business to go around for most everyone.

One deal that did close in the last few months was Entriq's acquisition of DayPort. I recently had a briefing with Guy Tennant, Entriq's COO and Cory Factor, DayPort's former CEO and now CTO of the combined entity to understand their joint strategy and a recently-expanded deal with Inergize Digital Media.

I've been familiar with Entriq for a while as it was primarily focused on enabling media companies to support paid business models. It specialized in things like rights management, DRM, security, business rules and the like. Yet as advertising as emerged as the business model of choice for many, Entriq has been on a bit of a roller-coaster; there has been some senior management turnover and also I've heard of layoffs.

I've been familiar with Entriq for a while as it was primarily focused on enabling media companies to support paid business models. It specialized in things like rights management, DRM, security, business rules and the like. Yet as advertising as emerged as the business model of choice for many, Entriq has been on a bit of a roller-coaster; there has been some senior management turnover and also I've heard of layoffs. By acquiring DayPort, which supports advertising, Entriq expands its capabilities, allowing it to serve customers regardless of business model choice. This would also include hybrid pay/ad-supported models, which I continue to hear more and more about. The combined company is focusing on verticals like broadcasting (where DayPort always had a presence), independent producers and long-form content, particularly sports. Syndication is another key focus of the combined companies, mirroring the trend that I've written about in the past.

The recently-expanded deal with Inergize builds on a prior relationship DayPort had with the company. Inergize itself provides online solutions to broadcasters and Entriq has now integrated its combined capabilities more deeply with Inergize to serve the market. The two companies are also trying to deeply tie in to existing broadcast work-flow and production operations. One joint customer Guy and Cory cited was Newport Television, which recently acquired the Clear Channel TV stations which as deployed the Inergize/Entriq products.

Entriq-DayPort is competing in the very crowded broadband video content management/publishing space, which I've described previously. Yet by combining, the two companies have certainly strengthened their hand. As the market continues to evolve, they'll be fighting for their share.

Categories: Broadcasters, Deals & Financings, Technology

Topics: DayPort, Entriq, Inergize Digital Media

-

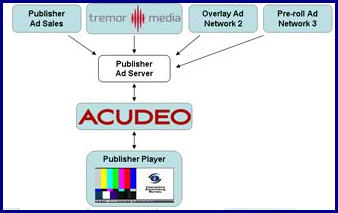

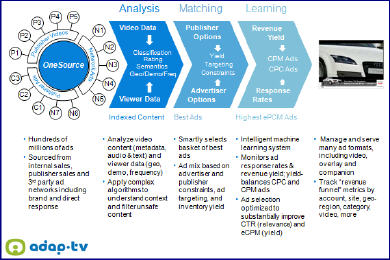

Tremor, Adap.tv Introduce New Ad Platforms

The video ad management and networks space

, marked by competition among a group of privately-held companies, continues to evolve. In the last few weeks two key players, Tremor Media and Adap.tv have announced new solutions giving content providers more flexibility to optimally monetize their video inventory by easily accessing multiple ad sources. Given how essential the ad business is to broadband video's ultimate success, both products are welcome.Ad networks play an important role for content providers which either don't have their own ad sales team or as an augment for those that do. For the latter, ad networks help monetize their unsold inventory, particularly important during unexpected spikes in viewership. Traditionally content providers had two basic choices, each of which had disadvantages:

First, they could select one ad management/network partner. This kept things simple, but didn't necessarily optimize the inventory, because it was dependent on how well that one network's advertisers were matched to available inventory (resulting in either the inventory going unsold or users seeing the same irrelevant ad over and over again).

The second was to go with multiple ad networks. This improved optimization, but created multiple operational challenges trying to work with different ad managers, formats and reporting.

Both Tremor's new "Acudeo" platform, and Adap.tv's "OneSource" seek to resolve these problems by providing one management platform capable of handling multiple ad sources/ad networks across all ad inventory.

Jason Glickman, Tremor's CEO, explained to me that he's positioning Acudeo to do for video advertising what DoubleClick's DART did for banner advertising. Content providers can easily enable all kinds of complex ad rules around their inventory - the type of ad format to be used, their frequency and contextual targeting (with partner Digitalsmiths), their cueing and lastly, standardized reporting, so that ongoing campaign adjustments can be made. Acudeo aims to support all third party ad networks. Tremor prices Acudeo flexibly depending on whether the content provider also uses Tremor's ad network.

Adap.tv's recently introduced OneSource platform has the same goal of improving ad optimization with lower complexity. Amir Ashkenazi, Adap.tv's says OneSource differentiates itself by using Adap.tv's contextual advertising capabilities to optimize which third-party's ads to run. It does this by understanding the video content itself and then matching the optimal ads, factoring in the ad rules the content provider has preset. Amir believes that by doing so, it can raise the effective CPM delivered by 65%, from which OneSource's fee is deducted. OneSource has 40 third party ad networks currently integrated and also aims to support all ad sources.

Acudeo's and OneSource's potential is to bring more spending into the video category, which obviously would be extremely valuable. Last week, I expressed concern that with so many video content providers relying on advertising, a short-term squeeze is a real risk. Both Acudeo and OneSource are encouraging signs that the ad management and network businesses are continuing to mature, which will benefit everyone.

What do you think? Post a comment and let everyone know!

(Note: Both Tremor Media and Adap.tv are VideoNuze sponsors)

Categories: Advertising, Technology

Topics: Acudeo, Adap.TV, OneSource, Tremor Media

-

Eyespot Shifts Focus to Network Model and Mid-Tail Video Providers

Another sign of how quickly broadband video companies are adapting themselves to market conditions: Eyespot, which started by providing video editing capabilities to users of big branded web sites has evolved its focus to a network model, specializing in mid-tail sized video providers. CEO/co-founder Jim Kaskade explained their shift to me and why it's paying off.

Eyespot's core capability remains providing video editing and sharing tools, but it is now also offering them in a self-serve model, enabling small-to-mid sized sites to quickly get up and running. Jim sees at least 2 clear differentiators for Eyespot:

First, for sites which want to offer a user-contributed video capability, Eyespot addresses all the complexities such as handling multiple file formats, offering strong moderation and monetization. ExpertVillage is a good example of a site benefiting from this approach. EP's myriad "experts" contribute their how-to videos to the site using Eyespot's tools. In this model, Eyespot is fundamental video infrastructure, powering all of the video publishing at the site.

Depending on the business model the provider chooses for the user-contributed capability, all of their video can be included for syndication to other sites by Eyespot to others in the network. This includes options for delivery to mobile devices. Eyespot monetizes the network, currently at $4-8 CPM. In addition to powering user contributions, this capability is also appealing for mid-tail providers who just intend to upload and manage their own video.

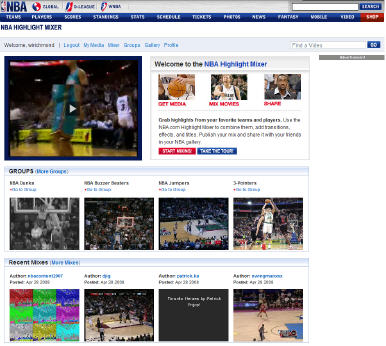

A second differentiator, for providers who don't necessarily want to allow user uploads, is Eyespot's core video studio. In this offering, content providers offer their own library of media assets for users to mix and publish. NBA.com is an example of this implementation. When you go to NBA.com, in the video tab, there's an option for "NBA Highlight Mixer," where the user will find media that NBA has offered for mixing. A gallery of users' mixes is displayed, along with tools to share and embed your mixes. In this example, Eyespot augments the NBA's other video initiatives powered by Akamai's StreamOS.

Jim explained that the payoff from offering video personalization is in driving more video views and hence more ad revenue. Jim explained that a typical site might get 10 video views per unique visitor per month, while Eyespot-powered sites get around 80.

I've been bullish for a while about the potential of user contributions and editing, yet it seemed like the market was slow to catch on. With Eyespot's new approach making access to its tools much easier, this will hopefully accelerate adoption.

Categories: Technology, UGC

Topics: ExpertVillage, Eyespot, NBA

-

Gotuit Launches Video Metadata Authoring Tool

Gotuit, whose technology allows for indexing longer-form content into individual scenes based on their metadata, is today announcing "VideoMarker Pro." This gives content providers the choice of indexing their video themselves, rather than relying on a service relationship with Gotuit, as customers like SI, Major League Soccer, Fox Reality and others traditionally have.

As I wrote last November, I've been very bullish about broadband's ability to create searchable segments

carved out of longer-form programming. A perfect example of this is what TheDailyShow.com has done, offering 19,000+ clips from all of the show's episodes. Searchable clips create a powerful new user experience leading to more video consumed. This in turn means more ad inventory which is also ripe for contextual targeting.

carved out of longer-form programming. A perfect example of this is what TheDailyShow.com has done, offering 19,000+ clips from all of the show's episodes. Searchable clips create a powerful new user experience leading to more video consumed. This in turn means more ad inventory which is also ripe for contextual targeting.The big problem with creating searchable clips has been that without the proper tools it would be painfully time-consuming. Worse is that a large library would spawn thousands of clips that would need to be managed. While TheDailyShow.com took the plunge, others have been reluctant, thereby leaving a lot of highly monetizable longer-form video locked in its original state.

Enter VideoMarker Pro. Last week, Patrick Donovan, Gotuit's VP of Product Management, demonstrated for me how a show such as "Lost" would be indexed.

The starting point is for a producer to set up the show's "Attributes" or key descriptors, based on how users might be expected to search (e.g. by character, plot line, topic, funniest lines, etc.) for specific clips. Once done, the show plays in a side panel while the editor uses the tools to mark "Time-In" and "Time-Out" points, and to assign attributes to that scene. Once a scene is marked up, the editor clicks save and quickly moves on to the next one.

The whole process is dead-simple, enabling an intern or offshore partner to crank out clips quickly and accurately. Patrick estimates the whole indexing process takes 25-30% of real time (e.g. a typical 1 hour show running 44 minutes would take less than 15 minutes to index.) When you do the math, you realize it would be ridiculously cheap to index an entire season or even multiple seasons. (This is particularly relevant given the recent emphasis on offering classic TV content online - see yesterday's Warner Bros post as an example.)

There are multiple ways to present the index, using thumbnails, playlists and search. In fact VideoMarker Pro is actually creating "virtual" clips by sending an XML message to the CDN with instructions to play the video at its specified time points. This creates a lot of flexibility, especially for syndicating clips to partners. There's no clip inventory to manage, transfer and update.

VideoMarker Pro is another example of how the technologies sprouting up around broadband video allow content providers to extract ever-growing value from their original investments.

What do you think? Post a comment and let everyone know!

(Disclaimer - I have a very minor advisory role with Gotuit)

Categories: Technology

Topics: Gotuit, TheDailyShow.com, VideoMarker Pro

-

Anystream Lands Hearst-Argyle and Brings New Competition in Video Management Space

Anystream, a long-time player in video transcoding, is announcing that its Media Lifecycle Platform has been implemented by 11 of Hearst-Argyle's 29 owned and operated TV stations.

The move suggests even more vigorous competition is coming to the video management/publishing space where players like thePlatform, Brightcove, Maven, ExtendMedia, PermissionTV, Akamai (StreamOS), WorldNow and others have focused.

I sat down with Anystream (note, a periodic VideoNuze sponsor) president Bill Holding and founder/chairman Geoff Allen recently to learn more about their expansion strategy.

Anystream is well-known in the digital media space as it Agility transcoding platform is deployed in over 700 companies. Leveraging this base of relationships and its knowledge of customers' work flows, Anystream is

now "moving north" by focusing on the video management layer. The core technology comes from Anystream's 2007 acquisition of Cauldron Solutions, which has been built out, renamed as Velocity and integrated with Agility.

now "moving north" by focusing on the video management layer. The core technology comes from Anystream's 2007 acquisition of Cauldron Solutions, which has been built out, renamed as Velocity and integrated with Agility. Anystream's new, broader positioning rests on its belief that the video "Produce-Manage-Monetize" lifecycle elements are deeply linked, and that ultimately a comprehensive, integrated solution will be prized by media companies serious about scaling their broadband video businesses. At the manage layer specifically, Velocity focuses on rights, scheduling, packaging, syndication and asset tracking.

Anystream believes metadata it gains access to, at the start of the video lifecycle through its transcoding role, is a unifying value driver in the video management and monetization phases.

Hearst-Argyle clearly saw the benefits of this approach, citing Anystream's metadata management as opening up new content re-use opportunities and creating competitive advantage. In the press release, Joe Addalia, H-A's director of technology projects, said H-A has cut its production and distribution to online channels "from 30 minutes to 3 1/2 minutes."

I continue to be impressed with how many companies are staking a claim in the broadband video management/publishing space. I'm constantly trying to discern the real competitive differentiators that separate industry players. Like many of you, I often find the landscape quite blurry, with overlapping capabilities. Each player tends to cite its traditional competencies as being the best building blocks from which to build a full scale management/publishing platform.

While it's tempting to say "they can't all be right," the fact that so many players are finding market success today indicates that content owners are not monolithic in their specific requirements and that a giant game of matchmaking seems to be occurring between content owners and video management providers. One day there may be a consensus on who truly has the "best" management platform, but for now that day seems to be far off.

What do you think? Post a comment and let us all know!

Categories: Broadcasters, Technology

Topics: Akamai, Anystream, Brightcove, ExtendMedia, Hearst-Argyle, Maven, PermissionTV, thePlatform, WorldNow

-

Video Ad Networks Coverage Continued: SpotXchange, YuMe

As evidence of the market's bullishness on ad-supported video, video-focused ad networks continue to flourish. I recently spoke to CEO/co-founders of two of the larger ones, SpotXchange and YuMe to learn more about their respective differentiators.

SpotXchange CEO Mike Shehan explains that his company has focused on building a real-time auction model for publishers to offer inventory and advertisers/agencies to bid on it. The 2 main verticals

SpotXchange is pursuing are local and casual games. Providing an easy on-ramp to video advertising is the key goal. Advertisers can load their campaigns, enter the marketplace, target by channel and/or region and determine how much they're willing to pay.

SpotXchange is pursuing are local and casual games. Providing an easy on-ramp to video advertising is the key goal. Advertisers can load their campaigns, enter the marketplace, target by channel and/or region and determine how much they're willing to pay. Though it's a fully self-service model, SpotXchange offers client service model as well for larger brand advertisers. Michael says there are now 300 publishers in the networks, reaching 50 million unique visitors per month. The company grew out of Booyah Networks, a search and interactive agency which has fully-funded its development.

Meanwhile, Jayant Kadambi, CEO of YuMe explains that the company spent the first 2 1/2 years from its

founding in October '04 developing an ad-management platform that could handle various ad units and formats. In the absence of standards, Jayant believes this gives the company an edge in servicing advertisers and agencies that don't want to customize assets for various publisher sites' players. YuMe has built a network of 400+ publishers with 46 million uniques/month and a sweet spot of 750K-1 million video views/month and above (for a network total 150 million streams/mo).

founding in October '04 developing an ad-management platform that could handle various ad units and formats. In the absence of standards, Jayant believes this gives the company an edge in servicing advertisers and agencies that don't want to customize assets for various publisher sites' players. YuMe has built a network of 400+ publishers with 46 million uniques/month and a sweet spot of 750K-1 million video views/month and above (for a network total 150 million streams/mo). Jayant says he's been pleasantly surprised at how much video content is monetizable, though he's not suggesting user-generated video will be monetized any time soon. YuMe's CPMs are in the $10-30 range. The company is now in the mode of building scale, which could involve marrying its ad management platform to others' networks using its "Adaptive Campaign Engine." In fact, one recent partnership that was announced to do this was with SpotXchange. YuMe has raised $16M from investors including Khosla Ventures, Accel Partners, BV Capital and DAG Ventures.

I'll have more on other video ad networks and how they fit into the larger broadband industry in the coming weeks.

Categories: Advertising, Technology

Topics: SpotXchange, YuMe