-

News from NAB

The press releases began flying today, timed with NAB's kickoff. Here are a few that caught my eye:

Move Networks Raises $46 Million

Move continues its fund-raising prowess, raising a large C round. As more content providers push the HD quality bar, Move's content delivery services have increased appeal.

Signiant Powers Hulu's Distribution Efforts

Hulu, the NBC-Fox aggregator is using Signiant's media management platform to ingest content from the various content partners it works with.

Widevine Provides Content Security for Microsoft's Silverlight

For the first time Microsoft has used a third-party content security system to add a layer of protection for content providers using the company's new rich media plug-in.

EveryZing Introduced "RAMP," Signs Up Cox Radio

Building on its recent launch of EZSearch and EZSEO to enable video discovery, EveryZing has introduced a management console for the products for which Cox Radio will be the first customer.

Live Streaming Quality Bar Raised Via Mogulus-Kulabyte Partnership

Live streaming gains further traction as Mogulus and Kulabyte announce deal to bring high-quality live Flash streaming to producers.

No doubt there will be plenty more over the next couple of days.

Categories: Aggregators, Broadcasters, CDNs, HD, Mobile Video, Technology

Topics: EveryZing, Hulu, Kulabyte, Microsoft, Mogulus, Move Networks, Signiant, Silverlight, Widevine

-

Why Adobe Media Player Could Matter

Yesterday brought the public release of Adobe Media Player 1.0, first announced almost a year ago. AMP enters a very crowded space of other media players including its own Flash player, plus Windows Media Player, RealPlayer, QuickTime, SilverLight and others.

At a time when the broadband video industry in general and mainstream users in particular crave

standardization and simplicity, can another media player, with a "walled garden" content strategy to boot, add new value? While it's awfully tempting to say "no," I think there are reasons why AMP could well matter, subject to how well Adobe delivers on its vision. Here's why:

standardization and simplicity, can another media player, with a "walled garden" content strategy to boot, add new value? While it's awfully tempting to say "no," I think there are reasons why AMP could well matter, subject to how well Adobe delivers on its vision. Here's why:AMP offers 2 things that, in my opinion, the market still needs. First, a widely used downloadable app that specializes in delivering on FREE video content. Before some of you jump up and say, "Will, what about iTunes?" keep in mind that iTunes offers primarily a PAID video catalog (though to be sure there are some free video podcasts). Second, and related, AMP' provides a download environment in which advertising can be properly inserted, measured and reported on.

These are important because together they open up an entirely new consumer use case for broadband video: offline, free, ad-supported viewing. I've been saying for a while that an odd dichotomy has taken root in the broadband industry, particularly for network programs: users can get either free, ad-supported streamed video at lots of places (provided they're online) OR they can get paid, downloaded video (iTunes model) which allows offline viewing. But this has meant that someone who wants to watch a show offline, but isn't willing to pay for the pleasure of doing so is out of luck (one exception is NBC Direct). Having media stored locally in AMP would allow the offline, free use case I'm describing. This would open up a boatload of premium ad inventory that advertisers savor.

If that's AMP's opportunity, then the question is how well are they executing on it? Though it's never fair to judge a version 1.0 on its first day, my experience with AMP shows there's room for improvement. First is the currently thin content selection that needs to be massively built out to be appealing and competitive. Second is an inconsistent user experience in which some shows are downloadable, yet many are not (e.g. CSI, Hawaii Five-O, Melrose Place). Third are getting the basics right. In my case, when I did download some episodes successfully (blip.tv's "DadLabs" and "Goodnight Burbank") they didn't show up in my download section at all. Ugh. I'm hopeful that Adobe will be able to address all of these.

On the ad side, I think there will be plenty of enthusiasm from ad technology firms to integrate with AMP as Adobe proves it can drive millions of AMP downloads (in fact Kiptronic announced its integration yesterday and other will surely follow). Plus, advertisers should be expected to get on board.

It should be noted however, that even for a mighty brand like Adobe, winning the hearts and minds of users to download and use AMP isn't a trivial undertaking. I have some personal experience with this from my early days consulting at Maven Networks, which offered an eerily similar download app as AMP when the company started up. Though that was in the Mesozoic broadband era of 2003 and Maven was an unknown entity, the company never got much traction with its download app and eventually transitioned over to a streaming model. Since then I've come to believe that premium content must drive the download process, not vice-versa. One successful example of this is ABC.com using its shows to drive millions of downloads of the Move Networks player.

Net, net, AMP is a timely product that could well matter. How well Adobe executes on its vision will determine to what extent it does.

Categories: Advertising, Broadcasters, Downloads, Technology

Topics: ABC, Adobe, Adobe Media Player, Kiptronic, Maven Networks

-

CBS Launches Local Ad Network; Local Space Heats Up

This morning CBS TV Stations is announcing the CBS Local Ad Network with a goal of widely syndicating CBS TV Stations' content into the maze of locally-focused web sites and blogs. A ground-breaking effort, it is the latest evidence that the local broadcast formula is being re-written by broadband's potential. I got an exclusive briefing on the CBS initiative last Friday from Jonathan Leess, President/GM of CBS TV Stations Digital Media and Aaron Radin, SVP, Ad Sales and Biz Dev.

As I wrote early last week in "CBS TV Stations Get Broadband," syndication is a key driver of video streaming growth for the company. Recognizing changing consumer behavior, the new Local Ad Network enables news "widgets" - small information badges carrying local headlines from CBS's 29 stations which can be easily selected and embedded by local sites and bloggers. When users click on a link in the widget they are carried back to the local CBS station site. See the right column in the below example:

Each widget carries ads which are sold by CBS, with a revenue share back to the local site. Radin is excited about the ad network because it has the potential for vastly expanded and targeted ad inventory, which can be sold to many different types of advertisers depending on their goals. For example for AT&T, a charter advertiser, the network provides a national player with enhanced local access. Additionally, the ad network can provide the local CBS station's digital sales team with more in-depth coverage for a local advertisers.

The significance of the CBS initiative is that it continues to show that broadband is opening up new opportunities for local stations to go well beyond their traditional broadcast models. The concept of local newscasts in the morning, evening and late night is increasingly irrelevant. Also gone is the concept of finite air-time. The CBS deal shows that the "shelf space" on which CBS local content sits doesn't even have to be owned by the station any longer. Now the shelf space could just as easily be a 15 year-old local kid's popular blog on local sports who wants to provide a customized feed of high-quality local video to his visitors. Think about how that expands a local station's business model.

The whole area of local content syndication is really heating up. In this deal, CBS has partnered with SyndiGo, a new unit of Seevast to build out the ad network's local web site and blog distribution network. For other local broadcasters seeking to pursue syndication there are other choices. For example, WorldNow (note: a VideoNuze sponsor), which now supports 260+ stations around the U.S. has also stepped up its syndication activity, in addition to technology provisioning. It recently launched Supernanny-related content into its lifestyle channel, enabling more choice and ad inventory.

WorldNow, like other 3rd parties, believe that, in these tumultuous times, local broadcasters should be focused on content, ad sales and distribution, not technology development. With technology and the market moving so fast, that logic makes a lot of sense. WorldNow and others present the classic "buy" vs. "build" option for stations. While CBS and others may "build," there's no question for many other who want to syndicate and drive new ad sales, they'll prefer to do it in a "buy" scenario. All of this activity will have the effect of spurring continued innovation in the space.

One thing's for certain, there are myriad new technology choices and go-to-market options facing local TV broadcasters in the "syndicated video economy." Broadband presents unprecedented challenges and opportunities to an industry that has long operated under a highly formulaic approach.

What do you think of the changes happening in the local broadcast business? Post a comment!

Categories: Broadcasters, Syndicated Video Economy, Technology

Topics: CBS, CBS TV Stations Digital Media Group, Seevast, WorldNow

-

Heavy Plans Big Push for Husky Ad Platform

(Note: This is the second in a series of posts with companies participating in the 2008 Media Summit, a premier industry event which will be held next week in NYC. VideoNuze has partnered with Digital Hollywood, the Media Summit's organizer, to provide select analysis and news coverage.)

Heavy Corporation, which operates Heavy.com, one of the most popular independent broadband video destinations for 18-34 males, is poised to make a push into the ad platform/network business through its

Husky Media unit. I spoke to Eric Hadley, Heavy's chief marketing officer yesterday who filled me in on their plans.

Husky Media unit. I spoke to Eric Hadley, Heavy's chief marketing officer yesterday who filled me in on their plans.The Husky platform is currently used today by Heavy.com. If you go to the site, you'll see how it operates, showing just one ad with the video selected. As Eric explains, the video is wrapped in the advertiser's skin, so upon starting the video player exposes a big interstitial ad for 2 1/2 second that sort of feels like "barn doors" before opening to the video itself. Then when the video plays, display ads surround the content. Additional related content is queued up and automatically starts playing subsequently. This approach has resulted in a 270% lift in videos viewed as compared with the pre-queuing implementation. This of course means more video usage and more advertising exposure.

Eric believes that this video presentation/ad format is unique in the industry (I agree, I haven't seen anything else like it), and goes straight to the biggest question in the industry: how are people actually going to make money from their broadband video content, especially original creations. Husky aims to combine the best of pre/mid-roll ads with the best of display.

Eric believes that this video presentation/ad format is unique in the industry (I agree, I haven't seen anything else like it), and goes straight to the biggest question in the industry: how are people actually going to make money from their broadband video content, especially original creations. Husky aims to combine the best of pre/mid-roll ads with the best of display.Eric said that advertiser enthusiasm for the Husky presentation has prompted Heavy to now offer it to other publishers who target demos other than Heavy.com's 18-34 males. It's still early days, but Eric said that in the next few weeks several major publishers will be launching Husky implementations, as will small-to-medium sized sites. This will form the beginnings of an ad network Heavy can assemble and offer to advertisers. By evolving Husky's focus from internal-only use to external use as well, Heavy will be competing with broadband ad players such as Tremor, Broadband Enterprises and others. The Husky move shows how dynamic the broadband video ad space is, with multiple kinds of formats and implementations being tested and used by content providers seeking to maximize monetization.

Meanwhile Heavy is continuing to build out its Heavy.com destination site, which currently receives 17M+ visitors/mo. Key upcoming focuses are music/urban, cars and racing, sports and travel categories. These are all the purview of the Heavy's recently added head of programming, Jimmy Jellinek, former editor at Maxim. Content sourcing is varied, with Heavy.com producing some of its own, producing some for its advertisers and also some it obtaining some from others, such as Transworld. In the U.S. today, Heavy does not syndicate its programming to others sites, which is a somewhat contrarian position vs. other content providers who are syndicating widely.

Looking ahead to the Media Summit, Eric plans to explain more about the upcoming Husky push and how content providers and advertisers can benefit from it. He also sees the Media Summit as an ideal forum to learn from others what's making a difference in the industry and what's hot.

Categories: Advertising, Indie Video, Technology

Topics: Heavy, Husky Media

-

FreeWheel: Helping Monetize the Syndicated Video Economy

Readers of VideoNuze know that for a long time I've been a big proponent of syndication as a key building block for broadband video success. In last week's webinar I explained that I see this trend only accelerating as content providers increasingly shift from aggregating the most eyeballs to accessing the most eyeballs. That means syndicating video far and wide through social networks, portals, broadband aggregators and others is fast-becoming a key success factor.

Yet aggressive syndication presents a complex set of issues around how to control and optimize the advertising to all those dispersed viewers. Absent the right set of tools to administer each deal's terms, there's a bias toward simplicity and hence, under-optimization. For example, I continually hear that all the broadcasters' syndication deals are 90-10 ad revenue splits. In some cases a plain vanilla approach like this may be fine. More likely though, to have a biz dev person's hands tied to very limited deal terms because of a lack of technology solutions significantly constrains the ecosystem.

FreeWheel is a new company aimed at unlocking these constraints with its "Monetization Rights Management" or MRM technology platform. MRM is a full ASP platform that empowers content providers'

biz dev teams to cut creative revenue/inventory sharing with syndication partners and then have ad sales teams follow through with far more intelligence about how to implement these deals and sell inventory. The result is revenue optimization for all parties. I caught up with CEO Doug Knopper, co-CEO and co-founder of FreeWheel last week to learn more.

biz dev teams to cut creative revenue/inventory sharing with syndication partners and then have ad sales teams follow through with far more intelligence about how to implement these deals and sell inventory. The result is revenue optimization for all parties. I caught up with CEO Doug Knopper, co-CEO and co-founder of FreeWheel last week to learn more. FreeWheel sits on top of existing ad management systems, as a sort of cross between a digital traffic cop and a green eyeshade - dynamically managing and allocating ad inventory, while keeping track of all ads and revenue across the content provider's syndicated network. MRM interfaces to a content provider's and partner's content management system through FreeWheel's API, allowing MRM to implement its predetermined business rules alongside the content being sent to partners. Clearly there's a huge network affect opportunity for FreeWheel - the more partners its early content provider customers get to implement MRM, the easier FreeWheel's sale will be to subsequent content providers.

FreeWheel reminds me a lot of Signiant, which I wrote about recently. Signiant is more focused on content distribution in a syndicated economy, while FreeWheel is focused on ad management. But both companies share a common purpose of greasing the skids for both content providers and distributors to play ball with each other with the intention of driving more video views and advertising revenue.

FreeWheel has signed up Next New Networks, Joost and Jumpstart Automotive Media as initial clients. The company was founded by three former DoubleClick executives, has 40 employees and has raised 2 rounds from Battery Ventures, though the total is undisclosed.

Categories: Advertising, Startups, Technology

Topics: FreeWheel, Joost, Jumpstart Automotive Media, Next New Networks, Signiant

-

Yahoo Acquires Maven, First Hilmi Ozguc Interview

The rumor mill of the past 2 weeks proved correct, as Yahoo announced this morning that it has acquired

Maven Networks for $160M. By my count this is the biggest pure-play broadband video deal to date, and is an excellent validation of broadband video's growing importance in the media and technology landscape.

Maven Networks for $160M. By my count this is the biggest pure-play broadband video deal to date, and is an excellent validation of broadband video's growing importance in the media and technology landscape. Hilmi Ozguc, Maven's CEO and co-founder, provided me with an exclusive briefing about the deal, his first comments following the announcement this morning. (As a quick disclaimer, I did some business development and product strategy consulting work for Maven and Hilmi in the company's early days. I didn't have any current financial relationship with Maven.)

As Hilmi says below, and as I've said before (most recently in "My Rant About Super Bowl Ads"), broadband video is increasingly becoming the terrain of the big guys - the biggest brands, publishers, technology providers, networks, etc. As the broadband medium continues to mature, its ability to attract ad

dollars from incumbent media, particularly TV, is going to strengthen. This process will be accelerated by Yahoo as it seeks to drive Maven's capabilities into its customer and partner base.

dollars from incumbent media, particularly TV, is going to strengthen. This process will be accelerated by Yahoo as it seeks to drive Maven's capabilities into its customer and partner base. Following is a summary of my briefing with Hilmi:

Why did you sell the company?

Broadband video is increasingly going to be a game fought between titans because billions of dollars are at stake and the question is how do you get to the top 50 or 100 global media brands and advertisers? We've focused on building tools and technologies that these media companies need. The time to sell was excellent as was the return for our investors.

Can you describe the sale process?

We had several high profile bidders, although I can't identify them. It was gratifying to see multiple companies validate the product initiatives we put in motion 2 to 2 1/2 years ago. Yahoo has the resources to buy anyone. They took a deliberate approach and looked far and wide and concluded that Maven was the right company to buy. The whole process took several months from start to finish. The deal was for $160M, mostly in cash and it officially closed yesterday.

What group will Maven report into?

Maven will be integrated very quickly and deeply into Yahoo because video is so key to what Yahoo is doing in terms of advertising. This will not end up being a little business unit off to the side somewhere. Our engineering team will be part of Yahoo's engineering team. All Maven executives including me will be staying and have similar responsibilities to what we've been doing. A lot of work has already gone into the integration.

Who do you report into?

I'm not sure I'm at liberty to discuss that, as it would be a little too revealing of Yahoo's strategy, but I think it's in the right place to be within the company.

What does Yahoo bring to Maven?

Enormous reach, 500M visitors around the world per month. An incredible roster of advertisers and publishers who are already in their ecosystem. Interesting and complimentary engineering capabilities. A sheer ability to scale this massively. This deal is all about getting our stuff into the hands of the biggest media, publishing and advertising companies and having it exposed to a massive audience. We started as a media technology company, and evolved to mostly an advertising business. So combining with the leader in display advertising was very logical. Being plugged deeply into a company that sells close to $2B of advertising every 90 days is a huge opportunity for us. It's a massive advertising machine.

Does Yahoo-Maven portend more consolidation?

Absolutely. I just don't see how as a small startup you can have a significant enough piece of the pie when all the giants have now woken up and have video as front and center. Other big players are going to come in more aggressively.

What are the implications of Microsoft's takeover bid of Yahoo on Maven?

We need to stay focused at Maven, and as long as we do that I'm not concerned about any distractions. And I shouldn't really talk about the Microsoft deal either!

What are the 2-3 lessons you've learned about the broadband video market in 5 1/2 years since starting Maven?

When we started virtually nobody really believed in video being delivered on the Internet. We had a singular vision that said, look, once broadband is in enough homes, video is going to take off. So that was our first mission: delivery of bits, playback, HD-quality, etc. As the market evolved, the Akamais of the world solved a lot of the delivery problems, so we shifted our focus to publishing and content syndication, advertising and monetization. Basically, how does a media company generate revenue from broadband? So we evolved along with the market. We tried to stay focused on advertising, professional video and largest media companies.

This is your second successful startup - what lessons do you have for entrepreneurs?

1. Focus is the most important thing and ignoring the naysayers. It's natural to want to hedge, but you have to be bold enough to make decisions. Markets do take time to develop. We were early no question, but the market caught up and we were at right place at right time when it did. 2. Agility is also important and being analytical about what the market is saying. So the ability to shoot a direction and switch. And do it fearlessly. Trial and error is key. 3. Bet on the right people. The wrong people can steer you down the wrong path. So you essentially have to be the world's most capable talent scout, to build a team of people at all levels of the organization. A great team will figure it out.

Where's the broadband video market going from here?

Startups got this space going and created a lot of the core technology and innovation, but this is no longer a game of startups. Big media companies want to deal with big technology companies and networks. Big advertisers want to work with biggest publishers. To achieve this scale independently would be very difficult.

What are the key challenges for broadband video market?

I don't want to say the "R" word that everyone's talking about, but if it comes, I hope it's a mild one. As we know, advertisers cut back quickly in difficult economies. Though I don't think this will happen in broadband because it is so promising and it's still pretty small. Another challenge is getting ad agencies and advertisers to think of broadband as being interactive and capable of more than TV ads. You've talked about that a lot at VideoNuze. And finally the need to scale the technology and infrastructure so it's rock-solid and dependable. That's what Yahoo and Maven will focus tightly on. And I think we have all the tools between us to grab the undisputed leadership position in this, if we move fast enough.

So are you going to do startup #3?

My focus for now is on integration and marshalling all these terrific resources. Yahoo has a great team and has been chomping at the bit to have a competitive video offering to sit alongside their display offerings. They have a killer ad sales force, along with great relationships with the biggest publishers. They have mastered how to play on the media company side, and in being a partner to other media companies. We can't wait to get going.

Congrats again.

Categories: Deals & Financings, Portals, Technology

-

CES 2008 Broadband Video-Related News Wrap-up

CES 2008 broadband video-related news wrap-up:

Panasonic and Comcast Announce Products With tru2way™ Technology

Panasonic And Comcast Debut AnyPlay™ Portable DVR

NETGEAR® Joins BitTorrent™ Device PartnersD-Link Joins BitTorrent™ Device Partners

Vudu Expand High Definition Content Available Through On-Demand Service

Sling Media Unveils Top-of-Line Slingbox PRO-HD

Open Internet Television: A Letter to the Consumer Electronics Industry

Paid downloads a thing of the past

Samsung, Vongo Partner To Offer Movie Downloads For P2 Portable Player

Comcast Interactive Media Launches Fancast.com

New Year Brings Hot New Shows and Longtime Favorites to FLO TV

P2Ps and ISPs team to tame file-sharing traffic

ClipBlast Releases OpenSocial API

Categories: Advertising, Aggregators, Broadband ISPs, Broadcasters, Cable Networks, Cable TV Operators, Devices, Downloads, FIlms, Games, HD, Mobile Video, P2P, Partnerships, Sports, Technology, UGC, Video Search, Video Sharing

Topics: ABC, BitTorrent, BT, Comcast, D-Link, Disney, Google, HP, Microsoft, NBC, Netgear, Panasonic, Samsung, Sony, TiVo, XBox, YouTube

-

Showtime Innovates with "Dexter" Finale

I continue to be impressed with Showtime's innovative use of broadband video to increase fan loyalty while adding new value to their programs and bolstering their brand image.

The latest example is a mini-site built for its "Dexter" season finale featuring an exclusive video of the 3 executive producers chatting about the finale and the program's story lines, with comments from various actors interspersed. The video premiered after last Sunday night's finale and is paired with a chat capability powered by Meebo, allowing rabid fans to interact with each other.

I caught up with Rob Hayes, SVP of Digital Media at Showtime and his colleagues Ken Todd and Michael Kuritzky to learn more about their motivation and how the mini-site has performed. It sounds like a resounding success. Video views are running 5 times greater than any one clip offered on the Showtime web site and the chat room has generated tens of thousands of users. There's also a sweepstakes on the site, which requires an email address to sign up. Rob reports that these sign-ups have increased Showtime's email list by 30% alone.

Showtime's motivation was to forge a deeper connection between fans and the program by providing ongoing interaction. So while there's no direct monetization of the mini-site, Rob said next time around, they could easily insert pre-rolls or overlays. And that means that Showtime, a stalwart premium programmer, would be leveraging broadband to create a new advertising revenue stream.

All of this demonstrates how this relatively modest video initiative is at the center of generating multiple rewards. It provides new value for fans. A basis around which to interact. Email addresses to use for ongoing communications. A new monetization path. Lessons learned for how to succeed in a multi-platform environment. An enhanced brand image. And the list goes on. Kudos to Showtime for continuing to be an innovator and showing others that broadband success comes in all shapes and sizes.

Categories: Cable Networks, Technology

-

Signiant: Plumber for Broadband Video Era

As many of you know, business development executives (and CEOs!) tend to be guilty of "throwing completed deals over the wall", expecting operations people and developers to implement as intended, while they move on to do the next deal. I know this first-hand as I was a biz dev guy for many years!

Yet, as I learned over many years and with multiple companies, each and every deal comes with its own particular implementation characteristics. These include things like multiple formats, encoding rates, business rules, file transfer processes, approvals and so forth. Do enough deals and pretty soon you've introduced massive complexity into your organization involving tons of manual tasks and costs which can quickly erase any profitability the underlying deal assumed.

This is where a company named Signiant comes into play. They're a sort of "plumber for the broadband video era." This unglamorous-sounding description does them no injustice; just think for a moment what the world would be like without actual plumbing, and you then you'll begin to appreciate how important the role

is that Signiant plays in powering broadband video. The executive team includes a number of ex-Avid people, who bring a valuable perspective to the challenges of broadband video distribution. And as the broadband video market matures further and a spiraling number of deals get done, the plumbing to move all this video around only becomes more complex.

is that Signiant plays in powering broadband video. The executive team includes a number of ex-Avid people, who bring a valuable perspective to the challenges of broadband video distribution. And as the broadband video market matures further and a spiraling number of deals get done, the plumbing to move all this video around only becomes more complex. Last week I caught up with Tony Lapolito, Signiant's VP of Marketing who shared the company's strategy and product details. While the company's been around for over 10 years (staring as an internal project at Nortel), it has only identified the media industry as a key vertical focus in the last 2 years. It has quickly won respect, working with marquee customers like NBC, Disney, BT and just yesterday announcing a deal with Current.

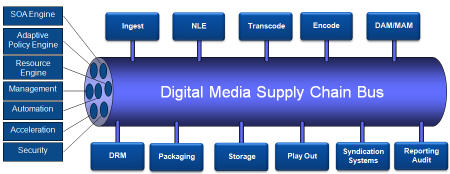

Signiant brings an enterprise orientation to broadband video delivery, considering itself a "digital media supply chain" company. This may be unfamiliar territory for some of you, so to boil it down, the point of Signiant is to ensure that desired content is where it needs to be, when it needs to be there, and delivered with maximum efficiency, least cost and highest security/reliability. Below is a basic diagram depicting how Signiant works.

Signiant allows users to set up work flow processes to automatically handle a wide range of tasks. For example, NBC currently uses Signiant to securely distribute its content to approximately 20 partners following business rules for each. Tony said NBC expects its partnership roster to rise to 200 in the next 2 years and that Signiant will allow it to scale by allowing easy configuration of the content distribution process and business rules for each of these new deals.

Signiant does a lot of other things, such as prioritizing and allocating bandwidth, tracking all digital assets and managing approvals, all while tying into existing digital asset management systems and other legacy platforms in use. For Current, Signiant is streamlining the process of uploading viewer-created content, allowing Current to more quickly collect, approve and post inbound video.

There's not enough space to get into further detail, but suffice to say, if your operation is already groaning under the weight of implementing myriad deals, and/or you're pursuing a distribution-centric business strategy for your broadband video assets, it's well worth understanding the technology and business case behind Signiant.

Categories: Technology

Topics: Signiant

-

Move Networks $40.1M Round Could Increase, '08 Expansion Planned

Move Networks, which quietly closed on a recent $40.1 million second round, may expand it further pending diligence being conducted by one more investor. Move CEO John Edwards shared the information with me in a briefing. The company still hasn't officially announced the round or its participants. John did say they're mainly strategic investors and the official word should come in a couple of weeks. The funding comes on top of its $11.3 million first round announced in February '07.

Move is focused on high-quality broadband video delivery, especially for long-form content, and optimizing the user experience. It is clearly gaining traction with both customers (e.g. Disney, Fox, CW, Discovery, etc.) and users. Move's client runs its proprietary adaptive "stream selection protocol", which dynamically detects the user's bandwidth and CPU, thereby optimizing the video experience. This leads to low video stall-out or re-buffering incidents, which Move believes is the #1 cause for terminating video sessions.

Move is focused on high-quality broadband video delivery, especially for long-form content, and optimizing the user experience. It is clearly gaining traction with both customers (e.g. Disney, Fox, CW, Discovery, etc.) and users. Move's client runs its proprietary adaptive "stream selection protocol", which dynamically detects the user's bandwidth and CPU, thereby optimizing the video experience. This leads to low video stall-out or re-buffering incidents, which Move believes is the #1 cause for terminating video sessions.John shared a few interesting statistics. Its customers have delivered Move-powered video to a cumulative 27 million users since March '07. Using its client, Move can track all manner of user behavior including time spent with the selected video. This yields another stat: for a single one hour episode delivered, approximately 60% watch longer than 30 minutes, with an average session length of 53 minutes.

Demonstrating that it can deliver higher-quality video and consistently longer viewing is at the heart of Move's value proposition, as it allows content providers to sell more ad inventory, driving top line revenue and ROI. Move also offers an ad module, allowing improved targeting and insertion of flexible cue points based on user behaviors plus a drag-and-drop syndication feature. The company also focuses on reducing customer expenses by optimizing delivery over multiple CDNs and augmenting this with a peer-sharing capability.

Move has a lot on its plate going into '08. John says they are running projects with all the major networks, are supporting all the live streaming for the Olympics plus lots of other live event broadcasts, rolling out integrations with set-top boxes and expanding internationally with new offices in Europe and Asia.

Categories: Technology

Topics: CW, Discovery, Disney, FOX, Move Networks

-

Building B Has Cable and Satellite in its Crosshairs

Building B is major league stealthy company with an audacious vision for how consumers will access video content in the future. If it succeeds current multichannel video service providers (namely cable and satellite providers) will feel the brunt.

Building B has a blue chip executive team and pantheon of accomplished investors and advisors. It made headlines a few months ago when it announced a $17.5M funding round led by Morgenthaler Ventures, OmniCapital and Index Ventures.

Last week I had a briefing with Buno Pati, CEO/Co-founder and Phil Wiser (Chairman/President/Co-founder). They are both highly-experienced and successful technology executives who are also quite PR savvy. They know how to stay on message and close to their stealthy script. I needed to use my "virtual crowbar" persistently to try to pry a few new morsels of information out of them. From what I learned, it's a pretty cool story. Following is what I learned about what the company.

The company's plan rests on a number of key assumptions:- TV must be the center of the consumer video experience, and today's service must be redefined

- Access to broadcast content is critical for success

- On demand, high def is in, linear, standard def is out

- Open access to robust wireless networks will be prevalent

- Advertising will be key value driver in the future

- Price of storage is going to virtually zero;

Given all this, in Buno's words, "Building B's opportunity is to unify, simplify and deliver a video experience to consumers at a more palatable price." This simple sounding statement belies an excruciatingly tall order.

The company is creating a next generation set top box of sorts that will deliver the gamut of video: TV, movies and broadband. Buno and Phil don't see their box as comparable to ones from say Akimbo, Vudu or Apple TV. These are really broadband-only augments, whereas Building B aspires to be a full-on substitute for cable or satellite. Their box will be able to access content through both wired and wireless delivery infrastructures. One engineering challenge is to match content with the optimal delivery network. So for example, one-to-many broadcast networks might be delivered over wireless while niche and interactive content would use broadband.

But Building B doesn't see a model selling the box at retail (though Phil concedes this might be a secondary outlet). Others have tried and failed at retail. Rather, its go-to-market strategy contemplates partnering with service providers like telcos and ISPs which want or need to be in the video business, but don't have the stomach or cash to upgrade their networks to do so.

Building B plans to develop a video entertainment service offering incorporating its box which can be made available turnkey to partners. These partners could include smaller telcos, particularly in rural areas, which have traditionally stapled on a satellite offering to fill out their triple play bundle. Or they could be larger telcos like AT&T or Verizon, who might augment their fiber rollouts with Building B's approach. Or they could be broadband ISPs, portals and others who aspire to be in the video business.

A key hurdle for Building B is assembling a fully competitive video lineup to what today video providers offer. This is no easy feat. Cable programmers in particular are reluctant to make advantageous deals with new distributors for fear of antagonizing existing cable and satellite affiliates. Yet Buno feels confident that Building B will gain access to major cable networks' fare, on demand, and on deal terms that are both economic to the company and non-disruptive to these networks' current arrangements. Accomplishing these deals alone would be noteworthy.

Lastly, Building B envisions delivering a personalized and easy-to-access service. Buno speaks of having a "dumbed down approach" aimed at satisfying only primary consumer needs and routines. Given its emphasis on HD, this is the part of the Building B vision that must necessitate a colossal hard drive in the box to cache content for ready access. Indeed, Buno said the company is "betting heavily that the price of storage is going to zero." If this assumption is off the bill of materials on storage alone could bust the box's budget.

Listening to Building B's vision, it's hard not to get enthusiastic about the world it seeks to create. As a consumer it would be thrilling. Yet the technology landscape is littered with ambitious would-be contenders whose aspirations foundered when faced with real-world engineering, marketing and business model challenges. Building B is simultaneously climbing tall mountains in multiple directions. If it succeeds, it will become a big-time disruptor of today's business models. It's going to be fun to watch it try.

Categories: Cable Networks, Cable TV Operators, Devices, Startups, Technology

Topics: Building B, Index Ventures, Morgenthaler Ventures, OmniCapital

-

How to Monetize a Video Archive? XONtv and Gotuit Show the Way.

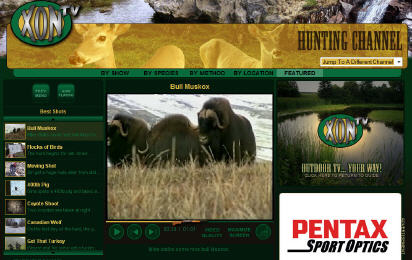

I'm very jazzed about an initiative being announced this morning by XONtv.tv and Gotuit Media Corp available at http://www.xontv.tv/(Xtreme Outdoor Network, a broadband programmer).

If you're sitting on a video archive and looking to monetize it more fully with an immersive broadband user experience, it's well worth checking out.

I have been very bullish on broadband's ability to create libraries of searchable segments carved out of longer-form programming. That's one of the reasons I was excited about Comedy Central's recent launch of TheDailyShow.com, which is packed with 19,000 clips from all of the show's episodes. However, Comedy Central 'fessed up that it took a team of 16 working double shifts over many months to create the site's clip library. This labor intensity shows that monetizing an archive has been a non-trivial pursuit.

And that's where Gotuit's solution comes in. Yesterday I got an update from Patrick Donovan, their VP of Marketing, about the XONtv deal.

First, to understand Gotuit (to which I am a minor advisor), the company has created an indexing work flow platform that allows entry-level staffers to quickly churn out clips using metadata guidelines developed by the specific content provider. Each segment has a title, a text description, a series of customizable preset attributes (or tags), thumbnails and time-code start/stop points.

One thing that's critical to understand is that Gotuit-powered clips are really "virtual clips." When a user accesses a clip, the Gotuit platform is making an XML call to the CDN to begin streaming from the original video file at the time-code starting point. So no new tangible clip asset has actually been created in the Gotuit workflow. That means that unlike TheDailyShow.com, which now has 19,000 new assets to manage (likely created using standard video editing software), with Gotuit, there are new no "assets", just files with metadata descriptors. Needless to say, this approach drastically simplifies ongoing management, especially for content providers with vast libraries. By following the metadata guidelines, playlists can be created which allow multiple entry points into each video segment.

XOXtv partnered with Gotuit as a service provider, shipping Gotuit 300+ hours of XONtv's video programming. Gotuit took about 1 1/2 weeks to crank out all the clips. At the XONtv site you'll see 13 "channels", each of which is then sub-divided into programs, "episodes" and the segments themselves. All content is in the clear right now, soon XONtv will be pursuing a subscription-based business model.

Other benefits of the Gotuit approach include no buffering, full-screen option, embedding, bandwidth detection and sequential play-out. All of this means a more immersive experience, driving more viewership and value. On the monetization side, Gotuit has integrated with a number of broadband ad management/servers, and obviously offers rich targeting against specific segments otherwise unavailable. Alternatively, as XONtv intends, paid models are also supported.

Gotuit can work as a service bureau for the content provider or license the platform and let the content provider use their own resources to index their video. (I happen to believe this would be a perfect off-shore project, with the right training). In either service bureau or license model Gouit charges an ongoing platform fee plus usage fees tied usually tied to video consumption. Beyond XONtv, Gotuit has announced deals with Fox Reality, SI.com, NHL.com and others.

The XONtv implementation is a great reminder of how broadband enables deeper user engagement, business model flexibility and re-use opportunities never before possible. Wrap a robust social/community-building suite around this and the value proposition for content providers becomes even stronger.

Categories: Indie Video, Partnerships, Technology

Topics: Comedy Central, Gotuit, TheDailyShow.com, XONtv

-

ExtendMedia Powers SanDisk Broadband Video Initiatives

I recently caught up with Keith Kocho, founder of ExtendMedia to discuss how Extend is supporting SanDisk's recently announced Sansa TakeTV player and companion Fanfare application. In a recent review, I was impressed with SanDisk's approach, which is somewhat akin to the iPod-iTunes pairing. Extend (disclaimer, a VideoNuze sponsor) is playing a key behind-the-scenes role, which will become especially important as FanFare transitions from its current trial model to a hybrid ad-supported and paid download approach.

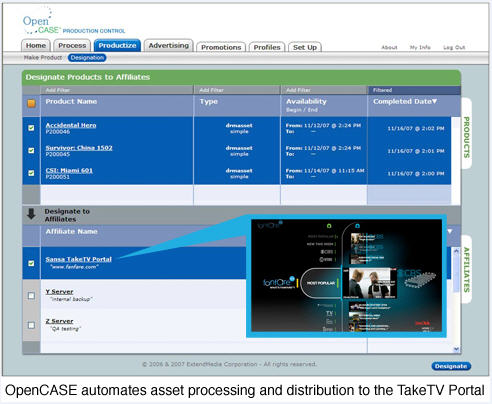

Keith explained that Extend's OpenCASE product is providing the ability for SanDisk to manage Fanfare's content catalog, create the business rules for each piece of content and deliver encryption depending on the rules. OpenCASE also allows SanDisk to bake ads into the video file as its currently doing, or dynamically insert them as SanDisk intends to do in the next phase.

The screen grab below illustrates how a piece of content uploaded to OpenCASE can be delivered into Fanfare with appropriate rules.

Kate Purmal, SanDisk's SVP/GM for Digital Content offered this perspective, "OpenCASE is seamless and flexible and has proven to be truly 'plug and play; with our encryption and DRM software with Extend's business rules layered on top. As we expand into our next phase with more content and commerce options, OpenCASE is going to be able to easily scale up with Fanfare."

I think Kate's latter point hits the nail on the head: in the future, for any of these digital video stores to succeed - whether they are tied to a device, as Take TV is to Fanfare, or they aren't - the digital video stores of the future are going to all offer hybrid approaches for consumer to access content.

The concept of an iTunes, which only offers an a la carte purchase/download model is going to quickly become antiquated. Instead consumers will be offered choices including a la carte downloads, ad-supported downloads, ad-supported streaming, ad-supported and paid subscriptions and more. This is one of the hallmarks of broadband - that it offers content providers and aggregators unlimited monetization flexibility depending on the circumstances and rights. As such, I think that platforms such as OpenCASE and others that can support flexible models are going to become increasingly valuable.

Categories: Devices, Technology

Topics: ExtendMedia, SanDisk

-

Adap.tv Improves Broadband Video Ad Targeting with CPC Approach

As the broadband video world continues to coalesce around advertising as its primary business model, there is a flurry of companies seeking to improve the monetization process. As I've written before, this is critical work, because at some point the bloom will be off the broadband video rose if participants can't earn an attractive ROI.

Enter Adap.tv, which is addressing the ad monetization challenge. The company was founded last year and is based in San Mateo, CA. It is backed by Redpoint and Gemini and now has 20 employees.

CEO/co-founder Amir Ashkenazi recently gave me a run-down on Adap.tv's approach and progress. Amir was the founder of Shopping.com, which was acquired by eBay and he has brought together many former colleagues for his experienced management team.

Like its competitors, the heart of Adap.tv's model is its ad targeting and relevance engine. Adap.tv uses a "multi-disciplinary approach": analysis of the video/audio (context, metadata, etc.), analysis of the ad (keyword submission, etc.) and analysis of the user (demographics, location, etc.). This data is then fed to a matching engine to pair ads with the most relevant video. Over time the system optimizes based on actual click behavior.

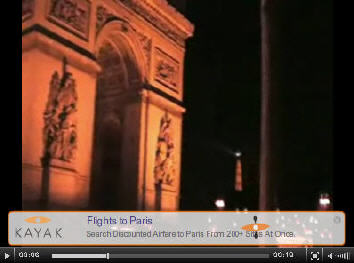

Adap.tv is highly focused on overlays (Amir believes this will be the "de-facto standard" soon), and provides a series of customizable templates for advertisers (see below Kayak overlay). It is also positioning itself as a cost-per-click model, so there's no fixed cost to advertisers. In fact, advertisers can power Adap.tv ads using the same keyword feeds they use for their keyword campaigns.

So far publishers have been responsive to the CPC model because they see overlays as opening up a lot of untapped inventory. Obviously implementing overlays needs to be done judiciously or the viewer experience will become cluttered and broken. Amir believes the whole broadband video ad model will move to CPC over time as advertisers become more sophisticated and focused on performance. This Google-like model would be very good news for advertisers, but would be a brave new world for traditional broadcast and cable networks long accustomed to CPM approaches in their traditional businesses.

While I think a more performance-based broadband ad environment would be welcome, I continue to believe a CPC/overlay approaches will ultimately co-exist with CPM/pre-rolls. There's a lot of interest in overlays, yet there are too many great 15 and 30 second TV spots not be re-used online and the CPMs are way too rich for big branded content providers to walk away from.

Other companies that are in the contextual analysis and/or overlay space include: ScanScout, Digitalsmiths (note: a VideoNuze sponsor), YuMe, blinkx, VideoEgg, YouTube, Brightcove, AdBrite, Viddler (which TechCrunch just wrote about yesterday) and others I'm sure I'm missing or are yet to surface.

Categories: Advertising, Startups, Technology

Topics: Adap.TV, AdBrite, Blinkx, Brightcove, Digitalsmiths, ScanScout, Viddler, VideoEgg, YouTube, YuMe

-

Red Lasso: Exclusive First Look

Red Lasso is a stealthy company that's been around for about 2 years, though only now coming up to the surface. I did a phone briefing earlier this week with Kevin O'Kane, President/founder and Al McGowan, COO. They also gave me access to the private beta and I've been playing around with it for the last couple of days.

Red Lasso's goal is "to help broadcasters extend the life of their content, legitimately." They're positioning themselves as "an anti-YouTube", allowing broadcasters to proactively contribute long form video and audio, which users can then search and clip for exactly the content they're looking for. The video can simply be watched or it can be embedded. Though they don't want to be seen as an "online DVR", it is tempting to see them as such. Monetization is most likely through advertising, though a licensing model is possible as well.

Red Lasso's playing in the same basic space as Voxant (note: a VideoNuze sponsor) and Clip Syndicate (see this for more), with a key differentiator being the long form content availability and clipping feature. Red Lasso is currently taking 150 different broadcast feeds from around the country, and their ability to get the industry to cooperate is helped by the fact that Al and Kevin are broadcast veterans.

Red Lasso is trying to appeal to at least 3 types of users: broadcasters seeking to flexibly publish specific video clips on their own sites, independent web sites trying to feature key segments of their own video (e.g. sports teams) and bloggers seeking to embed video. They believe this third group is the most fertile territory and I agree.

Bloggers across the spectrum (politics, entertainment, sports, etc.) have been hungry for video clips to enhance their sites. I believe this demand will only increase. If you're a blogger looking just for the "money quote", clipping from long form assets provides a lot of value. I did some searching and clipping (below is one result).

I found the clipping pretty straightforward, and I liked the fact that I could save mine, which I can also publish to the community for widespread viral use if I choose to. The searching is based on phonetic and closed caption text. It was not quite as accurate as I hoped, but video search is a very tough nut to crack, and so I'd expect room for improvement there.

At a strategic level, Red Lasso again demonstrates how broadband's influence is going to be felt in the broadcast TV industry. I think traditional concepts of appointment viewing, geographic constraints and local ad sales are all going to seem quaint as broadband allows quality video to fly around the net. I'd urge broadcasters to be looking closely at all the players in this space.

Red Lasso has a staff of about 20 and is based in King of Prussia, PA. It has raised $6.5M from investors including Pat Croce (former head of Philadelphia 76ers), Anthem Capital, Osage Ventures and the Guggenheim Opportunity Fund.Categories: Broadcasters, Technology, Video Sharing

Topics: Anthem Capital, Clip Syndicate, Guggenheim Opportunity Fund, Osage Ventures, Pat Croce, Red Lasso, Voxant

-

Exclusive Brightcove Update with Jeremy Allaire

Yesterday I did an hour-long briefing with Jeremy Allaire, Brightcove's CEO/founder at their Cambridge offices.

If I were to make a list of the 5 questions I've been asked most frequently over the last two years, "What do you think about Brightcove?" would easily be on the list. Certainly a lot of the attention Brightcove has generated relates to its fund-raising leadership. Through three rounds, the company has raised $82 million, including the monster $59.5 million C round closed in January 2007.

By my count the only pure-play, private broadband video company that has raised more is Hulu, which raised $100M in one round from Providence Equity. But Hulu's probably not a fair comparison given that NBC and News Corp are the company's primary owners and are contributing exclusive content. (btw, if anyone has a different take on who's raised more, please leave a comment)

So this briefing was a great opportunity to get a first-hand update and also channel many of the follow-on questions I've been asked about Brightcove. (Full disclaimer, Brightcove is a VideoNuze sponsor.) Jeremy also shared some new stats with me that haven't been disclosed before.

(To read the full update on Brightcove's positioning, Broadband Video Market and Advertising, Syndication and Going Forward, click here)

Categories: Technology

Topics: Brightcove

-

Exclusive Brightcove Update with Jeremy Allaire

Yesterday I did an hour-long briefing with Jeremy Allaire, Brightcove's CEO/founder at their Cambridge offices.

Background

If I were to make a list of the 5 questions I've been asked most frequently over the last two years, "What do you think about Brightcove?" would easily be on the list. Certainly a lot of the attention Brightcove has generated relates to its fund-raising leadership. Through three rounds, the company has raised $82 million, including the monster $59.5 million C round closed in January 2007.

By my count the only pure-play, private broadband video company that has raised more is Hulu, which raised $100M in one round from Providence Equity. But Hulu's probably not a fair comparison given that NBC and News Corp are the company's primary owners and are contributing exclusive content. (btw, if anyone has a different take on who's raised more, please leave a comment)

So this briefing was a great opportunity to get a first-hand update and also channel many of the follow-on questions I've been asked about Brightcove. (Full disclaimer, Brightcove is a VideoNuze sponsor.) Jeremy also shared some new stats with me that haven't been disclosed before.

Positioning

Brightcove's positioning has shifted around in the 18 months since its official launch causing many industry tongues to wag.

Jeremy explained that in the summer of 2007 the company did a candid assessment of its competitive standing across areas in which it was involved. While his original vision included a consumer-facing destination site (named Brightcove TV), this assessment concluded that with YouTube's dominance, Brightcove's goal to be number 1 in that business was unlikely to ever materialize. Further, the potential for conflict with its own media customers had become real. So though Brightcove TV had 8 million unique visitors in August, 2007 according to comScore (making it the number 5 player in that space), Brightcove decided to de-emphasize it and reduce investment spending on it to zero. As a result, Brightcove TV now functions mainly as a showcase site.

The company narrowed its focus to its broadband media publishing and management platform, which Jeremy says is now used by 4,000 professional publishers (sample list here), which Brightcove thinks makes it number 1 among its competitors. These publishers operate 7,000 web sites with an estimated combined reach of 120 million unique visitors per month.

The platform business model includes an annual software licensing fee with upside revenue based on the customers' usage. Jeremy denied that the company is taking ad revenue shares in lieu of platform fees, a rumor that has persistently circulated in the market. Brightcove has also continued to build out a professional support team serving the gamut of design, support, integration and customization required by customers.

Broadband Video Market and Advertising

From Jeremy's vantage point the major media companies Brightcove is serving are aggressively focused on building out their direct-to-consumer broadband video destinations, and only recently have they begun also considering syndication. Brightcove's customers' business models skew overwhelmingly in favor of advertising support, with only negligible interest being shown in Brightcove's commerce capabilities.

On this point Jeremy and I have been in agreement for a long time - the macro factors driving ad-supported broadband businesses are very strong, while those driving paid downloads continue to be challenged. The key catalysts for paid models will be mass connections from broadband to TVs, better portability and improved competitiveness with the DVD platform. In the longer-term all of these will no doubt fall into place, however, for as far as the eye can see, broadband is going to remain an ad-dominated industry.

The follow-up question of course is, what kind of advertising will predominate? Brightcove supports a range of options and Jeremy said that recently interest in overlays is running very high, though 15 second pre and mid-rolls are still used by 99% of its customers today. There's a lot of planning or rolling out of overlays coming shortly by Brightcove customers. People.com was shown as an example of a hybrid pre/mid-roll and overlay model that Jeremy thinks will become more prevalent.

Syndication

Brightcove is also starting to see heightened interest in syndication, and the company offers a set of tools to support it. One example Jeremy showed which I haven't followed is Sony BMG's "MusicBox" service, which offers an array of syndication options. Sony BMG demonstrates that for sites serious about syndication, it's about far more than moving video files around to third parties. Of course the goals of syndication are still to proliferate the content and brand to drive new revenues from far-flung corners of the Internet, but the mechanisms for optimizing this can be quite involved. There's integration of players, advertising, widgets and more. I've been very bullish on syndication for a while, and the actions by Hulu and CBS's Audience Network to distribute their content show real signs of life in the syndication model.

Going Forward

Not surprisingly, Jeremy's extremely bullish on broadband's future growth and sees opportunities galore to grow Brightcove's revenues by deepening its penetration of existing customers, driving more international business, especially in Asia, and expanding its fledgling presence in the enterprise/government sectors, where there's also been a lot of recent interest.

Regarding competition, Jeremy says Brightcove still sees internal development as an alternative being considered by some major media companies, though to a lesser and lesser extent recently. He also volunteered that both Maven and thePlatform are two companies Brightcove sees most often competing for deals. When asked what differentiates Brightcove, Jeremy cites product quality, ease-of-use, customer/market leadership, quality of its people and R&D. On this last point, he believes Brightcove's relatively deep pockets have helped it maintain a far more aggressive R&D budget, which grew by 300% this year.

Key upcoming priorities include launching "Brightcove Show", its new HD initiative, "Aftermix", its mash-up feature, which just finished up its beta test, multimedia capabilities (photos and audio) and enabling a slew of social/sharing features.

I couldn't resist asking Jeremy about Brightcove's last round valuation rumored to be north of $200 million. I've heard much skepticism in the market that the Brightcove's platform-centric strategy does not justify this lofty figure.

Jeremy's response is that based on the company's current revenue and recent growth trajectory, it has "grown into" its valuation and that its multiple is comparable to others he's aware of. His main objective is building a "significant global business" and if that's accomplished then there will be numerous options open for what ultimately happens with the company. He wouldn't comment on M&A, IPO or other potential exits, only saying that he feels no pressure from his investors to liquify their positions any time soon.

To achieve his global ambition, Jeremy says he's focused primarily on what actions Brightcove needs to make to dramatically scale the business, which he thinks can drive a real premium for Brightcove's valuation. To the extent that broadband remains mainly an ad-supported business, I think Jeremy correctly understands that scale - in customers, streams, usage, geographic reach, etc. - are absolutely central to success. When asked the classic "what keeps him up at night?", he cites as his chief source of insomnia the challenge of building out every part of the organization to support his goal of massive scale.

As Brightcove continues to evolve and grow, one thing is for certain - all eyes in the broadband industry will be watching its progress.

Categories: Technology

Topics: Brightcove, CBS, Hulu, Maven, Providence Equity, Sony BMG, thePlatform

-

UGC Video Ads Becoming More Viable

Announcements from both ScanScout and Digitalsmiths continue to show that ads against UGC video may become more viable. There has been much skepticism about whether the vast trove of UGC video will be monetizable. Concerns about UGC monetization have been partly behind the recent emphasis by traditionally UGC-centric sites like YouTube, Metacafe, Veoh and others to move up the video quality food chain by offering branded or independent video.

Last week ScanScout announced trademark approval for its "Brand Protector" technology which is aimed at

allowing advertisers to have their messages accompany only content that is deemed appropriate. And today Digitalsmiths (disclaimer: VideoNuze sponsor) has announced "AdSafe", which has the same basic intent and may also functional at a more granular levels of acceptability. Both of these initiatives are should be read as good news in helping the UGC ad market get its footing. Brands looking to harness the power and popularity of UGC video should definitely be investigating these kinds of solutions.

allowing advertisers to have their messages accompany only content that is deemed appropriate. And today Digitalsmiths (disclaimer: VideoNuze sponsor) has announced "AdSafe", which has the same basic intent and may also functional at a more granular levels of acceptability. Both of these initiatives are should be read as good news in helping the UGC ad market get its footing. Brands looking to harness the power and popularity of UGC video should definitely be investigating these kinds of solutions.

Today Digitalsmiths also introduced "AdIQ", which brings the concept of "conquest ads" to the broadband video advertising world. For those unfamiliar with conquest ads, this is when a brand in the same category as a competitor buys inventory where a competitor is somehow mentioned or identified in the content itself. Here's a pretty good explanation from iMedia.

So for example, say Reebok is mentioned or identified in a video scene and say Nike wants to buy an overlay ad to play at that moment. Conversely, AdIQ allows Nike to ensure that its ad never runs against Reebok (or other competitors') content mentions. This is pretty cool stuff. But how about the media buyer who gets the responsibility to administer all this? I haven't seen the implementation, but I hope Digitalsmiths has made it simple to set up and monitor these campaigns!

Categories: Advertising, Technology, UGC

Topics: Digitalsmiths, ScanScout

-

The Fifth Network Poised to Emerge

Today I had a pretty interesting meeting with The Fifth Network, a company which I'd only been minimally

aware of. TFN's been focused on media services for the past couple of years, but is now poised to launch a pretty comprehensive solution for broadband video delivery.

aware of. TFN's been focused on media services for the past couple of years, but is now poised to launch a pretty comprehensive solution for broadband video delivery.We didn't get into too much detail or extensive demos, but what I did see looked impressive, especially from a video quality perspective. They shared a preview of a deal being implemented for a big brand advertiser and also for a potential film studio.

I thought all the companies that had planted their flag in the content/ad management and content publishing spaces were now declared, but TFN shows that there are still some stealthy efforts out there, which when released will continue to push further innovation in this space. I'll have more details on TFN's deals just before they go live.

Categories: Startups, Technology

Topics: The Fifth Network

-

Broadband Video vs. IPTV, The Differences Do Matter

It's funny how often I'll be talking to someone and they will casually start interchanging the terms "IPTV" and "broadband video/online video/Internet TV".

The fact that many people, including some that are actually well-informed, continue doing so is a reminder of how nascent these delivery platforms still are, and how common terms of use and understandings have yet to be established.

Yet it's important to clarify that there are differences and they do matter. While some of the backend IP transport technology is common between IPTV and broadband video, the front end technology, business models and content approaches are quite different.

In presentations I do, I distinguish that, to me at least, "IPTV" refers to the video rollouts now being pursued by large telcos (AT&T, etc.) here in the U.S. and internationally. These use IPTV-enabled set-top boxes which deliver video as IP packets right to the box, where they are converted to analog video to be visible to the viewer. IPTV set tops have more capabilities and features than traditional MPEG set-tops, and telcos are trying this as a point of differentiation.

However, at a fundamental level, receiving IPTV-based video service is akin to subscribing to traditional cable TV - there are still multi-channel tiers the consumer subscribes to. And IPTV is a closed "walled garden" paradigm - video only gets onto the box if a "carriage" deal has been signed with the service provider (AT&T, etc.). IPTV can be viewed as an evolutionary, next-gen technology upgrade to existing video distribution business models.

On the other hand, broadband video/online video/Internet TV (whatever term you prefer) is more of a revolutionary approach because it is an "open" model, just like the Internet itself. In the broadband world, there's no set-top box "control point" governing what's accessible by consumers. As with the Internet, anyone can post video, define a URL and quickly have video available to anyone with a broadband connection.

The catch is that today, displaying broadband-delivered video on a TV set is not straightforward, because most TVs are not connected to a broadband network. There are many solutions trying to solve this problem such as AppleTV, Microsoft Media Extender, Xbox, Internet-enabled TVs from Sony and others, networked TiVo boxes, etc. Each has its pros and cons, and while I believe eventually watching broadband video on your TV will be easy, that day is still some time off.

Many people ask, "Which approach will win?" My standard reply is there won't be a "winner take all" ending. Some people will always prefer the traditional multichannel subscription approach (IPTV or otherwise), while others will enjoy the flexibility and features broadband's model offers. However, for those in the traditional video world, it's important to recognize that over time broadband is certainly going to encroach on their successful models. Signs of change are all around us, and many content companies are now seizing on broadband as the next great medium.UPDATE: Mark Ellison, who is the SVP of Business Affaris and General Counsel at the NRTC (National Rural Telecommunications Cooperative, an organization which delivers telecom solutions to rural utilities) emailed to clarify that it's not just LARGE telcos that are pursuing IPTV, but many SMALLER ones as well. Point well taken Mark, it was an oversight to suggest that IPTV is solely the province of large telcos like AT&T.Categories: Cable TV Operators, IPTV, Technology, Telcos

Topics: Apple, AppleTV, Media Extender, Microsoft, Sony, TiVo, XBox