-

Recapping 2010 CES Video-Related News

The 2010 Consumer Electronics Show (CES) is now behind us. There were tons of announcements to come out of this year's show, including many in the online and mobile video areas. Increasingly a core focus of new devices is how to playback online and mobile-delivered video, how to move it around the consumer's house and how to make it portable. Following is a filtered list of the product announcements (or pertinent media coverage if no release was available) that I found noteworthy. They are listed in no particular order and I'm sure I've missed some important ones - if so, please add a comment with the relevant link.

Boxee box internals revealed. NVIDIA Tegra 2 FTW

Syabas Announces Popbox for Big Screen Everything

Sling Media Announces Support for Adobe Flash Platform in Hardware and Software Products

LG Electronics Expands Access to Content-on-Demand with New High-Performance Blu-ray Disc Players

ESPN 3D to show soccer, football, more

TV Makers ready to test depths of market for 3D

DirecTV is the First TV Provider to Launch 3D

DISH Network Introduces TV Everywhere

Microsoft Unites Software and Cloud Services to Power New TV Experiences

FLO TV and mophie to Bring Live Mobile TV to the Apple iPhone and iPod Touch

Broadcom Drives the Transition to Connected Consumer Electronics at 2010 International CES

New NVIDIA Tegra Processor Powers the Tablet Revolution

Digital Entertainment Content Ecosystem (DECE) Announces Key Milestones

Disney offers KeyChest, but where is the KeyMaster?

DivX Launches New Internet TV Platform to Redefine the Future of Entertainment

Blockbuster, ActiveVideo Announce Agreement for Cloud-based Online Navigation

Skype Ushers in New Era in Face-to-Face Online Video Communication

Aside from CES, but also noteworthy last week:

Apple Acquires Quattro Wireless

AT&T Adds Android, Palm to Its Lineup

Tremor Media Launches New Video Ad Products That Enhance Consumer Choice and Engagement

Categories: 3D, Advertising, Aggregators, Cable Networks, Devices, FIlms, Mobile Video, Satellite, Telcos

Topics: CES

-

4 Items Worth Noting for the Jan 4th Week (Netflix-WB Continued, comScore Nov. '09 stats, TV Everywhere, 3D at CES)

Following are 4 items worth noting for the Jan 4th week:

1. TechCrunch disagrees with my Netflix-Warner Bros. deal analysis - In "Netflix Stabs Us In The Heart So Hollywood Can Drink Our Blood," (great title btw) MG Siegler at the influential blog TechCrunch excerpts part of my post from yesterday, and takes the consumer's point of view, decrying the new 28 day "DVD window" that Netflix has agreed to in its Warner Bros deal. Siegler's main objection is that "Hollywood thinks that with this new 28-day DVD window deal, the masses are going to rush out and buy DVDs in droves again." Instead, Siegler believes the deal hurts consumers and is going to touch off new, widespread piracy.

I think Siegler is wrong on both counts, and many of TechCrunch's readers commenting on the post do as well. First, nobody in Hollywood believes DVD sales are going to spike because of deals like this. However, they do believe that any little bit that can be done to preserve the appeal of DVD's initial sale window can only help DVD sales which are critical to Hollywood's economics. Everyone knows DVD is a dying business; the new window is intended to help it die more gracefully. And because new releases are not that critical to many Netflix users anyway, Netflix has in reality given up little, but presumably gotten a lot, with improved access for streaming and lower DVD purchase prices.

The argument about new, widespread piracy by Netflix users is specious. With or without the 28 day window, there will always be some people who don't respect copyright and think stealing is acceptable. But Netflix isn't running its business with pirates as their top priority. With 11 million subscribers and growing, Netflix is a mainstream-oriented business, and the vast majority of its users are not going to pirate movies - both because they don't know how to (and don't want to learn) and because they think it's wrong. Netflix knows this and is making a calculated long-term bet (correctly in my opinion) that enhancing its streaming catalog is priority #1.

2. comScore's November numbers show continued video growth - Not to be overlooked in all the CES-related news this week was comScore's report of November '09 online video usage, which set new records. Key highlights: total video viewed were almost 31 billion (double Jan '09's total of 14.8 billion), number of videos viewed/average viewer was 182 (up 80% from Jan '09's 101) and minutes watched/mo were approximately 740 (more than double Jan '09's total of 356).

Notably, with 12.2 billion views, YouTube's Nov '09 market share of 39.4% grew vs. its October share of 37.7%. As I've previously pointed out, YouTube has demonstrated amazingly consistent market dominance, with its share hovering around 40% since March '08. Hulu also notched another record month, with 924 million streams, putting it in 2nd place (albeit distantly) to YouTube. Still, Hulu had a blowout year, nearly quadrupling its viewership (up from Jan '09's 250 million views). But with 44 million visitors, Hulu's traffic was pretty close to March '09's 41.6 million. In '10 I'm looking to see what Hulu's going to do to break out of the 40-45 million users/mo band it was in for much of '09.

3. Consumer groups protest TV Everywhere, but their arguments ring hollow - I was intrigued by a joint letter that 4 consumer advocacy groups sent to the Justice Department on Monday, urging it to investigate "potentially unlawful conduct by MVPDs (Multichannel Video Programming Distributors) offering TV Everywhere services." The letter asserts that MVPDs may have colluded in violation of antitrust laws.

I'm not a lawyer and so I'm in no position to judge whether any actions alleged to have taken place by MVPDs violated any antitrust laws. Regardless though, the letter from these groups demonstrates that they are missing a fundamental benefit of TV Everywhere - to provide online access to cable TV programming that has not been available to date because there hasn't been an economical model for doing so. In the eyes of people who think that making money is evil, the TV Everywhere model of requiring consumers to first subscribe to a multichannel video service seems anti-consumer and anti-competitive. But to people trying to make a living creating quality TV programming, the preservation of a highly functional business model is essential.

These advocacy groups need to remember that consumers have a choice; if they don't value cable's programming enough to pay for it, then they can instead just watch free broadcast programs.

4. 3D is the rage at CES - I'll be doing a CES recap on Monday, but one of the key themes of the show has been 3D. There were two big announcements of new 3D channels, from ESPN and Discovery/Sony/IMAX. LG, Panasonic, Samsung and Sony announced new 3D TVs. And DirecTV announced that it would launch 3 new 3D channels by June 2010, with Panasonic as the presenting sponsor. 3D sets will be an expensive proposition for consumers for some time, but prices will of course come down over time.

Something that I wonder about is what impact will 3D have on online and mobile video? Will this spur innovation in computer monitors so that the 3D experience can be experienced online as well? And how about mobile - will we soon be slipping on 3D glasses while looking at our iPhones and Android phones? It may seem like a ridiculous idea, but it's not out of the realm of possibility.

Enjoy your weekend!

Categories: 3D, Aggregators, Broadcasters, Cable Networks, Cable TV Operators, FIlms, Studios

Topics: 3D, comScore, Netflix, TV Everywhere, Warner Bros.

-

VideoNuze Report Podcast #45 - January 8, 2010

Daisy Whitney and I are pleased to present the first VideoNuze Report podcast of 2010 (and the 45th edition overall!).

In today's podcast we first discuss my post from yesterday, "Why Netflix's Long-Term Focus in New Warner Bros. Deal is a Win for Everyone," in which I assert that the new 28 day "DVD window" that the deal creates helps Netflix, Hollywood studios and ultimately consumers. There is a lot of consternation in the blogosphere and Twittersphere about whether Netflix is hosing its subscribers with this new policy, but I believe there's actually little risk of that, and the payoff for Netflix is better content for its streaming catalog as well as lower costs for its DVD purchases. While WB surely doesn't expect to sell more DVDs due to the deal, it can only help make the DVD model's demise a little less disruptive.

Switching gears, Daisy then reviews some of eMarketer's predictions for ad spending in 2010, with particular focus on online video advertising, which eMarketer expects to grow from about $1 billion in '09 to $1.4 billion in '10. Listen in to find out more.

Click here to listen to the podcast (12 minutes, 30 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, Aggregators, FIlms, Podcasts

Topics: eMarketer, Netflix, Warner Bros.

-

Why Netflix's Long-Term Focus in New Warner Bros. Deal is a Win for Everyone

Netflix's new deal with Warner Bros., in which it agreed to a 28 day "DVD window" for new releases, in exchange for greater access to WB's films for its Watch Instantly streaming feature and reduced pricing on its own DVD purchases, is further proof that Netflix is squarely focused on the long-term. That's not only smart for Netflix, it's also a win for Hollywood studios and also for consumers.

With 11 million subscribers and growing, Netflix has emerged as one of Hollywood's most important home video customers. This dynamic has only increased recently due to slowing sales of DVDs (down another 13% in 2009) and Netflix's dominance in DVD rentals. Yet Netflix is viewed warily by Hollywood, primarily

due to concerns that in the digital age, Netflix could gain too much power over Hollywood's fate. This concern was reinforced by Netflix's deal with premium cable channel Starz, a de facto end-run around Hollywood in which Netflix got streaming access to certain Disney, Sony and Lionsgate films.

due to concerns that in the digital age, Netflix could gain too much power over Hollywood's fate. This concern was reinforced by Netflix's deal with premium cable channel Starz, a de facto end-run around Hollywood in which Netflix got streaming access to certain Disney, Sony and Lionsgate films.As I've pointed out many times (as recently as this past Monday, in item #6), despite the Starz deal and the impressive adoption of Watch Instantly to date, Netflix faces a major challenge in building out its catalog of recent films for streaming use. Part of the challenge is Hollywood's "windowing" approach; in particular, other premium channels like HBO, Showtime and Epix have made significant financial commitments for electronic distribution during certain time periods that effectively preclude Netflix gaining streaming rights. Because much of Netflix's value proposition relies on its vast DVD selection (100K+ titles currently), if its streaming catalog continues to look meager by comparison, then Netflix's goal of migrating its users to streaming delivery over time will be seriously undermined.

That's where the new WB deal comes in. While the companies didn't disclose which titles or how many

would be available, my guess is that the benefits of the deal, when it's fully implemented, will be noticeable to Netflix's subscribers or Netflix wouldn't have signed on. While WB is just one studio, if the new deal can be used as a template, Netflix could have a solid plan for gaining more films without paying big bucks. And the studios would get greater leverage against Redbox, which is viewed with even greater alarm by much of Hollywood.

would be available, my guess is that the benefits of the deal, when it's fully implemented, will be noticeable to Netflix's subscribers or Netflix wouldn't have signed on. While WB is just one studio, if the new deal can be used as a template, Netflix could have a solid plan for gaining more films without paying big bucks. And the studios would get greater leverage against Redbox, which is viewed with even greater alarm by much of Hollywood.Netflix's focus on the long term is smart strategy, and complements well the company's near-term emphasis on riding the convergence wave by embedding its Watch Instantly software in every conceivable living room device (e.g. PS3, Xbox, Roku, Bravia, Blu-ray players, etc.). It's also a strategy that benefits Hollywood. By creating a situation where studios preserve as much of their DVD sales as possible (allegedly 75% of a film's total DVD sales occur in the first 4 weeks following release), Netflix is helping Hollywood gracefully wind down and milk the DVD business.

Not surprisingly, consumers' first reaction to the deal was sour. Yesterday the Twittersphere was alight with grousing about the 28 day DVD window and how Netflix was "selling out its customers." Some even talked about canceling their Netflix service. I think most of this is idle chatter. Netflix has publicly said that just 30% of its DVD rentals come from recent releases (though it is likely that for Netflix's heaviest DVD renters, recent releases are far more important). In the end, Netflix is making a calculated bet that it can manage the potential subscriber consequences of creating the DVD window in order to benefit its larger goal of migrating its business to online delivery.

If Netflix is right, and it can sign on additional studios to similar deals, then ultimately consumers will win. That's because, as Netflix proves in the value of streaming, it will be able to offer improved terms to studios, resulting in Netflix getting better and better access to films. But this will be a gradual process that unfolds over time. Whereas consumers always "want everything yesterday," the reality is that if Hollywood and Netflix can avoid disruption and instead preserve most of their economics by gracefully transitioning their businesses to digital delivery, consumers stand a better chance of continuing to receive the kind of premium-quality (i.e. expensive to produce) films they value. The demise of the newspaper industry is a cautionary example of what happens when disruption instead prevails and an industry's traditional economics are destroyed.

We are still on the front end of seismic shifts that will alter how Hollywood's films are distributed to consumers. By focusing on the long-term, as evidenced by its WB deal, Netflix is playing an important role in increasing the odds of a successful transition.

What do you think? Post a comment now.

Categories: Aggregators, FIlms, Studios

Topics: Netflix, Starz, Warner Bros.

-

4 Items Worth Noting for the Dec 14th Week (New pre-roll ad data, Paramount movie clips, Thwapr mobile, next week's preview)

Following are 4 items worth noting for the Dec 14th week:

1. New pre-roll data shows format's strength - Though many in the industry still scorn the pre-roll ad, this week 2 ad networks, ScanScout and YuMe, released data showing its continued prevalence as well as innovation that's improving its performance. ScanScout said its "Super Pre-roll" unit, which allows for integrating overlay graphics on the video that viewers can engage with, is driving 350% higher click-through rates compared with typical pre-rolls. In this example for Unilever's Vaseline, note how the creative nicely reinforces the messaging. The enhanced interactivity feels like the start of a new trend; another pre-roll that offers something similar is Innovid's iRoll unit. ScanScout separately announced this week a host of new premium publishers have joined its network.

Meanwhile YuMe released its Video Advertising Metrics Report for Jan-Nov '09, which showed that, at least within YuMe's network, 90%+ of all ads served were pre-rolls, with 30 second spots generating a 1.8% overall click-through rate, a 50% higher rate than the 1.2% that 15 second spots achieved. The volume of 30 second ads also grew 50% faster than 15 second volume in Q3 '09. Kids age 6-14 achieved a 3.7% click-through rate, the highest of any group, which YuMe's Jayant Kadambi told me could be explained by the more engaging nature of child-focused ads (e.g. click to play games, etc.). Jayant believes the sizable amount of existing creative for TV ads that can be easily repurposed for online is a key reason pre-rolls continue to dominate.

2. Paramount clipping site powered by Digitalsmiths is slick - I was impressed with a demo of Paramount Pictures' newly launched ParamountClips.com site that I got this week. The site is only open to Paramount's business partners, allowing them to either choose from an existing stock of clips from over 80 different Paramount movies, or to easily create their own. Desired clips are moved into a shopping cart and released for download, per previously determined licensing terms.

The site is powered by Digitalsmiths, which indexed all of the scenes from the movies using their proprietary recognition process, and then generated meta-data for each, which makes searching a snap. The new self-service site replaces the laborious previous process of a Paramount staffer working with each partner to extract jus the scene they want. As a result, a new highly-scalable licensing opportunity has been created. Paramount is taking advantage of Digitalsmiths VideoSense 2.5 release announced last week that is focused on clip generation, for both on demand and live streams, improved asset management and more integrated reporting.

3. Thwapr launches beta of mobile-to-mobile video sharing - Continuing the buildout of the mobile video ecosystem, Thwapr, a new mobile-to-mobile content sharing platform, launched its beta this week. Duncan Kennedy, Thwapr's COO told me that although there's been a proliferation of video capable smartphones, there's currently no easy, fool-proof way of sharing videos from one device to another (e.g. from an iPhone to a BlackBerry). Enter Thwapr, which lets the user upload videos to Thwapr and then have them shared with their contacts. Thwapr identifies the receiving phone's "user agent" so that it can dynamically decide the optimal format the video should be viewed in. The user simply clicks on a link and the video plays. I can attest that it worked beautifully on my BlackBerry Pearl.

Thwapr's raised about $3 million from angels and has a very strong team, including Duncan and others who worked on Apple's QuickTime. I'm a fan of how video, social/sharing and mobile intersect to create new opportunities, though there are business model unknowns. For now Thwapr is focused on a free ad-supported model, with a particular emphasis on geo-tagging videos to make advertising especially appealing for local merchants. Still, YouTube has illustrated how difficult it is to monetize user-generated content. Thwapr also envisions a business-grade option for real estate, travel, dating type applications which sound promising. I wonder too about whether a freemium model should be explored, though Duncan said Thwapr's analysis suggested this would be a relatively small opportunity. We'll see how things shape up.

4. Next week is 2009 wrap-up week on VideoNuze - Keep an eye on VideoNuze next week, as I'll be summarizing Q4 '09 venture capital investments and deals in the broadband/mobile video space, reviewing my 2009 predictions and looking ahead to what to expect in 2010. It's been an incredibly active year and based on the pre-CES briefings I've been doing, there's lots more to look forward to next year.

Enjoy your weekend!

Categories: Advertising, FIlms, Mobile Video, Predictions, Startups, Studios, Technology

Topics: Digitalsmiths, Paramount, ScanScout, Thwapr, YuMe

-

VideoNuze Report Podcast #40 - November 13, 2009

Daisy Whitney and I are pleased to present the 40th edition (whoo-hoo!) of the VideoNuze Report podcast, for November 13, 2009.

This week Daisy first shares observations on her recent interview with Gary Vaynerchuk, who is best known as the host of Wine Library TV/The Thunder Show. Gary has a new book out called "Crush It!" part of a 10-book deal he did with HarperStudio. The book focuses on how you can build your personal brand using all of the Internet's various communications tools. Vaynerchuk has a lot of credibility as he's built up a huge following for Wine Library TV. Now with the books, he's showing how online popularity can be leveraged into the print world. For a good example of the show, check out this episode featuring Wayne Gretzky.

We then shift to my post from earlier this week, "Sony Gets It Wrong with 'Meatballs' Promotion." I took Sony Electronics to task for a new promotion they're starting which provides a free 24 hour rental of the movie "Cloudy With a Chance of Meatballs" to buyers of connected Sony Bravia TVs and Blu-ray disc players. It's also available as a $24.95 rental for current owners of these devices. I explain more about why I think this promotion falls way short and does little to advance the agenda of delivering movies via broadband.

Click here to listen to the podcast (14 minutes, 12 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: FIlms, Indie Video, Podcasts, Studios

Topics: Sony, Wine Library TV

-

Sony Gets It Wrong with "Meatballs" Promotion

On Monday, Sony Electronics announced a holiday promotion in which buyers of select Internet-connected Sony Bravia TVs and Blu-ray players would receive a free 24 hour rental of the Columbia/Sony Pictures film

"Cloudy with a Chance of Meatballs." In addition, current owners of these devices would be able to rent the film for $24.95. For all of these consumers, the film would be available from Dec. 8th to Jan 4th, the month leading up to the film's DVD release.

"Cloudy with a Chance of Meatballs." In addition, current owners of these devices would be able to rent the film for $24.95. For all of these consumers, the film would be available from Dec. 8th to Jan 4th, the month leading up to the film's DVD release. Ordinarily I would applaud any move by Hollywood to modify its rigid release "windows" to benefit broadband delivery of films. Yet in this case I think Sony's promotion is ill-conceived and is extremely unlikely to contribute any real momentum to studios' future broadband delivery plans. In fact, it may actually have the opposite effect and further stunt the broadband medium's emergence. Here's why:

The release window is too tight - Release windows allow Hollywood studios to mine new value from the same content given each successive distribution medium's unique attributes and audience. But by trying to squeeze in this promotional window, Sony is exacerbating an already very tight windowing plan for "Meatballs" that called for DVD release less than 2 months following its theatrical run. Remarkably, even as Sony is trumpeting this new promotion, the film is actually still playing in theaters nationwide. Given it's already only 27 days until Dec 8th, there will be virtually no gap between theatrical and promotional windows. That undermines the theatrical value proposition, in turn ticking off exhibitors who are threatening to pull the film early, according to The Hollywood Reporter.

Theatrical to DVD windows have been getting progressively tighter as studios have sought to bolster sagging DVD sales. The problem is that like a good wine, lengthy windows allow a film to age and increase in value for both those consumers who saw the movie and those who did not. With this promotion, Sony is giving consumers an in-home opportunity to see the film immediately adjacent to the DVD's availability. That can do nothing but also hurt the DVD's sales.

The promotional offer isn't strong enough - For Sony Electronics, trying to differentiate its devices in a brutally competitive landscape is key. But do the marketing pros at Sony really believe that giving away a 24 hour rental is going to have a big impact? Personally I doubt it. The prices of the Sony TVs in the promotion are in the $1,000-$2,000 range, so a $25 incentive is easily swamped by the rampant deep discounts found in Sunday circulars (not to mention even deeper online deals). Further, I don't see any retailer incentives included in the promotion that would influence the sales process.

The "Meatballs" offer might have a stronger effect on sales of Sony's Blu-ray players, though here too, it's unlikely to be profound. With Blu-ray player sales lagging, manufacturers and retailers have largely decided that hitching their wagons to Netflix's Watch Instantly streaming is the best way to bump up sales. But with sub-$100 Netflix-capable Blu-ray players now available, a "Meatballs" rental valued at $25 on a $200-250 Sony player will have a hard time breaking through. Last but not least, it's important to remember, Sony's promotion is for a 24 hour rental. Not offering consumers ownership of "Meatballs" makes the promotional value ephemeral. And with Walmart, Target and Amazon now offering top DVDs for just $10 apiece, a 24 hour rental valued at $25 is underwhelming, not to mention somewhat specious, given it is Sony that's setting the "price." Given all of this, I suspect Sony would have done better by just offering a free "Meatballs" DVD with purchase.

Device audience too small to prove broadband delivery's appeal - Looked at differently, the small base of connected Sony Bravia and connected Blu-ray players, plus the new device sales over the promotional period, is unlikely to generate a large volume of "Meatballs" streaming anyway. That means that the promotion will do little to encourage Sony or other studios to more strongly embrace broadband delivery of their films. In fact, when the weak results of the promotion come in (as I expect they will), "Meatballs" could become future industry shorthand for "broadband delivery isn't ready for prime-time." That would be a shame, because I believe consumers very much want on-demand access to films in their homes. Netflix's success with Watch Instantly certainly proves that, as does the success VOD is having.

From my perspective, rather than setting up half-baked promotions like this one, studios should take a step back and think through how to do broadband delivery (for both rental and download-to-own) correctly. There are a lot of moving pieces, but clearly addressing what to do about the DVD window is critical. Studios are rightfully worried about killing off this cash cow. But compressing the DVD window and then trying to insert a new broadband delivery window isn't going to be the answer. Rather than seeing more "Meatballs" like promotions, I'd prefer to see a cohesive strategy out of Hollywood for how it can fully tap into broadband delivery's potential.

What do you think? Post a comment now.

Categories: Devices, FIlms, Studios

-

"VideoSchmooze" is Tomorrow Night, Oct. 13th

Tomorrow is VideoNuze's next "VideoSchmooze" Broadband Video Leadership Evening, from 6-9pm in NYC.

VideoSchmooze promises to be an exciting night of networking and industry learning. We have about 200

executives registered to attend, from across the spectrum of technology and media companies such as MTV, Cisco, NBCU, PBS, Cox, Hearst, Hulu, Tremor Media, Scripps, Showtime, HealthiNation, HBO, FLO TV and many others.

executives registered to attend, from across the spectrum of technology and media companies such as MTV, Cisco, NBCU, PBS, Cox, Hearst, Hulu, Tremor Media, Scripps, Showtime, HealthiNation, HBO, FLO TV and many others.Our panel (which I'll moderate), "Realizing Broadband Video's Potential" features an amazing group of industry executives:

- Dina Kaplan - Co-founder, blip.tv

- George Kliavkoff - EVP & Deputy Group Head, Hearst Entertainment & Syndication (and formerly Chief Digital Officer, NBCU and first CEO of Hulu)

- Perkins Miller - SVP, Digital Media and GM, Universal Sports, NBCU Sports & Olympics

- Matt Strauss - SVP, New Media, Comcast

Click here to learn more and register now.

Following the panel, we'll have networking and cocktails from 7:45-9:00pm. It will be a great opportunity to meet the panelists and industry colleagues.

VideoSchmooze will be held at the Hudson Theater, a beautifully renovated turn-of-the-century venue on West 44th Street just off Times Square. NATPE, VideoNuze's partner since launch, is teaming up with VideoNuze for the event. And I'm extremely grateful to lead sponsor Microsoft Silverlight and supporting sponsors Akamai Technologies, Digitalsmiths, FAST (a Microsoft subsidiary), FreeWheel, Horn Group, Kyte and mPoint for making the evening possible.

Click here to learn more and register now.

The Twitter hashtag for VideoSchmooze is #VS09

Categories: FIlms

Topics: VideoSchmooze

-

4 Items Worth Noting (comScore, Viral videos' formula, Netflix, VideoSchmooze) for Sept 26th Week

Following are 4 news items worth noting from the week of Sept. 26th:

1. Summer '09 was a blockbuster for online video - comScore released U.S. online video viewership data early this week, providing evidence of how big a blockbuster the summer months were for each metric comScore tracks. The 3 metrics that I watch most closely each month showed the healthiest gains vs. April, the last pre-summer month comScore reported. Total videos viewed in August were 25.4 billion, a 51% increase over April's 16.8 billion. The average number of videos watched per viewer was 157, up 41% from April's 111. And the average online video viewer watched 582 minutes (9.7 hours), a 51% increase from April's 385 (6.4 hours).

Also worth noting was YouTube crossing the 10 billion videos viewed in a single month mark for the first time, maintaining a 39.6% share of the market. According to comScore's stats I've collected, YouTube has been in the 39% to 44% market share range since May '08, having increased from 16.2% in Jan '07 when comScore first started reporting. Hulu also notched a winning month. While its unique viewers fell slightly to 38.5M from 40.1M in April, its total video views increased from 396M to 488.2M, with its average viewer watching 12.7 videos for a total of 1 hour and 17 minutes. It will be very interesting to see if September's numbers hold these trends or dip back to pre-summer levels.

2. So this is how to make funny viral branded videos - I was intrigued by a piece in ClickZ this week, "There's a Serious Business Behind Funny Viral Videos" which provided three points of view - from CollegeHumor.com, The Onion and Mekanism (a S.F.-based creative production agency) - about how to make branded content funny and then how to make it go viral. The article points out that a whole new sub-specialty has emerged to service brands looking to get noticed online with their own humorous content.

Humor works so well because the time to hook someone into a video is no more than 2-3 seconds according to Mekanism's Tommy Means. Beyond humor, successful videos most often include stunts or cool special effects or shock value. Once produced the real trick is leveraging the right distribution network to drive viral reach. For example, Means describes a network of 100 influencers with YouTube channels who can make a video stand out. After reading the article you get the impression that there's nothing random about which funny videos get circulated; there's a lot of strategy and discipline involved behind the scenes.

3. Wired magazine's article on Netflix is too optimistic - I've had several people forward me a link to Wired magazine's article, "Netflix Everywhere: Sorry Cable You're History" in which author Daniel Roth makes the case that by Netflix embedding its streaming video software in multiple consumer electronics devices, the company has laid the groundwork for a rash of cable cord-cutting by consumers.

I've been bullish for sometime on Netflix's potential as an "over-the-top" video alternative. But despite all of Netflix's great progress, particularly on the device side, its Achilles' heel remains content selection for its Watch Instantly streaming feature (as an example, my wife and I have repeatedly tried to find appealing recent movies to stream, but still often end up settling for classic, but older movies like "The English Patient").

Roth touches on this conundrum too, but in my opinion takes a far too optimistic point of view about what a deal like the one Netflix did with Starz will do to eventually give Netflix access to Hollywood's biggest and most current hits. The Hollywood windowing system is so rigid and well-protected that I've long-since concluded the only way Netflix is going to crack the system is by being willing to write big checks to Hollywood, a move that Netflix CEO is unlikely to make. The impending launch of TV Everywhere is going to create whole new issues for budding OTT players.

Although I'm a big Netflix fan, and in fact just ordered another Roku, I'm challenged to understand how Netflix is going to solve its content selection dilemma. This is one of the topics we'll discuss at VideoNuze's CTAM Summit breakfast on Oct. 26th in Denver, which includes Roku's VP of Consumer Products Tim Twerdahl.

4. VideoSchmooze is just 1 1/2 weeks away - Time is running out to register for the "VideoSchmooze" Broadband Video Leadership Evening, coming up on Tues, Oct 13th from 6-9pm at the Hudson Theater in NYC. We have an amazing discussion panel I'll be moderating with Dina Kaplan (blip.tv), George Kliavkoff (Hearst), Perkins Miller (NBC Sports) and Matt Strauss (Comcast). We'll be digging into all the hottest broadband and mobile video questions, with plenty of time for audience Q&A.

Following the panel we'll have cocktails and networking with industry colleagues you'll want to meet. Registration is running very strong, with companies like Sprint, Google/YouTube, Cox, MTV, Cox, PBS, NY Times, Morgan Stanley, Hearst, Showtime, Hulu, Telemundo, Cisco, HBO, Motorola and many others all represented. Register now!

Categories: Aggregators, Branded Entertainment, Events, FIlms, Studios

Topics: CollegeHumor.com, comScore, Hulu, Mekanism, Netflix, The Onion, VideoSchmooze, Wired, YouTube

-

YouTube Movie Rentals: An Intriguing But Dubious Idea

Last week the WSJ broke the news that YouTube is in talks with Lionsgate, Sony, MGM and Warner Bros. about launching streaming movie rentals. On the surface this is an intriguing proposition: the 800 pound gorilla of the online video world tantalizing Hollywood with its massive audience and promotional reach. However, when you dig a little deeper, I believe it's a dubious distraction for YouTube, which is still trying to prove that it can make its ad model work.

I appreciate all the possible reasons YouTube is eyeing movie rentals. To evolve from its UGC roots, the company has been anxious for more premium content to monetize. But with Hulu locking up exclusive access

to ABC, Fox and NBC shows for at least the next year and a half or longer, full-length broadcast TV shows are largely unavailable. And now TV Everywhere threatens to foreclose access to cable TV programs. All this makes movies even more attractive.

to ABC, Fox and NBC shows for at least the next year and a half or longer, full-length broadcast TV shows are largely unavailable. And now TV Everywhere threatens to foreclose access to cable TV programs. All this makes movies even more attractive. Then there's Google's uber mission to organize the world's information. YouTube executives are savvy enough to know that not all content can be delivered solely on an ad-supported basis - not yet nor possibly ever (for more about the challenges of effectively monetizing broadcast TV shows, let alone movies, see my prior posts on Hulu). To succeed in gaining access to certain content, offering a commerce model is ultimately essential. Since YouTube has already put in place some key commerce-oriented infrastructure pieces like download-to-own and click-to-buy, rolling out a rental option is less of a stretch. Lastly, YouTube can position itself to Hollywood as a more flexible partner and viable alternative to Apple's iTunes.

Regardless, YouTube movie rentals are still a dubious idea for at least 3 reasons: they're a distraction from YouTube's as yet unproven ad model, there are too many competitors and too little opportunity to differentiate itself and the revenue opportunity is relatively small.

Focus on getting the ad model working right - Given its market-leading 40% share of all online video streams, I've long believed that YouTube is the best-positioned company to make the online video ad model work. YouTube has made solid progress adding premium content to the site that it can monetize, but it still has a lot of work ahead to make its ads profitable. As I wrote in June, Google's own senior management cannot yet clearly articulate YouTube's financial performance, causing many in the industry to worry about YouTube's sustainability. Some might assert that YouTube can keep tweaking the ad model while also rolling out rentals but I disagree. With the ongoing ad spending depression, YouTube must stay laser-focused on making its ad model work, and also on communicating its success.

Too many competitors, too little differentiation - It's hard to believe the world really needs another online option for accessing movies, and mainly older ones at that. There's Hulu, iTunes, Netflix, Amazon, Xbox and soon cable, satellite and telcos rolling out movies on TV Everywhere, just to name a few. Maybe YouTube has some secret differentiator up its sleeve, but I doubt it. Rather, it will be just one more comparably-priced option for consumers. And in some ways it will actually be inferior. For example, unlike Netflix and Amazon, YouTube's browser-centric approach means watching movies on YouTube will remain a suboptimal, computer-based experience. Unless YouTube is willing to pay up big-time, there's also no reason to believe it will get Hollywood product any earlier than proven services like Netflix and iTunes.

Revenue upside is small - It's hard to estimate how many movie rentals YouTube could generate, but here's one swag, which shows how limited the revenue opportunity likely is. Let's say YouTube ramped up to .5% of its 120M+ monthly U.S. viewers (assuming it had U.S. rights only to start) renting 1 movie per week (not a trivial assumption considering virtually none of YouTube's users have ever spent a dime on the site and there are plenty of existing online movie alternatives). YouTube's revenue would be 600K rentals/week x $4/movie (assumed price) x 30% (YouTube's likely revenue share) = $720K/week. For the full year it would be $37.4M. With YouTube's 2009 revenue estimates in the $300M range, that's about 12% of revenue. Nothing to sneeze at, but not world-beating either, especially as compared to YouTube's massive advertising opportunity.

Given these considerations, I contend that YouTube would be far better off trying to become the dominant player in online video advertising, replicating Google's success in online advertising. Like all other companies, YouTube has finite resources and corporate attention - it should focus where it can become a true leader. There's enough quality content and brands willing to partner with YouTube on an ad-supported basis to keep the company plenty busy, and on the road to eventual financial success.

What do you think? Post a comment now.

Categories: Advertising, Aggregators, FIlms, Studios

Topics: Hulu, Lionsgate, MGM, Sony, Warner Bros., YouTube

-

Netflix's ABC Deal Shows Streaming Progress and Importance of Broadcast TV Networks

Yesterday's announcement by Netflix that it will be adding to its Watch Instantly library past seasons ABC's "Lost," "Desperate Housewives," "Grey's Anatomy" and "Legend of the Seeker" is another step forward for Netflix in strengthening its online competitiveness.

At a broader level though, I think it's also further evidence that the near-term success of Watch Instantly and other "over-the-top" broadband video services is going to be tied largely to deals with broadcast TV networks, rather than film studios, cable TV networks or independently-produced video sources.

Key fault lines are beginning to develop in how premium programming will be distributed in the broadband era. Content providers who have traditionally been paid by consumers or distributors in one way or another are redoubling their determination to preserve these models. Examples abound: the TV Everywhere initiative Comcast/Time Warner are espousing that now has 20+ other networks involved; Epix, the new premium movie service backed by Viacom, Lionsgate and MGM; new distribution deals by the premium online service ESPN360.com, bringing its reach to 41 million homes; MLB's MLB.TV and At Bat subscription offerings; and Disney's planned subscription services. As I wrote last week in "Subscription Overload is On the Horizon," I expect these trends will only accelerate (though whether they'll succeed is another question).

On the other hand, broadcast TV networks, who have traditionally relied on advertising, continue mainly to do so in the broadband world, whether through aggregators like Hulu, or through their own web sites. However, ABC's deal with Netflix, coming on top of its prior deals with CBS and NBC, shows that broadcast networks are both motivated and flexible to mine new opportunites with those willing to pay.

That's a good thing, because as Netflix tries to build out its Watch Instantly library beyond the current 12,000 titles, it is bumping up against two powerful forces. First, in the film business, well-defined "windows"

significantly curtail distribution of new films to outlets trying to elbow their way in. And second, in the cable business, well-entrenched business relationships exist that disincent cable networks from offering programs outside the traditional linear channel affiliate model to new players like Netflix. These disincentives are poised to strengthen with the advent of TV Everywhere.

significantly curtail distribution of new films to outlets trying to elbow their way in. And second, in the cable business, well-entrenched business relationships exist that disincent cable networks from offering programs outside the traditional linear channel affiliate model to new players like Netflix. These disincentives are poised to strengthen with the advent of TV Everywhere.In this context, broadcast networks represent Netflix's best opportunity to grow and differentiate Watch Instantly. Last November in "Netflix Should be Aggressively Pursuing Broadcast Networks for Watch Instantly Service," I outlined all the reasons why. The ABC deal announced yesterday gives Netflix a library of past seasons' episodes, which is great. But it doesn't address where Netflix could create the most value for itself: as commercial-free subscription option for next-day (or even "next-hour") viewing of all prime-time broadcast programs. That is the end-state Netflix should be striving for.

I'm not suggesting for a moment that this will be easy to accomplish. But if it could, Netflix would really enhance the competitiveness of Watch Instantly and its underlying subscription services. It would obviate the need for Netflix subscribers to record broadcast programs, making their lives simpler and freeing up room on their DVRs. It would be jab at both traditional VOD services and new "network DVR" service from Cablevision. It would also be a strong competitor to sites like Hulu, where comparable broadcast programs are available, but only with commercial interruptions. And Hulu still has limited options for viewing on TVs, whereas Netflix's Watch Instantly options for viewing on TVs includes Roku, Xbox, Blu-ray players, etc. Last but not least, it would also be a powerful marketing hook for Netflix to use to bulk up its underlying subscription base that it intends to transition to online-only in the future.

Beyond next-day or next-hour availability, Netflix could also offer things like higher-quality full HD delivery or download options for offline consumption. Broadcasters, who continue to be pinched on the ad side, should be plenty open to all of the above, assuming Netflix is willing to pay.

I continue to believe Netflix is one of the strongest positions to create a compelling over-the-top service offering. But with numerous barriers in its way to gain online distribution rights to films and cable programs, broadcast networks remain its key source of premium content. So keep an eye for more deals like the one announced with ABC yesterday, hopefully including fast availability of current, in-season episodes.

What do you think? Post a comment now.

Categories: Aggregators, Broadcasters, Cable Networks, Cable TV Operators, FIlms

Topics: ABC, Cablevision, CBS, Comcast, EPIX, ESPN360, MLB, NBC, Netflix, Time Warner

-

YouTube Continues Its March Up the Content Quality Ladder

Late yesterday YouTube announced "a new destination for TV shows and an improved destination for movies," moves that continue the site's evolution from its UGC/video sharing roots to an aggregator of premium-quality video.

The reality is that this evolution has been underway for some time now, and I expect it will only continue. Two weeks ago in "6 Reasons Why the Disney-YouTube Deal Matters" I explained again why, as the 8,000 pound gorilla of the online video market, YouTube is in an excellent position to partner with premium content providers. In a media landscape marked by massive audience fragmentation, the online destination (YouTube) that accounts for 40-50% of all streams and is 15 times as big as the #2 destination (Hulu) is quite simply a must-have promotion and distribution partner.

The new destinations address what has been an ongoing Achilles' heel for the site - enabling users to easily find premium video "needles" in YouTube's user-generated "haystack." YouTube's UI weaknesses for

premium video have been highlighted by the gold-plated user experience Hulu - and more recently TV.com and Sling.com - have brought to market. The sites have quickly gained passionate fans, and at least in the case of Hulu, significant viewership.

premium video have been highlighted by the gold-plated user experience Hulu - and more recently TV.com and Sling.com - have brought to market. The sites have quickly gained passionate fans, and at least in the case of Hulu, significant viewership. From a design perspective, while there's nothing I would call truly breakthrough about YouTube's premium destinations, they are still a step forward and a solid start. For users solely interested in premium content, they help organize things nicely. There's a decent selection of content, including titles from deals with MGM, BBC, CBS, Crackle and Lionsgate and lots of other partners, which will no doubt continue to grow.

Possibly more important though, is that for content providers they show how YouTube is serious about addressing their needs for clean, well-lit spaces. Premium content providers want the benefits of being in the massive YouTube site, but without the risk of their brands showing up too close to scruffy UGC material. Being clustered with other premium content is a must.

YouTube's concurrent beta launch of Google TV Ads Online, which allows targeted instream ads, is another positive for premium content providers. Beyond YouTube's massive traffic, Google's potent monetization capabilities are the other reason I've been so bullish on YouTube's prospects for premium content. As I wrote on Monday, with increased DVR penetration driving rampant ad-skipping, broadcast and cable's traditional ad model is looking more and more defunct. Online video ads offer a lot of promise as an even higher value ad medium, but much of it is still unproven. Having large players like Google and YouTube involved is significant for showing online video advertising's true upside.

One last take on this is how YouTube continues to position itself in the "over-the-top" sweepstakes, where multiple competitors are vying to be viewed as bona fide substitutes for cable/satellite/telco subscribers itching to cut the cord. I remain skeptical that the trickle of cord-cutters is going to turn into a gusher any time soon, but I will say that with its move up the content ladder, YouTube continues to burnish its standing as a must-have partner for any convergence device-maker looking to make over-the-top inroads (e.g. Roku, Vudu, AppleTV, etc.). YouTube is the most-recognized online video brand, the most-heavily trafficked, and increasingly a credible alternative to premium aggregators like Hulu and others.

For everyone in the online video ecosystem, YouTube continues to be a key player to watch.

What do you think? Post a comment now.

Categories: Aggregators, Broadcasters, Cable Networks, FIlms

Topics: Disney, Google, Hulu, Sling, TV.com, YouTube

-

Babelgum's Deal for "The Linguists" Showcases Online Distribution Model

Babelgum, the ad-supported broadband/mobile video aggregator and platform has recently embarked on an expansion into the U.S. market. A discussion I had with Karol Martesko-Fenster, the producer of Babelgum's film channel about the company's recent deal for exclusive worldwide Internet and mobile distribution rights for the new documentary film "The Linguists" reveals how Babelgum is seeking to succeed in an already crowded market, and also provides an outline for how independent content creators can tap the broadband medium.

Karol explained that Babelgum is focusing on premium-only content that fits within its half dozen curated channels. Babelgum's focus is the "Internet Free on Demand" (IFOD) window and it always seeks worldwide

distribution rights, since it targets a global audience. A window of exclusive distribution is also important. To find new films, Babelgum has an acquisitions team that scouts film festivals and also works closely with digital rights aggregators such as Cinetic Rights Management, Content Republic, CAA and others. In addition it often deals directly with the content creators.

distribution rights, since it targets a global audience. A window of exclusive distribution is also important. To find new films, Babelgum has an acquisitions team that scouts film festivals and also works closely with digital rights aggregators such as Cinetic Rights Management, Content Republic, CAA and others. In addition it often deals directly with the content creators. That was the case with The Linguists, a new documentary film from Ironbound Films which Babelgum spotted at the 2008 Sundance Film Festival. Karol noted that the producers had been careful about retaining all of their rights. Babelgum secured a 4 month IFOD exclusive window for The Liguistics in exchange for an advance payment and a 50-50 split of ad/sponsorship revenue. Karol wouldn't specify the size of the advance, but said it's typically in the 4 to 6 figure range and is fully recouped before the splits kick in.

Karol believes Babelgum's willingness to pay advances is a key differentiator relative to competitors who he said are mainly focused on pure revenue-sharing deals. His experience is that for most creators who are even somewhat established, revenue-sharing alone won't be appealing.

Of course to make this model work on ad/sponsorship revenue alone requires Babelgum to be pretty careful about which films it acquires. Karol explained the variables that go into calculating the advance. Among other things, how exposed the film is, the length of exclusivity period and the ad sales team's projections. Then there's the traffic expectations. Babelgum pursues an aggressive online campaign including distributing excerpts to social media sites like Facebook and also distributing the film via an affiliate player to film festival sites and on mobile platforms (iPhone only today).

Karol acknowledges that there's some risk involved here, and that it's still very early days in figuring out the formula for how ad-supported only films will work online. However, Babelgum believes the IFOD window augments other distribution (theatrical, DVD, paid online, TV, etc.) and that the industry has recently begun to understand this. Babelgum's progress will be well worth following.

It's no secret that there's a huge amount of interest among independent content creators to exploit the emerging broadband medium. Karol's advice for independents is to get talks started with online distributors simultaneous with hitting the film festivals, clear all the worldwide rights, and be willing to carve up distribution rights into many different slices (with or without the help of digital rights aggregators).

What do you think? Post a comment now.

Categories: Aggregators, FIlms, Indie Video

Topics: Babelgum

-

Blockbuster Follows Netflix Onto TiVo Boxes; Ho-Hum

Blockbuster and TiVo have announced that Blockbuster OnDemand movies will be available on TiVo devices. Though I'm all for creating more choice for viewers to gain access to the content they seek, in this

case I don't see the deal creating a ton of new value in the market, as it comes 6 months after Netflix and TiVo announced that Netflix's Watch Instantly service would be available on TiVo devices and nearly 2 years after Amazon and TiVo made Amazon's Unbox titles available for purchase and download to TiVo users. It looks like the main differentiator here is that Blockbuster will begin selling TiVos in their network of physical stores.

case I don't see the deal creating a ton of new value in the market, as it comes 6 months after Netflix and TiVo announced that Netflix's Watch Instantly service would be available on TiVo devices and nearly 2 years after Amazon and TiVo made Amazon's Unbox titles available for purchase and download to TiVo users. It looks like the main differentiator here is that Blockbuster will begin selling TiVos in their network of physical stores. The deal underscores the flurry of partnership activity now underway (which I think will accelerate) between aggregators/content providers and companies with some kind of device enabling broadband access to TVs. I believe the key to these deals actually succeeding rests on 2 main factors: the content offering some new consumer value (selection, price, convenience, exclusivity, etc.) and the access device gaining a sufficiently large footprint. Absent both of these, the new deals will likely find only limited success.

Consumers now have no shortage of options to download or stream movies, meaning that announcements along the lines of Blockbuster-TiVo break little new ground. To me, a far more fertile area to create new consumer value is offering online access to cable networks' full-length programs. As I survey the landscape of how premium quality video content has or has not moved online, this is the category that has made the least progress so far. That's one of the reasons I think the recent Comcast/Time Warner Cable plans are so exciting.

With these plans in the works, but no timetables yet announced, non-cable operators need to be thinking about how they too can gain select distribution rights. There's still a lot of new consumer value to be created in this space. Given lucrative existing affiliate deals between cable networks and cable/satellite/telco operators, I admit this won't be easy. However, Hulu's access to Comedy Central's "Daily Show" and "Colbert Report" does prove it's possible.

We're well into the phase where premium video content is delivered to TVs via broadband. Those that bring distinctive content to large numbers of consumers as easily as possible will be the winners.

What do you think? Post a comment now.

Categories: Aggregators, Devices, FIlms, Partnerships

Topics: Amazon, Blockbuster, Comcast, Netflix, Time Warner Cable, TiVo

-

The Video Industry's Winners and Losers 10 Years from Now: 5 Factors to Consider

Last week a publicly-traded communications-equipment company invited me to speak to a group of investment analysts it had assembled for its annual "investor day." In the Q&A session following my presentation I took a question that I'm not often asked, nor do I give much thought to: "10 years from now, who will be the video industry's winners and losers?"

It's a far-reaching question that doesn't lend itself well to an impromptu answer. Also, while it's great fun to prognosticate about the long run, I've found that it's also a complete crapshoot, which is why my focus is much shorter-term. I've long-believed there are just too many variables in play to predict with any sort of certainty what might unfold 10 years into the future.

Still, as I've thought more about the question, it seems to me that there are at least 5 main factors that will influence the video industry's winners and losers over the next 10 years:

1. Penetration rate of broadband-connected TVs -There's a lot of energy being directed to "convergence" technologies and devices which connect broadband to the TV. Broadband to the TV is a big opportunity for video providers outside the traditional video distribution value chain. It's also a minefield for those who have dominated the traditional model, such as broadcasters. The Hulu-Boxee spat demonstrates this. A high rate of adoption of broadband to the TV technologies will result in more openness and choice for consumers. That's a good or a bad thing depending on where you currently sit.

2. The effectiveness of the broadband video ad model - A large swath of broadband-delivered video is and will be ad-supported. But key parts of the broadband ad model such as standards, reporting and the buying process are still not mature. There's a lot of work going into these elements which is promising. The extent to which the ad model matures (and the economy rebounds) will have a huge influence on how viable broadband delivery is. Producers need to get paid to do good work or it won't get done. The imploding newspaper industry offers ample evidence. Those with robust online ad models like Google are likely to play a key role in helping distribute and monetize premium content.

3. How well the broadcast industry adapts to broadband delivery - The broadcast TV industry generates about $70 billion of ad revenue annually. But both broadcast networks and local stations are on the front lines of broadband's change and disruption, putting a chunk of that ad revenue up for grabs. With broadband-to-the-TV coming, broadcast networks must figure out how to make broadband-only viewership of their programs profitable on a stand-alone basis (i.e. when the online viewing is the sole viewing proposition). Local stations face bigger challenges. As the Internet was to newspapers, broadband delivery is to local stations. They face a slew of new competitors for ad dollars and audiences, while losing their exclusive access to network programming. To what extent they're able to reinvent themselves will determine how much share they hold on to and how much others peel off.

4. How aggressively today's video providers (cable/telco/satellite) and new paid aggregators pursue broadband video delivery - While anecdotes about "cord-cutting" will no doubt only intensify, the reality is that if today's video providers adapt themselves to broadband realities, they are likely to be as strong or stronger 10 years from now. The recent moves from Comcast and Time Warner are encouraging signs that the cable industry gets that being ostriches about the importance of broadband delivery is a road to nowhere. Consumers expect more flexibility and value; incumbents are in a tremendous position to deliver. Ownership of local broadband access networks that serve consumers' unquenchable bandwidth demands is going to be a very good business to be in. That all said, new paid aggregators like Netflix, Amazon and Apple could well steal some share if they aggressively beef up their content, offer a competitive user experience and deliver a better value. They could have a major impact on online movie distribution in particular.

5. The level of investment in startups - The venture capital industry, crucial to the funding of early-stage innovative technology companies, is going through its own turmoil. The industry's limited partners have been wounded by the market's drop, causing VCs to raise smaller funds (if they're even able to do this), limit the number of investments they make, and shy away from betting on big transformational startups. Plenty of strong video technology companies are still successfully raising money, but it's harder than ever. Lots of potentially promising ideas are going begging. The length and severity of the economic slowdown will have a big effect on just how much funding new technologies that can potentially reshape the video landscape over the next 10 years.

So there are 5 factors to consider in how the video landscape shapes up over the next 10 years. Now back to the here and now..

What's your crystal ball say? Post a comment now.

Categories: Advertising, Aggregators, Broadcasters, Cable TV Operators, FIlms

Topics: Boxee, Comcast, Google, Hulu, Time Warner

-

Amazon VOD Now On Roku; Battle with Apple Looms Ahead

Amazon and Roku announced yesterday that Amazon's VOD service will soon be available on Roku's $99 Digital Video Player. The deal starts to make good on Roku CEO Anthony Woods's intentions about "opening up the platform to anyone who wants to put their video service on this box."

With Amazon VOD's 40,000+ TV programs and movies added to the 12,000 titles already available to Netflix subscribers via its Watch Instantly service (plus more content deals yet to come), little Roku is starting to look like a potentially important link in the evolving "over-the-top" video distribution value chain.

More interesting though, is that I think we're starting to see the battle lines drawn for supremacy in the download-to-own/download-to-rent premium video category between Amazon on one side and Apple on the other. Though Apple dominates this market today, having sold 200 million TV programs alone, there are ample reasons to believe competition is going to stiffen.

Apple is of course in the video download business for the same reasons it was in the music download business: to drive sales of the iPod and more recently - and to a lesser extent - the iPhone. According to the latest info I could find, iTunes now has 32,000+ TV programs and movies, including a growing number in

HD. For now that's slightly less than Amazon VOD, but my guess is that over time the two libraries will be virtually identical.

HD. For now that's slightly less than Amazon VOD, but my guess is that over time the two libraries will be virtually identical. While Apple has a near monopoly on portable viewing via the iPod and iPhone, it is a laggard in bridging broadband-to-the-TV. Its Apple TV device, introduced in January, 2007, and meant to give iTunes access on the TV, has been an underperformer. Certainly a detractor has been price, with the 40GB lower-end model still running $229. But more importantly, as an iTunes-only box, Apple TV perpetuates a closed, "walled-garden" paradigm that consumers are increasingly rejecting (as companies like Roku astutely understand).

For Amazon, the world's largest online retailer, video downloads are a rich growth market. The company brings significant advantages to the table, starting with tens of millions of existing customer relationships with credit cards or other payment options just waiting to be charged for video downloads. Amazon has strong brand name recognition and trust. And of course, it has a near-limitless ability to cross-promote downloads with DVDs and other products.

Determined not to be left behind in the great race to get broadband delivered video all the way to the TV, it has been integrating its VOD service with 3rd party devices like TiVo, Sony's Bravia Internet Video Link, Xbox 360 and Windows Media Center PCs. Its latest deal with Roku is far from its last.

Amazon VOD's adoption will benefit from the fact that there are many non-Amazon reasons that people will be buying these devices. For example, consider Roku, TiVo and Xbox 360. With Roku, Netflix is fueling sales. As Netflix subscribers realize that new releases are generally not available in Watch Instantly, but are through Amazon VOD on Roku, they'll be prone to give Amazon VOD a try (the Netflix limitation is course due to Hollywood's windowing, and another reason why I believe it's crucial for Netflix to make deals with broadcast networks for online distribution of their hit programs). For TiVo and Xbox 360, each has a well-defined value proposition for consumers to purchase. Amazon VOD's availability is a pure bonus for buyers.

Amazon VOD's adoption will benefit from the fact that there are many non-Amazon reasons that people will be buying these devices. For example, consider Roku, TiVo and Xbox 360. With Roku, Netflix is fueling sales. As Netflix subscribers realize that new releases are generally not available in Watch Instantly, but are through Amazon VOD on Roku, they'll be prone to give Amazon VOD a try (the Netflix limitation is course due to Hollywood's windowing, and another reason why I believe it's crucial for Netflix to make deals with broadcast networks for online distribution of their hit programs). For TiVo and Xbox 360, each has a well-defined value proposition for consumers to purchase. Amazon VOD's availability is a pure bonus for buyers.Still, Amazon VOD's Achilles heel that it is missing a portable playback companion on a par with the iPod and iPhone. Users clearly value portability and Amazon needs to solve this problem (hmm, can you say "Kindle for Video?"). Yet another issue is that despite its various 3rd party device deals, the user experience will always be governed by these devices' strengths and weaknesses. In this respect, Apple's ownership of the whole hardware/software/services ecosystem gives it significant user experience advantages (which of course it has masterfully exploited with iTunes/iPod).

Apple and Amazon hardly have the market to themselves though. Others like Microsoft Xbox LIVE, Vudu and Sezmi are vying for a place in the market. And then of course there are the VOD offerings from the cable/satellite/telco video service providers, who have big-time incumbency advantages. Not to be forgotten in all of this is consumer inertia around the robust DVD market, which to a large extent all of these video download options seek to supplant.

In the middle of all this are Joe and Jane Consumer - soon to be overwhelmed by a barrage of competing and confusing offers for how to get on-demand TV program and movie downloads in better, faster and cheaper ways. In this market, I believe simplicity, content choices, brand and especially price will determine the eventual winners and losers. These are front and center considerations for Amazon, Apple and all the others going forward.

What do you think? Post a comment now.

Categories: Aggregators, Devices, Downloads, FIlms, HD

Topics: Amazon, Apple, iTunes, Roku, SezMi, TiVo, VUDU, XBox

-

Fox, Metacafe Have a Winner with New "Australia" Contest

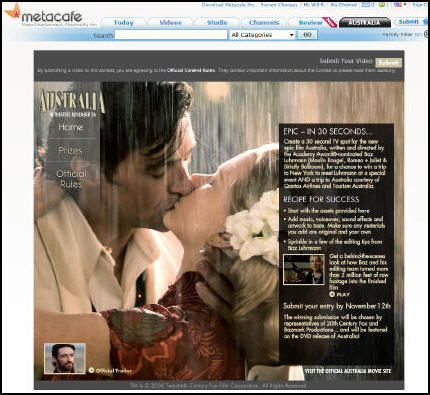

This morning Twentieth Century Fox and Metacafe are announcing "The Thirty Second Film Contest," which challenges contestants to put together a winning thirty second spot for the epic film "Australia," opening on November 26th. Though not yet fully live, I like the direction of this initiative a lot, and believe it provides an innovative example of how to blend traditional film marketing techniques with broadband-enabled audience participation.

Contestants visit the promotional site hosted at Metacafe, a large aggregator of short-form entertainment, to obtain film-related assets provided by Fox. These can be augmented with the contestant's own music, voiceovers, sound effects and artwork to create a highly original entry. Entries are submitted through Metacafe and will be judged by the folks at Fox and Bazmark (Australia director Baz Luhrman's company).

The contest is actually meant to be quite serious and semi-professional; Luhrmann has also created a whole library of videos about film-making, which a student of the art can use to help shape his/her entry, or just watch to learn. The grand prize is enticing: a trip for two to Australia, another to NY for a private screening/meeting with Luhrmann and inclusion of the winning entry on the film's eventual DVD.

The Australia contest builds on a similar one that Metacafe and Universal offered for "The Bourne Ultimatum" last year, which I reviewed enthusiastically here. The concept also follows on previous posts I've done about the value of what I call "purpose-driven user generated video" or "YouTube 2.0" opportunities for users to create videos that have actual business value. I continue to believe that user-submitted videos which go beyond goofball entertainment are a huge area of broadband industry opportunity.

The Australia contest is a winner on multiple levels as it; creates pre-release buzz for the film, allows fans and aspiring artists to get involved and showcase their work, taps into a large base of original (and free!) ideas to help promote the movie, and introduces a fresh, updated approach to film marketing that is sorely needed for differentiation.

This week I've been talking a lot about engagement and why it's so critical in the broadband era. While media and entertainment companies must always focus on driving ratings points or a big opening day box office, the ways to do so are changing. The key change I see is that films, TV programs and other entertainment must become part of a larger experience - complete with multifaceted engagement opportunities - rather than just a one-off moment of audience consumption. Broadband enables this shift in a big way. More marketers need to take advantage of the possibilities.

What do you think? Post a comment now!

Categories: Aggregators, Brand Marketing, FIlms, UGC

Topics: Bazmark, FOX, MetaCafe, Universal, YouTube

-

May '08 VideoNuze Recap - 3 Key Topics

Looking back over two dozen posts in May and countless industry news items, I have synthesized 3 key topics below. I'll have more on all of these in the coming months.

1. Broadband-delivered movies inch forward - breakthroughs still far out

In May there was incremental progress in the holy grail-like pursuit of broadband-delivered movies. Apple established day-and-date deals with the major studios for iTunes. Netlix and Roku announced a new lightweight box for delivering Netlix's "Watch Now" catalog of 10,000 titles to TVs. Bell Canada launched its Bell Video Store, complete with day-and-date Paramount releases, with others to come soon. And Starz announced a deal with Verizon to market "Starz Play" a newly branded version of its Vongo broadband subscription and video-on-demand service.

Taken together, these deals suggest that studios are warming to the broadband opportunity. This is certainly influenced by slowing DVD sales. Yet as I explained in "iTunes Film Deals Not a Game Changer" and "Online Move Delivery Advances, Big Hurdles Still Loom" broadband movies are still bedeviled by a lack of mass PC-TV connectivity, no real portability, well-defined consumer behavior around DVDs and the studios' well-entrenched, window-driven business model. Despite May's progress, major breakthroughs in the broadband movie business are still way out on the horizon.

2. Broadcast TV networks are embracing broadband delivery - but leading to what?

Unlike the film studios, the broadcast TV networks are plowing headlong into broadband delivery, yet it's not at all clear where this leads. In "Does Broadband Video Help or Hurt Broadcast TV Networks" and "Fox's 'Remote-Free TV': Broadband's First Adverse Impact on Networks?" I laid out an initial analysis about broadband's pluses and minuses for networks. I'll have more on this in the coming weeks, including more in-depth financial analysis.

On the plus side, in "2009 Super Bowl Ads to Hit $3 Million, Broadband's Role Must Grow," "Sunday Morning Talk Shows Need Broadband Refresh" and "Today Show Interview with McClellan Showcases Broadband's Power," I illustrated some opportunities broadband is creating. On the other hand, "Bebo Pursues Distinctive Original Programming Model" and "More Questions than Answers at Digital Hollywood" explained how exciting new programming approaches are taking hold, challenging traditional TV production models. Broadcasters are in the eye of the broadband storm.

3. Advertising's evolution fueled by innovation and resources

Last, but hardly least, I continued on one of my favorite topics: the impact broadband video is having on the advertising industry. Over the last 10 years the Internet, with its targetability, interactivity and measurability has caused major shifts in marketers' thinking. With broadband further extending these capabilities to video, the traditional TV ad business is now ripe for budget-shifting. We'll be exploring a lot of this at a panel I'm moderating at Advertising 2.0 this Thursday.

In "Tremor, Adap.tv Introduce New Ad Platforms" and "All Eyes on Cable Industry's 'Project Canoe'" (from Mugs Buckley), key players' innovations were described along with how the cable industry plans to compete. Content providers are being presented with more and more options for monetizing their video, a trend which will only accelerate. Yet as I wrote in "Key Themes from My 2 Panel Discussions Last Week," many issues remain, and with so many content start-ups reliant on ads, there may be some disappointment looming when people realize the ad market is not as mature as they had hoped.

That's it for May. Lots more coming in June. Please stay tuned.

Categories: Advertising, Aggregators, Broadcasters, Cable TV Operators, Devices, Downloads, FIlms, Studios, Video Sharing

Topics: Adap.TV, Apple, Bell Canada, Canoe, iTunes, Netflix, Paramount, Roku, Starz, Tremor, Verizon, Vongo

-

Online Movie Delivery Advances, Big Hurdles Still Loom

Online movie delivery is back in the news, but dramatic change is still well down the road in this space as usability, rights issues and incumbent business models/consumer behaviors pose formidable hurdles.

Yesterday Netflix announced a $99 appliance with Roku, enabling the company's "Watch Instantly" streaming service on TVs. That news follows Apple's deals with a number of big studios in early May obtaining "day-and-date" access to current titles. And today brings news that Bell Canada, that country's largest telco, is formally launching its Bell Video Store, also providing day-and-date delivery, of Paramount titles to start (and soon others), plus portable viewing on Archos devices.

Netflix, which I last wrote about here, took a shot across the bow of Apple TV and Vudu by introducing the

Roku box, the lowest-priced broadband movies appliance yet. Apples-to-apples comparisons aren't fair as the stripped-down Netflix/Roku box doesn't have a hard-drive or equivalent processing. That inevitably means lower quality delivery vs. locally-stored content with the others, plus uncertainty about HD-delivery. Netflix/Roku's big advantage is that it's a value-add service for current Netflix subscribers, meaning no new fees as with the Apple TV/Vudu approaches.

Roku box, the lowest-priced broadband movies appliance yet. Apples-to-apples comparisons aren't fair as the stripped-down Netflix/Roku box doesn't have a hard-drive or equivalent processing. That inevitably means lower quality delivery vs. locally-stored content with the others, plus uncertainty about HD-delivery. Netflix/Roku's big advantage is that it's a value-add service for current Netflix subscribers, meaning no new fees as with the Apple TV/Vudu approaches.However, Watch Instantly has older titles and amounts to less than 10% of Netflix's total catalog. I don't see that changing much; Watch Instantly runs smack into studios' incumbent windowing approach and deals with HBO, Showtime and Starz for premium TV. Netflix's model is built on the home video window, so new online delivery rights must be obtained which will be a tough road. However, with Paramount, MGM, Lionsgate and others splintering from Showtime recently to set up their own premium channel, it's possible that some studios' rights may loosen up, but of course at a price.

Still, I don't see the Netflix/Roku box breaking 10% penetration of Netflix's sub base any time soon, barring a box giveaway. Enlarging the value proposition by licensing the Roku technology for inclusion in other devices (e.g. Blu-ray) could also help drive adoption.

Meanwhile, today Bell Canada is announcing the formal launch of its Bell Video Store. In beta since late '07,

it offers 1,500 titles, now including day-and-date delivery from Paramount (and others soon according to Michael Freeman, Bell's director of product management who I spoke to yesterday). This is noteworthy, as it appears to be the first time a service provider has received day-and-date online access from any studio. If other providers follow suit we may finally witness some internal competition with sacrosanct-to-date Video on Demand initiatives.

it offers 1,500 titles, now including day-and-date delivery from Paramount (and others soon according to Michael Freeman, Bell's director of product management who I spoke to yesterday). This is noteworthy, as it appears to be the first time a service provider has received day-and-date online access from any studio. If other providers follow suit we may finally witness some internal competition with sacrosanct-to-date Video on Demand initiatives.By using ExtendMedia's platform, Bell is also enabling downloads-to-own directly to Archos portable devices. With a couple million satellite homes and fiber IPTV fiber-based deployments continuing, there are multiple three screen options looming for Bell. Yet for now these are limited. Michael confirmed Bell has no plans to offer a branded movie appliance a la Netflix/Roku, meaning it will dependent on XBoxes and other PC-TV bridge devices.

Renewed progress and experimentation are welcome in this space, but lots of hard work remains for online movie delivery to become mainstream.