-

5 News Items of Interest for the Week of Aug 2nd

In addition to producing daily original analyses focused on the evolution of the online/mobile video industry, another key element of VideoNuze is collecting and curating links to industry coverage from around the web. Each week there are typically 30-40 stories that VideoNuze aggregates in its exclusive news roundup. Many readers have come to depend on this curated news collection to ensure they're always up to speed.

Now, to take news curation up another level, on Fridays I'm going to test out highlighting 5-6 of the most intriguing news items of the week. In case you missed VideoNuze for a day or two during the week, you can check in on Friday to see the these top 5-6 industry stories of the week, some of which VideoNuze may have covered itself. Synopses and implications are noted. Enjoy and let me know your reactions!

Wired to Produce Short Films For iPad

The tech magazine recruits Will Ferrell for four short videos that lampoon inventions that failed to take off. Exclusively for its iPad app. More evidence of print pub capitalizing on video.

Motorola and Verizon team up for TV tablet

Enjoying success with its Droid smartphones, Motorola now looks to challenge the iPad, with its own tablet device, using Google's Android OS. A partnership with Verizon could mean new online video features for the phone giant's FiOS service. Another sign of evolution in the pay-TV business.

Bewkes: Rental Delays From Netflix, Redbox Is Paying Off For DVD Sales

The 28-day DVD delayed release window Warner Bros. struck with Netflix earlier this year is helping the studio gain better sales for films The Blind Side and Sherlock Holmes. The deal helps Netflix position itself as a valued partner in the midst of declining DVD sales.

Dish to stream live TV on iPad, other devices

Dish Network takes place-shifting to a new level with plans for an iPad app that would allow remote streaming, likely using its Sling technology. Subscription TV, mobile video viewing and cool devices converge.

FCC Calls Off Stakeholders Meetings

The FCC's private net neutrality negotiations are off the rails as a reported bilateral deal between Verizon and Google causes controversy. Next steps are unknown as the FCC's plan to keep Internet playing field level hits a major pothole.Categories: Devices, FIlms, Magazines, Regulation, Satellite, Telcos

Topics: DISH, FCC, iPad, Motorola, Netflix, Verizon, Warner Bros., Wired

-

Roku Brings Flixster Trailers to the Big Screen

I've become a bigger fan of Flixster since downloading its Android app a couple of weeks ago to my new Droid X. It offers basically everything you need to know about movies already released and those upcoming. So I welcomed the news late yesterday that Flixster had launched a free channel to watch movie trailers on Roku.

need to know about movies already released and those upcoming. So I welcomed the news late yesterday that Flixster had launched a free channel to watch movie trailers on Roku.

I've played around with the Flixster channel and though there are still some quality and formatting issues (especially for older movies), for the most part, it's a welcome addition to the Roku channel store. You can browse trailers in categories including, "Now in Theaters," "Coming Soon," "New on DVD" and "Certified Fresh" (which offers ratings by Rotten Tomatoes). You can also use your remote control to search the full database of trailers.

-

Best Buy's "Movie Mode" Mobile App is Part of New Promotional Trend

When I got home from my long holiday weekend I noticed a huge promotion on the cover of the Best Buy Sunday circular for its new "Movie Mode" app (see below). The app was featured with an offer to buy the new Sprint Evo, but it works on other Android devices as well as iPhones and certain BlackBerry models.

Categories: FIlms, Mobile Video

Topics: Best Buy, Droid X, Evo, Sprint, Verizon

-

Katzenberg's Right, the DVD Ownership Era Seems All But Over

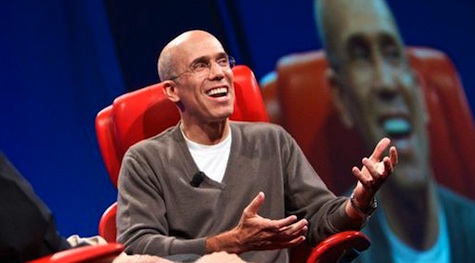

At the tail end of an interview with Walt Mossberg at the recent D8 conference, Jeffrey Katzenberg, CEO of Dreamworks Animation SKG, and a long-time Hollywood executive, argued that rapidly-declining DVD sales are "systemic," and should not be considered a "secular" downturn that will reverse itself when the economy improves. Katzenberg believes that what's really at work are fundamentally changing consumer habits. He argued that with DVDs costing $20 or more, consumers are questioning the value of ownership since there are so many other ways to access the film on an on-demand basis (he mentioned Netflix, Blockbuster, Redbox, VOD, iTunes as among the options).

I agree with Katzenberg, but would take his argument one step further. While it is no secret that there are more options than ever for accessing content (as mentioned above), of even more significance is that technology awareness and aptitude - the prerequisites for taking advantage of the choices now available - are deeper and more diffuse in our society than ever.

Categories: FIlms

Topics: D8, Dreamworks Animation SKG, Jeffrey Katzenberg

-

Metacafe Expands Movies Hub; Emphasizes Short-form Premium Content

Today, Metacafe announced the expansion of the Metacafe Movies "hub," which adds to existing film content. Metacafe is continuing its emphasis on short-form premium content targeted at the young male audience. The expansion includes adding new original programming, creating an HD Channel MetaHD, and building out a fully immersive online stereoscopic 3D showcase, where even the advertisements will be in 3D. Additionally, Metacafe CEO Erick Hachenburg explained that new team leads, Mark Poggi, recruited from Netflix and Steven Horn, from Rotten Tomatoes, will help shape an editorial voice to the video selection, keeping it fresh with content directly from the studios.

expansion includes adding new original programming, creating an HD Channel MetaHD, and building out a fully immersive online stereoscopic 3D showcase, where even the advertisements will be in 3D. Additionally, Metacafe CEO Erick Hachenburg explained that new team leads, Mark Poggi, recruited from Netflix and Steven Horn, from Rotten Tomatoes, will help shape an editorial voice to the video selection, keeping it fresh with content directly from the studios.

Erick cited Metacafe's editorial voice and emphasis on video as the key sources of its differentiation. He sees Metacafe users exploring 5 or 6 additional Metacafe exclusive clips instead of just a trailer. He compared competitive video sites like YouTube, Hulu, and even Yahoo/AOL to "broadcast" networks with clips for everyone, but not enough targeted navigable content. On the other hand he sees Metacafe catering to a key demographic, much like a niche cable network.

Categories: FIlms

Topics: MetaCafe

-

Hollywood Considers Squeezing Theatrical Window

An article in the WSJ.com this past weekend, "Hollywood Eyes Shortcut to TV," describes how some Hollywood studios' appear ready to further squeeze their bread-and-butter theatrical relationships in the name of accelerated electronic distribution to viewers' TVs.

The article cites proposals that Time Warner Cable, America's 2nd largest cable operator, is discussing with studios to offer movies to Video-on-Demand (VOD) just 1 month after they open in theaters, instead of today's typical 4 months. The idea, dubbed "home theater on demand" ("HTOD" for short) would mean a movie would be available on HTOD while still playing in theaters. Adopting such an approach would be akin to Hollywood sticking its finger in the eye of its theatrical partners, who would obviously suffer some degree of diminished ticket sales.

Hollywood studios surely know the firestorm an HTOD move would create. In the past 6 months, plans to overlap theatrical and electronic distribution - with Disney's "Alice in Wonderland" and Sony's "Cloudy With a Chance of Meatballs" - met with stiff resistance from theater owners. With the new HTOD concept, studios seem intent on pushing further into this perilous territory, motivated by a desire to get movies into viewers' hands earlier than ever before.

In general I applaud studios willingness to experiment, but I think the value of HTOD and other early release plans is overestimated and more likely to backfire on studios than produce any tangible financial benefits.

The first issue is cannibalization. It's hard to imagine, given all the marketing effort around a movie's premiere, that the aggregate short-term audience for a particular movie can be expanded all that much. Certainly few people who just paid to see the movie in the theater will pay again to see it at home so quickly thereafter. And if you really wanted to see a movie, wouldn't you have made it to the theater in the first place?

Instead of tempting people to not bother going out, studios should be giving consumers more reasons to actually do so. Studios have so many new opportunities with social media, local-based services and user-generated content to add excitement to movie premieres. This is particularly true for younger audiences critical to box office results. Some of these new efforts can extend all the way through a movie's DVD and electronic release, adding downstream value as well.

In addition, even with movie ticket prices now approaching or hitting $20 apiece, in my opinion, HTOD's proposed fee of $20-30 is way too high. Most VOD movies today cost around $5-6; trying to justify a multiple of that price for HTOD, for the sole benefit of earlier in-home access, is a huge stretch. In reality, consumers seem plenty willing to wait in exchange for lower prices. That's the key takeaway from Netflix's willingness to do the 28-day DVD window deals with major studios. If a consumer can pay a paltry $9/mo they'll be just fine waiting until the movie becomes available on DVD or for streaming. Hollywood needs to be careful not to overestimate the value of its product.

Last but not least, HTOD is a risky play because cable-delivered VOD itself is going to be coming under intensifying competition. Recently I explained how competition for movie rentals is intensifying, making VOD just one of many, many choices for consumers. Initiatives like Google TV undermine VOD because when a consumer can just as easily access movies from various online outlets directly on their TVs, VOD usage will inevitably suffer. Though I'm skeptical about new efforts from retailers like Wal-Mart and Best Buy, they will add more on-demand movie choices and will further turn up the pressure on VOD.

Electronic distribution is a hot topic these days, and studios are right to explore their options. But while studios' relationships with theater owners are far from optimal, in my opinion studios need to be very careful about jeopardizing them further. Rather than undermining theatrical release with ever-earlier electronic distribution plans, studios should be figuring out how to build more value into them.

(Note - if you want to learn more about how Hollywood succeeds in the digital distribution era, make sure to join us for the upcoming VideoSchmooze breakfast in Beverly Hills on June 15th! Click here to learn more and register for the early bird discount)

What do you think? Post a comment now (no sign-in required).Categories: Cable TV Operators, FIlms, Studios, Video On Demand

Topics: Disney, Netflix, Sony, Time Warner Cable

-

Hollywood Video's Closing Underscores End of Video Rental Store Era

When it was reported earlier this week that Hollywood Video, once the 2nd largest operator of video rental stores, would close all its remaining stores, it was further evidence of how much the landscape for movie rentals has changed. When you stop and think about it, it wasn't really that long ago when Hollywood Video, Blockbuster and other rental stores dotted America's cities and towns, making rentals a short drive or walk away (no matter how short though, if the movie wasn't returned promptly major late fees kicked in).

changed. When you stop and think about it, it wasn't really that long ago when Hollywood Video, Blockbuster and other rental stores dotted America's cities and towns, making rentals a short drive or walk away (no matter how short though, if the movie wasn't returned promptly major late fees kicked in).

Fast forward to today, and electronic delivery options abound, but with lots of quirks consumers need to understand. As I wrote recently in "The Battle Over Movie Rentals is Intensifying," the options vary and include VOD, download to rent and own, subscription access, DVD purchase, etc. And the devices through which consumers access movies is dizzying - set-top boxes, special purpose appliances, game consoles, DVRs, mobile devices, iPads, etc. Even still, there is so much more yet to happen with movie delivery as wireless and wired broadband coverage expands, HD online delivery increases, portability between devices happens and so on.

What do you think? Post a comment now (no sign-in required).

Categories: FIlms

Topics: Hollywood Video

-

Fox and Netflix Agree to 28-Day Window

Netflix and Fox are announcing this morning an expanded content licensing agreement which creates a 28-day DVD window and gives Netflix streaming access to certain prior season Fox TV shows. The 28-day window, which delays Netflix access to new DVDs until 28 days after their release date is similar to a deal that Netflix struck with Warner Bros. earlier this year.

I continue to be a fan of the 28-day window, as it allows studios a little more time to eke further revenue out of the rapidly-declining DVD sales business, while expanding Netflix's catalog for streaming and reducing its cost on physical DVD purchases. Netflix's Watch Instantly streaming feature has been a game-changer for the company, essentially reinventing the company's value proposition from a DVD subscription business defined by the number of discs out at any time, to one where subscribers get unlimited digital use. The key to its success is building the library of titles for streaming and that's what these 28-day deals are all about.

while expanding Netflix's catalog for streaming and reducing its cost on physical DVD purchases. Netflix's Watch Instantly streaming feature has been a game-changer for the company, essentially reinventing the company's value proposition from a DVD subscription business defined by the number of discs out at any time, to one where subscribers get unlimited digital use. The key to its success is building the library of titles for streaming and that's what these 28-day deals are all about.

Update: Universal also announced a 28-day deal with Netflix this morning. Release is here.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators, FIlms, Studios

-

Blockbuster Hangs In with New Fox, Sony and Warner Deals

Netflix wasn't the only distributor modifying how it does business with Hollywood studios this week; Blockbuster also unveiled new deals with Fox, Sony and Warner, giving it "day-and-date" availability of these studios' films for store and mail rental (note, not for its on demand streaming service). Blockbuster also got "enhanced payment terms" from the studios in exchange for giving them a first lien on Blockbuster's Canadian assets (which would imply that if Blockbuster files for bankruptcy, the studios could end up owning/operating a slew of Canadian stores). Seems like steep terms for Blockbuster to hang in there.

for store and mail rental (note, not for its on demand streaming service). Blockbuster also got "enhanced payment terms" from the studios in exchange for giving them a first lien on Blockbuster's Canadian assets (which would imply that if Blockbuster files for bankruptcy, the studios could end up owning/operating a slew of Canadian stores). Seems like steep terms for Blockbuster to hang in there.

As I wrote a few weeks ago in "The Battle Over Movie Rentals is Intensifying," there are multiple distributors jockeying to be the consumer's preferred movie source. That means consumers need to figure out, on a title by title basis what works best for them.

For example, I'm a Netflix subscriber and let's say I want to watch the recently released "Sherlock Holmes" DVD. Netflix doesn't get it until April 27th per its 28-day window with Warner Bros. But when I check online, a local Blockbuster store I've never been to shows that it's in stock (though I'm a little skeptical). Do I want to drive down there to find out? Meanwhile, Comcast is offering it on-demand. But do I want to pay $4.99 for it when I'm already paying a monthly Netflix subscription? Alternatively, there's iTunes and Amazon VOD. But then I need to either watch on my computer or on the TV that's hooked to the Roku or temporarily connect my laptop to the TV. See what I mean about the choices facing consumers?

(Note - online movie distribution is among the topics we'll cover at the next VideoSchmooze on April 26th. Early bird discounted tickets available for just one more week!)

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators, FIlms, Studios

Topics: Blockbuster, FOX, Netflix, Sony, Warner Bros.

-

The Battle Over Movie Rentals is Intensifying

News this morning of a $30 million advertising campaign being launched by 8 Hollywood studios and 8 cable operators promoting "Movies on Demand" is fresh evidence that the battle over movie rentals is intensifying. According to the press release, the 12-week campaign, dubbed "The Video Store Just Moved In" is meant to raise consumer awareness of the convenience and affordability of renting movies on cable.

News this morning of a $30 million advertising campaign being launched by 8 Hollywood studios and 8 cable operators promoting "Movies on Demand" is fresh evidence that the battle over movie rentals is intensifying. According to the press release, the 12-week campaign, dubbed "The Video Store Just Moved In" is meant to raise consumer awareness of the convenience and affordability of renting movies on cable.

Cable Video-on-Demand (VOD) has been around for a long while (in fact 20 years ago my summer internship for Continental Cablevision was studying the ROIs for VOD's precursor, "Pay-per-view"). What's new more recently is the growth of so-called "day-and-date" availability - which means movies are released to VOD at the same time as they become available on DVD. The other recent phenomenon is the widespread adoption of digital set-top boxes and other technologies which makes selection, ordering and delivery easier than ever.

Day-and-date availability is a key competitive differentiator for cable vs. other options, though on the surface it seems somewhat incongruous that studios are on board with this considering their desire to protect DVD sales (this was the key goal of the 28-day "DVD sale" window Netflix and Warner Bros. recently created). Yet Kevin Tsujihara, president of Warner Bros. Home Entertainment Group said that apparently research has shown that simultaneous VOD release doesn't hurt DVD sales. All titles Warner Bros. releases to VOD this year will have day-and-date availability.

The day-and-date advantage is evident at least vs. Netflix for the 9 movies the press release cited as the opening slate being promoted: "Precious," "New Moon," "Ninja Assassin," "Pirate Radio," "Astro Boy," "Bandslam," "Did You Hear About the Morgans," Fantastic Mr. Fox" and "The Fourth Kind." A search on Netflix for the 9 revealed that 5 are listed as "Short wait," 1 becomes available on Mar 20th, 1 on Mar 23rd, and 2 on April 13th (none are available for streaming). However, it's a different story for Amazon - all of the cable VOD movies are currently available for rental from Amazon (except "Mr. Fox") and for purchase. The Amazon rental price is $3.99 for each, whereas the rental price from Comcast (my service provide) is $4.99.

For now anyway, it seems Hollywood studios have decided that cable VOD and online rental firms get day-and-date access, while subscription services like Netflix wait longer (btw Redbox too is being pushed into the "wait longer" category). According to the NY Times article, this is likely because VOD and online rental give studios a 65% share of revenue vs. lower percentages for other outlets.

For consumers, the cable VOD option is likely the most convenient and instantly gratifying. There's no new box to set up or pay for as with Roku, TiVo or another, which would be needed to access Amazon VOD, for example, on TV. For those that haven't bridged broadband to their TV with such a box or a direct connection, on-computer viewing only would be a limitation in the experience. Still, while the day-and-date option is key for those consumers who just have to see a particular title right then, because it's a la carte, it's a far more expensive option than a monthly Netflix subscription, which starts at $8.99/mo. Convenience clearly has its price.

Consumers aren't monolithic though; there isn't one right or wrong model. Each viewing option offers pros and cons and consumers will choose which one, given the particular moment or circumstance, best meets their needs. With the battle for movie rentals escalating, the real winner here looks like the consumer who is being presented more choices than ever.

What do you think? Post a comment now (no sign-in required).

Categories: Cable TV Operators, FIlms, Studios, Video On Demand

Topics: 20th Century Fox, Armstrong, Bend Broadband, Bright House Networks, Comcast, Cox, Focus Featu, Insight, iO TV, Time Warner Cable

-

MovieClips.com is Poised to Provide Addictive Fun

With the Oscars coming up on Sunday night (my prediction btw: "Avatar" wins everything) - it was timely to speak earlier this week to MovieClips.com's co-founders Zach James and Richard Raddon. MovieClips.com, which launched in December, just announced that it was taking away its geo-restriction, effectively making its clips available to most of the world. It also released an API so 3rd parties (bloggers and others) can incorporate some of the site's key features.

MovieClips.com is a wonderful example of how online video is unlocking value in archived assets. As its name implies, the site offers searching and browsing for your favorite movie scenes/quotes. Rich and Zach have been going through the arduous process of signing deals with studios for legitimate rights to index their movies (of course a lot of this already lives illegitimately at social media myriad sites). Their goal is to become the key source of movie clips, supported primarily by ads.

in archived assets. As its name implies, the site offers searching and browsing for your favorite movie scenes/quotes. Rich and Zach have been going through the arduous process of signing deals with studios for legitimate rights to index their movies (of course a lot of this already lives illegitimately at social media myriad sites). Their goal is to become the key source of movie clips, supported primarily by ads.

As you would expect from the recently-launched site, clip availability is a still a little hit-or-miss. While Rich and Zach said they believe they have about 65-70% of the most sought after clips, I needled them because I came up empty on my first 3 searches (Terminator 2's "Hasta la vista, baby," The Shawshank Redemption's "Get busy living or get busy dying" and Risky Business's "Who's the U-boat commander?"). I did have better luck on subsequent searches. The company is filled with film buffs and so they have very good insight on what films and studios they need to pursue most aggressively to build out the clip library. A huge part of the site's appeal is the social media opportunities. When you're looking to relive some favorite movie memories, MovieClips.com is going to be very addictive.

What do you think? Post a comment now (no sign-in required).Topics: MOVIECLIPS.com

-

VideoNuze Report Podcast #52 - March 5, 2010

Daisy Whitney and I are pleased to present the 52nd edition of the VideoNuze Report podcast, for March 5, 2010.

First up this week I discuss my post from this past Monday, "ABC.com is Now Achieving 'DVR Economics' for Its Programs," in which I described how ABC is now generating roughly the same revenue per program per viewer in online as it is when its programs are watched in DVR playback mode. Albert Cheng, EVP of Digital Media at Disney-ABC had explained to me last week that ABC recently concluded that since online and DVR are both "catch-up" opportunities, it was more appropriate to compare them to each other than to on-air.

Key to this logic is that ABC maintains a release window for its programs, with them being posted on the site 4-6 hours after broadcast. As a result, people who really want to see the program when it's first available still watch on-air (and may in fact re-watch online or via DVR). As long as there's an audience for broadcast, and online doesn't cannibalize it, the logic makes sense to me. Albert also explained that there's further upside in online through increasing the ad load, which is something ABC has experimented with.

Daisy picks up on that point, noting that CBS's Anthony Soohoo told her in an interview for Beet.tv that CBS is considering moving to a full ad load online because the online and on-air experience are converging, which suggests to them that viewers would tolerate more ads. We dig into the interplay between online and DVR usage, which I think is increasingly going to be a key focus for networks in how they choose to monetize online viewing.

Wrapping up, we review what some of the social media "listening" sites that are tracking the Oscar predictions are saying. Daisy appears officially addicted to following the online chatter.

Click here to listen to the podcast (14 minutes, 41 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, Broadcasters, FIlms, Podcasts

-

U.K. Theaters Will Show "Alice in Wonderland" Ending DVD Early Release Flap

The brinksmanship between Disney and the 3 largest U.K. theater chains over whether they would show Tim

Burton's new "Alice in Wonderland" film is officially done, with all 3 chains now signed on. As I described last week in "In Trying to Preserve DVD Sales, Studios Are in a Tight Spot," in a bid to boost DVD sales, Disney was looking to trim the DVD release of "Alice" to just 12 1/2 weeks after its opening, from the customary 16 1/2. British and other European theaters revolted, angry that the move would diminish their box-office take, a particular hot-button in light of significant investments they've recently made in digital technologies.

Burton's new "Alice in Wonderland" film is officially done, with all 3 chains now signed on. As I described last week in "In Trying to Preserve DVD Sales, Studios Are in a Tight Spot," in a bid to boost DVD sales, Disney was looking to trim the DVD release of "Alice" to just 12 1/2 weeks after its opening, from the customary 16 1/2. British and other European theaters revolted, angry that the move would diminish their box-office take, a particular hot-button in light of significant investments they've recently made in digital technologies. Specific details of the Disney-U.K. deals aren't known, but as the Guardian reported, it appears that Disney has agreed to cap the number of movies that will get earlier-than-usual DVD releases and provided some improved financial terms. Despite the U.K. resolution, some other European chains are still holding out, as is the AMC chain in the U.S. Regardless of the final outcome of the "Alice" situation, early DVD releases are going to remain a priority for Hollywood studios who are desperate to stanch the fall-off in DVD sales brought about by the recession and the shift by consumers to rental, subscription and online viewing options. There are many more chapters to be written in this saga.

What do you think? Post a comment now (no sign-in required).

Categories: FIlms, International, Studios

Topics: Alice in Wonderland, Disney

-

Wal-Mart's Acquisition of Vudu Makes Little Difference

Yesterday's announcement by retailing giant Wal-Mart that it was acquiring Vudu, the on-demand movie service, generated a flurry of reactions from industry commentators. Some think it gives Wal-Mart the juice it needs to finally be a major digital media player. Others believe that Wal-Mart's miserable record in digital media suggests that the deal will be much ado about nothing. I'm in the latter camp, but not because of Wal-Mart's track record, but rather because of Vudu's own shortcomings.

Vudu's problem is that its value proposition is hamstrung by both the deals the Hollywood studios insist on to give Vudu access to their titles and by the current state of technology. Each of Vudu's 2 movie delivery

models - rental and download-to-own - has its own problems that severely curtail its consumer appeal. No matter how slick the service looks or how many CE devices it's embedded in, consumers will readily see these drawbacks and resist embracing Vudu.

models - rental and download-to-own - has its own problems that severely curtail its consumer appeal. No matter how slick the service looks or how many CE devices it's embedded in, consumers will readily see these drawbacks and resist embracing Vudu.The rental model is primarily handicapped by the ongoing provision that the rental period "expires" 24 hours after the movie was started. That means that if real life (e.g. a crying child, a call from an old friend, a household emergency) interrupts the Vudu's users' planned viewing window, they're out of luck. It's an absurd restriction, but all online movie rentals are laboring under it. Then there's the provision that most new releases aren't available for rental until 30 days after they debut on DVD. This kind of delay doesn't mean as much for a subscription service like Netflix (which of course just agreed to a new 28-day "DVD sales window" with Warner Bros.), because it has a huge back catalog to offer. But for Vudu (and Redbox) these delays are very noticeable to users.

The download-to-own model is even more challenged. First off, tech-savvy and value-conscious consumers are increasingly focused on cost-effective rentals or subscriptions, not purchasing films. The demise of DVD sales is ample evidence of this. The idea of creating a movie "collection" in a fully on-demand world is already on the verge of seeming as archaic as creating a CD collection has been for a while. And with download-to-own prices of approximately $20, which are more than a DVD costs, consumers will be even more hesitant.

But the real killer for download-to-own is the technology limitations, more specifically the lack of portability and interoperability. Say you're actually inclined to own movies using Vudu. What do you do, download them to an external hard drive? And when you travel, do you lug that thing around with you? When you get to your destination, what device will actually let you play back your movie from your hard drive? The issues go on. The reality is that ubiquitous, cheap DVD players and the compact size of the discs themselves have created a very high bar for digital delivery to exceed. "Digital locker" concepts like DECE and Disney's KeyChest are desperately needed to move digital downloads along, but even they are just a part of a larger CE puzzle.

So, although the Vudu service is very impressive, with a slick user experience and really nice quality video, the reality is that unless Wal-Mart is able to break through these challenges, the Vudu service is going to be marginally attractive to consumers at best. That means the Wal-Mart acquisition, in fact, makes little difference.

Maybe Wal-Mart has the clout to move the studios, but given mighty Apple's own difficulties doing so, I'm skeptical that Wal-Mart will have better luck. I continue to believe that Netflix's model - which combines the full selection of DVDs with the convenience and growing selection of online delivery (including TV shows by the way) - is a far better approach. Netflix may not have all the HD and user interface bells and whistles that Vudu has, but it's a far better value proposition for consumers. This is partly why Netflix has doubled in size, to 12.3 million subscribers, in the last 3 years.

What do you think? Post a comment now (no sign-in required).

Categories: Deals & Financings, FIlms, Studios

Topics: Apple, DECE, Disney, KeyChest, Netflix, VUDU, Wal-Mart

-

VideoNuze Report Podcast #50 - February 19, 2010

Daisy Whitney and I are pleased to present the 50th (woohoo!) edition of the VideoNuze Report podcast, for February 19, 2010.

This week Daisy first walks us through a piece she's writing for AdAge focused on viral video. In reviewing data on which videos have broken out online, Daisy concludes that invariably they are also supported by related advertising. In other words, viral video isn't accidental any more (if it ever was) - now it must be stoked by paid support. An example Daisy provides is for Evian's "Live Young" babies ad which has been seen online 76 million times. Evian initially promoted the ad with YouTube takeover ads. Daisy also discusses the online performance of Super Bowl ads based on Visible Measures' new Trends application, which shows a big disparity between ads that were viewed heavily online vs. rated highly when seen on TV.

Then we discuss my post, "In Trying to Preserve DVD Sales, Studios are in a Tight Spot," in which I described the lengths to which Hollywood studios are going to squeeze out the last remaining profits from DVD sales. As I explain, while the recession has had a dampening effect on DVD sales, the larger problem is that rather than buying them, increasingly consumers are expecting films to be available for rental or subscription or even for free, with ad support. A number of moves from Disney, Sony and Warner Bros. in the last week underscore the consequences studios face as they try to shore up DVD sales.

Click here to listen to the podcast (14 minutes, 8 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, FIlms, Studios

Topics: Disney, Podcast, Sony, Visible Measures, Warner Bros.

-

In Trying to Preserve DVD Sales, Studios Are in a Tight Spot

It's not news that DVD sales - the lifeblood of Hollywood studios' P&Ls - are in a freefall. In response, the studios are doing all sorts of things to eke out just a little more profitability from the sales of the shiny discs. But as several news items over the last week underscore, the studios have little wiggle room before their efforts to shore up DVD sales have real or perceived consequences for key business partners.

Exhibit A is the brouhaha over Disney's new plan to release Johnny Depp's "Alice in Wonderland" on DVD 12 1/2 weeks after its theatrical opening, instead of the usual 16 1/2 weeks, regardless of whether it's still playing in theaters. In the past, when a film's "release windows" were distinct and well-separated, everyone in the distribution chain knew they'd have their separate bite of the apple. With collapsing windows, those bites are converging, leaving some feeling they're not going to get their fair share. In the U.S. there has mostly been just grousing about Disney's plan among theater owners, but in Europe there are threats by large theater chains of an all-out boycott of the film.

It's hard not to feel some sympathy for the theater owners as the "Alice" plan isn't a random event. Sony recently ran a misguided promotional campaign giving away "Cloudy with a Chance of Meatballs" DVDs to certain Bravia buyers while the film was still playing in theaters. And it attempted to accelerate the release of the Michael Jackson "This Is It" DVD until theater owners drew the line. No doubt there are plenty of other examples being floated privately in Hollywood.

Meanwhile, news also broke this week that Redbox, the $1 a day rental kiosk chain had acceded to Warner Bros.' demand that it not rent any films until 28 days after their DVD release, in order to help preserve initial sales. As part of the deal Warner dropped its lawsuit against Redbox. In return, Redbox got lower pricing on its Warner DVD purchases. The deal mirrors the 28-day deal Netflix did with Warner last month, which I thought was a win for everyone. But the key difference in that deal vs. Redbox's is that Netflix has a huge rental catalog available for its subscribers to choose from, meaning new releases are far less important (Netflix says only 23% of rental requests are for new releases). On the other hand, Redbox's whole value proposition rests on low prices and selection of new releases. What is Redbox's fate if it does similar deals with other studios?

Putting the squeeze on Redbox and its kiosks seems like a dubious strategy by studios. In an age where piracy looms large, studios should be focused on enhancing, not diminishing the accessibility of their product (as a Coke executive once famously explained the company's marketing goal: "always within an arm's length of desire"). While Hollywood doesn't like Redbox's lower margins, focusing on that issue excessively when the product is clearly in decline is missing the forest for the trees.

Studios' desire to preserve DVD sales is going to further intensify, but defending them is only going to get harder. Certainly part of the reason is that the ongoing recession is forcing many consumers to cut back on their discretionary purchases. But the larger issue is that there's huge momentum behind the shift to online subscription/rental and even free models. The data shows that online viewing hit an inflection point in 2009, with free premium sites like Hulu experiencing extraordinary growth.

And the data showing online's appeal pours in almost daily; yesterday it was The Diffusion Group reporting results of a study of Netflix users showing that two-thirds of them that have a broadband connection are now using the "Watch Instantly" streaming feature. This week's launch of HBO Go, the premium channel's site for its subscribers, and its distribution deal with Verizon, are evidence that even the mighty HBO can't resist online's allure. Last but not least, in 2010 TV Everywhere rollouts will gain steam.

There's no denying the truth that DVD sales are under assault from all sides. Studios, desperate to hold on to DVDs' precious profits, are increasingly contorting themselves to keep the DVD cash cow alive a little longer. No surprise though, their efforts are not without consequences. At what point do the studios capitulate and throw DVD sales under the bus? We'll have to wait and see.

What do you think? Post a comment now (no sign-in required).

Topics: Disney, Netflix, Redbox, Sony, Warner Bros.

-

New "Trends" Application from Visible Measures is Invaluable - and Addictive

Visible Measures, the third-party measurement firm for online video, is taking the wraps off its new "Trends" web-based application this morning. I've been playing around with it for the last couple of days with a courtesy login and not only does it pack a ton of value, it's also really addictive.

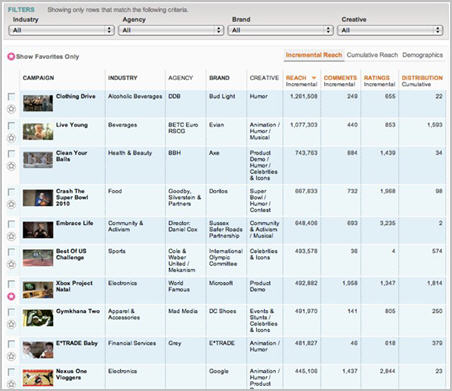

Trends offers access to videos in 3 different data sets, or "collections": Social Video (currently 165 online ad campaigns that have gone viral), Film Trailers (currently 115, and growing by 3-4 per week), and all the recent 2010 Super Bowl ads. The results table for a query displays the campaign's thumbnail image and its name, along with its views or "reach" based on Visible Measures' "True Reach" data (either incremental or cumulative) plus the number of comments, ratings and points of distribution. The table also displays each ad's industry categorization, ad agency, brand name and type of creative type (humor, contest, product demo, etc.). Viewing any particular ad is also just one click away.

Users can take advantage of Trends in any number of ways, depending on their particular interest. As one example, I started by choosing the Social Video collection and "Cumulative Reach" for the current time period. I was interested to see just campaigns for beverages, so I chose that category, but allowed all agencies, brands and creative types to be displayed. In an instant I was presented with a table of 20 results on 2 pages, starting with Evian's hilarious "Live Young" campaign featuring the dancing babies that has garnered almost 74 million views to date. After looking it over, I also reviewed the other campaigns in the top 5, from Pepsi, AMP and Anheuser-Busch. Click on the image below if you'd like to see a 4 minute video demo.

In the social and online video-dominated world we now live in, Trends data is invaluable for brand advertisers and their agencies. It allows them to customize their views of the database, compare different campaigns and analyze what worked online and what didn't. Online distribution is now a key part of calculating the ROI on a campaign, so being able to benchmark the performance of past campaigns provides insight not normally available in traditional TV advertising.

For example, say an agency is formulating a plan for its client's new shampoo - Trends lets its creative executives understand whether prior campaigns featuring product demos, humor or celebrities worked best online. A few quick queries will yield data that can be exported to create charts and graphs for everyone on the team to review. Of course past experience can perfectly predict the future, but Trends provides hard data that lets the creative discussion quickly move beyond gut instinct.

The Visible Measures team told me last week that they've been gradually exposing more and more of their data, through top 10 lists with media partners like AdAge, Variety, Mashable and Motor Trend. With Trends, the data is even more accessible. Visible Measure is also making a public beta of Trends available, though just for the Social Video collection. It's free and it's fun - I recommend giving it a try.

What do you think? Post a comment now (now sign-in required).

Note - Visible Measures is a VideoNuze sponsor.

Categories: Advertising, Analytics, FIlms

Topics: Visible Measures

-

YouTube's Meager Sundance Rental Revenues Really Weren't That Surprising

This week brought news that YouTube's recent foray into rentals netted the company a whopping $10,709.16. I wasn't surprised by the results, as YouTube only made 5 Sundance films available for 10 days. As I suggested 2 weeks ago, even with YouTube's massive audience, it would be unreasonable to expect too

much. Still, it was great promotion for the indie film producers and no doubt a learning experience for YouTube.

much. Still, it was great promotion for the indie film producers and no doubt a learning experience for YouTube. I'm not religiously opposed to YouTube broadening its model beyond free and ad-supported video, but I do think YouTube needs to be wary of spending a lot of time trying to secure me-too rights for distribution of Hollywood's prime TV and movie output. That's highly competitive ground, and Netflix for one, has enormous advantages given its robust subscription model. YouTube is in the pole position when it comes to the ad-supported online video model and it needs to be relentlessly focused on proving it can make the model profitable.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators, FIlms, Indie Video

Topics: Sundance Film Festival, YouTube

-

4 Items Worth Noting for the Jan 18th Week (YouTube rentals, Newspaper bankruptcies, Prada's film, iSlate hype)

Following are 4 items worth noting for the January 18th week:

1. YouTube dips toe into film rentals, more to come - This week YouTube took a very small step into film rentals, announcing that 5 indie films will be available for $3.99 apiece until the end of the Sundance Film Festival on Jan. 31st, and that it is launching a "Filmmakers Wanted" program to bring additional indie films (and possibly other content) to YouTube's audience for rental.Last fall, when the WSJ first broke the news that YouTube was negotiating with a number of Hollywood studios about launching a full-blown rental store, I thought the plan was intriguing, but dubious. I argued that YouTube needed to stay focused on getting its ad model right, that it would be hard to differentiate its film rentals from those of myriad competitors and that the revenue upside for YouTube was relatively small.

I continue to believe those things and hope YouTube isn't still pursuing Hollywood dreams. That said, I do like the idea of it offering a paid option for indie and other hard-to-find video. YouTube's massive audience brings real promotional value to these often-obscure, yet high-quality titles, potentially significant revenue to their producers and for YouTube, another meaningful step away from pure UGC content. Rentals won't generate significant revenue for YouTube, but with Google executives on the company's earnings call yesterday saying that "YouTube is monetizing well," so long as it doesn't divert too many resources away from advertising, that's ok.

2. Revenue models matter, just ask the newspaper industry - This week brought news that MediaNews Group, publisher of 54 U.S. newspapers, including the Denver Post and San Jose Mercury News, will file for bankruptcy. For those keeping count, it's at least the 13th bankruptcy filing by a major U.S. newspaper publisher in the last year.

While the newspaper industry has been racked by the recession and ad-spending slowdown, the larger issue is that 15 years since the Internet's popularity took off, newspapers still have not been able to define a sustainable online business model. Many simply lunged headlong into providing their full print editions online, only to find out that online advertising wasn't sufficient to support their overhead and that Google commoditized their headlines. Others, like the NYTimes tried (and will continue to try) to find a balance between advertising and reader payments.

I've touched on this before, but the havoc being wreaked in the newspaper is a red-letter warning to video industry participants to cautiously guard existing revenue models while transitioning to digital delivery. Some consumers and techies may consider a deliberate pace to be bureaucratic foot-dragging, but for video content producers and distributors to remain viable, a deliberate ready-aim-fire approach to digital delivery is essential.

3. Prada's short online film is intriguing - speaking of newspapers, lately I've become convinced that one of the choicest pieces of online real estate for advertisers is the home page of NYTimes.com, which I frequent. On any given day you'll see huge rich media ads and roadblocks for high-profile brands and product launches. One that caught my attention earlier this week was by luxury fashion company Prada, promoting a 9-minute film by Chinese director Yang Fudong called "First Spring" (it's also available on YouTube) in which the actors are wearing Prada menswear.

I'm not a Prada patron, and I found the film dreary and odd, nonetheless, what intrigued me was how online video has given Prada a whole new outlet to build its brand's aura, a key to success for all luxury brands. Buying TV ads would be incredibly inefficient for Prada, and magazine spreads only go so far. With a short online film, Prada can target its audience well and engage them as long as it pleases. For creative and advertising types alike, that's a compelling opportunity.

4. Get ready for the week of the Apple tablet - In case you missed it, this week Apple sent invites to the press for a Jan. 27th event to "come see our latest creation" - widely believed to be the company's new tablet computer. The buzz behind the product, thought to be called the "iSlate," has been steadily building for weeks now. Next week it will reach a crescendo. We can expect Steve Jobs to bring his A game to the mother of all product demos as the stakes are high for Apple to deliver major wows.

While the product will no doubt be off the charts cool, the nagging question is whether large numbers of people will buy it for the rumored price of $1,000. Gadgets in that price range rarely get much traction, so to succeed the iSlate has to offer essential new value. Video could be its key differentiator, especially if Apple has new content deals to announce. A connected iSlate, with a gorgeous screen and easy portability (sort of an "iPhone on steroids") could open yet another chapter in video distribution and consumption.

Enjoy your weekend!

Categories: Aggregators, Branded Entertainment, FIlms, Newspapers

Topics: Apple, MediaNews Group, NYTimes, Prada, YouTube

-

ActiveVideo Networks Helping Blockbuster on Demand Deliver a Converged Experience

Amid all of the attention Netflix has been receiving for embedding its streaming software in one consumer electronics device after another (the Wii just yesterday) and its recent Warner Bros. deal, it's been easy to overlook the fact that Blockbuster has been getting some online traction itself. One announcement at CES last week, by ActiveVideo Networks, caught my attention as it has the potential to leapfrog Blockbuster On Demand's user experience past Netflix's Watch Instantly.

Much as I'm a big fan of Netflix's Watch Instantly streaming feature, one of its limitations is that the user experience is very segregated between computer and TV. You browse and search online for titles - just as you would for DVDs - and then when you've made your choices, they show up in your Instant Queue online and on your connected TV (via Roku, Blu-ray, Xbox or other device). While it's a perfectly functional approach, wouldn't it be nice if you could do the entire process of search, discovery, previewing, selection and viewing on the TV itself?

That's the experience that ActiveVideo Networks' CloudTV will be helping Blockbuster on Demand deliver to its users. As ActiveVideo's CEO Jeff Miller explained to me yesterday, when deployed, the Blockbuster on Demand app (developed using ActiveVideo's JavaScript/HTML authoring kit), will give Blockbuster's users a web-like experience of search, discovery and previewing on their TVs, via connected devices. In addition, it will present viewing options - streaming, download-to-own and in-store rental (via an API it will even show current availability in selected stores).

The requirements are that ActiveVideo's thin client has been integrated with the device, and that Blockbuster has its own deal with to distribute through the specific device manufacturer. Navigation is via the remote control using an on-screen keypad (see example screen shots below from last week's CES demos).

To date, Blockbuster has announced CE device deals with Samsung, 2Wire, and through its deal with Sonic Solutions, the ecosystem of devices already working with Roxio CinemaNow, such as TiVo. For now, that's small in comparison to Netflix's constellation of device partners, but it's still early in the convergence game. Outside of CE devices - and in a case of somewhat strange bedfellows - Blockbuster is also focused on cable operators. It recently announced partnership deals with top 10 cable operators Suddenlink and Mediacom to enhance their VOD offerings.

To date, Blockbuster has announced CE device deals with Samsung, 2Wire, and through its deal with Sonic Solutions, the ecosystem of devices already working with Roxio CinemaNow, such as TiVo. For now, that's small in comparison to Netflix's constellation of device partners, but it's still early in the convergence game. Outside of CE devices - and in a case of somewhat strange bedfellows - Blockbuster is also focused on cable operators. It recently announced partnership deals with top 10 cable operators Suddenlink and Mediacom to enhance their VOD offerings.Similarly, ActiveVideo is also focused both on CE (currently through a partnership with middleware provider Videon Central) and on cable. It has deployed on set-top boxes with Cablevision and Oceanic Time Warner Cable in Hawaii, reaching an audience of 5 million homes. Content providers that have developed apps include Showtime, HSN and Fox, among others. No doubt ActiveVideo and Blockbuster will synch up their biz dev activities to proliferate the Blockbuster on Demand app as widely as possible.

I have to admit that I haven't been paying too much attention to Blockbuster, as it has worked to re-position itself, aiming to close another 1,000 stores by the end of the year and installing more kiosks to compete with Redbox. Of course, it can ill afford to allow Netflix to get too far out in front of it in digital delivery as DVD rentals are poised to be supplanted by streaming down the road.

But Blockbuster has an ubiquitous, if somewhat dated, brand that could be skillfully leveraged into the digital era, provided it has the right services in its arsenal. In this respect, the potential to bring a converged user experience between online and connected TVs is a meaningful differentiator. No initial joint customers have yet been announced by Blockbuster and ActiveVideo, though I expect that soon. And, as online video and TV continue to converge, ActiveVideo is likely to find itself in the middle of a lot of action. All of this is worth keeping an eye on.

Update: Looks like I'm 1 step behind on Netflix's Xbox implementation. Apparently in Aug '09 it was updated to allow full browsing and search for the Watch Instantly catalog. I'm used to the Roku and Blu-ray experiences. Hat tip to Brian Fitzgerald for bringing to my attention.

What do you think? Post a comment now.(Note - ActiveVideo Networks is a VideoNuze sponsor)

Categories: Aggregators, Devices, FIlms, Partnerships

Topics: ActiveVideo Networks, Blockbuster, Mediacom, Netflix, Suddenlink, Videon