-

Watching Hulu Content on Facebook Through ClipBlast's App is Cool

Here's something cool: ClipBlast updated its Facebook app yesterday to now include access to practically all of Hulu's content. ClipBlast's CEO/founder Gary Baker walked me through a demo and I was quite impressed. Once you've added the app, you can favorite certain Hulu shows and they appear as tiles which you can then easily scroll through. It's a huge step forward from Hulu's own mediocre Facebook app. You can also choose video from over 8,500 other sources that ClipBlast offers.

Though I'm personally not a huge Facebook user, the app resonated with me because it makes discovering and sharing video even more powerful as Facebook friends are just a click away. Of course Hulu has offered embedding from the start, but to get almost the whole Hulu library into Facebook, in front of a potential audience of 400 million users is classic "syndicated video economy" thinking. In the SVE, instead of solely trying to bring audience to your content (the traditional media model), efforts are also focused on bringing your content to the audience, wherever they live. All of Hulu's ads flow through as well, so views are still fully monetized. What's missing is full screen viewing, which Gary said is coming shortly.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators, Syndicated Video Economy, Video Sharing

Topics: ClipBlast, Facebook, Hulu

-

YouTube's Meager Sundance Rental Revenues Really Weren't That Surprising

This week brought news that YouTube's recent foray into rentals netted the company a whopping $10,709.16. I wasn't surprised by the results, as YouTube only made 5 Sundance films available for 10 days. As I suggested 2 weeks ago, even with YouTube's massive audience, it would be unreasonable to expect too

much. Still, it was great promotion for the indie film producers and no doubt a learning experience for YouTube.

much. Still, it was great promotion for the indie film producers and no doubt a learning experience for YouTube. I'm not religiously opposed to YouTube broadening its model beyond free and ad-supported video, but I do think YouTube needs to be wary of spending a lot of time trying to secure me-too rights for distribution of Hollywood's prime TV and movie output. That's highly competitive ground, and Netflix for one, has enormous advantages given its robust subscription model. YouTube is in the pole position when it comes to the ad-supported online video model and it needs to be relentlessly focused on proving it can make the model profitable.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators, FIlms, Indie Video

Topics: Sundance Film Festival, YouTube

-

It's Official: Netflix Has Entered a "Virtuous Cycle"

Looking at Netflix's Q4 '09 and full year '09 results released late last Wednesday, plus Netflix's performance over the last 3 years, I have concluded the company has officially entered a "virtuous cycle." For those of you not familiar with the term, a virtuous cycle is when a single change or improvement leads to a cascading series of follow-on benefits which both reinforce themselves and add further momentum to the original change (a hyper "one good thing leads to another" scenario, if you will). Virtuous cycles are extremely rare in business, and when they happen they have profound implications.

The start of Netflix's virtuous cycle is obvious: the company's introduction of its free "Watch Instantly" streaming feature in January, 2007. Streaming has fundamentally changed the Netflix service offering and consumers are increasingly aware of this. Traditionally, Netflix subscription plans were defined by limits - 1 DVD out at a time for $8.99/mo, 2-out for $13.99/mo or 3-out for $16.99/mo. But with the company's decision to remove the confusing original caps it placed on streaming consumption and move to an unlimited model, Netflix is now providing enormous new value at the same DVD rental price points. Netflix has also changed how it advertises its services, strongly emphasizing streaming (see its home page for example). The "unlimited streaming" message is breaking through and Netflix subscriber growth momentum over the last 3 years reflects this.

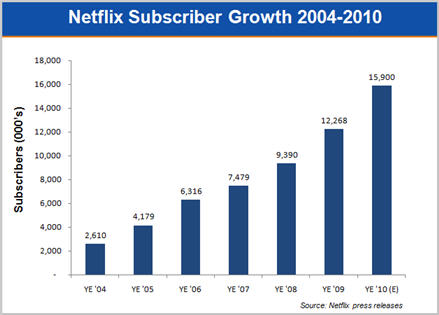

Subscribers grew to 12.3 million at the end of '09, 31% higher than YE '08. To get a sense of Netflix's momentum, '09 growth handily beat '08 (26%) and '07 (18%) growth. The 2.9 million subs added in '09 was 85% above the company's own 2009 beginning year forecast of 1.56 million sub additions. Looking ahead, the mid-point of Netflix's forecast for '10 is for another 30% growth in subs.

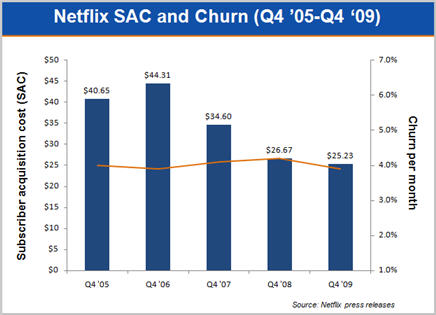

As the streaming benefits have resonated, it's very important to note that subscriber growth is actually getting progressively cheaper for Netflix to accomplish. As the following graph shows, Netflix's subscriber acquisition cost (SAC) has decreased by an impressive 43% from $44.31 in Q4 '06 to $25.23 in Q4 '09 (the 2nd lowest SAC in the company's history). Better still, the quality of these new subs seems high; average monthly churn in Q4 '09 was 3.9%, equal to the lowest churn the company has ever achieved. While Netflix isn't "buying" growth with low-quality additions (an old trick for subscription-oriented businesses), it is however putting more emphasis on the "1-out" service, which, with the addition of unlimited streaming, is an outstanding value for the low-end of the market. Netflix is eager to penetrate this segment, to whom $1 Redbox rentals are very attractive.

While Netflix's financials already reflect the virtuous cycle impact streaming is having on the business, it is likely there is much more to come as streaming takes further hold. Netflix revealed that 48% of its subscribers streamed at least 15 minutes/mo in Q4 '09, up from 41% in Q3 '09 and 26% in Q4 '08 (Incidentally, I think it's conceivable that 80% or more of recently-added subscribers are streaming). But it's just in the last year that Netflix streaming has begun to make the move from computer-only consumption to TV-based consumption, truly making it a mainstream experience. Netflix has inked deals with all the major game consoles (with a Wii marketing campaign beginning in '10), plus numerous CE devices, Blu-ray players, etc. Just ahead is a future where Wi-Fi will be ubiquitous in all new TVs and Netflix's deals with all the major TV manufacturers will ensure it is even more front and center for consumers.

To make streaming attractive, Netflix has had to essentially build a second content library. As I've suggested in the past, this isn't easy, as the company must navigate a thicket of pre-existing Hollywood rights and business relationships. Most notably, Netflix has run into the premium cable networks (HBO, Showtime, Starz and Epix) which have a monopoly on Hollywood's output for their release window. Netflix's deal with Starz was an important first step but still, I've been skeptical that Netflix would land streaming deals with the others.I'm now gaining more confidence that this will indeed happen, especially for these networks' original productions. Netflix is simply getting too big to ignore. It represents a whole new revenue opportunity for premium channels, plus an important loyalty-building outlet. Further out though, while Netflix CEO Reed Hastings says he wants the company to be a distributor for these premium channels, I think it's nearly inevitable that Netflix will compete head-on with them for Hollywood's output. Economics dictate that eventually it makes more sense for Netflix to bid directly for Hollywood rights than work through a premium channel middleman.

In fact, Netflix already has tons of Hollywood relationships, and its recent deal with Warner Bros, creating a 28-day DVD window is emblematic of how Netflix looks at streaming content acquisition going forward. In that superb deal, which was ludicrously criticized by some, Netflix simultaneously helped a critical partner sustain its DVD sales window, while gaining cheaper access to more DVD copies on day 29 and increased streaming rights for catalog titles. As Hastings pointed out on the Q4 earnings call, given the inconsistencies in DVD release strategies, most consumers have little-to-no idea when a title becomes available on DVD, so, while still early, opening up the 28 day window has caused no subscriber complaints. And the company's analysis of subscriber "Queues" indicates, just 27% of requests are for newly-released titles.

Importantly, Netflix's strategy is to pour savings from its DVD deals into streaming content acquisition. As I noted recently, Netflix's detailed subscriber data and usage analysis gives it a huge asymmetric advantage in negotiating additional streaming licenses from Hollywood. Netflix can surgically concentrate its resources on only those titles it knows its subscribers will value. Over time, as DVD sales continue to collapse, Netflix will be there to offer its subs a broader and broader rental selection.

The biggest challenge to Netflix for streaming content acquisition is how much it chooses to spend. Netflix's relatively small size among giants like Comcast and others is what prompted me to suggest over a year ago that Microsoft would acquire Netflix. I'm officially retracting that prediction now, as 2009 demonstrated how much streaming progress Netflix can make on its own. In fact, I think all rumors of a possible Netflix acquisition are off-base; I see the company remaining independent for some time to come.

Netflix is now riding a serious wave and its executives recognize the mile-wide opportunity ahead of it. The product is immeasurably stronger and more appealing with unlimited streaming included. That's in turn leading to impressive sub growth with much-reduced SAC and improving churn. The number of devices bridging Netflix to the TV is growing and portends ubiquity at some point down the road as these devices further leverage Netflix's platinum consumer brand. Streaming content selection is improving, bringing side benefits of reduced DVD postage and inventory costs. With millions of subscribers Netflix now has both the economics and the scale to be a very significant player in the video ecosystem.

Last but not least is a very favorable competitive climate. Aside from a hobbled Blockbuster, astoundingly, Netflix doesn't have any other direct DVD subscription/online streaming hybrid competitor (Amazon and Apple, are you paying attention?). And while Comcast and other multichannel video programming distributors ("MVPDs") are rolling out TV Everywhere services (5 years later than they should have, in my opinion), these are still early stage, and still encumbered by archaic regional limitations. Indeed, Netflix's growth may well cause these companies to consider their own over-the-top plans, as I've suggested.

For years I have been saying that broadband video is the single most disruptive influence on the traditional video distribution value chain. Netflix's success with streaming and the consequences that are yet to play out are resounding evidence of this. Above and beyond YouTube, Hulu, Amazon, Apple and others, Netflix is by far the most important video distributor to watch.

What do you think? Post a comment now (no sign-in required)

Categories: Aggregators, Devices

Topics: Comcast, Netflix, Warner Bros.

-

4 Items Worth Noting for the Jan 25th Week (Netflix Q4, Nielsen ratings, AOL-StudioNow, Net Neutrality Webinar)

With the new Apple iPad receiving wall-to-wall coverage this week, it was easy to overlook other significant news. Here are 4 items worth noting for the January 25th week:

1. Netflix Q4 earnings increase my bullishness - On Wednesday, Netflix reported blowout results for Q4 '09, adding almost 3 million subscribers during the year (and a million just in Q4), bringing their YE '09 subscriber count to 12.3 million. Netflix also forecasted to end this year with between 15.5 million and 16.3 million subscribers, implying subscriber growth will be in the range of 26% to 33%. Importantly, Netflix also said that 48% of its subscribers used the company's streaming feature to watch a movie or TV show in Q4, up from 41% in Q3 and 28% a year ago. Wall Street reacted with glee, sending the stock up $12 yesterday to a new high of $63.04.

VideoNuze readers know I've been bullish on Netflix for some time now, and the Q4 results make me more so. A key concern I've had has been around their ability to gain further premium content for streaming. On the earnings call, CEO Reed Hastings and CFO Barry McCarthy addressed this issue, offering up additional details of their content strategy and how the recent Warner Bros. 28-day DVD window deal will work. On Monday I'm planning a deep dive post based on what I heard. As a preview, I'm now convinced that Netflix is the #1 cord-cutting threat. Cable, satellite and telco operators need to be watching Netflix very closely.

2. Nielsen announces combined TV/online ratings plan, but still falls short - This week brought news that Nielsen intends to unveil a "combined national television rating" in September that merges traditional Nielsen TV ratings with certain online viewing data. This is data that TV networks have been hungering for as online viewing has surged, potentially siphoning off TV audiences. I pointed out recently that the lack of such a measurement could seriously retard the growth of TV Everywhere, as cable networks hesitate to risk shifting TV audiences to unmeasurable online viewing.

Nielsen's move is welcome, but still doesn't go far enough. As reported, it seems the new merged ratings will only count online views that had the same ads and ad load as on-air. That immediately rules out Hulu, which of course carries far fewer ads than on-air, and sometimes uses custom creative as well. Obviously if the new Nielsen ratings don't truly capture online viewership they'll be worth little in the market. Ratings are a story with many future chapters to come.

3. AOL acquires StudioNow in bid for to ramp up video content - Also not to be overlooked this week was AOL's acquisition of StudioNow for $36.5 million in cash. StudioNow operates a distributed network of 3,000 video producers, creating cost-effective video for small and large companies alike. I'm very familiar with StudioNow, having spoken with their CEO and founder David Mason a number of times.

AOL is clearly looking to leverage the StudioNow network to generate a mountain of new video content, complementing its Seed.com "content farm." In addition, AOL picks up StudioNow's recently-launched Video Asset Management & Syndication Platform (AMS) which gives it video management capabilities as well. For AOL the deal suggests the company is finally waking up to video's vast potential. But with the rise of online video syndication, it's still a question mark whether creating a whole lot of new video is the right strategy, or whether AOL would have been better served by just partnering with a syndicator like 5Min.

Meanwhile, AOL isn't the only portal realizing video is the place to be. In Yahoo's earnings call this week, CEO Carol Bartz said "Frankly, our competition is television" and as Liz wrote, Bartz also said "that makes video really important." Yahoo just partnered with Ben Silverman's new Electus indie video shop, and it sounds like more action is coming. Geez, the prospect of AOL and Yahoo competing on acquisitions? It would be like the old days again.

4. Net Neutrality webinar next Thursday is going to be awesome - A reminder that next Thurs, Feb. 4th at 11am PT/2pm ET The Diffusion Group and VideoNuze will present a complimentary webinar "Demystifying Net Neutrality." The webinar is the first in a series of 6 throughout 2010, exclusively sponsored by ActiveVideo Networks. Colin Dixon from TDG and I will be hosting and we have 2 fabulous guests, who are on opposing sides of the net neutrality debate: Barbara Esbin, Senior Fellow and Director of the Center for Communications and Competition Policy at the Progress and Freedom Foundation and Chris Riley, Policy Counsel for Free Press.

Net neutrality is a critically important part of the landscape for over-the-top video services, and yet it is widely misunderstood. Join us for this one-hour session which promises to be educational and impactful.

Enjoy your weekend!

Categories: Aggregators, Broadband ISPs, Deals & Financings, Portals, Regulation, Webinars

Topics: AOL, Net Neutrality, Netflix, Nielsen, StudioNow, Webinar

-

4 Items Worth Noting for the Jan 18th Week (YouTube rentals, Newspaper bankruptcies, Prada's film, iSlate hype)

Following are 4 items worth noting for the January 18th week:

1. YouTube dips toe into film rentals, more to come - This week YouTube took a very small step into film rentals, announcing that 5 indie films will be available for $3.99 apiece until the end of the Sundance Film Festival on Jan. 31st, and that it is launching a "Filmmakers Wanted" program to bring additional indie films (and possibly other content) to YouTube's audience for rental.Last fall, when the WSJ first broke the news that YouTube was negotiating with a number of Hollywood studios about launching a full-blown rental store, I thought the plan was intriguing, but dubious. I argued that YouTube needed to stay focused on getting its ad model right, that it would be hard to differentiate its film rentals from those of myriad competitors and that the revenue upside for YouTube was relatively small.

I continue to believe those things and hope YouTube isn't still pursuing Hollywood dreams. That said, I do like the idea of it offering a paid option for indie and other hard-to-find video. YouTube's massive audience brings real promotional value to these often-obscure, yet high-quality titles, potentially significant revenue to their producers and for YouTube, another meaningful step away from pure UGC content. Rentals won't generate significant revenue for YouTube, but with Google executives on the company's earnings call yesterday saying that "YouTube is monetizing well," so long as it doesn't divert too many resources away from advertising, that's ok.

2. Revenue models matter, just ask the newspaper industry - This week brought news that MediaNews Group, publisher of 54 U.S. newspapers, including the Denver Post and San Jose Mercury News, will file for bankruptcy. For those keeping count, it's at least the 13th bankruptcy filing by a major U.S. newspaper publisher in the last year.

While the newspaper industry has been racked by the recession and ad-spending slowdown, the larger issue is that 15 years since the Internet's popularity took off, newspapers still have not been able to define a sustainable online business model. Many simply lunged headlong into providing their full print editions online, only to find out that online advertising wasn't sufficient to support their overhead and that Google commoditized their headlines. Others, like the NYTimes tried (and will continue to try) to find a balance between advertising and reader payments.

I've touched on this before, but the havoc being wreaked in the newspaper is a red-letter warning to video industry participants to cautiously guard existing revenue models while transitioning to digital delivery. Some consumers and techies may consider a deliberate pace to be bureaucratic foot-dragging, but for video content producers and distributors to remain viable, a deliberate ready-aim-fire approach to digital delivery is essential.

3. Prada's short online film is intriguing - speaking of newspapers, lately I've become convinced that one of the choicest pieces of online real estate for advertisers is the home page of NYTimes.com, which I frequent. On any given day you'll see huge rich media ads and roadblocks for high-profile brands and product launches. One that caught my attention earlier this week was by luxury fashion company Prada, promoting a 9-minute film by Chinese director Yang Fudong called "First Spring" (it's also available on YouTube) in which the actors are wearing Prada menswear.

I'm not a Prada patron, and I found the film dreary and odd, nonetheless, what intrigued me was how online video has given Prada a whole new outlet to build its brand's aura, a key to success for all luxury brands. Buying TV ads would be incredibly inefficient for Prada, and magazine spreads only go so far. With a short online film, Prada can target its audience well and engage them as long as it pleases. For creative and advertising types alike, that's a compelling opportunity.

4. Get ready for the week of the Apple tablet - In case you missed it, this week Apple sent invites to the press for a Jan. 27th event to "come see our latest creation" - widely believed to be the company's new tablet computer. The buzz behind the product, thought to be called the "iSlate," has been steadily building for weeks now. Next week it will reach a crescendo. We can expect Steve Jobs to bring his A game to the mother of all product demos as the stakes are high for Apple to deliver major wows.

While the product will no doubt be off the charts cool, the nagging question is whether large numbers of people will buy it for the rumored price of $1,000. Gadgets in that price range rarely get much traction, so to succeed the iSlate has to offer essential new value. Video could be its key differentiator, especially if Apple has new content deals to announce. A connected iSlate, with a gorgeous screen and easy portability (sort of an "iPhone on steroids") could open yet another chapter in video distribution and consumption.

Enjoy your weekend!

Categories: Aggregators, Branded Entertainment, FIlms, Newspapers

Topics: Apple, MediaNews Group, NYTimes, Prada, YouTube

-

ActiveVideo Networks Helping Blockbuster on Demand Deliver a Converged Experience

Amid all of the attention Netflix has been receiving for embedding its streaming software in one consumer electronics device after another (the Wii just yesterday) and its recent Warner Bros. deal, it's been easy to overlook the fact that Blockbuster has been getting some online traction itself. One announcement at CES last week, by ActiveVideo Networks, caught my attention as it has the potential to leapfrog Blockbuster On Demand's user experience past Netflix's Watch Instantly.

Much as I'm a big fan of Netflix's Watch Instantly streaming feature, one of its limitations is that the user experience is very segregated between computer and TV. You browse and search online for titles - just as you would for DVDs - and then when you've made your choices, they show up in your Instant Queue online and on your connected TV (via Roku, Blu-ray, Xbox or other device). While it's a perfectly functional approach, wouldn't it be nice if you could do the entire process of search, discovery, previewing, selection and viewing on the TV itself?

That's the experience that ActiveVideo Networks' CloudTV will be helping Blockbuster on Demand deliver to its users. As ActiveVideo's CEO Jeff Miller explained to me yesterday, when deployed, the Blockbuster on Demand app (developed using ActiveVideo's JavaScript/HTML authoring kit), will give Blockbuster's users a web-like experience of search, discovery and previewing on their TVs, via connected devices. In addition, it will present viewing options - streaming, download-to-own and in-store rental (via an API it will even show current availability in selected stores).

The requirements are that ActiveVideo's thin client has been integrated with the device, and that Blockbuster has its own deal with to distribute through the specific device manufacturer. Navigation is via the remote control using an on-screen keypad (see example screen shots below from last week's CES demos).

To date, Blockbuster has announced CE device deals with Samsung, 2Wire, and through its deal with Sonic Solutions, the ecosystem of devices already working with Roxio CinemaNow, such as TiVo. For now, that's small in comparison to Netflix's constellation of device partners, but it's still early in the convergence game. Outside of CE devices - and in a case of somewhat strange bedfellows - Blockbuster is also focused on cable operators. It recently announced partnership deals with top 10 cable operators Suddenlink and Mediacom to enhance their VOD offerings.

To date, Blockbuster has announced CE device deals with Samsung, 2Wire, and through its deal with Sonic Solutions, the ecosystem of devices already working with Roxio CinemaNow, such as TiVo. For now, that's small in comparison to Netflix's constellation of device partners, but it's still early in the convergence game. Outside of CE devices - and in a case of somewhat strange bedfellows - Blockbuster is also focused on cable operators. It recently announced partnership deals with top 10 cable operators Suddenlink and Mediacom to enhance their VOD offerings.Similarly, ActiveVideo is also focused both on CE (currently through a partnership with middleware provider Videon Central) and on cable. It has deployed on set-top boxes with Cablevision and Oceanic Time Warner Cable in Hawaii, reaching an audience of 5 million homes. Content providers that have developed apps include Showtime, HSN and Fox, among others. No doubt ActiveVideo and Blockbuster will synch up their biz dev activities to proliferate the Blockbuster on Demand app as widely as possible.

I have to admit that I haven't been paying too much attention to Blockbuster, as it has worked to re-position itself, aiming to close another 1,000 stores by the end of the year and installing more kiosks to compete with Redbox. Of course, it can ill afford to allow Netflix to get too far out in front of it in digital delivery as DVD rentals are poised to be supplanted by streaming down the road.

But Blockbuster has an ubiquitous, if somewhat dated, brand that could be skillfully leveraged into the digital era, provided it has the right services in its arsenal. In this respect, the potential to bring a converged user experience between online and connected TVs is a meaningful differentiator. No initial joint customers have yet been announced by Blockbuster and ActiveVideo, though I expect that soon. And, as online video and TV continue to converge, ActiveVideo is likely to find itself in the middle of a lot of action. All of this is worth keeping an eye on.

Update: Looks like I'm 1 step behind on Netflix's Xbox implementation. Apparently in Aug '09 it was updated to allow full browsing and search for the Watch Instantly catalog. I'm used to the Roku and Blu-ray experiences. Hat tip to Brian Fitzgerald for bringing to my attention.

What do you think? Post a comment now.(Note - ActiveVideo Networks is a VideoNuze sponsor)

Categories: Aggregators, Devices, FIlms, Partnerships

Topics: ActiveVideo Networks, Blockbuster, Mediacom, Netflix, Suddenlink, Videon

-

Top Rental Data from Netflix is More Evidence that Warner Bros. Deal is a Win

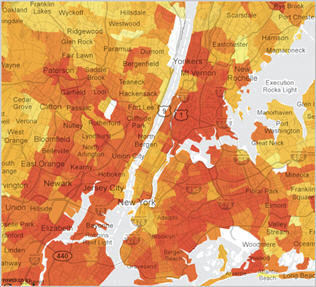

Following my 2 posts late last week (here and here) about how Netflix's new deal with Warner Bros is win for everyone, the NYTimes has posted a terrific interactive map showing the top rentals in 12 geographic areas of the U.S., sorted by zip code. The map is based on data that Netflix provided to the NYTimes. Playing around with the map, you'll quickly hunger for more details, but you'll also get a sense of the mountain of viewership data Netflix maintains on its 11 million+ subscribers. This data, when combined with the Netflix's algorithms for predicting its users' preferences, further demonstrates how valuable a deal like the one with WB could be for Netflix as it emphasizes streaming.

In the digital era, data is king because when used properly, it can dramatically improve the quality of the product delivered, in turn driving user satisfaction and profitability. Netflix has always used data very

effectively; examples include how it has chosen sites for its distribution centers so that most Americans are within 1 day's delivery, or how it has recommended other titles based on yours and others' preferences, or how much inventory of newly-released DVDs it decides to build. Now, as Netflix shifts its business from physical to digital delivery, it has another big opportunity to leverage the data it has collected from its users.

effectively; examples include how it has chosen sites for its distribution centers so that most Americans are within 1 day's delivery, or how it has recommended other titles based on yours and others' preferences, or how much inventory of newly-released DVDs it decides to build. Now, as Netflix shifts its business from physical to digital delivery, it has another big opportunity to leverage the data it has collected from its users. While a lot of attention was focused last week on the new 28-day "DVD window" which precludes Netflix from renting recently-released WB titles, I believe more attention should be paid instead to how effectively Netflix will be able to use its trove of data to selectively tap into WB's catalog of titles to boost its streaming selection. Using the data it has collected on physical rentals and search queries, for example, Netflix should be able to literally request title-by-title streaming rights from WB. That's not to say Netflix will necessarily receive access to those particular titles, but by being able to focus its requests, Netflix avoids wasting energy asking for things that are unlikely to have much appeal to its users.

It's interesting to talk to friends who are Netflix users, including those who don't work in technology-related industries. They have an amazingly high awareness and usage of Netflix's streaming and recognize that it represents the company's future. It's also obvious to them how meager the options are in Watch Instantly as compared with DVD and desperately want more choice. Netflix knows all this, as Netflix CEO Reed Hastings said last week, "our number one objective now is expanding the digital catalog." But Netflix is in a tight position to get new releases due to existing output deals that Hollywood studios maintain with HBO and other premium channels for electronic delivery. So, as with the WB deal, and others likely to follow, Netflix is trying to be clever about how it builds its streaming catalog by tapping into older, but still valuable titles.

It's unclear whether Netflix will conclude similar deals with other Hollywood studios. If it can't then the above-described benefits will be limited. In fact, as a couple of people pointed out to me last week, with Hollywood also highly dependent on cable, it's not readily apparent that helping Netflix build its streaming selection is actually in their interest as TV Everywhere services continue to roll out. WB is actually an interesting example; on the one hand, Time Warner's CEO Jeff Bewkes has been the strongest proponent of TV Everywhere, but on the other hand, WB's deal with Netflix creates more competition for it. In short, Hollywood will have its hands full trying to recast its distribution strategy in the digital era.

DVDs are not going away overnight, but the user data Netflix has will be an enormously valuable tool in helping transition its business to digital delivery and add more value to its subscribers. As long as Netflix complies with its users' privacy expectations, that gives it a big strategic advantage.

What do you think? Post a comment now.

Categories: Aggregators, Studios

Topics: Netflix, Warner Bros.

-

Recapping 2010 CES Video-Related News

The 2010 Consumer Electronics Show (CES) is now behind us. There were tons of announcements to come out of this year's show, including many in the online and mobile video areas. Increasingly a core focus of new devices is how to playback online and mobile-delivered video, how to move it around the consumer's house and how to make it portable. Following is a filtered list of the product announcements (or pertinent media coverage if no release was available) that I found noteworthy. They are listed in no particular order and I'm sure I've missed some important ones - if so, please add a comment with the relevant link.

Boxee box internals revealed. NVIDIA Tegra 2 FTW

Syabas Announces Popbox for Big Screen Everything

Sling Media Announces Support for Adobe Flash Platform in Hardware and Software Products

LG Electronics Expands Access to Content-on-Demand with New High-Performance Blu-ray Disc Players

ESPN 3D to show soccer, football, more

TV Makers ready to test depths of market for 3D

DirecTV is the First TV Provider to Launch 3D

DISH Network Introduces TV Everywhere

Microsoft Unites Software and Cloud Services to Power New TV Experiences

FLO TV and mophie to Bring Live Mobile TV to the Apple iPhone and iPod Touch

Broadcom Drives the Transition to Connected Consumer Electronics at 2010 International CES

New NVIDIA Tegra Processor Powers the Tablet Revolution

Digital Entertainment Content Ecosystem (DECE) Announces Key Milestones

Disney offers KeyChest, but where is the KeyMaster?

DivX Launches New Internet TV Platform to Redefine the Future of Entertainment

Blockbuster, ActiveVideo Announce Agreement for Cloud-based Online Navigation

Skype Ushers in New Era in Face-to-Face Online Video Communication

Aside from CES, but also noteworthy last week:

Apple Acquires Quattro Wireless

AT&T Adds Android, Palm to Its Lineup

Tremor Media Launches New Video Ad Products That Enhance Consumer Choice and Engagement

Categories: 3D, Advertising, Aggregators, Cable Networks, Devices, FIlms, Mobile Video, Satellite, Telcos

Topics: CES

-

4 Items Worth Noting for the Jan 4th Week (Netflix-WB Continued, comScore Nov. '09 stats, TV Everywhere, 3D at CES)

Following are 4 items worth noting for the Jan 4th week:

1. TechCrunch disagrees with my Netflix-Warner Bros. deal analysis - In "Netflix Stabs Us In The Heart So Hollywood Can Drink Our Blood," (great title btw) MG Siegler at the influential blog TechCrunch excerpts part of my post from yesterday, and takes the consumer's point of view, decrying the new 28 day "DVD window" that Netflix has agreed to in its Warner Bros deal. Siegler's main objection is that "Hollywood thinks that with this new 28-day DVD window deal, the masses are going to rush out and buy DVDs in droves again." Instead, Siegler believes the deal hurts consumers and is going to touch off new, widespread piracy.

I think Siegler is wrong on both counts, and many of TechCrunch's readers commenting on the post do as well. First, nobody in Hollywood believes DVD sales are going to spike because of deals like this. However, they do believe that any little bit that can be done to preserve the appeal of DVD's initial sale window can only help DVD sales which are critical to Hollywood's economics. Everyone knows DVD is a dying business; the new window is intended to help it die more gracefully. And because new releases are not that critical to many Netflix users anyway, Netflix has in reality given up little, but presumably gotten a lot, with improved access for streaming and lower DVD purchase prices.

The argument about new, widespread piracy by Netflix users is specious. With or without the 28 day window, there will always be some people who don't respect copyright and think stealing is acceptable. But Netflix isn't running its business with pirates as their top priority. With 11 million subscribers and growing, Netflix is a mainstream-oriented business, and the vast majority of its users are not going to pirate movies - both because they don't know how to (and don't want to learn) and because they think it's wrong. Netflix knows this and is making a calculated long-term bet (correctly in my opinion) that enhancing its streaming catalog is priority #1.

2. comScore's November numbers show continued video growth - Not to be overlooked in all the CES-related news this week was comScore's report of November '09 online video usage, which set new records. Key highlights: total video viewed were almost 31 billion (double Jan '09's total of 14.8 billion), number of videos viewed/average viewer was 182 (up 80% from Jan '09's 101) and minutes watched/mo were approximately 740 (more than double Jan '09's total of 356).

Notably, with 12.2 billion views, YouTube's Nov '09 market share of 39.4% grew vs. its October share of 37.7%. As I've previously pointed out, YouTube has demonstrated amazingly consistent market dominance, with its share hovering around 40% since March '08. Hulu also notched another record month, with 924 million streams, putting it in 2nd place (albeit distantly) to YouTube. Still, Hulu had a blowout year, nearly quadrupling its viewership (up from Jan '09's 250 million views). But with 44 million visitors, Hulu's traffic was pretty close to March '09's 41.6 million. In '10 I'm looking to see what Hulu's going to do to break out of the 40-45 million users/mo band it was in for much of '09.

3. Consumer groups protest TV Everywhere, but their arguments ring hollow - I was intrigued by a joint letter that 4 consumer advocacy groups sent to the Justice Department on Monday, urging it to investigate "potentially unlawful conduct by MVPDs (Multichannel Video Programming Distributors) offering TV Everywhere services." The letter asserts that MVPDs may have colluded in violation of antitrust laws.

I'm not a lawyer and so I'm in no position to judge whether any actions alleged to have taken place by MVPDs violated any antitrust laws. Regardless though, the letter from these groups demonstrates that they are missing a fundamental benefit of TV Everywhere - to provide online access to cable TV programming that has not been available to date because there hasn't been an economical model for doing so. In the eyes of people who think that making money is evil, the TV Everywhere model of requiring consumers to first subscribe to a multichannel video service seems anti-consumer and anti-competitive. But to people trying to make a living creating quality TV programming, the preservation of a highly functional business model is essential.

These advocacy groups need to remember that consumers have a choice; if they don't value cable's programming enough to pay for it, then they can instead just watch free broadcast programs.

4. 3D is the rage at CES - I'll be doing a CES recap on Monday, but one of the key themes of the show has been 3D. There were two big announcements of new 3D channels, from ESPN and Discovery/Sony/IMAX. LG, Panasonic, Samsung and Sony announced new 3D TVs. And DirecTV announced that it would launch 3 new 3D channels by June 2010, with Panasonic as the presenting sponsor. 3D sets will be an expensive proposition for consumers for some time, but prices will of course come down over time.

Something that I wonder about is what impact will 3D have on online and mobile video? Will this spur innovation in computer monitors so that the 3D experience can be experienced online as well? And how about mobile - will we soon be slipping on 3D glasses while looking at our iPhones and Android phones? It may seem like a ridiculous idea, but it's not out of the realm of possibility.

Enjoy your weekend!

Categories: 3D, Aggregators, Broadcasters, Cable Networks, Cable TV Operators, FIlms, Studios

Topics: 3D, comScore, Netflix, TV Everywhere, Warner Bros.

-

VideoNuze Report Podcast #45 - January 8, 2010

Daisy Whitney and I are pleased to present the first VideoNuze Report podcast of 2010 (and the 45th edition overall!).

In today's podcast we first discuss my post from yesterday, "Why Netflix's Long-Term Focus in New Warner Bros. Deal is a Win for Everyone," in which I assert that the new 28 day "DVD window" that the deal creates helps Netflix, Hollywood studios and ultimately consumers. There is a lot of consternation in the blogosphere and Twittersphere about whether Netflix is hosing its subscribers with this new policy, but I believe there's actually little risk of that, and the payoff for Netflix is better content for its streaming catalog as well as lower costs for its DVD purchases. While WB surely doesn't expect to sell more DVDs due to the deal, it can only help make the DVD model's demise a little less disruptive.

Switching gears, Daisy then reviews some of eMarketer's predictions for ad spending in 2010, with particular focus on online video advertising, which eMarketer expects to grow from about $1 billion in '09 to $1.4 billion in '10. Listen in to find out more.

Click here to listen to the podcast (12 minutes, 30 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, Aggregators, FIlms, Podcasts

Topics: eMarketer, Netflix, Warner Bros.

-

Why Netflix's Long-Term Focus in New Warner Bros. Deal is a Win for Everyone

Netflix's new deal with Warner Bros., in which it agreed to a 28 day "DVD window" for new releases, in exchange for greater access to WB's films for its Watch Instantly streaming feature and reduced pricing on its own DVD purchases, is further proof that Netflix is squarely focused on the long-term. That's not only smart for Netflix, it's also a win for Hollywood studios and also for consumers.

With 11 million subscribers and growing, Netflix has emerged as one of Hollywood's most important home video customers. This dynamic has only increased recently due to slowing sales of DVDs (down another 13% in 2009) and Netflix's dominance in DVD rentals. Yet Netflix is viewed warily by Hollywood, primarily

due to concerns that in the digital age, Netflix could gain too much power over Hollywood's fate. This concern was reinforced by Netflix's deal with premium cable channel Starz, a de facto end-run around Hollywood in which Netflix got streaming access to certain Disney, Sony and Lionsgate films.

due to concerns that in the digital age, Netflix could gain too much power over Hollywood's fate. This concern was reinforced by Netflix's deal with premium cable channel Starz, a de facto end-run around Hollywood in which Netflix got streaming access to certain Disney, Sony and Lionsgate films.As I've pointed out many times (as recently as this past Monday, in item #6), despite the Starz deal and the impressive adoption of Watch Instantly to date, Netflix faces a major challenge in building out its catalog of recent films for streaming use. Part of the challenge is Hollywood's "windowing" approach; in particular, other premium channels like HBO, Showtime and Epix have made significant financial commitments for electronic distribution during certain time periods that effectively preclude Netflix gaining streaming rights. Because much of Netflix's value proposition relies on its vast DVD selection (100K+ titles currently), if its streaming catalog continues to look meager by comparison, then Netflix's goal of migrating its users to streaming delivery over time will be seriously undermined.

That's where the new WB deal comes in. While the companies didn't disclose which titles or how many

would be available, my guess is that the benefits of the deal, when it's fully implemented, will be noticeable to Netflix's subscribers or Netflix wouldn't have signed on. While WB is just one studio, if the new deal can be used as a template, Netflix could have a solid plan for gaining more films without paying big bucks. And the studios would get greater leverage against Redbox, which is viewed with even greater alarm by much of Hollywood.

would be available, my guess is that the benefits of the deal, when it's fully implemented, will be noticeable to Netflix's subscribers or Netflix wouldn't have signed on. While WB is just one studio, if the new deal can be used as a template, Netflix could have a solid plan for gaining more films without paying big bucks. And the studios would get greater leverage against Redbox, which is viewed with even greater alarm by much of Hollywood.Netflix's focus on the long term is smart strategy, and complements well the company's near-term emphasis on riding the convergence wave by embedding its Watch Instantly software in every conceivable living room device (e.g. PS3, Xbox, Roku, Bravia, Blu-ray players, etc.). It's also a strategy that benefits Hollywood. By creating a situation where studios preserve as much of their DVD sales as possible (allegedly 75% of a film's total DVD sales occur in the first 4 weeks following release), Netflix is helping Hollywood gracefully wind down and milk the DVD business.

Not surprisingly, consumers' first reaction to the deal was sour. Yesterday the Twittersphere was alight with grousing about the 28 day DVD window and how Netflix was "selling out its customers." Some even talked about canceling their Netflix service. I think most of this is idle chatter. Netflix has publicly said that just 30% of its DVD rentals come from recent releases (though it is likely that for Netflix's heaviest DVD renters, recent releases are far more important). In the end, Netflix is making a calculated bet that it can manage the potential subscriber consequences of creating the DVD window in order to benefit its larger goal of migrating its business to online delivery.

If Netflix is right, and it can sign on additional studios to similar deals, then ultimately consumers will win. That's because, as Netflix proves in the value of streaming, it will be able to offer improved terms to studios, resulting in Netflix getting better and better access to films. But this will be a gradual process that unfolds over time. Whereas consumers always "want everything yesterday," the reality is that if Hollywood and Netflix can avoid disruption and instead preserve most of their economics by gracefully transitioning their businesses to digital delivery, consumers stand a better chance of continuing to receive the kind of premium-quality (i.e. expensive to produce) films they value. The demise of the newspaper industry is a cautionary example of what happens when disruption instead prevails and an industry's traditional economics are destroyed.

We are still on the front end of seismic shifts that will alter how Hollywood's films are distributed to consumers. By focusing on the long-term, as evidenced by its WB deal, Netflix is playing an important role in increasing the odds of a successful transition.

What do you think? Post a comment now.

Categories: Aggregators, FIlms, Studios

Topics: Netflix, Starz, Warner Bros.

-

Back from the Vacation? Here Are 7 Video Items You May Have Missed

Happy New Year. If you're just back from a holiday vacation and have been partially or totally off the grid for the last week or two, here are 7 video-oriented items you may have missed:

1. Time Warner Cable and News Corp fight over fees, then settle - Two behemoths of the cable and broadcast TV ecosystem spatted publicly during the holidays over the size of "retransmission consent" fees that News Corp (owner of the Fox Broadcast Network and cable channels like Fox News) wanted TWC (the 2nd largest U.S. cable operator) to pay to carry its 14 local stations. While a last minute deal averted the channels going dark, broadcasters' interest in dipping into cable's monthly subscription revenues will only intensify as audience fragmentation accelerates and ad revenues are pressured.

For my part I wish Fox and other broadcasters were as focused on building new and profitable digital delivery models for their programs as they were on trying to redistribute cable's revenues. Even as Rupert Murdoch continues advocating the paid content model, the freely-available Hulu is seeing its traffic skyrocket (see below). But if Hulu's viewership isn't incrementally profitable, then all that growth is pointless. Urgency is mounting too; in '10 convergence devices that bridge broadband to the TV are going to get a lot of attention. In the wake of their adoption, consumers are going to want Hulu on their TVs. If Hulu doesn't allow this it will be marginalized. But if it does without first solidifying its business model, it could hurt broadcasters further.

2. Hulu has a big traffic year, but no further information provided on its business model - Hulu's CEO Jason Kilar pulled back the curtain a bit on the company's strong progress in 2009, citing 95% growth in monthly users, to 43 million, 307% growth in monthly streams, to 924 million (both as measured by comScore) and a doubling of available content, to 14,000 hours. While noting that its advertisers increased from 166 to 408 during the year, with respect to performance, Jason only said that "we are extremely excited about atypically strong results we have been able to drive for our marketing partners."

Though Hulu is under no obligation to disclose details of its business model, I think it would dramatically increase the company's credibility if it shared some metrics about how its lighter ad load model is working (e.g. improved awareness, click throughs, leads, conversions, etc.). Per the 1st item above, as Hulu grows, a lot of people have a lot at stake in understanding what effect it may have on broadcast economics. In addition, as I pointed out recently, it is important to understand whether Hulu thinks it may have already saturated its U.S. audience. After a jump in Q1 '09 from 24.6 million to 41.6 million users, traffic actually dipped below 40 million until October. What does Hulu do from here to gain significantly more users?

3. Cable networks' primetime audience is nearly double broadcasters' - Punctuating the ascendancy of cable over broadcast, this Multichannel News article pointed out that in 2009, ad-supported cable networks as a group captured 60.7% of primetime audience vs. 32% for the 4 broadcast networks. That's a major change from 2000 when the broadcasters had a 46.8% share vs. cable's 41.2%. Cable increased its share every single year of the last decade, powered by its innovative original programming. NBCU's USA Network in particular has become the real standout performer, winning its second consecutive ratings crown, with 3.2 million average primetime viewers, up 14% vs. 2008.

The surging popularity of cable programming is a crucial barrier to consumers cutting the cord on cable. Since cable networks are highly invested in the monthly multichannel subscription model, they are unlikely to disrupt themselves by offering their best shows to others under substantially different terms than how they're offered today. So to the extent cable programs are either unavailable to over-the-top alternatives or offered less attractively (e.g. less choice, higher cost, delayed availability), little cord-cutting can be expected. And if TV Everywhere achieves its online access goals, the cable ecosystem will only be further strengthened.

4. YouTube is working to drive higher viewership - Amidst the turmoil in the traditional ecosystem and Hulu's growth, YouTube, the 800 pound gorilla of the online video world, is working hard to deepen the site's viewership. As this insightful NYTimes article explains, a team of YouTube developers is analyzing viewing patterns and tweaking its recommendation practices to encourage more usage. YouTube says time on the site has increased by 50% in the last year, and comScore reports that the average number of clips viewed per user per month jumped to 83 in October, up from 53 a year earlier. Still, as comScore also reports, duration of an average session has yet to crack 4 minutes, meaning video snacking on YouTube is still the norm. YouTube's moves must be watched closely in '10.

5. Showtime's "Weeds" available online before on DVD - This WSJ article (reg req'd) pointed out that Lionsgate, producer of Showtime's hit "Weeds" series is offering episodes online before they're available on DVD. By putting the digital "window" ahead of DVD's, Lionsgate is further pressuring DVD's appeal. We've seen periodic experimentation in this regard, and I anticipate more to come, especially as the universe of convergence devices expands and consumers can watch on their TVs instead of just their computers. Until a tipping point occurs though, "Weeds" like initiatives will be the exception, not the rule.

6. Netflix goes shopping in Hollywood - And speaking of reversing distribution windows, this Bloomberg Businessweek piece was the latest to highlight Netflix's efforts to woo studios into giving it more recent releases. Netflix has of course made huge progress with its Watch Instantly streaming feature, but its appeal to heaviest users will slow at some point unless it can dramatically expand its current slate of 17K titles available online. Hollywood is understandably wary of Netflix given all the variables in play and a desire to avoid Netflix becoming master of Hollywood's post-DVD, digital future. Whether Netflix will spend heavily to obtain better rights is a major question.

7. Get ready for Google's Nexus One and Apple's "iSlate" - Unless you've really been off the grid, you're probably aware by now that two very significant mobile product releases are coming this month. Tomorrow (likely) Google will unveil the Nexus One, its own smartphone, powered by its Android 2.1 operating system. The Nexus One will be "unlocked," meaning it can operate on multiple providers using GSM networks. The device will further fuel the mobile Internet, and mobile video consumption along with it. Separately, Apple is widely rumored to introduce its tablet computer later in the month, which many believe will be called the "iSlate." The tablet market is completely virgin territory, and while it's early to make predictions, I believe Apple could have most of the ingredients needed to make the product another big hit. The prospect of watching high-quality video on a thin, light, user-friendly device is extremely compelling.

Categories: Aggregators, Broadcasters, Cable Networks, Cable TV Operators, Devices, Mobile Video, Studios

Topics: Apple, FOX, Google, Hulu, Lionsgate, Netflix, News Corp, Showtime, Time Warner Cable, YouTube

-

Goodbye 2009, Hello 2010

It's time to say goodbye to 2009 and begin looking ahead to 2010.

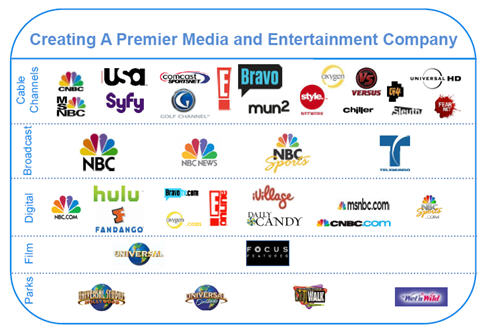

2009 was yet another important year in the ongoing growth of broadband and mobile video. There were many exciting developments, but several stand out for me: the announcement and launches of initial TV Everywhere services, the raising of at least $470 million in new capital by video-oriented companies, YouTube's and Hulu's impressive growth to 10 billion streams/mo and 856 million streams/mo, respectively, the iPhone's impact on popularizing mobile video, the Comcast-NBCU deal, the maturing of the online video advertising model, the proliferation of Roku and other convergence devices and the growth of Netflix's Watch Instantly, just to name a few.

Looking ahead to next year, there are plenty of reasons to be optimistic about video's growth: the rollout of TV Everywhere by multiple providers, the proliferation of Android-powered smartphones and buildout of advanced mobile networks, both of which will contribute to mobile video's growth, the launch of Apple's much-rumored tablet, which could create yet another category of on-the-go content access, the introduction of new convergence devices, helping bridge video to the TV for more people, new made-for-broadband video series, which will help expand the medium's appeal, and wider syndication, which will make video ever more available.

In the midst of all this change, monetization remains the fundamental challenge for broadband and mobile video. More specifically, for both content providers and distributors, the challenge is how to ensure that the video industry avoids the same downward revenue spiral that the Internet itself has wrought on print publishers.

Regardless of all the technology innovations, high-quality content still costs real money to produce. If consumers are going to be offered quality choices, a combination of them paying for it along with advertising, is essential. While it's important to be consumer-friendly, this must always be balanced with a sustainable business model. In short, no matter what the size of the audience is, giving something away for free without a clear path for effectively monetizing it is not a strategy for long-term success.

VideoNuze will be on hiatus until Monday, January 4th (unless of course something big happens during this time). I'll be catching my breath in anticipation of a busy 2010, and hope you will too.

Thank you for finding time in your busy schedules to read and pass along VideoNuze. It's incredibly gratifying to hear from many of you about how important a role VideoNuze plays in helping you understand the disruptive change sweeping through the industry. I hope it will continue to do so in the new year.

A huge thank you also to VideoNuze's sponsors - without them, VideoNuze wouldn't be possible. This year, over 40 companies supported the VideoNuze web site and email, plus the VideoSchmooze evenings and other events. I'm incredibly grateful for their support. As always, if you're interested in sponsoring VideoNuze, please contact me.

Happy holidays to all of you, see you in 2010!

Categories: Advertising, Aggregators, Broadcasters, Cable Networks, Cable TV Operators, Devices, Mobile Video

Topics: Android, Comcast, Hulu, iPhone, NBCU, Netflix, YouTube

-

The Fuzzy Math of Apple's TV Subscription Service Doesn't Add Up

Yesterday's Wall Street Journal story, suggesting that CBS and Disney may participate in Apple's planned TV subscription service, caused was yet another tremor in the already chaotic video industry. Though Apple's plans are still preliminary, when I consider the numbers the Journal reported, the company's fuzzy math suggests incumbent distributors have little to worry about just yet.

The Journal said that in "In at least some versions of the proposal, Apple would pay media companies about $2 to $4 a month per subscriber for a broadcast network like CBS or ABC, and about $1 to $2 a month per subscriber for a basic-cable network..." Let's assume the mid-points for both: $3/mo for broadcast networks and $1.50/mo for cable networks. With 4 broadcast networks (assuming NBC participates, which under Comcast ownership is itself unlikely), that would be $12 in fees/mo. Say Apple signed up 12 cable networks, that would be another $18 in fees/mo. Together the $30 in fees/mo equals what Apple is reportedly looking to charge consumers. And this package would only deliver 16 channels, which would induce few consumers to cut the cord. And by the way, there's zero chance that one of those 16 cable channels would be Disney's ESPN, which already gets north of $3/mo/sub in all of its existing affiliate deals.

Given the broadcast networks' woes, it's within the realm of possibility that they would be enticed by the $2-$4/mo, considering it's above the $1/mo/sub that is often bandied about in retransmission consent discussions. Yet, Apple is supposedly talking about delivering the programs commercial-free, which means broadcasters' total revenue per month has to equal or exceed what they're already making per month for the plan to be interesting to them. With $60 billion/year in TV advertising revenue at stake, that's a big gamble for broadcast networks to make. Even the notion that consumers would pay for broadcast programs simply because they're commercial-free is speculative. Most research I've seen suggests the opposite consumer preference (they'd rather stomach ads in exchange for free content).

An even bigger challenge for Apple is to get cable networks to play ball. Starting with my post over a year ago, "The Cable Industry Closes Ranks," I've continued to assert that, despite ongoing skirmishes, cable networks and cable operators are joined at the hip in their desire to defend the traditional multichannel subscription model. In the model, big owners of cable networks bundle smaller channels with bigger, more popular ones, and require that cable operators, telcos and satellite operators take these as a package. This is the backdrop for why consumers often grouse that there are lots of channels, but little on that interests them personally. Meanwhile, TV Everywhere is intended to preserve this model as online viewing expectations build.

It stretches my imagination to believe that big cable network owners (Disney included) are going to allow Apple to cherry-pick which cable networks they want and disrupt the traditional model, especially at a time when cable networks want more, not less control. That cable networks would be willing to put Steve Jobs in the driver's seat of their digital futures is very unlikely. Analogies to the music business only go so far: remember, music companies were already under assault from rampant piracy and reeling under financial pressure when Apple came riding to their rescue. Cable networks feel no such urgency; they've been the brightest star in the media landscape as the recession has worn on.

I've learned never to underestimate Steve Jobs or Apple. But based on what's been reported so far, Apple's subscription TV math seems very fuzzy and any service that emerges from it is likely, for the most part, to be non-threatening to incumbent distributors. And that's before getting to the issues of Apple being a closed system and requiring consumers to buy a proprietary Apple TV box to get their programs onto their TVs. In the budding 'over-the-top" sweepstakes, Apple is one to watch for sure. But there are a lot of variables in play here. It will be fun to see if Jobs has yet another rabbit up his sleeve.

What do you think? Post a comment now.

Categories: Aggregators, Broadcasters, Cable Networks, Cable TV Operators

Topics: ABC, Apple, CBS, Disney

-

Scoring My 2009 Predictions

As 2009 winds down, in the spirit of accountability, it's time to take a look back at my 5 predictions for the year and see how they fared. As when I made them, they're listed below in the order of most likely to least likely to pan out.

1. The Syndicated Video Economy Accelerates

My least controversial prediction for 2009 was that video would continue to flow freely among content providers numerous third parties, in what I labeled the "Syndicated Video Economy" back in early 2008. The idea of the SVE is that "destination" sites for online audiences are waning; instead audiences are fragmenting to social networks, mobile devices, micro-blogging sites, etc. As a result, the SVE compels content providers to reach eyeballs wherever they may be, rather than trying to continue driving them to one particular site.

Video syndication continued to gain ground in '09, with a number of the critical building blocks firming up. Participants across the ecosystem such as FreeWheel, 5Min, RAMP, YouTube, Visible Measures, Magnify.net, Grab Networks, blip.TV, Hulu and others were all active in distributing, monetizing and measuring video across the SVE. I heard from many content executives during the year that syndication was now driving their businesses, and that they only expected that to increase in the future. So do I.

2. Mobile Video Takes Off, Finally

When the history of mobile video is written, 2009 will be identified as the year the medium achieved critical mass. I was bullish on mobile video at the end of 2008 primarily due to the iPhone's success and my expectation that other smartphones coming to market would challenge it with ever more innovation. The iPhone has continued its amazing run in '09, on track to sell 20 million+ units. Late in the year the Droid, which Verizon has relentlessly promoted, began making inroads. It also benefitted from Verizon highlighting AT&T's inadequate 3G network. Elsewhere, 4G carrier Clearwire continued its nationwide expansion.

While still behind online video in its development, mobile video is benefiting from comparable characteristics. Handsets are increasingly video capable, just as were computers. Mobile content is flowing freely, leaving the closed "on-deck" only model behind and emulating the open Internet. Carriers are making significant network investments, just as broadband ISPs did. A range of monetization companies have emerged. And so on. As I noted recently, the mobile video ecosystem is healthy and growing. The mobile video story is still in its earliest stages, we'll see much more action in 2010.

3. Net Neutrality Remains Dormant

Given all the problems the Obama administration was inheriting as it prepared to take office a year ago, I predicted that it would not expend energy and political capital trying to restart the net neutrality regulatory process. With broadband ISP misbehavior not factually proven, I also thought Obama's predilection for data in determining government action would prevail. However, I cautioned that politics is a tough business to predict, and so anything can happen.

And indeed, what turned out is that in September, new FCC Chairman Julius Genachowski launched a vigorous net neutrality initiative, despite the fact that there was still little data supporting it. With backwards logic, Genachowski said the FCC would be guided by data it would be collecting, though he was already determined to proceed. In "Why the FCC's Net Neutrality Plan Should Go Nowhere" I argued, among other things, that the FCC is way off the mark, and that in the midst of the gripping recession, to risk the unintended consequences that preemptive regulation carries, was foolhardy. Now, with Comcast set to acquire a controlling interest in NBCU, net neutrality advocates will say there's even more to be worried about. It looks like we can expect action in 2010.

4. Ad-Supported Premium Video Aggregators Shakeout

The well-funded category of ad-supported premium video aggregators was due for a shakeout in '09 and sure enough it happened. Players were challenged by little differentiation, hardly any exclusive content and difficulty attracting audiences. The year's biggest casualty was highflying Joost, which made a last ditch attempt to become a white label video platform before being quietly acquired by Adconion. Veoh, another heavily funded player, cut staff and changed its model. TidalTV barely dipped its toe in the aggregation waters before it became an ad network.

On the positive side, Hulu, YouTube and TV.com continued their growth in '09. Hulu benefited from Disney coming on board as both an investor and content partner, while YouTube improved its appeal to premium content partners and brought on Univision and PBS, among others. Aside from these, Fancast and nichier sites like Dailymotion and Babelgum, there isn't much left to the aggregator category. With TV Everywhere services starting to launch, the opportunity for aggregators to get access to cable programming is less likely than ever. And despite their massive traffic, Hulu and YouTube have significant unresolved business model issues.

5. Microsoft Will Acquire Netflix

This was my long ball prediction for '09, and unless something happens in the waning days of the year, I'll have to concede I got this one wrong. Netflix has remained independent and is charging along with its own streaming "Watch Instantly" feature, now used by over half its subscribers, according to recent research. Netflix has also broadened its penetration of 3rd party devices, adding PS3, Sony Bravia TVs and Blu-ray players, Insignia Blu-ray players this year, in addition to Roku, XBox and others. Netflix is quickly becoming the most sought-after content partner for "over-the-top" device makers.

But as I've previously pointed out, Netflix's number 1 challenge with Watch Instantly is growing its content selection. Though it has a deal with Starz, it is largely boxed out of distributing recent hit movies via Watch Instantly by the premium channels HBO, Showtime and Epix. My rationale for the Microsoft acquisition is that Netflix will need far deeper pockets than it has on its own to crack open the Hollywood-premium channel ecosystem to gain access to prime movies. For its part, Microsoft, locked in a pitched battle with Google and Apple on numerous fronts, could gain advantage with a Netflix deal, positioning it to be the leader in the convergence era. Meanwhile, others like Amazon and YouTube continue to circle this space.

The two big countervailing forces for how premium video gets distributed in the future are TV Everywhere, which seeks to maintain the traditional, closed ecosystem, and the over-the-top consumer device-led approach, which seeks to open it up. It's hard not to see both Netflix and Microsoft playing a major role.

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Broadband ISPs, Deals & Financings, Mobile Video, Regulation, Syndicated Video Economy

Topics: Apple, AT&T, Fancast, FCC, Hulu, iPhone, Joost, Microsoft, Netflix, Veoh, Verizon, YouTube

-

New "If I Can Dream" Series Taps Streaming, Mobile, Social Media

Simon Fuller's 19 Entertainment announced a new reality series yesterday, "If I Can Dream" which will rely on streaming, mobile and social media to dramatically enhance audience engagement. "If I Can Dream" will follow five young actors as they pursue Hollywood fame and fortune. The series will be distributed on its own site and through Hulu, MySpace, Clear Channel and others.

While the show will have a traditional 30 minute television-show format, it's clear that Fuller plans to use technology to differentiate the show from the myriad other reality offerings. All of the actors' moves will be

streamed live using new sensor technology and audiences will interact with the actors via text, blogs, Twitter, MySpace and other in real-time. For sponsors Pepsi and Ford, we'll no doubt see new brand engagement opportunities. Some of this has already been done with other shows, but Fuller appears to be looking to take it to a whole new level.

streamed live using new sensor technology and audiences will interact with the actors via text, blogs, Twitter, MySpace and other in real-time. For sponsors Pepsi and Ford, we'll no doubt see new brand engagement opportunities. Some of this has already been done with other shows, but Fuller appears to be looking to take it to a whole new level. Hulu's role is also intriguing. I haven't thought of Hulu as having a place in broadband-only original productions, but as I consider this move, it makes sense. Though deal terms were not disclosed, Hulu is likely putting up no money, and is instead bringing its substantial traffic and promotional capabilities to the partnership. It costs Hulu nothing to give "If I Can Dream" visibility on the site, so it's in a strong position to help establish the show. With the company's reach into brands and agencies it can sell ads without bumping into broadcast networks' sales reps.

It will be interesting to see how "If I Can Dream" unfolds. All the technology in the world can't make a show compelling, but with "American Idol" and "So You Think You Can Dance" to his credit, Fuller clearly knows what goes into making a hit. And the trailer looks pretty good. Layer on the audience engagement and this could be the start of an exciting new programming model.

What do you think? Post a comment now.

Categories: Aggregators, Indie Video

Topics: 19 Entertainment, Clear Channel, Hulu, MySpace, Simon Fuller

-

Vevo Launches: Decent Start, Lots of Work Ahead

Vevo, the much-heralded "Hulu for the music industry" venture backed by Universal Music Group, Sony BMG, Abu Dhabi Music Company and Google/YouTube (and with video provided by EMI as well) officially launched late last night. I've been browsing around the site this morning and my first reaction is that it's a decent start, but has a long way to go if it is to fulfill its lofty mission.

Conceptually, I like the idea behind Vevo. The music industry, which has suffered multiple blows over the last 10 years, is getting together to create a destination site where music videos are distributed legally, with a coherent ad strategy. YouTube's participation means that videos that have been watched in the labels' YouTube channels can be branded Vevo, giving the new site tons of visibility, and helping migrate traffic over time.

From a design standpoint, the Vevo site has a similar feel to Hulu: large, wide-screen images on the home page promoting certain videos/artists, thumbnails below, of top videos, playlists and artists, quick links to most popular today, and search/navigation. A nav bar at the bottom of the screen invites users to easily create new playlists by adding up to 75 videos with one click. Videos are embeddable and shareable, and there are quick links to buy the music at Amazon and iTunes. The site was periodically very slow to load and occasionally even gave me a server error page. I don't know how much of this to ascribe day 1 hiccups that will be worked out over time or really poor capacity planning.

Less clear to me is how Vevo distinguishes itself from a user experience standpoint from YouTube itself. This has been a question that's nagged at me since the Vevo concept was first unveiled - how do the partners plan to make 1+1=3? The partners have made references to being indifferent to whether users watch at Vevo.com or YouTube, presumably because there would be similar advertising on both with similar splits. Yet, my experience going back and forth between the sites, albeit very limited, reveals lots of inconsistencies and a lot of promotional leverage left untapped.

Focusing on U2, one of my personal favorites, I found only about a dozen of the band's music videos on Vevo. Switching over to YouTube, I found many more tracks, such as "Beautiful Day," "I Still Haven't Found What I'm Looking For" and "Where the Streets Have No Name," all in the Universal Music Group's channel. All of the videos were monetized: the first was preceded by a 15 second pre-roll ad for Chevy Malibu and the latter two carried an overlay ad to "Play Free Games" which was accompanied by a companion ad in the right column (the overlay was incredibly distracting, but that's another story). None of the videos had any Vevo branding whatsoever. It's also worth noting that even the UMG channel in YouTube has no Vevo branding or promotion.

Conversely, a search in YouTube for "All Because of You," a video that is available on Vevo, loads in YouTube with full Vevo branding. Above the video window are options to "Watch with Lyrics," "View Artist Profile," and "Create a Playlist." Clicking on any of these carries you over to the Vevo site. However, none of these actions are well-executed. "Watch with Lyrics" restarts the video, whereas a much slicker implementation would resume playing on Vevo from the point of drop-off. "View Artist Profile" simply displays a list other videos available, without any real artist profile information offered (background, upcoming concerts, etc.). And "Create a Playlist" just brings you to Vevo's home page, without any prompts for what to do next if indeed you want to actually want to create a playlist.

Elsewhere, the Vevo team hasn't even bothered to update its blog to officially announce the site's launch (it still says "Launching Tonight!" at the top). That's a missed opportunity, especially considering there was a splashy launch party in NYC last night (attendees ranging from Google's Eric Schmidt to Rhianna, Bono and Mariah Carey) and pictures and video from that event would have been a big drawing card. Come on - where's the Vevo PR team here?

How much of this should be forgiven to it being early days of Vevo's launch is a subjective call. From my vantage point though, I think the Vevo team could have done a lot more to think through and execute on the user experience. Back in November '07, when I looked at Hulu in its private beta, I gave it a solid B+. The Hulu team had clearly obsessed about each and every detail of the site - and have continued to do so. Hulu's user experience isn't perfect, but it has set the bar very high for those seeking to emulate it. For now Vevo probably rates around a C; much work is still ahead.

What do you think? Post a comment now.Update: Vevo's blog post that "It's awesome that millions of people are checking it out, but the response has been orders of magnitude larger than even our highest estimate" suggests poor capacity planning by the Vevo ops team. I mean,"orders of magnitude larger"? If that's really the case then the ops team gets serious demerits for a ridiculously big miss.Categories: Aggregators, Music

Topics: EMI, Google, Sony BMG, Universal Music, VEVO, YouTube

-

4 Items Worth Noting for the Nov 30th Week (Alicia Keys on YouTube, Jeff Zucker's record, Comcast's Xfinity, SI's tablet demo)

Following are 4 items worth noting for the Nov 30th week:

1. Alicia Keys concert on YouTube is an underwhelming experience - Did you catch any of the Alicia Keys concert on YouTube this past Tuesday night celebrating World AIDS Day? I watched parts of it, and while the music was great, I have to say it was disappointing from a video quality standpoint -lots of buffering and pixilation, plus watching full screen was impossible.

I think YouTube is on to something special webcasting live concerts. Recall its webcast of the U2 concert from the Rose Bowl on Oct 25th drew a record 10 million viewers. That concert's quality was far superior, and separately, the dramatic staging and 97,000 in-person fans also helped boost the excitement of the online experience. It's still early days, but to really succeed with the concert series, YouTube is going to have to guarantee a minimum quality level. Notwithstanding, American Express, the lead sponsor of the Keys concert had strong visibility and surely YouTube has real interest from other sponsors for future concerts. It could be a very valuable franchise YouTube is building and is further evidence of YouTube's evolution from its UGC roots.

2. Being a Jeff Zucker fan is lonely business - In yesterday's post, "Comcast-NBCU: The Winners, Losers and Unknowns" I said I've been a fan of Jeff Zucker's since seeing him deliver a brutally candid and very sober assessment of the broadcast TV industry at the NATPE conference in Jan '08. My praise elicited a number of incredulous email responses from readers who vehemently disagreed, thinking Zucker's performance merits him being sent to the woodshed rather than to the CEO's office for the new Comcast-NBCU JV.