-

Roku Ready to Push Snazzy New Netflix UI

Roku will begin pushing out a snazzy new UI for Netflix Watch Instantly users tomorrow. I've been playing around with it today and can enthusiastically say it's a huge step forward over the prior UI. First and foremost the new UI allows on-screen search, browse and Watch Instantly queuing - features that eliminate the process of teeing something up on your computer and then flipping over to your TV to watch. These have been available on the game consoles for some time and are an important step forward for Roku.

Roku owners will be able to use their remote controls to scroll through cover art and select what they want to watch. The cover art is arranged in nearly identical categories to those displayed in Netflix's own Watch Instantly online UI (e.g. new arrivals, comedy, kids, etc.). It's impressive how fast the Roku app interacts with Netflix online. I added and deleted movies in each and toggled back and forth to see if the other was updated. In all cases the queue was immediately current.

Categories: Aggregators, Devices

-

Kylo TV Browser Can Now be Tweaked to Watch Hulu

Hillcrest Labs, maker of the Kylo browser, which lets users browse the Internet on their TVs, is announcing the Kylo 0.7 beta release this morning. The new release includes updates allowing advanced users to change the browser's user agent string in order to view Hulu. Just two months ago, when Kylo was introduced, Hulu very quickly blocked access, just as it had when boxee tried delivering Hulu to TVs. The new workaround represents another step in the cat-and-mouse game that Kylo is playing with Hulu.

browser's user agent string in order to view Hulu. Just two months ago, when Kylo was introduced, Hulu very quickly blocked access, just as it had when boxee tried delivering Hulu to TVs. The new workaround represents another step in the cat-and-mouse game that Kylo is playing with Hulu.

In the press release, Dan Simkins, Hillcrest's CEO and founder said, "It remains our position that Kylo is simply a Web browser based on open-source Mozilla code, like Firefox. We fully respect the rights of content owners and aggregators, and as such, we do no deep link, re-index, divert users past ads, or overlay different user interfaces on video players. However, we believe consumers should be able to use the Kylo browser to visit any site on the Web on the display screen of their choice. Our hope is that a respectful dialog with Hulu will encourage them to consider changing their policies."

To my knowledge Hulu hasn't ever publicly addressed this situation and I'm guessing it's won't this time either. It is extremely likely that Hulu will once again block Kylo, as it seeks to enforce its computer-only viewing model. As I wrote last week in "5 Reasons Google TV Looks Like a Winner," this insistence is really backing Hulu into a corner marginalizing the site for users who just want to watch whenever, wherever they'd like.

Aside from the Hulu tweak, Hillcrest is also announcing new features including a Windows Media Center plug-in, auto-hide control bar, improved zoom, keyboard hiding, multi-screen support for Mac, printing and updated links. Hillcrest is also putting its Loop pointer on half-price sale of $49 through June 11th. The Loop lets you easily navigate Kylo.

What do you think? Post a comment now (no sign-in required).Categories: Aggregators, Technology

Topics: Hillcrest Labs, Hulu, Kylo

-

Video Interview with Netflix CEO Reed Hastings

Last week when I was in CA for the Cable Show, I did a side-trip to Los Gatos to meet with and interview Netflix CEO Reed Hastings at the company's headquarters. We met up in the "Green Acres" conference room, one of the building's many meeting spaces named for popular TV shoes and movies. As I've written over the past several months, Netflix is on a huge roll, having grown its subscriber base 25% in just the last 2 quarters from 11.1 million subs at the end of Q3 '09 to almost 14 million subs at the end of Q1 '01.

Watch the interviews to learn more about topics like what Reed thinks is really driving Netflix's rapid growth, what Netflix pays to stream a movie online vs. deliver a DVD, whether streaming will remain unlimited, why Reed thinks TV Everywhere is "frustratingly brilliant," who the real competition is, what's on Netflix's streaming product roadmap, why sports are so important to cable, how net neutrality will be resolved and importantly, why Netflix's message to Hollywood is "our checkbook is open."

Reminder: Netflix's Chief Content Officer Ted Sarandos will be on the VideoSchmooze breakfast panel on Tuesday, June 15th at the SLS Hotel in Beverly Hills. Click here to learn more and save with the early bird discount.

Part 1 (9 minutes, 27 seconds):

Part 2: (9 minutes, 20 seconds):

What do you think? Post a comment now (no sign-in required).Categories: Aggregators, People

Topics: Netflix, Reed Hastings

-

Roku To Add Netflix Browse, Search and Queue Features

Roku just announced that by June it will soon be introducing a handful of features that improve the Netflix streaming experience when using Roku, including the ability to do the following all within its channel UI: search the Netflix Watch Instantly library, browse and play content and add content to your Watch Instantly queue (here's a short company-produced demo video).

Currently users are first required to do all of these things online in their Netflix account, and then go to the Roku when ready to play their selections. This 2-step process has always felt a bit clunky to me and the new features obviously simplify the experience a lot. Roku spokesman Brian Jaquet told me he believes Roku is the first to offer the search function of the many CE devices Netflix is integrated with. I know Xbox introduced the browsing function last fall and I believe that at least PS3 and Wii (and possibly others) offer this as well.

Netflix has been hitting it out of the park recently with subscriber additions, with streaming an increasingly important drawing card. Things that Roku and others do that improve the TV-based experience are valuable, especially for more mainstream users.

What do you think? Post a comment now (no sign-in required).Categories: Aggregators, Devices

-

Comcast and Netflix in the Context of Cord-Cutting

There's likely no hotter debate in the online video world right now than how big "cord-cutting" - the concept of consumers dropping their pay TV service in favor of online-only options - might be in the future. To the extent that cord-cutting or "cord-shaving" trends develop (and despite some recent research findings, these are still highly uncertain), no company is in a better position to both drive and benefit from them than Netflix.

Netflix cannot be considered a pure substitute for today's pay TV services for many reasons, primarily because there's no live or sports programming, and also because it offers just a fraction of what's available on TV. However, Netflix can be considered a key building block for consumers motivated to cobble together multiple sources to meet their video needs (for example, viewers can augment Netflix with Hulu/YouTube, over the air antenna, iTunes/Amazon downloads, out-of-home viewing, etc.). This is the more likely scenario for would-be cord-cutters than a one-for-one replacement of current pay TV services.

considered a key building block for consumers motivated to cobble together multiple sources to meet their video needs (for example, viewers can augment Netflix with Hulu/YouTube, over the air antenna, iTunes/Amazon downloads, out-of-home viewing, etc.). This is the more likely scenario for would-be cord-cutters than a one-for-one replacement of current pay TV services.

If cord-cutting or cord-shaving did take off, then Comcast, with the largest number of video subscribers of any pay TV provider, would likely be hurt the most (though as the largest broadband ISP, it could actually benefit on that side of its business as users upgrade for more bandwidth).

In this context, and with both companies reporting their Q1 '10 earnings in the past week, it's interesting to look at their performance to consider what to expect going forward.

The natural place to start the comparison is purely the number of video subscribers each company has. Netflix has been on a tear, more than doubling the number of its paying subscribers from just under 7 million in Q1 '07 to just under 14 million in Q1 '10. The biggest chunk of that growth has come in the last 2 quarters alone, when Netflix has added 2.9 million subscribers. Conversely, in that same 3 year time period, Comcast has lost approximately 1.5 million video subscribers to end Q1 '10 at 23.5 million. At the current rates, Netflix could have approximately as many subscribers as Comcast by end of next year.

However, the companies' subscribers are very different. On the one hand, Netflix is seeing its strongest growth in its least expensive $8.99/mo tier, which is a compelling value since it also allows unlimited streaming. Netflix is using this tier to entice many new subscribers and also to defend itself against $1 DVD rental competition from Redbox. As a result its average revenue per subscriber is declining. On the other hand, Comcast has been steadily increasing the penetration of additional services its subscribers take, primarily through "triple play" bundling of video with voice and broadband Internet access. This is reflected in the growth of its average revenue per video subscriber from $107.20 in Q1 '08 to almost $123 in Q1 '10. This, plus other lines of business like advertising, business services and its own programming networks contributes to Comcast generating $9.2 billion in revenue in Q1 '10 compared with Netflix's $494 million.

The flip side of Comcast's drive to increase its ARPU is that it potentially opens up higher cord-cutting interest. Some subscribers who open their billing statements to see a monthly tab in the $200 or more range when premium channels, DVRs, additional set-top boxes, VOD purchases and the like are all added up are inevitably going to get "sticker shock" and start asking the question how much value do they get from their cable subscription? While the cable industry has always made a strong argument that the sheer volume of programming available each month makes it a great subscription value, my sense is that with the massive number of alternative viewing options consumers are now accessing, it's not pure volume that matters, but rather actual cable use, in particular relative to other options.

billing statements to see a monthly tab in the $200 or more range when premium channels, DVRs, additional set-top boxes, VOD purchases and the like are all added up are inevitably going to get "sticker shock" and start asking the question how much value do they get from their cable subscription? While the cable industry has always made a strong argument that the sheer volume of programming available each month makes it a great subscription value, my sense is that with the massive number of alternative viewing options consumers are now accessing, it's not pure volume that matters, but rather actual cable use, in particular relative to other options.

For example, consider a home with a couple of teenagers who rarely watch live TV any more and instead spend a lot of their free time on Facebook, YouTube, Hulu, etc. Say Dad is only a light sports fan and doesn't consider ESPN or Fox Sports essential, and has long since moved the bulk of his news consumption to online sources. He loves Jon Stewart, but is content to catch his jokes online the next day when he has a few minutes of downtime at work. He also loves some of the broadcast network shows, but can watch them sporadically on Hulu. Mom is into the shows on HBO, plus some favorites on ad-supported cable channels like USA, Bravo and Food Network. Still, she's been having less time lately to actually watch these recently and has also started to gravitate to back seasons that are now available on Netflix. Since the family's Nintendo/Blu-ray player/Roku allows streaming to the TV, it's as simple as cable to use. Net it all out and the family's cable usage has declined markedly in the last couple of years.

Does this example sound familiar to you? I believe this is the kind of situation where cord-cutting or cord-shaving starts to gain some interest. Families faced with the real opportunity to save a few bucks each month, though with clearly reduced program options and convenience, will have decisions to make in the coming years. How they make them and how Comcast, Netflix and others react will have huge implications on their performance.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators, Cable TV Operators

-

Hulu Missed Its Window for Subscription Success

Unless Hulu has something very unpredictable up its sleeve in the $9.95/mo subscription service it's rumored to begin testing in May, the bad news for the site is that it has already missed its window of opportunity for subscription success. In a one sense it's not Hulu's fault; as a startup 3 years ago, it had to choose what strategy to focus on and execute. Hulu chose the free, ad-supported route, with widespread distribution that has made it the 2nd most-used video site.

success. In a one sense it's not Hulu's fault; as a startup 3 years ago, it had to choose what strategy to focus on and execute. Hulu chose the free, ad-supported route, with widespread distribution that has made it the 2nd most-used video site.

The problem is that the world has changed significantly since Hulu was started 3 years ago, and launching a successful online subscription service now is far harder to do now than it would have been then. Here are some of the top reasons why:

Subscription competition - 3 years the online video subscription field was wide open, but now there's Netflix to contend with. As the company's blowout Q1 '10 results amply demonstrate, Netflix is firing on all cylinders. By providing unlimited streaming as a value add even for its $8.99/mo subs, Netflix has muddied the waters for any would-be online-only subscription competitor, which has to articulate a value prop to prospects of why they should pay the same or more for online-only access, for what will likely be a smaller catalog initially. Netflix also has the device partnerships, 28-day studio deals for more content, well-baked UI/recommendations and deep financial resources. 3 years ago it had none of this; back then it was still imposing confusing online usage caps and pursuing its own set-top box with LG Electronics.

TV Everywhere - 3 years ago cable operators were contemplating their navels when it came to online video delivery, now with TV Everywhere they have a game plan (though admittedly not a lot of actual success just yet). For most cable networks, preserving their relationships in the cable ecosystem is paramount. Taking a leap by licensing content for a Hulu subscription service isn't going to be very appealing. Absent cable content, Hulu will be pitching a monthly subscription to archived commercial free broadcast network programs; that's a pretty narrow value prop.

Comcast-NBCU deal - 3 years ago Comcast was still licking its wounds from its ill-considered bid for Disney; now it has a deal to acquire NBCU, one of Hulu's original partners and a top-tier cable network owner. While Comcast will say all the right things during the deal's review process, I've wondered how long Comcast would even retain its Hulu stake once the deal is completed. Hulu's free "ad-lite" model is antithetical to Comcast's belief in subscriptions and bottom line accountability. A Hulu subscription service is unlikely to help either. Why would Comcast want another competing subscription offer in the market, much less one that would tempt would-be "cord-cutters?"

Lack of ownership will - 3 years ago, NBCU and News Corp were full of platitudes about their new online video baby. But in addition to NBCU's changed status, News Corp has become the most vocal content provider for the paid online content model. MySpace's travails are rumored to have soured Rupert Murdoch's appetite for chasing fickle online users. Meanwhile, Disney, the last partner to the Hulu venture, is plenty interested in subscriptions, but it wants to offer them directly. Then there's Hulu's key financial partner, Providence Equity Partners. I've never quite understood their investment decision given Hulu's limited exit opportunities, but one thing's for sure - they're unlikely to be motivated to help fund the considerable development and marketing expenses Hulu must undertake to make subscriptions succeed.

Retransmission consent - 3 years ago, the idea of broadcasters getting paid for their content still seemed like a stretch. But broadcasters are winning their chosen high-stakes battles, and given their success, are far more inclined to pursue a wholesale model (i.e. getting distributors to pay them monthly) than back a retail, subscription model. Plus, a Hulu subscription model departs from the message of free broadcast service that the broadcast lobby is using with the FCC and Congress to justify why it should retain its excess spectrum, rather than yielding it to mobile data providers under the National Broadband Plan's reclamation program.

User expectations - As if these weren't enough to contend with, the single biggest impediment Hulu faces is likely itself. Having invested its brand heavily in the free ad-supported positioning (and computer-based viewing only) Hulu lacks what experts would call "brand permission" to now pursue subscriptions. Companies are frequently chastened to find out what their customers really think when stretching for new products or business models. Moving customers from free to paid is one of the hardest things any company can do (just ask YouTube which is attempting to do the same); trying to pull it off from a cold start is nearly impossible in my mind. Hindsight is 20-20, but what Hulu probably should have done 3 years ago is offered a "freemium" model that would have immediately conditioned its users to thinking Hulu stands for both free and paid.

I've learned to never say never in this business, but to succeed, Hulu has to surmount the above challenges and more. If it can do so, it will be a significant win for the company. If it can't it will be yet another reminder of how treacherous things are even for well-funded startups trying to navigate a quickly-shifting competitive landscape.

What do you think? Post a comment now (no sign-in required).Categories: Aggregators

Topics: Comcast, Disney, FCC, FOX, Hulu, NBC

-

VideoNuze Report Podcast #58 - April 23, 2010

Daisy Whitney and I are pleased to present the 58th edition of the VideoNuze Report podcast, for April 23, 2010.

In today's podcast Daisy and I focus on Netflix's Q1 '10 results, which were the best in the company's history. I posted an analysis here, and in our discussion we dig in further to the competitive dynamics Netflix finds itself in and what consumers can expect going forward. Then Daisy takes us on a quick tour of what she saw at Ad:Tech.

Click here to listen to the podcast (15 minutes, 19 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!Categories: Aggregators, Podcasts

Topics: Ad:Tech, Netflix, Podcast

-

Netflix Blows Away Q1 '10; Adds Almost 1.7 Million Subscribers

Netflix reported its Q1 '10 results yesterday and they're the best in the company's history, blowing away its own guidance for the quarter. Net subscriber additions totaled 1.699 million, above the high end of the company's own guidance range of 1.232 million to 1.532 million net subs. It's by far the biggest quarter the company has ever reported, and is 85% higher than Q1 '09 net sub adds of 920K. Netflix upped its full year guidance range for ending subs to 16.5 to 17.3 million, from the previous range of 15.5 to 16.3 million.

In addition, the company reported subscriber acquisition cost of $21.54 which is the lowest in the company's history. This continues the downward trend in SAC over the last 4 years. Churn came in at 3.8% which is also a record low, just below Q4' 09's 3.9%.

To get a sense of how big Q1 '10 was, look at the below chart showing net sub adds for the five first quarters back to 2006. Note that net sub adds in Q1 '10 were more than twice as much as just 2 years ago in Q1 '08. The SAC line shows the steady drop over the last 3 years. As I said yesterday, the record low churn in Q1 '10 is strong evidence that all this growth isn't coming at the expense of subscriber quality.

On the earnings call, CEO Reed Hastings and CFO Barry McCarthy gave a very upbeat report on the business and reiterated several themes from prior earnings calls. Increasing the streaming library is clearly the company's number one objective, and the recent 28-day DVD deals with Warner Bros, Universal, Fox and HBO, all serve this purpose. Hastings mentioned a number of times that savings on DVD purchases resulting from these deals is being plowed back into gaining more streaming content.

The company noted that subscribers using its Watch Instantly streaming feature for at least 15 minutes per month in Q1 '10 rose to 55% from 48% in Q4 '09. In fact, Hastings and McCarthy often referenced the positive interplay between improving the streaming value proposition and increasing subs, reducing churn and reducing SAC. This is the fundamental dynamic the company is now in. Three plus years since introducing Watch Instantly, the hybrid offer of DVD rental and streaming has reinvented Netflix's value proposition and propelled its unprecedented growth.

A few other interesting tidbits in no order, from the earnings call and commentary:- New subscribers are disproportionately choosing the $8.99 "1 DVD out" plan.

- A significant number of streaming users have connected their computers to their TVs.

- TV program content available for streaming has grown significantly in last 2 years and now accounts for a significant percentage of weekly viewing hours.

- iPad app has had minor effect on business, but being in Apple ecosystem has generated great PR.

- Wii launch in Q2 is expected to have big impact on streaming usage.

- 28-day DVD deals is prompting some consumer shifting to purchase and VOD, but that was expected and isn't harming Netflix's subscription value.

- Netflix has no interest in setting up a digital storefront for single-use rental or downloads. It believes Amazon, iTunes and others do that model well and it would cause partner conflicts. Subscription is Netflix's only focus.

- Netflix hasn't seen any upside from alleged "cord-cutting" of cable/satellite/telco services and doesn't see itself as a relevant substitute for these services.

- Plan is to continue as a distribution partner for pay channels like HBO, Showtime, Starz and Epix - not to compete with them, or introduce original programming like they do.

- 24% of households in Bay area now Netflix subscribers, and in spite of streaming's growth, DVD shipments in the area still increased in Q1 '10.

- Hastings swapped a large percentage of his cash compensation for stock awards in a vote of confidence in the business.

- Not concerned about reports of Hulu or Redbox subscription offers; Netflix's competitiveness is based on scale, UI, recommendations, content breadth.

- More news on international expansion later this year, but expected to start small.

As I said previously, Netflix is by far the most formidable "over the top" player, and with its continued strong growth is creating many interesting strategic options for itself down the road. The thing that continues to really surprise me about the Netflix story is that no meaningful competitor has emerged. How companies like Apple, Amazon, Walmart, Comcast, DirecTV and Microsoft plus big venture capital/private equity investors have sat on the sidelines and not aggressively introduced subscription DVD/streaming services of their own is both a mystery and a gigantic boon for Netflix. Given Netflix's size and formidable capabilities, it may already be "game over" for any of these potential competitors.

What do you think? Post a comment now (no sign in required).

Categories: Aggregators

Topics: Netflix

-

What to Look for in Netflix's Q1 '10 Results Later Today

Later today Netflix will report its Q1 '10 results which will be closely scrutinized to see if the company's strong momentum has continued following its blowout Q4 '09. Netflix is easily the most important "over the top" (OTT) contender and recently it announced further moves that will strengthen its position (e.g. launch of Wii streaming, Warner Bros., Universal and Fox 28-day DVD window deals, iPad app, more CE partners and additional indie content).

In January the company forecasted Q1 ending subscribers would be in a range of 13.5 to 13.8 million, which would represent net sub growth of 1.232 million to 1.532 subs over its Q4 '09 ending 12.268 million subs. The forecasts are a sign of how bullish Netflix management itself is; even the low end would represent the strongest quarterly net sub growth ever. Netflix's best Q1 was in '09 when it added 920K net subs meaning even the low end of the Q1 '10 forecast is 34% higher than the Q1 '09 actual. And a strong Q1 would also bode very well for full 2010 results; historically Q1 represents between 32-41% of Netflix's full year net sub adds.

As I explained in my Feb post, "It's Official: Netflix has Entered a Virtuous Cycle" there are several other key numbers to zero in on today. First is subscriber acquisition cost (SAC), which is what the company spends to add each new sub. SAC in Q4 '09 was $25.23, the second lowest ever (only Q2 '09 SAC of $23.88 was better). SAC has been falling dramatically (it was $47.46 in Q1 '07). I think this is a direct reflection of the company's unlimited streaming feature becoming better understood and valued as online video viewing has soared and convergence devices have proliferated. A continued decline of SAC in Q1 '10 would be very good news.

each new sub. SAC in Q4 '09 was $25.23, the second lowest ever (only Q2 '09 SAC of $23.88 was better). SAC has been falling dramatically (it was $47.46 in Q1 '07). I think this is a direct reflection of the company's unlimited streaming feature becoming better understood and valued as online video viewing has soared and convergence devices have proliferated. A continued decline of SAC in Q1 '10 would be very good news.

Churn is another number to focus on. In Q4 '09 it was 3.9%, matching the company's all time low. Churn is tightly related to sub growth. If new subs are low quality (e.g. responding to promotional offers, not understanding up-front what to expect, high delinquencies, etc.), churn will increase. If Netflix can sustain sub 4% churn in the face of unusually high sub growth that means sub quality is strong.

The percentage of subs using its streaming feature for at least 15 minutes/month is yet another number to focus on. In Q4 '09 it was 48%, up from 41% in Q3 '09 and 26% in Q4 '08. I'm sure we'll see an increase in this percentage in Q1 '10, the only question is to what. Last but not least, it will be interesting to see where gross margin comes in. Gross margin ticked up to 38% in Q4 '09, a level not seen since 2006, but it's not clear whether this will be sustained. Benefits of the 28-day DVD deals, which in part reduce the company's cost of acquiring DVDs from these studios will likely not be visible yet in Q1.

Netflix has a huge amount of momentum in its fundamentals, which the stock market seems to have woken up to recently. The company's stock price closed at $87.07 yesterday, up 58% from its 12/31/09 price of $55.09 and up 71% from $50.97, the level that it was at just prior to when it reported its blowout Q4 results. Investors will no doubt be looking at Q1 results to help justify the stock's big recent move. In particular, if sub growth beats the high end of the forecasted range, it could well trigger another strong move higher for the stock (and no that's not a recommendation to buy). Netflix has a wide open playing field, later today we'll find out how well it continues to capitalize on it.

What do you think? Post a comment now (no sign-in required).Categories: Aggregators

Topics: Netflix

-

Widevine Announces Product Update, List of Supported Devices and New Customers

Widevine is announcing the 4.4.4 version of its video optimization and DRM platform today, with new features, a list of supported devices and new customers. Widevine's CEO Brian Baker brought me up to speed yesterday.

customers. Widevine's CEO Brian Baker brought me up to speed yesterday.

Widevine is supporting HTTP streaming and also adaptive bit rate streaming for live events and shows, not just on-demand. Devices supported include Apple products, Blu-ray players (Haier, LG, Philips, Samsung, Toshiba), connected TVs, Nintendo Wii, Windows PCs and 50 models of set-top boxes. As TV Everywhere services begin to roll out, secure delivery is a key to success, and Brian explained that Widevine is positioning itself to be in the middle of the action.

On the customer front, Netflix and Best Buy are being announced as new customers. Netflix has been aggressively rolling out new content and supported devices for its Watch Instantly streaming feature. Brian wouldn't confirm, but it seems fair to assume that Widevine is the DRM solution Netflix is using for streaming to the Nintendo Wii, which, given its massive installed base could quickly become a significant percentage of Netflix's streaming use (it just went live last week). In a related move, last week Irdeto announced that Netflix had licensed its Cloakware software as part of its DRM efforts.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators, Devices, DRM

Topics: Best Buy, Netflix, Widevine

-

Netflix Signs Up Irdeto to Secure Streaming Delivery

Irdeto, the digital media security provider, is announcing this morning that Netflix has licensed the company's Cloakware Embedded Security software as part of its solution to secure content streamed to multiple consumer devices. Cloakware is a set of tools to defend against unauthorized tampering and attacks. Irdeto has a broad customer base internationally and has lately been raising its profile in the U.S.

part of its solution to secure content streamed to multiple consumer devices. Cloakware is a set of tools to defend against unauthorized tampering and attacks. Irdeto has a broad customer base internationally and has lately been raising its profile in the U.S.

For Netflix, the push for enhanced security comes as the company begins expanding to additional CE devices beyond the desktop for its hugely popular Watch Instantly streaming feature. The iPad is the first new device Netflix has targeted, and its app is considered one of the most widely downloaded in the iPad's first weeks on the market. No doubt this success will spawn further Netflix Watch Instantly implementations, particularly as competing tablets come on the market in 2010 and smartphones proliferate, especially those powered by Android.

Categories: Aggregators, DRM

-

Fox and Netflix Agree to 28-Day Window

Netflix and Fox are announcing this morning an expanded content licensing agreement which creates a 28-day DVD window and gives Netflix streaming access to certain prior season Fox TV shows. The 28-day window, which delays Netflix access to new DVDs until 28 days after their release date is similar to a deal that Netflix struck with Warner Bros. earlier this year.

I continue to be a fan of the 28-day window, as it allows studios a little more time to eke further revenue out of the rapidly-declining DVD sales business, while expanding Netflix's catalog for streaming and reducing its cost on physical DVD purchases. Netflix's Watch Instantly streaming feature has been a game-changer for the company, essentially reinventing the company's value proposition from a DVD subscription business defined by the number of discs out at any time, to one where subscribers get unlimited digital use. The key to its success is building the library of titles for streaming and that's what these 28-day deals are all about.

while expanding Netflix's catalog for streaming and reducing its cost on physical DVD purchases. Netflix's Watch Instantly streaming feature has been a game-changer for the company, essentially reinventing the company's value proposition from a DVD subscription business defined by the number of discs out at any time, to one where subscribers get unlimited digital use. The key to its success is building the library of titles for streaming and that's what these 28-day deals are all about.

Update: Universal also announced a 28-day deal with Netflix this morning. Release is here.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators, FIlms, Studios

-

Blockbuster Hangs In with New Fox, Sony and Warner Deals

Netflix wasn't the only distributor modifying how it does business with Hollywood studios this week; Blockbuster also unveiled new deals with Fox, Sony and Warner, giving it "day-and-date" availability of these studios' films for store and mail rental (note, not for its on demand streaming service). Blockbuster also got "enhanced payment terms" from the studios in exchange for giving them a first lien on Blockbuster's Canadian assets (which would imply that if Blockbuster files for bankruptcy, the studios could end up owning/operating a slew of Canadian stores). Seems like steep terms for Blockbuster to hang in there.

for store and mail rental (note, not for its on demand streaming service). Blockbuster also got "enhanced payment terms" from the studios in exchange for giving them a first lien on Blockbuster's Canadian assets (which would imply that if Blockbuster files for bankruptcy, the studios could end up owning/operating a slew of Canadian stores). Seems like steep terms for Blockbuster to hang in there.

As I wrote a few weeks ago in "The Battle Over Movie Rentals is Intensifying," there are multiple distributors jockeying to be the consumer's preferred movie source. That means consumers need to figure out, on a title by title basis what works best for them.

For example, I'm a Netflix subscriber and let's say I want to watch the recently released "Sherlock Holmes" DVD. Netflix doesn't get it until April 27th per its 28-day window with Warner Bros. But when I check online, a local Blockbuster store I've never been to shows that it's in stock (though I'm a little skeptical). Do I want to drive down there to find out? Meanwhile, Comcast is offering it on-demand. But do I want to pay $4.99 for it when I'm already paying a monthly Netflix subscription? Alternatively, there's iTunes and Amazon VOD. But then I need to either watch on my computer or on the TV that's hooked to the Roku or temporarily connect my laptop to the TV. See what I mean about the choices facing consumers?

(Note - online movie distribution is among the topics we'll cover at the next VideoSchmooze on April 26th. Early bird discounted tickets available for just one more week!)

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators, FIlms, Studios

Topics: Blockbuster, FOX, Netflix, Sony, Warner Bros.

-

Is Hulu Now Blocking Access for Kylo Users? Yes, It Is.

No sooner did I post "With New Kylo Browser Convergence is Another Step Closer" this morning, than I've come to understand that Hulu programs are now not accessible through the Kylo browser. Hulu worked completely fine for me yesterday, but now when I go to watch a program on Hulu, I'm getting the text message, "Unfortunately this video is not available on your platform. We apologize for any inconvenience." Huh, what's going on here? Is Hulu blocking Kylo users' access to its programs? I've asked Hulu for a comment.

If Hulu is indeed doing this, it's a PR fiasco in the making for the site. Blocking access to its content would mean that Hulu is putting itself on the wrong side of convergence and risking turning off its users (not to mention censoring as if this were China). The episode recalls February, 2009, when Hulu demanded that boxee turn off access to Hulu at the request of its content partners. That tempest highlighted the artificially made quagmire that Hulu's owners find themselves in - eager to have Hulu boost their programs' viewership, so long as it remains on the computer and not on the TV.

With Kylo, Hulu will once again be called upon to justify how it's making decisions. For example, if I'm using Kylo on my computer, how is watching Hulu content any different than if I were using IE, Firefox, Safari, etc? And if I choose to connect my computer to a TV screen, how is that any different than if I connected it to a large monitor? In short, this is a hairball for Hulu.

Update: Hillcrest Labs, the company behind the new Kylo browser, has confirmed that Hulu is indeed preventing its content from being shown. The statement from Hillcrest's CEO Dan Simpkins:

"We have confirmed with Hulu that they are preventing the Kylo browser from playing Hulu videos. Prior to our formal launch, Hulu videos would play within the Kylo browser. Like Internet Explorer, Firefox or Safari, the Kylo browser is simply a Web browser that enables consumers to visit any site on the Web. We have tremendous respect for Hulu, and we hope that a continued dialog might influence their thinking."

Meanwhile Hulu seems to be in a bunker. I haven't heard back from them, nor has anyone else it appears. I have confirmed from ABC (one of Hulu's owners) that it found out about Hulu's action when everyone else did, which means that ABC is not the instigator here. Much more on this story as it unfolds.

Update 2: Now Tuesday morning and still no word back from Hulu. Nobody else seems to have heard from them either. It looks like their PR strategy is avoidance. That's a bad move because going mum just means that story continues to live (just ask Tiger).

Hulu's decision to block Kylo users is all about preventing Hulu viewership from migrating to TVs, which would undermine broadcast network economics. That's because Hulu, with its light ad load, still hasn't been able to prove its business model. The problem for Hulu - and the networks - is bigger than Kylo though as the push toward convergence between online video delivery and TV is going to be relentless (lots more on this tomorrow). Hulu is facing an escalating "Whac-a-mole" problem which will only lead to huge user frustration and increasingly tortured justifications.

What do you think? Post a comment now (no sign-in required).Categories: Aggregators, Technology

-

Wrapping Up the YouTube-Viacom Court Documents Coverage

Wow, based on the extensive coverage of the newly disclosed court documents in the Viacom-YouTube copyright lawsuit, you'd almost think the business press hit the pause button on everything else going on yesterday to spend time reading the details. The combination of 2 heavyweight companies slugging it out, billions of dollars at stake and juicy, behind-the-scenes details finally revealed (like how the $1.6 YouTube acquisition largesse was shared) makes this an irresistible story with lots of legs.

I've only spent a little time reviewing the documents, but for those interested in the 360 degree immersion, following is some of the best coverage I've been reading, in no particular order. No doubt there's plenty more to come. And if you're a real glutton for punishment, just google "Viacom YouTube court documents" and you can spend your entire weekend reading everything!

Viacom Says YouTube Ignored Copyrights - NY Times

YouTube Accuses Viacom of Secretly Uploading Clips - Mediapost

Viacom, YouTube Trade Barbs in Copyright Feud - Multichannel News

Viacom and Google Trade Accusations - WSJ

YouTube Says Viacom Agents Secretly Uploaded Video, Then Lawyers Sued - AdAge

The Numbers Behind the World's Fastest Growing Web Site: YouTube's Finances Revealed - AllThingsD.com

Viacom, Google Air Dirty Laundry in Court Docs - CNET

Did YouTube Jilt Viacom for Google - NewTeeVee

Revealing Docs Emerge in Viacom, YouTube Spat - Variety

What do you think? Post a comment now (no sign-in required)Categories: Aggregators, Cable Networks

Topics: Google, Viacom, YouTube

-

Potential Blockbuster Bankruptcy Another Reminder of Changed Movie Landscape

In case you missed it, this week Blockbuster, the once dominant movie rental chain, filed its 10K annual report with the SEC, in which it warned of "substantial doubt about our ability to continue as a going concern," continuing on to say it may seek relief through a bankruptcy filing. A filing has been rumored for a while now, but until its annual report, Blockbuster has resisted acknowledging this path.

Aside from whatever else can be said about Blockbuster in recent years - vast over-expansion, poor financial management, slowness to respond to new competitors like Netflix and Redbox - the company's potential bankruptcy is surely one of the most vivid reminders of how much the movie rental industry has changed in the last 10 years and how much it is yet to change in the next 10 years. Blockbuster will likely be remembered as a temporary player that drove wider movie access in the analog era, but then got crushed as rentals shifted in the digital era. The separate news this week of cable operators and studios beginning to vigorously promote VOD shows cable operators are determined not to be left behind, like Blockbuster has been, as the next chapter of movie rentals unfolds.

competitors like Netflix and Redbox - the company's potential bankruptcy is surely one of the most vivid reminders of how much the movie rental industry has changed in the last 10 years and how much it is yet to change in the next 10 years. Blockbuster will likely be remembered as a temporary player that drove wider movie access in the analog era, but then got crushed as rentals shifted in the digital era. The separate news this week of cable operators and studios beginning to vigorously promote VOD shows cable operators are determined not to be left behind, like Blockbuster has been, as the next chapter of movie rentals unfolds.

What do you think? Post a comment now (no sign-in required)Categories: Aggregators, Deals & Financings

Topics: Blockbuster

-

Comedy Central Pulls Out of Hulu - Was This Really a Surprise?

This week brought news that Comedy Central was pulling its programs, including its hits "The Daily Show with Jon Stewart" and "The Colbert Report," from Hulu on March 9th. Both had been available on Hulu since the summer of 2008 in what Comedy Central had initially positioned as a test. Both will still be freely available at ComedyCentral.com.

The Daily Show in particular had been enormously popular on Hulu since launch, so in this respect losing it is a setback for Hulu. Still, Comedy Central's decision should come as a surprise to nobody. As I've been saying since I wrote "The Cable Industry Closes Ranks" in November '08, a bright line is being drawn in the broadband world between programs that consumers currently pay for and those that they don't. The industry is determined make sure the former stay that way and don't leak out onto the free Internet (in this sense, it's actually amazing to me that the Comedy programs are still available for free on its own site, but that's another story).

Central's decision should come as a surprise to nobody. As I've been saying since I wrote "The Cable Industry Closes Ranks" in November '08, a bright line is being drawn in the broadband world between programs that consumers currently pay for and those that they don't. The industry is determined make sure the former stay that way and don't leak out onto the free Internet (in this sense, it's actually amazing to me that the Comedy programs are still available for free on its own site, but that's another story).

The free ad-only Hulu model is bumping up against the industry's big TV Everywhere push (another effort to maintain the subscription model) and so it was inevitable that Comedy's programs would get pulled. Hulu could make itself more attractive to networks - and open up new opportunities for itself - if it offered a subscription model. This is something I've suggested for some time, however I'm somewhat skeptical that anything will happen on this front until the Comcast-NBCU deal closes. Comcast would then become an approximately 20% owner of Hulu and will surely want to influence its strategic direction.

What do you think? Post a comment now (no sign-in required).Categories: Aggregators, Cable Networks

Topics: Comedy Central, Hulu

-

Why Did Online Video Consumption Spike in 2009?

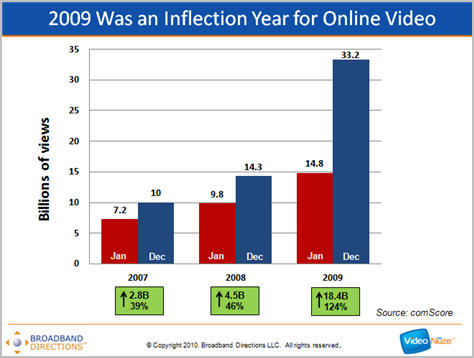

If you want to get a sense of how significant an inflection year 2009 was for online video, have a look at the chart below.

As you can see, according to comScore data, while Jan-Dec growth in 2007 (up 2.8 billion views or 39%) and 2008 (up 4.5 billion views or 46%) were impressive by any standard, the Jan-Dec 2009 growth of 18.4 billion views, up 124%, completely blows them away. Growth was so significant in 2009 that I think years down the road it will be pointed to as the year that online video really turned the corner.

But if that's the case, the question begs, "Why did growth accelerate so much in 2009 vs. prior years?" That's what I've been asked several times by industry colleagues since posting "comScore Data Shows 2009 Was a Blistering Year for Online Video" 2 weeks ago. It's a great question and though I don't have a really precise answer, here's my best sense of what happened.

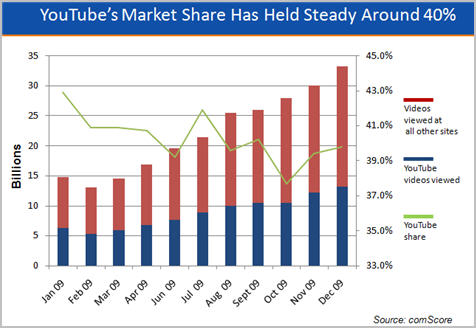

No surprise, the most important contributor to the year's growth was YouTube. It zoomed from 6.3 billion views in Jan '09 to 13.2 billion in Dec. '09. That increase of 6.9 views accounts for 38% of the 18.4 billion delta between Jan and Dec. So what did YouTube do to generate such significant growth? Part of the reason is surely organic; more people uploading, sharing and viewing YouTube videos. But in 2009 YouTube also made strides in professionalizing the content on YouTube, broadening its value proposition to users. For example, its "Content ID" program, which lets media companies manage and monetize user-uploaded videos, has largely addressed the copyright infringement concerns from past years (the Viacom suit is a notable exception).

In 2009, among other things, YouTube also signed up Disney/ESPN, Univision and others as content partners, began implementing FreeWheel's ad system so 3rd party content providers could better monetize their views, engaged a number of leading brands to use it as a promotional platform, and with "YouTube Direct" engaged news organizations as partners. In short, YouTube continues to immerse itself into the fabric of the Internet. Whether users are viewing videos at its site or through its wildly popular embeds, YouTube has become omnipresent. YouTube now also claims to be the 2nd largest search site.

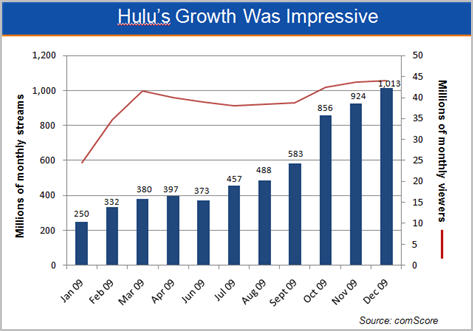

A second, but distant contributor to 2009's growth was Hulu, which saw its views increase by over 763 million from Jan to Dec, accounting for about 4% of the 18.4 billion increase in total views during that period. Hulu's mindshare leaped following its 2009 "Evil Plot" Super Bowl ad featuring Alec Baldwin and the subsequent ones. No doubt the addition of ABC programs throughout the year, plus other new content partners, also helped generate more viewership, along with the hugely popular SNL clips.

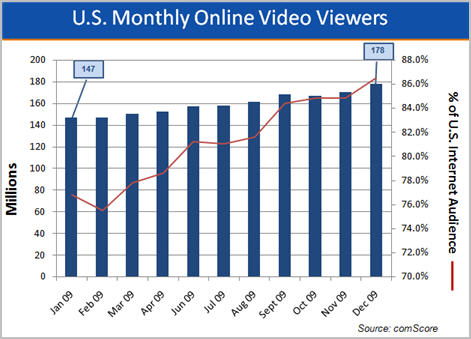

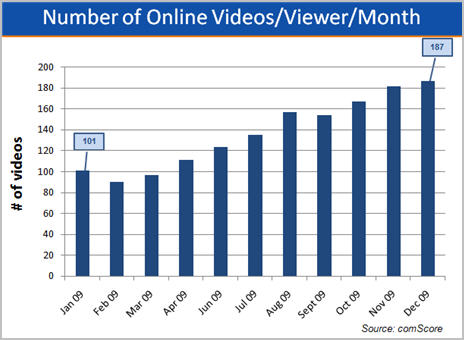

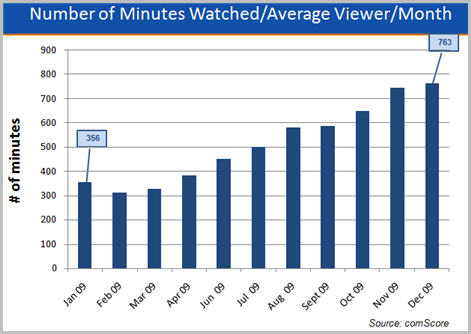

Once you get beyond these top 2 sites, the individual contributions to 2009's growth are more dispersed. The comScore data shows that across all video sites, usage intensified significantly during the year. For example, the number of videos viewed per viewer increased from 101 in Jan to 187 in Dec. The number of minutes watched jumped from 356 in Jan (almost 6 hours) to 762 in Dec (more than 12 1/2). There were also 31 million more U.S. Internet users watching video in Dec vs. Jan (178 million vs 147 million).

Looking beyond the numbers and thinking more qualitatively, it's also fair to conclude than in '09 online video reached a certain level of awareness that made it almost ubiquitous. There is just so much video online, and it is shared so widely, and highlighted so frequently by mainstream media, that it is unavoidable, even for the least technically-savvy among us. People are increasingly entertaining themselves with online video, but they're also finding new uses for it in their daily personal and professional lives.

I think it's unlikely we'll see the same level of growth in 2010 as in 2009, but I do believe the growth curve over the next 5 years will be very steep. The primary contributor will be convergence devices (e.g. game consoles, Blu-ray players, Roku, etc.) that are bridging online video to the TV where longer-form consumption will be the norm. Another key contributor will be TV Everywhere services, which are just now getting off the starting blocks. Lastly, I think growth in mobile consumption will be another important contributor. Add them all up and the 33.2 billion videos viewed in Dec. '09 will look relatively small 5 years from now.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators

Topics: comScore, Hulu, YouTube

-

Veoh Throws in the Towel After $70 Million Invested

Veoh declared bankruptcy yesterday and laid off the last of its employees. For those of us who follow the online video industry closely, it wasn't a huge surprise, as Veoh has struggled for a while to find a business model while facing Universal Music Group's relentless copyright challenge (in which Veoh ultimately

prevailed). Veoh's failure is a cautionary tale that even an early start, $70 million invested from blue-chip backers and strong user support aren't necessarily enough for success.

prevailed). Veoh's failure is a cautionary tale that even an early start, $70 million invested from blue-chip backers and strong user support aren't necessarily enough for success.Veoh lived in YouTube's shadow from day one, and as it became apparent that UGC was a winner-take-all market which YouTube had won, Veoh scrambled for a new opportunity. It discontinued support for adult content, which alienated a core group of its users. It pushed to be an aggregator for premium video, sealing partnerships with CBS, MTV, Lionsgate, PBS and others, while continuing to attract independent content. But it got squeezed when Hulu appeared on the scene, which quickly became the de facto destination for premium programming. Veoh's last stand was promoting its "Video Compass" browser plug-in offering enhanced video discovery. A neat feature, but clearly not enough to build a company around. R.I.P. Veoh.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators, Deals & Financings

Topics: Veoh

-

comScore Data Shows 2009 Was a Blistering Year for Online Video (Slides Available)

Last Friday, comScore released its Dec. '09 data for online video usage. I've been tracking comScore's data for the last 3 years and Dec put an exclamation mark on what many of us already knew: 2009 was a blistering year of growth in online video consumption. Below are graphs of the most important data (Click here if you'd like a complimentary PDF download of all of the slides.)

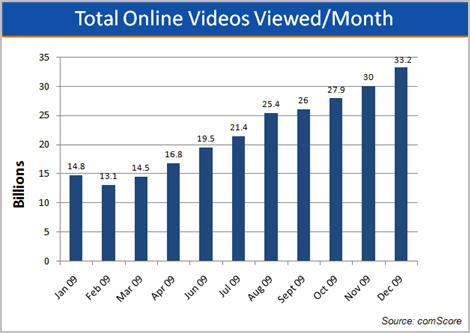

The first graph shows total online video views more than doubled from 14.8 billion in Jan '09 to 33.2 billion in Dec '09. The historical growth is even more impressive. Just two years ago, in Dec '07, comScore reported 10 billion video views.

Online video usage is now nearly ubiquitous in the U.S. According to comScore, in Dec '09, 86.5% of all U.S. Internet users watched online video, up nearly 10 percentage points from the 76.8% in Jan '09. That translates to 178 million people watching video in Dec '09, up from 147 million in Jan '09. Back in Jan '07, there were 123 million viewers.

Those users are watching a whole lot more videos as well. For Dec '09, comScore reported that 187 videos were watched per average viewer, up 85% from 101 in Jan '09, and more than triple the 59 watched in Jan '07.

As well, those viewers spent a lot more time watching online video. In Dec '09 comScore said that the average online viewer watched 762.6 minutes or 12.7 hours, more than double the 356 minutes viewed on average in Jan '09. Here's the really incredible stat: back in Jan '07, comScore pegged this number at just 151 minutes or about 2 1/2 hours, meaning average viewing time has more than quintupled in the last 3 years.

I've talked many times about how YouTube is the 800 pound gorilla of the online video market, and 2009 only further cemented this. Videos viewed at YouTube surged from 6.3 billion in Jan '09 to 13.2 billion in Dec '09. To put this in perspective, Google closed its acquisition in Nov '06. In Jan '07 (the first month comScore publicly released online video data), YouTube notched 1.2 billion views. That means that in the 3+ years that Google has owned YouTube, it has grown more than 10x in size. More amazing is that even with all the growth by other sites (particularly Hulu), YouTube has kept up its approximate 40% share of the overall online video market, starting the year at 42.9% and ending at 39.8%.

Speaking of Hulu, in its first full year of operation, the site surged from 250 million views in Jan '09 to 1,013 billion views in Dec '09. Unique viewers increased from 24.4 million in Jan '09 to 44.1 million in Dec '09. But if you look at the red line in the graph below, you'll see that uniques jumped to 41.6 million by Mar '09 which I believe must be due, at least in part, to a likely measurement change by comScore. Since Mar you'll notice that uniques hovered right around 40 million each month, dipping below during the summer and then bouncing back in Q4.

A few months ago I speculated that Hulu's relatively flat pattern in uniques could suggest that, in its current configuration, Hulu may have saturated the market for its content and user experience (for example, contrast Hulu with YouTube, which grew its uniques by 33% in '09 to 135.8 million by Dec '09). I'll be looking to see if Hulu can notch more noteworthy increases in uniques during '10; if not, then I think my thesis will be proven correct.

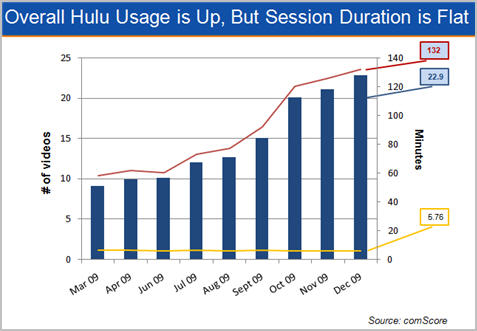

Nonetheless, Hulu's viewers clearly love the site, with average number of videos per viewer more than doubling to 22.9 in Dec '09, up from 9.8 in Dec '08. Users are spending more time on Hulu, increasing the amount of total minutes on the site from 58 in Mar '09 to 132 in Dec '09. What's remarkable though is that the average minutes watched per video (the yellow line below), has stayed virtually constant at around 6 minutes each month. That shows that while there's plenty of long-form consumption happening at Hulu, clips are still very popular too.

comScore is a great source of month in and month out online video data, but as always my caveat is that no third party can ever track usage as closely as the sites themselves, so take these numbers with a small grain of salt!

Click here if you'd like a complimentary PDF download of all of the slides.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators

Topics: comScore, Hulu, YouTube