-

May '08 VideoNuze Recap - 3 Key Topics

Looking back over two dozen posts in May and countless industry news items, I have synthesized 3 key topics below. I'll have more on all of these in the coming months.

1. Broadband-delivered movies inch forward - breakthroughs still far out

In May there was incremental progress in the holy grail-like pursuit of broadband-delivered movies. Apple established day-and-date deals with the major studios for iTunes. Netlix and Roku announced a new lightweight box for delivering Netlix's "Watch Now" catalog of 10,000 titles to TVs. Bell Canada launched its Bell Video Store, complete with day-and-date Paramount releases, with others to come soon. And Starz announced a deal with Verizon to market "Starz Play" a newly branded version of its Vongo broadband subscription and video-on-demand service.

Taken together, these deals suggest that studios are warming to the broadband opportunity. This is certainly influenced by slowing DVD sales. Yet as I explained in "iTunes Film Deals Not a Game Changer" and "Online Move Delivery Advances, Big Hurdles Still Loom" broadband movies are still bedeviled by a lack of mass PC-TV connectivity, no real portability, well-defined consumer behavior around DVDs and the studios' well-entrenched, window-driven business model. Despite May's progress, major breakthroughs in the broadband movie business are still way out on the horizon.

2. Broadcast TV networks are embracing broadband delivery - but leading to what?

Unlike the film studios, the broadcast TV networks are plowing headlong into broadband delivery, yet it's not at all clear where this leads. In "Does Broadband Video Help or Hurt Broadcast TV Networks" and "Fox's 'Remote-Free TV': Broadband's First Adverse Impact on Networks?" I laid out an initial analysis about broadband's pluses and minuses for networks. I'll have more on this in the coming weeks, including more in-depth financial analysis.

On the plus side, in "2009 Super Bowl Ads to Hit $3 Million, Broadband's Role Must Grow," "Sunday Morning Talk Shows Need Broadband Refresh" and "Today Show Interview with McClellan Showcases Broadband's Power," I illustrated some opportunities broadband is creating. On the other hand, "Bebo Pursues Distinctive Original Programming Model" and "More Questions than Answers at Digital Hollywood" explained how exciting new programming approaches are taking hold, challenging traditional TV production models. Broadcasters are in the eye of the broadband storm.

3. Advertising's evolution fueled by innovation and resources

Last, but hardly least, I continued on one of my favorite topics: the impact broadband video is having on the advertising industry. Over the last 10 years the Internet, with its targetability, interactivity and measurability has caused major shifts in marketers' thinking. With broadband further extending these capabilities to video, the traditional TV ad business is now ripe for budget-shifting. We'll be exploring a lot of this at a panel I'm moderating at Advertising 2.0 this Thursday.

In "Tremor, Adap.tv Introduce New Ad Platforms" and "All Eyes on Cable Industry's 'Project Canoe'" (from Mugs Buckley), key players' innovations were described along with how the cable industry plans to compete. Content providers are being presented with more and more options for monetizing their video, a trend which will only accelerate. Yet as I wrote in "Key Themes from My 2 Panel Discussions Last Week," many issues remain, and with so many content start-ups reliant on ads, there may be some disappointment looming when people realize the ad market is not as mature as they had hoped.

That's it for May. Lots more coming in June. Please stay tuned.

Categories: Advertising, Aggregators, Broadcasters, Cable TV Operators, Devices, Downloads, FIlms, Studios, Video Sharing

Topics: Adap.TV, Apple, Bell Canada, Canoe, iTunes, Netflix, Paramount, Roku, Starz, Tremor, Verizon, Vongo

-

Key Themes from My 2 Panel Discussions Last Week

Last week I moderated 2 panel discussions, one for Streaming Media East in New York, and the other for MITX, the Massachusetts Innovation and Technology Exchange, in Boston. In the former, "Reinventing the Ad Model Through Discovery and Targeting" and the latter, "Driving Audiences to Your Online Video Content: Strategies for Success in a Crowded Market" panelists discussed many of the key themes I continue observing in the broadband video market.

Early adopters are heaviest broadband usersDespite research that continues to show broadening adoption of broadband video usage (11.5 billion videos viewed in March, according to comScore), at SME, Nielsen's Jon Gibs confirmed that the vast majority of the market is still very casual users, with only 5-8% of overall users showing more habitual and long-form viewing. For many today, the viewing experience is still limited to watching a YouTube clip emailed to them or found in a friend's MySpace or Facebook page. Plus user attention spans remain short. At MITX, Visible Measures' Brian Shin showed how viewership drops off a cliff following the climactic moment of a hilarious user-generated clip. Broadband is driving significant behavioral change for a segment of the market, but transitioning to a heavily-used mainstream medium will take years.Video proliferatesNonetheless, the number and range of video producers continues to expand, as all kinds of organizations recognize that video is a totally new opportunity to connect with their audiences, whoever that may be. At the MITX event, panelists showed examples from politicians, cultural organizations, small businesses, schools, brands and users themselves. I've said for a while that we're entering a "golden age" of video, with a massive proliferation of the quantity and range of sources. The market is already well into this phase.Discovery is a huge problemWith this massive proliferation comes the huge problem of how users will actually find what they're looking for. At SME, Mike Henry from Veoh discussed promising results of Veoh's proprietary behavioral recommendation engine. At MITX, Tom Wilde from EveryZing showed how it can surface video for search engine discovery by using its speech-to-text engine; while Murali Aravamudan from Veveo explained how its algrorithms can quickly distinguish the video users are truly searching for. All of these approaches improve the users' experience. Yet what's equally clear is that, having never experienced the explosion of video choices we're now witnessing, it's impossible to know what will ultimately end up working. Discovery is an ongoing problem to be solved.Ad market still immatureLast but not least, for the many fledgling and established video providers relying on advertising, the good news is that there's a lot of buyer interest, but the bad news is that it's still a very immature market. At SME we discussed how many media buyers look at broadband video through their traditional TV lenses, leading to a focus on TV's "Gross Rating Points" or GRPs model. But this undervalues the real engagement opportunities that broadband enables. At MITX, Bob Lentz of PermissionTV discussed how broadband is changing the role of ad agencies, traditional stewards of the creative process, allowing them to now do much more. Advertising is the primary business model for content providers, yet the shift of dollars the medium is anything but straightforward.These were four of the key themes from these two sessions. There was plenty more information exchanged, if you're interested, drop me a line and I'll be happy to discuss.

Categories: Advertising, Events

Topics: EveryZing, MITX, Nielsen, PermissionTV, Streaming Media East, Veoh, Veveo, Visible Measures

-

All Eyes on Cable Industry's "Project Canoe"

To the disappointment of many, it looks like there won't be any big news about the cable industry's "Project Canoe" at the Cable Show convention in New Orleans this week.

Project Canoe is a high-profile partnership among the nation's six largest cable companies (Comcast, Time Warner Cable, Cablevision, Cox Communications, Charter Communications and Bright House Networks) to enable national interactive advertising campaigns to be executed across the companies' cable operations. The code-name Canoe is meant to emphasize that cable operators are working together in the same boat, so to speak.

For the past nine months, the partners' Canoe leads have been meeting weekly. Once a top secret initiative, Canoe's existence was leaked in a September, 2007 Wall Street Journal article. But since then there has been no new information, leading to speculation about how much progress has been made.

Yet Canoe remains a top priority throughout the industry, and for good reason. With big advertisers like GM and Intel shifting their once big-budgeted TV ad campaigns to the Internet in significant sums, it's key that the cable operators need to figure out a way to not only protect the $5 billion or so that they generate in spot-cable advertising today, but also to increase their piece of the $70 billion dollar TV ad spend or cut into other slices of the massive US total ad spend pie. The next 3-5 years will be critical as cable advertising, the Internet and broadband video jostle for advertisers' affections.

The buzz in New Orleans suggests advertisers and agencies are excited about Canoe, though its development seems slower than they prefer. Why the slow progress that's perceived? Several operators stated that integrating the infrastructure required to execute Canoe with cable's legacy systems is hard stuff. No doubt. Then of course there are other key priorities weighing on the industry resources, such as the February 2009 digital transition.

Meanwhile, the Internet and broadband video advertising continue steaming ahead, giving advertisers and their agencies the measurement and targetability that they yearn for on TV. Cable operators have been stymied in their ability to jointly offer advertisers easy access to a nationwide or near-nationwide footprint, especially critical for Video on Demand. Canoe addresses this and other opportunities, in part by creating a set of standards for all to follow.

The only Canoe "news" at this week's Cable Show came from Comcast's Steve Burke, who stated that a CEO would be announced on June 1. Comcast is a key player in Canoe, funding between $50-70 million of the $150 million initial investment. Rumors have swirled that David Verklin, who recently stepped down as CEO of Aegis North America (a large advertising services firm) will assume the position of CEO. If true, that could be the news to break on June 1.

For those of us who have been around the interactive advertising and TV mulberry bush for many years, Canoe's potential is exciting. But we're hoping that the Canoe gets it in gear. Paddle on, gang.

What do you think of Project Canoe's prospects? Post a comment now!

Categories: Advertising, Cable TV Operators

Topics: Aegis, Bright House Networks, Cablevision, Charter Communications, Comcast, Cox Communications, Project Canoe, Time Warner Cable

-

Fox's "Remote-Free TV": Broadband's First Adverse Impact on Networks?

One of the more interesting tidbits to come out of last week's upfront was Fox's "Remote-Free TV" initiative. In case you missed it, Fox Entertainment President Peter Liguori announced that two of the network's new programs, "Fringe" and "Dollhouse" will carry approximately half the typical amount of advertising. As a result, the programs will run as long as 50 minutes compared to the customary 42-44.

Why is Fox doing this and why does it matter? According to TV Week's coverage, Mr. Liguori said: "The broadcast business needs a jolt. This gives viewers one less reason to change the channel." The first statement is certainly true, but the second seemed off somehow. If the programming's really compelling, it seems unlikely that viewers are going to change the channel (when did you ever change the channel in the middle of "24" for example?).

Switching channels doesn't seem to be the issue; rather, I think the more pressing concerns behind RFTV are ad-skipping from DVR usage and broadband's growing influence. But on the DVR side, if I'm a viewer

watching programs like these in recorded mode, are fewer pods or shorter ads going to make me any less inclined to hit the fast-forward button to skip the ads? Doubtful. I only need to retrain myself to hit the "play" button sooner.

watching programs like these in recorded mode, are fewer pods or shorter ads going to make me any less inclined to hit the fast-forward button to skip the ads? Doubtful. I only need to retrain myself to hit the "play" button sooner. If that's the case, then it seems to me that "RFTV" should be interpreted as a response to viewers' preference for broadband's "limited commercial interruptions" model. But when Fox cuts these programs' on-air ad time in half, it needs to double its fees per ad to remain even. Fox is now talking to advertisers to see if it can turn that goal into a reality. Maybe it can. Maybe it can't. If it can't, then these 2 new programs' on-air monetization will be lower than traditional expectations. Could this mean that "RFTV" may actually end up representing broadband's first demonstrably adverse impact on the network TV business? Quite possibly.

In my post last week, "Does Broadband Video Help or Hurt Broadcast TV Networks?" I argued that while broadband offers short-term benefits, in the long-term it's going to force broadcast TV networks to fundamentally adjust to different economics. Broadband's limited commercial interruptions means far fewer ad slots to monetize. RFTV may be a harbinger that this approach may now be coming to on-air as well.

Though broadband delivery is still nascent, its implications are far-reaching. In this case, having moved most of their prime-time programs online, networks now need to show it brings positive results. That will be interesting to watch. Longer-term may be nearer than I thought.

What do you think of Fox's "RFTV" initiative? And how does it impact the network's business? Post a comment and let everyone know!

Categories: Advertising, Broadcasters

Topics: FOX

-

Does Broadband Video Help or Hurt Broadcast TV Networks?

Yesterday's article in the NY Times, "In the Age of TiVo and Web Video, What is Prime Time?" was the latest of many about the changing landscape of broadcast network TV. An underlying question that receives a lot of attention, yet little in the way of clear-cut conclusions: Does broadband video help or hurt broadcast TV networks?

The jumble of conflicting data and opinions on this topic (as well as the related topic of DVRs' impact on the networks) is causing plenty of speculation during this important upfront week of when billions of dollars of networks' ads are bought and sold.

Here's a synopsis of how I think proponents of each would defend their answer:

Broadband video helps: The world is changing - consumers are more empowered than ever and it's pointless to resist. Broadband is a great way to catch up on episodes missed, conveniently sample programs, engender interactivity, transform viewers into viral promoters, etc. More exposure will translate into more on-air viewership. Plus as broadband audience size builds ad revenue will as well. Network programming is and always will be the most watched, most valued source of video entertainment and with broadband opening up all kinds of new revenue opportunities, there's ample reason to be optimistic.

Broadband video hurts: Broadband kills networks' success formula, driving profitable on-air viewership to profitless broadband viewership. It's pie-in-the-sky thinking to believe that broadband revenues will ever catch up. Since only a limited amount of ads can be included in online broadcasts, even the higher CPMs received per ad deliver nowhere close to the revenue per episode per viewer as the on-air model does. All the interactivity and engagement in the world will never offset this shortfall. As more programs move online and viewers can eventually watch these right on their TVs, the shift from on-air to online consumption will only accelerate, causing permanent erosion to the traditional economic formula.

So which is it - are networks helped or hurt by broadband? I think the answer is short-term it helps, but long-term it hurts. In the short-term, there is evidence that broadband expands audiences. For example, The Office's premiere last fall 9.7 million people tuned in, but another 2.7 million watched online.

Expanding viewership is great, but what happens to networks' revenues if next fall 7.7 million watch on-air and 4.7 million online? And 3 years from now, 5.7 million on-air and 6.7 million online? You can count on viewers to gravitate to the optimal viewing experience, and if online further improves, expect more eyeballs to shift. Again, since there are fewer ads online, the only way for total network revenues to keep pace are to show more ads online (see ABC's plan on that front), dramatically raise CPMs and/or dramatically raise viewership. My guess is that even the most optimal mix of these three will not deliver enough to offset on-air's revenue decline.

Broadband offers lots of complementary benefits to broadcasters to be sure. But NBCU's Jeff Zucker is absolutely right that the industry's number one challenge is the risk of turning "analog dollars into digital pennies." I can't say I see how that's to be avoided, unless networks go cold turkey, following CW, which recently pulled down streaming episodes of "Gossip Girl" to enhance on-air viewership. But I don't see that happening. Instead I think broadcast networks are going to have to adjust to fundamentally different economics in the future.

What do you think? Does broadband video help or hurt broadcasters? Post a comment!

Categories: Advertising, Broadcasters

-

Tremor, Adap.tv Introduce New Ad Platforms

The video ad management and networks space

, marked by competition among a group of privately-held companies, continues to evolve. In the last few weeks two key players, Tremor Media and Adap.tv have announced new solutions giving content providers more flexibility to optimally monetize their video inventory by easily accessing multiple ad sources. Given how essential the ad business is to broadband video's ultimate success, both products are welcome.Ad networks play an important role for content providers which either don't have their own ad sales team or as an augment for those that do. For the latter, ad networks help monetize their unsold inventory, particularly important during unexpected spikes in viewership. Traditionally content providers had two basic choices, each of which had disadvantages:

First, they could select one ad management/network partner. This kept things simple, but didn't necessarily optimize the inventory, because it was dependent on how well that one network's advertisers were matched to available inventory (resulting in either the inventory going unsold or users seeing the same irrelevant ad over and over again).

The second was to go with multiple ad networks. This improved optimization, but created multiple operational challenges trying to work with different ad managers, formats and reporting.

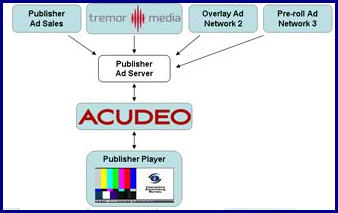

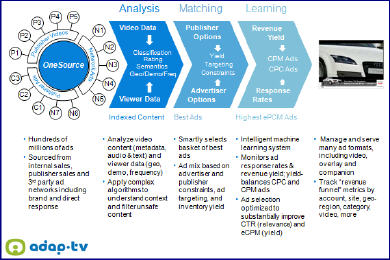

Both Tremor's new "Acudeo" platform, and Adap.tv's "OneSource" seek to resolve these problems by providing one management platform capable of handling multiple ad sources/ad networks across all ad inventory.

Jason Glickman, Tremor's CEO, explained to me that he's positioning Acudeo to do for video advertising what DoubleClick's DART did for banner advertising. Content providers can easily enable all kinds of complex ad rules around their inventory - the type of ad format to be used, their frequency and contextual targeting (with partner Digitalsmiths), their cueing and lastly, standardized reporting, so that ongoing campaign adjustments can be made. Acudeo aims to support all third party ad networks. Tremor prices Acudeo flexibly depending on whether the content provider also uses Tremor's ad network.

Adap.tv's recently introduced OneSource platform has the same goal of improving ad optimization with lower complexity. Amir Ashkenazi, Adap.tv's says OneSource differentiates itself by using Adap.tv's contextual advertising capabilities to optimize which third-party's ads to run. It does this by understanding the video content itself and then matching the optimal ads, factoring in the ad rules the content provider has preset. Amir believes that by doing so, it can raise the effective CPM delivered by 65%, from which OneSource's fee is deducted. OneSource has 40 third party ad networks currently integrated and also aims to support all ad sources.

Acudeo's and OneSource's potential is to bring more spending into the video category, which obviously would be extremely valuable. Last week, I expressed concern that with so many video content providers relying on advertising, a short-term squeeze is a real risk. Both Acudeo and OneSource are encouraging signs that the ad management and network businesses are continuing to mature, which will benefit everyone.

What do you think? Post a comment and let everyone know!

(Note: Both Tremor Media and Adap.tv are VideoNuze sponsors)

Categories: Advertising, Technology

Topics: Acudeo, Adap.TV, OneSource, Tremor Media

-

2009 Super Bowl Ads to Hit $3 Million, Broadband's Role Must Grow

The Wall Street Journal reported yesterday that NBC will announce next week that the starting price for a 30 second ad during the 2009 Super Bowl will cost $3 million, a 10% increase over 2008. For sure one thing this

means to me: broadband video's role must grow in order to earn Super Bowl advertisers a return on these outsized rates.

means to me: broadband video's role must grow in order to earn Super Bowl advertisers a return on these outsized rates.As some of you know I've been writing about this topic for the last few years, even preceding the launch of VideoNuze. In Jan '06, in "The $10 Million Super Bowl Ad?" I argued that Super Bowl ad prices were heading nowhere but up given the historic opportunity to fuse the best of brand advertising with the best of online advertising.

I thought the linchpin would be brands recognizing that broadband video elements (e.g. larger campaign narratives, user contests, etc.) should precede and/or follow the game ad, creating a far larger engagement and ROI scenario. With more potential benefits, Super Bowl ad buying would be far less risky and therefore more advertisers would be compelled to buy, thus driving prices up.

While prices have risen, it's been more because audiences have continued fragmenting, making the Super Bowl truly a once-a-year advertising opportunity. NBC's willingness to raise prices by 10% over '08, in the face of a difficult U.S. economy is further testament to the big game's luster.

Back in '06 I forecasted that creative lightbulbs would be going off on Madison Avenue for how to capitalize on broadband's potential to add value. Sadly in the last 2 years this hasn't materialized. In Jan '08, in "My Rant About Super Bowl Ads" I lamented the fact that of the 52 game ads, only 5 (later revised to 6) ads had a broadband component. While the ads themselves were viewed for weeks after in online galleries, the stark reality was that tens of millions of dollars of client ad spending was being dramatically sub-optimized by not incorporating any broadband video elements.

It may be unfair of me to say, but I place the disproportionate share of the blame for this on the agencies behind the Super Bowl ads. They seem oblivious to how their clients' ad strategies must change to reflect broadband and online's importance.

So here's my message to brands considering a Super Bowl '09 ad buy: with 8 full months until game day, if your agency is not presenting you now with at least a half dozen compelling ideas for how to incorporate broadband elements into your Super Bowl ads, switch agencies now. I mean it. They are under-serving you. Find an agency that gets it, not one that is stuck in a time warp. The brands that will really score in the '09 game will have ads that reflect today's broadband realities.

Categories: Advertising, Brand Marketing, Sports

Topics: Super Bowl

-

Video Ad Networks Coverage Continued: SpotXchange, YuMe

As evidence of the market's bullishness on ad-supported video, video-focused ad networks continue to flourish. I recently spoke to CEO/co-founders of two of the larger ones, SpotXchange and YuMe to learn more about their respective differentiators.

SpotXchange CEO Mike Shehan explains that his company has focused on building a real-time auction model for publishers to offer inventory and advertisers/agencies to bid on it. The 2 main verticals

SpotXchange is pursuing are local and casual games. Providing an easy on-ramp to video advertising is the key goal. Advertisers can load their campaigns, enter the marketplace, target by channel and/or region and determine how much they're willing to pay.

SpotXchange is pursuing are local and casual games. Providing an easy on-ramp to video advertising is the key goal. Advertisers can load their campaigns, enter the marketplace, target by channel and/or region and determine how much they're willing to pay. Though it's a fully self-service model, SpotXchange offers client service model as well for larger brand advertisers. Michael says there are now 300 publishers in the networks, reaching 50 million unique visitors per month. The company grew out of Booyah Networks, a search and interactive agency which has fully-funded its development.

Meanwhile, Jayant Kadambi, CEO of YuMe explains that the company spent the first 2 1/2 years from its

founding in October '04 developing an ad-management platform that could handle various ad units and formats. In the absence of standards, Jayant believes this gives the company an edge in servicing advertisers and agencies that don't want to customize assets for various publisher sites' players. YuMe has built a network of 400+ publishers with 46 million uniques/month and a sweet spot of 750K-1 million video views/month and above (for a network total 150 million streams/mo).

founding in October '04 developing an ad-management platform that could handle various ad units and formats. In the absence of standards, Jayant believes this gives the company an edge in servicing advertisers and agencies that don't want to customize assets for various publisher sites' players. YuMe has built a network of 400+ publishers with 46 million uniques/month and a sweet spot of 750K-1 million video views/month and above (for a network total 150 million streams/mo). Jayant says he's been pleasantly surprised at how much video content is monetizable, though he's not suggesting user-generated video will be monetized any time soon. YuMe's CPMs are in the $10-30 range. The company is now in the mode of building scale, which could involve marrying its ad management platform to others' networks using its "Adaptive Campaign Engine." In fact, one recent partnership that was announced to do this was with SpotXchange. YuMe has raised $16M from investors including Khosla Ventures, Accel Partners, BV Capital and DAG Ventures.

I'll have more on other video ad networks and how they fit into the larger broadband industry in the coming weeks.

Categories: Advertising, Technology

Topics: SpotXchange, YuMe

-

Insights Aplenty from How-to Video Category

One of the hottest corners of the broadband video market is the ad-supported "how-to" category. How-to lends itself well to video because, if a picture's worth a thousand words, a video is surely worth a million. Recognizing this, there's now a host of start-ups in this category which together have raised tens of millions of dollars. I wrote about some of this a couple months ago.

Several recent calls with industry participants got me to thinking the how-to category actually offers many valuable insights for all broadband industry participants. These fall into 3 key areas: content development, traffic acquisition and monetization.

1. Content: "Build Our Own" or "Offer a Superstore of Others' Videos"?

Players like Expert Village, 5Min, VideoJug and MonkeySee are pursuing the "build our own" video library approach, incenting individual "experts" to contribute to their sites. On the other hand, sites like WonderHowTo (WHT) and SuTree rely primarily on scouring user-generated video sites like YouTube, plus those above to aggregate the best videos available. With how-to being the ultimate "Long Tail" space,

WHT's Stephen Chao told me in a recent briefing that trying to cover the infinite number of niches would be impossible. So to be comprehensive, relevant and high-quality, WHT curates what its crawlers return with a small in-house team and presents the cream of the crop to users, complete with a range of community-building features.

WHT's Stephen Chao told me in a recent briefing that trying to cover the infinite number of niches would be impossible. So to be comprehensive, relevant and high-quality, WHT curates what its crawlers return with a small in-house team and presents the cream of the crop to users, complete with a range of community-building features. Here's one non-statistically significant example that illustrates the two approach's results: I did a search for "bbq steak video" on Expert Village, which bills itself as the "World's Largest How-to Video Site" and on WHT. EV returned 15 results, regrettably not one of which was relevant. WHT returned 357 results, and on the first page of 20 results alone, at least 12 looked relevant. These came from a wide variety of sources. Try doing a few searches and see what you find - my guess is your experience will be consistent with mine.

2. Traffic acquistion: Syndication or SEO?

All of these sites are ad-supported, so traffic is key. The sites with private libraries can syndicate to heavily-trafficked partners. Ordinarily, as a big syndication fan, I'd say that sounds like an advantageous traffic generating plan. But how-to may have a different traffic acquisition dynamic. It may well be that far more traffic will always come to these how-to video sites via searches at Google and other search sites, as compared with the sum of various syndication deals. That's because, absent a household brand-name in how-to, default consumer behavior may well be to simply type their how-to video query into Google.

If that's the case, then it will actually be those sites which have the most highly-optimized pages for all the

niche videos that will gain greater traffic. Though I'm not an SEO expert, it seems to me that, taking my "bbq steak videos" example, WHT, with 357 related videos can optimize better than say EV with 15. And sure enough, when I ran the "bbq steak video" search on Google, right on the first page is a result from WHT, whereas nothing shows up for EV even after 5 pages. Bottom line: more relevant videos = more zero cost, Google-driven traffic.

niche videos that will gain greater traffic. Though I'm not an SEO expert, it seems to me that, taking my "bbq steak videos" example, WHT, with 357 related videos can optimize better than say EV with 15. And sure enough, when I ran the "bbq steak video" search on Google, right on the first page is a result from WHT, whereas nothing shows up for EV even after 5 pages. Bottom line: more relevant videos = more zero cost, Google-driven traffic. 3. Monetization: Video ads or Keyword-driven text/display ads?

Last but not least is monetization. How-to sites have lots of contextual ad potential. In my "bbq steak" example, any company that sells grills, steaks, sauces, etc, would love to advertise to me. It's tempting to believe that those with their own video libraries have more profit potential, because they can sell pre-roll or overlay ads, whereas a superstore site like WHT or SuTree cannot, because they're linking off to the source sites.

But consider this: how many of these potential advertisers will actually have video ads or the budget to create them? Unlike entertainment video, how-to, with its Long Tail character, seems to lend itself more to a low cost keyword ad approach which can be pursued by even the smallest advertiser. So say WHT or SuTree can build traffic in all those video niches and surround the video with keyword-driven text or display ads, all automated through a bidding system. Though yielding lower revenue per ad, my bet is that the total revenue for all ads with the keyword approach would be greater.

Summary

The how-to category is nascent and dynamic. I'm not suggesting for a second that it's a winner-take-all space or that all of the above are strictly "either/or." But I do believe the above analysis raises valuable points all industry participants should consider when developing their content, traffic and monetization strategies.

What do you think? Post a comment now!

Categories: Advertising, Indie Video, Startups, Strategy, Video Search

Topics: 5Min, Expert Village, MonkeySee, SuTree, VideoJug, WonderHowTo, YouTube

-

The Reality of Web Video Advertising Just Doesn't Seem to Add Up

Today's post is from TDG's Mugs Buckley, who discusses the confusing state of video advertising projections.

The Reality of Web Video Advertising Just Doesn't Seem to Add Up

by: Mugs Buckley, Contributing Analyst, The Diffusion Group

I used to think I was pretty good at math, but after trying to make sense of recent forecasts regarding web video advertising, I'm beginning to doubt my skills. Let it be known that I'm a big believer in the growth potential of the Internet video ad business; I'm simply struggling to follow the numbers that have been reported. Since no single analysis offers an "apples-to-apples" industry comparison, I thought I'd offer up some of the available forecasts and offer a few thoughts.

So here's where I'm stuck.

The estimates and forecasts for only video ads are all over the place. For example:

- eMarketer estimates that US marketers spent $775M in 2007 and will spend $1.3B in 2008 for online video streaming and in-page ads.

- Jupiter Research predicts that 2008 online video ads in the US will yield $768M.

- comScore reported that online viewers consumed 9.8B videos in January 2008 (down from December 2007's 10.1B) of which 3.4B were Google/YouTube videos.

- In a November 2007 Financial Times article, a leading media buyer for Starcom Media Group (who is well aware of her buys and rates) predicted that the 2007 market for "The Big Four" broadcast networks was likely to generate around $120M.

So here's where it gets a bit confusing.

- If we use the 3.4B monthly view Google/YouTube view estimate for January and run that out for a 12-month period, add some growth for fun, we come up with about 45B views for all of 2008.

- YouTube charges $15 CPMs for their in-video overlay ads (down from the initial $20 CPMs used during beta testing).

- If 100% of the 45B Google/YouTube videos were sold at $15 CPMs, that would yield revenue of $675M. But that assumes 100% inventory sold, which won't happen for a variety for reasons (in particular because YouTube only sells overly ads on their contracted partner deals, not user-generated content).

- According to Bear Stearns, YouTube is set to generate $22.6M in revenue for video ads, about 3.3% of the possible $675M at 100% inventory sold.

Hmmm. So if YouTube (at 34% of all web video consumed) could generate $22.6M in revenue in 2008, and the Big Four were running about $120M in 2007, how does one arrive at these impressive near-billion dollar predictions? Where else is this revenue coming from?

Let's not rule out operator error - I'll quickly admit that I may have misinterpreted how these numbers were derived and what they represent. That being said, however, there doesn't seem to be a rational way to reconcile these disparate estimates. Can anyone out there help to square these numbers? Is it simply a matter of under- or over-reporting? Are the measurement systems currently in place so poor and mutually exclusive in methodology that they necessarily offer conflicting estimates?

Something just isn't adding up. Yes, this may seem to be a bit nit-picky on my part; the rambling of an analyst with too much time on her hands. Then again, without accurate revenue and usage estimates, it is impossible to know the real value of any form of advertising, much less an emerging model such as web-based video advertising.

Please let us know what you think!

Categories: Advertising

Topics: comScore, eMarketer, Jupiter Research, The Diffusion Group, YouTube

-

Why Adobe Media Player Could Matter

Yesterday brought the public release of Adobe Media Player 1.0, first announced almost a year ago. AMP enters a very crowded space of other media players including its own Flash player, plus Windows Media Player, RealPlayer, QuickTime, SilverLight and others.

At a time when the broadband video industry in general and mainstream users in particular crave

standardization and simplicity, can another media player, with a "walled garden" content strategy to boot, add new value? While it's awfully tempting to say "no," I think there are reasons why AMP could well matter, subject to how well Adobe delivers on its vision. Here's why:

standardization and simplicity, can another media player, with a "walled garden" content strategy to boot, add new value? While it's awfully tempting to say "no," I think there are reasons why AMP could well matter, subject to how well Adobe delivers on its vision. Here's why:AMP offers 2 things that, in my opinion, the market still needs. First, a widely used downloadable app that specializes in delivering on FREE video content. Before some of you jump up and say, "Will, what about iTunes?" keep in mind that iTunes offers primarily a PAID video catalog (though to be sure there are some free video podcasts). Second, and related, AMP' provides a download environment in which advertising can be properly inserted, measured and reported on.

These are important because together they open up an entirely new consumer use case for broadband video: offline, free, ad-supported viewing. I've been saying for a while that an odd dichotomy has taken root in the broadband industry, particularly for network programs: users can get either free, ad-supported streamed video at lots of places (provided they're online) OR they can get paid, downloaded video (iTunes model) which allows offline viewing. But this has meant that someone who wants to watch a show offline, but isn't willing to pay for the pleasure of doing so is out of luck (one exception is NBC Direct). Having media stored locally in AMP would allow the offline, free use case I'm describing. This would open up a boatload of premium ad inventory that advertisers savor.

If that's AMP's opportunity, then the question is how well are they executing on it? Though it's never fair to judge a version 1.0 on its first day, my experience with AMP shows there's room for improvement. First is the currently thin content selection that needs to be massively built out to be appealing and competitive. Second is an inconsistent user experience in which some shows are downloadable, yet many are not (e.g. CSI, Hawaii Five-O, Melrose Place). Third are getting the basics right. In my case, when I did download some episodes successfully (blip.tv's "DadLabs" and "Goodnight Burbank") they didn't show up in my download section at all. Ugh. I'm hopeful that Adobe will be able to address all of these.

On the ad side, I think there will be plenty of enthusiasm from ad technology firms to integrate with AMP as Adobe proves it can drive millions of AMP downloads (in fact Kiptronic announced its integration yesterday and other will surely follow). Plus, advertisers should be expected to get on board.

It should be noted however, that even for a mighty brand like Adobe, winning the hearts and minds of users to download and use AMP isn't a trivial undertaking. I have some personal experience with this from my early days consulting at Maven Networks, which offered an eerily similar download app as AMP when the company started up. Though that was in the Mesozoic broadband era of 2003 and Maven was an unknown entity, the company never got much traction with its download app and eventually transitioned over to a streaming model. Since then I've come to believe that premium content must drive the download process, not vice-versa. One successful example of this is ABC.com using its shows to drive millions of downloads of the Move Networks player.

Net, net, AMP is a timely product that could well matter. How well Adobe executes on its vision will determine to what extent it does.

Categories: Advertising, Broadcasters, Downloads, Technology

Topics: ABC, Adobe, Adobe Media Player, Kiptronic, Maven Networks

-

What Media Planners Think of Online Video Advertising

Continuing VideoNuze's series of posts about the online video advertising industry, last week I spoke to Alistair Goodman, who's the VP of Strategic Marketing at Exponential Interactive, a media services company with hundreds of advertising clients and publishers in the digital media space.

Exponential recently released the results of a survey of 100 ad agency media planners' perceptions of online video advertising. To the best of my knowledge, the survey, "The Trials and Tribulations of Online Video

Advertising," is the first one focused on what the people actually responsible for spending money in this new medium think (the survey is evenly split between those who have bought and those considering buying). Most prior research has focused on users' or publishers' attitudes. The research confirms many things I hear each day, and also reveals some new insights on the market.

Advertising," is the first one focused on what the people actually responsible for spending money in this new medium think (the survey is evenly split between those who have bought and those considering buying). Most prior research has focused on users' or publishers' attitudes. The research confirms many things I hear each day, and also reveals some new insights on the market.I'm very pleased to offer a complimentary download of a subset of the Exponential's slides exclusively here at VideoNuze. If your business is reliant on video advertising, I highly suggest reviewing them. If you have questions or want to receive the full deck, there is contact info on the last slide.

The top 2 issues for planners who have actually bought video ads are operationally-oriented: "smooth delivery" and "detailed reporting." As Alistair described it, these factors (and others cited) confirm the complexity of executing a campaign at scale. The complexity results from lack of standards, multiple players/formats, fragmentation of viewership and non-standard metrics. None of this is unexpected in a market as nascent as online video; the challenge is addressing and resolving these quickly for online video to reach its full potential.

In the past I've mentioned repeatedly that monetization is the number 1 priority for both established and early stage video content providers. This is an urgent issue because lots of energy and money is being invested in creating online video content, but the financial returns are not there yet. These payoffs need to materialize if the enthusiasm around this new medium is to be sustained.

Click here to download the Exponential slides.

(Note: I have created a new section in VideoNuze to offer all downloads of all relevant market research. If you have complimentary industry data please contact me and I'll add it to the page.)

Categories: Advertising

Topics: Exponential Interactive, Tribal Fusion

-

BobVila.com Illustrates Opportunities, Challenges for 'Mid-Tail' Content Providers

I frequently hear the same segmentation framework used to describe today's broadband video providers. Between the small group of premium providers (e.g. broadcasters) and user-generated sites (e.g. YouTube), lie the so-called "mid-tail" (in "Long Tail" terminology) providers such as newspapers, magazines, online publishers, and indie producers. BobVila.com is a perfect example of a mid-tail provider. Dan Newberry, the company's VP Advertising and Marketing, who I recently spoke with, discussed these opportunities and challenges.

Some of you may know that Bob Vila hosted a hugely popular PBS program from 1979-1989 called "This Old House." He then set up his own production company and produced 2 syndicated shows, "Bob Vila's Home Again" and "Bob Vila." At the end of the latter's run, he decided to shift his focus exclusively to online, to his BobVila.com web site which had been growing since the Internet's earliest days.

As Dan explains, one of the motivations (in addition to Bob Vila's personal reasons) was the improving climate for online advertising in general and video advertising in particular. The economics of creating quality programming for TV vs. for online, plus the CPMs available online, made the case for shifting to online only. The site now generates 1.7 million unique visitors/mo and 600K-700K video streams/mo, with 1,700 video clips available.

Responding to its audience's desires, BobVila.com now produces 5-7 minute step-by-step how-to videos for the site. It has created about 100 since June '07. While broadband enables this new model, Dan is clear about the challenges.

First and foremost is making the financial equation work. This involves producing videos on a disciplined budget and maximizing ROI. Their target cost to produce each video is $4-5K, which requires a different approach than with TV production. Given current viewership and CPMs, Dan calculates that break-even on an individual video is projected at 24 months.

To monetize their video, BobVila.com uses an internal sales team and is able to generate pre-and mid-roll CPMs in the $25-40 range. If there's unsold inventory then it uses a network to sell it, usually garnering $7-12 CPM. In addition, it also selectively uses overlay ads from Google AdSense. Setting the ad strategy to maximize revenue is key. As Dan noted, staffing and managing an internal sales team in this highly competitive environment is a challenge that startup sites need to fully recognize.

Increasing video views is another key challenge. Acknowledging the limitations of search and on-site generated traffic, BobVila.com is ramping up an aggressive syndication effort. While offering lots of upside, Dan explains that this syndication will present new operational and financial complexities such as ensuring BobVila.com gets paid, content is distributed where and when it should be, enforcing various rights issues, etc. Dan pointed out the importance of having a solid technology partner (BobVila.com used PermissionTV) which enables syndication, flexible players and content management.

When you put it all together, it's clear that while broadband offers mid-tail providers like BobVila.com huge new opportunities, it also creates new challenges and responsibilities that many content providers have not typically dealt with. Surmounting these will determine how well these mid-tail providers ultimately fare.

Categories: Advertising, Indie Video

Topics: BobVila.com

-

BrightRoll Targets High-Quality Video Ad Network

Over the next few weeks I'll be doing a series of posts on broadband video advertising's key opportunities and challenges, based on briefings with industry players. Advertising has increasingly become the industry's business model of choice, so understanding its future development is critical.

Just as there are advertising networks for Internet display or banner advertising, there are now a number of independent ad networks dedicated to broadband video advertising. These ad networks perform a crucial role in aggregating and selling inventory, creating efficiencies for both publishers and advertisers alike. These are particularly critical functions given how fragmented video is online.

I recently had a chance to catch up with Tod Sacerdoti, CEO/co-founder of BrightRoll, a big independent video ad network, who's in the trenches every day and is as knowledgeable as anyone about today's market and

key challenges. BrightRoll is focused on building a network of high-quality publishers offering advertisers full transparency about which sites their ads run on. It is flexible to support all formats, players and units and has served over 1 billion ads to date.

key challenges. BrightRoll is focused on building a network of high-quality publishers offering advertisers full transparency about which sites their ads run on. It is flexible to support all formats, players and units and has served over 1 billion ads to date.Though BrightRoll just introduced an HD in-banner ad unit, it generally shies away from pioneering new formats, leaving it to publishers to drive the market. Tod believes that technical leadership will be a key differentiator and so BrightRoll builds all its own technology in-house.

For ad networks, the size and quality of their publisher network is obviously critical. BrightRoll's sweet-spot are premium branded sites that it can sell for around $15-25 CPM. This is the middle part of the market, below the "super-premium" sites but above the vast amount of user-generated video which is tough to sell.

Tod breaks down the market's current 10 billion streams/mo. Of the 40% non-YouTube videos, about half of the streams are monetizable, yielding about 2 billion streams. Tod thinks about half of these are sold. Two reasons for such a high unsold ratio are that many premium sites are maintaining minimum CPM requirements and because there are usage spikes that create unsold inventory. One of BrightRoll's key goals is to get the "unsold" server call from premium sites which want to maximize yield on usage spikes.

From Tod's standpoint a big challenge remains lack of standards, and therefore the reluctance of big publishers to fully integrate with ad networks. The IAB has been focusing on video standards which are expected soon. I have thought for a while that broadband video advertising will be driven by big brands diverting budget from TV ad spending. This contrasts with search, where Google in particular has relied on tens of thousands of smaller, ROI-focused advertisers. Tod sees it the same way and therefore is focused on driving high-quality online reach that brands require, along with reliable tracking and reporting.

With so many sites churning out video and hoping to tap advertising budgets, appealing to big brands becomes ever-more important. Between this and the difficulty of finding talented sales people, ad networks like BrightRoll will play an ever-greater role in the industry.

What do you think? Post a comment!

(Note: VideoNuze won't be published tomorrow, March 28th)

Categories: Advertising

Topics: BrightRoll

-

My 3 Takeaways from 2008 Media Summit

I had 3 key takeaways from the 2008 Media Summit which just wrapped up in NYC. The event just keeps getting better - great keynotes, terrific informal hallway chit-chats/networking and tons of well-directed energy. Though the event's agenda is broad, I was focused on the video-related elements. Here are 3 takeaways:

1. Iger and Moonves Get Tech; Lots of Innovation/Growth Ahead

A clear highlight for all attendees was the 2 morning keynote interviews, day 1 with Disney CEO Bob Iger and day 2 with CBS CEO Leslie Moonves. Both were ably conducted by senior Businessweek editors. Until a couple years ago, big media was in a defensive crouch regarding technology's uninvited incursion into their businesses. No more. Iger and Moonves are obviously convinced that technology, the Internet and broadband video delivery are now their companies' friends. Iger in particular really pounded this theme home.

An example of how technology helps which Iger repeatedly touched on was how Disney will leverage the platform of Club Penguin, its recent acquisition, to build communities for other properties (e.g. "Cars", "Pirates," etc.). These moves are intended to engender ever-greater levels of engagement. By the way, if you're a parent of youngsters and you've ever bemoaned how Disney's gotten its hooks deeply into your kids, you ain't seen nothing yet!

Moonves was emphatic that the Internet extends the value of CBS properties. March Madness was an example he offered. Three years ago it generated $250K of broadband subscription revenue. Two years ago CBS converted to ad-support and generated $4M. Then last year it generated $10M and this year is projected for $23M. And as Moonves pointed out, other than bandwidth, it's all incremental profit for the company. Echoing another conference theme, he further added that "the Internet should not be used to just regurgitate TV," but rather for the medium's unique capabilities.

Iger's and Moonves's mantras are no doubt being sent down to the troops from the executive suite. That suggests we can all expect a whole lot of tech-based innovation springing from these media giants.

2. Engagement and Originality: Buzzwords or More?

Two touchstones in many sessions were "engagement" and "originality." Both reflect the evolving viewpoint that broadband video has its own unique capabilities and that breaking through requires going far beyond traditional, passive programming approaches. With respect to engagement, the concept of introducing "social media" opportunities was often cited as the key tactic. An amorphous term, social media refers to all manner of user participation: content sharing, interactivity, personalization, mashups, uploading, commenting, rating and so on. Basically it's anything that gets viewers to do more than just sit back and enjoy the show. (For those looking to learn more, note next week's webinar on social media, presented by VideoNuze sponsors KickApps and Akamai)

Regarding originality, this relates back to Moonves's comment about not using the medium for regurgitation of TV shows (though to be sure there's value to that). Many people echoed that theme, emphasizing broadband must be used for original programming. The proliferation of independent "broadband studios" is encouraging early evidence that the originality bar will keep rising, prompting established and startup players to harness broadband's limitless possibilities.

3. Missing in Action: Paid business models

It wasn't that long ago that discussions about broadband video business models focused evenly on paid and ad-supported. No more. The paid model was completely missing in action at the event. I think I can count on one hand the number of times the concept was raised in sessions. Also MIA was DRM, the paid model's enabler (or torturer, depending on your perspective).

I detect a broad consensus that the broadband video industry has hitched its wagon to free ad-supported video for the foreseeable future. Many of you know I've been a long-time and enthusiastic proponent of this approach and I'm extremely happy to see things unfold this way. Though the broadband video ad model is still immature, all macro trends point to a bright future. One in particular is video syndication, which I wrote about 2 days ago. Syndication was a dominant theme, as panel representatives from both large and small content providers enthusiastically embraced it. See my post earlier this week, "Welcome to the Syndicated Video Economy" for more on this.

Ok, there you have it. There's plenty more tidbits I took away from the summit, so feel free to ping me if you'd like. And if you attended, post a comment and share your takeaways as well!

Categories: Advertising, Broadcasters, Downloads, Syndicated Video Economy, UGC, Video Sharing

Topics: Akamai, CBS, Disney, KickApps

-

Welcome to the "Syndicated Video Economy"

I am ever mindful of the old adage about "missing the forest for the trees" as I try daily to understand the often minor feature differences between competing vendors or the nuances of startups' market positioning. As we all know, when you get too close to something, it's quite easy to lose the larger perspective. So periodically I think it's essential to take a huge step back to try to identify the larger patterns or trends that crystallize from the daily frenzy of deals and announcements.

As a result, I've come to believe that recent industry activity points to an emerging and significant trend: the early formation of what I would term the "syndicated video economy." By this I mean to suggest that I'm

seeing more and more industry participants' strategies - in both media and technology - start from the proposition that the broadband video industry will only succeed if video assets are widely dispersed and revenue creatively apportioned.

seeing more and more industry participants' strategies - in both media and technology - start from the proposition that the broadband video industry will only succeed if video assets are widely dispersed and revenue creatively apportioned. For content providers the notion of widespread video syndication big change in their business approach. In the past year I think we've observed content providers of all stripes transition from "aggregating eyeballs", to "accessing eyeballs," wherever they may live now or in the future: portals, social networks, portable devices, game consoles, etc. Underlying this shift is the realization that advertising-based revenues are going to fuel the broadband video industry for the foreseeable future. The ad model requires scale and syndication is the best way to deliver it.

This shift by content providers has been accompanied by a loosening of traditional tightly-controlled, scarcity-driven distribution strategies, an acknowledgement that fighting newly-empowered consumers is a futile exercise. The evidence of this shift abounds. Consider the broadcasters like CBS, NBC and Fox, which through their affiliates (Hulu, CBS Audience Network) are syndicating programming to many portals/aggregators (e.g. Yahoo, MSN, AOL, YouTube), social networks (e.g. Facebook, MySpace, Bebo) and others. And Disney's Stage 9 digital studio, which premiered with YouTube and explicitly plans to tap into broadband video hubs. And cable networks like MTV Networks, which is pursuing a plethora of distribution deals. And traditional news-gatherers like local TV stations, newspapers and news services (e.g. Reuters, AP) which have stepped up their activity to scatter their video clips to the Internet's nooks and crannies. And the list goes on and on.

Taking their cue from the media companies' strategy shift, technology entrepreneurs and investors have ramped up their focus on this market opportunity. The prospect of the syndicated video economy blossoming drives news/information distributors such as Voxant, ClipSyndicate, Mochilla, TheNewsMarket and RedLasso, an ad manager such as FreeWheel, and a content accelerator such as Signiant, plus many others. Then there are more established companies guiding areas of their product development process by the prospect of the syndicated video economy's growth: Google, WorldNow, Akamai, thePlatform, Anystream, Maven Networks, Brightcove, PermissionTV and plenty of others (apologies to those I've left out!)

All of this suggests that the eventual "value chain" of the broadband video industry will look quite different than the traditional one (for more on this, I've posted some my slides from late '07 here.) As with all economies, in the nascent syndicated video economy there is vast interdependence among the various players, not to mention shifting market positions and degrees of pricing power and negotiating leverage. It is far too early to gauge who will emerge as the syndicated video economy's winners and losers. But make no mistake, lots of energy and investment will be expended trying to nurture its growth and exploit its opportunities.

Do you see the syndicated video economy forming as well? Post a comment and let us all know!

Categories: Advertising, Aggregators, Broadcasters, Cable Networks, Newspapers, Portals, Startups, Syndicated Video Economy

Topics: Akamai, Anystream, ClipSyndicate, FreeWheel, Google, Mochilla, RedLasso, Signiant, TheNewsMarket, thePlatform, Voxant, WorldNow

-

Heavy Plans Big Push for Husky Ad Platform

(Note: This is the second in a series of posts with companies participating in the 2008 Media Summit, a premier industry event which will be held next week in NYC. VideoNuze has partnered with Digital Hollywood, the Media Summit's organizer, to provide select analysis and news coverage.)

Heavy Corporation, which operates Heavy.com, one of the most popular independent broadband video destinations for 18-34 males, is poised to make a push into the ad platform/network business through its

Husky Media unit. I spoke to Eric Hadley, Heavy's chief marketing officer yesterday who filled me in on their plans.

Husky Media unit. I spoke to Eric Hadley, Heavy's chief marketing officer yesterday who filled me in on their plans.The Husky platform is currently used today by Heavy.com. If you go to the site, you'll see how it operates, showing just one ad with the video selected. As Eric explains, the video is wrapped in the advertiser's skin, so upon starting the video player exposes a big interstitial ad for 2 1/2 second that sort of feels like "barn doors" before opening to the video itself. Then when the video plays, display ads surround the content. Additional related content is queued up and automatically starts playing subsequently. This approach has resulted in a 270% lift in videos viewed as compared with the pre-queuing implementation. This of course means more video usage and more advertising exposure.

Eric believes that this video presentation/ad format is unique in the industry (I agree, I haven't seen anything else like it), and goes straight to the biggest question in the industry: how are people actually going to make money from their broadband video content, especially original creations. Husky aims to combine the best of pre/mid-roll ads with the best of display.

Eric believes that this video presentation/ad format is unique in the industry (I agree, I haven't seen anything else like it), and goes straight to the biggest question in the industry: how are people actually going to make money from their broadband video content, especially original creations. Husky aims to combine the best of pre/mid-roll ads with the best of display.Eric said that advertiser enthusiasm for the Husky presentation has prompted Heavy to now offer it to other publishers who target demos other than Heavy.com's 18-34 males. It's still early days, but Eric said that in the next few weeks several major publishers will be launching Husky implementations, as will small-to-medium sized sites. This will form the beginnings of an ad network Heavy can assemble and offer to advertisers. By evolving Husky's focus from internal-only use to external use as well, Heavy will be competing with broadband ad players such as Tremor, Broadband Enterprises and others. The Husky move shows how dynamic the broadband video ad space is, with multiple kinds of formats and implementations being tested and used by content providers seeking to maximize monetization.

Meanwhile Heavy is continuing to build out its Heavy.com destination site, which currently receives 17M+ visitors/mo. Key upcoming focuses are music/urban, cars and racing, sports and travel categories. These are all the purview of the Heavy's recently added head of programming, Jimmy Jellinek, former editor at Maxim. Content sourcing is varied, with Heavy.com producing some of its own, producing some for its advertisers and also some it obtaining some from others, such as Transworld. In the U.S. today, Heavy does not syndicate its programming to others sites, which is a somewhat contrarian position vs. other content providers who are syndicating widely.

Looking ahead to the Media Summit, Eric plans to explain more about the upcoming Husky push and how content providers and advertisers can benefit from it. He also sees the Media Summit as an ideal forum to learn from others what's making a difference in the industry and what's hot.

Categories: Advertising, Indie Video, Technology

Topics: Heavy, Husky Media

-

FreeWheel: Helping Monetize the Syndicated Video Economy

Readers of VideoNuze know that for a long time I've been a big proponent of syndication as a key building block for broadband video success. In last week's webinar I explained that I see this trend only accelerating as content providers increasingly shift from aggregating the most eyeballs to accessing the most eyeballs. That means syndicating video far and wide through social networks, portals, broadband aggregators and others is fast-becoming a key success factor.

Yet aggressive syndication presents a complex set of issues around how to control and optimize the advertising to all those dispersed viewers. Absent the right set of tools to administer each deal's terms, there's a bias toward simplicity and hence, under-optimization. For example, I continually hear that all the broadcasters' syndication deals are 90-10 ad revenue splits. In some cases a plain vanilla approach like this may be fine. More likely though, to have a biz dev person's hands tied to very limited deal terms because of a lack of technology solutions significantly constrains the ecosystem.

FreeWheel is a new company aimed at unlocking these constraints with its "Monetization Rights Management" or MRM technology platform. MRM is a full ASP platform that empowers content providers'

biz dev teams to cut creative revenue/inventory sharing with syndication partners and then have ad sales teams follow through with far more intelligence about how to implement these deals and sell inventory. The result is revenue optimization for all parties. I caught up with CEO Doug Knopper, co-CEO and co-founder of FreeWheel last week to learn more.

biz dev teams to cut creative revenue/inventory sharing with syndication partners and then have ad sales teams follow through with far more intelligence about how to implement these deals and sell inventory. The result is revenue optimization for all parties. I caught up with CEO Doug Knopper, co-CEO and co-founder of FreeWheel last week to learn more. FreeWheel sits on top of existing ad management systems, as a sort of cross between a digital traffic cop and a green eyeshade - dynamically managing and allocating ad inventory, while keeping track of all ads and revenue across the content provider's syndicated network. MRM interfaces to a content provider's and partner's content management system through FreeWheel's API, allowing MRM to implement its predetermined business rules alongside the content being sent to partners. Clearly there's a huge network affect opportunity for FreeWheel - the more partners its early content provider customers get to implement MRM, the easier FreeWheel's sale will be to subsequent content providers.

FreeWheel reminds me a lot of Signiant, which I wrote about recently. Signiant is more focused on content distribution in a syndicated economy, while FreeWheel is focused on ad management. But both companies share a common purpose of greasing the skids for both content providers and distributors to play ball with each other with the intention of driving more video views and advertising revenue.

FreeWheel has signed up Next New Networks, Joost and Jumpstart Automotive Media as initial clients. The company was founded by three former DoubleClick executives, has 40 employees and has raised 2 rounds from Battery Ventures, though the total is undisclosed.

Categories: Advertising, Startups, Technology

Topics: FreeWheel, Joost, Jumpstart Automotive Media, Next New Networks, Signiant

-

Three Broadband Video Themes from February `08

At the end of each month I plan to step back and recap a few key themes from recent VideoNuze posts. Here are three from February '08:

Brand marketers embrace broadband video

One clear theme from the past 4 weeks has been brand marketers' accelerating moves into the broadband video space. This was on full display by select Super Bowl and Oscar advertisers. We are witnessing an unprecedented commitment by brands to create their own entertainment/information video content and also to induce consumers to create brand-related video through user-generated contests. As I detailed in yesterday's webinar, examples in the former category include Kraft/Tassimo, J&J, CIT Financial and GoDaddy.com, while examples in the latter category include TideToGo/MyTalkingStain.com, Heinz/Top This, Dove Cream Oil Body Wash and T-Mobile/Current TV.

Through VideoNuze I track all brands' broadband video initiatives, and it is clear that their involvement in this new medium is intensifying. Faced with splintering audiences, ad-skipping DVRs and changing media consumption habits - particularly by younger demos - brands have no choice but to get into broadband video. This results in an entirely different awareness/engagement paradigm than we're accustomed to from the world of interruptive TV advertising. Brands today increasingly recognize that a key way to create loyalty (and generate sales!) is by engaging the audience on its terms, using broadband and other technologies to accomplish this.

Monetization is the #1 challenge

Another key theme of the past month was the ongoing quest for broadband video monetization. As I also mentioned in yesterday's webinar, this is the number 1 business challenge for all broadband video industry participants - both content and technology providers. Two companies I wrote about this month, EveryZing and Veveo, are focused on improving content discovery, which leads to more consumption and revenue-generating opportunities. I also wrote about Jake Sasseville, a young entertainer who is pioneering multi-platform initiatives to forge a new revenue model.

Innovation is key in this space. Next week I'll be writing about Freewheel, an innovative startup that's just surfaced, which is providing a new approach to managing broadband video advertising. And yesterday, Magnify.net, one of my favorite early-stage companies, which focuses on enabling video content distribution, announced that it has raised an additional $1 of financing.

In addition, the big dogs of the technology and media landscape are in hot pursuit of improved video monetization as well. This month alone brought news of Yahoo's acquisition of Maven Networks, an ad-centric video platform, Google's beta rollout of AdSense for video, and the hostile bid by Microsoft for Yahoo, a deal that has vast longer-term implications for online and broadband video advertising. In short, monetization is a key focus for all large and small industry participants - cracking this nut is crucial to the long-term health of the industry.

Net neutrality re-surfaces

Lastly, this month also brought a lot of news on the regulatory front. Twice I wrote about "net neutrality," a regulatory concept its proponents believe will keep the Internet free from discrimination by broadband ISPs. While I don't agree with their viewpoint, what is clearly true is that net neutrality is being spurred by the massive adoption of broadband video, which places an unprecedented load on broadband ISPs' networks.

So that's it for this leap year month. Three themes you'll be hearing much more about going forward: brand marketers' broadband video initiatives, video monetization and net neutrality. See you on Monday for the start of a new month!

Categories: Advertising, Brand Marketing, Broadband ISPs, Regulation

Topics: EveryZing, FreeWheel, Google, Magnify.net, Maven Networks, Microsoft, Net Neutrality, Veveo, Yahoo

-

Making Sense of Google's AdSense for Video

For me, Google and its initiatives in broadband video advertising and distribution have conjured a comparison to the lion of the jungle. Like the lion, Google often seems to be slumbering in this hot space, yet every once in a while it wakes up, raises its head and roars to the market with a new video advertising announcement. These roars serve as a reminder to others that it is, of course, the king of the online jungle.

But then, rather than following up these periodic roars with steady follow-on news of accomplishments,

financial success and new features, Google inexplicably seems to go back to its slumber, thus returning the jungle to the startup antelopes and established elephants to do the spade work of building the broadband video ad market.

financial success and new features, Google inexplicably seems to go back to its slumber, thus returning the jungle to the startup antelopes and established elephants to do the spade work of building the broadband video ad market. Yesterday, Google roared again, this time announcing the "beta" release of its AdSense for Video product and the launch of its destination "Video Advertising Solutions" center, which explains all of Google's video ad opportunities and offers very well produced explanatory videos.

Video ads have been previously announced by Google, and AdSense for video builds on these by allowing a broad range of content providers to tap into AdSense for graphical or text overlay ads on their video streams. Google announced a large network of content and platform partners, augmenting the massive inventory already available on YouTube.

By tying AdSense for Video to its AdWords capability, advertisers have a one-stop shop for text and video ads contextually placed across web pages and video streams. Since participating publishers can expose a percentage of their streams to AdSense, they enhance their overall monetization opportunities.

I spoke with a number of people in the advertising/technology/content communities yesterday and there was a consensus that Google's actions help validate the broadband video advertising market opportunity and overlays in particular (note Google doesn't support pre-rolls). I agree with those who said that with the overall market growing fast, Google isn't terribly competitive with other contextual ad firms; there's clearly room for more than just one player.

On the content provider side, of course any initiative to better monetize video streams, particularly by an established player like Google, will always be welcomed. This feeling is offset somewhat by the underlying anxiety that all content providers have vis-a-vis Google - it is part competitor on the content side, and also part competitor on the ad sales side. This is particularly true of YouTube, which offers significant distribution benefits to content providers, but while also competing for eyeballs.

For content providers' advertising revenues, while AdSense promises improved monetization, it might also lead to channel conflict as advertisers may try to pay less for targeted ad inventory available through Google rather than from the provider itself. This has been less a concern in traditional web publishing, because Google hasn't sold display ads. The risk is that over time AdSense for video could lead to a "hollowing out" of content providers' crucial ad sales capabilities. This dynamic reinforces why it's so important that those who work with AdSense for video set business rules and then adhere to them, rather than be too tempted to grab the easy, short-term money Google can provide.

With the beta of AdSense for video, Google has again reminded the market that its unparalleled technology, content, monetization and financial strength makes it the lion of the online jungle. It is well-positioned to also become the lion of the broadband video ad jungle. Let's see if Google keeps on roaring, or if it appears to lapse back into slumber.

Categories: Advertising