-

My Reflections on NATPE Conference

Last week's NATPE conference brought numerous opportunities for attendees to learn about broadband and digital media. Based on the Q&A I heard, plus the hallway chatter, there is intense interest - especially from independent producers - about how to take advantage of the rapidly changing video landscape. Today I want to spend a few minutes reviewing some of what I learned at the conference.

A big chunk of my time was spent hosting a day-long Digital Briefing track, during which 10 companies presented for 30 minutes each, back-to-back throughout the day. The companies that presented were:

Leichtman Research Group, Joost, SpotStock.com, Broadband Enterprises, Livid Media, Vuze, Enticent, Teletrax, PermissionTV and Digital Fountain.These companies offered a highly diverse range of products, services and solutions, all aimed at growing the broadband video industry. Joost, Vuze and Broadband Enterprises in particular drew lots of audience questions, focused on distribution and monetization, 2 key items for indie broadband producers. Similarly PermissionTV received lot of interest for how it can help large and small content providers build out their broadband presence. And Digital Fountain's demos of its high-quality video distribution network garnered a lot of attention (btw, it's soliciting participants for its beta trial here).

The other companies also showed valuable products and services: Livid Media demonstrated its personality-based content and Enticent its loyalty programs. SpotStock premiered its new digital stock footage library aimed at helping indie producers quickly and legitimately gain access valuable resources. And Teletrax explained how its watermarking technology helps broadcasters secure and track their digital streams. Last but not least, Bruce Leichtman of Leichtman Research demystified what's really happening with consumer behavior changes based on his firm's extensive market research.

Outside of the Digital Briefings day, the advertising-related sessions provided lots of needed information to attendees about how monetization is unfolding for broadband delivery. I've already written about Shelly Lazarus branded entertainment speech. Tim Armstrong, head of sales at Google provided insights on how the company is approaching YouTube monetization. Another session elicited reactions from big-time brand marketers about issues with pre-rolls and explored alternatives. And as I previously wrote, NBCU's Jeff Zucker delivered a candid wake-up call to the industry about challenges ahead. Even as someone who follows this stuff pretty closely, I thought there was a lot of new info and perspectives being shared.

All in all, these sessions all served as another reminder to me about how broadband video is becoming a vibrant part of the overall economy. There is so much entrepreneurial energy going into developing all the pieces of the overall broadband ecosystem. A consistent theme I heard at NATPE was that people recognize broadband is challenging incumbent media distribution, but it is also expanding producers' options in unprecedented ways. For me that's the real potential ahead.

If you want to discuss the specifics of any of these, just drop me a line!

Categories: Advertising, Events

Topics: Broadband Enterprises, Enticent, Joost, Leichtman Research Group, Livid Media, NATPE, PermissionT, SpotStock.com, Teletrax, Vuze

-

My Rant About Super Bowl Ads

I love the Super Bowl ads as much as anyone. I never stop being amazed by the creativity and humor on display during each year's big game. This year was no exception: screeching squirrels, a strutting heart,

shrunken heads, talking babies, the list goes on. For what Super Bowls ads are and always have been, they're terrific. My problem is that I believe broadband video allows Super Bowl ads to be much more than what they are and always have been. But the agency world does not seem to be getting this message.

shrunken heads, talking babies, the list goes on. For what Super Bowls ads are and always have been, they're terrific. My problem is that I believe broadband video allows Super Bowl ads to be much more than what they are and always have been. But the agency world does not seem to be getting this message.Two years ago I wrote "The Ten Million Dollar Super Bowl Ad?", where I outlined a scenario under which a 30 second spot could someday go for ten million bucks. How? By combining the best of brand advertising (the big emotional play) with the best of online advertising (the big measurable, performance-oriented play).

I wrote in that post: "What I envision is that the 30-second spot during the game will become the viewer's introduction or re-introduction to the brand or product. Numerous online, broadband-centric tactics will follow, with video being the center of the action. In football terms, the 30-second spot will morph from throwing a long pass (which is accompanied by high drama, but low probability of an actual score) to executing a more consistent ground game (accompanied by lower drama, but a much higher probability of an actual score). With this added measurability and a direct feedback loop, marketers will have much less anxiety about whether to ante up for the big game (and therefore the price will spiral upward).

I thought agencies and marketers would see this light and rush toward it. Boy was I over-optimistic. After watching all 52 Super Bowl ads this morning (thanks AOL), I am completely dismayed to report that, by my count, only 5 ads had any broadband video component:

GoDaddy - promoting Danica Patrick's "Exposure" banned ad and other videos

TideToGo - promoting "MyTalkingStain.com" a fun microsite

Life Water - promoting "Thrillicious.com" a microsite with a 2nd spot with the dancing iguanas

Sunsilk - promoting "LifeCantWait.com", a microsite with a UGC contest which is not yet active

Pepsi - promoting "PepsiStuff.com", with Amazon (ok, more focused on music than video)

All of the other 47 ads, representing tens of millions of dollars of clients' money, followed the same game plan from Super Bowls' past: go for either the clever, the funny or the gross, in an attempt to create buzz and fond memories for fans.

For me, this hidebound behavior showcases agencies at their most disappointing: unable to break out of the box, recognize new consumer engagement opportunities for their clients or embrace new technologies. Their inability or unwillingness to be more progressive is at the heart of why the whole advertising industry is in such chaos, with an increasing share of total spending shifting to online each year.

Nonetheless, I remain a long-term optimist. Maybe I'm crazy, but I'm still betting that someday, somehow, more agencies and brands will wake up and realize what the 5 brands above did this year: the combination of on-air and broadband is how to score a touchdown.

What do you think? Post a comment and let us all know!

Categories: Advertising, Sports

Topics: GoDaddy, Life Water, Pepsi, Sunsilk, Super Bowl, TideToGo

-

Microsoft, Yahoo and Broadband Video

Well, here I was waiting for news to officially cross the wire that Yahoo was acquiring Maven Networks for $150-$170 million (heavily rumored in the blogosphere yesterday and for weeks now) so that I could weigh in, when instead what emerged this morning was that Microsoft is making an unsolicited offer for Yahoo. Quite a day for Yahoo. (Note, I'll have more on Yahoo-Maven if and when that becomes official).

Today's big news is Microsoft's unsolicited $44.6B offer for Yahoo. Talks between the companies have been off and on for a long time, and it looks like Microsoft finally got fed up with the dithering at Yahoo and

decided to make a pre-emptive move. Steve Ballmer's letter to Yahoo's board and today's release is here.

decided to make a pre-emptive move. Steve Ballmer's letter to Yahoo's board and today's release is here. The deal is all about increasing scale to compete more effectively with Google in the online advertising space. Both Microsoft and Yahoo have lagged Google badly and have spent billions in the past year on ad infrastructure acquisitions. Yahoo immediately brings MSN lots of new traffic, which can be monetized with both search and display advertising.

Though Ballmer's letter also highlights "emerging user experiences" such as video, mobile, online commerce, social media and social platforms" down the list, as the fourth area of potential synergies, I would argue that

the upside in video is actually the most strategic benefit of the deal. Why?

the upside in video is actually the most strategic benefit of the deal. Why?The concept of scale, i.e. being able to both reach gigantic audiences and drive massive traffic from them, is absolutely essential for broadband video advertising to become core part of the marketing mix for big brands. Unlike search-based advertising, which has been driven by long-tail advertisers, broadband video advertising is going to be driven by big brands. That's because, notwithstanding the growth of overlays and other formats, pre-, mid- and post-roll ads are going to be with us for a while to come, and they are expensive to produce. The average garage-sized business isn't going to be making them.

Big brands spend tens of billions of dollars on TV ads. Shifting a meaningful part of this spending to broadband delivery is essential for broadband's growth. Brands spend on TV because that's been the only way for them to buy enough audience reach. Though they're beginning to trickle some spending over to broadband, the central obstacle to increasing their broadband spending is that there simply is not enough high quality, targeted video inventory for them to buy in order to achieve their reach objectives and therefore materially impact their businesses.

This is a theme I hear all the time, and just heard many times in the ad-related sessions I attended at NATPE earlier this week. Microsoft knows that to tap the long-term broadband ad opportunity in branded video advertising, it must offer advertisers greater reach, along with interactivity, reporting, social features, etc. This is all the more urgent because MSN and Yahoo are already playing catch-up to YouTube which still drive approximately 40% of all video views, a dominant market position.

MSN has worked hard to cross-promote MSN video in the rest of the site, and this has driven improved user experiences and impressive traffic gains. Yahoo, which has been mired down with a dysfunctional and bloated bureaucracy, has been far less coordinated and effective in video, leaving lots of room for MSN to make improvements.

You won't hear much about video as a key motivator for the deal because Wall Street, which is Microsoft's key audience to persuade, doesn't give a whit about long-term strategic positioning. It only cares about short-term financial metrics like dilution, earnings growth, cost-reductions and so forth. But behind the scenes, I'm giving credit to Microsoft. I think it is reading the tea leaves correctly about how the broadband video ad market is going to unfold and how to get MSN positioned properly for long-term success.

What do you think? Post a comment!

Categories: Advertising, Deals & Financings, Portals

-

"Mac vs. PC" Roadblocks on WSJ & NYT

Ending the week on a slightly lighter note, if you happened to go to WSJ.com or NYT.com yesterday, you would have seen that Apple bought out all the top of page ad inventory at both sites for its latest "Get a Mac" video spot (also known as the "Mac vs. PC" ads), which have been hugely popular on TV and online.

Apple's so-called "roadblock" strategy yesterday meant that every single visitor to these 2 sites were exposed to the same leaderboard/skyscraper video ad highlighting WSJ writer Walt Mossberg's opinion that Apple's latest Leopard OS release is "better and faster than Vista." Apple has a whole gallery of its "Get a Mac" ads here, though this new one is not yet posted.

In the online ad business, this type of video ad is referred to as "rich media." I haven't spent much time in VideoNuze discussing rich media ads, instead concentrating on pre-rolls and overlays ads which are actually adjacent to video content. Rich media ads show that there are many different ways to leverage video's emotional and informational impact even when there is no underlying video content to be adjacent to. Given the limitation of high-quality video content against which to run video ads, rich media has become an important and growing segment of the overall online ad business.

While, some rich media ads are way too "in your face" and spoil the user's experience, I think the way the yesterday's roadblock was executed is well within bounds. The video begins playing when the site loads, but the audio is muted. The user has to click the audio icon, and then the spot replays from the start. This means there's been an opt-in decision, which leads to higher engagement. Also, unlike many other rich media spots, the ad is composed solely of a leaderboard and skyscraper, so it doesn't have any obnoxious "pop-ups", "floating" or "expandable" components that block the underlying site content. These are the types of things that drive users crazy.

Rich media ads are an important part of the mix for fully understanding what's happening with video online, especially for advertisers who want to explore all options for leveraging video's emotional impact. I see the category continuing to grow. If ads are well-executed like Apple's, there will not only be minimal user pushback, but rather genuine opportunities for branding and interactivity.

Categories: Advertising

Topics: Apple

-

CES 2008 Broadband Video-Related News Wrap-up

CES 2008 broadband video-related news wrap-up:

Panasonic and Comcast Announce Products With tru2way™ Technology

Panasonic And Comcast Debut AnyPlay™ Portable DVR

NETGEAR® Joins BitTorrent™ Device PartnersD-Link Joins BitTorrent™ Device Partners

Vudu Expand High Definition Content Available Through On-Demand Service

Sling Media Unveils Top-of-Line Slingbox PRO-HD

Open Internet Television: A Letter to the Consumer Electronics Industry

Paid downloads a thing of the past

Samsung, Vongo Partner To Offer Movie Downloads For P2 Portable Player

Comcast Interactive Media Launches Fancast.com

New Year Brings Hot New Shows and Longtime Favorites to FLO TV

P2Ps and ISPs team to tame file-sharing traffic

ClipBlast Releases OpenSocial API

Categories: Advertising, Aggregators, Broadband ISPs, Broadcasters, Cable Networks, Cable TV Operators, Devices, Downloads, FIlms, Games, HD, Mobile Video, P2P, Partnerships, Sports, Technology, UGC, Video Search, Video Sharing

Topics: ABC, BitTorrent, BT, Comcast, D-Link, Disney, Google, HP, Microsoft, NBC, Netgear, Panasonic, Samsung, Sony, TiVo, XBox, YouTube

-

6 Predictions for 2008

With 2007 wrapping up, it's time to look ahead to the new year and make 6 predictions about what's ahead for broadband video in 2008. In general, I'm extremely optimistic about broadband's potential in the new year. To be sure, there are lots of challenges ahead, but much to look forward to.

Here's what my crystal ball is telling me:

1. Advertising business model gains further momentum.

Many of you have been hearing me beat this drum for a long time now; I'm just going to go right on beating it in 2008. Advertising is the primary business model for broadband video and this will only continue to grow in importance as the year goes along.

All the elements are falling in place for the ad model's momentum. In '08 we'll see more video consumption, especially of high-quality video, and more syndication, all of which will lead to more ad inventory. But 2008 is about more than just a quality and volume; it's also about better targeting, better formats, more sophisticated sales processes and more interactivity/community building around video. I'm impressed with the range of companies pursuing each of these areas and expect them to gain lots of traction.

2. Brand marketers jump on broadband bandwagon.

2007 marked the continuation of brand marketers creating their own broadband video-centric destinations, wrapped in increasingly clever campaigns. I track these initiatives very closely and wrote about many of them (Dell and Gap, Frito-Lay, Neiman-Marcus, Smirnoff, Dove, CIT, Campari, Universal Pictures, Showtime, etc.).

In 2008, we're going to see a proliferation of these direct-to-consumer broadband-centric marketing campaigns. Marketers and agencies across the board are coming to recognize how important broadband is for engaging their audiences in a way that TV spots simply can't match. Then factor in the high cost of TV and the rampant use of DVRs to ad-skip. I'm expecting lots of creativity from brand marketers in '08 as they push deeper into broadband, further pressuring the traditional TV ad business.

3. Beijing Summer Olympics is a broadband blowout.

NBC plans to stream an unprecedented 2,200 hours of live Olympics coverage at NBCOlympics.com. All of this is going to completely redefine how broadband adds new value to live sporting events. In particular, NBC's coverage is going to shine a very bright light on the appeal of broadband to deliver multiple simultaneous events in their entirety as they occur, instead of the usual chockablock, tape-delayed coverage. It's also going to demonstrate how well-suited broadband delivery is for niche but passionate audiences.

If NBC executes well, I think it has the potential to open up a whole new horizon in how broadband can augment (and in some cases, maybe even replace) broadcast coverage of sports events. For example, golf is a sport that cries out for improved coverage that broadband can offer. Instead of cutting back and forth to players' key shots, broadband would allow for cameras to stream all players' full rounds simultaneously, with fans able to watch just their favorite player, while also keeping an eye on the main feed. Bottom line, the '08 Olympics is going to show sports and live events producers everywhere what broadband can offer them too.

4. 2008 is the "Year of the broadband presidential election."

What TV was to the 1960 presidential campaign is what broadband is going to be to the '08 campaign. Broadband's impact has already been felt. Virginia Gov. George Allen's campaign was aborted after he was caught uttering a racial slur in his classic "YouTube moment." CNN has already hosted joint debates with YouTube. Hillary Clinton announced her candidacy in a video posted on her web site and also just launched TheHillaryIKnow.com with a passel of video testimonials about her softer side. Barack Obama's web site brims with video from the trail.

In '08 broadband video will be interweaved into the fabric of the major candidates' campaigns. It won't be an augment, it will be a central feature for reaching voters, particularly young ones. Broadband offers an unprecedented inexpensive way to convey the candidates' emotions and connect with voters. Presidential campaigning will never be the same again.

5. WGA strike fuels broadband video proliferation.

As the writers' strike slogs on, it is inevitable that many writers and producers (especially below the top tier) are going to look upon broadband as an attractive new medium to ply their trade. The signs are already there. It will be an ironic twist that the strike, which is centered on reallocating "new media" revenues, is going to stoke more interest in broadband productions, but outside the traditional apparatus.

I can't put my finger on exactly how this is going to unfold, but I think I can say with confidence that there is a lot of smart money eager to place bets on broadband video content. Writers and producers with track records and plausible plans will get funded. Quarterlife, Next New Networks, FunnyOrDie are all pre-strike examples of this. The strike only accelerates things.

6. Broadband consumption remains on computers, but HD delivery proliferates.

I wrote about this in detail just last week: regrettably broadband video is NOT coming to the masses' TVs any time soon. My guess is that 99.9% of users who start the year watching broadband video on their computers (or mobile devices in some cases) will end the year no closer to watching broadband on their TVs. Some initiatives will gain some ground, but on the whole, don't expect any mass adoption of devices or mechanisms to converge broadband with TVs in '08.

Nonetheless, do expect that HD or near HD-quality broadband video is going to proliferate in '08. A survey I worked on with a client, whose results will be shared in early '08, will attest to strong content provider interest in HD broadband video. That means that viewer experiences are only going to improve, and for those with big monitors and/or easy chairs, it may actually start to feel like this whole connect-the-computer-to-the-TV is unnecessary anyway.

So there you have it. Post a comment and let me know if you agree or disagree!

Categories: Advertising, Brand Marketing, Indie Video, Predictions, Sports, Video Sharing

-

5 Conclusions from Broadband Ad Webcast

Yesterday's Internet TV Advertising Forum/Maven Networks webcast "Pre-Roll vs. Overlay: Consumer Reaction to New Online Video Advertising Formats" yielded a lot of interesting usability information about various broadband video ad formats. For any content provider or aggregator who's relying on advertising as their business model of choice, it's clear that there are some significant opportunities and challenges ahead.

Below is a summary of the 5 key usability conclusions I heard in the webcast along with my take on each:

1. Users hate pre-rolls. Respondents overwhelmingly agreed that video ads are annoying and have developed the same kinds of coping techniques (tuning out, bailing out, etc.) they use to avoid TV ads.

My take: Yes, but unfortunately for users, I don't see pre-rolls going away any time soon. They're easy to execute, fit media buying habits well, are selling strongly especially for high-quality long-form video and best for advertisers seeking a tonic from DVR behaviors, pre-rolls can't be outright skipped by users. Given all this, let's all hope that targeting improves and publishers use them with some discipline, so users don't preemptively turn off to the broadband video medium.

2. Overlay ads' effectiveness is correlated to content fit, not demographics. Testing showed that users welcomed ads for products that were highly related to the content itself, and lost interest the less related the two were. Demos were less important.

My take: This point reinforces the importance of contextual targeting, which of course has worked well on the Internet as a whole. Yet as Bob Kernen at Maven says, a lot of content is "non-endemic" (i.e. doesn't lend itself to specific products or ads), so my guess is that this correlation opportunity is going to be lost for many content providers. Network programs in particular seem non-endemic and therefore will need to rely mainly on demo-based and possibly behavioral targeting.

3. Overlay ads need better execution to work well. Jeff Rosenblum from Questus summarized 8 best practices for executing overlay ads, such as appropriate frequency and duration, user control, calls-to-action, navigation and the like. For anyone looking to run an overlay campaign (and even for those who have), these serve as a great roadmap of do's and don't's.

My take: As always, executing right can make the difference between a campaign's success and failure. If you're planning to run an overlay campaign, I highly suggest you review this checklist against your plans to make sure you haven't overlooked anything.

4. It's difficult to engage an audience. The testing again showed how hard it is to engage online audiences, regardless of approach. Bob laid out a handy engagement hierarchy, Impression, Interaction and Immersion (from least to most engaging). Knowing what level of engagement your campaign aspires to must guide specific tactics and execution.

My take: Getting the consumer's attention and prompting them to act is the ad industry's oldest goal. It's even harder in the broadband sector. People have shorter attention spans than ever, so grabbing them and getting them to do what you hope gets more difficult all the time. Fortunately video offers emotional appeal unlike any text or graphical ad in the Internet world, so broadband offers new engagement techniques previously unavailable.

5. More research needed. While this first round of usability testing from the Internet Ad Forum shed a lot of new light on the broadband ad opportunity, it's clearly just a first step. The Forum has ambitious goals to keep researching and testing, continuously educating the market.

My take: As I mentioned in my remarks at the beginning of the webcast, everyone has a vested interest in solidifying the ad model as soon as possible. The enthusiasm around broadband will soon dry up if participants don't earn an acceptable ROI for their efforts.

Categories: Advertising, Events

Topics: Internet TV Advertising Forum, Maven Networks

-

blinkx Focuses on Network and Ads

blinkx, which has been around as long as just about anyone in the video search space, is steadily building out its distribution network and advertising capabilities. I caught up with Suranga Chandratillake, CEO of blinkx, who's led the company since its spinoff from Autonomy, and successfully took the company public on London's AIM earlier this year.

Suranga said blinkx is now supporting 5 million searches/day and generating 50 million unique visitors/mo across its network. Network partners featuring a blinkx search box now include Ask.com, Real, Lycos, Infospace and scores of smaller sites that use blinkx's API. Suranga says blinkx can't distinguish between traffic coming from network partners vs. at blinkx.com itself. And the revenue splits in the business deals seem to vary widely, though typically they average out to 50-50. All deals are based on advertising, with the partner usually selling the inventory.

On the ad side, blinkx took a big step forward earlier this year, launching its "AdHoc" contextual ad program. Given the analysis blinkx is doing on video to drive search, it's a natural that the company now leverages this knowledge to improve targeting for ads. In fact, Suranga sees AdHoc as a sort of AdSense for video, dynamcially matching ads with relevant content.

With improved targeting of course comes improved CPMs. Suranga says they've seen CPMs as high as $66 through AdHoc. blinkx is relying on the scale of its 220+ content relationships and millions of impressions to make AdHoc work. Formats can vary but the one that has been most successful so far in a mid-roll banner with an invitation for user to click and engage. As I've written before, AdHoc plays in the same space as other contextual video ad companies such as ScanScout, Adap.tv, DigitalSmiths, AdBrite, YuMe and of course YouTube, plus others.

Both the contextual ad and video search spaces are growing increasingly crowded. Players recognize these are 3 interrelated Achilles heels of the current broadband video model: users finding desired content, content providers getting paid for their work and advertisers getting sufficient and well-targeted industry. blinkx seems well-positioned to address all three.

Categories: Advertising, Video Search

Topics: Adap.TV, AdBrite, Blinkx, Digitalsmiths, ScanScout, YouTube, YuMe

-

Webcast Reminder

A quick reminder about tomorrow's complimentary webcast (Dec. 12) entitled, "Pre-Roll vs. Overlay: Consumer Reaction to New Online Video Advertising Formats," hosted by the Internet TV Advertising Forum and Maven Networks. If you're motivated to learn about what real consumers think about different types of broadband video ad formats, this webcast is for you. Results from recent usability tests will be shared. I'll be offering some brief remarks at the beginning.

If you're interested in attending, click here to register.

(Note: I have no financial interest in the Forum, this webcast or Maven Networks.)

Categories: Advertising, Events

-

Terrific Webcast About Broadband Video Ad Formats on Wed.

From time to time I'll take the opportunity to bring worthwhile industry events to your attention. In this spirit, there will be a terrific complimentary webcast this Wed, Dec. 12, entitled, "Pre-Roll vs. Overlay: Consumer Reaction to New Online Video Advertising Formats."

The webcast is hosted by the Internet TV Advertising Forum and Maven Networks. If you're motivated to learn about what real consumers think about different types of broadband video ad formats, then I believe this 1 hour webcast will be well worth your time.

(Note: I have no financial interest in the Forum, this webcast or Maven Networks.)

The Internet TV Advertising Forum, which was founded by Maven, includes a group of leading companies such as Digitas, DoubleClick, Fox News Digital, Microsoft, Oglivy, Scripps Networks Interactive, TV Guide, 24/7 Real Media and 4Kids Entertainment. The Forum is working to define the next generation of broadband video advertising strategies, formats and best practices.

The Forum conducted a series of usability tests in October, 2007, to study new, interactive ad formats designed for broadband video. During the webcast, Jeff Rosenblum, co-president of Questus, the market research firm that oversaw the usability testing, will share the data and conclusions.

As many of us would agree, 2007 has been marked by an increasing awareness that ad-support is going to be the primary business model for broadband video, at least in the near-term. Yet there is still much uncertainty about how best to capitalize on the advertising opportunity. So I view events like this, which further industry participants' understanding of what consumers want, as crucial to building consensus and standards necessary for the broadband video medium to succeed.

Maven has graciously invited me to share some context about the broadband video industry at the beginning of the webcast. Again, I have no financial stake in this event. Rather, I view it merely as an opportunity to share some thoughts, learn alongside all of you about the conclusions of this usability testing and participate in the follow-up Q&A session.

If you're interested in this complimentary webcast, click here to register.

Categories: Advertising, Events

Topics: Internet TV Advertising Forum, Maven Networks

-

Adap.tv Improves Broadband Video Ad Targeting with CPC Approach

As the broadband video world continues to coalesce around advertising as its primary business model, there is a flurry of companies seeking to improve the monetization process. As I've written before, this is critical work, because at some point the bloom will be off the broadband video rose if participants can't earn an attractive ROI.

Enter Adap.tv, which is addressing the ad monetization challenge. The company was founded last year and is based in San Mateo, CA. It is backed by Redpoint and Gemini and now has 20 employees.

CEO/co-founder Amir Ashkenazi recently gave me a run-down on Adap.tv's approach and progress. Amir was the founder of Shopping.com, which was acquired by eBay and he has brought together many former colleagues for his experienced management team.

Like its competitors, the heart of Adap.tv's model is its ad targeting and relevance engine. Adap.tv uses a "multi-disciplinary approach": analysis of the video/audio (context, metadata, etc.), analysis of the ad (keyword submission, etc.) and analysis of the user (demographics, location, etc.). This data is then fed to a matching engine to pair ads with the most relevant video. Over time the system optimizes based on actual click behavior.

Adap.tv is highly focused on overlays (Amir believes this will be the "de-facto standard" soon), and provides a series of customizable templates for advertisers (see below Kayak overlay). It is also positioning itself as a cost-per-click model, so there's no fixed cost to advertisers. In fact, advertisers can power Adap.tv ads using the same keyword feeds they use for their keyword campaigns.

So far publishers have been responsive to the CPC model because they see overlays as opening up a lot of untapped inventory. Obviously implementing overlays needs to be done judiciously or the viewer experience will become cluttered and broken. Amir believes the whole broadband video ad model will move to CPC over time as advertisers become more sophisticated and focused on performance. This Google-like model would be very good news for advertisers, but would be a brave new world for traditional broadcast and cable networks long accustomed to CPM approaches in their traditional businesses.

While I think a more performance-based broadband ad environment would be welcome, I continue to believe a CPC/overlay approaches will ultimately co-exist with CPM/pre-rolls. There's a lot of interest in overlays, yet there are too many great 15 and 30 second TV spots not be re-used online and the CPMs are way too rich for big branded content providers to walk away from.

Other companies that are in the contextual analysis and/or overlay space include: ScanScout, Digitalsmiths (note: a VideoNuze sponsor), YuMe, blinkx, VideoEgg, YouTube, Brightcove, AdBrite, Viddler (which TechCrunch just wrote about yesterday) and others I'm sure I'm missing or are yet to surface.

Categories: Advertising, Startups, Technology

Topics: Adap.TV, AdBrite, Blinkx, Brightcove, Digitalsmiths, ScanScout, Viddler, VideoEgg, YouTube, YuMe

-

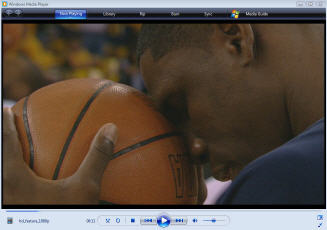

HD Broadband Video Rollouts Will Be Driven by Advertising Model Growth and ROI

Last week's unveiling of HDWeb from Akamai (disclaimer: a VideoNuze sponsor), coupled with Limelight's recent announcement of its LimelightHD service offering, further raise the visibility and near-term prospect of higher-quality video streaming.

Underlining this was the impressive array of support in the two press releases from customers willing to be quoted expressing their interest in HD. I read all this as putting to rest any doubts about whether content providers are interested in offering HD. Supporting Akamai's release were MTV, NBA, Gannett, while supporting Limelight's release were Fox

Interactive, Brightcove, Adobe, Silverlight and Rajshri.com (India's #1 broadband portal).

Interactive, Brightcove, Adobe, Silverlight and Rajshri.com (India's #1 broadband portal). Content providers I talk to are enthusiastic about pushing the quality bar, though a key issue is cost of delivery and potential ROI. Obviously to push out HD-quality streams means higher bandwidth and storage needs, the 2 key drivers of CDN charges. To support higher costs, improved revenue potential is required. And this is why HD rollouts are dependent on broadband video advertising prospects.

With ad support the primary business model for broadband video, I think a chicken-and-egg dynamic between ads and HD is going to play out. The better the ad revenue prospects, the more willing content providers will be to invest in HD. This is a reminder of why further maturing of broadband video ad models and supporting technologies are so important. So while the paid download model will also continue to grow, if you really want to get a handle on HD's prospects, keep an eye on the broadband video ad business. Continued traction will govern how much HD we'll all be seeing.

In the mean time, HDWeb from Akamai provides an enticing glimpse of an online HD future. I had no problem accessing its content over my standard Comcast broadband connection. The video quality is unlike anything I've yet seen online. If you get a chance, take a look at the NBA highlights clip (screen shot below). The clarity is mind-boggling.

Can Akamai actually deliver this at scale? At the recent Akamai analyst day I attended, Chief Scientist/co-founder Tom Leighton said their network roadmap is to have 100TB of capacity by 2010, which could theoretically support 50 million concurrent 2MB streams. We're a long way from that usage level, but Akamai seems to be squarely focused on making HD a reality. And they're not alone, along with Limelight there are numerous other HD CDN initiatives underway. All this means that the video quality bar will inevitably rise.

Categories: Advertising, CDNs, HD

Topics: Akamai, HDWeb, Limelight

-

UGC Video Ads Becoming More Viable

Announcements from both ScanScout and Digitalsmiths continue to show that ads against UGC video may become more viable. There has been much skepticism about whether the vast trove of UGC video will be monetizable. Concerns about UGC monetization have been partly behind the recent emphasis by traditionally UGC-centric sites like YouTube, Metacafe, Veoh and others to move up the video quality food chain by offering branded or independent video.

Last week ScanScout announced trademark approval for its "Brand Protector" technology which is aimed at

allowing advertisers to have their messages accompany only content that is deemed appropriate. And today Digitalsmiths (disclaimer: VideoNuze sponsor) has announced "AdSafe", which has the same basic intent and may also functional at a more granular levels of acceptability. Both of these initiatives are should be read as good news in helping the UGC ad market get its footing. Brands looking to harness the power and popularity of UGC video should definitely be investigating these kinds of solutions.

allowing advertisers to have their messages accompany only content that is deemed appropriate. And today Digitalsmiths (disclaimer: VideoNuze sponsor) has announced "AdSafe", which has the same basic intent and may also functional at a more granular levels of acceptability. Both of these initiatives are should be read as good news in helping the UGC ad market get its footing. Brands looking to harness the power and popularity of UGC video should definitely be investigating these kinds of solutions.

Today Digitalsmiths also introduced "AdIQ", which brings the concept of "conquest ads" to the broadband video advertising world. For those unfamiliar with conquest ads, this is when a brand in the same category as a competitor buys inventory where a competitor is somehow mentioned or identified in the content itself. Here's a pretty good explanation from iMedia.

So for example, say Reebok is mentioned or identified in a video scene and say Nike wants to buy an overlay ad to play at that moment. Conversely, AdIQ allows Nike to ensure that its ad never runs against Reebok (or other competitors') content mentions. This is pretty cool stuff. But how about the media buyer who gets the responsibility to administer all this? I haven't seen the implementation, but I hope Digitalsmiths has made it simple to set up and monitor these campaigns!

Categories: Advertising, Technology, UGC

Topics: Digitalsmiths, ScanScout

-

Maven Moves the Broadband Video Ad Market Forward

Maven Networks got a lot of ink today with 2 announcements, first the launch of a new broadband ad platform and the second, the launch of a new industry collaboration dubbed the "Internet TV Advertising Forum." These have been in the works for a while and Maven gave me a heads up on both over the summer.

The Ad Forum is noteworthy, as it appears to be a genuine "good guy" effort to move the whole industry forward in optimizing the ad model. Ten companies signed on for launch, including heavies like Scripps, Fox News, Oglivy, TV Guide, Microsoft, DoubleClick and 24/7.

I caught up by phone with Kristen Fergason, Maven's VP of Marketing to learn more. First, the Forum is completely open to everyone. Though initially underwritten by Maven, over time it will probably take on more of a "dues-paying" model. And to show that "open" really does mean open, I asked what happens if competitors like Brightcove for example, wanted in? Her reply: "we'd happily accept them".

The forum is mean to bring together agencies, content providers and vendors to build consensus about how to move past the market's current reliance on pre-rolls. Kristen said industry players have been "chomping at the bit" to get involved and Maven received 40 applications today alone. Importantly, the Forum is meant to augment IAB initiatives, not compete with them. The Forum will run focus groups and collect research based on ideas generated by Forum members to see what works and what doesn't. Results will be available to everyone.

Maven believes that a "rising tide lifts all ships", but because its ad platform is ready now, it will benefit disproportionately. That's where today's other announcement comes in. The demo I saw shows how new ad units (videos, overlays, banners, etc.) can be dynamically inserted, not just at the beginning of the video, but throughout. The result is that a lot of new inventory is available. The below graphic shows "cue points" for manual insertion, but an algorithm can also be used to insert based on what the system knows about things like clip length, average user session time, click-thru, etc. Note I didn't see this feature in action, so I can't say for sure how well it actually works.

There's also pretty neat telescoping transaction capability as shown below, which allows the content provider or advertiser to collect specific user information. The video resumes when the user is done.

There's also pretty neat telescoping transaction capability as shown below, which allows the content provider or advertiser to collect specific user information. The video resumes when the user is done. The ad platform looks like a solid entry and when taken together with other myriad ad initiatives in the market, everything suggests that we may actually see life beyond pre-rolls. Hallelujah.

The ad platform looks like a solid entry and when taken together with other myriad ad initiatives in the market, everything suggests that we may actually see life beyond pre-rolls. Hallelujah.Categories: Advertising, Technology

Topics: 24/7, Brightcove, DoubleClick, Fox News, Maven, Microsoft, Oglivy, Scripps, TV Guide

-

Black Arrow Shoots for Multiplatform Ad Success

Black Arrow has an ambitious goal of managing and serving ads across broadband video, DVR and VOD platforms. With audience fragmentation causing chaos in the advertising world, such a solution, when fully implemented, would have enormous value to content companies and service providers (cable, satellite, telco).

Black Arrow has an ambitious goal of managing and serving ads across broadband video, DVR and VOD platforms. With audience fragmentation causing chaos in the advertising world, such a solution, when fully implemented, would have enormous value to content companies and service providers (cable, satellite, telco).Black Arrow has been around for a while but went under the radar for the past few months. Now it's re-emerging, with new CEO Dean Denhart installed about 6 months ago.

Dean briefed me last week on news the company announced today, which included closing a $12M B round from existing investors Comcast, Cisco, Intel, Mayfield and Polaris and officially launching their ad platform.

The company is trying to differentiate itself from many others serving ads in the broadband video space by tackling the thorny problem of also inserting in both the DVR and VOD environments. DVR insertion today is non-existent and for VOD it's not scalable. To succeed, the company will need to integrate its servers with the service providers, which is no easy feat. As many of you know, the rap on cable operators - and I've experienced this first-hand - is that selling into them wears out early-stage companies, using up precious time and capital in long drawn-out testing, selling and negotiation cycles.

If Black Arrow survives this process and proliferates its gear into headends, it will have a formidable competitive advantage against competitors. And on the encouraging side, in the cable world at least, a nascent set of standards dubbed "DVS 629" governing digital ad insertion is now being worked on. Black Arrow is following these closely. Dean explained that the company has proven in its technology and in 2008 it will be pursuing field trials and initial rollouts with major operators. Certainly having Comcast as a lead investor can't hurt its chances.

Black Arrow's real appeal to content companies will only begin when it has significant deployments. Dean explained that while the cable sell-in process continues to unfold, it will follow a parallel track of managing ads for broadband, with the longer-term value prop of multi-platform support. And it's taking a wait-and-see approach on which business model to use to fund the capex for proliferating its servers. An analogous and interesting approach is the one Akamai has mastered - i.e. not charging ISPs. Instead it positions its gear contributing to top-line growth and opex reductions. This strategy has been a massive success for Akamai, helping it achieve widespread deployments and a huge entry barrier for competitors.

I really like this company's vision; however achieving it in full is going to take tenacity, patient and deep-pocketed investors and a few good breaks.

Categories: Advertising, Cable TV Operators, Deals & Financings, Startups

Topics: Black Arrow, Cisco, Comcast, Intel, Mayfield, Polaris

-

Google's "Video Units": Turbocharging Video Syndication

Google/YouTube's formal announcement of its "Video Units" content syndication this morning is a welcome development following previous moves in this direction that did not seem to materialize (there was a test with MTV and also comments about doing same with partners Sony BMG and Warner Music Group). What Google'sAdSense has already done in distributing ads to the "Long Tail" of publishers, Google is now going to try replicating with video. It's a very smart move.

Google/YouTube's formal announcement of its "Video Units" content syndication this morning is a welcome development following previous moves in this direction that did not seem to materialize (there was a test with MTV and also comments about doing same with partners Sony BMG and Warner Music Group). What Google'sAdSense has already done in distributing ads to the "Long Tail" of publishers, Google is now going to try replicating with video. It's a very smart move.As I have written repeatedly, robust syndication is a crucial piece of the broadband video economy. That's because advertising is going to be the main business model for a long time to come. And the only way to make the ad business work is through massive traffic increases, and of course improved ad monetization methods.

There's no better way to scale up traffic than through turnkey syndication. Google's ability to harness AdSense as a combination video syndication engine and monetization platform for content providers (by eventually marrying video units to AdWords) is unmatchable by anyone else.

As Google expands this initiative, it will be simultaneously alluring and threatening to others. Trying to capture the same benefits without the same underlying technology infrastructure and far-reaching distribution network is going to be very challenging to replicate.

Take for example, Hulu, the News Corp/NBCU JV, meant to regain control over their broadcast TV programs. Hulu has been striking its own distribution deals and will no doubt monetize its traffic with a "feet-on-the-street" ad sales approach. While there are benefits to this approach to aggregate the biggest sites as partners, Google's one-stop syndication/monetization capability provides the turnkey, hands-off approach needed to gather up the all the rest of the market (i.e. the Long Tail).

Depending how Google chooses to split the revenues between AdSense partners and content providers, Google/YouTube could well become a dominant part of the broadband-centric video value chain that is now taking shape.

Categories: Advertising, Broadcasters, Video Sharing

-

Paid vs. Free, Where is the Grass Greener?

Two conversations I had last week, with executives at two separate independent video content companies, one based on a pay model, and the other on an ad-supported model, struck the same theme: the "grass must be greener" for other's model.

These conversations were illustrative of others going on across the video landscape today. Everyone's grappling with which model offers more profitability, stability and growth. At least for now, ad-supported appears to have the "greener grass".

Paid sites are struggling with the fact that so much video has come online in the past couple of years that the bar to get users to open their wallets moves higher each day. The question becomes, "what sorts of video are consumers truly willing to pay for when so much is now available for free?" Of course, the more free stuff there is, the less compelled users feel to pay, even to get something good. Thus a major struggle ensues for pay sites to generate sufficient volume to become profitable.

The rising supply of video makes life equally tough, if not tougher, on the ad-supported sites. Breaking through the noise with quality content is no simple trick. Great content is table stakes. I think the real differentiators are great marketing and distribution which leads to significant awareness, traffic and revenues. So skills like knowing how to create a viral wave, strike partnerships with portals that have real teeth, and syndicating to many smaller players, are all paramount. And that's all before the skills required to sell ads and actually generate revenue.

The grass will remain greener for ad-supported for some time to come. When broadband to the TV becomes widely adopted, Hollywood is willing to cannibalize DVD revenues, formats are further standardized and consumers are better acclimated to broadband delivery, the pay model is going to take off. The ad-supported model is no layup, but with the right ingredients, success is currently attainable.

Categories: Advertising, Downloads

Topics: Advertising, Downloads

-

MSN Improves Pre-roll Experience

Kudos to MSN for evolving the pre-roll format by announcing they'll only insert at the beginning of a session and then only every three minutes. This "capping" policy is yet another effort to make pre-rolls more digestible.

Like it or not, pre-rolls are here to stay. They're an easy re-use of expensive creative. They're straightforward to see, because they're easily understandable by buyers. And while few viewers will admit they want ads, with better targeting, they're actually a familiar experience for viewers and could be useful.

Everyone I talk to agrees. Especially in the broadcast community. So while overlays and other formats will make inroads on pre-roll's turf, significant attention should be focused on improving the pre-roll experience and effectiveness, because that's where a lot of the ad dollars will remain.

So moves like MSN's are welcome. The question of course is, what effect does this capping policy have on their inventory and economics? The question of fleshing out the ad-based broadband video business model persists. If MSN can demonstrate viewership and satisfaction increase, and the economics work, I expect other aggregators and providers will experiment with this approach as well.

Categories: Advertising, Portals

Topics: MSN, MSN Video, pre-roll ads

-

ScanScout Update and New TW Investment

On Friday I had a chance to meet with and get an update from Waikit Lau, COO/President and Co-Founder of ScanScout. They had given me a heads up earlier in the week about this morning's announcement of a strategic investment by Time Warner and new board member appointments, so I wanted to get a closer look.

ScanScout is among a group of companies that are trying to improve monetization of broadband video by using analysis techniques (e.g. audio, visual and metadata) to deliver highly contextual ads that go beyond conventional pre-roll ads. This group includes, to one extent or another, Digitalsmiths, Yume, Adap.tv, blinkx and Nexidia. ScanScout's format of choice is the "overlay", subject of much recent rabble following YouTube's decision to jump on this format's bandwagon.

Waikit explained that ScanScout sees its secret sauce in "extracting signals" (or descriptive data) from video streams, identifying semantics and correlations of like data and enabling "brand protection."

ScanScout first analyzes video content to characterize it so that scenes can become valuable in a way that today's keywords are. This is done though speech recognition, visual analysis and meta-data collection. Next, ScanScout technology is crawling the web each day to find all nouns and pronouns to determine how they relate to one another. By understanding these correlations and the underlying semantics, ScanScout's system becomes smarter, in turn enabling its advertisers to optimize their targeting. Finally, ScanScout's "brand protection" allows advertisers to de-select certain kinds of content and keywords so that their ads don't run in those offending videos.

The company is focusing on a network business model, so it's trying to sign up as many valuable publishers as possible to build its inventory, while also enticing advertisers and agencies to allocate some budget to its platform. Certainly having Time Warner in its corner will help the company gain access to the trove of TW content. However the company isn't focusing solely on big branded content. Waikit favors "torso" video (in Long Tail-speak, content between the head and UGC), that is monetization-challenged. And the company is focusing now on the entertainment vertical and on shorter form content, which Waikit sees as ideal for the overlay format.

It's a pretty cool model, but still needs time to be fully proven. Big brands love the CPMs they're getting for pre-rolls, so overlays are going to be less appealing for now. And for ScanScout and all its competitors, the proof of their wizzy technology will be tangibly improved targeting leading to higher user click-throughs and engagement. It's still too early to know whether the science leads to actual results. But with broadband content providers large and small scrambling for improved monetization, ScanScout and the others are playing in very fertile ground.

Categories: Advertising, Deals & Financings

Topics: ScanScout, Time Warner

-

DailyMotion Raises $34 Million, Is Category Over-Funded?

WSJ reported today that DailyMotion, the French video sharing site, has raised $34 million in a round led by Advent Venture Partners LLP of London and AGF Private Equity. This financing adds to a wave of capital that has poured into the overall ad-supported video sharing/video aggregator platform space in the last few months.

Companies that I think fit in this group that have recently raised big money are Joost ($45 million), Veoh ($26 million), Metacafe ($30 million) and blip.tv ($10 million). Hulu, the NBC-News Corp JV which raised $100 million could even be considered in this category. And thinking a little more broadly you could include sites like Heavy.com, Break, Vuguru, Next New Networks, DaveTV, Babelgum, BitTorrent and others which are creating and/or aggregating broadband programming.

To be fair, each of these companies has a slightly different approach to their content strategy (pure aggregation vs. original development vs. hybrids), market positioning and technology capabilities. However, as best I can tell, they're all trying to offer distinctive video content into broadband-only delivery networks and to one extent or another, surround this programming with interactive tools. The intended result is unique viewing experiences.

In the aggregator roles they play, they're muscling themselves into the market owned by traditional video distributors like cable and satellite operators, and more recently telcos. These new companies are all very interesting to watch because ultimately they must do at least 3 things to generate traffic and revenue: (1) differentiate themselves from each other, (2) add value to content providers/producers relative to CPs/producers relying solely on a direct-to-consumer approach and (3) shift viewing time from the traditional distributors' programming to their own.

Any one of these would be a pretty high hurdle to get over. Doing all three will be even tougher. Yet a lot of smart money keeps backing these companies, further demonstrating how hot this overall category is -- and how quickly it could become overfunded. But I don't expect things to cool down any time soon. We can expect further funding in this space as investors clamor to get a piece of the action in broadband video.

Categories: Advertising, Deals & Financings, UGC, Video Sharing

Topics: BitTorrent, DailyMotion, Hulu, MetaCafe, Next New Networks, Veoh, Vuguru, YouTube