-

Brightcove Appoints David Mendels President and COO

Brightcove has appointed David Mendels as president and COO, a new executive position at the company.

Mendels has been on Brightcove's board of directors since late 2008 and for the last several months has been its acting head of sales. He was most recently the EVP and GM of Adobe's $1 billion enterprise software and business productivity division which includes Acrobat, Connect, LiveCycle and Flex. Prior, he was an early employee and spent many years at Macromedia, where he helped the company expand internationally, ran business development and alliances and managed a number of the company's key products.

Mendels and Jeremy Allaire, Brightcove's founder, Chairman and CEO, briefed me over the holidays on the appointment. The two worked together following Macromedia's acquisition of Allaire back in 2001. From Jeremy's perspective, bringing on Mendels won't prompt any radical changes. Rather, the goal is to

strengthen the company operationally and help it scale to capture opportunities both see in its 3 target markets: core media, non-media (i.e. business, government and education, which Jeremy said already account for over half the company's revenues) and small organizations (which Brightcove is pursuing with its recently launched Express product). Both also envision Mendels further globalizing Brightcove's business and also building out its channel sales efforts.

strengthen the company operationally and help it scale to capture opportunities both see in its 3 target markets: core media, non-media (i.e. business, government and education, which Jeremy said already account for over half the company's revenues) and small organizations (which Brightcove is pursuing with its recently launched Express product). Both also envision Mendels further globalizing Brightcove's business and also building out its channel sales efforts.For his part, Mendels thinks of Brightcove as being comparable to Macromedia back in 1993 when he joined it - still relatively small but profitable, with a strong management team in place and operating in a product area with huge mainstream opportunities ahead, yet where no single company or larger enterprise has established a dominant position. Mendels said he's not coming to Brightcove with a big agenda for change, but instead to help drive execution, create efficiencies and further penetrate newer market segments. One important area of emphasis is building out a developer program to help proliferate video applications based on Brightcove's APIs. As part of Mendels' transition, Brightcove is also searching for a head of North American sales and a head of Asia Pacific sales (Japan excluded).

The two believe that a continuing preference by many organizations to build vs. buy is Brightcove's biggest source of competition, though they see this starting to soften as video becomes more integral to customers' overall operations. Both are also very mindful of the plethora of other online video platforms in the market, as well as new startups that continue to spring up. As Jeremy and other Brightcove executive have told me in the past, the company believes it distinguishes itself from others not only on the basis of its platform, but also by its breadth of offerings, international presence and simultaneous pursuit of numerous market segments.

Brightcove is indeed well-positioned, though as I pointed out recently, I don't foresee there being any single, truly dominant provider in the video platform market any time soon. It is still relatively early days in the industry and there will be lots of competitors. I continue to believe that the best way for prospective customers to determine which provider meets their own particular requirements is to intensively demo various products and see how they each perform.

However, as the market inevitably matures, requirements converge and video becomes more mission critical, video platform providers' ability to effectively scale all aspects of their operations is going to become an increasingly important differentiator. In this respect, Mendels' Macromedia and Adobe experience is going to be extremely valuable to Brightcove's ongoing success.

What do you think? Post a comment now.

(note: Brightcove is a VideoNuze sponsor)

Categories: People, Technology

Topics: Adobe, Brightcove, Macromedia

-

Brightcove 4 Launches With More Features; New Low-Priced "Express" Option Introduced

Brightcove is launching the fourth generation of its platform today and is also introducing a new low-priced "Express" option that complements its "Professional" and "Enterprise" editions. Brightcove's SVP of Marketing Jeff Whatcott recently walked me through the new features and Express strategy.

Brightcove is enhancing its customers' ability to publish across 3 screens by introducing, among other things, a "universal delivery service" option which allows the same video to be delivered via multi-bit rate

streaming and progressive download. When selected, this means that publishers' video can be uploaded once, but delivered more intelligently depending on the device being targeted and the bandwidth available. Brightcove is also introducing an SDK for iPhone publishing which streamlines the workflow for publishers targeting the iPhone. Brightcove is also broadening its appeal to non-media customers that require a behind-the-firewall solution, providing delivery only to approved IP addresses and helping manage assets stored on private CDN infrastructure.

streaming and progressive download. When selected, this means that publishers' video can be uploaded once, but delivered more intelligently depending on the device being targeted and the bandwidth available. Brightcove is also introducing an SDK for iPhone publishing which streamlines the workflow for publishers targeting the iPhone. Brightcove is also broadening its appeal to non-media customers that require a behind-the-firewall solution, providing delivery only to approved IP addresses and helping manage assets stored on private CDN infrastructure.Given how increasingly strategic video is for its media customers, Brightcove is also introducing live streaming (including ad insertion), improved video sharing (with a particular focus on Facebook's Live Stream Box Widget), better analytics and monetization and improvements in media sharing across multiple divisions within an organization.

Brightcove is also introducing a slew of under-the-hood improvements that streamline the workflow, improve integration with 3rd parties and enhance SEO. These include new player APIs allowing more customized experiences, ad rules APIs and integrations with other web applications.

Importantly, the company is also broadening its target customer base. Although Brightcove had recently started focusing more on non-media (e.g. government, education, business) customers, these were still typically larger entities with high willingness-to-pay. Jeff explained though that with Brightcove's well-known brand, it was receiving many daily inquiries from prospects looking for a low-cost, turnkey solution. Lacking one, Brightcove felt it was leaving business on the table.

Now with the Express product (with 3 monthly price points, $99, $199 and $499), the company is making its first concerted effort to satisfy those with smaller video libraries, less need for customization and simpler monetization strategies. Moving to the low-end of the market puts Brightcove into more direct competition with players like Fliqz, Delve and others, while creating another new option for those with modest needs that have used YouTube.

As I've written recently, the video platform space continues to be quite crowded, with new entrants continuing to crop up. While I suspect that will continue to be the case, Brightcove argues persuasively that its feature set is far beyond anything that newer players yet offer, and that its track record of delivering video globally, at scale, provides major content providers quality assurance that others cannot yet match.

While the video platform space continues to evolve, Brightcove always impresses me with the methodical approach it takes to its product roadmap. Having been in the business for so long and having wide breadth of customers, the company is unlikely to fall behind anyone else when it comes to new customer requirements. Even in instances when competitors get a jump on it by offering distinctive new features, Brightcove is quick to respond. Brightcove 4 positions the company to continue as one of market's key leaders.

What do you think? Post a comment now.

(Note: Brightcove is a VideoNuze sponsor)

Categories: Technology

Topics: Brightcove

-

As Episodic Launches, How to Make Sense of the Crowded Video Platform Space?

Surely one of the most enduring questions I and others who watch the online video industry are asked (and in fact often ask ourselves) is: How can video management and publishing platform companies continue to launch, even as the space already seems so crowded?

Personally I've been hearing this question for at least 6 years, going back to when I consulted with Maven Networks, whose acquisition by Yahoo was one of the few industry exits (and likely the best from an

investor ROI perspective, regardless of the fact that it was shut down little more than a year later as part of Yahoo's retrenching. With yesterday's launch of Episodic and the recent launch of Unicorn Media, plus last week's $10M Series C round by Ooyala, it's timely to once again try to make sense of all the activity in the platform space.

investor ROI perspective, regardless of the fact that it was shut down little more than a year later as part of Yahoo's retrenching. With yesterday's launch of Episodic and the recent launch of Unicorn Media, plus last week's $10M Series C round by Ooyala, it's timely to once again try to make sense of all the activity in the platform space. The best explanation I offer traces from my Econ 101 class: supply is expanding to meet demand. Over the past 10 years, there has been an enormous surge of interest in publishing online video by an incredible diversity of content providers. Importantly, interest by content providers has intensified in the last few years. I can vividly recall 2003 and 2004, trying to explain to leading content providers why online video was an important initiative to pursue. Still, their projects were often experimental and non-revenue producing. Contrast this with today, where every media company on earth now recognizes online video as a strategic priority.

But even as online video's prioritization has grown, many media companies don't have all the strategic technology building blocks in place. In fact, many continue to use home-brewed technology developed a while back. The range of video features needed continues to grow and evolve rapidly. Consider how requirements have expanded recently: live, as well as on-demand video; long-form programs as well as clips; paid, as well as ad-supported business models; mobile, as well broadband distribution; multiple bit rate, as well as single stream encoding; in-depth analytics as well as top-line metrics; widespread syndication as well as destination-site publishing; off-site, as well as on-site ad management. The list goes on and on.

As media company interest has grown, technology executives and investors have taken note. Venture capital firms continue to see online video as a high-growth industry (even if the revenue model for content providers is still developing, as are many of the platforms' own revenue models), with significant macro trends (e.g. changing consumer behavior, proliferation of devices, improved video quality, etc.) as fueling customer interest. Another important factor for platforms is rapidly declining development costs. As Noam Lovinsky, CEO of Episodic told me last week, open source and other development tools has made it cheaper than ever to enter the market with a solid product. With ever lower capital needs, a new video platform entrant that can grab its fair share of the market has the potential to produce an attractive ROI.

Of course all the noise in the platform space means media executives need to do their homework more rigorously than ever. I'm a strong believer that the only way to really understand how a video platform works, how well-supported it is and how well-matched it is to the content provider's needs is to vigorously test drive it. Hands-on use reveals how comprehensive a platform really is, or how comfortable its work flow is, or how well its APIs work. While I get a lot of exposure to the various platforms through the demos I experience and the questions I ask, I'll readily concede this is not the same as actually living with a platform day-in and day-out.

Another complicating factor is that while there are some companies purely focused on video management and publishing, there are many others who offer some of these features, while positioning themselves in adjacent or larger markets. When I add these companies in, then the list of participants that most often hits my radar would include thePlatform, Brightcove, Ooyala, Twistage, Digitalsmiths, Delve, KickApps, VMIX, Grab Networks, ExtendMedia, Cisco EOS, Irdeto, KIT Digital, Kaltura, blip.tv, Magnify.net, Fliqz, Gotuit, Move Networks, Multicast Media, WorldNow, Kyte, Endavo, Joost, Unicorn Media and Episodic (apologies to anyone I forgot). Again though, this list combines apples and oranges; some of these companies are direct competitors, some are partners with each other, some have a degree of overlap and so on.

There's a long list of platforms to choose from, yet I suspect the list will only get longer as online and mobile video continues to grow and mature. At the end of the day, who survives and succeeds will depend on having the best products, pricing the most attractively and actually winning profitable business.

What do you think? Post a comment now.

Categories: Technology

Topics: Brightcove, Cisco EOS, Delve, Digitalsmiths, ExtendMedia, Grab Networks, Irdeto, KickApps, Ooyala, thePlatform, Twistage, VMIX

-

2 Complimentary Upcoming Webinars

I'll be participating in 2 complimentary upcoming webinars that will be of interest to VideoNuze readers.

First, this Thurs, Sept. 23rd, Colin Dixon, Senior Partner at The Diffusion Group and I will present "The Terror of Terminology: Demystifying Broadband TV." Colin is a savvy broadband analyst, with whom I often compare notes on the market. We've both been hearing similar types of questions in the market, so we've decided take on 5-6 items and address misunderstandings that linger.

We'll discuss the difference between "broadband TV" and "Internet TV," whether online video ads can support long-form premium content, why so many cable programs are available online, but so few cable programs are, what's the difference between hybrid set-top boxes and Internet set-top boxes, and why TV Everywhere is so significant. Expect a fun and educational conversation, with plenty of time for audience Q&A. Learn more and register.

Then on Wed, Sept. 30th I'll be participating in a Brightcove-sponsored webinar, "New Video Distribution Strategies - Taking Video Beyond the PC." Other speakers include Chris Little, Technology Director at Brightcove and Rich Ezekial, Director of Strategic Partnerships, Connected TV, Yahoo. Accessing online video on other devices like TVs and smartphones is one of the hottest areas of the broadband video landscape, and we'll be digging in to key trends, best practices and monetization opportunities. In particular, we'll hear specifics about Yahoo's Connected TV strategy. Learn more and register.

I look forward to seeing you on one or both of these exciting webinars!

Categories: Events

Topics: Brightcove, The Diffusion Group, Webinars, Yahoo

-

2 Complimentary Upcoming Webinars

I'll be participating in 2 complimentary upcoming webinars that will be of interest to VideoNuze readers.

First, on Thurs, Sept. 24th, Colin Dixon, Senior Partner at The Diffusion Group and I will present "The Terror of Terminology: Demystifying Broadband TV." Colin is one of the smartest broadband analysts around, and we periodically compare notes on the market. In an effort to clarify some of the confusion we continually hear around certain terminology in the market, we're going to discuss 5-6 different concepts and try to clear away the fog. Expect a fun and educational conversation, with plenty of time for audience Q&A. Learn more and register.

Then on Wed, Sept. 30th I'll be participating in a Brightcove-sponsored webinar, "New Video Distribution Strategies - Taking Video Beyond the PC." Other speakers include Chris Little, Technology Director at Brightcove and Rich Ezekial, Director of Strategic Partnerships, Connected TV, Yahoo. Accessing online video on other devices like TVs and smartphones is one of the hottest areas of the broadband video landscape, and we'll be digging in to key trends, best practices and monetization opportunities. In particular, we'll hear specifics about Yahoo's Connected TV strategy. Learn more and register.

I look forward to seeing you on one or both of these exciting webinars!

Categories: Events

Topics: Brightcove, TDG, Yahoo

-

Will Kaltura's Open Source Video Platform Disrupt the Industry?

This morning Kaltura takes the wraps off its "Community Edition" open source video platform, available as a free download, thereby threatening to disrupt its established proprietary competitors (e.g. Brightcove, thePlatform, Ooyala, Digitalsmiths, Fliqz, Delve, VMIX, etc.). Yesterday Kaltura's CEO Ron Yekutiel explained open source and Community Edition's opportunity. Later in the day I spoke to executives at many of its competitors to get their take what impact open source will have on the video platform market.

As a quick primer, open source isn't a novelty; it's a standard way that certain kinds of software are now developed. Successful companies like Red Hat have been built around open source. In fact many of today's web sites run on the open source software stack commonly known as "LAMP" - Linux (OS), Apache (web server), MySQL (database) and Perl/PHP/Python (scripts). Kaltura has been pioneering open source in the video platform industry which has been dominated by proprietary competitors. Ron believes the video platform industry is ripe for open source success because it has too many proprietary companies offering minor feature differences, all using a SaaS model only and competing too heavily on price.

Kaltura Community Edition's three big differentiators are that it's free for the base platform and offers greater control through self-hosting which can be behind the customer's firewall. Ron also believes that by tapping

into the open source community, CE can offer more flexibility and extensibility than its competitors.

into the open source community, CE can offer more flexibility and extensibility than its competitors. As with all open source options though, free isn't "free," because if you're interested in support and maintenance, professional services for customization and certain features like syndication, advertising, SEO and content delivery, these all cost extra. And you can't forget about the costs of the internal staff you'd need to run the video platform or the costs of the infrastructure itself (servers, bandwidth, storage, etc.). In the SaaS world, many of these costs are borne by the provider and then reflected in the monthly fee. Determining which approach is more cost-effective depends on your particular circumstances and needs.

All of this is why, as one competitor's CEO told me yesterday, the choice to go open source more often than not isn't primarily price-based; rather it's features-based. In fact, given the range of low cost proprietary alternatives (e.g. $100-$200/mo packages from companies like Fliqz and Delve), even free doesn't represent really significant savings.

When it comes to features, clearly the ability to download CE and self-host is a big differentiator, and will be valued by segments of the market. As Ron pointed out, there are government agencies, universities and others who have mandates to self-host. He also noted that by customers' gaining access to CE's code, their ability to integrate with other applications and customize is enhanced (though again, not without an additional cost).

Other industry executives countered that unless you have to self-host, these advantages are diminished by the fact that in this capex and opex budget constraints make SaaS more appealing than ever, especially for smaller customers with less in-house technical expertise. They added that they're rarely asked about self-hosting options (though that could well be due to self-selection).

Further, many of the leading video platform companies offer a slew of APIs, which open their platforms to 3rd party developers without needing to be open source per se (examples include Brightcove's and thePlatform's robust partner programs). Another industry CEO noted that while there's a gigantic and highly active open source community in the LAMP world, it remains to be seen just how vibrant it is in the video space. And it's important to remember that the intense competition among today's video platforms have already driven the feature bar quite high.

So the question remains: will Kaltura's CE open source approach truly disrupt the video platform industry, causing rampant customer switching and gutting today's pricing models? My sense is no, or at least not immediately. Instead, Kaltura will definitely grow the market, creating new video customers from those who have been dissatisfied with current choices or have not yet jumped into video, but inevitably will. CE will likely peel away some percentage of existing proprietary customers who have been eager for a self-hosted, open source alternative. For many others though, they'll be keeping an eye on open source and will successfully push their existing providers to adopt similar capabilities if they're valued.

What do you think? Post a comment now.

Categories: Technology

Topics: Brightcove, Delve, Digitalsmiths, Fliqz, Kaltura, Ooyala, thePlatform, VMIX

-

Brightcove and Qik Partner

Brightcove and Qik are announcing a partnership this morning that further fuses the broadband and mobile video worlds. Under the partnership Qik users will be able to distribute their mobile-recorded video through Brightcove players if they have a Brightcove account. For Brightcove customers the deal will enables mobile recording as a new source of video into their catalogs.

Qik's client is one of a number of options for mobile video recording and uploading. As I wrote yesterday regarding the iPhone's new video recording capabilities, mobile video capture (and eventually full-featured editing) is poised to become a big activity, implying that few spontaneous significant live events will go unrecorded. We will see additional partnerships like Qik-Brightcove as mobile recording becomes a key source for content providers distributing video over both broadband and mobile.

Categories: Mobile Video, Partnerships, Technology

Topics: Brightcove, Qik

-

Origin Digital's New Business TV Solution is Like Hulu-for-the-Enterprise

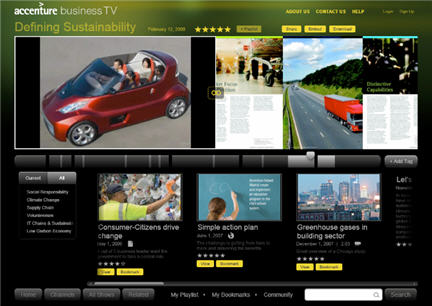

Switching gears a bit, lately it has become apparent to me that broadband video is not just proliferating for consumers, it is also beginning to change how businesses communicate with their constituencies. As people spend more of their time watching video at sites like YouTube, Hulu and others, it was probably inevitable that businesses would embrace video as well. This is the context for Origin Digital's new business TV solution, which can be thought of as a "Hulu-for-the-Enterprise" solution. Origin's Darcy Lorincz recently walked me through their strategy and showed me a demo at NAB.

Origin has been managing large scale corporate video events for 10+ years, and was recently acquired by Accenture. With the business TV solution it is leveraging that experience and its relationships to present a one stop solution for companies to communicate their messages. The solution is a hosted white-label video content management system, player, customizable UI/template and social media features, rolled into one. In a sense the business TV solution turns enterprises into video publishers presenting TV-like experiences.

Origin's goals are to help companies improve on how key messages and information are communicated to constituencies and save on face-to-face meetings and travel budget. Darcy explained how Accenture itself has used the business TV solution to build 11 internal "channels." The most active is for human resources, a crucial function in a professional services firm with offices worldwide.

In the HR channel I saw, supporting written materials are still available (with some neat zooming options) and they are arranged alongside relevant videos. Topics include HR policies and procedures, training classes offered, company updates, etc. The business TV solution can also integrate with existing ERP and SAP resources. Other channel examples are executive communications, marketing, sales, investor relations, etc. Users can save specific videos, create playlists, embed, download, share and comment.

Of course, to make use of something like this presupposes that the company has a library of video assets, and/or is ready to commit to shooting ongoing video. Darcy said feedback it has received suggests that a lot of big companies already have lots of video; the problem is there's been no easy way to organize and present it. Further, with the cost of producing high-quality video becoming cheaper and more available through companies like TurnHere and StudioNow, this will become less of any issue over time. Still, it's a paradigm change that will take time to adjust to.

Interestingly, Origin's is just one of many business-focused initiatives hitting my radar. Brightcove told me recently that they've set up a group focused on non-media (i.e. business/government/education) sectors which is getting traction. KickApps has also shared with me they've seen an uptick in corporate communications interest, with an emphasis on social media/interactivity (Alcatel Lucent's Network Cafe is an example). Lastly, a consumer-oriented video platform company recently explained to me confidentially that they're planning a full shift of their model to support business video.

If you happen to be going to next week's All Things D conference, Origin will be demo'ing its business TV solution. If not, there's a pretty good overview video here. Between it and all of these other business-focused initiatives, there could be a lot of Hulu-like activity coming soon.

What do you think? Post a comment now.

Categories: Business Apps

Topics: Accenture, Brightcove, Business TV, KickApps, Origin Digital

-

Adap.tv Launches Player Partner Program

The ad management company Adap.tv has taken the wraps off its new "Player Partner Program" this morning. Initial partners include Brightcove, thePlatform, Mogulus, VMIX, Twistage and Kaltura. All are now integrated with Adap.tv's "OneSource" ad management system.

Yesterday, Dakota Sullivan, Adap.tv's VP of Marketing told me that though the company has been working with Brightcove and thePlatform informally to date, the new program will provide more structure to partners. Included are a central location on the Adap.tv web site for partners for promotional purposes along with other co-marketing and technology updates. No cash is changing hands with partners though, as Adap.tv tries to maintain neutrality.

These types of partnership programs are springing up all around the broadband video ecosystem, as companies continue to carve out their specific niches, and seek to benefit from partners' marketing efforts in a resource-constrained environment. I expect we'll continue to see them get rolled out.

Categories: Advertising, Partnerships

Topics: Adap.TV, Brightcove, Kaltura, Mogulus, thePlatform, Twistage, VMIX

-

HD and Convergence Themes Pick Up Steam at NAB Show

Two highly related broadband video themes - HD delivery and convergence between broadband and TV - are both picking up steam at this week's NAB show. Among the key announcements are:

Adobe extending Flash into digital home devices

Move Networks acquiring Inuk Networks (announced just this morning)

Akamai detailing HD monetization opportunities in new white paper with IDC

Microsoft releasing "Smooth Streaming" HD delivery feature in its IIS Media Services

Limelight supporting Microsoft's IIS and Adobe Flash Media Server 3.5

CDNetworks commercially deploying first Adobe Flash Media Server 3.5 for first time

And separate from the show, TiVo and Roku supporting Amazon VOD HD titles

The entire broadband video ecosystem is getting more and more focused on both HD delivery and convergence. However, the former, which is primarily an infrastructure upgrade, is easier to execute on than the latter, which almost always requires users to buy and install some new device (either single or multi-purpose). Given the lousy economy and natural replacement cycles, this means that for many users, those gorgeous online HD experiences will be viewed on their computers for some time to come.

I think that's actually OK though. By proliferating online HD delivery, users will increasingly be getting a taste of what would be available to them if their broadband was connected to their TVs. Further, plenty of early adopters will become evangelists, showing off online HD experiences for their friends and families. Making things more tangible will help create the necessary promotional tailwind that convergence devices need to succeed.

Convergence has been a long time in coming, but the elements are now beginning to fall into place. I believe that the more HD content that's available online, the faster the convergence device market will develop.

What do you think? Post a comment now.

Topics: Adobe, Amazon, Brightcove, CDNetworks, Limelight, Microsoft, Move Networks, Roku, TiVo

-

Brightcove Executive and Board Updates, '08 Review

Brightcove is announcing some significant executive and board additions today and also posting a review of its '08 progress. On the executive front, Jeff Whatcott (formerly at Adobe and Acquia) is coming on as SVP

of Marketing, replacing Adam Berrey, who's been in the role from the company's inception. Mike Quinn (formerly at FAST) is joining as SVP, Sales for the Americas. And David Mendels (formerly at Adobe) and Deb Besemer (formerly at Lotus and BrassRing) are joining the company's board of directors.

of Marketing, replacing Adam Berrey, who's been in the role from the company's inception. Mike Quinn (formerly at FAST) is joining as SVP, Sales for the Americas. And David Mendels (formerly at Adobe) and Deb Besemer (formerly at Lotus and BrassRing) are joining the company's board of directors.As for '08, CEO Jeremy Allaire's letter to customers (posted here) provides the following highlights:

- Launch of Brightcove 3, the updated version of the company's platform

- International expansion with a new office in Germany and formation of a Japanese subsidiary

- Launch of Brightcove Alliance, the ecosystem of 100+ partners (see VideoNuze related post)

- Triple digit revenue growth for third consecutive year

- Plan to reach profitability in '09

As the video management/publishing platform company that has raised the most funding, many in the industry continue to focus on Brightcove as a key indicator of the market's health. With economic and ad spending pressure everywhere, their 2009 progress will be closely watched.

What do you think? Post a comment now.

Categories: People, Technology

Topics: Brightcove

-

Brightcove Alliance Launches

Brightcove is unveiling "Brightcove Alliance" today, a wide-ranging ecosystem of technology, distribution and solution partners who have integrated with and/or are building applications on the the company's platform. Jeremy Allaire, Brightcove's CEO briefed me last week.

As he explained it, Brightcove 3, the recently released, latest generation of the company's platform,

represented a new push on openness and extensibility which are the key requirements for building out an ecosystem. Alliance partner benefits include platform APIs, training, support and improved access to Brightcove's long list of content provider customers through pre-built integrations.

represented a new push on openness and extensibility which are the key requirements for building out an ecosystem. Alliance partner benefits include platform APIs, training, support and improved access to Brightcove's long list of content provider customers through pre-built integrations. The company is announcing more than 80 partners today, covering just about every aspect of the broadband world. The press release includes supporting quotes from a dozen partners and customers and Jeremy added that many others expressed interest and will be included subsequently.

The only other large and formalized industry ecosystem I'm aware of is thePlatform's Framework program, which was announced last February and added to in September. It now totals over 60 companies and includes some overlapping names with Brightcove.

Having been involved in several alliance programs in the past, my take has always been that the litmus test for their success is whether they generate real revenue for partners. Too often what you get is the initial "Barney" press releases (i.e. "I love you, you love me") but little more in the way of actual new business.

Brightcove has two advantages to help it avoid a similar trap: (1) a lengthy list of existing customers who will likely welcome pre-integrated partner products and services that can be easily and inexpensively accessed and (2) a large group of partners, who, given the lousy economy, will be aggressive in pursuing Brightcove to identify customer opportunities. Brightcove should capitalize on both to expand its market position.

What do you think? Post a comment now.

Categories: Partnerships, Technology

Topics: Brightcove, thePlatform

-

Giving Thanks and Keeping Perspective

If ever there was a year for giving thanks - and for trying to keep perspective - this is surely it. For the last several months or more, all of us have been buffeted by the economic meltdown to one extent or another. It isn't fun for anyone, and regrettably, if you believe the experts, things aren't going to turn around anytime soon.

Still, as I mentioned in last week's "Deflation's Risks to the Broadband Video's Ecosystem," for those of us who make our living focused in one way or another on broadband video, there are reasons to remain optimistic. Consumers continue to shift their behavior toward on demand, broadband-delivered alternatives. Clever entrepreneurs are introducing ever-more innovative technology-based products and services. Large pools of existing revenues are shifting around, in search of better, higher ROI ways to be allocated. And investors recognize all of this, motivating them to continue funding companies throughout the broadband ecosystem.

These are all things to be thankful for, and hopefully allow us to keep a little perspective. For those of us old enough to remember past downturns, it is also important to keep in mind that there have been difficult times in the past, and fortunately, eventually, things do correct. That doesn't relieve the current pain, but at least gives us a measure of hope for better days ahead.

Speaking of giving thanks, I want to give a shout out to the 30 companies that sponsored VideoNuze or its events in 2008. VideoNuze is just over a year old now, and I've been truly gratified by the support its received from both sponsors and the community of readers and participants.

VideoNuze is not immune from the economic meltdown, so I'd like to also mention that we're offering some great sponsorship specials going into '09. If you're interested in reaching a highly-targeted, broadband-centric group of senior decision-makers, VideoNuze is an outstanding value. I welcome your calls or emails.

Thanks to our '08 sponsors below. Happy Thanksgiving and see you on Monday.

ActiveVideo Networks, Adap.tv, Adobe, Akamai, Atlas Venture, Anystream (Grab Networks), Brightcove, ChoiceStream, Critical Media (Syndicaster), Digitalsmiths, ExtendMedia, EyeWonder, FAST Search & Transfer, Flybridge Capital Partners, Goodwin Procter, Gotuit, Jambo Media, KickApps, Kiptronic, Macrovision, Move Networks, Multicast Media, PermissionTV, Signiant, Silicon Valley Bank, thePlatform, Tremor Media, VMIX, WorldNow and Yahoo

Categories: Miscellaneous

Topics: ActiveVideo Networks, Adap.TV, Adobe, Akamai, Anystream (Grab Networks), Atlas Venture, Brightcove, ChoiceStream, D, Syndicaster

-

EveryZing's New MetaPlayer Aims to Shake Up Market

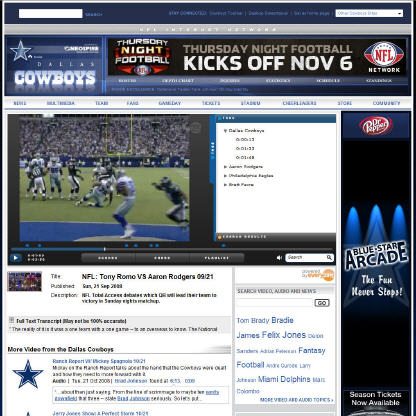

EveryZing, a company I wrote about last February, is announcing the launch of its MetaPlayer today and that DallasCowboys.com is the first customer to implement it. My initial take is that MetaPlayer should have strong appeal in the market, and could well shake things up for other broadband technology companies and for content providers. Last week I spoke to EveryZing's CEO Tom Wilde to learn more about the product.

MetaPlayer is interesting for at least three reasons: (1) it drives EveryZing's video search and SEO capabilities inside the videos themselves, (2) it provides deeper engagement opportunities than typically found in other video player environments and (3) it enables content providers to dramatically expand their video catalogs, while maintaining branding and editorial integrity.

To date EveryZing's customers have used its speech-to-text engine to create metadata for their sites' videos, which are then grouped into SEO-friendly "topical pages" that users are directed to when entering terms into the sites' search box. Speech-to-text and other automated metadata generating techniques from companies like Digitalsmiths are becoming increasingly popular as content providers continue to recognize the value of robust metadata.

MetaPlayer takes metadata usage a step further by creating virtual clips based on specified terms, which are exposed to the user. A user's search produces an index of these virtual clips, which can be navigated through time-stamped cue points, transcript review, and thumbnail scenes (see below for example). The virtual clip approach is comparable in some ways to what Gotuit has been doing and is pretty powerful stuff, as it lets the user jump to desired points, thus avoiding wasted viewing time (e.g. just showing the moments when "Tony Romo" is spoken)

Next, MetaPlayer enables deeper engagement with available video. Yesterday, in "Broadband Video Needs to Become More Engaging," I talked about how the importance of engagement to both consumers and content providers. MetaPlayer is a move in this direction as it allows intuitive clipping, sharing and commenting of a specific video clip within MetaPlayer. Example: you can easily send friends just the clips of Romo's touchdown passes along with your comments on each.

Last, and possibly most interesting from a syndication perspective, MetaPlayer allows content providers to dramatically expand their video offerings through the use of what's known as "chromeless" video players. I was first introduced to the chromeless approach by Metacafe's Eyal Hertzog last summer. It basically allows the content provider to maintain elements of the underlying video player, such as its ability to enforce a video's business policies (ad tags, syndication rules, etc.), while allowing new features to be overlayed (customized look-and-feel, consistent player controls, etc.).

MetaPlayer takes advantage of chromeless APIs available now from companies like Brightcove, and also importantly YouTube. For example, the Cowboys could harvest select Cowboys-related YouTube videos and incorporate them into their site (this is similar to what Magnify.net also enables). With the chromeless approach, the Cowboys's user experience and their video player's branding is maintained while YouTube's rules, such as no pre-roll ads are also enforced.

To the extent that chromeless APIs become more widely available, it means that syndication can really flourish. The underlying content provider's model is protected while simultaneously enabling widespread distribution. All of this obviously leads to more monetization opportunities through highly targeted ads.

Bottom line: EveryZing's new MetaPlayer addresses at least three real hot buttons of the broadband video landscape: improved navigation, enhanced engagement and expanding content selection/monetization. All of this should give MetaPlayer strong appeal in the market.

What do you think? Post a comment now!

Categories: Advertising, Sports, Syndicated Video Economy, Technology, Video Search, Video Sharing

Topics: Brightcove, Dallas Cowboys, Digitalsmiths, EveryZing, Gotuit, Magnify.net, MetaCafe, YouTube

-

Broadband Video Needs to Become More Engaging

Notwithstanding the countless times I've received emails with links to video clips or visited social networking pages where video is embedded, I've often had the sense that true social engagement around premium quality video has been lacking.

"Engagement" is one of those nebulous Internet words that can mean many things to different people. To me, the most appropriate online engagement opportunities should be modeled on how we have traditionally engaged with offline media. Some relevant offline examples that come to mind include recommending a movie to a friend, clipping a newspaper article to send to a colleague, chatting informally with friends and family during a TV show or sharing opinions about favorite actors and actresses over drinks.

As consumers shift their viewing to broadband, the key to engagement is to enable users to effortlessly and intuitively emulate some or all of these behaviors. I concede that's easier said than done. Yet in addition to existing efforts, I see new signs that premium video sites are starting to understand how strategic it is for them to incent user engagement. New steps are being taken to make deeper, more consistent engagement a reality, not just a goal.

For example, just yesterday CBS announced its "Social Viewing Rooms" which allow users to view programs together while commenting, interacting and finding each other (note this is something that Paltalk and others have pursued for a while). It wasn't clear from the announcement, but I think a critical success factor for CBS will be allowing users to bring existing friends (from Facebook, MySpace, etc.) into the rooms, rather than requiring new relationships to be built.

I found another example in a presentation I recently attended by Ian Blaine, thePlatform's CEO. In it, he made clear that his company is planning a big push into engagement-oriented features ranging from recommendations to ratings to social networking via sister company Plaxo. Still another initiative is "MediaFriends" a clever application that's coming soon from Integra5 which converges text messaging and social networking with viewing across multiple screens. Finally, another is from Volo Media, which is today announcing a plug-in for iTunes that allows one-touch sharing, bookmarking and more, helping open up a window from iTunes into the larger web environment.

All of these activities are in addition to other social media capabilities being brought to premium video from companies like KickApps, PermissionTV, Brightcove, Gotuit and Magnify.net. Then of course there's the steady migration of premium video into YouTube, which is the granddaddy of video sharing and social engagement.

Broadband is much more than an exciting new distribution outlet for video providers, it's also a whole new platform for extending social behaviors that are deeply valued and highly ingrained in all of us into the virtual world. Embracing opportunities for deeper engagement with and around premium video means thinking of viewers more as participants and less as passive audiences. When done right the payoffs in engagement, loyalty, viewing time and monetization will be substantial.

What do you think? Post a comment now!

Categories: Video Sharing

Topics: Brightcove, CBS, Gotuit, Integra 5, iTunes, KickApps, Magnify.net, PermissionTV, thePlatform, Volo Media

-

5 Updates to Note: Brightcove 3, Silverlight 2, Google-YouTube-MacFarlane, NBC-SNL-Tina Fey, Joost-Hulu

With so much going on in the broadband video world, I rarely get an opportunity to follow up on previously discussed items. So today, an attempt to catch up on some news that's worth paying attention to:

Brightcove 3 is released - Back in June I wrote about the beta release of Brightcove 3, the company's updated video platform. Today Brightcove is officially releasing the product. I got another good look at it a couple weeks ago in a briefing with Adam Berrey, Brightcove's SVP of Marketing. I like what I saw. Much more intuitive publishing/workflow. Improved ability to mix and match video and non-video assets in the way content is actually consumed. New emphasis on high-quality delivery to keep up with ever-escalating quality bar. Flexibility around video player design and implementation. And so on.

The broadband video publishing/management platform is incredibly crowded, and only getting more competitive. Brightcove 3 ups the ante further.

Silverlight 2 is released - Speaking of releases, Microsoft officially unveiled Silverlight 2 yesterday, making it available for download today. I was on a call yesterday with Scott Guthrie, corporate VP of the .NET developer Division, who elaborated on the details. NBC's recent Olympics was Silverlight 2 beta's big public event, and as I wrote in August, the user experience was seamless and offered up exciting new features (PIP, concurrent live streams, zero-buffer rewinds, etc.).

A pitched battle between Microsoft and Adobe is underway for the hearts and minds of developers, content providers and consumers. Silverlight has a lot of catching up to do, but as is evident from the release, it intends to devote a lot of resources. Can you say Netscape-IE or Real-WMP? This will be a battle worth watching.

Google and Seth MacFarlane are hitting a home run with "Cavalcade of Comedy" - A month since its debut, Google/YouTube and Seth MacFarlane seem to have hit on a winning formula at the intersection of video syndication, audience growth and brand sponsorship. On YouTube alone, the 10 short episodes have generated over 12.7 million views according to my calculations, while this TV Week piece quotes 14 million + when all views are tallied.

Last month, in "Google Content Network Has Lots of Potential, Implications" I wrote at length about how powerful GCN and YouTube could be for the budding Syndicated Video Economy, yet noted that the jury is still out on whether Google's really committed to GCN. "Cavalcade's" early success surely gives GCN some tailwind. (Btw, for more on Google/YouTube's myriad video initiatives, join me on Nov. 10th for the Broadband Video Leadership Breakfast Panel, which David Eun, the company's VP of Content Partnerships will be a panelist)

NBC/SNL and Tina Fey set a new standard for viral success - Tina Fey's Sarah Palin skits are hilarious and unlike anything yet seen in viral video. Usage is through the roof: a new study by IMMI suggests that twice as many people watched the skits online and on DVR than did on-air, while Visible Measures's data (as of 3 weeks ago!), shows over 11 million video views. SNL is smack in the middle of the cultural zeitgeist once again, with Thursday night specials and reports of a new dedicated web site in the mix.

To put in perspective how disruptive viral video can be to the uninitiated, several weeks ago I heard a pundit on CNN's AC360 dismiss the potential impact of the Fey skits on the election with a wave of his hand and a remark to the effect of "come on, how many people stay up that late to watch SNL really?" How's that for being out of touch with the way today's world really works? Political pros and other taste-makers should take heed - viral video can be a cultural tour de force.

Joost Flash version is here, finally - Remember Joost? Originally the super-secret "Venice Project" from the team that made a killing on KaZaA and Skype (the latter of which was acquired by eBay, permanently undermining former eBay CEO Meg Whitman's M&A acumen), Joost today is announcing its Flash-based video service. You might ask what took the company so long given this is where the market's been for several years already? I have no idea.

But here's one key takeaway from Joost's story: because of its lineage, the company was once regaled as the "it" player of the broadband video landscape. Conversely, Hulu, because of its big media NBC and Fox parentage, was dismissed by many right from the start. Now look at how their fortunes have turned. When your mom used to tell you "don't judge a book by its cover," she was right.

What do you think? Post a comment.

Categories: Aggregators, Broadcasters, Politics, Syndicated Video Economy, Technology

Topics: Brightcove, Google, Hulu, Joost, Microsoft, NBC, Saturday Night Live, Seth MacFarlane, Silverlight, YouTube

-

June '08 VideoNuze Recap - 3 Key Topics

Wrapping up a busy June, I'd like to quickly recap 3 key topics covered in VideoNuze:

1. Execution matters as much as strategy

I've been mindful since the launch of VideoNuze to not just focus on big strategic shifts in the industry, but also on the important role of execution. I'm not planning to get too far into the tactical weeds, but I do intend to show examples where possible of how successful execution can make a difference. This month, in 2 posts comparing and contrasting Hulu and Fancast (here and here) I tried to constructively show how a nimble upstart can get a toehold against an entrenched incumbent by getting things right.

While great execution is a key to successful online businesses, it may sometimes feel pretty mundane. For example, in "Jacob's Pillow Uses Video to Enhance Customer Experience" I shared an example of an arts organization has begun including video samples of upcoming performances on its web site, improving the user experience and no doubt enhancing ticket sales. A small touch with a big reward. And in this post about the analytics firm Visible Measures, I tried to explain how rigorous tracking can enhance programming and product decisions. I'll continue to find examples of where execution has had an impact, whether positive or negative.

2. Cable TV industry impacted by broadband

As many of you know, I believe the cable TV industry is a crucial element of the broadband video industry. Cable operators now provide tens of millions of consumer broadband connections. And cable networks have become active in delivering their programs and clips via broadband. Yet the broadband's relationships with operators and networks are complex, presenting a range of opportunities and challenges.

On the opportunities side, in "Cable's Subscriber Fees Matter, A Lot," I explained how the monthly sub fees that networks collect put them on a firm financial footing for weathering broadband's changes and an advantageous position compared to broadband content startups which must survive solely on ads. Further, syndication is offering new distribution opportunities, as evidenced by Scripps Networks syndication deal with AOL in May and Comedy Central's syndication of Daily Show and Colbert Report to Hulu and Adobe. Yet cable networks are challenged to exploit broadband's new opportunities while not antagonizing their traditional distributors.

For operators, though broadband access provides billions in monthly revenues, broadband is ultimately going to challenge their traditional video subscription business. In "Video Aggregators Have Raised $366+ Million to Date," I itemized the torrent of money that's flowed into the broadband aggregation space, with players ultimately vying for a piece of cable's aggregation revenue. These and other companies are working hard to change the video industry's value chain. There will be a lot more news from them yet to come.

3. Video publishing/management platforms continue to evolve

Lastly, I continued covering the all-important video content publishing/management platform space this month, with product updates from PermissionTV, Brightcove and Entriq/Dayport. Yesterday, in introducing Delve Networks, another new player, I included a chart of all the companies in this space. I put a significant emphasis on this area because it is a key building block to making the broadband video industry work.

These companies are jostling with each other to provide the tools that content providers need to deliver and optimize the broadband experience. The competitive dynamic between these companies is very blurry though, with each emphasizing different features and capabilities. Nonetheless, each seems to be winning a share of the expanding market. I'll continue covering this segment of the industry as it evolves.

That's it for June; I have lots more good stuff planned for July!

Categories: Aggregators, Cable Networks, Cable TV Operators, Technology

Topics: AOL, Brightcove, Comedy Central, Delve, Entriq, Fancast, Hulu, Jacobs Pillow, PermissionTV, Scripps, Visible Measures

-

Overview of New Brightcove 3 Beta Release

Today Brightcove is announcing the beta version of its Brightcove 3 platform. Last week CEO/Founder

Jeremy Allaire briefed me on what he called a "pretty dramatic new version of the platform." There are three new areas:

Jeremy Allaire briefed me on what he called a "pretty dramatic new version of the platform." There are three new areas:1. Contextualization - Brightcove is changing how its customers display their video from the current standalone video player/index environment to one where the player window is embedded within in an HTML page with surrounding contextual content and ads. In tests it has done, Brightcove has found that, no surprise, integrating the video window results in more video and page views. Also by surfacing video in context, it enhances search engine optimization. This is similar to EveryZing's SEO-focused approach. (see my profile). Brightcove has new APIs that work with existing content management systems to match relevant non-video content.

2. Dynamic delivery - Brightcove is upping its emphasis on high-quality long-form content by introducing a dynamic delivery feature that modulates the quality of the video delivered based on detection of the user's bandwidth. This adaptive bit rate streaming idea was pioneered by Move Networks and allows on-the-fly video file delivery adjustments. Brightcove is doing this on top of Flash with no new plug-in required by users. It will also automatically generate various encoded files for customers.

3. Producer tools overhaul - Brightcove is updating the back-end work flow tools that its customers' producers use, so they can more quickly do things like upload large video files, create tags, generate business rules, transcode files and so forth. Jeremy demo'd it for me; it's a complete drag and drop environment that looked pretty straightforward.

All-in-all these look like positive steps. Since Brightcove had invested heavily in its earlier versions, I give them credit for emphasizing continuous improvement and not sitting still. Brightcove 3 is in beta (Showtime is one site that's already using it) with wider deployment in the fall. Jeremy added that other updates are expected then too. I pried out of him that these will include monetization and distribution/syndication among others.

Categories: Technology

Topics: Brightcove, EveryZing, Move Networks, Showtime

-

Anystream Lands Hearst-Argyle and Brings New Competition in Video Management Space

Anystream, a long-time player in video transcoding, is announcing that its Media Lifecycle Platform has been implemented by 11 of Hearst-Argyle's 29 owned and operated TV stations.

The move suggests even more vigorous competition is coming to the video management/publishing space where players like thePlatform, Brightcove, Maven, ExtendMedia, PermissionTV, Akamai (StreamOS), WorldNow and others have focused.

I sat down with Anystream (note, a periodic VideoNuze sponsor) president Bill Holding and founder/chairman Geoff Allen recently to learn more about their expansion strategy.

Anystream is well-known in the digital media space as it Agility transcoding platform is deployed in over 700 companies. Leveraging this base of relationships and its knowledge of customers' work flows, Anystream is

now "moving north" by focusing on the video management layer. The core technology comes from Anystream's 2007 acquisition of Cauldron Solutions, which has been built out, renamed as Velocity and integrated with Agility.

now "moving north" by focusing on the video management layer. The core technology comes from Anystream's 2007 acquisition of Cauldron Solutions, which has been built out, renamed as Velocity and integrated with Agility. Anystream's new, broader positioning rests on its belief that the video "Produce-Manage-Monetize" lifecycle elements are deeply linked, and that ultimately a comprehensive, integrated solution will be prized by media companies serious about scaling their broadband video businesses. At the manage layer specifically, Velocity focuses on rights, scheduling, packaging, syndication and asset tracking.

Anystream believes metadata it gains access to, at the start of the video lifecycle through its transcoding role, is a unifying value driver in the video management and monetization phases.

Hearst-Argyle clearly saw the benefits of this approach, citing Anystream's metadata management as opening up new content re-use opportunities and creating competitive advantage. In the press release, Joe Addalia, H-A's director of technology projects, said H-A has cut its production and distribution to online channels "from 30 minutes to 3 1/2 minutes."

I continue to be impressed with how many companies are staking a claim in the broadband video management/publishing space. I'm constantly trying to discern the real competitive differentiators that separate industry players. Like many of you, I often find the landscape quite blurry, with overlapping capabilities. Each player tends to cite its traditional competencies as being the best building blocks from which to build a full scale management/publishing platform.

While it's tempting to say "they can't all be right," the fact that so many players are finding market success today indicates that content owners are not monolithic in their specific requirements and that a giant game of matchmaking seems to be occurring between content owners and video management providers. One day there may be a consensus on who truly has the "best" management platform, but for now that day seems to be far off.

What do you think? Post a comment and let us all know!

Categories: Broadcasters, Technology

Topics: Akamai, Anystream, Brightcove, ExtendMedia, Hearst-Argyle, Maven, PermissionTV, thePlatform, WorldNow

-

Brightcove Partners for Enhanced Video Syndication

The broadband video market's focus on content syndication continued this morning as Brightcove, a

leading video management platform, announced partnerships with Bebo, Meebo, RockYou, Slide and Veoh.

leading video management platform, announced partnerships with Bebo, Meebo, RockYou, Slide and Veoh. Enabling managed syndication is becoming an imperative for video management platforms like Brightcove as customers increasingly seek to proliferate their content to multiple distributors. In particular, social networks like Bebo and others are prime syndication targets. They have huge and highly engaged users who can drive huge volumes of video streams.

However, syndication raises a host of new operational issues, which in turn creates an opportunity for companies like Brightcove to add value to their platforms. Issues include rights management, monetization, tracking/reporting, business model implementation and others. Syndication is an exciting new push for many, but is already starting to pay off. One recent example is CBS Television Stations, which now derives more than 50% of its total monthly streams just through its syndication deal with Yahoo.

(Note: Brightcove is a VideoNuze sponsor)

Categories: Partnerships, Syndicated Video Economy, Video Sharing

Topics: Bebo, Brightcove, Meebo, RockYou, Slide, Veoh