-

Google Fiber To Expand To A Second City; But If It's Not A "Hobby," Then What Is It Exactly?

Google announced late yesterday plans to extend its Google Fiber service to a second city, Olathe, KS (population 125,000), in Johnson County, about 30 minutes from Kansas City, where Google Fiber has been initially deployed. With the news, the question once again arises, if Google Fiber isn't a "hobby" (as Google executives recently stated), then what is it exactly? And by extension, what are its real implications for broadband ISPs, consumers and over-the-top video?

Categories: Broadband ISPs

Topics: Google Fiber, Time Warner Cable

-

L.A.'s Non Sports Fans Will Pay At Least $6 Billion to Subsidize New Sports Network

Last week, when Time Warner Cable and the L.A. Dodgers sealed a deal creating a new regional sports network to carry the team's games, the Dodgers' CEO Stan Kasten released a statement that read in part, "Our fans deserve the best - the best players, the best baseball and the best experience - whether that's at the newly renovated Dodger Stadium or on television."

That's a wonderful aspiration, but there's one significant problem with it: the reality is that non-fans (or at least those that don't tune in regularly to watch the team play) will be paying the lion's share for all of these "bests." Given the reported terms of the new Time Warner Cable - Dodgers deal, by my calculations, the non-fans' tab could amount to a staggering $6 billion over the life of the deal, making it the single biggest non-fan "tax" the pay-TV world has yet tried to assess on beleaguered non-sports fans.Categories: Cable Networks, Sports

Topics: LA Dodgers, Time Warner Cable

-

Digitalsmiths Lands Time Warner Cable and i.TV for Personalized Video Discovery; Now Topping 1 Billion Transactions/Mo

Digitalsmiths has announced deals this morning to power personalized video search and discovery across all platforms for Time Warner Cable, and for i.TV, the TV guide app for iPhone/iPad, Nintento Wii U, AOL, Huffington Post and others.

Ben Weinberger, Digitalsmiths CEO, also told me this morning that the company's "Seamless Discovery" technology is now powering over 1 billion transactions per month, which consist of user requests for search, recommendations and other data. At this level, Ben believes Digitalsmiths is now the largest provider of search and recommendations in North America, its main geographic customer area.Categories: Cable TV Operators, Technology, Video Search

Topics: Digitalsmiths, i.TV, Time Warner Cable

-

Scrappy Roku Makes More Deals, Keeps Elbowing Its Way Into the Big Leagues

You gotta love Roku. In the insanely competitive world of consumer devices - where the big boys like Microsoft, Google, Apple, Amazon, Samsung, Sony and others have enormous retail, financial and existing customer base advantages - little Roku just keeps on cranking out inexpensive, yet solid products, meaningful partnerships and scads of content deals, establishing itself as a leader in the connected TV space.

The latest evidence of Roku's momentum are two announcements at CES today; first, that it has signed up another 6 "Roku Ready" TV manufactures as partners whose models can accept the company's "Streaming Stick" device and second, that it has signed new video channel partners Blockbuster on Demand, Dailymotion, DISHWorld, Flingo, Fox Now, PBS, PBS Kids, Syfy and VEVO. All of these channels bring to 700 the number of video and audio choices in the Roku Channel Store, a breadth that easily rivals - though is clearly distinct from - today's pay-TV services.Categories: Cable TV Operators, Devices, TV Everywhere

Topics: Roku, Time Warner Cable

-

DirecTV CEO: "Regional Sports Networks' Structure Is Broken"

Talk to any pay-TV operator executive these days and you'll get an earful on the relentless rise in their programming costs - what they pay to deliver both cable and broadcast TV networks into their subscribers' homes. Programming costs drive up subscribers' rates, in turn exacerbating pay-TV's affordability crisis, which in turn exposes the industry to cord-cutting, cord-shaving and over-the-top alternatives.

As I've written numerous times, scratch the surface of the programming cost issue and the focus quickly turns to sports networks and more specifically Regional Sports Networks ("RSNs") which have the geographic rights to air their local professional teams' games. One pay-TV executive who's attempting to take a hard line on RSNs' escalating costs is Michael White, CEO of DirecTV, who, on the company's earnings call on Tuesday, once again said that "regional sports networks' structure in the industry is broken" and that "we are taxing most of our customers who wouldn't be willing to pay for that content."Categories: Cable Networks, Satellite, Sports

Topics: DirecTV, LA Lakers, Time Warner Cable

-

VideoNuze-TDG Podcast #148 - Microsoft Hires CBS Vet; TWC Open to Apple TV; In-Flight WiFi and VOD

Colin Dixon, senior partner at The Diffusion Group and I are back for the 148th edition of the VideoNuze-TDG podcast.

First up this week we discuss Microsoft hiring former CBS Entertainment executive Nancy Tellem to develop original content for the Xbox platform and other devices. Colin thinks it's a odd choice because of the apparent mismatch between the type of programming CBS has excelled at vs. the type of programming that will likely resonate with Xbox owners. In particular, Colin notes that 40% of Xbox owners are age 18-24, whereas Nielsen has found that CBS's average viewer's age is 55. Clearly Microsoft is betting that Ms. Tellem can extend her significant programming skills to different formats, audiences and devices.

Speaking of confusing, we then turn our attention to comments that Time Warner Cable's COO Rob Marcus made this week in reference to the company potentially working with Apple on a set-top box. On the one hand he said that TWC is "open to giving up control of the user experience" to new devices, but on the other, that this does not mean it is willing "to give up the customer relationship." Both Colin and I find the two objectives at odds with one another, particularly when introducing a UI powerhouse like Apple into the living room. As I wrote a couple of weeks ago, if cable operators partner with Apple and its set-top, it will be akin to allowing the fox into the henhouse. We know how that story ended.

Lastly, as frequent flyers, both of us were excited to read about Delta's new in-flight VOD plans, and JetBlue's forthcoming high-speed WiFI rollout. We discuss implications briefly.

Listen in to learn more!

Click here to listen to the podcast (20 minutes, 20 seconds)

Click here for previous podcasts

The VideoNuze-TDG Report podcast is available in iTunes...subscribe today!Categories: Cable TV Operators, Devices, Indie Video, Podcasts

Topics: Apple, Delta Air Lines, JetBlue, Microsoft, Podcast, Time Warner Cable

-

Time Warner Cable's Strategy Head On Embracing the "4 Any's" of Content Distribution [VIDEO]

Peter Stern, Chief Strategy Officer of Time Warner Cable, the second-largest cable operator in the U.S., spent time with me at the recent Cable Show, explaining a concept guiding the company's content distribution strategy he calls the "4 Any's." This refers to any content, any device, any time and anywhere. In the interview, Peter discusses how TWC is executing against each of the 4 any's and why they're so important.

In particular, Peter notes that all 255 linear cable networks TWC carries are now available for streaming within subscriber homes to certain devices. Next up is layering on VOD and out-of-home access. Peter talks about the roles of TWC's app for aggregated viewing experiences vs. how "super-fans" will gravitate to the networks' own apps (e.g HBO GO, WatchESPN, etc.).

Beyond content distribution, Peter also describes the strategy behind "CableWiFi," a new roaming collaboration announced at the Cable Show among 5 cable operators, totaling 50K hotspots nationwide (note WiFi usage is uncapped, which TWC believes is a real differentiator relative to wireless services) as well as why business services is a growing part of TWC's services portfolio. Watch the interview (7 minutes, 34 seconds).Categories: Cable TV Operators

Topics: Time Warner Cable

-

Time Warner Cable Promoting WatchESPN App for Wimbledon Viewing

Time Warner Cable is sending the below email to subscribers promoting the WatchESPN app for anytime/anywhere Wimbledon viewing. The email is the first consumer-facing example I've seen of a cable operator promoting a specific cable programmer's TV Everywhere app.

The email's copy hits the right messages nicely, emphasizing free access for existing Digital TV customers, anytime/anywhere/anyplace access on mobile devices and tablets, and easy app download instructions. The email is a winner in terms of getting the message out that TWC understands its subscribers' new viewing expectations and that it delivering a service that meets them.

Categories: Cable Networks, Cable TV Operators, Sports

Topics: ESPN, Time Warner Cable, Wimbledon

-

Forget Cord-Cutting, Greed May Destroy the Cable Industry

For all the ink that's been spilled over the past year about consumer-driven cord-cutting leading to the demise of the cable industry, could it instead end up that greed will cause the industry's own destruction? Maybe so. With the fracas over Time Warner's iPad app reaching ridiculous new levels each week, the industry is experiencing its own version of the old adage "We have met the enemy and he is us."

Yesterday's turn of events - Time Warner Cable seeking a declaratory judgment from the U.S. District Court that it has the contractual rights to stream cable programming to its iPad app inside subscribers' homes, and Viacom responding with its own suit against Time Warner Cable - represent a dangerous breakdown in key industry relationships at a time when competitive forces loom larger than ever.

Categories: Cable Networks, Cable TV Operators, Devices

Topics: Discovery, iPad, Scripps, Time Warner Cable, Viacom

-

Time Warner Cable iPad App Disrupting the Cable Industry

It's been less than 2 weeks since Time Warner Cable announced its iPad app, but the fur has been flying ever since. In the WSJ's latest coverage today, it details how TWC is continuing to insist that its contracts with cable networks give it the right to stream their linear channels to iPads in subscribers' homes. Conversely, multiple network groups, including Scripps, Viacom and Discovery have disagreed, leading to an increasingly public internecine industry fight.

Categories: Cable Networks, Cable TV Operators, Devices

Topics: Discovery, iPad, Scripps, Time Warner Cable, Viacom

-

Adobe Pass Boosts Cable Networks' TV Everywhere Role

Adobe is announcing a new service this morning called Adobe Pass, which is intended to streamline how pay-TV subscribers gain access to authenticated premium content online. While Adobe Pass offers a key benefit to users in the ability to have "single sign-on" across multiple devices and web sites, a more critical upside is that with Adobe Pass, cable networks gain far greater control over their relationships with viewers as TV Everywhere efforts ramp up. In this respect Adobe Pass is a potentially significant building block in helping make TV Everywhere a reality. Todd Greenbaum, senior product manager at Adobe, briefed me earlier this week.

First, from a technical perspective, Adobe Pass looks like a pretty elegant solution that positions it well to be the glue that hold TV Everywhere authentication together. The idea is that when a user visits a content provider's web site they'll still see freely available content, but they'll now also see some that is for paying subscribers only (see TNT example below). If the site has added the Adobe Pass software, then when the user clicks on the authenticated content, a selection of pay-TV operators who have integrated the Adobe Pass API will appear (currently Comcast, Cox, DISH and Verizon are all on board). The user selects their pay-TV provider and is then asked for the user name and password they use with their pay-TV operator.

Categories: Cable Networks, Cable TV Operators, Technology

Topics: Adobe, Time Warner Cable

-

Will Cable TV Networks Kill Their Golden Goose?

I've been dismayed, though not entirely surprised, by reactions from cable TV networks over the launch of Time Warner Cable's new iPad app earlier this week. A pair of articles, in Adweek and the WSJ summarize various networks' protestations about the new iPad app, namely that it is an unauthorized use of their content by Time Warner Cable, per their interpretations of their affiliation agreements with TWC.

That may well be the case, and TWC may well be pushing the edge of the envelope in this implementation of its larger TV Everywhere goals. However, in my opinion the bigger question that cable network heads should be asking themselves is whether, by resisting initiatives such as these, they want to risk contributing to killing their golden goose, or whether they want to do their part in helping usher in the future? What they decide to do is at the heart of what role the pay-TV industry will play in the online video era.

Categories: Cable Networks, Cable TV Operators, Devices

Topics: iPad, Time Warner Cable

-

Disney Has Religion on Digital, ESPN Is At the Core

Disney held its annual investor day yesterday, and as usual, technology, and the opportunities it creates for the company, was at center stage. Disney introduced a new initiative called "Disney Studio All Access" providing a central location for consumers to securely access the company's range of content. Though details were sketchy, key to the plan is more flexible consumer ownership and multi-device playback. For paid, downloadable video, that remains the holy grail.

introduced a new initiative called "Disney Studio All Access" providing a central location for consumers to securely access the company's range of content. Though details were sketchy, key to the plan is more flexible consumer ownership and multi-device playback. For paid, downloadable video, that remains the holy grail.

Aside from the company's digital initiatives on the entertainment side of its house, the most important asset that Disney is trying to re-imagine digitally is ESPN. Just yesterday, the company announced a new distribution deal with Verizon, which emphasizes live online streaming of ESPN, ESPN2, ESPNU and ESPN Buzzer Beater. The deal is similar to one inked last September with Time Warner Cable, the country's 2nd-largest cable operator. No doubt others will follow.

Categories: Cable Networks, Cable TV Operators, Sports, Telcos

Topics: Disney, ESPN, Time Warner Cable, Verizon

-

Time Warner Cable-LA Lakers Deal Is More Bad News For Pay-TV's Non-Sports Fans

If you live in the Los Angeles area and are not a sports fan, or you are a casual one, Time Warner Cable's new 20-year deal with the LA Lakers is more bad news. That's because, as I explained last week in "Not a Sports Fan? Then You're Getting Sacked For At Least $2 Billion Per Year," virtually all digital pay-TV subscribers in the LA area - sports fans or not - are going to be footing the bill for this massive deal.

The TWC-Lakers deal is just the latest example of how ever-higher monthly fees pay-TV distributors must fork over to carry sports networks help drive up subscription rates. In this case, TWC, the 2nd largest pay-TV operator, is positioning itself to also be a major sports network owner, just as Comcast has with Comcast SportsNet. TWC's deal will help create an even bigger inequity for non-sports fans and casual fans than already existed. For this group of subscribers, who are primarily entertainment-oriented, and likely more on-demand focused in their viewership than ever, higher subscription rates - tied to a small cluster of very expensive sports networks - are inevitably going to drive them to drop their pay-TV service.

positioning itself to also be a major sports network owner, just as Comcast has with Comcast SportsNet. TWC's deal will help create an even bigger inequity for non-sports fans and casual fans than already existed. For this group of subscribers, who are primarily entertainment-oriented, and likely more on-demand focused in their viewership than ever, higher subscription rates - tied to a small cluster of very expensive sports networks - are inevitably going to drive them to drop their pay-TV service.

Categories: Cable Networks, Cable TV Operators, Sports

Topics: Hulu Plus, LA Lakers, Netflix, Time Warner Cable

-

Cisco Feels Pain of Shifting Set-Top Box Landscape

This week technology giant Cisco reported its fiscal Q2 earnings and once again sales of its set-top boxes to big pay-TV operators were a glaring weak spot. This business has practically gone off a cliff, falling 29% from last year's similar quarter, a loss which followed a 40% decline in North America set-top sales for the prior quarter. While Cisco tried to put a positive spin on things by pointing to stronger sales of its IP-enabled set-tops and international results, the problems reflect a significant shift in how pay-TV operators view set-top boxes in a larger IP-related context, trends which are likely to only accelerate going forward.

similar quarter, a loss which followed a 40% decline in North America set-top sales for the prior quarter. While Cisco tried to put a positive spin on things by pointing to stronger sales of its IP-enabled set-tops and international results, the problems reflect a significant shift in how pay-TV operators view set-top boxes in a larger IP-related context, trends which are likely to only accelerate going forward.

Categories: Cable TV Operators, Devices

Topics: Cisco, Comcast, Samsung, Sony, Time Warner Cable

-

CES Takeaway #2: Don't Count Out the Pay-TV Operators

(Note: Each day this week I'll be writing about one key takeaway from CES 2011.)

If you've been thinking that pay-TV operators were imminent roadkill due to burgeoning "over-the-top" consumption and imminent cord-cutting mania, then important news from CES 2011 should cause you to reassess your assumptions. Instead of new technology undermining pay-TV businesses (which is too often how media characterizes things), the largest operators are starting to show how technology can be used to create compelling new value for their subscribers and enhance their competitiveness even as they relinquish a little control.

At CES, pay-TV announcements focused primarily on 2 areas: extending viewing to tablet computers and eliminating the set-top box by delivering full channel line-ups over broadband to connected TVs. Comcast, the largest U.S. pay-TV operator, made announcements spanning both: live, in-home access on iPads, with on-demand access outside the home, plus Xfinity TV access on certain Samsung connected TVs and on its new Galaxy Tab tablet. Time Warner Cable announced deals with both Samsung and Sony to deliver its line-up to certain connected TVs as well. Dish Network also unveiled its "Remote Access" service for Android tablets, allowing both live and on-demand viewing using the Sling Adapter (it had announced this for iPads in December). Last fall, Dish was also the first pay-TV operator to integrate with Google TV.

Categories: Cable TV Operators, Devices, Satellite, Telcos

Topics: AT&T, Comcast, Netflix, Samsung, Sony, Time Warner Cable, Verizon

-

10 Online/Mobile Video Items from CES Worth Noting

Happy Friday. Below are 10 interesting CES news items related to online and mobile video that hit my radar this week, but that I didn't have an opportunity to write about. There were many more cool things coming out of Las Vegas, and on so on Wed, January 19th TDG's Colin Dixon and I will present our next complimentary webinar, "Demystifying CES 2011" to review everything more fully. Mark your calendars, registration will be open shortly.

Intel "Insider" Movie Service unveiled - Intel unexpectedly launched its own online movie service as part of its "Sandy Bridge" chip announcement. The world probably doesn't need another service, but when Intel soon enabled is "WiDi" wireless display to project content to HDTVs, Insider will get more attention.

EchoStar acquires Move Networks assets - an inglorious ending for early leader in adaptive bit rate (ABR) streaming. As CDN prices plummeted and ABR competition emerged, Move's service was over-priced and marginalized.

Funai integrates ActiveVideo Networks into connected devices - The first integration of AVN's "CloudTV" into connected CE devices allows interactive streaming content to be delivered in standard MPEG format.

Orb BR launches - Orb Networks launches "Orb BR," a disc that inserted into connected Blu-ray players or PS3 that allows viewers to access content from the full Internet. Cost? $19.95. Waiting to try one out, this could be a winner.

Comcast and Time Warner Cable service coming directly to Sony and Samsung TVs - Hate that cable set top box? Soon Comcast subscribers will be able to buy a connected Samsung TV and access the full Xfinity TV channel lineup. Similarly, Time Warner Cable subscribers will be able to buy Sony connected TV buyers and see the full cable channel lineup. Who would have thought?

Skype plans to acquire Qik mobile video service - Moving to bulk up its involvement with video, Skype plans to acquire Qik, which allows users to record and share video via mobile devices.

Motorola and AT&T unveil Atrix 4G - Have a look at this video to see what the future of mobile devices look like - the power of a full computer in your pocket. Two very clever docks mean that users can easily view video on bigger screens as well as work with a full keyboard and mouse.

Vudu to offer 3D movies - a first for online delivery, aggregator Vudu announced that it is currently offering 3D movies to certain Samsung connected devices, and will soon offer it to PS3, Vizio, LG, Mitsubishi, Toshiba and boxee.

Boxee gains access to CBS programs - Boxee broke some new ground by gaining access to CBS programs, something that neither Apple TV, Roku or Google TV currently have. No word on pricing yet.

Yahoo adds feature to its Connected TV platform - Yahoo, one of the early entrants in the connected TV area, launches a feature call "broadcast interactivity" which allows further engagement with TV program content.

Categories: Devices

Topics: ActiveVideo Networks, Comcast, EchoStar, Funai, Intel, Motorol, Move Networks, Orb, Qik, Samsung, Skype, Sony, Time Warner Cable

-

Are Live Sports Pay-TV's Firewall or Its Albatross?

I've long assumed that live sports carried on cable TV networks (e.g. ESPN, Fox Sports, TNT, TBS, NFL Network, regional sports networks, etc.) would be a key firewall against cord-cutting since the games they air are unavailable online. In other words, if you're a sports fan, dropping your pay-TV subscription would be unthinkable. While I still believe that's mostly true, recently I've started wondering if it's possible that sports actually may also be an albatross for pay-TV operators, limiting their ability to effectively compete with online-only alternatives.

I use the word albatross because pay-TV providers actually have very little flexibility to offer non-sports fans lower-priced packages that don't include sports-oriented channels. In fact, the most surprising aspect of last week's announcement by Time Warner Cable of a new lower-priced tier called "TV Essentials" it's testing is that it will exclude ESPN, which is virtually unheard-of in pay-TV packaging. Because the underlying deals that cable networks have with sports leagues and rights-holders are so expensive, the networks try to get carried on the most popular pay-TV service tiers, thereby ensuring the highest number of subscriber homes (basic cable networks are paid by distributors on a per subscriber basis, so the more subscriber homes, the higher their revenue).

Categories: Cable Networks, Cable TV Operators, Satellite, Sports, Telcos

Topics: ESPN, Fox Sports, NFL Network, TBS, Time Warner Cable, TNT

-

5 Items of Interest for the Week of Nov. 15th

After a short break, VideoNuze's Friday feature of curating 5-6 interesting online/mobile video industry news items that we weren't able to cover this week, returns today. Read them now or take them with you this weekend!

Time Warner Cable Experiments With Lower Tier Video Package

It's a rare day when a cable operator announces a lower-priced offering, but that's what Time Warner Cable did yesterday, unveiling a test of what it's calling "TV Essentials." The new tier, priced between $30-$40, will most notably exclude ESPN, the most expensive channel in the cable universe, meaning right away TV Essentials isn't targeted to sports fans. I've argued for a while now that pay-TV operators have ceded the low-priced/value-oriented end of the video market to Netflix (and others), which given the ongoing recession is a mistake. It will be interesting to see how the new bargain service fares; 2 things that will limit its appeal though are that no channels will be offered in HD, and that it appears those with broadband Internet and telephone services won't benefit from typical package discounts.

Nielsen study: We're still a nation of couch pumpkins

More evidence this week that despite all the deserved enthusiasm over online and mobile delivery, good old-fashioned TV viewing still rules in terms of hours of consumption. Nielsen said that the average person watched 143 hours of TV per month in Q2, essentially flat vs. a year ago. For homes with DVRs, hours of time watched on them nudged up a bit to about 24 1/2 hours. On a related note, this week comScore released its online video viewing data for October, which showed average viewing of 15.1 hours per person. While online video has made huge progress in the last few years, it still has a ton of room to grow to catch up with TV.

More Videos Ads, More User Acceptance

Speaking of the comparison between online video and TV, this week brought some interesting new data on monetization patterns for premium online video. Online video ad manager FreeWheel released data that showed mid-roll ads are the fastest-growing category of ads (up 693% since Q1), and now represent 8% of its ad volume. Completion rates have increased for pre, mid and post-roll ads this year, but notably mid-rolls have the highest completion rate, at 90%. FreeWheel's conclusion is that monetization of premium online video is starting to look a lot like TV, with ad pods inserted throughout. Going a step further, if viewer acceptance of mid-rolls stays high, then this represents a valuable opportunity for TV networks in particular to combat DVR-based ad-skipping.

Startup Claims To Have Set-Top Hulu Can't Block

It was inevitable that Hulu's decision to block access to its programs would set off a game of whack-a-mole, with various devices springing up to do end-arounds. Sure enough, the $99 Orb TV debuted this week, prominently positioning itself as the device that can bring Hulu (among other content) to your TV. One catch is that Orb streams video from your computer and only does so in standard definition. It addresses the "keyboard in the living room" challenge by also including a smartphone app to control the device. It's not a perfect solution, but it does provide a glimpse into the PR-unfriendly dynamic that Hulu, and the broadcast networks, have created for themselves by blocking access to their content by Google TV and others. No doubt there will be plenty more Orb-like devices to come to market in the months ahead, all positioning themselves as solving the blocking problem.

Comcast's Top Digital Exec Amy Banse to Open New Silicon Valley Equity Fund for Cable Giant and NBC

As Comcast enters the final stages of approval for its NBCU deal, the company this week announced a new NBCU management structure. One item that wasn't formally announced yet, but was reported by AllThingsD earlier this week was that Amy Banse, formerly head of Comcast Interactive Media (now headed by Matt Strauss), will be heading to Silicon Valley to run the combined operations of Comcast's current Comcast Interactive Capital venture arm, and NBCU's current Peacock Equity (a JV with GE). With all the distribution, technology and content assets that will be under the Comcast roof, the fund will be at the top of any online/mobile video startup's list of strategic investors. I've known Amy for a while and have enjoyed having her on industry panels; she'll be a huge asset to Comcast in the Valley venture world.Categories: Advertising, Cable Networks, Cable TV Operators, Deals & Financings, Devices

Topics: Comcast, comScore, ESPN, FreeWheel, Hulu, NBCU, Nielsen, Orb, Time Warner Cable

-

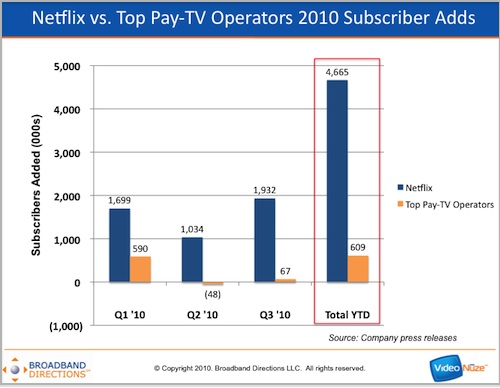

Netflix Has Added 8 Times As Many Subscribers in 2010 As Top Pay-TV Operators, Combined

Here's a pretty amazing factoid to end your week: in 2010 Netflix has added nearly 8 times as many subscribers as 8 of the top 9 pay-TV operators have, combined (#3 cable operator Cox is private and doesn't report). In the first 3 quarters of 2010, Netflix has added nearly 4.7 million subscribers while the top pay-TV operators have gained 609K.

Breaking down the pay-TV industry net gain further, the 2 main telcos (Verizon and AT&T) have added over 1.2 million subscribers and the 2 main satellite providers (DirecTV and DISH) have added 563K, while the top 4 reporting cable operators (Comcast, Time Warner Cable, Charter and Cablevision) have lost over 1.1 million.

Categories: Aggregators, Cable TV Operators, Satellite, Telcos

Topics: AT&T, Cablevision, Charter, Comcast, Cox, DirecTV, DISH, Netflix, Time Warner Cable, Verizon