-

TiVo's New iPad Video Downloader is a Winner for On the Go Viewing [VIDEO]

Streaming video is awesome, but of course it requires you to have a robust broadband connection. Once you're outside your home or business, that's an iffy proposition. WiFi hotspots aren't always available, and even when they are, they're often over-shared so connection quality is too low for video. Wireless 3G or 4G cards are better, but their relatively low data caps seriously crimps viewing. And if you're on a plane, forget streaming entirely, Gogo doesn't cut it at all.

These real-world mobile limitations mean downloading video in advance, rather than streaming it, is the key to on the go viewing. This has been one of the value props of iTunes, Amazon and other services. But the reality is that lots of great content is already sitting on your DVR (and if you're like me, 30K feet is when I most often actually have time to watch any of it). Further, you've already paid a lot of great content with your pay-TV subscription. The problem is that DVR video has been pretty much locked in your home, without an easy way to take it with you. All of above problems are solved with TiVo's new "Stream" companion device, which TiVo announced last week.Categories: Devices, DVR, Mobile Video

Topics: TiVo

-

TiVo Research: OTT and DVR Viewing Surges, Live Viewing Plummets

More research validating how on-demand viewership is ascendant and live viewing is declining. TiVo released new data showing that 62% of viewing on connected TiVo devices is either of recorded programs or from over-the-top sources, while 38% of viewing is live. For TiVo users that watched Netflix, YouTube, Hulu Plus and other OTT options, live viewership declined to 27%.

viewing is declining. TiVo released new data showing that 62% of viewing on connected TiVo devices is either of recorded programs or from over-the-top sources, while 38% of viewing is live. For TiVo users that watched Netflix, YouTube, Hulu Plus and other OTT options, live viewership declined to 27%.

The research is based on second-by-second analysis of users of 2 million TiVo devices. No trend data was released, so it's not clear how these numbers compare to prior periods.

Categories: Advertising

Topics: TiVo

-

Comcast's TiVo Deal Breaks New Ground, Unifies VOD, OTT Navigation

Yesterday, Comcast and TiVo announced an interesting deal that allows TiVo Premiere owners who subscribe to Comcast's digital video service to also receive Xfinity TV VOD alongside over-the-top choices like Netflix, Hulu Plus, Amazon, etc. It's a little bit of an alphabet soup situation to understand, which will make marketing it a challenge, but if the two companies are successful, it could actually be quite meaningful to consumers who choose to take advantage of the offer. I caught up with TiVo's EVP Jeff Klugman and had a slew of questions answered by Comcast to understand things better.

which will make marketing it a challenge, but if the two companies are successful, it could actually be quite meaningful to consumers who choose to take advantage of the offer. I caught up with TiVo's EVP Jeff Klugman and had a slew of questions answered by Comcast to understand things better.

Under the deal, TiVo Premiere owners can have Comcast come to their home at no charge and install the box and a CableCARD, making sure everything is working properly with the video service and their broadband connection (this will start in the SF area, with other markets to follow). One of Premiere's primary benefits is that when a user search is conducted for a TV show or movie, the results include all potential sources - Comcast linear and VOD as well as OTT options. That's beneficial to users because as long as rights are granted according to studios' adherence to windows, trying to understand what's available on which service/device at any particular time is virtually impossible for any average consumer.

Categories: Cable TV Operators, Devices, Video On Demand

-

TiVo Links Up With Charter

TiVo scored a big deal this week, as Charter Communications, the fourth-largest U.S. cable operator, announced that it would be offering TiVo's interface and its latest Premiere boxes to its subscribers. Because TiVo has integrations with lots of online video sources (including Netflix, Amazon, etc.), the deal is significant because it blends the traditional cable experience with the new over-the-top competitors. The deal also suggests what I pointed out in my review of Cisco's "Videoscape " - that beyond the very largest pay-TV operators, partnerships are going to be the way to go for them to deliver competitive experiences. For TiVo, the Charter win follows recent deals with both DirecTV and Cox. No doubt more will follow.

latest Premiere boxes to its subscribers. Because TiVo has integrations with lots of online video sources (including Netflix, Amazon, etc.), the deal is significant because it blends the traditional cable experience with the new over-the-top competitors. The deal also suggests what I pointed out in my review of Cisco's "Videoscape " - that beyond the very largest pay-TV operators, partnerships are going to be the way to go for them to deliver competitive experiences. For TiVo, the Charter win follows recent deals with both DirecTV and Cox. No doubt more will follow. Categories: Cable TV Operators, Devices

-

Both Roku and TiVo Get Hulu Plus Access

Hulu is extending access to its Hulu Plus subscription service to Roku devices and to TiVo Premiere. The service will be available to owners of these devices for $9.95/mo. Roku and TiVo follow availability of Hulu Plus on Samsung connected devices, Sony PS3 and the iOS devices.

Of course it's a real benefit to Hulu Plus subscribers to gain on-TV viewing through inexpensive connected devices, and no doubt we can expect more devices to come, with boxee right at the top of the list. Still, with Hulu Plus following Netflix onto these devices, consumers are inevitably going to closely compare the two services. In this respect, as I've pointed out numerous times, most recently in the wake of Netflix's expanded deal with NBCU, Hulu Plus's content is going to look skimpy.

devices to come, with boxee right at the top of the list. Still, with Hulu Plus following Netflix onto these devices, consumers are inevitably going to closely compare the two services. In this respect, as I've pointed out numerous times, most recently in the wake of Netflix's expanded deal with NBCU, Hulu Plus's content is going to look skimpy.

To be fair, for what it is - access to current and past seasons of broadcast programs, Hulu Plus is a great service. The problem is that DVRs already solve the current season episode value proposition for many (40% of homes and growing, according to Leichtman Research) while the prior seasons episodes are increasingly available on Netflix. Meanwhile, with TV Everywhere rolling out, Hulu Plus will be challenged to get access to cable TV network programs.

Expanding the number of devices that can access Hulu Plus is the right move (and a refreshing update after previously blocking free Hulu.com content). Nonetheless the big challenge for Hulu Plus remains getting more content.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators, Devices

Topics: Hulu Plus, Netflix, Roku, TiVo

-

For Connected Devices, To Browse or Not to Browse - That is the Question

If Hamlet were considering what functionality devices connecting the Internet to TVs should have, he might well pose the question, "to browse or not to browse?" In other words, should connected devices come with a browser that allows users to freely the surf the entire Internet - as they do online and on mobile devices - or should they present content and services through walled gardens of approved "apps?"

With new connected devices proliferating (see Apple iTV tomorrow), and becoming less and less expensive (see Roku price cuts yesterday), it's inevitable that massive connected device adoption lies ahead. Yet even as these devices are poised to take on greater importance in consumers' lives and be ever more strategic to any company committed to a three-screen strategy, it is still far from clear which device approach will dominate.

Categories: Devices

Topics: Apple, Espial, Roku, Samsung, TiVo, Vizio

-

5 News Items of Interest for the Week of Aug 23rd

Following is the latest update to VideoNuze's new Friday feature, highlighting 5-6 of the most intriguing industry news items from the week that VideoNuze wasn't able to cover.

Ads skipped by 86% of TV viewers, but TV ads still most memorable

A new Deloitte survey unsurprisingly finds high rates of ad skipping among DVR users watching time-shifted programs, yet also notes that 52% of respondents say TV advertising is more memorable than any other type (only 2% cited online video advertising). Is there a love-hate relationship with good old TV advertising?

Endemol USA Plans Kobe Bryant Web Series

Online video continues attracting celebrities, with the latest being LA Laker star Kobe Bryant, who will be featured in 8 episodes teaching Filipino kids about hoops. The series is being produced and promoted by powerhouse Endemol. More evidence that independent online video is gaining.

NFL Sunday Ticket To-Go, Without DirecTV

DirecTV unbundles its popular NFL package, selling online access to non-subscribers for $350. It's not clear there will be many takers at this price point, but it does raise interesting possibilities about unbundled subscribers connecting to their TVs and also how sports will be impacted by online and mobile viewing.

TiVo Launches Remote with Slide-Out Keyboard

TiVo is enhancing navigation with a long-awaited keyboard that slides out of its standard-shaped remote control for $90. With TiVo's new Premiere box offering more video choices than ever, quicker navigation is required. As other connected devices hit the market, it will be interesting to see what clever solutions they come up with too.

MTVN's Greg Clayman Heads to News Corp to Lead iPad Newspaper

Amid the ongoing shuffle of digital media executives, MTV Networks lost a key leader in Greg Clayman, who's moving to News Corp to head up their new iPad newspaper. Greg's been on VideoSchmooze panels and we've done webinars together; he always brings great insights as well as a terrific sense of humor.Categories: Advertising, Cable Networks, Devices, Indie Video, People, Satellite, Sports

Topics: Deloitte, DirecTV, Endemol USA, MTV, News Corp, NFL, TiVo

-

Cox Embraces Over-the-Top Video In Unique Deal With TiVo

Another day, another head-turning example of how the boundaries between traditional and over-the-top (OTT) online video distribution are blurring. This morning Cox Communications, the 3rd-largest U.S. cable operator, is announcing that it will integrate its entire VOD library into TiVo's Premiere multi-purpose box, the first time a major cable operator has done so with a retail-only product. Cox will promote and offer free installation for Premiere which, when coupled with a CableCARD, will support Premiere as a full set-top box solution in its markets (Premiere boxes cost $300 or $500). The deal is a significant win for TiVo, which has continued to rollout clever products, but has been challenged to go beyond its traditional retail proposition.

announcing that it will integrate its entire VOD library into TiVo's Premiere multi-purpose box, the first time a major cable operator has done so with a retail-only product. Cox will promote and offer free installation for Premiere which, when coupled with a CableCARD, will support Premiere as a full set-top box solution in its markets (Premiere boxes cost $300 or $500). The deal is a significant win for TiVo, which has continued to rollout clever products, but has been challenged to go beyond its traditional retail proposition.

As important, TiVo will continue to make available all of its integrated online video offerings (e.g. Netflix, Amazon, YouTube, Break, Howcast, CNET, etc.), which means that Cox is enabling online video options to be exposed and promoted side-by-side with its own video offerings. As Jeff Klugman, TiVo's SVP/GM of Products and Revenue explained to me yesterday, TiVo's search function would allow, for example, a user searching for "30 Rock" to see results including Cox VOD listings for the current season and upcoming on-air episodes blended with prior seasons available from Netflix, Amazon or Blockbuster.

video offerings (e.g. Netflix, Amazon, YouTube, Break, Howcast, CNET, etc.), which means that Cox is enabling online video options to be exposed and promoted side-by-side with its own video offerings. As Jeff Klugman, TiVo's SVP/GM of Products and Revenue explained to me yesterday, TiVo's search function would allow, for example, a user searching for "30 Rock" to see results including Cox VOD listings for the current season and upcoming on-air episodes blended with prior seasons available from Netflix, Amazon or Blockbuster.

Categories: Cable TV Operators, Devices

Topics: Cox, EPIX, Netflix, Starz, TiVo

-

thePlatform Unveils Support for Numerous Over-the-Top Devices

thePlatform is announcing this morning that it has integrated with numerous "over-the-top" consumer electronics devices, enabling its content customers to more easily deliver online video to them. Devices cited are boxee, Roku, TiVo, Vudu (which includes connected TVs and Blu-ray players from LG, Mitsubishi, Samsung, Toshiba and Vizio), DivX devices, Syabas (popbox), FlingoTV and others to come (including Google TV when ready). I caught up with Marty Roberts, thePlatform's VP of Sales and Marketing yesterday to learn more.

to more easily deliver online video to them. Devices cited are boxee, Roku, TiVo, Vudu (which includes connected TVs and Blu-ray players from LG, Mitsubishi, Samsung, Toshiba and Vizio), DivX devices, Syabas (popbox), FlingoTV and others to come (including Google TV when ready). I caught up with Marty Roberts, thePlatform's VP of Sales and Marketing yesterday to learn more.

Marty explained the impetus was thePlatform's content customers telling the company they want to generate more video views and have easy access to the range of OTT devices coming to market. While conceding that the universe of all these devices combined is still probably in the low single-digit millions, thePlatform and its content customers are betting on future growth. The move is significant as it underscores the mindshare that direct access to TVs via broadband and connected devices has gained in the content community.

Categories: Devices, Technology

Topics: Boxee, DivX, FlingoTV, Google TV, LG, Mitsubishi, Roku, Samsung, Syabas, thePlatform, TiVo, Toshiba and Vizio, VUDU

-

TiVo's New Boxes are Very Cool But Old Challenges Persist

The two new boxes TiVo unveiled last night - the Premiere and the Premiere XL - go right to the top of my list of most impressive devices that handle both broadcast and broadband content in one seamless experience. The new boxes continue TiVo's pattern of always being one step ahead of the competition in delivering an outstanding user experience. All of that is the good news. The bad news is that unfortunately, nothing I learned in my briefing earlier this week with Jim Denney, TiVo's VP of Product Marketing, suggests that these boxes will find their way into any more than the relatively few homes that prior TiVo boxes have.

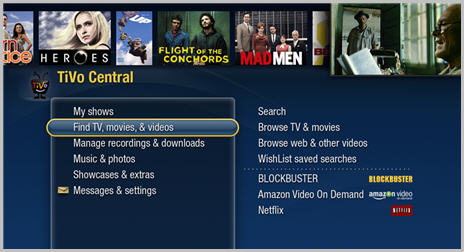

First the boxes themselves. The key Premiere innovation is that TiVo now elegantly recognizes broadband sources such as Netflix, Amazon, Blockbuster, YouTube and hundreds of others as bona fide content options, right alongside the customary broadcast and cable channels. That means that when you do a search for a specific TV program or movie, TiVo returns all the viewing options. Say for example it's Saturday night and you search for the classic movie "Raising Arizona." It may be on a cable channel the following Tuesday, but you want to watch it now. Well it is also available from Netflix's Watch Instantly. Assuming you've linked your Netflix account to the Premiere, a couple of clicks of the remote and you're watching right then. That type of all-in-one-box convenience isn't available elsewhere.

The TiVo browse and recommendation experience is tremendously improved also with a new "Discovery bar" - a strip of artwork and images from the programming that adds a lot of zip to the previously text-heavy browsing UI. Selecting an image triggers an expansion window with relevant details (program description, air time, cast, etc.) You can then immerse yourself in a "6 degrees of Kevin Bacon" IMDb-like experience by subsequently selecting an actor, subsequent movies, co-stars, etc, all in a rich, graphical interface. You can also select "Bonus Features" and immediately start reviewing accompanying clips from YouTube.

TiVo is also introducing "Collections," a set of curated categories like "Oscar Winning Films," "Sundance Award Winners" and "AFI's 10 Top 10" which, with accompanying artwork that are another quick, fun new way to browse for what's on (again these collections tap all broadcast and broadband sources). The gorgeous user experience is all built on Flash and is formatted for HD widescreen, to maximize the amount of real estate used. Another first for TiVo is a full QWERTY keyboard that slides out of the remote control for enhanced navigation.

That's a lot of new goodness from TiVo, which as expected comes at a price. The Premiere, with 320 GB of storage (enough for 45 hours of HD recording) is $299 and the Premiere XL, with 1 TB of storage is $499. Best Buy is again highlighted as a key marketing partner. Then of course there's the $13.95/mo TiVo service charge.

These are basically consistent with previous prices, suggesting that yet again TiVo will bump up against the brick wall of most consumers' resistance to buying expensive hardware. No matter how cool TiVo's boxes have been over the years, this is TiVo's traditional Achilles heel and it doesn't seem likely to lessen with the Premiere. When I highlighted this issue Jim allowed that the purpose of the standalone box is to be a "crucible of innovation" and that it is intended mainly for "discerning customers" (my interpretation: TiVo itself doesn't plan to sell a ton of Premiere boxes).

To address the sell-through problem, TiVo has worked hard to develop "TiVo-inside" relationships with video service providers, so that it can become more of a software and services company. For instance, I've been getting my TiVo service as part of my Comcast set-top box for a while now. With the Premiere announcements, TiVo said that RCN, a smallish American "overbuilder" and Virgin Media, a significant U.K. operator would include the Premiere features in their new set-top boxes, which is great.

However, no plans were revealed for what Comcast, by far the largest operator with TiVo inside, will do with the Premiere. In fact, one sticking point for Comcast is almost certainly the very access to broadband content that TiVo is trumpeting with the Premiere. My Comcast box frustratingly disables all of the previous "TiVoCast" broadband features I used to enjoy on my Series 2 box as Comcast seeks to maintain its "walled garden" approach. While RCN may be aggressive about providing access to 3rd-party broadband sources, I'm doubtful that Comcast will be given their own extensive TV Everywhere plans. That raises doubts about whether Comcast's TiVo customers will ever see the Premiere's full range of features.

And so all that brings us back to where TiVo always seems to find itself - with market-leading devices that have serious hurdles to widespread consumer adoption. I really hope there's a forthcoming breakthrough this time around for TiVo. Otherwise history will repeat itself yet again and TiVo will continue to be a well-respected, but relatively marginal player in the digital media landscape.

What do you think? Post a comment now (no sign-in required).

Categories: Cable TV Operators, Devices

Topics: Comcast, RCN, TiVo, Virgin Media

-

Made-for-Broadband Video and VOD are Looking Like Peanut Butter and Chocolate

Remember "two great tastes that taste great together," the slogan from the classic Reese's ads featuring the mixing of peanut butter and chocolate? Recent developments suggest that independently produced/made-for-broadband video and Video-on-Demand could be another Reese's-like combination, bringing together two disparate worlds that have attracted loyal audiences in an offering that could have significant consumer appeal.

Consider, last week Multichannel News reported that Verizon plans to bring over 7 million broadband video clips from providers like blip.tv, Veoh and Dailymotion to its FiOS service, which users can browse with their set-top boxes. Also last week, AnySource Media, a software company that powers broadband-connected TVs, announced content deals with TheStreet.com, Break.com, Revision3 and Next New Networks, creating hundreds of "virtual VOD channels." And yesterday, Clearleap, a startup technology platform I recently profiled, announced its own deals with blip.tv, Revision3 and Next New Networks, providing content that cable operators can meld with their VOD offerings.

This push among made-for-broadband producers, technology companies and incumbent video service providers is not coincidental. While they each have their own motivations, their alignment could signal a winning proposition for viewers.

For the indie content producers, on-demand access on TVs augments their viewing experience and access to their programming. Given how difficult the environment has become for independents (Daisy had a good piece on this topic yesterday) on-demand access is a real differentiator. For cable operators and telcos, popular indie video gives them a targeted pitch to the tech-savvy, younger audiences who have become loyal fans of indie content. Down the road this group is probably most up-for-grabs for alternative "over-the-top" services, so focusing on defending them is smart. And for technology providers, a big market opportunity looms trying to connect the previously disparate worlds of broadband and VOD.

In fact, in a conversation I had last week with Braxton Jarratt, CEO/founder of Clearleap, he explained that cable operators get all this. They're looking for quality "mid-tail" video from broadband producers, including clips and short-form programs. The company's technology is currently feeding broadband video to a couple hundred thousand cable VOD homes, with a backlog of "double digit" markets pending deployment. Braxton has a lot of content deals on Clearleap's docket, creating a menu for its cable customers to pick and choose from to incorporate into their VOD offerings. Clearleap also offers an ad insertion platform, so indie video can be monetized, not just offered as a value add.

Meanwhile, VOD has long proven itself popular with viewers. Comcast recently announced it has delivered 11B views since it launched VOD. It has continued to augment its library and add more HD titles. While VOD hasn't really been a money-maker itself, it has become a strong part of the digital value proposition and a defensive move against other viewing alternatives. By incorporating popular broadband video into its VOD choices, its appeal is only strengthened.

While the tectonic plates of "convergence" continue to shift, examples of broadband video making its way to the TV continue to happen. TiVo has been at this for a while with its "TiVoCast" service, along with technology providers like ActiveVideo Networks and others. The likelihood for independently-produced broadband video and VOD to get together seems poised to increase.

What do you think? Post a comment now.

Categories: Cable TV Operators, Indie Video, Technology, Telcos

Topics: ActiveVideo Networks, AnySource Media, Clearleap, Comcast, TiVo, Verizon

-

HD and Convergence Themes Pick Up Steam at NAB Show

Two highly related broadband video themes - HD delivery and convergence between broadband and TV - are both picking up steam at this week's NAB show. Among the key announcements are:

Adobe extending Flash into digital home devices

Move Networks acquiring Inuk Networks (announced just this morning)

Akamai detailing HD monetization opportunities in new white paper with IDC

Microsoft releasing "Smooth Streaming" HD delivery feature in its IIS Media Services

Limelight supporting Microsoft's IIS and Adobe Flash Media Server 3.5

CDNetworks commercially deploying first Adobe Flash Media Server 3.5 for first time

And separate from the show, TiVo and Roku supporting Amazon VOD HD titles

The entire broadband video ecosystem is getting more and more focused on both HD delivery and convergence. However, the former, which is primarily an infrastructure upgrade, is easier to execute on than the latter, which almost always requires users to buy and install some new device (either single or multi-purpose). Given the lousy economy and natural replacement cycles, this means that for many users, those gorgeous online HD experiences will be viewed on their computers for some time to come.

I think that's actually OK though. By proliferating online HD delivery, users will increasingly be getting a taste of what would be available to them if their broadband was connected to their TVs. Further, plenty of early adopters will become evangelists, showing off online HD experiences for their friends and families. Making things more tangible will help create the necessary promotional tailwind that convergence devices need to succeed.

Convergence has been a long time in coming, but the elements are now beginning to fall into place. I believe that the more HD content that's available online, the faster the convergence device market will develop.

What do you think? Post a comment now.

Topics: Adobe, Amazon, Brightcove, CDNetworks, Limelight, Microsoft, Move Networks, Roku, TiVo

-

DVR Usage is Making Broadband Video Ads Look Better for Broadcast Networks

Data that TiVo released last week indicating that nearly 60% of broadcast TV programs in the 8pm and 9pm primetime slots are timeshifted for later viewing should be interpreted as another positive for broadband

video advertising for two reasons.

video advertising for two reasons. First, because the high propensity of DVR users to skip ads means that broadband delivery can be increasingly considered the only way for big brands' ads to be guaranteed to be seen. And second, because all that ad-skipping is making the effective cost of each TV ad more expensive, thereby making broadband-delivered ads look like a better value.

In prior posts (here and here) I've outlined how a top network show drives around $.50-$.75 of ad revenue per on-air viewer. Said another way, advertisers are willing to pay $.50-$.75 to reach that show's audience. But now factor in that nearly 60% of the targeted viewers are watching via DVR, and that of this group maybe only 10% watch any ads at all. That means maybe only half or so of the intended audience actually see the ads. With half the audience, an advertiser is effectively paying 2x the CPM it thought it was.

Advertisers understand this as well, and as we know from newspapers' current plight, expecting they'll pay more to reach shrinking audiences is not a sustainable strategy. So, on the assumption that smaller and smaller targetable audiences long-term reduces the demand for on-air network ad inventory, CPMs should decline as well. On a relative basis that means that for broadcast networks, broadband video ads, which can't be skipped, have better targeting and more interactivity (all of which already drives higher broadband CPMs), start looking better and better. In short, DVRs' surging popularity is very good news for broadband video ads.

But as I explained in the posts cited above, the problem for networks today is that higher CPM broadband ads still result in lower total revenue per program for broadband vs. on-air. That's because networks are inserting a far smaller number of ad in a broadband-delivered program vs. an on-air delivered program (my estimate is somewhere around 3 minutes for broadband vs. 20 minutes for on-air). Hence the broadcasters' challenge - get total broadband ad revenue up while DVR usage acts to drive on-air revenue down.

Doing so requires better strategy and better execution. On the strategy side, I've said it before (and it always pains me to say it again), but broadcast networks have to increase ad avails in their broadband-delivered programs. That probably means more ads per pod, but could also mean other types of non-intrusive units like banners. On the execution side, it means more attention to each stream to ensure well-targeted ads that are actually delivered.

With broadband revenue still accounting for a miniscule amount of total broadcast network revenue, it's tempting to deprioritize addressing these issues. I think that would be a mistake. TiVo's stats on DVR usage in primetime (combined with other shifting consumer behaviors) should be a major wake-up call for networks about how their business models need to change. Fortunately for them, broadband offers an even-higher value delivery option if it is exploited properly.

What do you think? Post a comment now.

Categories: Advertising, Broadcasters, DVR

Topics: TiVo

-

Blockbuster Follows Netflix Onto TiVo Boxes; Ho-Hum

Blockbuster and TiVo have announced that Blockbuster OnDemand movies will be available on TiVo devices. Though I'm all for creating more choice for viewers to gain access to the content they seek, in this

case I don't see the deal creating a ton of new value in the market, as it comes 6 months after Netflix and TiVo announced that Netflix's Watch Instantly service would be available on TiVo devices and nearly 2 years after Amazon and TiVo made Amazon's Unbox titles available for purchase and download to TiVo users. It looks like the main differentiator here is that Blockbuster will begin selling TiVos in their network of physical stores.

case I don't see the deal creating a ton of new value in the market, as it comes 6 months after Netflix and TiVo announced that Netflix's Watch Instantly service would be available on TiVo devices and nearly 2 years after Amazon and TiVo made Amazon's Unbox titles available for purchase and download to TiVo users. It looks like the main differentiator here is that Blockbuster will begin selling TiVos in their network of physical stores. The deal underscores the flurry of partnership activity now underway (which I think will accelerate) between aggregators/content providers and companies with some kind of device enabling broadband access to TVs. I believe the key to these deals actually succeeding rests on 2 main factors: the content offering some new consumer value (selection, price, convenience, exclusivity, etc.) and the access device gaining a sufficiently large footprint. Absent both of these, the new deals will likely find only limited success.

Consumers now have no shortage of options to download or stream movies, meaning that announcements along the lines of Blockbuster-TiVo break little new ground. To me, a far more fertile area to create new consumer value is offering online access to cable networks' full-length programs. As I survey the landscape of how premium quality video content has or has not moved online, this is the category that has made the least progress so far. That's one of the reasons I think the recent Comcast/Time Warner Cable plans are so exciting.

With these plans in the works, but no timetables yet announced, non-cable operators need to be thinking about how they too can gain select distribution rights. There's still a lot of new consumer value to be created in this space. Given lucrative existing affiliate deals between cable networks and cable/satellite/telco operators, I admit this won't be easy. However, Hulu's access to Comedy Central's "Daily Show" and "Colbert Report" does prove it's possible.

We're well into the phase where premium video content is delivered to TVs via broadband. Those that bring distinctive content to large numbers of consumers as easily as possible will be the winners.

What do you think? Post a comment now.

Categories: Aggregators, Devices, FIlms, Partnerships

Topics: Amazon, Blockbuster, Comcast, Netflix, Time Warner Cable, TiVo

-

Clearleap Bridges Broadband Video and Ads to TVs

Summary:

What: Clearleap has introduced a new technology platform for distributing broadband video content directly to TVs and an accompanying ad management system.

For whom: Incumbent service providers (cable/telco) and new over-the-top entrants (device makers, aggregators, etc.), content providers and advertisers

Benefits: For service providers, a flexible, cost-effective system for offering broadband content to their subscribers with minimal technology integration; for content providers a scalable system for distributing content across multiple providers and platforms; for advertisers a new method of targeting on-demand audiences.

More innovation is coming to the ongoing quest to bring broadband content to TVs as Clearleap, an Atlanta-based startup, pulled back the curtain yesterday on its ambitious technology platform. Last fall, CEO/founder Braxton Jarratt gave me a glimpse into what the company was working on and yesterday he explained it more fully.

Clearleap aims to do multiple things with its "clear|flow" and "clear|profit" products. For incumbent video service providers (cable and telco operators) and new "over-the-top" entrants (device makers, aggregators,

etc.), Clearleap enables delivery of broadband and other video to the TV including integrating with existing Video-on-Demand infrastructure when present; for content providers, it improves the process of distributing of content across multiple providers and platforms; and for both service providers and content providers it offers an ad management solution that allows flexible ad insertion and business rules for ads running with Clearleap-delivered video.

etc.), Clearleap enables delivery of broadband and other video to the TV including integrating with existing Video-on-Demand infrastructure when present; for content providers, it improves the process of distributing of content across multiple providers and platforms; and for both service providers and content providers it offers an ad management solution that allows flexible ad insertion and business rules for ads running with Clearleap-delivered video. That's a mouthful, so to break it down a bit, here's my interpretation. First the delivery side. Obviously there's been a lot of discussion, particularly just since CES in January, of new entrants delivering broadband content to TVs, thereby presenting potential alternatives for consumers to "cut the cord" on existing cable and telco providers. One way for incumbent to combat this is for them to offer the best of the web (like TiVo has been doing with TiVoCast for a while now) in one seamless package delivered through the existing set-top box.

To date incumbents haven't pursued this strategy much though. Braxton attributes this intransigence to lack of adequate technology, than to lack of interest. Braxton says Clearleap has a couple of small deployments active and other announcements pending. The key to success is allowing the incumbents to control the process of what content they acquire and to present it in context with other VOD offerings. clear|flow ingests video from content partners into Clearleap's data centers, transcodes it and properly formats it for target devices, adds metadata and business rules and then enables service providers to subscribe to whatever content they want. The video is either served from Clearleap's data centers or pushed to an incumbent's own hosting facility.

On the other side of the coin, another goal of clear|flow is to become the glue that allows content providers who want to distribute across all these emerging platforms to do so with minimal work. Just upload your content, specify business rules and the service providers take it from there. Of course, there's a "chicken and egg" challenge here that content providers will only take an interest when there's sufficient distribution. Braxton recognizes this issue as well and said they've been encouraged by the willingness of certain "friendlies" to get involved, which he hopes will provide validation for others to come on board soon.

Last, but not least, clear|profit allows ad avails to be created and properly divided between the content providers and service providers according to specified rules. Ad management and insertion has of course been the Achilles heel for existing VOD systems, rendering today's VOD a largely revenue-free pursuit for most service providers. Cost-effectively solving the ad insertion process for VOD alone would be a major win.

Clearleap has an ambitious vision and ordinarily I'd say it feels like a lot for any startup to bite off. But Clearleap has a veteran executive team from N2 Broadband, which was a successful VOD software provider prior to its acquisition by Tandberg Television. The Clearleap team knows its way around cable data centers, has strong industry relationships and is benefitting from pressure incumbents feel to broaden their offerings - all no doubt key factors in helping the company raise money.

Still, there's going to be plenty of competition. Others circling this space in one way or another include ActiveVideo Networks, AnySource Media, GridNetworks, Sezmi, TiVo and lots of others who all have their own approaches and systems for connecting content providers with incumbent and new service providers to bring broadband video to TVs. It's going to be an interesting space to watch as there is no shortage of energy aimed at merging broadband with the TV and vice versa.

What do you think? Post a comment now.

Categories: Cable TV Operators, Startups, Telcos

Topics: ActiveVideo Networks, AnySource Media, Clearleap, GridNetworks, SezMi, TiVo

-

TiVo's Tom Rogers Puts TV Executives on Notice at NATPE

At the NATPE conference in Las Vegas yesterday I listened to TiVo CEO Tom Rogers send television executives an unmistakable message: either adopt a sense of urgency to address the two main forces upending the industry or prepare to watch the world as you've known it go away.

Rogers didn't mince words, forecasting for the TV industry a crisis comparable to the ones that have

engulfed the financial services and newspaper industries if TV executives are complacent. Why Rogers didn't also cite the even more desperate U.S. auto industry was unclear....Is it possible that no other industry could ever find itself in that much pain?

engulfed the financial services and newspaper industries if TV executives are complacent. Why Rogers didn't also cite the even more desperate U.S. auto industry was unclear....Is it possible that no other industry could ever find itself in that much pain? The two forces underpinning Rogers' potential doomsday scenario are rampant time-shifting/ad-skipping by DVR-enabled households and fragmented viewing due to inevitable widespread broadband-connected TVs. On the DVR front, Rogers cited forecasts of DVR penetration in 60 million U.S. homes in several years, up from 30 million today. He explained that at that penetration level research suggests that brands will suffer major erosion from ad skipping.

I think Rogers is absolutely right. If you live in a DVR-enabled household, consider how different your (and your kids') viewing patterns are vs. in the pre-DVR age. Rogers noted that plenty of industry executives themselves have admitted to him that they too skip the ads.

As for broadband, Rogers said that 85% of TiVo HD buyers now connect their boxes to TiVo's broadband features. And he echoed a point that I'm fond of making: despite all of the broadband consumption on PCs that has occurred in recent years, for most consumers video isn't really "TV' until it is actually consumed on the TV. TiVo has been incredibly aggressive in introducing broadband features (see their site for a listing), and clearly its buyers are getting the message.

Rogers' comments were serving a larger purpose which is to position TiVo's new ad products as a key solution to these problems. For the past couple of years TiVo has begun promoting a slew of new ad units, targeting and measurement capabilities that it believes can make the TV ad model comparable or superior to the online advertising model (I wish you could see more details but oddly, information about TiVo's ad products sits behind a password-protected area of the company's site.) Rogers conceded the irony that the company most responsible for undermining the traditional ad model through ad-skipping adoption is now trying to ride to the industry's rescue.

Be that as it may, the main problem dogging TiVo's ad solution is that TiVo's subscriber base of under 4 million is just a tiny percentage of all U.S. TV households. And that's unlikely to change. The big driver of DVR penetration is service providers including the feature (sometimes from TiVo) in their set-top boxes.

Further, in the cable world at least, TiVo's ad solutions are going to run smack into Canoe, the industry's advanced advertising initiative. TiVo has already learned about how cable companies follow their own agenda; when TiVo is included in cable set-tops none of the broadband features are enabled. I know this first-hand. My old TiVo Series 2 in the basement gets all the broadband goodies, my Comcast TiVo in the family room gets none of them.

Rogers emphasized that his comments should be taken positively, in the context of the massive opportunities being created, rather than as an assertion that the industry is doomed to failure. I applaud Rogers for calling out the massive problems that lie ahead for the TV industry if it doesn't act with urgency to address these issues. TiVo is doing its part, but much more must also be done.

What do you think? Post a comment now.

Categories: Devices

Topics: TiVo

-

Amazon VOD Now On Roku; Battle with Apple Looms Ahead

Amazon and Roku announced yesterday that Amazon's VOD service will soon be available on Roku's $99 Digital Video Player. The deal starts to make good on Roku CEO Anthony Woods's intentions about "opening up the platform to anyone who wants to put their video service on this box."

With Amazon VOD's 40,000+ TV programs and movies added to the 12,000 titles already available to Netflix subscribers via its Watch Instantly service (plus more content deals yet to come), little Roku is starting to look like a potentially important link in the evolving "over-the-top" video distribution value chain.

More interesting though, is that I think we're starting to see the battle lines drawn for supremacy in the download-to-own/download-to-rent premium video category between Amazon on one side and Apple on the other. Though Apple dominates this market today, having sold 200 million TV programs alone, there are ample reasons to believe competition is going to stiffen.

Apple is of course in the video download business for the same reasons it was in the music download business: to drive sales of the iPod and more recently - and to a lesser extent - the iPhone. According to the latest info I could find, iTunes now has 32,000+ TV programs and movies, including a growing number in

HD. For now that's slightly less than Amazon VOD, but my guess is that over time the two libraries will be virtually identical.

HD. For now that's slightly less than Amazon VOD, but my guess is that over time the two libraries will be virtually identical. While Apple has a near monopoly on portable viewing via the iPod and iPhone, it is a laggard in bridging broadband-to-the-TV. Its Apple TV device, introduced in January, 2007, and meant to give iTunes access on the TV, has been an underperformer. Certainly a detractor has been price, with the 40GB lower-end model still running $229. But more importantly, as an iTunes-only box, Apple TV perpetuates a closed, "walled-garden" paradigm that consumers are increasingly rejecting (as companies like Roku astutely understand).

For Amazon, the world's largest online retailer, video downloads are a rich growth market. The company brings significant advantages to the table, starting with tens of millions of existing customer relationships with credit cards or other payment options just waiting to be charged for video downloads. Amazon has strong brand name recognition and trust. And of course, it has a near-limitless ability to cross-promote downloads with DVDs and other products.

Determined not to be left behind in the great race to get broadband delivered video all the way to the TV, it has been integrating its VOD service with 3rd party devices like TiVo, Sony's Bravia Internet Video Link, Xbox 360 and Windows Media Center PCs. Its latest deal with Roku is far from its last.

Amazon VOD's adoption will benefit from the fact that there are many non-Amazon reasons that people will be buying these devices. For example, consider Roku, TiVo and Xbox 360. With Roku, Netflix is fueling sales. As Netflix subscribers realize that new releases are generally not available in Watch Instantly, but are through Amazon VOD on Roku, they'll be prone to give Amazon VOD a try (the Netflix limitation is course due to Hollywood's windowing, and another reason why I believe it's crucial for Netflix to make deals with broadcast networks for online distribution of their hit programs). For TiVo and Xbox 360, each has a well-defined value proposition for consumers to purchase. Amazon VOD's availability is a pure bonus for buyers.

Amazon VOD's adoption will benefit from the fact that there are many non-Amazon reasons that people will be buying these devices. For example, consider Roku, TiVo and Xbox 360. With Roku, Netflix is fueling sales. As Netflix subscribers realize that new releases are generally not available in Watch Instantly, but are through Amazon VOD on Roku, they'll be prone to give Amazon VOD a try (the Netflix limitation is course due to Hollywood's windowing, and another reason why I believe it's crucial for Netflix to make deals with broadcast networks for online distribution of their hit programs). For TiVo and Xbox 360, each has a well-defined value proposition for consumers to purchase. Amazon VOD's availability is a pure bonus for buyers.Still, Amazon VOD's Achilles heel that it is missing a portable playback companion on a par with the iPod and iPhone. Users clearly value portability and Amazon needs to solve this problem (hmm, can you say "Kindle for Video?"). Yet another issue is that despite its various 3rd party device deals, the user experience will always be governed by these devices' strengths and weaknesses. In this respect, Apple's ownership of the whole hardware/software/services ecosystem gives it significant user experience advantages (which of course it has masterfully exploited with iTunes/iPod).

Apple and Amazon hardly have the market to themselves though. Others like Microsoft Xbox LIVE, Vudu and Sezmi are vying for a place in the market. And then of course there are the VOD offerings from the cable/satellite/telco video service providers, who have big-time incumbency advantages. Not to be forgotten in all of this is consumer inertia around the robust DVD market, which to a large extent all of these video download options seek to supplant.

In the middle of all this are Joe and Jane Consumer - soon to be overwhelmed by a barrage of competing and confusing offers for how to get on-demand TV program and movie downloads in better, faster and cheaper ways. In this market, I believe simplicity, content choices, brand and especially price will determine the eventual winners and losers. These are front and center considerations for Amazon, Apple and all the others going forward.

What do you think? Post a comment now.

Categories: Aggregators, Devices, Downloads, FIlms, HD

Topics: Amazon, Apple, iTunes, Roku, SezMi, TiVo, VUDU, XBox

-

Watching Reed Hastings at NewTeeVee Live

Yesterday I had my own positive broadband video experience, remotely watching portions of the

NewTeeVee Live conference held in SF from the comfort of my office. Om Malik and crew put together a packed agenda and I had wanted to go, but a personal conflict kept me in Boston.

NewTeeVee Live conference held in SF from the comfort of my office. Om Malik and crew put together a packed agenda and I had wanted to go, but a personal conflict kept me in Boston. I caught most of Netflix CEO Reed Hastings' keynote (until the UStream feed froze up, arghh...) and thought he offered some interesting tidbits about how he sees the broadband video market unfolding. VideoNuze readers know I've been avidly following Netflix's recent moves with Watch Instantly and I've come to think of the company as one of three key aggregators best-positioned to disrupt the cable model (the other two being YouTube and Apple).

Three noteworthy points that Hastings made:

Standards needed to interface broadband to the TV - Hastings catalogued the efforts Netflix is making to integrate with various devices like Roku, LG, TiVo, Xbox, etc, but concluded by saying that these one-off, ad hoc integrations are not scalable and are really slowing the market's evolution. Most of us would agree with this assessment. Still, he was quite pessimistic about a standards setting process's ability to move quickly enough - saying this could be a 10-30 year endeavor. Instead, if I understood him correctly, he thinks the TV approach should just be browser- based, and also that today's remotes should be scrapped in favor of pointer-driven (i.e. mouse-like) navigation.

Cable should evolve to focus on broadband delivery and de-emphasize multichannel packaging - Of course this is incredibly self-serving from Netflix's standpoint, but Hastings made the case that broadband margins for cable operators are nearly 100%, because they have no content costs, whereas on the cable side, they have high and ever-increasing programming costs. He cited Comcast's recent announcement of 50 Mbps service as evidence that cable operators should focus on winning the broadband war, and eventually letting go of the multichannel model. Nice try Reed, but I don't see that happening anytime soon. However, as I recently wrote in "Comcast: A Company Transformed," there's no question that broadband is becoming an ever greater part of its revenue and cash flow mix.(Reed emailed to clarify the above point. He didn't say cable should focus on broadband delivery over the current multichannel model; rather that cable - and satellite/telco - should focus more on web-like viewing experiences through improved navigation and VOD/DVR to be more on-demand, personalized and browser-friendly. And he added that with the shift to heavier broadband consumption, cable is a winner either way. Note - I thought I interpreted him correctly, but between UStream choking and my own scribble, it seems I was a bit off here. Thanks for correcting Reed.)Game consoles in leading position to bridge broadband to the TV - Hastings made a pretty strong case for the Wii - and to a lesser extent the PlayStation and Xbox - as the leading bridge devices. The Wii in particular could be a real broadband winner if it could support HD and Flash. As I've been thinking about broadband to the TV, I've concluded - barring anything from left field - that game devices, IP-enabled TVs and IP-enabled Blu-ray players are where the action will be concentrated for the next 3-4 years (this doesn't take account of forklift substitutes like a Sezmi or others sure to come).

NewTeeVee has a good wrap-up of Hastings' talk as well, here. The video replay isn't up yet, but when I see it, I'll post an update.

What do you think? Post a comment now!

Categories: Aggregators, Cable TV Operators, Devices

Topics: Apple, Comcast, LG, Netflix, PlayStation, Roku, TiVo, Wii, XBox, XBox, YouTube

-

Netflix Should be Aggressively Pursuing Broadcast Networks for Watch Instantly Service

Over the past several months Netflix has made a series of announcements related to its "Watch Instantly" feature. On the device side, there are new partnerships with TiVo (for Series 3, HD and HD XL models), Microsoft Silverlight (for Mac viewing), Samsung (for Blu-ray players), LG (for Blu-ray players), Xbox 360 and of course Roku. All allow Netflix Watch Instantly content to be delivered directly to users' TVs. Meanwhile on the content side, there have been deals with Starz, CBS and Disney Channel, with more no doubt yet to come.

Our household has been an enthusiastic subscriber to Netflix for years and I welcome the commitment that

Netflix appears to be making to Watch Instantly. However, as I pointed out in May, in "Online Movie Delivery Advances, Big Hurdles Still Loom," Watch Instantly is hobbled by its limited catalog, now totaling around 12,000 titles, just 10% of Netflix's total catalog, even after including the recently added Starz titles.

Netflix appears to be making to Watch Instantly. However, as I pointed out in May, in "Online Movie Delivery Advances, Big Hurdles Still Loom," Watch Instantly is hobbled by its limited catalog, now totaling around 12,000 titles, just 10% of Netflix's total catalog, even after including the recently added Starz titles. The fundamental problem Netflix is bumping up against in building out Watch Instantly's film catalog is Hollywood's well-established windowing process. Studios have wisely and methodically maximized their films' lifetime financial value by doling out the rights to air them to a series of distribution outlets. These rights unfold in a carefully calibrated timeline and have become wrapped up in a thick layer of contractual agreements extending to all parties in the value chain. It is a system that has served all constituencies well, generating billions of dollars of value. It is also unlikely to change in any material way any time soon.

As such, Netflix, the "world's largest online movie rental service," as it calls itself, is increasingly discordant. On the one hand, growing the Watch Instantly service is crucial to Netflix's long term success in the digital/broadband era but on the other, it doesn't have the ability to offer a competitive catalog that meets consumers' online delivery expectations. So what to do?

My recommendation is for Netflix to incorporate the delivery of TV programming, via Watch Instantly, into its core value proposition. Specifically, Netflix should be making an all-out effort (if it is not already doing so) to secure next-day rights to deliver all prime-time broadcast network programs to its subscribers.

This strategy provides Netflix with many clear benefits and positions it well for long-term success. First, in these tight economic times, it dramatically expands the value of the Watch Instantly feature, turning it into both a bona fide subscriber retention tool to battle churn as well as a high-profile subscriber acquisition lever (not to mention an exciting pull-through offer big box retailers could use in their Sunday circulars to generate traffic).

Second, it is a clever competitive strike against four primary alternative ways whereby consumers can watch network programs on demand: cable-based VOD, a la carte paid downloads at iTunes/Amazon/others, free online aggregators like Hulu/Fancast/others and DVRs (though note the TiVo deal addresses this last option).

A comprehensive Netflix prime-time catalog compares well with each alternative. Against cable VOD it offers familiar, superior navigation plus a viable revenue stream for broadcasters while cable tries to get Canoe ready; against paid downloads, the obvious advantage of being a value-add service; against online aggregators, commercial free delivery; and against DVRs, the lack of consumer hardware purchases and persistent recording space limitations.

All of this should make Netflix a very appealing partner for the broadcast networks. They are getting hammered by ad-skipping, audience fragmentation, quality programming migrating to cable and an inferior single revenue source business model. The prospect of Netflix offering payments for their programs should be well-received. There may be concerns about programs' long term syndication value and also the potential enablement of a new gatekeeper. In better times these might be deal-killers; in this climate they shouldn't be.

Finally, there's the big potential long-term Netflix prize: if it can stitch together a large-scale network of compatible devices for Watch Instantly distribution, it could create a viable "over-the-top" alternative to today's multichannel subscription services (cable/telco/satellite). As I described in my recent "Cord Cutters" post, to really succeed, Netflix would have to eventually incorporate cable network programming. But if its reach is wide and its economics sound, that's within the realm of possibility as well.

But those are long-term issues. For now, while the recent CBS deal is a great start, Netflix should be working double-time to build out a full library of broadcast programs. It would dramatically improve Watch Instantly's appeal and value, while positioning Netflix well for the broadband era.

What do you think? Post a comment now.

Categories: Aggregators, Broadcasters, Devices, Partnerships

Topics: CBS, Disney, LG, Microsoft, Netflix, Roku, Samsung, Silverlight, Starz, TiVo

-

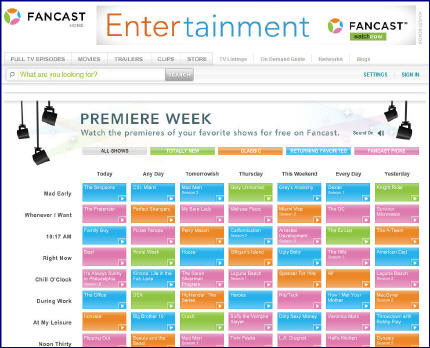

Comcast's Fancast Becomes Hub for Premieres; But Where's Project Infinity?

Here's a clever move from Comcast's Fancast broadband portal to create new value for users and generate excitement in the broadband market: this week it is running "Premiere Week," an aggregation of 168 premiere TV episodes. The episodes span series premieres ("Desperate Housewives," "Dexter," "The Office"), season premieres ("Fringe," "Sons of Anarchy," "Crash") and classic pilots ("Dynasty," "The A-Team," "Miami Vice"). It's great fun and a visitor could get lost on the site for hours, as I nearly did.

These are the kinds of promotions that Comcast should be all over. Given its extensive reach and programming muscle, the company has definite - though not insurmountable - advantages over other aggregators to pull this kind of promotion together.

The competition for aggregating premium programming continues to intensify. Business models are all over the board as are approaches for getting video all the way to the TV. For example, last week Amazon launched its pay-per-use VOD initiative which includes a page of info for how to watch using TiVo, Sony Bravia Internet Video Link, Xbox 360, etc. Then yesterday, Netflix announced that it will incorporate about 2,500 of Starz's movies, TV shows and concerts in its Watch Instantly feature, along with a feed of its linear channel. Still other moves are forthcoming.

Comcast's real lever though is unifying its currently siloed worlds of digital TV, broadband Internet access and Fancast. When converged they're a blockbuster; companies like Netflix, Amazon and others cannot replicate this combination. In particular, Comcast, and other cable operators are ideally positioned to bridge broadband all the way to the TV. That's the last big hurdle to unlock broadband's ultimate value. Whether they'll do so is an open question.

Earlier this year Comcast CEO Brian Roberts unveiled the company's "Project Infinity" which suggested Comcast was looking to unify its various video offerings and bring broadband to its subscribers' TV. It seemed like a promising move, though there was no timeline disclosed. Now, nearly 9 months later I can't find any updates on the status of Project Infinity. It would be great for the company to publicly release a progress report or sense of upcoming milestones.

Promotions like "Premiere Week" are a positive step from Comcast, but real competitive advantage for the company lies in launching services which are truly impossible for others to match.

What do you think? Post a comment.

Categories: Aggregators, Cable TV Operators, Portals

Topics: Amazon, Comcast, Fancast, Netflix, Starz, TiVo