-

March '08 Recap - 3 Key Themes

As I mentioned at the end of February, each month I plan to step back and recap a few key themes from recent VideoNuze posts. Here are three from March '08. (And remember you can see all of March's broadband news, aggregated from across the web, by clicking here)

The Syndicated Video Economy: An Introduction

In March I introduced the concept of the "Syndicated Video Economy" ("SVE") to describe how the broadband video providers are increasingly coalescing on a strategy for widespread distribution of video through myriad outlets. In the SVE media companies shift their focus from "aggregating eyeballs" in a centralized destination to "accessing eyeballs" wherever (and whenever) they live. The SVE is a big departure from traditional tightly-controlled, scarcity-driven distribution approaches. Investors have responded by funding SVE-oriented content and technology startups.

In March I provided several examples of SVE initiatives. CBS launched its Local Ad Network to distribute content to local bloggers and web sites. 60Frames, a new broadband studio, is explicitly focused on partnerships for distribution, and is not even building destination web sites for its programs. And FreeWheel is developing management tools so that content can be optimally monetized across a content provider's sprawling network of syndication partners.

The SVE resonated strongly with VideoNuze readers; many are focused on it and vested in its further development. Expect to hear a lot more about the SVE from me in coming posts. I'll also have supporting slides I'm developing for upcoming webinars on the topic.

Over-the-Top: Getting Broadband Video to the TV

Bringing broadband video all the way to the TV by bypassing existing service providers (so-called "over-the-top") continues to be the big elusive prize for many. This past month YouTube and TiVo announced a partnership to let a subset of TiVo owners gain full YouTube access on their TVs, a welcome move.

Following that, in "YouTube: Over-the-Top's Best Friend" I suggested the YouTube, with its dominant market position and brand loyalty could in fact be the linchpin to over-the-top devices gaining a foothold with consumers. Google-YouTube executives' vision for YouTube as a video platform, powering experiences wherever they are, lends support to my proposition. Lastly on over-the-top, new contributor Michael Greeson, founder of market researcher TDG, proposed that adapting low-cost devices like DVD player may well be the best way to bridge broadband and TV.

Social media and video: 2 sides of the same coin

This past month also continued an escalation of interest in the intersection of social media and broadband video. At the Media Summit there was intense focus on engagement, and how broadband can uniquely create new user experiences that deeply involve the user. These social experiences include sharing, personalization, commenting, rating and so on. In this vein, Maginfy.net introduced new social features to support its specialized user-created channels, a smart evolution of its product.

And in a follow-up to "The Intersection of UGC and Brand Marketing?" I clarified the opportunities that brand marketers may or may not have to get involved with this hot space. For those interested in more on this subject, new VideoNuze sponsor KickApps provided an informative webinar which is still available here.

So that's March's recap. There will be plenty more on all of these and other broadband video topics in April and beyond!

Categories: Brand Marketing, Devices, Syndicated Video Economy, Video Sharing

Topics: 60Frames, CBS, FreeWheel, KickApps, Magnify.net, Media Summit, Syndicated Video Economy, TDG, TiVo, YouTube

-

YouTube: "Over-the-Top's" Best Friend

The announcement a couple of weeks ago that YouTube was partnering with TiVo got me to thinking that YouTube is probably the best friend that so called "over-the-top" or "cable bypass" aspirants could have.

As a quick refresher, "over-the-top" and "cable bypass" refer to the emerging category of devices and service providers seeking to bring broadband video to the consumer's TV, but without the involvement of existing video providers such as cable and satellite. Some of these efforts (Apple TV, Vudu and Internet-enabled TVs) are positioned as augmenting incumbent providers, while some (Building B, others) are meant to compete directly.

Today's players share the common trait of being closed, "walled gardens," offering only certain content that they select. This contrasts with the open Internet/broadband model, where users are able to access any content they choose. Many of you know that I have been a strong proponent that open is the winning competitive path for aspiring over-the-top players.

If the over-the-top crowd adopts the open approach, YouTube is their perfect ally; it is the best-known brand name in broadband video, has the largest library of both user-generated and increasingly premium

video and has huge loyalty. Positioned properly it could be a killer value proposition for over-the-top players. I've previously argued that Apple missed the boat by not adopting this positioning for Apple TV.

video and has huge loyalty. Positioned properly it could be a killer value proposition for over-the-top players. I've previously argued that Apple missed the boat by not adopting this positioning for Apple TV.I talked last week with David Eun, VP of content partnerships at Google and Chris Maxcy, head of biz dev for YouTube, and they both made clear that the goal is to morph YouTube from a consumer destination site to a full-fledged video platform distributing video everywhere - devices, mobile, web sites, others. To this end, YouTube recently published an expanded set of APIs to allow 3rd parties to gain easier access to YouTube's content. This of course is great news for over-the-top devices, who should have considerable flexibility for how to incorporate YouTube into their offering. For now TiVo is leading the way in offering YouTube, albeit to a very small audience.

If you were wondering whether YouTube or Google itself will enter the device business, that seems unlikely. David and Chris were clear in saying that devices are not their core competency, and they'll leave it to others to decide how to implement the YouTube APIs and create and test various user experiences. Meanwhile with more premium content flowing into YouTube, its value as an over-the-top partner only increases.

What do you think? Post a comment!

Categories: Aggregators, Devices

Topics: Apple, Apple TV, Google, TiVo, VUDU, YouTube

-

Hurray for TiVo-YouTube

Hurray for TiVo and YouTube, which yesterday announced a partnership to allow certain TiVo users to watch YouTube videos on their TVs. While the actual number of homes which have the right TiVo model

and have it connected to broadband numbers under a million, TiVo-YouTube shows there is still hope that the worlds of broadband video and TV will indeed converge.

and have it connected to broadband numbers under a million, TiVo-YouTube shows there is still hope that the worlds of broadband video and TV will indeed converge.Some of you will remember that in December '07 I wrote a post entitled "Broadband Video on TV is a Mirage" in which regrettably concluded that the mass availability of broadband video on TVs was nowhere on the horizon. In that post I wrote:

"The minority of consumers who will actually see broadband video on their TVs will either (1) shell out big bucks to buy a broadband appliance such as Vudu or Apple TV, (2) tackle the challenge of connecting their TVs via wireless networks (3) use a device built for another primary purpose, such as Xbox 360 or TiVo, to selectively augment their viewing with broadband-delivered choices or (4) use a service provider that has decided to throw in a few morsels of broadband video."

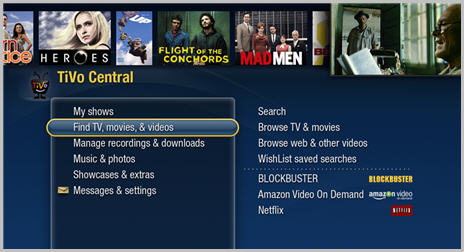

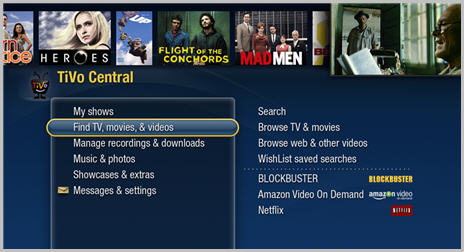

With the YouTube deal, TiVo continues to deliver on option 3, augmenting an already impressive array of broadband video available on select TiVo models. TiVo enhances its overall reputation for innovation

(although still absent resounding market success or profitability), with a particular focus on broadband video. TiVo has previously offered up Amazon Unbox, TiVoCast, Music Choice, Home Movies, etc. Providing access to YouTube, the world's most popular video site, is another notable accomplishment for TiVo.

(although still absent resounding market success or profitability), with a particular focus on broadband video. TiVo has previously offered up Amazon Unbox, TiVoCast, Music Choice, Home Movies, etc. Providing access to YouTube, the world's most popular video site, is another notable accomplishment for TiVo.I continue to believe that whichever company cracks the code on how to deliver wide open broadband video access to the TV - coupled with a strong user experience - is going to hit it big. At the risk of looking too far backward, at the end of 2006 I conjectured that Apple's then still-to-be-launched Apple TV product could be a resounding success if it got the content strategy right (i.e. offering open broadband access and even focusing particularly on easy YouTube access through the device). Instead Apple TV has turned into yet another walled garden and to date has been a market failure. Apple continues to miss the open broadband market opportunity which is sitting right in front of it with a big bulls-eye plainly visible.

The TiVo-YouTube partnership will hopefully have the effect of accelerating the wake up call to other market participants that this gigantic opportunity awaits. Broadband video to the TV is a natural. It simply extends the cable/satellite model of the last 30 years: offering ever more video choices right to the TV.

As I've often said, as amazing as the growth curve has been for broadband video consumption over the last 5 years, even more amazing is that virtually all of this consumption has happened on the computer - a completely parallel world to the traditional TV viewing platform. Nobody could have imagined this level of consumer adoption for a non-TV viewing platform. So then look forward and imagine the possibilities when broadband video and the TV are fused for the masses.

Categories: Devices, Partnerships

Topics: Apple, Apple TV, TiVo, YouTube

-

TiVo + Comcast: My Experience to Date

Yesterday TiVo and Comcast announced that their joint service offering, known as "Comcast DVR with TiVo" is now available to Greater Boston residents. The announcement comes almost 3 years since the

partnership was announced. Multichannel News recently reported that Comcast has funded $24 million of co-development work to date. I have had the service since late October as part of the beta test, but the companies had asked me to stay mum until its official launch.

partnership was announced. Multichannel News recently reported that Comcast has funded $24 million of co-development work to date. I have had the service since late October as part of the beta test, but the companies had asked me to stay mum until its official launch.  The first thing to know about this new service is that it really is familiar, lovable TiVo inside a Motorola cable set-top box. I am a long-time TiVo Series 2 owner, and as best I can tell all of the core TiVo features are available (e.g. Season Pass, Wish List, Suggestions) along with the inimitable TiVo blooping sounds effects. The box has a dual tuner so you can record one show while watching another. The navigation also incorporates all of Comcast's VOD selections, so all linear and VOD programs are considered in your searches. It's an HD-capable box, which can hold 15-20 hours of HD video. The peanut-shaped remote control is virtually unchanged.

The first thing to know about this new service is that it really is familiar, lovable TiVo inside a Motorola cable set-top box. I am a long-time TiVo Series 2 owner, and as best I can tell all of the core TiVo features are available (e.g. Season Pass, Wish List, Suggestions) along with the inimitable TiVo blooping sounds effects. The box has a dual tuner so you can record one show while watching another. The navigation also incorporates all of Comcast's VOD selections, so all linear and VOD programs are considered in your searches. It's an HD-capable box, which can hold 15-20 hours of HD video. The peanut-shaped remote control is virtually unchanged.

What's not included are all the wonderful broadband features (e.g. TiVoCast, Amazon Unbox, Rhapsody, Music Choice, Photos, Home Movies, etc.) and network features (e.g. remote scheduling, whole house service). The absence of broadband content (CNET, The Onion, NY Times, etc.) in particular will be missed. TiVo has gradually been introducing this over the last couple years. I've written a lot about broadband-to-the-TV solutions recently, and TiVo's approach has been very solid. However, Comcast obviously wanted to retain strict control over what video gets pumped into the set-top box. I have discussed this "closed" vs. "open" mindset earlier - hopefully something that will change down the road.

The service itself has mostly worked well. There were some initial hiccups requiring the Comcast service techs to return to the house and for me to call in for service. There are a few small issues that have persisted. These include periodically getting a green screen which requires me to turn the box on and off. I can't continuously lower the volume or change channels by suppressing the appropriate button on the remote control (this is possibly a TV-specific issue). I also find the service just a little less responsive than my Series 2 box - my fingers have had to adjust their muscle memory somewhat when working the familiar remote control. None of these are deal-breakers, but I do intend to have Comcast come out a take a look one of these days.

Comcast has priced the service at $2.95/mo, on top of its plain vanilla DVR service fee of $12.95/mo. I continue to believe that for consumers this proposition makes a lot of sense when compared with buying a standalone Series 3 box. It's a $3 delta over paying the monthly service charge directly to TiVo, but you avoid buying the Series 3 box (about $600 street price around $400) and potential maintenance and obsolescence issues. And it means one less box in your rack. The downside is the missing TiVo features described above.

If Comcast markets the TiVo service aggressively and correctly I think they can shift a lot of current DVR subscribers over plus add plenty of new ones down the road. It's a meaningful competitive advantage for a company caught up in a brutal battle with satellite and telco competitors. For TiVo, which has also done a deal with Cox (and others in the future presumably), it's a great shot at migrating itself out of the hardware business, into software and solutions.

Categories: Cable TV Operators, Devices, Partnerships

-

CES 2008 Broadband Video-Related News Wrap-up

CES 2008 broadband video-related news wrap-up:

Panasonic and Comcast Announce Products With tru2way™ Technology

Panasonic And Comcast Debut AnyPlay™ Portable DVR

NETGEAR® Joins BitTorrent™ Device PartnersD-Link Joins BitTorrent™ Device Partners

Vudu Expand High Definition Content Available Through On-Demand Service

Sling Media Unveils Top-of-Line Slingbox PRO-HD

Open Internet Television: A Letter to the Consumer Electronics Industry

Paid downloads a thing of the past

Samsung, Vongo Partner To Offer Movie Downloads For P2 Portable Player

Comcast Interactive Media Launches Fancast.com

New Year Brings Hot New Shows and Longtime Favorites to FLO TV

P2Ps and ISPs team to tame file-sharing traffic

ClipBlast Releases OpenSocial API

Categories: Advertising, Aggregators, Broadband ISPs, Broadcasters, Cable Networks, Cable TV Operators, Devices, Downloads, FIlms, Games, HD, Mobile Video, P2P, Partnerships, Sports, Technology, UGC, Video Search, Video Sharing

Topics: ABC, BitTorrent, BT, Comcast, D-Link, Disney, Google, HP, Microsoft, NBC, Netgear, Panasonic, Samsung, Sony, TiVo, XBox, YouTube

-

Broadband Video on TV is a Mirage

In yesterday's WSJ, Nick Wingfield wrote a lengthy article outlining the 5 key challenges encountered by the myriad devices aimed at bringing broadband video to TVs. He lists them as: consumer resistance to adding another box, complications in setting them up, cost, lack of content and slow downloads.

The article has a generally optimistic tone, posing "solutions" to each of the challenges. You're left with the impression that mass-scale broadband video on TV could actually happen sometime soon.

At the risk of being the "skunk at the picnic," I have recently come to believe that broadband video on TVs is a mirage, tantalizingly close yet in reality nowhere on the horizon. Unless there is some new box or approach I've yet to hear about, I've regrettably concluded that broadband video will be tied to computers, and select mobile devices, for a long time to come.

The minority of consumers who will actually see broadband video on their TVs will either (1) shell out big bucks to buy a broadband appliance such as Vudu or Apple TV, (2) tackle the challenge of connecting their TVs via wireless networks (3) use a device built for another primary purpose, such as Xbox 360 or TiVo, to selectively augment their viewing with broadband-delivered choices or (4) use a service provider that has decided to throw in a few morsels of broadband video.

Those of you with good memories will remember that in a Broadband Directions newsletter at the end of 2007 I wrote bullishly about Apple TV's ability to become the breakout convergence device, if only Apple opened up the box to all broadband content. Instead Apple has kept the box closed, available for iTunes downloads and selected YouTube videos. Consequently it has been a flop.

To help explain why products succeed or not, I tend to reach for Prof. Clayton Christensen's abiding lesson that people "hire" products to do "jobs" they have to be done. In other words, products that meet the buyer's true desires are the ones that succeed.

For me, the "job" that consumers increasingly want "done" is to be presented with an integrated, easy-to-access service (not just a new box) that offers all video programming they value in an on-demand manner and priced appropriately. That's a tall order, but ultimately one which will drive wide-spread success of any new product in this space.

Some of the possibilities include TiVo, which believes in this "seamless" philosophy, though it is still dependent on current service providers (cable, satellite, telco) to deliver programming. ICTV has a very interesting approach, though it is also reliant on existing service providers. Building B is taking a bold approach that seems to meet the full test for success, though it's still too early to know whether they can successfully execute on their vision.

But hodge-podge, costly broadband appliances just create new inconveniences while only partially addressing true consumer needs. As a result, they're not going to find a broad market. And so, barring some other new innovation, most of the world will still be watching broadband video on their computers and some mobile devices for a long time to come.

Categories: Devices

Topics: Apple, Apple TV, Building B, ICTV, TiVo, VUDU

-

Broadband Video vs. IPTV, The Differences Do Matter

It's funny how often I'll be talking to someone and they will casually start interchanging the terms "IPTV" and "broadband video/online video/Internet TV".

The fact that many people, including some that are actually well-informed, continue doing so is a reminder of how nascent these delivery platforms still are, and how common terms of use and understandings have yet to be established.

Yet it's important to clarify that there are differences and they do matter. While some of the backend IP transport technology is common between IPTV and broadband video, the front end technology, business models and content approaches are quite different.

In presentations I do, I distinguish that, to me at least, "IPTV" refers to the video rollouts now being pursued by large telcos (AT&T, etc.) here in the U.S. and internationally. These use IPTV-enabled set-top boxes which deliver video as IP packets right to the box, where they are converted to analog video to be visible to the viewer. IPTV set tops have more capabilities and features than traditional MPEG set-tops, and telcos are trying this as a point of differentiation.

However, at a fundamental level, receiving IPTV-based video service is akin to subscribing to traditional cable TV - there are still multi-channel tiers the consumer subscribes to. And IPTV is a closed "walled garden" paradigm - video only gets onto the box if a "carriage" deal has been signed with the service provider (AT&T, etc.). IPTV can be viewed as an evolutionary, next-gen technology upgrade to existing video distribution business models.

On the other hand, broadband video/online video/Internet TV (whatever term you prefer) is more of a revolutionary approach because it is an "open" model, just like the Internet itself. In the broadband world, there's no set-top box "control point" governing what's accessible by consumers. As with the Internet, anyone can post video, define a URL and quickly have video available to anyone with a broadband connection.

The catch is that today, displaying broadband-delivered video on a TV set is not straightforward, because most TVs are not connected to a broadband network. There are many solutions trying to solve this problem such as AppleTV, Microsoft Media Extender, Xbox, Internet-enabled TVs from Sony and others, networked TiVo boxes, etc. Each has its pros and cons, and while I believe eventually watching broadband video on your TV will be easy, that day is still some time off.

Many people ask, "Which approach will win?" My standard reply is there won't be a "winner take all" ending. Some people will always prefer the traditional multichannel subscription approach (IPTV or otherwise), while others will enjoy the flexibility and features broadband's model offers. However, for those in the traditional video world, it's important to recognize that over time broadband is certainly going to encroach on their successful models. Signs of change are all around us, and many content companies are now seizing on broadband as the next great medium.UPDATE: Mark Ellison, who is the SVP of Business Affaris and General Counsel at the NRTC (National Rural Telecommunications Cooperative, an organization which delivers telecom solutions to rural utilities) emailed to clarify that it's not just LARGE telcos that are pursuing IPTV, but many SMALLER ones as well. Point well taken Mark, it was an oversight to suggest that IPTV is solely the province of large telcos like AT&T.Categories: Cable TV Operators, IPTV, Technology, Telcos

Topics: Apple, AppleTV, Media Extender, Microsoft, Sony, TiVo, XBox

-

I Got My Official Comcast-TiVo Beta Trial Invite This Week

This week I heard from the folks at Comcast who are running the upcoming beta trial with TiVo. I'm officially on the list and should be getting a box soon. Hooray.

This week I heard from the folks at Comcast who are running the upcoming beta trial with TiVo. I'm officially on the list and should be getting a box soon. Hooray.As many of you are aware, Comcast has been on the cusp of kicking off this trial for some time now, which will let real users experience the joys of TiVo software running inside a Comcast digital set-top box. This will mark a milestone for Comcast in delivering a better user experience than the generic DVR feature that it and other cable operators rolled out a couple of years ago.

After hosting Jeff Klugman, TiVo's Senior VP, GM of its Service Provider and Advertising Engineering Division for a "fireside chat" at a cable industry conference last July, I became very bullish on the opportunity for TiVo to transform itself through these cable deals into a software and services powerhouse. In other words, long-term getting out of the high-cost, low-margin consumer device business.

Running a successful trial with Comcast is all-important to TiVo and they've been working for 2 years on this integration. Success will likely mean wide rollouts with Comcast, followed by #3 operator Cox (with whom TiVo already has a deal), and then others no doubt to follow. I'll be keeping you posted on my experience when I get the box. If it works as advertised it's going to be a killer device.

Categories: Cable TV Operators, Devices, Partnerships

-

TiVo: The Comeback Kid

If some kind of ratio could be calculated to measure consumers’ love for a product in relation to that product’s actual market success, TiVo’s score would undoubtedly top the list. Few products have ever achieved such undying fervor from their owners as have TiVo’s. Yet at the same time, few companies have underachieved their market potential as dramatically as has TiVo since its inception ten years ago.

If some kind of ratio could be calculated to measure consumers’ love for a product in relation to that product’s actual market success, TiVo’s score would undoubtedly top the list. Few products have ever achieved such undying fervor from their owners as have TiVo’s. Yet at the same time, few companies have underachieved their market potential as dramatically as has TiVo since its inception ten years ago.Despite my own love for my TiVo Series 2 box, not that long ago when I was asked by a friend what the future held in store for TiVo, I responded that with deep regret, I was hard-pressed to envision a happy ending for this plucky little company.

However, that was before last week when I had the opportunity to spend an evening with Jeff Klugman, TiVo’s Senior VP, General Manager of its Service Provider and Advertising Engineering Division and David Sandford, TiVo’s Vice President, Marketing & Product Management, Service Provider and Media & Advertising Divisions.

In addition to this time together, I also saw a presentation and demo of TiVo’s new integrated cable TV digital set-top box offering and also hosted them for a "fireside chat." All of this happened at a CTAM of New England-organized session at a cable TV industry conference in Newport, R.I.

Much as I thought I’d never say this, hear me now: TiVo is going to be the Comeback Kid. And it’s completely clear why. Read on to understand my logic.

The Old TiVo: Making Buyers "Crawl Across Broken Glass" to Enjoy the ProductAn immutable law of TiVo ownership has always existed: once you get one set up, you will fall in love with it. With its simple program recording process, tantalizing ad-skipping capability, intuitive user interface and more recently, its endless series of innovations (home networking readiness, remote scheduling, TiVoToGo portability, WishLists, Amazon Unbox downloads, Universal Swivel Search, TiVoCast broadband video channels, etc. etc.) TiVo is a blockbuster consumer value proposition.Despite all this, TiVo has always suffered from a problem that Jeff Klugman astutely describes: the company has essentially made prospective buyers "crawl across broken glass" to get from purchase decision to completed setup. Such a harsh assessment is well-earned. Consider: first TiVo required the user to find their way to a retail store (or go online) to buy the TiVo box, further cluttering the precious shelf space beneath the TV set. Then it required the buyer to select a monthly service plan that was on top of what the consumer already paid for cable TV or satellite service (to add insult to injury, TiVo did away with its $300 "Lifetime"plan a while ago). This change meant that a consumer’s choice to have a one-time bloodletting was replaced with a requirement that TiVo stick its probe into your credit card for as long as you wished to continue getting the service.

But that wasn’t all. Get the TiVo box home and you faced the oh-so-pleasurable task of contorting your body to access the back of your TV, while fending off that embarrassing swarm of dust bunnies lurking back there, all the while juggling a flashlight to figure out how TiVo’s gaggle of wires should marry up to your existing gaggle of wires. Your persistent fear was that not only might you end up not actually getting TiVo to work, you might find that you irreversibly tampered with your existing set-up, reducing your TV to a snow-and-static haze. Factor in your family members glowering at you while you puzzled through this process and it’s a pretty daunting and ugly picture.

This picture became even uglier when cable and satellite operators introduced a viable alternative to TiVo several years ago: simply pay a few extra bucks to them and you can have DVR features (ok, a sucky imitation of TiVo to be sure) built right into your new digital set-top box. So no contorting, fretting, glowering and of course, no extra box to buy and install.

TiVo’s Picture Darkens FurtherGiven this rigmarole, it’s no surprise that, despite the love fest people have for TiVo, it has only managed to sell a few million standalone boxes over the years, a relatively minor market impact. In fact, by far the majority of its market presence is through a deal with DirectTV, which contributes several million TiVo-enabled set-top boxes deployed. However, growth with DirectTV is over, with the company instead choosing to use technology from former sister company NDS instead.The sudden popularity of high definition TV brought yet another huge challenge for TiVo. Eventually, as consumers fully understand HD, they will all want an HD set-top box, capable of delivering real HD programming. Right on the heals of HD, people will want DVR features - of course HD-capable. Cable and satellite operators figured this out a few years ago and stepped up by offering their HD-DVR integrated set-top boxes for just a few extra dollars per month.

But TiVo only recently managed to release its own standalone HD-capable box, the "Series 3." And while the box is a marvel of product design, it weighed in with an $800 price tag, a price completely discordant for consumers whose expectations have been set by the fact that DVD players can now be had for as little as $13 at their local Wal-Mart. Coincidentally, it’s worth noting that just today TiVo announced a $300 version of the Series 3, which, while helping relieve upfront sticker shock, still requires the additional monthly service fees. And also the contorting, puzzling and glowering aspects of the installation process.

And Now for the Silver Lining in this StoryBy now you’re probably wondering how all of this doom-and-gloom is going to give way to the "Comeback Kid" scenario.In fact, the secret to TiVo’s success is, and has always been, jettisoning its hardware business model and becoming a software company. In other words, stop making boxes and instead just license the TiVo software to others whose boxes stand a better chance of being accepted by consumers (i.e. video providers). This was the vision from the start. I recalled reading a trenchant New York Times magazine piece that Michael Lewis (of Liar’s Poker and Moneyball fame) wrote 7 summers ago in August, 2000 on TiVo and Replay, its competitor at the time. I was able to dredge it up (thanks, Google) and in it, Jim Barton, TiVo’s co-founder, and current CTO plainly put it, "We’ll know we’ve succeeded when the TiVo box vanishes."

With TiVo’s promising, but ultimately unfulfilling deal with DirectTV unraveling, the company’s real potential to deliver on its vision lay with making deals with the cable industry. For a variety of reasons not worth recounting here, those deals proved elusive until early 2005 when TiVo struck a deal with Comcast. Things started looking even better for this game plan when the TiVo appointed Tom Rogers, who has significant cable bona fides, as CEO in mid-2005.

Flash forward 2 years later and it is looking increasingly likely that TiVo is on the cusp of executing its original strategy, positioning itself, at long last, for its moment in the sun.

TiVo + the Cable Industry, A Match Made in ARPU HeavenAs summer turns to fall, Comcast, by far the largest cable operator in the US and Cox, the third largest, are planning their initial rollouts of TiVo-enabled HD set-top boxes.After all these years, a more perfect time for TiVo and the cable industry to get together can scarcely be imagined. The incentives for these deals to succeed are very strong all around.

The cable industry is fighting hard to convince consumers to resist switching to Verizon and AT&T in the communities in which these telcos have rolled out their wizzy new video services. With telcos offering stiff price competition, ARPU (average revenue per unit) growth can only happen through new services, not price increases. Further, Comcast in particular has been working overtime to convince Wall Street that Video-on-Demand is its killer competitive advantage to satellite even while it struggles with its poorly-designed user interfaces which serve to impede, not assist, its subscribers’ discovery of valuable VOD programming.

Enter TiVo. TiVo offers Comcast/Cox/the cable industry one of the best-known and best-loved consumer brands with which to align itself on a de-facto exclusive basis. As mentioned, DirectTV’s deal is over. EchoStar’s relationship with TiVo is toxic due to mammoth patent litigation between the two companies. Verizon and AT&T barely have the resources to get their networks up and running much less take on the challenge of how to integrate their set-top boxes with TiVo software.

Meanwhile, the cable industry continues to grapple with how to get more consumers to sign on for digital cable service. Years after its introduction, digital still remains a sketchy value proposition for many. But TiVo gives cable operators a powerful feature to goose demand. Further, since Jeff showed how elegantly TiVo has incorporated VOD navigation and recording into its UI, integrated TiVo service also offers the promise of addressing that cable operators’ challenge in that area.

Last, but not least, on the assumption that TiVo service will carry an upsell charge of around $3-4 per month to the consumer (which are completely my estimates, with nothing having been disclosed by TiVo or its partners at this point), and assuming 2/3 of that goes to the cable operator, TiVo provides tantalizingly high-margin new ARPU growth for cable operators. Those high margins are made possible through the magic of OCAP, the cable industry’s new standard for remotely downloading applications like TiVo to tens of millions of currently-deployed set-tops (i.e. no expensive truck rolls).

That Sweet Sound of Ka-Ching, Ka-ChingTo help understand the revenue and margin potential of the cable deals for TiVo, consider the following:Pick your favorite analyst’s forecast for DVR growth. Forrester, for example believes that by 2011 there will be 65 million DVR homes, up from somewhere around 15-17 million today. So net adds of around 50 million homes. Comcast and Cox together pass about 58 million or 53% of all American homes. So their proportionate share of those 50 million DVR net adds should be at least 26 million. If they market the service right, it’s probably fair to assume that over time, at least 80% of DVR users are going to prefer the TiVo solution to cable’s crummy homegrown DVR alternative (if this option even survives). If so, then these deals’ potential is about 21 million homes taking the TiVo cable service by 2011.

Again, say the TiVo service costs an incremental $3 per month and then assume TiVo keeps a $1 of that, which is my approximation for the combination of its per sub and technology licensing fees. So, eventually 21 million new TiVo homes x $1 month x 12 months. Just from Comcast and Cox that would eventually total $252 million of annual revenue for TiVo. Now factor in when all the other cable operators smell the coffee and abandon their homegrown DVR solutions in favor of TiVo. And then of course it’s inevitable that TiVo will sign up Verizon and AT&T. However in those deals TiVo should be able to negotiate to keep maybe half the monthly fee instead of just a third as they did with the cable crowd (hey, it’ll be a proven service, plus the telcos will be playing catch-up, as usual).

To put all of this in context, for the fiscal year ending 1/31/07, TiVo’s revenues were $259 million, so if the Comcast and Cox deals alone succeed to even a fraction of their fullest potential, they should still have a major impact on the company’s financials. And bear in mind that if the cable strategy succeeds, then along the way TiVo’s retail hardware business would have been euthanized, erasing all that low margin box revenue. What would be left is a high-margin software licensing and services powerhouse, ready to go international, add portable applications and generate all kinds of new features, such ramping up its already solid broadband programming lineup.

But perhaps most important, with TiVo able to track the viewing behavior of all of those millions of homes, its long-held vision of building out an ad-based revenue business based on precise user viewing suddenly seems attainable. Of course it’ll be a little cheeky of TiVo to be pitching agencies and advertisers on these ad services after TiVo all but wrecked their traditional model with its ad-skipping features. But what choice will these folks really have if they want to succeed? And these meetings are already happening, and according to Jeff, who oversees all this, it sounds like all is forgiven and good progress is already being made.

What’s the Catch?The catch here is that initially TiVo is almost entirely dependent on Comcast and Cox putting enough marketing muscle behind this new service and executing it properly. So will Comcast and Cox do this? Though it’s way too early to tell, given all of the aforementioned incentives, there’s ample reason to believe that both will. For Comcast alone, which has borne the brunt of two years of arduous technical integration work with TiVo, failure to follow through with strong marketing would be a huge and embarrassing blunder. So I’m betting these savvy cable guys will get the marketing part right (if you’re really interested in how, keep scrolling to see the below Addendum for a couple of sample marketing scenarios).And if they do, then you heard it here first— TiVo is well-poised to become The Comeback Kid.

ADDENDUM: 2 MARKETING SCENARIOS FOR COMCAST

To make TiVo’s potential more tangible, consider the following 2 scenarios. In both cases you just bought a 42 inch LCD or plasma TV. Of course you now need an HD-capable set-top box. You call Comcast to order one and here’s what should happen:

Scenario 1: You own or have owned a TiVo Series 1 or 2 box

You’re told that an HD set-top will run you $5.00 more per month than your current box. Then you say you’re interested in DVR capability. "Ah," the Comcast rep says, "have you ever owned a TiVo?". You say "Yes." "Well", she continues, "did you know that you can now get the same (mostly) awesome TiVo service - including the familiar user interface, remote control and blooping sounds as you program the box AND have all Video-on-Demand programming expertly integrated into the service, only from Comcast? It is one of our most popular services, and I can offer it to you today for just another $8 more per month than the HD set-top box you want." You say, "let me get this straight, I’m already used to paying $13/month for my TiVo Series 2 service, so instead of paying that, I would pay $8 per month and get virtually all the same benefits of TiVo, but don’t have to go out and buy another TiVo box? And this isn’t the crummy DVR service I saw at my neighbor’s house that I know you also offer, right?" "No sir, it’s TiVo." "Any other sneaky upfront charges?" "No." "Any disconnect charges if I want to drop it?" "No." "Am I missing something here?" "No." "WOW, sign me up - what a great offer. Thanks Comcast."

Scenario 2: You’ve never owned a TiVo box, but you have some familiarity with the product because any number of friends, neighbors, relatives and co-workers have been bragging to you for years that it’s the greatest thing since sliced bread.

You’re told that an HD set-top will run you $5.00 more per month than your current box. Then you say, "I’m kind of interested in this whole DVR thing everyone keeps talking about." After the Comcast rep verifies you’ve never actually owned a TiVo, but that you’re sort of familiar with what it does, she says, "Well, Comcast has a very special offer for you. TiVo DVR service has become one of our most popular services and we think if you experience it for yourself, you’ll see why. So I’d like to offer you 90 days of free TiVo service. If you don’t like it, simply call us at any time and we’ll remotely remove it from your box. That means you don’t need to wait at home for a technician to disable TiVo service for you." You ask what it will cost per month and upon hearing the answer ($8 more per month than the HD box base rate) you make a mental note to ask your friends, neighbors, relatives how much they pay, to see what kind of deal you’re getting (later they’ll confirm it’s the same as they’re currently paying for their Series 1 or 2 monthly plans). You see no downside to trying it, so you do. After you and your family use TiVo for approximately 3 days, you all fall in love with it and wonder how you could have ever lived without it. You call Comcast to say thanks.

Categories: Cable TV Operators, Devices, Partnerships

-

One Pleasant Experience with Amazon Unbox

Last night I watched "Thank You For Smoking" (great movie by the way) courtesy of Amazon Unbox and TiVo. I took advantage of the companies' recent announcement which lets TiVo owners choose to have their Unbox videos delivered directly to their TiVos. The whole experience was seamless - linking my Amazon and TiVo accounts, selecting the movie in Unbox, downloading it, watching it, etc. My only complaint is that it was available for only 24 hours after starting it, which is obviously a studio issue, not an Amazon or TiVo issue. However, for the sheer "video-on-demand" spontaneity of finding a movie while already online, and then watching it shortly after, it's hard to beat this.Categories: Aggregators, Devices, Downloads

-

TiVo - The Broadband Innovator in the Living Room

David Pogue at the NYTimes had a great article this week extolling all of the innovations the TiVo has come out with. TiVo is the like the little engine that could. Even with cable and satellite operators rolling out DVR capabilities in their set tops, TiVo continues to set the bar for innovation.

Of particular interest to me is how their tapping broadband. As Pogue points out, if you have your TiVo on your home network, you can now upload home movies, download content from Amazon Unbox, record broadband video from many sources, play Internet radio, record podcast and on and on. Despite all the talk of devices meant to bridge the PC and TV, TiVo is probably furthest along in terms of actually bringing broadband capabilities to users today.Let’s see if the cable and satellite folks keep pace.

Categories: Devices

Topics: TiVo

Posts for 'TiVo'

Previous |