-

It's Hard to See How Streaming Movies Will Surpass DVD/Blu-ray In 2012

Last Thursday night, a Bloomberg headline, "Online Film Viewing in U.S. to Top Discs in 2012, IHS Says," caught my eye. The article reported that media research firm IHS Screen Digest is forecasting that "legal online

viewings of films will more than double to 3.4 billion this year from 1.4 billion in 2011." Meanwhile IHS is forecasting that DVD/Blu-ray viewing will decline from 2.6 billion viewings in 2011 to 2.4 billion in 2012.

viewings of films will more than double to 3.4 billion this year from 1.4 billion in 2011." Meanwhile IHS is forecasting that DVD/Blu-ray viewing will decline from 2.6 billion viewings in 2011 to 2.4 billion in 2012.

Over the weekend, as I kept seeing other publications essentially reiterating the Bloomberg story, I started wondering how IHS arrived at its forecast, the details of which I haven't seen. Doing a little back of the envelope analysis, as I show below, it's awfully hard to see how streaming movies in the U.S. will more than double from last year, unless some very unexpected things happen with Netflix (IHS notes that 94% of streaming movie volume was subscription-based, and of course, Netflix massively dominates this segment). Rather, it seems likely DVD/Blu-ray will hold on for another year.Categories: Aggregators, Analytics, FIlms

Topics: IHS Screen Digest, Netflix

-

VideoNuze Report Podcast #126 - Sky's NOW TV; iPad's Data Cap Problems

I'm pleased to be joined once again by Colin Dixon, senior partner at The Diffusion Group, for the 126th edition of the VideoNuze Report podcast, for Mar. 23, 2012. This week finds Colin in London, providing him an even better perspective on our first topic this week, Sky's new over-the-top service called NOW TV, which it will launch this summer. Colin is bullish on NOW TV and likes the lessons it provides for U.S. pay-TV operators.

Categories: Advertising, Aggregators, Analytics, Books, Devices, International, Podcasts, Satellite, Telcos

Topics: iPad, Sky, Verizon Wireless

-

Visible Measures Introduces "Share of Choice" Metric

Media measurement firm Visible Measures has introduced another clever way for brands to follow the success of their online video initiatives, called "Share of Choice." A play on the "Share of Voice" concept in the offline media world, Share of Choice measures the frequency of consumer viewership of brands' online video ads and content. Share of Voice lets brands measure their own success as well as track competitors' efforts.

Share of Choice measures the frequency of consumer viewership of brands' online video ads and content. Share of Voice lets brands measure their own success as well as track competitors' efforts.

By understanding consumers' online preferences and social behavior, brands get up-to-date insight on how well their video is performing, and what potential changes should be made. Because online video is driven entirely by users' interests, Share of Choice becomes a really good gauge not simply of what ads are running (as in traditional TV), but who's choosing to watch and how often. Visible Measures has segmented Share of Choice into 12 different industry reports with subscriptions available to each. Subscription pricing wasn't disclosed.

What do you think? Post a comment now (no sign-in required).Categories: Analytics, Branded Entertainment

-

Kantar Video Opens Public Beta of Videolytics Platform

This morning Kantar Video is converting access to its new Videolytics real-time tracking, measurement and syndication service for online and mobile video from private to public beta. Kantar Video is a relatively new unit of mega-agency holding company WPP but as CEO Bill Lederer explained to me in a demo earlier this week, it brings a very strong brand and agency perspective, as well as WPP intracompany assets to the Videolytics product.

Though adoption of online video is soaring and ad spending is hitting new records in 2010, Bill sees the market as still limited by a lack of comprehensive tools for content providers, brands and agencies to measure the impact of their campaigns by reach and engagement metrics. Videolytics "Track" module relies on both cookies and digital fingerprinting technology embedded in both video players and ad platforms to track users' viewing behavior and then provides detailed tracking and measurement.

Categories: Analytics

Topics: Kantar Video

-

5 Items of Interest for the Week of Sept. 27th

It's Friday and that means that once again VideoNuze is featuring 5-6 interesting online/mobile video industry stories that we weren't able to cover this week. Have a look at them now, or take them with you for weekend reading!

Nielsen Unveils New Online Advertising Measurement

comScore Introduces Digital GRP `Overnights` in AdEffx Campaign Essential

Dueling initiatives from Nielsen and comScore were announced on Monday, aimed at translating online usage into comparable TV ratings information, including reach, frequency and Gross Ratings Points (GRPs). While online video ad buying is ramping up, the tools to measure viewership in a comprehensive way have been lacking. This is one of the main issues holding back content providers from participating in TV Everywhere.

Analyst: Cord-cutting fears overblown

New research shared this week by BTIG analyst Rich Greenfield concludes that less than 8% of the market is actually interested in cord-cutting. The big impediment: losing access to sports and cable programming, which is unlikely to migrate to free over-the-top alternatives. Greenfield's conclusion is that cord-cutting isn't a major threat to pay-TV operators over the next 3-5 years. Notwithstanding the research, another factor I'd point to that could tip cord-cutting the other way is consumers' belt-tightening. Much as nobody wants to lose access to programming, if the price is perceived as too high, they'll make compromises.

Why YouTube Viewers Have ADD and How to Stop It

Abandonment rates for online video have always been a concern, and using new research, Visible Measures CMO Matt Cutler now quantifies the behavior. Expect 20% of the audience to drop out within 10 seconds of hitting play, 33% by the 30 second mark and 44% by 60 seconds in. Pretty sobering data but incredibly important in thinking about content creation and monetization.

Networks Have Sharing Issues With Hulu

Hulu's New Hoop

On the one hand, Hulu's network partners, ABC, NBC and Fox are reportedly pulling back ad inventory that Hulu is allowed to sell, yet on the other, Hulu is reportedly out aggressively selling ads in Hulu Plus, its subscription service. Meanwhile this week Hulu also announced that Hulu Plus will be accessible on both Roku devices and TiVo Premiere, as it continues chasing Netflix in the subscription game.

The New Apple TV Reviewed: It`s All About the Video

Apple TV devices started shipping this week, and reviews began popping up all over the web. This mostly positive review indicates that the user experience is solid, but that content selection is still skimpy. That's no surprise given how few deals Apple has struck to date. Yet to be seen is how Apple TV performs when it can access other iOS apps.Categories: Advertising, Aggregators, Analytics, Broadcasters, Devices

Topics: ABC, Apple TV, comScore, FOX, Hulu, NBC, Nielsen, Visible Measures, YouTube

-

MeFeedia Unveils HTML5 Analytics for All Player

Search engine MeFeedia is announcing this morning a new real-time analytics suite for HTML5 video viewed using the company's All Player.

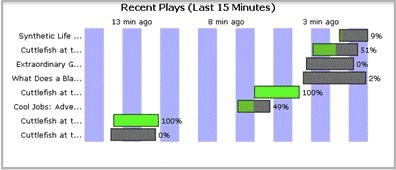

Content providers using All Player will be able to track a variety of data for video consumed across all devices supporting HTML5 - iPads, iPhones, Android phones and the web. They can view data by summary, recent, popular, devices, videos and channels to monitor an individual or group of videos' performance. Data can also be exported for offline analysis and viewing. The type of data tracked includes view-through rates, time watched, impressions and the viewing device.

As with the All Player itself, the analytics package is free.

The analytics release follows MeFeedia announcing support for HTML5 advertising just before the iPad's recent launch. MeFeedia CEO Frank Sinton explained to me yesterday that though it's still early for HTML5, the company is committed to building out further HTML5 features for the All Player.

For those not familiar with All Player, which MeFeedia launched last June, it's targeted primarily to small and mid-sized content providers who want to improve their ad monetization. All Player's value prop is that it has integrated with key video ad networks, so that once an All Player content provider is approved, it can add or improve monetization immediately. Content providers can use All Player stand alone or in conjunction with their OVP.

All Player has moved MeFeedia from being solely a video search engine to also being a monetization partner. Frank explained that numerous providers now partner with MeFeedia, in some cases simply syndicating a feed of their content, which MeFeedia offers and monetizes through All Player, in turn sending a revenue share back to the content provider. Frank says MeFeedia is fully ad supported and is now profitable. As HTML5 emerges, adding complexity in the short-term to content providers' work flow, tools like All Player look even more important.

What do you think? Post a comment now (no sign-in required).Categories: Advertising, Analytics

-

BT Wholesale Readies CDN Launch; Relies on Skytide for Analytics

While most of my focus is on the U.S. market for online video, I recently had a chance to catch up with Simon Orme, GM, Content Services Group of BT Wholesale, who gave me a deep dive update on what's happening in the U.K. market. Simon's specific focus has been a 2-year long project for BT to roll out CDN services to broadband ISPs who lease BT's network. The project is now moving into trial.

The U.K. video industry has robust satellite and cable competition, and more recently the BT Retail side has been rolling out its BT Vision IPTV service as a competitor to both. BT is also involved in "Project Canvas" a partnership of the major U.K. broadcasters and several communications companies to roll out broadband content.

A key challenge for Simon has been how to enhance the value of these CDN services for the ISPs who in turn offer them to content providers. Simon believes that a key driver is end-to-end quality of service. To deliver this BT is using Skytide, a U.S. provider of reporting and analytics software.

Simon explained that ISPs are already relatively sophisticated about how they manage their networks, yet traditionally they haven't had a lot of insight into what data is running on their networks. Therefore, the opportunity is to marry CDN services to these networks. In Simon's view, since most content providers are already using CDNs, the ISP must further distinguish itself in order to gain business. Doing so requires deeper insight about quality of service through a reporting and analytics layer. This is why BT is offering Skytide as part of its CDN service offering.

Skytide ingests multiple data sources in real time and then crunches the data, presenting it in various dashboard views, which might include for example network capacity utilization, volume of traffic by customer and distribution of traffic. Having evaluated multiple options, Simon said BT chose Skytide as the best of breed. The goal is to give its ISP customers all the potential levers to adjust in order to maintain the highest quality of service to their content customers.

There are currently a lot of moving pieces in video delivery in the U.K. and it will be worth keeping an eye on to see how they unfold.

(Note if you want to hear Simon talk in more detail about the U.K market and CDN dynamics, here is a recent interview he did with Murali Nemani from Cisco.)Categories: Analytics, CDNs, International, Telcos

-

Kantar Video Pursues a Holistic Approach to Video Analytics

This morning I'm pleased to introduce Adam Wright, VideoNuze's newest contributor. Adam has a strong background in online video, having worked at NBCU in digital distribution, MySpace in branded content, and more recently at Tubefilter in research. Adam has a BS in Business and an MS in Entertainment Industry Management from Carnegie Mellon University. After 2 1/2 years of carrying the full daily editorial load at VideoNuze, it's great to have Adam on board contributing several times per week!

Kantar Video Pursues a Holistic Approach to Video Analytics

by Adam Wright

Kantar Video announced itself last week, but with the torrent of news coming out of both SME and the Cable Show, it slipped under the radar. So late last week, I took some time to talk with Bill Lederer, CEO of Kantar Video, who is a seasoned veteran in online and set-top box research, to get a better understanding of the company's holistic approach to their research/analytics service and the implications on the analytics space.

who is a seasoned veteran in online and set-top box research, to get a better understanding of the company's holistic approach to their research/analytics service and the implications on the analytics space.

Kantar Video's "Videolytics," which is currently in a private beta, will be tracking everything from online video, advanced TV, and most interestingly mobile, which is a rapidly growing space. Kantar Video plans to combine this data with the extremely rich marketing data sets from other Kantar Media business units. Bill explained, "for instance, we're the world's biggest company in the attitudinal area. We're going to work with Dynamic Logic, TNS, [etc.]. We're going to capture things like ad expenditure data." In addition, he mentioned cross-referencing data from other sets such as demographics, psychographics, purchase data, and much more from other Kantar Media affiliated branches.

Kantar Video's overall goal is to create a decision system to harness all this data to provide relevant information for business decisions. As a result, Kantar Video's holistic approach might be considered a "Nielsen for online video" analytics/research service. While there have been many options for online video analytics and research, few have come to encompass this breadth of data, which will ultimately help users understand the implications of online video and online video advertising down through the purchase chain, helping grow and better monetize the space.

Though there's a lot of data already floating around, in Bill's opinion often it isn't entirely useful to decision-makers. As Bill put it, "The medium is producing Latin. The customers are in need of Greek." He sees Kantar Video as trying to answer tough questions from marketers. For instance, "What's the real ROI for investing in video? Online guys will talk about views, but marketers talk about how did it do relative to not just campaign execution, but the brand?" Bill said, "We're trying to create a multi-channel solution - real time turn-around with deep domain expertise."

Kantar Video is trying to set itself apart competitively by focusing exclusively on analytics, as compared with others like TubeMogul and BBE's recently spun off Vindico who are also providing ad serving. Kantar Video has some similarity to analytics provider Visible Measures, but with more varied data sets and tools from other business units.

Finally, Bill was quick to trumpet that "we're able to bring in a significant number of advertisers and media companies. I think we'll have some quick validation." With a big name like WPP behind it, Kantar Video has a certain built-in credibility with many brands and advertisers, but Bill also stressed they are working with non-WPP companies as well. "We have built a career on coalitions and partnerships within and without in order to provide more value." In addition, they are preparing to go global quickly by building out their platform in many languages.

Kantar Video is definitely an analytics firm to look out for, with a company like WPP backing it financially and developmentally, it would seem to have some natural momentum. Only time will tell if it catches on, but either way, this means more competition in the analytics space.

What do you think? Post a comment now (no sign-in required).Categories: Analytics, Startups

Topics: Kantar Video, TubeMogul, VINDICO, Visible Measures

-

New "Trends" Application from Visible Measures is Invaluable - and Addictive

Visible Measures, the third-party measurement firm for online video, is taking the wraps off its new "Trends" web-based application this morning. I've been playing around with it for the last couple of days with a courtesy login and not only does it pack a ton of value, it's also really addictive.

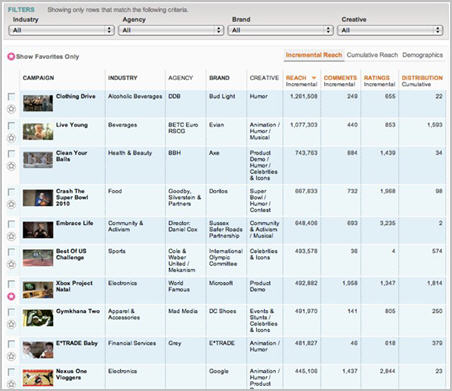

Trends offers access to videos in 3 different data sets, or "collections": Social Video (currently 165 online ad campaigns that have gone viral), Film Trailers (currently 115, and growing by 3-4 per week), and all the recent 2010 Super Bowl ads. The results table for a query displays the campaign's thumbnail image and its name, along with its views or "reach" based on Visible Measures' "True Reach" data (either incremental or cumulative) plus the number of comments, ratings and points of distribution. The table also displays each ad's industry categorization, ad agency, brand name and type of creative type (humor, contest, product demo, etc.). Viewing any particular ad is also just one click away.

Users can take advantage of Trends in any number of ways, depending on their particular interest. As one example, I started by choosing the Social Video collection and "Cumulative Reach" for the current time period. I was interested to see just campaigns for beverages, so I chose that category, but allowed all agencies, brands and creative types to be displayed. In an instant I was presented with a table of 20 results on 2 pages, starting with Evian's hilarious "Live Young" campaign featuring the dancing babies that has garnered almost 74 million views to date. After looking it over, I also reviewed the other campaigns in the top 5, from Pepsi, AMP and Anheuser-Busch. Click on the image below if you'd like to see a 4 minute video demo.

In the social and online video-dominated world we now live in, Trends data is invaluable for brand advertisers and their agencies. It allows them to customize their views of the database, compare different campaigns and analyze what worked online and what didn't. Online distribution is now a key part of calculating the ROI on a campaign, so being able to benchmark the performance of past campaigns provides insight not normally available in traditional TV advertising.

For example, say an agency is formulating a plan for its client's new shampoo - Trends lets its creative executives understand whether prior campaigns featuring product demos, humor or celebrities worked best online. A few quick queries will yield data that can be exported to create charts and graphs for everyone on the team to review. Of course past experience can perfectly predict the future, but Trends provides hard data that lets the creative discussion quickly move beyond gut instinct.

The Visible Measures team told me last week that they've been gradually exposing more and more of their data, through top 10 lists with media partners like AdAge, Variety, Mashable and Motor Trend. With Trends, the data is even more accessible. Visible Measure is also making a public beta of Trends available, though just for the Social Video collection. It's free and it's fun - I recommend giving it a try.

What do you think? Post a comment now (now sign-in required).

Note - Visible Measures is a VideoNuze sponsor.

Categories: Advertising, Analytics, FIlms

Topics: Visible Measures

-

Conviva Addresses Video Quality Problems Impressively

Undoubtedly we've all had the experience at one time or another of watching (or trying to watch) a particular online video, only to have some problem arise that interrupts our experience. To the average user, it's a mystery what might have happened. Is it a problem with my computer? With my personal Internet connection? With my Internet service provider? With the source of the content?

Regardless, it causes user frustration, which can lead to clicking away from the video, possibly never to return. More often than not, the content provider isn't even aware of these user problems. As online video becomes more central to content providers' strategies and P&Ls, inferior user experiences are a growing concern for content providers. And given the vagaries of the Internet and the exploding volume of video being consumed, it's an issue unlikely to go away anytime soon.

That's where Conviva comes in. Conviva gives content providers unprecedented insight into their users' viewing behaviors as well as tools to quickly identify and resolve problems. As Darren Feher, Conviva's new

CEO explained to me when I met up with him recently, and in a subsequent demo, the company's studies show that at least 25% of all streams suffer one problem or another. Affected users watch between 30-80% less video than those who don't have problems.

CEO explained to me when I met up with him recently, and in a subsequent demo, the company's studies show that at least 25% of all streams suffer one problem or another. Affected users watch between 30-80% less video than those who don't have problems.Here's how Conviva works: a small bit of its code is integrated by the content provider alongside the Flash or Silverlight player, whichever is used (in either case no user download involved). Conviva is also integrating with online video platforms (so far just thePlatform, but others to come), so the step is eliminated for the content provider. When deployed, Conviva's code monitors the user's video experience and sends back "heartbeat" reports every 10 seconds to the Conviva console. The console gives the content provider multiple views of their users' experiences, including things like a geographic distribution of current viewing, what player's being used, the average time it's taking to start streaming, the average duration of viewing, the amount of buffering, and so on. Conviva shares the science behind all of this if you're so inclined.

Conviva's secret sauce is mashing up all that in-bound data in real-time and detecting if/where problems exist, and when they do, what the source is. Problems could include buffering on the user's machine, issues with the currently-used CDN, congestion in the local ISP, etc. In addition to these telemetry/analytics services, the company also offers a service it calls "Conviva Distribution" which will seek to remedy problems as they arise based on a set of pre-configured policies. For example, if the user's machine is buffering, Conviva will adjust the stream being sent to a lower bit rate. Or if the CDN being used is the problem, Conviva will switch to another CDN (of the content provider's choosing) in mid-stream, unbeknownst to the user. The content provider gets real-time visibility into what troubleshooting is happening.

In addition to improving the user experience, Darren believes this degree of insight opens up new opportunities for content providers. For example, say there's a higher value set of streams, maybe for a subscription service or a live event. Those streams can be tagged and monitored separately, and have greater resources allocated to them to ensure up-time. Improved visibility into videos that are going viral means their placement on the site and their monetization can be enhanced. Another example is better-informed customer service agents responding to issues specific to a certain set of videos.

Some of what Conviva does is similar to analytics products like Omniture, performance measurement from companies like Keynote and Gomez and some of the reporting CDNs themselves provide to customers. But Conviva seems to bring together user viewing data in a unique and far deeper way than any of these. This week Conviva is helping NBC better understand its Olympics streaming using Silverlight. Conviva also counts Fox, ABC, NFL and others as customers. Conviva started life as Rinera Networks, pursing managed P2P distribution. It has raised $29 million to date from UV Partners, New Enterprise Associates and Foundation Capital.

What do you think? Post a comment now (no sign-in required).

Categories: Analytics, Technology

Topics: Conviva, Flash, NBC, Silverlight

-

SpotXchange to Partner with Quantcast for Demographic Targeting and GRP Pricing

Performance-based video ad network SpotXchange will announce this week a new partnership with audience profiling firm Quantcast that will allow SpotXchange to offer demographic targeting across its entire network as well as Gross Ratings Points (GRP) based campaigns, the standard for TV media buying. As Bryon Evje,

SpotXchange's EVP told me last week, being able to translate campaigns into a "cost-per-point" model for its clients means SpotXchange will be more appealing to traditional TV media buyers evaluating online video ad opportunities. SpotXchange's goal is of course to lure over ad dollars traditionally spent on TV.

SpotXchange's EVP told me last week, being able to translate campaigns into a "cost-per-point" model for its clients means SpotXchange will be more appealing to traditional TV media buyers evaluating online video ad opportunities. SpotXchange's goal is of course to lure over ad dollars traditionally spent on TV.If a SpotXchange advertiser is also a Quantcast client, then the advertiser will be able to proactively define a specific audience it wants to target and then buy just those ad placements from SpotXchange that fulfill its objective. SpotXchange can use Quantcast's data on particular segments to determine how many GRPs are available, and then by combining its own pricing, can calculate what it would cost a client to reach that audience on a per point basis.

SpotxChange can separately offer demographically-targeted ads by doing a real-time match against Quantcast's data, before an ad is served. If there isn't a targeted user available, then no ad would be served, reducing spending waste and enhancing the overall campaign's ROI.

Quantcast's demographic information is derived by tracking the behaviors of 220 million Internet users across thousands of web sites. I talked briefly with Quantcast's head of business development Winston Crawford who explained that the company's secret sauce is an "inference model" that takes the behavioral data and mathematically translates it into affinity levels.

From this Quantcast is able to build a "lookalike" model which allows advertisers to target those users who have similar affinities (and as a result a higher probably of converting) elsewhere on the web. In the case of SpotXchange, the lookalikes targeted would be users of sites in its publisher network. Quantcast already works with other video ad networks such as Tremor and BBE, along with many display ad networks.

Melding online video ad campaigns with traditional GRP measurement has gained momentum this year, as other video ad networks like Tremor, BBE and YuMe have announced their own initiatives. Combining a GRP approach with demographic targeting offered by firms like Quantcast is further evidence that the online video ad medium is continuing to mature. Despite the news today that CBS Interactive is phasing out its use of third-party ad networks, as video ad networks move to offering campaigns that can be evaluated along traditional TV criteria, this should in turn draw traditional TV ad dollars to online video. That would mean video ad networks' value would increase.

What do you think? Post a comment now.

Categories: Advertising, Analytics

Topics: BBE, Quantcast, SpotXchange, Tremor, YuMe

-

Adobe-Omniture Could Work, But I'm Waiting to See the Proof

Late yesterday Adobe surprised the market by unveiling a $1.8 billion cash acquisition of Omniture, the web analytics and optimization company. With Omniture's trailing 4 quarter revenues of $335 million, the deal was done at a little over 5x revenues and a 45% premium to Omniture's average stock price over the last 30 days - not ridiculous bubble-era terms by any stretch, but still plenty rich in this down economy.

I listened to yesterday's investor relations call explaining the rationale for the deal, talked to a number of industry executives for their reactions, and read some of the online coverage. My takeaway is that while the deal could work out, I'm somewhat skeptical until I see actual proof.

First, when I look at Adobe, I'm focused narrowly on its video-oriented products and strategy (Flash, Flash Media Server, Strobe its open player framework, etc). While a leader currently, Adobe has significant

challenges ahead in the video space. It faces major competitive threats from Microsoft, which is ramping up a Silverlight and Smooth Streaming onslaught (we've seen this movie before and know how it ends) and Apple, which has frozen Flash out of its world-beating iPhones in an attempt to thwart the advance of Flash's desktop hegemony to mobile devices. From my perspective, an acquisition the size of Omniture must provide specific differentiated value to Flash, in order to help Adobe compete in the video space.

challenges ahead in the video space. It faces major competitive threats from Microsoft, which is ramping up a Silverlight and Smooth Streaming onslaught (we've seen this movie before and know how it ends) and Apple, which has frozen Flash out of its world-beating iPhones in an attempt to thwart the advance of Flash's desktop hegemony to mobile devices. From my perspective, an acquisition the size of Omniture must provide specific differentiated value to Flash, in order to help Adobe compete in the video space. I hear the top-line rationale being provided for the acquisition: that integrating Omniture's measurement and analysis tools into the front-end creative process will help digital media executives more effectively monetize content and improve advertising ROIs. In Adobe CEO Shantanu Narayen's words, the deal "completes the loop of content creation, delivery and optimization." Omniture's CEO Josh James put the goal simply: "to drive ad dollars from offline to online."

That's an incredibly important goal; I have written many times that advertising, particularly for long-form online video, is not remotely close yet to supporting the high cost of creating premium-quality programs. To the extent that eyeballs shift from offline to online without a parity (or better) economic model, content providers will be in a death spiral - racking up profitless online viewership.

While the deal's high-level rational makes some sense, I have 3 concerns about whether it's robust enough to ultimately pay off for Adobe, and more specifically strengthen their hand in the video space: (1) Are there actually incremental product integration opportunities beyond those already being pursued through the companies' existing partnership? (2) Are there actually incremental sales to be gained (and for which products), by putting the companies together? (3) Is this the optimal use of Adobe's resources given current and future market conditions for video?

The product integration issue received a lot of attention in the analyst Q&A portion of the investor call. Yet, despite the number of times both CEOs answered it, few specifics were ever revealed, leaving what I perceived as a sense among the analysts and me (manifested by repeated similar questions), that the product benefits might not be well-understood, or worse, overblown.

In my mind optimal product integration requires that the same person or team in an organization gets value from the 2 products being put together. Yet today the creative people using Flash are different from the marketing people using Omniture. In the organizations I've worked with there's already significant interaction between these groups as they continually modify apps to enhance user engagement and monetization. Maybe more can be achieved here, but with different audiences for the respective products, I'd want to see evidence.

Incremental sales were another area of intense analyst interest. Typically in acquisitions a key deal driver is that one (or both) of the companies' products can be put through the others' sales channels to increase volume. Yet, per the above, Adobe's creative tools are typically purchased in the creative group, not the marketing organization (sometimes it's even more complicated as a whole different entity is the buyer, as with CDNs and Flash Media Server). However there is a case to be made that as digital revenues become more important to companies, marketing will exert more influence.

But still, is it likely that notoriously autonomous creative types are going to be swayed to use Adobe's tools because marketing types say that improved integration with Omniture makes analysis/tracking better? Conversely, is a marketing executive going to be persuaded to use Omniture because the creative group insists it must use Flash? Looming also is the question of whether one sales team and channel versed in selling packaged software (Adobe) can effectively help sell SaaS analytics (Omniture) and vice versa.

These questions ultimately raise the final one - is this the best use of Adobe's resources? On the one hand,

Omniture helps diversify Adobe's revenue and product base, opening up new markets for it. Diversification isn't a bad thing per se, but if the acquired products don't help the core business, it can quickly turn into a distraction, changing the organization into cluster of silos. Plus, while Omniture's revenues have quadrupled in 3 years, it has already forecast slowing growth. Generally I'm very skeptical of big acquisitions. Evidence has shown they rarely deliver the intended results, and often (as in the case of Ebay-Skype) they can actually be a value destroyer.

Omniture helps diversify Adobe's revenue and product base, opening up new markets for it. Diversification isn't a bad thing per se, but if the acquired products don't help the core business, it can quickly turn into a distraction, changing the organization into cluster of silos. Plus, while Omniture's revenues have quadrupled in 3 years, it has already forecast slowing growth. Generally I'm very skeptical of big acquisitions. Evidence has shown they rarely deliver the intended results, and often (as in the case of Ebay-Skype) they can actually be a value destroyer. My guess is that much of what Adobe will eventually achieve with Omniture could have likely been achieved through expanding its current partnership. But I stand ready to be proven wrong as it's quite possible I just don't get it. Both leadership teams are intelligent and savvy about the market. They obviously see the benefits of the deal. We'll eagerly await the proof.

What do you think? Post a comment now.

Categories: Analytics, Deals & Financings, Technology

-

Blip.TV's New Deals Give Broadband Producers a Boost

Broadband-only producers got a boost yesterday as blip.tv, which provides technology, ad sales and

distribution for thousands of online shows, announced a variety of new deals as well as product improvements. The deals offer blip's producers new distribution, new monetization and new access to TVs. In order:

distribution for thousands of online shows, announced a variety of new deals as well as product improvements. The deals offer blip's producers new distribution, new monetization and new access to TVs. In order:Distribution: blip's new deal with YouTube means that producers using blip can deliver their episodes directly to their YouTube accounts, eliminating the two step process. With YouTube's massive traffic, getting in front of this audience is critical to any independent producer. Since my first conversation with blip's co-founder Mike Hudack several years ago, the company's mantra has been widespread syndication. Blip already distributed its producers' shows to iTunes, AOL Video, MSN Video, Facebook, Twitter, and others. Vimeo is another new distribution partner announced yesterday.

Monetization: A new integration with FreeWheel means that ads blip sells can follow the programs it distributes wherever they may be viewed. I've written about FreeWheel in the past, which offers essential monetization capability for the Syndicated Video Economy. With the blip deal, FreeWheel delivered ads can be inserted on YouTube. This follows news earlier this week that YouTube and FreeWheel had struck an agreement which allows content providers that use FreeWheel and distribute their video on YouTube can have FreeWheel insert their ads on YouTube (slowly but surely YouTube is opening itself up to 3rd parties).

Access to TVs - Last but not least is blip's integration with the Roku player which will help bring blip's shows directly to TVs (adding to deals blip already had with TiVo, Sony Bravia, Verizon FiOS, Boxee and Apple TV). While Roku's footprint is still modest, it is positioned for major growth given current deals with Netflix and Amazon, and others no doubt pending. At $100, Roku is an inexpensive and easy-to-operate convergence device that is a great option for consumers trying to gain broadband access on their TVs. Gaining parity access to TV audiences for its broadband producers is a key value proposition for blip.

In addition to the above, blip also redesigned its dashboard and work flow, making it easier for producers to manage their shows along with their distribution and monetization. An additional deal with TubeMogul announced yesterday allows second by second viewer tracking, providing more insight on engagement.

Taken together the new deals help blip further realize its vision of being a "next generation TV network" and provide much-needed services to broadband-only producers. This group has taken a hit this year, given the tough ad sales and funding environments, so they need every advantage they can get.

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Analytics, Devices, Indie Video, Syndicated Video Economy

Topics: blip.TV, FreeWheel, Roku, TubeMogul, Vimeo, YouTube

-

YuMe/Mindshare's iGRP is Another Important Building Block for Video Ads

This week's announcement by YuMe and Mindshare to introduce an "iGRP" calculation for online video ad campaigns is another important building block in the online video industry's maturation process. Under the plan, YuMe and Mindshare will offer a reach and frequency metric for ad campaigns running across YuMe's network, which will correlate to GRPs that media planners use for TV ads. I spoke to YuMe's president and co-founder Jayant Kadambi about the iGRP plan yesterday.

Jayant explained that as the online video medium has grown, YuMe's sales team has begun interacting with more and more TV ad buyers, in addition to online ad buyers it customarily dealt with. While a lot of the

spending for online video ads is still based on number of uniques and impressions, recently virtually all of the TV ad buyers YuMe deals with have been asking for a way to correlate and compare online video ad buys with TV buys. To address this need YuMe introduced the iGRP calculation a little while back and this week took the wraps off of it publicly. For those interested in understanding GRPs better, and the iGRP calculation, YuMe also released this useful white paper.

spending for online video ads is still based on number of uniques and impressions, recently virtually all of the TV ad buyers YuMe deals with have been asking for a way to correlate and compare online video ad buys with TV buys. To address this need YuMe introduced the iGRP calculation a little while back and this week took the wraps off of it publicly. For those interested in understanding GRPs better, and the iGRP calculation, YuMe also released this useful white paper.The white paper suggests that in addition to measuring reach and frequency, iGRPs can also capture an "interactivity factor" which would measure things like mouseovers, click-throughs and leads. YuMe and Mindshare plan to work with agencies and advertisers on various experiments testing the performance of different ad formats, durations, content types and targeting schemes.

I've believed for a while, as have others, that while there will be experimental ad dollars flowing into online video advertising, in order for the industry to truly scale, it is going to have to draw spending away from TV advertising. This is especially true in the down economy where advertisers are paring budgets, not increasing them. The $60 billion or so that's spent per year on TV ads is a rich pot of gold for online video to tap into. And given how reliant the online video industry is on advertising (vs. the paid model), the urgency to do so is quite high.

But actually making this happen is no easy feat. The TV ad industry is well-understood by all its

participants, and despite its shortcomings and recent pressures such as surging DVR usage, many in the industry have little incentive to change. As a result, I believe online video ad executives must address and resolve all the friction points in shifting ad spending. Learning to speak in the same language - GRPs in this case - that traditional TV buyers have used in building media plans and doing post-campaign analysis is essential for the online video industry's growth.

participants, and despite its shortcomings and recent pressures such as surging DVR usage, many in the industry have little incentive to change. As a result, I believe online video ad executives must address and resolve all the friction points in shifting ad spending. Learning to speak in the same language - GRPs in this case - that traditional TV buyers have used in building media plans and doing post-campaign analysis is essential for the online video industry's growth.YuMe's and Mindshare's GRP plan comes on the heels of Tremor Media's own GRP announcement with comScore from February. No doubt others will follow with their own approaches as well. This will make for a noisy period until the industry coalesces around standard ways of calculating GRPs and other metrics. Nonetheless, this awkward adolescence should be viewed as an expected part of the maturation process for an industry seeking to convert an already massive, and still rapidly growing amount of monthly eyeballs into meaningful ad revenues.

What do you think? Post a comment now.

Categories: Advertising, Analytics

Topics: comScore, Mindshare, Tremor Media, YuMe

-

September '08 VideoNuze Recap - 3 Key Themes

Welcome to October. Recapping another busy month, here are 3 key themes from September:

1. When established video providers use broadband, it must be to create new value

Broadband simultaneously threatens incumbent video businesses, while also opening up new opportunities. It's crucial that incumbents moving into broadband do so carefully and in ways that create distinct new value. However, in September I wrote several posts highlighting instances where broadband may either be hurting existing video franchises, or adding little new value.

Despite my admiration for Hulu, in these 2 posts, here and here, I questioned its current advertising implementations and asserted that these policies are hurting parent company NBC's on-air ad business. Worse yet, In "CNN is Undermining Its Own Advertisers with New AC360 Live Webcasts" I found an example where a network is using broadband to directly draw eyeballs away from its own on-air advertising. Lastly in "Palin Interview: ABC News Misses Many Broadband Opportunities" I described how the premier interview of the political season produced little more than an online VOD episode for ABC, leaving lots of new potential value untapped.

Meanwhile new entrants are innovating furiously, attempting to invade incumbents' turf. Earlier this week in "Presidential Debate Video on NYTimes.com is Classic Broadband Disruption," I explained how the Times's debate coverage positions it to steal prime audiences from the networks. And at the beginning of this month in "Taste of Home Forges New Model for Magazine Video," I outlined how a plucky UGC-oriented magazine is using new technology to elbow its way into space dominated by larger incumbents.

New entrants are using broadband to target incumbents' audiences; these companies need to bring A-game thinking to their broadband initiatives.

2. Purpose-driven user-generated video is YouTube 2.0

In September I further advanced a concept I've been developing for some time: that "purpose-driven" user-generated video can generate real business value. I think of these as YouTube 2.0 businesses. Exhibit A was a company called Unigo that's trying to disrupt the college guidebook industry through student-submitted video, photos and comments. While still early, I envision more purpose-driven UGV startups cropping up in the near future.

Meanwhile, brand marketers are also tapping the UGV phenomenon with ongoing contests. This trend marked a new milestone with Doritos new Super Bowl ad contest, which I explained in "Doritos Ups UGV Ante with $1 Million Price for Top-Rated 2009 Super Bowl Ad." There I also cataloged about 15 brand-sponsored UGV contests I've found in the last year. This is a growing trend and I expect much more to come.

3. Syndication is all around us

Just in case you weren't sick of hearing me talk about syndication, I'll make one more mention of it before September closes out. Syndication is the uber-trend of the broadband video market, and several announcements underscored its growing importance.

For example, in "Google Content Network Has Lots of Potential, Implications" I described how well-positioned Google is in syndication, as it ties AdSense to YouTube with its new Seth MacFarlane "Cavalcade of Cartoon Comedy" partnership. The month also marked the first syndication-driven merger, between Anystream and Voxant, a combination that threatens to upend the competitive dynamics in the broadband video platform space. Two other syndication milestones of note were AP's deal with thePlatform to power its 2,000+ private syndication network, and MTV's comprehensive deal with Visible Measure to track and analyze its 350+ sites' video efforts.

I know I'm a broken record on this, but regardless of what part of the market you're playing in, if you're not developing a syndication plan, you're going to be out of step in the very near future.

That's it for September, lots more planned in October. Stay tuned.

What do you think? Post a comment!

Categories: Aggregators, Analytics, Brand Marketing, Broadcasters, Magazines, Partnerships, Syndicated Video Economy, UGC

Topics: ABC, Anystream, AP, CNN, Doritos, Google, Hulu, MTV, NY Times, Taste of Home, thePlatform, Unigo, Visible Measu, Voxant, YouTube

-

Key Takeaways from Yesterday's MTV - Visible Measures Deal

Yesterday brought news that MTV Networks has signed a deal with Visible Measures, a third-party analytics firm, to measure broadband video activity across over 340 of its sites. This is by far the biggest deal that Visible Measures has landed to date. And in the torrent of broadband deals and partnerships that hit my inbox each day, I believe this one is noteworthy for 3 reasons:

1. More evidence of syndication's growing importance to major media companies

A number of recent announcements have underscored the broadband market's shift to the "syndicated

video economy," but this move by MTV demonstrates how the SVE concept is starting to infiltrate major media companies' thinking. To date many of these companies have taken a somewhat informal approach to syndication, giving users embed code or passing clips on to YouTube for promotion, but not diligently measuring the activity or benefits.

video economy," but this move by MTV demonstrates how the SVE concept is starting to infiltrate major media companies' thinking. To date many of these companies have taken a somewhat informal approach to syndication, giving users embed code or passing clips on to YouTube for promotion, but not diligently measuring the activity or benefits. MTV's deal shows serious intent to measure its syndication activity and use the resulting data to help shape its broadband video efforts. As a leader in broadband video, MTV's Visible Measures deal is certain to prompt other major media companies to up their commitment to syndication as well. This would synch with a comment a CEO of a broadband technology vendor told me yesterday: "...every content company we deal with has now prioritized syndication and they are actively addressing the technical, business and political issues."

2. Programming business changing to be more data-centric

You can be sure that when armed with a trove of new Visible Measures-generated data about how its users watch and engage with its video, MTV's programming decisions will be influenced accordingly. As I wrote in my initial post about Visible Measures last June, that's one of the beauties of broadband consumption vs. TV - all user behavior can be tracked and assessed. By knowing - down to the frame - things like when viewers dropped out, what scenes they rewound/viewed repeatedly and what clips they most shared, MTV's programming decisions should become ever smarter.

Stalwart creatives may decry this research-intensive approach to program development, but in media businesses challenged to reduce costs and increase profitability, anything that helps predict what users will watch (and therefore help drive a higher ROI per program) is invaluable. This is especially true for TV networks trying to rationalize the pilot process. Gauging real-life user reactions to various videos online can only make the pilot process more effective.

Stalwart creatives may decry this research-intensive approach to program development, but in media businesses challenged to reduce costs and increase profitability, anything that helps predict what users will watch (and therefore help drive a higher ROI per program) is invaluable. This is especially true for TV networks trying to rationalize the pilot process. Gauging real-life user reactions to various videos online can only make the pilot process more effective.3. Ad model becomes even more important, and more refined

Though there's wide consensus that advertising will drive the broadband business for the foreseeable future, there is acute anxiety about how advertising will ultimately work (formats, insertion frequency, etc.) and how much revenue it will produce. While there's been plenty of testing to date, there's also been much guesswork involved. MTV for one will now have a bird's-eye view into its users' reactions to various ad implementations so it can continually refine its approach.

Optimizing the broadband ad model is a key issue for all players in the market. Recently I asserted that Hulu is leaving a lot of money on the table with its current ad approach, and is also pressuring parent company NBC's own ad business. I suggested Hulu could insert more ads, but without hard data, it's impossible to say how much more. Here's another example: all those viral SNL clips of Tina Fey doing Sarah Palin could mean real money for NBC, yet without proper tracking and ad implementations their real value is being underoptimized. The list of examples goes on. More data on video usage can really help the ad model.

In sum, MTV's deal with Visible Measures is both a positive step in the ongoing maturation of broadband video, syndication and advertising and a harbinger of more deals to come.

(Note: if you'd like to learn more about MTV's and others' syndication strategies, please join me for a panel I'll be moderating next Tuesday, October 7th at Contentonomics in LA. Joining me are MTV's Greg Clayman, Revision3's Damon Berger, ClipBlast's Gary Baker and EgoTV's Jimmy Hutcheson. Information and registration is here.)

What do you think? Post a comment.Categories: Analytics, Cable Networks

Topics: MTV, Visible Measures

-

August '08 VideoNuze Recap - 3 Key Topics

Welcome to September. Before looking ahead, here's a quick recap of 3 key topics from August:

1. Advertising model remains in flux

Broadband video advertising was a key story line in August, as it seems to be every month. The industry is rightly focused on the ad model's continued evolution as more and more players in the value chain are increasingly dependent on it. This month, in "Pre-Roll Video Advertising Gets a Boost from 3 Research Studies," I noted how recent research is showing that user acceptance and engagement with the omnipresent pre-roll format is already high and is improving. However, as many readers correctly noted, research from industry participants must be discounted, and some of the metrics cited are not necessarily the best ones to use. I expect we'll see plenty more research - on both sides of pre-roll's efficacy - yet to come.

Meanwhile, comScore added to the confusion around the ad model by first highly ranking YuMe, a large ad network, very high in its reach statistics, only to then reverse itself by downgrading YuMe, before regrouping entirely by introducing a whole new metric for measuring reach. In this post, "comScore Gets Its Act Together on Ad Network Traffic Reporting," I tried to unravel some of this mini-saga. Needless to say, without trustworthy and universally accepted traffic reporting, broadband video is going to have a tough slog ahead.

2. Broadband Olympics are triumphant, but accomplishments are overshadowed

And speaking of a tough slog, the first "Broadband Olympics" were a huge triumph for both NBC and all of its technology partners, yet their accomplishments were overshadowed by a post-mortem revenue estimate by eMarketer suggesting NBC actually made very little money for its efforts. This appeared to knock broadband video advertising back on its heels, yet again, as outsiders pondered whether broadband is being overhyped.

The Olympics became a hobbyhorse of mine in the last 2 weeks as I tried to clarify things in 2 posts, "Why NBCOlympics.com's Video Ad Revenues Don't Matter" part 1 and part 2. These posts triggered a pretty interesting debate about whether technology/operational achievements are noteworthy, if substantial revenues are absent. My answer remains a resounding yes. But having exhausted all my arguments in these prior posts, I'll leave it to you to dig in there if you'd like to learn more about why I feel this way.

3. Broadband's impact is wide-ranging

VideoNuze readers know that another favorite topic of mine is how widespread broadband's impact is poised to become, and in fact already is. A number of August's posts illustrated how broadband's influence is already being felt across a diverse landscape.

Here's a brief sampling: "Vogue.TV's Model.Live: A Magazine Bets Big on Broadband" (magazines), "Tanglewood and BSO Pioneer Broadband Use for Arts/Cultural Organizations," (arts/culture), "American Political Conventions are Next Up to Get Broadband Video Treatment," (politics), "Citysearch Offering Local Merchants Video Enhancement," (local advertising) and "1Cast: A Legit Redlasso Has Tall Mountain to Climb" (local news).

I expect this trend will only accelerate, as more and more industries begin to recognize broadband video's potential benefits.

That's it for August and for the busy summer of '08. Lots more action to coming this fall!

Categories: Advertising, Analytics, Broadcasters, Magazines, Politics, Sports

Topics: 1Cast, CitySearch, comScore, eMarketer, NBC, RedLasso, Tanglewood, Vogue, YuMe

-

WebTrends Beefs Up its Focus on Video Measurement

Late last week, WebTrends, the long-time player in web analytics, announced an important improvement in its video measurement capabilities. The company introduced a rich media plug-in that is compatible with most video formats (Flash, Silverlight, WMP, Real, etc.) providing customers with deeper understanding of users' behavior with video. I had a quick chat with Roger Corvill and Sean Browning at WebTrends to learn more.

Most everyone who has ever worked in any online business has likely had contact with WebTrends and other analytics packages like Omniture and Google Analytics. All of these provide valuable insight about site traffic, page usage, clickstream data, referring links and the like.

But the massive explosion of video has introduced new complexity in the analytics world because video is a new media type requiring unique measurement capabilities. Relevant video metrics include things like abandonment rates, rewind/resume behavior, and conversion rates on offers. As user engagement shifts to video, publishers require the same degree of insight as they've come to expect in the HTML world.

But the massive explosion of video has introduced new complexity in the analytics world because video is a new media type requiring unique measurement capabilities. Relevant video metrics include things like abandonment rates, rewind/resume behavior, and conversion rates on offers. As user engagement shifts to video, publishers require the same degree of insight as they've come to expect in the HTML world.Roger and Sean said customers have been expressing these kinds of needs to them as they are urgently focused on how best to monetize their video efforts. This synchs with what I hear often from content executives; they're excited about the opportunity to be more data-driven in both their programming decisions and monetization strategies.

In ad-supported video alone, there are a bewildering array of ad formats and implementation models, with varying impacts on the user's experience. This is the crux of today's experimentation: which ad model results in optimal consumption and monetization. I think of these attributes mapped on an XY chart, with the goal to operate as far out to the right corner as possible (i.e. high consumption AND high monetization). But this can only happen with solid underlying measurement.

Until now, WebTrends customers had to customize in order to get deep video-related stats; now they will be available out of the box. One limitation, at least for now, is that WebTrends only measures video consumption on-site. That means that as video is virally spread though embedding, emailing and syndication WebTrends doesn't yet keep track. That's an important limitation given how viral video consumption is. This is a key feature that Visible Measures, a video analytics startup which I've written about previously, has focused on.

Still, just gaining greater insight about how visitors engage with on-site video is a great leap forward, and one which WebTrends customers will no doubt welcome.

Categories: Analytics

Topics: Visible Measures, WebTrends

Posts for 'Analytics'

Previous |