-

SundaySky - AOL StudioNow Partnership is a Great Example of Video Innovation

A partnership announced yesterday between SundaySky and StudioNow is another great example of how video is being used to innovate traditional ways of doing business. For those not familiar with either company, SundaySky's technology platform, which I last wrote about here, creates real-time, personalized videos at scale using templates and data feeds, and StudioNow (which is part of AOL's Advertising.com division) offers distributed video production and syndication services.

The partnership creates a new sales channel for SundaySky, while enhancing the range of services StudioNow can offer its clients. As SundaySky's president and CRO Jim Disco explained to me yesterday, the exciting part is how SundaySky's technology is being innovatively applied and the new value it creates for customers like real estate service provider ListingBook, which was also announced yesterday.

Categories: Partnerships, Technology

Topics: AOL, ListingBook, StudioNow, SundaySky

-

5 Lessons AOL CEO Tim Armstrong Has Learned About Online Video Success

At WPP Group's Global Video Summit yesterday afternoon, (hosted by Kantar Video, GroupM and WPP Digital), AOL CEO Tim Armstrong shared 5 lessons he's learned for online video success:

1. Dedicated teams for video are required; it's too important to share resources

2. Video assets must be organized and catalogued; most companies don't even know how much or what they own as he found when he arrived at AOL 2 years ago

3. A great video player is needed; it's at the center of the user experience

4. Video should be put everywhere; distribution is crucial

5. Collecting data on video performance is essential; data is particularly useful in determining the optimal ad formats and user experience

Categories: Indie Video, Portals

Topics: AOL

-

AOL Makes Yet Another Move Into Video With Eisner's Vuguru Studio

Another day, another move by AOL to deepen its commitment to online video. Today the company announced that Michael Eisner's independent online video studio Vuguru will produce at least 6 original series for distribution by AOL. Each series will be 90 minutes in length and broken into segments for episodic distribution. The companies are positioning the series as filling a role between high-cost Hollywood content and user-generated content on the low end.

The deal follows AOL's recent acquisition of video syndicator 5Min and its acquisition earlier this year of video platform and production company StudioNow. With 5Min in particular, AOL can further distribute the Vuguru series to a network of third-party publishers as well as on its own site. By expanding reach and leveraging its own ad sales capabilities, AOL is much better positioned to monetize the original content. I would also expect involvement of brands along the way as well, morphing some of the series or episodes into branded content or involving clever product placement. AOL has tied its future heavily to advertising, and clearly recognizes that video offers higher value opportunities than other forms and is therefore pushing hard to create more content and video ad inventory.

What do you think? Post a comment now (no sign-in required).Categories: Indie Video, Portals

-

5Min Acquired By AOL, Why Exit So Early?

This morning AOL announced that it has acquired 5Min with the rumor mill suggesting the price is $65 million. For AOL, the deal makes a lot of sense and is yet another building block in its video and niche content strategy. 5Min is especially relevant to AOL since it acquired Studio Now earlier this year. 5Min gives AOL significant distribution reach both for video that Studio Now creates and for other content AOL develops. 5Min has masterfully executed the video syndication opportunity that I've been bullish about for some time and I've been a big 5Min fan for a while.

The bigger question for me, which I've emailed to Ran Harnevo, 5Min's CEO and Co-Founder, is why sell now? While $65 million is certainly nothing to sneeze at, given $13 million was invested in the company the returns for investors are likely in the 2-4x range, again not shabby, but not a grand slam.

Categories: Deals & Financings, Portals, Syndicated Video Economy

-

4 Items Worth Noting for the Jan 25th Week (Netflix Q4, Nielsen ratings, AOL-StudioNow, Net Neutrality Webinar)

With the new Apple iPad receiving wall-to-wall coverage this week, it was easy to overlook other significant news. Here are 4 items worth noting for the January 25th week:

1. Netflix Q4 earnings increase my bullishness - On Wednesday, Netflix reported blowout results for Q4 '09, adding almost 3 million subscribers during the year (and a million just in Q4), bringing their YE '09 subscriber count to 12.3 million. Netflix also forecasted to end this year with between 15.5 million and 16.3 million subscribers, implying subscriber growth will be in the range of 26% to 33%. Importantly, Netflix also said that 48% of its subscribers used the company's streaming feature to watch a movie or TV show in Q4, up from 41% in Q3 and 28% a year ago. Wall Street reacted with glee, sending the stock up $12 yesterday to a new high of $63.04.

VideoNuze readers know I've been bullish on Netflix for some time now, and the Q4 results make me more so. A key concern I've had has been around their ability to gain further premium content for streaming. On the earnings call, CEO Reed Hastings and CFO Barry McCarthy addressed this issue, offering up additional details of their content strategy and how the recent Warner Bros. 28-day DVD window deal will work. On Monday I'm planning a deep dive post based on what I heard. As a preview, I'm now convinced that Netflix is the #1 cord-cutting threat. Cable, satellite and telco operators need to be watching Netflix very closely.

2. Nielsen announces combined TV/online ratings plan, but still falls short - This week brought news that Nielsen intends to unveil a "combined national television rating" in September that merges traditional Nielsen TV ratings with certain online viewing data. This is data that TV networks have been hungering for as online viewing has surged, potentially siphoning off TV audiences. I pointed out recently that the lack of such a measurement could seriously retard the growth of TV Everywhere, as cable networks hesitate to risk shifting TV audiences to unmeasurable online viewing.

Nielsen's move is welcome, but still doesn't go far enough. As reported, it seems the new merged ratings will only count online views that had the same ads and ad load as on-air. That immediately rules out Hulu, which of course carries far fewer ads than on-air, and sometimes uses custom creative as well. Obviously if the new Nielsen ratings don't truly capture online viewership they'll be worth little in the market. Ratings are a story with many future chapters to come.

3. AOL acquires StudioNow in bid for to ramp up video content - Also not to be overlooked this week was AOL's acquisition of StudioNow for $36.5 million in cash. StudioNow operates a distributed network of 3,000 video producers, creating cost-effective video for small and large companies alike. I'm very familiar with StudioNow, having spoken with their CEO and founder David Mason a number of times.

AOL is clearly looking to leverage the StudioNow network to generate a mountain of new video content, complementing its Seed.com "content farm." In addition, AOL picks up StudioNow's recently-launched Video Asset Management & Syndication Platform (AMS) which gives it video management capabilities as well. For AOL the deal suggests the company is finally waking up to video's vast potential. But with the rise of online video syndication, it's still a question mark whether creating a whole lot of new video is the right strategy, or whether AOL would have been better served by just partnering with a syndicator like 5Min.

Meanwhile, AOL isn't the only portal realizing video is the place to be. In Yahoo's earnings call this week, CEO Carol Bartz said "Frankly, our competition is television" and as Liz wrote, Bartz also said "that makes video really important." Yahoo just partnered with Ben Silverman's new Electus indie video shop, and it sounds like more action is coming. Geez, the prospect of AOL and Yahoo competing on acquisitions? It would be like the old days again.

4. Net Neutrality webinar next Thursday is going to be awesome - A reminder that next Thurs, Feb. 4th at 11am PT/2pm ET The Diffusion Group and VideoNuze will present a complimentary webinar "Demystifying Net Neutrality." The webinar is the first in a series of 6 throughout 2010, exclusively sponsored by ActiveVideo Networks. Colin Dixon from TDG and I will be hosting and we have 2 fabulous guests, who are on opposing sides of the net neutrality debate: Barbara Esbin, Senior Fellow and Director of the Center for Communications and Competition Policy at the Progress and Freedom Foundation and Chris Riley, Policy Counsel for Free Press.

Net neutrality is a critically important part of the landscape for over-the-top video services, and yet it is widely misunderstood. Join us for this one-hour session which promises to be educational and impactful.

Enjoy your weekend!

Categories: Aggregators, Broadband ISPs, Deals & Financings, Portals, Regulation, Webinars

Topics: AOL, Net Neutrality, Netflix, Nielsen, StudioNow, Webinar

-

4 Items Worth Noting for the Nov 16th Week (FCC's Open Access, Broadcast woes, Droid sales, AOL cuts)

Following are 4 items worth noting for the Nov 16th week:

1. FCC raises "Open Access" possibility, would further government's control of the Internet - As reported by the WSJ this week, the FCC is now considering an "Open Access" policy that would require broadband Internet providers to open up their networks for use by competitors. The move comes on top of FCC chairman Julius Genachowski's recent proposal for formalizing net neutrality, a plan that I vigorously oppose. Open Access gained steam recently due to a report released by Harvard's Berkman Center that characterized the U.S. as a "middle-of-the-pack" country along various broadband metrics. The report has been roundly dismissed by service providers as drawing incorrect conclusions due to reliance on incomplete data.

The FCC is in the midst of crafting a National Broadband Plan, as required by Congress, aimed at providing universal broadband service throughout the U.S. as well as faster broadband speeds. Improving broadband Internet access in rural areas of the U.S. is a worthy goal, but the FCC should be pursuing surgical approaches for accomplishing this, rather than turning the whole broadband industry upside down. As for increasing speeds, major ISPs are already pushing 50 and 100 mbps services, more than most consumers need right now anyway. Broadband connectivity is the lifeblood for online video providers and any government initiative that risks unintended consequences of slowing network infrastructure investments is unwise.

2. Broadcast TV executives waking up to online video's challenges - Reading the coverage of B&C/Multichannel News's panel earlier this week, "Free Streaming: Killing or Saving the Television Business" featuring Marc Graboff (NBCU), Bruce Rosenblum (Warner Bros.), Nancy Tellem (CBS) and John Wells (WGA), I kept wondering where were these sentiments when the Hulu business plan was being crafted?

Hulu is of course the poster child for providing free access to the networks' programs, with just a fraction of the ad load as on-air. While the panelists agreed that the industry should be dissuading consumers from cord-cutting, Hulu is (purposefully or not) the chief reason some people consider dropping cable/satellite/telco service. For VideoNuze readers, it's old news already that broadcast networks have been hurting themselves with their current online model. What was amazing to me in reading about the panel is that what now seems obvious should have been very apparent to industry executives from the start.

3. Motorola Droid sales off to a strong start - The mobile analytics firm Flurry released data suggesting that first week Verizon sales of the Motorola Droid smartphone were an estimated 250,000. Flurry tracks applications on smartphones to estimate sales volume of devices. While the Droid results are lower than the 1.6 million iPhone 3GS units sold in that device's first week, Flurry notes that the iPhone 3GS was available in 8 countries and also had an installed base of 25 million 1st generation iPhones to draft on.

The Droid's success is important for lots of reasons, but from my perspective the key is how it expands the universe of mobile video users. As I noted in "Mobile Video Continues to Gain Traction," a robust mobile ecosystem is developing, and getting more smartphones into users' hands is crucial. I was in my local Verizon store this week and saw the Droid for the first time - though it lacks some of the iPhone's sleekness, the video quality is even better.

4. AOL's downsizing suggests further pain ahead - AOL was back in the news this week, planning to cut one-third of its employees ahead of its spin-off from Time Warner on Dec. 9th. The cuts will bring the company's headcount to 4,500-5,000, down from its peak of 18,000 in 2001. As I explained recently, no company has been hurt more by the rise of broadband than AOL, whose dial-up subscribers have fled en masse to broadband ISPs. Now AOL is going all-in on the ad model, even as the ad business itself is getting hurt by the ongoing recession. New AOL CEO Tim Armstrong is clearly a guy who loves a challenge; righting the AOL ship is a real long shot bet. I once thought of AOL as being a real leader in online video. Now I'm hard-pressed to see how the AOL story is going to have a happy ending.

Enjoy your weekends!

Categories: Advertising, Aggregators, Broadband ISPs, Broadcasters, Mobile Video, Portals, Regulation

Topics: AOL, Droid, FCC, Hulu, iPhone, Motorola, Verizon

-

FreeWheel is Close to Managing 1 Billion Video Ads Per Month

In a quick call yesterday with FreeWheel Co-CEO and Co-Founder Doug Knopper, who was on his way to NYC for tonight's VideoSchmooze, he told me that the company is poised to manage 1 billion video ads next month, all against premium video streams.

In addition, FreeWheel has now been integrated by AOL, MSN and Fancast, among others, with Yahoo testing currently and ready to go live soon. It looks like the major portals are being encouraged to integrate with FreeWheel's Monetization Rights Management system by the company's premium content customers.

The benefit to the content providers is better control and monetization of their ad inventory across their portal distribution deals. The portal activity comes on top of FreeWheel's recently-reported implementation with YouTube, allowing the site's premium content partners to sell and insert ads against their YouTube-initiated streams.

The benefit to the content providers is better control and monetization of their ad inventory across their portal distribution deals. The portal activity comes on top of FreeWheel's recently-reported implementation with YouTube, allowing the site's premium content partners to sell and insert ads against their YouTube-initiated streams.FreeWheel is another great example of the Syndicated Video Economy (SVE) I've frequently talked about. Doug says FreeWheel's progress is proof that the SVE is really "hitting its stride."

It is hard though to put FreeWheel's 1 billion number into perspective. One way of thinking about it is comparing it to the data that comScore reported for August '09 for the top 10 video sites. Assuming only 5-10% of YouTube's views are from its premium partners and maybe half of Fox Interactive's are (due to MySpace's user-generated videos being included in its 380M streams) the top 10 video providers would account for about 3.5B videos. If each video had an average of 2 ads (which is a decent assumption when averaging short clips vs. full programs), then the top 10 video sites would account for about 7B video ads.

Relative to the top 10 then, FreeWheel's 1B ads managed look pretty healthy. To get a fuller picture, you'd also have to consider how many premium streams are in the 12B+ video views that fall outside of comScore's top 10 video sites, and how many ads run against those. If anyone has any ideas for how to determine these numbers, I'd love to hear them.

What do you think? Post a comment now.

Categories: Advertising, Portals, Syndicated Video Economy, Technology

Topics: AOL, Fancast, FreeWheel, MSN, Yahoo, YouTube

-

Hubris Cursed AOL But Broadband Crushed It

I highly recommend reading Saul Hansell's piece in last Friday's NY Times, recapping the ridiculously optimistic quotes senior executives at AOL and Time Warner have made over the years (and be sure to peruse readers' consistently vitriolic comments). For anyone who's watched AOL's rise and fall, the quotes are a stroll down memory lane. But while the picture that emerges is that hubris cursed AOL and contributed mightily to its downfall, in reality it was broadband, and AOL's colossal mismanagement in transitioning to it, that crushed the company.

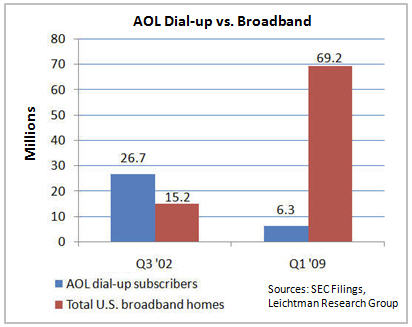

The chart below shows that AOL's dial-up subscribers topped out in Q3 '02 at 26.7 million, and have been in a free-fall ever since, sitting at just 6.3 million at the end of Q1 '09, a drop-off of 20.4 million or 76%. Where did those 20.4 million dial-up subs go, along with tens of millions of other dial-up and new Internet users? To broadband Internet access, supplied by cable companies and telcos. These companies have grown their U.S. broadband subs from 15.2 million in Q3 '02 to 69.2 million in Q1 '09, an astonishing increase of 54 million subscribers in just 7 years.

Cable and telco broadband providers have feasted on the carcasses of AOL and other dial-up services like MSN and Earthlink. But, here's what's both incredible and really sad: had AOL management been less arrogant and more strategic in its approach to broadband, it's quite possible that things could have turned out quite differently.

Back in the mid-to-late '90s, I had a front-row seat at AOL's initial reactions to broadband. In that period I was VP Business Development at Continental Cablevision, then the 3rd largest cable operator in the U.S. with over 5 million video subscribers. We were one of the pioneers in testing and rolling out "high-speed" Internet service. While we thought our speedy and always-on broadband connections were a better mousetrap vs. dial-up, we were very concerned about our lack of online content, video-centric branding and ability to effectively market this exciting new service.

In the pre-@Home days, I pushed to explore how we could partner with AOL to help us get our service off to a faster start. A deal with AOL would have had significant advantages to them as well. AOL at the time had a huge capex burden building out more modem banks to keep up with its swelling subscriber ranks. Even still, there was already plenty of AOL subscriber frustration with the slowness of the AOL network, and often you couldn't even get connected on your first or second tries. At least in our geographic footprint we could unburden them of their network build-out, offer better-quality connections and allow them to focus on content and brand-building. As the 3rd largest cable operator, we also offered them a valuable proof-point that they could use to build industry-wide relationships.

After much preparation and scheduling, we met with one of AOL's most senior executives. After articulating our broadband vision and opportunity to work together, he arrogantly dismissed us as if we were precocious children. To him the opportunity we were describing was far too small, and to illustrate his point he asserted that AOL would have 10 million subscribers before we had our first 100,000 (a prediction that was probably correct!).

Needless to say, no meaningful deal with us - or any other cable operator - every materialized. AOL went on to flounder around with various incarnations of AOL Broadband, none of which ever got any traction. AOL continued to grow its subscribers for a number of years and capitalized on its reach by extracting hundreds of millions of dollars from VC-backed startups eager for access to its massive captive audience (some of those deals would later come under scrutiny, as would AOL's accounting treatment for its subscriber business). AOL then bought Time Warner, and the rest as we know is history.

But what if things had gone differently? What if that AOL executive and others had seen the handwriting on the wall - that broadband would eventually render dial-up obsolete - and decided that AOL needed to figure out how to transition to it, instead of dismissing it? Had that happened, it could have forged partnerships throughout the cable and telco industries that would have let it focus on content and services in an open, broadband environment. In fact, I think it's quite possible that AOL could have pre-empted @Home and the RoadRunner venture that Continental eventually joined from getting traction (why start over when AOL, the 800 pound gorilla is in your corner?).

Instead AOL fell victim to its own arrogance and limited strategic vision. Broadband went on to become the single most powerful enabler of the Internet as we know it today (e.g. billions of spontaneous Google searches, Tweets, Amazon purchases, and more recently video views). AOL is now a crippled mish-mash of mostly second-rate properties, on its umpteenth management team, led by new CEO Tim Armstrong.

In retrospect, those fateful decisions AOL made about broadband 10-15 years ago set the stage for the company's eventual demise.

What do you think? Post a comment now.

Categories: Broadband ISPs, Cable TV Operators, Portals, Telcos

-

June '08 VideoNuze Recap - 3 Key Topics

Wrapping up a busy June, I'd like to quickly recap 3 key topics covered in VideoNuze:

1. Execution matters as much as strategy

I've been mindful since the launch of VideoNuze to not just focus on big strategic shifts in the industry, but also on the important role of execution. I'm not planning to get too far into the tactical weeds, but I do intend to show examples where possible of how successful execution can make a difference. This month, in 2 posts comparing and contrasting Hulu and Fancast (here and here) I tried to constructively show how a nimble upstart can get a toehold against an entrenched incumbent by getting things right.

While great execution is a key to successful online businesses, it may sometimes feel pretty mundane. For example, in "Jacob's Pillow Uses Video to Enhance Customer Experience" I shared an example of an arts organization has begun including video samples of upcoming performances on its web site, improving the user experience and no doubt enhancing ticket sales. A small touch with a big reward. And in this post about the analytics firm Visible Measures, I tried to explain how rigorous tracking can enhance programming and product decisions. I'll continue to find examples of where execution has had an impact, whether positive or negative.

2. Cable TV industry impacted by broadband

As many of you know, I believe the cable TV industry is a crucial element of the broadband video industry. Cable operators now provide tens of millions of consumer broadband connections. And cable networks have become active in delivering their programs and clips via broadband. Yet the broadband's relationships with operators and networks are complex, presenting a range of opportunities and challenges.

On the opportunities side, in "Cable's Subscriber Fees Matter, A Lot," I explained how the monthly sub fees that networks collect put them on a firm financial footing for weathering broadband's changes and an advantageous position compared to broadband content startups which must survive solely on ads. Further, syndication is offering new distribution opportunities, as evidenced by Scripps Networks syndication deal with AOL in May and Comedy Central's syndication of Daily Show and Colbert Report to Hulu and Adobe. Yet cable networks are challenged to exploit broadband's new opportunities while not antagonizing their traditional distributors.

For operators, though broadband access provides billions in monthly revenues, broadband is ultimately going to challenge their traditional video subscription business. In "Video Aggregators Have Raised $366+ Million to Date," I itemized the torrent of money that's flowed into the broadband aggregation space, with players ultimately vying for a piece of cable's aggregation revenue. These and other companies are working hard to change the video industry's value chain. There will be a lot more news from them yet to come.

3. Video publishing/management platforms continue to evolve

Lastly, I continued covering the all-important video content publishing/management platform space this month, with product updates from PermissionTV, Brightcove and Entriq/Dayport. Yesterday, in introducing Delve Networks, another new player, I included a chart of all the companies in this space. I put a significant emphasis on this area because it is a key building block to making the broadband video industry work.

These companies are jostling with each other to provide the tools that content providers need to deliver and optimize the broadband experience. The competitive dynamic between these companies is very blurry though, with each emphasizing different features and capabilities. Nonetheless, each seems to be winning a share of the expanding market. I'll continue covering this segment of the industry as it evolves.

That's it for June; I have lots more good stuff planned for July!

Categories: Aggregators, Cable Networks, Cable TV Operators, Technology

Topics: AOL, Brightcove, Comedy Central, Delve, Entriq, Fancast, Hulu, Jacobs Pillow, PermissionTV, Scripps, Visible Measures

-

Bebo Pursues Distinctive Original Programming Model

Bebo, the social networking giant being acquired by AOL for $850 million, is pioneering a new programming model by mixing original online-only video series, community engagement and brand integration. While in

LA last week I attended an invite-only session in which Bebo VP of Marketing Ziv Navoth provided an overview of its approach and elaborated on its upcoming plans.

LA last week I attended an invite-only session in which Bebo VP of Marketing Ziv Navoth provided an overview of its approach and elaborated on its upcoming plans.Since its inception in 2005, Bebo has quickly mushroomed to 40 million+ members with a core audience of 16-24 year olds, concentrated in the U.K. While a distant third to Facebook and MySpace in size, the depth of Bebo's user engagement is significant.

I think Bebo has cleverly grasped the notion that by offering original online video series, it is providing valuable, relatively inexpensive fodder for its members to engage with. So valuable is this programming to serving Bebo's larger corporate mission that its "Open Media" model allows content partners to keep 100% of revenue generated.

Bebo's programming initiatives are gaining traction with its members. Its first series, "KateModern," the successor to "LonelyGirl15," the YouTube phenomenon, received 35 million views in its first season, and is currently averaging 1.5 million views per week, according to the company. Its next series, "Sofia's Diary," is getting half a million viewers per episode according to the company, and its broadcast rights were just acquired by FIVER, the UK broadcaster. Other programs launched or in the works include Vuguru's "The All-for-Nots", "Conquering Demons" (in association with Oakley, the sunglass company) and "The Gap Year."

When you look across all these programs, a key thread is that they all showcase young characters to whom Bebo's audience can easily relate and/or fantasize about being. Ziv repeatedly referenced that in Bebo's model, community and programming are inseparable. Bebo encourages members' feedback and involvement in the stories, and in some cases will bend the narrative to members' desires. Meanwhile Bebo offers a range of community tools to help shows gain promotion to its member base. Bebo's promotional capabilities, massive reach and member engagement are of course the main reasons why producers will seek out Bebo as a partner.

If there's one current weakness I perceive in Bebo's programming model it is monetization. Given its young, media-savvy audience, Bebo knows that advertising must be approached with care. To date Bebo has emphasized product placement, but in a way that "propels the story line forward" according to Ziv, and is believable, not gratuitous. This of course necessitates a lot of custom, one-off selling, which not a model that is scalable across dozens of eventual programs. My guess is that traditional pre-rolls and even possibly overlays will have to play a bigger part if AOL wants to fully monetize Bebo's viewership. If done with proper targeting and capping this could be acceptable to its audience.

What I like about Bebo's programming approach is that it is clearly indigenous to the online medium. As such, it is distinct from models like Hulu, which though also valuable, are primarily new conduits for existing broadcast programming. To the extent Bebo succeeds, it will become a model for how new programming that is exclusively tailored for the online medium will work.

What do you think of Bebo's programming model? Post a comment and let everyone know!

Categories: Indie Video, Video Sharing

-

ESPN Capitulates to Syndicated Video Economy

You'd have to have slept through yesterday to miss the big news that ESPN is now syndicating video clips from a cluster of its programs to AOL, its first-ever such deal. I interpret the deal as an extremely strong indicator that the "Syndicated Video Economy" (as I described this trend 3 weeks ago) is inexorable, even for the richest and most powerful video brands.

ESPN is one such brand. In 2007 it generated 1.2 billion video views from its own site, placing it in the top 10 of all sites. In January '08, ESPN generated 81 million views according to comScore, ranking it #9. And much

of ESPN's broadband video (aside from what it shows exclusively on ESPN360, its online subscription service) is essentially re-purposed from on-air, likely making the margins on ESPN's online efforts insanely profitable.

of ESPN's broadband video (aside from what it shows exclusively on ESPN360, its online subscription service) is essentially re-purposed from on-air, likely making the margins on ESPN's online efforts insanely profitable. Yet with the AOL deal, even the mighty ESPN has now capitulated to the lure of the syndicated video model. And the AOL deal is surely the first of many more deals to come. ESPN has likely come to the same conclusion as have scores of other video content providers, including the major broadcast networks: the future broadband video value chain is going to be more about "accessing eyeballs" - wherever they may live, at portals, social networks and devices - than about "acquiring eyeballs" by driving them to one central destination site. As the most stalwart proponent of the latter approach, other market participants should take heed of ESPN's strategy change.

The motivation behind video providers shifting from traditional scarcity-driven distribution strategies lies in the peculiar dynamics of the Internet: while audiences continue to fragment to a bewildering range of sites, they are simultaneously coalescing in a relatively small number of influential new brands such as YouTube, MySpace, Facebook and the traditional portals. Consider the comScore January stats again. The Google sites (dominated by YouTube) drove 3.4 billion video views or 42 times ESPN's video volume. A distant second was the Fox Interactive Media sites, including MySpace, which drove 584 million views, still 7 times ESPN's total.

These dynamics incent established video providers and startups in particular to get their video in front of all those eyeballs with more flexible business models. (For those interested in more detail on how the video distribution value chain is fast-changing due to these emerging players, I've posted slides from late '07 here. I'll have updated slides soon.)

The "Syndicated Video Economy" is creating both unprecedented opportunities and challenges for video providers. I continue to believe the future winners will be relentlessly flexible and willing to adopt new business approaches that keep them in synch with evolving consumer behaviors.

Categories: Cable Networks, Partnerships, Portals, Sports, Syndicated Video Economy

Topics: AOL, comScore, ESPN, Fox Interactive Media, MySpace, Syndicated Video Economy, YouTube

-

Modern Feed Jumps Into Video Navigation Space

With the proliferation of available broadband video comes a massive user navigation challenge. Modern Feed is launching today to address this. It is part search engine, part aggregator, with a specific focus on indexing professionally-produced programming, not user-generated video. It's also focused on actual programs, not promotional clips.

J.D. Heilprin, Modern Feed's founder/CEO told me yesterday that the company is targeting mainstream users providing the easiest way to find available, high-quality video. It employs a team of "Feeders" charged with curating the best videos to include on the site. The result is approximately 550 "networks" and 25,000 pieces of content now indexed, where "networks" is a loose term ranging from traditional broadcasters to indies new entrants like Boston Symphony or Architectural Digest.

Modern Feed is rights-holder friendly, not indexing any illegal or pirated video, and playing the video from the source's site (though sometimes with a thin Modern Feed navigation frame at the top of the screen). I played around with Modern Feed and found it to be easy-to-use and well-laid out. Modern Feed also offers an iPhone implementation that looks pretty cool, other devices are to follow.

The big challenge (and opportunity) for Modern Feed is that it's entering a very noisy space where user behavior is very undefined. There are myriad video search engines (Truveo, ClipBlast, blinkx, Veveo), portals (AOL, Yahoo, MSN), navigation sites (TV Guide, recently-launched PrimeTime Rewind) and of course the networks' own sites (and syndication efforts) offering users the ability to quickly find quality content. Then there's YouTube, the first stop for many users when it comes to video. And YouTube is increasingly moving up market by striking partnerships with premium providers.

Modern Feed's strong user experience, focus on mainstream users and device integrations are differentiators for the company. Whether these are ultimately success factors really depends on how user behavior unfolds in the nascent video navigation space. Modern Feed has raised several million dollars from angels and has 30 full-timers with aggressive growth planned.

What do you think? Post a comment and let everyone know!

See prior posts:

YouTube, C-SPAN Team Up for User-Generated, Multi-Platform Voter Project

Categories: Startups, Video Search

Topics: AOL, Blinkx, ClipBlast, Modern Feed, MSN, PrimeTime Rewind, Truveo, TV Guide, Yahoo, YouTube

-

TidalTV: Another Well-Funded Aggregator Goes For It

(Note: This is the first of a series of posts with companies participating in the 2008 Media Summit, a premier industry event which will be held next week in NYC. VideoNuze has partnered with Digital Hollywood, the Media Summit's producer, to provide select news and analysis coverage.)

Investors continue to show lots of optimism about the broadband video aggregator category. The latest data point is TidalTV, a new entrant that announced last week it has raised $15 million from NEA and Valhalla Partners. This comes on top of a crowd of well-funded startups: Joost ($45M+), Veoh ($40M+ to date), Building B ($17.5M), Vuze ($32M+), Hulu ($100M) and many others who are attacking this space in one way or another.

To better understand how TidalTV will distinguish itself from the pack, yesterday I had a lengthy briefing with CEO Mollie Spilman. She provided her first extensive remarks about TidalTV's game plan since last week's announcement. (Thanks to my old friend Tom MacIsaac, former CEO of Lightningcast, for facilitating the introduction. Tom recently launched Cove Street Partners and is as smart a player in the broadband video ad space as anyone around.)

The first thing to know about TidalTV is that it is pursuing mainstream users, not early adopters. This targeting pervades all its decision-making: site design is clean and approachable (Mollie said Apple is their role model), content is professional/well-branded only (no UGC), user experience incorporates a traditional linear programming sensibility combined with full on-demand access and advertising mimics traditional pods, while also integrating new broadband-only formats.

In short, TidalTV's making a bet that given how nascent broadband video adoption is among mainstream users, there is ample room to become the brand/destination of choice by providing an experience that feels more similar to traditional TV than to online. Though Mollie says that Apple is TidalTV's heaviest influence, I see clear parallels to AOL from the mid-late '90s. Recall that AOL's pervasive consumer-friendly UI, content and marketing (the Steve Case mantra) enabled it to crush all the dial-up ISPs which had more techie, complicated orientations. Watching AOL's rise made me a big believer that consumer-friendliness can indeed be a meaningful competitive differentiator if executed really well.

AOL is an interesting point of comparison because TidalTV's founder Scott Ferber was a co-founder of Advertising.com, which was sold to AOL in 2004, albeit after the Case era ended at AOL. Mollie was at Ad.com for 6 years as well. Other TidalTV executives come from Ad.com, Joost and Fox. The Ad.com lineage helps explain why TidalTV has chosen to invest significantly in optimizing its advertising capabilities rather than building a lot of its own publishing or delivery features (note TidalTV is all Flash-based streaming with no downloads and no P2P).

TidalTV has some interesting challenges ahead. First is content. It sounds like the company has made substantial progress in deals to obtain content from the "top 50 brands" which includes not only broadcast and cable network fare, but also print, online publishers and others who produce professional video. Yet Mollie concedes that "90% of TidalTV's content at launch could probably be found somewhere on-air or online," as content providers increasingly pursue widespread syndication. TidalTV's opportunity is to pull the content together in a neat, intuitive manner that mainstream users appreciate.

TidalTV will do so by using a "faux linear" presentation, which entails it becoming a "digital programmer," assembling its partners' shows into their own channelized formats (e.g. "The CSI Channel"), with traditional linear air times. For example, if you come to the site at 4pm, you'd see "what's on now" on multiple channels. At launch Mollie anticipates offering 10-15 channels, all on a revenue share basis with providers. This presentation approach is meant to appeal to mainstream users by providing a tangible link to a TV-oriented experience. If a user clicks to start watching, a linear "feed" will start playing, including ad breaks. However, TidalTV will also offer all programs on a full, on-demand basis as well.

But to illustrate how complicated the content acquisition terrain is for 3rd parties like TidalTV, consider Hulu, the NBC/FOX JV. It has insisted that prospective syndication partners take the Hulu player if they're to gain access to popular shows like "Heroes" and "24." Doing so could break TidalTV's user-friendly design. Mollie acknowledged this challenge, but felt confident that in examples like these, there should be adequate incentives to work out an arrangement. Then there's ABC, which to date has not pursued syndication aggressively. If it maintains its ABC.com centric approach, simply not making its programs available to 3rd parties, that leaves aggregators with obvious holes in their offerings. This would be especially challenging for a site like TidalTV, which appeals directly to mainstream users. Speaking generically, Mollie said that TidalTV's neutral "Switzerland" approach (i.e. no investments from media companies) should help in all of its content negotiations.

Driving traffic is another key issue. With other players in the market already, they've had a chance to build their traffic, though not necessarily in TidalTV's core target audience. For instance, Veoh alone says it's getting 20M+ unique visitors per month. To jumpstart traffic, Mollie said that TidalTV is prepared to fund an aggressive marketing plan, testing direct marketing, search, offline ads, outdoor, SEO, viral, PR and other tactics.

TidalTV expects to offer a geo-based limited beta in the Maryland, Virginia and DC area in late March, expanding to a national beta in mid-April. I'll be getting a peek at the beta product next week, so I'll have more to say then. Though it's still far too early to make a definitive assessment of TidalTV's chances of success, I like the fact that Mollie repeatedly uses the word "experimental" in her comments. That's a recognition of how early-stage this market space is and suggests TidalTV will stay flexible and open to all approaches to find success.

What do you think of TidalTV's chances? Post a comment and let everyone know!

Categories: Aggregators, Startups

Topics: ABC, AOL, Building B, FOX, Joost, NBC, New Enterprise Associates, TidalTV, Valhalla Partners, Veoh

-

Truveo Capitalizes on Video Search Explosion

Continuing my analysis of the video search space, just before the holidays, I had a briefing with Tim Tuttle, CEO and co-founder of Truveo, to preview some information the company released today. Started in early 2004 and acquired by AOL in December, 2005 qualifies Truveo as one of the main established players in video search.

I've been focusing a lot on this area as I believe that broadband video navigation is going to follow a similar pattern as general web content navigation -- with search taking center stage.

Truveo's growth in '07 reflects the overall surge of interest in broadband video. On the demand side, Tim reports that Truveo experienced a 20x increase in number of queries vs. a year ago. And on the supply side, Truveo has experienced a similar jump, now indexing 100 million videos, up from the 5-10 million videos it indexed at the beginning of '07.

Truveo now reaches 50 million unique visitors/mo, through its own site and across a network of partner sites where Truveo search is embedded, including AOL, MSN Video, CNET Search, Time Warner Cable, Qwest, Netvibes and many other smaller players which use Truveo's API. The company doesn't break out uniques by site, but with its recent international emphasis, Tim believes that at least 50% of its traffic now comes from outside the U.S.

A big shift Truveo has noticed in just the last 6 months is toward user searches for network TV programs and other professional video. This has displaced some of the searching for viral videos that was the traditional core. From my perspective, this is further evidence that the networks are succeeding with their online distribution initiatives. Tim sees this trend continuing in '08, as users' expectations for finding high-quality video online continues to grow.

Tim believes this shift is particularly beneficial to Truveo as it specifically built its "visual crawling" technology to find video that's in Flash or Ajax sites, and therefore hard for traditional search techniques to find.

While Truveo still operates with a fair amount of independence from its base in the Bay area, AOL seems to be recognizing more and more its strategic value. AOL has recently begun raising the visibility of Truveo in the overall AOL experience and will continue to do so.

Meanwhile on the revenue front, Tim said that the AOL acquisition has allowed Truveo to "de-prioritize" for a time its focus on revenue growth, instead concentrating on expanded reach. Despite this, Truveo is intent on capitalizing on its traffic and Tim sees the recent flurry of activity around contextual targeting as playing right to Truveo's strengths. We agreed there is much in flux about broadband video advertising and that formats beyond pre-rolls are essential. Of course what those are remains uncertain - overlays or something else?

Categories: Video Search

-

MTV Networks Dips Toe Into Syndication Waters

I was very happy to see news today of MTVN striking a big video syndication deal for its multiple networks' content with AOL Video.

Recently I praised Comedy Central's launch of TheDailyShow.com, but I took it to task for what appeared to be a destination-centric strategy, which was further supported by some executives' remarks. In this age of syndication, I thought that was a wrong-headed approach. Coupled with Viacom's misguided lawsuit against Google/YouTube, it felt like further evidence that MTVN was falling out of step with key broadband opportunities.

Today's news shows renewed hope that this may not be the case. I know these deals don't get done in a day, but I'd really like to see more syndication momentum from MTVN (and other content providers for that matter) to spread its content far and wide. Broadband Internet users don't expect to have to go to destination sites to get their favorite videos, they want them accessible where they already frequently visit. Hulu and CBS, to name two content providers that are solidly focused on syndication understand this, as do many others.

Categories: Cable Networks, Partnerships, Portals

Topics: AOL, CBS, Google, Hulu, MTVN, TheDailyShow.com, Viacom, YouTube

-

ClipBlast 3.0 Beta Released; Further Video Search Improvements

Next week ClipBlast, a player in video search space, will announce that is has launched a beta of its 3.0 product. It's actually now live and I've had a chance to play around with it for the last couple of days. I also got a briefing and demo when I met up with Gary Baker, ClipBlast's CEO, at Digital Hollywood a few weeks ago.

Video search has been a murky, yet fast-evolving area. You have to get way down into the weeds to fully understand the nuances, but here is the gist. First, video isn't nearly as searchable as text is. Video search primarily relies on metadata, which describes what's inside the video itself. This metadata can be created by the content provider or by the video search engine itself using techniques like speech-to-text processing. A key challenge for video search engines has been returning results in which the context matches what the user was intending. This is no easy feat, as the same word can obviously be used in many different contexts, yielding lots of useless results.

ClipBlast's 3.0 beta is crawling 10,000 different video providers now and they've continued to make many enhancements to their metadata processing. They've also done a lot of work to improve user navigation so that browsing is a viable complement to search. (This gets to how users actually interact with video search engines, which is yet another issue in the video search world). ClipBlast now places all videos into 70 different categories, which have easy scrolling thumbnails, showcases featured clips and featured partners and today's most popular searches.

ClipBlast has also introduced more personalization features such as saving providers, categories, searches and results. You can also configure your own personal home page and set email alerts for when new video matching your search criteria. Perhaps most fun is a new widget feature, allowing ClipBlast widgets to be embedded on your desktop and blog with customized video. Gary demo'd this for me and it's quite cool. It's only available for Macs right now with a PC release coming soon.

I'm planning a deeper dive into video search in December and will have more detailed analysis on the category then. In the mean time I suggest the best way to get into it and evaluate which video search engine is best for you is to run the same search across some of the more popular video search engines. A good list would include: Truveo (now owned by AOL), Google (still officially in "beta"), blinkx, SearchForVideo, EveryZing, Dabble, Pixsy, Fooooo and others I'm sure I'm missing.

I'm interested in what you find, so please post a comment or email me.

Categories: Video Search

Topics: AOL, Blinkx, Dabble, EveryZing, Fooooo, Google, Pixsy, SearchForVideo, Truveo

-

TV and Broadband: Who's Morphing into Whom?

Does TV programming beget broadband video programming or is it the other way around?

If you were expecting a simple answer, recent evidence suggests that none will be forthcoming. Step away from the relatively straightforward model of streamed or downloaded TV episodes, and the question of how original video content will be produced and distributed between broadband and TV is whole lot more complicated. Layer on the writers' strike and the world only fogs up further.

For those who see broadband as a pathway to TV, Quarterlife's deal announced last Friday with NBC to bring their new Quarterlife series to the network following its run on MySpace offers encouragement that Internet programming can move to the TV (bear in mind that Quarterlife was originally pitched as a TV series however).

Another example is TMZ.com, which has been successfully syndicated as TMZ TV this fall by Warner Bros. TMZ shows us that a brand that was created and built solely online can make the leap to TV. And just last week TV Week reported that Twentieth Television and Yahoo were close to a deal to create a new syndicated series based on popular broadband videos that they've collected.

On the flip side, there is plenty of evidence of opportunities for TV programs spinning off broadband programming, or existing TV producers with assets and skills pushing into broadband as a first outlet for their work.

Consider Sony's Minisode Network, with distribution on MySpace, Joost, AOL and Crackle. In an effort to squeeze more life out of its library of classics, in June Sony launched abbreviated versions, for broadband "snacking". This initiative is being closely watched as a model for how to repurpose existing assets to make them more palatable for attention-challenged online audiences.

And Endemol's recent deal with Bebo to produce "The Gap Year" series for exclusively for Bebo's audience shows that a successful TV producer is turning its sites on broadband as a first outlet.

All of these deals underscore broadband's disruptive nature - its ability to create new opportunities for incumbent players, and also for new entrants. My read is that most (though not all) broadband producers would love to make the leap to the TV. In the mean time, broadband offers a low-cost, interactive distribution path to experiment with more engaged audiences.

Many key industry players are now waking up to the idea that broadband is fundamentally re-writing traditional equations of how to extract value from well-produced video. But these equations are not yet well-understood. Some of the early deals, as outlined above, will be showing everyone the way.

Categories: Broadcasters, Indie Video, Partnerships, Video Sharing

Topics: AOL, Bebo, Crackle, Endemol, Joost, MySpace, NBC, Quarterlife, Sony, TMZ, Twentieth Television, Warner Bros, Yahoo

-

Hulu Launches Private Beta

Not breaking news now, but Hulu lifted the veil of secrecy a bit today, releasing some screen shots and setting up a private beta (I'm trying to yank some strings to get access), in advance of a planned public launch early next year.

Hulu's been surrounded by a bunch of naysayers from the beginning, though much of the nay-ing has been based on little else than cheap shots about the name, delayed launch, etc. Things that in the grand scheme of things mean virtually nothing in my opinion and only serve to distract attention from the real question at hand: can Hulu become NBC and Fox's (for now) formula for success in the broadband video era?

Now it's time for Hulu to silence the rabble. Until I get my own hands on it, I'm going to reserve in-depth commentary. But at least several things that look intriguing:

- Shorter commercial breaks and overlays - Looks like the tension between user focus vs. advertiser focus is skewing toward users. A welcome change from traditional media thinking.

- Widespread distribution - I've been a big fan of this from the start. Deals with AOL, Yahoo, MySpace, Comcast, etc. ensures that Hulu content is widely available where users already are.

- More content deals - One of the knocks on Hulu was that neither CBS nor ABC joined up front. However, recent deals with Sony and MGM show Hulu continues to gain traction with other premium providers.

- Features - Beyond the standard range of embed, full-screen, send-to-friend features, it looks like there's an interesting "custom clip" capability to let users crop out scenes from favorite shows to pass along. This user control could enable massive new short form video inventory and could be a precursor to more interesting and creative user-generated mashups. All of this is highly monetizable.

More thoughts on Hulu to come.

Categories: Aggregators, Broadcasters, Strategy

Topics: ABC, AOL, Comcast, Disney, FOX, Hulu, Microsoft, MySpace, NBC, News Corp, Yahoo

-

Music Videos are Another Example of Broadband's Ability to Create Unforeseen Revenues

On my flight home last night I was thumbing through my hotel-provided USA Today and happened on this interesting piece about how record labels are transforming their music videos from promotional tool to a bona fide new revenue source. Chalk up another unforeseen win for broadband's ability to enable new business models.

On my flight home last night I was thumbing through my hotel-provided USA Today and happened on this interesting piece about how record labels are transforming their music videos from promotional tool to a bona fide new revenue source. Chalk up another unforeseen win for broadband's ability to enable new business models.Rio Caraeff, EVP of eLabs, Universal Music Group's digital division says that licensing its music videos to the likes of Yahoo, AOL, YouTube and others now generates over $20M/year and is growing briskly. Supporting a forecast of solid growth ahead, Ian Rogers, Yahoo Music's GM believes that viewership of music videos will expand by "10 to 100 times over the next one to two years."

According to comScore, Yahoo is the web's #1 music destination, pulling in 23.4M uniques in August. Caraeff also noted that streaming accounts for the lion's share of the revenue, with paid downloads of music videos still miniscule. He cites the best-selling download of all-time, a Justin Timberlake single as generating only 58K buys, which, at $1.99 apiece, adds up to less than $120K.

None of this is to say that music videos won't continue to be used as promotional fodder. But these nascent, growing licensing and ad-sharing revenues show broadband's power to mine content value that was previously inaccessible. Sports leagues, particularly MLB.com, have been masterful at this as well, driving successful broadband-only subscription businesses. I expect others to sprout up as well.

Categories: Music

Topics: AOL, eLabs, MySpace, Sony BMG, Universal Music Group, Yahoo, YouTube

-

Josh Freeman Moves from AOL to Discovery

File this one under "AOL's loss is Discovery's gain." Today Discovery announced that Josh Freeman, who had been an SVP of AOL Video, has joined Discovery as its Executive Vice President, Digital Media.

Josh and I did business together when I was consulting for TotalVid and we signed a distribution/promotion deal with AOL Video. Josh is among the smartest, most experienced people in the broadband video space and will no doubt have a huge impact on Discovery's growth in the area.

From the release:

"As Discovery's top digital media strategist, Freeman will be responsible for growing Discovery brands across digital platforms globally. Charged with seeking out new technology and strategic alliances, and developing new business models and markets, he is expected to help Discovery expand its footprint through the role and visibility of its world-class portfolio of brands online, on mobile and through other digital platforms."

At Discovery Josh will report to Bruce Campbell, President, Digital Media and Business Development. Coincidentally, Bruce, who's also relatively new to Discovery, will be on my CTAM NY Blue Ribbon Breakfast panel in 2 weeks, joining other panelists Dallas Clement (Cox), David Eun (Google), Herb Scannell (Next New Networks) and Matt Strauss (Comcast). The session promises to be a blockbuster and is already fully sold out.

Categories: Cable Networks, People, Portals

Topics: AOL, Discovery, Josh Freeman