-

VideoNuze Report Podcast #27 - August 14, 2009

Daisy Whitney and I are pleased to present the 27th edition of the VideoNuze Report podcast, for August 14, 2009.

In this week's podcast, Daisy and I discuss "The Future of Internet Video," a new research report released this week by eMarketer. Coincidentally, we had each read the press release about the report and found ourselves disagreeing with its conclusions.

As Daisy explains, the report essentially asserts that for online video advertising to continue to grow, the viewing experience between the computer and TV must converge. The logic is that TV's "lean-back" viewing mode is a preferred context for advertisers, and therefore for advertising against online video to grow, the video must be accessible on TVs.

Daisy takes issue with this, arguing that while convergence is great, there are indeed times when watching on a computer is preferred by consumers. A "new norm" has emerged with the computer as a parallel viewing platform. Rather than looking at this as an obstacle, advertisers should embrace consumers' behavior, and capitalize on it.

My main disagreement is that eMarketer believes that a "lean-back" TV viewing mode is preferred by advertisers over the "lean-forward" computer viewing mode. While eMarketer argues the computer mode creates viewer distraction and incents clicking away from ads, I see it the other way around: when watching video on computers, ads cannot be skipped, calls to action can be easily implemented (e.g. "click here to receive....) and everything of course can be measured. Contrast this with the rampant ad-skipping that now occurs in DVR-enabled homes.

Listen in and draw your own conclusions.

Separately, I can't resist touching on the topic of "authenticity" of broadband video I wrote about earlier this week in "How I Got Punked by the Megawoosh Waterslide Video." I received lots of feedback on this post, with plenty of people 'fessing up that they got punked too, while others called me the "poster child for gullibility!" Either way, authenticity of broadband video is a fascinating topic.

Click here to listen to the podcast (13 minutes, 58 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, Podcasts

-

4 Items Worth Noting from the Week of August 3rd

Following are 4 items worth noting from the week of August 3rd:

1. Research, research, research - For some unknown reason, there was a flurry online video-related research and forecasts released this week. In no particular order:

eMarketer was out with a new forecast indicating 188 million online video viewers in the U.S. in 2013.

Veronis Suhler released its forecast of 2009-2013 communications industry spending, showing advertising shrinking as a percentage of total spending.

PWC's UK office released its 2009-2013 forecast, which also anticipates declines in advertising.

CBS's research head David Poltrack used detailed data to explain the company's online video strategy and buttress its argument that in a TV Everywhere world, it should be compensated for its content (slides are here, via PaidContent).

Ipsos found that Americans streamed a record amount of TV programs and movies, doubling their consumption from Sept '08 to July '09.

Yahoo and a group of research partners released data finding that 70% of online video consumption happens throughout the day and night, as opposed to traditional TV viewing which is concentrated in the prime-time window.

Last but not least, TDG released excerpts of its research on "over-the-top" video services, available for download at VideoNuze.

2. Unicorn Media launches, hires ex-Move Networks executive David Rice - It will be hard for some to believe there's room for yet another white label video publishing and management platform, but startup Unicorn Media is going to try elbowing its way into the crowded space, with a specific focus on large media companies. I spoke with Unicorn's executive team this week, led by Bill Rinehart, who was the founding CEO of Limelight.

Unicorn is positioning itself as the first "enterprise-grade" solution, staking out key differentiators such as enhanced analytics/reporting, faster/easier transcoding, improved APIs for content ingest/management and more flexible monetization/ad queuing. I have not yet seen a demo, but I'm intrigued by what I heard. The company has raised $5M to date from executives/angels and has a staff of 25. David Rice, formerly Move's VP of Marketing has come on board as Chief Strategy Officer. Given the team's industry expertise and relationships, this could be a company to watch.

3. Google acquires On2 Technologies and other encoding-related news - The blogosphere was in a flurry about Google's $106M acquisition of video compression provider On2 Technologies this week. Speculation flew about Google open-sourcing On2 new VP8 codec, which could potentially force a new standard to emerge as a challenge to H.264, today's leading codec. This is important stuff, though a little further down the stack than I usually focus, so I refer you to Dan Rayburn's analysis of the deal's implications, which is the best I've seen.

There was other news in the emerging cloud-based encoding/transcoding/delivery market this week, as Encoding.com announced a new premium service with tighter service level agreements (4 minute max wait time and 50 Gbyte/hour/customer throughput). Encoding.com's Gregg Heil and Jeff Malkin explained the company is using the new SLAs to move upmarket to service tier 1 and 2 media companies. Separate, Encoding.com's competitor mPoint's CEO Chiranjeev Bordoloi told me they're now on a $3M annualized revenue run rate as cloud-based alternatives continue to gain acceptance.

4. Don't try this at home - On a lighter note, there's been no shortage of knuckle-head stunt videos we've all seen online, but this one is near the top of my personal favorite list. Do NOT try replicating this over the weekend!Categories: Deals & Financings, Technology

Topics: CBS, eMarketer, Google, Ipsos, ON2, PWC, TDG, Unicorn Media, Veronis Suhler, Yahoo

-

New Complimentary TDG Research on Over-the-Top Video Services

Continuing a past VideoNuze practice of making key data available from industry research firms, today I'm pleased to provide a dozen excerpt slides from The Diffusion Group's recent study, "Consumer Interest in

OTT Video Services." TDG is one of the leading firms studying broadband adoption and shifting video consumption habits (and is also a long-time VideoNuze partner). These slides are from TDG's Q1 '09 proprietary survey of 2,000 U.S. adults, the results of which have only been shared with its paying clients to date.

OTT Video Services." TDG is one of the leading firms studying broadband adoption and shifting video consumption habits (and is also a long-time VideoNuze partner). These slides are from TDG's Q1 '09 proprietary survey of 2,000 U.S. adults, the results of which have only been shared with its paying clients to date.Click here to download the slides

"Over-the-top" is an industry term for any video provider (e.g. free, paid, on-demand, live, streaming, etc.) using the broadband infrastructure of an unaffiliated ISP to reach their intended audience. Since most broadband ISPs are either cable companies or telcos who also offer their own subscription multichannel video services, the idea is that these new services (e.g. Netflix, YouTube, Hulu, Amazon VOD, etc.) are provided "over-the-top" of these broadband/video incumbents, directly to broadband-enabled audiences.

With the proliferation of convergence devices (e.g. Roku, Xbox, AppleTV, etc.) OTT video is increasingly getting all the way to viewers' TVs. Many of you have heard me talk about how powerful and unprecedented broadband's "openness" is in the traditionally tightly controlled video industry. Like the Internet itself, broadband's openness is foundational; it has enabled a totally new and free-flowing relationship between video content providers and viewers.

There's been no shortage of buzz that OTT providers could disrupt the multibillion dollar per year subscription TV business, enticing subscriber's to "cut the cord" on incumbent cable/telco/satellite providers. I've weighed in multiple times on the likelihood of cord-cutting, originally laying out my arguments last October in "Cutting the Cord on Cable: For Most of Us It's Not Happening Any Time Soon." With cable's TV Everywhere services now gaining steam, I think the likelihood of cord-cutting en masse is even more remote.

Nonetheless OTT remains a genuine long-term threat for many good reasons. So TDG's survey is a welcome effort at quantifying consumers' potential interest in OTT services, at various price points and in multiple types of offerings. TDG identifies 4 audience segments: "Replacers," "Supplementers," "OTT Optimals," and "Non-OTT Consumers." The survey tests demand for paid OTT services at various price points, revealing each segment's willingness to pay. Each segment is motivated by different reasons, meaning that OTT service providers are going to have to be very disciplined about understanding who exactly they're targeting and how to generate appeal.

No doubt there will be plenty more research on OTT and cord-cutting yet to come. For anyone thinking about these market opportunities, I think the TDG research is very useful.

Categories:

Topics: TDG

-

4 News Items Worth Noting from the Week of July 27th

Following are 4 news items worth noting from the week of July 27th:

New Pew research confirms online video's growth - Pew was the latest to offer statistics confirming that online video usage continues to soar. Among the noteworthy findings: Long-form consumption is growing as 35% of respondents say they have viewed a TV show or movie online (up from 16% in '07); watching video is widely popular, draw more people (62%) than social networking (46%), downloading a podcast (19%) or using Twitter (11%); usage is up across all age groups, but still skews young with 90% of 18-29 year olds reporting they watch online vs. 27% of 65+ year olds; and convergence is happening with 23% of people who have watched online reporting they have connected their computers to their TVs.

FreeWheel has a very good week - FreeWheel, the syndicated video ad management company I most recently wrote about here, had a very good week. On Monday, AdAge reported that YouTube has begun a test allowing select premium partners to bring their own ads into YouTube, served by FreeWheel. Then on Wednesday, blip.tv announced that it too had integrated with FreeWheel, so ads could be served for blip's producers across their entire syndication network. I caught up with FreeWheel's co-CEO Doug Knopper yesterday who added that more deals, especially with major content producers, are on the way. FreeWheel is riding the syndication wave in a big way.

Plenty of action with CDNs - CDNs were in the news this week, as Vusion (formerly Jittr Networks) bit the dust, after going through $11 million in VC money. Elsewhere CDN Velocix (formerly CacheLogic) was acquired by Alcatel-Lucent. ALU positioned the deal as fitting with its "Application Enablement" strategy, supporting customers' needs in a "video-centric world." Limelight announced its LimelightREACH and LimelightADS services for mobile media delivery and monetization (both are based on Kiptronic, which it acquired recently). Last but not least, bellwether Akamai reported Q2 '09 earnings, that while up 5% vs. year ago, were down sequentially from Q1. Coupled with a cautious Q3 outlook, the company's stock dropped 20%.

IAC is making big moves into online video - IAC is making no bones about its interest in online video. Last week the company unveiled Notional, a spin-out of CollegeHumor.com, to be headed by that site's former editor-in-chief Ricky Van Veen. Then this week it announced another new video venture, with NBCU's former co-entertainment head Ben Silverman. IAC chief Barry Diller seems determined to push the edge of the envelope, as IAC talks up things like multi-platform distribution and brand integration. With convergence and mobile consumption starting to take hold, the timing may finally be right for these sorts of plays. At a minimum IAC will keep things interesting for industry watchers like me.

Click here to see an aggregation of all of the week's broadband video news

Categories: Advertising, CDNs, Indie Video, Syndicated Video Economy

Topics: Akamai, Alcatel-Lucent, blip.TV, FreeWheel, IAC, Limelight, Pew, Velocix, Vusion, YouTube

-

Google is Being Clumsy in Explaining YouTube's Performance

Yesterday's "YouTube myth busting" post on its YouTube Biz Blog had the opposite of its intended effect: rather than providing more transparency about YouTube's performance as it hoped to do, it only set off

another round of frustrated posts in the blogosphere imploring Google to release actual YouTube numbers.

another round of frustrated posts in the blogosphere imploring Google to release actual YouTube numbers. The post came on the heels of last week's Q2 '09 earnings call and supplementary briefing call (transcripts here and here) which were full of optimistic, yet confusing comments about YouTube's "trajectory" from a handful of Google's senior executives.

Here's what CFO Patrick Pichette said on the supplementary call: "I think that it is true that we are pleased with YouTube's trajectory. And in part the reason why we're communicating it to the Street is there's been so much press over the last quarter with all of these documentations of, you know, massive cost and no business models and all kind of negative press that we've read a lot about. And we just wanted to kind of reaffirm to the Street that this is a very credible business model and it's one that's got trajectory. So in that sense it's just to kind of tell everybody that we're on progress on the plan that we had made for it."

But what plan is he referring to? In almost 3 years of owning YouTube, Google has never publicly disclosed a specific plan for YouTube or laid out its business model, so attempts at reaffirming it fall flat because there's nothing against which progress can be judged. Here are other comments, with my reactions in parentheses.

Pichette on the earnings call: "We are really pleased both in terms of its (YouTube's) revenue growth, which is really material to YouTube and in the not long, too long distance future, we actually see a very profitable and good business for us, so from that perspective, we are really pleased with the trajectory." (WR: that sounds pretty bullish)

Jonathan Rosenberg, SVP of Product Management on the earnings call: "I think what I said - or what I meant to say was that monetizable views have tripled in the last year and that we are monetizing billions of views every month." (WR: that sounds bullish too, but wouldn't some actual numbers really bolster this point?)

Rosenberg on the supplementary call: "And that's part of why I think it's taken us time to kind of triangulate toward what works, and I think some of the things that we have now are still in the pretty nascent stages..." (WR: nonetheless, per earlier comment, profitability can already be forecast in the not too distant future?)

Nikesh Arora, President of Global Sales Operations and Business Development on the earnings call: "So we are seeing significant sell-through in most of our major markets where we have YouTube homepage for sale." (WR: of what ad unit - pre-rolls or display?)

Arora on the earnings call: "So I think the next phase of YouTube is going to be toward pre-roll video on short clips and long form video (which we are in the process of doing) various deals in, which we've announced in the past." (WR: that's new news, YouTube's spoken primarily of overlays in the past)

Rosenberg on the supplementary call: "I would not say our overall optimism that we expressed with respect to YouTube is primarily a function of one specific format. We've actually been testing pre-rolls, I think, for quite a while. So if you interpret that one single comment to pre-rolls to imply the broad conclusion with respect to optimism on YouTube, I think that's probably a mistake." (WR: so maybe pre-rolls aren't actually the next big thing?)

Yesterday's post: "Myth 5 YouTube is only monetizing 3-5% of the site. This oft-cited statistic is old and wrong, and continues to raise much speculation." (WR: what is the percentage then?)

CEO Eric Schmidt on the earnings call: "The majority of YouTube views are not professional content. They are user generated content because that's the majority of what people are watching." In response to whether YouTube is able to monetize user-generated content: "Has not been our focus." (WR: again, letting us know what percentage is professional and the focus of monetization would be very helpful)

These comments raise lots of questions about how far along Google actually is in understanding YouTube's traffic and its ability/plan to monetize it. I think Google is being clumsy in explaining YouTube's performance because it got nervous about the eye-popping estimates that have been floating around lately about how much money YouTube is losing and rushed to try to mitigate this perception, but without being ready to present real numbers as backup. Further, I don't think it rehearsed its executives very well about what to say or how to say it, so the improvised comments did not convey a clear consistent message.

As someone who believes YouTube has enormous long-term value for Google, my advice is that its executives should just stay mum on YouTube until they're ready to make a logical case backed by facts and data. That may take longer than Google or the market hoped, allowing the rumor mill to continue to churn. But continuing to make unsupported statements will only rile YouTube followers further, and eventually sap Google's credibility.

What do you think? Post a comment now.

Categories: Aggregators, UGC

-

4 News Items Worth Noting from the Week of July 13th

Following are 4 news items worth noting from the week of July 13th:TV Everywhere survey should have cable industry clicking their heels - I wasn't at all surprised to read results of a new Solutions Research Group survey fielded to 500 Comcast and Time Warner Cable subscribers giving the concept of TV Everywhere positive reviews. As Multichannel News reported, in the overall survey 28% of respondents said the idea was "excellent" and 45% said it was "good." Digging in further though, among those 18-49 the "excellent" score surged to 80%, while 87% of Hulu and Fancast users approved of the idea. Unprompted, respondents cited benefits like convenience, remote viewing, getting better value from their cable subscriptions, watching on PCs in rooms without TVs and catching up on missed programs. My take: consumers "get" what TV Everywhere is all about and already have positive initial reactions, meaning there's very significant upside for the cable industry.Paid video forecast to surpass free - A Strategy Analytics forecast that got attention this week says that the global paid online video market will be worth $3.8B in 2009, exceeding the global free online video segment which will total $3.5B. I haven't seen the details of the forecast, but I'm very curious what's being included in each of these numbers as both seem way too high to me. The firm forecasts the two segments to grow at comparable rates (37% and 39%), suggesting that their size will remain relatively even. I suspect we're going to be seeing a lot of other research suggesting the paid market is going to be far larger than the ad-supported market as sentiment seems to be shifting toward subscriptions and paid downloads.

Consumer generated video contests remain popular - VideoNuze readers know I've been intrigued for a while now about contests that brands are regularly running which incent consumers to create and submit their own videos. Just this week I read about two more brands jumping on the bandwagon: Levi's and Daffy's retail stores. NewTeeVee had a good write-up on the subject, citing new research from Forrester which reviewed 102 different contests and found the average prize valued at $4,505. I see no end in sight for these campaigns as the YouTube generation realizes it's more lucrative to pour their time into these contests than training their cats to skateboard. Brands too are recognizing the wealth of amateur (read cheap!) talent out there and are moving to harness it.

MySpace has lots of work ahead to become a meaningful entertainment portal - The WSJ ran a piece on Monday based on an interview with Rupert Murdoch in which he was quoted as saying MySpace will be refocused "as an entertainment portal." That may be the winning ticket for MySpace, but I'm not totally convinced. MySpace has been in a downward spiral lately, with a 5% decline in audience over the past year, a 30% headcount reduction and an executive suite housecleaning. While always strong in music, according to comScore, its 48 million video viewers in April '09 were less than half YouTube's 108 million, while its 387 million video views were about 5% of YouTube's 6.8 billion. Clearly MySpace has a very long way to go to give YouTube serious competition. It will be interesting to see if the new management team Murdoch has installed at MySpace can pull off this transition.

Categories: Aggregators, Brand Marketing, Cable Networks, Cable TV Operators, UGC

Topics: Comcast, Forrester, MySpace, Strategy Analytics, Time Warner

-

MTV Unveils Research on Short-Form Video Advertising

MTV Networks released some interesting research yesterday on the optimal way to present advertising in short-form online video. Its "Project Inform" looked at how multiple ad presentations from 3 blue chip

advertisers performed and were liked by users across 50 million video streams on MTV.com, ComedyCentral.com, VH1.com, NickJr.com and CMT.com. The research was conducted in partnership with InsightExpress using Panache's video ad platform.

advertisers performed and were liked by users across 50 million video streams on MTV.com, ComedyCentral.com, VH1.com, NickJr.com and CMT.com. The research was conducted in partnership with InsightExpress using Panache's video ad platform. The research found that the most effective ad product was a "lower 1/3 product suite" consisting of a 5 second pre-roll combined with a 10 second lower 1/3 semi-transparent Flash overlay that began about 10 seconds after the video itself began. Effectiveness was defined as brand lift, measured by metrics like unaided awareness, aided awareness and purchase intent. The research also measured consumers' likeability of each ad product. This finding provides support for why overlays seem to keep popping up; for example I now see overlays on most of the video clips I watch on YouTube.

In second place was a conventional 30 second pre-roll which did well on both effectiveness and consumer likeability. That surprises me somewhat because I've believed for a while that 30 seconds is way too long for an ad where the content itself may only be 1-3 minutes in length. Granted it's a subjective judgment, but my personal experience has been that 30 seconds feels like an eternity when I know the content I'm accessing is going to be pretty brief. In fact I've noticed a clear trend toward 15 second pre-rolls accompanying short video clips, which I assumed suggested content providers had thankfully come to a similar conclusion.

In third place in the MTV research was a "sideloader product suite", which included a 5 second pre-roll with a 10 second custom unit that slides out of the right side of the video window 10 seconds after the video itself began (so it sounds like the lower 1/3 product suite except the overlay is on the right instead of the bottom). I've never seen a unit like this, but to the extent that it may block valuable content in the right side of the window I could see users feeling it was intrusive.

There's lots of research underway about different ad formats' effectiveness, and the MTV research adds to the industry's collective knowledge about best practices. There's still a ways to go though as industry participants launch and test new types of ad formats in search of the ultimate ad presentation.

What do you think? Post a comment now.

Categories: Advertising, Cable Networks

Topics: InsightExpress, MTV, Panache

-

Catching Up on Last Week's Industry News

I'm back in the saddle after an amazing 10 day trip to Israel with my family. On the assumption that I wasn't the only one who's been out of the office around the recent July 4th holiday, I've collected a batch of industry news links below so you can quickly get caught up (caveat, I'm sure I've missed some). Daily publication of VideoNuze begins again today.

Hulu plans September bow in U.K.

Rise of Web Video, Beyond 2-Minute Clips

Nielsen Online: Kids Flocking to the Web

Amid Upfronts, Brands Experiment Online

Clippz Launches Mobile Channel for White House Videos

Prepare Yourself for iPod Video

Study: Web Video "Protail" As Entertaining As TV

In-Stat: 15% of Video Downloads are Legal

Kazaa still kicking, bringing HD video to the Pre?

Office Depot's Circuitous Route: Takes "Circular" Online, Launches "Specials" on Hulu

Upload Videos From Your iPhone to Facebook Right Now with VideoUp

Some Claims in YouTube lawsuit dismissed

Concurrent, Clearleap Team on VOD, Advanced Ads

Generating CG Video Submissions

MJ Funeral Drives Live Video Views Online

Why Hulu Succeeded as Other Video Sites Failed

Invodo Secures Series B Funding

Comcast, USOC Eye Dedicated Olympic Service in 2010

Consumer Groups Push FTC For Broader Broadband Oversight

Crackle to Roll Out "Peacock" Promotion

Earlier Tests Hot Trend with "Kideos" Launch

Mobile entertainment seeking players, payment

Netflix Streams Into Sony Bravia HDTVs

Akamai Announces First Quarter 2009 State of the Internet Report

Starz to Join Comcast's On-Demand Online Test

For ManiaTV, a Second Attempt to be the Next Viacom

Feeling Tweety in "Web Side Story"

Most Online Videos Found Via Blogs, Industry Report

Categories: Advertising, Aggregators, Broadcasters, Cable Networks, Cable TV Operators, CDNs, Deals & Financings, Devices, Indie Video, International, Mobile Video, Technology, UGC

Topics: ABC, C, Clearleap, Clippz, Comcast, Concurrent, Hulu, In-Stat, Invodo, iPod, Kazaa, Nielsen, Office Depot, Qik, VideoUp, YouTube

-

VideoNuze Report Podcast #23 - July 2, 2009

Below is the 23rd edition of the VideoNuze Report podcast, for July 2, 2009.

This week Daisy shares additional information about ESPN's Ad Lab for emerging media. The Ad Lab, which was first disclosed by ESPN last year, is intended to various ad formats in the ESPN video player. It is one of many different tests and research projects in the market. As Daisy and I say, everyone's trying to learn how best to monetize the nascent online video; this creates a lot of valuable data, which market participants then need to parse through to fully understand.

I get into further details on my post yesterday, "Video Companies Raised $64M in Q2 '09, Notching Another Stellar Quarter." Despite the recession and the slowdown in venture capital investments, at least 26 industry companies have raised at least $219M over the last 3 quarters, which is impressive by any measure. Still, it hasn't been easy, and one indicator of what investors prefer is that not one of the 26 investments is in a content provider or video aggregator.

Click here to listen to the podcast (14 minutes, 24 seconds)

(Note, with vacations planned, our next podcast will be July 24th)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, Cable Networks, Deals & Financings

-

4 Industry Items from this Week Worth Noting

YouTube mobile video uploads exploding; iPhones are a key contributor - The folks at YouTube revealed that in the last 6 months, uploads from mobile phones to YouTube have jumped 1,700%, while in the last week, since the new iPhone GS was released, uploads increased by 400% per day. I didn't have access to these stats when I wrote on Monday "iPhone 3GS Poised to Drive User-Generated Mobile Video," but I was glad to see some validation. The iPhone 3GS - and other smartphone devices - will further solidify YouTube as the world's central video hub. I stirred some controversy last week with my "Does It Actually Matter How Much Money YouTube is Losing?" post, yet I think the mobile video upload explosion reinforces the power of the YouTube franchise. Google will figure out how to monetize this over time; meanwhile YouTube's pervasiveness in society continues to grow.

Nielsen study debunks mythology around teens' media usage - Nielsen released a new report this week "How Teens Use Media" which tries to correct misperceptions about teens' use of online and offline media. The report is available here. On the one hand, the report underscores prior research from Nielsen, but on the other it reveals some surprising data. For example, more than a quarter of teens read a daily newspaper? Also, 77% of teens use just one form of media at one time (note, data from 2007)? I'm not questioning the Nielsen numbers, but they do seem out of synch with everything I hear from parents of teens.

Paid business models resurfacing - There's been a lot of talk from media executives about the revival of paid business models in the wake of the recession's ad spending slowdown and also the newspaper industry's financial calamity. For those who have been offering their content for free for so long, putting the genie back in the bottle is going to be tough. Conversely for others, like those in the cable TV industry, who have resisted releasing much content for free, their durable paid models now look even more attractive.

Broadcast TV networks diverge on strategy - Ad Age had a good piece this week on the divergence of strategy between NBC and CBS. The former is breaking industry norms by putting Leno on at 10pm, emphasizing cable and avidly pursuing new technologies. Meanwhile CBS is focused on traditional broadcast network objectives like launching hit shows and amassing audience (though to be fair it is pursuing online distribution as well with TV.com). Both strategies make sense in the context of their respective ratings' situations. Regardless, broadcasters need to eventually figure out how to successfully transition to online distribution, something that is still unproven (as I wrote here).

Categories: Aggregators, Broadcasters, Mobile Video, UGC

Topics: Apple, CBS, iPhone, NBC, Nielsen, YouTube

-

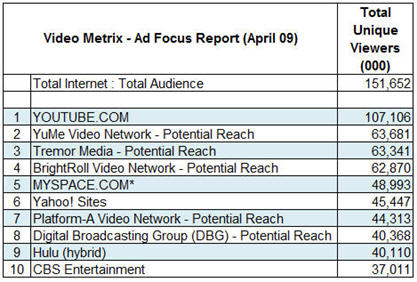

Unraveling comScore's Monthly Viewership Data for Online Video Ad Networks

A monthly reminder that online video remains a work in progress is comScore's viewership data for online video ad networks. Even as someone who follows the industry closely, I find these reports confusing. The press

releases often distributed by various online video ad networks touting their progress only adds to the confusion. I touched on this last month, and to clear away some of the fog, last week I spoke to Tania Yuki, comScore's product manager for its Video Metrix measurement service.

releases often distributed by various online video ad networks touting their progress only adds to the confusion. I touched on this last month, and to clear away some of the fog, last week I spoke to Tania Yuki, comScore's product manager for its Video Metrix measurement service. comScore's traffic reports are extremely important for the online video industry's growth because they are a key source of data for advertisers, media buyers, agencies and others looking to tap into this new medium. Ad networks in particular are an important part of the online video ecosystem because they provide significant reach, targeting and delivery technology, all of which are required by prospective advertisers.

A key part of the current confusion is that each month comScore's Video Metrix Ad Focus report - which details the total audience of unique viewers for online properties and ad networks - combines both the actual audience of destination properties with the potential reach of video ad networks. For example, here's the top 10 for April:

As you can see, 5 of the top 10 listed are ad networks, whose measurement is potential, while the other 5 are actuals. "Potential" is supposed to represent the aggregate number of viewers of all the sites that the ad network has the right to place ads on. However even the validity of this number is amorphous, because networks are only required to provide comScore proof of their relationships if the site accounts for more than 2% of all streaming or web activity.

Recognizing the need to provide more clarity, comScore has recently made available the option for networks to participate in a "hybrid" measurement approach, meant to track networks' actual viewership. To participate, networks need to place a 1x1 pixel, or "beacon" inside any video player where their ads appear. comScore takes the data reported by the beacons and combines it with its 2 million member panel of users whose behavior it tracks. It reconciles differences between the two through a "scaling" process that looks at the intensity of users' non-video behaviors.

To give a sense of the difference between potential and actual, comScore reports BrightRoll - which along with Nabbr are the only video ad networks to have implemented the beacons by April - as having 26M actual viewers vs. the 62M potential reported.

comScore's hybrid approach, which fits with its recently-announced "Media Metrix 360" service, is an important step forward in providing more clarity on how video ad networks are actually performing. Still, as Tania explained, even the hybrid approach has its own idiosyncrasies. For example, some publishers resist having a network's beacon incorporated into their video player, because they want to receive traffic credit themselves. Further, it is a voluntary program. Tania said that in addition to BrightRoll and Nabbr, other networks like BBE, YuMe and Tremor are all working through the implementation currently.

The actual numbers are important for buyers, so that ad networks' viewership can be assessed on an "apple to apples" basis with online properties, as well as non-video options. Tania said that media buyers tell comScore they value both potential and actual numbers. Though that sounds right to me, I think that for the online video medium to mature, buyers are going to put increasing emphasis on actual performance, particularly as it relates to existing media. That's why recent efforts from YuMe and Tremor to translate online video's impact into TV's gross rating points (GRP) paradigm are also important.

In short, comScore seems to be doing its part to improve reporting clarity. However, this isn't going to resolve itself overnight; the market will continue to experience reporting confusion for some time to come.

What do you think? Post a comment now.

Categories: Advertising

Topics: BBE, BrightRoll, comScore, Nabbr, Tremor Media, YuMe

-

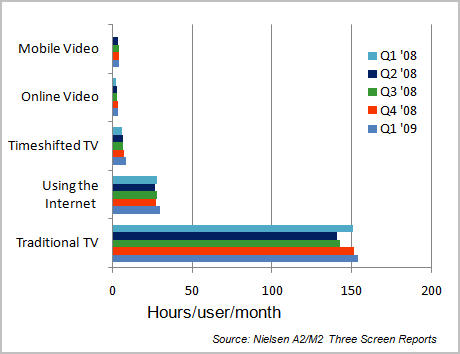

VideoNuze Report Podcast #18 - May 29, 2009

Below is the 18th edition of the VideoNuze Report podcast, for May 29, 2009.

This week I review the Q1 '09 Nielsen A2/M2 Three Screen Report data recently released, comparing it to Q1 '08 data. My comments pick up on a post I wrote earlier this week, "Video Behavior Changes Suggest Evolution, Not Revolution For Now."

Don't get me wrong, video consumption on alternative platforms (i.e. broadband, mobile, DVR) is continuing to grow briskly. But the reality is that when you look at the numbers, they suggest steady rather than dramatic, overnight change is what's really happening in the market. This reality is sometimes missed in the ongoing hype.

Meanwhile Daisy adds more detail to a post she wrote, "Fox's Prison Break Finale Demonstrates the Power of Social Media," which describes how Fox cleverly used social media to promote a DVD with 2 additional episodes following the on-air finale. Fox used various social media sites to release a teaser picture from the new episodes and began promoting the DVD which will be available on July 21 on DVD and for purchase on iTunes. It's an intriguing way for the studio to migrate users beyond traditional TV consumption and generate additional revenue.

Click here to listen to the podcast (13 minutes, 37 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Broadcasters, Podcasts

-

Video Behavior Changes Suggest "Evolution," Not "Revolution" For Now

Last week's latest Nielsen A2/M2 Three Screen Report confirmed what I've been saying for a while: when it comes to characterizing changes in consumers' overall video behaviors, "evolution" is a better descriptor than "revolution." To be sure there are certain age segments and behaviors where change is happening very fast. But the overall Nielsen tracking data suggests that until a significant catalyst comes along, major market changes will play out quite gradually.

I've been tracking Nielsen's periodic releases of its Three Screen reports since last year, and the graph below captures the data during this period.

No surprise, time spent watching online video experienced the biggest year-to-year jump (53%) to 3 hours/month. That's solid growth, but even at this rate, it would be a long time before online video viewing takes a significant overall share of the video market. Part of the reason is that time spent on traditional TV just keeps on increasing, nudging up almost 3 hours in the last year to almost 153 1/2 hours/month. That trend has to keep a lot of TV executives smiling.

Still, industry participants have to be watching younger viewers, where adoption of alternate viewing platforms is on the leading edge. For example, 18-34 year olds consume 70% more online video (5 hours, 7 minutes per month) than average, 12-17 years consume 85% more mobile video (6 hours, 30 minutes per month) than average and 25-34 year olds consume 109% more timeshifted TV (12 hours, 12 minutes per month) than average. All of these segments are most coveted by advertisers and their more-rapidly shifting behaviors are clearly (and correctly) driving major media to experiment with new broadband and mobile models.

The "x factor" that would scramble these trends is the introduction of significant market catalyst, like the iPhone, which has ignited mobile video market. In online video viewing specifically, a market catalyst would be a convergence device or enabler that would allow seamless broadband connectivity to TVs. I've talked about this a lot on VideoNuze, and there are many different approaches underway. When one begins experiencing serious adoption, as the iPhone has, I expect Nielsen Three Screen Data will reflect it.

Until then we can expect broadband, mobile and timeshifting to have a significant, yet gradual impact on the overall market.

What do you think? Post a comment now.

Categories:

Topics: Nielsen

-

comScore Data Shows Tremor Media, Others Gaining in Premium Reach

Amid the steady stream of sneak peek press releases I'm sent each day, one I received late Tuesday from Tremor Media, the video ad network and monetization platform, caught my eye.

The release cited March data from comScore indicating that Tremor's network now had potential reach of 137M unique users and 57M unique video viewers (both unduplicated). The former number is from comScore's Media Metrix Ad Focus report and the latter from its Video Metrix Ad Focus report.

In particular, the latter number stuck out because I recalled comScore numbers from just 2 weeks ago that revealed the viewership for the top 10 video sites. Google (YouTube) was #1 with about 100M viewers, and Fox Interactive (mainly MySpace) was #2 with about half the amount, 55M.

comScore's new data meant that Tremor's potential reach was second only to YouTube's actual reach. And if you make the argument that much of YouTube's viewership is still UGC, while Tremor's network focuses

solely on premium publishers, Tremor would be #1 in potential reach against premium video, a key point of the release. It's also worth noting that 2 other video ad networks focused on premium publishers also show up in comScore's top 10 for potential unique viewers- BrightRoll with 56M and YuMe with 41M.

solely on premium publishers, Tremor would be #1 in potential reach against premium video, a key point of the release. It's also worth noting that 2 other video ad networks focused on premium publishers also show up in comScore's top 10 for potential unique viewers- BrightRoll with 56M and YuMe with 41M. Tremor's VP of Marketing Shane Steele and market research manager Ryan Van Fleet walked me through the data further yesterday.

First, it's important to read these numbers carefully, as there's a little bit of apples vs. oranges going on. The Video Metrix Ad Focus report combines actual viewership by the destination sites (e.g. YouTube, MySpace, Yahoo, Hulu, etc.) with potential viewership by the ad networks. The report clearly denotes what's considered "potential." If I understand it correctly then, the comScore numbers for ad networks should be read as "here's the total potential audience of viewers you have access to." However, what percentage of this accessible audience actually gets an ad served by the ad network is only known by the ad network itself.

VideoNuze readers will recall there's been a lot of sensitivity around these comScore numbers, since last summer a minor kerfuffle broke out over comScore's ranking of YuMe's traffic. Initially it attributed MSN's full audience to YuMe, but later revised YuMe's ranking down by only included pages against which YuMe ads could be served. comScore also stated that on an ongoing basis it would report "potential" reach for ad networks based on documented agreements and "actual" reach for those networks that included certain tags. The new Tremor numbers reflect this potential reach measurement.

It's also important to remember that comScore filters its data to arrive at unduplicated reach. As I understand it that means that if for example Tremor had USAToday.com and Fox.com in its network (note Tremor doesn't disclose its publishers except to its advertisers) and a single user watched video at both sites, the user would only be counted once in Tremor's potential reach. I don't know how exactly comScore de-duplicates viewership, but let's assume it's accurate.

The extent of Tremor's reach (along with BrightRoll's and YuMe's), particularly against premium video is an encouraging sign. I've written in the past that key inhibitors of TV ad dollars moving over to online video are both scale and various friction points in the ad buying process. The comScore data demonstrates that a cluster of ad networks is emerging that can deliver against TV ad buyer's reach expectations, while adding new targeting and reporting capabilities unavailable in TV. There have also been recent enhancements to these companies' reporting/analytics (particularly around GRPs) to synch up with TV ad buyers' expectations.

The online video ad model continues to grow and evolve in spite of the current recession. This is particularly important for expensively-produced premium video where effective online monetization is crucial.

Chime in here with a comment if you think the comScore data or its implications needs further clarification.

Categories: Advertising

Topics: BrightRoll, comScore, Tremor Media, YuMe

-

Daisy Whitney's E-Book on Fair Use is a Must-Read for Content Creators

Daisy Whitney, my podcast colleague and omnipresent broadband video industry reporter, has recently released an excellent 25-page E-Book on fair use. It is titled "Keeping You and Your Content Out of Court"

is a solidly researched piece on an extremely gray subject area that has tripped up even some of the biggest content creators. If you've ever been concerned about how much of someone else's content you can freely use in your work, and what the guidelines for such usage are, this E-Book is a must-read.

is a solidly researched piece on an extremely gray subject area that has tripped up even some of the biggest content creators. If you've ever been concerned about how much of someone else's content you can freely use in your work, and what the guidelines for such usage are, this E-Book is a must-read. The E-Book is available here, with a VideoNuze discount (enter code "VideoNuze" at checkout), for $31.50. Note, there's no commission in this for me.

In this short interview below, Daisy explains what you can expect.

VideoNuze: Tell us more about the E-Book you've written. What are the key benefits to readers?

Daisy Whitney: For the E-Book I interviewed more than a dozen leading copyright attorneys and IP experts, asking for their understanding of fair use and how they advise their clients. I describe the most important fair use court rulings of the last 35 years and what they mean in day-to-day practice. The E-Book gives content creators the tools and "litmus tests" they need to assess whether a video they've created complies with fair use standards. The book is a cost-effective alternative to hiring a lawyer to address these kinds of questions. I hope that creators will learn how to evaluate, edit and distribute their work in a way that avoids any legal troubles.

VN: Why does "fair use" matter to online video creators in the first place?

DW: The fair use doctrine from U.S. Copyright law impacts many decisions video creators make about their videos. For example: What if you wanted to play background music in a video? Can you zoom in on a copyrighted photograph on a web site in your video? And how about incorporating a 5 or 10 second video clip from a TV show? Are you allowed to do any of these things or are you putting yourself at risk of being sued? The answers are not black and white. Just ask the mom of two who shot a video of her toddler dancing to a Prince song and is now being sued by Universal Music Group!

VN: At a high level, what makes compliance with fair use such a gray area?

DW: Fair use - like many areas of law - is ultimately an art, not a science. That's why lawyers have jobs! Fair use isn't a law per se, it's a set of standards, which can be either a sword or a shield. I have distilled what I heard from the lawyers and experts I interviewed into a set of guidelines and precedents which I think will be invaluable for content creators.

VN: Can you give a couple examples of how fair use has been viewed by the courts?

DW: The Harry Potter case - Warner Bros. and J.K. Rowling vs. RDR Books, is a great example because it helps to define the concept of "transformative" work, which is an important fair use standard. In the case, Warner/Rowling argued that a new online encyclopedia being written with the use of Potter materials would have competed with a similar project Potter author Rowling was also working on. The court ruled that the new encyclopedia did not significantly alter or change the original work so as to become a wholly new work, therefore it was not considered fair use. Ultimately the author added his own comments and critiques, "transforming" his encyclopedia into a new work and qualifying for fair use.

VN: What are the main things an online video creator can do to comply with fair use conventions?

DW: For starters, they should educate themselves about fair use. For instance, some people still believe there's a mythical "15 second rule" that freely allows you to use 15 seconds of someone else's work. That's not true! If your use of someone else's work causes marketplace harm and infringes someone else's commercial rights, that's where you'll get into hot water. So again, the goal of "transforming" the original work into something new is paramount.

VN: Thanks Daisy!

Click here to learn more about Daisy's E-Book and to purchase online.

Categories:

Topics: Daisy Whitney, Fair use

-

Broadband Subscriptions Chug Along in 2008

Last Friday, Leichtman Research Group released is quarterly roundup of broadband subscription growth sorted by major cable operators and telcos. LRG, run by my former colleague and friend Bruce Leichtman, has long been the bible for many in the industry for tracking broadband subscriber growth. LRG's numbers continue to demonstrate why broadband video has become such an exciting new distribution medium while adding context to Comcast's and Time Warner's recent moves to begin making online access to cable programming available to their subs.

To highlight a few key numbers, at the end of '08 the top broadband ISPs had 67.7 million subscribers, with top cable operators accounting for about 54.5% and top telcos the remainder. Top cable operators continue to maintain their edge in subscriber acquisition as well, grabbing 59% of all new broadband subs in '08.

And no surprise to anyone, with the rising penetration levels, the annual increases in total new subs have continued to slow: in '06 top cable and telco ISPs added 10.4M subs, in '07, 8.5M subs and in '08, 5.4M subs. Still, in the teeth of harsh economic downturn in Q4 '08, these ISPs were still able to add over 1M subs, growth that contracting industries like autos, retail and home-building would no doubt have killed for.

Broadband has long since become a utility for many American homes, a service that is as much expected as essentials like electricity and plumbing. A key reason broadband video is enjoying the success it is owes to the fact that broadband subscriptions have been driven for other reasons (e.g. faster email access, music downloads, always-on connectivity) over the years. Video has only recently become an additional and highly-valued benefit, which broadband ISPs now expect will drive interest in faster (and more expensive) broadband service plans.

Broadband's importance to the cable industry is demonstrated by the chart below showing #1 cable operator Comcast's performance over the last 2 years, which I originally posted on last November ("Comcast: A Company Transformed).

Note the company has now lost basic cable subscribers for 7 straight quarters, even as it continues to add digital video subs and broadband subs (and voice subs) at a healthy clip. I expect these trend lines will continue in their current pattern. No doubt this is the kind of picture that has helped spur Comcast (and #2 operator Time Warner Cable) to begin planning online distribution of cable programming, a feature that I believe will provide highly popular. Operators are in a tremendous position to capitalize on the shifting interests of their subscribers.

What do you think? Post a comment now.

Categories: Broadband ISPs, Cable TV Operators

Topics: Comcast, Leichtman Research Group, Time Warner Cable

-

New Research from TDG Sheds Light on Consumers' Three Screen Intentions

This past Tuesday I highlighted some of Nielsen's recent data which showed, among other things, significant online and mobile video usage by younger age groups. In that post I noted that marketers need to pay close attention to these trends to ensure their products and services meet these users' needs and expectations.

New research from The Diffusion Group (a long-time VideoNuze partner) provides a window into how users think about accessing video across multiple screens, and who the providers might be. TDG has recently completed a survey of 2,000 adults (18 or above) which tested interest in two-screen and three-screen services along with content and features. TDG has graciously provided a sample of the slides for complimentary download by VideoNuze. You can download the slides here.

TDG defined a three-screen service as "a single video service which feeds all your household TVs, PCs and mobile devices, for a single monthly fee, from a single service provider, and with relatively equal content, variety and quality of service for all three devices."

TDG found that almost 25% of those surveyed responded positively to such a package. Whereas video marketers would have traditionally considered heavy TV viewership (25 hours/week and above) to be the most important criterion for driving more video services adoption, these so-called "three-screen intenders" don't exhibit heavier TV viewership than non-intenders (though they're slightly higher in moderate viewership, 11-25 hours/week).

Rather, the behavior that distinguishes three-screen intenders is how much online viewing they're doing. The intenders are far higher consumers of online video in general, and of online TV programs in particular. In other words, their behaviors are already self-selecting them as the targets for a three-screen service offering. That of course makes it much easier for marketers to find and target them.

All of this certainly supports Comcast's and Time Warner Cable's recently revealed plans to offer their video subscribers online access to programs. Better news still for these companies is that TDG found that cable operators were the top choice by intenders as the preferred three-screen provider. Cable was chosen by 31.7% of intenders, almost double the amount that selected satellite operators. Translation: there is a sizable group of consumers interested in three-screen services and cable appears to be in the prime position to capitalize on this.

Of course, the next question then is whether cable operators should charge for these services or imitate Netflix's example with Watch Instantly by including them as a value add to existing digital services. In my opinion, at least some of the online viewing capability should be included for no extra charge. That would go a long way toward establishing loyalty, and position cable for even greater competitive gains.

Click here to download the complimentary slides.

What do you think? Post a comment now.

Categories: Cable TV Operators

Topics: Comcast, The Diffusion Group, Time Warner Cable

-

New Nielsen Numbers Reveal Key Video Behaviors by Age Group

Yesterday Nielsen released the Q4 version of its A2/M2 Three Screen Report, which measures video usage across TV, online and mobile. The report is here, and Nielsen does a nice job of summarizing some of the key numbers and trends. In particular, for those concerned about traditional TV's potential demise, the new data should provide some comfort. Nielsen reports that TV viewership was at a record 151 hours per month per average viewer in Q4, up from 140 hours in Q3 (a jump that Nielsen doesn't explain, but which I can only ascribe to the growing ranks of the unemployed spending more time in front of the tube).

I looked at the data Nielsen released and there are additional key insights that I think are worth noting. I always find it most useful to focus on the changes in younger people's consumption habits. That's because

younger people are generally more comfortable with technology and what they do today is often a leading indicator of what older cohorts will be doing tomorrow. For marketers in particular, younger people's behavior is crucial because it reveals the preferences of a greater and greater share of would-be buyers in the years to come.

younger people are generally more comfortable with technology and what they do today is often a leading indicator of what older cohorts will be doing tomorrow. For marketers in particular, younger people's behavior is crucial because it reveals the preferences of a greater and greater share of would-be buyers in the years to come. With that context, I was interested in the consumption of three newer forms of video Nielsen is measuring (timeshifted/DVR-based video, Online video and Mobile video) as a ratio of traditional TV consumption. While not exact, I believe these respective ratios give us a glimpse into the emerging viewing preferences by age group, and what trends may lie ahead. When looked at this way, I found three interesting things.

First, the ratio of mobile video consumed to traditional TV consumed for the 12-17 age group is off the charts compared to all other age groups. For those in this age group that watch mobile video, they watch about 6:38 hours/minutes per month, compared to their average of 103.48 hours/minutes of traditional TV per month. That ratio of 6.2% far outpaces all other age groups; the next nearest one is 25-34 year olds which watch 2.4%. The youngest are clearly embracing mobile video and will no doubt expect more out-of-home options and value as they mature.

Second, the ratio of online video consumed to traditional TV consumed for the next youngest age group, 18-34 is significantly higher than for all other age groups. 18-34 year olds watch 5:03 hours/minutes of online video per month on average, compared with just 118:28 hours/minutes of traditional TV per month on average, for a ratio of 4.3%. No other age group exceeds a 3% ratio. Further, 18-34 years watch slightly more online video than time-shifted video. Clearly this group views online as a bona fide on-demand platform and is likely most primed for "cord-cutting." Cable operators' moves to offer programs online will likely resonate strongly.

Lastly, the ratios of timeshifted/DVR video consumed to traditional TV consumed for the 25-34 and 35-44 age groups are far higher than for all the other age groups. 25-34 year olds watch 10:50 hours/minutes of timeshifted TV per month on average, compared to 142:29 hours/minutes of traditional TV per month on average for a 7.4% ratio. For 35-44 year-olds its 9:44 hours/minutes of timeshifted compared to 147:21 hours/minutes of traditional TV for a 6.4% ratio. No other age group even reaches a ratio of 5%. Time-shifting and its ad-skipping - its frequent companion behavior - are becoming increasingly prevalent for these age groups.

On the surface the Nielsen data suggests that traditional TV consumption is quite durable even as newer viewing platforms are introduced. Yet when numbers like those above are factored in, it becomes apparent that for certain age groups, behavioral change is well underway. This is data that market participants need to pay close attention to and then plan accordingly.

What do you think? Post a comment now.

Categories:

Topics: Nielsen

-

Crunching comScore's Video Data Yields Market Insights

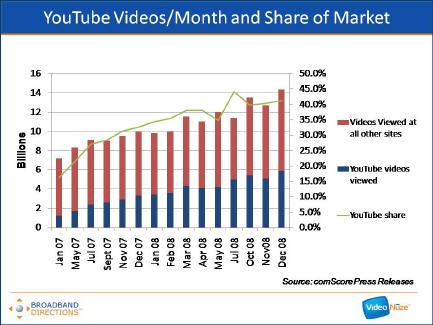

Last week when comScore announced data from its Video Metrix service for December '08, I made a note to myself to go back and look at all the video usage data comScore has released and see what it reveals. Below are 5 charts that I've compiled from comScore's press releases covering January 2007 - December 2008 (note comScore didn't report on every single month during this 24 month period so there are some holes in the graphs).

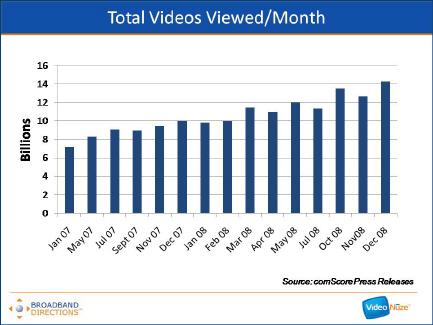

The first graph shows the growth in total videos viewed per month, roughly doubling from 7.2 billion views in Jan. '07 to 14.3 billion views in Dec. '08.

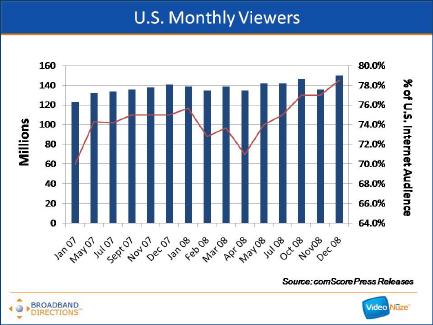

That growth is driven by a number of factors including an increase in the number of monthly viewers from 123 million in Jan. '07 (70% of U.S. Internet users) to 150 million in Dec. '08 (78.5% of U.S. Internet users).

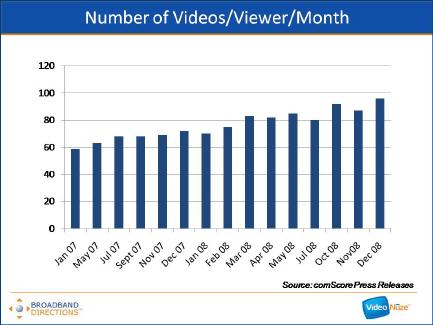

It also reflects an increase in the number of videos viewed per viewer from 59 in Jan. '07 to 96 in Dec. '08.

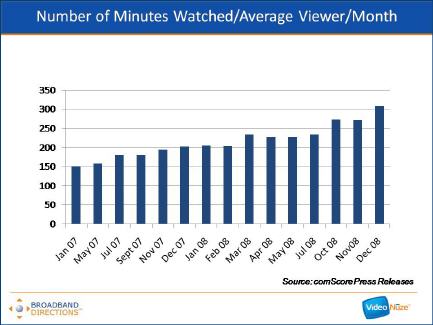

Which further translates into the growth of total number of minutes the average viewer watched per month from 151 minutes per month in Jan. '07 to 309 minutes per month in Dec. '08.

Aside from the sheer growth of the market over the last two years, the most striking thing about the comScore data is the growth in usage and market share by YouTube. Back in Jan. '07, YouTube generated approximately 1.2 billion video views per month for a 16.2% share of all videos viewed. Two years later in Dec. '08 YouTube generated approximately 5.9 billion video views per month for a 41.2% market share. YouTube's share growth is staggering: in every month but 1 during this period YouTube increased its sequential monthly views and in all but 3 months it increased its sequential monthly market share.

Aside from the sheer growth of the market over the last two years, the most striking thing about the comScore data is the growth in usage and market share by YouTube. Back in Jan. '07, YouTube generated approximately 1.2 billion video views per month for a 16.2% share of all videos viewed. Two years later in Dec. '08 YouTube generated approximately 5.9 billion video views per month for a 41.2% market share. YouTube's share growth is staggering: in every month but 1 during this period YouTube increased its sequential monthly views and in all but 3 months it increased its sequential monthly market share.

Recall that Google closed on the YouTube acquisition in Nov. '06 and at $1.65 billion, many thought Google had grossly overpaid. Some may still believe this as YouTube is still very much a work in progress in terms of how it generates revenue. But there's no questioning the phenomenal two-year run it has had in terms of its usage and market share growth. This is one of the reasons why I continue to believe YouTube is one of the most powerful platforms for eventually disrupting the traditional video distribution value chain.

If these slides are hard to view, I've uploaded them all to SlideShare.

What do you think? Post a comment now.

Categories: Aggregators

Topics: comScore, Google, YouTube

-

Surging Video Consumption Drives Cisco's Mobile Traffic Forecast

Last summer I wrote about Cisco's Visual Networking Index, a model that the company originally built to forecast traffic for its own internal planning, but which it now releases externally as well. Cisco's methodology is to combine analyst projections with data that it collects from its own customers.

Yesterday Cisco released an updated forecast focused on mobile traffic, which is an area of intense interest

for many, in light of the huge success of the iPhone and the App Store. Once again Cisco has given me permission to make available the forecast slides for complimentary download. It was a pretty long deck so I've culled out the most salient slides.

for many, in light of the huge success of the iPhone and the App Store. Once again Cisco has given me permission to make available the forecast slides for complimentary download. It was a pretty long deck so I've culled out the most salient slides. Cisco is forecasting mobile traffic will grow 66x from 2008-2013 to 2.5 million terabytes/mo. The primary driver of that growth is video, which it believes will account for 64% of mobile traffic in '13, more than triple data's 19% share. Cisco believes that most of the mobile video consumed will be on demand, not streamed live.

As for devices that will fuel all this growth, Cisco believes that handsets (primarily smartphones) will account for 53% of traffic, and portable devices (primarily laptops using aircards) will account for 40%. According to its analysis, smartphones generate at least 30x the mobile traffic that standard handsets do, while laptops generate 450x the traffic of handsets. The forecast slides also break out growth by traffic type in each region of the world.

I've said in the past that although mobile video is lagging broadband fixed line video today, it is poised to quickly catch up. All of this traffic growth of course creates both issues and opportunities for wireless carriers. Soon enough consumers are going to expect that they can take their full video experience on the road with them. It's an exciting vision.

What do you think? Post a comment now.

Categories: Mobile Video

Topics: Cisco