-

Lack of Viewership Data Could Stall TV Everywhere

Based on a number of conversations I've had with cable programming executives, Nielsen's current inability to measure online viewing of TV programs and meld that data effectively with on-air viewing is emerging as a key stumbling block to successful rollouts of TV Everywhere services.

Cable networks are justifiably concerned that any viewership that potentially shifts from on-air to online that they are not credited for will adversely impact their ratings and therefore their advertising revenue. Until the issue is fixed cable networks will be reluctant to offer their most popular programs to TV Everywhere providers, in turn diluting TV Everywhere's appeal to consumers.

Nielsen, the de facto standard in TV ratings measurement, is well aware of these concerns and as

Multichannel News reported this past Monday, it plans to accelerate the deployment of its "TVandPC" software which measures online viewing to 7,500 of its National People Meter households by Aug. 31, 2010. While that's a start, as industry executives have told me, it's not just the online viewing data that's needed, but also the proper blending of that data with the on-air data that's critical.

Multichannel News reported this past Monday, it plans to accelerate the deployment of its "TVandPC" software which measures online viewing to 7,500 of its National People Meter households by Aug. 31, 2010. While that's a start, as industry executives have told me, it's not just the online viewing data that's needed, but also the proper blending of that data with the on-air data that's critical. Among the issues is how online viewing, which offers consumers the potential of much-delayed on-demand viewing, should be aligned with Nielsen's "C3" ratings, which captures up to 3 days playback on DVRs. Another issue is understanding and measuring new TV Everywhere viewership patterns (e.g. college students remotely watching shows on a laptop which has been authenticated by Mom and Dad's cable account). Then there's the question of whether the online ad loads are going to be comparable to those on-air (e.g. if the online share of a program's overall viewership carried far fewer ads than the on-air viewership, advertisers and media planners will want to know this). No doubt other issues loom as well.

Add it all up and the process of collecting and then blending online and on-air viewership data is non-trivial and will require a significant investment and testing on Nielsen's part to accomplish. From Nielsen's standpoint, it could be reluctant to make such an investment in overhauling its measurement service unless there were pre-commitments from some of its clients to accepting and buying the enhanced ratings service.

On the one hand, it would seem that cable networks' reluctance to embrace TV Everywhere until adequate measurement systems were in place would be a strong incentive for TV Everywhere providers to support Nielsen's enhancements. However, I've been told that when Nielsen previously made improvements to track Video-on-Demand viewership, not many service providers implemented necessary mechanisms to denote programs were VOD-based, and therefore Nielsen's investment yielded little return. Particularly given the tough economic times, that could make Nielsen more cautious about how it proceeds with online ratings. For now Nielsen has not disclosed its plans.

Still, Nielsen is under pressure to move forward given the formation of the Coalition for Innovative Media Measurement (CIMM), which is comprised of 14 TV networks, agencies and advertisers. CIMM's goal is to explore new methodologies for audience measurement, particularly for set-top box data and cross-platform media consumption. While some in the industry have tagged CIMM as a Nielsen challenger, its members have said they have no intention of trying to replace Nielsen. Regardless, the presence of an industry-backed group trying to wrap its arms around cross-platform audience measurement is likely to only accelerate Nielsen's online tracking efforts.

As VideoNuze readers know, I've been quite enthusiastic about TV Everywhere's potential, though I'm plenty cognizant of the challenges it faces. Measurement is surely near the top of that list. One of the benefits to Comcast of owning NBCU is that, if it chooses to, it can release NBCU's cable networks' programs for TV Everywhere viewing, absent complete online tracking. This would be comparable to what Hulu's owners have chosen to do by distributing their broadcast network shows online (they're at least partly motivated by the belief that online viewing augments on-air viewing). But Comcast won't take ownership of NBCU for another year or so. By that time Nielsen may well be close to rolling a blended online/on-air offering.

In sum, it could well be that 2010 ends up being more a year of experimentation for TV Everywhere while building blocks like audience measurement get put in place. VOD, which years since its launch still lacks many primetime programs as well as dynamic advertising insertion, offers a cautionary example for TV Everywhere providers of how a lack of investment can block the realization of a new medium's full potential. Cable networks in particular will keep looking for signals that TV Everywhere will be more robust than VOD before they get too enthusiastic about online distribution.

What do you think? Post a comment now.

Categories: Cable Networks, Cable TV Operators

-

ExpoTV's New Research Service is Another Example of "Purpose-Driven" UGV

ExpoTV has formally launched "Kitchen Table Conversations," (KTC in my shorthand) a new research service in which certain members of its community provide video responses to a set of brand-sponsored research questions. The resulting video footage provides authentic, qualitative insights on actual consumers' habits, attitudes and behaviors. KTC is yet another example of "purpose-driven" user-generated video, a concept I began discussing in Fall '08 that continues to gain traction. I talked with Expo's president Bill Hildebolt yesterday to learn more about how the new research service works.

For those not familiar with Expo, it is a community-oriented site where consumers create videos of themselves reviewing products they've used. The site now offers a catalog of 300,000+ of these

"videopinions" on a wide diversity of products, generated by 60K+ community members. Over time Expo has evolved from being an outlet where users alone chose which products to review (which they can still do) to a model where sponsors are able to tap the community for video reviews of specific products. Members receive points in exchange for their video submissions and other activities.

"videopinions" on a wide diversity of products, generated by 60K+ community members. Over time Expo has evolved from being an outlet where users alone chose which products to review (which they can still do) to a model where sponsors are able to tap the community for video reviews of specific products. Members receive points in exchange for their video submissions and other activities. Bill explained that the KTC research service originated from sponsors approaching Expo with a desire to interact with community members on a deeper level. With KTC, the research sponsor (e.g. brand, ad agency, trade organization, etc.) can submit a series of questions and the respondent profiles they want to target. Expo then taps into its member database and offers invitations to participate. Because participants have a track record of submitting video to Expo, a minimum quality level is pretty well assured. As part of its service, Expo can edit the submitted videos into a package or just provide them raw to the research sponsor to use as they'd like.

While online research is not a new concept (how many of us have filled out surveys or email questionnaires), what's different here is the reliance on video, which provides a different level of insight. Bill said that for researchers, KTC fits between traditional focus groups (where a group of individuals is brought together in a room to discuss their views of a product) and "ethnography" (a process whereby professional researchers actually live with participants for a period of time studying and capturing their behaviors). Bill believes that KTC provides many of the same authentic, on-location benefits of ethnography, but at a price comparable to focus groups and in a far-quicker turnaround time of 2 weeks or less.

Expo has run half a dozen KTC research projects over the past 9-12 months, working to refine the process. The adjacent video, from one of the research projects (focusing on moms' grocery shopping habits), is a

good example of an edited result. In it, you see and hear women in their own homes, speaking authentically and showing specifics (e.g. a coupon folder, handwritten lists, etc.) of how they do their shopping. The video won't be mistaken for prime-time entertainment, but to researchers looking for nuggets of insight, it's golden. For agencies in particular, which can incorporate select segments of KTC video into their client pitches, it's a totally new approach to consumer research.

good example of an edited result. In it, you see and hear women in their own homes, speaking authentically and showing specifics (e.g. a coupon folder, handwritten lists, etc.) of how they do their shopping. The video won't be mistaken for prime-time entertainment, but to researchers looking for nuggets of insight, it's golden. For agencies in particular, which can incorporate select segments of KTC video into their client pitches, it's a totally new approach to consumer research.KTC is the latest example to hit my radar of how certain types of user-generated video can be used for very productive purposes. Regardless of what might be said about YouTube's and others' inability to monetize the user-generated video uploaded to their sites, one of the derivative benefits of all this user activity is that an army of amateur videographers has been created, many of whom are comfortable in front of and behind the camera. Their video won't win an Oscar or Emmy any time soon, but as Expo and others are proving, their skills and passion are valuable and can be tapped for various purposes.

What do you think? Post a comment now.

Categories: UGC

Topics: ExpoTV

-

Parsing Hulu's 856 Million Streams Yields Valuable Insights

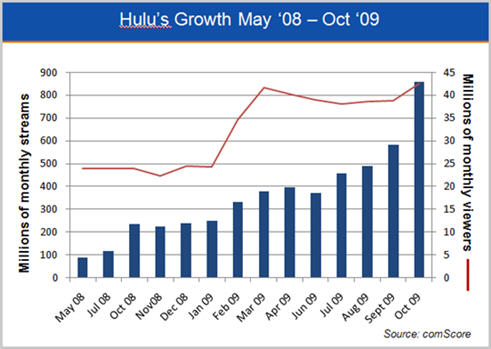

Just before the Thanksgiving buzzer went off for many last Wednesday, comScore released its October 2009 Video Metrix data under the banner headline "Hulu Delivers Record 856 Million U.S. Video Views in October During Height of Fall TV Season." Hulu's 856 million views (which are 47% higher than its September total of 583 million) are indeed eye-grabbing. When viewed in the context of Hulu's performance to date, as tracked by comScore since May, 2008 shortly after the site's launch, it's possible to glean a number of valuable insights.

Below is a chart with comScore's data for Hulu's total monthly video views and unique visitors since May '08. The blue bars would make any online content CEO swoon; in the 18 months since it launched, Hulu has increased its monthly views nearly 10-fold, from 88.2 million in May '08 to this past October's 856 million.

Two clear viewership spikes are noticeable - from July '08 to Oct '08 there was a 97% increase in views (from 119.3 million to 235 million) and from July '09 to Oct '09 there was an 87% increase (from 457 million to 856 million). It should be noted that the Nov '08 total of 226.5 million was down nearly 4% vs. Oct '08, potentially foreshadowing a decrease to come in Nov '09 as well. Other than this dip, there has been only 1 other sequential monthly drop in Hulu's views, a 6% drop from April '09 to June '09. Taken together, Hulu's steady, yet dramatic increase in viewership is remarkable.

On the other hand, I believe the red line in the chart, showing unique monthly visitors, raises some concerns. You'll notice that after a solid 20% jump in uniques from Feb '09 (34.7 million) to March '09 (41.6 million), unique visitors have stayed in a fairly level range through Oct '09 (42.5 million), with uniques actually below the 40 million mark for Jun-Sept. This contributes to a theory I've been developing about Hulu for some time now: in its current configuration, I think it's quite possible that Hulu has saturated the market for its content and user experience. This isn't a hard-and-fast conclusion, but it's worth noting that even with the addition of the ABC programs, Hulu's uniques are scarcely better than they were 6 months ago. Unless the unique number jumps in the coming months (and I doubt it will), Hulu will have to meaningfully enhance its value proposition to grow its audience (can you say "Hulu-to-the-TV-via-Xbox/Roku/Apple TV/etc?").

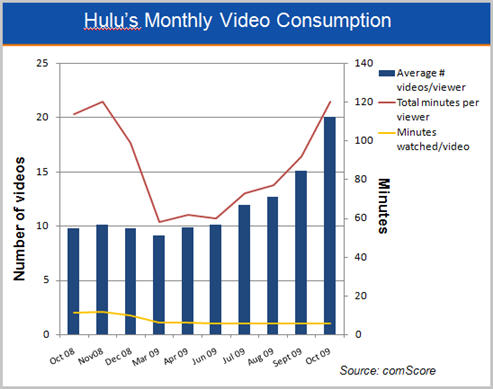

As the blue bars in the chart below show, usage of Hulu by its users is growing nicely. According to comScore, the average Hulu viewer viewed 20.1 videos on the site in October, up 33% from September's 15.1 videos, and nearly double July's 10.1 videos. In October Hulu drove almost double the number of videos/viewer as the Microsoft (11.1 videos) and Viacom (10.3 videos) sites, though it still lags the Google sites, which are primarily YouTube (83.5 videos) by an enormous margin. As I've said many times, YouTube is the month-in-and-month-out 800 pound gorilla of the online video market.

As shown by the red line in the chart, the 120 total minutes viewed per Hulu viewer is roughly even with Nov '08. However, it's possible that comScore was measuring this differently a year ago, as Hulu's minutes per viewer drop dramatically and oddly, from Nov '08 to Mar 09 (58 minutes). Since that time though Hulu's minutes per viewer have steadily increased.

That said, as the yellow line shows, the minutes watched per video have stayed remarkably constant, hovering in a very narrow range around 6 minutes since Mar '09. Hulu's users are spending more time on the site watching more total videos, but it seems they watch a very consistent mix of short clips and longer programs each month. In fact, while Hulu is commonly thought of as a site for full-length TV programs, only 1 of its top 10 most popular videos of all time is a full program and not a short clip, and only 6 out of its top 20 videos are full programs (though the mix may be changing as this month 8 out of the top 10 and 16 out of the top 20 most popular are full programs). To the extent that Hulu viewers stick with a program to its end, the current month's usage would suggest that minutes watched per video is poised to increase, along with it revenue per user session, which is an important barometer of the site's success.

With its exclusive access to 3 of the 4 broadcast networks' hit programs, Hulu has significant competitive advantages, which it has further capitalized on with its superb user experience. Despite positive and encouraging reports about its ad sales efforts, Hulu still has a long way to go to prove it can monetize its audience as effectively as its parent companies can do with programs viewed on-air. As a result speculation about a Hulu subscription service (which I consider inevitable) will continue to loom.

Other variables affecting Hulu's future also swirl: what will Comcast do if/when it acquires NBCU and therefore becomes a Hulu owner? What happens to Fox's programs on Hulu should Rupert Murdoch expand his focus beyond his newspapers' online content going premium? What if Disney decides to launch its own subscription services? What if Google or Microsoft or Netflix (or someone else) decides to open their wallet and make a bigger play in premium online video?

Hulu is still a relatively young site and the insights above are not fully conclusive, especially because they're based on 3rd party data. Hulu has clearly built a solid brand and user experience. Its monthly performance is well worth following.

What do you think? Post a comment now.

Categories: Aggregators

-

4 Items Worth Noting for the Nov 16th Week (FCC's Open Access, Broadcast woes, Droid sales, AOL cuts)

Following are 4 items worth noting for the Nov 16th week:

1. FCC raises "Open Access" possibility, would further government's control of the Internet - As reported by the WSJ this week, the FCC is now considering an "Open Access" policy that would require broadband Internet providers to open up their networks for use by competitors. The move comes on top of FCC chairman Julius Genachowski's recent proposal for formalizing net neutrality, a plan that I vigorously oppose. Open Access gained steam recently due to a report released by Harvard's Berkman Center that characterized the U.S. as a "middle-of-the-pack" country along various broadband metrics. The report has been roundly dismissed by service providers as drawing incorrect conclusions due to reliance on incomplete data.

The FCC is in the midst of crafting a National Broadband Plan, as required by Congress, aimed at providing universal broadband service throughout the U.S. as well as faster broadband speeds. Improving broadband Internet access in rural areas of the U.S. is a worthy goal, but the FCC should be pursuing surgical approaches for accomplishing this, rather than turning the whole broadband industry upside down. As for increasing speeds, major ISPs are already pushing 50 and 100 mbps services, more than most consumers need right now anyway. Broadband connectivity is the lifeblood for online video providers and any government initiative that risks unintended consequences of slowing network infrastructure investments is unwise.

2. Broadcast TV executives waking up to online video's challenges - Reading the coverage of B&C/Multichannel News's panel earlier this week, "Free Streaming: Killing or Saving the Television Business" featuring Marc Graboff (NBCU), Bruce Rosenblum (Warner Bros.), Nancy Tellem (CBS) and John Wells (WGA), I kept wondering where were these sentiments when the Hulu business plan was being crafted?

Hulu is of course the poster child for providing free access to the networks' programs, with just a fraction of the ad load as on-air. While the panelists agreed that the industry should be dissuading consumers from cord-cutting, Hulu is (purposefully or not) the chief reason some people consider dropping cable/satellite/telco service. For VideoNuze readers, it's old news already that broadcast networks have been hurting themselves with their current online model. What was amazing to me in reading about the panel is that what now seems obvious should have been very apparent to industry executives from the start.

3. Motorola Droid sales off to a strong start - The mobile analytics firm Flurry released data suggesting that first week Verizon sales of the Motorola Droid smartphone were an estimated 250,000. Flurry tracks applications on smartphones to estimate sales volume of devices. While the Droid results are lower than the 1.6 million iPhone 3GS units sold in that device's first week, Flurry notes that the iPhone 3GS was available in 8 countries and also had an installed base of 25 million 1st generation iPhones to draft on.

The Droid's success is important for lots of reasons, but from my perspective the key is how it expands the universe of mobile video users. As I noted in "Mobile Video Continues to Gain Traction," a robust mobile ecosystem is developing, and getting more smartphones into users' hands is crucial. I was in my local Verizon store this week and saw the Droid for the first time - though it lacks some of the iPhone's sleekness, the video quality is even better.

4. AOL's downsizing suggests further pain ahead - AOL was back in the news this week, planning to cut one-third of its employees ahead of its spin-off from Time Warner on Dec. 9th. The cuts will bring the company's headcount to 4,500-5,000, down from its peak of 18,000 in 2001. As I explained recently, no company has been hurt more by the rise of broadband than AOL, whose dial-up subscribers have fled en masse to broadband ISPs. Now AOL is going all-in on the ad model, even as the ad business itself is getting hurt by the ongoing recession. New AOL CEO Tim Armstrong is clearly a guy who loves a challenge; righting the AOL ship is a real long shot bet. I once thought of AOL as being a real leader in online video. Now I'm hard-pressed to see how the AOL story is going to have a happy ending.

Enjoy your weekends!

Categories: Advertising, Aggregators, Broadband ISPs, Broadcasters, Mobile Video, Portals, Regulation

Topics: AOL, Droid, FCC, Hulu, iPhone, Motorola, Verizon

-

4 Items Worth Noting for the Nov 9th Week (Flip ads, YouTube ad-skipping, NY Times video, Nielsen data)

Following are 4 items worth noting for the Nov 9th week:

1. Will Cisco's new Flip Video camera ad campaign fly? - Cisco deserves credit for its new "Do You Flip" ad campaign for its Flip Video camera, a real out-of-the-box effort comprised entirely of user-generated video clips shot by ordinary folks and celebrities alike. As the campaign was described in this Online Media Daily article, finding the clips and then editing them together sounds like heavy lifting, but the results perfectly reinforce the value proposition of the camera itself. The ads are being shown on TV and the web; there's an outdoor piece to the campaign as well.

Cisco acquired Flip for nearly $600 million earlier this year in a somewhat incongruous deal that thrust the router powerhouse into the intensely competitive consumer electronics fray. Cisco will have to spend aggressively to maintain market share as other pocket video cameras have gained steam, like the Creative Vado HD, Samsung HMX and Kodak Z series. There's also emerging competition from smartphones (led by the iPhone of course) that have built-in video recording capabilities. I've been somewhat skeptical of the Cisco-Flip deal, but with the new campaign, Cisco looks committed to making it a success.

2. YouTube brings ad-skipping to the web - Speaking of out-of-the-box thinking, YouTube triggered a minor stir in the online video advertising space this week by announcing a trial of "skippable pre-roll" ads. On the surface, it feels unsettling that DVR-style ad-skipping - a growing and bedeviling trend on TV - is now coming to the web. Yet as YouTube explained, there's actually ample reason and some initial data to suggest that by empowering viewers, the ads that are watched could be even more valuable.

One thing pre-roll skipping would surely do is up the stakes for producing engaging ads that immediately capture the viewer's attention. And it would also increase the urgency for solid targeting. Done right though, I think pre-roll skipping could work quite well. At a minimum I give YouTube points for trying it out. Incidentally, others in the industry are doing other interesting things improve the engagement and effectiveness of the pre-roll. I'll have more on this in the next week or two.

3. Watching the NY Times at 30,000 feet - Flipping channels on my seat-back video screen on a JetBlue flight from Florida earlier this week, I happened on a series of highly engaging NY Times videos: a black and white interview with Oscar-winning actor Javier Bardem, then a David Pogue demo of the Yoostar Home Greenscreen Kit and then an expose of Floyd Bennett Field, the first municipal airport in New York City. It turned out that all were running on The Travel Channel.

Good for the NY Times. Over the past couple of years I've written often about the opportunities that broadband video opens up for newspapers and magazines to leverage their brands, advertising relationships and editorial skills into the new medium. By also running their videos on planes, the NY Times is exposing many prospective online viewers to its video content, thereby broadening what the NY Times brand stands for and likely generating subsequent traffic to its web site. That's exactly what it and other print pubs should be doing to avoid the fate of the recently-shuttered Gourmet magazine, which never fully mined the web's potential. I know I'm a broken record on this, but video producers must learn that syndicating their video as widely as possible is imperative.

4. Nielsen forecast underscores smartphones' mobile video potential - A couple of readers pointed out that in yesterday's post, "Mobile Video Continues to Gain Traction" I missed relevant Nielsen data from just the day before. Nielsen forecasts that smartphones will be carried by more than 50% of cell phone users by 2011, totaling over 150 million people. Nielsen assumes that 60% of these smartphone owners will be watching video translating to an audience size of 90 million people. Its research also shows that 47% of users of the new Motorola Droid smartphone are watching video, vs. 40% of iPhone users. Not a huge distinction, but more evidence that the Droid and other newer smartphones are likely to increase mobile video consumption still further.

Enjoy your weekends!

Categories: Advertising, Aggregators, Devices, Mobile Video, Newspapers, UGC

Topics: Cisco, Droid, Flip, iPhone, Nielsen, NY Times, YouTube

-

New Forrester Report Evaluates 6 Online Video Platforms

On Friday, Forrester Research released an analysis of 6 online video platform vendors. As with other comparison reports that come out regularly, Forrester's will have value as a starting point in evaluating options, but should be considered far from definitive.

With only 6 vendors evaluated, the biggest shortcoming of the new report (parts of which I've seen) is its lack of comprehensiveness. Selecting the field is always a key issue in any comparison process. And when trying to evaluate a market like online video platforms, with dozens of competitors, there's a natural tension between comprehensiveness and quality/cost. The broader the field that Forrester chose to evaluate, the more time-consuming and costly the report would have been to produce.

The downside of choosing only 6 is that a lot of other high-quality competitors, along with their particular strengths, are left out. This clearly skews overall conclusions. In Forrester's case it's also not entirely clear why the 6 - Brightcove, Ooyala, Kaltura, VMIX, Fliqz and Twistage - were actually chosen. For example, the report indicates that vendors that primarily focus on the high end of the market such as thePlatform and Digitalsmiths were not included. Yet arguably, Brightcove has as much focus on premium content providers as either of these companies do. thePlatform is also the most established player in the market, so to not include it means missing a critical market benchmark.

Forrester used 37 criteria to evaluate the vendors, grouped into 3 categories, Current Offering, Strategy and Market Presence. The sources of the data it used to assign scores to each vendor for the criteria were vendor surveys, product demos and customer reference calls. All of this is very useful, but it appears that Forrester did not do any hands-on testing itself. Having seen so many demos myself, I've come to believe that the only way to truly get a sense of the vendor's work flow and specific capabilities is to use with the platform directly. By definition demos are orchestrated to shine the best light on a platform's work flow; it's only through using one day-to-day that a nitty-gritty understanding can be gained.

Lastly, Forrester's conclusion that Brightcove and Ooyala are "Leaders," Kaltura and VMIX are "Strong Performers," and Twistage and Fliqz are "Contenders" feels like it could be more rigorous. For example, if statements like "stay away from these guys, they're truly inferior" or "if x, y and z features are critical to you, look no further" had been used, the reader would gain more clarity on where Forrester stands. Instead each vendor seems to have its own strengths, while weaknesses such as "...lack strong capabilities in areas such as distribution and scalability..." seem too high level.

All of this said, for customers looking for a first-cut evaluation of a limited segment of the market (which is how Forrester itself seems to be positioning the report), it is a useful tool. Whether it's worth the $1,749 asking price is another matter. I'd recommend also having a look at sources like VidCompare.com and the market snapshot from Marketing Mechanics.

What do you think? Post a comment now.

Categories: Technology

Topics: Forrester Research

-

VideoNuze Report Podcast #39 - November 6, 2009

Daisy Whitney and I are pleased to present the 39th edition of the VideoNuze Report podcast, for November 6, 2009.

This week Daisy and I first dig into the research I shared about Netflix's Watch Instantly users that I wrote about earlier this week. The research, by One Touch Intelligence and The Praxi Group, indicated that 62% of respondents have used the Watch Instantly streaming feature, with 54% saying they use it to watch at least 1 movie or TV show per month. Daisy and I discuss the significance of these and other data from the research. As a reminder the research is available as a complimentary download from VideoNuze.

Daisy is in NY this week attending Ad:Tech, and she then shares observations from a couple of sessions she's attended. In particular she passes on the advice that Sir Martin Sorrell, head of large agency holding company WPP, about where the advertising business is heading and how he's preparing WPP for the future.

Click here to listen to the podcast (14 minutes, 45 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, Aggregators, Podcasts

-

New Research on Netflix's "Watch Instantly" Shows Surging Usage

Netflix's "Watch Instantly" streaming video usage is surging, according to new research by One Touch Intelligence, in association with The Praxi Group. The firms surveyed a qualified online panel of 1,000 Netflix subscribers in October. I've been eagerly following the Netflix's streaming initiative and this is the first research I've seen which reveals Netflix subscribers' Watch Instantly usage patterns. I'm pleased to offer the top-line results and analysis as a complimentary download.

Click here to download the research

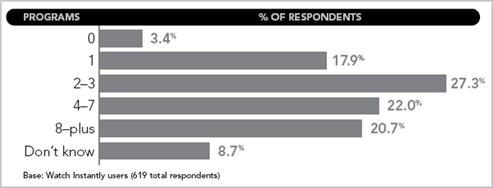

The research confirms that Watch Instantly ("WI") enjoys broad support, with 62% of respondents (extrapolated to approximately 6.9 million of Netflix's 11.1 million subscribers) reporting that they have used WI since it was introduced and 54% (extrapolated to approximately 6 million subs) saying that they use it to watch at least 1 movie or TV show per month. Netflix itself has only disclosed (on its recent Q3 '09 earnings call) that 42% of its subscribers streamed at least 15 minutes of a TV show or movie during the 3rd quarter.

Netflix subscribers also appear to be using WI intensively, watching an average 6 titles per month. The following chart shows the distribution of usage from zero to 8+ titles per month.

WI usage is heavily tilted toward movie watching, with 92% saying they've used WI to stream a movie vs. 55% for a TV show. For each monthly usage level, more movies were watched than TV shows, likely reflecting the fact that movies are the majority of the 17,000 title WI catalog.

Though Netflix has made huge strides in embedding the WI client software in CE devices (e.g. Xbox, Roku, Blu-ray DVD players, PS3, etc.), over 60% of WI viewing still happens on the computer. Coming in second, with 13.4% is computers connected to a TV. Only then do the CE devices start showing up in the research: video game console (11.1%), DVD player (5.7%) and Roku (3.6%). Clearly we're still in the very early days of the "convergence era" where broadband is widely connected to the TV. The research does highlight that the 3.6% Roku figure could be extrapolated to suggest that about 400,000 Roku devices are being used by Netflix subscribers, a relatively strong showing by the company.

Meanwhile, if you thought Netflix WI would be leading to rampant "cord-cutting" of current video services (cable/satellite/telco), think again. Only 2% of the respondents said they've cancelled their incumbent video service, and it should be noted that the question asked if the disconnect was due to Netflix in general, not just WI in particular.

Further encouraging to current video service providers is that 67% of respondents say they prefer to have both a Netflix and a cable/satellite subscription. Asked if they had to give up one, 20% said they'd give up Netflix first vs. 13% who said they'd give up cable/satellite first. None of this is reason for incumbent for relax - especially as WI and other streaming video services are poised to improve - but it does suggest that at least for now, Netflix isn't an either/or proposition for most people.

This is just a quick summary of the findings; there's more available in the report. My view is that Netflix has made enormous progress with WI in a very short period of time. The decision to make it a value add to subscribers, rather than charging for it, has no doubt been key. In fact, TV Everywhere providers have wisely taken a cue from WI by also planning to offer TVE as a value add. Netflix has also made WI extremely easy to use, with only 15% of survey respondents saying it is "too complicated to use regularly." This too is a lesson for others to follow.

With WI offering the prospect of Netflix lowering its massive postage bill, reducing its DVD inventory, and providing greater convenience to its subscribers, we can expect the company to continue investing heavily in WI. The big challenge for Netflix, as I've noted many times before, is beefing up their content selection. With WI the company is running into the thicket of prevailing Hollywood release windows which are not going to dramatically change any time soon. Still, I continue to consider Netflix the best-positioned emerging player in broadband-only premium video delivery. This story is still in its earliest days.

(Thanks to One Touch's Stewart Schley for providing the research)

What do you think? Post a comment now.

Categories: Aggregators

Topics: Netflix, One Touch Intelligence, The Praxi Group

-

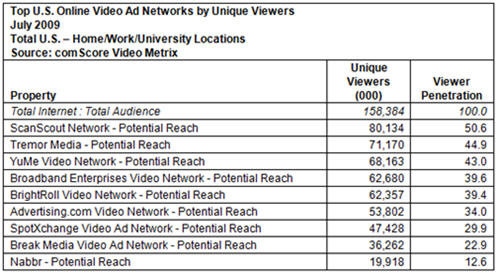

First Look At comScore's September Video Rankings Show Tremor Media Gains

According to comScore's September Video Metrix report reflecting actual unique viewers, Tremor Media is the top-ranked video ad network, with 33.6 million unique viewers, followed by BBE with 27.4 million and BrightRoll with 25.1 million.

comScore has not yet released it monthly top 10 results, but a sneak peek shows that Tremor places #8 on the list (I believe the first time an ad network has cracked the top 10), Jambo Media, a video syndicator (and also a VideoNuze sponsor) comes in at #9 with 32.3 million viewers and Facebook shows up at #10 with 31.1 million. All 3 companies are new to comScore's top 10 and compared to comScore's August top 10 list, they replace Turner (now #12), AOL (now #15) and Disney (now #20). All 7 other top 10 sites are back, though with a little shuffling (Google/YouTube, Fox, Yahoo, CBS, Viacom, Microsoft and Hulu).

With respect to the video ad networks specifically, as I've written previously, there's an ongoing debate about which numbers are most relevant to focus on. comScore has been working to fully populate its actuals

list, which requires cooperation from the video ad networks themselves. Another way of measuring video ad networks' size is by "potential reach," which considers the total number of viewers of all the sites in a network (so for an ad network that would mean all sites it has the right to place ads on). Looking at both provides a broader picture of video ad networks' size.

list, which requires cooperation from the video ad networks themselves. Another way of measuring video ad networks' size is by "potential reach," which considers the total number of viewers of all the sites in a network (so for an ad network that would mean all sites it has the right to place ads on). Looking at both provides a broader picture of video ad networks' size.By the potential reach measure, among video ad networks, Tremor is the top-ranked, with 72.9 million unique viewers, YuMe is #2 with 66.2 million, Ad.com is #3 with 57 million, SpotXchange is #4 with 55.7 million, ScanScout is #5 with 54.9 million and BrightRoll is #6 with 51.4 million. Oddly missing from the potential reach list is BBE, which in August was the fourth-largest video ad network with 62.7 million unique viewers. I'm trying to get an answer to that one. Tremor also announced yesterday that 60 sites have recently joined its publisher network, including A&E, Hachette Filippachi US, Thompson Reuters and SBTV.

It's also worth mentioning that Google/YouTube continues to dominate the video landscape. In September it is up to 10.4 billion videos viewed (vs. 10 billion in August), with a 40.2% market share (vs. 39.6%) in August. As the comScore data compilation slides I offered on August 31st support, Google/YouTube's share has hovered consistently around 40% since the middle of 2008.

Data like the above is obviously extremely important for understanding the evolving online video landscape. I'm cognizant of many people's concerns that the comScore data is incomplete or does not synch with internal logs or other measurement techniques. However, comScore is the only third-party data source that consistently releases results, providing trend data to analyze. Although I wouldn't suggest "taking the data to the bank," I do believe comScore provides great directional evidence of the market's growth and the standing of individual players.

What do you think? Post a comment now.

Categories: Advertising

Topics: comScore, Tremor Media

-

4 Items Worth Noting for the Oct 19th Week (FCC/Net neutrality, Cisco research, Netflix earnings, Yahoo-GroupM)

Following are 4 items worth noting from the Oct 19th week:

1. FCC kicks off net neutrality rulemaking process among flurry of input - As expected, the FCC kicked off its net neutrality rulemaking process yesterday, with all commissioners voting to explore how to set rules regulating the Internet for the first time, though Republican appointees dissented on whether new rules were in fact needed.

Leading up to the vote there was a flurry of input by stakeholders and Congress. Everyone agrees on the "motherhood and apple pie" goal that the Internet must remain open and free. The disagreement is over whether new rules are required to accomplish this, and if there are to be new rules what specifically should they be. As I argued here, the FCC is treading into very tricky waters, and law of unintended consequences looms. Already telco executives are talking about curtailing investments in network infrastructure, the opposite of what the FCC is trying to foster. The FCC will be seeking input from stakeholders as part of the process. Even though chairman Genachowski's bias to regulate is very clear, let's hope that as the data and facts are presented, the FCC is able to come to right decision, which is to leave the well-functioning Internet alone.

2. New Cisco research substantiates video, social networking usage - Speaking of the well-functioning Internet, Cisco released its Visual Networking Index study this week based on research gathered from 20 leading service providers. Cisco found that the average broadband connection consumes 4.3 gigabytes of "visual networking applications" (video, social networking and collaboration) per month, or the equivalent of 20 short videos. (Note that comScore's Aug data said of the 161 million viewers in the U.S. alone, the average number of videos viewed per month was 157.) I'm not sure what the difference is other than Cisco is measuring global traffic and comScore data is at U.S. only. Regardless, the Cisco research continues to demonstrate that users are shifting to more bandwidth-intensive applications, and the Internet is scaling up to meet their demands.

3. Netflix reports strong Q3 '09 earnings, streaming usage surges - Netflix continues to stand out as unaffected by the economy's woes, reporting its Q3 results late yesterday that included adding 510,000 net new subscribers, almost double the 261,000 from Q3 '08. The company finished the quarter with 11.1 million subs and projects to end the year with 12 to 12.3 million subs. If Netflix were a cable operator it would be the 3rd largest, just behind Time Warner Cable, which has approximately 13 million video subscribers.

Netflix CEO Reed Hastings also disclosed that 42% of Netflix's subscribers watched a TV episode or movie using the "Watch Instantly" streaming feature during the quarter, up from 22% in Q3 '08. Hastings also said in 2010 the company will begin streaming internationally, even though it has no plans to ship DVDs outside the U.S. He added that in Q4 Netflix will announce yet another CE device on which Watch Instantly will be available (just this week it also announced a partnership with Best Buy to integrate Watch Instantly with Insignia Blu-ray players). Net, net, Watch Instantly looks like it's getting great traction for Netflix and will continue to be a bigger part of the company's mix. Yet as I've mentioned in the past, a key challenge for Netflix is making more content available for streaming.

4. Yahoo's pact with GroupM for original branded entertainment raises more questions - Shifting gears, Yahoo and GroupM, the media buying powerhouse announced a deal this week to begin co-producing original branded entertainment for advertisers. The idea is to then distribute the video throughout Yahoo's News, Sports, Finance and Entertainment sections. GroupM has had some success in the past, as its "In the Motherhood" series, created for Sprint and Unilever, was picked up by ABC, though it was quickly canceled. As I pointed out in my recent post about Break Media, branded entertainment initiatives continue to grow.

Less clear to me is Yahoo's approach to video. CEO Carol Bartz said last month that "video is so crucial to our users and our advertisers..." that "there's a big emphasis inside Yahoo on our video platforms" and that "a big cornerstone of our strategy is video." OK, but these comments came just months after Yahoo closed down its Maven Networks platform, which it had only acquired in Feb '08. Having spent time at Maven, I can attest that its technology would have been well-suited to supporting the engagement and interactivity requirements of these new Yahoo-GroupM branded entertainment projects. Yahoo's video strategy, such as it is, remains very confusing to me.

Note there will be no VideoNuze email on Monday as I'll be in Denver moderating the Broadband Video Leadership Breakfast at the CTAM Summit...enjoy your weekend!

Categories: Aggregators, Branded Entertainment, Broadband ISPs, Portals, Regulation, Telcos

Topics: Cisco, FCC, GroupM, Net Neutrality, Netflix, Yahoo

-

4 Items Worth Noting for the Oct 5th Week

Following are 4 items worth noting for the Oct 5th week:

New research shows TV viewing shifting - Mediapost had a good piece this week on Horowitz Associates' new research showing that 2% of all TV programming watched now occurs on non-TV devices. This translates to 2 hours of the 130.2 hours of TV that viewers watch each month shifting. This top line number is a little deceiving though, as the research also shows that for viewers who own a PC or laptop, they watch 9%, or 13 hours of TV programming per month, other than on their TV. I plan to follow up to see if I can get breakout info for young age groups, my guess is that their percentages are even higher.

I've been very interested in these kinds of numbers because there has been much debate about whether making full-length programs available online augments or cannibalizes traditional TV viewing. The broadcast networks have forcefully asserted that it only augments. I agree online augments, but I've suspected for a while that it is also beginning to cannibalize. If networks generated as much revenue per program from an online view as they do from an on-air view this shifting wouldn't matter. But as I wrote in Mediapost myself this week, the problem is they probably only earn 20-25% as much online. TV viewers' shifting usage is a key area to focus on as broadband video viewership continues to grow.

PermissionTV becomes VisibleGains, targets B2B selling - PermissionTV, one of the original media-focused online video publishing and management platforms, officially switched gears this week, changing its name to VisibleGains. Cliff Pollan, CEO and Matt Kaplan, VP of Marketing/Chief Strategy Officer briefed me months ago on their plans and I caught up with them again this week. Their new focus is on enabling companies to provide their prospects with informative videos during the information-gathering phase of the sales process.

Cliff argues persuasively that in the old days the sales rep presented 80% of the information about a product to a prospect; now prospects collect 80% of what they need to know online, and the sales rep then fills in the blanks. Through VisibleGains "ask and respond" branching format, companies better inform their prospects, qualify leads and add personality to their typical text-heavy web sites. It's another great example of how video can be used beyond the media model.

Unicorn Media demo is impressive - Even as PermissionTV changes its focus, Unicorn Media is entering the crowded video platform space. I mentioned Unicorn, which was founded by Bill Rinehart, founding CEO of Limelight, in my 4 items post a couple months. This week I got a demo from CTO AJ McGowan and Chief Strategy Officer David Rice and I was impressed. Key differentiators AJ focused on were an enterprise-style user rights model for accessing the platform, APIs that allow drag-and-drop content feeds, and an "ad proxy" for configuring ad rules.

Most interesting though is Unicorn's real-time data warehouse feature, which provides granular performance data up to the minute. Data can be displayed in a number of ways, but most compelling was what AJ termed the "magic Frisbee," a clever format for showing multiple data points (e.g. streaming time, ad completes, # of plays, etc.) all at once, so that decision-makers can hone in on performance issues. AJ says prospects are responding to this feature in particular as assembling this level of information today often requires multiple staffers and data sources. David reports that Unicorn is finding its biggest opportunity is with large media companies that have built their own in-house video solutions, as opposed to competing with other 3rd party platforms. Unicorn doesn't charge a platform fee, instead it bills by hours viewed. Separately, I have a briefing next week with yet another stealthy platform company; there seems to be no shortage of interest in this space.

Vitamin D shows breakthrough approach to object recognition in video - Speaking of demos, Greg Shirai, VP of Marketing and Rob Haitani, Chief Product Officer from startup Vitamin D showed me their very cool demo this week. Vitamin D is pioneering a completely new approach to recognizing objects in video streams, using "NuPIC", an intelligent computing platform from Numenta, a company founded by Jeff Hawkins, Donna Dubinsky and Dileep George. Some of you will recognize Hawkins and Dubinsky as the founders of Palm and Handspring.

The demo showed how Vitamin D can recognize the presence of moving humans or objects throughout hours of video footage. While the system starts with the assumption that upright humans are tall and thin, it learns over time that their shapes can vary, if for example they are crouching, or carrying a big box, or are partially obscured behind bushes. Once recognized, it's possible to filter for specific actions the humans are taking, such as walking in and out of a door to a room. Vitamin D is first targeting video surveillance in homes or businesses, but as it is further developed, I see very interesting applications for the technology in online video, particularly in sports and advertising. Say you wanted to filter a Yankees game for all of CC Sabathia's strikeouts, or insert a specific hair care ad only when a blond woman was in the last scene. Vitamin D and others are continuing to raise the bar on visual search which is still in its infancy.

Reminder - VideoSchmooze is coming up on next Tuesday night, Oct. 13th in NYC. We have an awesome panel discussion planned and great networking with over 200 industry colleagues. Hope you can join us!Categories: Enterprises, Startups, Technology

Topics: Horowitz Associates, Numenta, PermissionTV, Unicorn Media, VideoSchmooze, VisibleGains, Vitamin D

-

Lots of News Yesterday - Adobe, Hulu, IAB, Yahoo, AEG, KIT Digital, VBrick, Limelight, Kaltura

Yesterday was one of those days when meaningful broadband video-related news and announcements just kept spilling out. While I was writing up the 5Min-Scripps Networks deal, there was a lot of other stuff happening. Here's what hit my radar, in case you missed any of it:

Adobe launches Flash 10.1 with numerous video enhancements - Adobe kicked off its MAX developer conference with news that Flash 10.1 will be available for virtually all smartphones, in connection with the Open Screen Project initiative, will support HTTP streaming for the first time, and with Flash Professional CS5, will enable developers to build Flash-based apps for the iPhone and iPod Touch. All of this is part of the battle Adobe is waging to maintain Flash's lead position on the desktop and extend it to mobile devices. The HTTP streaming piece means CDNs will be able to leverage their HTTP infrastructure as an alternative to buying Flash Media Server 3.5. Meanwhile Apple is showing no hints yet of supporting Flash streaming on the iPhone, making it the lone smartphone holdout.

Hulu gets Mediavest multi-million dollar buy - Hulu got a shot in the arm as Mediaweek reported that the Publicis agency Mediavest has committed several million dollars from 6 clients to Hulu in an upfront buy. Hulu has been flogged recently by other media executives for its lightweight ad model, so the deal is a well-timed confidence booster, though it is still just a drop in the bucket in overall ad spending.

IAB ad spending research reports mixed results - Speaking of ad spending, the IAB and PriceWaterhouseCoopers released data yesterday showing overall Internet ad spending declined by 5.3% to $10.9B in 1H '09 vs. 1H '08. Some categories were actually up though, and online video advertising turned in a solid performance, up 38% from $345M in 1H '08 to $477M in 1H '09. Though still a small part of the overall pie, online video advertising's resiliency in the face of the recession is a real positive.

Yahoo ups its commitment to original video - Yahoo is one of the players relying on advertising to support its online video initiatives, and so Variety's report that Yahoo may as much as double its proportion of originally-produced video demonstrates how strategic video is becoming for the company. Yahoo has of course been all over the map with video in recent years including the short tenure of Lloyd Braun and then the Maven acquisition, which was closed down in short order. Now though, by focusing on short-form video that augments its core content areas, Yahoo seems to have hit on a winning formula. New CEO Carol Bartz is reported to be a big proponent of video.

AEG Acquires Incited Media, KIT Digital Acquires The FeedRoom and Nunet - AEG, the sports/venue operator, ramped up its production capabilities by creating AEG Digital Media and acquiring webcasting expert Incited Media. Company executives told me late last week that when combined with AEG's venues and live production expertise, the company will be able to offer the most comprehensive event management and broadcasting services. Elsewhere, KIT Digital, the acquisitive digital media technology provider picked up two of its competitors, Nunet, a German company focused on mobile devices, and The FeedRoom, an early player in video publishing/management solutions which has recently been focused on the enterprise. KIT has made a slew of deals recently and it will be interesting to watch how they knit all the pieces together.

Product news around video delivery from VBrick, Limelight and Kaltura - Last but not least, there were 3 noteworthy product announcements yesterday. Enterprise video provider VBrick launched "VEMS" - VBrick Enterprise Media System - a hardware/software system for distributing live and on-demand video throughout the enterprise. VEMS is targeted to companies with highly distributed operations looking to use video as a core part of their internal and external communications practices.

Separate, Limelight unveiled "XD" its updated network platform that emphasizes "Adaptive Intelligence," which I interpret as its implementation of adaptive bit rate (ABR) streaming (see Limelight comment below, my bad) that is becoming increasing popular for optimizing video delivery (Adobe, Apple, Microsoft, Apple, Akamai, Move Networks and others are all active in ABR too). And Kaltura, the open source video delivery company I wrote about here, launched a new offering to support diverse video use cases by educational institutions. Education has vast potential for video, yet I'm not aware of many dedicated services. I expect this will change.

I may have missed other important news; if so please post a comment.

Categories: Advertising, Aggregators, CDNs, Deals & Financings, Enterprises, Portals, Technology

Topics: Adobe, AEG, Hulu, IAB, Kaltura, KIT Digital, Limelight, Nunet, The FeedRoom, VBrick, Yahoo

-

4 Items Worth Noting (comScore, Viral videos' formula, Netflix, VideoSchmooze) for Sept 26th Week

Following are 4 news items worth noting from the week of Sept. 26th:

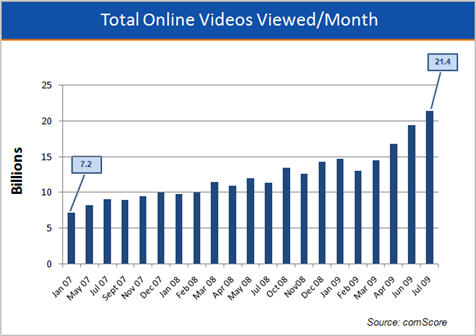

1. Summer '09 was a blockbuster for online video - comScore released U.S. online video viewership data early this week, providing evidence of how big a blockbuster the summer months were for each metric comScore tracks. The 3 metrics that I watch most closely each month showed the healthiest gains vs. April, the last pre-summer month comScore reported. Total videos viewed in August were 25.4 billion, a 51% increase over April's 16.8 billion. The average number of videos watched per viewer was 157, up 41% from April's 111. And the average online video viewer watched 582 minutes (9.7 hours), a 51% increase from April's 385 (6.4 hours).

Also worth noting was YouTube crossing the 10 billion videos viewed in a single month mark for the first time, maintaining a 39.6% share of the market. According to comScore's stats I've collected, YouTube has been in the 39% to 44% market share range since May '08, having increased from 16.2% in Jan '07 when comScore first started reporting. Hulu also notched a winning month. While its unique viewers fell slightly to 38.5M from 40.1M in April, its total video views increased from 396M to 488.2M, with its average viewer watching 12.7 videos for a total of 1 hour and 17 minutes. It will be very interesting to see if September's numbers hold these trends or dip back to pre-summer levels.

2. So this is how to make funny viral branded videos - I was intrigued by a piece in ClickZ this week, "There's a Serious Business Behind Funny Viral Videos" which provided three points of view - from CollegeHumor.com, The Onion and Mekanism (a S.F.-based creative production agency) - about how to make branded content funny and then how to make it go viral. The article points out that a whole new sub-specialty has emerged to service brands looking to get noticed online with their own humorous content.

Humor works so well because the time to hook someone into a video is no more than 2-3 seconds according to Mekanism's Tommy Means. Beyond humor, successful videos most often include stunts or cool special effects or shock value. Once produced the real trick is leveraging the right distribution network to drive viral reach. For example, Means describes a network of 100 influencers with YouTube channels who can make a video stand out. After reading the article you get the impression that there's nothing random about which funny videos get circulated; there's a lot of strategy and discipline involved behind the scenes.

3. Wired magazine's article on Netflix is too optimistic - I've had several people forward me a link to Wired magazine's article, "Netflix Everywhere: Sorry Cable You're History" in which author Daniel Roth makes the case that by Netflix embedding its streaming video software in multiple consumer electronics devices, the company has laid the groundwork for a rash of cable cord-cutting by consumers.

I've been bullish for sometime on Netflix's potential as an "over-the-top" video alternative. But despite all of Netflix's great progress, particularly on the device side, its Achilles' heel remains content selection for its Watch Instantly streaming feature (as an example, my wife and I have repeatedly tried to find appealing recent movies to stream, but still often end up settling for classic, but older movies like "The English Patient").

Roth touches on this conundrum too, but in my opinion takes a far too optimistic point of view about what a deal like the one Netflix did with Starz will do to eventually give Netflix access to Hollywood's biggest and most current hits. The Hollywood windowing system is so rigid and well-protected that I've long-since concluded the only way Netflix is going to crack the system is by being willing to write big checks to Hollywood, a move that Netflix CEO is unlikely to make. The impending launch of TV Everywhere is going to create whole new issues for budding OTT players.

Although I'm a big Netflix fan, and in fact just ordered another Roku, I'm challenged to understand how Netflix is going to solve its content selection dilemma. This is one of the topics we'll discuss at VideoNuze's CTAM Summit breakfast on Oct. 26th in Denver, which includes Roku's VP of Consumer Products Tim Twerdahl.

4. VideoSchmooze is just 1 1/2 weeks away - Time is running out to register for the "VideoSchmooze" Broadband Video Leadership Evening, coming up on Tues, Oct 13th from 6-9pm at the Hudson Theater in NYC. We have an amazing discussion panel I'll be moderating with Dina Kaplan (blip.tv), George Kliavkoff (Hearst), Perkins Miller (NBC Sports) and Matt Strauss (Comcast). We'll be digging into all the hottest broadband and mobile video questions, with plenty of time for audience Q&A.

Following the panel we'll have cocktails and networking with industry colleagues you'll want to meet. Registration is running very strong, with companies like Sprint, Google/YouTube, Cox, MTV, Cox, PBS, NY Times, Morgan Stanley, Hearst, Showtime, Hulu, Telemundo, Cisco, HBO, Motorola and many others all represented. Register now!

Categories: Aggregators, Branded Entertainment, Events, FIlms, Studios

Topics: CollegeHumor.com, comScore, Hulu, Mekanism, Netflix, The Onion, VideoSchmooze, Wired, YouTube

-

4 Items Worth Noting (Hulu, TiVo-Emmys, GAP-VMIX, Long Tail) for Sept 21st Week

Following are 4 news items worth noting from the week of Sept. 21st:

1. Bashing Hulu gains steam - what's going on here? - These days everyone seems to want bash Hulu and its pure ad-supported business model for premium content. Last week it was Soleil Securities releasing a report that Hulu costs its owners $920 per viewer in advertising when they shift their viewership. This week, it was a panel of industry executives turn. Then a leaked email from CBS's Quincy Smith showed his dissatisfaction with Hulu, and interest in trying to prove it is the cause of its parent networks' ratings declines.

What's happening here is that the world is waking up to the fact that although Hulu's user experience is world-class, its ad model implementation is simply too light to be sustainable. I wrote about this a year ago in "Broadcast Networks' Use of Broadband Video is Accelerating Demise of their Business Model," following up in May with "OK, Hulu Now Has ABC. But When Will it Prove Its Business Model?" Content executives are finally realizing that it is still too early to put long form premium quality video online for free. Doing so spoils viewers and reinforces their expectation that the Internet is a free-only medium. When TV Everywhere soon reasserts the superiority of hybrid pay/ad models, ad-only long-form sites are going to get squeezed. At VideoSchmooze on Oct 13th, we have Hulu's first CEO George Kliavkoff on our panel; it's going to be a great opportunity to understand Hulu's model and dig further into this whole issue.

2. TiVo data on ad-skipping for Emmy-winning programs should have TV industry alarmed - As if ad-skipping in general wasn't already a "hair-on-fire" problem for TV executives, research TiVo released this week on ad-skipping behavior specifically for Emmy-winning programs should have the industry on DEFCON 1 alert. Using data from its "Stop | Watch" ratings service, TiVo found that audiences for the winning programs in the 5 top Emmy categories - Outstanding Comedy Series, Drama Series, Animated Program, Reality-Competition and Variety/Music/Comedy Series - all show heavier than average (for their genre) time-shifting. The same pattern is true for ad-skipping; the only exception is "30 Rock" (winner of Outstanding Comedy Series) which performs slightly better than its genre average.

The numbers for AMC's "Mad Men" (winner of Outstanding Drama Series), are particularly eye-opening: 85% of the TiVo research panel's viewers time-shifted, and of those, 83% ad-skipped. (Note as an avid Mad Men viewer, I've been doing both since the show's premiere episode. It's unimaginable to me to watch the show at its appointed time, and with the ads.) The data means that even when TV execs produce a critical winner, their ability to effectively monetize it is under siege. How long will BMW sign up to be Mad Men's premier sponsor with research like this? TiVo's time-shifting data shows why network executives have to get the online ad model right. When TV Everywhere launches it will cater to massive latent interest in on-demand access by viewers; it is essential these views be better monetized than Hulu, for example, is doing today.

3. Radio stations push into online video as GAP Broadcasting launches with VMIX - Lacking its own video, the radio industry has been a little bit of the odd man out in the online video revolution. Some of the industry's bigger players like Clear Channel have jumped in, but there hasn't been a lot of momentum, especially with the ad downturn. But this week GAP Broadcasting, owner of 116 stations in mostly smaller markets announced a partnership with video platform and content provider VMIX. I talked to VMIX CEO Mike Glickenhaus who reported that radio stations are starting to get on board. For GAP, VMIX is providing an online video platform, premium content from hundreds of licensed partners, user-generated video tools and sales training, among other things. GAP's goal is to be a "total audience engagement platform" not just a radio station. Sounds right, but there's lots of hard work ahead.

4. So is there a "Long Tail" or isn't there? Ever since Chris Anderson's book "The Long Tail" appeared in 2006 there have been researchers challenging his theory which asserts that infinite shelf space drives customer demand into the niches. The latest attempt is by 2 Wharton professors, who, using Netflix data, observe that the Long Tail effect is not ironclad. Sometimes it's present, sometimes it's not. Anderson disputes their findings. The argument boils down to the definitions of the "head" and "tail" of the markets being studied. Anderson defines them in absolute terms (say the top 100 products), whereas the Wharton team defines them in terms of percentages (the top 1 %).

I've been fascinated with the Long Tail concept since the beginning, as it potentially represents a continued evolution of video choice; over-the-air broadcasting allowed for 3 channels originally, cable then allowed for 30, 50, 500, now broadband creates infinite shelf space. Independent online video producers and their investors have bet on the Long Tail effect working for them to drive viewership beyond broadcast and cable. With Nielsen reporting hours of TV viewership holding steady, we haven't yet seen cannibalization. However, with Nielsen, comScore and others reporting online video consumption surging, audiences may be carving out time from other activities to go online and watch.

Enjoy your weekends! There will be no VideoNuze on Monday as I'll be observing Yom Kippur.

Categories: Advertising, Aggregators, Broadcasters, Indie Video, Radio

Topics: AMC, GAP Broadcasting, Hulu, Long Tail, Netflix, VMIX

-

4 Items Worth Noting from the Week of September 14th

Following are 4 news items worth noting from the week of Sept. 14th:

1. Ad spending slowdown continues - TNS Media Intelligence reported that 1st half '09 U.S. ad spending declined 14.3% vs. a year ago, to $60.87 billion. Spending in Q2 '09 alone was down 13.9% vs. a year ago, the 5th straight declining quarter. The only bright spots TNS reported were Internet display ads (up 6.5%) and Free Standing Inserts (up 4.6%).

Rupert Murdoch and others in the industry have lately been suggesting that advertising is starting to improve and that the worst is behind us. But TNS SVP Research Jon Swallen was less sanguine, saying only that "Early data from third quarter hint at possible improvements for some media due to easy comparisons against distressed levels of year ago expenditures." While the online video ad sector has held up far better than most, the ad spending crash has caused many in the industry to re-evaluate whether ad-only models are viable, particularly for long-form premium content online. Subscription-oriented initiatives will only intensify the longer the ad slowdown lasts.

2. Veoh's court victory is important for all in the industry - I'd be remiss not to note the significance of U.S. District Judge A. Howard Matz's granting of Veoh's motion for summary judgment, effectively throwing out Universal Music's suit alleging Veoh had infringed UMG's copyrights. Judge Matz articulated the specific reasons he believed Veoh operated within the "safe harbor" provisions of the DMCA.

As a content producer myself (albeit at a completely different level than a music publisher or film studio!), I've generally been a huge advocate of copyright protection. But the fact is that DMCA - for better or worse - set out the rules for digital copyright use and they must be enforced clearly and forcefully. Anything less leaves the market in a state of confusion, with industry participants wary of inviting costly, time-consuming legal action (Veoh has said the UMG suit cost it millions of dollars in legal fees). For online video to thrive the rules of the road need to be well-understood; Judge Matz's ruling made an important contribution toward that goal.

3. Digitalsmiths announces new senior level hires - This week Digitalsmiths announced that it has brought on board Josh Wiggins as its new VP, Business Development, West Coast and two others, who will collectively be the company's first L.A.-based presence. They'll report in to Bob Bryson, SVP of Sales and Business Development.

I caught up with Digitalsmiths' CEO Ben Weinberger briefly, who explained that with tier 1 film/TV studios and other content owners (news, sports, etc.) the company's major focus, it was essential to have a full-time presence there staffed with people who know the industry cold. Ben reported that the company has honed in on target customers who have very large files, have video as their core business/revenue center, require sophisticated metadata management and often need a rapid video capture, processing and playout workflow. Digitalsmiths is proving a solid example of how to effectively differentiate through product and customer focus in a very crowded space. Announced customers include Warner Bros., Telepictures and TMZ.com, others are in the hopper (note Digitalsmiths is a VideoNuze sponsor).

4. New EmmyTVLegends.org site is a worth its weight in gold - On a somewhat lighter note, this week the Academy of Television Arts & Sciences Foundation unveiled EmmyTVLegends.org, which offers thoughtful, introspective video interviews with a wide range of TV's most influential personalities. If you have nostalgia for the classic TV shows from your youth, or just appreciate the amazing talent that has made the medium what it is, this site is for you. It is remarkably well-organized and accessible and brilliant proof of online video's power in presenting invaluable material that was previously available only to a lucky few.

I happily got lost in the site listening to Alan Alda talk about the fabulous writers of M*A*S*H and Steven Bochco describing the magic of "Hill Street Blues." I searched by "Happy Days" and quickly found the exact clips of Ron Howard talking about the role of his "Richie Cunningham" character in the show's arc and Henry Winkler revealing the influence of Sylvester Stallone on how he developed the voice of "Fonzie." Mary Tyler Moore is irresistible discussing specific scenes of the Mary Tyler Moore show and her poignant memories of Mary Richards navigating the working world. Kudos to the Academy, the site is a gem.

Enjoy the weekend and L'shanah tova (Happy New Year) to those of you, who like me, will be observing Rosh Hashanah this weekend!

Categories: Advertising, Aggregators, Music, People, Technology

Topics: Academy of Television Arts & Sciences Foundation, Digitalsmiths, EmmyTVLegends.org, TNS, UMG, Veoh

-

VideoNuze Report Podcast #32 - September 18, 2009

Daisy Whitney and I are pleased to present the 32nd edition of the VideoNuze Report podcast, for September 18, 2009.

This week Daisy and I first discuss my post from earlier this week, "How TV Everywhere Could Turn Cable Operators and Telcos Into Over-the-Top's Biggest Players," which has become one of the most popular posts I've written in the past 2 years.

In the post I asserted that if certain cable operators and telcos were to unbundle their TV Everywhere ("TVE") offering from their video subscription requirement, they could offer a "TVE 2.0" service outside their current geographic areas. In effect they'd be going over the top of their industry counterparts, invading new service territories.

It would be a bold move, but one that I suggested might be irresistible. Between slowing growth in their existing markets and new competitors rolling out OTT services nationwide, big cable operators and telcos could face the prospect of being turned into marginalized, geographically-bound players. I've heard from lots of folks this week about the TVE 2.0 concept - some who think it's inevitable; some who think it's inconceivable. I explain more in the post and on the podcast. You decide.

Meanwhile, Daisy provides an update from this week's iMedia Brand Summit, where marketers and agencies spent a lot of time discussing the effectiveness of traditional TV advertising vs. online video advertising. Daisy shares some very interesting statistics she gathered at the conference concerning how some industries are overspending in TV and getting underperformance. As Daisy explains, the key to advertising is no longer reach, but targeting. Listen in to learn more.

Click here to listen to the podcast (15 minutes, 9 seconds)Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, Cable TV Operators, Podcasts

-

VideoNuze Report Podcast #31 - September 11, 2009

Daisy Whitney and I are pleased to present the 31st edition of the VideoNuze Report podcast, for September 11, 2009.

This week Daisy and I first discuss my post from yesterday, "StudioNow Begins March Into Video Platform Space with AMS Launch." For those not familiar with StudioNow, it has been operating a network that links geographically-dispersed video professionals with its clients' projects using a backend work flow/project management platform.

Yesterday the company launched its Video Asset Management & Syndication Platform ("AMS"), which its clients can use to manage, transcode and syndicate their videos. It's a clever move by StudioNow, and I believe paves the way for the company to compete more directly in the video management and publishing platform space. StudioNow will benefit by leveraging its position as a trusted partner to content providers and directories which it serves on the video creation/production side.

We then discuss the new Coalition for Innovative Media Measurement (CIMM) which was just announced yesterday. CIMM brings together 14 different broadcast and cable TV networks, media agencies and advertisers to create new audience measurement for TV and cross-platform media. CIMM intends to run pilot studies focusing on TV measurement through set-top box data and cross-platform media measurement. It's hard not to see CIMM as a "Nielsen-killer" though CIMM has asserted that it should not viewed as such.

With so many companies involved, Daisy is skeptical of the venture's likelihood of success and favors a more market-driven solution. I think it actually can succeed, but only if the partners are truly committed and invest accordingly. I haven't followed measurement that closely, but in my view the partners' commitment level will likely be correlated to the level of dissatisfaction they each have with Nielsen, and this will determine CIMM's eventual success. More detail in the podcast.

Click here to listen to the podcast (15 minutes, 1 second)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Podcasts, Technology

Topics: Nielsen, Podcast, StudioNow

-

4 Items Worth Noting from the Week of August 31st

Following are 4 news items worth noting from the week of August 31st:

1. Nielsen "Three Screen Report" shows no TV viewing erosion - I was intrigued by Nielsen's new data out this week that showed no erosion in TV viewership year over year. In Q2 '08 TV usage was 139 hours/mo. In Q2 '09 it actually ticked up a bit to 141 hours 3 minutes/mo. Nielsen shows an almost 50% increase in time spent watching video on the Internet, from 2 hours 12 minutes in Q2 '08 to 3 hours 11 minutes in Q2 '09 (it's worth noting that recently comScore pegged online video usage at a far higher level of 8.3 hours/mo raising the question of how to reconcile the two firms' methodologies).

I find it slightly amazing that we still aren't seeing any drop off in TV viewership. Are people really able to expand their media behavior to accommodate all this? Are they multi-tasking more? Is the data incorrect? Who knows. I for one believe that it's practically inevitable that TV viewership numbers are going to come down at some point. We'll see.

2. DivX acquires AnySource - Though relatively small at about $15M, this week's acquisition by DivX of AnySource Media is important and further proof of the jostling for position underway in the "broadband video-to-the-TV" convergence battle (see this week's "First Intel-Powered Convergence Device Being Unveiled in Europe" for more). I wrote about AnySource earlier this year, noting that its "Internet Video Navigator" looked like a content-friendly approach that would be highly beneficial to CE companies launching Internet-enabled TVs. I'm guessing that DivX will seek to license IVN to CE companies as part of a DivX bundle, moving AnySource away from its current ad-based model. With the IBC show starting late next week, I'm anticipating a number of convergence-oriented announcements.

3. iPhone usage swamps AT&T's wireless network - The NY Times carried a great story this week about the frustration some AT&T subscribers are experiencing these days, as data-centric iPhone usage crushes AT&T's network (video is no doubt the biggest culprit). This was entirely predictable and now AT&T is scrambling to upgrade its network to keep up with demand. But with upgrades not planned to be completed until next year, further pain can be expected. I've been enthusiastic about both live and on-demand video applications on the iPhone (and other smartphones as well), but I'm sobered by the reality that these mobile video apps will be for naught if the underlying networks can't handle them.

4. Another great Netflix streaming experience for me, this time in Quechee VT courtesy of Verizon Wireless - Speaking of taxing the network, I was a prime offender of Verizon's wireless network last weekend. While in Quechee, VT (a pretty remote town about 130 miles from Boston) for a friend's wedding, I tethered my Blackberry during downtime and streamed "The Shawshank Redemption" (the best movie ever made) to my PC using Netflix's Watch Instantly. I'm happy to report that it came through without a single hiccup. Beautiful full-screen video quality, audio and video in synch, and totally responsive fast-forwarding and rewinding. I've been very bullish on Netflix's Watch Instantly, and this experience made me even more so.

Per the AT&T issue above, it's quite possible that occupants of neighboring rooms in the inn who were trying to make calls on their Verizon phones while I was watching weren't able to do so. But hey, that was their problem, not mine!

Enjoy the weekend (especially if you're in the U.S. and have Monday off too)!

Categories: Aggregators, Deals & Financings, Devices, Mobile Video

Topics: AnySource, Apple, AT&T, comScore, DivX, Intel, iPhone, Netflix, Nielsen, Verizon Wireless

-

comScore's Online Video Data Charts for Jan '07-July '09 Available for Download

Last Thursday comScore released July 2009 data from its Video Metrix service showing record online video usage for the month. I've been charting comScore's data for 2 1/2 years, making updates each month when comScore provides new data. Today I'm offering these charts as a complimentary download (if you incorporate them into your presentations please identify comScore as the source). Here's an example slide for total online videos viewed per month: