-

VideoNuze Report Podcast #63; Yankee Group Cord-Cutting Research Download Available

Daisy Whitney and I are pleased to present the 63rd edition of the VideoNuze Report podcast, for May 27, 2010.

In today's podcast Daisy starts us off by discussing her New Media Minute this week, in which she highlights recent research from Yankee Group forecasting that 1 in 8 consumers will become cord-cutters in the next 12 months. With the rise of online video viewing, cord-cutting - the idea of consumers discontinuing their pay-TV subscription service in favor of free online sources - has become a very hot topic.

In this context, the Yankee research got a lot of attention when it was released. I recently had a chance to speak to the 2 analysts responsible for the research, Vince Vittore and Dmitriy Molchanov, who walked me through some of their assumptions. They've also been kind enough to share half a dozen of their slides, which are available for a complimentary download here.

Yankee's conclusion is based on annual research the firm conducts which includes certain questions about consumers' intent. In this year's survey the question, "Does Internet video offer enough options for you to consider canceling your pay TV subscription?" As slide 3 shows, Yankee took the respondents who are considering this and then extrapolated how many will actually follow through based on trend lines from past research. I think it's a plausible approach, though 1 in 8 over the next 12 months seems very aggressive to me.

Personally, I've been skeptical about any onslaught of cord-cutting. Back in October, 2008 I laid out my 2 principal arguments: that it's difficult to watch online video on TVs (where it must be enjoyable by mainstream audiences in order for cord-cutting to really take off) and that cable programming will be very limited on the free Internet (and as a result this will be a big disincentive for fans of cable channels to drop them).

While a lot is happening on the convergence front (e.g. Google TV, Roku, etc.), with the advent of TV Everywhere, the likelihood that cable programs will not leak out onto the open Internet is lower than ever. That's not to say there isn't a ton of great video available for free or through other paid options (like Netflix's streaming), but for the vast majority of pay-TV subscribers, I'd maintain that cutting the cord will be a distant option for a while to come. Nonetheless, it is a fascinating topic which will surely get even more attention going forward.

What do you think? Post a comment now (no sign-in required).

Click here to listen to the podcast (12 minutes, 59 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!Categories: Cable Networks, Devices, Podcasts

Topics: Yankee Group

-

For Online Video Households, 31% of Video Time Now from Online Sources

New research from One Touch Intelligence says that among households with adults who watch long-form TV shows and movies online, the percentage of their total video viewership spent online is now up to 31%. That equates to twice as much time spent watching DVDs and 5 times the amount spent using VOD. The research also shows that in these households, the most-used site for watching long-form content is Hulu, with 53% citing it.

In addition, 48% of respondents said they watch online video on TV screens in their homes and that 11% of online viewing time in these homes is on TVs. The top devices used to connect online to the TV are Xbox 360 or connected PC (each 40%), PS3 (37%), Wii (36%) and TV with Internet capability (29%).

As convergence devices continue to proliferate and long-form content is increasingly available, I expect that these numbers are only going to move higher. The full report, "Internet Video 2010: Content Usage and Devices" is available from One Touch.

Categories:

Topics: One Touch Intelligence

-

VideoNuze Report Podcast #60 - May 7, 2010

Daisy Whitney and I are pleased to present the 60th edition of the VideoNuze Report podcast, for May 7, 2010.

In today's podcast Daisy and I discuss research that Brightcove and TubeMogul released yesterday on online video consumption and engagement in the media industry. Though the data isn't statistically significant, the report caught our eye because it offers a great assortment of insights based on actual platform data plus survey responses. It's freely downloadable here. Listen in to hear our reactions.

Click here to listen to the podcast (13 minutes, 47 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!Categories: Podcasts

Topics: Brightcove, Podcast, TubeMogul

-

Online Video Viewing Rebounds in March According to comScore; Hulu Performance is Mixed

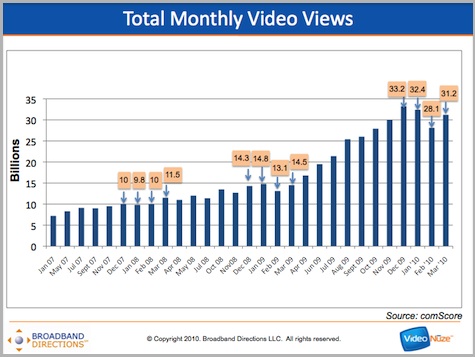

Online video viewing rebounded to 31.2 billion total streams in March '10 according to comScore's newly-released numbers. The March total marks an 11% increase in streams over February's 28.1 billion. As I wrote a couple of weeks ago, it also continues a leveling-dipping-rebounding pattern that has occurred in the Dec-Mar months for the last 2 years as shown in the chart below. If the pattern holds, we'll see strong growth for the next 6 months or so.

As always, YouTube was the top video site by a wide margin. In March it notched 13.1 billion views, up 10% vs. February's 11.9 billion. Its share was down just slightly to 41.8% from February's 42.5%. Still, it was the 21st consecutive month that YouTube's share has been plus or minus 2-3 percentage points of 40%, a remarkable run.

Hulu also bounced back strongly in March, recording its best month to date with 1.070 billion streams, up 7.5% vs. February's 912.5 million. But with Hulu viewers averaging 156 minutes, the minutes per viewer in March actually slipped to 5.84 from 6.18 in Feb. Hulu's average minutes has stayed stubbornly around 6 minutes for over a year now. In addition, total unique viewers came in at just over 40 million. As I've pointed out in the past, Hulu's viewership has been stuck around the 40 million mark now for a year. Absent a radical change, it seems that neither one of these metrics will break out of their respective range any time soon.

Lastly, on the ad network site, Tremor Media, which earlier this week announced a $40 million financing, saw its reach increase to 96 million viewers.

What do you think? Post a comment now (no sign-in required).Categories:

Topics: comScore, Hulu, YouTube

-

Is "Cord-Cutting" a Big Deal or Not?

"Cord-cutting," the idea of disconnecting your cable/satellite/telco video subscription service in favor of online viewing only, got renewed attention this week as new research from a Canadian firm named Convergence Consulting Group said that 800,000 U.S. households have unplugged in the last 2 years. Though that number is a teeny-tiny fraction of the population that still takes subscription TV, the question begs, is this an early indicator of rampant cord-cutting to follow, or a blip that's unlikely to get that much bigger over time?

Back in the fall of '08 I asserted that for most people cord-cutting isn't going to be happening any time soon for 2 key reasons. First, that it's still relatively hard for most mainstream users to connect broadband to their TVs, which is an essential ingredient to long-form viewing. There's no question that this has gotten easier since, and will only get easier still. Eventually broadband to the TV will be ubiquitous. But until it is, cord-cutting raises technical and comfort challenges most people don't want to confront.

The bigger obstacle to cord-cutting is the loss of cable-only programming that isn't available for free online. Back in '08 the concept of TV Everywhere wasn't yet around. Now that it's beginning to rollout (albeit painfully slowly), it's evident that the cable ecosystem is determined to see cable programming remain accessible only to those who maintain a paid subscription.

My take is that cable programming is the key firewall against cord-cutting. For some, losing cable programs won't matter. But my guess is that for most, losing their favorite cable programs by cutting the cord will be a non-starter. As Conan's move this week to TBS illustrates, increasingly the most distinctive shows are on cable. And note the "firewall within the firewall" is marquee sports programming on channels like ESPN, TNT and Fox Sports, which isn't going online for free ever. This precludes virtually all true sports fans from cord-cutting.

Net-net, the debate about cord-cutting's potential needs to focus on how much value audiences place on their favorite cable programs. If it's a lot, then little cord-cutting will ensue; if it's a little - and there are suitable free online substitutes - then we'll see lots more cord-cutting.

(Note - all of this is fodder for our VideoSchmooze panel discussion on April 26th "Money Talks - Is Online Video Shifting to the Paid Model?" Early bird discounted registration expires today!)

What do you think? Post a comment now (no sign-in required).Categories: Cable Networks, Cable TV Operators

Topics: Convergence Consulting Group

-

comScore's February 2010 Numbers Show Further Online Video Usage Declines

comScore released its Feb '10 online video rankings yesterday, which showed the 2nd straight month of usage declines in aggregate and for many of the top 10 sites. Total video views came in at 28.1 billion, vs. 32.4 billion in January and 33.2 billion in December '09. As I pointed out in my analysis of comScore's Jan numbers last month, and as the chart below shows, in each of the last 3 years, the period from December to February has seen flat to slightly declining viewership.

It's still too early in online video's evolution to form hard and fast conclusions about the impact of seasonality, but judging from the past 3 years it seems as though we're beginning to see the pattern. February is also a shorter month than either Dec or Jan, so this too plays a role in explaining the downward trend in viewership.

As usual, YouTube was the most-used video site, generating 11.9 billion views, down from 12.8 billion in Jan and 13.2 billion in Dec. YouTube's share jumped up to 40% in Jan, marking almost 2 years that the site's share of the overall video market has been plus or minus 3 percentage points of 40% share, a remarkable achievement given the growth of other video sites.

Hulu is one of those sites that achieved growth in Feb, increasing its video views to 912.5 million from January's 903 million, though both are down from the site's December record of just over a billion views. In Feb Hulu averaged 6.18 minutes viewed per video, the first time the site has been back up over 6 minutes since Sept '09. Hulu's audience came in at 39.2 million uniques, continuing to be stubbornly stuck around the 40 million mark for a full year. I've commented before that Hulu appears to be encountering a challenge broadening its user base. The deletion of the Jon Stewart and Stephen Colbert programs will only make this challenge harder.

As the chart above also shows, in the past 2 years March has been a month when viewership rebounded, setting the stage for growth over the following 9 months. We'll see whether the same pattern starts to play out next month.

What do you think? Post a comment now (no sign-in required).

Categories:

Topics: comScore, Hulu, YouTube

-

VideoNuze Report Podcast #55 - April 2, 2010

Daisy Whitney and I are pleased to present the 55th edition of the VideoNuze Report podcast, for April 2, 2010.

This week Daisy and I first discuss my post from this past Monday, "New comScore Research Available; More Ads Tolerable in Online TV Programs" (the post also includes a link for a complimentary download of the research presentation). Among other things the research concludes is that viewers of online-delivered TV programs could tolerate 6-7 minutes of ads which is approximately double the typical current ad load.

I have argued for some time that the ad load in online programs is way too light and that it was jeopardizing the broadcast networks' P&Ls, particularly as convergence devices allow online video viewing directly on TVs. Coincidentally, this week the CW Network announced that it would double its ad load next TV season. And Hulu, though announcing this week that it has been profitable for the past 2 quarters, is under continued pressure by its content partners to increase its ad load to generate more revenue (recall that Hulu recently blocked the new Kylo browser, which I asserted was due to concern about cannibalizing audience and ad dollars from on-air).

Daisy then tells us more about "hot-spotting," which is the ability to click on an item in an online video and learn more about it and possibly purchase. Hot-spotting has become very hot (no pun), with multiple companies now offering technology that appears to be yielding significant results. Daisy reports that ConciseClick, ClickThrough and VideoClix are among the leaders and she provides some interesting stats on their performance. Listen in to learn more.

Click here to listen to the podcast (14 minutes, 45 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!Categories: Advertising, Podcasts

Topics: ClickThrough, comScore, ConciseClick, CW, Hulu, VideoClix

-

New comScore Research Available: More Ads Tolerable in Online TV Programs

An article I read last week in Mediaweek about new comScore research which concluded more ads are tolerable in online-delivered TV programs really intrigued me. The research was presented by Tania Yuki, comScore's director of cross media and video products at an Advertising Research Foundation meeting. I called Tania to follow up and learn more about the data. Today I'm pleased to share her presentation with the research findings as a complimentary PDF download. Outside of the ARF meeting, this is the first time this data has been made available.

Click here to download the research presentation

As VideoNuze readers know, I've been a proponent of increasing the number of ads in online TV shows, in order to improve their economics. Note, I'm not advocating a jump to 18-20 minutes of ads typically found in on-air distribution that would likely turn users off. But I do believe that the current model of 3-4 minutes of ads in premium network programs is way too light, and that viewers will tolerate more without any drop-off in usage, particularly if the ads are well-targeted and engaging. ABC has told me in the past that research it conducted when it experimented with doubling its ad load corroborated this point, just as the comScore research now does as well. Just last week the CW announced it would double the number of ads in its online-delivered programs.

model of 3-4 minutes of ads in premium network programs is way too light, and that viewers will tolerate more without any drop-off in usage, particularly if the ads are well-targeted and engaging. ABC has told me in the past that research it conducted when it experimented with doubling its ad load corroborated this point, just as the comScore research now does as well. Just last week the CW announced it would double the number of ads in its online-delivered programs.

Increasing the number of ads - and thereby strengthening the economic model for online-delivered TV - is critical for the industry to succeed long-term. The current lack of economic parity between online and on-air is gaining urgency; just last week when Hulu blocked access to its content via the new Kylo browser (meant for on-TV browsing), we were reminded of the absurd lengths to which the popular site will go to prevent its viewership from migrating to TVs. This is because Hulu was conceived as an online-only augment. Given its lack of economic parity with on-air (or with DVR viewing, as ABC.com is now achieving), Hulu on TV would undermine its owners' P&Ls.

The new comScore research concludes that viewers will tolerate 6-7 minutes of "total advertising time" during online-delivered TV programs. And note that this response reflects expectations of conventional advertising. I think it's quite possible that if respondents had been shown the kinds of targeted, entertaining and interactive video ads that blip.TV and others are now offering, they would have said their tolerance would be even higher. Providing further comfort that more ads are reasonable, when asked about the most important reasons for watching TV online, the answers were first, "Missed an episode on TV" (71%) and second, "Convenience" (57%). A distant third was "Less ads" (38%). Ad avoidance is important to online viewers, but it isn't their sole motivator.

The comScore research further underscores the growing importance of online, particularly in terms of raising programs' visibility and sampling. For example, for people who watch both on TV and online, an "online video site" (28%) is already the third most-cited way of discovering new TV shows, following "TV advertising" (59%) and "Friend/family member recommendation" (44%). Related, 28% said that they believed that if they hadn't been made aware of their favorite program online first, they probably wouldn't have discovered it on TV, and therefore would have missed the show entirely. Across all respondents, 20% of shows watched regularly had been watched first online.

As Tania reminded me, TV is still by far the dominant platform for viewing TV programs and that it's important to remember that online-only viewing is nascent. ComScore's research found that only 6% of respondents tune-in online only, though another 29% view both online and on-air. The key for me is looking toward the future. When the 6% of online-only viewers is broken down by age groups, about 75% are between 18-34. And if my 8 and 10-year old kids are any example, no doubt that those under 18 are only going to be even more avid online video viewers. In order for the TV industry to succeed in the future, it is essential that the business models to sustain online viewing be figured out pronto.

For this research, comScore which surveyed 1,825 people from its U.S.-only panel, weighted to match the total online population in age, income and gender. The research was conducted between Dec. 30, 2009 and Jan. 22, 2010. It was not sponsored by any third-party.

A reminder that if you're keen on this topic, join us for the complimentary April 8th webinar, "Demystifying Free vs. Paid Online Video" and then at the April 26th VideoSchmooze in NYC, where our panel topic is "Money Talks: Is Online Video Shifting toe the Paid Model?" (early bird tickets now available).

What do you think? Post a comment now (no sign-in required).

Categories: Advertising, Broadcasters

-

Interpreting comScore's January 2010 Online Video Usage Decline

comScore released its Jan '10 online video rankings yesterday, and while the numbers were still very strong, they did show declines from Dec '09. For example, in Jan, total monthly views were 32.4 billion, compared with 33.2 billion in Dec '09, a decline of 2.4%. To try to put this blip downward in a little more context see the chart below. I've called out the Dec-Feb period for the past 3 years. In prior years there have been slight to moderate decreases somewhere in this period. This might suggest some seasonality, based on limited historical data.

It's also worth noting that over the course of the last 3 years there have been 7 monthly sequential declines in the total monthly video views. Obviously nothing grows uninterrupted forever, and nobody should expect this from the online video market. Still, when you look at the overall growth curve, there can't be too many other Internet activities that have grown as consistently, with the exceptions maybe of social media (e.g. Twitter, Facebook, etc.).

Elsewhere in the comScore stats, YouTube remained the undisputed 800 pound gorilla for another month, once again maintaining its approximate 40% market share (39.4% in Jan to be exact). According to comScore, YouTube's market share hasn't been below 35% since May '08, when total video views were 12 billion. In other words, even as total views have almost tripled, YouTube has consistently held onto its market share. Pretty amazing.

Hulu also had another strong month, notching 903 million views (its 3rd best month) from 38.4 million unique visitors. Still, the unique visitor count tumbled by 13% from 44.2 million in Dec '09 to 38.4 million in Jan (by comparison YouTube increased from 135.8 million unique visitors in Dec to 136.5 million in Jan). As I mentioned recently, I'm looking for evidence that Hulu can expand its U.S. user base beyond the 35-45 million range it's been in for over a year.

One other point worth noting from the Jan data is that Vevo, the music video aggregation site just launched in Dec '09 broke into the top 10 with 32.3 million unique viewers and 226.1 videos viewed. Vevo's rapid growth is further testament to the popularity of music videos online and the continued importance of short-form.

What do you think? Post a comment now (no sign-in required).

Categories:

Topics: comScore, Hulu, VEVO, YouTube

-

Why Did Online Video Consumption Spike in 2009?

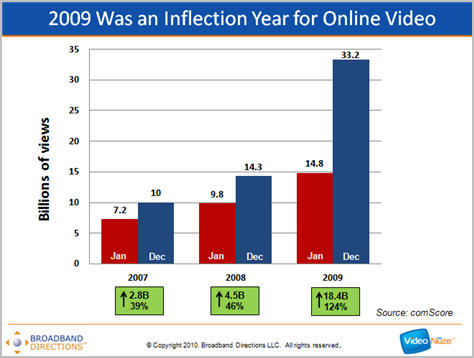

If you want to get a sense of how significant an inflection year 2009 was for online video, have a look at the chart below.

As you can see, according to comScore data, while Jan-Dec growth in 2007 (up 2.8 billion views or 39%) and 2008 (up 4.5 billion views or 46%) were impressive by any standard, the Jan-Dec 2009 growth of 18.4 billion views, up 124%, completely blows them away. Growth was so significant in 2009 that I think years down the road it will be pointed to as the year that online video really turned the corner.

But if that's the case, the question begs, "Why did growth accelerate so much in 2009 vs. prior years?" That's what I've been asked several times by industry colleagues since posting "comScore Data Shows 2009 Was a Blistering Year for Online Video" 2 weeks ago. It's a great question and though I don't have a really precise answer, here's my best sense of what happened.

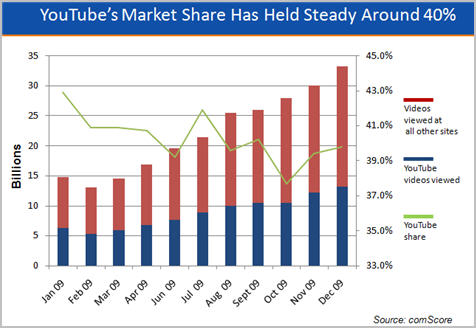

No surprise, the most important contributor to the year's growth was YouTube. It zoomed from 6.3 billion views in Jan '09 to 13.2 billion in Dec. '09. That increase of 6.9 views accounts for 38% of the 18.4 billion delta between Jan and Dec. So what did YouTube do to generate such significant growth? Part of the reason is surely organic; more people uploading, sharing and viewing YouTube videos. But in 2009 YouTube also made strides in professionalizing the content on YouTube, broadening its value proposition to users. For example, its "Content ID" program, which lets media companies manage and monetize user-uploaded videos, has largely addressed the copyright infringement concerns from past years (the Viacom suit is a notable exception).

In 2009, among other things, YouTube also signed up Disney/ESPN, Univision and others as content partners, began implementing FreeWheel's ad system so 3rd party content providers could better monetize their views, engaged a number of leading brands to use it as a promotional platform, and with "YouTube Direct" engaged news organizations as partners. In short, YouTube continues to immerse itself into the fabric of the Internet. Whether users are viewing videos at its site or through its wildly popular embeds, YouTube has become omnipresent. YouTube now also claims to be the 2nd largest search site.

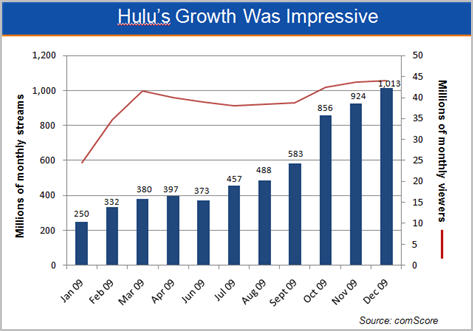

A second, but distant contributor to 2009's growth was Hulu, which saw its views increase by over 763 million from Jan to Dec, accounting for about 4% of the 18.4 billion increase in total views during that period. Hulu's mindshare leaped following its 2009 "Evil Plot" Super Bowl ad featuring Alec Baldwin and the subsequent ones. No doubt the addition of ABC programs throughout the year, plus other new content partners, also helped generate more viewership, along with the hugely popular SNL clips.

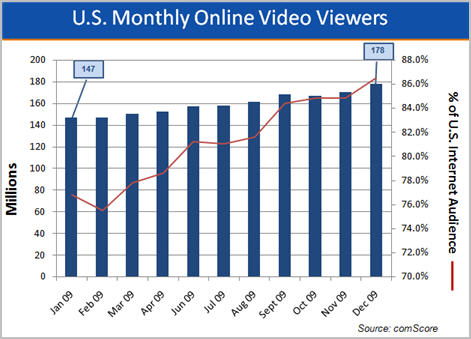

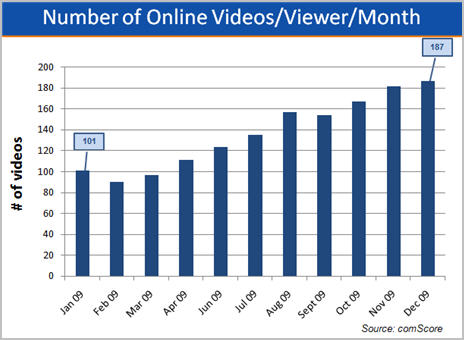

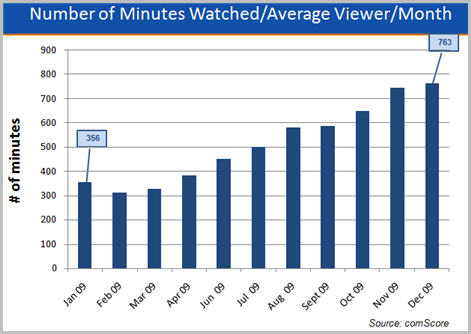

Once you get beyond these top 2 sites, the individual contributions to 2009's growth are more dispersed. The comScore data shows that across all video sites, usage intensified significantly during the year. For example, the number of videos viewed per viewer increased from 101 in Jan to 187 in Dec. The number of minutes watched jumped from 356 in Jan (almost 6 hours) to 762 in Dec (more than 12 1/2). There were also 31 million more U.S. Internet users watching video in Dec vs. Jan (178 million vs 147 million).

Looking beyond the numbers and thinking more qualitatively, it's also fair to conclude than in '09 online video reached a certain level of awareness that made it almost ubiquitous. There is just so much video online, and it is shared so widely, and highlighted so frequently by mainstream media, that it is unavoidable, even for the least technically-savvy among us. People are increasingly entertaining themselves with online video, but they're also finding new uses for it in their daily personal and professional lives.

I think it's unlikely we'll see the same level of growth in 2010 as in 2009, but I do believe the growth curve over the next 5 years will be very steep. The primary contributor will be convergence devices (e.g. game consoles, Blu-ray players, Roku, etc.) that are bridging online video to the TV where longer-form consumption will be the norm. Another key contributor will be TV Everywhere services, which are just now getting off the starting blocks. Lastly, I think growth in mobile consumption will be another important contributor. Add them all up and the 33.2 billion videos viewed in Dec. '09 will look relatively small 5 years from now.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators

Topics: comScore, Hulu, YouTube

-

VideoNuze Report Podcast #49 - February 12, 2010

Daisy Whitney and I are pleased to present the 49th edition of the VideoNuze Report podcast, for February 12, 2010.

This week Daisy and I dig into the 2009 comScore data that I detailed in my post on Tuesday (slides available for download too). It was a blistering year for online video, with total streams growing from 14.8 billion in Jan '09 to 33.2 billion in Dec '09. All the other relevant metrics also recorded strong growth. I share more details on the numbers and what they mean, focusing particularly on the top 2 sites YouTube and Hulu.

Then Daisy discusses her takeaways from the recent iMedia conference she helped organize. She talks about how brands are trying to break through the clutter, and the role of online video ad networks. Finally, she also discusses recent interviews she conducted with Facebook executives.

Click here to listen to the podcast (13 minutes, 55 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, Podcasts

Topics: comScore, Hulu, iMedia, YouTube

-

comScore Data Shows 2009 Was a Blistering Year for Online Video (Slides Available)

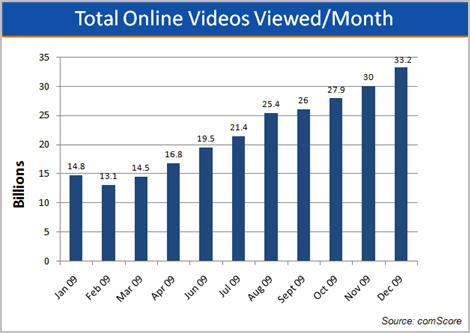

Last Friday, comScore released its Dec. '09 data for online video usage. I've been tracking comScore's data for the last 3 years and Dec put an exclamation mark on what many of us already knew: 2009 was a blistering year of growth in online video consumption. Below are graphs of the most important data (Click here if you'd like a complimentary PDF download of all of the slides.)

The first graph shows total online video views more than doubled from 14.8 billion in Jan '09 to 33.2 billion in Dec '09. The historical growth is even more impressive. Just two years ago, in Dec '07, comScore reported 10 billion video views.

Online video usage is now nearly ubiquitous in the U.S. According to comScore, in Dec '09, 86.5% of all U.S. Internet users watched online video, up nearly 10 percentage points from the 76.8% in Jan '09. That translates to 178 million people watching video in Dec '09, up from 147 million in Jan '09. Back in Jan '07, there were 123 million viewers.

Those users are watching a whole lot more videos as well. For Dec '09, comScore reported that 187 videos were watched per average viewer, up 85% from 101 in Jan '09, and more than triple the 59 watched in Jan '07.

As well, those viewers spent a lot more time watching online video. In Dec '09 comScore said that the average online viewer watched 762.6 minutes or 12.7 hours, more than double the 356 minutes viewed on average in Jan '09. Here's the really incredible stat: back in Jan '07, comScore pegged this number at just 151 minutes or about 2 1/2 hours, meaning average viewing time has more than quintupled in the last 3 years.

I've talked many times about how YouTube is the 800 pound gorilla of the online video market, and 2009 only further cemented this. Videos viewed at YouTube surged from 6.3 billion in Jan '09 to 13.2 billion in Dec '09. To put this in perspective, Google closed its acquisition in Nov '06. In Jan '07 (the first month comScore publicly released online video data), YouTube notched 1.2 billion views. That means that in the 3+ years that Google has owned YouTube, it has grown more than 10x in size. More amazing is that even with all the growth by other sites (particularly Hulu), YouTube has kept up its approximate 40% share of the overall online video market, starting the year at 42.9% and ending at 39.8%.

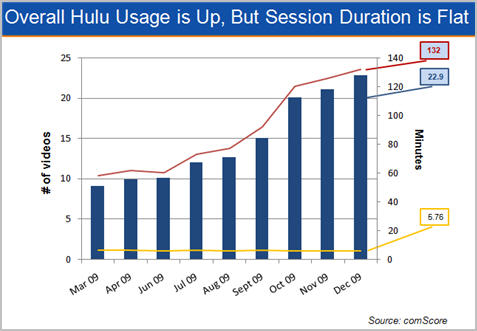

Speaking of Hulu, in its first full year of operation, the site surged from 250 million views in Jan '09 to 1,013 billion views in Dec '09. Unique viewers increased from 24.4 million in Jan '09 to 44.1 million in Dec '09. But if you look at the red line in the graph below, you'll see that uniques jumped to 41.6 million by Mar '09 which I believe must be due, at least in part, to a likely measurement change by comScore. Since Mar you'll notice that uniques hovered right around 40 million each month, dipping below during the summer and then bouncing back in Q4.

A few months ago I speculated that Hulu's relatively flat pattern in uniques could suggest that, in its current configuration, Hulu may have saturated the market for its content and user experience (for example, contrast Hulu with YouTube, which grew its uniques by 33% in '09 to 135.8 million by Dec '09). I'll be looking to see if Hulu can notch more noteworthy increases in uniques during '10; if not, then I think my thesis will be proven correct.

Nonetheless, Hulu's viewers clearly love the site, with average number of videos per viewer more than doubling to 22.9 in Dec '09, up from 9.8 in Dec '08. Users are spending more time on Hulu, increasing the amount of total minutes on the site from 58 in Mar '09 to 132 in Dec '09. What's remarkable though is that the average minutes watched per video (the yellow line below), has stayed virtually constant at around 6 minutes each month. That shows that while there's plenty of long-form consumption happening at Hulu, clips are still very popular too.

comScore is a great source of month in and month out online video data, but as always my caveat is that no third party can ever track usage as closely as the sites themselves, so take these numbers with a small grain of salt!

Click here if you'd like a complimentary PDF download of all of the slides.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators

Topics: comScore, Hulu, YouTube

-

Exclusive: FreeWheel Serving Almost 2 Billion Video Ads/Mo, MLB is Newest Customer

FreeWheel is on a roll, now serving almost 2 billion video ads/month, doubling its volume just since November, 2009. In addition, the company has added Major League Baseball Advanced Media to its customer roster and began implementing ads during the fall playoff season. The MLB win comes on top of recently announced customers Turner Broadcasting System and VEVO. FreeWheel's co-CEO/co-founder Doug Knopper brought me up to speed on all the news late last week.

Doug said that part of the increase in FreeWheel's volume is attributable to the additional customers that have come on board, but he's also very excited about the year-over-year growth in ad volume FreeWheel is

seeing for longer-term customers ("same store sales" if you will). FreeWheel is seeing big increases due to 3 factors: customers posting greater quantities of video, plus deepening viewership of that video (all of this borne out by comScore's '09 video consumption data); customers' improving ability to actually sell ads against these videos (reflecting the shift of budgets to the online video medium); and reduced friction through the emergence of "accepted practices" in ad operations.

seeing for longer-term customers ("same store sales" if you will). FreeWheel is seeing big increases due to 3 factors: customers posting greater quantities of video, plus deepening viewership of that video (all of this borne out by comScore's '09 video consumption data); customers' improving ability to actually sell ads against these videos (reflecting the shift of budgets to the online video medium); and reduced friction through the emergence of "accepted practices" in ad operations. FreeWheel is also benefiting from its specialization in helping content providers monetize their video on third-party sites (e.g. YouTube, AOL, MSN, Fancast, etc.). More and more content executives are realizing that sizable viewership opportunities exist by syndicating their video outside of their own properties. Doug said that every content company FreeWheel is now talking to is interested in some kind of syndication.

Doug described 3 types of syndication he's seeing: (1) across a family of sister corporate sites, such as PGA.com providing CNN.com video, which are both owned by Turner; (2) between affiliated entities like local MLB teams providing video to the main MLB.com hub and (3) externally, to unaffiliated 3rd parties, such as WMG music providing videos to YouTube. Given all this syndication activity, I was interested to learn from Doug what percentage of the ads FreeWheel serves fall into each of these 3 buckets vs. what percentage are served on the customer's sites themselves. Doug said that FreeWheel is pulling those numbers together in a way that ensures its customers privacy and will get back to me when he has them.

In addition to the above syndication activity, FreeWheel is seeing experimentation with delivering ads to mobile devices, convergence/CE players and Internet-enabled TVs. In all these cases, customized ad policies determine who sells what ad inventory and how revenue is shared and reported. Powering all of this has been part of FreeWheel's core mission from inception, making it a key player in what I've called the 'syndicated video economy."

FreeWheel's growth echoes what I've been hearing lately from both video ad network executives and video content providers. They too are talking about rapidly rising volumes and improving monetization. As I wrote recently, I've been impressed lately by efforts to make video ads more engaging and provide a better ROI, a trend I see continuing. Taken together, while it's still relatively early days, online video advertising seems to be making great strides.

What do you think? Post a comment now (no sign-in required)

Categories: Advertising, Sports

Topics: FreeWheel, MLB, Turner, VEVO

-

Interview with Will Richmond on Beet.TV

For those of you who read my words each day, but haven't actually heard or seen me, Beet.TV has a short interview with me below. Daisy Whitney asked me a few questions about the future of online video at the recent NATPE conference in Las Vegas and I offered up 3 key trends to watch. Please, don't throw any virtual tomatoes at me!Categories: People

Topics: Will Richmond

-

4 Items Worth Noting for the Jan 25th Week (Netflix Q4, Nielsen ratings, AOL-StudioNow, Net Neutrality Webinar)

With the new Apple iPad receiving wall-to-wall coverage this week, it was easy to overlook other significant news. Here are 4 items worth noting for the January 25th week:

1. Netflix Q4 earnings increase my bullishness - On Wednesday, Netflix reported blowout results for Q4 '09, adding almost 3 million subscribers during the year (and a million just in Q4), bringing their YE '09 subscriber count to 12.3 million. Netflix also forecasted to end this year with between 15.5 million and 16.3 million subscribers, implying subscriber growth will be in the range of 26% to 33%. Importantly, Netflix also said that 48% of its subscribers used the company's streaming feature to watch a movie or TV show in Q4, up from 41% in Q3 and 28% a year ago. Wall Street reacted with glee, sending the stock up $12 yesterday to a new high of $63.04.

VideoNuze readers know I've been bullish on Netflix for some time now, and the Q4 results make me more so. A key concern I've had has been around their ability to gain further premium content for streaming. On the earnings call, CEO Reed Hastings and CFO Barry McCarthy addressed this issue, offering up additional details of their content strategy and how the recent Warner Bros. 28-day DVD window deal will work. On Monday I'm planning a deep dive post based on what I heard. As a preview, I'm now convinced that Netflix is the #1 cord-cutting threat. Cable, satellite and telco operators need to be watching Netflix very closely.

2. Nielsen announces combined TV/online ratings plan, but still falls short - This week brought news that Nielsen intends to unveil a "combined national television rating" in September that merges traditional Nielsen TV ratings with certain online viewing data. This is data that TV networks have been hungering for as online viewing has surged, potentially siphoning off TV audiences. I pointed out recently that the lack of such a measurement could seriously retard the growth of TV Everywhere, as cable networks hesitate to risk shifting TV audiences to unmeasurable online viewing.

Nielsen's move is welcome, but still doesn't go far enough. As reported, it seems the new merged ratings will only count online views that had the same ads and ad load as on-air. That immediately rules out Hulu, which of course carries far fewer ads than on-air, and sometimes uses custom creative as well. Obviously if the new Nielsen ratings don't truly capture online viewership they'll be worth little in the market. Ratings are a story with many future chapters to come.

3. AOL acquires StudioNow in bid for to ramp up video content - Also not to be overlooked this week was AOL's acquisition of StudioNow for $36.5 million in cash. StudioNow operates a distributed network of 3,000 video producers, creating cost-effective video for small and large companies alike. I'm very familiar with StudioNow, having spoken with their CEO and founder David Mason a number of times.

AOL is clearly looking to leverage the StudioNow network to generate a mountain of new video content, complementing its Seed.com "content farm." In addition, AOL picks up StudioNow's recently-launched Video Asset Management & Syndication Platform (AMS) which gives it video management capabilities as well. For AOL the deal suggests the company is finally waking up to video's vast potential. But with the rise of online video syndication, it's still a question mark whether creating a whole lot of new video is the right strategy, or whether AOL would have been better served by just partnering with a syndicator like 5Min.

Meanwhile, AOL isn't the only portal realizing video is the place to be. In Yahoo's earnings call this week, CEO Carol Bartz said "Frankly, our competition is television" and as Liz wrote, Bartz also said "that makes video really important." Yahoo just partnered with Ben Silverman's new Electus indie video shop, and it sounds like more action is coming. Geez, the prospect of AOL and Yahoo competing on acquisitions? It would be like the old days again.

4. Net Neutrality webinar next Thursday is going to be awesome - A reminder that next Thurs, Feb. 4th at 11am PT/2pm ET The Diffusion Group and VideoNuze will present a complimentary webinar "Demystifying Net Neutrality." The webinar is the first in a series of 6 throughout 2010, exclusively sponsored by ActiveVideo Networks. Colin Dixon from TDG and I will be hosting and we have 2 fabulous guests, who are on opposing sides of the net neutrality debate: Barbara Esbin, Senior Fellow and Director of the Center for Communications and Competition Policy at the Progress and Freedom Foundation and Chris Riley, Policy Counsel for Free Press.

Net neutrality is a critically important part of the landscape for over-the-top video services, and yet it is widely misunderstood. Join us for this one-hour session which promises to be educational and impactful.

Enjoy your weekend!

Categories: Aggregators, Broadband ISPs, Deals & Financings, Portals, Regulation, Webinars

Topics: AOL, Net Neutrality, Netflix, Nielsen, StudioNow, Webinar

-

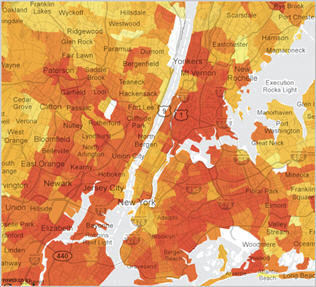

Top Rental Data from Netflix is More Evidence that Warner Bros. Deal is a Win

Following my 2 posts late last week (here and here) about how Netflix's new deal with Warner Bros is win for everyone, the NYTimes has posted a terrific interactive map showing the top rentals in 12 geographic areas of the U.S., sorted by zip code. The map is based on data that Netflix provided to the NYTimes. Playing around with the map, you'll quickly hunger for more details, but you'll also get a sense of the mountain of viewership data Netflix maintains on its 11 million+ subscribers. This data, when combined with the Netflix's algorithms for predicting its users' preferences, further demonstrates how valuable a deal like the one with WB could be for Netflix as it emphasizes streaming.

In the digital era, data is king because when used properly, it can dramatically improve the quality of the product delivered, in turn driving user satisfaction and profitability. Netflix has always used data very

effectively; examples include how it has chosen sites for its distribution centers so that most Americans are within 1 day's delivery, or how it has recommended other titles based on yours and others' preferences, or how much inventory of newly-released DVDs it decides to build. Now, as Netflix shifts its business from physical to digital delivery, it has another big opportunity to leverage the data it has collected from its users.

effectively; examples include how it has chosen sites for its distribution centers so that most Americans are within 1 day's delivery, or how it has recommended other titles based on yours and others' preferences, or how much inventory of newly-released DVDs it decides to build. Now, as Netflix shifts its business from physical to digital delivery, it has another big opportunity to leverage the data it has collected from its users. While a lot of attention was focused last week on the new 28-day "DVD window" which precludes Netflix from renting recently-released WB titles, I believe more attention should be paid instead to how effectively Netflix will be able to use its trove of data to selectively tap into WB's catalog of titles to boost its streaming selection. Using the data it has collected on physical rentals and search queries, for example, Netflix should be able to literally request title-by-title streaming rights from WB. That's not to say Netflix will necessarily receive access to those particular titles, but by being able to focus its requests, Netflix avoids wasting energy asking for things that are unlikely to have much appeal to its users.

It's interesting to talk to friends who are Netflix users, including those who don't work in technology-related industries. They have an amazingly high awareness and usage of Netflix's streaming and recognize that it represents the company's future. It's also obvious to them how meager the options are in Watch Instantly as compared with DVD and desperately want more choice. Netflix knows all this, as Netflix CEO Reed Hastings said last week, "our number one objective now is expanding the digital catalog." But Netflix is in a tight position to get new releases due to existing output deals that Hollywood studios maintain with HBO and other premium channels for electronic delivery. So, as with the WB deal, and others likely to follow, Netflix is trying to be clever about how it builds its streaming catalog by tapping into older, but still valuable titles.

It's unclear whether Netflix will conclude similar deals with other Hollywood studios. If it can't then the above-described benefits will be limited. In fact, as a couple of people pointed out to me last week, with Hollywood also highly dependent on cable, it's not readily apparent that helping Netflix build its streaming selection is actually in their interest as TV Everywhere services continue to roll out. WB is actually an interesting example; on the one hand, Time Warner's CEO Jeff Bewkes has been the strongest proponent of TV Everywhere, but on the other hand, WB's deal with Netflix creates more competition for it. In short, Hollywood will have its hands full trying to recast its distribution strategy in the digital era.

DVDs are not going away overnight, but the user data Netflix has will be an enormously valuable tool in helping transition its business to digital delivery and add more value to its subscribers. As long as Netflix complies with its users' privacy expectations, that gives it a big strategic advantage.

What do you think? Post a comment now.

Categories: Aggregators, Studios

Topics: Netflix, Warner Bros.

-

4 Items Worth Noting for the Jan 4th Week (Netflix-WB Continued, comScore Nov. '09 stats, TV Everywhere, 3D at CES)

Following are 4 items worth noting for the Jan 4th week:

1. TechCrunch disagrees with my Netflix-Warner Bros. deal analysis - In "Netflix Stabs Us In The Heart So Hollywood Can Drink Our Blood," (great title btw) MG Siegler at the influential blog TechCrunch excerpts part of my post from yesterday, and takes the consumer's point of view, decrying the new 28 day "DVD window" that Netflix has agreed to in its Warner Bros deal. Siegler's main objection is that "Hollywood thinks that with this new 28-day DVD window deal, the masses are going to rush out and buy DVDs in droves again." Instead, Siegler believes the deal hurts consumers and is going to touch off new, widespread piracy.

I think Siegler is wrong on both counts, and many of TechCrunch's readers commenting on the post do as well. First, nobody in Hollywood believes DVD sales are going to spike because of deals like this. However, they do believe that any little bit that can be done to preserve the appeal of DVD's initial sale window can only help DVD sales which are critical to Hollywood's economics. Everyone knows DVD is a dying business; the new window is intended to help it die more gracefully. And because new releases are not that critical to many Netflix users anyway, Netflix has in reality given up little, but presumably gotten a lot, with improved access for streaming and lower DVD purchase prices.

The argument about new, widespread piracy by Netflix users is specious. With or without the 28 day window, there will always be some people who don't respect copyright and think stealing is acceptable. But Netflix isn't running its business with pirates as their top priority. With 11 million subscribers and growing, Netflix is a mainstream-oriented business, and the vast majority of its users are not going to pirate movies - both because they don't know how to (and don't want to learn) and because they think it's wrong. Netflix knows this and is making a calculated long-term bet (correctly in my opinion) that enhancing its streaming catalog is priority #1.

2. comScore's November numbers show continued video growth - Not to be overlooked in all the CES-related news this week was comScore's report of November '09 online video usage, which set new records. Key highlights: total video viewed were almost 31 billion (double Jan '09's total of 14.8 billion), number of videos viewed/average viewer was 182 (up 80% from Jan '09's 101) and minutes watched/mo were approximately 740 (more than double Jan '09's total of 356).

Notably, with 12.2 billion views, YouTube's Nov '09 market share of 39.4% grew vs. its October share of 37.7%. As I've previously pointed out, YouTube has demonstrated amazingly consistent market dominance, with its share hovering around 40% since March '08. Hulu also notched another record month, with 924 million streams, putting it in 2nd place (albeit distantly) to YouTube. Still, Hulu had a blowout year, nearly quadrupling its viewership (up from Jan '09's 250 million views). But with 44 million visitors, Hulu's traffic was pretty close to March '09's 41.6 million. In '10 I'm looking to see what Hulu's going to do to break out of the 40-45 million users/mo band it was in for much of '09.

3. Consumer groups protest TV Everywhere, but their arguments ring hollow - I was intrigued by a joint letter that 4 consumer advocacy groups sent to the Justice Department on Monday, urging it to investigate "potentially unlawful conduct by MVPDs (Multichannel Video Programming Distributors) offering TV Everywhere services." The letter asserts that MVPDs may have colluded in violation of antitrust laws.

I'm not a lawyer and so I'm in no position to judge whether any actions alleged to have taken place by MVPDs violated any antitrust laws. Regardless though, the letter from these groups demonstrates that they are missing a fundamental benefit of TV Everywhere - to provide online access to cable TV programming that has not been available to date because there hasn't been an economical model for doing so. In the eyes of people who think that making money is evil, the TV Everywhere model of requiring consumers to first subscribe to a multichannel video service seems anti-consumer and anti-competitive. But to people trying to make a living creating quality TV programming, the preservation of a highly functional business model is essential.

These advocacy groups need to remember that consumers have a choice; if they don't value cable's programming enough to pay for it, then they can instead just watch free broadcast programs.

4. 3D is the rage at CES - I'll be doing a CES recap on Monday, but one of the key themes of the show has been 3D. There were two big announcements of new 3D channels, from ESPN and Discovery/Sony/IMAX. LG, Panasonic, Samsung and Sony announced new 3D TVs. And DirecTV announced that it would launch 3 new 3D channels by June 2010, with Panasonic as the presenting sponsor. 3D sets will be an expensive proposition for consumers for some time, but prices will of course come down over time.

Something that I wonder about is what impact will 3D have on online and mobile video? Will this spur innovation in computer monitors so that the 3D experience can be experienced online as well? And how about mobile - will we soon be slipping on 3D glasses while looking at our iPhones and Android phones? It may seem like a ridiculous idea, but it's not out of the realm of possibility.

Enjoy your weekend!

Categories: 3D, Aggregators, Broadcasters, Cable Networks, Cable TV Operators, FIlms, Studios

Topics: 3D, comScore, Netflix, TV Everywhere, Warner Bros.

-

4 Items Worth Noting for the Dec 14th Week (New pre-roll ad data, Paramount movie clips, Thwapr mobile, next week's preview)

Following are 4 items worth noting for the Dec 14th week:

1. New pre-roll data shows format's strength - Though many in the industry still scorn the pre-roll ad, this week 2 ad networks, ScanScout and YuMe, released data showing its continued prevalence as well as innovation that's improving its performance. ScanScout said its "Super Pre-roll" unit, which allows for integrating overlay graphics on the video that viewers can engage with, is driving 350% higher click-through rates compared with typical pre-rolls. In this example for Unilever's Vaseline, note how the creative nicely reinforces the messaging. The enhanced interactivity feels like the start of a new trend; another pre-roll that offers something similar is Innovid's iRoll unit. ScanScout separately announced this week a host of new premium publishers have joined its network.

Meanwhile YuMe released its Video Advertising Metrics Report for Jan-Nov '09, which showed that, at least within YuMe's network, 90%+ of all ads served were pre-rolls, with 30 second spots generating a 1.8% overall click-through rate, a 50% higher rate than the 1.2% that 15 second spots achieved. The volume of 30 second ads also grew 50% faster than 15 second volume in Q3 '09. Kids age 6-14 achieved a 3.7% click-through rate, the highest of any group, which YuMe's Jayant Kadambi told me could be explained by the more engaging nature of child-focused ads (e.g. click to play games, etc.). Jayant believes the sizable amount of existing creative for TV ads that can be easily repurposed for online is a key reason pre-rolls continue to dominate.

2. Paramount clipping site powered by Digitalsmiths is slick - I was impressed with a demo of Paramount Pictures' newly launched ParamountClips.com site that I got this week. The site is only open to Paramount's business partners, allowing them to either choose from an existing stock of clips from over 80 different Paramount movies, or to easily create their own. Desired clips are moved into a shopping cart and released for download, per previously determined licensing terms.

The site is powered by Digitalsmiths, which indexed all of the scenes from the movies using their proprietary recognition process, and then generated meta-data for each, which makes searching a snap. The new self-service site replaces the laborious previous process of a Paramount staffer working with each partner to extract jus the scene they want. As a result, a new highly-scalable licensing opportunity has been created. Paramount is taking advantage of Digitalsmiths VideoSense 2.5 release announced last week that is focused on clip generation, for both on demand and live streams, improved asset management and more integrated reporting.

3. Thwapr launches beta of mobile-to-mobile video sharing - Continuing the buildout of the mobile video ecosystem, Thwapr, a new mobile-to-mobile content sharing platform, launched its beta this week. Duncan Kennedy, Thwapr's COO told me that although there's been a proliferation of video capable smartphones, there's currently no easy, fool-proof way of sharing videos from one device to another (e.g. from an iPhone to a BlackBerry). Enter Thwapr, which lets the user upload videos to Thwapr and then have them shared with their contacts. Thwapr identifies the receiving phone's "user agent" so that it can dynamically decide the optimal format the video should be viewed in. The user simply clicks on a link and the video plays. I can attest that it worked beautifully on my BlackBerry Pearl.

Thwapr's raised about $3 million from angels and has a very strong team, including Duncan and others who worked on Apple's QuickTime. I'm a fan of how video, social/sharing and mobile intersect to create new opportunities, though there are business model unknowns. For now Thwapr is focused on a free ad-supported model, with a particular emphasis on geo-tagging videos to make advertising especially appealing for local merchants. Still, YouTube has illustrated how difficult it is to monetize user-generated content. Thwapr also envisions a business-grade option for real estate, travel, dating type applications which sound promising. I wonder too about whether a freemium model should be explored, though Duncan said Thwapr's analysis suggested this would be a relatively small opportunity. We'll see how things shape up.

4. Next week is 2009 wrap-up week on VideoNuze - Keep an eye on VideoNuze next week, as I'll be summarizing Q4 '09 venture capital investments and deals in the broadband/mobile video space, reviewing my 2009 predictions and looking ahead to what to expect in 2010. It's been an incredibly active year and based on the pre-CES briefings I've been doing, there's lots more to look forward to next year.

Enjoy your weekend!

Categories: Advertising, FIlms, Mobile Video, Predictions, Startups, Studios, Technology

Topics: Digitalsmiths, Paramount, ScanScout, Thwapr, YuMe

-

4 Items Worth Noting for the Dec 7th Week (boxee's box, AT&T's iPhone woes, Nielsen data, 3D is coming)

Following are 4 items worth noting for the Dec 7th week:

1. Boxee's new box with D-Link - It was hard to miss the news from boxee this week that it will be launching its first box, in partnership with D-Link, in early 2010. Boxee has gained a rabid early adopter following, but the high hurdle requirement of downloading and configuring its software onto a 3rd party device meant it was unlikely to gain mainstream appeal. Strategically, the new box is the right move for the company.

For other standalone box makers such as Roku, boxee's box, with its open source ability to easily offer lots of content, is a new challenge (though note, still no Hulu programming and little cable programming will be available on the boxee box). The indicated price point of $200 is on the high side, particularly as broadband-enabled Blu-ray players are already sub-$150 and falling. Roku has set a high standard for out-of-the-box usability whereas D-Link's media adaptors have never been considered ease-of-use standouts. Boxee's snazzy, but very unconventional sunken-cube design for the D-Link box is also risky. While eye-catching, it introduces complexity for users already challenged by how to squeeze another component onto their shelves. If boxee only succeeds in getting its current early adopters to buy the box it will have gained little. This one will be interesting to watch unfold.

2. AT&T tries to solve its iPhone data usage problem - In the "be careful what you ask for, you might just get it" category, AT&T Wireless head Ralph de la Vega revealed an interesting factoid this week at the UBS media conference: 3% of its smartphone (i.e. iPhone) users consume 40% of its network's capacity. Of course video and audio capabilities were one of the big ideas behind the iPhone, so AT&T should hardly be surprised by this result. AT&T, which has been hammered by Verizon (not to mention its users) over network quality, thinks the solution to its problem is giving heavy users unspecified "incentives" to reduce their activity. No word on what that means exactly.

Mobile video has become very hot this year, largely due to the iPhone's success. But the best smartphones in the world can't compensate for lack of network capacity. While AT&T is adding more 3G availability, it's questionable whether they'll ever catch up to user demand. That could mean the only way to manage this problem is to throttle demand through higher data usage pricing. That would be unfortunate and surely stunt the iPhone's video growth. Verizon, with its line of Android-powered phones, could be a key beneficiary.

3. Q3 '09 Nielsen data shows TV's supremacy remains, though early slippage found - Nielsen released its latest A2/M2 Three Screen Report this week, offering yet another reminder that despite online video's incredible growth, TV viewing still reigns supreme. Nielsen found that TV viewing accounted for 129 hours, 16 minutes in Q3. While that amount is more than 40 times greater than the 3 hours, 24 minutes spent on online video viewing, it is actually down a slight .4% from Q3 '08 of 129 hours 45 minutes.

How much weight should we give that drop of 29 minutes a month (which equates to just less than a minute/day)? Not a lot until we see a sustained trend over time. There are plenty of other video options causing competition for consumers' attention, but good old fashioned TV is going to dominate for a long time to come. This is one of the key motivators behind Comcast's acquisition of NBCU.

4. 3D poised for major visibility - In my Oct. 30th "4 Items" post I mentioned being impressed with a demo from 3D TV technology company HDLogix I saw while in Denver for the CTAM Summit. This Sunday the company will do a major public demonstration, broadcasting the Cowboys-Chargers in 3D on the Cowboys Stadium's 160 foot by 72 foot HDTV display. HDLogix touts its ImageIQ 3D as the most cost-effective method for generating 3D video, as it upconverts existing 2D streams in real-time, meaning no additional production costs are incurred.

Obviously those watching from home won't be able to see the 3D streaming, but it will surely be a sight to see the 80,000 attendees sporting their 3D glasses oohing and aahing. Between this and James Cameron's 3D "Avatar" releasing next week, 3D is poised for a lot of exposure.

Enjoy the weekend!

Categories: Devices, Mobile Video, Sports, Technology, Telcos

Topics: AT&T, Boxee, D-Link, HDLogix, iPhone, Nielsen, Roku

-

VideoNuze Report Podcast #43 - December 11, 2009

Daisy Whitney and I are pleased to present the 43rd edition of the VideoNuze Report podcast, for December 11, 2009.

This week Daisy kicks us off, discussing key trends to look for from early adopters online in 2010, based on her recent interview with Bill Tancer, the author of Click, and the head of research at Hitwise. The insights may surprise you. Daisy also discusses what sites are heating up and tools that are available to help you detect trends yourself.

Then I dig into further detail on my post from yesterday, "Lack of Viewership Data Could Stall TV Everywhere," in which I outline concerns cable TV networks have regarding Nielsen's current inability to measure online viewership of TV programs. Until this is fixed, many networks will be reluctant to provide their primetime programs to TV Everywhere providers as they won't receive ratings credit for programs viewed online. If online viewership were to cannibalize on-air viewing, networks' ratings-based advertising revenues would suffer. Listen in to learn more.

Click here to listen to the podcast (14 minutes, 25 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories:

Topics: Hitwise, Nielsen, Podcast