-

EveryZing Becomes RAMP, Focuses on "Content Optimization"

EveryZing is changing its name to RAMP, and positioning itself around "Content Optimization." Ordinarily a name change signals a change in strategic or product direction, but in this case, as CEO Tom Wilde explained to me last week, the re-naming is neither. The change to RAMP unifies the company name with its platform name (plus descriptive extensions), and completes the evolution of the company as a consumer destination originally named PodZinger.

I've been bullish on RAMP since my original post on the company in February '08, in which I detailed how RAMP married online video to the ubiquitous consumer search experience, addressing the chronic need for

improved video discoverability. RAMP did this by using core technology to extract metadata for any type of video, audio, text and image and then organizing related content onto search engine-friendly topic pages that grouped related content.

improved video discoverability. RAMP did this by using core technology to extract metadata for any type of video, audio, text and image and then organizing related content onto search engine-friendly topic pages that grouped related content. RAMP has continued to build out its platform since then, unveiling its "chromeless" MetaPlayer in Oct '08 that creates "virtual clips" so users can navigate to just the scene they're looking for, while content providers can maintain their existing business rules. Then earlier this year RAMP released "MediaCloud," which moved the metadata extraction process into the cloud, giving content providers the ability to manage the metadata themselves and deeply integrate it into their workflow and larger content publishing activities.

As metadata has become recognized as the currency underpinning content discovery and monetization, RAMP has added large customers, such as NBCU (also its lead investor), FOX, Meredith Publishing and others. RAMP's capabilities to handle all media types (video, audio, text and images) has become increasingly important as content providers realize that mixing and matching different assets is now required to provide audiences with the best experience. For the most advanced publishers, the days of siloing off video or audio are in the past.

In its new white paper, RAMP articulates well the fundamental shifts happening in the media business: the move away from "containers" (e.g. a magazine, album or newspaper) into content "objects" that users find, share and self-organize online; the trend toward syndication, where brand success is more about proliferating content everywhere on the web than attracting users to a specific destination site; the opportunity for content providers to enhance their monetization through dynamic contextual targeting rather than by simply selling eyeballs. Addressing these and other elements effectively is what RAMP calls content optimization.

Many of the themes RAMP espouses align with what I've been describing for a while now as the "Syndicated Video Economy." I only see these themes accelerating in importance as the supply of video escalates, devices proliferate and social media grows. With its flexible, SaaS platform that integrates well into other 3rd party content management and publishing platforms, I expect RAMP will continue to succeed as content providers become more sophisticated about how to operate online.

What do you think? Post a comment now.

Categories: Syndicated Video Economy, Technology

-

EveryZing Lands FOXNews.com and FOXBusiness.com for Universal Search

EveryZing, the search and publishing technology firm, is announcing this morning that it has been chosen by FOXNews.com and FOXBusiness.com to power universal search for both sites. The deal means that current and archived videos, podcasts, articles and images on each site will be indexed and presented online using EveryZing's SaaS-based Universal Search Solution. The two FOX implementations are great examples of how EveryZing can cohesively present various media formats to benefit both the user and content provider. Tom Wilde, EveryZing's CEO walked me through the FOX implementations last Friday.

The starting point for content providers working with EveryZing is to have their content indexed, transcribed and tagged by the EveryZing system. For the FOX sites that meant millions of content objects,

EveryZing's largest implementation to date. From the user's standpoint, the most compelling thing about EveryZing is the control and flexibility it allows to pull out of the index just the results desired and in the preferred media format.

EveryZing's largest implementation to date. From the user's standpoint, the most compelling thing about EveryZing is the control and flexibility it allows to pull out of the index just the results desired and in the preferred media format. For example, if you start a search with "Stimulus" you're presented with results ordered by relevancy. But if you select to filter by video, then you see just videos tied to the topic. Each video is presented with time stamps you can roll over to see the sentence in which the search term was used. Clicking on that time stamp takes you to that specific point in the video. Other time stamps are presented in the video clip as well, for easy jumping.

Conversely, if you're interested in a comprehensive package of all results tied to the keyword, EveryZing offers related "universal topic pages." So for "stimulus," the two related topic pages are "Stimulus Package" and "Economic Stimulus." Click on either and you'll see all results for these terms. A topic page is EveryZing's way of grouping all related assets onto one page, which enhances discoverability by search engines and engagement by users. On the "Stimulus Package" topic page, you can drill down by media type (e.g. video, story, blogs). You're also presented with a dynamically-upated list of related topics. For the two FOX sites, EveryZing has created 3,500 topic pages, along with 125,000 video landing pages. EveryZing also enables promotions of specific on-air shows that are related to the topic, a great tool for boosting visibility and audience.

With EveryZing's SaaS approach, the FOX sites are not hosting any EveryZing software. Instead, FOX has created the search results page templates, and when a user runs a search, the results are published by EveryZing into these templates and served (along with the videos themselves) by Akamai, which is FOX's CDN. EveryZing's model is to be paid a monthly fee on the basis of how much content it indexes and how many hits to the database are generated. All activity should result in another ad opportunity for the content provider, so as long as the content provider can sell its ad inventory, the model should be positive.

I've been bullish on EveryZing for sometime (see here and here) because it exposes content providers' burgeoning volume of video content to their users' well-established search behavior patterns. Importantly, by blending video with other media formats, EveryZing allows users to decide what format they want to engage with at that particular time. Because no two user experiences are ever the same and more and more content providers are utilizing different media formats, I see EveryZing's approach only increasing in value.

What do you think? Post a comment now.

Categories: Video Search

Topics: EveryZing, FOXBusiness.com, FOXNews.com

-

thePlatform Adds Partners to Its Framework Program

thePlatform is announcing this morning that another 20 companies have joined its "Framework" partner program originally rolled out in Feb. '08. There are now over 80 companies participating.

In its release, thePlatform notes that its "role is to make online video publishing a seamless process for our customers...." That's a commonly-shared goal among video platform companies, yet I continue to hear from

various content providers that stitching together the various pieces they require into a total solution can be difficult. That's why these kinds of programs, where partner products are pre-integrated, add a lot of value for customers.

various content providers that stitching together the various pieces they require into a total solution can be difficult. That's why these kinds of programs, where partner products are pre-integrated, add a lot of value for customers.Among the many companies thePlatform cites as new partners are quite a few I've written about previously on VideoNuze (click to see each write-up): Aspera, Azuki Systems, BrightRoll, EveryZing, Transpera, Visible Measures, YuMe and others.

(Note: thePlatform is a VideoNuze sponsor)

Categories: Partnerships, Technology

Topics: Aspera, Azuki Systems, BrightRoll, EveryZing, thePlatform, Transpera, Visible Measures, YuMe

-

Video Companies Raised $64M in Q2 '09, Notching Another Stellar Quarter

In Q2 '09, 9 broadband and mobile video-oriented companies raised at least $64M, notching another stellar quarter. Here's what I tracked for the quarter (if I missed anything, please drop me a note). I've identified when new investors participated:

- TubeMogul (3M) 4/1 - Trinity Ventures

- ScanScout ($5.1M) 4/13

- FreeWheel ($12M) 4/30 - Foundation Capital

- Azuki Systems ($6M) 5/5

- EveryZing ($8.25M) 5/11 - Peacock Equity

- Grab Networks ($12M) 6/2

- beeTV ($8M) 6/3 - Innogest

-

YuMe ($2.9M) 6/12

-

Nokeena Networks ($6.5M) 6/25 - Mayfield

(Note that I've included beeTV, which offers a cross-platform TV recommendation system, so isn't a pure broadband or mobile video company. On the other hand, one might argue that Sugar's $16M round should also be included, since the company simultaneously announced the acquisition of video-oriented Shopflick.com and launch of Sugar Digital Entertainment. However, I haven't counted it since Sugar's more of a pure blog network.)

Excluding Sugar, the $64M comes on the heels of approximately $75M raised in Q1 '09 and over $80M raised in Q4 '08. That means over the last 3 quarters - arguably the heart of the current recession - at least 26 companies have raised a total of $219M. To be sure, everyone I've spoken to has told me these rounds have been hard work to raise, but these companies' successes demonstrate the appeal of the broadband video sector to investors and their anticipation for continued rapid growth.

One thing worth noting is that of the 26 companies, not a single one is a video producer itself, or even an aggregator of video. There has been a significant shift in investor sentiment away from content and towards the platforms and tools required to power video. While that's lamentable, it's also completely understandable. The bruising advertising environment, combined with ongoing business model uncertainty and the death of certain independent producers (e.g. 60Frames, Ripe Digital, etc.) has frozen new content investments. Aggregators aren't faring much better. Just today it was reported that Joost CEO Mike Volpi is stepping aside, as the company tries to relaunch itself as a technology provider. Veoh also restructured during the quarter, shedding half its staff and replacing CEO Steve Mitgang (in addition, just yesterday a VideoNuze reader emailed me saying he can't seem to find a working phone number for the company).

Couple all this with the rise of Hulu, the dominance of YouTube, the entry of cable operators and networks with TV Everywhere, and it's clear that on the content side at least, incumbents and earlier market entrants are ascendant, while more recent entrants and startups are having a tough time surviving the downturn. I anticipate this will continue to be the trend, at least until the economy rebounds.

What do you think? Post a comment now.

Categories: Deals & Financings

Topics: Azuki, beeTV, EveryZing, FreeWheel, Grab Networks, Nokeena, ScanScout, TubeMogul, YuMe

-

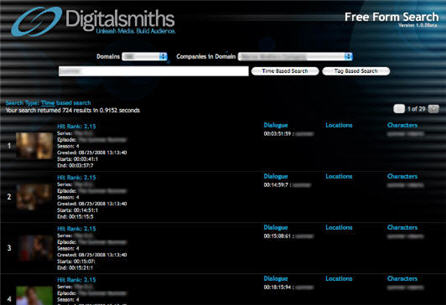

Digitalsmiths Launches VideoSense 2.0 Including New "Free Form" Video Search Capability

This morning Digitalsmiths, a leading video platform company, is launching VideoSense 2.0, a suite of content management, publishing, presentation and search products. In particular, the new release includes an innovative "free form" video search box that leverages Digitalsmiths' metadata creation capability. Last week I spoke to Ben Weinberger, Digitalsmiths' CEO to learn more.

A key Digitalsmiths' strength has always been its metadata tools, which use a broader, proprietary set of algorithms such as facial recognition, scene classification and object identification. With this release the metadata tags are being organized into what Digitalsmiths' calls a "MetaFrame" - a frame-by--frame analysis of the video file(s) that are all based on time stamps. A MetaFrame in turn enables more accurate video search, content organization and monetization both within a video and across a library of videos.

With respect to video search specifically, Ben explained that VideoSense's search technology matches the submitted term against a video library to return results based on criteria like names, locations, dialogue, objects within a scene or other criteria the content owner specifies. The content owner can also tweak the rules so that specific criteria receive higher weighting. Results are typically returned in half a second or less, providing a video search experience close to what we've come to expect in web search. There's also a "Did you mean?" prompt for more refined results. The free form search box can be integrated onto any web page via an API.

The below example shows the results of a search Ben ran in the demo against a customer's library (unfortunately blurriness is added here due to customer confidentiality).

Of course the more valuable the experience is, the more video is likely to be consumed, generating more streams and ad inventory. Ads too can gain better targeting through MetaFrame processing (and VideoSense is integrated with all the major video ad servers and networks). Deeper, richer search can also power B2B use of video clips, such as when a specific scene from one video is to be incorporated into another (think of a movie like "Forest Gump" that has myriad historical scenes interspersed).

From my perspective metadata is going to become more and more important as the sheer number of videos available explodes with both long-form and derivative short clips. Content owners' key challenge will be to manage these ever-larger libraries (Ben uses the notion of "metadata as the glue" holding libraries together; I think that's an apt description). Others like EveryZing, Grab Networks and Gotuit have also recognized the importance of metadata and have their own approaches. For Digitalsmiths, a differentiator is its focus on extremely large files and its focus on studio customers. It aims to function as a full-blown video platform provider for all forms of digital distribution.

Ben said Digitalsmiths has a slew of customers it will be unveiling in the coming weeks that are using MetaFrame and the VideoSense 2.0 suite.

What do you think? Post a comment now.

(Note Digitalsmiths is a VideoNuze sponsor)

Categories: Technology

Topics: Digitalsmiths, EveryZing, Gotuit, Grab Networks

-

EveryZing Raises $8.25M from Peacock, Lands NBCU as Biggest Customer

EveryZing, the search and publishing technology firm, is announcing this morning that it has raised a third round of $8.25M from GE/NBC's Peacock Equity Fund and existing investors, bringing its total funding to date to $22M. In conjunction with the funding NBC Universal will integrate EveryZing's four products into NBC's Media Works platform for deployment across all of NBCU's online properties. Tom Wilde, EveryZing's CEO confirmed it was a flat round and gave me some further details last Friday.

Tom believes that EveryZing is the only 3rd party technology provider that has been integrated across Media Works. This has two key benefits - first, it means EveryZing's products will be readily available to all

NBCU properties, thereby minimizing upfront work involved with each successive deployment. And second, the pre-negotiated pricing and standing purchase order means individual properties (and EveryZing) will avoid time-consuming negotiations each time around.

NBCU properties, thereby minimizing upfront work involved with each successive deployment. And second, the pre-negotiated pricing and standing purchase order means individual properties (and EveryZing) will avoid time-consuming negotiations each time around.I've been bullish on EveryZing in the past (here and here) as I think their focus on generating metadata for and indexing all content forms (video, audio, text and image) allows content providers to leverage consumers' huge adoption of search. With respect to video specifically, I've long thought that one of the key inhibitors of online viewership has simply been lack of robust discovery in traditional search environments (e.g. Google, Yahoo, etc.). EveryZing addresses this, essentially merging video's surging popularity with search's universal acceptance. One other key benefit this leads to is enhanced targetability of ads.

Tom's been an evangelist on these fronts, recently publishing "Is Your SEM Strategy Ready for Web 3.0," which makes very salient points about how content consumption is shifting from a traditional "container" paradigm to new "objects" paradigm. In the old model, content providers packaged their works into discreet units (e.g. newspapers, albums, etc.). More recently though the content itself has atomized into "objects", which consumers in turn package themselves (e.g. playlists, RSS feeds, etc.). Lacking their historical packaging heft, content providers must find new ways to associate objects, lest many be left undiscovered, and therefore unmonetized.

Tom explained how this notion is at play in the NBC deal. Obviously NBC has a sprawling content empire, which it wants to fully expose across all of its disparate audiences. But until now, even clearly related content hasn't always been shared with users. Worse, this means that interested ad dollars may not be able to find enough inventory to be allocated against, leaving money on the table.

With EveryZing, NBC's goal is to be able to describe and index all of its content, allowing it to drive improved discovery and monetization. In the non-linear video-on-demand world that defines the broadband video experience, my sense is that these capabilities will become more and more valuable.

What do you think? Post a comment now.

Categories: Deals & Financings, Technology

Topics: EveryZing, NBCU, Peacock Equity Fund

-

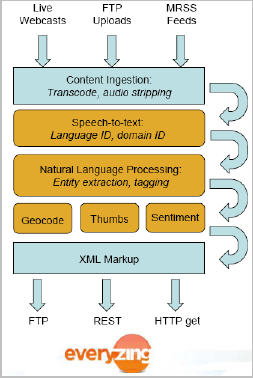

Metadata Creation Scales Up with EveryZing's New "MediaCloud"

Summary

What: EveryZing is introducing a new metadata creation service called MediaCloud, which can scalably generate metadata for large publishers' video, audo, images and text.

Benefits: High-volume, high-quality metadata creation; avoidance of expensive enterprise software; XML file integration with existing work flow/publishing systems; cohesive multimedia user experiences; more targetable ad inventory

For whom: publishers, ad networks, monitoring services, PR professionals

The process of affordably generating large quantities of high-quality metadata (the information that describes content itself) makes a big leap forward today with EveryZing's announcement of its new "MediaCloud" service.

EveryZing is one of my favorite technology companies focused on video because its products leverage search behavior to drive increased and more specific video views. Regardless of the category (news, sports, entertainment, business) one of the key ways to incent more online video consumption is by returning more accurate results to users when they're seeking something specific. It's not just the improved user experience that counts; it's also that with rich metadata, accompanying ad avails are more targetable, therefore resulting in higher CPMs and/or pay-per-action ads.

Last Friday, EveryZing's CEO Tom Wilde walked me through MediaCloud and how it fits into the company's portfolio. With MediaCloud, which is offered on a SaaS (software-as-a-service) basis, customers' video is

ingested either through live, FTP or MRSS feeds and is then processed through several steps of EveryZing's proprietary technology to generate the metadata. These steps (depicted at right) include conversion of speech-to-text, natural language processing to extract things like people, places and things, and finally generating thumbnails, geocodes and soon, sentiment. The result is an XML file that publishers and others then incorporate into their content work flow. The process occurs at a 1:1 level with the video itself and costs $.50 per minute of content. All of this happens in the cloud, which Tom believes is a first.

ingested either through live, FTP or MRSS feeds and is then processed through several steps of EveryZing's proprietary technology to generate the metadata. These steps (depicted at right) include conversion of speech-to-text, natural language processing to extract things like people, places and things, and finally generating thumbnails, geocodes and soon, sentiment. The result is an XML file that publishers and others then incorporate into their content work flow. The process occurs at a 1:1 level with the video itself and costs $.50 per minute of content. All of this happens in the cloud, which Tom believes is a first.MediaCloud essentially takes what's behind EveryZing's ezSearch and ezSEO products and offers it to customers directly. According to Tom, customers' appreciation for the value of metadata has grown considerably in the last couple of years, therefore making a service like MediaCloud both timely and appealing. Today MediaCloud is geared for more sophisticated publishers who are ready to "graduate" to managing the metadata creation process themselves, but my sense is that eventually this will become a fairly standard part of the work flow for all reasonably-sized video publishers.

There are many exciting uses of MediaCloud's metadata, but two resonate most strongly for me. First is how it enables more universal publishing and multimedia search results for content providers at scale. For example, when you consider how much video is being created by so many different providers (e.g. broadcasters, cable networks, newspapers, magazines, online publishers, brands, etc.), you begin to realize how critical it is that they be able to cohesively deliver all types of assets to users. A scalable way to produce high-quality metadata which pulls related content together and allows each user to consume in the format they prefer is becoming essential.

Second is how contextual ad targeting is enabled at a whole new level. VideoNuze readers know that one of my fixations has been untargeted and/or redundant video ads. Everyone agrees there's much improvement to be made to the video ad value chain. Allowing publishers to expose their videos' metadata to ad networks in particular would provide significantly improved targeting, resulting in better CPMs and making pay-per-action models much more viable.

Net, net, MediaCloud is another important advancement in helping publishers mesh video into their users' behavioral patterns, helping monetize it at a potentially far higher level. No doubt we'll see more SaaS-type video metadata services in the future, but for now MediaCloud is a leader.

What do you think? Post a comment.

Categories: Technology

Topics: EveryZing, MediaCloud

-

NFL.com's "Game Rewind" Feature is Pretty Cool

I got a tip yesterday about "Game Rewind," a feature that NFL.com has apparently launched in the last week or so. For a mere $20/season, you can now watch full, commercial-free replays of all the season's games. The video is delivered in terrific quality by Move Networks, and as seen below, also offers a side window that shows a synopsis of the game's scoring. I'm not a huge football fan, but since I missed the exciting end of last week's Patriots-Seahawks game, I simply dragged to the fourth quarter and sat back and enjoyed (btw, how nice is it to watch commercial-free?!).

One suggestion for the NFL team: introduce EveryZing's MetaPlayer, Gotuit VideoMarkerPro or Digitalsmiths (or someone else's metadata-based search technology) so that fans can quickly retrieve only the highlights they care about (especially for the fantasy crowd). If I just want to see Matt Cassel's touchdown passes, it would sure be nice to enter that phrase and be shown those specific highlights only. Still, Game Rewind is a very cool new feature, of course only possible courtesy of broadband delivery.

What do you think? Post a comment now.

Categories: Sports

Topics: Digitalsmiths, EveryZing, Gotuit, Move Networks, NFL

-

October '08 VideoNuze Recap - 3 Key Themes

Welcome to November. October was a particularly crazy month with the unfolding financial crisis. Here are 3 key themes.

1. Financial crisis hurts all industries; broadband is no exception

In October the financial crisis was omnipresent. During the month I addressed its probable effects on the broadband industry here and here so I'm not going to spend much more time on it today. Suffice to say, for the foreseeable future, the key industry metrics are financing, staffing and customer spending. Conserving cash and getting to breakeven are paramount for all.

In particular, in "Thinking in Terms of a 'GOTI' Objective" I tried to provide some food for thought about why focus is so important right now. Industry CEOs' jobs have gotten a whole lot harder in the wake of the meltdown; those with the best strategic and financial skills will come through the storm, others will encounter significant challenges.

2. Broadband video is still in very early stages of development

I'm constantly trying to gauge just how developed the broadband video industry actually is. All kinds of indicators continue to suggest to me that we're still in the very early days. For example, in one post this month comparing iTunes and Hulu, it was evident that iTunes is currently far outpacing Hulu in TV episode-related revenues. Remember that Hulu is the undisputed premium ad-supported aggregator. And that the ad-supported business model itself is predicted by most to eventually be far larger than the paid model. That iTunes is so far ahead for now shows how young Hulu really is (in fact, just celebrating its first anniversary) and how much more development the ad-supported model still has ahead of it.

I think another relevant indicator of progress is how well the broadband medium is distinguishing itself from alternatives by capitalizing on its key strengths. In "Broadband Video Needs to Become More Engaging," I noted that while there have recently been positive signs of progress, overall, much of broadband's engagement potential is still untapped. That's why I'm always encouraged by compelling UGV contests like the one Fox and Metacafe unveiled this month or by technology like EveryZing's new MetaPlayer that drives more granular interactivity. To truly succeed, broadband must become more than just an online video-on-demand medium.

3. Cable operators are central to broadband video's development

As ISPs, cable operators account for the lion's share of broadband Internet access. Further, their ongoing efforts to increase bandwidth widens the universe of addressable homes for high-quality content delivery. Still, their multichannel subscription-based business model is increasingly threatened by broadband's on-demand, a la carte nature. As delivery quality escalates and consumer spending remains pinched, the notion of dropping cable in favor of online-only access become more alluring.

Yet in "Cutting the Cord on Cable: For Most of Us It's Not Happening Any Time Soon," I explained why restricted access to popular cable network programs and an inability to easily view broadband video on the TV will keep cable operators in a healthy position for some time to come. Still, it's a confusing landscape; this month I noticed Time Warner Cable itself helped foster cable bypass, when in the midst of its retransmission standoff with LIN TV, it offered an instructive video for how to watch most broadcast network programming online. Comcast also got into the act, unveiling "Premiere Week" on its Fancast portal. These kinds of initiatives remind consumers there's a lot of good stuff available for free online; all you need is a broadband connection.

Lots more to come in November, stay tuned.

Categories: Broadband ISPs, Broadcasters, Cable Networks, Cable TV Operators, Technology, UGC

Topics: Comcast, EveryZing, FOX, Hulu, iTunes, LIN TV, MetaCafe, Time Warner Cable

-

EveryZing's New MetaPlayer Aims to Shake Up Market

EveryZing, a company I wrote about last February, is announcing the launch of its MetaPlayer today and that DallasCowboys.com is the first customer to implement it. My initial take is that MetaPlayer should have strong appeal in the market, and could well shake things up for other broadband technology companies and for content providers. Last week I spoke to EveryZing's CEO Tom Wilde to learn more about the product.

MetaPlayer is interesting for at least three reasons: (1) it drives EveryZing's video search and SEO capabilities inside the videos themselves, (2) it provides deeper engagement opportunities than typically found in other video player environments and (3) it enables content providers to dramatically expand their video catalogs, while maintaining branding and editorial integrity.

To date EveryZing's customers have used its speech-to-text engine to create metadata for their sites' videos, which are then grouped into SEO-friendly "topical pages" that users are directed to when entering terms into the sites' search box. Speech-to-text and other automated metadata generating techniques from companies like Digitalsmiths are becoming increasingly popular as content providers continue to recognize the value of robust metadata.

MetaPlayer takes metadata usage a step further by creating virtual clips based on specified terms, which are exposed to the user. A user's search produces an index of these virtual clips, which can be navigated through time-stamped cue points, transcript review, and thumbnail scenes (see below for example). The virtual clip approach is comparable in some ways to what Gotuit has been doing and is pretty powerful stuff, as it lets the user jump to desired points, thus avoiding wasted viewing time (e.g. just showing the moments when "Tony Romo" is spoken)

Next, MetaPlayer enables deeper engagement with available video. Yesterday, in "Broadband Video Needs to Become More Engaging," I talked about how the importance of engagement to both consumers and content providers. MetaPlayer is a move in this direction as it allows intuitive clipping, sharing and commenting of a specific video clip within MetaPlayer. Example: you can easily send friends just the clips of Romo's touchdown passes along with your comments on each.

Last, and possibly most interesting from a syndication perspective, MetaPlayer allows content providers to dramatically expand their video offerings through the use of what's known as "chromeless" video players. I was first introduced to the chromeless approach by Metacafe's Eyal Hertzog last summer. It basically allows the content provider to maintain elements of the underlying video player, such as its ability to enforce a video's business policies (ad tags, syndication rules, etc.), while allowing new features to be overlayed (customized look-and-feel, consistent player controls, etc.).

MetaPlayer takes advantage of chromeless APIs available now from companies like Brightcove, and also importantly YouTube. For example, the Cowboys could harvest select Cowboys-related YouTube videos and incorporate them into their site (this is similar to what Magnify.net also enables). With the chromeless approach, the Cowboys's user experience and their video player's branding is maintained while YouTube's rules, such as no pre-roll ads are also enforced.

To the extent that chromeless APIs become more widely available, it means that syndication can really flourish. The underlying content provider's model is protected while simultaneously enabling widespread distribution. All of this obviously leads to more monetization opportunities through highly targeted ads.

Bottom line: EveryZing's new MetaPlayer addresses at least three real hot buttons of the broadband video landscape: improved navigation, enhanced engagement and expanding content selection/monetization. All of this should give MetaPlayer strong appeal in the market.

What do you think? Post a comment now!

Categories: Advertising, Sports, Syndicated Video Economy, Technology, Video Search, Video Sharing

Topics: Brightcove, Dallas Cowboys, Digitalsmiths, EveryZing, Gotuit, Magnify.net, MetaCafe, YouTube

-

Non-Linear Presentation + Long-form Premium Video = Big Opportunity

I continue to be surprised that more long-form premium content providers have not pursued initiatives to slice and dice their programs into a non-linear user presentation. This is what "The Daily Show" has done at its site, deconstructing every episode into searchable clips. I think it's a big opportunity to drive more fan engagement, new ad inventory and provide insight about new programming ideas.

While this idea is a natural for archived sports and news programming, I think the model applies to scripted programs as well. Here's an example:

As I've written before, my wife and I were huge fans of "The West Wing" during its seven-year run on NBC.

While we now own the full DVD collection, periodically I'll talk to someone about the show and reminisce about a specific moment from years back. (In fact, TWW seems cosmically related to the current election cycle, given the show's last narrative around 2 candidates - one younger and one older - battling to succeed Bartlet.) This spurs many of those, "boy, I'd love to see that scene right now!" moments.

While we now own the full DVD collection, periodically I'll talk to someone about the show and reminisce about a specific moment from years back. (In fact, TWW seems cosmically related to the current election cycle, given the show's last narrative around 2 candidates - one younger and one older - battling to succeed Bartlet.) This spurs many of those, "boy, I'd love to see that scene right now!" moments.So wouldn't it be awesome if NBC or Warner Bros. (its producer), or whoever has the rights, were to create a site where all the episodes were archived and fully indexed for searching? This would go far beyond the show's current lame-o web site. I could type in "Bartlet speeches," "Josh meltdowns" or even "C.J.-Danny fights" and instantly see collections of relevant clips.

Before you accuse me of being geeky, stop and consider that we all have our favorite programs and love to relive memorable lines and moments. I'd argue that a really vibrant community could be built at these sites, attracting traditional advertisers eager to continue their audience relationships. Then of course there's the opportunity to embed clips into Facebook and MySpace pages, extending the community further. And think about what this ongoing loyalty would do to drive up the value of broadcast syndication rights.

The big challenge here is indexing the archive. The process must rely heavily on accurate metadata generation, but in a highly scalable, cost-effective manner. That's a mouthful of requirements, so clearly this isn't easy stuff. Various players are trying to crack this nut; two which I've previously written about are Gotuit (which is announcing a partnership with Move Networks today) and EveryZing, but there are others too. Recently I've had briefings with 2 companies that are investing in this area and will have news in the coming months.

Long-from premium providers are facing an onslaught of competition from short-form alternatives while also commonly experiencing a shortage of available inventory. Non-linear presentations of their content addresses both these issues, while delighting loyal fans. I see this as an emerging and sizable opportunity.

Am I missing something here? Post a comment now!

Categories: Advertising, Broadcasters, Technology

Topics: Daily Show, EveryZing, Gotuit, Move Networks, NBC, Warner Bros., West Wing

-

Overview of New Brightcove 3 Beta Release

Today Brightcove is announcing the beta version of its Brightcove 3 platform. Last week CEO/Founder

Jeremy Allaire briefed me on what he called a "pretty dramatic new version of the platform." There are three new areas:

Jeremy Allaire briefed me on what he called a "pretty dramatic new version of the platform." There are three new areas:1. Contextualization - Brightcove is changing how its customers display their video from the current standalone video player/index environment to one where the player window is embedded within in an HTML page with surrounding contextual content and ads. In tests it has done, Brightcove has found that, no surprise, integrating the video window results in more video and page views. Also by surfacing video in context, it enhances search engine optimization. This is similar to EveryZing's SEO-focused approach. (see my profile). Brightcove has new APIs that work with existing content management systems to match relevant non-video content.

2. Dynamic delivery - Brightcove is upping its emphasis on high-quality long-form content by introducing a dynamic delivery feature that modulates the quality of the video delivered based on detection of the user's bandwidth. This adaptive bit rate streaming idea was pioneered by Move Networks and allows on-the-fly video file delivery adjustments. Brightcove is doing this on top of Flash with no new plug-in required by users. It will also automatically generate various encoded files for customers.

3. Producer tools overhaul - Brightcove is updating the back-end work flow tools that its customers' producers use, so they can more quickly do things like upload large video files, create tags, generate business rules, transcode files and so forth. Jeremy demo'd it for me; it's a complete drag and drop environment that looked pretty straightforward.

All-in-all these look like positive steps. Since Brightcove had invested heavily in its earlier versions, I give them credit for emphasizing continuous improvement and not sitting still. Brightcove 3 is in beta (Showtime is one site that's already using it) with wider deployment in the fall. Jeremy added that other updates are expected then too. I pried out of him that these will include monetization and distribution/syndication among others.

Categories: Technology

Topics: Brightcove, EveryZing, Move Networks, Showtime

-

Pixsy Zeroes in on White-Label Video and Image Search

As the proliferation of broadband video continues apace, the task of finding what you're looking for is only intensifying. That's set off a scramble by many to solve this problem, trying to become in effect, the "Google of video search."

I've previously written about players such as blinkx, Truveo, ClipBlast, Veveo and EveryZing. The latest video search company to hit my radar is Pixsy, which has its own distinctive approach for capturing its share of the growing video search market. I recently spoke with Chase Norlin, Pixsy's CEO to learn more.

Pixsy has three key differentiators:

First, it's purely focused on the B2B white-label opportunity, eschewing the destination site route. Pixsy only wants to power other sites' search capabilities as a white-label provider.

Second, in addition to video search, Pixsy also does image search, which Chase believes is actually the fastest growing part of the search market. Being able to offer image search broadens Pixsy's value proposition to partners, driving enhanced monetization opportunities.

Third, Pixsy doesn't seek to have the broadest index, rather it seeks to balance the breadth of its index with having the most current results. It uses RSS feeds, not web crawlers, to build its index and focuses mainly on current events categories like news, sports and entertainment. Clearly having the most up-to-date results in these kinds of categories is a real plus.

Pixsy's approach seems to be paying off, as it is now powering video and/or image search at sites including

Veoh, Lycos, PureVideo, National Lampoon and others. This morning it's also announcing a deal with MMORPRG.com, the web's largest massive multiplayer online role playing site.

Veoh, Lycos, PureVideo, National Lampoon and others. This morning it's also announcing a deal with MMORPRG.com, the web's largest massive multiplayer online role playing site. Pixsy works with a number of business models. Sites generating anything under 10K search queries per month can freely use Pixsy's API. Above that volume, Pixsy licenses its index with about a third of partners selling their own ads, and the other two-thirds relying on Pixsy to sell the ads alongside the search results. As Google and others have shown, search results are extremely monetizable.

Based in Seattle and San Francisco, much of Pixsy's team comes from Microsoft and ValueClick. Considering it has been around for about 2 years, has only 15 employees and has raised just an angel round, Pixsy seems to show that the barriers to entry for savvy video search startups can be relatively low. With so many other video search players, I anticipate the category is going to remain fragmented and chaotic for some time to come.

Categories: Video Search

Topics: Blinkx, ClipBlast, EveryZing, Pixsy, Truveo, Veveo

-

Key Themes from My 2 Panel Discussions Last Week

Last week I moderated 2 panel discussions, one for Streaming Media East in New York, and the other for MITX, the Massachusetts Innovation and Technology Exchange, in Boston. In the former, "Reinventing the Ad Model Through Discovery and Targeting" and the latter, "Driving Audiences to Your Online Video Content: Strategies for Success in a Crowded Market" panelists discussed many of the key themes I continue observing in the broadband video market.

Early adopters are heaviest broadband usersDespite research that continues to show broadening adoption of broadband video usage (11.5 billion videos viewed in March, according to comScore), at SME, Nielsen's Jon Gibs confirmed that the vast majority of the market is still very casual users, with only 5-8% of overall users showing more habitual and long-form viewing. For many today, the viewing experience is still limited to watching a YouTube clip emailed to them or found in a friend's MySpace or Facebook page. Plus user attention spans remain short. At MITX, Visible Measures' Brian Shin showed how viewership drops off a cliff following the climactic moment of a hilarious user-generated clip. Broadband is driving significant behavioral change for a segment of the market, but transitioning to a heavily-used mainstream medium will take years.Video proliferatesNonetheless, the number and range of video producers continues to expand, as all kinds of organizations recognize that video is a totally new opportunity to connect with their audiences, whoever that may be. At the MITX event, panelists showed examples from politicians, cultural organizations, small businesses, schools, brands and users themselves. I've said for a while that we're entering a "golden age" of video, with a massive proliferation of the quantity and range of sources. The market is already well into this phase.Discovery is a huge problemWith this massive proliferation comes the huge problem of how users will actually find what they're looking for. At SME, Mike Henry from Veoh discussed promising results of Veoh's proprietary behavioral recommendation engine. At MITX, Tom Wilde from EveryZing showed how it can surface video for search engine discovery by using its speech-to-text engine; while Murali Aravamudan from Veveo explained how its algrorithms can quickly distinguish the video users are truly searching for. All of these approaches improve the users' experience. Yet what's equally clear is that, having never experienced the explosion of video choices we're now witnessing, it's impossible to know what will ultimately end up working. Discovery is an ongoing problem to be solved.Ad market still immatureLast but not least, for the many fledgling and established video providers relying on advertising, the good news is that there's a lot of buyer interest, but the bad news is that it's still a very immature market. At SME we discussed how many media buyers look at broadband video through their traditional TV lenses, leading to a focus on TV's "Gross Rating Points" or GRPs model. But this undervalues the real engagement opportunities that broadband enables. At MITX, Bob Lentz of PermissionTV discussed how broadband is changing the role of ad agencies, traditional stewards of the creative process, allowing them to now do much more. Advertising is the primary business model for content providers, yet the shift of dollars the medium is anything but straightforward.These were four of the key themes from these two sessions. There was plenty more information exchanged, if you're interested, drop me a line and I'll be happy to discuss.

Categories: Advertising, Events

Topics: EveryZing, MITX, Nielsen, PermissionTV, Streaming Media East, Veoh, Veveo, Visible Measures

-

Join Me in Boston for a Great Panel Discussion on May 22nd

If you're in the Boston area next Thursday, May 22nd, please join me for a great panel I'll be moderating,

"Driving Audiences to Your Online Video Content: Strategies for Success in a Crowded Market." The session is being presented by MITX, the Massachusetts Innovation & Technology Exchange and includes a terrific group of panelists from Boston-area video companies:

"Driving Audiences to Your Online Video Content: Strategies for Success in a Crowded Market." The session is being presented by MITX, the Massachusetts Innovation & Technology Exchange and includes a terrific group of panelists from Boston-area video companies:- Murali Aravamudan, CEO/Founder, Veveo

- Michael Kolowich, CEO/Founder, DigiNovations

- Bob Lentz, CEO, PermissionTV

- Brian Shin, CEO/Founder, Visible Measures

- Tom Wilde, CEO, EveryZing

Session details are here. Hope you can make it!

Categories: Events

Topics: DigiNovations, EveryZing, MITX, PermissionTV, Veveo, Visible Measures

-

blinkx's New Advanced Media Platform for On-Site Video Search, Discovery, Monetization

blinkx, which has been steadily expanding its portfolio beyond its core video search product, this week announced Advanced Media Platform or "AMP" (not to be confused with Adobe Media Player/AMP or Yahoo's Advertising Management Platform/AMP). I spoke with Suranga Chandratillake, blinkx's founder/CEO last week to learn more.

blinkx is addressing a problem that I hear about often - how can content providers which have increasingly large volumes of video on their sites make it more discoverable, helping drive usage and therefore ad

revenues. Just this week on a panel at Digital Hollywood, Andy Forssell, Hulu's SVP, Content and Distribution, highlighted this problem, saying "we believe great content is significantly underwatched."

revenues. Just this week on a panel at Digital Hollywood, Andy Forssell, Hulu's SVP, Content and Distribution, highlighted this problem, saying "we believe great content is significantly underwatched."With AMP, blinkx has packaged up various offerings previously available web-wide into an enterprise product. These include its core video search/indexing technology, plus an SEO module and AdHoc, its contextual advertising platform for targeted monetization. blinkx is positioning AMP as a comprehensive approach that content providers can implement quickly on their sites. AMP is available in both licensing and ASP models. In the ASP model, AMP is available for a fee, or through ad revenue sharing. Suranga believes the ad sharing approach will likely end up being most popular.

blinkx announced 3 new AMP customers, Conde Nast's Portfolio.com, WallSt.net and Kiplinger.com. blinkx's AMP reminds me most of EveryZing, which I wrote about here. EveryZing's ezSearch and ezSEO take a similar approach to wringing value out of video assets. Pixsy is another company offering white label video search. Earlier this week it announced National Lampoon's network of sites as a new customer.

As content providers shift their focus from just getting their video online to actually monetizing and earning an ROI on it, discovery becomes critical. Therefore, I expect lots more activity in this space yet to come.

Categories: Video Search

Topics: Blinkx, EveryZing, Pixsy

-

News from NAB

The press releases began flying today, timed with NAB's kickoff. Here are a few that caught my eye:

Move Networks Raises $46 Million

Move continues its fund-raising prowess, raising a large C round. As more content providers push the HD quality bar, Move's content delivery services have increased appeal.

Signiant Powers Hulu's Distribution Efforts

Hulu, the NBC-Fox aggregator is using Signiant's media management platform to ingest content from the various content partners it works with.

Widevine Provides Content Security for Microsoft's Silverlight

For the first time Microsoft has used a third-party content security system to add a layer of protection for content providers using the company's new rich media plug-in.

EveryZing Introduced "RAMP," Signs Up Cox Radio

Building on its recent launch of EZSearch and EZSEO to enable video discovery, EveryZing has introduced a management console for the products for which Cox Radio will be the first customer.

Live Streaming Quality Bar Raised Via Mogulus-Kulabyte Partnership

Live streaming gains further traction as Mogulus and Kulabyte announce deal to bring high-quality live Flash streaming to producers.

No doubt there will be plenty more over the next couple of days.

Categories: Aggregators, Broadcasters, CDNs, HD, Mobile Video, Technology

Topics: EveryZing, Hulu, Kulabyte, Microsoft, Mogulus, Move Networks, Signiant, Silverlight, Widevine

-

Three Broadband Video Themes from February `08

At the end of each month I plan to step back and recap a few key themes from recent VideoNuze posts. Here are three from February '08:

Brand marketers embrace broadband video

One clear theme from the past 4 weeks has been brand marketers' accelerating moves into the broadband video space. This was on full display by select Super Bowl and Oscar advertisers. We are witnessing an unprecedented commitment by brands to create their own entertainment/information video content and also to induce consumers to create brand-related video through user-generated contests. As I detailed in yesterday's webinar, examples in the former category include Kraft/Tassimo, J&J, CIT Financial and GoDaddy.com, while examples in the latter category include TideToGo/MyTalkingStain.com, Heinz/Top This, Dove Cream Oil Body Wash and T-Mobile/Current TV.

Through VideoNuze I track all brands' broadband video initiatives, and it is clear that their involvement in this new medium is intensifying. Faced with splintering audiences, ad-skipping DVRs and changing media consumption habits - particularly by younger demos - brands have no choice but to get into broadband video. This results in an entirely different awareness/engagement paradigm than we're accustomed to from the world of interruptive TV advertising. Brands today increasingly recognize that a key way to create loyalty (and generate sales!) is by engaging the audience on its terms, using broadband and other technologies to accomplish this.

Monetization is the #1 challenge

Another key theme of the past month was the ongoing quest for broadband video monetization. As I also mentioned in yesterday's webinar, this is the number 1 business challenge for all broadband video industry participants - both content and technology providers. Two companies I wrote about this month, EveryZing and Veveo, are focused on improving content discovery, which leads to more consumption and revenue-generating opportunities. I also wrote about Jake Sasseville, a young entertainer who is pioneering multi-platform initiatives to forge a new revenue model.

Innovation is key in this space. Next week I'll be writing about Freewheel, an innovative startup that's just surfaced, which is providing a new approach to managing broadband video advertising. And yesterday, Magnify.net, one of my favorite early-stage companies, which focuses on enabling video content distribution, announced that it has raised an additional $1 of financing.

In addition, the big dogs of the technology and media landscape are in hot pursuit of improved video monetization as well. This month alone brought news of Yahoo's acquisition of Maven Networks, an ad-centric video platform, Google's beta rollout of AdSense for video, and the hostile bid by Microsoft for Yahoo, a deal that has vast longer-term implications for online and broadband video advertising. In short, monetization is a key focus for all large and small industry participants - cracking this nut is crucial to the long-term health of the industry.

Net neutrality re-surfaces

Lastly, this month also brought a lot of news on the regulatory front. Twice I wrote about "net neutrality," a regulatory concept its proponents believe will keep the Internet free from discrimination by broadband ISPs. While I don't agree with their viewpoint, what is clearly true is that net neutrality is being spurred by the massive adoption of broadband video, which places an unprecedented load on broadband ISPs' networks.

So that's it for this leap year month. Three themes you'll be hearing much more about going forward: brand marketers' broadband video initiatives, video monetization and net neutrality. See you on Monday for the start of a new month!

Categories: Advertising, Brand Marketing, Broadband ISPs, Regulation

Topics: EveryZing, FreeWheel, Google, Magnify.net, Maven Networks, Microsoft, Net Neutrality, Veveo, Yahoo

-

EveryZing: Video Search Meets SEO

As some of you may suspect by now, I've become a little obsessed with understanding the nascent video search space. It's a source of continued fascination for me that there are so many smart people with so many different technology and business strategies pursuing this area. Google's success in web search is surely influencing the massive interest in reaching for the brass ring of video search.

The latest to hit my screen is EveryZing, which is announcing today two new products, ezSEO (Search Engine Optimization) and ezSearch. These two products combine to increase exposure/discoverability of broadband video content (plus, text, audio and images) and drive more monetization opportunities. New customers announced today include boston.com, Dow Jones, Reuters and Entercom. I caught up with CEO Tom Wilde yesterday to learn more.

EveryZing isn't a consumer destination site a la Truveo or blinkx. Instead, it's a pure white-label technology ASP for content providers. It uses proprietary speech-to-text technology to create meaningful text-based descriptions of video and other assets. As Tom says, because "text is the navigation currency of the web" it is essential that video assets be characterized this way for them to be fully discoverable. EveryZing takes a holistic view of search, allowing its content providers to also use its technology for HTML documents and other assets if they choose to. Either way, EveryZing enables universal search across media types. All of this is the role of role of ezSearch.

But EveryZing realizes that just making video more discoverable within web sites doesn't drive a lot of new revenue for content companies. Instead these videos (and other assets) must be packaged and presented in an SEO-friendly way to drive maximum traffic from the search economy (aka Google). More traffic means more ad inventory to monetize. In short, ezSEO addresses the most vexing issue facing all video providers - how to actually make money in broadband video? EveryZing achieves SEO by pouring the results of ezSearch into its publishing system, which in turn creates search-friendly multimedia topic pages that are SEO-friendly. See example below:

EveryZing's focus on creating these search-friendly topic pages reflects a tried and true tactic in SEO. For example, just last week at the FAST Forward '08 conference, the NYTimes.com shared how it does exactly the same thing for 16,000+ topics. (For example, type "Global Warming" into Google and the 8th result will be the NYTimes.com topic page). The pursuit of these kinds of SEO techniques has spawned an entire cottage industry for helping web publishers get their content noticed and monetized.

EveryZing is taking a page from this playbook and applying it to broadband video. It seems like a very sound and logical approach, which is showing a lot of early promise. Tom shared statistics for boston.com. Since it implemented EveryZing's technology last fall, the number of page views for its SEO-friendly pages has increased 37-fold, and the number of videos streamed from these pages 172-fold. Of course all those new video streams yield monetizable ad inventory, but it's important to remember that the SEO pages themselves also yield lots of valuable, context-rich ad inventory for display ads.

When you combine the huge enthusiasm around SEO and video, an obvious question is "why hasn't anyone done this already?" Tom's answer is instructive for all entrepreneurs, and goes to the heart of what increases the odds of success for early-stage companies: it takes a very unique combination of distinctive technology, executives' deep domain expertise, proper market timing, specific strategy/focus and respect for customers' finite resources. I completely agree with his assessment, particularly the importance of executives' domain expertise which I've observed really helps in unearthing subtle market opportunities. EveryZing seems to have all of the above which makes it a company well-worth watching. It has 40 employees and has raised $13.5M to date.

Categories: Startups, Video Search

Topics: EveryZing

-

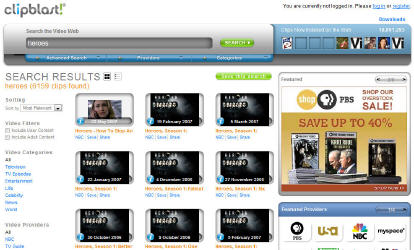

ClipBlast 3.0 Beta Released; Further Video Search Improvements

Next week ClipBlast, a player in video search space, will announce that is has launched a beta of its 3.0 product. It's actually now live and I've had a chance to play around with it for the last couple of days. I also got a briefing and demo when I met up with Gary Baker, ClipBlast's CEO, at Digital Hollywood a few weeks ago.

Video search has been a murky, yet fast-evolving area. You have to get way down into the weeds to fully understand the nuances, but here is the gist. First, video isn't nearly as searchable as text is. Video search primarily relies on metadata, which describes what's inside the video itself. This metadata can be created by the content provider or by the video search engine itself using techniques like speech-to-text processing. A key challenge for video search engines has been returning results in which the context matches what the user was intending. This is no easy feat, as the same word can obviously be used in many different contexts, yielding lots of useless results.

ClipBlast's 3.0 beta is crawling 10,000 different video providers now and they've continued to make many enhancements to their metadata processing. They've also done a lot of work to improve user navigation so that browsing is a viable complement to search. (This gets to how users actually interact with video search engines, which is yet another issue in the video search world). ClipBlast now places all videos into 70 different categories, which have easy scrolling thumbnails, showcases featured clips and featured partners and today's most popular searches.

ClipBlast has also introduced more personalization features such as saving providers, categories, searches and results. You can also configure your own personal home page and set email alerts for when new video matching your search criteria. Perhaps most fun is a new widget feature, allowing ClipBlast widgets to be embedded on your desktop and blog with customized video. Gary demo'd this for me and it's quite cool. It's only available for Macs right now with a PC release coming soon.

I'm planning a deeper dive into video search in December and will have more detailed analysis on the category then. In the mean time I suggest the best way to get into it and evaluate which video search engine is best for you is to run the same search across some of the more popular video search engines. A good list would include: Truveo (now owned by AOL), Google (still officially in "beta"), blinkx, SearchForVideo, EveryZing, Dabble, Pixsy, Fooooo and others I'm sure I'm missing.

I'm interested in what you find, so please post a comment or email me.

Categories: Video Search

Topics: AOL, Blinkx, Dabble, EveryZing, Fooooo, Google, Pixsy, SearchForVideo, Truveo

Posts for 'EveryZing'

|