-

A Netflix Distribution Deal With Cablevision Now Seems Virtually Guaranteed

Today Cablevision announced a first of its kind distribution deal with Hulu. The deal follows the introduction of Cablevision's new low-cost "cord-cutter" package (broadband plus a free OTA antenna) last week and its agreement to promote the new HBO Now OTT service. Given all of this I think it is now virtually guaranteed that Cablevision will soon announce that it will also distribute/promote Netflix.

Categories: Aggregators, Broadband ISPs, Cable TV Operators

Topics: Cablevision, Hulu, Netflix

-

VideoNuze Podcast #169 - More on Cablevision vs. Viacom; FOX NOW Syndicates Second Screen Content

I'm pleased to present the 169th edition of the VideoNuze podcast with my weekly partner Colin Dixon of nScreenMedia. First up today, we review the latest video industry litigation, Cablevision vs. Viacom. We mostly agree that major industry change is unlikely to occur due to the litigation, but rather, over time, the expense of pay-TV and appeal of OTT alternatives will drive changes in consumer choices, which in turn is what will change the pay-TV industry's dynamics.

Speaking of changing dynamics, it's no secret that live TV viewing is under huge pressure as viewers turn to on-demand choices and DVR usage. To help reverse things, Colin discusses an interesting new initiative announced this week by Fox and Watchwith. Fox will be syndicating its FOX NOW "sync-to-broadcast" second screen companion content via Watchwith to numerous network partners such as Shazam, Viggle, ConnecTV and NextGuide, helping drive higher usage and monetization. As Colin wrote earlier this week, it's a clever way of proliferating FOX NOW content and improving the live experience.

Listen in to learn more!

Click here to listen to the podcast (19 minutes, 21 seconds)

Click here for previous podcasts

The VideoNuze podcast is available in iTunes...subscribe today!Categories: Broadcasters, Cable Networks, Cable TV Operators, Devices, Podcasts

Topics: Cablevision, FOX, Viacom, Watchwith

-

Cablevision vs. Viacom: Is Cable's Internecine Battle Finally On?

Yesterday, Cablevision announced that it has filed suit against Viacom, seeking, among other things, to void a carriage deal it struck just 2 months ago. Cablevision is alleging that Viacom illegally coerced it into carrying 14 of its low-rated cable networks in order to get access to the 8 popular ones Cablevision really wanted.

The most obvious first question to ponder is why would Cablevision agree to a deal in December, only to sue to nullify it in February? Surely the presiding judge will ask something similar. If Cablevision was so perturbed by Viacom's negotiating position, why not bite the bullet and sue then? Another interesting question is that given bundling has been upheld by the courts in the past, what's different this time around?Categories: Cable Networks, Cable TV Operators

Topics: Cablevision, Viacom

-

Guess What? This Cord Cutter Family Story Has a Happy Ending for The Cable Company

Today VideoNuze features a guest post from Ephraim Cohen, founder and managing partner of The Fortex Group, a public relations firm with many clients in the online video and social media industries. Ephraim has also become a good friend through his firm's work on past VideoSchmooze events and the upcoming ELEVATE conference.

As a VideoNuze reader, Ephraim was inspired to think about and share his own family's experience and changing behaviors with video. As you read it, you'll no doubt get the sense that this is still an early adopter's behavior pattern, with some technical knowledge required to make everything work. However, to me, a key takeaway is that for entertainment-only consumers, expanding choice will inevitably cause them to consider their video options and seek better experiences. Even more important, as Ephraim explains, this can actually be a surprisingly good thing for cable operators which ready to adapt to these new realities. Read on to learn more.

Guess What? This Cord Cutter Family Story Has a Happy Ending for The Cable Company

by Ephraim Cohen

Sure, my home is a virtual consumer electronics lab - all the major game consoles on one main TV, two Rokus, Android and iOS devices and other gadgets. But other than me, we are, tech-wise, a normal family with three youngsters. So cutting the cord had to work for everyone, not just me.

And everyone is happy, mainly due to a well-designed system by our main OTT platforms, Roku and the Playstation 3, and viewing habits built around video-on-demand. Even our three year-old knows how to find her show using the Roku remote to watch the same Garfield over and over and over and over.

Categories: Cable TV Operators, Devices

Topics: Cablevision, The Fortex Group

-

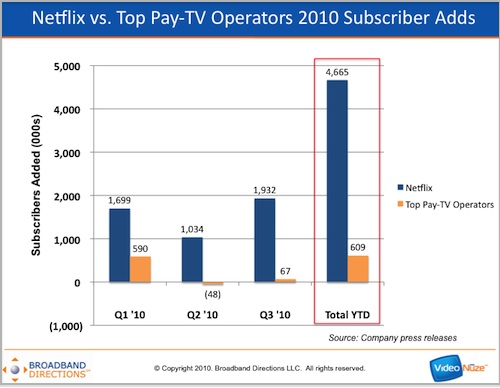

Netflix Has Added 8 Times As Many Subscribers in 2010 As Top Pay-TV Operators, Combined

Here's a pretty amazing factoid to end your week: in 2010 Netflix has added nearly 8 times as many subscribers as 8 of the top 9 pay-TV operators have, combined (#3 cable operator Cox is private and doesn't report). In the first 3 quarters of 2010, Netflix has added nearly 4.7 million subscribers while the top pay-TV operators have gained 609K.

Breaking down the pay-TV industry net gain further, the 2 main telcos (Verizon and AT&T) have added over 1.2 million subscribers and the 2 main satellite providers (DirecTV and DISH) have added 563K, while the top 4 reporting cable operators (Comcast, Time Warner Cable, Charter and Cablevision) have lost over 1.1 million.

Categories: Aggregators, Cable TV Operators, Satellite, Telcos

Topics: AT&T, Cablevision, Charter, Comcast, Cox, DirecTV, DISH, Netflix, Time Warner Cable, Verizon

-

Top U.S. Pay-TV Operators Post Narrow Subscriber Gains in Q3, Rebounding From Q2 Loss

Eight out of the nine largest U.S. pay-TV operators have reported their Q3 '10 results, gaining a slim 66,700 video subscribers, a rebound from a loss of 47,600 subscribers in Q2 '10. The Q2 loss was the first on record for the industry and fueled speculation that "cord-cutting" due to adoption of Internet-delivered video alternatives was rising. With only mildly positive subscriber adds - and 5 of the top 8 operators actually losing subscribers in Q3 - fears that cord-cutting is rising will surely accelerate.

The 8 operators (privately-held Cox Cable, the 3rd-largest cable operator does not disclose its results) represent more than 85% of all U.S. pay-TV households. Though they collectively showed a quarterly gain, if Cox and other cable operators lost subscribers at a comparable rate as the 4 large cable operators in the top 8 (Comcast, Time Warner Cable, Charter and Cablevision), the industry as a whole would have actually lost about 97K subscribers in the 3rd quarter.

Categories: Cable TV Operators, Satellite, Telcos

Topics: AT&T, Cablevision, Charter, Comcast, Cox, DirecTV, DISH, Netflix, Time Warner Cable, Verizon

-

Cablevision is Now Offering to Reimburse Subscribers To Watch World Series on MLB.com

The Cablevision-Fox retransmission fight just took another ugly turn, as Cablevision is now emailing subscribers an offer (see below) to reimburse them $10 if they subscribe to the MLB.com's "Postseason.TV" package which includes the World Series starting tonight.

The gloves are clearly off in this fight, and Cablevision is obviously not hesitating to introduce its subscribers to the virtues of over-the-top streaming, which could have longer-term negative consequences. What comes next in this battle?

What do you think? Post a comment now (no sign-in required).Categories: Broadcasters, Cable TV Operators, Sports

Topics: Cablevision, FOX, World Series

-

CBS-Comcast Deal Underscores Importance of Subscriptions

Yesterday's 10-year retransmission consent deal between Comcast and CBS further underscores the importance of subscription revenue streams in addition to advertising. Under the deal, CBS is rumored to receive between $.50-$1.00 per subscriber per month from the biggest cable operator in the U.S., putting it in the top tier of cable network compensation. When combined with other deals CBS has previously struck, plus additional ones it will likely conclude in the future, CBS has laid firm claim to the same "dual revenue" (monthly payments + advertising) business model as cable TV networks have long enjoyed.

The CBS-Comcast deal is more evidence of how dynamic the relationships have become between broadcast TV networks, cable TV networks, pay-TV operators and new distributors like Hulu and Netflix. The online/mobile/on-demand era has set off a scramble by premium content providers to lock in payments for their programming, while also remaining nimble enough to gain new distribution opportunities. Likewise, distributors are hungry for exclusive well-branded content.

Consider what's happened in just the last 8 months:

Categories: Aggregators, Broadcasters, Cable Networks, Cable TV Operators

Topics: Cablevision, CBS, Comcast, Hulu, Netflix, Time Warner Cable

-

ActiveVideo Lights Up 2 Dozen Interactive Channels for Cablevision

Cablevision, the 5th largest cable operator in the US and dominant provider in the NYC metro area, and ActiveVideo Networks, provider of "CloudTV" interactive solutions are announcing this morning that Cablevision is now delivering over 2 dozen interactive channels to its entire digital video subscriber base. The offerings include hyper-local sports and news, advertising showcases and "Quick View" mosaic navigational channels. Plans are to roll out additional channels.

For those not familiar with ActiveVideo Networks, its focus is enabling video service providers to bridge web-based content, including video, directly to the TV. ActiveVideo provides a content developer's kit (CDK) set of set of standards-based tools (Javascript, XHTML/DHTML) so customers can develop web-based content and deliver it to a digital set-top box as an MPEG stream. The CDK allows much faster development cycles plus lots of flexibility. As the name implies, content is delivered from the cloud, with a thin client in the digital set-top box.

standards-based tools (Javascript, XHTML/DHTML) so customers can develop web-based content and deliver it to a digital set-top box as an MPEG stream. The CDK allows much faster development cycles plus lots of flexibility. As the name implies, content is delivered from the cloud, with a thin client in the digital set-top box.

All of this is important because as convergence devices (e.g. game consoles, TiVo, Roku, Blu-ray devices, boxee, etc.) consumers' expectations are growing that they'll be able to get web content on their TVs. That's turning up the heat on service providers to make the TV experience more interactive and engaging. Whereas "TV Everywhere" initiatives are about bringing TV content online, convergence efforts are about bringing web content to the TV, complete with interactivity and constant updates. Games are another important application and just last week ActiveVideo acquired TAG Networks, a gaming platform that will allow service providers to deliver casual games through their set-top boxes.

I've seen various ActiveVideo implementations and they are remarkably web-like and responsive. The interface is similar to what you experience online. And using your remote control you're able to quickly navigate around. I expect that as the pressure mounts on incumbent service providers to deliver more web-like content to TVs, but with minimal client or network upgrades, the addition of CloudTV services will make more and more sense.

What do you think? Post a comment now (no sign-in required).

(Note - ActiveVideo Networks is a VideoNuze sponsor)Categories: Cable TV Operators, Technology

Topics: ActiveVideo Networks, Cablevision

-

Government to the Rescue in the Retransmission Consent Quagmire?

Earlier this week, in "Will Nasty Fee Fights Fuel Consumers' Cord-Cutting Interest," I conjectured that last weekend's WABC-Cablevision retransmission consent fee fight (the most recent of many fee fights) would ultimately sow consumers' interest "cutting the cord" in favor of free, online-only alternatives. Obviously that would be bad news for multichannel video programming distributors (MVPDs), but it would also be bad for the whole video ecosystem that depends on consumer payments for its economics to work.

In this context it's only mildly surprising that subsequently this week a group of MVPDs including Time Warner Cable, Cablevision, DirecTV, Verizon and others petitioned the FCC to intervene and revise the retransmission consent rules (for what it's worth, I can't remember the last time MVPDs asked the government for anything, except to stay out of their business). In a sure sign of who currently has the negotiating leverage, broadcasters sent their own letter saying the playing field was level and in no need of a review.

With broadcasters intent on getting paid for their signals, there are many chapters yet to be written in the retransmission consent story. The big risk here is that the parties' jousting will ultimately kill the proverbial golden goose, with consumers getting fed up and deciding they'll make do with whatever they can get through the combination of good old-fashioned antennas and a cheap convergence device that hooks their broadband connection to their TV. Cord-cutting has lacked a strong catalyst to date, but history shows that a wronged consumer is a motivated consumer. The TV industry as a whole needs to figure out the retransmission morass before consumers take things into their own hands.

What do you think? Post a comment now (no sign-in required)Categories: Broadcasters, Cable TV Operators, Satellite, Telcos

Topics: Cablevision, DirecTV, NAB, Time Warner Cable, Verizon

-

Will Nasty Fee Fights Fuel Consumers' Cord-Cutting Interest?

Another weekend, another high-stakes fee fight between a multi-billion dollar media company and a multi-billion dollar cable operator. This time around it was Disney's WABC station in the New York City market in a standoff with Cablevision, which has 3.3 million subscribers there, with the Oscars broadcast the main hostage (WABC, which was pulled late Saturday night, came back on the air at 8:44pm subject to an initial agreement between the companies).

This fight, like recent ones between Time Warner Cable and News Corp, Cablevision and Scripps, plus others, is a no win PR situation for its combatants, and in my mind will lead to one inevitable result - heightened consumer disgust with the hyper-corporatized TV business, where CEOs who are paid tens of millions of dollars per year accuse each other of not being sufficiently focused on satisfying their customers. Inevitably, consumers' disgust will translate into interest in finding alternatives, particularly those that are cheaper. While the WABC/Cablevision brought out switching enticements from Verizon, the real competition is increasingly going to be "cutting the cord" and getting programming from online-only sources.

consumer disgust with the hyper-corporatized TV business, where CEOs who are paid tens of millions of dollars per year accuse each other of not being sufficiently focused on satisfying their customers. Inevitably, consumers' disgust will translate into interest in finding alternatives, particularly those that are cheaper. While the WABC/Cablevision brought out switching enticements from Verizon, the real competition is increasingly going to be "cutting the cord" and getting programming from online-only sources.

Generally I don't believe that there's latent cord-cutting interest waiting to explode (even as monthly subscription fees have grown and the amount paid to cable networks is readily available). The fact is that popular cable programs are so diffused across so many channels - and that most of these programs are not available online (the very issue TV Everywhere aims to address) - that cutting the cord is a practical impossibility in most American homes. Sports alone is the ultimate firewall in a huge percentage of homes. How many sports fans would willingly say goodbye to ESPN, Fox Sports or TNT?

That said, more fee fights, affecting more consumers, are certainly in the offing. While fee fights in the past have focused on amounts paid for cable networks, future fee fights are more likely to look like the WABC-Cablevision one - squabbles over how much cable operators should pay for broadcast stations. These fights are related to "retransmission consent" payments and reflect a very different dynamic unfolding between broadcast stations and cable operators.

offing. While fee fights in the past have focused on amounts paid for cable networks, future fee fights are more likely to look like the WABC-Cablevision one - squabbles over how much cable operators should pay for broadcast stations. These fights are related to "retransmission consent" payments and reflect a very different dynamic unfolding between broadcast stations and cable operators.

In the past broadcast stations were plenty happy to have cable operators take in their feed directly, and then position the station on a low channel number, enhancing visibility. Now, however, with broadcast economics under extreme pressure, and intense broadcaster envy for cable networks' dual revenue model (monthly fees + advertising), monthly retransmission fee payments are the new normal. Never mentioned in broadcasters payment demands is the fact that they still have government-granted access to free broadcast spectrum which should likely be returned to the government if they want to operate more like cable networks. To the contrary, in fact broadcasters are arguing that government efforts to reclaim the spectrum for higher value mobile data uses are off-base. But that's a subject for another day.

Even as big media companies and cable operators are poised for future skirmishes, the online universe marches on. Convergence devices that bridge broadband to the TV are gaining further traction. And services like Netflix, iTunes, MLB and others are increasing consumers' expectations for what's expected and possible. As I've pointed out before, big media companies and cable operators have a mutually shared interest in defending the current subscription-based model. Nonetheless, how that model's riches are apportioned between the parties is what's being hotly contested. As they do this though, they risk killing the golden goose.

What do you think? Post a comment now (no sign-in required).Categories: Broadcasters, Cable TV Operators

Topics: ABC, Cablevision, Disney

-

4 Items Worth Noting for the Nov 2nd Week (Q3 earnings review, Blu-ray streaming, Apple lurks, "Anywhere" coming)

Following are 4 items worth noting for the Nov 2nd week:

1. Media company and service provider earnings underscore improvements in economy - This was earnings week for the bulk of the publicly-traded media companies and video service providers, and the general theme was modest increases in financial performance, due largely to the rebounding economy. The media companies reporting - CBS, News Corp, Time Warner. Discovery, Viacom and the Rainbow division of Cablevision - showed ongoing strength in their cable networks, with broadcast networks improving somewhat from earlier this year. For ad-supported online video sites, plus anyone else that's ad-supported, indications of a healthier ad climate are obviously very important.

Meanwhile the video service providers reporting - Comcast, Cablevision, Time Warner Cable and DirecTV all showed revenue gains, a clear reminder that even in recessionary times, the subscription TV business is quite resilient. Cable operators continued their trend of losing basic subscribers to emerging telco competitors (with evidence that DirecTV might now be as well), though they were able to offset these losses largely through rate increases. Though some people believe "cord-cutting" due to new over-the-top video services is real, this phenomenon hasn't shown up yet in any of the financial results. Nor do I expect it will for some time either, as numerous building blocks still need to fall into place (e.g. better OTT content, mass deployment of convergence devices, ease-of-use, etc.)

2. Blu-ray players could help drive broadband to the TV - Speaking of convergence devices, two articles this week highlighted the role that Blu-ray players are having in bringing broadband video to the living room. The WSJ and Video Business both noted that Blu-ray manufacturers see broadband connectivity as complementary to the disc value proposition, and are moving forward aggressively on integrating this feature. Blu-ray can use all the help it can get. According to statistics I recently pulled from the Digital Entertainment Group, in Q3 '09, DVD players continue to outsell Blu-ray players by an almost 5 to 1 ratio (15 million vs. 3.3 million). Cumulatively there are only 11.2 Blu-ray compatible U.S. homes, vs. 92 million DVD homes.

Still, aggressive price-cutting could change the equation. I recently noticed Best Buy promoting one of its private-label Insignia Blu-ray players, with Netflix Watch Instantly integrated, for just $99. That's a big price drop from even a year ago. Not surprisingly, Netflix's Chief Content Officer Ted Sarandros said "streaming apps are the killer apps for Blu-ray players." Of course, Netflix execs would likely say that streaming apps are also the killer apps for game devices, Internet-connected TVs and every other device it is integrating its Watch Instantly software into. I've been generally pessimistic about Blu-ray's prospects, but price cuts and streaming could finally move the sales needle in a bigger way.

3. Apple lurks, but how long will it stay quiet in video? - The week got off to a bang with a report that Apple is floating a $30/mo subscription idea by TV networks. While I think the price point is far too low for Apple to be able to offer anything close to the comprehensive content lineup current video service providers have, it was another reminder that Apple lurks as a major potential video disruptor. How long will it stay quiet is the key question.

While in my local Apple store yesterday (yes I'm preparing to finally ditch my PC and go Mac), I saw the new 27 inch iMac for the first time. It was a pretty stark reminder that Apple is just a hair's breadth away from making TVs itself. Have you seen this beast yet? It's Hummer-esque as a workstation for all but the creative set, but, stripped of some of its computing power to cost-reduce it, it would be a gorgeous smaller-size TV. Throw in iTunes, a remote, decent content, Apple's vaunted ease-of-use and of course its coolness cachet and the company could fast re-order the subscription TV industry, not to mention the TV OEM industry. The word on the street is that Apple's next big product launch is a "Kindle-killer" tablet/e-reader, so it's unlikely Steve Jobs would steal any of that product's thunder by near-simultaneously introducing a TV. If a TV's coming (and I'm betting it is), it's likely to be 2H '10 at the earliest.

4. Get ready for the "Anywhere" revolution - Yesterday I had the pleasure of listening to Emily Green, president and CEO of tech research firm Yankee Group, deliver a keynote in which she previewed themes and data from her forthcoming book, "Anywhere: How Global Connectivity is Revolutionizing the Way We Do Business." Emily is an old friend, and 15 years ago when she was a Forrester analyst and I was VP of Biz Dev at Continental Cablevision (then the 3rd largest cable operator), she was one of the few people I spoke to who got how important high-speed Internet access was, and how strategic it would become for the cable industry. 40 million U.S. cable broadband homes later (and 70 million overall) amply validates both points.

Emily's new book explores how the world will change when both wired and wireless connectivity are as pervasive as electricity is today. No question the Internet and cell phones have already dramatically changed the world, but Emily makes a very strong case that we ain't seen nothing yet. I couldn't help but think that TV Everywhere is arriving just in time for video service providers whose customers increasingly expect their video anywhere, anytime and on any device. "Anywhere" will be a must-read for anyone trying to make sense of how revolutionary pervasive connectivity is.

Enjoy your weekends!

Categories: Aggregators, Books, Broadcasters, Cable Networks, Cable TV Operators, Devices

Topics: Best Buy, Bl, Cablevision, CBS, Comcast, DirecTV, Netflix, News Corp, Rainbow, Time Warner Cable, Time Warner. Discovery, Viacom

-

Netflix's ABC Deal Shows Streaming Progress and Importance of Broadcast TV Networks

Yesterday's announcement by Netflix that it will be adding to its Watch Instantly library past seasons ABC's "Lost," "Desperate Housewives," "Grey's Anatomy" and "Legend of the Seeker" is another step forward for Netflix in strengthening its online competitiveness.

At a broader level though, I think it's also further evidence that the near-term success of Watch Instantly and other "over-the-top" broadband video services is going to be tied largely to deals with broadcast TV networks, rather than film studios, cable TV networks or independently-produced video sources.

Key fault lines are beginning to develop in how premium programming will be distributed in the broadband era. Content providers who have traditionally been paid by consumers or distributors in one way or another are redoubling their determination to preserve these models. Examples abound: the TV Everywhere initiative Comcast/Time Warner are espousing that now has 20+ other networks involved; Epix, the new premium movie service backed by Viacom, Lionsgate and MGM; new distribution deals by the premium online service ESPN360.com, bringing its reach to 41 million homes; MLB's MLB.TV and At Bat subscription offerings; and Disney's planned subscription services. As I wrote last week in "Subscription Overload is On the Horizon," I expect these trends will only accelerate (though whether they'll succeed is another question).

On the other hand, broadcast TV networks, who have traditionally relied on advertising, continue mainly to do so in the broadband world, whether through aggregators like Hulu, or through their own web sites. However, ABC's deal with Netflix, coming on top of its prior deals with CBS and NBC, shows that broadcast networks are both motivated and flexible to mine new opportunites with those willing to pay.

That's a good thing, because as Netflix tries to build out its Watch Instantly library beyond the current 12,000 titles, it is bumping up against two powerful forces. First, in the film business, well-defined "windows"

significantly curtail distribution of new films to outlets trying to elbow their way in. And second, in the cable business, well-entrenched business relationships exist that disincent cable networks from offering programs outside the traditional linear channel affiliate model to new players like Netflix. These disincentives are poised to strengthen with the advent of TV Everywhere.

significantly curtail distribution of new films to outlets trying to elbow their way in. And second, in the cable business, well-entrenched business relationships exist that disincent cable networks from offering programs outside the traditional linear channel affiliate model to new players like Netflix. These disincentives are poised to strengthen with the advent of TV Everywhere.In this context, broadcast networks represent Netflix's best opportunity to grow and differentiate Watch Instantly. Last November in "Netflix Should be Aggressively Pursuing Broadcast Networks for Watch Instantly Service," I outlined all the reasons why. The ABC deal announced yesterday gives Netflix a library of past seasons' episodes, which is great. But it doesn't address where Netflix could create the most value for itself: as commercial-free subscription option for next-day (or even "next-hour") viewing of all prime-time broadcast programs. That is the end-state Netflix should be striving for.

I'm not suggesting for a moment that this will be easy to accomplish. But if it could, Netflix would really enhance the competitiveness of Watch Instantly and its underlying subscription services. It would obviate the need for Netflix subscribers to record broadcast programs, making their lives simpler and freeing up room on their DVRs. It would be jab at both traditional VOD services and new "network DVR" service from Cablevision. It would also be a strong competitor to sites like Hulu, where comparable broadcast programs are available, but only with commercial interruptions. And Hulu still has limited options for viewing on TVs, whereas Netflix's Watch Instantly options for viewing on TVs includes Roku, Xbox, Blu-ray players, etc. Last but not least, it would also be a powerful marketing hook for Netflix to use to bulk up its underlying subscription base that it intends to transition to online-only in the future.

Beyond next-day or next-hour availability, Netflix could also offer things like higher-quality full HD delivery or download options for offline consumption. Broadcasters, who continue to be pinched on the ad side, should be plenty open to all of the above, assuming Netflix is willing to pay.

I continue to believe Netflix is one of the strongest positions to create a compelling over-the-top service offering. But with numerous barriers in its way to gain online distribution rights to films and cable programs, broadcast networks remain its key source of premium content. So keep an eye for more deals like the one announced with ABC yesterday, hopefully including fast availability of current, in-season episodes.

What do you think? Post a comment now.

Categories: Aggregators, Broadcasters, Cable Networks, Cable TV Operators, FIlms

Topics: ABC, Cablevision, CBS, Comcast, EPIX, ESPN360, MLB, NBC, Netflix, Time Warner

-

4 Industry Items from this Week Worth Noting - 7-2-09

Clearleap announces Atlantic Broadband as first public customer - Clearleap, the Internet-based technology firm I wrote about here, announced Atlantic Broadband as its first public customer. Atlantic is the 15th largest cable operator in the U.S. I spoke with David Isenberg, Atlantic's VP of Products, who explained that Clearleap was the first packaged solution he's seen that allows broadband video to be inserted into VOD menus without the need for IT resources to be involved. Atlantic initially plans to use Clearleap to insert locally-oriented videos into its local programming lineup. It also has special events planned like "Operation Mail Call." which allows veterans' families to upload videos, plus coverage of local sports, and eventually filtered UGC. By blending broadband with VOD, Isenberg thinks Clearleap gives him a "giant marketing tool" to raise VOD's visibility. As I've said in the past, VOD and broadband are close cousins which can be mutually reinforcing; Clearleap facilitates this relationship.

New Balance's "Made in USA" video - Have you seen the new 3 minute video from athletic shoemaker New Balance? Yesterday I noticed a skyscraper ad for it at NYTimes.com and a full back-page ad in the print version of the Boston Globe. New Balance's video promotes the fact that it's the only athletic shoemaker still manufacturing in the U.S. (though it says only 25% of its shoes are made here). There's also a fundraising contest to win a trip to one of its manufacturing facilities. Taking ads in online and offline media to drive viewership of a brand's original video is another way that advertising is being reimagined and customers are being engaged.

Joost - R.I.P.-in-Waiting - There's been a lot written this week about Joost's decision to switch business models from content aggregation to white label video platform provider. Regrettably, I think this is Joost's last gasp and they are in "R.I.P.-in-waiting" mode. Joost, which started off with lots of buzz and financing ($45M) by the co-founders of Skype and Kazaa, is a cautionary tale of how quickly the broadband video market is moving, and how those out of step can get shoved aside. Joost made a critical strategic blunder insisting on a client download based on P2P delivery when the market was already moving solidly in the direction of browser-based streaming. It never recovered. Given how crowded the video platform space is, I'm hard-pressed to see how Joost will carve out a substantial role.

Cablevision wins its network DVR case - Not to be missed this week was the U.S. Supreme Court's decision to refuse to hear an appeal from programmers regarding cable operator Cablevision's "network DVR" plan. The decision means Cablevision can now deploy a service that allows subscribers to record programs in a central data center, rather than in their set-top boxes. This leads to lower capex, fewer truckrolls, and more storage capacity for consumers. There's also an intersection point with "TV Everywhere," as cable subscribers will potentially have yet another remote viewing option available to them. Content is increasingly becoming untethered to any specific box.

Categories: Aggregators, Brand Marketing, Cable TV Operators, DVR, Technology, Video On Demand

Topics: Atlantic Broadband, Cablevision, Clearleap, Joost, New Balance

-

4 Industry News Items Worth Noting

Looking back over the past week's news, there are at least 4 industry items worth noting. Here are brief thoughts on each:

Time Warner starts to acknowledge execution realities of "TV Everywhere" - I was intrigued to read this piece in Multichannel News covering comments that Time Warner Cable COO Landel Hobbs made about its TV Everywhere's plans being slowed by "business rules." Though I love TV Everywhere's vision, I've been skeptical of it because it's overly ambitious from technical and business standpoints. This was the first time I've seen anyone from TW begin to acknowledge these realities (though Hobbs insists "the hard part is not the technology"). I fully expect we'll see further tempered comments from TW executives in the months to come as it realizes how hard TV Everywhere is to execute.

VOD and broadband video vie for ad dollars - I've been saying for a while that broadband can be viewed as another video-on-demand platform, which inevitably means that it's in competition with VOD initiatives from cable operators. For both content providers and advertisers, a key driver of their decision to put resources into one or the other of the two platforms is monetization. And with VOD advertising still such a hairball, broadband has gained a decisive advantage. As a result, I wasn't surprised to read in this B&C article that ad professionals are imploring cable operators to get on the stick and improve VOD's ad insertion processes. Cablevision took an important step in this direction, announcing this week 24 hour ad insertion. Still, much more needs to be done if VOD is going to effectively compete with broadband video for ad dollars.Cisco sees an exabyte future - Cisco released an updated version of its "Visual Networking Index" which I most recently wrote about in February. Once again, Cisco sees video as the big driver of IP traffic growth, accounting for 91% of global consumer IP traffic by 2013. The fastest growing category is "Internet video to the TV" (basically the convergence play), while the biggest chunk of video usage will still be "Internet video to the PC" (today's primary model). Speaking to Cisco market intelligence people recently, it's clear that from CEO John Chambers on down, the company believes that video is THE growth engine in the years to come.

iPhone's new video capabilities - Daisy reviews this in her podcast comments today. It's hard to underestimate the impact of the iPhone on the mobile video market, and the forthcoming iPhone 3G S's video capabilities (adaptive live streaming, video capture/edit and direct video downloads for rental or own) mean the iPhone will continue to raise the mobile video bar even as new smartphone competitors emerge. Nielsen has a good profile of iPhone users here. It notes that 37% of iPhone users watch video on their phone, which 6 times more likely than regular mobile subscribers.

Categories: Advertising, Cable TV Operators, Mobile Video, Video On Demand, Worth Noting

Topics: Apple, Cablevision, Cisco, iPhone, Time Warner Cable, TV Everywhere

-

The Cablevision nDVR Decision: Winners, Losers and How it Relates to Broadband

Last Monday's decision by the Second Circuit Court of Appeals, reversing a lower court's March 2007 ruling that Cablevision's plan to deploy a Network Digital Video Recorder (nDVR) violated copyright law has huge potential implications across the video landscape. DVR, Video on Demand and broadband video are all close cousins jockeying for position in the race to provide on-demand choice to consumers. So for those interested in broadband's deployment, it's important to understand ongoing developments in DVR and VOD as well.

Today, I'm pleased to have Mugs Buckley and Colin Dixon, analysts at The Diffusion Group weigh in with their thoughts on last week's ruling.

The Cablevision nDVR Decision: Winners, Losers and How it Relates to Broadband

by Mugs Buckley and Colin Dixon, The Diffusion Group

The August 4th Cablevision nDVR decision by the Second Circuit Court of Appeals opens up the

possibility that the company will be able to move ahead with its original nDVR plan, much to the dismay of the plaintiffs, a group of major studios and TV broadcasters. For a primer on the significance of the decision, we offer the following thoughts:

possibility that the company will be able to move ahead with its original nDVR plan, much to the dismay of the plaintiffs, a group of major studios and TV broadcasters. For a primer on the significance of the decision, we offer the following thoughts:WHAT'S AN nDVR vs. a DVR?

The root of the nDVR case is where a TV viewer's recorded show gets stored: on a hard drive in a DVR located in the home (as is the current model) or on a hard drive in a cable operator's network (as Cablevision and other network operators prefer).

WHY DOES IT MATTER?

To the viewer, it doesn't; since using either approach allows recording and playback of programs.

But since the correlation between digital recording and ad-skipping is well-documented, the studios' and networks' key concern is that nDVR could dramatically accelerate recording usage, thereby accelerating the ad-skipping trend. That would be a big blow to their economic model. For Cablevision and other operators, it's all about cost. Storage in the network is much cheaper than a truck roll to a customer's home and individual DVR box deployments. nDVR also allows the operator to leverage their huge investment in VOD systems.

WHERE DO THINGS GO FROM HERE?

While Cablevision won its appeal, the ruling is far from conclusive. The next step is for the lower court to revisit this ruling, so when Cablevision will actually be able to roll out the nDVR service is totally unknown. They must wait for the lower court to decide if they agree with the upper court's decision, which is not expected before the end of 2008. And of course we expect the studios and content providers to file subsequent appeals.

WHERE DO OTHER OPERATORS STAND?

If Cablevision wins, other cable and telco network operators will implement nDVR too. For example, Time Warner Cable's CEO Glenn Britt told Multichannel News on August 6th, "We've said for a long time that a centralized network DVR is a better engineering solution than having hard drives all over everybody's home. If this particular court case is upheld, we will deploy that."

AND THE BROADBAND IMPLICATIONS?

Should the ruling stand, a company like TiVo could possibly be able to capitalize on it by delivering the nDVR experience over broadband. Of course, TiVo's been shifting its model to work with service providers anyway, so this may not be a strategy it would pursue.

As for other broadband implications, this is where the interplay between nDVR, VOD and broadband video can get murky. For instance, sites like Hulu and ABC.com are already storing programs in the network (albeit in a way that they control) for on-demand consumption. This obviates the requirement that the consumer take the action to record say the latest episode of "The Office" in a DVR or nDVR environment.

And of course, the content providers control the ad insertion (although presumably they could do that for nDVR as well). Other than making ALL TV programs available vs. just the subset currently available for broadband delivery (and VOD) and the fact that nDVR can be viewed easily on TVs, which is not currently the case for broadband, the differences between nDVR and broadband start to feel quite blurry.

As you can see, nDVR has lots of implications for everyone in the video value chain.

Bottom line: Much more to come. Stay tuned.

Categories: Broadcasters, Cable TV Operators, Studios

Topics: Cablevision, Network DVR

-

thePlatform's New Cable Deals: Finally, an Industry Push into Broadband Video Delivery?

thePlatform, the video management/publishing company that's been a part of Comcast since early '06, had a very good day yesterday. First it jointly announced with Time Warner Cable a deal to power the #2 cable operator's Road Runner portal. And the Wall Street Journal ran a story stating that it has also signed deals with the cable industry's #3 player Cox Communications and #5 player, Cablevision Systems, which thePlatform corroborates.

Netting all this out, thePlatform will now power 4 of the top 5 cable industry's broadband portals (all except

Charter Communications), with a total reach exceeding 28 million broadband homes, according to data collected by Leichtman Research Group. That also equals approximately 44% of all broadband homes in the U.S. And it's a fair bet that thePlatform's industry penetration will further grow.

Charter Communications), with a total reach exceeding 28 million broadband homes, according to data collected by Leichtman Research Group. That also equals approximately 44% of all broadband homes in the U.S. And it's a fair bet that thePlatform's industry penetration will further grow.I caught up with Ian Blaine, thePlatform's CEO yesterday to learn a little more about the deals and whether the industry's semi-standardization around one broadband video management platform harkens a serious, and I'd argue overdue, industry push into broadband video delivery.

Ian noted that of its various customer deals, the ones with distributors like these are particularly valuable because of their potential for "network effects." This concept means that content and application providers are more likely to also adopt thePlatform if their key distributors are already using it themselves. Ian's point is very valid, as I constantly hear from content providers about the costs of complexity in dealing with multiple distributors and their varying management platforms. Yet the potential is only realized if the distributors actually build out and promote their services, offering sizable audiences to would-be content partners.

This of course has been the aching issue in the cable industry. While they've had their portal plays for years, they've been eclipsed in the hearts and minds of users by upstarts ranging from YouTube to Hulu to Metacafe to countless others, each now drawing millions of visitors each month. While solidly utilitarian, cable's portals (with the possible exception of Comcast's Fancast) are not generally regarded as go-to places for high-quality, or even UGC video. That's been a real missed opportunity.

Ian thinks the industry is experiencing an awakening of sorts, now recognizing the massive potential it's sitting on. This includes its content relationships, network ownership and huge customer reach. Of course, all of this was plainly visible in 1998 as broadband was first taking off, yet here we are 10 years later, and it somehow seems discordant to think the industry is only now grasping its strategic strengths.

Some would explain this as the cable industry being more of a "fast follower" than a true pioneer, a posture that has helped the industry avoid hyped-up and costly opportunities others have chased to their early graves. Others would offer a less charitable explanation: the industry's executives have either been asleep at the switch, overly focused on defending traditional closed video models against open broadband's incursion, or both.

In truth, and as I've mentioned repeatedly, the broadband video industry is still very early in its development, making a "fast follower" strategy still quite viable. Semi-standardization on thePlatform gives the industry a huge potential advantage in attracting content providers. It also gives the industry a more streamlined mechanism for bridging broadband video over to the TV, an area of intense interest now being pursued by juggernauts including Microsoft, Apple, Sony, Panasonic and others.

Still, cable operators' broadband video delivery potential (and the true upside of thePlatform's omnipresence) rests more on whether cable operators are finally going to embrace broadband as an eventual complement, and possibly even successor to their traditional video business model. That would be a major leap for an industry better known for cautious, incremental steps. Time will tell how this plays out.

What do you think? Post a comment!

Categories: Cable TV Operators, Devices, Technology

Topics: Apple, Cablevision, Comcast, Cox, Microsoft, Panasonic, Sony, thePlatform, Time Warner

-

All Eyes on Cable Industry's "Project Canoe"

To the disappointment of many, it looks like there won't be any big news about the cable industry's "Project Canoe" at the Cable Show convention in New Orleans this week.

Project Canoe is a high-profile partnership among the nation's six largest cable companies (Comcast, Time Warner Cable, Cablevision, Cox Communications, Charter Communications and Bright House Networks) to enable national interactive advertising campaigns to be executed across the companies' cable operations. The code-name Canoe is meant to emphasize that cable operators are working together in the same boat, so to speak.

For the past nine months, the partners' Canoe leads have been meeting weekly. Once a top secret initiative, Canoe's existence was leaked in a September, 2007 Wall Street Journal article. But since then there has been no new information, leading to speculation about how much progress has been made.

Yet Canoe remains a top priority throughout the industry, and for good reason. With big advertisers like GM and Intel shifting their once big-budgeted TV ad campaigns to the Internet in significant sums, it's key that the cable operators need to figure out a way to not only protect the $5 billion or so that they generate in spot-cable advertising today, but also to increase their piece of the $70 billion dollar TV ad spend or cut into other slices of the massive US total ad spend pie. The next 3-5 years will be critical as cable advertising, the Internet and broadband video jostle for advertisers' affections.

The buzz in New Orleans suggests advertisers and agencies are excited about Canoe, though its development seems slower than they prefer. Why the slow progress that's perceived? Several operators stated that integrating the infrastructure required to execute Canoe with cable's legacy systems is hard stuff. No doubt. Then of course there are other key priorities weighing on the industry resources, such as the February 2009 digital transition.

Meanwhile, the Internet and broadband video advertising continue steaming ahead, giving advertisers and their agencies the measurement and targetability that they yearn for on TV. Cable operators have been stymied in their ability to jointly offer advertisers easy access to a nationwide or near-nationwide footprint, especially critical for Video on Demand. Canoe addresses this and other opportunities, in part by creating a set of standards for all to follow.

The only Canoe "news" at this week's Cable Show came from Comcast's Steve Burke, who stated that a CEO would be announced on June 1. Comcast is a key player in Canoe, funding between $50-70 million of the $150 million initial investment. Rumors have swirled that David Verklin, who recently stepped down as CEO of Aegis North America (a large advertising services firm) will assume the position of CEO. If true, that could be the news to break on June 1.

For those of us who have been around the interactive advertising and TV mulberry bush for many years, Canoe's potential is exciting. But we're hoping that the Canoe gets it in gear. Paddle on, gang.

What do you think of Project Canoe's prospects? Post a comment now!

Categories: Advertising, Cable TV Operators

Topics: Aegis, Bright House Networks, Cablevision, Charter Communications, Comcast, Cox Communications, Project Canoe, Time Warner Cable

Posts for 'Cablevision'

|