-

Why NBCOlympics.com's Video Ad Revenues Don't Matter

There was much reporting yesterday of eMarketer's estimate that NBC generated revenue of $5.75 million from its broadband Olympics video. The firm's press release dismissively called the sum "a passable performance." Others, from the blogosphere to mainstream media piled on, characterizing NBC's video revenues as underwhelming, using terms such as "pittance," "piddling," and "unimpressive."

Let's hold on a second here. At the risk of sounding like an irrepressible NBC supporter, I'd like to offer the alternative viewpoint: NBCOlympics.com's video ad revenues actually don't matter.

Don't get me wrong, when it comes to high-stakes Olympics broadcasting - and a sagging economy to boot -

every dime counts. Rather, my point is that by focusing on the broadband ad number (which at virtually any level would have been a mere rounding error on NBC's $1 billion+ of overall Olympic ad revenues) we are getting distracted from NBC's real and very valuable broadband accomplishments.

every dime counts. Rather, my point is that by focusing on the broadband ad number (which at virtually any level would have been a mere rounding error on NBC's $1 billion+ of overall Olympic ad revenues) we are getting distracted from NBC's real and very valuable broadband accomplishments.Consider this: there were more on-demand and live sports choices for Olympics viewers than ever, NBC and its technology partners conquered herculean operational challenges without any major snafus and the foundation was laid for broadband to play an increasingly important and integral role in all future iconic programming events.

Focusing just on the operational achievements for a moment, a conversation I had yesterday with Brick Eksten, President of Digital Rapids, the company that provided all of the video encoding and streaming technology for NBC's live streaming events was a reminder of all the complexities NBC and its partners took on. There were up over 100 live simultaneous feeds that needed to be ingested, encoded in multiple bit-rates and delivered in real time across the globe to the right distribution points. All of this had never been done before.

Unlike domestic implementations or those focusing mainly on on-demand delivery, live broadband delivery from China meant spec'ing out all the delivery systems in advance and then shipping all of the gear well in advance of the event itself. There were many unknown variables, beginning with the vast potential range of concurrent users. So long hours were invested by partners modeling different scenarios to meet targeted delivery quality goals. Compounding matters, Brick explained that due to space, manpower and time limitations, Digital Rapids and others were challenged to push their systems to do things not previously done.

Meanwhile, NBC faced a pioneer's balancing act, simultaneously trying to preserve the value for its on-air broadcast rights/supporting advertisers, while meeting consumers' expectations for broadband on-demand access to everything. NBC could have chosen to charge for broadband access (as CBS originally did with March Madness, and as MLB continues to do) or provide only highlights clips or nothing via broadband at all. Instead, it offered up - at no charge - 2,200 hours of live streaming and 3,000 hours of on-demand.

Some fans on the sidelines have groused this wasn't enough. Now some analysts are saying that NBC could have generated more ad revenue if it had opened the broadband spigot further. These comments miss the bigger point: NBC moved the broadband market dramatically forward with its Olympics coverage. Focusing on what NBC proved with the first "Broadband Olympics," rather than what attributable revenue it generated, is what's most important for all of us to remember.

What do you think? Post a comment now.

Categories: Advertising, Broadcasters, Sports

Topics: CBS, Digital Rapids, MLB, NBC, Olympics

-

Citysearch Offering Local Merchants Video Enhancement

Citysearch, the big online local information company, is making an aggressive push into video. The company is currently running a new promotion which allows its merchants to have a complimentary video made for them, which enhances their Citysearch listing, and can also be used on their own web site and on YouTube.

I'm always on the lookout for ways video can drive more revenue, and Citysearch's effort (originally begun in early '07) qualifies on at least two levels. First, it's a valuable enhancement to Citysearch's pay-for-performance ad model, increasing the ARPU the company derives from its merchants. Second, it appears to be a bona fide differentiator for merchants in helping them attract new business. And of course it helps deliver on users' growing expectations for video experiences.

Last week I spoke with Brian McCarthy, Citysearch's VP of Merchant Product to learn more about how the program works. I also spoke to Marc Edward, who runs Marc Edward Skincare in West Hollywood, CA, which is a merchant that's been offering video in its Citysearch listing for over a year.

Under the current promotion, Citysearch will make a 60-90 second video for its merchants for no cost to them. Citysearch has partnered with 3 production firms, TurnHere, StudioNow and GeoBeats to produce the video, which Brian said cost under $1,000 apiece. The merchant is involved in the editing process and then the video is added to the merchant's listing. When a user watches the video for at least 10 seconds, the merchant is charged a fee ranging from $.40 to $2.00, as part of Citysearch's "multimedia package."

Marc was one of the early users of Citysearch video and is quite enthusiastic about the results. He feels that nothing can convey what his business is about better than prospects actually seeing him talk about it, and explaining what they can expect. While he hasn't tracked new business directly to the video he offers, anecdotally he said new clients mention and cite the video as a major reason why they chose his shop over others.

While it's still early days for video enhancements in local listings/search results, it seems like a natural way to extend the model. Other local players like WorldNow, CBS and other broadcasters are on to this as well. The key is getting the financial model right for all parties: who pays to get the video made and how it generates a return over time. Citysearch seems to be making progress proving how the model can work.

What do you think? Post a comment now.

Categories: Advertising

Topics: CBS, CitySearch, GeoBeats, StudioNow, TurnHere, WorldNow

-

Dispatch from the Syndicated Video Economy's Front Line

Yesterday I moderated a panel at the NATPE LATV Festival Digital Day entitled, "The Syndicated Video

Economy: Expanding Broadband's Reach." The Syndicated Video Economy or SVE, is a concept I introduced back in March, to help articulate the trend toward widespread video distribution online, and the ecosystem of companies facilitating it.

Economy: Expanding Broadband's Reach." The Syndicated Video Economy or SVE, is a concept I introduced back in March, to help articulate the trend toward widespread video distribution online, and the ecosystem of companies facilitating it. The session was a unique opportunity to hear from four executives whose companies are very much on the front line of the trend toward syndication. They shared many insights based on their experiences, and I thought it would be worth passing on a synopsis of these today.

The four panelists were:

- Greg Clayman, EVP, Digital Distribution and Business Development, MTV Networks

- John Fitzpatrick, Director of Business Development, blip.tv

- Jonathan Leess, President and General Manager, Digital Media Group, CBS Television Stations

- Brian Shin, Founder and CEO, Visible Measures

Here are four key takeaways:

1. Syndication is required to capitalize on the significant fragmentation of online audiences. John summed this up well, suggesting that content creators need to think in terms of their "total potential audience," not just viewers that may come to their web sites. Particularly for established media companies, steeped in traditional destination-oriented, "must-see" mind-sets, this is a crucial point of adaptation to the online world. Jonathan's group gets this, as he reported 60% of its 25 million monthly are already coming from third parties.

2. Syndication is operationally complex. Jonathan made the point that, for all of syndication's appeal, it poses daunting tactical challenges, particularly with an "always-on" news gathering/dissemination ethos. Challenges he cited include integrating video players with partners' sites, implementing ad management across heterogeneous environments, distributing content correctly and promptly, measuring results and honoring financial obligations. Until the ecosystem of companies enabling the SVE significantly matures, scaling the model will cause ample headaches.

3. Retaining full control of advertising sales is crucial. While the SVE opens up new audiences, Greg reminded us that nobody is better equipped to sell MTV's inventory - wherever it may be generated - than MTV's own sales team. This is one of the reasons content providers seek to syndicate not just their video, but also their player as well. Jonathan echoed this point from the local perspective. Lack of tight advertising control leads to chaos for media buyers and sub-optimization of pricing. A bonus, as John pointed out, is that distributors will often be happy to just collect their revenue-sharing checks and not have to sell themselves.

4. Analytics are the ultimate key to fully exploiting the SVE. While traditional web analytics have focused on on-site performance, SVE analytics must encompass video performance over many distribution points. Brian noted that making sense of how a video performs in varying environments - and then adjusting ongoing syndication strategies accordingly - is necessary to optimize viewership across the total audience. Inevitably viewership and engagement will vary by distributor. Collecting, understanding and acting on the data optimizes syndication and monetization.

Ok, that's a mouthful. Like the panelists I remain optimistic about the SVE's potential, but I'm also clear-eyed about the challenges the SVE raises. I'll continue to track its progress and share findings.

What do you think? Post a comment now!

(Note, if you'd like to learn more about the SVE, and also hear from MTV's Greg Clayman, join me on August 6th for a complimentary webinar, hosted by Akamai. Click here to register.)

Categories: Events, Syndicated Video Economy

Topics: blip.TV, CBS, MTV, Visible Measures

-

New Magid Survey: Short-Form Dominates Online Video Consumption and Hurts TV Viewership

Survey results being released this morning by Frank N. Magid Associates, a research consultancy, and video aggregator Metacafe provide fresh evidence that short-form video dominates online video consumption. Notably, the survey also goes a step further, finding that 28% of respondents who watch online video report watching less TV as a result.

Meanwhile though, on the same day earlier this week that I was talking to Mike Vorhaus, managing director at Magid, and Erick Hachenburg, CEO of Metacafe about this new survey, Mediaweek was reporting a separate Magid survey, commissioned by CBS, which found that "35% of the nearly 50,000 streamers surveyed...reported that they are more likely to view shows on the network as a result of having been exposed to content on the web."

As I learned from Mike, there's no actual contradiction in these 2 surveys' findings, but you do have to squint your eyes a bit to make sure you're understanding the data accurately.

First, the findings on short-form's domination. The Metacafe survey asked respondents about the most commonly viewed types of video and presented them with category choices. The top 5 selected were all short-form oriented: Comedy/jokes/bloopers (37%), music videos (36%), videos shot and uploaded by consumers (33%), news stories (31%) and movie previews (28%). TV shows comes in at #6 (25%), followed by more short-form categories of weather, TV clips and sports clips.

First, the findings on short-form's domination. The Metacafe survey asked respondents about the most commonly viewed types of video and presented them with category choices. The top 5 selected were all short-form oriented: Comedy/jokes/bloopers (37%), music videos (36%), videos shot and uploaded by consumers (33%), news stories (31%) and movie previews (28%). TV shows comes in at #6 (25%), followed by more short-form categories of weather, TV clips and sports clips. That short-form, snackable video dominates is not really a huge surprise, given YouTube's market share and the preponderance of virally shared clips. Yet Mike emphasized that short-form does not equal UGC, a point that Erick also highlights. Rather, Mike sees short-form as a legitimate alternative entertainment format that creatives are embracing and audiences are adopting. It is causing further audience fragmentation resulting in the TV audience erosion that the survey also uncovered.

Which of course begs how Magid's CBS survey data squares up. Mike explained that the key here is that the

CBS survey is based solely on users of CBS.com. These people naturally have a greater affinity for CBS programming and their likelihood of watching CBS shows on TV will be far higher than randomly-selected audiences (such as in the Metacafe survey). Here's the CBS press release for more details.

CBS survey is based solely on users of CBS.com. These people naturally have a greater affinity for CBS programming and their likelihood of watching CBS shows on TV will be far higher than randomly-selected audiences (such as in the Metacafe survey). Here's the CBS press release for more details.So the CBS data suggests that networks should be encouraged that streaming their shows builds loyalty and broadcast viewership, and therefore that they should keep on doing it. Nevertheless they need to be mindful that their shows now compete in a far larger universe of video choices, and that short-form - as a new genre - is something they too should be looking to exploit. Appropriately, all the networks, and many studios, are doing exactly that.

There is no shortage of research concerning consumer media behavior floating around these days. As the two Magid surveys show, superficially data may appear to be conflicting, though in reality it is not. Observers need to make sure they're digging in, and taking away the right lessons.

What do you think? Post a comment now!

Categories: Aggregators, Broadcasters

Topics: CBS, Magid, MetaCafe, YouTube

-

Sunday Morning Talk Shows Need Broadband Refresh

In the heat of the Democratic primary, the five major Sunday morning talk shows have recently taken on greater prominence. For political junkies like me, even after a week's worth of endless campaign coverage, it is great sport to watch the candidates and their surrogates put the best face on the week's events, while eagerly trying to tee up issues for the coming week's news cycle.

The Sunday shows are also perfect fodder for broadband video consumption. On-air they are neatly segmented by guests and topics, their archives offer a vivid research opportunity for both editorial and user-driven curation, and the audiences that tune in are upscale and appealing to advertisers.

With all this going for them, I decided to investigate the online presence of the five Sunday morning shows, ABC's "This Week with George Stephanopoulos," CBS's "Face the Nation with Bob Schieffer," FOX's "Fox News Sunday with Chris Wallace," NBC's "Meet the Press with Tim Russert" and CNN's "Late Edition with Wolf Blitzer."

Though all of the sites had their strengths, as a group I found them to be surprisingly average initiatives, especially in comparison to the superb efforts these same networks have mounted for their online entertainment programming. (Note that all I found for "Late Edition" was a brochure page)

"FTN" would have to rank at the top of my list, primarily because it segments the show by its guests and topics and displays them in the user-friendliest manner. This allows the user to quickly zero in on desired segments. "This Week" and "MTP" do some of this as well, though I found their presentation not as straightforward. What's missing from all are related clips across episodes curated in a meaningful way. Presentation is very episode-centric.

While all the sites rely heavily on pre-roll ads, "FTN" gets credit for using some frequency capping. "This Week," seems to ignore the best practices that ABC.com follows in presenting its shows with limited interruptions. Not only does it not frequency cap, it also ran the same 2 ads - one for Intel and one for Verizon Wireless - over and over. Needless to say this became tiresome after clicking to watch several segments.

Meanwhile, navigation and available content on these sites are all over the board. "MTP" offers a link to watch the whole program with limited interruptions, while "FNS" offers a text transcript of the most recent program, but not a video of the whole program. "This Week's" main text navigation has links to pure text stories, text stories with embedded video clips, and video clips alone, but no way to sort the list by media type. Search on each site also yields highly diverse results - some video, some not. One missed opportunity is that none offer any user editing features. Putting together your own highlights reel to be embedded on a blog or social networking site would likely be great fun for many hard-core viewers.

The Sunday talk shows offer dynamite content, highly leverageable for broadband consumption. Hopefully as the political season rolls on we'll see the networks recognize this and continue to invest in new features and improved usability.

What do you think? Post a comment and let us all know!

Categories: Broadcasters, Cable Networks

Topics: ABC, CBS, CNN, FOX, NBC

-

March '08 Recap - 3 Key Themes

As I mentioned at the end of February, each month I plan to step back and recap a few key themes from recent VideoNuze posts. Here are three from March '08. (And remember you can see all of March's broadband news, aggregated from across the web, by clicking here)

The Syndicated Video Economy: An Introduction

In March I introduced the concept of the "Syndicated Video Economy" ("SVE") to describe how the broadband video providers are increasingly coalescing on a strategy for widespread distribution of video through myriad outlets. In the SVE media companies shift their focus from "aggregating eyeballs" in a centralized destination to "accessing eyeballs" wherever (and whenever) they live. The SVE is a big departure from traditional tightly-controlled, scarcity-driven distribution approaches. Investors have responded by funding SVE-oriented content and technology startups.

In March I provided several examples of SVE initiatives. CBS launched its Local Ad Network to distribute content to local bloggers and web sites. 60Frames, a new broadband studio, is explicitly focused on partnerships for distribution, and is not even building destination web sites for its programs. And FreeWheel is developing management tools so that content can be optimally monetized across a content provider's sprawling network of syndication partners.

The SVE resonated strongly with VideoNuze readers; many are focused on it and vested in its further development. Expect to hear a lot more about the SVE from me in coming posts. I'll also have supporting slides I'm developing for upcoming webinars on the topic.

Over-the-Top: Getting Broadband Video to the TV

Bringing broadband video all the way to the TV by bypassing existing service providers (so-called "over-the-top") continues to be the big elusive prize for many. This past month YouTube and TiVo announced a partnership to let a subset of TiVo owners gain full YouTube access on their TVs, a welcome move.

Following that, in "YouTube: Over-the-Top's Best Friend" I suggested the YouTube, with its dominant market position and brand loyalty could in fact be the linchpin to over-the-top devices gaining a foothold with consumers. Google-YouTube executives' vision for YouTube as a video platform, powering experiences wherever they are, lends support to my proposition. Lastly on over-the-top, new contributor Michael Greeson, founder of market researcher TDG, proposed that adapting low-cost devices like DVD player may well be the best way to bridge broadband and TV.

Social media and video: 2 sides of the same coin

This past month also continued an escalation of interest in the intersection of social media and broadband video. At the Media Summit there was intense focus on engagement, and how broadband can uniquely create new user experiences that deeply involve the user. These social experiences include sharing, personalization, commenting, rating and so on. In this vein, Maginfy.net introduced new social features to support its specialized user-created channels, a smart evolution of its product.

And in a follow-up to "The Intersection of UGC and Brand Marketing?" I clarified the opportunities that brand marketers may or may not have to get involved with this hot space. For those interested in more on this subject, new VideoNuze sponsor KickApps provided an informative webinar which is still available here.

So that's March's recap. There will be plenty more on all of these and other broadband video topics in April and beyond!

Categories: Brand Marketing, Devices, Syndicated Video Economy, Video Sharing

Topics: 60Frames, CBS, FreeWheel, KickApps, Magnify.net, Media Summit, Syndicated Video Economy, TDG, TiVo, YouTube

-

CBS Launches Local Ad Network; Local Space Heats Up

This morning CBS TV Stations is announcing the CBS Local Ad Network with a goal of widely syndicating CBS TV Stations' content into the maze of locally-focused web sites and blogs. A ground-breaking effort, it is the latest evidence that the local broadcast formula is being re-written by broadband's potential. I got an exclusive briefing on the CBS initiative last Friday from Jonathan Leess, President/GM of CBS TV Stations Digital Media and Aaron Radin, SVP, Ad Sales and Biz Dev.

As I wrote early last week in "CBS TV Stations Get Broadband," syndication is a key driver of video streaming growth for the company. Recognizing changing consumer behavior, the new Local Ad Network enables news "widgets" - small information badges carrying local headlines from CBS's 29 stations which can be easily selected and embedded by local sites and bloggers. When users click on a link in the widget they are carried back to the local CBS station site. See the right column in the below example:

Each widget carries ads which are sold by CBS, with a revenue share back to the local site. Radin is excited about the ad network because it has the potential for vastly expanded and targeted ad inventory, which can be sold to many different types of advertisers depending on their goals. For example for AT&T, a charter advertiser, the network provides a national player with enhanced local access. Additionally, the ad network can provide the local CBS station's digital sales team with more in-depth coverage for a local advertisers.

The significance of the CBS initiative is that it continues to show that broadband is opening up new opportunities for local stations to go well beyond their traditional broadcast models. The concept of local newscasts in the morning, evening and late night is increasingly irrelevant. Also gone is the concept of finite air-time. The CBS deal shows that the "shelf space" on which CBS local content sits doesn't even have to be owned by the station any longer. Now the shelf space could just as easily be a 15 year-old local kid's popular blog on local sports who wants to provide a customized feed of high-quality local video to his visitors. Think about how that expands a local station's business model.

The whole area of local content syndication is really heating up. In this deal, CBS has partnered with SyndiGo, a new unit of Seevast to build out the ad network's local web site and blog distribution network. For other local broadcasters seeking to pursue syndication there are other choices. For example, WorldNow (note: a VideoNuze sponsor), which now supports 260+ stations around the U.S. has also stepped up its syndication activity, in addition to technology provisioning. It recently launched Supernanny-related content into its lifestyle channel, enabling more choice and ad inventory.

WorldNow, like other 3rd parties, believe that, in these tumultuous times, local broadcasters should be focused on content, ad sales and distribution, not technology development. With technology and the market moving so fast, that logic makes a lot of sense. WorldNow and others present the classic "buy" vs. "build" option for stations. While CBS and others may "build," there's no question for many other who want to syndicate and drive new ad sales, they'll prefer to do it in a "buy" scenario. All of this activity will have the effect of spurring continued innovation in the space.

One thing's for certain, there are myriad new technology choices and go-to-market options facing local TV broadcasters in the "syndicated video economy." Broadband presents unprecedented challenges and opportunities to an industry that has long operated under a highly formulaic approach.

What do you think of the changes happening in the local broadcast business? Post a comment!

Categories: Broadcasters, Syndicated Video Economy, Technology

Topics: CBS, CBS TV Stations Digital Media Group, Seevast, WorldNow

-

My 3 Takeaways from 2008 Media Summit

I had 3 key takeaways from the 2008 Media Summit which just wrapped up in NYC. The event just keeps getting better - great keynotes, terrific informal hallway chit-chats/networking and tons of well-directed energy. Though the event's agenda is broad, I was focused on the video-related elements. Here are 3 takeaways:

1. Iger and Moonves Get Tech; Lots of Innovation/Growth Ahead

A clear highlight for all attendees was the 2 morning keynote interviews, day 1 with Disney CEO Bob Iger and day 2 with CBS CEO Leslie Moonves. Both were ably conducted by senior Businessweek editors. Until a couple years ago, big media was in a defensive crouch regarding technology's uninvited incursion into their businesses. No more. Iger and Moonves are obviously convinced that technology, the Internet and broadband video delivery are now their companies' friends. Iger in particular really pounded this theme home.

An example of how technology helps which Iger repeatedly touched on was how Disney will leverage the platform of Club Penguin, its recent acquisition, to build communities for other properties (e.g. "Cars", "Pirates," etc.). These moves are intended to engender ever-greater levels of engagement. By the way, if you're a parent of youngsters and you've ever bemoaned how Disney's gotten its hooks deeply into your kids, you ain't seen nothing yet!

Moonves was emphatic that the Internet extends the value of CBS properties. March Madness was an example he offered. Three years ago it generated $250K of broadband subscription revenue. Two years ago CBS converted to ad-support and generated $4M. Then last year it generated $10M and this year is projected for $23M. And as Moonves pointed out, other than bandwidth, it's all incremental profit for the company. Echoing another conference theme, he further added that "the Internet should not be used to just regurgitate TV," but rather for the medium's unique capabilities.

Iger's and Moonves's mantras are no doubt being sent down to the troops from the executive suite. That suggests we can all expect a whole lot of tech-based innovation springing from these media giants.

2. Engagement and Originality: Buzzwords or More?

Two touchstones in many sessions were "engagement" and "originality." Both reflect the evolving viewpoint that broadband video has its own unique capabilities and that breaking through requires going far beyond traditional, passive programming approaches. With respect to engagement, the concept of introducing "social media" opportunities was often cited as the key tactic. An amorphous term, social media refers to all manner of user participation: content sharing, interactivity, personalization, mashups, uploading, commenting, rating and so on. Basically it's anything that gets viewers to do more than just sit back and enjoy the show. (For those looking to learn more, note next week's webinar on social media, presented by VideoNuze sponsors KickApps and Akamai)

Regarding originality, this relates back to Moonves's comment about not using the medium for regurgitation of TV shows (though to be sure there's value to that). Many people echoed that theme, emphasizing broadband must be used for original programming. The proliferation of independent "broadband studios" is encouraging early evidence that the originality bar will keep rising, prompting established and startup players to harness broadband's limitless possibilities.

3. Missing in Action: Paid business models

It wasn't that long ago that discussions about broadband video business models focused evenly on paid and ad-supported. No more. The paid model was completely missing in action at the event. I think I can count on one hand the number of times the concept was raised in sessions. Also MIA was DRM, the paid model's enabler (or torturer, depending on your perspective).

I detect a broad consensus that the broadband video industry has hitched its wagon to free ad-supported video for the foreseeable future. Many of you know I've been a long-time and enthusiastic proponent of this approach and I'm extremely happy to see things unfold this way. Though the broadband video ad model is still immature, all macro trends point to a bright future. One in particular is video syndication, which I wrote about 2 days ago. Syndication was a dominant theme, as panel representatives from both large and small content providers enthusiastically embraced it. See my post earlier this week, "Welcome to the Syndicated Video Economy" for more on this.

Ok, there you have it. There's plenty more tidbits I took away from the summit, so feel free to ping me if you'd like. And if you attended, post a comment and share your takeaways as well!

Categories: Advertising, Broadcasters, Downloads, Syndicated Video Economy, UGC, Video Sharing

Topics: Akamai, CBS, Disney, KickApps

-

CBS TV Stations Get Broadband Under Leess

(Note: This is the third in a series of posts with companies participating in the 2008 Media Summit, a premier industry event starting tomorrow in NYC. VideoNuze has partnered with Digital Hollywood, the Media Summit's producer, to provide select analysis and news coverage.)

A few months ago, in a post I wrote called "Broadcast TV Stations Most Threatened By Broadband/On-Demand," I asserted that broadband was bringing a perfect storm to the world of local TV stations.

These thoughts were in the background when I spoke last week with Jonathan Leess, President and GM of CBS TV Stations Digital Media Group. CBS owns 29 stations around the U.S. mostly in bigger markets. Leess has been in his role since April '04 and by all accounts has done an admirable job leading the CBS stations into the broadband era.

Most significant is the delicate balance he's tried to strike in centralizing certain online/broadband responsibilities while keeping others at the local level. This is no easy feat. Succeeding online requires scale and common technology platforms. Yet historically local stations enjoy wide autonomy in decision-making as long as they meet their numbers.

Leess explained that in broadband he's focused his corporate group on accessing and providing new non-local content, creating an internal syndication network for stations, developing technology and tools for all stations to use, focusing on national ad sales and training for local sales reps, and importantly generating new viewership by syndicating local stations' video to third parties.

A key part of executing the balancing act has been a relentless focus on work-flow and supporting technologies. Leess explained that the broadband activities at CBS TV Stations are a 24/7 operation involving hundreds of people around the country. Turning all of this into a well-oiled operation, particularly in the context of long-standing operational biases, has been an enormous operational challenge that Leess seems to have embraced.

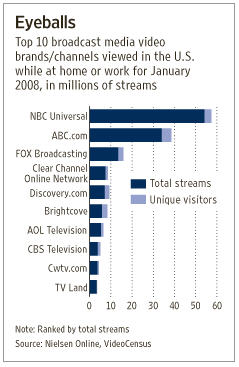

His efforts seem to be paying off. CBS TV Stations drove 89 million video views from their own sites in '07, an average of around 8 million video views/mo from their own sites, a 71% increase over '06. It's gaining an additional 10 million video views/mo through syndication partners. The primary current contributor to

syndication is Yahoo, with whom CBS TV Stations partnered in Oct '06. To put this in context, today's WSJ carried the adjacent graphic of select broadcasters' video views. Putting aside CBS TV Stations' 10 million monthly syndication streams, its '07 monthly average traffic would appear to rank it in the top 5, right around Discovery.com.

syndication is Yahoo, with whom CBS TV Stations partnered in Oct '06. To put this in context, today's WSJ carried the adjacent graphic of select broadcasters' video views. Putting aside CBS TV Stations' 10 million monthly syndication streams, its '07 monthly average traffic would appear to rank it in the top 5, right around Discovery.com. In addition, video clips are a big part of CBS TV Stations' success, as it is posting around 520/day and now offers a searchable library of 350K clips.

Meanwhile the Yahoo deal has been so successful that CBS TV Stations has clearly gotten syndication religion, with several significant announcements planned for the coming weeks. Leess explained how these syndication deals drive unprecedented consumption from out-of-market viewers while also creating valuable ad inventory. For pre-rolls, CBS is getting between $28-75 CPM, with banners fetching $8-18 CPM. Importantly, CBS TV Stations are aggressively bundling on-air/online/broadband packages, having sworn off broadband as a pure "value-add" some time ago.

While I stand by my assertion that local TV stations are most vulnerable to broadband's rise, it is also true that broadband offers stations fresh opportunities. CBS TV Stations' offensive approach shows that with the right leadership, strategy and operational plan, executing a successful transition to the broadband era is quite possible.

What do you think? Post a comment and let everyone know!

Categories: Broadcasters, Portals

Topics: CBS, CBS TV Stations Digital Media Group, Yahoo

-

MTV Networks Dips Toe Into Syndication Waters

I was very happy to see news today of MTVN striking a big video syndication deal for its multiple networks' content with AOL Video.

Recently I praised Comedy Central's launch of TheDailyShow.com, but I took it to task for what appeared to be a destination-centric strategy, which was further supported by some executives' remarks. In this age of syndication, I thought that was a wrong-headed approach. Coupled with Viacom's misguided lawsuit against Google/YouTube, it felt like further evidence that MTVN was falling out of step with key broadband opportunities.

Today's news shows renewed hope that this may not be the case. I know these deals don't get done in a day, but I'd really like to see more syndication momentum from MTVN (and other content providers for that matter) to spread its content far and wide. Broadband Internet users don't expect to have to go to destination sites to get their favorite videos, they want them accessible where they already frequently visit. Hulu and CBS, to name two content providers that are solidly focused on syndication understand this, as do many others.

Categories: Cable Networks, Partnerships, Portals

Topics: AOL, CBS, Google, Hulu, MTVN, TheDailyShow.com, Viacom, YouTube

-

Broadcast TV Stations Most Threatened by Broadband/On-Demand

Last week a journalist interviewing me for a story asked: "Which industry or industries are potentially threatened the most by the rise of broadband video and on-demand usage?"

It's a tough question to answer because there are so many different variables at play. However, if pressed, my answer would have to be local broadcast TV stations. Taking aside the current WGA strike which exposes yet another industry vulnerability, local TV stations find themselves on the short end of just about every macro trend being driven by broadband and on-demand adoption. To thrive in the future, stations are going to have to radically reinvent their business models. It's by no means an impossible task, but it is going to require savvy and aggressive strategic moves.

Consider the perfect storm local stations are up against:

1. Broadcast networks (ABC, CBS, FOX, NBC) are avidly pursuing broadband distribution of their hit shows, creating competition to the traditional model of geographic programming exclusivity for local stations. Initiatives such as Hulu and CBS's Audience Network can be thought of as 'digital replicas" of the old analog affiliate model. Networks have gotten broadband religion; notwithstanding their finessed protestations, they're only going to be increasing their digital bets, leaving their affiliates with new competition for eyeballs at every turn.

2. On demand viewing is shattering prime time viewership and the all important "lead-in" to late news broadcasts. Between DVRs and VOD, more and more of the world is habituating itself to watching programs when they want to, not when they originally ran. So appointment viewing is out and along with it the concept of audience aggregation. Strip out prime time and the local station needs to build audience for its own shows and newscasts by itself.

3. Local news, weather and sports content are the mainstays of local newscasts, yet the availability of this kind of content is becoming pervasive and conveniently accessible. Remember when you had to stay up late to find out what the scores were? Doesn't that seem quaint now? These days every spec of information about these key categories is just a click away, further undermining local newscasts' value.

4. Advertisers have more options than ever and are gradually going to move spending to approaches that are both more ROI-centric (e.g. Google) and a better match for their customers' media behavior. Think about it - if you're a Honda, Scion or Volkswagen dealer targeting younger demos, is local TV really the best way to reach this audience? The range of options for local advertisers is already robust and is only going to become more so in the future.

All of this said, however, all is not lost by any stretch. With the right leadership, I happen to believe that local stations can find ways to manage their way through the chaotic days ahead. Tops on my list would be embracing broadband as a new programming platform to leverage their local expertise, blasting their content out through every possible distribution path, radically re-training their ad sales teams to be Internet-literate, cross platform-obsessed warriors and re-creating their brands' perceptions for the broadband and on-demand era.

Broadcast TV stations need to look no further than their cross-town rival newspapers to understand the gale-force competitive winds coming their way. Hopefully with these examples plainly visible, they'll prepare themselves appropriately.

Categories: Broadcasters

Topics: ABC, CBS, CBS Audience Network, FOX, Hulu, NBC, News Corp

-

Exclusive Brightcove Update with Jeremy Allaire

Yesterday I did an hour-long briefing with Jeremy Allaire, Brightcove's CEO/founder at their Cambridge offices.

Background

If I were to make a list of the 5 questions I've been asked most frequently over the last two years, "What do you think about Brightcove?" would easily be on the list. Certainly a lot of the attention Brightcove has generated relates to its fund-raising leadership. Through three rounds, the company has raised $82 million, including the monster $59.5 million C round closed in January 2007.

By my count the only pure-play, private broadband video company that has raised more is Hulu, which raised $100M in one round from Providence Equity. But Hulu's probably not a fair comparison given that NBC and News Corp are the company's primary owners and are contributing exclusive content. (btw, if anyone has a different take on who's raised more, please leave a comment)

So this briefing was a great opportunity to get a first-hand update and also channel many of the follow-on questions I've been asked about Brightcove. (Full disclaimer, Brightcove is a VideoNuze sponsor.) Jeremy also shared some new stats with me that haven't been disclosed before.

Positioning

Brightcove's positioning has shifted around in the 18 months since its official launch causing many industry tongues to wag.

Jeremy explained that in the summer of 2007 the company did a candid assessment of its competitive standing across areas in which it was involved. While his original vision included a consumer-facing destination site (named Brightcove TV), this assessment concluded that with YouTube's dominance, Brightcove's goal to be number 1 in that business was unlikely to ever materialize. Further, the potential for conflict with its own media customers had become real. So though Brightcove TV had 8 million unique visitors in August, 2007 according to comScore (making it the number 5 player in that space), Brightcove decided to de-emphasize it and reduce investment spending on it to zero. As a result, Brightcove TV now functions mainly as a showcase site.

The company narrowed its focus to its broadband media publishing and management platform, which Jeremy says is now used by 4,000 professional publishers (sample list here), which Brightcove thinks makes it number 1 among its competitors. These publishers operate 7,000 web sites with an estimated combined reach of 120 million unique visitors per month.

The platform business model includes an annual software licensing fee with upside revenue based on the customers' usage. Jeremy denied that the company is taking ad revenue shares in lieu of platform fees, a rumor that has persistently circulated in the market. Brightcove has also continued to build out a professional support team serving the gamut of design, support, integration and customization required by customers.

Broadband Video Market and Advertising

From Jeremy's vantage point the major media companies Brightcove is serving are aggressively focused on building out their direct-to-consumer broadband video destinations, and only recently have they begun also considering syndication. Brightcove's customers' business models skew overwhelmingly in favor of advertising support, with only negligible interest being shown in Brightcove's commerce capabilities.

On this point Jeremy and I have been in agreement for a long time - the macro factors driving ad-supported broadband businesses are very strong, while those driving paid downloads continue to be challenged. The key catalysts for paid models will be mass connections from broadband to TVs, better portability and improved competitiveness with the DVD platform. In the longer-term all of these will no doubt fall into place, however, for as far as the eye can see, broadband is going to remain an ad-dominated industry.

The follow-up question of course is, what kind of advertising will predominate? Brightcove supports a range of options and Jeremy said that recently interest in overlays is running very high, though 15 second pre and mid-rolls are still used by 99% of its customers today. There's a lot of planning or rolling out of overlays coming shortly by Brightcove customers. People.com was shown as an example of a hybrid pre/mid-roll and overlay model that Jeremy thinks will become more prevalent.

Syndication

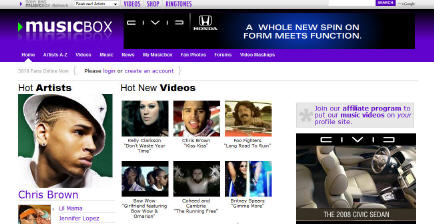

Brightcove is also starting to see heightened interest in syndication, and the company offers a set of tools to support it. One example Jeremy showed which I haven't followed is Sony BMG's "MusicBox" service, which offers an array of syndication options. Sony BMG demonstrates that for sites serious about syndication, it's about far more than moving video files around to third parties. Of course the goals of syndication are still to proliferate the content and brand to drive new revenues from far-flung corners of the Internet, but the mechanisms for optimizing this can be quite involved. There's integration of players, advertising, widgets and more. I've been very bullish on syndication for a while, and the actions by Hulu and CBS's Audience Network to distribute their content show real signs of life in the syndication model.

Going Forward

Not surprisingly, Jeremy's extremely bullish on broadband's future growth and sees opportunities galore to grow Brightcove's revenues by deepening its penetration of existing customers, driving more international business, especially in Asia, and expanding its fledgling presence in the enterprise/government sectors, where there's also been a lot of recent interest.

Regarding competition, Jeremy says Brightcove still sees internal development as an alternative being considered by some major media companies, though to a lesser and lesser extent recently. He also volunteered that both Maven and thePlatform are two companies Brightcove sees most often competing for deals. When asked what differentiates Brightcove, Jeremy cites product quality, ease-of-use, customer/market leadership, quality of its people and R&D. On this last point, he believes Brightcove's relatively deep pockets have helped it maintain a far more aggressive R&D budget, which grew by 300% this year.

Key upcoming priorities include launching "Brightcove Show", its new HD initiative, "Aftermix", its mash-up feature, which just finished up its beta test, multimedia capabilities (photos and audio) and enabling a slew of social/sharing features.

I couldn't resist asking Jeremy about Brightcove's last round valuation rumored to be north of $200 million. I've heard much skepticism in the market that the Brightcove's platform-centric strategy does not justify this lofty figure.

Jeremy's response is that based on the company's current revenue and recent growth trajectory, it has "grown into" its valuation and that its multiple is comparable to others he's aware of. His main objective is building a "significant global business" and if that's accomplished then there will be numerous options open for what ultimately happens with the company. He wouldn't comment on M&A, IPO or other potential exits, only saying that he feels no pressure from his investors to liquify their positions any time soon.

To achieve his global ambition, Jeremy says he's focused primarily on what actions Brightcove needs to make to dramatically scale the business, which he thinks can drive a real premium for Brightcove's valuation. To the extent that broadband remains mainly an ad-supported business, I think Jeremy correctly understands that scale - in customers, streams, usage, geographic reach, etc. - are absolutely central to success. When asked the classic "what keeps him up at night?", he cites as his chief source of insomnia the challenge of building out every part of the organization to support his goal of massive scale.

As Brightcove continues to evolve and grow, one thing is for certain - all eyes in the broadband industry will be watching its progress.

Categories: Technology

Topics: Brightcove, CBS, Hulu, Maven, Providence Equity, Sony BMG, thePlatform

-

NFL Demonstrates Syndication is Not Right for Everyone

As many of you know, in general I'm a big-time advocate of syndication as a strategy to permeate broadband video into all the "nooks and crannies" of the Internet. Many content providers have embraced this path, most recently Hulu and CBS (with its Audience Network). The purpose of syndication is to ensure that content reaches users where they currently visit, as opposed to requiring them to come to a new destination. That "destination-centric" approach was of course the way the traditional media industry worked.

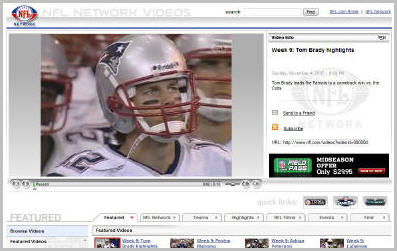

But the NFL shows that syndication isn't right for everyone. In instances where there is genuinely unique content, it can make sense to pursue a pure destination strategy.

To illustrate, yesterday I missed part of the Patriots-Colts game. Though I did catch the end, I was eager to see the big plays. During the parts of the game I saw there were several promos for video available at NFL.com. So post-game I started pinging the NFL's site and it turned out that within about 1 1/2 hours of the end of the game, there was a 5:13 edited montage posted. It included most of the big plays and was available exclusively at NFL.com.

The NFL caused a kerfuffle earlier this year when it issued highly restrictive rules governing use of and monetization of its game video. But having had this experience, I think they made the right call. When you have must-see content and own all the rights, I think it is indeed better to pursue a destination strategy. You get all the views. You get all the monetization. You get all the site loyalty and cross-promotion opportunities. You get everyone linking to you. And you have the exclusive archive.

It's rare to own something as valuable as NFL game video. But if your video does have similar attributes, then I would encourage considering destination over syndication. If you go this route though, being highly proactive to serve users' interests, as the NFL is doing, is essential to success.

Categories: Sports

-

Local TV Broadcasters: Gird Yourselves for Broadband's Onslaught

Today I had the privilege of speaking to a top broadcast TV group's senior executives at their annual offsite. Their president has seen my presentation at the NAB Futures Summit 6 months ago and invited me in to speak.

It's important to recognize there's a bit of a schism happening in the broadcast TV industry, fueled by broadband. One the one hand, broadcast networks (ABC, CBS, FOX, NBC) are rushing headlong into broadband distribution. It's hard to remember, but it's been less than 2 years since Disney/ABC did its first digital distribution deal with iTunes. Since that time all networks have struck iTunes and other download deals, have put made most of their hit shows available for streaming, and more recently have plowed into new ventures (Hulu, CBS IAN, etc.) meant to dramatically broaden their digital reach. In short, the networks have smelled the coffee - they are moving to create what I've called a "digital replica" of the traditional broadcast industry.

None of this is good news for local TV broadcasters, until recently the only place to go for networks' hit programs. Naturally these digital alternatives will further fragment audiences jeopardizing lead-ins for late news and undermining ad revenues. On the bright side, many broadcasters aren't sitting still. In recent research Broadband Directions completed, we found that 46 of 50 (92%) stations we've been tracking now offer broadband video at their web sites. And of the 46, 39 (85%) are selling some kind of ads (pre-roll, display, sponsorships) against their video.

While this is encouraging, there's a long way to go. By and large local broadcasters' broadband video is a collection of newsclips, offering little personalization, targeted ads or widespread syndication. These and other areas offer broadcasters ample opportunity. Broadband is a real game-changer for local broadcasters, who need to gird themselves for its coming onslaught. But with sufficient willingness to adapt their models, they should be beneficiaries as well.

Categories: Broadcasters

-

CBS Begins to Embrace

CBS has announced that it is partnering with at least 13 "leading community-building websites and social application providers" to allow its users to incorporate clips in their pages at these sites.

CBS has announced that it is partnering with at least 13 "leading community-building websites and social application providers" to allow its users to incorporate clips in their pages at these sites.I think this is a great step by CBS toward embracing what I have termed the "clip culture."

Our Q4 '06 report on the broadcast industry and broadband video concluded that to date, the networks have looked at broadband as simply a new distribution path for existing programming. While this is a significant opportunity, another big one is using the broadband medium to redefine the kind of programming they offered and how fans could engage with it.

Since traditional networks are steeped in 30 and 60 minute thinking, they've been slow to recognize how powerful short (i.e. 2 minute'ish clips) are online. YouTube exploited networks' reticence, with users uploading tons of networks' clips (albeit without permission, but that's another story).

The language of the CBS press release is a little vague, but it suggests that CBS will determine which clips users can embed. This is a great start. While this announcement is a positive, it doesn't appear to go far enough in allowing users to actually create their own clips for embedding. That would be the ideal. Hopefully that's coming next. That's what today's users want.

Categories: Cable Networks

Topics: CBS

-

CBS Announcement is More Great Fodder for Upcoming NAB Super Session

Yesterday’s announcement from CBS that it has formed the CBS Interactive Audience Network, and partnered with AOL, Microsoft, CNET, Comcast, Joost, Bebo, Brightcove, Netvibes, Sling Media and Veoh provides even more discussion material for the Super Session panel I’m moderating, which is coming up on Tuesday, April 17th at NAB 2007 (“The Revolutionizing Impact of Broadband Video”).

I’m always a little reluctant to use a word like “revolutionizing”, as it just feels a bit hyperbolic. Yet, what CBS announced yesterday, in combination with the NBC-News Corp JV announcement a few weeks ago sure does seem to signal that these networks themselves are willing to take new risks and be much more opportunistic with how their prized programs get to audiences’ homes. I give these companies all a lot of credit – they are demonstrating a willingness to challenge their existing (and longstanding) business models though the economics and potential of these new models are not yet clear.We’ll be getting into all of this and more at NAB – come join us!Categories: Broadcasters, Partnerships

Topics: AOL, Bebo, Brightcove, CBS, CBS Interactive Audience Network, CNET, Comcast, Joost, Microsoft, Netvibes, Sling Media, Veoh

Posts for 'CBS'

Previous |