-

Channels.com Launches "Web Video DVR"

Inevitably, the explosion of broadband video programming has led to the problem of how to keep viewers' favorites organized and receive updates when new episodes appear. Recognizing this problem and believing it is likely to become even more acute as more mainstream users adopt video and choices continue to grow, Channels.com is launching today, positioning itself as "your web video DVR." Last week, Sean Doherty, Channels.com's CEO and founder gave me an overview.

I've known Sean since our cable days in the mid-'90s, and he's been tweaking Channels for a couple of years, providing me periodic sneak peeks. The best way to think of Channels is analogously: Channels is for video what RSS readers are for text. Sean's insight was that most serialized video is now published with MRSS, RSS 2.0 or iTunes feeds which can be collected and then presented well in a central viewing environment. Channels is like a feed reader that is optimized for video.

Importantly, Channels doesn't touch the source video or the accompanying ads; everything is passed through as is. That means for content providers Channels increases reach and ad inventory without

disrupting the experience. Channels also doesn't actually record web shows, making its "DVR" tagline and references to "recording" somewhat misnomers. More accurately Channels is a "network DVR" since it's simply organizing feeds that exist in the cloud. Channels' secret sauce is how it crawls the web searching for feeds that may contain video "enclosures" or files. Those that do are then incorporated into the Channels directory with searchable metadata. Sean reports that Channels now includes 160K+ shows, including 400+ TV shows.

disrupting the experience. Channels also doesn't actually record web shows, making its "DVR" tagline and references to "recording" somewhat misnomers. More accurately Channels is a "network DVR" since it's simply organizing feeds that exist in the cloud. Channels' secret sauce is how it crawls the web searching for feeds that may contain video "enclosures" or files. Those that do are then incorporated into the Channels directory with searchable metadata. Sean reports that Channels now includes 160K+ shows, including 400+ TV shows.I've been playing around with Channels and my experience has been mostly positive. I was quickly able to find and view recent episodes of some of my favorite shows like David Pogue from the NY Times, "The Daily Show with Jon Stewart," "Barely Political" and a couple Revision 3 shows I dip in and out of like "AppJudgment." On the flip side, it was hard to find shows like "Heroes" and "Lost" although Sean says they're still in the process of loading up all the content.

Though a display advertising model is readily at hand, Sean says he has no immediate plan to monetize Channels. For now he's focused on building traffic, optimizing the user experience and seeing how the video landscape unfolds. Once past its development phase, Channels is a pretty low-burn rate operation, self-funded by Sean and other angels. A key part of building its distribution and use is by incenting video providers to place a Channels "chicklet" on their sites, so video can be instantly added to users' Channels playlists.Valuable as Channels and others trying to organize the web video user experience are for computer-based viewing, where they will really resonate is when web video moves to the TV. A significant navigation challenge lies ahead in the living room, compounded by lack of keyboards and mice there. In fact after using Netflix's Watch Instantly feature to send content to my Roku, I'm becoming more convinced that the convergence paradigm may be that you organize/choose content on your computer and navigate/consume on your TV.

All of these issues still lie ahead. For now Channels has introduced a neat new way of making the most of the broadband video viewing experience.

What do you think? Post a comment now.

Categories: Startups, Technology

Topics: Channels.com

-

VideoNuze Report Podcast #28 - August 21, 2009

Daisy Whitney and I are pleased to present the 28th edition of the VideoNuze Report podcast, for August 21, 2009.

In this week's podcast, Daisy and I first tackle the subject of the Southeastern Conference's new media policy fumble that I wrote about on Wednesday this week. For the upcoming football season, the SEC first banned all social media in the stadiums by game attendees, and later revised it to just exclude fan-generated video of game action.

I took the SEC to task, suggesting that the policy was wrongheaded because it limits the role that fan video could play in expanding the game experience and incorrectly assumes that fan video might actually compete with live game feeds from partners ESPN and CBS. Further, the policy is completely impractical to enforce, requiring security officers to frisk entering students and examine cell phones for video capability.

Daisy raises the example of when YouTube posted the infamous SNL "Lazy Sunday" clip, and NBC ordered it to take the clip down, foregoing tons of free promotion. That incident occurred almost 4 years ago, and since then major media companies have come a long way in adopting the role of user-generated video and video sharing as a promotional tool (see this week's Time Warner-YouTube clip deal as further evidence). On the other hand, the SEC still appears to be living in the stone ages. Somebody there needs to get their game on.

Shifting gears, Daisy explores the idea of how technology is helping video producers collaborate far more extensively than ever before. Producers and creators are now able to share images and raw footage to an unprecedented degree, which is making the creative process far more efficient. That in turn leads to more extensive creative output. Daisy identifies a slew of technology providers who are active in this emerging space.

Click here to listen to the podcast (13 minutes, 50 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Podcasts, Sports, Technology

Topics: CBS, ESPN, Southeastern Conference, XOS

-

Motionbox, Others Target Families' "Chief Memory Officers"

If your family or extended family is like most, then someone in your home is what Josh Grotstein, CEO of Motionbox, refers to as a "Chief Memory Officer" or family "CMO." That's the person who's responsible for toting the camera/camcorder, uploading, developing and distributing the family's photos and videos to family and friends, and storing the treasures for future use.

And just as the proliferation of digital cameras launched Ofoto, Shutterfly and SnapFish (plus sites like Flickr, Picassa, etc.), who targeted the family CMO to help manage and create further value from their growing digital photo collections, the advent of inexpensive video cameras is creating a new set of companies looking to help CMOs manage their family's video assets.

While still early days, the impending explosion of video-capable smartphones, coupled with cheaper HD camcorders and popular low-end video cameras (e.g. Flip, etc.), all suggests this is yet another growing

corner of the market fueled by broadband video's adoption. To learn more I spoke last week with Josh and with Andres Espineira, President and co-founder of Pixorial, which recently emerged from private beta.

corner of the market fueled by broadband video's adoption. To learn more I spoke last week with Josh and with Andres Espineira, President and co-founder of Pixorial, which recently emerged from private beta. These companies and others in the space like iMemories, provide a number of key features and value propositions - uploading new or archived digital video (or sending physical tapes), easy transcoding from multiple formats into multiple formats, storage, online editing to create short movies which can be shared online and offline, and customized hard goods/gifts

The primary play here is to get the CMO engaged in the act of editing raw video footage, to stay organized

and/or optimize their memories. Sharing becomes a pretty logical extension though, as does getting other stakeholders involved. For example, these stakeholders could include other moms/dads uploading video from their kids' soccer games to multiple wedding guests who shot their own video. Getting these people to mix and edit (and then share and order hard goods/gifts) is the behavior these companies hope to engender. Since most people don't fancy themselves as video editors, the online tools need to be extremely easy-to-use.

and/or optimize their memories. Sharing becomes a pretty logical extension though, as does getting other stakeholders involved. For example, these stakeholders could include other moms/dads uploading video from their kids' soccer games to multiple wedding guests who shot their own video. Getting these people to mix and edit (and then share and order hard goods/gifts) is the behavior these companies hope to engender. Since most people don't fancy themselves as video editors, the online tools need to be extremely easy-to-use. Another point of commonality is that these companies all use some type of "freemium" model, where a base level of service is offered for free, with the goal of converting a percentage of freebies to paid services tiers. The freemium model has become widely used online, and has been further popularized recently by Chris Anderson's new book "Free," which contends "freemium" is the way of the future.

Yet as Josh explained, freemium creates a delicate balance, where user behavior must be carefully monitored. The biggest cost driver is storage, so as more free users look to these services as providing back-up redundancy, a higher percentage of them need to be converted to paying in order to make the whole model work. Josh explained that Motionbox (which has raised $17M to date and is the granddaddy of the category with 2M+ registered users) has continuously tweaked its model to optimize the conversion process. It is moving to a model where free users get a finite number of free uploads, and then beyond that you have to pay. In a world where YouTube is the free standard for video sharing, creating and effectively communicating the value of being a premium sub is all-important.

Assuming this hurdle can be surmounted, the proliferation of convergence devices suggests even more tailwind for the category. Think about being able to easily share and access your movies online through devices like Roku, Xbox, Internet-connected TVs, etc. Even incumbent service providers (cable/satellite/telco) could find value in offering personal video services, white-labeled by these companies.

While video is a more complex media format than photos, as more CMOs shoot more video that they want to save and share, it's likely this category will continue to see plenty of growth.

What do you think? Post a comment now.

Categories: Technology, Video Sharing

Topics: iMemories, Motionbox, Pixorial

-

4 Items Worth Noting from the Week of August 10th

Following are 4 news items worth noting from the week of August 10th:

Discovery Channel signs onto Comcast On Demand Online trial - Comcast added yet another cable programmer this week to the roster of those participating in its TV Everywhere trial. Discovery will make available episodes of "Man vs. Wild," "Swords," "Stormchasers" and "Verminators" though with some delayed windows that take a little edge off their appeal. Comcast has made a ton of progress corralling networks for its trial, but 4 of the big 5 cable network owners - Disney, Fox, NBCU and Viacom - remain holdouts. No coincidence that the first 3 are Hulu's owners.

Swarmcast powers MLB.TV on Roku, introduces "Autobahn Live for CE" - Following on Roku's announcement this week that it is offering MLB.TV, Swarmcast announced it was powering the service through a new offering called "Autobahn Live for CE." Swarmcast's COO Chad Tippin explained to me that integrating with CE devices that drive broadband/TV convergence is a key company goal. Chad is confident that Swarmcast's high-quality, scalable HTTP streaming service will work on these various CE devices, and that as the number of them deployed swells, a new "long tail of live sports" will flourish. Live sports and events (e.g. concerts) could be a significant contributor to device adoption. For example, picture getting a coupon for $50 off the purchase of a Roku when you buy a pay-per-view of a streaming blockbuster concert.

Babelgum grows to nearly 1.7 million unique visitors in July, 2009 - I heard from Michael Rosen, EVP and Chief Revenue Officer at Babelgum this week, with news that the site has grown to nearly 1.7 million unique visitors in July (comScore), following its U.S. launch in April. I profiled Babelgum back in April and was cautiously optimistic about its approach to curate high-quality, independently-produced video into 5 channels (music, film, comedy, Our Earth and Metropolis). The site is fully ad-supported. Babelgum's growth comes on top of a slew of made-for-broadband video initiatives I detailed recently. The NY Times also had a great story this week on how independent filmmakers are taking distribution into their own hands. Despite the recession, this corner of the broadband market seems to be hanging in there.

Zune HD coming Sept 15th - Microsoft at last announced this week that the Zune HD digital media player will be in retail on Sept 15th, with pre-orders now being accepted. Zune HD introduces a touch-screen interface, 720p video playback, HD radio and other goodies. It is sure to raise the visibility of high-quality portable video another notch. But I find myself wondering: as the iPhone and other smartphones incorporate video playback (and recording) into one device, how large is the market for standalone high-end media players like Zune? Related, the iPhone's risk of cannibalizing the iPod has become a hot topic recently. Things to ponder: will users want to carry 2 devices? Or might they appreciate the ability to drain their battery watching video without risking the loss of their cell phone? Lots of different things in play.

Categories: Aggregators, Cable Networks, Cable TV Operators, Devices, Indie Video, Sports, Technology

Topics: Apple, Babelgum, Comcast, Discovery, iPhone, iPod, Microsoft, MLB.TV, Roku, Swarmcast, Zune

-

4 Items Worth Noting from the Week of August 3rd

Following are 4 items worth noting from the week of August 3rd:

1. Research, research, research - For some unknown reason, there was a flurry online video-related research and forecasts released this week. In no particular order:

eMarketer was out with a new forecast indicating 188 million online video viewers in the U.S. in 2013.

Veronis Suhler released its forecast of 2009-2013 communications industry spending, showing advertising shrinking as a percentage of total spending.

PWC's UK office released its 2009-2013 forecast, which also anticipates declines in advertising.

CBS's research head David Poltrack used detailed data to explain the company's online video strategy and buttress its argument that in a TV Everywhere world, it should be compensated for its content (slides are here, via PaidContent).

Ipsos found that Americans streamed a record amount of TV programs and movies, doubling their consumption from Sept '08 to July '09.

Yahoo and a group of research partners released data finding that 70% of online video consumption happens throughout the day and night, as opposed to traditional TV viewing which is concentrated in the prime-time window.

Last but not least, TDG released excerpts of its research on "over-the-top" video services, available for download at VideoNuze.

2. Unicorn Media launches, hires ex-Move Networks executive David Rice - It will be hard for some to believe there's room for yet another white label video publishing and management platform, but startup Unicorn Media is going to try elbowing its way into the crowded space, with a specific focus on large media companies. I spoke with Unicorn's executive team this week, led by Bill Rinehart, who was the founding CEO of Limelight.

Unicorn is positioning itself as the first "enterprise-grade" solution, staking out key differentiators such as enhanced analytics/reporting, faster/easier transcoding, improved APIs for content ingest/management and more flexible monetization/ad queuing. I have not yet seen a demo, but I'm intrigued by what I heard. The company has raised $5M to date from executives/angels and has a staff of 25. David Rice, formerly Move's VP of Marketing has come on board as Chief Strategy Officer. Given the team's industry expertise and relationships, this could be a company to watch.

3. Google acquires On2 Technologies and other encoding-related news - The blogosphere was in a flurry about Google's $106M acquisition of video compression provider On2 Technologies this week. Speculation flew about Google open-sourcing On2 new VP8 codec, which could potentially force a new standard to emerge as a challenge to H.264, today's leading codec. This is important stuff, though a little further down the stack than I usually focus, so I refer you to Dan Rayburn's analysis of the deal's implications, which is the best I've seen.

There was other news in the emerging cloud-based encoding/transcoding/delivery market this week, as Encoding.com announced a new premium service with tighter service level agreements (4 minute max wait time and 50 Gbyte/hour/customer throughput). Encoding.com's Gregg Heil and Jeff Malkin explained the company is using the new SLAs to move upmarket to service tier 1 and 2 media companies. Separate, Encoding.com's competitor mPoint's CEO Chiranjeev Bordoloi told me they're now on a $3M annualized revenue run rate as cloud-based alternatives continue to gain acceptance.

4. Don't try this at home - On a lighter note, there's been no shortage of knuckle-head stunt videos we've all seen online, but this one is near the top of my personal favorite list. Do NOT try replicating this over the weekend!Categories: Deals & Financings, Technology

Topics: CBS, eMarketer, Google, Ipsos, ON2, PWC, TDG, Unicorn Media, Veronis Suhler, Yahoo

-

VideoNuze Report Podcast #26 - August 7, 2009

Daisy Whitney and I are pleased to present the 26th edition of the VideoNuze Report podcast, for August 7, 2009.

In this week's podcast, Daisy discusses her article on ExtendMedia's new OpenCase Publisher product targeted to support TV Everywhere-type initiatives, which I also wrote about this week. Daisy is observing a trend toward vendors organizing themselves for TV Everywhere, recognizing that while Comcast appears to be the first to market in testing TV Everywhere, other service providers are moving ahead as well. It's a complex new area and we both expect to see a number of vendors throw their hat in the ring to become preferred solutions.

Separate, I add further detail to my post, "Despite Hurdles, Made-for-Broadband Video Projects Proliferate," which describes many examples of new independent web series that have been announced over the past couple of months. It turns out to be a pretty lengthy list, helping to debunk some of the doom and gloom that's hung over this market, created by the ongoing recession in general plus the failure of some high-profile independents like 60Frames, Ripe, ManiaTV and others. When you review the list, you realize there's still a lot of experimentation going on and plenty of people trying to capitalize on the broadband medium. We expect this to continue.

Click here to listen to the podcast (12 minutes, 58 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Indie Video, Podcasts, Technology

Topics: ExtendMedia, Podcast

-

ExtendMedia Looks to Support TV Everywhere Initiatives with OpenCase Publisher Launch

With momentum growing for "TV Everywhere" type services, it's to be expected that technology vendors will begin offering products that meet the evolving range of requirements video service providers will

encounter. One example is ExtendMedia, which today is introducing OpenCase "Publisher." With TV Everywhere type services still so new, even labeling the various capabilities video service providers will require to succeed is still a work in process. In a meeting last week, Extend's executives helped me understand what will be needed and what the Publisher product provides.

encounter. One example is ExtendMedia, which today is introducing OpenCase "Publisher." With TV Everywhere type services still so new, even labeling the various capabilities video service providers will require to succeed is still a work in process. In a meeting last week, Extend's executives helped me understand what will be needed and what the Publisher product provides. To date, much attention around TV Everywhere has focused on "authentication" - how a service provider would implement credentials (e.g. logins and passwords) so only authorized users could access its online video catalog. This gatekeeping step has rightly received a lot of focus, because leakage of any premium video must be prevented. Authentication is tricky though, as users must be verified as being who they say they (e.g. passwords haven't been improperly shared). But assuming for a moment that tight authentication processes are implemented, other challenges and opportunities remain.

For example, once authenticated, service providers need to be able to expose only those parts of their overall catalog each specific user is entitled to view (e.g. if I'm not an HBO subscriber, I shouldn't get access to HBO programs online). This notion of "service management and provisioning" means service providers need to create different bundles online, just as they have done offline. And the bundles need to be easy to change: a service provider may want to change a channel lineup and/or a subscriber may want to add a new channel.

Service management and provisioning itself requires that there's a scalable content management system in place. The service provider will need to be able to ingest lots of premium video from many different sources while also and accepting and assigning specific rules to each program as needed (e.g. one program may be available immediately and indefinitely, while another will be available just for a week, but starting at a specified future time). In addition, metadata must be assigned so programs can be tracked, and searched by users.

The above requirements are further complicated because TV Everywhere services are envisioned to work across multiple devices as well. That means that authentication must also work on smartphones, gaming consoles, portable media players, etc. The devices themselves must be registered and recognized so they can be linked to users' accounts. In some cases license terms will further restrict how specific parts of services are accessible, and under what addition terms (in turn possibly requiring DRM).

Last but not least is monetization. Given current plans not to charge extra for TV Everywhere, advertising from online viewing is the main new revenue-generating opportunity. So integrations with ad servers already used by content providers, along with the ability to measure and report on usage, is another crucial capability. Separate, a totally new monetization opportunity will be trying to upsell online subscribers on new services. For instance, HBO might run a promotion offering a sneak peek of a "True Blood" premiere to all TV Everywhere users. The service provider needs to not only support the promotion, but also offer one-click upsell subscription to HBO, and dynamic provisioning of the whole HBO catalog to the new subscriber.

As I've written previously, TV Everywhere is an exciting step forward for both the broadband industry and video service providers. Yet it is a very new world where things get complicated very fast. Vendors like Extend - and other leaders like thePlatform and Irdeto to name two - which have traditionally focused on cross-platform support for video service providers are increasingly going to be called on to turn executives' visions into reality.

What do you think? Post a comment now.

(Note - ExtendMedia and thePlatform are VideoNuze sponsors)

Categories: Technology

Topics: ExtendMedia, Irdeto, thePlatform

-

Will Kaltura's Open Source Video Platform Disrupt the Industry?

This morning Kaltura takes the wraps off its "Community Edition" open source video platform, available as a free download, thereby threatening to disrupt its established proprietary competitors (e.g. Brightcove, thePlatform, Ooyala, Digitalsmiths, Fliqz, Delve, VMIX, etc.). Yesterday Kaltura's CEO Ron Yekutiel explained open source and Community Edition's opportunity. Later in the day I spoke to executives at many of its competitors to get their take what impact open source will have on the video platform market.

As a quick primer, open source isn't a novelty; it's a standard way that certain kinds of software are now developed. Successful companies like Red Hat have been built around open source. In fact many of today's web sites run on the open source software stack commonly known as "LAMP" - Linux (OS), Apache (web server), MySQL (database) and Perl/PHP/Python (scripts). Kaltura has been pioneering open source in the video platform industry which has been dominated by proprietary competitors. Ron believes the video platform industry is ripe for open source success because it has too many proprietary companies offering minor feature differences, all using a SaaS model only and competing too heavily on price.

Kaltura Community Edition's three big differentiators are that it's free for the base platform and offers greater control through self-hosting which can be behind the customer's firewall. Ron also believes that by tapping

into the open source community, CE can offer more flexibility and extensibility than its competitors.

into the open source community, CE can offer more flexibility and extensibility than its competitors. As with all open source options though, free isn't "free," because if you're interested in support and maintenance, professional services for customization and certain features like syndication, advertising, SEO and content delivery, these all cost extra. And you can't forget about the costs of the internal staff you'd need to run the video platform or the costs of the infrastructure itself (servers, bandwidth, storage, etc.). In the SaaS world, many of these costs are borne by the provider and then reflected in the monthly fee. Determining which approach is more cost-effective depends on your particular circumstances and needs.

All of this is why, as one competitor's CEO told me yesterday, the choice to go open source more often than not isn't primarily price-based; rather it's features-based. In fact, given the range of low cost proprietary alternatives (e.g. $100-$200/mo packages from companies like Fliqz and Delve), even free doesn't represent really significant savings.

When it comes to features, clearly the ability to download CE and self-host is a big differentiator, and will be valued by segments of the market. As Ron pointed out, there are government agencies, universities and others who have mandates to self-host. He also noted that by customers' gaining access to CE's code, their ability to integrate with other applications and customize is enhanced (though again, not without an additional cost).

Other industry executives countered that unless you have to self-host, these advantages are diminished by the fact that in this capex and opex budget constraints make SaaS more appealing than ever, especially for smaller customers with less in-house technical expertise. They added that they're rarely asked about self-hosting options (though that could well be due to self-selection).

Further, many of the leading video platform companies offer a slew of APIs, which open their platforms to 3rd party developers without needing to be open source per se (examples include Brightcove's and thePlatform's robust partner programs). Another industry CEO noted that while there's a gigantic and highly active open source community in the LAMP world, it remains to be seen just how vibrant it is in the video space. And it's important to remember that the intense competition among today's video platforms have already driven the feature bar quite high.

So the question remains: will Kaltura's CE open source approach truly disrupt the video platform industry, causing rampant customer switching and gutting today's pricing models? My sense is no, or at least not immediately. Instead, Kaltura will definitely grow the market, creating new video customers from those who have been dissatisfied with current choices or have not yet jumped into video, but inevitably will. CE will likely peel away some percentage of existing proprietary customers who have been eager for a self-hosted, open source alternative. For many others though, they'll be keeping an eye on open source and will successfully push their existing providers to adopt similar capabilities if they're valued.

What do you think? Post a comment now.

Categories: Technology

Topics: Brightcove, Delve, Digitalsmiths, Fliqz, Kaltura, Ooyala, thePlatform, VMIX

-

Move Networks' New President/CEO Roxanne Austin Explains Company's Advantages

I spoke to Roxanne Austin this afternoon, whom Move Networks announced as its new president/CEO earlier today. Roxanne is a former president/COO of DirecTV, partner at Deloitte & Touche, and current board member of Ericsson, Target, Abbott Laboratories and Teledyne. Since 2004 she's been running her own investment and consulting firm Austin Investment Advisors. Move's president/CEO slot has been vacant since the spring when John Edwards was shifted to Executive Chairman.

Roxanne believes Move's distinct competitive advantage is that it is the only provider of end-to-end solutions for high-quality live, streaming and VOD video delivery. Roxanne sees the timing as being right for

Move because the industry has evolved to an understanding that broadband video must have both paid and advertising-based models. In addition, it must be able to offer users traditional linear experiences as well as VOD, all in HD.

Move because the industry has evolved to an understanding that broadband video must have both paid and advertising-based models. In addition, it must be able to offer users traditional linear experiences as well as VOD, all in HD.My recent post on Move's repositioning detailed the company's new focus on supporting video service providers (e.g. cable, satellite, telco, ISPs, etc.), however Roxanne equally weights content providers (its traditional customer base). As Roxanne put it, "we want to follow the rights." In other words, whoever has the ability to distribute premium video content - either the creator or the authorized distributor - is in Move's sights.

Roxanne wants to see Move's adaptive bit rate streaming technology remain best-of-breed, even as new competition from Microsoft and Adobe heats up. But I think she correctly emphasizes that the company's total solution - which now includes Inuk's "virtual set-top box" software - is how it will distinguish itself.

As all industry participants feel the pinch of the recession and the need to demonstrate viable broadband business models, better video quality alone is not sufficient to succeed. Move is betting that by supporting traditional linear, paid models, along with new VOD (and sometimes ad-only)-based models, it will be the technology partner of choice.

There are a lot of moving pieces here, but Roxanne's industry relationships and know-how surely enhance Move's odds of eventual success.

What do you think? Post a comment now.

Categories: People, Technology

Topics: Move Networks

-

Catching Up on Last Week's Industry News

I'm back in the saddle after an amazing 10 day trip to Israel with my family. On the assumption that I wasn't the only one who's been out of the office around the recent July 4th holiday, I've collected a batch of industry news links below so you can quickly get caught up (caveat, I'm sure I've missed some). Daily publication of VideoNuze begins again today.

Hulu plans September bow in U.K.

Rise of Web Video, Beyond 2-Minute Clips

Nielsen Online: Kids Flocking to the Web

Amid Upfronts, Brands Experiment Online

Clippz Launches Mobile Channel for White House Videos

Prepare Yourself for iPod Video

Study: Web Video "Protail" As Entertaining As TV

In-Stat: 15% of Video Downloads are Legal

Kazaa still kicking, bringing HD video to the Pre?

Office Depot's Circuitous Route: Takes "Circular" Online, Launches "Specials" on Hulu

Upload Videos From Your iPhone to Facebook Right Now with VideoUp

Some Claims in YouTube lawsuit dismissed

Concurrent, Clearleap Team on VOD, Advanced Ads

Generating CG Video Submissions

MJ Funeral Drives Live Video Views Online

Why Hulu Succeeded as Other Video Sites Failed

Invodo Secures Series B Funding

Comcast, USOC Eye Dedicated Olympic Service in 2010

Consumer Groups Push FTC For Broader Broadband Oversight

Crackle to Roll Out "Peacock" Promotion

Earlier Tests Hot Trend with "Kideos" Launch

Mobile entertainment seeking players, payment

Netflix Streams Into Sony Bravia HDTVs

Akamai Announces First Quarter 2009 State of the Internet Report

Starz to Join Comcast's On-Demand Online Test

For ManiaTV, a Second Attempt to be the Next Viacom

Feeling Tweety in "Web Side Story"

Most Online Videos Found Via Blogs, Industry Report

Categories: Advertising, Aggregators, Broadcasters, Cable Networks, Cable TV Operators, CDNs, Deals & Financings, Devices, Indie Video, International, Mobile Video, Technology, UGC

Topics: ABC, C, Clearleap, Clippz, Comcast, Concurrent, Hulu, In-Stat, Invodo, iPod, Kazaa, Nielsen, Office Depot, Qik, VideoUp, YouTube

-

4 Industry Items from this Week Worth Noting - 7-2-09

Clearleap announces Atlantic Broadband as first public customer - Clearleap, the Internet-based technology firm I wrote about here, announced Atlantic Broadband as its first public customer. Atlantic is the 15th largest cable operator in the U.S. I spoke with David Isenberg, Atlantic's VP of Products, who explained that Clearleap was the first packaged solution he's seen that allows broadband video to be inserted into VOD menus without the need for IT resources to be involved. Atlantic initially plans to use Clearleap to insert locally-oriented videos into its local programming lineup. It also has special events planned like "Operation Mail Call." which allows veterans' families to upload videos, plus coverage of local sports, and eventually filtered UGC. By blending broadband with VOD, Isenberg thinks Clearleap gives him a "giant marketing tool" to raise VOD's visibility. As I've said in the past, VOD and broadband are close cousins which can be mutually reinforcing; Clearleap facilitates this relationship.

New Balance's "Made in USA" video - Have you seen the new 3 minute video from athletic shoemaker New Balance? Yesterday I noticed a skyscraper ad for it at NYTimes.com and a full back-page ad in the print version of the Boston Globe. New Balance's video promotes the fact that it's the only athletic shoemaker still manufacturing in the U.S. (though it says only 25% of its shoes are made here). There's also a fundraising contest to win a trip to one of its manufacturing facilities. Taking ads in online and offline media to drive viewership of a brand's original video is another way that advertising is being reimagined and customers are being engaged.

Joost - R.I.P.-in-Waiting - There's been a lot written this week about Joost's decision to switch business models from content aggregation to white label video platform provider. Regrettably, I think this is Joost's last gasp and they are in "R.I.P.-in-waiting" mode. Joost, which started off with lots of buzz and financing ($45M) by the co-founders of Skype and Kazaa, is a cautionary tale of how quickly the broadband video market is moving, and how those out of step can get shoved aside. Joost made a critical strategic blunder insisting on a client download based on P2P delivery when the market was already moving solidly in the direction of browser-based streaming. It never recovered. Given how crowded the video platform space is, I'm hard-pressed to see how Joost will carve out a substantial role.

Cablevision wins its network DVR case - Not to be missed this week was the U.S. Supreme Court's decision to refuse to hear an appeal from programmers regarding cable operator Cablevision's "network DVR" plan. The decision means Cablevision can now deploy a service that allows subscribers to record programs in a central data center, rather than in their set-top boxes. This leads to lower capex, fewer truckrolls, and more storage capacity for consumers. There's also an intersection point with "TV Everywhere," as cable subscribers will potentially have yet another remote viewing option available to them. Content is increasingly becoming untethered to any specific box.

Categories: Aggregators, Brand Marketing, Cable TV Operators, DVR, Technology, Video On Demand

Topics: Atlantic Broadband, Cablevision, Clearleap, Joost, New Balance

-

R.I.P. Maven Networks

Well, it looks as though it's official: as reported by TechCrunch and others, Yahoo is discontinuing Maven Networks's third party video publishing activities though Yahoo's statement says it will use Maven technology for internal video efforts. As I've mentioned periodically, I was an early consultant to Maven, which was a pioneer in the video platform space.

Way back then (!) in 2003 most people in the media business still had a difficult time imagining why broadband video was so strategic and game-changing. Maven's team did a lot of the early spadework in evangelizing broadband's potential and building market momentum. Its reward was being acquired for $160M by Yahoo in February, 2008 in what I believe is still the largest pure play broadband deal.

However, the Yahoo acquisition was never a perfect strategic fit, even before factoring in the well-documented chaotic mess that Yahoo has become in recent years. The problem was that Yahoo is a media company, deriving the majority of its revenue from advertising. On the other hand, Maven was a technology/products company (though some in the industry always questioned the true proprietary value of Maven's technology). The most strategic deal for Maven would have been with a larger technology/products company, where it would have become part of broader suite of video products and services. Yahoo was never really well-suited to support Maven's third party video customers (and in reality it hasn't for a while now), and with all its other troubles, this move was widely expected.

For Maven's founders and investors, the company's acquisition marked a successful exit that others in the industry envy, particularly in this crummy M&A market. Still, the Yahoo-Maven deal is yet another example that when selling a company, price isn't the sole criteria for longer-term success.

Categories: Deals & Financings, Portals, Technology

-

Digitalsmiths Launches VideoSense 2.0 Including New "Free Form" Video Search Capability

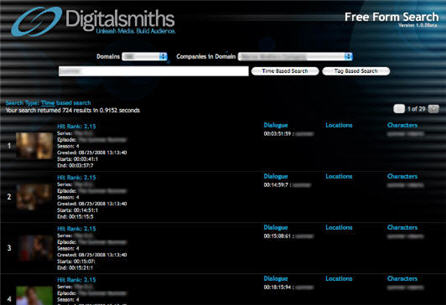

This morning Digitalsmiths, a leading video platform company, is launching VideoSense 2.0, a suite of content management, publishing, presentation and search products. In particular, the new release includes an innovative "free form" video search box that leverages Digitalsmiths' metadata creation capability. Last week I spoke to Ben Weinberger, Digitalsmiths' CEO to learn more.

A key Digitalsmiths' strength has always been its metadata tools, which use a broader, proprietary set of algorithms such as facial recognition, scene classification and object identification. With this release the metadata tags are being organized into what Digitalsmiths' calls a "MetaFrame" - a frame-by--frame analysis of the video file(s) that are all based on time stamps. A MetaFrame in turn enables more accurate video search, content organization and monetization both within a video and across a library of videos.

With respect to video search specifically, Ben explained that VideoSense's search technology matches the submitted term against a video library to return results based on criteria like names, locations, dialogue, objects within a scene or other criteria the content owner specifies. The content owner can also tweak the rules so that specific criteria receive higher weighting. Results are typically returned in half a second or less, providing a video search experience close to what we've come to expect in web search. There's also a "Did you mean?" prompt for more refined results. The free form search box can be integrated onto any web page via an API.

The below example shows the results of a search Ben ran in the demo against a customer's library (unfortunately blurriness is added here due to customer confidentiality).

Of course the more valuable the experience is, the more video is likely to be consumed, generating more streams and ad inventory. Ads too can gain better targeting through MetaFrame processing (and VideoSense is integrated with all the major video ad servers and networks). Deeper, richer search can also power B2B use of video clips, such as when a specific scene from one video is to be incorporated into another (think of a movie like "Forest Gump" that has myriad historical scenes interspersed).

From my perspective metadata is going to become more and more important as the sheer number of videos available explodes with both long-form and derivative short clips. Content owners' key challenge will be to manage these ever-larger libraries (Ben uses the notion of "metadata as the glue" holding libraries together; I think that's an apt description). Others like EveryZing, Grab Networks and Gotuit have also recognized the importance of metadata and have their own approaches. For Digitalsmiths, a differentiator is its focus on extremely large files and its focus on studio customers. It aims to function as a full-blown video platform provider for all forms of digital distribution.

Ben said Digitalsmiths has a slew of customers it will be unveiling in the coming weeks that are using MetaFrame and the VideoSense 2.0 suite.

What do you think? Post a comment now.

(Note Digitalsmiths is a VideoNuze sponsor)

Categories: Technology

Topics: Digitalsmiths, EveryZing, Gotuit, Grab Networks

-

Unveiling Move Networks's New Strategy

Move Networks, the well-funded Internet television technology company which has been virtually silent for the last 60 days since acquiring Inuk Networks and bumping former CEO John Edwards to Executive Chairman, is pursuing a major repositioning. Earlier this week I met with Marcus Liassides, Inuk's former CEO and founder who joined Move's management team, who previewed the company's new strategy to be a wholesale provider of IPTV video services delivered over open broadband networks.

Broadband video industry participants know Move best for its proprietary adaptive bit rate (ABR) technology and player, which power super-high quality live and on-demand video streams for broadcasters

like ABC and Fox. Move gained a lot of attention by raising over $67M, including a $46M Series C round in April '08 from blue chip investors.

like ABC and Fox. Move gained a lot of attention by raising over $67M, including a $46M Series C round in April '08 from blue chip investors.Despite all this, Marcus explained that coming into 2009 Move had at least 3 significant problems, symbolic of how fluid the broadband video market remains.

First, its core business of charging content providers in the range of $.30/GB of video delivered was being pressured by the fact that advertising-only business models couldn't support this pricing. Content providers loved Move's quality; they just couldn't afford it, particularly given the alternative of plunging CDN delivery rates.

Second, Move's pricing and business model were being challenged by both Microsoft and Adobe entering the market with ABR streaming features of their own (I wrote about this here). But because both were enabled on the server side (IIS and FMS respectively), the cost of ABR moved from content providers to CDNs, who might or might not choose to charge extra for these features. Either way, Move's direct cost looked comparatively more expensive, especially as the recession pounded ad spending.

Last, but not least, Marcus explained that Move's product development approach was undisciplined, leading to resources being spread too thin in too many directions. That was reflected by the market's ongoing difficulty in categorizing which business Move was really in.

Meanwhile, U.K.-based Inuk, which had been on its own funding and product development roller-coaster, was delivering its Freewire IPTV service to about 200K university students in the UK, Ireland and Canada. Because Inuk needed to serve these students when they were off campus, it had developed a "virtual set-top box" application that duplicates on the PC the IPTV service that had traditionally been delivered via an expensive IPTV set-top box. Inuk was using Move's ABR technology to power video delivery to the PC. Recognizing potential synergies and trying to address its other issues, Move acquired Inuk in April.

Move's new positioning as a provider of IPTV video services delivered over open broadband networks essentially replicates what Inuk has been doing, except that going forward services will be offered wholesale, not retail like with Freewire. Move's strategy starts from the proposition that to get cable TV networks online requires that they be paid consistent with the norms, rather than expecting them to free and ad-supported only. It also anticipates that consumers demand not just VOD offerings, but a full linear lineup as well (as an aside, that aligns with Sezmi's thinking too). While Move will continue supporting existing customers like ABC and others, its new wholesale model is a major shift in that it uses the company's core technology to support packaged multichannel video services, instead of a la carte web-based video.

Marcus explained that Move is targeting 3 verticals: (1) telcos which haven't traditionally offered video services (or have through direct satellite partnerships), (2) broadband ISPs looking to get into the video business, and (3) existing video service providers looking for a lightweight capex approach for extending their service either for remote access (a la "TV Everywhere") or in other rooms in the house (a model which has traditionally required another set-top box and truck roll for installation).

Marcus demo'd the Freewire service to me using his PC and a large monitor, and it looks great. There's instant channel changing, HD (when available), a great looking guide and auto-DVR of every program, all in the cloud. Freewire also offers targeted advertising, and HTML-based apps like Twitter integration, etc. My caveat is that I have no idea how well the service would scale to millions of homes.

Move's new positioning puts it in the middle of tectonic video industry shifts. For example, what's the appetite of 3rd parties like telcos and ISPs for new video solutions? Will other, well-suited consumer brands like Google, Netflix, Yahoo enter the multichannel video business, and if so how? What approach will cable operators like Comcast use for emerging, "TV Everywhere" services that would benefit from Move's lightweight capex model (note Comcast said it was using Move in its 5,000 subscriber technical trial yesterday)? How will major cable TV networks expect to get compensated in the broadband era where individuals, not homes, are the new unit of measurement? How will local ISPs, over whose networks remotely-accessed video will run, expect to be compensated? It's way too early to know the answers, but if Move's technology works as intended, and its costs are reasonable, it will likely find itself in the middle of a lot of very strategic industry discussions.

Another big change is that Marcus said the company's messaging will be focused more around business cases and services than its specific technologies. That seems smart given giants like Microsoft and Adobe are closely circling these waters with lots of their own technology, which could easily swamp Move. If all this wasn't enough, Move is also in the midst of hiring a new CEO and implementing a new management team, all of which will be announced imminently. One thing Move isn't doing for now is raising additional capital, which Marcus said is not needed.

What do you think? Post a comment now.

(Note: Move Networks is a current sponsor of VideoNuze)

Categories: Broadcasters, Cable Networks, Cable TV Operators, Deals & Financings, IPTV, Technology, Telcos

Topics: ABC, Adobe, FOX, Microsoft, Move Networks

-

Nokeena Raises $6.5M from Mayfield

Nokeena Networks is announcing this morning that it has raised $6.5M from Mayfield Fund, bringing its total funding to $15M. The new funding will be used primarily for marketing and sales. Nokeena's Media Flow Director is a software appliance that combines storage, caching and network optimization to deliver high-quality video at lower cost. I noted Nokeena in my recent post about the robust ecosystem of technology companies enabling higher-quality broadband video delivery.

Categories: Deals & Financings, Technology

-

Brightcove and Qik Partner

Brightcove and Qik are announcing a partnership this morning that further fuses the broadband and mobile video worlds. Under the partnership Qik users will be able to distribute their mobile-recorded video through Brightcove players if they have a Brightcove account. For Brightcove customers the deal will enables mobile recording as a new source of video into their catalogs.

Qik's client is one of a number of options for mobile video recording and uploading. As I wrote yesterday regarding the iPhone's new video recording capabilities, mobile video capture (and eventually full-featured editing) is poised to become a big activity, implying that few spontaneous significant live events will go unrecorded. We will see additional partnerships like Qik-Brightcove as mobile recording becomes a key source for content providers distributing video over both broadband and mobile.

Categories: Mobile Video, Partnerships, Technology

Topics: Brightcove, Qik

-

Aspera: Today Super-Fast Video File Transfers for the Media Industry. Tomorrow Super-Fast Video Downloads for Consumers?

Last week in "Robust Ecosystem Promises that Online Video Will Keep Looking Better and Better," I briefly mentioned a company called Aspera in the last paragraph. Aspera has been on my radar for quite some time, as I've had many industry colleagues mention to me the company's key role in the online video work flow process. Last week I got a chance to talk to Francois Quereuil, director of marketing to learn more.

Aspera addresses a key - and growing - operational problem in the online video work flow process: the time-consuming and resource-intensive step of moving around large video files, whether internally or to third-parties. This step has grown increasingly onerous as the number of files to be moved has expanded due to multiple bit rate encodings and multiple syndication partners. Further, the shift to higher-quality, HD video files has also made the file sizes bigger than ever.

When the company was started 5 years ago, Aspera's co-founders' premise was that the traditional approach for moving files, primarily by using FTP ("File Transfer Protocol"), was inherently inefficient because it was

optimized for text and used TCP, the underlying protocol that most Internet traffic relies on. Rather than trying to improve FTP or TCP as others have done, they instead designed their own protocol called "fasp" (Fast and Secure Access Protocol). By installing Aspera's fasp software at the file's send and receive points, large files can be sent over existing network infrastructure. fasp can send files 10 to 100s of times faster than FTP (there are charts here that show Aspera's tests).

optimized for text and used TCP, the underlying protocol that most Internet traffic relies on. Rather than trying to improve FTP or TCP as others have done, they instead designed their own protocol called "fasp" (Fast and Secure Access Protocol). By installing Aspera's fasp software at the file's send and receive points, large files can be sent over existing network infrastructure. fasp can send files 10 to 100s of times faster than FTP (there are charts here that show Aspera's tests). Francois explained that Warner Bros. became Aspera's initial customer, and that now every studio, CDN, aggregator, post-production house and many content providers use Aspera. A perfect example customer is Apple, which uses Aspera to ingest most of the HD video content it now makes available in iTunes. The media industry now accounts for 70% of Aspera's revenue, though there are other industries with large files such as government and biotech, for whom Aspera is also very appealing. For example, the oil and gas industry sends seismic data files that are terabytes in size using Aspera.

From the core fasp innovation, Aspera has built out a suite of products, including a web browser plug-in that lets remote users quickly upload their video files, a console product that allows multiple facilities running fasp to be centrally monitored and controlled, and a collaborative solution that allows drag and drop distribution of files to various end-points. Aspera seems well positioned to grow alongside increasing file complexity; the only company focusing on the media industry with file transfer acceleration that I'm aware of (and that Francois noted as competition) is Signiant, which I first wrote about here.

Clearly Aspera has already had a significant impact on powering high-quality video transfers and distribution, but what may still be ahead for the company could be even more interesting. Francois and I discussed the possibility that Aspera software could make its way into consumer devices like set-top boxes, gaming consoles, smartphones, etc. The company is in discussions with device manufacturers and service providers, but it is clearly still very early.

Still, the prospect of having Aspera-enabled devices could create what I think of as a "super-premium" video service, enabling near-instantaneous video-on-demand downloads. For over-the-top service providers this could be a meaningful differentiator. For incumbents like cable operators Aspera could have significant benefits in creating premium revenue opportunities and also capex savings by not having to continually upgrade their networks to deliver faster speeds and more capacity. Francois explained that fasp co-exists well with TCP-based networks and is distance-independent; this suggests that such premium services could be offered to all cable subscribers, not just those in select areas, and also that they could be centrally managed.

Exciting as the consumer-facing opportunity is, for now Aspera is mainly focused on its bread-and-butter business of improving the efficiency of large file transfers that are becoming more and more prevalent. Aspera is another perfect example of how innovative technologies up and down the stack are laying the foundation for an all-broadband future.

What do you think? Post a comment now.

Categories: Technology

-

VideoNuze Report Podcast #20 - June 12, 2009

Below is the 20th edition of the VideoNuze Report podcast, for June 12, 2009.

This week I discuss the rampant innovation that I'm observing throughout the broadband video industry. My last few posts have provided several great examples of the technology, content and business model innovation now underway. These include product introductions from Blackwave and thePlatform, original online video from the Pennsylvania Tourism Office and syndicated product videos to online retailers from Invodo. Broadband video is far more than just a new entertainment medium!

Meanwhile Daisy discusses the Apple Worldwide Developers Conference, which was held this week in San Francisco. Among other things, the company unveiled several video-centric features for its new iPhone 3G S. These include adaptive live streaming, video capture/edit and direct video downloads for rental or own (i.e. a sideload from iTunes no longer required). Daisy explains that the video capture/edit capability positions the iPhone closer to the Flip video camera, setting up a new competitive dynamic for Flip and its new parent, Cisco.

Daisy sees the iPhone becoming a bona fide "media portal" that takes on some of the appeal of Amazon's Kindle. I agree with that comparison. Notwithstanding other smartphones launching like last week's Palm Pre, the iPhone will continue to have the greatest impact on the budding mobile video market.

Click here to listen to the podcast (14 minutes, 23 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Indie Video, Mobile Video, Podcasts, Technology

Topics: Apple, Blackwave, iPhone, Kindle, Podcast, thePlatform

-

Robust Ecosystem Promises that Online Video Will Keep Looking Better and Better

I continue to be impressed with the ecosystem of technology companies whose products enable online video to be delivered better, cheaper and faster. Video quality has made incredible strides over the last ten years, evolving from grainy postage stamp-sized experiences to gorgeous HD or near-HD experiences that are becoming more routine. This is causing a powerful "virtuous cycle" to take hold: as users' video experiences improve they watch more video. As they watch more they help fuel more investment in the online video medium.

In particular, CDNs' ability to offer better service even as their delivery rates continue to plummet is based on continuous improvements in their infrastructure. Similarly, content providers' ability to offer higher-quality video is based on improving operational efficiencies and costs in their content management and publishing processes. Two announcements today illustrate both of these dynamics quite well.

First, Blackwave, a Boston-area early-stage provider of video storage and delivery systems that I've been following for a while, is announcing today the R6, its first production system, along with its first major CDN customer, CDNetworks. Last week, Andrew Grant, Blackwave's director of business development and Mike Killian, CTO gave me an update,

Blackwave's focus in on giving CDNs a more powerful, more efficient way of storing and serving high-

quality video content. The R6 reduces the CDN's hardware requirements by offering both higher-density and more intelligent storage. One example is that Blackwave continuously gauges the popularity of certain pieces of content. If their popularity increases, more resources are provisioned for higher-availability; if their popularity decreases (as for Long Tail content), they get fewer resources. Among other things, Blackwave is also able to support WMS and Flash streaming, FTP uploading for content ingest and "multi-tenancy" for customer resource sharing.

quality video content. The R6 reduces the CDN's hardware requirements by offering both higher-density and more intelligent storage. One example is that Blackwave continuously gauges the popularity of certain pieces of content. If their popularity increases, more resources are provisioned for higher-availability; if their popularity decreases (as for Long Tail content), they get fewer resources. Among other things, Blackwave is also able to support WMS and Flash streaming, FTP uploading for content ingest and "multi-tenancy" for customer resource sharing.The net effect of all this is that Blackwave believes it can deliver 10x improvements in both capex (through lower hardware requirements) and opex (through lower power, cooling, data center costs). All of this of course means that CDNs gain more financial flexibility to deliver ever higher quality content from their customers.

Separate, thePlatform (note a VideoNuze sponsor) is announcing today that it is launching mpsManage Ingest, a new streamlined feature for ingesting its customers' content. Marty Roberts, thePlatform's VP of Marketing told me last week that as video quality has increased - thereby causing an explosion of file sizes - the time and effort to ingest them has grown more burdensome and costly. This is particularly true for companies with large or dynamic video libraries.

mpsManage Ingest sets up "Watch Folders" where customers push their content via FTP, a feed reader for thePlatform to subscribe to updates and multi-format ingest adaptors. mpsManage Ingest carries no extra charge, and continues the company's recent efforts to lower the total cost of operating for video content providers (see earlier post on thePlatform's mpsManage Storage and mpsManageCDN offerings).

These are just two examples of how improved technology is enabling higher-quality video. There's plenty more happening; I recently received a briefing from Nokeena, which provides video caching, streaming and delivery intelligence for delivery across screens, a category that includes others like Verivue and EdgeWare, which I haven't spoken to yet. Then there is adaptive bit rate streaming from companies like Move Networks, Adobe and Microsoft, efficient transcoding from companies like Grab Networks, HD Cloud, mPoint and Encoding.com and file transfer and work flow acceleration from companies like Aspera and Signiant.

Adding it all up, the ecosystem of technology helping enable higher-quality, more efficient delivery of online video is impressive and its momentum is growing. Users will continue to benefit from all of these initiatives, as the quality line between conventional delivery and online delivery further blurs.

What do you think? Post a comment now.

Categories: CDNs, Technology

Topics: Blackwave, EdgeWare, Nokeena, thePlatform, Verivue

-

Grab Networks Raises $12M

Grab Networks has announced a new $12M round of debt and equity financing from existing investors Softbank Capital, SCP Capital, Longworth Venture Partners and Court Square Partners. Horizon Technology Finance led the venture debt piece.

I've written about Grab (formed from the merger of Anystream and Voxant) several times on VideoNuze, and have been impressed with the demos I've seen of their new hosted solution which includes, among other things, auto-generated clips, metadata creation/management and syndication. For now the foundation of the business is still Anystream's traditional licensed transcoding product, but the new end-to-end solution pushes the company far beyond this base, into what I've called the "syndicated video economy." Among others, local broadcasters are a key target market.

This round continues the financing momentum that broadband video companies have experienced despite the financial meltdown. In Q1 '09, industry companies raised over $80M, which came on top of another $80M or so in the Fall '08. Skittish investors are clearly still optimistic about broadband's potential.

(Note, at the end of June I'll be participating in a webinar Grab Networks in organizing about video syndication. More details to come shortly.)

What do you think? Post a comment now.

Categories: Deals & Financings, Technology

Topics: Grab Networks