-

Ooyala Launches Updated Video Player as It Prepares for Strobe Entry

Today Ooyala is officially releasing its updated video player, named "Swift," with a lighter-weight, more modular design intended to deliver faster loading/playback for users and improved integration of advanced features for its content provider customers. Sean Knapp, one of Ooyala's 3 co-founders, and head of

technology shared more details of the new player with me last week, and also provided a perspective on the coming entry of Adobe's Strobe video player framework, which will undoubtedly impact all of the video player/content management companies.

technology shared more details of the new player with me last week, and also provided a perspective on the coming entry of Adobe's Strobe video player framework, which will undoubtedly impact all of the video player/content management companies.A key focus of the Swift's development has been modularizing its code, so that only what's required for that particular user experience is downloaded to the user. Faster response times and better playback are critical drivers in the user experience, as we've all no doubt endured the wait for a video, only to end up clicking away. It's no surprise that Ooyala - with a cadre of people from Google, where cutting milliseconds from the time to deliver search results is an obsession - should be focusing on response times.

Playback quality is another focus of the new player, with improved bandwidth detection that supports Ooyala's adaptive bit rate ("ABR") or "dynamic video" delivery. ABR/dynamic video has become a competitive battleground lately, with companies like Move Networks (an ABR pioneer), Microsoft, Adobe, Brightcove and others all touting ABR delivery.

ABR delivery detects on a moment-to-moment basis the user's available bandwidth and computer processing capability so that an appropriately encoded video file can be dynamically delivered. Sean said that via an HTTP delivery workaround it created over a year ago, Ooyala has been able to offer ABR in Flash, thereby preceding Flash Media Server 3.5 (FMS 3.5 was released last November as the first Flash server to support dynamic streaming; it has only recently been deployed by CDNs).

Sean explained that the new player's design approach aligns with the coming entry of Adobe's "Strobe" video player framework later this year, which he welcomes. From his perspective, Strobe has the potential to address a lot of the core video functions that Ooyala and other video player companies have had to develop themselves. If successful, Strobe will provide a standardized foundation layer ("getting us out of the muck" as Sean happily said) that would free up Ooyala to focus on supporting higher value components such as advanced monetization (e.g. micro-payments, subscriptions). Ooyala has not yet announced support for Strobe, but it plans to.

This is basically how Adobe itself would like Strobe to be perceived. In a recent conversation with Sumner Paine, Strobe's product manager, he explained to me that Strobe's tools and frameworks are intended to accelerate the development of custom Flash players, to better support content providers' specific objectives (and of course reinforce the Flash value proposition).

Key to Strobe are third party plug-ins from the growing video ecosystem meant to replace the duplicative process of each video player company having to integrate with each third party. Sumner sees video player companies with freed-up resources being able to move up the stack, for example, to provide tighter integrations with customers' content management systems.

Strobe's Q3 entry is going to be another milestone in the ongoing maturation of the broadband video industry. Adobe is trying to create additional industry scalability and drive further customization while defending its turf against Silverlight and other potential entrants. If Strobe is successful, the bevy of video players on the market will need to find new ways to innovate to differentiate themselves, such as Ooyala's trying to do here with Swift. With so many moving parts this is going to be a closely watched space.

What do you think? Post a comment now.

Categories: Technology

-

NBC.com Bolsters Mobile Video Ad Model with Kiptronic's Help

While broadband video consumption continues to surge, mobile video usage is also now showing strong signs of growth, mainly due to the iPhone's popularity. In fact Nielsen just reported last week that iPhone users are 6 times as likely to watch mobile video as are other mobile subscribers. And for Q4 '08, it reported that 11.2M people watched mobile video, with 51% stating they're new to the medium, viewing for less than 6 months. This is still small compared with the 150M or so people (U.S.) watching broadband video each month, but with an onslaught of new or upgraded video-capable smartphones hitting the market, mobile video is poised to grow rapidly.

All of this is very good news for content providers, for whom this "3rd screen" (after TV and PC) opens up all kinds of new opportunities. Many have been participating to date in carrier-provided (e.g. VCast, FLO TV) and other (e.g. MobiTV) subscription services that have achieved solid growth. But with still advertising the primary business model for many content providers, they've been eager make ad-supported video available to growing base of mobile video users as well.

NBC for example has been pursuing ad-supported mobile video, and last summer, made a big mobile push with its Summer Olympics coverage. Still, as Stephen Andrade, NBC.com's SVP and GM and Robert Angelo director web/mobile, told me recently, inserting ads in its mobile-distributed video has been painfully laborious and grossly underoptimized. To address these issues, NBC recently struck a deal with Kiptronic, an ad serving firm that specialized in non web-based content.

Stephen and Robert explained that their overarching goal with NBC.com video is to "publish once, distribute everywhere" - a goal I often hear from other video content providers as well. However mobile-distributed video was siloed and not fully incorporated into its online/broadband work flows. This was especially problematic on the ad side, where mobile inventory wasn't exposed in DART, on which NBC has standardized its ads. As a result a lot of mobile inventory was unsold, and even when it was sold, advertisers were required to jump through a bunch of new hoops to get their ads to NBC, which itself then "hand-stitched" the ads to its mobile-distributed video.

After looking at multiple solutions to address these issues, NBC chose Kiptronic's kipMobile. Stephen and Robert said the key was kipMobile's flexibility in plugging into NBC's existing content management system

and work flow. Now when an NBC producer uploads video, upon preset instructions kipMobile transcodes the HD source file into relevant mobile formats and transfers them to Akamai (NBC's CDN). When a mobile user calls for a video, kipMobile determines which format is best-suited for that particular device, dynamically grabs appropriate ads from DART and combines the two into a file which Akamai then serves to the user.

and work flow. Now when an NBC producer uploads video, upon preset instructions kipMobile transcodes the HD source file into relevant mobile formats and transfers them to Akamai (NBC's CDN). When a mobile user calls for a video, kipMobile determines which format is best-suited for that particular device, dynamically grabs appropriate ads from DART and combines the two into a file which Akamai then serves to the user. Beyond dramatically simplifying NBC's work flow, Stephen and Robert are also excited about the new revenue potential, given NBC's booming mobile usage (Q1 '09 video streams jumped to 9.6M from 2.5M in Q1 '08 with mobile page views increasing from 32M to 96M in the same period). Looking deeper into the usage patterns, NBC sees more than half the mobile video usage occurring at home, as users increasingly look at their mobile device as an alternative screen when the TV isn't available. While 75% of NBC mobile usage is iPhone-based today, they're seeing strong adoption by non iPhone devices. Though still early, geo-identification is creating yet another ad opportunity unique to mobile.

NBC and many other content providers are going to be riding the wave of surging mobile video consumption. kipMobile and other monetization solutions will become increasingly important as these content providers seek to unify their online/broadband and mobile work flows and to fully monetize their views.

What do you think? Post a comment now.(Updated May 21st: Things move fast - Limelight just announced it has acquired Kiptronic.)Categories: Advertising, Broadcasters, Mobile Video, Technology

-

Made-for-Broadband Video and VOD are Looking Like Peanut Butter and Chocolate

Remember "two great tastes that taste great together," the slogan from the classic Reese's ads featuring the mixing of peanut butter and chocolate? Recent developments suggest that independently produced/made-for-broadband video and Video-on-Demand could be another Reese's-like combination, bringing together two disparate worlds that have attracted loyal audiences in an offering that could have significant consumer appeal.

Consider, last week Multichannel News reported that Verizon plans to bring over 7 million broadband video clips from providers like blip.tv, Veoh and Dailymotion to its FiOS service, which users can browse with their set-top boxes. Also last week, AnySource Media, a software company that powers broadband-connected TVs, announced content deals with TheStreet.com, Break.com, Revision3 and Next New Networks, creating hundreds of "virtual VOD channels." And yesterday, Clearleap, a startup technology platform I recently profiled, announced its own deals with blip.tv, Revision3 and Next New Networks, providing content that cable operators can meld with their VOD offerings.

This push among made-for-broadband producers, technology companies and incumbent video service providers is not coincidental. While they each have their own motivations, their alignment could signal a winning proposition for viewers.

For the indie content producers, on-demand access on TVs augments their viewing experience and access to their programming. Given how difficult the environment has become for independents (Daisy had a good piece on this topic yesterday) on-demand access is a real differentiator. For cable operators and telcos, popular indie video gives them a targeted pitch to the tech-savvy, younger audiences who have become loyal fans of indie content. Down the road this group is probably most up-for-grabs for alternative "over-the-top" services, so focusing on defending them is smart. And for technology providers, a big market opportunity looms trying to connect the previously disparate worlds of broadband and VOD.

In fact, in a conversation I had last week with Braxton Jarratt, CEO/founder of Clearleap, he explained that cable operators get all this. They're looking for quality "mid-tail" video from broadband producers, including clips and short-form programs. The company's technology is currently feeding broadband video to a couple hundred thousand cable VOD homes, with a backlog of "double digit" markets pending deployment. Braxton has a lot of content deals on Clearleap's docket, creating a menu for its cable customers to pick and choose from to incorporate into their VOD offerings. Clearleap also offers an ad insertion platform, so indie video can be monetized, not just offered as a value add.

Meanwhile, VOD has long proven itself popular with viewers. Comcast recently announced it has delivered 11B views since it launched VOD. It has continued to augment its library and add more HD titles. While VOD hasn't really been a money-maker itself, it has become a strong part of the digital value proposition and a defensive move against other viewing alternatives. By incorporating popular broadband video into its VOD choices, its appeal is only strengthened.

While the tectonic plates of "convergence" continue to shift, examples of broadband video making its way to the TV continue to happen. TiVo has been at this for a while with its "TiVoCast" service, along with technology providers like ActiveVideo Networks and others. The likelihood for independently-produced broadband video and VOD to get together seems poised to increase.

What do you think? Post a comment now.

Categories: Cable TV Operators, Indie Video, Technology, Telcos

Topics: ActiveVideo Networks, AnySource Media, Clearleap, Comcast, TiVo, Verizon

-

EveryZing Raises $8.25M from Peacock, Lands NBCU as Biggest Customer

EveryZing, the search and publishing technology firm, is announcing this morning that it has raised a third round of $8.25M from GE/NBC's Peacock Equity Fund and existing investors, bringing its total funding to date to $22M. In conjunction with the funding NBC Universal will integrate EveryZing's four products into NBC's Media Works platform for deployment across all of NBCU's online properties. Tom Wilde, EveryZing's CEO confirmed it was a flat round and gave me some further details last Friday.

Tom believes that EveryZing is the only 3rd party technology provider that has been integrated across Media Works. This has two key benefits - first, it means EveryZing's products will be readily available to all

NBCU properties, thereby minimizing upfront work involved with each successive deployment. And second, the pre-negotiated pricing and standing purchase order means individual properties (and EveryZing) will avoid time-consuming negotiations each time around.

NBCU properties, thereby minimizing upfront work involved with each successive deployment. And second, the pre-negotiated pricing and standing purchase order means individual properties (and EveryZing) will avoid time-consuming negotiations each time around.I've been bullish on EveryZing in the past (here and here) as I think their focus on generating metadata for and indexing all content forms (video, audio, text and image) allows content providers to leverage consumers' huge adoption of search. With respect to video specifically, I've long thought that one of the key inhibitors of online viewership has simply been lack of robust discovery in traditional search environments (e.g. Google, Yahoo, etc.). EveryZing addresses this, essentially merging video's surging popularity with search's universal acceptance. One other key benefit this leads to is enhanced targetability of ads.

Tom's been an evangelist on these fronts, recently publishing "Is Your SEM Strategy Ready for Web 3.0," which makes very salient points about how content consumption is shifting from a traditional "container" paradigm to new "objects" paradigm. In the old model, content providers packaged their works into discreet units (e.g. newspapers, albums, etc.). More recently though the content itself has atomized into "objects", which consumers in turn package themselves (e.g. playlists, RSS feeds, etc.). Lacking their historical packaging heft, content providers must find new ways to associate objects, lest many be left undiscovered, and therefore unmonetized.

Tom explained how this notion is at play in the NBC deal. Obviously NBC has a sprawling content empire, which it wants to fully expose across all of its disparate audiences. But until now, even clearly related content hasn't always been shared with users. Worse, this means that interested ad dollars may not be able to find enough inventory to be allocated against, leaving money on the table.

With EveryZing, NBC's goal is to be able to describe and index all of its content, allowing it to drive improved discovery and monetization. In the non-linear video-on-demand world that defines the broadband video experience, my sense is that these capabilities will become more and more valuable.

What do you think? Post a comment now.

Categories: Deals & Financings, Technology

Topics: EveryZing, NBCU, Peacock Equity Fund

-

mPOINT's TranSend Offers New Transcoding, Syndication and Metadata Management Solution

Three weeks ago, in "HD Cloud Launches Video Encoding Platform, Capitalizing on Cloud Computing," I detailed how the company is offering video content providers a new, "cloud-based" approach to meet their escalating transcoding needs. Today's post is about mPOINT, another new entrant in cloud-based transcoding and syndication, whose TranSend service goes a step further by also offering metadata creation and management. Chiranjeev Bordoloi, mPOINT's co-founder and CEO and Chris Cali, co-founder and CTO, gave me a rundown recently.

There are multiple drivers behind TranSend (and others in this space): an exploding array of video encoding and metadata formats, skyrocketing premium-quality content consumption and syndication, distribution to mobile devices and various business models/rules, to name just a few.

In fact, though I'm often skeptical of vendor-written white papers, mPOINT's recently released free white paper "Content Syndication in the Cloud" provides a pretty unbiased overview of the evolving video market and the resulting operational complexities. Many of its themes resonate with what I've been hearing from content executives for a while, which are genuine inhibitors to the further development of the "Syndicated Video Economy" I've written about so often. Especially for those new to cloud-based computing, the white paper is an excellent resource. There's even a handy "buyer's guide" to assist in evaluating alternatives.

As Chiranjeev and Chris explained, one of the key differentiators for TranSend is its comprehensiveness. It offers transcoding, metadata creation and management, syndication, packaging, delivery and reporting - all

performed in the cloud, which generates cost-savings and simpler work flows. Another focus is on mobile video advertising, where TranSend is able to call an ad server like DART and the source file for the requested video and on-the-fly encode both into the phone's optimal file format.

performed in the cloud, which generates cost-savings and simpler work flows. Another focus is on mobile video advertising, where TranSend is able to call an ad server like DART and the source file for the requested video and on-the-fly encode both into the phone's optimal file format. Chiranjeev and Chris said they're repeatedly told by customers that simplicity, without feature sacrifices, is a key goal. And on the cost side, with a model based on GB in and GB out, plus the number of transcodes, the price usually works out to approximately $2/GB, which mPOINT believes is a fraction of non-cloud alternatives.

mPOINT is focusing on mid-tier and larger media companies that emphasize syndication, which increasingly is most everyone. Yesterday the company announced SnagFilms, the independent film aggregator backed by former AOL executives Ted Leonsis and Steve Case as an early customer. Other announcements are in the hopper. mPOINT bootstrapped itself to profitability and took a seed round in December '08 from Greycroft Partners to tap its relationships for growth. The company is also building out a growing ecosystem of partners which currently include Amazon, Aspera and IBM.

TranSend and others offer the kind of infrastructure advances that are helping lubricate the broadband video business model. I constantly hear from small-to-mid video content providers who are enticed by the surging popularity of online distribution but are often still daunted by its immature business models and operational complexity. mPOINT and others are showing that clever entrepreneurs are steadily addressing these needs.

While executives at other incumbent encoding/transcoding vendors have told me that they have not seen any customer erosion due to cloud-based alternatives, they are watching the developments closely and planning their own initiatives. For now the largest content providers, who have the deepest pockets to staff their own encoding, syndication and metadata operations may be reluctant to be early adopters of cloud-based alternatives. Their concerns span security in the cloud to insufficient proof of cloud success as yet. But with TranSend and others addressing so many critical market drivers, my sense is that this space is going to attract a lot of attention quickly and is poised to become quite hot.

What do you think? Post a comment now.

Categories: Technology

-

April '09 Recap - Innovation is Alive and Well in the Broadband Video Space

Looking over last month's posts with an eye for 2-3 themes to extract for my recap post today, I was instead struck by one overarching theme: innovation is alive and well in the broadband video space. Other sectors of the economy may have ground to a halt in the current recession, but whether it's new technologies, new service models or new approaches by traditional media companies, the pace of innovation in all things related to broadband video seems only to be accelerating.

Here are some of the examples from last month's posts:

New technologies

- SundaySky - a new approach to dynamically generate videos out of web site content

- HD Cloud - cloud-based encoding and transcoding plus 3rd party syndication

- Market7 - web-based platform for collaboratively creating and producing video

- FreeWheel - ad management/distribution company raises another $12M

New service models

- Sezmi - next-gen video service provider aiming to replace cable/satellite/telco

- TurnHere - distributed video production services for the corporate market

- Babelgum - premium-quality content destination for independent producers

- YuMe Mindshare iGRP - new measurement unit to compare on-air and online ad performance

- YouTube-Disney - short-form promotional deal

New approaches by traditional media companies

- Disney-Hulu - Exclusive 3rd party online distribution for established broadcast network

- Cable networks launching webisodes - online initiatives to attract and retain new online audiences

- New York magazine video re-launch - emphasis on curating best-of-the web videos with brand

- WWE Smashup - fan-submitted video mashup content driving awareness of on-air special

Now granted I have an eye out for broadband innovations so this list is somewhat self-serving. But remember that for every item above I was probably pitched on 2-3 others that I didn't write about due to time limitations. Some of these other items may have been picked up by other news outlets and captured in the news aggregation side of VideoNuze, while plenty of them likely received little attention.

My point is that throughout the whole broadband video ecosystem there is a vibrant sense of entrepreneurialism that is slowly but surely remaking the traditional video landscape. To be sure, not all of this stuff is going to work out; either business models will be faulty, technologies won't deliver as promised or consumers will reject what they're being offered. Nonetheless, from my vantage point, the wheels of innovation continue to spin faster. That makes it a very exciting time to be part of the industry.

What do you think? Post a comment now.

Categories: Aggregators, Broadcasters, Technology

Topics: Babelgum, Disney, FreeWheel, HD Cloud, Hulu, Market7, New York, SezMi, SundaySky, TurnHere, WWE, YouTube, YuMe

-

Sezmi Update: Fall '09 Commercial Rollout Planned

I chatted with Sezmi director of product marketing Barbara Cassidy at the NAB Show last week and had a follow up call with co-founder/president Phil Wiser yesterday to get an update on the company's progress.

Sezmi is now aiming for a Fall '09 commercial rollout. Phil explained the launch was pushed back by roughly 6 months. The company is continuing to optimize the user experience. It is also being conservative with

resources in the wake of staff reductions last Fall (and the economic slowdown), and is seeking to align with the '09 holiday season/its channel partners' goals. In the meantime the Seattle trial is continuing.

resources in the wake of staff reductions last Fall (and the economic slowdown), and is seeking to align with the '09 holiday season/its channel partners' goals. In the meantime the Seattle trial is continuing.I've been enthusiastic about Sezmi as a full-on, next-gen alternative to cable/satellite/telco service, assuming it its "FlexCast" distribution technology performs as expected. The short demo I saw at NAB looks much as at it has in the past and is quite slick. Sezmi has a hugely ambitious vision, but if it delivers as planned, it is going to offer a pretty compelling alternative for consumers. Lots more to come on this story.

What do you think? Posta comment now.

Categories: Devices, Technology

Topics: SezMi

-

Grab Networks, Syndicaster, Others Offering Local TV Stations Opportunity to Reinvent Themselves

Last Friday, in "Broadcasters in Transition at NAB Show. But to What?" I painted a pretty downbeat picture of local broadcast TV stations' prospects in the broadband era. Coincidentally this week I had briefings with Syndicaster and Grab Networks, two companies offering technology solutions that could set local stations on the path to reinventing themselves and capitalizing on the Syndicated Video Economy.

Though quite different in the scale and scope of their product offerings, Syndicaster and Grab share a common starting point: local stations need to learn how to better leverage and distribute their video content into the broadband ecosystem. Doing so means local stations must have the right tools to ingest, prepare, distribute, track and monetize their content - all steps that go far beyond their traditional and well-understood broadcast work flows.

For its part, Syndicaster capitalizes on its parent company's (Critical Media) position of capturing and digitizing hundreds of local stations' broadcast signals. Syndicaster providers a web interface to transcripts

of each on-air segment, which an editor is then able to easily edit into clips, generate metadata and distribute online. The process is very straightforward, and in the demo I saw, clips from various stations already using Syndicaster were being added in real-time.

of each on-air segment, which an editor is then able to easily edit into clips, generate metadata and distribute online. The process is very straightforward, and in the demo I saw, clips from various stations already using Syndicaster were being added in real-time. More recently Syndicaster has added the ability to upload video directly from the field to further compress the time required to get video up online. It has also integrated with Brightcove, YouTube, Yahoo and others for one click 3rd party syndication. It plans for user-captured video to be incorporated into the video catalog and a widget distribution model. Yesterday the company announced Journal Interactive is using the platform, along with other customers Bloomberg Television, LIN TV and Bonneville.

Separately, Grab Networks, a company that was formed from the merger of Anystream and Voxant last Fall has in the last 60 days begun taking the wraps off its integrated solution, with plans for a formal announcement later this quarter.

Grab too, begins with multiple ingestion options. But a key difference is that Grab auto-generates clips from

the video feeds, assigning metadata to them and indexing them for editorial review or straight publication. This process, which Anystream has been working on for a long while, uses its own algorithms to analyze 40 different "tracks" of information about the video (e.g. speech-to-text, scene detection, facial recognition, close captioning, etc.). It then statistically distills the information gathered to generate the clips, metadata and index.

the video feeds, assigning metadata to them and indexing them for editorial review or straight publication. This process, which Anystream has been working on for a long while, uses its own algorithms to analyze 40 different "tracks" of information about the video (e.g. speech-to-text, scene detection, facial recognition, close captioning, etc.). It then statistically distills the information gathered to generate the clips, metadata and index. Grab believes this core proprietary process is the heart of its value proposition and persuading broadcasters of its efficacy has been a key part of its early sales efforts. Grab executives explained that many customers are initially skeptical that all of this can be done by without human intervention, but upon seeing the results have become believers. (I only saw a limited demo, but it looked pretty darn good). Recognizing that some producers will want to refine clips further, Grab offers an editing module. It's important to understand this process doesn't just make publishing clips more efficient, it also creates more inherent value in each clip as the greater intelligence each clip now has enhances its discovery and monetization potential.

Beyond clip generation, Grab's solution encompasses capabilities that many other companies offer as their primary business (transcoding, video CMS and player, ad insertion, DRM and rights control, pre-integrated syndication to multiple 3rd party distributors, etc.) And via the Voxant deal, Grab also offers a large (Feb comScore rank #26, 6M uniques) built-in syndication network for broadcasters to distribute into and obtain rights-cleared content from. Grab's executives said its comprehensive approach is a response to customers' requests for all-in-one solutions.

Grab is in trials with 5 large station groups and anticipates announcing its first deal for the solution in the next 30 days (remember though that Anystream is building off a core transcoding business that has 700+ customers). Beyond local broadcasters, Grab thinks it will be appealing to other media segments like newspapers, cable networks, magazines, etc. - basically anyone that needs a full solution to power their video efforts ("an operating system for the syndicated video economy" as Grab CEO Fred Singer puts it)

A bold vision indeed. But for local stations ready to acknowledge the urgency of their situations, quite possibly a technology lifeline.

What do you think? Post a comment now.

Categories: Broadcasters, Technology

Topics: Critical Media, Grab Networks, Syndicaster

-

SundaySky Enables Unlimited Customized Videos from Web Site Content

An occupational hazard of following the online video space as closely as I do is that it's rare when I see a technology that feels truly breakthrough. So when it happens, it's not only an "aha!" moment, but also a tangible reminder of how much running room the online video industry still has ahead of it. These were my reactions when SundaySky's CTO and founder, Yaniv Axen, showed me a private demo of the company's "DynamicVideo" platform and explained its model to me.

In a nutshell, DynamicVideo integrates with a web site's database or content management system, and then upon a user's request, it creates short videos out of specified pieces of web site content, completely on the fly. Yaniv explained that DynamicVideo does for building on-the-fly videos what ASP or JSP does for creating dynamic web pages. All of the generated videos are completely customized based on the specific pieces of site content being assembled.

The process of implementing DynamicVideo starts with an upfront creative step in which SundaySky works with the site's team to create "Videolet" templates. This step includes generating all the creative elements

(graphics, voiceovers, music, etc.) that would conceivably be needed in any of the videos to be created, along with the shell templates for the videos. When a user request a video, what's happening is that the required content is pulled from the site's database/CMS, matched against the corresponding creative elements and assembled into the correct shell template. All of this happens instantaneously and the video begins playing as quickly as you'd expect a web page to load. SundaySky also provides full analytics so it's easy to test and optimize different pieces of the video.

(graphics, voiceovers, music, etc.) that would conceivably be needed in any of the videos to be created, along with the shell templates for the videos. When a user request a video, what's happening is that the required content is pulled from the site's database/CMS, matched against the corresponding creative elements and assembled into the correct shell template. All of this happens instantaneously and the video begins playing as quickly as you'd expect a web page to load. SundaySky also provides full analytics so it's easy to test and optimize different pieces of the video.All of that may feel a bit abstract for some of you. Yaniv showed me several different mock implementations (though the company isn't ready to show any publicly, Yaniv did supply this example of an Israeli ecommerce site, which really just scratches the surface). One of the mockups was for Expedia. Imagine clicking on a suggested hotel and instead of (or in addition to) scanning the page for the hotel's number of stars, proximity to attractions, pictures, reviews, rates and contact info, a 1+ minute video instead presented it all to you. I believe the video brings the hotel to life far better than even the best-designed page can.

The mockups showed a broad range of potential applications: MyYahoo (personalized video summary of recent updates), CNET (product comparisons), YellowPages search results (vendor profile information), MySpace (social media presentation) and NBA.com (6 degrees of separation game). Basically, any content that can be extracted from a database/CMS becomes fodder for a video, tailored to the site's particular goals.

What's most compelling to me about SundaySky are the financial implications for content providers. Implementing DynamicVideo allows site owners to generate not just a ton of new and highly targetable videos and but also a ton of associated ad inventory (the idea of a "this video brought to you by" brand slate is a natural). Site owners can also deliver a totally new consumer experience that helps them meet users' increasing expectations for video. This can only help drive higher engagement and desired actions.

And last but not least, by providing a low-cost and automated "manufacturing" process for creating an unlimited number of videos, SundaySky completely changes the video business case, thereby enabling more sites to profitably embrace the online video medium. As I wrote recently in "Inside Demand Media's Content Factory," sites that learn how to crank out large volumes of high-quality video will have real competitive advantages in the broadband era.

On the heels of an $8M first round it raised in January, SundaySky is just starting to share more details. Yaniv alluded to a couple of big media deals coming soon. But, for competitive reasons, it's still keeping things very close to the vest. If its platform scales as well as the demos suggest, this is going to be a very interesting company to watch.

What do you think? Post a comment now.

Categories: Startups, Technology

Topics: SundaySky

-

Digitalsmiths Adds 2 Senior Executives

Digitalsmiths has added to its executive team, hiring Bob Bryson as SVP of Sales and Business Development and Melissa Sargeant as VP of Marketing. Both are industry veterans; Bob was most recently in a similar role at Move Networks and Melissa was director of product marketing at CA.

Digitalsmiths has been expanding beyond its roots in indexing by also offering content management and publishing solutions. In Q4 '08 it raised a $10M round, and in Q1 '09 it received a strategic investment from Cisco. The hirings continue a trend I see throughout the industry - companies with traction are able to continue to raise money and bring on new talent. Other recent examples include Betawave, Brightcove, ExtendMedia and Tremor Media.

Categories: People, Technology

Topics: Digitalsmiths

-

HD Cloud Launches Video Encoding Platform, Capitalizing on "Cloud Computing"

Three significant trends are behind today's launch of HD Cloud, a new video transcoding service being announced today: the proliferation of video file formats and encoding rates, the increase in syndication activity to multiple distributors and the cost and scale benefits of "cloud computing." HD Cloud founder and CEO Nicholas Butterworth (who I have known since he ran MTV's digital operations 10 years ago) walked me through the company's plan yesterday and how it benefits content providers looking to cost-effectively capitalize on broadband video's surging popularity.

Anyone who spends a little time watching broadband video will notice variations in video formats and quality. Behind the scenes there are diverse encoding specs for how video is prepared from its source file before it is served to users. This video encoding work is multiplied significantly for content providers if they also want to distribute through 3rd parties like Hulu, Netflix, Fancast, TV.com, etc, all of which have their own encoding specs. Further, these 3rd parties all have their own ways of accepting video feeds and associated metadata from content partners. Yet another driver of complexity are adaptive bit rate players like Move Networks which automatically hop between multiple files encoded at different bit rates depending on the user's available bandwidth. Combine it all and it means encoding has become a labor-intensive, complicated, yet highly-necessary process.

Traditionally encoding has been done locally by content providers using encoding solutions from enterprise-class companies like Anystream, Telestream, Digital Rapids and others. By offering encoding as a service, HD Cloud gives certain content providers an alternative to spending capex and running their own encoding farms. Content providers choose which source files are to be encoded into which formats and bit rates. They also provide HD Cloud with their credentials for distributing to authorized 3rd party sites. When a job is configured, HD Cloud performs the encoding and 3rd party distribution. HD Cloud doesn't store the files or keep a copy, mainly for security reasons.

The key to making all this work is so-called "cloud computing," whereby HD Cloud (and many others) essentially rent computing capacity from providers like Amazon's EC2. As new jobs come in, HD Cloud

requests capacity, temporarily loads its encoding software (which is a combination of open source and its own custom code) and runs its jobs. When they're done, HD Cloud releases the capacity back to Amazon. It's all a little analogous to the old days of timesharing on mainframes, except with new efficiencies. HD Cloud's economics are based on Amazon buying the computing capacity and operating the facilities and utilizing them at a far higher rate than HD Cloud or any other customer would have on their own.

requests capacity, temporarily loads its encoding software (which is a combination of open source and its own custom code) and runs its jobs. When they're done, HD Cloud releases the capacity back to Amazon. It's all a little analogous to the old days of timesharing on mainframes, except with new efficiencies. HD Cloud's economics are based on Amazon buying the computing capacity and operating the facilities and utilizing them at a far higher rate than HD Cloud or any other customer would have on their own. The result is that HD Cloud prices its encoding at $2/gigabyte, which Nicholas thinks will only get cheaper as bandwidth prices continue to fall. A financial model he sent along suggests that the content provider's ROI given certain assumptions about the amount of content encoded and streamed could be 3-4 times higher than with traditional local encoding solutions. This also assumes the avoidance of upfront capex for local software and hardware encoding alternatives, an important cost-savings for many given the economy. HD Cloud is announcing Magnify.net as its first client today. Others in this space include mPoint, Encoding.com, ON2 and others.

Between encoding's growing complexity and syndication's appeal, content providers are going to need more extensive and cost-effective encoding solutions. Cloud computing in general, and HD Cloud (and others) seem well-positioned to address these needs.

What do you think? Post a comment now.

Categories: Startups, Technology

Topics: Anystream, Digital Rapids, Encoding.com, HD Cloud, mPOINT, ON2, Telestream

-

Interview with Tom MacIsaac, New CEO, ExtendMedia

This morning ExtendMedia is announcing that one of its board members, Tom MacIsaac has been named CEO. Tom is a long-time technology executive and venture capitalist. He and I got to know each other when he was running Lightningcast, one of the earliest broadband video advertising companies, which was sold to AOL in 2006. Tom went on to run strategy and M&A at AOL, where he led a $1B in acquisitions and more recently has been a venture partner at BlueRun Ventures and run Cove Street Partners, his own investment and advisory firm.

Tom's addition is a big step forward for the company, which has established a strong, yet relatively low-key position in the market. In my view that's been for two reasons: first, because Extend has emphasized pay media models, whereas a lot of the attention has been on ad-supported ones, and second, because while

Extend has had a very strong team, the CEO role itself has been vacant for some time. For better or worse, one of the lessons I've learned over the years is that a high-profile, well-known CEO, who spends a significant portion of his/her time on externally-oriented visibility-building activities is a key success factor for young companies. I'm not a fan of the "rock star" CEO model, but I do believe in the "CEO as #1 company salesman" approach. Without such a person in place, a young company's whole team has to work that much harder to succeed.

Extend has had a very strong team, the CEO role itself has been vacant for some time. For better or worse, one of the lessons I've learned over the years is that a high-profile, well-known CEO, who spends a significant portion of his/her time on externally-oriented visibility-building activities is a key success factor for young companies. I'm not a fan of the "rock star" CEO model, but I do believe in the "CEO as #1 company salesman" approach. Without such a person in place, a young company's whole team has to work that much harder to succeed.Tom and I talked about his new role, ExtendMedia's opportunities and the broadband market in general. An edited transcript follows:

VN: Congratulations on joining ExtendMedia. What attracted you to the role?

TM: Extend is in an extremely exciting space as IP video changes the entire media and communications landscape. It has a great team with deep domain expertise, is very well-funded with great investors in Atlas Venture, Venrock and TVM Capital and has an enviable competitive position being the leading independent carrier-grade multi-screen video platform.

VN: Describe ExtendMedia's key product and technology differentiators and who its primary competitors are.

TM: We provide an enterprise class, multi-screen video platform that content owners and distributors use as a foundational asset in building video services. We manage video content across the lifecycle from ingest to monetization and across IPTV, web and mobile services in both ad-supported and pay media business models.

Our primary competitor is thePlatform, a division of Comcast. We don't really run into the Flash-based web video publishing companies like Brightcove, Ooyala, PermissionTV, etc. because we are usually deeper in the our customers' infrastructure trying to solve more complex problems that span the set-top box, PC and/or mobile devices, using multiple business models.

VN: ExtendMedia has always been strong with pay media business models, but has focused less on ad-supported ones. Given your background at Lightningcast, do you think that will change?

TM: Extend has always supported both ad-based streaming business models as well as pay media, but you're certainly right that we have been particularly strong in pay media. That said, we have new additional capabilities to help our customers in their ad-supported streaming media businesses in our next release and later this year will have yet another set of interesting enhancements targeted on maximizing video CPMs for our customers. We aren't going to get into the ad serving business but we are going to extend the boundaries of our product in that direction so that we can help the ad monetization engines we partner with leverage everything at our customers' and our disposal to maximize CPMs. We have some specific ideas on how we can really add value here.

VN: What kind of company is an ideal ExtendMedia customer?

TM: A telco, cable MSO or mobile carrier that is building a multi-screen video platform or a large diversified media company that has built several stove-piped digital video services over the last few years and is now trying to pull everything together on a single infrastructure.

VN: What areas of your background and experience do you think will be most valuable to the company?

TM: I've been in the technology business for 20 years, as a lawyer to tech companies, as a venture capitalist, as a board member, as a founder/entrepreneur and as an executive in large technology companies. I've sold three companies that I've run to public companies and acquired five venture-backed companies as an executive at AOL. That's a pretty good array of perspectives to bring to the table.

But my video advertising expertise in particular will definitely come into play at Extend. At Lightningcast we built the first advertising technology platform designed to monetize IP video and were at the table at the inception of some of the most successful video services out there - Comcast's Fancast and Hulu, for example. Despite all the activity and investment in the area, with possibly one or two exceptions, in the three years since I left Lightningcast no one's doing anything we didn't think of and do first.

VN: What do you think your top 2-3 priorities will be?

TM: We're on the right track, so it's all about execution.

VN: What's your perspective on the broadband video market today? And what would you say about incumbent service providers' evolving role in delivering broadband video services?

TM: I think the incumbent service providers are getting much smarter about IP video. They are leveraging their advantages much more effectively. When the web video phenomenon took off it was initially about user-generated content and giving the little guy content creator a direct-to-consumer path. The problem is that that hasn't paid off - the business model doesn't work yet - the dollars just aren't there.

The trend today is back to professional content and that plays to service providers' strengths. Initially it was all about advertising, and now the trend is toward dual offerings of both ad-supported and pay media business models, which is also good for incumbents. Many service providers, like our customers AT&T and Bell Canada for example, have set-top box, web and mobile sand boxes to play with and if folks like Extend can help them deliver video across and between those platforms and help manage the environments and entitlements from a single platform that will provide real value to their consumers and will drive loyalty. Comcast's On-Demand Online and Time Warner's TV Anywhere initiatives are good examples of service providers figuring out how to leverage their strengths in ways that benefit them, their content partners and consumers.

VN: You've been a venture capitalist, have raised venture financing and have successfully sold companies. What advice do you have for broadband video entrepreneurs given the state of the economy?

TM: The space is clearly overbuilt in many segments. There will be a lot of fallout. Investors are gun-shy. So do your research and make sure you have something unique. That said, it is going to be one of the most interesting and lucrative areas in all of technology over the next decade. So if you've got something truly innovative - go for it.

VN: Thanks Tom, and good luck.

(note: ExtendMedia is a VideoNuze sponsor)

Categories: People, Technology

Topics: ExtendMedia

-

Visible Measures $10M Series C Round Caps Solid Q1 of Investments in Broadband Video Sector

Yesterday's announcement by Visible Measures that it raised a $10M Series C round is further evidence that broadband video companies are still able to attract financing in this brutal economic climate. Here are other video sector investments I've tracked on VideoNuze in Q1 '09:

- RipCode ($12.5M) - 1/5/09

- SundaySky ($8M) - 1/6/09

- JibJab ($7.5M) - 1/08/09

- Motionbox ($6M) - 1/14/09

- Digitalsmiths (undisclosed from Cisco) - 1/26/09

- Fliqz ($6M) - 1/28/09

- Mixpo ($4M) - 2/2/09

- WhistleBox ($2.3M) - 2/9/09

- Tremor Media ($18M) - 2/19/09

- Auditude ($10.5M) - 3/11/09

Plus 7 others totaling over $80M in the Fall of '08, and no doubt others I've missed.

Visible Measures founder and CEO Brian Shin and Matt Cutler, VP, Marketing & Analytics explained to me yesterday that key to their financing was having both solid short-term traction in the form of customer acquisitions and a long-term story built around increasing transparency and accountability for the burgeoning broadband video medium. This echoes criteria I continue to hear from other industry CEOs successfully raising money in this environment.

Since I initially profiled Visible Measures last June, and then followed-up with a post about their deal with MTV Networks last September, the company has continued to build momentum. Brian said that it's now

powering video measurement and reporting for many of the largest web properties and dozens of advertisers. Revenue is about evenly split between the two categories.

powering video measurement and reporting for many of the largest web properties and dozens of advertisers. Revenue is about evenly split between the two categories. Despite its progress, Brian explained the company has maintained a relatively low profile because neither it nor its customers have wanted to publicize their activities. Brian said there are a few competitors but none that he feels are that close to offering what Visible Measures has, and he'd like to keep it that way by being low-key about their wins. Skeptics might say "a publicity-shy early-stage company? Hmm...." but knowing Brian and his team as I do, I know that's been their approach since starting the company.

Brian added that the new round, led by Northgate Capital, a fund of funds that has also does some direct investing, "presented itself" without Visible Measures out looking for it. But Brian was quick to note that he considers the company extremely fortunate, given that he believes the current environment is even tougher than the post-bubble years in 2001-2003. Northgate is a limited partner in MDV-Mohr Davidow Ventures, one of the company's two original investors, along with General Catalyst. The company has raised a total of $29M to date.

Visible Measures plans to use the new funds to accelerate product development and grow faster. Brian and Matt made repeated references to the mountain of tracking data the company is sitting on, and that many people are interested in accessing it (which I can believe). The intent is to further productize the data, though no specifics were offered.

With publishers facing more pressure than ever to monetize effectively, and advertisers' need to understand the ROI of their spending intensifying, Visible Measures is at the intersection of two very strong trends in the fast-growing broadband video industry. It's also a textbook "syndicated video economy" company, which is yet more wind at its back. I've been bullish for a while on the company's prospects and continue to be so.

What do you think? Post a comment now.

Categories: Deals & Financings, Syndicated Video Economy, Technology

Topics: General Catalyst, MDV-Mohr Davidow, MTV, Northgate Capital, Visible Measures

-

VideoNuze Report Podcast #10 - March 13, 2009

Happy Friday the 13th...

Below is the 10th edition of the VideoNuze Report podcast, for March 13, 2009.

This week Will adds some detail to his recent post, "Clarifying Comcast's and Time Warner's Plans to Deliver Cable Programming via Broadband to Their Subscribers." These plans are not fully locked in, but since there have been a lot of questions about them, it seemed worthwhile to provide a quick update.

Also, Daisy discusses a recent article she wrote about Clearleap, a new broadband-to-the-TV technology company that recently announced its platform. The whole broadband-to-the-TV area has been really hot recently and we expect a lot more activity to come.

Since this is the 10th edition of the VideoNuze Report podcast, we thought it would be a good time to check in with listeners and get you reactions. What do you think of the format and length? We thought the most meaningful content approach would be to provide some additional insight about what we've written recently, but does this feel fresh and substantive enough? Would it be better if we discussed recent market activities that we haven't necessarily written about yet? Or maybe answered some listener questions? Or something else?

The podcast format is very flexible and Daisy and I view the VideoNuze Report as a work in progress. We'd love to hear what listeners think and how we can change and improve. Either drop me an email (wrichmondATvideonuze.com) or leave a comment.

Click here to listen to the podcast (14 minutes, 29 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Cable TV Operators, Podcasts, Technology

Topics: Clearleap, Comcast, Podcast, Time Warner

-

Adap.tv Releases OneSource 2.0

Adap.tv is announcing its upgraded OneSource 2.0 ad management platform this morning. The Adap team explained to me on Friday what's new in this release.

OneSource 2.0 builds on the product's initial vision of improving ad optimization while reducing complexity. Adap noted that the main pain point that its customers are expressing especially given the weak economy, is

the need to spend more time focused on selling ads and less time on operationalizing the ad relationships. The need to improve their ROIs through both higher ad rates and higher fill rates is driving them to source ads from multiple sources and to want to refine those sources to find the optimal mix. All of this increases implementation and reporting complexity.

the need to spend more time focused on selling ads and less time on operationalizing the ad relationships. The need to improve their ROIs through both higher ad rates and higher fill rates is driving them to source ads from multiple sources and to want to refine those sources to find the optimal mix. All of this increases implementation and reporting complexity.OneSource 2.0's new features are meant to address these issues. The video provider can now accept ad tags from virtually any source, and do so more efficiently. In addition, through a management dashboard, the provider's ad ops manager can specify and adjust the fill order for the ad sources on a per ad basis. That means that for a specific piece of content there can be one queue for pre-rolls and another for overlays or for two pieces of content there can be two different pre-roll queues, and so on.

By sequencing multiple sources, OneSource creates a failover system so that an ad is likely always served, thereby increasing fill rates. Adap pointed to one provider who has been able to increase their fill rate from 20% to 70%.

In addition, OneSource 2.0 allows reporting by revenue source, video positions and geographic regions, which, at least in the demo screens that I saw, looked quite powerful. The ad ops manager can track performance on a daily basis and re-order sources accordingly. Lastly, there are enhanced tools for managing ads when content is syndicated, along with performance reporting.

I continue to see OneSource in a competitive set with Tremor Media's Acudeo ad management system, and also to some extent with Panache and FreeWheel. All of these systems are, in one way or another trying to improve video content providers' monetization and/or syndication efforts. Adap notes that by not also operating an ad network, it can be more agnostic about ad sources and solely focused on its technology. It now has 300+ publishers on board, helping monetize "high 100s of millions" of impressions per month, which it said is a 10x increase from OneSource's launch in May '08.

What do you think? Post a comment now.

Categories: Advertising, Technology

Topics: Adap.TV, FreeWheel, Panache, Tremor Media

-

Metadata Creation Scales Up with EveryZing's New "MediaCloud"

Summary

What: EveryZing is introducing a new metadata creation service called MediaCloud, which can scalably generate metadata for large publishers' video, audo, images and text.

Benefits: High-volume, high-quality metadata creation; avoidance of expensive enterprise software; XML file integration with existing work flow/publishing systems; cohesive multimedia user experiences; more targetable ad inventory

For whom: publishers, ad networks, monitoring services, PR professionals

The process of affordably generating large quantities of high-quality metadata (the information that describes content itself) makes a big leap forward today with EveryZing's announcement of its new "MediaCloud" service.

EveryZing is one of my favorite technology companies focused on video because its products leverage search behavior to drive increased and more specific video views. Regardless of the category (news, sports, entertainment, business) one of the key ways to incent more online video consumption is by returning more accurate results to users when they're seeking something specific. It's not just the improved user experience that counts; it's also that with rich metadata, accompanying ad avails are more targetable, therefore resulting in higher CPMs and/or pay-per-action ads.

Last Friday, EveryZing's CEO Tom Wilde walked me through MediaCloud and how it fits into the company's portfolio. With MediaCloud, which is offered on a SaaS (software-as-a-service) basis, customers' video is

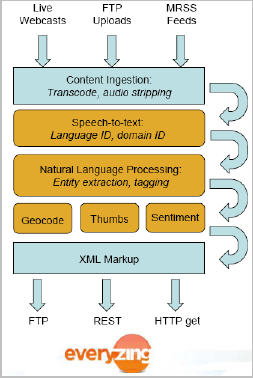

ingested either through live, FTP or MRSS feeds and is then processed through several steps of EveryZing's proprietary technology to generate the metadata. These steps (depicted at right) include conversion of speech-to-text, natural language processing to extract things like people, places and things, and finally generating thumbnails, geocodes and soon, sentiment. The result is an XML file that publishers and others then incorporate into their content work flow. The process occurs at a 1:1 level with the video itself and costs $.50 per minute of content. All of this happens in the cloud, which Tom believes is a first.

ingested either through live, FTP or MRSS feeds and is then processed through several steps of EveryZing's proprietary technology to generate the metadata. These steps (depicted at right) include conversion of speech-to-text, natural language processing to extract things like people, places and things, and finally generating thumbnails, geocodes and soon, sentiment. The result is an XML file that publishers and others then incorporate into their content work flow. The process occurs at a 1:1 level with the video itself and costs $.50 per minute of content. All of this happens in the cloud, which Tom believes is a first.MediaCloud essentially takes what's behind EveryZing's ezSearch and ezSEO products and offers it to customers directly. According to Tom, customers' appreciation for the value of metadata has grown considerably in the last couple of years, therefore making a service like MediaCloud both timely and appealing. Today MediaCloud is geared for more sophisticated publishers who are ready to "graduate" to managing the metadata creation process themselves, but my sense is that eventually this will become a fairly standard part of the work flow for all reasonably-sized video publishers.

There are many exciting uses of MediaCloud's metadata, but two resonate most strongly for me. First is how it enables more universal publishing and multimedia search results for content providers at scale. For example, when you consider how much video is being created by so many different providers (e.g. broadcasters, cable networks, newspapers, magazines, online publishers, brands, etc.), you begin to realize how critical it is that they be able to cohesively deliver all types of assets to users. A scalable way to produce high-quality metadata which pulls related content together and allows each user to consume in the format they prefer is becoming essential.

Second is how contextual ad targeting is enabled at a whole new level. VideoNuze readers know that one of my fixations has been untargeted and/or redundant video ads. Everyone agrees there's much improvement to be made to the video ad value chain. Allowing publishers to expose their videos' metadata to ad networks in particular would provide significantly improved targeting, resulting in better CPMs and making pay-per-action models much more viable.

Net, net, MediaCloud is another important advancement in helping publishers mesh video into their users' behavioral patterns, helping monetize it at a potentially far higher level. No doubt we'll see more SaaS-type video metadata services in the future, but for now MediaCloud is a leader.

What do you think? Post a comment.

Categories: Technology

Topics: EveryZing, MediaCloud

-

Reality Digital Pursues SMBs with New Harmony Social Media Platform

Yesterday, Reality Digital, a player in the white-label social media space, announced "Harmony," a new self-service social media/online video sharing platform targeted to small-to-medium sized businesses. SMBs are getting a lot of love recently as more and more technology providers are realizing there's opportunity to serve them (see post on Jivox and Pixel Fish earlier this week for more).

Cynthia Francis, Reality Digital's CEO/co-founder explained to me that Harmony was borne out of interest that smaller prospects were showing for its Opus platform (which powers such projects as the NFL's "Replay Re-Cutter"). However, with its cost of $50K or more per year, Opus was out of reach for many.

Reality Digital was also seeing a lot of SMBs simply using WordPress and YouTube to cobble together a

community/video presence. So Harmony's goal was to improve on this, enabling SMBs to go beyond template-only social community building and video sharing. Among the differentiators Cynthia sees for Harmony are full drag-and-drop configuration, 100% branding control and self-service advertising in addition to the core community-building and video tools.

community/video presence. So Harmony's goal was to improve on this, enabling SMBs to go beyond template-only social community building and video sharing. Among the differentiators Cynthia sees for Harmony are full drag-and-drop configuration, 100% branding control and self-service advertising in addition to the core community-building and video tools. Most big media companies have now embraced social media to one extent or another. The main challenges with these efforts are keeping the community vibrant, safe and engaging. For resource-constrained SMBs, these issues will take on even greater importance. Still, with video so inexpensive to produce and all businesses striving for customer loyalty, it is appealing to give social media a try. Harmony makes it easy for SMBs to dip their toe in and test to see if it is right for them.

What do you think? Post a comment now.

Categories: Technology

Topics: Reality Digital

-

Silverlight Gets Nod for March Madness

Microsoft's Silverlight notched another high-profile win with yesterday's announcement by CBS Sports and the NCAA that CBSSports.com's March Madness on Demand (MMOD) will offer a high definition option using powered by Silverlight.

Over the past few years MMOD has become the signature online video sports event, with CBSSports.com successfully converting it in 2006 from a paid, subscription based model to one fully supported by ads. The payoff has been evident: in '08 MMOD had 4.8 million unique visitors (a 164% increase over '07) who watched 5 million hours of live video (an 81% increase over '07).

Over the past few years MMOD has become the signature online video sports event, with CBSSports.com successfully converting it in 2006 from a paid, subscription based model to one fully supported by ads. The payoff has been evident: in '08 MMOD had 4.8 million unique visitors (a 164% increase over '07) who watched 5 million hours of live video (an 81% increase over '07). CBSSports.com is building on its MMOD success by offering the higher quality option via Silverlight this year. Users who download the plug-in will get 1.5 mbps streams vs. the standard player's 550 kbps. Once again, all 63 games, from the first round through the championship game will be available. For office workers unable to watch on TV, online distribution continues to be a compelling value.

With MMOD, Microsoft is continuing to push Silverlight into high-profile sports events. Recall that Silverlight's inaugural run, supporting the 2008 Summer Olympics, was executed superbly. It showcased new features like multiple viewing windows and instant rewind/fast-forward. MMOD promises yet another premier opportunity for Silverlight to show its stuff.

What do you think? Post a comment now.

Categories: Broadcasters, Sports, Technology

Topics: CBS, CBSSports.com, Microsoft, NCAA, Silverlight

-

VMIX Reports Growth, Adds Staff

In this economic environment, it's always refreshing to see signs of growth and progress. VMIX, a white-label video management and publishing platform is reporting both today. It has added Ted Utz, formerly VP of National Sales for CBS Televisions Stations Digital Media Group to open its New York office along with other new headcount in its main office in San Diego.

Mike Glickenhaus, VMIX's CEO told me the earlier this week that the company is also continuing to expand beyond its original media vertical. It is working with Pure Digital, JVC, Toyota's Scion and will be announcing deals in other verticals soon. This is partly the result of a new reseller program that's beginning to pay dividends.

Mike noted that while he believes VMIX's technology is competitive with that of others, the company has also been able to differentiate itself through its focus on monetization, service and experience with user-generated content. As I've written before, the video platform space is quite crowded, but it looks as though VMIX is continuing to win its share of business.

Categories: Technology

Topics: VMIX

-

AnySource Media Seeks to Power Broadband TVs

Last month's CES brought a wave of news from TV manufacturers about plans to integrate broadband access directly into their new sets. There's going to be growing momentum around this capability and I believe it's inevitable that broadband connectivity will one day be a standard feature in virtually all HDTVs.

The wrinkle in this scenario is that for broadband video on TV to be a compelling experience for consumers there must be a user-friendly environment to discover and navigate to desired video. Simply offering an Ethernet jack or wireless connection is insufficient. In fact a strong UI becomes even more important as video choices expand.

Seeking to solve the problem of how to organize, present and deliver broadband video via connected TVs is an early-stage company called AnySource Media that I believe is going to be getting a lot of attention over the next couple of years. I saw a demo of their service last fall and recently I talked to Mike Harris, AnySource's CEO to learn more.

The first and most important thing to know about AnySource is that its executive team has deep and

successful roots in the consumer electronics (CE), video processing and semiconductor industries. As a result, it has the relationships, technical understanding and subtle know-how to get things done with the opaque CE industry. For example, a key question for me with the new crop of connected TVs has been whether new, specialized chips would be required in the TVs. These would inevitably cause upward retail price pressure, thereby suppressing consumer demand. Mike was able to walk me through the specific capabilities of chipsets commonly found in digital set-top boxes, how they are already migrating into TVs and how AnySource intends to leverage them to avoid creating new costs for the manufacturers.

successful roots in the consumer electronics (CE), video processing and semiconductor industries. As a result, it has the relationships, technical understanding and subtle know-how to get things done with the opaque CE industry. For example, a key question for me with the new crop of connected TVs has been whether new, specialized chips would be required in the TVs. These would inevitably cause upward retail price pressure, thereby suppressing consumer demand. Mike was able to walk me through the specific capabilities of chipsets commonly found in digital set-top boxes, how they are already migrating into TVs and how AnySource intends to leverage them to avoid creating new costs for the manufacturers. There are two pieces to the AnySource Internet Video Navigator (IVN) solution: a software client freely embedded into the TV's chipset, and a back-end data center that aggregates and streams/downloads the content, creates metadata, organizes the presentation experience and passes on relevant advertising or commerce information.

AnySource's goal is not to disrupt the underlying content provider's experience or require any new encoding; it simply passes through whatever the content provider wants to make available. At CES it demo'd with 80 content providers and Mike said over 200 deals are in the works. Given the simplicity of its pitch, I think that as AnySource's footprint expands content providers will be very interested partners. AnySource doesn't plan to obtain revenue shares from content providers, rather its business model is to sell its own ads in the presentation screens.

The key to AnySource's model is of course is getting TV manufacturers to embed the IVN software. Mike was reluctant to get into specifics, but at CES AnySource demo'd on a Sylvania set from Funai. The goal is be in the market with at least 2-3 TV brands in '09 with more in '10. Obviously if AnySource's model gets traction, further deals will become a lot easier to get done. Unlike other devices which require new remotes or keyboards, AnySource-powered content will be available using the TV's remote control.

The connected TV space is the most exciting frontier in the broadband video landscape because it holds the potential to unlock vast new value for consumers and content providers. We've started to see some traction from third party devices like Xbox, TiVo, Roku, etc, but long-term the market will only achieve ubiquity when TVs themselves come with user-friendly broadband access. It's a highly disruptive scenario, and one which AnySource could well be a central player in.

What do you think? Post a comment now.

Categories: Devices, Technology

Topics: AnySource Media, CES, Funai