-

Syndicated Video Model Gains Momentum Among Top Properties

Long-time VideoNuze readers know I've been talking about the trend toward content providers' video being syndicated to third-party publishers' sites for a while now, and judging by comScore's August data, the model appears to be gaining further momentum.

Two of the top 10 video properties - NDN and Grab Media - have syndication as their core business model, while a third - AOL, via its 5Min acquisition, uses syndication to power a significant amount of its views. Meanwhile, YouTube, which is consistently the largest property, leverages embedding for organic syndication, while #4 property VEVO syndicates a lot of its music videos to YouTube. Beyond the overall top 10, as I've written previously, in the sports vertical specifically, syndicators took 2 of the top 4 spots in the first half of '12.Categories: Syndicated Video Economy

Topics: AOL, Grab Media, NDN, Sharethrough

-

Sports Video Syndicators Nab 2 of Top 4 Traffic Positions in First Half of 2012

The Olympics is currently dominating the sports world's attention, but have a look at comScore's first half 2012 data (chart below), and what jumps out is that 2 of the top 4 properties aren't well-known branded destinations, but rather little-known video syndicators, Perform Sports and CineSport.

Perform is #2, with 14.6 million average monthly unique viewers, trailing predictable leader ESPN, which has 20.5 million. And CineSport is #4 with 11.4 million average monthly unique viewers, behind #3 Yahoo Sports, which has 12.4 million. Following them are properties you'd expect to see on any top 10 list: Turner Sports, MLB, Fox Sports, NBC Sports, NFL and CBS Sports.Categories: Sports, Syndicated Video Economy

-

Grab Media's Growth Underscores Power of Video Syndication Model

It's been a little over four years since I started discussing a concept I called the "Syndicated Video Economy." My thesis was that for content creators to succeed, they needed to distribute their videos to relevant third-parties in addition to their own sites. Only by leveraging syndication would they gain enough scale to achieve an ROI. Flash forward to today, and value of syndication is strong and growing.

One of the companies which is capitalizing on the syndication trend is Grab Media, which in 2011 saw its unique viewers jump from about 7.3 million to about 24 million, the second-fastest growth of an video property according to comScore. Grab works with hundreds of content providers of all sizes and has built a catalog of 800K-900K short videos (usually 3-5 minutes), which it makes available to 140,000 different publisher sites. All of this aggregates to almost 300M video views per month.Categories: Syndicated Video Economy

Topics: Grab Media

-

Video Syndicators Are Finding Success in Sports Category

The power of the video syndication model is on full display in the online sports category, where 2 of the top 3 properties in December, 2011 were little known, early stage video syndicators, rather than well-known media brands and sports leagues. As the chart below shows, the #2 slot belonged to CineSport, a company I wrote about 6 months ago, with 15.7 million unique viewers while the #3 position went to Perform Sports, a year-old entrant, with 14.6 million unique viewers. Both trailed ESPN with 24.7 million unique viewers, but were still well ahead of stalwarts like CBS, Turner and Fox. Earlier this week I spoke to Juan Delgado, Managing Director of Perform Americas to learn more about its syndication formula.

Categories: Sports, Syndicated Video Economy

-

RealGravity Seeks to Shake Up Video Platforms and Syndication With All-in-One Solution

Newcomer RealGravity is looking to shake up online video platform/publishing and syndication with a no-commitment, risk-free, all-in-one solution. RealGravity hit my radar recently as it is powering CineSport, which has become one of the top online video sports properties this year (recently with more viewers than Yahoo Sports, ESPN and SI Digital) by focusing exclusively on syndicating its content to larger 3rd-party publishers.

RealGravity hit my radar recently as it is powering CineSport, which has become one of the top online video sports properties this year (recently with more viewers than Yahoo Sports, ESPN and SI Digital) by focusing exclusively on syndicating its content to larger 3rd-party publishers.

As VideoNuze readers know, online video syndication has been a focus of mine for several years, as I'm a big believer that it's critical for generating audience and revenues, particularly for smaller content providers that lack well-trafficked destinations. RealGravity is providing important infrastructure for fueling syndication, and recently I caught up with Luke McDonough, co-founder and CEO to learn more about what makes RealGravity different.

Categories: Syndicated Video Economy

Topics: RealGravity

-

HealthiNation Lands on Roku; Now #3 in Health Vertical Due To Syndication Strategy

Health and lifestyle video creator HealthiNation is announcing its availability on Roku devices this morning. The move extends HealthiNation's content syndication approach which helped place it third in comScore's Video Metrix ranking of health-related sites last month. HealthiNation racked up 3.1 million unique visitors, putting it ahead of WebMD and Everyday Health, and trailing only 5Min and HealthGuru. As Raj Amin, HealthiNation's CEO told me last week, the company gains the bulk of its traffic through its third-party syndication network of approximately 25 partners.

syndication approach which helped place it third in comScore's Video Metrix ranking of health-related sites last month. HealthiNation racked up 3.1 million unique visitors, putting it ahead of WebMD and Everyday Health, and trailing only 5Min and HealthGuru. As Raj Amin, HealthiNation's CEO told me last week, the company gains the bulk of its traffic through its third-party syndication network of approximately 25 partners.

Categories: Devices, Indie Video, Syndicated Video Economy

Topics: HealthiNation, Roku

-

Meredith and AlphaBird Partner For Branded Video Distribution

Meredith Video Studios, the branded entertainment division of magazine giant Meredith Corp. and AlphaBird, a click-to-play video syndicator, have partnered to distribute advertisers' branded video across the Meredith Video Network. Chase Norlin, AlphaBird's CEO explained that the company will become Meredith's branded video sales agent, and MVS will offer video production as part of packaged deals.

Categories: Branded Entertainment, Magazines, Syndicated Video Economy

-

LongTail.tv Targets Small to Mid-Sized Publishers With Hosted Video Solution

LongTail Video, the company behind the free, hugely popular JW Player, has launched a public beta of LongTail.tv, which includes a hosted version of the JW Player, a gallery of embeddable videos from 5Min (and others soon) and turnkey advertising. Dave Otten, co-founder and CEO of Long Tail, told me that with LongTail.tv addresses small to mid-sized customers' demands for a solution that requires minimal technical expertise, offers easy access to premium content and provides incremental revenue. LongTail.tv has been in private beta with 300 publishers for over a month.

While LongTail.tv allows publishers to insert URLs to their own videos (an upload option and other features are coming soon with the full integration of LongTail's Bits on the Run OVP product) to play within the hosted JW player, the main value proposition is gaining access to the 5Min videos, which are sorted by category and new revenue. A publisher can simply grab the "Arts" or "Business" channels and a curated set of up-to-date videos from various 5Min content partners will be available on its site.

Categories: Syndicated Video Economy, Technology

Topics: 5Min, LongTail Video, LongTail.tv

-

Guess Which Sports Property Had the Most Unique Viewers in May (Hint: It's Not Yahoo, ESPN, MLB or SI)

Here's a interesting tidbit from comScore's Video Metrix - the top sports property in May, as ranked by unique viewers, wasn't any of the names you'd expect (e.g. Yahoo Sports, ESPN, MLB, SI, etc.), but rather a little-known, four year-old start-up named CineSport. As the chart below shows, CineSport generated 13.1 million unique viewers in May to top the list (CineSport was actually number one in April too, and has been so periodically before as well). How CineSport is generating so much viewership says a lot about how online video is creating unexpected new opportunities for those with clever approaches. Last week I caught up with CineSport's CEO and founder Gregg Winik to learn more.

Categories: Sports, Syndicated Video Economy

-

5Min Acquired By AOL, Why Exit So Early?

This morning AOL announced that it has acquired 5Min with the rumor mill suggesting the price is $65 million. For AOL, the deal makes a lot of sense and is yet another building block in its video and niche content strategy. 5Min is especially relevant to AOL since it acquired Studio Now earlier this year. 5Min gives AOL significant distribution reach both for video that Studio Now creates and for other content AOL develops. 5Min has masterfully executed the video syndication opportunity that I've been bullish about for some time and I've been a big 5Min fan for a while.

The bigger question for me, which I've emailed to Ran Harnevo, 5Min's CEO and Co-Founder, is why sell now? While $65 million is certainly nothing to sneeze at, given $13 million was invested in the company the returns for investors are likely in the 2-4x range, again not shabby, but not a grand slam.

Categories: Deals & Financings, Portals, Syndicated Video Economy

-

NYTVF Digital Day Highlights: Indie Success through Branded Entertainment, Syndication

Originally conceived four years ago as a platform for burgeoning independent television producers, the New York Television Festival (NYTVF), which just finished up this weekend, has jumped ahead of the looming convergence by giving online video a progressively larger focus, particularly through its "Digital Day."

Started in 2008, Digital Day is a daylong event with panels discussing the digital entertainment landscape. This year's panels included producers and executives from MSN/Bing, Blip.TV, Next New Networks, Digitas' The Third Act, NBC Universal, and Electus' Ben Silverman. The topics discussed were primarily monetization through brand integration and syndication on major portals.

Categories: Branded Entertainment, Syndicated Video Economy

Topics: New York Television Festival

-

5Min Expands Reach With Dailymotion Partnership

5Min, a leader in online video syndication, will distribute its 200K lifestyle and how-to videos to aggregator Dailymotion, in a partnership deal announced this morning. For 5Min and its content partners, Dailymotion with its 66 million monthly unique visitors, offers a huge additional audience. For its part, Dailymotion gets a curated library of premium quality content across 21 categories such as sports, health, travel, games and others. A quick check of Dailymotion today indicates the 5Min integration is not yet live.

million monthly unique visitors, offers a huge additional audience. For its part, Dailymotion gets a curated library of premium quality content across 21 categories such as sports, health, travel, games and others. A quick check of Dailymotion today indicates the 5Min integration is not yet live.

5Min has been an early leader in video syndication, using its "VideoSeed" technology to understand publishers' text pages and then contextually match relevant content to them, from content partners like IGN, Hearst, Meredith, Scripps and others. Premium content providers have been attracted to work with 5Min because it drives significant incremental viewership of their videos beyond their own destination web sites.

Categories: Aggregators, Syndicated Video Economy

Topics: 5Min, DailyMotion

-

Webinar Today: Independent Online Video and Syndication

Please join The Diffusion Group and VideoNuze today at 11am PT/2pm ET when we will present the fourth complimentary webinar in our 2010 "Demystifying" series, with this session's focus on demystifying independent online video and syndication models. The series is exclusively sponsored by ActiveVideo Networks.

TDG's Colin Dixon and I will be hosting and moderating the webinar, which will include guests Jim Louderback, CEO of Revision3, and Rich Bloom, SVP of Business Development for 5Min. Jim and Rich will each do short presentations and then we'll have moderated Q&A followed by plenty of time for audience Q&A.

Jim and Rich will cover what's working for their companies and what's in store for the broader online video industry going forward. If you're an independent video producer, or part of an established media company looking to succeed in the online medium, this webinar is for you!

Click here to learn more and register about this complimentary webinar

Categories: Events, Indie Video, Syndicated Video Economy

Topics: 5Min, ActiveVideo Networks, Revision3, TDG, Webinar

-

AlphaBird Spreads Its Wings With Warner Bros./Dailymotion Syndication Deal

This morning, AlphaBird, a branded entertainment syndication startup, is announcing that it has syndicated 4 digital series from Warner Bros. Television Group's web content arm, Studio 2.0, to Dailymotion. In addition to distributing and selling advertising around the programs, Dailymotion will promote the various series on its homepage every Monday through the end of the year. Ad revenue will be split between Dailymotion, Warner Bros. and AlphaBird.

The deal is the latest example of premium online video being distributed to a third-party with sizable audience in order to build awareness and viewership (part of what Will has called the "Syndicated Video Economy"). As AlphaBird's CEO Chase Norlin explained yesterday, while it's always challenging to create high-quality content, with the fragmentation and noisiness of the Internet, these days an even bigger challenge is gaining audience.

Categories: Syndicated Video Economy

Topics: AlphaBird, DailyMotion, Warner Bros.

-

Bloomberg is Now Using Taboola's Video Recommendations

Browsing the web last week, I noticed that Bloomberg.com is now incorporating videos throughout its site from Taboola, the video recommendations engine. If you click on any article on the site, in the lower part of the right column you'll see several thumbnails of recommended videos (here's an example from an article today about Motorola's earnings). When you click any video you're then brought to a playback page, which has additional recommended videos (see below).

Categories: Syndicated Video Economy, Technology

-

Syndicating Branded Entertainment Gains on AlphaBird-Fremantle Deal

This morning AlphaBird is announcing a deal with FremantleMedia to package and syndicate online the new branded entertainment web series, "As Worn Buy." AlphaBird recently launched as a new video content syndication service and is headed by Chase Norlin and Alex Rowland, both online video industry veterans. I caught up with Chase and Alex to understand how the Fremantle deal works, and also how the company is looking to differentiate itself.

Taking a step back for a moment, AlphaBird is working in the "Syndicated Video Economy" a term I coined a couple of years ago. The SVE is an ecosystem of companies facilitating consumption and monetization of online video across a broad network of sites and environments. In the SVE it is more important for content providers to access eyeballs wherever they happened to be - for example on 3rd party sites, on mobile devices, in social media settings, etc. than to solely try attracting them to a destination web site (along the lines of the "must-see TV" model of appointment, channel-based viewing).

The SVE recognizes that the Internet is a highly fragmented, on-demand centric medium that requires its own unique formulas for success. Everyone working in the SVE understands that it's still very early in the game, and the rules of the road are being figured out in real time. The key to the SVE is simultaneously pleasing the main constituencies - video content creators, advertisers, publisher sites and users. All of this needs to be done in the context of long-standing expectations that each constituency has about how things have always worked. The SVE can't be a revolution; rather, to bring all the constituents along, it needs to gradually migrate from and respect the way things have always been done.

AlphaBird is trying to carve out its role in the SVE by focusing on syndicating branded entertainment (web series with deep brand/product involvement/visibility/placement) to a network of publishers. Alex explained that AlphaBird's key differentiator is to insert the video in an editorial position within publisher web pages, as opposed to in advertising positions (e.g. existing 300x250 in-banner placements). The goal is to provide incremental value to publishers and their audiences. The proposed payoff to the brand is higher awareness (through editorial positioning), engagement (all video is click-to-play) and ROI (all pricing is performance-based). AlphaBird is guaranteeing audience to brands, though not down to certain specific sites just yet. Clarification - AlphaBird is offering site level guarantees.

involvement/visibility/placement) to a network of publishers. Alex explained that AlphaBird's key differentiator is to insert the video in an editorial position within publisher web pages, as opposed to in advertising positions (e.g. existing 300x250 in-banner placements). The goal is to provide incremental value to publishers and their audiences. The proposed payoff to the brand is higher awareness (through editorial positioning), engagement (all video is click-to-play) and ROI (all pricing is performance-based). AlphaBird is guaranteeing audience to brands, though not down to certain specific sites just yet. Clarification - AlphaBird is offering site level guarantees.

Given the trend of brands creating their own content, and the difficulty of generating online audiences, AlphaBird's concept is appealing (though to be fair, it's not entirely unique as Grab Networks, for example, also does editorial placements). It's easy to see why Fremantle, which is a content creation expert, but an online video syndication newbie, would value this kind of partnership. Chase said that achieving distribution goals is the number one challenge facing content creators, and that's where AlphaBird is focused.

My main concern is that achieving pure editorial placements is a very heavy lift and is hard to scale. It requires high-touch interactions to gain buy-in from editorial staff who are rightly concerned about their product's integrity (and as a result often bringing a bias against 3rd party video). That creates a far higher bar to clear than convincing the ad team to run something in a location already used for advertising in order to pick up a few extra bucks. A lack of scale would challenge AlphaBird's ability to win deals from major brands requiring significant exposure.

AlphaBird's hand-crafted approach also means a lot of detailed integration and follow-on QA to ensure the video is running according to expectations conveyed to the brand upfront. That would be welcome, given some of the stories emerging about low-quality syndication market activity, but it's costly to deliver. Alex acknowledged all of this and agreed that trying to automate as much as possible is the key to scaling the model successfully.

With the Fremantle deal, AlphaBird is plowing new ground for branded entertainment in the SVE. Chase says the company is already profitable, and it is begin funded from revenue. For those interested in the SVE's ongoing evolution, AlphaBird will also be worth keeping an eye on.

What do you think? Post a comment now (no sign-in required).Categories: Indie Video, Syndicated Video Economy

Topics: AlphaBird, FremantleMedia

-

Watching Hulu Content on Facebook Through ClipBlast's App is Cool

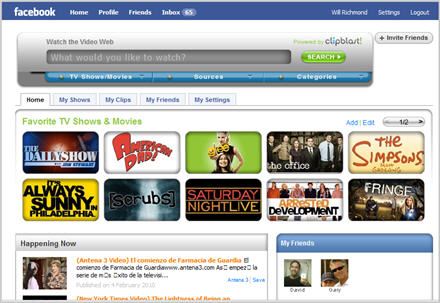

Here's something cool: ClipBlast updated its Facebook app yesterday to now include access to practically all of Hulu's content. ClipBlast's CEO/founder Gary Baker walked me through a demo and I was quite impressed. Once you've added the app, you can favorite certain Hulu shows and they appear as tiles which you can then easily scroll through. It's a huge step forward from Hulu's own mediocre Facebook app. You can also choose video from over 8,500 other sources that ClipBlast offers.

Though I'm personally not a huge Facebook user, the app resonated with me because it makes discovering and sharing video even more powerful as Facebook friends are just a click away. Of course Hulu has offered embedding from the start, but to get almost the whole Hulu library into Facebook, in front of a potential audience of 400 million users is classic "syndicated video economy" thinking. In the SVE, instead of solely trying to bring audience to your content (the traditional media model), efforts are also focused on bringing your content to the audience, wherever they live. All of Hulu's ads flow through as well, so views are still fully monetized. What's missing is full screen viewing, which Gary said is coming shortly.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators, Syndicated Video Economy, Video Sharing

Topics: ClipBlast, Facebook, Hulu

-

Scoring My 2009 Predictions

As 2009 winds down, in the spirit of accountability, it's time to take a look back at my 5 predictions for the year and see how they fared. As when I made them, they're listed below in the order of most likely to least likely to pan out.

1. The Syndicated Video Economy Accelerates

My least controversial prediction for 2009 was that video would continue to flow freely among content providers numerous third parties, in what I labeled the "Syndicated Video Economy" back in early 2008. The idea of the SVE is that "destination" sites for online audiences are waning; instead audiences are fragmenting to social networks, mobile devices, micro-blogging sites, etc. As a result, the SVE compels content providers to reach eyeballs wherever they may be, rather than trying to continue driving them to one particular site.

Video syndication continued to gain ground in '09, with a number of the critical building blocks firming up. Participants across the ecosystem such as FreeWheel, 5Min, RAMP, YouTube, Visible Measures, Magnify.net, Grab Networks, blip.TV, Hulu and others were all active in distributing, monetizing and measuring video across the SVE. I heard from many content executives during the year that syndication was now driving their businesses, and that they only expected that to increase in the future. So do I.

2. Mobile Video Takes Off, Finally

When the history of mobile video is written, 2009 will be identified as the year the medium achieved critical mass. I was bullish on mobile video at the end of 2008 primarily due to the iPhone's success and my expectation that other smartphones coming to market would challenge it with ever more innovation. The iPhone has continued its amazing run in '09, on track to sell 20 million+ units. Late in the year the Droid, which Verizon has relentlessly promoted, began making inroads. It also benefitted from Verizon highlighting AT&T's inadequate 3G network. Elsewhere, 4G carrier Clearwire continued its nationwide expansion.

While still behind online video in its development, mobile video is benefiting from comparable characteristics. Handsets are increasingly video capable, just as were computers. Mobile content is flowing freely, leaving the closed "on-deck" only model behind and emulating the open Internet. Carriers are making significant network investments, just as broadband ISPs did. A range of monetization companies have emerged. And so on. As I noted recently, the mobile video ecosystem is healthy and growing. The mobile video story is still in its earliest stages, we'll see much more action in 2010.

3. Net Neutrality Remains Dormant

Given all the problems the Obama administration was inheriting as it prepared to take office a year ago, I predicted that it would not expend energy and political capital trying to restart the net neutrality regulatory process. With broadband ISP misbehavior not factually proven, I also thought Obama's predilection for data in determining government action would prevail. However, I cautioned that politics is a tough business to predict, and so anything can happen.

And indeed, what turned out is that in September, new FCC Chairman Julius Genachowski launched a vigorous net neutrality initiative, despite the fact that there was still little data supporting it. With backwards logic, Genachowski said the FCC would be guided by data it would be collecting, though he was already determined to proceed. In "Why the FCC's Net Neutrality Plan Should Go Nowhere" I argued, among other things, that the FCC is way off the mark, and that in the midst of the gripping recession, to risk the unintended consequences that preemptive regulation carries, was foolhardy. Now, with Comcast set to acquire a controlling interest in NBCU, net neutrality advocates will say there's even more to be worried about. It looks like we can expect action in 2010.

4. Ad-Supported Premium Video Aggregators Shakeout

The well-funded category of ad-supported premium video aggregators was due for a shakeout in '09 and sure enough it happened. Players were challenged by little differentiation, hardly any exclusive content and difficulty attracting audiences. The year's biggest casualty was highflying Joost, which made a last ditch attempt to become a white label video platform before being quietly acquired by Adconion. Veoh, another heavily funded player, cut staff and changed its model. TidalTV barely dipped its toe in the aggregation waters before it became an ad network.

On the positive side, Hulu, YouTube and TV.com continued their growth in '09. Hulu benefited from Disney coming on board as both an investor and content partner, while YouTube improved its appeal to premium content partners and brought on Univision and PBS, among others. Aside from these, Fancast and nichier sites like Dailymotion and Babelgum, there isn't much left to the aggregator category. With TV Everywhere services starting to launch, the opportunity for aggregators to get access to cable programming is less likely than ever. And despite their massive traffic, Hulu and YouTube have significant unresolved business model issues.

5. Microsoft Will Acquire Netflix

This was my long ball prediction for '09, and unless something happens in the waning days of the year, I'll have to concede I got this one wrong. Netflix has remained independent and is charging along with its own streaming "Watch Instantly" feature, now used by over half its subscribers, according to recent research. Netflix has also broadened its penetration of 3rd party devices, adding PS3, Sony Bravia TVs and Blu-ray players, Insignia Blu-ray players this year, in addition to Roku, XBox and others. Netflix is quickly becoming the most sought-after content partner for "over-the-top" device makers.

But as I've previously pointed out, Netflix's number 1 challenge with Watch Instantly is growing its content selection. Though it has a deal with Starz, it is largely boxed out of distributing recent hit movies via Watch Instantly by the premium channels HBO, Showtime and Epix. My rationale for the Microsoft acquisition is that Netflix will need far deeper pockets than it has on its own to crack open the Hollywood-premium channel ecosystem to gain access to prime movies. For its part, Microsoft, locked in a pitched battle with Google and Apple on numerous fronts, could gain advantage with a Netflix deal, positioning it to be the leader in the convergence era. Meanwhile, others like Amazon and YouTube continue to circle this space.

The two big countervailing forces for how premium video gets distributed in the future are TV Everywhere, which seeks to maintain the traditional, closed ecosystem, and the over-the-top consumer device-led approach, which seeks to open it up. It's hard not to see both Netflix and Microsoft playing a major role.

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Broadband ISPs, Deals & Financings, Mobile Video, Regulation, Syndicated Video Economy

Topics: Apple, AT&T, Fancast, FCC, Hulu, iPhone, Joost, Microsoft, Netflix, Veoh, Verizon, YouTube

-

EveryZing Becomes RAMP, Focuses on "Content Optimization"

EveryZing is changing its name to RAMP, and positioning itself around "Content Optimization." Ordinarily a name change signals a change in strategic or product direction, but in this case, as CEO Tom Wilde explained to me last week, the re-naming is neither. The change to RAMP unifies the company name with its platform name (plus descriptive extensions), and completes the evolution of the company as a consumer destination originally named PodZinger.

I've been bullish on RAMP since my original post on the company in February '08, in which I detailed how RAMP married online video to the ubiquitous consumer search experience, addressing the chronic need for

improved video discoverability. RAMP did this by using core technology to extract metadata for any type of video, audio, text and image and then organizing related content onto search engine-friendly topic pages that grouped related content.

improved video discoverability. RAMP did this by using core technology to extract metadata for any type of video, audio, text and image and then organizing related content onto search engine-friendly topic pages that grouped related content. RAMP has continued to build out its platform since then, unveiling its "chromeless" MetaPlayer in Oct '08 that creates "virtual clips" so users can navigate to just the scene they're looking for, while content providers can maintain their existing business rules. Then earlier this year RAMP released "MediaCloud," which moved the metadata extraction process into the cloud, giving content providers the ability to manage the metadata themselves and deeply integrate it into their workflow and larger content publishing activities.

As metadata has become recognized as the currency underpinning content discovery and monetization, RAMP has added large customers, such as NBCU (also its lead investor), FOX, Meredith Publishing and others. RAMP's capabilities to handle all media types (video, audio, text and images) has become increasingly important as content providers realize that mixing and matching different assets is now required to provide audiences with the best experience. For the most advanced publishers, the days of siloing off video or audio are in the past.

In its new white paper, RAMP articulates well the fundamental shifts happening in the media business: the move away from "containers" (e.g. a magazine, album or newspaper) into content "objects" that users find, share and self-organize online; the trend toward syndication, where brand success is more about proliferating content everywhere on the web than attracting users to a specific destination site; the opportunity for content providers to enhance their monetization through dynamic contextual targeting rather than by simply selling eyeballs. Addressing these and other elements effectively is what RAMP calls content optimization.

Many of the themes RAMP espouses align with what I've been describing for a while now as the "Syndicated Video Economy." I only see these themes accelerating in importance as the supply of video escalates, devices proliferate and social media grows. With its flexible, SaaS platform that integrates well into other 3rd party content management and publishing platforms, I expect RAMP will continue to succeed as content providers become more sophisticated about how to operate online.

What do you think? Post a comment now.

Categories: Syndicated Video Economy, Technology

-

FreeWheel is Close to Managing 1 Billion Video Ads Per Month

In a quick call yesterday with FreeWheel Co-CEO and Co-Founder Doug Knopper, who was on his way to NYC for tonight's VideoSchmooze, he told me that the company is poised to manage 1 billion video ads next month, all against premium video streams.

In addition, FreeWheel has now been integrated by AOL, MSN and Fancast, among others, with Yahoo testing currently and ready to go live soon. It looks like the major portals are being encouraged to integrate with FreeWheel's Monetization Rights Management system by the company's premium content customers.

The benefit to the content providers is better control and monetization of their ad inventory across their portal distribution deals. The portal activity comes on top of FreeWheel's recently-reported implementation with YouTube, allowing the site's premium content partners to sell and insert ads against their YouTube-initiated streams.

The benefit to the content providers is better control and monetization of their ad inventory across their portal distribution deals. The portal activity comes on top of FreeWheel's recently-reported implementation with YouTube, allowing the site's premium content partners to sell and insert ads against their YouTube-initiated streams.FreeWheel is another great example of the Syndicated Video Economy (SVE) I've frequently talked about. Doug says FreeWheel's progress is proof that the SVE is really "hitting its stride."

It is hard though to put FreeWheel's 1 billion number into perspective. One way of thinking about it is comparing it to the data that comScore reported for August '09 for the top 10 video sites. Assuming only 5-10% of YouTube's views are from its premium partners and maybe half of Fox Interactive's are (due to MySpace's user-generated videos being included in its 380M streams) the top 10 video providers would account for about 3.5B videos. If each video had an average of 2 ads (which is a decent assumption when averaging short clips vs. full programs), then the top 10 video sites would account for about 7B video ads.

Relative to the top 10 then, FreeWheel's 1B ads managed look pretty healthy. To get a fuller picture, you'd also have to consider how many premium streams are in the 12B+ video views that fall outside of comScore's top 10 video sites, and how many ads run against those. If anyone has any ideas for how to determine these numbers, I'd love to hear them.

What do you think? Post a comment now.

Categories: Advertising, Portals, Syndicated Video Economy, Technology

Topics: AOL, Fancast, FreeWheel, MSN, Yahoo, YouTube