-

VideoNuze Report Podcast #59 - April 30, 2010

Daisy Whitney and I are pleased to present the 59th edition of the VideoNuze Report podcast, for April 30, 2010.

In today's podcast Daisy and I discuss Tremor Media's new $40 million round led by DFJ Growth, announced earlier this week, and about broader investment trends in the online video and advanced advertising space. As I wrote a few weeks ago, money continues to pour into online video companies, and in today's podcast we talk about the key reasons why. Listen in to learn more!

Click here to listen to the podcast (13 minutes, 13 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!Categories: Advertising, Deals & Financings, Podcasts

Topics: Podcast, Tremor Media

-

Tremor Media Raises $40 Million; Biggest Recent Deal in Online Video Sector

This morning the online video ad network and management company Tremor Media is announcing a monster $40 million financing, bringing total capital in Tremor to $82 million. I've been tracking venture capital investments in the online and mobile video sector for the past 5 quarters and I believe this is the largest recent private company deal yet (I think the only one bigger is Ustream's $75 million deal last quarter, but only $20 million was upfront). Draper Fisher Jurveston Growth Fund is leading the new round, with participation from existing investors. Last night I talked to Jason Glickman, Tremor's CEO and exchanged emails with Randy Glein, managing director at DFJ Growth to learn more.

online and mobile video sector for the past 5 quarters and I believe this is the largest recent private company deal yet (I think the only one bigger is Ustream's $75 million deal last quarter, but only $20 million was upfront). Draper Fisher Jurveston Growth Fund is leading the new round, with participation from existing investors. Last night I talked to Jason Glickman, Tremor's CEO and exchanged emails with Randy Glein, managing director at DFJ Growth to learn more.

Jason explained that since Tremor raised $20 million last year and turned profitable, it actually didn't need the money. However, the team believes that online video advertising is at an inflection point and so the decision to really step up and "go for it" as Jason said. Primarily, that means adding more features for publishers and advertisers and enhancing the Acudeo management platform. It also means pursuing a 3 screen strategy to encompass mobile and TV platforms.

Randy said that DFJ has known Tremor for over 2 years and is motivated by the transformation underway in the advertising industry, driven by exploding online video usage to both computers and other connected devices. The shift in ad spending from traditional TV to online video is just beginning, and Randy sees Tremor - with its huge network and ad management platform - as being positioned right in the middle of all this change.

Jason further explained that the company now has the scale to attract 6 and 7-figure campaigns from brands that are increasingly drawn to the online video medium. Key challenges going forward include proving brands with the data that their online campaigns not only reach their intended targets, but also provide required brand lift and ROI. In particular, Jason said Tremor's ability to optimize against certain audiences or by metrics objectives is an important part of its success.

At VideoSchmooze on Monday night there was considerable discussion around hybrid pay/ad-supported models for premium video content. Clearly, if a content provider can garner consumer payments they should. However, the new Tremor financing is further evidence to me of the innovation and excitement around online video advertising that will make it far more valuable than TV advertising ever was. As brands come to recognize online video advertising's value proposition I see monetization per viewer (or whatever other metric of advertising success that's preferred) going up over time.

(Separate, note also that online video management provider KIT Digital yesterday also completed what is probably the largest public company financing in the online video sector - raising $55 million from the sale of over 4.2 million shares.)

What do you think? Post a comment now (no sign-in required).

Categories: Advertising, Deals & Financings

Topics: KIT Digital, Tremor Media

-

FreeWheel Raises $16.8 Million; Steamboat is Lead Investor

Video ad management provider FreeWheel just announced a new $16.8 million financing, led by Steamboat Ventures, which is affiliated with Disney, with participation from existing investors Turner Broadcasting System, Battery Ventures and Foundation Capital. It's another big win for FreeWheel is which is the clear leader in ad management in the syndicated video economy.

participation from existing investors Turner Broadcasting System, Battery Ventures and Foundation Capital. It's another big win for FreeWheel is which is the clear leader in ad management in the syndicated video economy.

Doug Knopper and Jon Heller, co-CEOs, who are 2 of FreeWheel's 3 co-founders will be at VideoSchmooze tonight, along with many other from their team. Join us!Categories: Advertising, Deals & Financings

Topics: FreeWheel, Steamboat Ventures

-

Discovery and PointRoll Combine Editorial and Ads in "Dig@torial" In-Banner Video Unit

A new ad unit announced by Discovery and PointRoll and called "Dig@torial" (pronounced "digitorial") caught my attention a few weeks ago, and I've been meaning to write about it since. The unit intrigued me because it dynamically leverages Discovery's video library to enhance an advertiser's message in an easy-to-navigate rich media banner. I hadn't seen anything quite like it before and believe it is yet another indicator of how content and ads are blurring into one seamless experience.

To learn more, I talked to Michael Aronowitz, VP of Channel Development at PointRoll, which is owned by Gannett, and Brent Spitzer, VP and Leigh Solomon, Manager of Activation, both at Discovery Digital Media Advertising Sales.

PointRoll worked with Discovery to build a shell in the requested leaderboard and 160x600 skyscraper formats. In these examples 50% of the space promotes Montana Office of Tourism specifically and the other 50% offers opportunities to engage with Discovery content. When you roll over the ad it unfolds to show a mosaic of photos to look at in the Montana space (plus a link to visit www.visitmt.com), and a choice of relevant articles and videos from Discovery's library in its space. A video begins playing in-banner automatically with 4 thumbnails exposed below, plus a link to view more on a customized landing page. The videos play with a 10 second pre-roll for Montana that is frequency-capped.

Brent and Leigh explained that with the Dig@torial, Discovery works collaboratively with its advertising clients to select the most relevant content to incorporate into the ads. Discovery's team combs through its archive of video clips and proposes a playlist to the client. If the client has its own video that can be incorporated too. The video is fed dynamically into the Dig@torial unit, so it can be updated at any time. The key to making all this possible for Discovery is that it owns all of its programs, so it has a free hand to carve them up and integrate them into ads like these.

It's still early for the Dig@torial unit, but it appears to be succeeding. Michael said that the benchmark "interaction rate" for the PointRoll network (which is the first time someone interacts with a PointRoll ad) over the last 1 1/4 years is 6.4% with a 14 second engagement time. The Dig@torial press release says that regular rich media ads on Discovery's sites exceed the PointRoll benchmark by 70% and that the Dig@torial ads provide another 50% lift. That would imply an approximately 16% interaction rate and 36 second engagement time, both of which are very strong. Attesting to the Dig@torial's appeal, Brent and Leigh said that Dig@torial campaigns for 8 other clients have also recently launched or are being launched (I combed through Discovery's sites, but wasn't able to find them though).

Brands and sites are perpetually trying to identify ways to increase user engagement and conversion. By blending client messages with relevant and strongly branded content, the Dig@torial unit is breaking new ground in delivering value to all parties. It's also a reminder that for content providers, it's worth trying to secure re-use rights to programming and then archiving and tagging them for subsequent retrieval. Dig@torial is showing that content's value can extend well beyond its initial airing.

What do you think? Post a comment now (no sign-in required).Categories: Advertising, Cable Networks

-

NDS Leads $20 Million Investment in BlackArrow for Advanced Advertising

Amid all the coverage that online video advertising receives, it's also important to remember that advanced advertising in on-demand and pre-recorded TV continues to evolve. News today that NDS, one of the largest technology providers to multichannel video programming distributors ("MVPDs") is leading a $20 million Series C round in BlackArrow, a provider of advanced advertising solutions, is a reminder of progress. Last week I spoke to Todd Narwid, VP of New Media for NDS and Dean Denhart, BlackArrow's CEO, to learn more about the deal.

("MVPDs") is leading a $20 million Series C round in BlackArrow, a provider of advanced advertising solutions, is a reminder of progress. Last week I spoke to Todd Narwid, VP of New Media for NDS and Dean Denhart, BlackArrow's CEO, to learn more about the deal.

To put the deal and its upside in context, it's important to first understand there's a big difference between how online video advertising against free streams in the open Internet works vs. how advertising against VOD and DVR programs in paid, subscription-based services run by MVPDs works. In the Internet world, there are pretty well-established standards, allowing significant interoperability among sites and ad servers. While measurement challenges persist, the act of getting video ads inserted where they're supposed to be is now pretty straightforward.

Conversely, in the MVPD world, the first challenge is just getting ad serving systems approved and deployed. Because ads are served from within the MVPD's own infrastructure, new ad servers must be tested and integrated with existing video delivery infrastructure residing in distribution centers often called "headends" in the cable world. Unlike MVPDs' broadband deployments, much of MVPDs' TV delivery architecture pre-dates the Internet and therefore is heterogeneous and often difficult to integrate with. In addition, there are the tens of millions of deployed set-top boxes which also differ in their capabilities and openness. MVPDs have made significant progress in creating their own standards and in deploying advanced services, but as anyone who's ever tried to implement any kind of advanced service in the MVPD world can attest, it's hard work and has ground down many promising technology start-ups.

When I first wrote about BlackArrow, on its launch in Oct, '07, I liked its vision of delivering advanced advertising in VOD and DVR programs, but I noted the above challenges gave it a steep hill to climb. Since then, BlackArrow has made progress, deploying with Comcast in Jacksonville, FL and with other operators (though Dean isn't able to mention them due to MVPD restrictions). Still, MVPDs have so many priorities and their resources for testing and integrating new technology are limited. Further, there's a lingering sentiment that MVPDs have only made a half-hearted attempt to really monetize VOD and DVR.

Given these circumstance, the NDS deal appears to offer BlackArrow a lot of upside. As one of the largest technology providers to MVPDs globally ("conditional access" systems that provide secure MVPD video delivery are its main product line, among others), NDS immediately gives BlackArrow both credibility and significantly improved sales and support reach, particularly outside North America. The companies also announced a joint solution offering, which will be key to realizing actual sales Importantly, NDS gives BlackArrow improved financial footing for what promises to be a very long-term process of deploying advanced advertising by MVPDs. Conversely, for NDS, as Todd explained, BlackArrow provides the monetization piece of the puzzle that MVPDs need to create business cases to help them justify NDS's advanced technology delivery systems.

upside. As one of the largest technology providers to MVPDs globally ("conditional access" systems that provide secure MVPD video delivery are its main product line, among others), NDS immediately gives BlackArrow both credibility and significantly improved sales and support reach, particularly outside North America. The companies also announced a joint solution offering, which will be key to realizing actual sales Importantly, NDS gives BlackArrow improved financial footing for what promises to be a very long-term process of deploying advanced advertising by MVPDs. Conversely, for NDS, as Todd explained, BlackArrow provides the monetization piece of the puzzle that MVPDs need to create business cases to help them justify NDS's advanced technology delivery systems.

For MVPDs, who are witnessing the rapid adoption of online video and the threat of cord-cutting down the road, it is essential to be able to offer subscribers more flexible viewing options like VOD and DVR and to give their content partners opportunities to effectively monetize these views. This has been the Achilles heel of VOD and DVR to date, and the scarcity of ad-supported programs in VOD (particularly relative to what's available online) is a direct reflection of this.

Going forward, the challenge for MVPDs will only intensify as content providers face escalating choices about where to optimally monetize their programming. This is where BlackArrow fits in. Plus the company has always had a multi-platform vision, so once it's enabled for TV and DVR, BlackArrow could also provide a pathway to online monetization, which given MVPDs' TV Everywhere initiatives, is also a growing priority.

What do you think? Post a comment now (no sign-in required).

Categories: Advertising, Cable TV Operators, Deals & Financings, DVR, Satellite, Technology, Telcos, Video On Demand

Topics: BlackArrow, Comcast, NDS

-

VideoNuze Report Podcast #56 - April 9, 2010

Daisy Whitney and I are pleased to present the 56th edition of the VideoNuze Report podcast, for April 9, 2010.

First up this week, Daisy gives us an update on increasing ad loads in TV programs distributed online, building on our discussion from last week. Daisy reports on an interview she did with Mark Garner, SVP of Business Development at A&E Television Networks. AETN has found that in their TV Everywhere trials, when they increased ad loads by 20%, the rate at which people watch the programs all the way to the end was unchanged.

Research continues to build that incremental increases in ads doesn't harm viewership, but enhances monetization. Daisy concludes that AETN's experience is yet more evidence that soon enough more ads in online programs will be pervasive. Separate, Daisy previews an article she's writing about ad verification and how it figures in to the online video space.

Then I add some further color to my post from earlier this week in which I tallied up Q1 '10 financings for private video companies to at least $277.4 million. It was another stellar quarter for video companies, despite the fact that credit markets are still tight. Listen in to learn more.

Click here to listen to the podcast (13 minutes, 44 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!Categories: Advertising, Deals & Financings, Podcasts

Topics: AETN

-

VideoNuze Report Podcast #55 - April 2, 2010

Daisy Whitney and I are pleased to present the 55th edition of the VideoNuze Report podcast, for April 2, 2010.

This week Daisy and I first discuss my post from this past Monday, "New comScore Research Available; More Ads Tolerable in Online TV Programs" (the post also includes a link for a complimentary download of the research presentation). Among other things the research concludes is that viewers of online-delivered TV programs could tolerate 6-7 minutes of ads which is approximately double the typical current ad load.

I have argued for some time that the ad load in online programs is way too light and that it was jeopardizing the broadcast networks' P&Ls, particularly as convergence devices allow online video viewing directly on TVs. Coincidentally, this week the CW Network announced that it would double its ad load next TV season. And Hulu, though announcing this week that it has been profitable for the past 2 quarters, is under continued pressure by its content partners to increase its ad load to generate more revenue (recall that Hulu recently blocked the new Kylo browser, which I asserted was due to concern about cannibalizing audience and ad dollars from on-air).

Daisy then tells us more about "hot-spotting," which is the ability to click on an item in an online video and learn more about it and possibly purchase. Hot-spotting has become very hot (no pun), with multiple companies now offering technology that appears to be yielding significant results. Daisy reports that ConciseClick, ClickThrough and VideoClix are among the leaders and she provides some interesting stats on their performance. Listen in to learn more.

Click here to listen to the podcast (14 minutes, 45 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!Categories: Advertising, Podcasts

Topics: ClickThrough, comScore, ConciseClick, CW, Hulu, VideoClix

-

New comScore Research Available: More Ads Tolerable in Online TV Programs

An article I read last week in Mediaweek about new comScore research which concluded more ads are tolerable in online-delivered TV programs really intrigued me. The research was presented by Tania Yuki, comScore's director of cross media and video products at an Advertising Research Foundation meeting. I called Tania to follow up and learn more about the data. Today I'm pleased to share her presentation with the research findings as a complimentary PDF download. Outside of the ARF meeting, this is the first time this data has been made available.

Click here to download the research presentation

As VideoNuze readers know, I've been a proponent of increasing the number of ads in online TV shows, in order to improve their economics. Note, I'm not advocating a jump to 18-20 minutes of ads typically found in on-air distribution that would likely turn users off. But I do believe that the current model of 3-4 minutes of ads in premium network programs is way too light, and that viewers will tolerate more without any drop-off in usage, particularly if the ads are well-targeted and engaging. ABC has told me in the past that research it conducted when it experimented with doubling its ad load corroborated this point, just as the comScore research now does as well. Just last week the CW announced it would double the number of ads in its online-delivered programs.

model of 3-4 minutes of ads in premium network programs is way too light, and that viewers will tolerate more without any drop-off in usage, particularly if the ads are well-targeted and engaging. ABC has told me in the past that research it conducted when it experimented with doubling its ad load corroborated this point, just as the comScore research now does as well. Just last week the CW announced it would double the number of ads in its online-delivered programs.

Increasing the number of ads - and thereby strengthening the economic model for online-delivered TV - is critical for the industry to succeed long-term. The current lack of economic parity between online and on-air is gaining urgency; just last week when Hulu blocked access to its content via the new Kylo browser (meant for on-TV browsing), we were reminded of the absurd lengths to which the popular site will go to prevent its viewership from migrating to TVs. This is because Hulu was conceived as an online-only augment. Given its lack of economic parity with on-air (or with DVR viewing, as ABC.com is now achieving), Hulu on TV would undermine its owners' P&Ls.

The new comScore research concludes that viewers will tolerate 6-7 minutes of "total advertising time" during online-delivered TV programs. And note that this response reflects expectations of conventional advertising. I think it's quite possible that if respondents had been shown the kinds of targeted, entertaining and interactive video ads that blip.TV and others are now offering, they would have said their tolerance would be even higher. Providing further comfort that more ads are reasonable, when asked about the most important reasons for watching TV online, the answers were first, "Missed an episode on TV" (71%) and second, "Convenience" (57%). A distant third was "Less ads" (38%). Ad avoidance is important to online viewers, but it isn't their sole motivator.

The comScore research further underscores the growing importance of online, particularly in terms of raising programs' visibility and sampling. For example, for people who watch both on TV and online, an "online video site" (28%) is already the third most-cited way of discovering new TV shows, following "TV advertising" (59%) and "Friend/family member recommendation" (44%). Related, 28% said that they believed that if they hadn't been made aware of their favorite program online first, they probably wouldn't have discovered it on TV, and therefore would have missed the show entirely. Across all respondents, 20% of shows watched regularly had been watched first online.

As Tania reminded me, TV is still by far the dominant platform for viewing TV programs and that it's important to remember that online-only viewing is nascent. ComScore's research found that only 6% of respondents tune-in online only, though another 29% view both online and on-air. The key for me is looking toward the future. When the 6% of online-only viewers is broken down by age groups, about 75% are between 18-34. And if my 8 and 10-year old kids are any example, no doubt that those under 18 are only going to be even more avid online video viewers. In order for the TV industry to succeed in the future, it is essential that the business models to sustain online viewing be figured out pronto.

For this research, comScore which surveyed 1,825 people from its U.S.-only panel, weighted to match the total online population in age, income and gender. The research was conducted between Dec. 30, 2009 and Jan. 22, 2010. It was not sponsored by any third-party.

A reminder that if you're keen on this topic, join us for the complimentary April 8th webinar, "Demystifying Free vs. Paid Online Video" and then at the April 26th VideoSchmooze in NYC, where our panel topic is "Money Talks: Is Online Video Shifting toe the Paid Model?" (early bird tickets now available).

What do you think? Post a comment now (no sign-in required).

Categories: Advertising, Broadcasters

-

VideoNuze Report Podcast #52 - March 5, 2010

Daisy Whitney and I are pleased to present the 52nd edition of the VideoNuze Report podcast, for March 5, 2010.

First up this week I discuss my post from this past Monday, "ABC.com is Now Achieving 'DVR Economics' for Its Programs," in which I described how ABC is now generating roughly the same revenue per program per viewer in online as it is when its programs are watched in DVR playback mode. Albert Cheng, EVP of Digital Media at Disney-ABC had explained to me last week that ABC recently concluded that since online and DVR are both "catch-up" opportunities, it was more appropriate to compare them to each other than to on-air.

Key to this logic is that ABC maintains a release window for its programs, with them being posted on the site 4-6 hours after broadcast. As a result, people who really want to see the program when it's first available still watch on-air (and may in fact re-watch online or via DVR). As long as there's an audience for broadcast, and online doesn't cannibalize it, the logic makes sense to me. Albert also explained that there's further upside in online through increasing the ad load, which is something ABC has experimented with.

Daisy picks up on that point, noting that CBS's Anthony Soohoo told her in an interview for Beet.tv that CBS is considering moving to a full ad load online because the online and on-air experience are converging, which suggests to them that viewers would tolerate more ads. We dig into the interplay between online and DVR usage, which I think is increasingly going to be a key focus for networks in how they choose to monetize online viewing.

Wrapping up, we review what some of the social media "listening" sites that are tracking the Oscar predictions are saying. Daisy appears officially addicted to following the online chatter.

Click here to listen to the podcast (14 minutes, 41 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, Broadcasters, FIlms, Podcasts

-

ABC.com is Now Achieving "DVR Economics" for Its Programs

Last week while I was in LA I had a chance to sit down for an extended chat with Albert Cheng, EVP of Digital Media for Disney-ABC Television. Aside from general catch-up, I wanted to dig into a comment I'd heard Albert make at the recent NATPE conference - that full-length programs on ABC.com are now achieving "DVR economics."

The comment caught my attention because, as I've written a number of times, I've been concerned that the broadcast networks' streaming initiatives (and Hulu specifically) could be undermining their traditional business models. The main reason for this is that the ad load in streaming programs is a small fraction vs. what it is in on-air. If all online viewing is incremental to on-air that wouldn't matter. But despite certain research that suggests online doesn't cannibalize on-air, for some viewers who have long since transitioned to time-shifted consumption, it surely does. More importantly, as convergence devices that link broadband to TVs gain penetration, the choice for viewers of how to watch a particular program - via online or via on-air - gets even more pronounced, putting further pressure on on-air.

Albert explained that ABC has been closely following the economics of programs' different viewing methods and recently concluded that it was more appropriate to compare online's economics to DVR's economics

than to on-air's. Their reasoning is that because online is a "catch-up" medium it should be weighed against other comparable opportunities, not against on-air. Importantly, ABC "windows" the online release of its programs by 4-6 hours, so that hard-core fans who have to watch immediately will skew to on-air, rather than waiting. (Of course the question arises - in our increasingly on-demand, time-shifted world, how sizable is the "must-see" audience for all but the most popular programs like "Lost?" But that's a question for another day.)

than to on-air's. Their reasoning is that because online is a "catch-up" medium it should be weighed against other comparable opportunities, not against on-air. Importantly, ABC "windows" the online release of its programs by 4-6 hours, so that hard-core fans who have to watch immediately will skew to on-air, rather than waiting. (Of course the question arises - in our increasingly on-demand, time-shifted world, how sizable is the "must-see" audience for all but the most popular programs like "Lost?" But that's a question for another day.)When looked at this way, ABC believes online delivery compares favorably to DVR. No surprise, Albert would not disclose ABC's revenues or research, but he did give me a wink-and-a-nod when I shared my estimate that the on-air revenue per program per viewer is in the $.50-$.75 range (of course specific programs and specific episodes are above and below this range). To be clear, this only means the revenue generated is in this range. Because of bathroom breaks, channel flipping, viewers chit-chatting, etc. obviously not all of the ads are actually viewed.

Estimating the revenue per program per viewer range for DVR playback, given its attendant ad-skipping, is more complicated. Ad-skipping is surely high, but it's unclear exactly how high. For example, last Nov, the NY Times reported Nielsen research that somewhat remarkably showed that 46% of viewers age 18-49 still watched a program's commercials when in DVR playback mode. A different story is told by TiVo, which released data last Sept saying that for the programs that won the top Emmy awards, somewhere between 55-83% of the audience viewing these programs in DVR mode skipped the ads.

Just to round off, if we say that 60% of the ads in DVR playback are skipped, then DVR economics - and therefore ABC.com's economics - are in the $.20-$.30 range on a per program per viewer basis (i.e. 40% of $.50-$.75). Even on the low side of that range, that's better than my previous estimate of $.15 per program per viewer for Hulu in particular (which in reality was probably a little high anyway).

Further, Albert said that there's plenty of room for improving online's economics. One key focus is increasing the ad load, possibly to as much as double the current 5 ads per program. ABC.com has experimented with this and its research shows that neither the viewer nor the advertiser experience is diminished. As a result, ABC is inclined to increase the ad load to continue improving online economics further, but is somewhat constrained by advertisers' desire to minimize clutter and their own desire to remain consistent with non-ABC sites' ad loads.

Online distribution of full-length programs is still in its relative infancy. Yet as consumers hunger for it, broadcast networks have little choice but to provide it. The key is how to make this new delivery method profitable and also not harmful to the traditional network P&L. The use of windows for example, seems like an effective tactic insofar as there exists an audience intent on watching a program the moment it's shown on-air. Based on last week's conversation with Albert, along with prior ones, it seems like ABC is balancing things well - taking steps to pursue online, but doing so in a well-researched and analytically sound manner.

What do you think? Post a comment now (no sign-in required).

Categories: Advertising, Broadcasters

-

VideoNuze Report Podcast #50 - February 19, 2010

Daisy Whitney and I are pleased to present the 50th (woohoo!) edition of the VideoNuze Report podcast, for February 19, 2010.

This week Daisy first walks us through a piece she's writing for AdAge focused on viral video. In reviewing data on which videos have broken out online, Daisy concludes that invariably they are also supported by related advertising. In other words, viral video isn't accidental any more (if it ever was) - now it must be stoked by paid support. An example Daisy provides is for Evian's "Live Young" babies ad which has been seen online 76 million times. Evian initially promoted the ad with YouTube takeover ads. Daisy also discusses the online performance of Super Bowl ads based on Visible Measures' new Trends application, which shows a big disparity between ads that were viewed heavily online vs. rated highly when seen on TV.

Then we discuss my post, "In Trying to Preserve DVD Sales, Studios are in a Tight Spot," in which I described the lengths to which Hollywood studios are going to squeeze out the last remaining profits from DVD sales. As I explain, while the recession has had a dampening effect on DVD sales, the larger problem is that rather than buying them, increasingly consumers are expecting films to be available for rental or subscription or even for free, with ad support. A number of moves from Disney, Sony and Warner Bros. in the last week underscore the consequences studios face as they try to shore up DVD sales.

Click here to listen to the podcast (14 minutes, 8 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, FIlms, Studios

Topics: Disney, Podcast, Sony, Visible Measures, Warner Bros.

-

Panache Unveils "Ad Flow" Tool for Streamlined Fulfillment

Panache has unveiled Ad Flow, a new work flow tool for online video ads intended to streamline the process for publishers adding and approving new video campaigns. I got a short demo of Ad Flow from the Panache team and it looked intuitive and thorough.

According to Panache's EVP Cheryl Kellond, who was formerly a VP of Advertising at Yahoo, ordinarily this process is very manual and is based on home-brewed work flow tools which can result in a lot of emails back

and forth among the publisher's team members. The result is that it can take up to 6 weeks and end up costing 25-40% of the value of the campaign with all the personnel time involved. With these delays, Cheryl said Yahoo sometimes had to turn business away because they couldn't process the ads quickly enough.

and forth among the publisher's team members. The result is that it can take up to 6 weeks and end up costing 25-40% of the value of the campaign with all the personnel time involved. With these delays, Cheryl said Yahoo sometimes had to turn business away because they couldn't process the ads quickly enough.Though I've never personally been involved in this type of process at a major publisher, I have a glimpse into how complicated it must be from my own experience with VideoNuze's ads. First I receive sponsors' creative which was to have been developed according to published specs. Then I load the ads into my ad system and test them along a number of different dimensions. For one reason or another, frequently there are 1-2 rounds of revisions before they finally go live.

Even for a relatively simple site like VideoNuze which accepts Flash ads, though not video ads, there are a number of things that can cause deviations, resulting in delays for the campaign's start date. Mind you I'm not complaining, I've just come to understand that all of this is part of being in an ad-supported business.

With Ad Flow, the publisher's ad sales, ad product strategy, operations and creative teams can all monitor the step-by-step progress of new campaigns from initially being loaded through testing and to final approval. Rather than using email to monitor progress, everyone gets access to the tool for their specific tasks. Importantly, testing can be in the publisher's video player offline, which has been hard in the past. Ad Flow is another element in online video's foundation which will reduce the friction involved in getting ads live so that more TV ad budgets can be shifted to online video.

What do you think? Post a comment now (no sign-in required)

Categories: Advertising, Technology

Topics: Panache

-

New "Trends" Application from Visible Measures is Invaluable - and Addictive

Visible Measures, the third-party measurement firm for online video, is taking the wraps off its new "Trends" web-based application this morning. I've been playing around with it for the last couple of days with a courtesy login and not only does it pack a ton of value, it's also really addictive.

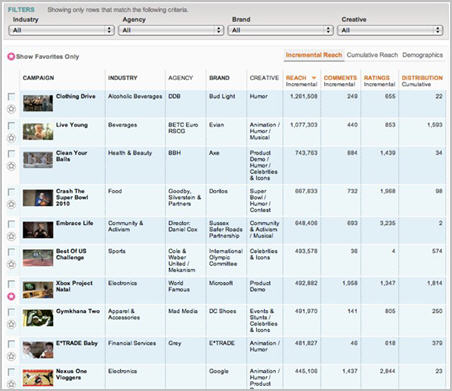

Trends offers access to videos in 3 different data sets, or "collections": Social Video (currently 165 online ad campaigns that have gone viral), Film Trailers (currently 115, and growing by 3-4 per week), and all the recent 2010 Super Bowl ads. The results table for a query displays the campaign's thumbnail image and its name, along with its views or "reach" based on Visible Measures' "True Reach" data (either incremental or cumulative) plus the number of comments, ratings and points of distribution. The table also displays each ad's industry categorization, ad agency, brand name and type of creative type (humor, contest, product demo, etc.). Viewing any particular ad is also just one click away.

Users can take advantage of Trends in any number of ways, depending on their particular interest. As one example, I started by choosing the Social Video collection and "Cumulative Reach" for the current time period. I was interested to see just campaigns for beverages, so I chose that category, but allowed all agencies, brands and creative types to be displayed. In an instant I was presented with a table of 20 results on 2 pages, starting with Evian's hilarious "Live Young" campaign featuring the dancing babies that has garnered almost 74 million views to date. After looking it over, I also reviewed the other campaigns in the top 5, from Pepsi, AMP and Anheuser-Busch. Click on the image below if you'd like to see a 4 minute video demo.

In the social and online video-dominated world we now live in, Trends data is invaluable for brand advertisers and their agencies. It allows them to customize their views of the database, compare different campaigns and analyze what worked online and what didn't. Online distribution is now a key part of calculating the ROI on a campaign, so being able to benchmark the performance of past campaigns provides insight not normally available in traditional TV advertising.

For example, say an agency is formulating a plan for its client's new shampoo - Trends lets its creative executives understand whether prior campaigns featuring product demos, humor or celebrities worked best online. A few quick queries will yield data that can be exported to create charts and graphs for everyone on the team to review. Of course past experience can perfectly predict the future, but Trends provides hard data that lets the creative discussion quickly move beyond gut instinct.

The Visible Measures team told me last week that they've been gradually exposing more and more of their data, through top 10 lists with media partners like AdAge, Variety, Mashable and Motor Trend. With Trends, the data is even more accessible. Visible Measure is also making a public beta of Trends available, though just for the Social Video collection. It's free and it's fun - I recommend giving it a try.

What do you think? Post a comment now (now sign-in required).

Note - Visible Measures is a VideoNuze sponsor.

Categories: Advertising, Analytics, FIlms

Topics: Visible Measures

-

SpotXchange Releases Ad Retargeting Service, Demonstrates Higher Conversion

SpotXchange, the performance-based video ad network, took the wraps off its retargeting service this week and shared a case study of a quick service restaurant that used it to achieve dramatically higher conversion results. For those not familiar, retargeting refers to the practice of tracking users' behavior on specific sites

and then serving them different ads on these sites (or others) they subsequently visit, depending on what behavior they've exhibited. Re-targeting is common in online display advertising, but as SpotXchange's CEO Michael Shehan explained to me, it's still nascent in online video advertising.

and then serving them different ads on these sites (or others) they subsequently visit, depending on what behavior they've exhibited. Re-targeting is common in online display advertising, but as SpotXchange's CEO Michael Shehan explained to me, it's still nascent in online video advertising. Because of its emotional impact, most video advertising is focused on branding, rather than trying to elicit a direct response, which is of course what search marketing is all about. Retargeting is a tactic to try blending the two benefits. Imagine a user who has poked around at a site promoting trips to the Caribbean, but who didn't click on the "Book Now" link. In subsequent visits to this site or others, video ads promoting Caribbean travel, with messaging like "What are you waiting for" and clear calls to action would help move the user along the buying process. It's still early for video ad retargeting, but to the extent that it can help conversion rates and in turn spur higher CPMs, it will be welcomed in the market.

What do you think? Post a comment now (no sign-in required).

Categories: Advertising

Topics: SpotXchange

-

VideoNuze Report Podcast #49 - February 12, 2010

Daisy Whitney and I are pleased to present the 49th edition of the VideoNuze Report podcast, for February 12, 2010.

This week Daisy and I dig into the 2009 comScore data that I detailed in my post on Tuesday (slides available for download too). It was a blistering year for online video, with total streams growing from 14.8 billion in Jan '09 to 33.2 billion in Dec '09. All the other relevant metrics also recorded strong growth. I share more details on the numbers and what they mean, focusing particularly on the top 2 sites YouTube and Hulu.

Then Daisy discusses her takeaways from the recent iMedia conference she helped organize. She talks about how brands are trying to break through the clutter, and the role of online video ad networks. Finally, she also discusses recent interviews she conducted with Facebook executives.

Click here to listen to the podcast (13 minutes, 55 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, Podcasts

Topics: comScore, Hulu, iMedia, YouTube

-

From an Online Video Perspective, Super Bowl Ads Are a Mixed Bag

The great Super Bowl game last night was once again not matched by the quality of the ads, at least when viewed for how well they leveraged online video. For several years now, I've been arguing that the $2.5-3 million that advertisers spend on their 30 second Super Bowl spots could yield a far higher ROI if they figured out how to extend their experiences through online video. So once again this year I've reviewed all of the Super Bowl ads - not for how funny, creative or gross they were - but for how well they took advantage of the benefits online video offers.

First, some basic stats: of the 58 ads that ran during the game last night (which I viewed this morning at CBSSports.com), 38 of them were tagged with a URL and 20 were not. On a percentage basis that's about equal to last year, when 37 of the 56 ads carried a URL. Of the 38 ads with a URL, only 4 of them explicitly urged the viewer to see more or watch more at their web sites:

-

Focus On the Family - The controversial Tim Tebow advocacy ad invites viewers to visit the Focus web site to see the full Tebow story. The site has a long interview with Tebow's parents along with lots of other video. Regardless of your politics, the ad works well as a friendly teaser for viewers to learn more about the organization.

-

Boost Mobile - Jim McMahon and the hilarious rapping NFL players take it to a new level by actually ending their rap with the line "Go online to find the rest of our jam," then exposing the URL. Further videos at the site continue the fun.

-

GoDaddy - The web site hosting company was back with its ads featuring Danica Patrick and teasing viewers to "See more now at GoDaddy.com." The scantily-clad GoDaddy girls concept is a little stale now, but for the male-dominated game audience, there's no doubting its appeal.

- HomeAway.com - My personal favorite, this vacation home rental company bought back Chevy Chase and Beverly D'Angelo as The Griswolds for "Hotel Hell," a spoof of the famous "Vacation" movie series. The ad is totally focused on getting viewers to see the film at HomeAway.com. Chase is a classic and the videos are very clever.

Outside of these four, a handful of others are on my honorable mention list. From a user involvement standpoint, CareerBuilder's provocative ad with workers walking around in their underwear (which was the result of its "Hire My TV Ad" contest) was a winner and built on the success Doritos has had with its own $1 million user-generated contest. Monster.com has an interesting engagement opportunity at its site, allowing users to create their own "Fiddle a Friend" music videos with their violin-playing beaver. Speaking of animals, you had to love Bridgestone Tires' "Whale of a Tale" ad featuring 3 guys trying to drive a whale back to the ocean - Bridgestone makes behind the scenes clips here.For more behind the scenes, Dove's new Men Care line features an interview with MVP Drew Brees, who's also shown lathering up in the shower (a blatant pitch to women as well as men). E-Trade was back with its talking babies, but this year with a twist, allowing site visitors to send their own "Baby Mail" emails. The new Honda Accord Crosstour features a well-produced video of the car, though no mention of the video is made in its game ad. And how about the futuristic Vizio ad trumpeting its Internet-connected TVs? It's surely a sign of many more connected device ads to come in future years.

Lastly, a few real misses. First up, what's the deal with Budweiser? It ran 9 ads and not one of them carried a URL. These folks are mistaken in thinking that viewers wouldn't be interested in more about the Clydesdales on the web. Beyond the horses, it would have been cool to learn more about how Bud made the human bridge ad, or did the voice effects in the T-Pain spot. Ditto for Denny's which was promoting its Grand Slam breakfast hard, but didn't do any web tie-ins. The movie ads make me nuts too. They roll the credits so fast at the end of the ad and the text is so small that it's nearly impossible to find a URL to learn more about the movie, even if you wanted to.

The Super Bowl is the biggest event on the sports and advertising calendars, yet as evidenced by this year's performance, most brands and agency creative types still don't fully understand the power of online video. Sure, the post-game galleries drive millions of additional views, but I continue to contend they could be so much more. Oh well, onto Super Bowl XLV.

What do you think? Post a comment now (no sign-in required).

Categories: Advertising, Sports

Topics: Boost Mobile, Focus on the Family, GoDaddy, HomeAway.com, Super Bowl

-

-

Will This Year's Super Bowl Ads Finally Leverage Online Video?

It's Super Bowl time again, which means it's time for me to write my annual post wondering whether this will

be the year that Super Bowl advertisers really embrace online video and social networking opportunities. Four years ago, I speculated that at some point a Super Bowl ad could go for $10 million apiece, because the online video extensions could drive the ROI so much higher than what a traditional 30 second ad alone delivers. Nonetheless, advertisers and their agencies have been painfully slow to get with the online video program, and I've been ranting about the missed opportunities (see here and here) year after year.

be the year that Super Bowl advertisers really embrace online video and social networking opportunities. Four years ago, I speculated that at some point a Super Bowl ad could go for $10 million apiece, because the online video extensions could drive the ROI so much higher than what a traditional 30 second ad alone delivers. Nonetheless, advertisers and their agencies have been painfully slow to get with the online video program, and I've been ranting about the missed opportunities (see here and here) year after year.As this NY Times piece describes though, this could finally be a breakthrough year. I like the way that Kathy O'Brien, VP for personal care at Unilever put it, "The Super Bowl is an element of a complete, 360-degree campaign." That's smart thinking. On Monday I'll tally up the score to see how this year's Super Bowl advertisers did with their online video and social networking extensions.

What do you think? Post a comment now (no sign-in required).

Categories: Advertising, Sports

Topics: Super Bowl

-

VideoNuze Report Podcast #48 - February 5, 2010

Daisy Whitney and I are pleased to present the 48th edition of the VideoNuze Report podcast, for February 5, 2010.

This week we get started with me reviewing yesterday's post about FreeWheel now serving close to 2 billion video ads per month and signing up MLB Advanced Media as their newest customer. FreeWheel's Doug Knopper told me that it is benefitting from both its new customers and also from year-over-year increases in ads served for existing customers. FreeWheel is also in the middle of the "syndicated video economy" that I've written before, having integrated with big third parties such as YouTube, AOL, MSN, Fancast and others.

Then Daisy describes her interview from last week's NATPE show with Chloe Sladden, director of media partnership for Twitter. The company is planning to launch its Media Developer's Platform later this year, along with new measurement tools. Daisy shares what she learned.

Click here to listen to the podcast (12 minutes, 38 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, Podcasts, Technology

Topics: FreeWheel, MLB, Podcast, Turner, Twitter, VEVO

-

Exclusive: FreeWheel Serving Almost 2 Billion Video Ads/Mo, MLB is Newest Customer

FreeWheel is on a roll, now serving almost 2 billion video ads/month, doubling its volume just since November, 2009. In addition, the company has added Major League Baseball Advanced Media to its customer roster and began implementing ads during the fall playoff season. The MLB win comes on top of recently announced customers Turner Broadcasting System and VEVO. FreeWheel's co-CEO/co-founder Doug Knopper brought me up to speed on all the news late last week.

Doug said that part of the increase in FreeWheel's volume is attributable to the additional customers that have come on board, but he's also very excited about the year-over-year growth in ad volume FreeWheel is

seeing for longer-term customers ("same store sales" if you will). FreeWheel is seeing big increases due to 3 factors: customers posting greater quantities of video, plus deepening viewership of that video (all of this borne out by comScore's '09 video consumption data); customers' improving ability to actually sell ads against these videos (reflecting the shift of budgets to the online video medium); and reduced friction through the emergence of "accepted practices" in ad operations.

seeing for longer-term customers ("same store sales" if you will). FreeWheel is seeing big increases due to 3 factors: customers posting greater quantities of video, plus deepening viewership of that video (all of this borne out by comScore's '09 video consumption data); customers' improving ability to actually sell ads against these videos (reflecting the shift of budgets to the online video medium); and reduced friction through the emergence of "accepted practices" in ad operations. FreeWheel is also benefiting from its specialization in helping content providers monetize their video on third-party sites (e.g. YouTube, AOL, MSN, Fancast, etc.). More and more content executives are realizing that sizable viewership opportunities exist by syndicating their video outside of their own properties. Doug said that every content company FreeWheel is now talking to is interested in some kind of syndication.

Doug described 3 types of syndication he's seeing: (1) across a family of sister corporate sites, such as PGA.com providing CNN.com video, which are both owned by Turner; (2) between affiliated entities like local MLB teams providing video to the main MLB.com hub and (3) externally, to unaffiliated 3rd parties, such as WMG music providing videos to YouTube. Given all this syndication activity, I was interested to learn from Doug what percentage of the ads FreeWheel serves fall into each of these 3 buckets vs. what percentage are served on the customer's sites themselves. Doug said that FreeWheel is pulling those numbers together in a way that ensures its customers privacy and will get back to me when he has them.

In addition to the above syndication activity, FreeWheel is seeing experimentation with delivering ads to mobile devices, convergence/CE players and Internet-enabled TVs. In all these cases, customized ad policies determine who sells what ad inventory and how revenue is shared and reported. Powering all of this has been part of FreeWheel's core mission from inception, making it a key player in what I've called the 'syndicated video economy."

FreeWheel's growth echoes what I've been hearing lately from both video ad network executives and video content providers. They too are talking about rapidly rising volumes and improving monetization. As I wrote recently, I've been impressed lately by efforts to make video ads more engaging and provide a better ROI, a trend I see continuing. Taken together, while it's still relatively early days, online video advertising seems to be making great strides.

What do you think? Post a comment now (no sign-in required)

Categories: Advertising, Sports

Topics: FreeWheel, MLB, Turner, VEVO

-

Video Ads Become More Engaging as Industry Grows

Making video ads more engaging has become a key initiative for many online video ad companies. They're responding to agencies and advertisers searching for additional ways to generate an ROI from their online video ad campaigns and further flexibility in how they deliver their messages. The moves come amid strong growth across the industry. Companies that have introduced enhanced interactivity include:

YuMe - introducing today the new "Triple Play" ad unit, which allows the advertiser to insert up to 3 calls to action (e.g. sign up for more info, watch more videos, etc.) after the video ends. YuMe's co-founder and president Jayant Kadambi told me that increasing choice for advertisers and agencies is a key goal. Separately, YuMe reported delivering 2.5 billion ads in Q4 '09, its strongest quarter to date, including an average of 30 million ads/day in Dec '09.

Jivox - introducing today custom interactivity allowing advertisers and agencies the ability to add their own Flash and HTML applets so users can interact within the player itself (example here, roll over the "Experience BMW" to see the interactive options). Diaz Nesamoney, Jivox's President, CEO and founder also explained to me last week that while the company continues operating its own ad network, its fastest-growing segment in '09 was licensing its platform to media companies (e.g. Gannett, McClatchy, Meredith, etc.) who want to sell their own video ads. Revenues were up 600% in '09 with 3,000 new advertisers.

Tremor Media - last week Tremor rolled out six new ad formats for enhanced interaction and engagement: Pre-roll Plus Overlay, vChoice Select, vChoice Rotator, Data Feed, Sequencer and In-Stream Live. The formats, which all use the company's Acudeo ad management platform, build on last June's introduction of its vChoice format. According to comScore's most recent Nov '09 numbers, Tremor was the largest video ad network with potential reach of 85 million viewers or 49.8% of the total U.S. viewing audience and actual reach of 20% of viewers.

Innovid - launched the iRoll, interactive pre-roll ad unit, in '09, which can embed a mini-web site in the video ad itself. Innovid originally pursued product placement through the insertion of Flash objects, but CEO and co-founder Zvika Netter told me recently that, based on agency feedback, it has decided to focus on enhancing interactivity. Innovid is still early stage, but its profile is growing. For example, Netter was recently selected as one of Time magazine's eight "Tech Pioneers Who Will Change Your Life."

ScanScout - Last but not least, in Oct '09 ScanScout unveiled its "Super Pre-Roll" unit, which also enhances interactivity within the ad itself (the Vaseline demo for a great example). Waikit Lau, ScanScout's co-founder and president told me that advertisers are drawn to the unit's superior click-through rates, which are up to 4.5 times higher than typical pre-roll ads.

All of these moves show that in-stream video ads are continuing to evolve to provide more value and a better ROI to advertisers, while also delivering an improved experience to users. No doubt this contributed to the strong '09 that many online video ad executives have reported to me. With the ad climate improving and further engagement opportunities inevitable, there is plenty of reason to believe that spending in the medium will continue to grow.

Note - if there are other initiatives you're aware of that I've missed, please leave a comment.

What do you think? Post a comment now (no sign-in required)

Categories: Advertising

Topics: Innovid, Jivox, ScanScout, Tremor Media, YuMe