-

TV and Broadband: Who's Morphing into Whom?

Does TV programming beget broadband video programming or is it the other way around?

If you were expecting a simple answer, recent evidence suggests that none will be forthcoming. Step away from the relatively straightforward model of streamed or downloaded TV episodes, and the question of how original video content will be produced and distributed between broadband and TV is whole lot more complicated. Layer on the writers' strike and the world only fogs up further.

For those who see broadband as a pathway to TV, Quarterlife's deal announced last Friday with NBC to bring their new Quarterlife series to the network following its run on MySpace offers encouragement that Internet programming can move to the TV (bear in mind that Quarterlife was originally pitched as a TV series however).

Another example is TMZ.com, which has been successfully syndicated as TMZ TV this fall by Warner Bros. TMZ shows us that a brand that was created and built solely online can make the leap to TV. And just last week TV Week reported that Twentieth Television and Yahoo were close to a deal to create a new syndicated series based on popular broadband videos that they've collected.

On the flip side, there is plenty of evidence of opportunities for TV programs spinning off broadband programming, or existing TV producers with assets and skills pushing into broadband as a first outlet for their work.

Consider Sony's Minisode Network, with distribution on MySpace, Joost, AOL and Crackle. In an effort to squeeze more life out of its library of classics, in June Sony launched abbreviated versions, for broadband "snacking". This initiative is being closely watched as a model for how to repurpose existing assets to make them more palatable for attention-challenged online audiences.

And Endemol's recent deal with Bebo to produce "The Gap Year" series for exclusively for Bebo's audience shows that a successful TV producer is turning its sites on broadband as a first outlet.

All of these deals underscore broadband's disruptive nature - its ability to create new opportunities for incumbent players, and also for new entrants. My read is that most (though not all) broadband producers would love to make the leap to the TV. In the mean time, broadband offers a low-cost, interactive distribution path to experiment with more engaged audiences.

Many key industry players are now waking up to the idea that broadband is fundamentally re-writing traditional equations of how to extract value from well-produced video. But these equations are not yet well-understood. Some of the early deals, as outlined above, will be showing everyone the way.

Categories: Broadcasters, Indie Video, Partnerships, Video Sharing

Topics: AOL, Bebo, Crackle, Endemol, Joost, MySpace, NBC, Quarterlife, Sony, TMZ, Twentieth Television, Warner Bros, Yahoo

-

MySpace-VIBE-KickApps Deal May be a Harbinger of What's to Come

Traditional relationships between content providers and powerful aggregators/distributors are being fundamentally challenged broadband video. That's because broadband is an open medium, allowing content providers and brands to enjoy unprecedented direct access to their target audiences. This diminishes a lot of the leverage that aggregators/distributors have traditionally had.

Yet, as I have said for a while, I believe that there's a place for direct-to-consumer and third party distribution/promotion to co-exist harmoniously. But finding good examples has been a challenge. That's why a deal that KickApps announced today with MySpace and VIBE for its "Vibe Verses 3" promotion resonated strongly for me.

In a nutshell here's how the deal works: a major social networking site (MySpace) has partnered with a specialty publisher (VIBE) for a user generated video-dominated contest (VIBE Verses 3) to build a long term user-generated franchise (powered by KickApps), which will be mainly supported by ad sales.

To understand the deal better, I talked to Michael Chin, SVP of Marketing at KickApps earlier this week. For those not aware, VIBE is a major brand for the urban scene and VIBE Verses 3 is the third round of a contest that "challenges aspiring rap artists to upload videos of themselves performing original lyrics over pre-selected music tracks." Basically you can think of it as an "online-only, urban American Idol." All of the video uploads and social networking is powered by KickApps.

What's interesting to me is that MySpace is involved as the main promotional partner, seeking to build out its strength in this key category. As a large general purpose community site, they're partnering with VIBE, a well-known brand in the category, to bring more value to their members. As Josh Brooks at MySpace puts in the release, "VIBE is a pillar in hip hop and this partnership will help solidify MySpace as the place online for established and developing hip hop artists."

And according to Michael, this was done as a biz dev deal, not an ad sales deal. MySpace and VIBE believe that together they can build a franchise in hip hop that generates longer term value by creating a large, engaged audience of interest to other brands (e.g. Coke, Nike, etc.).

Of course none of this would be possible without broadband - it's the enabler for the user-generated videos that are at the heart of the contest.

In the open broadband video era where direct access to the consumer is ubiquitous, it's going to take more creativity to make deals work for everyone. I think this one is a good example of what can succeed. The deal serves as a template for how other specialty content providers and aggregators/distributors might work together, tapping user participation to build franchises that leverage each party's core skills and assets.

Categories: Aggregators, Brand Marketing, Partnerships, UGC

Topics: KickApps, MySpace, VIBE, VIBE Verses

-

MySpace-VIBE-KickApps Deal May be a Harbinger of What's to Come

Traditional relationships between content providers and powerful aggregators/distributors are being fundamentally challenged broadband video. That's because broadband is an open medium, allowing content providers and brands to enjoy unprecedented direct access to their target audiences. This diminishes a lot of the leverage that aggregators/distributors have traditionally had.

Yet, as I have said for a while, I believe that there's a place for direct-to-consumer and third party distribution/promotion to co-exist harmoniously. But finding good examples has been a challenge. That's why a deal that KickApps announced today with MySpace and VIBE for its "Vibe Verses 3" promotion resonated strongly for me.

In a nutshell here's how the deal works: a major social networking site (MySpace) has partnered with a specialty publisher (VIBE) for a user generated video-dominated contest (VIBE Verses 3) to build a long term user-generated franchise (powered by KickApps), which will be mainly supported by ad sales.

To understand the deal better, I talked to Michael Chin, SVP of Marketing at KickApps earlier this week. For those not aware, VIBE is a major brand for the urban scene and VIBE Verses 3 is the third round of a contest that "challenges aspiring rap artists to upload videos of themselves performing original lyrics over pre-selected music tracks." Basically you can think of it as an "online-only, urban American Idol." All of the video uploads and social networking is powered by KickApps.

What's interesting to me is that MySpace is involved as the main promotional partner, seeking to build out its strength in this key category. As a large general purpose community site, they're partnering with VIBE, a well-known brand in the category, to bring more value to their members. As Josh Brooks at MySpace puts in the release, "VIBE is a pillar in hip hop and this partnership will help solidify MySpace as the place online for established and developing hip hop artists."

And according to Michael, this was done as a biz dev deal, not an ad sales deal. MySpace and VIBE believe that together they can build a franchise in hip hop that generates longer term value by creating a large, engaged audience of interest to other brands (e.g. Coke, Nike, etc.).

Of course none of this would be possible without broadband - it's the enabler for the user-generated videos that are at the heart of the contest.

In the open broadband video era where direct access to the consumer is ubiquitous, it's going to take more creativity to make deals work for everyone. I think this one is a good example of what can succeed. The deal serves as a template for how other specialty content providers and aggregators/distributors might work together, tapping user participation to build franchises that leverage each party's core skills and assets.

Categories: Aggregators, Brand Marketing, Partnerships, UGC

Topics: KickApps, MySpace, VIBE, VIBE Verses

-

Movielink-Target Download Promotion Makes No Sense to Me

Yesterday I received the below email from Movielink promoting a "Steal of a Deal" offer with Target. Here's how it works: I purchase an Ocean's Thirteen DVD at a Target store and I receive a code that then entitles me to download Ocean's Thirteen from Movielink.

Maybe I'm missing something (and please let me know if I am), but this promotion makes no sense to me and instead seems to possibly undermine the value of the Movielink service.

As with all marketing and promotional efforts, the starting point must always be "What's our objective?" So what is Movielink's objective here?

To expose people to the Movielink brand and service? That wouldn't make sense since I only received the email because I was on their email list in the first place.

To demonstrate there's consumer appetite for downloading the same that was just bought on DVD? That seems like a silly and sort of pointless thing to prove in the first place if you believe the ultimate opportunity for digital downloads is to be a DVD substitute, not a compliment.

To expose people to the breadth of Movielink's service? That's worthy, but the offer is limited to downloading the same title that was purchased, so the user isn't incented to browse and see the full breadth of the Movielink catalog.

Maybe there's another objective, but if so I don't see it. Instead I think the campaign ends up detracting from Movielink by confusing the user and not creating any really new distinctive value. Think about it - if you're a consumer that just bought the Ocean's Thirteen DVD, what new value is the download providing you? (Let me know if you can think of anything, I can't)

Movielink could have enhanced this campaign to greater effect in lots of different ways. Ideas: Open the download choice to anything in the catalog. Or make the download easily giftable to a friend to virally increase Movielink's awareness. Or create a rewards-style program that gives DVD purchasers credits toward subsequent downloads. And so on.

I'm not trying to pick on Movielink's marketers, I see this kind of thing all the time. Murky objectives coupled with confusing/underwhelming offers. For broadband video to succeed - either in paid or ad-supported, marketers must be extremely thoughtful and precise about what they're trying to incent their target audiences to do, and how that specific action helps build the business.

Categories: Brand Marketing, Downloads, Partnerships

-

Google's Android: Striving for Broadband's Openness

Google's announcement on Monday of its "Android" mobile operating platform is another example of open platforms' appeal and underscores why broadband video has grown so quickly and is so compelling.

For those who missed the news, on Monday Google announced its Android mobile platform and the Open Handset Alliance, with 33 other companies, aiming to accelerate innovation and application development for mobile devices. In essence the goal is to develop a widely-deployed open platform,

comparable to the Internet itself. Mobile video would certainly be a key beneficiary if Android succeeds.

comparable to the Internet itself. Mobile video would certainly be a key beneficiary if Android succeeds.This push to openness in mobile can be seen as an attempt to emulate what's unfolded in the broadband video industry over the last 5 years. The result of broadband's openness has been nothing short of staggering, Whether it's video found at YouTube, iTunes, Hulu, NYTimes.com, MLB.com, Cosmopolitan.com or countless others, the torrent of video that's been unleashed, the shift in consumer behavior that's ensued and the capital that's been invested in this sector are all the direct result of broadband's open pipe.

In fact, as I have said innumerable times, the reason why broadband video delivery is the single most disruptive influence on the traditional video industry is precisely BECAUSE it offers an open platform for producers to send video directly to their target audiences. As such, it eliminates the requirement for video producers to land a deal with a traditional gatekeeper to the home such as a broadcast or cable TV network, or a cable TV, satellite or telco service provider.

In short, the ability for producers to connect directly with their audiences strikes at the heart of the traditional video distribution value chain, threatening a permanent re-ordering of the economics of the video business. It enables all kinds of players who have been shut out of the video game to now jump in.

And while broadband video is admittedly still in its embryonic stage from a revenue standpoint, its long-term appeal portends vulnerability for those who cling too long to the traditional closed, walled-garden model. The Internet has shown us all the power of open over closed models, of interoperability over proprietary approaches, and of often chaotic, but user-centric growth over top-down control.

Broadband's ecosystem is experiencing a rapid "layer-cake" effect where new technologies and applications are being built on top of preceding ones. The result is a vibrant, entrepreneurial culture in the broadband sector. If Android succeeds the same will be true in the mobile video sector as well.

Categories: Mobile Video, Partnerships

Topics: Android, Cosmopolitan, Google, Hulu, iTunes, MLB.com, NYTimes.com, Open Handset Alliance, YouTube

-

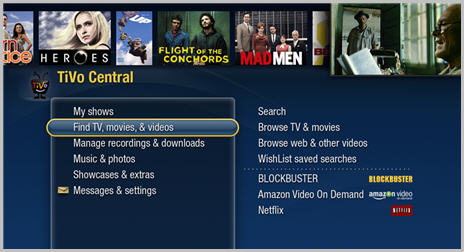

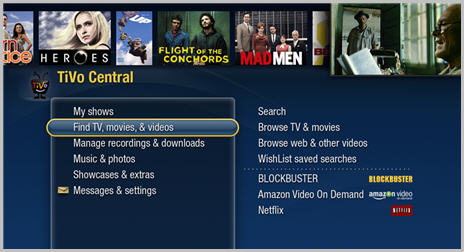

I Got My Official Comcast-TiVo Beta Trial Invite This Week

This week I heard from the folks at Comcast who are running the upcoming beta trial with TiVo. I'm officially on the list and should be getting a box soon. Hooray.

This week I heard from the folks at Comcast who are running the upcoming beta trial with TiVo. I'm officially on the list and should be getting a box soon. Hooray.As many of you are aware, Comcast has been on the cusp of kicking off this trial for some time now, which will let real users experience the joys of TiVo software running inside a Comcast digital set-top box. This will mark a milestone for Comcast in delivering a better user experience than the generic DVR feature that it and other cable operators rolled out a couple of years ago.

After hosting Jeff Klugman, TiVo's Senior VP, GM of its Service Provider and Advertising Engineering Division for a "fireside chat" at a cable industry conference last July, I became very bullish on the opportunity for TiVo to transform itself through these cable deals into a software and services powerhouse. In other words, long-term getting out of the high-cost, low-margin consumer device business.

Running a successful trial with Comcast is all-important to TiVo and they've been working for 2 years on this integration. Success will likely mean wide rollouts with Comcast, followed by #3 operator Cox (with whom TiVo already has a deal), and then others no doubt to follow. I'll be keeping you posted on my experience when I get the box. If it works as advertised it's going to be a killer device.

Categories: Cable TV Operators, Devices, Partnerships

-

TiVo: The Comeback Kid

If some kind of ratio could be calculated to measure consumers’ love for a product in relation to that product’s actual market success, TiVo’s score would undoubtedly top the list. Few products have ever achieved such undying fervor from their owners as have TiVo’s. Yet at the same time, few companies have underachieved their market potential as dramatically as has TiVo since its inception ten years ago.

If some kind of ratio could be calculated to measure consumers’ love for a product in relation to that product’s actual market success, TiVo’s score would undoubtedly top the list. Few products have ever achieved such undying fervor from their owners as have TiVo’s. Yet at the same time, few companies have underachieved their market potential as dramatically as has TiVo since its inception ten years ago.Despite my own love for my TiVo Series 2 box, not that long ago when I was asked by a friend what the future held in store for TiVo, I responded that with deep regret, I was hard-pressed to envision a happy ending for this plucky little company.

However, that was before last week when I had the opportunity to spend an evening with Jeff Klugman, TiVo’s Senior VP, General Manager of its Service Provider and Advertising Engineering Division and David Sandford, TiVo’s Vice President, Marketing & Product Management, Service Provider and Media & Advertising Divisions.

In addition to this time together, I also saw a presentation and demo of TiVo’s new integrated cable TV digital set-top box offering and also hosted them for a "fireside chat." All of this happened at a CTAM of New England-organized session at a cable TV industry conference in Newport, R.I.

Much as I thought I’d never say this, hear me now: TiVo is going to be the Comeback Kid. And it’s completely clear why. Read on to understand my logic.

The Old TiVo: Making Buyers "Crawl Across Broken Glass" to Enjoy the ProductAn immutable law of TiVo ownership has always existed: once you get one set up, you will fall in love with it. With its simple program recording process, tantalizing ad-skipping capability, intuitive user interface and more recently, its endless series of innovations (home networking readiness, remote scheduling, TiVoToGo portability, WishLists, Amazon Unbox downloads, Universal Swivel Search, TiVoCast broadband video channels, etc. etc.) TiVo is a blockbuster consumer value proposition.Despite all this, TiVo has always suffered from a problem that Jeff Klugman astutely describes: the company has essentially made prospective buyers "crawl across broken glass" to get from purchase decision to completed setup. Such a harsh assessment is well-earned. Consider: first TiVo required the user to find their way to a retail store (or go online) to buy the TiVo box, further cluttering the precious shelf space beneath the TV set. Then it required the buyer to select a monthly service plan that was on top of what the consumer already paid for cable TV or satellite service (to add insult to injury, TiVo did away with its $300 "Lifetime"plan a while ago). This change meant that a consumer’s choice to have a one-time bloodletting was replaced with a requirement that TiVo stick its probe into your credit card for as long as you wished to continue getting the service.

But that wasn’t all. Get the TiVo box home and you faced the oh-so-pleasurable task of contorting your body to access the back of your TV, while fending off that embarrassing swarm of dust bunnies lurking back there, all the while juggling a flashlight to figure out how TiVo’s gaggle of wires should marry up to your existing gaggle of wires. Your persistent fear was that not only might you end up not actually getting TiVo to work, you might find that you irreversibly tampered with your existing set-up, reducing your TV to a snow-and-static haze. Factor in your family members glowering at you while you puzzled through this process and it’s a pretty daunting and ugly picture.

This picture became even uglier when cable and satellite operators introduced a viable alternative to TiVo several years ago: simply pay a few extra bucks to them and you can have DVR features (ok, a sucky imitation of TiVo to be sure) built right into your new digital set-top box. So no contorting, fretting, glowering and of course, no extra box to buy and install.

TiVo’s Picture Darkens FurtherGiven this rigmarole, it’s no surprise that, despite the love fest people have for TiVo, it has only managed to sell a few million standalone boxes over the years, a relatively minor market impact. In fact, by far the majority of its market presence is through a deal with DirectTV, which contributes several million TiVo-enabled set-top boxes deployed. However, growth with DirectTV is over, with the company instead choosing to use technology from former sister company NDS instead.The sudden popularity of high definition TV brought yet another huge challenge for TiVo. Eventually, as consumers fully understand HD, they will all want an HD set-top box, capable of delivering real HD programming. Right on the heals of HD, people will want DVR features - of course HD-capable. Cable and satellite operators figured this out a few years ago and stepped up by offering their HD-DVR integrated set-top boxes for just a few extra dollars per month.

But TiVo only recently managed to release its own standalone HD-capable box, the "Series 3." And while the box is a marvel of product design, it weighed in with an $800 price tag, a price completely discordant for consumers whose expectations have been set by the fact that DVD players can now be had for as little as $13 at their local Wal-Mart. Coincidentally, it’s worth noting that just today TiVo announced a $300 version of the Series 3, which, while helping relieve upfront sticker shock, still requires the additional monthly service fees. And also the contorting, puzzling and glowering aspects of the installation process.

And Now for the Silver Lining in this StoryBy now you’re probably wondering how all of this doom-and-gloom is going to give way to the "Comeback Kid" scenario.In fact, the secret to TiVo’s success is, and has always been, jettisoning its hardware business model and becoming a software company. In other words, stop making boxes and instead just license the TiVo software to others whose boxes stand a better chance of being accepted by consumers (i.e. video providers). This was the vision from the start. I recalled reading a trenchant New York Times magazine piece that Michael Lewis (of Liar’s Poker and Moneyball fame) wrote 7 summers ago in August, 2000 on TiVo and Replay, its competitor at the time. I was able to dredge it up (thanks, Google) and in it, Jim Barton, TiVo’s co-founder, and current CTO plainly put it, "We’ll know we’ve succeeded when the TiVo box vanishes."

With TiVo’s promising, but ultimately unfulfilling deal with DirectTV unraveling, the company’s real potential to deliver on its vision lay with making deals with the cable industry. For a variety of reasons not worth recounting here, those deals proved elusive until early 2005 when TiVo struck a deal with Comcast. Things started looking even better for this game plan when the TiVo appointed Tom Rogers, who has significant cable bona fides, as CEO in mid-2005.

Flash forward 2 years later and it is looking increasingly likely that TiVo is on the cusp of executing its original strategy, positioning itself, at long last, for its moment in the sun.

TiVo + the Cable Industry, A Match Made in ARPU HeavenAs summer turns to fall, Comcast, by far the largest cable operator in the US and Cox, the third largest, are planning their initial rollouts of TiVo-enabled HD set-top boxes.After all these years, a more perfect time for TiVo and the cable industry to get together can scarcely be imagined. The incentives for these deals to succeed are very strong all around.

The cable industry is fighting hard to convince consumers to resist switching to Verizon and AT&T in the communities in which these telcos have rolled out their wizzy new video services. With telcos offering stiff price competition, ARPU (average revenue per unit) growth can only happen through new services, not price increases. Further, Comcast in particular has been working overtime to convince Wall Street that Video-on-Demand is its killer competitive advantage to satellite even while it struggles with its poorly-designed user interfaces which serve to impede, not assist, its subscribers’ discovery of valuable VOD programming.

Enter TiVo. TiVo offers Comcast/Cox/the cable industry one of the best-known and best-loved consumer brands with which to align itself on a de-facto exclusive basis. As mentioned, DirectTV’s deal is over. EchoStar’s relationship with TiVo is toxic due to mammoth patent litigation between the two companies. Verizon and AT&T barely have the resources to get their networks up and running much less take on the challenge of how to integrate their set-top boxes with TiVo software.

Meanwhile, the cable industry continues to grapple with how to get more consumers to sign on for digital cable service. Years after its introduction, digital still remains a sketchy value proposition for many. But TiVo gives cable operators a powerful feature to goose demand. Further, since Jeff showed how elegantly TiVo has incorporated VOD navigation and recording into its UI, integrated TiVo service also offers the promise of addressing that cable operators’ challenge in that area.

Last, but not least, on the assumption that TiVo service will carry an upsell charge of around $3-4 per month to the consumer (which are completely my estimates, with nothing having been disclosed by TiVo or its partners at this point), and assuming 2/3 of that goes to the cable operator, TiVo provides tantalizingly high-margin new ARPU growth for cable operators. Those high margins are made possible through the magic of OCAP, the cable industry’s new standard for remotely downloading applications like TiVo to tens of millions of currently-deployed set-tops (i.e. no expensive truck rolls).

That Sweet Sound of Ka-Ching, Ka-ChingTo help understand the revenue and margin potential of the cable deals for TiVo, consider the following:Pick your favorite analyst’s forecast for DVR growth. Forrester, for example believes that by 2011 there will be 65 million DVR homes, up from somewhere around 15-17 million today. So net adds of around 50 million homes. Comcast and Cox together pass about 58 million or 53% of all American homes. So their proportionate share of those 50 million DVR net adds should be at least 26 million. If they market the service right, it’s probably fair to assume that over time, at least 80% of DVR users are going to prefer the TiVo solution to cable’s crummy homegrown DVR alternative (if this option even survives). If so, then these deals’ potential is about 21 million homes taking the TiVo cable service by 2011.

Again, say the TiVo service costs an incremental $3 per month and then assume TiVo keeps a $1 of that, which is my approximation for the combination of its per sub and technology licensing fees. So, eventually 21 million new TiVo homes x $1 month x 12 months. Just from Comcast and Cox that would eventually total $252 million of annual revenue for TiVo. Now factor in when all the other cable operators smell the coffee and abandon their homegrown DVR solutions in favor of TiVo. And then of course it’s inevitable that TiVo will sign up Verizon and AT&T. However in those deals TiVo should be able to negotiate to keep maybe half the monthly fee instead of just a third as they did with the cable crowd (hey, it’ll be a proven service, plus the telcos will be playing catch-up, as usual).

To put all of this in context, for the fiscal year ending 1/31/07, TiVo’s revenues were $259 million, so if the Comcast and Cox deals alone succeed to even a fraction of their fullest potential, they should still have a major impact on the company’s financials. And bear in mind that if the cable strategy succeeds, then along the way TiVo’s retail hardware business would have been euthanized, erasing all that low margin box revenue. What would be left is a high-margin software licensing and services powerhouse, ready to go international, add portable applications and generate all kinds of new features, such ramping up its already solid broadband programming lineup.

But perhaps most important, with TiVo able to track the viewing behavior of all of those millions of homes, its long-held vision of building out an ad-based revenue business based on precise user viewing suddenly seems attainable. Of course it’ll be a little cheeky of TiVo to be pitching agencies and advertisers on these ad services after TiVo all but wrecked their traditional model with its ad-skipping features. But what choice will these folks really have if they want to succeed? And these meetings are already happening, and according to Jeff, who oversees all this, it sounds like all is forgiven and good progress is already being made.

What’s the Catch?The catch here is that initially TiVo is almost entirely dependent on Comcast and Cox putting enough marketing muscle behind this new service and executing it properly. So will Comcast and Cox do this? Though it’s way too early to tell, given all of the aforementioned incentives, there’s ample reason to believe that both will. For Comcast alone, which has borne the brunt of two years of arduous technical integration work with TiVo, failure to follow through with strong marketing would be a huge and embarrassing blunder. So I’m betting these savvy cable guys will get the marketing part right (if you’re really interested in how, keep scrolling to see the below Addendum for a couple of sample marketing scenarios).And if they do, then you heard it here first— TiVo is well-poised to become The Comeback Kid.

ADDENDUM: 2 MARKETING SCENARIOS FOR COMCAST

To make TiVo’s potential more tangible, consider the following 2 scenarios. In both cases you just bought a 42 inch LCD or plasma TV. Of course you now need an HD-capable set-top box. You call Comcast to order one and here’s what should happen:

Scenario 1: You own or have owned a TiVo Series 1 or 2 box

You’re told that an HD set-top will run you $5.00 more per month than your current box. Then you say you’re interested in DVR capability. "Ah," the Comcast rep says, "have you ever owned a TiVo?". You say "Yes." "Well", she continues, "did you know that you can now get the same (mostly) awesome TiVo service - including the familiar user interface, remote control and blooping sounds as you program the box AND have all Video-on-Demand programming expertly integrated into the service, only from Comcast? It is one of our most popular services, and I can offer it to you today for just another $8 more per month than the HD set-top box you want." You say, "let me get this straight, I’m already used to paying $13/month for my TiVo Series 2 service, so instead of paying that, I would pay $8 per month and get virtually all the same benefits of TiVo, but don’t have to go out and buy another TiVo box? And this isn’t the crummy DVR service I saw at my neighbor’s house that I know you also offer, right?" "No sir, it’s TiVo." "Any other sneaky upfront charges?" "No." "Any disconnect charges if I want to drop it?" "No." "Am I missing something here?" "No." "WOW, sign me up - what a great offer. Thanks Comcast."

Scenario 2: You’ve never owned a TiVo box, but you have some familiarity with the product because any number of friends, neighbors, relatives and co-workers have been bragging to you for years that it’s the greatest thing since sliced bread.

You’re told that an HD set-top will run you $5.00 more per month than your current box. Then you say, "I’m kind of interested in this whole DVR thing everyone keeps talking about." After the Comcast rep verifies you’ve never actually owned a TiVo, but that you’re sort of familiar with what it does, she says, "Well, Comcast has a very special offer for you. TiVo DVR service has become one of our most popular services and we think if you experience it for yourself, you’ll see why. So I’d like to offer you 90 days of free TiVo service. If you don’t like it, simply call us at any time and we’ll remotely remove it from your box. That means you don’t need to wait at home for a technician to disable TiVo service for you." You ask what it will cost per month and upon hearing the answer ($8 more per month than the HD box base rate) you make a mental note to ask your friends, neighbors, relatives how much they pay, to see what kind of deal you’re getting (later they’ll confirm it’s the same as they’re currently paying for their Series 1 or 2 monthly plans). You see no downside to trying it, so you do. After you and your family use TiVo for approximately 3 days, you all fall in love with it and wonder how you could have ever lived without it. You call Comcast to say thanks.

Categories: Cable TV Operators, Devices, Partnerships

-

Lifetime Debuts Programs on Yahoo, iTunes, How Long Will These Happy Faces Prevail?

B&C carried word yesterday that Lifetime will be the latest cable network to eschew unveiling its new programs or seasons on air, preferring instead to go the online route. This follows similar recent moves by Discovery/TLC, FX (in partnership with cousin company MySpace) and others, with plenty, I suspect, yet to come.

B&C carried word yesterday that Lifetime will be the latest cable network to eschew unveiling its new programs or seasons on air, preferring instead to go the online route. This follows similar recent moves by Discovery/TLC, FX (in partnership with cousin company MySpace) and others, with plenty, I suspect, yet to come.For now, there seem to be happy faces all around the cable industry regarding these online premieres. Cable networks argue that online generates upfront buzz leading to higher awareness and ratings for on air. This in turn builds value in multichannel subscription services. This was the point that Bruce Campbell, Discovery's president of digital media made at the recent CTAM NY panel I moderated. Of course, networks are doing the right thing following audiences online, all the while continuing to proclaim that their traditional affiliates (cable and satellite operators) are their most important customers.

Maybe I'm missing something, but I doubt all these happy faces will prevail for long. My guess is that at some point next year the lights are going to go on in the cable operator community that the portals and other new distributors are getting access to programs that operators' monthly affiliate fees pay for in the first place. Of course gone are the days of cable exclusivity, but if and when operators flex their muscles and express their change of heart about online premieres, my bet is they'll stop.

Operators should know that, at some point, the law of "there's only 24 hours in a day" kicks in - so if someone caught the premiere online, they don't actually need to tune in for the on air debut. And of course, do cable operators really want to allow viewers to grow accustomed to seeing high-quality long form programming online and/or through portals?

I think we'll see lots more of this activity until the cable operators call "foul". In the meantime, operators would be smart to start getting some of these premieres on their own portals, to bolster their own online positions.

Categories: Cable Networks, Partnerships, Portals

Topics: Discovery, FX, Lifetime, MySpace, TLC

-

MGM's "Lions for Lambs" Google/YouTube Promotion Continues Studios' UGC Efforts

MGM is the latest studio to reach out to fans to help promote one of its films, the upcoming "Lions for Lambs". In a deal with Google/YouTube, the studio is sponsoring a contest in which users can submit a 90 second video on a topic they're passionate about. Entries are being accepted until Oct. 17th and the winner, who will have $25,000 donated to a charity of his/her choice, will be selected on Nov 9th.

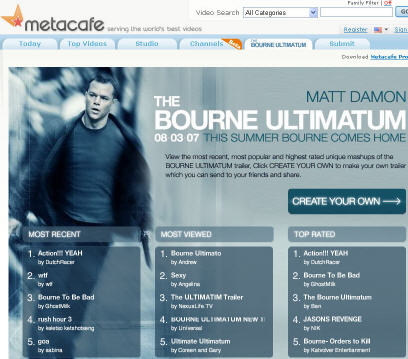

This promotion follows the mashup competition Metacafe and Universal conducted this past summer around the studio's "Bourne Ultimatum" release. At the time, I noted that broadband is introducing a whole new element into the film marketing equation, opening up huge opportunities for creativity and fan involvement. As the tools continue to improve I expect we're going to see a lot more of these "UGC-assisted" campaigns.

Studios (and others) are going to continue to experiment with just how much fans are willing to be a part of the marketing machinery. Of course nobody knows, but my guess is that if the incentives are right, the promotions are fun and the stars are compelling, it's going to be a pretty rich vein for film marketers to tap into.

Categories: Brand Marketing, FIlms, Partnerships, UGC

Topics: Google, Lions for Lambs, MGM, YouTube

-

Metacafe’s “Bourne Ultimatum” Mashup Will Spur Imitators

The Metacafe team posted a progress update on its "Bourne Ultimatum" mashup initiative, launched with Universal Pictures on July 23rd. To date, over 1,000 mashups have been posted, with the most popular ones highlighted on the site. Metacafe and Universal teamed up with Diffuse Media Group for the simple-to-use mashup tool.

These kinds of mashups are such a winning idea, it’s amazing to me that they still haven't gained a ton of market momentum. I think it’s just a matter of time, it’s so easy to execute.

Here, Universal provided a collection of scenes and music from the movie. Fans can express their enthusiasm by mixing them up as they please overlaying the music tracks provided. Especially for a franchise like "Bourne", where rabid fans eagerly await each sequel, allowing these folks to participate in the promotional buildup is a real win-win. Tomorrow, when "Bourne" opens everywhere, there will already have been tens (hundreds?) of thousands of people talking up the flick who have seen the mashups or created their own.

Compare this level of fan engagement and promotion to the traditional process of producing 1 trailer and then paying for expensive TV time to promote it. That model seems so yesterday by the standards of what broadband video and Web 2.0 are enabling.

Specifically, broadband is enabling a whole new element of the marketing mix to take root. And the possibilities for where mashups go from here are limitless. Consider: how about letting fans mix in their own voice-overs of certain scenes or mix in their own video clips or have the studio create contests to showcase and reward winning mashups (e.g. Matt Damon-signed, collector’s edition DVD for the winner and such). The list goes on.

I’m expecting lots of smart marketers are going to be increasing their mashup activity quite soon.

Categories: Brand Marketing, FIlms, Partnerships, UGC

Topics: Bourne, MetaCafe, Universal Pictures

-

More Big Hollywood Talent Piles Into Broadband Video

Today's splashy NY Times piece profiling Edward Zwick and Marshall Herskovitz's new series, QuarterLife, with MySpace again highlights how big name talent continues to embrace broadband video as a key focus of their activities.

Today's splashy NY Times piece profiling Edward Zwick and Marshall Herskovitz's new series, QuarterLife, with MySpace again highlights how big name talent continues to embrace broadband video as a key focus of their activities.This list continues to grow. Here are some of the names that are on it, and their activities:

-

Michael Eisner, Vuguru, Prom Queen

- Stephen Bochco, MetaCafe

- Ben Silverman, Reveille

- William Morris/Narrowstep

- Spike Lee and Babelgum's online film festival

- Herb Scannell, Next New Networks

- Albie Hecht, WorldWide Biggies

What do all these big names see? In 2 words: colossal opportunity. Broadband is a wide open playing field. They all understand that a classic paradigm shift is happening in the video industry and are rushing to understand the medium and its new rules. How to engage audiences? How to monetize most effectively? How to optimize the formats? How to retain creative control?

This activity is only going to accelerate. As early successes get more publicity and the business models crystallize expect even more big Hollywood talent to jump on the broadband video bandwagon.Categories: Aggregators, Indie Video, Partnerships, Video Sharing

Topics: Michael Eisner, Quarterlife, Stephen Bochco, Vuguru, WorldWide Biggies

-

-

Charter Redesigns Portal, Emphasizes Video

Tomorrow morning Charter Communications will announce a redesigned version of Charter.net, the company's portal for its broadband Internet subscribers. I got a sneak preview of the press release and the new site along with a briefing with Himesh Bhise, VP &GM of High-Speed Internet for Charter, who oversees the portal.

According to Himesh, this redesign is the first key milestone for three main themes the company is pursuing for its portal: improved functionality and feature accessibility on its home page, increased video availability and more extensive TV listings.

I'm impressed with the direction Charter's taking. Charter's goals of enhancing the value of its bundle of video and online services is right on the money. I've said for a while that cable operators are potentially going to be the biggest beneficiaries of broadband video because they already have longstanding relationships with cable TV networks and video consumers, plus a huge base of broadband subscribers (Charter has over 2.5 million).

Charter's in synch with this thinking. They've done deals with a range of partners from biggies like Nickelodeon, HBO and FX to smaller ones like IFC, ResearchChannel.org and HAVOC. Charter's bringing selected video clips into its portal and will also offer some exclusive premieres of certain programming. Other cable operators like Comcast, Time Warner and Cablevision are already down this road with similar activities. Charter's initiatives add further momentum to this trend.

While I'm a fan of these moves, I would love to see the cable guys step up their broadband video activities even further. For example, Himesh and I engaged in an interested mini-debate about the definition and value of "exclusive" broadband programming. To me there's an terrific opportunity for cable operators to negotiate and obtain the broadband rights, at least for a defined window, for certain programs exclusively for their Internet subscribers. This would mean their subscribers get video they just can't get elsewhere. (Btw, that's kind of the way the cable TV world used to work until Congress stepped in with the "program access rules" in the '92 Cable Act).

Some kind of exclusive broadband programming would differentiate cable's portals from the Joosts and other next-gen broadband aggregators coming into the market. I think it's inevitable we're going to see some jousting for these kinds of rights, especially as things get more competitive.

Categories: Cable Networks, Cable TV Operators, Partnerships

Topics: Charter, FX, HBO, IFC, Nickelodeon

-

Video Syndication Activity Builds

News earlier this week that Fox Entertainment Group would be working with Brightcove to ramp up its syndication efforts adds to the drumbeat around this trend that was already pretty steady.Six months ago in my December, 2006 e-newsletter, "7 Broadband Video Trends for 2007", I identified broadband video syndication as important going into 2007. Back then I noted that "Syndication is the handmaiden of the ad-supported broadband video business model. Successful online advertising requires scale and targeting. Syndication provides both." I think we're seeing that play out.Whether the NBC-News Corp JV, CBS Interactive Audience Network, FEG deal, or countless others I've heard will be announced soon, they all point to same underlying fundamentals. Producing high-quality video is expensive. Content providers want to maximize their ROIs. So they want their content in as many places as possible to aggregate as large an audience as they can, so they can harness online advertising's potential. While none of this is a surprise by online standards, it is a departure from the traditional video models of tight control, limited distribution and exclusive deals.It's very promising to see the how much progress is being made so quickly to evolve to Internet-centric distribution approaches. More evidence that the media industry's future will be quite different than its past.

News earlier this week that Fox Entertainment Group would be working with Brightcove to ramp up its syndication efforts adds to the drumbeat around this trend that was already pretty steady.Six months ago in my December, 2006 e-newsletter, "7 Broadband Video Trends for 2007", I identified broadband video syndication as important going into 2007. Back then I noted that "Syndication is the handmaiden of the ad-supported broadband video business model. Successful online advertising requires scale and targeting. Syndication provides both." I think we're seeing that play out.Whether the NBC-News Corp JV, CBS Interactive Audience Network, FEG deal, or countless others I've heard will be announced soon, they all point to same underlying fundamentals. Producing high-quality video is expensive. Content providers want to maximize their ROIs. So they want their content in as many places as possible to aggregate as large an audience as they can, so they can harness online advertising's potential. While none of this is a surprise by online standards, it is a departure from the traditional video models of tight control, limited distribution and exclusive deals.It's very promising to see the how much progress is being made so quickly to evolve to Internet-centric distribution approaches. More evidence that the media industry's future will be quite different than its past.Categories: Advertising, Partnerships

Topics: Brightcove, FOX, Hulu, NBC, News Corp

-

YouTube + Apple TV = A New Consumer Experience

Some pretty big news today from Steve Jobs that YouTube video will be embedded in directly AppleTV.Back in December '06, in my "7 Broadband Video Trends for 2007" e-newsletter, my #1 trend was that Apple's "iTV' box (as it was code-named then) would succeed - but only if Apple nuked its walled garden, iTunes/paid-only content strategy, in favor of allowing easy browsing of free online video. Though it would represent a big departure for Apple, I suggested the killer deal would be to make YouTube videos available to Apple TV users. (read the full entry below and here) True to its roots, Apple did launch Apple TV only with iTunes.And as it has floundered, I've taken plenty of flack from readers reminding me that these 3rd party, standalone boxes don't have a prayer. And that's why today's YouTube deal is a huge step in the right direction for Apple TV. YouTube is the big guerilla of all online video sites. But as big as it is, its use has mainly been constrained to computer screens. So by enabling easy viewership on TVs, Apple has created a whole new consumer experience, which I believe will prompt new buyers of Apple TV.And as Apple embeds more video sites (hey wouldn't it be easier if they just put a browser in Apple TV?), the proposition for box keeps getting stronger. This "over-the-top" or "cable bypass" approach should be another wake up call for cable and satellite operators. There is so much energy being invested in these alternative approaches (e.g. Xbox, TiVo, Sony, Netgear, etc.) that eventually some segment of consumers is just going to drop their traditional subscriptions and go a la carte. My original entry is below from December 20, 2006.All the 7 Trends for 2007 can be read here. -------------------------------------------------------------------------------------- "Apple's iTV box will likely succeed (but only if more than just iTunes video is easily accessible). This is clearly my most controversial prediction and the one I will devote the most ink to. Let me stipulate upfront - standalone appliances like these are indeed the "third rail" of consumer electronics. I understand all the reasons why they don't succeed. And the list of failures is long and undistinguished. However, my bet is that is that if ever a company stood a chance of succeeding and a box potentially met a clear consumer need, it is Apple and iTV. (by the way, "iTV" is just a code name, expect a new name prior to launch). Apple's user-centric design, functionality and coolness quotient are its key differentiators.First, for those of you who missed it, back in September Steve Jobs pre-announced the company's "iTV" box (see it here). Product pre-announcements are very rare for Apple. iTV's suggests that Jobs wanted to both lay some pre-launch buzz groundwork and also simply couldn't contain his enthusiasm for this product's market opportunity. To understand iTV's market opportunity, it is necessary to understand current broadband-delivered video viewership.As I see it, the amazing ramp up in broadband video consumption this year is surpassed by an even more amazing fact - that virtually all of this viewership has occurred on users' computers. Think about it - virtually all those clips, full-length programs and movies are consumed on the PC, not the TV! Nobody could have predicted that. But of course the TV is still the preferred viewing device for just about everyone. So logic suggests that if someone could make an affordable, easy-to-install box that unshackled users from their computers, allowing them to easily bridge the PC/broadband world with the TV, there would be a market for such a product. And that this could be far more than a niche opportunity, given that it could potentially disrupt cable and satellite operators' set-top box/walled garden stronghold.iTV's success turns on one key factor: Apple's content strategy for the product. And the hitch in iTV's potential is that to date Apple's content model has been to aggregate paid-only media in iTunes, its digital download store. The company has gotten off to a decently strong start selling TV programs and the like on an a la carte basis for $1.99 or more. But carrying over this paid approach is not a strong enough content strategy to support iTV.In fact, in the music world, a recent Ipsos study showed that only 25% of MP3 owners use fee-based download services. That's been OK for iPod sales because many people still have large CD collections (or share theirs with friends), which can be easily "ripped" to iPods. But what would the equivalent source of video content be to support iTV? Possibly DVDs, though converting them for iPod use is far from a mainstream activity (plus, why bother anyway?). How about the free video podcasts from a Byzantine array of providers also available through iTunes? Doubtful. Quite simply, if Apple extends its iTunes paid approach to iTV it would be forcing iTV buyers to pay for each and every incremental piece of video content to get value out of their iTV purchase. The number of people willing shell out $299 for an iTV box without readily available free content is tiny.Therefore, the alternative - providing easy TV-based viewing of free, ad-supported broadband video - should be iTV's core value proposition. Cracking this nut allows Apple to break open the video distribution value chain, with consumers finally getting TV-based access to the content they love. And it positions iTV as the key building block in making "long tail" video content accessible on TVs, potentially setting up Apple as a longer-term competitor for all video services (i.e. a possible competitor to cable and satellite).Exactly what content should be easily available through ITV is less clear to me. Certainly a key selection criterion is video that is either NOT currently available through cable or satellite. Many video content providers still dreaming of becoming a digital cable channel would salivate at the opportunity to be accessible on consumers' TVs. Plus broadcast and cable TV networks would love a way to get their broadband-only webisodes and other "broadband channels" all the way to the TV.But the most tantalizing content deal would be one with Google/YouTube. Consider how many YouTube devotees would love to get convenient access to this content right on their TVs. Since Apple has no in-house advertising skills and assets, and Google is the reigning advertising king, a partnership would be mutually beneficial. With Eric Schmidt, Google's CEO, now on Apple's board of directors, the personal relationship between he and Jobs would help clear the way for a deal.Packaging and offering easy access to ad-supported video would be a big content strategy departure for Apple, but a necessary one for iTV to fully flourish. Remember, selling hardware is what Apple's really all about. Given Apple's famous appetite for secrecy, I expect we'll only find out how Steve Jobs has decided to play his hand upon iTV's official launch. If it's to be iTunes-only paid video, I'll downgrade iTV's likelihood of big-time success considerably. "Categories: Devices, Partnerships, UGC

-

CBS Announcement is More Great Fodder for Upcoming NAB Super Session

Yesterday’s announcement from CBS that it has formed the CBS Interactive Audience Network, and partnered with AOL, Microsoft, CNET, Comcast, Joost, Bebo, Brightcove, Netvibes, Sling Media and Veoh provides even more discussion material for the Super Session panel I’m moderating, which is coming up on Tuesday, April 17th at NAB 2007 (“The Revolutionizing Impact of Broadband Video”).

I’m always a little reluctant to use a word like “revolutionizing”, as it just feels a bit hyperbolic. Yet, what CBS announced yesterday, in combination with the NBC-News Corp JV announcement a few weeks ago sure does seem to signal that these networks themselves are willing to take new risks and be much more opportunistic with how their prized programs get to audiences’ homes. I give these companies all a lot of credit – they are demonstrating a willingness to challenge their existing (and longstanding) business models though the economics and potential of these new models are not yet clear.We’ll be getting into all of this and more at NAB – come join us!Categories: Broadcasters, Partnerships

Topics: AOL, Bebo, Brightcove, CBS, CBS Interactive Audience Network, CNET, Comcast, Joost, Microsoft, Netvibes, Sling Media, Veoh

-

The TV Industry’s New Call Letters: Y-A-H-O-O, M-S-N, A-O-L and M-Y-S-P-A-C-E?

Today’s announcement from NBC and News Corp, that they have set up a venture to distribute full length programs plus promotional clips through 4 major distributors (with more to come) heralds a potentially new, and radically different era, for the broadcast, and possibly the cable TV industries.

In one fell swoop, 2 of the major broadcast networks have granted distribution rights to four of the Internet’s most-trafficked sites. If one assumes that it is inevitable that the broadband/PC world will be linked up with consumers’ living room TVs (whether through AppleTVs, Xboxes, Slingcatchers, etc.), then it sure seems to me as though we are on the brink of seeing a full-scale digital replica of the analog broadcast TV affiliate model being born. If that’s the case, what does that mean for existing players, most notably local broadcast TV stations? And how about cable TV and satellite operators, who have long relied on retransmitting high-quality feeds local broadcast feeds of network programming as a staple of their value proposition?

I’ve been writing about how the video distribution value chain is being impacted by broadband video for a while now. My March 2006 newsletter, “How Broadband is Changing Video Distribution” recapped my firm’s Q1 2006 report, “How Broadband is Creating a New Generation of Video Distributors: The Market Opportunity for Google, Yahoo, Microsoft, AOL, Apple and Others”. In this report we identified these companies as a so-called ‘Group of 5” which were best-positioned to benefit as new broadband-centric distributors and explained our reasons for this conclusion.

Flash forward one year. Today’s announcement cements the distribution heft of 3 of the 5 (Yahoo, MSN and AOL). Meanwhile, Google’s acquisition of YouTube has strengthened its distribution prowess. If it can build on initial partnerships with the many content providers with which it works, its power will only grow. And of course, Apple now boasts almost 60 TV networks and content producers providing programming to iTunes. Its launch of AppleTV strengthens its hand as the hardware provider-of-choice in linking up the broadband and TV worlds.

We’re exploring all of this in a report we’re (quite coincidentally) working on right now, which examines broadband’s impact on the video distribution value chain. It both updates the Q1 2006 report, and also expands it to include the roles of emerging players such as Joost, BitTorrent, Wal-Mart and others. We’ve been very fortunate to have access to many of the players in the space to gain unparalleled insights into their plans. The report is due out soon. I’ll keep you posted on its progress.

Categories: Aggregators, Broadcasters, Partnerships, Portals

Topics: AOL, MSN, MySpace, NBC, News Corp, Yahoo, YouTube

Posts for 'Partnerships'

Previous |