-

Scoring My 2009 Predictions

As 2009 winds down, in the spirit of accountability, it's time to take a look back at my 5 predictions for the year and see how they fared. As when I made them, they're listed below in the order of most likely to least likely to pan out.

1. The Syndicated Video Economy Accelerates

My least controversial prediction for 2009 was that video would continue to flow freely among content providers numerous third parties, in what I labeled the "Syndicated Video Economy" back in early 2008. The idea of the SVE is that "destination" sites for online audiences are waning; instead audiences are fragmenting to social networks, mobile devices, micro-blogging sites, etc. As a result, the SVE compels content providers to reach eyeballs wherever they may be, rather than trying to continue driving them to one particular site.

Video syndication continued to gain ground in '09, with a number of the critical building blocks firming up. Participants across the ecosystem such as FreeWheel, 5Min, RAMP, YouTube, Visible Measures, Magnify.net, Grab Networks, blip.TV, Hulu and others were all active in distributing, monetizing and measuring video across the SVE. I heard from many content executives during the year that syndication was now driving their businesses, and that they only expected that to increase in the future. So do I.

2. Mobile Video Takes Off, Finally

When the history of mobile video is written, 2009 will be identified as the year the medium achieved critical mass. I was bullish on mobile video at the end of 2008 primarily due to the iPhone's success and my expectation that other smartphones coming to market would challenge it with ever more innovation. The iPhone has continued its amazing run in '09, on track to sell 20 million+ units. Late in the year the Droid, which Verizon has relentlessly promoted, began making inroads. It also benefitted from Verizon highlighting AT&T's inadequate 3G network. Elsewhere, 4G carrier Clearwire continued its nationwide expansion.

While still behind online video in its development, mobile video is benefiting from comparable characteristics. Handsets are increasingly video capable, just as were computers. Mobile content is flowing freely, leaving the closed "on-deck" only model behind and emulating the open Internet. Carriers are making significant network investments, just as broadband ISPs did. A range of monetization companies have emerged. And so on. As I noted recently, the mobile video ecosystem is healthy and growing. The mobile video story is still in its earliest stages, we'll see much more action in 2010.

3. Net Neutrality Remains Dormant

Given all the problems the Obama administration was inheriting as it prepared to take office a year ago, I predicted that it would not expend energy and political capital trying to restart the net neutrality regulatory process. With broadband ISP misbehavior not factually proven, I also thought Obama's predilection for data in determining government action would prevail. However, I cautioned that politics is a tough business to predict, and so anything can happen.

And indeed, what turned out is that in September, new FCC Chairman Julius Genachowski launched a vigorous net neutrality initiative, despite the fact that there was still little data supporting it. With backwards logic, Genachowski said the FCC would be guided by data it would be collecting, though he was already determined to proceed. In "Why the FCC's Net Neutrality Plan Should Go Nowhere" I argued, among other things, that the FCC is way off the mark, and that in the midst of the gripping recession, to risk the unintended consequences that preemptive regulation carries, was foolhardy. Now, with Comcast set to acquire a controlling interest in NBCU, net neutrality advocates will say there's even more to be worried about. It looks like we can expect action in 2010.

4. Ad-Supported Premium Video Aggregators Shakeout

The well-funded category of ad-supported premium video aggregators was due for a shakeout in '09 and sure enough it happened. Players were challenged by little differentiation, hardly any exclusive content and difficulty attracting audiences. The year's biggest casualty was highflying Joost, which made a last ditch attempt to become a white label video platform before being quietly acquired by Adconion. Veoh, another heavily funded player, cut staff and changed its model. TidalTV barely dipped its toe in the aggregation waters before it became an ad network.

On the positive side, Hulu, YouTube and TV.com continued their growth in '09. Hulu benefited from Disney coming on board as both an investor and content partner, while YouTube improved its appeal to premium content partners and brought on Univision and PBS, among others. Aside from these, Fancast and nichier sites like Dailymotion and Babelgum, there isn't much left to the aggregator category. With TV Everywhere services starting to launch, the opportunity for aggregators to get access to cable programming is less likely than ever. And despite their massive traffic, Hulu and YouTube have significant unresolved business model issues.

5. Microsoft Will Acquire Netflix

This was my long ball prediction for '09, and unless something happens in the waning days of the year, I'll have to concede I got this one wrong. Netflix has remained independent and is charging along with its own streaming "Watch Instantly" feature, now used by over half its subscribers, according to recent research. Netflix has also broadened its penetration of 3rd party devices, adding PS3, Sony Bravia TVs and Blu-ray players, Insignia Blu-ray players this year, in addition to Roku, XBox and others. Netflix is quickly becoming the most sought-after content partner for "over-the-top" device makers.

But as I've previously pointed out, Netflix's number 1 challenge with Watch Instantly is growing its content selection. Though it has a deal with Starz, it is largely boxed out of distributing recent hit movies via Watch Instantly by the premium channels HBO, Showtime and Epix. My rationale for the Microsoft acquisition is that Netflix will need far deeper pockets than it has on its own to crack open the Hollywood-premium channel ecosystem to gain access to prime movies. For its part, Microsoft, locked in a pitched battle with Google and Apple on numerous fronts, could gain advantage with a Netflix deal, positioning it to be the leader in the convergence era. Meanwhile, others like Amazon and YouTube continue to circle this space.

The two big countervailing forces for how premium video gets distributed in the future are TV Everywhere, which seeks to maintain the traditional, closed ecosystem, and the over-the-top consumer device-led approach, which seeks to open it up. It's hard not to see both Netflix and Microsoft playing a major role.

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Broadband ISPs, Deals & Financings, Mobile Video, Regulation, Syndicated Video Economy

Topics: Apple, AT&T, Fancast, FCC, Hulu, iPhone, Joost, Microsoft, Netflix, Veoh, Verizon, YouTube

-

FreeWheel is Close to Managing 1 Billion Video Ads Per Month

In a quick call yesterday with FreeWheel Co-CEO and Co-Founder Doug Knopper, who was on his way to NYC for tonight's VideoSchmooze, he told me that the company is poised to manage 1 billion video ads next month, all against premium video streams.

In addition, FreeWheel has now been integrated by AOL, MSN and Fancast, among others, with Yahoo testing currently and ready to go live soon. It looks like the major portals are being encouraged to integrate with FreeWheel's Monetization Rights Management system by the company's premium content customers.

The benefit to the content providers is better control and monetization of their ad inventory across their portal distribution deals. The portal activity comes on top of FreeWheel's recently-reported implementation with YouTube, allowing the site's premium content partners to sell and insert ads against their YouTube-initiated streams.

The benefit to the content providers is better control and monetization of their ad inventory across their portal distribution deals. The portal activity comes on top of FreeWheel's recently-reported implementation with YouTube, allowing the site's premium content partners to sell and insert ads against their YouTube-initiated streams.FreeWheel is another great example of the Syndicated Video Economy (SVE) I've frequently talked about. Doug says FreeWheel's progress is proof that the SVE is really "hitting its stride."

It is hard though to put FreeWheel's 1 billion number into perspective. One way of thinking about it is comparing it to the data that comScore reported for August '09 for the top 10 video sites. Assuming only 5-10% of YouTube's views are from its premium partners and maybe half of Fox Interactive's are (due to MySpace's user-generated videos being included in its 380M streams) the top 10 video providers would account for about 3.5B videos. If each video had an average of 2 ads (which is a decent assumption when averaging short clips vs. full programs), then the top 10 video sites would account for about 7B video ads.

Relative to the top 10 then, FreeWheel's 1B ads managed look pretty healthy. To get a fuller picture, you'd also have to consider how many premium streams are in the 12B+ video views that fall outside of comScore's top 10 video sites, and how many ads run against those. If anyone has any ideas for how to determine these numbers, I'd love to hear them.

What do you think? Post a comment now.

Categories: Advertising, Portals, Syndicated Video Economy, Technology

Topics: AOL, Fancast, FreeWheel, MSN, Yahoo, YouTube

-

Recapping 5 Broadband Video Predictions for 2009

For those who weren't up for reading 700-1,000 words each day last week, today I offer a quick recap my 5 broadband video projections for 2009.

1. The Syndicated Video Economy Accelerates

This one is easily my least controversial prediction, since I've been writing about this trend for most of 2008. The "SVE" as I call it, is an ecosystem of video content providers, distributors and the technology companies who facilitate their relationships. In '08 video content providers increasingly realized that widespread distribution to the sites that users already frequent would improve on the "one central destination site" approach. That's a big change in the traditional media mentality. In '09 the SVE will only accelerate, as the technology building blocks for distributing, monetizing and measuring syndicated video continues to improve. To be sure, the SVE is still nascent, but many companies across the broadband landscape have begun embracing it in earnest.

2. Mobile Video Takes Off, Finally

In '08 VideoNuze has been mainly focused on wired broadband delivery of video to homes and businesses. But as the year has progressed, powerful new mobile devices have mutated the definition of broadband to also include wireless delivery. The huge success of the iPhone and other newer video-capable devices, coupled with 3G, and soon 4G networks, have contributed to mobile delivery finally realizing some of its long-held promise. Still, as some of you commented, obstacles remain. iPhones don't support Flash, the most popular video format. Wireless carriers are careful with doling out too much bandwidth for video apps. And so on. Still, '08 was a big year for video delivery to mobile devices, and I think '09 will be even bigger.

3. Net Neutrality Remains Dormant

Proponents of "net neutrality" legislation, which would codify the Internet's level playing field, expected that under an Obama administration they would finally be granted their wish, particularly since he supported the concept on the campaign trail. But I'm predicting that net neutrality will be dormant for yet another year. Mr. Obama has been emphatic about basing policy decisions on facts and data, and this is an area where net neutrality advocates continue to come up short as there's yet to be any sustained and proven ISP misbehavior. With Mr. Obama and his team having urgent fires to address all around them, there are only two scenarios I can see that move net neutrality up the prioritization list: a startling new pattern of ISP misbehavior or some kind of deal ISPs agree to in exchange for infrastructure buildout subsidies from the stimulus package.

4. Ad-Supported Premium Video Aggregators Shakeout

One of the best-funded categories of the broadband landscape has been aggregators of premium-quality video - TV programs, movies and other well-produced video. These companies have been thought of as potential long-term online competitors to today's video distributors (cable/satellite/telco). However, it's proving very difficult for these sites to differentiate themselves. Content is commonly available, user experience advantages are hard to maintain, user acquisition is not straightforward, audiences are fragmented and ad dollars are under pressure. All of this means that '09 will see a shakeout among the many players in this category, though it's hard to predict at this point who will be left standing (though at a minimum I expect Hulu and Fancast to be in this group).

5. Microsoft Will Acquire Netflix

My long-ball prediction was that at some point in '09 Microsoft will acquire Netflix. Though many of you emailed me offering kudos for boldness, not many are buying into my prediction. Fair enough, I'll either be flat-out wrong on this one or I'll get a gold star for prescience. I provided my rationale, which starts with the assumption that Apple and Google (Microsoft's two fiercest rivals in the consumer space) are best-positioned for success in the battle for the biggest consumer prize of the next 10 years: delivering broadband video services directly to the TV.

I think Microsoft needs to directly play in this space, and Netflix is a perfect vehicle. It has a great brand, a large and loyal subscriber base and excellent back-end fulfillment systems. In 2008 Netflix great strides in broadband, building out its "Watch Instantly" feature. Yet to grow WI's catalog from its current 12K titles to anything approaching the 100K+ available by DVD will require deep financial resources to deal with a recalcitrant Hollywood, and also shelter from quarter-to-quarter earnings pressures. Netflix's measured approach to broadband is consistent with its historical overall operating style. While that style has worked exceedingly well in the past, the broadband-to-the-TV service landscape is wide open right now, and Netflix should be pursuing in a thoughtful, yet ultra-aggressive way. Combined with Microsoft it would be poised to become the broadband video category leader over the next 10 years.

OK, there's the summary. I'll be checking back in on these as the year progresses.

What do you think? Post a comment now.

Categories: Aggregators, Broadband ISPs, Deals & Financings, Mobile Video, Predictions, Syndicated Video Economy

Topics: Apple, Fancast, Google, Hulu, Microsoft, Net Neutrality, Netflix

-

2009 Prediction #4: Ad-Supported Premium Video Aggregators Shakeout

"Look to your left, look to your right. One of you won't be here next year."

- Professor Charles Kingsfield, The Paper Chase

Professor Kingsfield's famous admonition to incoming Harvard Law School students applies equally well in 2009 to the ad-supported aggregators of premium video. My prediction #4 for the new year is that a shakeout is coming to this space.

As I wrote last summer in "Video Aggregators Have Raised $366+ Million to Date," there has been a lot of enthusiasm around broadband-only aggregators, especially those that focus on premium-quality video. Part of the excitement is based on the idea that they could eventually snatch a chunk of the $100 billion/year that today's cable, satellite and telco video distributors generate. This vision is enhanced by the inevitability of broadband connecting seamlessly to millions of consumers' TVs, enabling a pure on-demand, a-la-carte experience. The result has been many well-funded startups (e.g. Joost, Veoh, Vuze, etc.) as well as offensive/defensive initiatives backed by large media companies (e.g. Hulu, Fancast, portal sites, etc.).

However, ad-supported video aggregators face multiple challenges. First and most is that as their ranks have grown, the audience they're commonly targeting fragments. Not only does this make it hard to achieve scale, it makes it hard to identify meaningful audience differences that advertisers seek when allocating their budgets. The recent economic collapse and ad spending slowdown only exacerbate these audience-related issues.

The next big problem is that it is very difficult for aggregators to differentiate themselves. As with most web sites, there are really two main drivers of differentiation: content and user experience. On the content side, there is a finite amount of premium video available for ad-supported online distribution and there's no such thing as exclusivity (except to some extent with Hulu and its rights to NBC and Fox shows).

Increasingly broadcast programs are available in lots of places online, (starting with the broadcasters' own sites), while cable programs are in short supply (more on why that's the case and why it will stay that way in "The Cable Industry Closes Ranks"). Though there is lots of other quality video being produced, the reality is that once you get away from hit TV shows and recently-released movies (which themselves are not available except as paid downloads), little else has the same audience-driving appeal.

User experience is certainly a bona fide differentiator, and as I have spent time at all these sites, it's evident which sites are better and easier to use than others. But user experience differences are hard to maintain; it's all too easy for one site to emulate what another one does, and with cheap, open technology there are few barriers to doing so. Over time, most of the really important differences melt away (ample evidence of this is found in the ecommerce world, where checkout processes have long since gravitated to a set of best practices).

Another problem is customer acquisition and retention, which is a particular issue for the independent aggregators, who don't have incumbent advantages to leverage. With premium video only coming online relatively recently, users' video search processes are not yet well understood. Suppose someone is looking for a missed episode of Lost and don't want to pay for it. Do they start with a Google search for "Lost?" Or for "ABC?" Or do they reflexively go to ABC.com? Or maybe they're a heavy YouTube user, so they start by heading over to YouTube.com? Still others no doubt start by going to video search sites like blinkx or Truveo. Video aggregators need to insert themselves in the flow of an online user's video search process. But doing effectively is not yet anywhere close to the reasonably well-understood world of web-based optimization techniques.

I believe all of this leads to the inevitable result that not all of today's video aggregators are going to make it to the end of '09. Some will be bought or merged, others will simply close down. You're no doubt wondering which ones I think will fall into these categories. Though I have my hunches, for now I just can't offer an informed answer. There are just too many variables in play: actual performance (which only the sites themselves know), cash burn rates, strength of commitment by investors/owners, etc. What I will say though is that the list of survivors will include at least Hulu and Fancast. Both are highly strategic to their parent companies, have significant financial backing, and enjoy content or feature differentiation that is hard to replicate and/or is valued by users.

The landscape for video aggregators is still pretty wide open, so some winners will emerge. But there are just too many entrants chasing the same prize. I'll be keeping close track of the aggregator space on VideoNuze as '09 unfolds, and will keep you apprised of all developments.

What do you think? Post a comment now.

2009 Prediction #1:The Syndicated Video Economy Accelerates

2009 Prediction #2:Mobile Video Takes Off, Finally

2009 Prediction #3:Net Neutrality Remains Dormant

Tomorrow, 2009 Prediction #5

Categories: Aggregators

Topics: Fancast, FOX, Hulu, Joost, NBC, Veoh, Vuze

-

Here Comes Sling.com

Does the world need another broadband video aggregation site for premium quality video content?

The answer to that question will start to come early next week when Sling.com, the latest entrant in this already crowded space, officially launches. Recently Jason Hirschhorn, president of Sling Media's entertainment group and Brian Jaquet, Sling's Director of Public Relations came through Boston and caught me up on their plans to launch commercially on Nov. 24th.

Many of you know that Sling is the maker of the Slingbox, which connects to your TV or DVR, allowing you

to remotely watch programs on your computer. It's a very clever product, though I have to admit its use case has always been a little confounding to me. Nonetheless, just over a year ago, Sling was acquired by EchoStar in a $380 million deal. Shortly thereafter, EchoStar split itself into two parts, Dish Network, the satellite-delivered programming company, and EchoStar Corporation, which includes Sling and other technology-based businesses.

to remotely watch programs on your computer. It's a very clever product, though I have to admit its use case has always been a little confounding to me. Nonetheless, just over a year ago, Sling was acquired by EchoStar in a $380 million deal. Shortly thereafter, EchoStar split itself into two parts, Dish Network, the satellite-delivered programming company, and EchoStar Corporation, which includes Sling and other technology-based businesses.Sling.com, developed by Jason's entertainment group, is the first Sling offering not tethered to any of its devices and therefore open to all users. Acknowledging that Hulu has set a high bar on user experience, Jason explained that Sling.com is attempting to go one step further on usability, and will also differentiate itself with updated social networking capabilities and highly focused editorial content.

In particular, Sling.com offers a slew of Facebook-like features that allow users to subscribe to and favorite programs and networks, with users in turn able to follow these activities. As Jason aptly put it, the goal is to "digitize the water cooler conversation." The whole experience is geared toward engaging the user at a far deeper level than we're accustomed to in passive linear viewing, or even typical at other aggregators' sites.

The real differentiator for Sling long-term though is the integration of Sling.com with the remote viewing offered by Slingbox. Enabled by a new web-based player (instead of the prior downloadable client), users are able to seamlessly browse back and forth between watching live TV and cataloged programs, as shown below.

Taking this one step further, Sling's goal is to get its remote viewing technology embedded in others' set-top boxes as well. So for example, a Comcast STB with Sling inside would allow you to have live TV integrated into your Sling.com, without having to go buy another box.

That's an enticing prospect, but making it happen will be no small feat; the STB giants like Motorola and SA (now part of Cisco) will get on board only when their biggest customers - America's cable operators - ask for it. The prospect of these cable executives wanting to incorporate any technology controlled by Charlie Ergen, Echo's founder/CEO and the cable industry's arch-enemy, stretches my mind. However, stranger deals have been done, so who knows. In the meantime, there are a whole lot of other non-cable homes globally Sling can address first.

But much of that is down the road anyway. For now, Sling.com is going to compete head on with Hulu (which by my count supplies virtually the entire current movie catalog at Sling.com, in turn begging the question of how many different ways one relatively small ad revenue stream can get carved up?), Fancast, the portal sites, YouTube and so on. Jason readily admits that these sites will not compete on content exclusivity; ultimately they'll all have access to everything that's available.

So in this incredibly crowded space, is there room for a newcomer? On the surface, it's tempting to say "no." But history teaches us that "better mousetraps" can elbow their way into even the most crowded spaces. Remember how many search engines already existed when Google burst onto the scene? On a totally different level, I can relate to this challenge myself. A year ago I wondered whether there was room for a new broadband video-centric blog when so many others already existed; now here we are.

The reality is that newcomers succeed because they don't accept the status quo as final. Rather, they find smart ways of delivering new and better value to customers who didn't necessarily even know what they wanted, but when they got it, were delighted. That's Sling.com's challenge. Whether it can meet it remains to be seen. But in this crummy economy, their deep-pocketed backing certainly gives them a leg up on any VC-funded competitors when it comes to long-term staying power.

What do you think? Post a comment now!

Categories: Aggregators, Cable TV Operators, Devices, Satellite

Topics: Cisco, DISH Network, EchoStar, Fancast, Hulu, Motorola, SA, Sling, YouTube

-

The Cable Industry Closes Ranks

First, apologies for those of you getting sick of me talking about the cable TV industry and broadband video; I promise this will be my last one for a while.

After attending the CTAM Summit the last couple of days, moderating two panels, attending several others and having numerous hallway chats, I've reached a conclusion: the cable industry - including operators and networks - is closing ranks to defend its traditional business model from disruptive, broadband-centric industry outsiders.

Before I explain what I mean by this and why this is happening, it's critical to understand that the cable business model, in which large operators (Comcast, Time Warner Cable, etc.) pay monthly carriage or affiliate fees to programmers (e.g. Discovery, MTV, HGTV, etc.) and then bundle these channels into multichannel packages that you and I subscribe to is one of the most successful economic formulations of all time. The cable model has proved incredibly durable through both good times and bad. In short, cable has had a good thing going for a long, long time and industry participants are indeed wise to defend it, if they can.

It's also important to know that the industry is very well ordered and as consolidation has winnowed its ranks to about half a dozen big operators and network owners, the stakes to maintain the status quo have become ever higher. All the executives at the top of these companies have been in and around the industry for years and have close personal and professional ties. There's a high degree of transparency, with key metrics like cash flow, distribution footprint, ratings and even affiliate fees all commonly understood.

One last thing that's worth understanding is that the cable industry has very strong survival instincts, or as a long-time executive is fond of saying, "Real cable people (i.e. not recent interlopers from technology, CPG or online companies that have joined the industry) were raised in caves by wolves." The fact is that the industry started humbly and experienced many very shaky moments. Yet it has managed to survive and continually re-invent itself (for those who want to know more, I refer you to "Cable Cowboy: John Malone and the Rise of the Modern Cable Business" by Mark Robichaux, still the best book on the industry's history that I've read).

All of that brings us to broadband and its potential impact on the cable model. As I've said many times, broadband's openness makes it the single most disruptive influence on the traditional video distribution value chain. Principally that means that by new players going "over the top" of cable - using its broadband pipes to reach directly into the home - cable's model is at serious risk of breaking down, once and for all.

The cable industry now gets this, and I believe has closed ranks to frown heavily on the idea of cable programming, which operators pay those monthly affiliate fees for, showing up for free on the web, or worse in online aggregators' (e.g. Hulu, YouTube, Veoh, etc.) sites. The message is loud and clear to programmers: you'll be jeopardizing those monthly affiliate fees come renewal time if your crown jewels leak out; worse, you'll be subverting the entire cable business model.

And this message isn't being delivered just by cable operators such as Peter Stern from Time Warner who said on my Broadband Video Leadership Breakfast panel that "a move to online distribution by cable networks would directly undermine the affiliate fees that are critical to creating great content." It's also coming from the likes of Discovery CEO David Zaslav who said on a panel yesterday that "there's no economic value from online distribution," and that "great brands like Discovery's must not be undervalued by making full programs available for free online."

The issue is, as a practical matter, can the industry really control all this? If there's zero online distribution, then as Fancast's impressive new head, Karin Gilford said on my panel yesterday, "pressure builds up and another channel inevitably opens" (read that as The Piracy Channel). The problem is that if, for example, an operator does put programs up on its own site - as Fancast is doing - they're available to ALL the site's visitors, not just existing cable subscribers, unless other controls are put in place like passwords, IP address authentication, geo-targeting, etc. But these are confusing and cumbersome to users whose expectations are increasingly being set by broadcasters who are making their primetime programs seamlessly available to all comers.

So what does this closing ranks suggest? Going forward, I think we'll still see cable networks putting up plenty of clips and B-roll video from their programs, maybe the occasional online premiere, some made-for-the-web stuff, paid program downloads (iTunes, etc.) and promotional/community building contests, as Deanna Brown from Scripps described with "Rate My Space" or Zaslav discussed with "MythBusters."

But when it comes to full cable network programs going online, I think that spigot's going to dry up. That has implications for online aggregators like Hulu, who will continue to have big holes in their libraries until they're ready to pay up for these carriage rights. And it also means that broadband-to-the-TV plays are also going to be hampered by subpar lineups unless these companies too are willing to pay for cable programming.

By closing ranks the cable industry's making a bold bet that its ecosystem can withstand broadband's onslaught and the rise of the Syndicated Video Economy. In yesterday's post I noted that the music industry tried a similar approach; we know where that got them. There are plenty of reasons to think things could indeed be different for the cable industry, but there are as many other reasons to think the cable industry is massively deluding itself and could someday be grist for a chapter in the updated version of Clay Christensen's "The Innovator's Dilemma," (my personal bible for how to pursue successful disruption), right alongside the inevitable chapter about how the once mighty American auto industry spectacularly lost its way.

For my part, there are just too many moving parts for me to call this one just yet.

What do you think? Post a comment now!

Categories: Aggregators, Broadcasters, Cable Networks, Cable TV Operators, Devices, Syndicated Video Economy

Topics: Comcast, CTAM Summit, Discovery, Fancast, Scripps, Time Warner

-

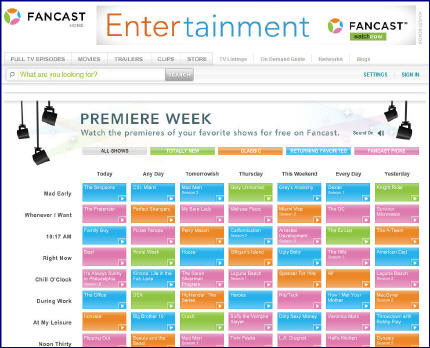

Comcast's Fancast Becomes Hub for Premieres; But Where's Project Infinity?

Here's a clever move from Comcast's Fancast broadband portal to create new value for users and generate excitement in the broadband market: this week it is running "Premiere Week," an aggregation of 168 premiere TV episodes. The episodes span series premieres ("Desperate Housewives," "Dexter," "The Office"), season premieres ("Fringe," "Sons of Anarchy," "Crash") and classic pilots ("Dynasty," "The A-Team," "Miami Vice"). It's great fun and a visitor could get lost on the site for hours, as I nearly did.

These are the kinds of promotions that Comcast should be all over. Given its extensive reach and programming muscle, the company has definite - though not insurmountable - advantages over other aggregators to pull this kind of promotion together.

The competition for aggregating premium programming continues to intensify. Business models are all over the board as are approaches for getting video all the way to the TV. For example, last week Amazon launched its pay-per-use VOD initiative which includes a page of info for how to watch using TiVo, Sony Bravia Internet Video Link, Xbox 360, etc. Then yesterday, Netflix announced that it will incorporate about 2,500 of Starz's movies, TV shows and concerts in its Watch Instantly feature, along with a feed of its linear channel. Still other moves are forthcoming.

Comcast's real lever though is unifying its currently siloed worlds of digital TV, broadband Internet access and Fancast. When converged they're a blockbuster; companies like Netflix, Amazon and others cannot replicate this combination. In particular, Comcast, and other cable operators are ideally positioned to bridge broadband all the way to the TV. That's the last big hurdle to unlock broadband's ultimate value. Whether they'll do so is an open question.

Earlier this year Comcast CEO Brian Roberts unveiled the company's "Project Infinity" which suggested Comcast was looking to unify its various video offerings and bring broadband to its subscribers' TV. It seemed like a promising move, though there was no timeline disclosed. Now, nearly 9 months later I can't find any updates on the status of Project Infinity. It would be great for the company to publicly release a progress report or sense of upcoming milestones.

Promotions like "Premiere Week" are a positive step from Comcast, but real competitive advantage for the company lies in launching services which are truly impossible for others to match.

What do you think? Post a comment.

Categories: Aggregators, Cable TV Operators, Portals

Topics: Amazon, Comcast, Fancast, Netflix, Starz, TiVo

-

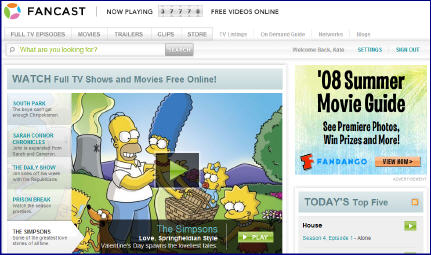

Fancast Gets a Facelift

Comcast's Fancast broadband portal has received a much-needed facelift, adding new features and content to compete with other well-funded players in this space. (Note: before you conclude that VideoNuze has become obsessed with covering Comcast - since just yesterday I dug into its ISP policies - rest assured, tomorrow I'll move on!)

Fancast is by far the most ambitious portal effort among the major cable operators. In fact, while other operators' portals target just their own ISP customers, Comcast's goal is to have Fancast compete for ANY broadband user's attention. That means that Fancast goes head to head with ad-based broadband aggregators like Hulu, Veoh, Joost, Metacafe, etc. And now with Fancast's new video download store, it also butts up against folks like iTunes, Amazon Unbox, Xbox LIVE Marketplace, etc. Then of course there's YouTube, the 800 pound gorilla of the broadband video world, which all aggregators, compete with on one level or another.

With such a formidable array of competitors, Fancast has a high bar to succeed. Still, I've maintained for a while that Comcast, with its 14 million+ broadband subscribers and 22 million+ cable subscribers is extremely well-positioned and needed to play aggressively in broadband video distribution. To date though I've been underwhelmed by Fancast, which seemed to have a solid vision, but sub-par execution. (For more on this, see 2 previous posts, here and here, comparing Hulu and Fancast.)

Now, with Fancast's facelift, the portal is getting some mojo. Fancast's director of communications Kate Noel recently took me on a spin through what's new. First up is a new home page (see below) that nicely showcases premium content that is curated by an in-house editorial team. Clicking on a selection reveals an oversize video player (which can be further enlarged to full screen). New features include embedding and sharing, along with a handy tool to be notified when a new episode is offered.

There's also a noticeable improvement in content selection, which Kate says now includes over 37,500 video assets; 320+ individual TV programs, 250+ movies and countless trailers and clips from over 100 content partners. Fancast is also putting a heavy emphasis on editorial differentiation, and has created sections such as "Today's Top 5," "Daily Buzz (blog)" and "Discover All Your Favorites." to help orient users on the site and provide editorial perspective.

This all plays to what Kate says is Fancast's larger mission to not just "offer TV online," but rather to "use Fancast as a cross-platform hub" that draws value from and drives value to Comcast's other offerings - digital cable, VOD and DVR service in particular.

With Comcast's huge cable subscriber base, that sounds right in theory. But how exactly Fancast fully executes on that potential still feels squishy. For example, doing a search for a current episode of "Mad Men" reveals a nice option to watch on VOD (since it's not currently on Fancast - that's a whole other story...), but is this really a game-changer? A much more significant lever at Comcast's disposal would be getting Fancast onto their digital cable boxes, so all that great Fancast content could be consumed in the living room (maybe along with YouTube, Funnyordie, NYTimes.com and other video?). The nagging question remains: will that day ever come?

One last thing that struck me about Fancast was its seemingly murky relationship with Hulu, which supplies many of Fancast's movies, and some of its TV programs. Is Hulu a Fancast competitor, a partner, both? Kate says Hulu is not competitive. Yet at the end of the day, aren't both Hulu and Fancast competing for the same ad dollars, and eyeballs? Here's another question: with Comcast's vast programming arm, why can't it procure movies directly from studios, instead of cutting Hulu in on the action? I must say, it's all very confusing.

Still, to the average user, the new Fancast is an improvement, and there is more progress yet to come.

What do you think? Post a comment now!

Categories: Aggregators, Cable TV Operators, Portals

Topics: Comcast, Fancast, Hulu

-

June '08 VideoNuze Recap - 3 Key Topics

Wrapping up a busy June, I'd like to quickly recap 3 key topics covered in VideoNuze:

1. Execution matters as much as strategy

I've been mindful since the launch of VideoNuze to not just focus on big strategic shifts in the industry, but also on the important role of execution. I'm not planning to get too far into the tactical weeds, but I do intend to show examples where possible of how successful execution can make a difference. This month, in 2 posts comparing and contrasting Hulu and Fancast (here and here) I tried to constructively show how a nimble upstart can get a toehold against an entrenched incumbent by getting things right.

While great execution is a key to successful online businesses, it may sometimes feel pretty mundane. For example, in "Jacob's Pillow Uses Video to Enhance Customer Experience" I shared an example of an arts organization has begun including video samples of upcoming performances on its web site, improving the user experience and no doubt enhancing ticket sales. A small touch with a big reward. And in this post about the analytics firm Visible Measures, I tried to explain how rigorous tracking can enhance programming and product decisions. I'll continue to find examples of where execution has had an impact, whether positive or negative.

2. Cable TV industry impacted by broadband

As many of you know, I believe the cable TV industry is a crucial element of the broadband video industry. Cable operators now provide tens of millions of consumer broadband connections. And cable networks have become active in delivering their programs and clips via broadband. Yet the broadband's relationships with operators and networks are complex, presenting a range of opportunities and challenges.

On the opportunities side, in "Cable's Subscriber Fees Matter, A Lot," I explained how the monthly sub fees that networks collect put them on a firm financial footing for weathering broadband's changes and an advantageous position compared to broadband content startups which must survive solely on ads. Further, syndication is offering new distribution opportunities, as evidenced by Scripps Networks syndication deal with AOL in May and Comedy Central's syndication of Daily Show and Colbert Report to Hulu and Adobe. Yet cable networks are challenged to exploit broadband's new opportunities while not antagonizing their traditional distributors.

For operators, though broadband access provides billions in monthly revenues, broadband is ultimately going to challenge their traditional video subscription business. In "Video Aggregators Have Raised $366+ Million to Date," I itemized the torrent of money that's flowed into the broadband aggregation space, with players ultimately vying for a piece of cable's aggregation revenue. These and other companies are working hard to change the video industry's value chain. There will be a lot more news from them yet to come.

3. Video publishing/management platforms continue to evolve

Lastly, I continued covering the all-important video content publishing/management platform space this month, with product updates from PermissionTV, Brightcove and Entriq/Dayport. Yesterday, in introducing Delve Networks, another new player, I included a chart of all the companies in this space. I put a significant emphasis on this area because it is a key building block to making the broadband video industry work.

These companies are jostling with each other to provide the tools that content providers need to deliver and optimize the broadband experience. The competitive dynamic between these companies is very blurry though, with each emphasizing different features and capabilities. Nonetheless, each seems to be winning a share of the expanding market. I'll continue covering this segment of the industry as it evolves.

That's it for June; I have lots more good stuff planned for July!

Categories: Aggregators, Cable Networks, Cable TV Operators, Technology

Topics: AOL, Brightcove, Comedy Central, Delve, Entriq, Fancast, Hulu, Jacobs Pillow, PermissionTV, Scripps, Visible Measures

-

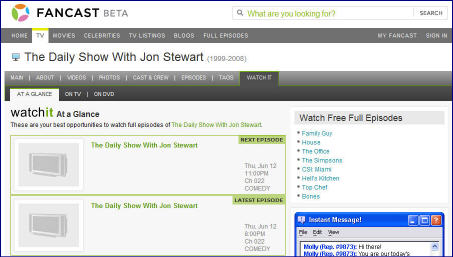

Hulu Out-Executing Comcast in On-Demand Programming?

The crew over at Hulu must be gleefully fist-bumping each other this week as Hulu scored a key strategic and public relations coup in adding to its lineup two of Comedy Central's most popular programs, "The Daily Show with Jon Stewart" and "The Colbert Report." Though officially positioned as a test, Hulu still deserves big-time kudos as the deal is an endorsement of its value proposition.

The deal and Hulu's execution illustrate a larger point that I've been making for a while: one of broadband's three key disruptions is that it enables new aggregators to gain an edge on larger incumbents by changing the dynamics of competition. To be more specific, in this case, I think that Hulu has out-executed Comcast, America's #1 cable operator by delivering new value to consumers and gaining important PR momentum. Here's why:

Fancast, which is Comcast's online portal (in beta), actually announced a deal with Comedy Central back on May 19th for access to these same programs and others. Yet go to Fancast and search for "Daily Show" and, as shown below, you won't find any Daily Show full episodes available, just an assortment of short clips and times when it's on TV. A Comcast spokesperson told me that Comcast's implementation is imminent, but its delay in getting the programs up and running is accentuated when you consider that Comedy Central must have done its distribution deal with Fancast BEFORE its deal with Hulu.

Second, and more concerning is that, as a Comcast digital subscriber, when I tried to find The Daily Show and Colbert in Comcast's VOD menu, all that is available are five older Colbert clips and 1 older Daily Show clip. My guess is these haven't been updated in a while. No full-length Daily Show or Colbert programs are available at all in VOD.

While the Comcast spokesperson told me that the company works closely with its programming partners like Viacom to figure out the optimal mix of programming to make available on VOD, I think an unavoidable conclusion here is that Comcast (and other cable operators) is constrained by its inability to monetize VOD programming with advertising (what this week's "Project Canoe" is meant to address) and to easily add new programming on the VOD menu. These programming gaps create opportunities for upstarts like Hulu to capitalize on.

It may be unfair to zero in so narrowly on Comcast's execution with Daily Show/Colbert, yet things weren't much different when I searched for MTV's popular "The Hills" on Hulu, Fancast and Comcast's VOD. While Hulu doesn't appear to have a deal for full episodes of "The Hills" it masks this cleverly by providing thumbail images and easy navigation back to MTV's site where the video lives, for over 50 episodes (this is tactic Hulu uses for ABC's shows as well). On the other hand, Fancast displays just 5 full episodes, 2 from this season and 3 from last. And on VOD there are also just 5 episodes, though all from this season.

I think it's pretty significant that Hulu, a site that only went live 3 months ago can not only gain access to hit Comedy Central programs like Daily Show/Colbert, but can execute quickly. Hulu is using its advantages - flexible technologies, interactive features (clipping, embedding, sharing), monetization capability, savvy PR and startup pluck to compete with far-larger incumbents like Comcast.

Of course Comcast racks up billions of VOD views each year and has vast resources, making it an important player in on-demand programming. Yet Hulu has managed to make Comcast's advantages look a little less intimidating. I asked the Comcast spokesperson about this. She acknowledged Hulu's progress, but maintained that Comcast believes its mulit-platform approach is stronger.

In the big picture that's true, but when it comes to winning consumers' hearts and minds, it's often execution, not broad strategy that carries the day. And don't forget, when Hulu is unshackled from the PC - with its content freely riding Comcast's broadband pipes all the way to the TV - execution will matter even more.

This week Hulu provided a textbook example of how broadband-only aggregators can gain a foothold against well-established incumbents. Comcast and other incumbents should be taking notice and getting their game on.

What do think? Post a comment and let everyone know!

Categories: Advertising, Aggregators, Cable Networks, Cable TV Operators

Topics: Comcast, Comedy Central, Fancast, Hulu, The Colbert Report, The Daily Show, Viacom

Posts for 'Fancast'

|