-

Sony Pictures Taps Value of Archive With Thought Equity's Metadata Editor

Major content providers are continuing to realize that new value can be mined from archives of long-form premium content by creating and indexing metadata in order to distribute shorter clips of key scenes. The latest example came this week as Sony Pictures Entertainment struck a deal with Thought Equity Motion to use its T3 Metadata (screen shot below) for its enormous catalog of entertainment content.

Categories: FIlms, Studios, Technology

Topics: Sony Pictures, Thought Equity Motion

-

Movie Windows Back in the Spotlight

Movie windows were back in the spotlight this week as Hollywood executives continue to air out their anxiety over digital distribution's impact. In a pair of articles (here and here), Home Media Magazine covered remarks by Disney CFO Jay Rasulo and Time Warner CEO Jeff Bewkes at the Deutsche Bank conference in Palm Beach, FL. Rasulo put his finger on Hollywood's challenge of how to "re-work release windows to generate incremental revenue, without cannibalizing existing revenue streams and upsetting distribution partners."

However, as Disney knows from its experiment last year of accelerating the DVD release of "Alice in Wonderland," which raised the ire of British theater owners, balancing these objectives is no easy feat. Meanwhile, as "Premium Video-on-Demand," an early window release plan for $30-$40 per movie approaches, theater owners' unhappiness will become even more apparent.

Categories: Aggregators, FIlms, Studios

Topics: Disney, Netflix, Time Warner

-

Facebook-Warner Bros.: Big Deal or Little Deal?

Speaking of movies, this week brought news that Facebook was dipping its toe into Hollywood's waters, by offering Warner Bros. "The Dark Knight" for purchase and rental to its members. Though Warner positioned the move as an experiment, Netflix stock went into a free-fall as investors swooned over Facebook's possibilities. But as a former business school professor of mine was fond of asking his class, "Is this a BIG deal or a LITTLE deal?"

Categories: FIlms, Social Media, Studios

Topics: Facebook, Neflix, Warner Bros.

-

As DVD Sales Wane, Experiments With Movies' Digital Delivery Windows Rise

Yesterday brought more evidence of how digital distribution release windows and promotions are rising as DVD sales wane. First there was news that Disney had teamed up with Wal-mart to allow buyers of the Toy Story 3 DVD to get a bonus digital version of the film playable through the company's recently acquired Vudu digital outlet. That offer was quickly one-upped by Amazon which announced an increase from 300 to 10,000 movies in its "Disc+" program, which provides a digital copy to the user's Amazon VOD account when they purchase a qualifying DVD.

Meanwhile at the Blu-con conference in Beverly Hills, studio executives debated how to best calibrate digital, VOD and DVD distribution. Even emerging practices come with exceptions and debates about results. For example, while VOD has largely gained day-and-date release with DVD, exceptions are still made on a case-by-case basis, such as with Universal's "Despicable Me" which will have its DVD go on sale on Dec 14, but its VOD release not until after Christmas.

Topics: Amazon, Apple, Best Buy, Disney, EPIX, FOX, Netflix, Sony, Starz, Universal, VUDU, Wal-Mart, Warner Bros.

-

Time Warner's "Premium Video-on-Demand" Experiment is a Blind Alley

Talk about an initiative that flies in the face of all prevailing sentiment: Time Warner is moving forward on testing a new window for early-release movies on VOD priced at $20-30 apiece in 2011, according to comments its CFO John Martin made yesterday at the Goldman Sachs conference. Never mind the wrath the idea will stir up among movie theater owners whose traditional windows get cannibalized as a consequence (Disney learned about that with its "Alice in Wonderland" early DVD release experiment last February), the real issue is that pay-TV operators should deem the idea a non-starter.

wrath the idea will stir up among movie theater owners whose traditional windows get cannibalized as a consequence (Disney learned about that with its "Alice in Wonderland" early DVD release experiment last February), the real issue is that pay-TV operators should deem the idea a non-starter.

Typical VOD rental rates of $4-5 already look expensive to consumers compared to Netflix's $9 all-you-can-eat monthly plans and Redbox's $1 DVD rentals. And while there are scenarios where getting a group or family together to watch a movie makes sense, it's getting harder than ever to do so. The reality is that families are atomizing to their individual activities; perusing or playing on Facebook, watching YouTube/Hulu/Netflix/etc., playing with the Wii or Farmville, chatting on Skype, shopping on Amazon, etc. Corralling this crowd and getting them to agree on any one movie is already a challenge; the prospect of paying $20-30 for the pleasure just sets the bar that much higher.

Categories: Cable TV Operators, FIlms, Satellite, Studios, Telcos

Topics: Disney, Netflix, Redbox, Time Warner, Time Warner Cable

-

Hollywood Considers Squeezing Theatrical Window

An article in the WSJ.com this past weekend, "Hollywood Eyes Shortcut to TV," describes how some Hollywood studios' appear ready to further squeeze their bread-and-butter theatrical relationships in the name of accelerated electronic distribution to viewers' TVs.

The article cites proposals that Time Warner Cable, America's 2nd largest cable operator, is discussing with studios to offer movies to Video-on-Demand (VOD) just 1 month after they open in theaters, instead of today's typical 4 months. The idea, dubbed "home theater on demand" ("HTOD" for short) would mean a movie would be available on HTOD while still playing in theaters. Adopting such an approach would be akin to Hollywood sticking its finger in the eye of its theatrical partners, who would obviously suffer some degree of diminished ticket sales.

Hollywood studios surely know the firestorm an HTOD move would create. In the past 6 months, plans to overlap theatrical and electronic distribution - with Disney's "Alice in Wonderland" and Sony's "Cloudy With a Chance of Meatballs" - met with stiff resistance from theater owners. With the new HTOD concept, studios seem intent on pushing further into this perilous territory, motivated by a desire to get movies into viewers' hands earlier than ever before.

In general I applaud studios willingness to experiment, but I think the value of HTOD and other early release plans is overestimated and more likely to backfire on studios than produce any tangible financial benefits.

The first issue is cannibalization. It's hard to imagine, given all the marketing effort around a movie's premiere, that the aggregate short-term audience for a particular movie can be expanded all that much. Certainly few people who just paid to see the movie in the theater will pay again to see it at home so quickly thereafter. And if you really wanted to see a movie, wouldn't you have made it to the theater in the first place?

Instead of tempting people to not bother going out, studios should be giving consumers more reasons to actually do so. Studios have so many new opportunities with social media, local-based services and user-generated content to add excitement to movie premieres. This is particularly true for younger audiences critical to box office results. Some of these new efforts can extend all the way through a movie's DVD and electronic release, adding downstream value as well.

In addition, even with movie ticket prices now approaching or hitting $20 apiece, in my opinion, HTOD's proposed fee of $20-30 is way too high. Most VOD movies today cost around $5-6; trying to justify a multiple of that price for HTOD, for the sole benefit of earlier in-home access, is a huge stretch. In reality, consumers seem plenty willing to wait in exchange for lower prices. That's the key takeaway from Netflix's willingness to do the 28-day DVD window deals with major studios. If a consumer can pay a paltry $9/mo they'll be just fine waiting until the movie becomes available on DVD or for streaming. Hollywood needs to be careful not to overestimate the value of its product.

Last but not least, HTOD is a risky play because cable-delivered VOD itself is going to be coming under intensifying competition. Recently I explained how competition for movie rentals is intensifying, making VOD just one of many, many choices for consumers. Initiatives like Google TV undermine VOD because when a consumer can just as easily access movies from various online outlets directly on their TVs, VOD usage will inevitably suffer. Though I'm skeptical about new efforts from retailers like Wal-Mart and Best Buy, they will add more on-demand movie choices and will further turn up the pressure on VOD.

Electronic distribution is a hot topic these days, and studios are right to explore their options. But while studios' relationships with theater owners are far from optimal, in my opinion studios need to be very careful about jeopardizing them further. Rather than undermining theatrical release with ever-earlier electronic distribution plans, studios should be figuring out how to build more value into them.

(Note - if you want to learn more about how Hollywood succeeds in the digital distribution era, make sure to join us for the upcoming VideoSchmooze breakfast in Beverly Hills on June 15th! Click here to learn more and register for the early bird discount)

What do you think? Post a comment now (no sign-in required).Categories: Cable TV Operators, FIlms, Studios, Video On Demand

Topics: Disney, Netflix, Sony, Time Warner Cable

-

Fox and Netflix Agree to 28-Day Window

Netflix and Fox are announcing this morning an expanded content licensing agreement which creates a 28-day DVD window and gives Netflix streaming access to certain prior season Fox TV shows. The 28-day window, which delays Netflix access to new DVDs until 28 days after their release date is similar to a deal that Netflix struck with Warner Bros. earlier this year.

I continue to be a fan of the 28-day window, as it allows studios a little more time to eke further revenue out of the rapidly-declining DVD sales business, while expanding Netflix's catalog for streaming and reducing its cost on physical DVD purchases. Netflix's Watch Instantly streaming feature has been a game-changer for the company, essentially reinventing the company's value proposition from a DVD subscription business defined by the number of discs out at any time, to one where subscribers get unlimited digital use. The key to its success is building the library of titles for streaming and that's what these 28-day deals are all about.

while expanding Netflix's catalog for streaming and reducing its cost on physical DVD purchases. Netflix's Watch Instantly streaming feature has been a game-changer for the company, essentially reinventing the company's value proposition from a DVD subscription business defined by the number of discs out at any time, to one where subscribers get unlimited digital use. The key to its success is building the library of titles for streaming and that's what these 28-day deals are all about.

Update: Universal also announced a 28-day deal with Netflix this morning. Release is here.

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators, FIlms, Studios

-

Blockbuster Hangs In with New Fox, Sony and Warner Deals

Netflix wasn't the only distributor modifying how it does business with Hollywood studios this week; Blockbuster also unveiled new deals with Fox, Sony and Warner, giving it "day-and-date" availability of these studios' films for store and mail rental (note, not for its on demand streaming service). Blockbuster also got "enhanced payment terms" from the studios in exchange for giving them a first lien on Blockbuster's Canadian assets (which would imply that if Blockbuster files for bankruptcy, the studios could end up owning/operating a slew of Canadian stores). Seems like steep terms for Blockbuster to hang in there.

for store and mail rental (note, not for its on demand streaming service). Blockbuster also got "enhanced payment terms" from the studios in exchange for giving them a first lien on Blockbuster's Canadian assets (which would imply that if Blockbuster files for bankruptcy, the studios could end up owning/operating a slew of Canadian stores). Seems like steep terms for Blockbuster to hang in there.

As I wrote a few weeks ago in "The Battle Over Movie Rentals is Intensifying," there are multiple distributors jockeying to be the consumer's preferred movie source. That means consumers need to figure out, on a title by title basis what works best for them.

For example, I'm a Netflix subscriber and let's say I want to watch the recently released "Sherlock Holmes" DVD. Netflix doesn't get it until April 27th per its 28-day window with Warner Bros. But when I check online, a local Blockbuster store I've never been to shows that it's in stock (though I'm a little skeptical). Do I want to drive down there to find out? Meanwhile, Comcast is offering it on-demand. But do I want to pay $4.99 for it when I'm already paying a monthly Netflix subscription? Alternatively, there's iTunes and Amazon VOD. But then I need to either watch on my computer or on the TV that's hooked to the Roku or temporarily connect my laptop to the TV. See what I mean about the choices facing consumers?

(Note - online movie distribution is among the topics we'll cover at the next VideoSchmooze on April 26th. Early bird discounted tickets available for just one more week!)

What do you think? Post a comment now (no sign-in required).

Categories: Aggregators, FIlms, Studios

Topics: Blockbuster, FOX, Netflix, Sony, Warner Bros.

-

The Battle Over Movie Rentals is Intensifying

News this morning of a $30 million advertising campaign being launched by 8 Hollywood studios and 8 cable operators promoting "Movies on Demand" is fresh evidence that the battle over movie rentals is intensifying. According to the press release, the 12-week campaign, dubbed "The Video Store Just Moved In" is meant to raise consumer awareness of the convenience and affordability of renting movies on cable.

News this morning of a $30 million advertising campaign being launched by 8 Hollywood studios and 8 cable operators promoting "Movies on Demand" is fresh evidence that the battle over movie rentals is intensifying. According to the press release, the 12-week campaign, dubbed "The Video Store Just Moved In" is meant to raise consumer awareness of the convenience and affordability of renting movies on cable.

Cable Video-on-Demand (VOD) has been around for a long while (in fact 20 years ago my summer internship for Continental Cablevision was studying the ROIs for VOD's precursor, "Pay-per-view"). What's new more recently is the growth of so-called "day-and-date" availability - which means movies are released to VOD at the same time as they become available on DVD. The other recent phenomenon is the widespread adoption of digital set-top boxes and other technologies which makes selection, ordering and delivery easier than ever.

Day-and-date availability is a key competitive differentiator for cable vs. other options, though on the surface it seems somewhat incongruous that studios are on board with this considering their desire to protect DVD sales (this was the key goal of the 28-day "DVD sale" window Netflix and Warner Bros. recently created). Yet Kevin Tsujihara, president of Warner Bros. Home Entertainment Group said that apparently research has shown that simultaneous VOD release doesn't hurt DVD sales. All titles Warner Bros. releases to VOD this year will have day-and-date availability.

The day-and-date advantage is evident at least vs. Netflix for the 9 movies the press release cited as the opening slate being promoted: "Precious," "New Moon," "Ninja Assassin," "Pirate Radio," "Astro Boy," "Bandslam," "Did You Hear About the Morgans," Fantastic Mr. Fox" and "The Fourth Kind." A search on Netflix for the 9 revealed that 5 are listed as "Short wait," 1 becomes available on Mar 20th, 1 on Mar 23rd, and 2 on April 13th (none are available for streaming). However, it's a different story for Amazon - all of the cable VOD movies are currently available for rental from Amazon (except "Mr. Fox") and for purchase. The Amazon rental price is $3.99 for each, whereas the rental price from Comcast (my service provide) is $4.99.

For now anyway, it seems Hollywood studios have decided that cable VOD and online rental firms get day-and-date access, while subscription services like Netflix wait longer (btw Redbox too is being pushed into the "wait longer" category). According to the NY Times article, this is likely because VOD and online rental give studios a 65% share of revenue vs. lower percentages for other outlets.

For consumers, the cable VOD option is likely the most convenient and instantly gratifying. There's no new box to set up or pay for as with Roku, TiVo or another, which would be needed to access Amazon VOD, for example, on TV. For those that haven't bridged broadband to their TV with such a box or a direct connection, on-computer viewing only would be a limitation in the experience. Still, while the day-and-date option is key for those consumers who just have to see a particular title right then, because it's a la carte, it's a far more expensive option than a monthly Netflix subscription, which starts at $8.99/mo. Convenience clearly has its price.

Consumers aren't monolithic though; there isn't one right or wrong model. Each viewing option offers pros and cons and consumers will choose which one, given the particular moment or circumstance, best meets their needs. With the battle for movie rentals escalating, the real winner here looks like the consumer who is being presented more choices than ever.

What do you think? Post a comment now (no sign-in required).

Categories: Cable TV Operators, FIlms, Studios, Video On Demand

Topics: 20th Century Fox, Armstrong, Bend Broadband, Bright House Networks, Comcast, Cox, Focus Featu, Insight, iO TV, Time Warner Cable

-

U.K. Theaters Will Show "Alice in Wonderland" Ending DVD Early Release Flap

The brinksmanship between Disney and the 3 largest U.K. theater chains over whether they would show Tim

Burton's new "Alice in Wonderland" film is officially done, with all 3 chains now signed on. As I described last week in "In Trying to Preserve DVD Sales, Studios Are in a Tight Spot," in a bid to boost DVD sales, Disney was looking to trim the DVD release of "Alice" to just 12 1/2 weeks after its opening, from the customary 16 1/2. British and other European theaters revolted, angry that the move would diminish their box-office take, a particular hot-button in light of significant investments they've recently made in digital technologies.

Burton's new "Alice in Wonderland" film is officially done, with all 3 chains now signed on. As I described last week in "In Trying to Preserve DVD Sales, Studios Are in a Tight Spot," in a bid to boost DVD sales, Disney was looking to trim the DVD release of "Alice" to just 12 1/2 weeks after its opening, from the customary 16 1/2. British and other European theaters revolted, angry that the move would diminish their box-office take, a particular hot-button in light of significant investments they've recently made in digital technologies. Specific details of the Disney-U.K. deals aren't known, but as the Guardian reported, it appears that Disney has agreed to cap the number of movies that will get earlier-than-usual DVD releases and provided some improved financial terms. Despite the U.K. resolution, some other European chains are still holding out, as is the AMC chain in the U.S. Regardless of the final outcome of the "Alice" situation, early DVD releases are going to remain a priority for Hollywood studios who are desperate to stanch the fall-off in DVD sales brought about by the recession and the shift by consumers to rental, subscription and online viewing options. There are many more chapters to be written in this saga.

What do you think? Post a comment now (no sign-in required).

Categories: FIlms, International, Studios

Topics: Alice in Wonderland, Disney

-

Wal-Mart's Acquisition of Vudu Makes Little Difference

Yesterday's announcement by retailing giant Wal-Mart that it was acquiring Vudu, the on-demand movie service, generated a flurry of reactions from industry commentators. Some think it gives Wal-Mart the juice it needs to finally be a major digital media player. Others believe that Wal-Mart's miserable record in digital media suggests that the deal will be much ado about nothing. I'm in the latter camp, but not because of Wal-Mart's track record, but rather because of Vudu's own shortcomings.

Vudu's problem is that its value proposition is hamstrung by both the deals the Hollywood studios insist on to give Vudu access to their titles and by the current state of technology. Each of Vudu's 2 movie delivery

models - rental and download-to-own - has its own problems that severely curtail its consumer appeal. No matter how slick the service looks or how many CE devices it's embedded in, consumers will readily see these drawbacks and resist embracing Vudu.

models - rental and download-to-own - has its own problems that severely curtail its consumer appeal. No matter how slick the service looks or how many CE devices it's embedded in, consumers will readily see these drawbacks and resist embracing Vudu.The rental model is primarily handicapped by the ongoing provision that the rental period "expires" 24 hours after the movie was started. That means that if real life (e.g. a crying child, a call from an old friend, a household emergency) interrupts the Vudu's users' planned viewing window, they're out of luck. It's an absurd restriction, but all online movie rentals are laboring under it. Then there's the provision that most new releases aren't available for rental until 30 days after they debut on DVD. This kind of delay doesn't mean as much for a subscription service like Netflix (which of course just agreed to a new 28-day "DVD sales window" with Warner Bros.), because it has a huge back catalog to offer. But for Vudu (and Redbox) these delays are very noticeable to users.

The download-to-own model is even more challenged. First off, tech-savvy and value-conscious consumers are increasingly focused on cost-effective rentals or subscriptions, not purchasing films. The demise of DVD sales is ample evidence of this. The idea of creating a movie "collection" in a fully on-demand world is already on the verge of seeming as archaic as creating a CD collection has been for a while. And with download-to-own prices of approximately $20, which are more than a DVD costs, consumers will be even more hesitant.

But the real killer for download-to-own is the technology limitations, more specifically the lack of portability and interoperability. Say you're actually inclined to own movies using Vudu. What do you do, download them to an external hard drive? And when you travel, do you lug that thing around with you? When you get to your destination, what device will actually let you play back your movie from your hard drive? The issues go on. The reality is that ubiquitous, cheap DVD players and the compact size of the discs themselves have created a very high bar for digital delivery to exceed. "Digital locker" concepts like DECE and Disney's KeyChest are desperately needed to move digital downloads along, but even they are just a part of a larger CE puzzle.

So, although the Vudu service is very impressive, with a slick user experience and really nice quality video, the reality is that unless Wal-Mart is able to break through these challenges, the Vudu service is going to be marginally attractive to consumers at best. That means the Wal-Mart acquisition, in fact, makes little difference.

Maybe Wal-Mart has the clout to move the studios, but given mighty Apple's own difficulties doing so, I'm skeptical that Wal-Mart will have better luck. I continue to believe that Netflix's model - which combines the full selection of DVDs with the convenience and growing selection of online delivery (including TV shows by the way) - is a far better approach. Netflix may not have all the HD and user interface bells and whistles that Vudu has, but it's a far better value proposition for consumers. This is partly why Netflix has doubled in size, to 12.3 million subscribers, in the last 3 years.

What do you think? Post a comment now (no sign-in required).

Categories: Deals & Financings, FIlms, Studios

Topics: Apple, DECE, Disney, KeyChest, Netflix, VUDU, Wal-Mart

-

VideoNuze Report Podcast #50 - February 19, 2010

Daisy Whitney and I are pleased to present the 50th (woohoo!) edition of the VideoNuze Report podcast, for February 19, 2010.

This week Daisy first walks us through a piece she's writing for AdAge focused on viral video. In reviewing data on which videos have broken out online, Daisy concludes that invariably they are also supported by related advertising. In other words, viral video isn't accidental any more (if it ever was) - now it must be stoked by paid support. An example Daisy provides is for Evian's "Live Young" babies ad which has been seen online 76 million times. Evian initially promoted the ad with YouTube takeover ads. Daisy also discusses the online performance of Super Bowl ads based on Visible Measures' new Trends application, which shows a big disparity between ads that were viewed heavily online vs. rated highly when seen on TV.

Then we discuss my post, "In Trying to Preserve DVD Sales, Studios are in a Tight Spot," in which I described the lengths to which Hollywood studios are going to squeeze out the last remaining profits from DVD sales. As I explain, while the recession has had a dampening effect on DVD sales, the larger problem is that rather than buying them, increasingly consumers are expecting films to be available for rental or subscription or even for free, with ad support. A number of moves from Disney, Sony and Warner Bros. in the last week underscore the consequences studios face as they try to shore up DVD sales.

Click here to listen to the podcast (14 minutes, 8 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, FIlms, Studios

Topics: Disney, Podcast, Sony, Visible Measures, Warner Bros.

-

In Trying to Preserve DVD Sales, Studios Are in a Tight Spot

It's not news that DVD sales - the lifeblood of Hollywood studios' P&Ls - are in a freefall. In response, the studios are doing all sorts of things to eke out just a little more profitability from the sales of the shiny discs. But as several news items over the last week underscore, the studios have little wiggle room before their efforts to shore up DVD sales have real or perceived consequences for key business partners.

Exhibit A is the brouhaha over Disney's new plan to release Johnny Depp's "Alice in Wonderland" on DVD 12 1/2 weeks after its theatrical opening, instead of the usual 16 1/2 weeks, regardless of whether it's still playing in theaters. In the past, when a film's "release windows" were distinct and well-separated, everyone in the distribution chain knew they'd have their separate bite of the apple. With collapsing windows, those bites are converging, leaving some feeling they're not going to get their fair share. In the U.S. there has mostly been just grousing about Disney's plan among theater owners, but in Europe there are threats by large theater chains of an all-out boycott of the film.

It's hard not to feel some sympathy for the theater owners as the "Alice" plan isn't a random event. Sony recently ran a misguided promotional campaign giving away "Cloudy with a Chance of Meatballs" DVDs to certain Bravia buyers while the film was still playing in theaters. And it attempted to accelerate the release of the Michael Jackson "This Is It" DVD until theater owners drew the line. No doubt there are plenty of other examples being floated privately in Hollywood.

Meanwhile, news also broke this week that Redbox, the $1 a day rental kiosk chain had acceded to Warner Bros.' demand that it not rent any films until 28 days after their DVD release, in order to help preserve initial sales. As part of the deal Warner dropped its lawsuit against Redbox. In return, Redbox got lower pricing on its Warner DVD purchases. The deal mirrors the 28-day deal Netflix did with Warner last month, which I thought was a win for everyone. But the key difference in that deal vs. Redbox's is that Netflix has a huge rental catalog available for its subscribers to choose from, meaning new releases are far less important (Netflix says only 23% of rental requests are for new releases). On the other hand, Redbox's whole value proposition rests on low prices and selection of new releases. What is Redbox's fate if it does similar deals with other studios?

Putting the squeeze on Redbox and its kiosks seems like a dubious strategy by studios. In an age where piracy looms large, studios should be focused on enhancing, not diminishing the accessibility of their product (as a Coke executive once famously explained the company's marketing goal: "always within an arm's length of desire"). While Hollywood doesn't like Redbox's lower margins, focusing on that issue excessively when the product is clearly in decline is missing the forest for the trees.

Studios' desire to preserve DVD sales is going to further intensify, but defending them is only going to get harder. Certainly part of the reason is that the ongoing recession is forcing many consumers to cut back on their discretionary purchases. But the larger issue is that there's huge momentum behind the shift to online subscription/rental and even free models. The data shows that online viewing hit an inflection point in 2009, with free premium sites like Hulu experiencing extraordinary growth.

And the data showing online's appeal pours in almost daily; yesterday it was The Diffusion Group reporting results of a study of Netflix users showing that two-thirds of them that have a broadband connection are now using the "Watch Instantly" streaming feature. This week's launch of HBO Go, the premium channel's site for its subscribers, and its distribution deal with Verizon, are evidence that even the mighty HBO can't resist online's allure. Last but not least, in 2010 TV Everywhere rollouts will gain steam.

There's no denying the truth that DVD sales are under assault from all sides. Studios, desperate to hold on to DVDs' precious profits, are increasingly contorting themselves to keep the DVD cash cow alive a little longer. No surprise though, their efforts are not without consequences. At what point do the studios capitulate and throw DVD sales under the bus? We'll have to wait and see.

What do you think? Post a comment now (no sign-in required).

Topics: Disney, Netflix, Redbox, Sony, Warner Bros.

-

Top Rental Data from Netflix is More Evidence that Warner Bros. Deal is a Win

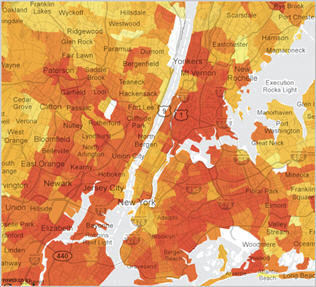

Following my 2 posts late last week (here and here) about how Netflix's new deal with Warner Bros is win for everyone, the NYTimes has posted a terrific interactive map showing the top rentals in 12 geographic areas of the U.S., sorted by zip code. The map is based on data that Netflix provided to the NYTimes. Playing around with the map, you'll quickly hunger for more details, but you'll also get a sense of the mountain of viewership data Netflix maintains on its 11 million+ subscribers. This data, when combined with the Netflix's algorithms for predicting its users' preferences, further demonstrates how valuable a deal like the one with WB could be for Netflix as it emphasizes streaming.

In the digital era, data is king because when used properly, it can dramatically improve the quality of the product delivered, in turn driving user satisfaction and profitability. Netflix has always used data very

effectively; examples include how it has chosen sites for its distribution centers so that most Americans are within 1 day's delivery, or how it has recommended other titles based on yours and others' preferences, or how much inventory of newly-released DVDs it decides to build. Now, as Netflix shifts its business from physical to digital delivery, it has another big opportunity to leverage the data it has collected from its users.

effectively; examples include how it has chosen sites for its distribution centers so that most Americans are within 1 day's delivery, or how it has recommended other titles based on yours and others' preferences, or how much inventory of newly-released DVDs it decides to build. Now, as Netflix shifts its business from physical to digital delivery, it has another big opportunity to leverage the data it has collected from its users. While a lot of attention was focused last week on the new 28-day "DVD window" which precludes Netflix from renting recently-released WB titles, I believe more attention should be paid instead to how effectively Netflix will be able to use its trove of data to selectively tap into WB's catalog of titles to boost its streaming selection. Using the data it has collected on physical rentals and search queries, for example, Netflix should be able to literally request title-by-title streaming rights from WB. That's not to say Netflix will necessarily receive access to those particular titles, but by being able to focus its requests, Netflix avoids wasting energy asking for things that are unlikely to have much appeal to its users.

It's interesting to talk to friends who are Netflix users, including those who don't work in technology-related industries. They have an amazingly high awareness and usage of Netflix's streaming and recognize that it represents the company's future. It's also obvious to them how meager the options are in Watch Instantly as compared with DVD and desperately want more choice. Netflix knows all this, as Netflix CEO Reed Hastings said last week, "our number one objective now is expanding the digital catalog." But Netflix is in a tight position to get new releases due to existing output deals that Hollywood studios maintain with HBO and other premium channels for electronic delivery. So, as with the WB deal, and others likely to follow, Netflix is trying to be clever about how it builds its streaming catalog by tapping into older, but still valuable titles.

It's unclear whether Netflix will conclude similar deals with other Hollywood studios. If it can't then the above-described benefits will be limited. In fact, as a couple of people pointed out to me last week, with Hollywood also highly dependent on cable, it's not readily apparent that helping Netflix build its streaming selection is actually in their interest as TV Everywhere services continue to roll out. WB is actually an interesting example; on the one hand, Time Warner's CEO Jeff Bewkes has been the strongest proponent of TV Everywhere, but on the other hand, WB's deal with Netflix creates more competition for it. In short, Hollywood will have its hands full trying to recast its distribution strategy in the digital era.

DVDs are not going away overnight, but the user data Netflix has will be an enormously valuable tool in helping transition its business to digital delivery and add more value to its subscribers. As long as Netflix complies with its users' privacy expectations, that gives it a big strategic advantage.

What do you think? Post a comment now.

Categories: Aggregators, Studios

Topics: Netflix, Warner Bros.

-

4 Items Worth Noting for the Jan 4th Week (Netflix-WB Continued, comScore Nov. '09 stats, TV Everywhere, 3D at CES)

Following are 4 items worth noting for the Jan 4th week:

1. TechCrunch disagrees with my Netflix-Warner Bros. deal analysis - In "Netflix Stabs Us In The Heart So Hollywood Can Drink Our Blood," (great title btw) MG Siegler at the influential blog TechCrunch excerpts part of my post from yesterday, and takes the consumer's point of view, decrying the new 28 day "DVD window" that Netflix has agreed to in its Warner Bros deal. Siegler's main objection is that "Hollywood thinks that with this new 28-day DVD window deal, the masses are going to rush out and buy DVDs in droves again." Instead, Siegler believes the deal hurts consumers and is going to touch off new, widespread piracy.

I think Siegler is wrong on both counts, and many of TechCrunch's readers commenting on the post do as well. First, nobody in Hollywood believes DVD sales are going to spike because of deals like this. However, they do believe that any little bit that can be done to preserve the appeal of DVD's initial sale window can only help DVD sales which are critical to Hollywood's economics. Everyone knows DVD is a dying business; the new window is intended to help it die more gracefully. And because new releases are not that critical to many Netflix users anyway, Netflix has in reality given up little, but presumably gotten a lot, with improved access for streaming and lower DVD purchase prices.

The argument about new, widespread piracy by Netflix users is specious. With or without the 28 day window, there will always be some people who don't respect copyright and think stealing is acceptable. But Netflix isn't running its business with pirates as their top priority. With 11 million subscribers and growing, Netflix is a mainstream-oriented business, and the vast majority of its users are not going to pirate movies - both because they don't know how to (and don't want to learn) and because they think it's wrong. Netflix knows this and is making a calculated long-term bet (correctly in my opinion) that enhancing its streaming catalog is priority #1.

2. comScore's November numbers show continued video growth - Not to be overlooked in all the CES-related news this week was comScore's report of November '09 online video usage, which set new records. Key highlights: total video viewed were almost 31 billion (double Jan '09's total of 14.8 billion), number of videos viewed/average viewer was 182 (up 80% from Jan '09's 101) and minutes watched/mo were approximately 740 (more than double Jan '09's total of 356).

Notably, with 12.2 billion views, YouTube's Nov '09 market share of 39.4% grew vs. its October share of 37.7%. As I've previously pointed out, YouTube has demonstrated amazingly consistent market dominance, with its share hovering around 40% since March '08. Hulu also notched another record month, with 924 million streams, putting it in 2nd place (albeit distantly) to YouTube. Still, Hulu had a blowout year, nearly quadrupling its viewership (up from Jan '09's 250 million views). But with 44 million visitors, Hulu's traffic was pretty close to March '09's 41.6 million. In '10 I'm looking to see what Hulu's going to do to break out of the 40-45 million users/mo band it was in for much of '09.

3. Consumer groups protest TV Everywhere, but their arguments ring hollow - I was intrigued by a joint letter that 4 consumer advocacy groups sent to the Justice Department on Monday, urging it to investigate "potentially unlawful conduct by MVPDs (Multichannel Video Programming Distributors) offering TV Everywhere services." The letter asserts that MVPDs may have colluded in violation of antitrust laws.

I'm not a lawyer and so I'm in no position to judge whether any actions alleged to have taken place by MVPDs violated any antitrust laws. Regardless though, the letter from these groups demonstrates that they are missing a fundamental benefit of TV Everywhere - to provide online access to cable TV programming that has not been available to date because there hasn't been an economical model for doing so. In the eyes of people who think that making money is evil, the TV Everywhere model of requiring consumers to first subscribe to a multichannel video service seems anti-consumer and anti-competitive. But to people trying to make a living creating quality TV programming, the preservation of a highly functional business model is essential.

These advocacy groups need to remember that consumers have a choice; if they don't value cable's programming enough to pay for it, then they can instead just watch free broadcast programs.

4. 3D is the rage at CES - I'll be doing a CES recap on Monday, but one of the key themes of the show has been 3D. There were two big announcements of new 3D channels, from ESPN and Discovery/Sony/IMAX. LG, Panasonic, Samsung and Sony announced new 3D TVs. And DirecTV announced that it would launch 3 new 3D channels by June 2010, with Panasonic as the presenting sponsor. 3D sets will be an expensive proposition for consumers for some time, but prices will of course come down over time.

Something that I wonder about is what impact will 3D have on online and mobile video? Will this spur innovation in computer monitors so that the 3D experience can be experienced online as well? And how about mobile - will we soon be slipping on 3D glasses while looking at our iPhones and Android phones? It may seem like a ridiculous idea, but it's not out of the realm of possibility.

Enjoy your weekend!

Categories: 3D, Aggregators, Broadcasters, Cable Networks, Cable TV Operators, FIlms, Studios

Topics: 3D, comScore, Netflix, TV Everywhere, Warner Bros.

-

Why Netflix's Long-Term Focus in New Warner Bros. Deal is a Win for Everyone

Netflix's new deal with Warner Bros., in which it agreed to a 28 day "DVD window" for new releases, in exchange for greater access to WB's films for its Watch Instantly streaming feature and reduced pricing on its own DVD purchases, is further proof that Netflix is squarely focused on the long-term. That's not only smart for Netflix, it's also a win for Hollywood studios and also for consumers.

With 11 million subscribers and growing, Netflix has emerged as one of Hollywood's most important home video customers. This dynamic has only increased recently due to slowing sales of DVDs (down another 13% in 2009) and Netflix's dominance in DVD rentals. Yet Netflix is viewed warily by Hollywood, primarily

due to concerns that in the digital age, Netflix could gain too much power over Hollywood's fate. This concern was reinforced by Netflix's deal with premium cable channel Starz, a de facto end-run around Hollywood in which Netflix got streaming access to certain Disney, Sony and Lionsgate films.

due to concerns that in the digital age, Netflix could gain too much power over Hollywood's fate. This concern was reinforced by Netflix's deal with premium cable channel Starz, a de facto end-run around Hollywood in which Netflix got streaming access to certain Disney, Sony and Lionsgate films.As I've pointed out many times (as recently as this past Monday, in item #6), despite the Starz deal and the impressive adoption of Watch Instantly to date, Netflix faces a major challenge in building out its catalog of recent films for streaming use. Part of the challenge is Hollywood's "windowing" approach; in particular, other premium channels like HBO, Showtime and Epix have made significant financial commitments for electronic distribution during certain time periods that effectively preclude Netflix gaining streaming rights. Because much of Netflix's value proposition relies on its vast DVD selection (100K+ titles currently), if its streaming catalog continues to look meager by comparison, then Netflix's goal of migrating its users to streaming delivery over time will be seriously undermined.

That's where the new WB deal comes in. While the companies didn't disclose which titles or how many

would be available, my guess is that the benefits of the deal, when it's fully implemented, will be noticeable to Netflix's subscribers or Netflix wouldn't have signed on. While WB is just one studio, if the new deal can be used as a template, Netflix could have a solid plan for gaining more films without paying big bucks. And the studios would get greater leverage against Redbox, which is viewed with even greater alarm by much of Hollywood.

would be available, my guess is that the benefits of the deal, when it's fully implemented, will be noticeable to Netflix's subscribers or Netflix wouldn't have signed on. While WB is just one studio, if the new deal can be used as a template, Netflix could have a solid plan for gaining more films without paying big bucks. And the studios would get greater leverage against Redbox, which is viewed with even greater alarm by much of Hollywood.Netflix's focus on the long term is smart strategy, and complements well the company's near-term emphasis on riding the convergence wave by embedding its Watch Instantly software in every conceivable living room device (e.g. PS3, Xbox, Roku, Bravia, Blu-ray players, etc.). It's also a strategy that benefits Hollywood. By creating a situation where studios preserve as much of their DVD sales as possible (allegedly 75% of a film's total DVD sales occur in the first 4 weeks following release), Netflix is helping Hollywood gracefully wind down and milk the DVD business.

Not surprisingly, consumers' first reaction to the deal was sour. Yesterday the Twittersphere was alight with grousing about the 28 day DVD window and how Netflix was "selling out its customers." Some even talked about canceling their Netflix service. I think most of this is idle chatter. Netflix has publicly said that just 30% of its DVD rentals come from recent releases (though it is likely that for Netflix's heaviest DVD renters, recent releases are far more important). In the end, Netflix is making a calculated bet that it can manage the potential subscriber consequences of creating the DVD window in order to benefit its larger goal of migrating its business to online delivery.

If Netflix is right, and it can sign on additional studios to similar deals, then ultimately consumers will win. That's because, as Netflix proves in the value of streaming, it will be able to offer improved terms to studios, resulting in Netflix getting better and better access to films. But this will be a gradual process that unfolds over time. Whereas consumers always "want everything yesterday," the reality is that if Hollywood and Netflix can avoid disruption and instead preserve most of their economics by gracefully transitioning their businesses to digital delivery, consumers stand a better chance of continuing to receive the kind of premium-quality (i.e. expensive to produce) films they value. The demise of the newspaper industry is a cautionary example of what happens when disruption instead prevails and an industry's traditional economics are destroyed.

We are still on the front end of seismic shifts that will alter how Hollywood's films are distributed to consumers. By focusing on the long-term, as evidenced by its WB deal, Netflix is playing an important role in increasing the odds of a successful transition.

What do you think? Post a comment now.

Categories: Aggregators, FIlms, Studios

Topics: Netflix, Starz, Warner Bros.

-

Back from the Vacation? Here Are 7 Video Items You May Have Missed

Happy New Year. If you're just back from a holiday vacation and have been partially or totally off the grid for the last week or two, here are 7 video-oriented items you may have missed:

1. Time Warner Cable and News Corp fight over fees, then settle - Two behemoths of the cable and broadcast TV ecosystem spatted publicly during the holidays over the size of "retransmission consent" fees that News Corp (owner of the Fox Broadcast Network and cable channels like Fox News) wanted TWC (the 2nd largest U.S. cable operator) to pay to carry its 14 local stations. While a last minute deal averted the channels going dark, broadcasters' interest in dipping into cable's monthly subscription revenues will only intensify as audience fragmentation accelerates and ad revenues are pressured.

For my part I wish Fox and other broadcasters were as focused on building new and profitable digital delivery models for their programs as they were on trying to redistribute cable's revenues. Even as Rupert Murdoch continues advocating the paid content model, the freely-available Hulu is seeing its traffic skyrocket (see below). But if Hulu's viewership isn't incrementally profitable, then all that growth is pointless. Urgency is mounting too; in '10 convergence devices that bridge broadband to the TV are going to get a lot of attention. In the wake of their adoption, consumers are going to want Hulu on their TVs. If Hulu doesn't allow this it will be marginalized. But if it does without first solidifying its business model, it could hurt broadcasters further.

2. Hulu has a big traffic year, but no further information provided on its business model - Hulu's CEO Jason Kilar pulled back the curtain a bit on the company's strong progress in 2009, citing 95% growth in monthly users, to 43 million, 307% growth in monthly streams, to 924 million (both as measured by comScore) and a doubling of available content, to 14,000 hours. While noting that its advertisers increased from 166 to 408 during the year, with respect to performance, Jason only said that "we are extremely excited about atypically strong results we have been able to drive for our marketing partners."

Though Hulu is under no obligation to disclose details of its business model, I think it would dramatically increase the company's credibility if it shared some metrics about how its lighter ad load model is working (e.g. improved awareness, click throughs, leads, conversions, etc.). Per the 1st item above, as Hulu grows, a lot of people have a lot at stake in understanding what effect it may have on broadcast economics. In addition, as I pointed out recently, it is important to understand whether Hulu thinks it may have already saturated its U.S. audience. After a jump in Q1 '09 from 24.6 million to 41.6 million users, traffic actually dipped below 40 million until October. What does Hulu do from here to gain significantly more users?

3. Cable networks' primetime audience is nearly double broadcasters' - Punctuating the ascendancy of cable over broadcast, this Multichannel News article pointed out that in 2009, ad-supported cable networks as a group captured 60.7% of primetime audience vs. 32% for the 4 broadcast networks. That's a major change from 2000 when the broadcasters had a 46.8% share vs. cable's 41.2%. Cable increased its share every single year of the last decade, powered by its innovative original programming. NBCU's USA Network in particular has become the real standout performer, winning its second consecutive ratings crown, with 3.2 million average primetime viewers, up 14% vs. 2008.

The surging popularity of cable programming is a crucial barrier to consumers cutting the cord on cable. Since cable networks are highly invested in the monthly multichannel subscription model, they are unlikely to disrupt themselves by offering their best shows to others under substantially different terms than how they're offered today. So to the extent cable programs are either unavailable to over-the-top alternatives or offered less attractively (e.g. less choice, higher cost, delayed availability), little cord-cutting can be expected. And if TV Everywhere achieves its online access goals, the cable ecosystem will only be further strengthened.

4. YouTube is working to drive higher viewership - Amidst the turmoil in the traditional ecosystem and Hulu's growth, YouTube, the 800 pound gorilla of the online video world, is working hard to deepen the site's viewership. As this insightful NYTimes article explains, a team of YouTube developers is analyzing viewing patterns and tweaking its recommendation practices to encourage more usage. YouTube says time on the site has increased by 50% in the last year, and comScore reports that the average number of clips viewed per user per month jumped to 83 in October, up from 53 a year earlier. Still, as comScore also reports, duration of an average session has yet to crack 4 minutes, meaning video snacking on YouTube is still the norm. YouTube's moves must be watched closely in '10.

5. Showtime's "Weeds" available online before on DVD - This WSJ article (reg req'd) pointed out that Lionsgate, producer of Showtime's hit "Weeds" series is offering episodes online before they're available on DVD. By putting the digital "window" ahead of DVD's, Lionsgate is further pressuring DVD's appeal. We've seen periodic experimentation in this regard, and I anticipate more to come, especially as the universe of convergence devices expands and consumers can watch on their TVs instead of just their computers. Until a tipping point occurs though, "Weeds" like initiatives will be the exception, not the rule.

6. Netflix goes shopping in Hollywood - And speaking of reversing distribution windows, this Bloomberg Businessweek piece was the latest to highlight Netflix's efforts to woo studios into giving it more recent releases. Netflix has of course made huge progress with its Watch Instantly streaming feature, but its appeal to heaviest users will slow at some point unless it can dramatically expand its current slate of 17K titles available online. Hollywood is understandably wary of Netflix given all the variables in play and a desire to avoid Netflix becoming master of Hollywood's post-DVD, digital future. Whether Netflix will spend heavily to obtain better rights is a major question.

7. Get ready for Google's Nexus One and Apple's "iSlate" - Unless you've really been off the grid, you're probably aware by now that two very significant mobile product releases are coming this month. Tomorrow (likely) Google will unveil the Nexus One, its own smartphone, powered by its Android 2.1 operating system. The Nexus One will be "unlocked," meaning it can operate on multiple providers using GSM networks. The device will further fuel the mobile Internet, and mobile video consumption along with it. Separately, Apple is widely rumored to introduce its tablet computer later in the month, which many believe will be called the "iSlate." The tablet market is completely virgin territory, and while it's early to make predictions, I believe Apple could have most of the ingredients needed to make the product another big hit. The prospect of watching high-quality video on a thin, light, user-friendly device is extremely compelling.

Categories: Aggregators, Broadcasters, Cable Networks, Cable TV Operators, Devices, Mobile Video, Studios

Topics: Apple, FOX, Google, Hulu, Lionsgate, Netflix, News Corp, Showtime, Time Warner Cable, YouTube

-

4 Items Worth Noting for the Dec 14th Week (New pre-roll ad data, Paramount movie clips, Thwapr mobile, next week's preview)

Following are 4 items worth noting for the Dec 14th week:

1. New pre-roll data shows format's strength - Though many in the industry still scorn the pre-roll ad, this week 2 ad networks, ScanScout and YuMe, released data showing its continued prevalence as well as innovation that's improving its performance. ScanScout said its "Super Pre-roll" unit, which allows for integrating overlay graphics on the video that viewers can engage with, is driving 350% higher click-through rates compared with typical pre-rolls. In this example for Unilever's Vaseline, note how the creative nicely reinforces the messaging. The enhanced interactivity feels like the start of a new trend; another pre-roll that offers something similar is Innovid's iRoll unit. ScanScout separately announced this week a host of new premium publishers have joined its network.

Meanwhile YuMe released its Video Advertising Metrics Report for Jan-Nov '09, which showed that, at least within YuMe's network, 90%+ of all ads served were pre-rolls, with 30 second spots generating a 1.8% overall click-through rate, a 50% higher rate than the 1.2% that 15 second spots achieved. The volume of 30 second ads also grew 50% faster than 15 second volume in Q3 '09. Kids age 6-14 achieved a 3.7% click-through rate, the highest of any group, which YuMe's Jayant Kadambi told me could be explained by the more engaging nature of child-focused ads (e.g. click to play games, etc.). Jayant believes the sizable amount of existing creative for TV ads that can be easily repurposed for online is a key reason pre-rolls continue to dominate.

2. Paramount clipping site powered by Digitalsmiths is slick - I was impressed with a demo of Paramount Pictures' newly launched ParamountClips.com site that I got this week. The site is only open to Paramount's business partners, allowing them to either choose from an existing stock of clips from over 80 different Paramount movies, or to easily create their own. Desired clips are moved into a shopping cart and released for download, per previously determined licensing terms.

The site is powered by Digitalsmiths, which indexed all of the scenes from the movies using their proprietary recognition process, and then generated meta-data for each, which makes searching a snap. The new self-service site replaces the laborious previous process of a Paramount staffer working with each partner to extract jus the scene they want. As a result, a new highly-scalable licensing opportunity has been created. Paramount is taking advantage of Digitalsmiths VideoSense 2.5 release announced last week that is focused on clip generation, for both on demand and live streams, improved asset management and more integrated reporting.

3. Thwapr launches beta of mobile-to-mobile video sharing - Continuing the buildout of the mobile video ecosystem, Thwapr, a new mobile-to-mobile content sharing platform, launched its beta this week. Duncan Kennedy, Thwapr's COO told me that although there's been a proliferation of video capable smartphones, there's currently no easy, fool-proof way of sharing videos from one device to another (e.g. from an iPhone to a BlackBerry). Enter Thwapr, which lets the user upload videos to Thwapr and then have them shared with their contacts. Thwapr identifies the receiving phone's "user agent" so that it can dynamically decide the optimal format the video should be viewed in. The user simply clicks on a link and the video plays. I can attest that it worked beautifully on my BlackBerry Pearl.

Thwapr's raised about $3 million from angels and has a very strong team, including Duncan and others who worked on Apple's QuickTime. I'm a fan of how video, social/sharing and mobile intersect to create new opportunities, though there are business model unknowns. For now Thwapr is focused on a free ad-supported model, with a particular emphasis on geo-tagging videos to make advertising especially appealing for local merchants. Still, YouTube has illustrated how difficult it is to monetize user-generated content. Thwapr also envisions a business-grade option for real estate, travel, dating type applications which sound promising. I wonder too about whether a freemium model should be explored, though Duncan said Thwapr's analysis suggested this would be a relatively small opportunity. We'll see how things shape up.

4. Next week is 2009 wrap-up week on VideoNuze - Keep an eye on VideoNuze next week, as I'll be summarizing Q4 '09 venture capital investments and deals in the broadband/mobile video space, reviewing my 2009 predictions and looking ahead to what to expect in 2010. It's been an incredibly active year and based on the pre-CES briefings I've been doing, there's lots more to look forward to next year.

Enjoy your weekend!

Categories: Advertising, FIlms, Mobile Video, Predictions, Startups, Studios, Technology

Topics: Digitalsmiths, Paramount, ScanScout, Thwapr, YuMe

-

VideoNuze Report Podcast #40 - November 13, 2009

Daisy Whitney and I are pleased to present the 40th edition (whoo-hoo!) of the VideoNuze Report podcast, for November 13, 2009.

This week Daisy first shares observations on her recent interview with Gary Vaynerchuk, who is best known as the host of Wine Library TV/The Thunder Show. Gary has a new book out called "Crush It!" part of a 10-book deal he did with HarperStudio. The book focuses on how you can build your personal brand using all of the Internet's various communications tools. Vaynerchuk has a lot of credibility as he's built up a huge following for Wine Library TV. Now with the books, he's showing how online popularity can be leveraged into the print world. For a good example of the show, check out this episode featuring Wayne Gretzky.

We then shift to my post from earlier this week, "Sony Gets It Wrong with 'Meatballs' Promotion." I took Sony Electronics to task for a new promotion they're starting which provides a free 24 hour rental of the movie "Cloudy With a Chance of Meatballs" to buyers of connected Sony Bravia TVs and Blu-ray disc players. It's also available as a $24.95 rental for current owners of these devices. I explain more about why I think this promotion falls way short and does little to advance the agenda of delivering movies via broadband.

Click here to listen to the podcast (14 minutes, 12 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: FIlms, Indie Video, Podcasts, Studios

Topics: Sony, Wine Library TV

-

Sony Gets It Wrong with "Meatballs" Promotion

On Monday, Sony Electronics announced a holiday promotion in which buyers of select Internet-connected Sony Bravia TVs and Blu-ray players would receive a free 24 hour rental of the Columbia/Sony Pictures film

"Cloudy with a Chance of Meatballs." In addition, current owners of these devices would be able to rent the film for $24.95. For all of these consumers, the film would be available from Dec. 8th to Jan 4th, the month leading up to the film's DVD release.

"Cloudy with a Chance of Meatballs." In addition, current owners of these devices would be able to rent the film for $24.95. For all of these consumers, the film would be available from Dec. 8th to Jan 4th, the month leading up to the film's DVD release. Ordinarily I would applaud any move by Hollywood to modify its rigid release "windows" to benefit broadband delivery of films. Yet in this case I think Sony's promotion is ill-conceived and is extremely unlikely to contribute any real momentum to studios' future broadband delivery plans. In fact, it may actually have the opposite effect and further stunt the broadband medium's emergence. Here's why:

The release window is too tight - Release windows allow Hollywood studios to mine new value from the same content given each successive distribution medium's unique attributes and audience. But by trying to squeeze in this promotional window, Sony is exacerbating an already very tight windowing plan for "Meatballs" that called for DVD release less than 2 months following its theatrical run. Remarkably, even as Sony is trumpeting this new promotion, the film is actually still playing in theaters nationwide. Given it's already only 27 days until Dec 8th, there will be virtually no gap between theatrical and promotional windows. That undermines the theatrical value proposition, in turn ticking off exhibitors who are threatening to pull the film early, according to The Hollywood Reporter.

Theatrical to DVD windows have been getting progressively tighter as studios have sought to bolster sagging DVD sales. The problem is that like a good wine, lengthy windows allow a film to age and increase in value for both those consumers who saw the movie and those who did not. With this promotion, Sony is giving consumers an in-home opportunity to see the film immediately adjacent to the DVD's availability. That can do nothing but also hurt the DVD's sales.

The promotional offer isn't strong enough - For Sony Electronics, trying to differentiate its devices in a brutally competitive landscape is key. But do the marketing pros at Sony really believe that giving away a 24 hour rental is going to have a big impact? Personally I doubt it. The prices of the Sony TVs in the promotion are in the $1,000-$2,000 range, so a $25 incentive is easily swamped by the rampant deep discounts found in Sunday circulars (not to mention even deeper online deals). Further, I don't see any retailer incentives included in the promotion that would influence the sales process.

The "Meatballs" offer might have a stronger effect on sales of Sony's Blu-ray players, though here too, it's unlikely to be profound. With Blu-ray player sales lagging, manufacturers and retailers have largely decided that hitching their wagons to Netflix's Watch Instantly streaming is the best way to bump up sales. But with sub-$100 Netflix-capable Blu-ray players now available, a "Meatballs" rental valued at $25 on a $200-250 Sony player will have a hard time breaking through. Last but not least, it's important to remember, Sony's promotion is for a 24 hour rental. Not offering consumers ownership of "Meatballs" makes the promotional value ephemeral. And with Walmart, Target and Amazon now offering top DVDs for just $10 apiece, a 24 hour rental valued at $25 is underwhelming, not to mention somewhat specious, given it is Sony that's setting the "price." Given all of this, I suspect Sony would have done better by just offering a free "Meatballs" DVD with purchase.

Device audience too small to prove broadband delivery's appeal - Looked at differently, the small base of connected Sony Bravia and connected Blu-ray players, plus the new device sales over the promotional period, is unlikely to generate a large volume of "Meatballs" streaming anyway. That means that the promotion will do little to encourage Sony or other studios to more strongly embrace broadband delivery of their films. In fact, when the weak results of the promotion come in (as I expect they will), "Meatballs" could become future industry shorthand for "broadband delivery isn't ready for prime-time." That would be a shame, because I believe consumers very much want on-demand access to films in their homes. Netflix's success with Watch Instantly certainly proves that, as does the success VOD is having.

From my perspective, rather than setting up half-baked promotions like this one, studios should take a step back and think through how to do broadband delivery (for both rental and download-to-own) correctly. There are a lot of moving pieces, but clearly addressing what to do about the DVD window is critical. Studios are rightfully worried about killing off this cash cow. But compressing the DVD window and then trying to insert a new broadband delivery window isn't going to be the answer. Rather than seeing more "Meatballs" like promotions, I'd prefer to see a cohesive strategy out of Hollywood for how it can fully tap into broadband delivery's potential.

What do you think? Post a comment now.

Categories: Devices, FIlms, Studios