-

Facebook Puts Video Center Stage

Facebook reported record results for 2015 late yesterday and on the earnings call, video was the first thing Mark Zuckerberg highlighted when discussing the company’s product strategy for delivering more engaging experiences. He added that 100 million hours of video are now watched daily on Facebook by 500 million people (though “watch” can be an ambiguous term for Facebook given its autoplay, audio-off format).

Categories: Advertising, Brand Marketing, Social Media

Topics: Facebook, Visible Measures

-

Nike's World Cup Campaigns Cap Record Quarter for Branded Videos

Late last week, Visible Measures released its quarterly Branded Video Report for Q2 '14, finding that branded videos were watched 2.8 billion times, an increase of over 50% vs. Q2 '13. The big driver of the record quarterly views was the World Cup, with videos related to it accounting for 19%, or almost 555 million of the views.

Nike was by far the biggest winner of World Cup related branded videos, with nearly 259 million True Reach views during the quarter, 84% of which were from its eight World Cup videos. Nike wasn't even an official World Cup sponsor, but its videos received 2.5x the 103.7 million views of adidas, which was the official sponsor and landed the brand in 3rd place for the quarter.Categories: Branded Entertainment

Topics: Adidas, Dove, Google, Nike, Samsung, Visible Measures

-

Branded Videos Generated 8.3 Billion Views in 2013, Up 44% vs. 2012

People want to skip ads, right? The conventional wisdom is yes, but it turns out the answer isn't quite so simple. In fact, viewers are seeking out, watching and sharing certain types of advertisers' messages in record numbers. According to Visible Measures 2013 Branded Video report, branded videos (video campaigns advertisers posted online, as opposed to video ads that run in-stream, etc.), generated 8.3 billion views, up 44% vs. 2012.

There's huge momentum in branded videos: of the 8.3 billion views, 6.5 billion, or 78%, were for campaigns newly launched in 2013. This compares with 3.8 billion views for new campaigns launched in 2012 and 1.7 billion views for campaigns launched in 2011.Categories: Brand Marketing

Topics: Visible Measures

-

Visible Measures and VivaKi Launch CONTAGION, An Earned Media Planning Tool

Getting a branded video to go hugely viral is like catching lightning in a bottle - it's hard to predict and very rare. But a viral video's huge branding benefits through free, or so-called "earned media" impressions, makes it extremely appealing.

Now Visible Measures, which has been tracking video viewership across devices for years, and Publicis Groupe's VivaKi and Starcom MediaVest have developed a planning tool called CONTAGION that uses data to help brands and agencies actually plan for how viral a branded video campaign could be. CONTAGION is launching today for use by Publicis Groupe agencies for a year before becoming available to the broader market.Categories: Advertising, Partnerships, Technology

Topics: Starcom MediaVest, Visible Measures, VivaKi

-

Visible Measures Launches Video Ad Metrics Program In Standardization Bid

Visible Measures is unveiling its "Certified Publisher Program" (CPP) this morning, to help establish standardized MRC-accredited online video campaign metrics for publishers to report to advertisers and agencies. The program, which is free to publishers and advertisers, is meant to enhance consistency and transparency. This in turn reduces the friction of agencies needing to expend resources normalizing self-reported and highly variable publisher results.

Categories: Advertising, Analytics

Topics: Visible Measures

-

Visible Measures Raises $21.5 Million; Video Ad Network Helps Power 300% Growth

Visible Measures, which provides video analytics and operates the Viewable Media video ad network, has raised another $21.5 million, led by DAG Ventures and including existing investors. The funds will be used to drive adoption of the company's products.

Visible Measures' CEO Brian Shin said that the company will achieve 300% revenue growth in 2012, for the second year in a row. That strong growth is aided by the April, 2011 launch of Viewable Media, the company's video ad network that is based on its core analytics platform. Viewable Media differentiates itself as performance-based and positions video ads as content that users can choose from on publishers' web pages. The company said that over one hundred brands and agencies have adopted Viewable Media since launch.Categories: Advertising, Deals & Financings

Topics: Viewable Media, Visible Measures

-

Visible Measures Gets MRC Accreditation, Grows Revenue 500%

Visible Measures is announcing this morning that the Media Rating Council (MRC), which certifies media measurement services, has accredited a number of the company's metrics, including its "TrueReach Views," a metric that spans paid, owned and earned media. Brian Shin, Visible Measures' founder and CEO, told me last week that it's the first time a metric has been accredited that covers all of the ways a brand's video campaign can now be propagated online.

Brian noted that the accreditation is also unusual for the MRC because it typically audits metrics that are tied to conventional ad serving. Conversely, in the case of TrueReach, MRC took account of social activity for the first time, requiring it to verify that Visible Measures' technology and methodologies accurately reflected viral distribution properly. Brian said that MRC did sample testing and vetted its documentation as part of the accreditation process.Categories: Advertising, Technology

Topics: Visible Measures

-

Investors Stay Bullish On Video As Vidyo and Visible Measures Raise New Rounds

Investors continue to be bullish on video-related companies, with news this morning of two more significant financings: Vidyo, an HD video telepresence provider has raised a $22.5 million Series D round (for a total of $97 million since inception), and Visible Measures, a social video advertising and analytics provider, has raised a $13 million Series D round (for a total of $45 million to date). The Vidyo financing was led by QuestMark Partners and the Visible Measures round by DAG Ventures and new strategic partner Advance Publications, parent of Conde Nast and other magazines. Each company's existing investors participated their financings as well.

Categories: Deals & Financings

Topics: Vidyo, Visible Measures

-

Visible Measures Leverages Data With New "Viewable Media" Video Ad Network

Just when you thought there couldn't be room for another video ad network, analytics provider Visible Measures is launching a new one this morning called Viewable Media. However, Viewable Media has a few key differentiators which will be fresh for publishers and advertisers, in turn raising the bar for other ad networks. Brian Shin, Visible Measures' CEO explained Viewable Media's approach to me late last week.

With Viewable Media, Visible Measures is leveraging its Viral Reach database that it has been building on viewership and engagement for over 400 million different videos since it began operations. To date this data has been packaged into different products so that advertisers and publishers can track various videos' performance. But as Brian explained, advertisers and media buyers have been encouraging Visible Measures to also use the data to enhance the online video ad buying process with better targeting and improved efficiency. That's where Viewable Media comes in.

different videos since it began operations. To date this data has been packaged into different products so that advertisers and publishers can track various videos' performance. But as Brian explained, advertisers and media buyers have been encouraging Visible Measures to also use the data to enhance the online video ad buying process with better targeting and improved efficiency. That's where Viewable Media comes in.

Categories: Advertising

Topics: Viewable Media, Visible Measures

-

NBC Testing Super Bowl Ad Rates of $3.5M Per 30-Second Spot

A report this week in AdAge indicated that NBC, which has the broadcast rights to next year's Super Bowl XLVI, is testing advertiser reaction to a rates of up to $3.5 million per certain 30-second ads. This would be a bump from this past year's rates of $2.8-$3.0 million and would easily be the most expensive ad time in history. However, the potential increase was not only predictable, I think it's actually just the start of a significant run up yet to come.

Topics: NBC, Super Bowl, Visible Measures, Volkswagen

-

5 Items of Interest for the Week of Sept. 27th

It's Friday and that means that once again VideoNuze is featuring 5-6 interesting online/mobile video industry stories that we weren't able to cover this week. Have a look at them now, or take them with you for weekend reading!

Nielsen Unveils New Online Advertising Measurement

comScore Introduces Digital GRP `Overnights` in AdEffx Campaign Essential

Dueling initiatives from Nielsen and comScore were announced on Monday, aimed at translating online usage into comparable TV ratings information, including reach, frequency and Gross Ratings Points (GRPs). While online video ad buying is ramping up, the tools to measure viewership in a comprehensive way have been lacking. This is one of the main issues holding back content providers from participating in TV Everywhere.

Analyst: Cord-cutting fears overblown

New research shared this week by BTIG analyst Rich Greenfield concludes that less than 8% of the market is actually interested in cord-cutting. The big impediment: losing access to sports and cable programming, which is unlikely to migrate to free over-the-top alternatives. Greenfield's conclusion is that cord-cutting isn't a major threat to pay-TV operators over the next 3-5 years. Notwithstanding the research, another factor I'd point to that could tip cord-cutting the other way is consumers' belt-tightening. Much as nobody wants to lose access to programming, if the price is perceived as too high, they'll make compromises.

Why YouTube Viewers Have ADD and How to Stop It

Abandonment rates for online video have always been a concern, and using new research, Visible Measures CMO Matt Cutler now quantifies the behavior. Expect 20% of the audience to drop out within 10 seconds of hitting play, 33% by the 30 second mark and 44% by 60 seconds in. Pretty sobering data but incredibly important in thinking about content creation and monetization.

Networks Have Sharing Issues With Hulu

Hulu's New Hoop

On the one hand, Hulu's network partners, ABC, NBC and Fox are reportedly pulling back ad inventory that Hulu is allowed to sell, yet on the other, Hulu is reportedly out aggressively selling ads in Hulu Plus, its subscription service. Meanwhile this week Hulu also announced that Hulu Plus will be accessible on both Roku devices and TiVo Premiere, as it continues chasing Netflix in the subscription game.

The New Apple TV Reviewed: It`s All About the Video

Apple TV devices started shipping this week, and reviews began popping up all over the web. This mostly positive review indicates that the user experience is solid, but that content selection is still skimpy. That's no surprise given how few deals Apple has struck to date. Yet to be seen is how Apple TV performs when it can access other iOS apps.Categories: Advertising, Aggregators, Analytics, Broadcasters, Devices

Topics: ABC, Apple TV, comScore, FOX, Hulu, NBC, Nielsen, Visible Measures, YouTube

-

Kantar Video Pursues a Holistic Approach to Video Analytics

This morning I'm pleased to introduce Adam Wright, VideoNuze's newest contributor. Adam has a strong background in online video, having worked at NBCU in digital distribution, MySpace in branded content, and more recently at Tubefilter in research. Adam has a BS in Business and an MS in Entertainment Industry Management from Carnegie Mellon University. After 2 1/2 years of carrying the full daily editorial load at VideoNuze, it's great to have Adam on board contributing several times per week!

Kantar Video Pursues a Holistic Approach to Video Analytics

by Adam Wright

Kantar Video announced itself last week, but with the torrent of news coming out of both SME and the Cable Show, it slipped under the radar. So late last week, I took some time to talk with Bill Lederer, CEO of Kantar Video, who is a seasoned veteran in online and set-top box research, to get a better understanding of the company's holistic approach to their research/analytics service and the implications on the analytics space.

who is a seasoned veteran in online and set-top box research, to get a better understanding of the company's holistic approach to their research/analytics service and the implications on the analytics space.

Kantar Video's "Videolytics," which is currently in a private beta, will be tracking everything from online video, advanced TV, and most interestingly mobile, which is a rapidly growing space. Kantar Video plans to combine this data with the extremely rich marketing data sets from other Kantar Media business units. Bill explained, "for instance, we're the world's biggest company in the attitudinal area. We're going to work with Dynamic Logic, TNS, [etc.]. We're going to capture things like ad expenditure data." In addition, he mentioned cross-referencing data from other sets such as demographics, psychographics, purchase data, and much more from other Kantar Media affiliated branches.

Kantar Video's overall goal is to create a decision system to harness all this data to provide relevant information for business decisions. As a result, Kantar Video's holistic approach might be considered a "Nielsen for online video" analytics/research service. While there have been many options for online video analytics and research, few have come to encompass this breadth of data, which will ultimately help users understand the implications of online video and online video advertising down through the purchase chain, helping grow and better monetize the space.

Though there's a lot of data already floating around, in Bill's opinion often it isn't entirely useful to decision-makers. As Bill put it, "The medium is producing Latin. The customers are in need of Greek." He sees Kantar Video as trying to answer tough questions from marketers. For instance, "What's the real ROI for investing in video? Online guys will talk about views, but marketers talk about how did it do relative to not just campaign execution, but the brand?" Bill said, "We're trying to create a multi-channel solution - real time turn-around with deep domain expertise."

Kantar Video is trying to set itself apart competitively by focusing exclusively on analytics, as compared with others like TubeMogul and BBE's recently spun off Vindico who are also providing ad serving. Kantar Video has some similarity to analytics provider Visible Measures, but with more varied data sets and tools from other business units.

Finally, Bill was quick to trumpet that "we're able to bring in a significant number of advertisers and media companies. I think we'll have some quick validation." With a big name like WPP behind it, Kantar Video has a certain built-in credibility with many brands and advertisers, but Bill also stressed they are working with non-WPP companies as well. "We have built a career on coalitions and partnerships within and without in order to provide more value." In addition, they are preparing to go global quickly by building out their platform in many languages.

Kantar Video is definitely an analytics firm to look out for, with a company like WPP backing it financially and developmentally, it would seem to have some natural momentum. Only time will tell if it catches on, but either way, this means more competition in the analytics space.

What do you think? Post a comment now (no sign-in required).Categories: Analytics, Startups

Topics: Kantar Video, TubeMogul, VINDICO, Visible Measures

-

VideoNuze Report Podcast #50 - February 19, 2010

Daisy Whitney and I are pleased to present the 50th (woohoo!) edition of the VideoNuze Report podcast, for February 19, 2010.

This week Daisy first walks us through a piece she's writing for AdAge focused on viral video. In reviewing data on which videos have broken out online, Daisy concludes that invariably they are also supported by related advertising. In other words, viral video isn't accidental any more (if it ever was) - now it must be stoked by paid support. An example Daisy provides is for Evian's "Live Young" babies ad which has been seen online 76 million times. Evian initially promoted the ad with YouTube takeover ads. Daisy also discusses the online performance of Super Bowl ads based on Visible Measures' new Trends application, which shows a big disparity between ads that were viewed heavily online vs. rated highly when seen on TV.

Then we discuss my post, "In Trying to Preserve DVD Sales, Studios are in a Tight Spot," in which I described the lengths to which Hollywood studios are going to squeeze out the last remaining profits from DVD sales. As I explain, while the recession has had a dampening effect on DVD sales, the larger problem is that rather than buying them, increasingly consumers are expecting films to be available for rental or subscription or even for free, with ad support. A number of moves from Disney, Sony and Warner Bros. in the last week underscore the consequences studios face as they try to shore up DVD sales.

Click here to listen to the podcast (14 minutes, 8 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, FIlms, Studios

Topics: Disney, Podcast, Sony, Visible Measures, Warner Bros.

-

New "Trends" Application from Visible Measures is Invaluable - and Addictive

Visible Measures, the third-party measurement firm for online video, is taking the wraps off its new "Trends" web-based application this morning. I've been playing around with it for the last couple of days with a courtesy login and not only does it pack a ton of value, it's also really addictive.

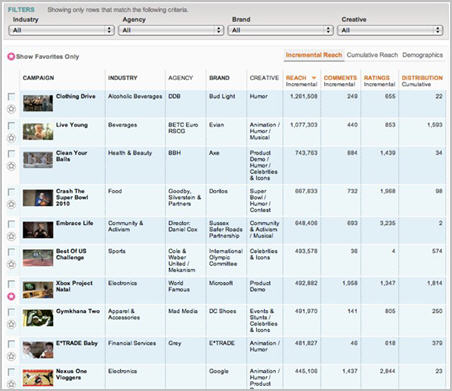

Trends offers access to videos in 3 different data sets, or "collections": Social Video (currently 165 online ad campaigns that have gone viral), Film Trailers (currently 115, and growing by 3-4 per week), and all the recent 2010 Super Bowl ads. The results table for a query displays the campaign's thumbnail image and its name, along with its views or "reach" based on Visible Measures' "True Reach" data (either incremental or cumulative) plus the number of comments, ratings and points of distribution. The table also displays each ad's industry categorization, ad agency, brand name and type of creative type (humor, contest, product demo, etc.). Viewing any particular ad is also just one click away.

Users can take advantage of Trends in any number of ways, depending on their particular interest. As one example, I started by choosing the Social Video collection and "Cumulative Reach" for the current time period. I was interested to see just campaigns for beverages, so I chose that category, but allowed all agencies, brands and creative types to be displayed. In an instant I was presented with a table of 20 results on 2 pages, starting with Evian's hilarious "Live Young" campaign featuring the dancing babies that has garnered almost 74 million views to date. After looking it over, I also reviewed the other campaigns in the top 5, from Pepsi, AMP and Anheuser-Busch. Click on the image below if you'd like to see a 4 minute video demo.

In the social and online video-dominated world we now live in, Trends data is invaluable for brand advertisers and their agencies. It allows them to customize their views of the database, compare different campaigns and analyze what worked online and what didn't. Online distribution is now a key part of calculating the ROI on a campaign, so being able to benchmark the performance of past campaigns provides insight not normally available in traditional TV advertising.

For example, say an agency is formulating a plan for its client's new shampoo - Trends lets its creative executives understand whether prior campaigns featuring product demos, humor or celebrities worked best online. A few quick queries will yield data that can be exported to create charts and graphs for everyone on the team to review. Of course past experience can perfectly predict the future, but Trends provides hard data that lets the creative discussion quickly move beyond gut instinct.

The Visible Measures team told me last week that they've been gradually exposing more and more of their data, through top 10 lists with media partners like AdAge, Variety, Mashable and Motor Trend. With Trends, the data is even more accessible. Visible Measure is also making a public beta of Trends available, though just for the Social Video collection. It's free and it's fun - I recommend giving it a try.

What do you think? Post a comment now (now sign-in required).

Note - Visible Measures is a VideoNuze sponsor.

Categories: Advertising, Analytics, FIlms

Topics: Visible Measures

-

thePlatform Adds Partners to Its Framework Program

thePlatform is announcing this morning that another 20 companies have joined its "Framework" partner program originally rolled out in Feb. '08. There are now over 80 companies participating.

In its release, thePlatform notes that its "role is to make online video publishing a seamless process for our customers...." That's a commonly-shared goal among video platform companies, yet I continue to hear from

various content providers that stitching together the various pieces they require into a total solution can be difficult. That's why these kinds of programs, where partner products are pre-integrated, add a lot of value for customers.

various content providers that stitching together the various pieces they require into a total solution can be difficult. That's why these kinds of programs, where partner products are pre-integrated, add a lot of value for customers.Among the many companies thePlatform cites as new partners are quite a few I've written about previously on VideoNuze (click to see each write-up): Aspera, Azuki Systems, BrightRoll, EveryZing, Transpera, Visible Measures, YuMe and others.

(Note: thePlatform is a VideoNuze sponsor)

Categories: Partnerships, Technology

Topics: Aspera, Azuki Systems, BrightRoll, EveryZing, thePlatform, Transpera, Visible Measures, YuMe

-

Visible Measures $10M Series C Round Caps Solid Q1 of Investments in Broadband Video Sector

Yesterday's announcement by Visible Measures that it raised a $10M Series C round is further evidence that broadband video companies are still able to attract financing in this brutal economic climate. Here are other video sector investments I've tracked on VideoNuze in Q1 '09:

- RipCode ($12.5M) - 1/5/09

- SundaySky ($8M) - 1/6/09

- JibJab ($7.5M) - 1/08/09

- Motionbox ($6M) - 1/14/09

- Digitalsmiths (undisclosed from Cisco) - 1/26/09

- Fliqz ($6M) - 1/28/09

- Mixpo ($4M) - 2/2/09

- WhistleBox ($2.3M) - 2/9/09

- Tremor Media ($18M) - 2/19/09

- Auditude ($10.5M) - 3/11/09

Plus 7 others totaling over $80M in the Fall of '08, and no doubt others I've missed.

Visible Measures founder and CEO Brian Shin and Matt Cutler, VP, Marketing & Analytics explained to me yesterday that key to their financing was having both solid short-term traction in the form of customer acquisitions and a long-term story built around increasing transparency and accountability for the burgeoning broadband video medium. This echoes criteria I continue to hear from other industry CEOs successfully raising money in this environment.

Since I initially profiled Visible Measures last June, and then followed-up with a post about their deal with MTV Networks last September, the company has continued to build momentum. Brian said that it's now

powering video measurement and reporting for many of the largest web properties and dozens of advertisers. Revenue is about evenly split between the two categories.

powering video measurement and reporting for many of the largest web properties and dozens of advertisers. Revenue is about evenly split between the two categories. Despite its progress, Brian explained the company has maintained a relatively low profile because neither it nor its customers have wanted to publicize their activities. Brian said there are a few competitors but none that he feels are that close to offering what Visible Measures has, and he'd like to keep it that way by being low-key about their wins. Skeptics might say "a publicity-shy early-stage company? Hmm...." but knowing Brian and his team as I do, I know that's been their approach since starting the company.

Brian added that the new round, led by Northgate Capital, a fund of funds that has also does some direct investing, "presented itself" without Visible Measures out looking for it. But Brian was quick to note that he considers the company extremely fortunate, given that he believes the current environment is even tougher than the post-bubble years in 2001-2003. Northgate is a limited partner in MDV-Mohr Davidow Ventures, one of the company's two original investors, along with General Catalyst. The company has raised a total of $29M to date.

Visible Measures plans to use the new funds to accelerate product development and grow faster. Brian and Matt made repeated references to the mountain of tracking data the company is sitting on, and that many people are interested in accessing it (which I can believe). The intent is to further productize the data, though no specifics were offered.

With publishers facing more pressure than ever to monetize effectively, and advertisers' need to understand the ROI of their spending intensifying, Visible Measures is at the intersection of two very strong trends in the fast-growing broadband video industry. It's also a textbook "syndicated video economy" company, which is yet more wind at its back. I've been bullish for a while on the company's prospects and continue to be so.

What do you think? Post a comment now.

Categories: Deals & Financings, Syndicated Video Economy, Technology

Topics: General Catalyst, MDV-Mohr Davidow, MTV, Northgate Capital, Visible Measures

-

thePlatform Targets SMB Customers with New Cost-Savings Initiatives

Here's another sign of the times: thePlatform is announcing this morning that it has launched three new initiatives aimed at reducing small-to-medium (SMB) sized content providers' total cost of running their broadband video operations. In the context of the woeful economy, it's a savvy move.

In effect thePlatform (note, a VideoNuze sponsor) is using its scale to create a buyer's cooperative to save

money on three services (CDN, storage and others), thereby enabling its SMB customers to receive pricing comparable to what big customers can negotiate themselves. With thePlatform's customers driving 440 million video views in December '08, (3rd place after Google's site and Fox Interactive Media) according to comScore, the company is in a strong position to use its size on behalf of its SMB customers. I talked to Marty Roberts, thePlatform's VP Marketing, who explained the specifics of how the savings would work.

money on three services (CDN, storage and others), thereby enabling its SMB customers to receive pricing comparable to what big customers can negotiate themselves. With thePlatform's customers driving 440 million video views in December '08, (3rd place after Google's site and Fox Interactive Media) according to comScore, the company is in a strong position to use its size on behalf of its SMB customers. I talked to Marty Roberts, thePlatform's VP Marketing, who explained the specifics of how the savings would work. thePlatform's initiatives are based on an analysis it conducted of its SMB customers' key cost elements. No surprise, the cost of delivery was the biggest chunk, coming in at 78% of total. This was calculated using a set of assumptions including $.55/GB for delivery. For its new "mpsManage CDN" service, thePlatform has partnered with EdgeCast to resell its service for $.35/GB, resulting in a 36% savings on delivery costs. It will also be available on a utility basis, meaning no monthly commitments. Marty said that thePlatform will continue to work with its other 15 CDN partners, but I would guess that this new program is going to gain a lot of attention among its SMB customer base.

Delivery costs have always been a central issue for making the broadband P&L work. Having done many business cases for various content providers over the years, I'm well-acquainted with how quickly CDN costs can gobble up potential profitability even though the cost/GB delivered has plunged over the years. Yet there is a raft of CDNs out there to choose from, and the key is finding the right one for your needs at the moment and your budget. Still delivery costs persist as a major flashpoint: some of you may have read Mark Cuban's post just 2 weeks ago "The Great Internet Video Lie" in which he basically asserted that large CDNs and their pricing are the real gatekeepers to a truly open broadband distribution model (for the record, I think some of his points are valid, but long-term his logic is flawed).

The other programs thePlatform is rolling out are important, though not as impactful as the delivery option, simply because their percentage of underlying total costs is so much smaller in size. thePlatform is offering a new storage program which slashes the cost of storage from $8/GB on average, to $2/GB. Though a big cut, thePlatform calculates storage only accounts for 5% of total costs today.

Lastly, through its new Advantage program it's tapping into a select group of its ecosystem partners to find another 10% or more cost reduction on services like advertising, reporting and analytics and online community creation. Advantage program participants include Panache, BlackArrow, TubeMogul, Live Rail, ScanScout, Gloto and Visible Measures.

Add it all up and thePlatform believes it can offer a 32% reduction in "total cost of ownership" for SMB video content providers. These new services create a new revenue stream for the company, as the reduced prices include a margin for thePlatform as well. And as Marty pointed out the SMB space is quite vibrant and these programs will allow thePlatform to be more competitive in winning deals by giving them another negotiating lever.

thePlatform's moves are also smart from a positioning standpoint; in this troubled economy I think providers who overtly message that they are doing what they can to save customers money generate valuable notoriety. In good times everyone's focused on top-line growth and wants more features and flexibility. In bad times those goals are still valued, but saving money - which can often make the difference in merely surviving - is prized over everything else (Ben Franklin said it best: "a penny saved is a penny earned"). As a result, I suspect we'll see more companies unveiling messages of this kind in the months to come.

What do you think? Post a comment now.

Categories: CDNs, Technology

Topics: BlackArrow, EdgeCast, Gloto, Live Rail, Panache, ScanScout, thePlatform, TubeMogul, Visible Measures

-

Key Takeaways from Yesterday's MTV - Visible Measures Deal

Yesterday brought news that MTV Networks has signed a deal with Visible Measures, a third-party analytics firm, to measure broadband video activity across over 340 of its sites. This is by far the biggest deal that Visible Measures has landed to date. And in the torrent of broadband deals and partnerships that hit my inbox each day, I believe this one is noteworthy for 3 reasons:

1. More evidence of syndication's growing importance to major media companies

A number of recent announcements have underscored the broadband market's shift to the "syndicated

video economy," but this move by MTV demonstrates how the SVE concept is starting to infiltrate major media companies' thinking. To date many of these companies have taken a somewhat informal approach to syndication, giving users embed code or passing clips on to YouTube for promotion, but not diligently measuring the activity or benefits.

video economy," but this move by MTV demonstrates how the SVE concept is starting to infiltrate major media companies' thinking. To date many of these companies have taken a somewhat informal approach to syndication, giving users embed code or passing clips on to YouTube for promotion, but not diligently measuring the activity or benefits. MTV's deal shows serious intent to measure its syndication activity and use the resulting data to help shape its broadband video efforts. As a leader in broadband video, MTV's Visible Measures deal is certain to prompt other major media companies to up their commitment to syndication as well. This would synch with a comment a CEO of a broadband technology vendor told me yesterday: "...every content company we deal with has now prioritized syndication and they are actively addressing the technical, business and political issues."

2. Programming business changing to be more data-centric

You can be sure that when armed with a trove of new Visible Measures-generated data about how its users watch and engage with its video, MTV's programming decisions will be influenced accordingly. As I wrote in my initial post about Visible Measures last June, that's one of the beauties of broadband consumption vs. TV - all user behavior can be tracked and assessed. By knowing - down to the frame - things like when viewers dropped out, what scenes they rewound/viewed repeatedly and what clips they most shared, MTV's programming decisions should become ever smarter.

Stalwart creatives may decry this research-intensive approach to program development, but in media businesses challenged to reduce costs and increase profitability, anything that helps predict what users will watch (and therefore help drive a higher ROI per program) is invaluable. This is especially true for TV networks trying to rationalize the pilot process. Gauging real-life user reactions to various videos online can only make the pilot process more effective.

Stalwart creatives may decry this research-intensive approach to program development, but in media businesses challenged to reduce costs and increase profitability, anything that helps predict what users will watch (and therefore help drive a higher ROI per program) is invaluable. This is especially true for TV networks trying to rationalize the pilot process. Gauging real-life user reactions to various videos online can only make the pilot process more effective.3. Ad model becomes even more important, and more refined

Though there's wide consensus that advertising will drive the broadband business for the foreseeable future, there is acute anxiety about how advertising will ultimately work (formats, insertion frequency, etc.) and how much revenue it will produce. While there's been plenty of testing to date, there's also been much guesswork involved. MTV for one will now have a bird's-eye view into its users' reactions to various ad implementations so it can continually refine its approach.

Optimizing the broadband ad model is a key issue for all players in the market. Recently I asserted that Hulu is leaving a lot of money on the table with its current ad approach, and is also pressuring parent company NBC's own ad business. I suggested Hulu could insert more ads, but without hard data, it's impossible to say how much more. Here's another example: all those viral SNL clips of Tina Fey doing Sarah Palin could mean real money for NBC, yet without proper tracking and ad implementations their real value is being underoptimized. The list of examples goes on. More data on video usage can really help the ad model.

In sum, MTV's deal with Visible Measures is both a positive step in the ongoing maturation of broadband video, syndication and advertising and a harbinger of more deals to come.

(Note: if you'd like to learn more about MTV's and others' syndication strategies, please join me for a panel I'll be moderating next Tuesday, October 7th at Contentonomics in LA. Joining me are MTV's Greg Clayman, Revision3's Damon Berger, ClipBlast's Gary Baker and EgoTV's Jimmy Hutcheson. Information and registration is here.)

What do you think? Post a comment.Categories: Analytics, Cable Networks

Topics: MTV, Visible Measures

-

Dispatch from the Syndicated Video Economy's Front Line

Yesterday I moderated a panel at the NATPE LATV Festival Digital Day entitled, "The Syndicated Video

Economy: Expanding Broadband's Reach." The Syndicated Video Economy or SVE, is a concept I introduced back in March, to help articulate the trend toward widespread video distribution online, and the ecosystem of companies facilitating it.

Economy: Expanding Broadband's Reach." The Syndicated Video Economy or SVE, is a concept I introduced back in March, to help articulate the trend toward widespread video distribution online, and the ecosystem of companies facilitating it. The session was a unique opportunity to hear from four executives whose companies are very much on the front line of the trend toward syndication. They shared many insights based on their experiences, and I thought it would be worth passing on a synopsis of these today.

The four panelists were:

- Greg Clayman, EVP, Digital Distribution and Business Development, MTV Networks

- John Fitzpatrick, Director of Business Development, blip.tv

- Jonathan Leess, President and General Manager, Digital Media Group, CBS Television Stations

- Brian Shin, Founder and CEO, Visible Measures

Here are four key takeaways:

1. Syndication is required to capitalize on the significant fragmentation of online audiences. John summed this up well, suggesting that content creators need to think in terms of their "total potential audience," not just viewers that may come to their web sites. Particularly for established media companies, steeped in traditional destination-oriented, "must-see" mind-sets, this is a crucial point of adaptation to the online world. Jonathan's group gets this, as he reported 60% of its 25 million monthly are already coming from third parties.

2. Syndication is operationally complex. Jonathan made the point that, for all of syndication's appeal, it poses daunting tactical challenges, particularly with an "always-on" news gathering/dissemination ethos. Challenges he cited include integrating video players with partners' sites, implementing ad management across heterogeneous environments, distributing content correctly and promptly, measuring results and honoring financial obligations. Until the ecosystem of companies enabling the SVE significantly matures, scaling the model will cause ample headaches.

3. Retaining full control of advertising sales is crucial. While the SVE opens up new audiences, Greg reminded us that nobody is better equipped to sell MTV's inventory - wherever it may be generated - than MTV's own sales team. This is one of the reasons content providers seek to syndicate not just their video, but also their player as well. Jonathan echoed this point from the local perspective. Lack of tight advertising control leads to chaos for media buyers and sub-optimization of pricing. A bonus, as John pointed out, is that distributors will often be happy to just collect their revenue-sharing checks and not have to sell themselves.

4. Analytics are the ultimate key to fully exploiting the SVE. While traditional web analytics have focused on on-site performance, SVE analytics must encompass video performance over many distribution points. Brian noted that making sense of how a video performs in varying environments - and then adjusting ongoing syndication strategies accordingly - is necessary to optimize viewership across the total audience. Inevitably viewership and engagement will vary by distributor. Collecting, understanding and acting on the data optimizes syndication and monetization.

Ok, that's a mouthful. Like the panelists I remain optimistic about the SVE's potential, but I'm also clear-eyed about the challenges the SVE raises. I'll continue to track its progress and share findings.

What do you think? Post a comment now!

(Note, if you'd like to learn more about the SVE, and also hear from MTV's Greg Clayman, join me on August 6th for a complimentary webinar, hosted by Akamai. Click here to register.)

Categories: Events, Syndicated Video Economy

Topics: blip.TV, CBS, MTV, Visible Measures

-

WebTrends Beefs Up its Focus on Video Measurement

Late last week, WebTrends, the long-time player in web analytics, announced an important improvement in its video measurement capabilities. The company introduced a rich media plug-in that is compatible with most video formats (Flash, Silverlight, WMP, Real, etc.) providing customers with deeper understanding of users' behavior with video. I had a quick chat with Roger Corvill and Sean Browning at WebTrends to learn more.

Most everyone who has ever worked in any online business has likely had contact with WebTrends and other analytics packages like Omniture and Google Analytics. All of these provide valuable insight about site traffic, page usage, clickstream data, referring links and the like.

But the massive explosion of video has introduced new complexity in the analytics world because video is a new media type requiring unique measurement capabilities. Relevant video metrics include things like abandonment rates, rewind/resume behavior, and conversion rates on offers. As user engagement shifts to video, publishers require the same degree of insight as they've come to expect in the HTML world.

But the massive explosion of video has introduced new complexity in the analytics world because video is a new media type requiring unique measurement capabilities. Relevant video metrics include things like abandonment rates, rewind/resume behavior, and conversion rates on offers. As user engagement shifts to video, publishers require the same degree of insight as they've come to expect in the HTML world.Roger and Sean said customers have been expressing these kinds of needs to them as they are urgently focused on how best to monetize their video efforts. This synchs with what I hear often from content executives; they're excited about the opportunity to be more data-driven in both their programming decisions and monetization strategies.

In ad-supported video alone, there are a bewildering array of ad formats and implementation models, with varying impacts on the user's experience. This is the crux of today's experimentation: which ad model results in optimal consumption and monetization. I think of these attributes mapped on an XY chart, with the goal to operate as far out to the right corner as possible (i.e. high consumption AND high monetization). But this can only happen with solid underlying measurement.

Until now, WebTrends customers had to customize in order to get deep video-related stats; now they will be available out of the box. One limitation, at least for now, is that WebTrends only measures video consumption on-site. That means that as video is virally spread though embedding, emailing and syndication WebTrends doesn't yet keep track. That's an important limitation given how viral video consumption is. This is a key feature that Visible Measures, a video analytics startup which I've written about previously, has focused on.

Still, just gaining greater insight about how visitors engage with on-site video is a great leap forward, and one which WebTrends customers will no doubt welcome.

Categories: Analytics

Topics: Visible Measures, WebTrends

Posts for 'Visible Measures'

| Next