-

4 Items Worth Noting for the Oct 19th Week (FCC/Net neutrality, Cisco research, Netflix earnings, Yahoo-GroupM)

Following are 4 items worth noting from the Oct 19th week:

1. FCC kicks off net neutrality rulemaking process among flurry of input - As expected, the FCC kicked off its net neutrality rulemaking process yesterday, with all commissioners voting to explore how to set rules regulating the Internet for the first time, though Republican appointees dissented on whether new rules were in fact needed.

Leading up to the vote there was a flurry of input by stakeholders and Congress. Everyone agrees on the "motherhood and apple pie" goal that the Internet must remain open and free. The disagreement is over whether new rules are required to accomplish this, and if there are to be new rules what specifically should they be. As I argued here, the FCC is treading into very tricky waters, and law of unintended consequences looms. Already telco executives are talking about curtailing investments in network infrastructure, the opposite of what the FCC is trying to foster. The FCC will be seeking input from stakeholders as part of the process. Even though chairman Genachowski's bias to regulate is very clear, let's hope that as the data and facts are presented, the FCC is able to come to right decision, which is to leave the well-functioning Internet alone.

2. New Cisco research substantiates video, social networking usage - Speaking of the well-functioning Internet, Cisco released its Visual Networking Index study this week based on research gathered from 20 leading service providers. Cisco found that the average broadband connection consumes 4.3 gigabytes of "visual networking applications" (video, social networking and collaboration) per month, or the equivalent of 20 short videos. (Note that comScore's Aug data said of the 161 million viewers in the U.S. alone, the average number of videos viewed per month was 157.) I'm not sure what the difference is other than Cisco is measuring global traffic and comScore data is at U.S. only. Regardless, the Cisco research continues to demonstrate that users are shifting to more bandwidth-intensive applications, and the Internet is scaling up to meet their demands.

3. Netflix reports strong Q3 '09 earnings, streaming usage surges - Netflix continues to stand out as unaffected by the economy's woes, reporting its Q3 results late yesterday that included adding 510,000 net new subscribers, almost double the 261,000 from Q3 '08. The company finished the quarter with 11.1 million subs and projects to end the year with 12 to 12.3 million subs. If Netflix were a cable operator it would be the 3rd largest, just behind Time Warner Cable, which has approximately 13 million video subscribers.

Netflix CEO Reed Hastings also disclosed that 42% of Netflix's subscribers watched a TV episode or movie using the "Watch Instantly" streaming feature during the quarter, up from 22% in Q3 '08. Hastings also said in 2010 the company will begin streaming internationally, even though it has no plans to ship DVDs outside the U.S. He added that in Q4 Netflix will announce yet another CE device on which Watch Instantly will be available (just this week it also announced a partnership with Best Buy to integrate Watch Instantly with Insignia Blu-ray players). Net, net, Watch Instantly looks like it's getting great traction for Netflix and will continue to be a bigger part of the company's mix. Yet as I've mentioned in the past, a key challenge for Netflix is making more content available for streaming.

4. Yahoo's pact with GroupM for original branded entertainment raises more questions - Shifting gears, Yahoo and GroupM, the media buying powerhouse announced a deal this week to begin co-producing original branded entertainment for advertisers. The idea is to then distribute the video throughout Yahoo's News, Sports, Finance and Entertainment sections. GroupM has had some success in the past, as its "In the Motherhood" series, created for Sprint and Unilever, was picked up by ABC, though it was quickly canceled. As I pointed out in my recent post about Break Media, branded entertainment initiatives continue to grow.

Less clear to me is Yahoo's approach to video. CEO Carol Bartz said last month that "video is so crucial to our users and our advertisers..." that "there's a big emphasis inside Yahoo on our video platforms" and that "a big cornerstone of our strategy is video." OK, but these comments came just months after Yahoo closed down its Maven Networks platform, which it had only acquired in Feb '08. Having spent time at Maven, I can attest that its technology would have been well-suited to supporting the engagement and interactivity requirements of these new Yahoo-GroupM branded entertainment projects. Yahoo's video strategy, such as it is, remains very confusing to me.

Note there will be no VideoNuze email on Monday as I'll be in Denver moderating the Broadband Video Leadership Breakfast at the CTAM Summit...enjoy your weekend!

Categories: Aggregators, Branded Entertainment, Broadband ISPs, Portals, Regulation, Telcos

Topics: Cisco, FCC, GroupM, Net Neutrality, Netflix, Yahoo

-

4 Items Worth Noting for the Oct 12th Week (Bell's TMN, BlackArrow-Comcast, Net neutrality opposition, hockey's wunderkind)

Following are 4 items worth noting from the week of Oct 12th week:

1. Bell Canada is first to offer "TV Everywhere" type service - While U.S. operators have been busy with their TV Everywhere trials, Bell Canada, which has 1.8 million linear video subscribers, has jumped into the lead, announcing this week the launch of "TMN Online." The service, available through the Bell TV Online portal, allows subscribers to The Movie Network premium channel to gain online access to about 130 hours of content.

I spoke briefly with Peter Wilcox, Bell TV's director of product strategy, who explained that ExtendMedia's OpenCASE is being used for content management, in conjunction with Microsoft's Silverlight and PlayReady DRM. Users login with their Bell user name and password and are authenticated against the billing database as valid TMN subs. Only 1 simultaneous log-in is allowed, and Bell is also geo-blocking, so for example, there's no accessing TMN Online from outside Canada. The launch is part of what Bell calls "TV Anywhere" - a broader context for eventual distribution to its mobile subscribers, and further content being added. The deployment is the first milestone in what promises to be a busy 2010 on the TV Everywhere news front.

2. BlackArrow launches ad insertion for Comcast video-on-demand - BlackArrow, the multiplatform ad technology provider, announced its first customer deployment this week, with Comcast's Jacksonville, FL operation. I talked to company CEO Dean Denhart and President Nick Troiano, who gave me an update on how the company dynamically inserts ads in long-form premium content across TV, broadband and mobile. As I wrote 2 years ago, BlackArrow has bitten off the hardest challenge first: working with cable operators to get its system into their headends/data centers. Dean and Nick believe that if the company can succeed in this goal then it will have created formidable differentiation that can be leveraged for the other two platforms.

The key risk is that cable operators are famous for grinding down promising technology startups with their endless testing and brutal negotiating tactics (I say this from personal experience with a promising technology startup earlier this decade, Narad Networks). Robust VOD ad insertion is plenty strategic for the industry, but years since cable operators launched free VOD, the fact that it still isn't widely deployed is a telling sign, particularly while ad insertion technology in broadband is now fully mature. Comcast's role as an investor in BlackArrow should help its odds of success. I'm rooting for BlackArrow; their holistic approach to multiplatform advertising is right on. Whether they have the juice to fully succeed remains the big question.

3. Political battle over net neutrality is heating up - This week brought fresh complaints from Republican Senators who are coalescing to fend off new FCC chairman Julius Genachowski's plan to introduce net neutrality regulations for both broadband ISPs and wireless carriers. B&C reported that 18 Republican senators wrote to Mr. Genachowski concerned that the FCC's process is "outcome driven" and unsupported by data.

I rarely find my views aligning with Republicans, but net neutrality is an exception. As I wrote last month in "Why the FCC's Net Neutrality Plans Should Go Nowhere," Mr. Genachowski's plan is deeply flawed and completely illogical. The core premise of the new regulations - that they're needed to ensure continued broadband investment and innovation - misses the reality that the market is already functioning well. As one example, investment in broadband-related technology is continuing apace. By my calculations, over $180 million was raised in Q3 '09 by video-related companies whose very viability depends on open broadband and wireless networks. The sector's potential is amplified by the fact that venture capital fundraising itself is at its lowest level since 2003, with new capital raised by the industry in 2009 down 58% from 2008. Despite the VC industry's troubles, it continues to bet big on video. Why do we need new Internet regulations to sustain innovation?

4. Have you seen the 9 year-old hockey player's trick goal? On a lighter note, you have to love the serendipity of online video sharing. For example, though I don't consider myself a hockey fan, when a friend sent me this video clip of a 9 year-old hockey player pulling off this incredible trick shot, I was reminded just how much fun online video is and promptly passed the clip on to my circle (it's also now all over YouTube). See for yourself, it's just amazing. And nothing fake about it either.

Enjoy the weekend!

Categories: Advertising, Broadband ISPs, Cable TV Operators, International, Regulation, Sports, Technology, Video Sharing

Topics: Bell Canada, BlackArrow, Comcast, ExtendMedia, FCC, Microsoft, Net Neutrality

-

VideoNuze Report Podcast #33 - September 25, 2009

Daisy Whitney and I are pleased to present the 33rd edition of the VideoNuze Report podcast, for September 25, 2009.

This week Daisy and I first discuss Daisy's New Media Minute topic of how technology firms should balance free/revenue-sharing business models with paid/licensed approaches. Daisy reports on two companies that have successfully migrated to licensing. The so-called "Freemium" business model has been in the news a lot recently, especially with Chris Anderson's new book, "Free," so the discussion is timely.

Then I touch on my post earlier this week, "Why the FCC's Net Neutrality Plan Should Go Nowhere," which has generated plenty of reader reaction, and has been circulated widely. I'm very dismayed by new FCC chairman Genachowski's decision to intervene in the well-functioning Internet market, and only hope that as the FCC goes through its planned data collection process, it will rethink things and conclude that no new regulatory action is needed at this time.

Click here to listen to the podcast (14 minutes, 6 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Broadband ISPs, Podcasts, Regulation, Technology

-

Why the FCC's Net Neutrality Plan Should Go Nowhere

My hopes that the FCC, under its new chairman Julius Genachowski, would undergo a much-needed course correction with respect to net neutrality, were dashed yesterday. VideoNuze readers will remember that my 3rd prediction for 2009 was that net neutrality, under President Obama's pragmatic leadership, would likely remain dormant.

Mr. Genachowski's policy address, "Preserving a Free and Open Internet: A Platform for Innovation, Opportunity, and Prosperity" made clear that regrettably, he will be a forceful advocate for unprecedented Internet regulation. Mr. Genachowski has proposed codifying the FCC's four existing principles into Commission rules, and adding two new, additional principles. But read beyond the high-minded rhetoric about "preserving the openness and freedom of the Internet" and need for "fair rules of the road," and what you'll instead find is a jumble of illogical premises, inflammatory and threatening admonitions and pre-emptive, non fact-based conclusions.

I know my opposition to net neutrality regulations will bother many of you. So before I'm accused of being a cranky regulatory libertarian with nothing but distaste for government intervention, let me assure you I am anything but. In fact, I'm a strong believer that when market failures occur, the government should aggressively intervene. If you've had the experience of hearing my rants on the gross incompetence of our nation's financial regulators in contributing to our recent near catastrophic market meltdown, you will have no doubt about the sincerity of my beliefs.

That said, I'm also a fierce proponent of allowing market forces and competition to work in determining winners and losers, and that when this occurs, government influence, which is often distortive, should remain in check. If ever there was an example of a well-functioning market, it is the Internet, which since bursting into the public's consciousness 15 years ago has operated virtually regulation-free. This open and free Internet has spawned myriad innovative services that consumers enjoy today. And while the Internet has created billions of dollars of wealth for astute investors and entrepreneurs, it has also ruthlessly gobbled up many other billions of dollars ventured on ideas of illusory potential. In this respect, it could be argued that among the Internet's many marvels, it is likely the most efficient capital allocation mechanism we human beings have ever created.

By far the most sizable capital investment in the Internet landscape has been in the so-called "last mile" of broadband access. The 70 million American homes, thousands of educational institutions and countless businesses of every size that receive fast, affordable broadband Internet access is largely attributable to the hundreds of billions of dollars of investments that cable operators and telephone companies have made in upgrading their networks over the past 15 years - upgrades that continue to this day and are planned well into the future. Investments, it should be noted, that were made without a penny of government subsidies, tax breaks or bailout funds. These companies were driven by robust supply and demand forces, quantifiable business cases, vigorous competition, technological innovation and supportive lenders and shareholders. It is not an exaggeration to say that the broadband networks these companies built are the very foundation of our 21st century economy.

You might think that in a major policy speech premised on the importance of the Internet to our daily lives and commerce, the new FCC chairman might dwell for a few minutes on these contributions, if for no other reason than to demonstrate his understanding of what's truly at the core of today's Internet experience. But you would be wrong; instead the new FCC chairman used just over 50 words in a passing reference. You might also think that these companies' track records of being market driven might also influence the new chairman with regard to whether decisive regulatory action, particularly in the thorny area of network management, is now necessary. Here again you'd be wrong.

In fact, with yesterday's remarks, Mr. Genachowski has picked up where his predecessor, Kevin Martin left off: pre-emptively tagging the nation's cable and telco broadband ISPs as untrustworthy conspirators plotting to wall-off the Internet to all but their own favored services. Though professing to "ensure that the (FCC's) rulemaking process will be fair, transparent, fact-based and data-driven," by first proposing the rules be adopted, before evidence of their very need has been established, the chairman has only ensured that the rule-making process will be anything but what he says he wants it to be. Deciding that net neutrality regulations are essential, after being officially on the job for less than 90 days and absent supporting data to point to, does not inspire confidence about the likely fairness of the Genachowski-led Commission.

Mr. Genachowski further upped the ante by suggesting that if such regulatory action is not taken, perilous consequences to the Internet's openness await. His choice of words - that we could see "the Internet's doors shut to entrepreneurs," "the spirit of innovation stifled," "a full and free flow of information compromised" and that "if we wait too long to preserve a free and open Internet, it will be too late" - represent the kind of inflammatory, unjustified hyperbole that only serves to distract from the facts and data yet to be reported. Such comments virtually guarantee that the debate will be transformed quickly into an escalating war of opinionated arm-waving (as have prior FCC open sessions). Did we not just witness our crucially important health care debate devolve into just this sort of spectacle? And did candidate Obama not remind us, rightfully, that "words matter?"

But worst of all is that despite the new chairman's lengthy service in the private sector, his remarks suggest a fundamental misunderstanding of how product innovation and the broadband market actually work. His view is that the government must pre-emptively step up to the plate to ensure that the Internet remains free and open, or innovation and investment will be curtailed, is just plain wrong.

The reality is that aside from random acts, no pattern of broadband ISP misconduct has ever been proven. Major industry players know this and their actions suggest they are utterly untroubled by the current state of laissez-faire Internet regulation. Consider recent deals predicated on the belief that the Internet will remain open and bandwidth plentiful: NBC, Fox and Providence Equity Partners (and later Disney) invested $100M in Hulu at a $1B pre-launch valuation; Cisco acquired Pure Digital, maker of the Flip video camera for $600M in a bid to further fuel user-generated video; and Marc Andreessen's investment firm is participating in a buyout of Skype valuing the firm at $2.75B. Then there's Apple, which has invested untold tens of millions of dollars upgrading the iPhone and iPod Nano to have video capabilities. And let's not forget Netflix, Intel, Sony, Microsoft and many others who are moving aggressively forward with bandwidth-heavy broadband video products and services. Looking ahead, as I suggested last week looms "TV Everywhere 2.0," portending massive over-the-top video competition.

But it's not just the giants that are investing. By my analysis, early and mid-stage broadband video-related companies raised almost $220M over the last 3 quarters, in the midst of the worst venture capital slump in memory. And as I'll report next week, Q3 '09 has been the highest fund-raising quarter of the last four. Deals are being done because history has repeatedly shown investors that in order to remain competitive and meet surging consumer demand, network operators are certain to continue to invest in upgrading their networks. When I helped start Continental Cablevision's high-speed Internet business 15 years ago, 1.5 mbps service was breakthrough; now 100 mbps or more is the state-of-art for wireline broadband.

Contrary to Mr. Genachowski's fear that the market will be immobilized absent FCC intervention, industry participants are moving briskly forward, confident that market and competitive forces will compel network operators to continue creating abundant, open bandwidth to support their new services.

This phenomenon appears to be true in the mobile space as well. AT&T's recent decision to accelerate its 3G wireless buildout is due mainly to high iPhone data traffic. And it should be noted that Apple's rejection of the Google Voice app (which continues a pattern of unfettered App Store selectivity by the company) raises the important question of who's the real gatekeeper when it comes to open wireless services - the network operator or the handset maker? How does Apple's newfound power figure into the FCC's regulatory paradigm?

Let's be clear: it is absolutely essential that the Internet remain open. But imposing new net neutrality and Internet regulation is not the way to ensure this. Instead, net neutrality remains a solution in search of a problem. With brushfires burning in every corner of the American economy, Washington's policy-makers would be wise to focus on real problems, not imaginary ones. The Internet has worked magnificently to date and there's every reason to believe it will continue to do so. The last thing we need are the unintended consequences that government intervention often brings. For now, FCC vigilance is required, but new regulations are not.

What do you think? Post a comment now.

Categories: Broadband ISPs, Cable TV Operators, Regulation, Telcos

Topics: FCC

-

Hubris Cursed AOL But Broadband Crushed It

I highly recommend reading Saul Hansell's piece in last Friday's NY Times, recapping the ridiculously optimistic quotes senior executives at AOL and Time Warner have made over the years (and be sure to peruse readers' consistently vitriolic comments). For anyone who's watched AOL's rise and fall, the quotes are a stroll down memory lane. But while the picture that emerges is that hubris cursed AOL and contributed mightily to its downfall, in reality it was broadband, and AOL's colossal mismanagement in transitioning to it, that crushed the company.

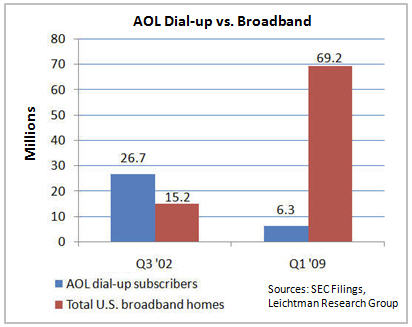

The chart below shows that AOL's dial-up subscribers topped out in Q3 '02 at 26.7 million, and have been in a free-fall ever since, sitting at just 6.3 million at the end of Q1 '09, a drop-off of 20.4 million or 76%. Where did those 20.4 million dial-up subs go, along with tens of millions of other dial-up and new Internet users? To broadband Internet access, supplied by cable companies and telcos. These companies have grown their U.S. broadband subs from 15.2 million in Q3 '02 to 69.2 million in Q1 '09, an astonishing increase of 54 million subscribers in just 7 years.

Cable and telco broadband providers have feasted on the carcasses of AOL and other dial-up services like MSN and Earthlink. But, here's what's both incredible and really sad: had AOL management been less arrogant and more strategic in its approach to broadband, it's quite possible that things could have turned out quite differently.

Back in the mid-to-late '90s, I had a front-row seat at AOL's initial reactions to broadband. In that period I was VP Business Development at Continental Cablevision, then the 3rd largest cable operator in the U.S. with over 5 million video subscribers. We were one of the pioneers in testing and rolling out "high-speed" Internet service. While we thought our speedy and always-on broadband connections were a better mousetrap vs. dial-up, we were very concerned about our lack of online content, video-centric branding and ability to effectively market this exciting new service.

In the pre-@Home days, I pushed to explore how we could partner with AOL to help us get our service off to a faster start. A deal with AOL would have had significant advantages to them as well. AOL at the time had a huge capex burden building out more modem banks to keep up with its swelling subscriber ranks. Even still, there was already plenty of AOL subscriber frustration with the slowness of the AOL network, and often you couldn't even get connected on your first or second tries. At least in our geographic footprint we could unburden them of their network build-out, offer better-quality connections and allow them to focus on content and brand-building. As the 3rd largest cable operator, we also offered them a valuable proof-point that they could use to build industry-wide relationships.

After much preparation and scheduling, we met with one of AOL's most senior executives. After articulating our broadband vision and opportunity to work together, he arrogantly dismissed us as if we were precocious children. To him the opportunity we were describing was far too small, and to illustrate his point he asserted that AOL would have 10 million subscribers before we had our first 100,000 (a prediction that was probably correct!).

Needless to say, no meaningful deal with us - or any other cable operator - every materialized. AOL went on to flounder around with various incarnations of AOL Broadband, none of which ever got any traction. AOL continued to grow its subscribers for a number of years and capitalized on its reach by extracting hundreds of millions of dollars from VC-backed startups eager for access to its massive captive audience (some of those deals would later come under scrutiny, as would AOL's accounting treatment for its subscriber business). AOL then bought Time Warner, and the rest as we know is history.

But what if things had gone differently? What if that AOL executive and others had seen the handwriting on the wall - that broadband would eventually render dial-up obsolete - and decided that AOL needed to figure out how to transition to it, instead of dismissing it? Had that happened, it could have forged partnerships throughout the cable and telco industries that would have let it focus on content and services in an open, broadband environment. In fact, I think it's quite possible that AOL could have pre-empted @Home and the RoadRunner venture that Continental eventually joined from getting traction (why start over when AOL, the 800 pound gorilla is in your corner?).

Instead AOL fell victim to its own arrogance and limited strategic vision. Broadband went on to become the single most powerful enabler of the Internet as we know it today (e.g. billions of spontaneous Google searches, Tweets, Amazon purchases, and more recently video views). AOL is now a crippled mish-mash of mostly second-rate properties, on its umpteenth management team, led by new CEO Tim Armstrong.

In retrospect, those fateful decisions AOL made about broadband 10-15 years ago set the stage for the company's eventual demise.

What do you think? Post a comment now.

Categories: Broadband ISPs, Cable TV Operators, Portals, Telcos

-

5 Lessons from Time Warner Cable's Consumption Based Billing PR Debacle

Last week, Time Warner Cable tried turning the page on a public relations debacle of its own making. Glenn Britt, TWC's CEO announced that it would postpone for now the company's Consumption Based Billing trials planned in 4 U.S. markets. The move came in response to a massive negative reaction in the blogosphere, at the grass-roots customer level, and in Congress.

On the one hand, it continues to astound me that the cable industry, which has invested billions of dollars of its own capital over the last 15 years to lead the deployment of broadband Internet access across America,

receives virtually no credit for this. Instead it is the constant object of derision and conspiracy theories about its uncompetitive behavior. Unfortunately, TWC's Frick and Frack handling of its planned changes to its broadband billing practices explains why this is so.

receives virtually no credit for this. Instead it is the constant object of derision and conspiracy theories about its uncompetitive behavior. Unfortunately, TWC's Frick and Frack handling of its planned changes to its broadband billing practices explains why this is so. Having observed the TWC billing melodrama play out over the last month or so, here are 5 lessons I think TWC and other broadband ISPs should learn:

1. A trial must be legitimate, with well-understood objectives that are communicated clearly

It may seem basic, but when a company runs a trial, it needs to have well-understood objectives that are communicated clearly to all constituencies. My sense is that TWC thought it was doing this, but in reality it wasn't. For example, were the trial's objectives to see how user behavior changes in response to the new billing practices? Or how TWC's network loads and costs are altered? Or maybe provide data to guide its strategy vis-a-vis new online video competitors? None of these things are cited. Rather TWC mentions "bandwidth consumption is growing exponentially," "increasing variable costs" and "Internet brownouts." OK, but what are the trial's objectives and how do they address these concerns?

By definition a trial also needs to be legitimately trying something new to see how it works. Instead TWC makes its "trial" look more like the kickoff of a new pricing plan. So why even bother calling this a "trial" when in fact there's no indication the company is seeking to learn something through some kind of testing? If TWC wants to change its pricing, then just call this step what it is - the first phase of rollout of new billing practices. Whiffs of disingenuousness are easily smelled.

2. Make changes in increments, targeting priority user segments first

A core part of the reason TWC and other broadband ISPs want to switch to consumption-based billing is because some users' online video viewing is surging and ISPs justifiably want to get compensated extra for this heavier network burden.

But if broadband ISPs are most worried about these heavy users, then they should address them first. TWC's mistake was to instead simultaneously also introduce lower price tiers and accompanying consumption caps and overage charges. As a result, instead of a contained minority of its users being affected by the new policy, everyone was. That type of comprehensive approach may have seemed smart in the planning process, but in the execution stage, it's very hard to pull off. Comprehensiveness dissipates the main issue - addressing heavy users - while drawing in outside advocacy groups and politicians to plead for everyone. That's a no-win position.

3. Be prepared to justify the billing changes with specific financial information

TWC argued vaguely that rising network costs were behind the need to change its billing practices. That may well be true, but by not disclosing more specifics, the company left itself vulnerable to naysayers. For example, in this NY Times interview, TWC COO Landel Hobbs was thrown some questions about whether in fact much of TWC's costs are fixed. He should have been prepared to respond in detail, citing specific capex or opex numbers that can be correlated with heavy video usage. Instead he ducked the questions, deferring them to a subsequent interview with an engineer. All of that leaves the reader suspicious about his arguments' legitimacy.

If a senior executive is going to be offered up for a NY Times interview, he should use the opportunity to make the strongest case possible for the planned change. In the wake of the Wall Street financial crisis, people increasingly expect accountability and transparency from senior executives. Poorly understood corporate decisions by fiat are prime for backlash.

4. If billing is to be metered, make sure customers have the ability to measure

Here again is PR 101 - if you're going to change to metered billing, customers need to know how they can measure and modify their usage. But TWC offered no specifics about the availability of a useful meter, or any demo of how it would work. Instead it said it would offer a grace period of 2 months on overage charges.

Talk about an impractical plan. I think most people understand and like the idea of variable pricing - paying just for what's used. But if they don't have to right tools to measure their usage, the model looks hollow. TWC ultimately acknowledged it is "working to make measurement tools available as quickly as possible." Hallelujah.

5. Billing changes need to be tied to online video policy

Simmering just below the surface of the billing change backlash is a suspicion that TWC is introducing these caps to constrain online video usage. You don't have to be a conspiracy theorist to understand that if an ISP like TWC charges more for access to 3rd party delivered video it will limit is use. TWC should have known it was prime for this allegation and been proactive about how it relates these 2 issues.

For example, what if TWC had acknowledged that some users prefer online program access, and that if they select its top capped rate of $150/mo now they will be forever grandfathered into that rate, even as their video usage grows further? Only a minority of users would have likely taken the plan, but it would have helped TWC demonstrate acceptance of 3rd party delivery.

Conclusion

I'm not suggesting any of this is easy, but it is necessary. Broadband ISPs are operating under a microscope these days as online video becomes more central to more users' everyday Internet experience. Broadband ISPS like TWC which want to change their billing practices need to do so in a thoughtful and pragmatic manner. Over the past 2 weeks we saw what happens when they aren't.

What do you think? Post a comment now.

Categories: Broadband ISPs, Cable TV Operators

Topics: Time Warner Cable

-

Broadband Subscriptions Chug Along in 2008

Last Friday, Leichtman Research Group released is quarterly roundup of broadband subscription growth sorted by major cable operators and telcos. LRG, run by my former colleague and friend Bruce Leichtman, has long been the bible for many in the industry for tracking broadband subscriber growth. LRG's numbers continue to demonstrate why broadband video has become such an exciting new distribution medium while adding context to Comcast's and Time Warner's recent moves to begin making online access to cable programming available to their subs.

To highlight a few key numbers, at the end of '08 the top broadband ISPs had 67.7 million subscribers, with top cable operators accounting for about 54.5% and top telcos the remainder. Top cable operators continue to maintain their edge in subscriber acquisition as well, grabbing 59% of all new broadband subs in '08.

And no surprise to anyone, with the rising penetration levels, the annual increases in total new subs have continued to slow: in '06 top cable and telco ISPs added 10.4M subs, in '07, 8.5M subs and in '08, 5.4M subs. Still, in the teeth of harsh economic downturn in Q4 '08, these ISPs were still able to add over 1M subs, growth that contracting industries like autos, retail and home-building would no doubt have killed for.

Broadband has long since become a utility for many American homes, a service that is as much expected as essentials like electricity and plumbing. A key reason broadband video is enjoying the success it is owes to the fact that broadband subscriptions have been driven for other reasons (e.g. faster email access, music downloads, always-on connectivity) over the years. Video has only recently become an additional and highly-valued benefit, which broadband ISPs now expect will drive interest in faster (and more expensive) broadband service plans.

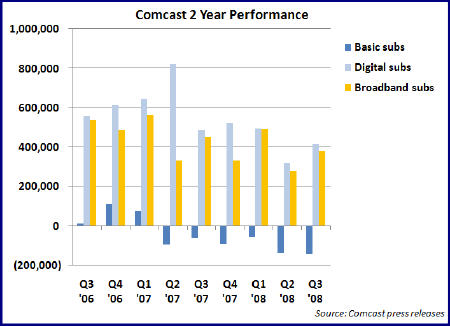

Broadband's importance to the cable industry is demonstrated by the chart below showing #1 cable operator Comcast's performance over the last 2 years, which I originally posted on last November ("Comcast: A Company Transformed).

Note the company has now lost basic cable subscribers for 7 straight quarters, even as it continues to add digital video subs and broadband subs (and voice subs) at a healthy clip. I expect these trend lines will continue in their current pattern. No doubt this is the kind of picture that has helped spur Comcast (and #2 operator Time Warner Cable) to begin planning online distribution of cable programming, a feature that I believe will provide highly popular. Operators are in a tremendous position to capitalize on the shifting interests of their subscribers.

What do you think? Post a comment now.

Categories: Broadband ISPs, Cable TV Operators

Topics: Comcast, Leichtman Research Group, Time Warner Cable

-

The Cable Industry Closes Ranks - Part 2

An article in Friday's WSJ "Cable Firms Look to Offer TV Programs Online" outlined a plan under which Comcast and Time Warner Cable, the nation's 2 largest cable operators, would give just their subscribers online access to cable networks' programming.

A Comcast spokesperson contacted me later Friday morning to explain that the plan, dubbed "OnDemand Online" is indeed in the works, though a release timeline is not yet set. The move is part of the company's

"Project Infinity" a wide-ranging on-demand programming vision that was unveiled at CES '08, but oddly has not been messaged much since. Meanwhile, thePlatform, Comcast's broadband video management/publishing subsidiary also called me on Friday to confirm that - unsurprisingly - it would be powering the OnDemand Online initiative (thePlatform's CEO Ian Blaine explains more in this post).

"Project Infinity" a wide-ranging on-demand programming vision that was unveiled at CES '08, but oddly has not been messaged much since. Meanwhile, thePlatform, Comcast's broadband video management/publishing subsidiary also called me on Friday to confirm that - unsurprisingly - it would be powering the OnDemand Online initiative (thePlatform's CEO Ian Blaine explains more in this post).The idea of cable operators setting up online walled gardens for their subscribers alone was first signaled by Peter Stern, Time Warner's EVP/Chief Strategy Officer on the panel I moderated at VideoNuze's Broadband Leadership Breakfast last November. As I wrote subsequently in "The Cable Industry Closes Ranks" my takeaway from his and other cable executives' recent comments was that the industry was poised to collaborate in order to defend cable's traditional - and highly profitable - business model. Under that model, cable operators currently pay somewhere between $20-25 billion per year in monthly "affiliate fees" to programmers whose networks are then packaged by operators into various consumer subscription tiers.

It should come as a surprise to nobody that both cable networks and operators are mightily incented to defend their model against the incursions of free "over the top" distribution alternatives. Indeed what's surprising to me is why it has taken the industry so long to act forcefully when the stakes are so high and the market's moving so fast? I mean cable operators themselves are the largest broadband Internet access providers in the country, and they have watched for years as their networks have been engorged by surging online viewing, courtesy of YouTube, Hulu, Netflix and others. While they've made some tepid moves to push programming online (though to be fair Comcast's Fancast portal has evolved quite a bit recently), overall their broadband video distribution activities have been underwhelming, evidence of broadband distribution's lower priority status vis-a-vis TV-based video-on-demand.

Meanwhile Friday's article triggered plenty of hackles from the blogosphere that those evil cable operators were up to their old monopolistic tricks, this time moving to control the broadband delivery market and choke off open access to premium video. While it's indeed tempting to see these plans that way, I think that would be the wrong conclusion.

Rather, I look at the Comcast/TWC moves as both welcome and likely to spur more, not less, consumer

access to broadband-delivered programming. That's because, if the cable networks are smart in their negotiations, they will gain from operators the approval to push more of their programs onto both their own web sites, and even to distribute some through others' sites. With net neutrality agitators hopeful in the wake of Barack Obama's election, Comcast and TWC need to tread carefully in these negotiations. Yet another part of the model I foresee is archived programs, which have been locked up in vaults due to programmers' concerns over operator reprisals if they leaked out online, becoming much more openly accessible.

access to broadband-delivered programming. That's because, if the cable networks are smart in their negotiations, they will gain from operators the approval to push more of their programs onto both their own web sites, and even to distribute some through others' sites. With net neutrality agitators hopeful in the wake of Barack Obama's election, Comcast and TWC need to tread carefully in these negotiations. Yet another part of the model I foresee is archived programs, which have been locked up in vaults due to programmers' concerns over operator reprisals if they leaked out online, becoming much more openly accessible. The Comcast/TWC hecklers need to remember one simple fact: to make quality programming requires solid business models. And in this economic climate, solid business models are far and few between. Despite having lost a total of over 500,000 video subscribers during the last 6 consecutive quarters, Comcast still owns one of those few sold models. And don't forget it is now investing to increase its broadband speeds, pledging 30 million, or 65% of its homes, will have 50 Mbps access by the end of '09 (a rollout which incidentally is all privately financed, without a dime of federal bailout money or other assistance).

In the utopian fantasy of some, all premium content flows freely, supported by a skimpy diet of ads alone. For some that works. Yet for cable networks accustomed to monthly affiliate fees this is completely unrealistic and uneconomic. One needs look no further than the wreakage of the American newspaper industry (including bankruptcy filings recently by the Chicago Tribune and today by the Philadelphia Inquirer) to understand the damage that occurs when business model disruption occurs in the absence of coherent, evolutionary planning.

Someday, when broadband video business models mature (as indeed they ultimately will), there will be lots of cable and other programming available for free online. For now though, getting Comcast and TWC to finally pursue an aggressive broadband distribution path is a welcome evolutionary step in unlocking this exciting new medium's ultimate potential.

What do you think? Post a comment now.

(Note: we'll be diving deep into this topic, and others, at VideoNuze's Broadband Video Leadership Evening on March 17th in NYC. More information and registration is here.)

Categories: Aggregators, Broadband ISPs, Cable Networks, Cable TV Operators

Topics: Comcast, Hulu, Netflix, Time Warner Cable, YouTube

-

Recapping 5 Broadband Video Predictions for 2009

For those who weren't up for reading 700-1,000 words each day last week, today I offer a quick recap my 5 broadband video projections for 2009.

1. The Syndicated Video Economy Accelerates

This one is easily my least controversial prediction, since I've been writing about this trend for most of 2008. The "SVE" as I call it, is an ecosystem of video content providers, distributors and the technology companies who facilitate their relationships. In '08 video content providers increasingly realized that widespread distribution to the sites that users already frequent would improve on the "one central destination site" approach. That's a big change in the traditional media mentality. In '09 the SVE will only accelerate, as the technology building blocks for distributing, monetizing and measuring syndicated video continues to improve. To be sure, the SVE is still nascent, but many companies across the broadband landscape have begun embracing it in earnest.

2. Mobile Video Takes Off, Finally

In '08 VideoNuze has been mainly focused on wired broadband delivery of video to homes and businesses. But as the year has progressed, powerful new mobile devices have mutated the definition of broadband to also include wireless delivery. The huge success of the iPhone and other newer video-capable devices, coupled with 3G, and soon 4G networks, have contributed to mobile delivery finally realizing some of its long-held promise. Still, as some of you commented, obstacles remain. iPhones don't support Flash, the most popular video format. Wireless carriers are careful with doling out too much bandwidth for video apps. And so on. Still, '08 was a big year for video delivery to mobile devices, and I think '09 will be even bigger.

3. Net Neutrality Remains Dormant

Proponents of "net neutrality" legislation, which would codify the Internet's level playing field, expected that under an Obama administration they would finally be granted their wish, particularly since he supported the concept on the campaign trail. But I'm predicting that net neutrality will be dormant for yet another year. Mr. Obama has been emphatic about basing policy decisions on facts and data, and this is an area where net neutrality advocates continue to come up short as there's yet to be any sustained and proven ISP misbehavior. With Mr. Obama and his team having urgent fires to address all around them, there are only two scenarios I can see that move net neutrality up the prioritization list: a startling new pattern of ISP misbehavior or some kind of deal ISPs agree to in exchange for infrastructure buildout subsidies from the stimulus package.

4. Ad-Supported Premium Video Aggregators Shakeout

One of the best-funded categories of the broadband landscape has been aggregators of premium-quality video - TV programs, movies and other well-produced video. These companies have been thought of as potential long-term online competitors to today's video distributors (cable/satellite/telco). However, it's proving very difficult for these sites to differentiate themselves. Content is commonly available, user experience advantages are hard to maintain, user acquisition is not straightforward, audiences are fragmented and ad dollars are under pressure. All of this means that '09 will see a shakeout among the many players in this category, though it's hard to predict at this point who will be left standing (though at a minimum I expect Hulu and Fancast to be in this group).

5. Microsoft Will Acquire Netflix

My long-ball prediction was that at some point in '09 Microsoft will acquire Netflix. Though many of you emailed me offering kudos for boldness, not many are buying into my prediction. Fair enough, I'll either be flat-out wrong on this one or I'll get a gold star for prescience. I provided my rationale, which starts with the assumption that Apple and Google (Microsoft's two fiercest rivals in the consumer space) are best-positioned for success in the battle for the biggest consumer prize of the next 10 years: delivering broadband video services directly to the TV.

I think Microsoft needs to directly play in this space, and Netflix is a perfect vehicle. It has a great brand, a large and loyal subscriber base and excellent back-end fulfillment systems. In 2008 Netflix great strides in broadband, building out its "Watch Instantly" feature. Yet to grow WI's catalog from its current 12K titles to anything approaching the 100K+ available by DVD will require deep financial resources to deal with a recalcitrant Hollywood, and also shelter from quarter-to-quarter earnings pressures. Netflix's measured approach to broadband is consistent with its historical overall operating style. While that style has worked exceedingly well in the past, the broadband-to-the-TV service landscape is wide open right now, and Netflix should be pursuing in a thoughtful, yet ultra-aggressive way. Combined with Microsoft it would be poised to become the broadband video category leader over the next 10 years.

OK, there's the summary. I'll be checking back in on these as the year progresses.

What do you think? Post a comment now.

Categories: Aggregators, Broadband ISPs, Deals & Financings, Mobile Video, Predictions, Syndicated Video Economy

Topics: Apple, Fancast, Google, Hulu, Microsoft, Net Neutrality, Netflix

-

2009 Prediction #3: Net Neutrality Remains Dormant

As promised, I'm continuing to push further out onto the limb with my five '09 broadband predictions as the week progresses. Today's prediction is that net neutrality legislation will remain dormant for at least another year. Given Barack Obama's campaign statements pledging support for net neutrality, many who hoped it was finally at hand will no doubt be quite disappointed.

I suspect many of you may not even be familiar with net neutrality or why it's relevant so let me offer a short primer. As I wrote back in November of '07, in "Net Neutrality in '08? Let's Hope Not," the Internet has functioned as a level playing field of sorts. Broadband Internet Service Providers have not biased in favor of delivering one web site's content over another's (i.e. their networks have remained neutral). Since the government has maintained a laissez-faire Internet regulatory stance, broadband ISPs' own self interests have aligned nicely with staying neutral. In other words, it made good business sense for them to behave this way.

To simplify somewhat, net neutrality advocates believe that in the broadband video era, "good business sense" cannot be counted upon to ensure ISPs' continued neutrality; hence the need for regulatory intervention. Their concern is that because large ISPs' (namely cable operators and telcos) also operate incumbent multichannel video services and have financial stakes in certain content providers - both of whose financial health would be threatened by open broadband delivery - these ISPs will start to bias toward better delivery of sites in which they have some financial interest or with whom they have a particular deal. This would in turn disadvantage sites outside the ISPs' financial orbit, hurting not just these sites, but also larger democratic goal of consumer choice.

All of these concerns are hypothetically valid. But the problem is that these concerns have not translated into any provable pattern of ISP misbehavior as yet. Having sat through an FCC hearing earlier this year meant to surface such evidence, I can say first-hand that while there are isolated instances of bias which have been compounded by bungled ISP explanations and sophomoric PR miscues, net neutrality advocates have little more than their concerns and assumptions about ISPs' future behavior on which to base their argument for preemptive legislation. And this is precisely the reason why net neutrality will remain dormant for another year, at least.

Net neutrality remains largely a solution in search of a problem. I believe this will put it outside the guiding philosophy of Mr. Obama's regulatory forces. Having read both of Mr. Obama's books and listened to his words intently, I've long since concluded that he's what I call a "principled pragmatist." Mr. Obama has a core set of beliefs about how the world should work, but he chooses his battles wisely and with a focus on solving real, not imaginary problems. Mr. Obama and his team have plenty on their plates addressing the economic mess they're inheriting. Time will not be made available to create rules in any area of business where there's no evident harm to anyone.

This pragmatic approach means that when the rubber meets the road on net neutrality, Mr. Obama and his policy advisors are unlikely to be swayed by the free-speechers and academics who form the core of the net neutrality advocacy camp, unless they're able to bring far more supporting data (note, as the WSJ pointed out earlier this week, net neutrality support even among some content companies like Google, Microsoft and Yahoo is either waning or becoming ambiguous).

All of this said, it may be politically expedient to throw a small bone to net neutrality's advocates. So we may see some new guidelines introduced, but nothing approaching the level of what some are seeking. The only exception is if broadband ISPs themselves acquiesce, possibly in exchange for infrastructure subsidies that may be part of the planned trillion dollar stimulus program.

Though politics is a notoriously hard business to protect, if in 2009 if broadband ISPs do a good job of behaving themselves, they will likely see net neutrality backburnered. The FCC should be vigilant in monitoring the industry for signs of bias. And if they are able to prove the case, net neutrality will rightly get moved up in prioritization.

What do you think? Post a comment now.

2009 Prediction #1 - The Syndicated Video Economy Accelerates

2009 Prediction #2 - Mobile Video Takes Off, Finally

Tomorrow, 2009 Prediction #4

Categories: Broadband ISPs, Predictions

Topics: Barack Obama, FCC

-

Video is the Killer App Driving Coming Bandwidth Explosion

A short interview in Multichannel News with Rouzbeh Yassini before the Thanksgiving break last week caught my eye.

Rouzbeh's name is likely unfamiliar to many of you. But for others who have been in and around the cable and broadband industries since the '90s, he is semi-famous. In those days Rouzbeh ran a company called LANCity, which was a pioneer in designing and manufacturing cable modems. These of course are the devices that now reside in tens of millions of homes around the world, enabling broadband Internet access and the high-quality video services like YouTube, Hulu, iTunes and others that run through them.

Though it's only been about 15 years, the early-to-mid '90s seem like another age entirely. Can you remember dial-up Internet access? Busying up your phone line if you wanted to be online? Listening to all those weird tones as your creaky 56K modem connected you to Prodigy, CompuServe, AOL, or eventually this thing everyone seemed to be talking about called the "World Wide Web?"

In my opinion, Rouzbeh deserves as much credit as anyone for the transformation of the dial-up Internet era

to the broadband world we now enjoy. He played a crucial role in articulating broadband's business potential to scores of senior cable executives who barely knew what a computer was, much less this new-fangled thing called the Internet. Importantly, he was a key technical architect of modern cable networks, which today barely resemble the passive, one-way networks of old.

to the broadband world we now enjoy. He played a crucial role in articulating broadband's business potential to scores of senior cable executives who barely knew what a computer was, much less this new-fangled thing called the Internet. Importantly, he was a key technical architect of modern cable networks, which today barely resemble the passive, one-way networks of old. In short, I've learned to take notice of Rouzbeh's prognostications. Though he can be irrepressibly optimistic, he's directionally right more often than not.

All of that brings me to his Multichannel interview. Rouzbeh now envisions the era of gigabit or 1,000 megabit Internet access within a decade. To put this in perspective, today's cable modems typically deliver around 10 megabit service or 1% of a gigabit. Spurred by competitive pressures, Comcast has recently announced the rollout of 50 megabit service to certain regions, with expansion to its entire footprint by 2010. These new rollouts are part of the cable industry's "DOCSIS 3.0" standards, covering a new generation of modems and channel management techniques.

There's an axiom in the broadband industry that usage always rises to the level of bandwidth provided. Yet when we're talking 1 gigabit service, one has to rightly ask, "what in the world are people going to do with all that bandwidth?" Rouzbeh posits things like corporate networking, remote offices, medical services and the like, but only touches briefly on video delivery.

From my perspective, video is the killer application that will drive this bandwidth explosion. As I wrote recently in "Video Quality Keeps Improving - What's it All Mean?" we are on the front end of a shift toward dramatically higher video quality, with near HD delivery already becoming common (Hulu, Netflix and Vudu are among the most recent to announce HD initiatives). This shift will only accelerate going forward. And to accommodate it will require lots more bandwidth from network providers.

In reality, the trickiest part of bandwidth expansion is less the technology development and deployment and more the business models that support the investments and make the most strategic sense. Questions abound: Is the right model to charge $150/mo for 50 megabit access as Comcast plans? Or to build a content service available only to those high-powered users? Or act like a CDN and provide services so as to charge content providers themselves to deliver higher-quality video? Maybe some hybrid of these, or some other model? And of course, what impact do these models have on the incumbent multichannel subscription video offering?

While there's murkiness now, like Rouzbeh, I'm a big believer that these things will ultimately be worked out and that bandwidth expansion is inevitable. Just as we now look back on the dial-up era and wonder how we got by, eventually we'll look at the mid-to-late 2000s and wonder how we survived on so little bandwidth.

What do you think? Post a comment now.

Categories: Aggregators, Broadband ISPs, Cable TV Operators, People

Topics: Comcast, DOCSIS, Hulu, Netflix, VUDU

-

Notes from Broadband Video Leadership Breakfast

Yesterday, I hosted and moderated the inaugural Broadband Video Leadership Breakfast, in association with the CTAM New England and New York chapters, here in Boston (a few pics are here). We taped the session and I'll post the link when the video is available. Here are a few of key takeaways.

My opening question to frame the discussion centered on broadband's eventual impact on the cable business model: does it ultimately upend the traditional affiliate fee-driven approach by enabling a raft of "over-the-top" competitors (e.g. Hulu, Netflix, Apple, YouTube, etc.) OR does it complement the model by creating new value and choice? As I said in my initial remarks, I believe that how this question is ultimately resolved will be the key determinant of success for many of the companies involved in today's broadband ecosystem and video industry.

I posed the question first to Peter Stern, who's in the middle of the action as Chief Strategy Officer of Time Warner Cable, the second largest cable company in the U.S. I thought his answer was intriguing: he said that it is cable networks themselves who will determine the sustainability of the model, depending on whether they choose to put their full-length programs online for free or not.

Later in the session, he put a finer point on his argument, saying that "a move to online distribution by cable networks would directly undermine the affiliate fees that are critical to creating great content" and that finding ways to offer these programs only to paying broadband Internet access subscribers was a far better model for today's cable networks and operators to pursue (for more see Todd Spangler's coverage at Multichannel News).

Peter's point echoes my recent "Cord-Cutters" post: to the extent that cable networks - which now attract over 50% of prime-time viewership, and derive a third or more of their total revenues from affiliate fees - withhold their most popular programs from online distribution, they provide a powerful firewall against cord-cutting. Speaking for myself for example, the prospect of missing AMC's "Mad Men" (not available online anywhere, at least not yet...) would be a powerful disincentive for me to yank out my Comcast boxes.

These thoughts were amplified by the other panelists, Deanna Brown, President of SN Digital, David Eun, VP of Content Partnerships for Google/YouTube, Roy Price, Director of Digital Video for Amazon and Fred Seibert, Creative Director and Co-founder of Next New Networks, who held fast to a highly consistent message that broadband should be thought of as expanding the pie, thereby creating a new medium for new kinds of video content. David, in particular cited the massive amount of user-uploaded and consumed video at YouTube (amazingly, about 13 hours of video uploaded every minute of every day) as strong evidence of the community and context that broadband fosters.

Still, our audience Q&A segment revealed some very basic cracks in the panelists' assertions that the transition to the broadband era can be orderly and managed (not to mention that afterwards, I was privately barraged by skeptical attendees). First and foremost these individuals argued the idea that the cable industry can maintain the value of its subscription service by using the control-oriented approach typified by the traditional windowing process flies in the face of valuable lessons learned by the music industry.

Of course most of us know that sorry story well by now: an assortment of entrenched, head-in-the-sand record labels forcing a margin rich, but speciously valued product (namely the full album or CD) on digitally empowered audiences, who decided to take matters into their own hands by stealing every song they could click their mouses on. Consequently, a white knight savior (Apple) offering a legitimate and consumer-friendly purchase alternative (iPod + iTunes), which would grew to be so popular that it has made the record labels beholden to it, while simultaneously hollowing out the last vestiges of the original album-oriented business model.

Does history repeat itself? Are Peter and the other brightest lights of the cable industry deluding themselves into thinking that a closed, high-margin, windowed platform like cable can ever possibly morph itself into a flexible, must-have service for today's YouTube/Facebook generation?

I've been a believer for a while that by virtue of their massive base of broadband-connected homes, high-ARPU customer relationships and programming ties, cable operators have enormous incumbent advantages to win in the broadband era. But incumbency alone does not guarantee success. Instead, what wins the day now is staying in tune with and adapting to drastically changed consumer expectations, and then executing well, day after day. One look at the now gasping-for-breadth behemoth that was once proud General Motors hammers this point home all too well.

As Fred succinctly wrapped things up, "The reason I love capitalism is that it forces all of us to keep doing things better and better." To be sure, broadband and digital delivery are unleashing the most powerful capitalistic forces the video industry has yet seen. What impact these forces ultimately have on today's market participants is a question that only time will answer.

What do you think? Post a comment now!

Categories: Aggregators, Broadband ISPs, Cable Networks, Cable TV Operators, Indie Video

Topics: Amazon, CTAM, Google, Next New Networks, Scripps, SN Digital, Time Warner Cable, YouTube

-

Comcast: A Company Transformed

Three numbers in last week's third quarter Comcast earnings release underscored something I've believed for a while: Comcast is a company transformed, now reliant on business drivers that barely existed just ten short years ago. Comcast's transformation from a traditional, plain vanilla cable TV operator to a digital TV and broadband Internet access powerhouse is profound proof of how consumer behaviors' are changing and value is going to be created in the future.

The three numbers that caught my attention were the net additions of 382,000 broadband Internet subscribers and 417,000 digital subscribers, with the simultaneous net loss of 147,000 basic subscribers. The latter number is the largest basic sub loss the company has sustained and, based on the company's own earnings releases, the sixth straight quarter of basic sub contraction. In the pre-digital, pre-broadband days, when a key measure of cable operators' health was ever-expanding basic subscribers, this trend would have caused a DEFCON 1 situation at the company. (see graph below for 2 year performance of these three services)

That it doesn't any longer owes to the company's ability to bolster video services revenue and cash flow through ever-higher penetration of digital services into its remaining sub base (at the end of Q3 it stood at 69% or 16.8 million subs). Years after Comcast and other cable operators introduced "digital tiers," stocked with ever-more specialized channels that consumers resisted adopting, the industry has hit upon a winning formula for driving digital boxes into Americans' homes: layering on advanced services like HD, VOD and DVR that are only accessible with digital set top boxes and then bundling them with voice and broadband Internet service into "triple play" packages. Comcast has in effect gone "up-market," targeting consumers willing and able to afford a $100-$200/month bundle in order to enjoy the modern digital lifestyle.

Still, in a sense the new advanced video services represent just the latest in a continuum of improved video services. Far more impressive to me is the broadband growth that both Comcast and other cable operators have experienced. Comcast's approximately 15 million YE '08 broadband subscribers will generate almost $8 billion in annual revenue for Comcast, up dramatically from its modest days as part of @Home 10 years ago. (It's also worth noting the company now also provides phone service to over 6 million homes today vs. zero 10 years ago)

The cable industry as a whole will end 2008 with approximately 37 million broadband subs, again up from single digit millions 10 years ago. And note that the 387,000 net new broadband subs Comcast added in Q3 '08 compares with just 277,000 net broadband subs that the two largest telcos, AT&T and Verizon added in quarter, combined. As someone who was involved in the initial trials of broadband service at Continental Cablevision less than 15 years ago, observing this growth is nothing short of astounding.

While broadband's financial contribution to Comcast is unmistakable, its real impact on the company is more

keenly felt in its newfound importance in its customers' lives. Broadband Internet access has become a true utility for many, as essential in many homes as heat, water and electricity. A senior cable equipment executive told me recently that research done by cable companies themselves has shown that in broadband households, broadband service would be considered the last service to get cut back in these tough economic times. In these homes cable TV itself - long thought to be recession-resistant - would get cut ahead of broadband.

keenly felt in its newfound importance in its customers' lives. Broadband Internet access has become a true utility for many, as essential in many homes as heat, water and electricity. A senior cable equipment executive told me recently that research done by cable companies themselves has shown that in broadband households, broadband service would be considered the last service to get cut back in these tough economic times. In these homes cable TV itself - long thought to be recession-resistant - would get cut ahead of broadband.But Comcast and other cable operators must not rest on their laurels. Their next big challenge is to figure out how to take this massive base of broadband subs and start delivering profitable video services to it. If Comcast allows its broadband service to be turned into a dumb pipe, with "over the top," on demand video offerings from the likes of Hulu, YouTube, Neflix, Apple and others to ascend to dominance, that would be criminal. Not only would it devalue the broadband business, it would dampen interest in the company's advanced video services (VOD in particular) while making the company as a whole vulnerable in the coming era of alternative, high-quality wireless delivery.

Comcast is indeed a company transformed from what it was just 10 years ago. Technology, changing consumer behaviors and a little bit of "being in the right place at the right time" dumb luck have combined to allow Comcast to remake itself. Comcast itself must fully recognize these changes and aggressively build out Fancast and other initiatives to fully capitalize on its newfound opportunities.

What do you think? Post a comment now.

Categories: Aggregators, Broadband ISPs, Cable TV Operators, Telcos

Topics: Apple, AT&T, Comcast, Netflix, Verizon, Verizon, YouTube

-

October '08 VideoNuze Recap - 3 Key Themes

Welcome to November. October was a particularly crazy month with the unfolding financial crisis. Here are 3 key themes.

1. Financial crisis hurts all industries; broadband is no exception

In October the financial crisis was omnipresent. During the month I addressed its probable effects on the broadband industry here and here so I'm not going to spend much more time on it today. Suffice to say, for the foreseeable future, the key industry metrics are financing, staffing and customer spending. Conserving cash and getting to breakeven are paramount for all.

In particular, in "Thinking in Terms of a 'GOTI' Objective" I tried to provide some food for thought about why focus is so important right now. Industry CEOs' jobs have gotten a whole lot harder in the wake of the meltdown; those with the best strategic and financial skills will come through the storm, others will encounter significant challenges.

2. Broadband video is still in very early stages of development

I'm constantly trying to gauge just how developed the broadband video industry actually is. All kinds of indicators continue to suggest to me that we're still in the very early days. For example, in one post this month comparing iTunes and Hulu, it was evident that iTunes is currently far outpacing Hulu in TV episode-related revenues. Remember that Hulu is the undisputed premium ad-supported aggregator. And that the ad-supported business model itself is predicted by most to eventually be far larger than the paid model. That iTunes is so far ahead for now shows how young Hulu really is (in fact, just celebrating its first anniversary) and how much more development the ad-supported model still has ahead of it.

I think another relevant indicator of progress is how well the broadband medium is distinguishing itself from alternatives by capitalizing on its key strengths. In "Broadband Video Needs to Become More Engaging," I noted that while there have recently been positive signs of progress, overall, much of broadband's engagement potential is still untapped. That's why I'm always encouraged by compelling UGV contests like the one Fox and Metacafe unveiled this month or by technology like EveryZing's new MetaPlayer that drives more granular interactivity. To truly succeed, broadband must become more than just an online video-on-demand medium.

3. Cable operators are central to broadband video's development

As ISPs, cable operators account for the lion's share of broadband Internet access. Further, their ongoing efforts to increase bandwidth widens the universe of addressable homes for high-quality content delivery. Still, their multichannel subscription-based business model is increasingly threatened by broadband's on-demand, a la carte nature. As delivery quality escalates and consumer spending remains pinched, the notion of dropping cable in favor of online-only access become more alluring.

Yet in "Cutting the Cord on Cable: For Most of Us It's Not Happening Any Time Soon," I explained why restricted access to popular cable network programs and an inability to easily view broadband video on the TV will keep cable operators in a healthy position for some time to come. Still, it's a confusing landscape; this month I noticed Time Warner Cable itself helped foster cable bypass, when in the midst of its retransmission standoff with LIN TV, it offered an instructive video for how to watch most broadcast network programming online. Comcast also got into the act, unveiling "Premiere Week" on its Fancast portal. These kinds of initiatives remind consumers there's a lot of good stuff available for free online; all you need is a broadband connection.

Lots more to come in November, stay tuned.

Categories: Broadband ISPs, Broadcasters, Cable Networks, Cable TV Operators, Technology, UGC

Topics: Comcast, EveryZing, FOX, Hulu, iTunes, LIN TV, MetaCafe, Time Warner Cable

-

Debunking the Paranoia Around Comcast's ISP Policies

While much of the world was on vacation last week, yet another Comcast-related fracas broke out in the blogosphere, this time over the company's latest update to its broadband internet access policies. While this latest flap cements Comcast's status as the favorite target of those who put a totally unfettered Internet on a par with life, liberty and the pursuit of happiness, my immediate reaction was more "what's the big deal?"

The latest fracas centers on a seemingly innocuous, yet possibly longer-term significant change in

Comcast's "Acceptable Use Policy" which governs how much use you can get out of your Comcast High-Speed Internet service each month. In the past there was no theoretical limit, though Comcast says it always had on eye on its heaviest users (under 1% of its total base of 14 million) who would be contacted when an undisclosed threshold was reached. Last Thursday, Comcast posted a change in its AUP stating that starting October 1st, the usage cap would be 250GB/mo.

Comcast's "Acceptable Use Policy" which governs how much use you can get out of your Comcast High-Speed Internet service each month. In the past there was no theoretical limit, though Comcast says it always had on eye on its heaviest users (under 1% of its total base of 14 million) who would be contacted when an undisclosed threshold was reached. Last Thursday, Comcast posted a change in its AUP stating that starting October 1st, the usage cap would be 250GB/mo.The blogosphere's reaction was immediate and sometimes raucously over-the-top (one well-known blogger pronounced the change "the end of the Internet as we know it"). While Comcast tried to translate the 250GB cap into say, how many emails a user could send each month (50 million) or songs that could be downloaded (62,500), others began furiously crunching the numbers to see more extreme scenarios, like how many HD movies/mo you'd be able to download.

For my part, I believe that Comcast's new cap - like much of the swirl surrounding its recent BitTorrent throttling - is much ado about nothing, at least for now. Where others see a raging fire threatening to burn down the Internet, I barely see signs of smoke just yet.

Yesterday I peppered Comcast spokesman Charlie Douglas with questions about the cap. While I had to ask several times whether it is intended to stifle broadband video consumption in any way (a favorite conspiracist belief), Charlie finally did provide an emphatic "no." He cited Comcast's own Fancast broadband portal as a key company priority, which itself would be harmed by any sort of broadband crackdown.

For sure some of you are thinking, "yeah but Will, he's their PR guy, what do you expect him to say?! Why do you believe him?!"

Fair questions. But contrary to the end-of-the-world crowd, I don't think Comcast has any sinister hidden motives with the cap, or with its network management policies. I do however think that Comcast does not take enough care in determining its policies or communicating them to its broadband users and other constituencies. Combined, these feed the distrust and dislike of Comcast that seems to be pervasive.

Even in my conversation with Charlie yesterday I found myself having several "huh?" moments that seem to strain credulity. For example:

Q: Why set a cap and especially one that's so high that it has little practical effect? A: Well, our customer feedback told us we needed to have a cap.

Q: How was the cap size determined? A: We thought it was a generous amount. Q: But the specific size? A: We thought it was a generous amount.

Q: Why release news of the cap in the last week of the summer (when many are on vacation and not paying attention) and in the midst of the ongoing FCC network management issue, instead of rolling out a comprehensive new plan that could be messaged accordingly? A: The cap and the FCC network management have nothing to do with each other, they are separate issues. Q: But in the media's coverage and public's perception, they are all considered part of the same picture. A: The cap and the FCC network management have nothing to do with each other, they are separate issues.

Q: Now that there's a formal cap, how about providing a simple tool so users can monitor their monthly usage, like cell phone companies do? A: Heavy users know how to find these tools; someone just told me last week that a Google search for "bandwidth meter" yields 290,000 hits. Q: Yes, but how about just offering a tool as a "good neighbor" gesture that your customers would appreciate? A: The cap is irrelevant to 99% of our users.

No doubt you'll find these answers as confounding as I do. All I can conclude is that 10+ years into the broadband game, Comcast still hasn't recognized how vital its broadband service is to its users nor how it has become part of a far-larger tableau including freedom of speech, the economy and American competitiveness. Comcast's seeming tone-deafness to all of this was fully evident in its continuously revised responses to the FCC's BitTorrent inquiry earlier this year.

This explanation will strike many as too generous and trusting. However, until I see real evidence of perniciousness on Comcast's part, to think anything else just feels like paranoia to me.

What do you think? Post a comment now.

Categories: Broadband ISPs

Topics: Comcast, FCC, Net Neutrality

-

The FCC's Comcast Sanction: More Problems, Fewer Solutions Ahead

In case you missed it, last Friday the FCC took the unprecedented step of sanctioning Comcast for what it considered unreasonable network management policies. Before you deem this "inside-the-beltway" bureaucratic wrangling and click away to your next piece of business, I suggest you take a moment to consider the broad-reaching implications of the FCC's action, and how they will undoubtedly affect you and your video business long-term.

(If you'd really like to dig in, the FCC commissioners' opinions are here)

There has been a lot written about what precipitated the FCC's action, so I won't restate all the gory details here. Very briefly, last Fall formal complaints were filed with the FCC alleging that Comcast treated certain of its broadband subscribers' use of BitTorrent, a peer-to-peer (P2P) application, in a discriminatory manner vis-a-vis other network traffic.