-

Another Update from the Front Lines of the Syndicated Video Economy

Having staked out the idea of the "Syndicated Video Economy" as a key driver of the broadband video landscape about 6 months ago, I'm continually looking for insights from those companies operating on its front lines. How is it evolving? What are the key challenges and opportunities? How are they being addressed?

I got more feedback yesterday, moderating a session at the Contentonomics conference in LA. On it were:

- Gary Baker, Founder and CEO, ClipBlast

- Jimmy Hutcheson, President, EgoTV

- Damon Berger, Senior Director of Programming & Business Development, Revision3

- Danny Wright, Senior Director, Business Development, Photobucket

Here are a few takeaways I scribbled down during the session:

Revenue issues persist - Jimmy was quick to note that while he's an optimist about syndication, EgoTV's current deals have yet to produce a lot of revenue. I pressed him on the reasons: lack of distributor promotion/traffic, their inability to monetize traffic, both or neither? Jimmy's response was that with so much video flowing through key distributors, gaining solid promotion is a real challenge. A bigger issue is distributors' ability to monetize the traffic they're generating. I've heard this from others as well. This could suggest a continued shift to content providers owning/selling their ad inventory, with distributors focusing mainly on promotion/traffic, and receiving a revenue share for their efforts.

Friction in executing syndication - Though Damon highlighted that Revision3 has 40 distribution partners, that's definitely the exception, not the norm these days; a recurrent SVE theme the panel discussed is the overhead involved in identifying partners, negotiating deals, implementing them, collecting performance stats and doing follow-up analysis. There are no easy answers here. As I've written in the past, some of this just gets resolved as the ecosystem of companies matures.

Brand building takes on greater importance in syndication - There was some consensus on the panel that with content be viewing through multiple outlets, a clear challenge is building a consistent and differentiated brand. The importance of a content provider's own web site magnifies in the SVE. Even though a lot of viewership may occur elsewhere, it's still the best opportunity to control and define the brand for viewers. Further, even if substantial revenues don't materialize from syndication, these deals are still viewed as solid brand-building.

Push to programming quality - As broadband video proliferates, getting noticed is harder than ever. As a result there's a real push to quality video that's underway. In part this involves pulling more high-quality talent into broadband originals. The quality bar is getting ever higher for broadband video especially as better-know talent adopts the medium. Distributors will be in a stronger position to choose which video to include and promote.

That's it for now. I'll keep providing regular updates on the SVE as I gather more information from those fully immersed in it.

What do you think? Post a comment.

(Note: tomorrow's a rare day off for VideoNuze as I observe Yom Kippur)

Categories: Syndicated Video Economy

Topics: ClipBlast, EgoTV, Photobucket, Revision3

-

Time Warner Cable Fostering Cable Bypass in LIN TV Retransmission Dispute?

The latest battle over "retransmission consent" is now underway between Time Warner Cable and LIN TV. These fights crop up periodically, but what's different about this one is that TW is offering instructions to its customers for how to hook their PCs to their TVs so they can view LIN's prime-time programming from the applicable network affiliate's web site.

Time Warner has set up instructional sites, such as http://www.tellthetruthwluk.com/main.phpfor residents of the Green Bay, WI area affected by the outage. Prominently displayed at the site is a 3 minute video with the step-by-step instructions for connecting a PC to a TV. (As a sidenote, the video itself is a great example of a how-to broadband video, but I'd bet that it makes the process look far easier than it is likely to be for most average consumers).

But the all-too-obvious question that I raise: once TW customers get the hookup working, how long will it take them to realize that by bypassing TW's service, some cable network programming can now also be viewed this way, and for free? TW may be inadvertently helping its own customers realize that the $40-$60/month or so they're paying TW may be avoidable.

To my knowledge, this is the first time in these regular retrans flareups involving broadcasters and cable

operators (mostly) that broadband has been injected into the mix. In these situations the warring companies usually focus on tactics like LIN offering a $50 credit to consumers to sign up for DISH satellite service or Time Warner handing out over 50,000 free antennas to its customers to receive LIN stations the pre-cable TV, over-the-air way.

operators (mostly) that broadband has been injected into the mix. In these situations the warring companies usually focus on tactics like LIN offering a $50 credit to consumers to sign up for DISH satellite service or Time Warner handing out over 50,000 free antennas to its customers to receive LIN stations the pre-cable TV, over-the-air way.But now, with broadband access to prime-time network programs rampant, cable operators have a new tactic to buttress their argument that these broadcast programs are available for free already, so they - and in turn the consumer - should not have to pay for them.

This situation underscores what I've been saying for a while: that broadcast networks' and local affiliates' strategic agendas are falling out of line, as the networks have embraced online delivery wholeheartedly and local stations are left without their historical de facto exclusivity to key prime-time programs.

Of course the root issue here is that local broadcasting is a business built on analog-determined geographic markets. With the advent of digital delivery over the Internet, the networks have increasingly realized that they can go direct to their target audiences. Sometimes they've been friendlier to their local affiliates by giving them some branding or cutting them in on the ad revenues. Yet long-term, the schism between networks and local affiliates seems inevitable. That means that these retransmission fights are bound to only get nastier in the future.

(Note: I'll have Peter Stern, Time Warner Cable's EVP of Product and Strategy on my Nov. 10th Broadband Video Leadership Panel in Boston, "How to Profit from Broadband Video's Disruptive Impact." Click here for early bird registration and information.)

What do you think? Post a comment now.

Categories: Broadcasters, Cable TV Operators

Topics: LIN TV, Time Warner Cable

-

Hulu to Stream Tonight's Presidential Debate; Reaction to NYTimes.com Coverage?

There are reports today that Hulu intends to stream tonight's second presidential debate along with the third debate planned for Oct. 15th. VideoNuze readers will recall that I observed two weeks ago that NYTimes.com

streamed the first debate on its home page. I regarded this as a noteworthy incursion of a print publisher onto broadcast/cable's traditional turf and asserted that the debates give the NYTimes a plum opportunity to use video to expand its audience appeal and ad revenue potential.

streamed the first debate on its home page. I regarded this as a noteworthy incursion of a print publisher onto broadcast/cable's traditional turf and asserted that the debates give the NYTimes a plum opportunity to use video to expand its audience appeal and ad revenue potential. Cause and effect that Hulu, backed by two broadcasters Fox and NBC, is now planning to stream the remaining debates? Hard to say. But no question, if Hulu hadn't done this, it would have been leaving the door open, again, for NYTimes to be a prime destination for live streaming of the debate. For broadcasters fighting for every eyeball out there, that would have been a mistake. More evidence of how broadband is creating competition between previously disparate media worlds.

Categories: Aggregators, Newspapers, Politics

Topics: FOX, Hulu, NBC, NYTimes.com

-

5 Conclusions About the Bad Economy's Effect on Broadband Video

If you're like me - and millions of other Americans - this past weekend likely found you involved in conversations with family or friends about the dismal state of the U.S. economy and where things go from here.

Of course nobody really knows. I've been spending time trying to get my head around what the economy's implications are for the broadband video industry. I've sought out reactions from industry colleagues, read up on what the "experts" say about a typical down economy's impact and considered my own past experiences. I concede my conclusions are anything but rock solid, but here they are for your consideration:

Broadband access is a now a utility, so addressable video universe remains strong - I was heartened by a new study out last week from Jupiter finding that only 2% of survey respondents would cut off their Internet service to reduce expenses in tough times. That affirms two assumptions I've held since helping launch broadband Internet access service for Continental Cablevision back in the mid-90's: once you're online, you're not going to go offline, and once you're on broadband, you're not going back to dialup. A stable universe of broadband homes means plenty of people to target broadband video to.

Free video beats paid video - With experts suggesting consumer spending is going off a cliff, the free, ad-supported video model becomes even more attractive. Some will counter that advertising spending always contracts in tough times, so relying on ads is no sanctuary. True enough, but my sense is that in this downturn, with the cost of so many essential goods (food, gas, health care, etc.) going up, any ad spending downturn may seem modest compared to the downturn in consumer discretionary spending. Another X factor: if you're paying $45-60/month for broadband Internet access, the more you use it, especially for high-quality experiences, the better value it is.

Advertising on broadband video is less affected than in other media sectors - I heard a widely respected industry analyst say last week that broadband ads will get hammered in this downturn, because most broadband spending is still experimental, and these budgets get eliminated first in a downturn. Yet video ad network executives I've spoken to say that while it's still early days for broadband spending, for many we're beyond experimentation. Plus several other fundamentals suggest broadband ads could hold up decently well: tight inventory for premium video, continued audience shifting to online viewing, better targeting and interactivity, relatively small total broadband spending, etc.

Tough holiday season for broadband devices - I see a tough holiday season coming for all discretionary broadband devices meant to bridge broadband to the TV or enable portable viewing. While they may be cool, for all but the least economically-impacted consumers these devices will fail the "Honey, do we really need this now?" test. That means we're likely to see some shaking out in the broadband device space post-Christmas.

Early stage/indie broadband video providers tighten their belts a bit - While major media companies have existing revenues to support their online initiatives, broadband-only players don't have this luxury. I see early stage/indie providers becoming extra judicious in their spending, likely cutting back on their production plans until the ad climate clears up.

That's all that I have for now. The good news is that broadband video's fundamentals are extremely strong. For all of us in the industry, be thankful you're not in autos, home construction, finance, retail or other hard-hit sectors. Still, there are difficult times ahead for everyone, no question about it. Try to remember the old saying: "what doesn't kill you makes you stronger.'

What do you think? Post a comment now.

Categories: Advertising, Devices, Indie Video

Topics: Jupiter Research

-

Inside the Netflix-Starz Play Licensing Deal

This past Wednesday, Starz, the Liberty Media-owned premium cable network, licensed its "Starz Play" broadband service to Netflix. The three year deal makes all of Starz's 2,500 movies, TV shows and concerts available to Netflix subscribers using its Watch Instantly streaming video feature. Very coincidentally I happened to be at Starz yesterday for an unrelated Liberty meeting, and had a chance to speak to Starz CEO Bob Clasen, who I've known for a while, to learn more.

On the surface the deal is an eye-opener as it gives a non-cable/telco/satellite operator access to Starz's

trove of prime content. As I've written in the past, cable channels, which rely on their traditional distributors for monthly service fees, have been super-sensitive to not antagonizing their best customers when trying to take advantage of new distribution platforms. This deal, which uses broadband-only distribution to reach into the home, no doubt triggers "over-the-top" or "cable bypass" alarm bells with incumbent distributors.

trove of prime content. As I've written in the past, cable channels, which rely on their traditional distributors for monthly service fees, have been super-sensitive to not antagonizing their best customers when trying to take advantage of new distribution platforms. This deal, which uses broadband-only distribution to reach into the home, no doubt triggers "over-the-top" or "cable bypass" alarm bells with incumbent distributors. Then there is the value-add/no extra cost nature of Netflix's Watch Instantly feature. That there is no extra charge to subscribers for Starz's premium content (as there typically is when subscribing to Starz through cable for example) raises the question of whether Starz might have given better pricing to Netflix to get this deal done than it has to its other distributors.

But Bob is quick to point out that in reality, the Netflix deal is a continuation of Starz's ongoing push into broadband delivery begun several years ago with its original RealNetworks deal and continued recently with Vongo. To Starz, Netflix is another "affiliate" or distributor, which, given its tiny current online footprint does not pose meaningful competition to incumbent distributors. With only about 17 million out of a total 100 million+ U.S. homes subscribing to Starz, broadband partnerships are seen as a sizable growth opportunity by the company.

Further, Starz has been aggressively pitching online deals to cable operators and telcos for a while now, though only the latter has bit so far (Verizon's FiOS is an announced customer). Cable operators seem interested in the online rights, but have been reluctant to pay extra for them as Starz requires.

Bob also noted that Starz's wholesale pricing was protected in its Netflix deal, and that for obvious reasons of not hurting its own profitability, Starz has strong incentives to preserve incumbent deal terms in all of its new platform deals.

To me, all of this adds up to at least a few things. First is that Netflix must be paying up in a big way to

license Starz Play. I assume this is an obvious recognition by Netflix that it needed more content to make Watch Instantly more compelling (see also Netflix's recent Disney Channel and CBS deals). Since it's not charging subscribers extra, Netflix is making a bet that over time - and aided by its Roku and other broadband-to-the-TV devices - Watch Instantly will succeed and as a result, will drive down its costs by reducing the number of DVDs the company needs to buy and ship. That seems like a smart long-term bet as the broadband era unfolds.

license Starz Play. I assume this is an obvious recognition by Netflix that it needed more content to make Watch Instantly more compelling (see also Netflix's recent Disney Channel and CBS deals). Since it's not charging subscribers extra, Netflix is making a bet that over time - and aided by its Roku and other broadband-to-the-TV devices - Watch Instantly will succeed and as a result, will drive down its costs by reducing the number of DVDs the company needs to buy and ship. That seems like a smart long-term bet as the broadband era unfolds.And while I agree that Starz Play on Netflix doesn't represent real competition to cable, telco and satellite outlets today, it's hard not to see it as a signal that traditional distributors are losing their hegemony in premium video distribution. (for another example of this, see Comedy Central's licensing of Daily Show and Colbert to Hulu). As I've said for a while, over the long term, the inevitability of broadband all the way to the TV portends significant disruption to current distribution models. I see Netflix at the forefront of this disruptive process.

What do you think? Post a comment now.

Categories: Aggregators, Cable Networks, Cable TV Operators, Devices, Telcos

Topics: CBS, Comedy Central, Disney, Liberty Media, Netflix, Starz, Verizon

-

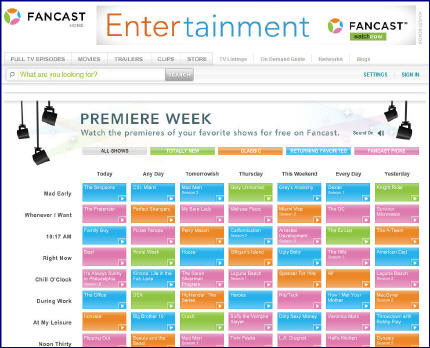

Comcast's Fancast Becomes Hub for Premieres; But Where's Project Infinity?

Here's a clever move from Comcast's Fancast broadband portal to create new value for users and generate excitement in the broadband market: this week it is running "Premiere Week," an aggregation of 168 premiere TV episodes. The episodes span series premieres ("Desperate Housewives," "Dexter," "The Office"), season premieres ("Fringe," "Sons of Anarchy," "Crash") and classic pilots ("Dynasty," "The A-Team," "Miami Vice"). It's great fun and a visitor could get lost on the site for hours, as I nearly did.

These are the kinds of promotions that Comcast should be all over. Given its extensive reach and programming muscle, the company has definite - though not insurmountable - advantages over other aggregators to pull this kind of promotion together.

The competition for aggregating premium programming continues to intensify. Business models are all over the board as are approaches for getting video all the way to the TV. For example, last week Amazon launched its pay-per-use VOD initiative which includes a page of info for how to watch using TiVo, Sony Bravia Internet Video Link, Xbox 360, etc. Then yesterday, Netflix announced that it will incorporate about 2,500 of Starz's movies, TV shows and concerts in its Watch Instantly feature, along with a feed of its linear channel. Still other moves are forthcoming.

Comcast's real lever though is unifying its currently siloed worlds of digital TV, broadband Internet access and Fancast. When converged they're a blockbuster; companies like Netflix, Amazon and others cannot replicate this combination. In particular, Comcast, and other cable operators are ideally positioned to bridge broadband all the way to the TV. That's the last big hurdle to unlock broadband's ultimate value. Whether they'll do so is an open question.

Earlier this year Comcast CEO Brian Roberts unveiled the company's "Project Infinity" which suggested Comcast was looking to unify its various video offerings and bring broadband to its subscribers' TV. It seemed like a promising move, though there was no timeline disclosed. Now, nearly 9 months later I can't find any updates on the status of Project Infinity. It would be great for the company to publicly release a progress report or sense of upcoming milestones.

Promotions like "Premiere Week" are a positive step from Comcast, but real competitive advantage for the company lies in launching services which are truly impossible for others to match.

What do you think? Post a comment.

Categories: Aggregators, Cable TV Operators, Portals

Topics: Amazon, Comcast, Fancast, Netflix, Starz, TiVo

-

September '08 VideoNuze Recap - 3 Key Themes

Welcome to October. Recapping another busy month, here are 3 key themes from September:

1. When established video providers use broadband, it must be to create new value

Broadband simultaneously threatens incumbent video businesses, while also opening up new opportunities. It's crucial that incumbents moving into broadband do so carefully and in ways that create distinct new value. However, in September I wrote several posts highlighting instances where broadband may either be hurting existing video franchises, or adding little new value.

Despite my admiration for Hulu, in these 2 posts, here and here, I questioned its current advertising implementations and asserted that these policies are hurting parent company NBC's on-air ad business. Worse yet, In "CNN is Undermining Its Own Advertisers with New AC360 Live Webcasts" I found an example where a network is using broadband to directly draw eyeballs away from its own on-air advertising. Lastly in "Palin Interview: ABC News Misses Many Broadband Opportunities" I described how the premier interview of the political season produced little more than an online VOD episode for ABC, leaving lots of new potential value untapped.

Meanwhile new entrants are innovating furiously, attempting to invade incumbents' turf. Earlier this week in "Presidential Debate Video on NYTimes.com is Classic Broadband Disruption," I explained how the Times's debate coverage positions it to steal prime audiences from the networks. And at the beginning of this month in "Taste of Home Forges New Model for Magazine Video," I outlined how a plucky UGC-oriented magazine is using new technology to elbow its way into space dominated by larger incumbents.

New entrants are using broadband to target incumbents' audiences; these companies need to bring A-game thinking to their broadband initiatives.

2. Purpose-driven user-generated video is YouTube 2.0

In September I further advanced a concept I've been developing for some time: that "purpose-driven" user-generated video can generate real business value. I think of these as YouTube 2.0 businesses. Exhibit A was a company called Unigo that's trying to disrupt the college guidebook industry through student-submitted video, photos and comments. While still early, I envision more purpose-driven UGV startups cropping up in the near future.

Meanwhile, brand marketers are also tapping the UGV phenomenon with ongoing contests. This trend marked a new milestone with Doritos new Super Bowl ad contest, which I explained in "Doritos Ups UGV Ante with $1 Million Price for Top-Rated 2009 Super Bowl Ad." There I also cataloged about 15 brand-sponsored UGV contests I've found in the last year. This is a growing trend and I expect much more to come.

3. Syndication is all around us

Just in case you weren't sick of hearing me talk about syndication, I'll make one more mention of it before September closes out. Syndication is the uber-trend of the broadband video market, and several announcements underscored its growing importance.

For example, in "Google Content Network Has Lots of Potential, Implications" I described how well-positioned Google is in syndication, as it ties AdSense to YouTube with its new Seth MacFarlane "Cavalcade of Cartoon Comedy" partnership. The month also marked the first syndication-driven merger, between Anystream and Voxant, a combination that threatens to upend the competitive dynamics in the broadband video platform space. Two other syndication milestones of note were AP's deal with thePlatform to power its 2,000+ private syndication network, and MTV's comprehensive deal with Visible Measure to track and analyze its 350+ sites' video efforts.

I know I'm a broken record on this, but regardless of what part of the market you're playing in, if you're not developing a syndication plan, you're going to be out of step in the very near future.

That's it for September, lots more planned in October. Stay tuned.

What do you think? Post a comment!

Categories: Aggregators, Analytics, Brand Marketing, Broadcasters, Magazines, Partnerships, Syndicated Video Economy, UGC

Topics: ABC, Anystream, AP, CNN, Doritos, Google, Hulu, MTV, NY Times, Taste of Home, thePlatform, Unigo, Visible Measu, Voxant, YouTube

-

Key Takeaways from Yesterday's MTV - Visible Measures Deal

Yesterday brought news that MTV Networks has signed a deal with Visible Measures, a third-party analytics firm, to measure broadband video activity across over 340 of its sites. This is by far the biggest deal that Visible Measures has landed to date. And in the torrent of broadband deals and partnerships that hit my inbox each day, I believe this one is noteworthy for 3 reasons:

1. More evidence of syndication's growing importance to major media companies

A number of recent announcements have underscored the broadband market's shift to the "syndicated

video economy," but this move by MTV demonstrates how the SVE concept is starting to infiltrate major media companies' thinking. To date many of these companies have taken a somewhat informal approach to syndication, giving users embed code or passing clips on to YouTube for promotion, but not diligently measuring the activity or benefits.

video economy," but this move by MTV demonstrates how the SVE concept is starting to infiltrate major media companies' thinking. To date many of these companies have taken a somewhat informal approach to syndication, giving users embed code or passing clips on to YouTube for promotion, but not diligently measuring the activity or benefits. MTV's deal shows serious intent to measure its syndication activity and use the resulting data to help shape its broadband video efforts. As a leader in broadband video, MTV's Visible Measures deal is certain to prompt other major media companies to up their commitment to syndication as well. This would synch with a comment a CEO of a broadband technology vendor told me yesterday: "...every content company we deal with has now prioritized syndication and they are actively addressing the technical, business and political issues."

2. Programming business changing to be more data-centric

You can be sure that when armed with a trove of new Visible Measures-generated data about how its users watch and engage with its video, MTV's programming decisions will be influenced accordingly. As I wrote in my initial post about Visible Measures last June, that's one of the beauties of broadband consumption vs. TV - all user behavior can be tracked and assessed. By knowing - down to the frame - things like when viewers dropped out, what scenes they rewound/viewed repeatedly and what clips they most shared, MTV's programming decisions should become ever smarter.

Stalwart creatives may decry this research-intensive approach to program development, but in media businesses challenged to reduce costs and increase profitability, anything that helps predict what users will watch (and therefore help drive a higher ROI per program) is invaluable. This is especially true for TV networks trying to rationalize the pilot process. Gauging real-life user reactions to various videos online can only make the pilot process more effective.

Stalwart creatives may decry this research-intensive approach to program development, but in media businesses challenged to reduce costs and increase profitability, anything that helps predict what users will watch (and therefore help drive a higher ROI per program) is invaluable. This is especially true for TV networks trying to rationalize the pilot process. Gauging real-life user reactions to various videos online can only make the pilot process more effective.3. Ad model becomes even more important, and more refined

Though there's wide consensus that advertising will drive the broadband business for the foreseeable future, there is acute anxiety about how advertising will ultimately work (formats, insertion frequency, etc.) and how much revenue it will produce. While there's been plenty of testing to date, there's also been much guesswork involved. MTV for one will now have a bird's-eye view into its users' reactions to various ad implementations so it can continually refine its approach.

Optimizing the broadband ad model is a key issue for all players in the market. Recently I asserted that Hulu is leaving a lot of money on the table with its current ad approach, and is also pressuring parent company NBC's own ad business. I suggested Hulu could insert more ads, but without hard data, it's impossible to say how much more. Here's another example: all those viral SNL clips of Tina Fey doing Sarah Palin could mean real money for NBC, yet without proper tracking and ad implementations their real value is being underoptimized. The list of examples goes on. More data on video usage can really help the ad model.

In sum, MTV's deal with Visible Measures is both a positive step in the ongoing maturation of broadband video, syndication and advertising and a harbinger of more deals to come.

(Note: if you'd like to learn more about MTV's and others' syndication strategies, please join me for a panel I'll be moderating next Tuesday, October 7th at Contentonomics in LA. Joining me are MTV's Greg Clayman, Revision3's Damon Berger, ClipBlast's Gary Baker and EgoTV's Jimmy Hutcheson. Information and registration is here.)

What do you think? Post a comment.Categories: Analytics, Cable Networks

Topics: MTV, Visible Measures