-

Early Bird Seating Available for VideoNuze's Broadband Leadership Breakfast

A reminder that early bird seating is now available for VideoNuze's inaugural Broadband Video Leadership Breakfast Panel. The breakfast, in association with CTAM's New York and New England chapters, will be held in Boston on Nov. 10th at 7:30am, preceding the first full day of the annual CTAM Summit (separate registration).

I'll be moderating the session which is entitled "How to Profit from Broadband Video's Disruptive Impact" and features an A-list group of executives:

- Deanna Brown - President, SN Digital, Scripps Networks

- Bill Carr - Vice President, Digital Media, Amazon

- David Eun - Vice President, Content Partnerships, Google/YouTube

- Fred Seibert - Creative Director/Co-Founder, Next New Networks

- Peter Stern - Executive Vice President, Strategy and Product Management, Time Warner Cable

Click here to register for the early bird special

This unique event is a must attend for anyone navigating today's broadband video world. We'll examine key broadband topics like business models, syndication, user-generated video and consumer behavior changes. You'll come away with a clear sense of how these 5 companies are benefiting from broadband's growth, and what you too can do to profit from its disruptive impact.

The Leadership Breakfast is generously sponsored by ActiveVideo Networks, Akamai, Anystream, KickApps and Yahoo.

Click here to register for the early bird special

I hope to see you there!

Categories: Events

Topics: Broadband Video Leadership Breakfast

-

Presidential Debate Video on NYTimes.com is Classic Broadband Disruption

Here's a classic example of how broadband is causing traditionally distinct worlds to collide: on Friday night the NYTimes.com opened up a dedicated streaming video window on their home page, where the presidential debate played for the full hour and a half. I watched the first half of the debate there, before switching on the TV and watching it on CNN HD. While HD was obviously superior, the NYTimes.com's video was more than adequate (though disappointing there was no full screen option).

Saturday morning and NYTimes.com is offering the video on demand, with an accompanying full written transcript. You can search (try typing "wrong" to see), to get how many times each candidate used that term, and then jump to the points in the video when it was used (alas, it would be great if the Times gave the ability to clip that specific segment and virally distribute it). The Times does offer a "check point" feature, where it fact checks the candidate's assertions. Note that other sites like ABCNews.com and CNN.com have the debate on demand today as well, but not the interactive features that NYTimes.com has.

Stop and consider how significant all of this is - a print publisher using broadband to offer a clear alternative to broadcasters and cable networks in carrying high-quality video. It's a great value proposition just for people without access to TVs at the moment of the live event, but more important, it provides a glimpse of some very interesting additional opportunities for NYTimes.com.

For example, the site could host its own post-debate punditry show, assembling its all-star lineup of daily Times columnists. Dedicated Times readers would no doubt love to see a roundtable with Frank Rich, Tom Friedman, William Kristol, Maureen Dowd and others dissect the candidates' performances, rather than waiting for their thoughts to come in columns over the next several days. Also think about how this type of show would scoop Sunday talk shows like NBC's "Meet the Press" or ABC's "This Week with George S." in bringing serious punditry to political junkies who can't wait.

In fact, the NYTimes.com could even offer viewers the ability to interact with their columnists, building on the wildly popular commenting feature already available with each daily piece in the paper itself. This type of immediacy and interactivity would be very compelling. The site could also offer the live debate video stream with a companion chat area that would enable viewer engagement during the debate itself (see Paltalk for an example of how this could work).

And last but not least, NYTimes.com could offer a single premium sponsorship slot to underwrite its whole debate coverage. Think Mercedes, Four Seasons, Cartier or other upscale brands might be interested?

As I've said many times, broadband blurs previously siloed worlds, bringing more competition to traditional players like broadcast and cable networks. They now need to deliver more to stay competitive. For video entrants like NYTimes, broadband creates enormous new opportunities to both leverage core assets/talent and pioneer new and different ways to create value. Another reminder why broadband is so disruptive for so many.

What do you think? Post a comment.

Categories: Broadcasters, Cable Networks, Newspapers, Politics

Topics: ABC News, CNN, NYTimes.com, Paltalk

-

Truveo Helps Clear Video Search Fog with New Study

A couple of days ago, Truveo, the big video search engine owned by AOL, released the results of an internal study which concluded that it provides the most comprehensive search results among 5 companies considered. Before you say, "Duh, Will, what else would you have expected Truveo to conclude?!" it's worth spending a few minutes considering the study's methodology, results and implications. Video search is an extremely strategic space, so all credible data has value.

When it comes to search, there are really two key criteria to judge quality - coverage and relevancy. A search engine can return a million results, but if none are relevant, it's pointless. Conversely, just one spot-on result and you'll rejoice, but you still may yearn for additional, relevant options (since video quality can vary, links may be broken, the user experience at certain sites may stink, etc.). So optimizing both coverage and relevancy must be the goal.

In Truveo's study, it has focused solely on coverage, having deemed relevancy too subjective to credibly

measure. To quantify coverage from a competitive standpoint, it chose 4 other search engines, Blinkx, Microsoft Live Video Search, Google Video and Yahoo Video. This limited pool immediately begs the question how the many other video search companies not included would have fared. Truveo explained that the testing was very resource-intensive, so they needed to keep the competitive set relatively small.

measure. To quantify coverage from a competitive standpoint, it chose 4 other search engines, Blinkx, Microsoft Live Video Search, Google Video and Yahoo Video. This limited pool immediately begs the question how the many other video search companies not included would have fared. Truveo explained that the testing was very resource-intensive, so they needed to keep the competitive set relatively small.To measure coverage, Truveo selected 100 top-ranked Alexa sites across 5 categories: news, sports, TV, music and movies. Then they found 10 representative videos from each and ran a query for those videos - using the exact title the site used - on each of the 5 search engines. Scoring was binary - a search engine got a 1 if they returned an accurate result for at least 5 of the 10 queries, a zero if they didn't. Final score from this process, Truveo 86, Blinkx 20, Microsoft Live Video Search 17, Google Video 3, and Yahoo 2.

Having reviewed the test's full methodology and spoken to a Truveo representative, I think for the most part their approach is pretty fair. An obvious limitation is that lots of video search engines (or web search engines like Google) weren't evaluated so the study is by no means conclusive. Further, only premium sites were included (i.e. no UGC, and actually very little indie video either), so one wonders how the results would have changed if sites like Break.com, Heavy and others were also tested. And then there's the small matter of YouTube, the market's 800 pound gorilla, not being included at all. Since for many users video search begins and ends with YouTube, its omission raises a question about just how reflective these results are of real-world user behavior.

Nonetheless, Truveo gets points in my book for shedding further light on a very confusing subject, and also constructing a relatively objective methodology that can be used by others (in fact Truveo is encouraging independent 3rd parties to undertake more testing of this kind).

Video search is one of the most intellectually challenging areas of the broadband video ecosystem, yet as Truveo asserts, there is surprisingly little evaluative data out there. From my standpoint, more data means more informed market participants and therefore continually improving user experiences. That benefits everyone in the broadband ecosystem.

What do you think? Post a comment now.

(Note, the complete methodology can be requested by emailing Josh Weinberg at jweinbergATtruveo.com)

Categories: Video Search

Topics: Blinkx, Google Video, Microsoft Live Video Search, Truveo, Yahoo Video, YouTube

-

Doritos Up UGV Ante with $1 Million Prize for Top-Rated 2009 Super Bowl Ad

The frenzy around user-generated video ads hit a new peak yesterday as Frito-Lay announced it is offering a $1 million prize to an amateur who creates a Doritos ad that scores the highest rank in USA Today's Super Bowl Ad Meter.

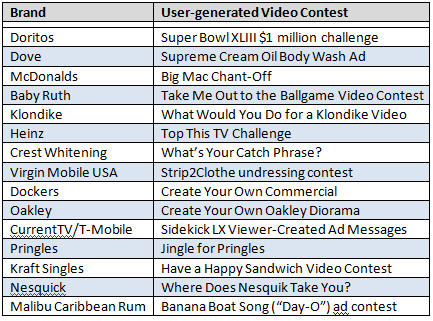

I believe the new campaign, which comes on top of 2 previously successful Super Bowl user-generated video ("UGV") ad contests from Doritos, is a sure-fire winner for the brand. It reflects some very smart thinking by Doritos' executives and will further accelerate the very significant trend around brand-sponsored UGV contests (see chart below for examples of UGV contests that have run in the past year). I've been writing about the UGV ad craze for a while now on VideoNuze and I see it driving continued evolution in brand-agency relations.

The new Doritos UGV campaign works for a variety of reasons. First and foremost, the top prize, and the four finalist prizes of $25,000 and a trip to the Super Bowl, are all very enticing awards, certain to drive tons of submissions. Winning the top prize - which requires the #1 rank in the USA Today Ad Meter - is a big-time challenge, but it is seriously aided by all the pre-game publicity this contest will be receiving. Doritos is cleverly stoking things by positioning the ad as an opportunity to "take down the big guys" - an obvious reference to Anheuser-Busch which has won the #1 rank for the last 10 years. With "Yes We Can" and "Yes We Will" political slogans ascendant, "power to the people" pitches like the one Doritos is making have a nice tailwind on their side.

This pre-game buzz means Super Bowl viewers are specifically going to be on the lookout for the Doritos UGV ad, helping its rank. Of course if you're an advertiser, especially in this ad-skipping era, viewer anticipation for your ad is close to nirvana as it gets. It builds brand awareness, engagement and presumably sales...3 big wins when you're spending an estimated $3 million for a 30 second Super Bowl ad. And of course, just think about all the free market research Doritos is collecting along the way, as loyal buyers showcase their thoughts and feelings about the product and brand.

In fact, it's Doritos' decision to morph a conventional Super Bowl ad buy into a broadband-centric, user-oriented campaign that's truly noteworthy here. VideoNuze readers know that I've been ranting for 3 straight Super Bowls that broadband opens up all kinds of new creative avenues for brands to extract new value from their game-day spending and generate a far-better ROI on the insane prices they're required to pay for this once a year extravaganza.

I have been appalled at how few Super Bowl advertisers have actually seized their broadband opportunities (note having ads playing in post-game online galleries is nice, but nowhere near what broadband is capable of). All of this has caused me to wonder whether agencies, and brands, were hopelessly oblivious to broadband's emerging role.

Doritos clearly is not among those trapped in yesterday's advertising thinking. It seems to get what broadband can do for its brand and its Super Bowl ad strategy. With its new UGV campaign, the ROI that Doritos will get on its actual game-day spend will far surpass those of its competitors. With luck that should help spur others to focus more on broadband in their future Super Bowl ads.

What do you think? Post a comment!

Categories: Brand Marketing, Sports, UGC

Topics: Anheuser-Busch, Doritos, Frito-Lay

-

Associated Press Ratchets Up Syndication Efforts with thePlatform

Another day, and another milestone reached in the market's ongoing embrace of video syndication.

Yesterday's significant news was that the Associated Press, which has built arguably the largest private broadband syndication network, including over 2,000 affiliates which receive thousands of video clips each month, has signed up thePlatform to power its Online Video Network. The deal effectively replaces Microsoft, which has been AP's partner for OVN for the past several years. AP uses OVN primarily to feed daily video clips to its newspaper and broadcast partner web sites which it monetizes through ads. Yesterday I caught up with Ian Blaine, thePlatform's CEO to learn more about the deal.

Ian explained that while the scale of AP's video syndication model is far more extensive than anything his company has supported in the past, thePlatform's ability to handle similar kinds of issues that AP faces was crucial in winning the deal. First and foremost is providing a workflow model that allows video assets to be ingested, encoded, tagged and distributed to the whole OVN in under 15 minutes. In the news business, obviously every second counts.

Beyond workflow efficiency, Ian explained that AP has a dizzying set of business rules that apply to its

syndicated video, depending upon the particular outlet. So AP producers also have to be able to expeditiously apply policies and track each video accordingly. AP is also enabling its affiliates to upload their own videos, which are melded with AP video in the affiliate's player. So that required some of thePlatform's tools to be extended to affiliates, along with some basic video player customization.

syndicated video, depending upon the particular outlet. So AP producers also have to be able to expeditiously apply policies and track each video accordingly. AP is also enabling its affiliates to upload their own videos, which are melded with AP video in the affiliate's player. So that required some of thePlatform's tools to be extended to affiliates, along with some basic video player customization.The obvious question here is whether and when AP will extend OVN to the thousands of sites beyond its 2,000 current affiliates. Like Google Content Network which has virtually infinite end points, or even Anystream-Voxant which has 30,000+ publishing partners, why should AP restrict itself, particularly when news video is one of the hottest categories around? While hesitating to speak for AP's roadmap, Ian's sense was that AP first wants to master syndication to its own affiliates before considering opening up a full-blown video marketplace.

As I've written previously, my enthusiasm for the Syndicated Video Economy is tempered by the reality that significant operational, financial and strategic friction still impedes the model. Coincidentally, late yesterday someone asked me:"How will this syndication friction be resolved and how long will it take?" My response: "I can't say how long it will take, but the more experience the broadband ecosystem gets with real-world syndication, the faster the model will mature." In this respect, partnerships between big content providers like AP and capable technology partners like thePlatform will help move the model forward for everyone.

What do you think? Click here to post a comment.

Categories: Syndicated Video Economy, Technology

Topics: Associated Press, thePlatform

-

Startup Unigo Harnesses "Purpose-Driven" User-Generated Video to Drive Disruption

I was absolutely riveted by an article I read in this past Sunday's NY Times Magazine entitled "The Tell-All Campus Tour," about Unigo, a tiny startup which threatens major disruption to the college guidebook industry. In particular, the company's emphasis on user (i.e. college student) generated video caught my attention. It got me thinking again about the business value that "purpose-driven" UGV has when it is properly channeled.

I've touched on this theme in the past, with respect to brand marketers' UGV contests that have unleashed all kinds of "amateur" creativity (see "Baby Ruth Hits a Home Run..." or "And the Oscar Goes To...Dove"). These contests have demonstrated that, with the proper incentives, users' passions and video know-how can lead to really compelling results. Now, upon reading about Unigo, I've become further convinced that there are bona fide startup opportunities in leveraging purpose-driven UGV.

To put this in context, YouTube struck gold by enabling, for the first time, random, and largely

unmonetizable, user generated video. Now a new generation of startups like Unigo can build on the YouTube phenomenon by focusing on purpose-driven UGV. To succeed, I think these companies will have 3 common elements: a reasonably large existing market that can be disrupted through the use of purpose-driven video (mixed with other web 2.0 features), a critical mass of amateur video creators who are self-motivated to produce high-quality, authentic video, and a group of advertisers eager to reach targeted audiences through new alternatives to traditional channels.

unmonetizable, user generated video. Now a new generation of startups like Unigo can build on the YouTube phenomenon by focusing on purpose-driven UGV. To succeed, I think these companies will have 3 common elements: a reasonably large existing market that can be disrupted through the use of purpose-driven video (mixed with other web 2.0 features), a critical mass of amateur video creators who are self-motivated to produce high-quality, authentic video, and a group of advertisers eager to reach targeted audiences through new alternatives to traditional channels. That's a mouthful, so let me use Unigo to break this down a bit. For starters, the company was founded by a precocious 23 year-old whose can-do energy and deep understanding of the college market is equally matched by his lack of real-world experience and formal company financing. All of that illustrates lesson #1 for purpose-driven UGV entrepreneurs: the barriers to creating these kinds of startups is shockingly low.

Somewhat buried in the 3,400+ word article is what resonated for me: Unigo bought a hundred Flip video cameras ($90 apiece at Amazon, fyi) and strategically distributed them to students at over 100 campuses nationwide, with no clear instructions on what to do next. The resulting student-created videos (which are continually submitted) span the gamut from slice-of-life to panoramic to comedic to everything in between. Unigo features text-based student submissions and photos, which, when combined with the videos, form an unvarnished - and unprecedented - user-generated multimedia guide to the America's campuses.

Simply put, Unigo is a product created by the YouTube/Facebook generation for the YouTube/Facebook generation. It offers a simple, breakthrough value proposition that will no doubt attract a large audience. And that large audience will be extremely interesting to all manner of advertisers.

Unigo's business value could make it a TripAdvisor-like, must have resource that initially augments, but could eventually squeeze traditional guidebooks and ratings services. While it is still way too early to call Unigo a success by any traditional standards, the work it has done to date offers a fascinating window into the emerging purpose-driven UGV-centric business model. That makes it well worth keeping an eye on.

What do you think? Click here to post a comment.

Topics: TripAdvisor, Unigo, YouTube

-

Anystream and Voxant Merge, Making Big Bet on Syndicated Video Economy's Future

This morning Anystream, a leading digital media management and production company and Voxant, a content syndication network, have announced their merger. The deal marks an important milestone: it's the first M&A transaction that I'm aware of which is predicated on the Syndicated Video Economy dominating the future broadband video landscape.

NewCo's combined capabilities are noteworthy on many levels, one of which is its potential to disrupt the

competitive dynamics of the video content management and publishing space by providing fundamental new value to content producers. There has been a lot of capital invested in this space, and by my recent count at least 18 companies are playing in or around it. With the broadband gold rush underway, there's been enough business to go around. Competition for new business has mainly focused on features and pricing/business models.

competitive dynamics of the video content management and publishing space by providing fundamental new value to content producers. There has been a lot of capital invested in this space, and by my recent count at least 18 companies are playing in or around it. With the broadband gold rush underway, there's been enough business to go around. Competition for new business has mainly focused on features and pricing/business models. Anystream has traditionally (and somewhat quietly) focused on digital media transcoding and workflow for more than 700 companies around the world. It too has moved up the stack into content management and publishing, lately handling the video management for NBC's Olympics on-demand distribution, and prior to that announcing deals with Hearst-Argyle Television and others. On the other hand, Voxant has been a mid/long tail syndicator, having built out a distribution network with 30,000 publishers gaining rights-cleared content from 400+ providers. These publishers generate 35 million video views per month, making the Voxant network #15 in video views according to comScore.

NewCo's belief is that the bilateral syndication deals we've seen to date (e.g. CBS-Yahoo, ESPN-AOL, Next New Networks - Hulu, among many others) has whetted the market's appetite for this emerging business model, but that there is still far too much friction for syndication to really take off. That fits with what I hear from even the most aggressive content syndicators, one of whose CTOs said on a recent panel I moderated that his company is overwhelmed just trying to fully implement the handful of deals its already done.

NewCo's belief is that the bilateral syndication deals we've seen to date (e.g. CBS-Yahoo, ESPN-AOL, Next New Networks - Hulu, among many others) has whetted the market's appetite for this emerging business model, but that there is still far too much friction for syndication to really take off. That fits with what I hear from even the most aggressive content syndicators, one of whose CTOs said on a recent panel I moderated that his company is overwhelmed just trying to fully implement the handful of deals its already done.So, much as I've considered the Syndicated Video Economy solidly into its first phase of development, I've been sobered by the reality that the operational overhead of negotiating deals, implementing them through distributors' often heterogeneous sub-systems, and monitoring their performance requires so much human intervention that the whole syndication concept could end up collapsing under its own weight. (Side note, this is why the Google Content Network which I wrote about last week also has so much potential).

NewCo seeks to blend Anystream's and Voxant's capabilities, offering to content producers a seamless solution to manage, publish AND distribute clips and programs, at scale, to the Internet's widely dispersed audience. As I see it, NewCo is also a potential two-pronged market disrupter if - and for now this is still a big if - it can monetize premium video at scale through advertising.

First, these new revenues could put NewCo in a position to cross-subsidize its technology platform, thereby altering some of the fundamental economics in the platform space. This could trigger possible price-cutting by others solely dependent on platform revenue. Given the vast number of players in the space, and everyone's hunger for market share, this scenario isn't unreasonable to imagine. Second, NewCo could create steep switching barriers for its media customers. Upon getting a taste for turnkey NewCo-driven syndication revenues, content producers would almost certainly be less enticed by new platform-centric features that other competitors may offer. Combined, these disruptions would create a markedly new competitive dynamic.

Yet don't expect competitors to stand still; many of them are examining how to capitalize on their own distinct advantages to alter the dynamics still further. NewCo's abundantly strong management team must now execute on its vision and help its media customers realize syndication's real value. The Anystream-Voxant merger is a bold and possibly game-changing bet on the Syndicated Video Economy being fully realized over time. If that happens, NewCo will surely be among the industry's long-term winners.

What do you think? Click here to post a comment.

(Disclosures: Anystream is a VideoNuze sponsor and I also provided very brief "sounding-board" reactions to this merger prior to its closing.)

Categories: Advertising, Deals & Financings, Syndicated Video Economy, Technology

Topics: Anystream, Google, Voxant

-

CNN is Undermining Its Own Advertisers with New AC360 "Live Webcasts"

Here's an example of how convoluted broadband's use can be.

On CNN's AC360 program last night, Anderson Cooper was promoting "live webcasts" with news anchor Erica Hill, which would run during on-air commercial breaks. As explained here, the idea is that CNN viewers can go "behind the scenes" to continue their AC360 experience by watching the live stream on their computers. I dutifully did this and watched Hill and Cooper somewhat mindlessly chatting/flirting for several minutes.

But wait: if CNN is urging on-air viewers to turn their attention to these "webcasts" during commercial breaks, then that means that CNN is diverting attention from its own on-air advertisers. That undermines CNN's all-important advertiser value proposition. That of course begs the question: is CNN's ad sales team on board with these webcasts? And if so, what are they thinking??

I guess the argument could be made that CNN believes anyone who would jump online would be multi-tasking, so they'd still have their TV on. Yet at a minimum they'll mute their TV's audio (as I did) to hear the webcast's audio. That means the users' eyes and ears are now focused online instead of on-air.

CNN has been laudably in the forefront of weaving online technology into their on-air programs. Tune in to anchor Rick Sanchez's show some time and you'll him juggling an orgy of on-air Twittering, Facebook emailing and YouTube video sharing. Cooper too has been relentlessly flogging his AC360.com web site since its recent relaunch.

That all works, in my opinion. But the "live webcasts" do not. They might work after or before the on air program, but not during. At a time when advertiser relationships are more tenuous than ever due to the rise of DVRs, VOD and broadband, the last thing a network should be doing is undermining their value proposition any further. Someone at CNN no doubt thought, "hey these will be really cool." That may be, but in my opinion, they're not smart business. Broadband should complement existing franchises not undermine them.

What do you think? Post a comment.

Categories: Cable Networks

Topics: CNN