-

Netflix, HBO, Others Coming to Google TV

Google released further details on Google TV this morning, unveiling a slew of content services and apps that will be available at launch. Chief among them are Netflix and HBO Go (both for subscribers), Amazon VOD and Pandora, plus new apps from NBA ("NBA Game Time"), NBCU ("CNBC Real-Time"), and "optimized" content from Turner Broadcasting, NY Times, USA Today, VEVO, Napster, Twitter and blip.TV. Google didn't specify what optimized means, but I suspect it means appropriate metadata so that programs can be exposed in Google TV searches. Of course, "Leanback," YouTube's 10-foot interface, will also be featured.

Categories: Devices

Topics: Amazon, blip.TV, Google TV, HBO, Logitech, Napster, NBCU, Netflix, NY Times, Pandora, Turner, Twitter, USA Today, VEVO

-

Netflix's Expanded NBCU Deal Further Marginalizes Hulu Plus

This morning Netflix announced its latest content licensing deal to bulk up the its streaming catalog, adding a range of programs from NBCU. It's a long list which includes next day access to Saturday Night Live (plus the full back catalog), last season episodes for 30 Rock, The Office and Law&Order: SVU (in addition to renewing back episodes already available), plus past seasons of Friday Night Lights, Psych, Monk, Battlestar Galactica, Destination Truth and Eureka. Netflix didn't identify exactly how many total episodes the deal adds to streaming, but it's very substantial.

catalog), last season episodes for 30 Rock, The Office and Law&Order: SVU (in addition to renewing back episodes already available), plus past seasons of Friday Night Lights, Psych, Monk, Battlestar Galactica, Destination Truth and Eureka. Netflix didn't identify exactly how many total episodes the deal adds to streaming, but it's very substantial.

On the losing end of this deal is Hulu, and more specifically, its budding subscription service Hulu Plus (note the irony that one of Hulu's parent companies is NBCU). As I explained in late August, in "88% of Hulu Plus Content is Already Available for Free on Hulu.com," when it comes to content, Hulu Plus is getting squeezed from all sides, seriously limiting its ability to be much more than an outlet for delayed-release current season and past seasons' episodes of broadcast programs. This is an extremely narrow value proposition which is unlikely to gain widespread adoption.

Categories: Aggregators, Cable Networks

Topics: Hulu, Hulu Plus, NBCU, Netflix

-

Justice Dept Considering Online Restrictions For Comcast-NBCU

An article in today's WSJ, "Comcast Gets Static on Net TV" describes how the Justice Department is scrutinizing the online video implications of Comcast's deal to acquire control of NBCU. According to the article, the Justice Department is digging in to try to understand what, if any, implications the deal could have on online-delivered TV shows and movies from NBCU.

The article points out that nothing is likely to come out of the investigation that could derail the deal. However, the results could provide the foundation for the Justice Department to impose restrictions on Comcast's flexibility to decide where and how NBCU's premium programming could be distributed online. The purpose would be to head off Comcast somehow gaining preferred and/or exclusive access.

The investigation is merited given the size of the deal and yet the yellow caution flags should be up regarding the government making too many assumptions about how the online video market will unfold. As I've written a number of times, we are continuing to see surprising deals, technologies and products which challenge popular assertions that online video and incumbent pay-TV models are on a collision course with one another, with one winning at the other's expense. Just in the last few weeks, the Netflix-Epix deal, the Cox-TiVo partnership, and possibly this week 99-cent broadcast TV rentals from Apple all show that the market is incredibly dynamic, with a blending of online and traditional distribution becoming more common.

That said, Comcast already has huge market power, and control of NBCU's top-notch assets mustn't deprive others of access from which consumers gain. Finding the delicate balance between just enough safeguards, but without limiting innovation, is the key.

What do you think? Post a comment now (no sign-in required).Categories: Broadcasters, Cable TV Operators, Deals & Financings, Regulation

-

Comcast's Roberts: "We Didn't Pick Up on Content Early Enough"

At the Cable Show in LA, Comcast CEO Brian Roberts conceded that Comcast "did not pick up on content early enough and that it is starting later than it should have." He said that Comcast missed opportunities early on - for example with Discovery to play a larger role in content, but noted that it's been working hard to catch up since. His remarks came in a one-on-one discussion with Peter Chernin, former head of News Corp.

Prior to the session Roberts did a short update on Comcast's VOD efforts, disclosing that to date it has delivered 15 billion views, with 350 million new views per month. The average VOD user accesses 20-25 times per month with TV series and kids programming the most popular genres. Comcast offered 100 day-and-date movies last year, compared to just 13 in 2007; in Q1 '10 it already had more than 60. Day-and-date releases on cable are a key strategy for Hollywood studios looking to buttress falling DVD sales and increase margins on digital delivery.

Regarding the pending NBCU acquisition, Roberts said that there are "No plans to Comcast-ize NBCU, particularly because there isn't just one culture at Comcast anyway, with each brand having its own culture." Chernin pressed Roberts to explain how editorial control will work when Comcast owns NBCU. Chernin wondered what Comcast would do in the instance of another controversial film being made like Martin Scorsese's "The Passion of Christ" or when MSNBC host Keith Olbermann blasts the same Republican senators that Comcast might also be courting on any number of regulatory-related matters. After joking resolving these issues is (Comcast COO) Steve Burke's role, Roberts said that since the company's early days in cable it has had to balance the fact that it doesn't agree with everything it distributes, and tries to offer flexibility to customers to opt-out or block certain channels. He resisted getting any more specific, saying the company will find its way after the deal closes.

Chernin also noted that with NBCU, the company will effectively find itself on both sides of the negotiating table when it comes to rates, and wondered how Comcast will decide "what's fair?" Roberts pointed out that there are lots of other players in the market who will contribute to answering the question, so it's by no means Comcast's alone to address. On the topic of content's value, Roberts sees multiple new distributors emerging, which should serve to increase content's value in the future.

Lastly, related to the FCC's net neutrality efforts, Roberts says he doesn't believe the government is "trying to turn the clock back" on cable, saying its actions are "a worry, but not a big worry."

Categories: Broadcasters, Cable TV Operators

-

KickApps Lands NBCU for Social Video Sites

KickApps and NBCU are announcing a licensing deal this morning which includes KickApps' App Studio and Premium Social Video Platform. The deal enables all of NBCU's entertainment properties to use KickApps' social software solution, expanding upon a prior relationship between the companies which has primarily focused on NBC's local media properties.

As Marc Siry, NBCU's SVP, Digital Products and Services explained to me, KickApps's key differentiator was its self-service App Studio which allows NBCU's brands to quickly create customized, socially-oriented sites and video players using drag-and-drop tools. Marc said that the self-service aspect to the App Studio was

particularly important as each NBCU property has its own customization requirements. With resources tight, it was key to be able to have each property be somewhat self-sufficient. Marc said that social wrapping is essential to all media today, and that no other online video platform that NBCU evaluated offered the same capabilities.

particularly important as each NBCU property has its own customization requirements. With resources tight, it was key to be able to have each property be somewhat self-sufficient. Marc said that social wrapping is essential to all media today, and that no other online video platform that NBCU evaluated offered the same capabilities. (As a side note, I have always thought of KickApps as a social platform first and foremost, which also offered video functionality. As a result it's not really a pure OVP, though with its NBC win, KickApps is showing that for some customers, it is a bona fide OVP competitor.)

NBC has strongly pursued social interaction on its local sites, encouraging users to submit comments, video, and other engagement opportunities. With local media impacted by audience fragmentation, efforts to re-invent how to connect with audiences have been crucial. Looking ahead - though unable to get too specific for now - Marc told me that NBCU already has several projects in the works that will leverage KickApps: a fan site from Telemundo, a new video portal emphasizing "secondary" non-TV program content with rabid fan interest, and a celebrity-oriented user-generated site. Parent company GE is even planning to use KickApps as an enterprise solution for video sharing among internal units.

Marc said that one other appealing aspect of KickApps was its embrace of Adobe's Open Source Media Framework ("OSMF"). For those not familiar with OSMF (formerly known as "Strobe") it is a public, pre-release initiative aimed at allowing developers to use pluggable components to create rich Flash-based playback experiences. It is still early days for OSMF and it represents something of a challenge to many online video platforms which offer similar integrations as part of their product or through professional services.

But as Marc explained, OSMF is valuable to NBCU because it is seeing more and more requirements from its brands and advertisers to do custom creative and OSMF gives it a baseline of functionality on which to build. Prior to KickApps, NBCU properties relied mainly on homegrown software for video applications, which Marc said had limited flexibility.

KickApps's NBCU win is yet another example of how dynamic the market for video solutions is today. I am continually hearing about how specific content providers each have their own unique requirements, so an individual video platform provider can be a perfect fit in one situation, but be less than optimal in another. While some requirements are converging, I anticipate a level of individuality will persist for some time to come, sustaining the OVP fragmentation we've seen to date.

What do you think? Post a comment now (no sign-in required).

Categories: Broadcasters, Technology

-

Goodbye 2009, Hello 2010

It's time to say goodbye to 2009 and begin looking ahead to 2010.

2009 was yet another important year in the ongoing growth of broadband and mobile video. There were many exciting developments, but several stand out for me: the announcement and launches of initial TV Everywhere services, the raising of at least $470 million in new capital by video-oriented companies, YouTube's and Hulu's impressive growth to 10 billion streams/mo and 856 million streams/mo, respectively, the iPhone's impact on popularizing mobile video, the Comcast-NBCU deal, the maturing of the online video advertising model, the proliferation of Roku and other convergence devices and the growth of Netflix's Watch Instantly, just to name a few.

Looking ahead to next year, there are plenty of reasons to be optimistic about video's growth: the rollout of TV Everywhere by multiple providers, the proliferation of Android-powered smartphones and buildout of advanced mobile networks, both of which will contribute to mobile video's growth, the launch of Apple's much-rumored tablet, which could create yet another category of on-the-go content access, the introduction of new convergence devices, helping bridge video to the TV for more people, new made-for-broadband video series, which will help expand the medium's appeal, and wider syndication, which will make video ever more available.

In the midst of all this change, monetization remains the fundamental challenge for broadband and mobile video. More specifically, for both content providers and distributors, the challenge is how to ensure that the video industry avoids the same downward revenue spiral that the Internet itself has wrought on print publishers.

Regardless of all the technology innovations, high-quality content still costs real money to produce. If consumers are going to be offered quality choices, a combination of them paying for it along with advertising, is essential. While it's important to be consumer-friendly, this must always be balanced with a sustainable business model. In short, no matter what the size of the audience is, giving something away for free without a clear path for effectively monetizing it is not a strategy for long-term success.

VideoNuze will be on hiatus until Monday, January 4th (unless of course something big happens during this time). I'll be catching my breath in anticipation of a busy 2010, and hope you will too.

Thank you for finding time in your busy schedules to read and pass along VideoNuze. It's incredibly gratifying to hear from many of you about how important a role VideoNuze plays in helping you understand the disruptive change sweeping through the industry. I hope it will continue to do so in the new year.

A huge thank you also to VideoNuze's sponsors - without them, VideoNuze wouldn't be possible. This year, over 40 companies supported the VideoNuze web site and email, plus the VideoSchmooze evenings and other events. I'm incredibly grateful for their support. As always, if you're interested in sponsoring VideoNuze, please contact me.

Happy holidays to all of you, see you in 2010!

Categories: Advertising, Aggregators, Broadcasters, Cable Networks, Cable TV Operators, Devices, Mobile Video

Topics: Android, Comcast, Hulu, iPhone, NBCU, Netflix, YouTube

-

4 Items Worth Noting for the Nov 30th Week (Alicia Keys on YouTube, Jeff Zucker's record, Comcast's Xfinity, SI's tablet demo)

Following are 4 items worth noting for the Nov 30th week:

1. Alicia Keys concert on YouTube is an underwhelming experience - Did you catch any of the Alicia Keys concert on YouTube this past Tuesday night celebrating World AIDS Day? I watched parts of it, and while the music was great, I have to say it was disappointing from a video quality standpoint -lots of buffering and pixilation, plus watching full screen was impossible.

I think YouTube is on to something special webcasting live concerts. Recall its webcast of the U2 concert from the Rose Bowl on Oct 25th drew a record 10 million viewers. That concert's quality was far superior, and separately, the dramatic staging and 97,000 in-person fans also helped boost the excitement of the online experience. It's still early days, but to really succeed with the concert series, YouTube is going to have to guarantee a minimum quality level. Notwithstanding, American Express, the lead sponsor of the Keys concert had strong visibility and surely YouTube has real interest from other sponsors for future concerts. It could be a very valuable franchise YouTube is building and is further evidence of YouTube's evolution from its UGC roots.

2. Being a Jeff Zucker fan is lonely business - In yesterday's post, "Comcast-NBCU: The Winners, Losers and Unknowns" I said I've been a fan of Jeff Zucker's since seeing him deliver a brutally candid and very sober assessment of the broadcast TV industry at the NATPE conference in Jan '08. My praise elicited a number of incredulous email responses from readers who vehemently disagreed, thinking Zucker's performance merits him being sent to the woodshed rather than to the CEO's office for the new Comcast-NBCU JV.

To be sure, NBC's abysmal performance under Zucker (falling from first place to fourth in prime-time), will be one of his legacies, but I take a broader view of his tenure. A good chunk of NBCU's cable network portfolio came to the company via the Vivendi deal around the time Zucker took over responsibility for cable. Since that time the networks have grown strongly in audience and cash flow has doubled from about $1 billion to a projected $2.2 billion in '09. NBCU added Oxygen (which combined with its iVillage property makes a strong proposition for women-focused advertisers) and The Weather Channel, in a joint buyout with two PE firms.

While Zucker's hiring of Ben Silverman to run NBC was a misstep, NBCU has enjoyed stability on the cable side, with two of the highest-regarded women in TV, Bonnie Hammer and Lauren Zalaznick cranking out hit after hit for their respective networks. A CEO's tenure is always a mixed one, with plenty of wins and losses. It can be hard to know how much of the wins to ascribe to the CEO personally, rather than the executives below, but at the end of the day, NBCU was transformed from a single network company to a cable powerhouse; even Zucker skeptics have to give him some credit for this.

3. Comcast rebrands On Demand Online to Fancast Xfinity TV - yuck! - Largely lost in the NBCU commotion this week was news that B&C broke that Comcast is changing the name of its soon-to-be-launched TV Everywhere service from On Demand Online to Fancast Xfinity TV. Yikes, the branding gurus need to head back to the drawing board, and quick. The name violates the first rule of branding: pronunciation must be obvious and easy. Not only is it unclear how you pronounce Xfinity, it's a an unnecessary mouthful that doesn't fit with any of Comcast's other workmanlike brands (e.g. "Digital Cable," "On Demand," "Comcast.net"). If we're talking about a new videogame targeted to teenage boys, Xfinity is great. If we're talking about a service that provides online access to TV shows, there's no need for something super-edgy. I'd suggest just sticking with "On Demand Online." But even more importantly, priority #1 is getting the product launched successfully.

4. Sports Illustrated demo builds tablet computing buzz - If you haven't seen SI's demo of its tablet version being shown off this week, it's well worth a look at the video here. Never mind that there isn't such a tablet device on the market yet, the rumors swirling around Apple's planned launch of one has created an air of inevitability for the whole category. As the SI demo shows, a tablet can be thought of a larger version of an iPhone (likely minus the phone), providing larger screen real estate to make the user experience even more interesting. It's fascinating to think about what a tablet could do for magazines in particular, along the lines of what the Kindle has done for books. The mobile video and gaming possibilities are endless. Judge for yourselves.

Enjoy the weekend!

Categories: Aggregators, Broadcasters, Cable TV Operators, Magazines, People

Topics: Comcast, NBCU, Sports Illustrated, YouTube

-

VideoNuze Report Podcast #42 - December 4, 2009

Daisy Whitney and I are pleased to present the 42nd edition of the VideoNuze Report podcast, for December 4, 2009.

Today's sole topic is of course the big news of the week, Comcast's acquisition of NBCU. Daisy and I chat about the winners/losers/unknowns that I detailed in my post yesterday. There are a lot of aspects to the Comcast-NBCU deal and the new entity will have wide-ranging implications for the media industry. Listen in to learn more.

Click here to listen to the podcast (15 minutes, 24 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Broadcasters, Cable Networks, Cable TV Operators, Deals & Financings, Podcasts

Topics: Comcast, GE, Hulu, NBCU, Podcast

-

Comcast-NBCU: The Winners, Losers and Unknowns

With Comcast's acquisition of NBCU finally official this morning (technically, it's not an acquisition, but rather the creation of a JV in which Comcast holds 51% and GE 49%, until GE inevitably begins unwinding its position), it's time to assess the winners, losers and unknowns from the deal, the biggest the media industry has seen in a long while. I listened to the Comcast investor call this morning with Brian Roberts, Steve Burke and Michael Angelakis and reviewed their presentation.

Here's how my list shakes out, based on current information:

Winners:

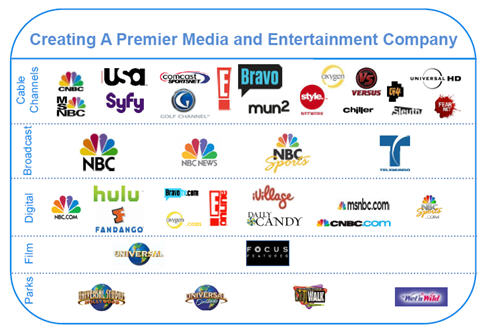

1. Comcast - the biggest winner in the deal is Comcast itself, which has pulled off the second most significant media deal of the decade (the first was its acquisition in 2002 of AT&T Broadband, which made Comcast by far the largest cable operator in the U.S.), for a relatively small amount of upfront cash. Comcast has long sought to become a major player in cable networks, but to date has been able to assemble an interesting, but mostly second tier group of networks (only one, E! has distribution to more than 90 million U.S. homes).

The deal moves Comcast into the elite group of top 5 cable channel owners, alongside Disney, Viacom, Time Warner and News Corp, with pro-forma 2010 annual revenues of $18.2 billion and operating cash flow of $3 billion. It also provides Comcast with a huge hedge on its traditional cable/broadband/voice businesses, as the JV, on a pro-forma basis would be 35% of Comcast's overall 2010 revenue of $52.1 billion, though importantly only 18% of its cash flow of $16.5 billion. On the investor call, Roberts emphasized that the deal should not be seen as the company diminishing its enthusiasm for the traditional cable business, but given the downward recent trends in fundamentals (vividly shown in slides from my "Comcast's Digital Transformation Continues" post 3 weeks ago), the conclusion that Comcast will be relying on its content business for future growth is inescapable.

2. Cable networks' paid business model/TV Everywhere - With Comcast's executives' platitudes about cable networks being "the best part of the media business," the fact that cable networks will contribute 80%+ of the JV's cash flow and the ongoing travails of the ad-supported broadcast TV business, the deal puts an exclamation mark on the primacy of the dual-revenue stream cable network model and Comcast's commitment to defending it (see "The Cable Industry Closes Ranks" for more on this.)

The deal can also be seen as cementing the paid business model for online access to cable networks' programs. Comcast is committed to having online distribution of TV programs emulate the cable model, where access is only given to those consumers who pay for a multichannel subscription service. Much as they may resist acknowledging it, Hollywood and the larger creative community must see Comcast as doing them a huge service by preserving the consumer-paid model, helping the video industry avoid the financial fate of newspapers, broadcasters and music. To be sure, some consumers will cut the cord and be satisfied with what they can get for free online, however it is unlikely to be a large number any time soon. As for aspiring over-the-top providers, they'll need to look outside the cable network ecosystem to generate competitive advantage.

3. Jeff Zucker - The current head of NBCU will migrate into the role of CEO of the JV, greatly expanding his portfolio and influence. Zucker has fought the good fight to preserve the NBC network's status, rotating in new creative heads, shifting Leno to primetime, backing Hulu, etc, but the reality, as he pointed out earlier this year, is that NBCU in his mind has long since become a cable programming company. I've been a Zucker fan since seeing him speak at NATPE in '08 when he laid out a sober assessment of the broadcast business. Through solid acquisitions and execution, Zucker has proved himself to be far more than the wonderboy of "Today" - he's going to fit in well at Comcast and be a great addition to its executive team.

Losers:

1. NBC broadcast network and the JV's 10 owned and operated stations - While Comcast executives said they "don't anticipate any need or desire to divest any businesses" and "take seriously their responsibility" to the iconic NBC brand, the reality is that with the broadcast business contributing just 10% of the JV's pro-forma annual cash flow, the network, and especially the stations, are not just in the back seat of the JV, they're in the third row. Though broadcast contributes 38% of the JV's pro-forma revenue and the deal is being struck near the bottom of the advertising recession, it's hard to see things improving much. Exceptions are the sports division (more on that below), the TV production arm and possibly the news division. The only thing saving the stations is retrans and Comcast's need to appease regulators to get the deal done and keep the regulators at bay thereafter.

2. Other cable operators, telcos and satellite operators - It's never good news when one of your main competitors owns the rights to a good chunk of the key ingredients in your product, yet that's the reality for all other cable operators, telcos and satellite operators. Sure Comcast must be disciplined about throwing its weight around too much, but if these distributors cried when NBCU (and other big network owners) forced bundling and drove fee increases, they haven't seen anything until Comcast runs the renewal processes. With 6 channels having 90+ million homes under agreement plus many others in the JV's portfolio, Comcast is in a very strong negotiating position. As the world moves online, the threat that Comcast eventually says to hell with other distributors and goes over the top itself (a scenario I described here), other distributors have even bigger problems ahead.

3. GE - Yes GE gets about $15 billion in cash and a graceful exit from NBCU, but 20 years since incongruously acquiring NBC, the question burns even brighter, what was GE doing in the entertainment business in the first place? Hasta la vista GE, time to focus on manufacturing turbines and unraveling the woes at GE Capital.

Unknowns:

1. Do content and distribution go together any better this time around - With the disastrous results of AOL-Time Warner still fresh in the mind, it's fair to ask whether vertical integration will work any better this time around. Sensitive to the issue and no doubt anticipating questions on it, Roberts said on the call that this is "a different time and a different deal" and, pointing to News Corp-DirecTV, noted that sometimes vertical integration does work. In addition, he highlighted that the deal's financials are not predicated on achieving any elusive synergies. Still, aside from the obvious benefits of getting bigger in cable networks, the primary reasons cited for Comcast pursuing the deal still have synergy at their core: a slide that clearly says that "Distribution Benefits Content" and "Content Benefits Distribution." As always there are plenty of opportunities to pursue in theory; the challenge is executing on them given the rampant conflicts and turf battles that inevitably ensue.

2. Hulu's future - the online aggregator was literally not mentioned once in the Comcast presentation and its logo only appears on just one of the 36 slides in the deck, yet its presence is hard to underestimate. Hulu is the embodiment of the free, ad-supported premium video model that Comcast is so fiercely committed to combating. So how does it fare when one of its controlling partners soon will be Comcast? In response to a question, Steve Burke said he sees "broadcast content going to Hulu" and that "Hulu and TV Everywhere are complementary products." He also tersely dismissed the much-rumored idea of a Hulu subscription offering. It's impossible to know what becomes of Hulu, but with such divergent interests among the owners, it wouldn't surprise me if Hulu is unwound at some point post closing.

3. ESPN's role - With the JV's NBC Sports assets, plus Comcast's Versus, regional sports networks and Golf Channel, the new JV is primed to play a bigger role in national sports. While Fox Sports and TNT have skirmished for high-profile rights deals with ESPN, the new JV has a much stronger hand to play. It's fair to wonder whether Comcast, which likely sends Disney a check for $70-80 million each month to carry ESPN to its 24 million subscribers, won't at some point say, "hey we can do some of this ourselves" and move to become a bona fide ESPN competitor. In fact, ESPN figures into a far larger Comcast vs. Disney story line in the media industry going forward. The two companies are incredibly dependent on each other, and yet are poised to become even tougher rivals. Expect to hear much more about this one.

4. Consumers - last but not least, what does the deal mean for consumers? Likely very little initially, but over time almost certainly an acceleration of digitally-delivered on-demand premium content - but at a price. Comcast has the best delivery infrastructure, with the JV, soon premier content assets and a persistent, if sometimes incomplete (as with VOD, for example) commitment to shape the digital future. I expect that will mean lots of experimentation with windows, multiplatform distribution and co-promotion across brands. Washington will scrutinize the deal thoroughly, but with continued public service assurances from Comcast, will eventually bless it. Then it will be vigilant for anything that smacks of anti-competitiveness. Consumers should buckle up, the next stage of their media experience is about to begin.

What do you think? Post a comment now.

Categories: Aggregators, Broadcasters, Cable Networks, Cable TV Operators, Deals & Financings

Topics: Comcast, GE, Hulu, NBCU

-

Recent Cable, Broadcast Financial Performance Suggests Hulu Subscription Model Should be Coming

As the annual "upfronts" - the TV industry's program preview and ad sales extravaganza - kick off today, the recent financial performance of the network TV industry and the cable TV industry continue to diverge. The cable network model, powered by both ad sales and monthly affiliate fees, is proving very durable in the Great Recession, while the ad-only network TV model has been hammered. One conclusion from these numbers is that Hulu's owners must be pushing to figure out how the site can introduce a paid subscription model.

I pulled together financial information for a select group of companies comparing performance for the recently concluded March 31 quarter vs. a year ago.

As the chart shows, operating income increased for all the cable networks and revenue was up for all of them as well, except Scripps Networks, where it was flat. The press release commentary from these cable networks was the same: affiliate revenues are up, with ad sales soft, but not disastrous. Cable operators like Comcast and Time Warner Cable also fared well in the quarter with both revenue and operating income/cash flow increasing.

Contrast this with the broadcast TV numbers for Disney, Fox and CBS, all of which operate both TV networks and own local TV stations. Disney fared the best, with revenues down 2% and operating income down 38%. CBS followed with revenues down 12% and operating income down 49%. Fox was affected the worst, with revenues down 29% and operating income down 99%. As two examples of purely local station performance, Gannett's broadcasting segment revenues were down 16% and operating income down 24%, with Sinclair's revenues down 19% and operating income down 43% (before an impairment charge). The commentary from all the broadcasters was the same: the ad market is terrible, and they're doing their best to contain costs (meaning laying off staff).

As the TV industry gears up to sell billions of dollars of ad time this week, a clear lesson from the above financial performance is that it is essential to diversify into the paid subscription ecosystem instead of relying on advertising alone. Disney, Fox and NBCU have recognized this for a while and have strongly built up their portfolio of cable networks.

With ad sales in the doldrums, it's hard not to wonder what Disney, Fox and NBCU, the three major owners of Hulu, are thinking about with respect to Hulu's own business model, which is of course currently 100% reliant on ads. I mean, if your incumbent business model is frayed, wouldn't it make sense, when essentially "starting over" online, to aggressively pursue the one that is resilient even in the recession?

Hulu's exclusive online lock on high-quality programming from 3 of the 4 broadcast networks would seem to position the company perfectly for a subscription play. If its owners looked hard at the divergent fortunes of cable vs. broadcast, it seems inevitable we'll see some type of paid subscription offering from Hulu - either directly or through distributors - sometime in the near future.

What do you think? Post a comment now.

Categories: Aggregators, Broadcasters, Cable Networks

Topics: CBS, Disney, FOX, Hulu, NBCU

-

EveryZing Raises $8.25M from Peacock, Lands NBCU as Biggest Customer

EveryZing, the search and publishing technology firm, is announcing this morning that it has raised a third round of $8.25M from GE/NBC's Peacock Equity Fund and existing investors, bringing its total funding to date to $22M. In conjunction with the funding NBC Universal will integrate EveryZing's four products into NBC's Media Works platform for deployment across all of NBCU's online properties. Tom Wilde, EveryZing's CEO confirmed it was a flat round and gave me some further details last Friday.

Tom believes that EveryZing is the only 3rd party technology provider that has been integrated across Media Works. This has two key benefits - first, it means EveryZing's products will be readily available to all

NBCU properties, thereby minimizing upfront work involved with each successive deployment. And second, the pre-negotiated pricing and standing purchase order means individual properties (and EveryZing) will avoid time-consuming negotiations each time around.

NBCU properties, thereby minimizing upfront work involved with each successive deployment. And second, the pre-negotiated pricing and standing purchase order means individual properties (and EveryZing) will avoid time-consuming negotiations each time around.I've been bullish on EveryZing in the past (here and here) as I think their focus on generating metadata for and indexing all content forms (video, audio, text and image) allows content providers to leverage consumers' huge adoption of search. With respect to video specifically, I've long thought that one of the key inhibitors of online viewership has simply been lack of robust discovery in traditional search environments (e.g. Google, Yahoo, etc.). EveryZing addresses this, essentially merging video's surging popularity with search's universal acceptance. One other key benefit this leads to is enhanced targetability of ads.

Tom's been an evangelist on these fronts, recently publishing "Is Your SEM Strategy Ready for Web 3.0," which makes very salient points about how content consumption is shifting from a traditional "container" paradigm to new "objects" paradigm. In the old model, content providers packaged their works into discreet units (e.g. newspapers, albums, etc.). More recently though the content itself has atomized into "objects", which consumers in turn package themselves (e.g. playlists, RSS feeds, etc.). Lacking their historical packaging heft, content providers must find new ways to associate objects, lest many be left undiscovered, and therefore unmonetized.

Tom explained how this notion is at play in the NBC deal. Obviously NBC has a sprawling content empire, which it wants to fully expose across all of its disparate audiences. But until now, even clearly related content hasn't always been shared with users. Worse, this means that interested ad dollars may not be able to find enough inventory to be allocated against, leaving money on the table.

With EveryZing, NBC's goal is to be able to describe and index all of its content, allowing it to drive improved discovery and monetization. In the non-linear video-on-demand world that defines the broadband video experience, my sense is that these capabilities will become more and more valuable.

What do you think? Post a comment now.

Categories: Deals & Financings, Technology

Topics: EveryZing, NBCU, Peacock Equity Fund

-

YouTube to Merge with Hulu, Entity to be Renamed Either "YouLu" or "HuTube"

In a surprising turn-of-events, VideoNuze has learned that Google will acquire Hulu and merge it with YouTube. The resulting entity will be named either 'YouLu' or 'HuTube.' The merger brings together the two most-trafficked video sites into a powerful new player.

In an interesting twist, the final acquisition price has not yet been determined. Instead, the price will be based on a new algorithm Google is creating to accurately measure just how effective Hulu is at turning its

users' brains into 'creamy giggity-goo' as Seth MacFarlane asserts it will in the latest of Hulu's alien-inspired ads. The algorithm will actually be able to count how many more of users' brain cells die as a result of watching shows on Hulu beyond the cells that already died due to regular on-air network TV viewership.

users' brains into 'creamy giggity-goo' as Seth MacFarlane asserts it will in the latest of Hulu's alien-inspired ads. The algorithm will actually be able to count how many more of users' brain cells die as a result of watching shows on Hulu beyond the cells that already died due to regular on-air network TV viewership. It turns out that Hulu's positioning as an 'evil plot to destroy the world' was considered highly synergistic with Google's longstanding mantra to 'do no evil.' Google CEO Eric Schmidt revealed that the company decided some time ago to move beyond its good-guy image, saying, "Look, we got a lot of mileage out of that 'doing no evil' malarkey, but it's time to get real. We're an avaricious multi-billion company now, and all these wacky tree-hugging green initiatives our engineers keep dreaming up can't hide that." He added, "We really admire the traction Hulu is getting by turning 'evil' into a virtue and want to tap into that concept further. Those Hollywood guys beat us hands-down when it comes to creativity."

For its part, Hulu's owners' decision to merge with YouTube, for a price not yet quantifiable, can only be seen as waiving the white flag of surrender. In an email exchange between Jeff Zucker, NBCU's CEO and Peter Chernin, Fox's former CEO (who made the original Hulu deal), obtained by VideoNuze, Zucker's frustration with Hulu's distant second place status is palpable. Among other things he says, "I thought we had dumbed down our shows as much as possible, but YouTube has clearly tapped into audiences' insatiable appetite for the inane. Who would have thought that skateboard-riding cats crashing into walls would have more audience appeal than our $2 million/episode scripted dramas. There really is no accounting for taste."

In response Chernin is quoted as saying, "Rupert always thought Hulu was a small potatoes deal, not really

capable of losing a large, exciting amount of money. On the other hand, YouTube has been a gigantic black hole for Google, so the opportunity to join forces and achieve scale at losing money together was just incredibly compelling." He added, "Plus, you have to remember, Rupert's heart is really in newspapers. He continues to think this whole Internet thing is a fad that will eventually blow over, with people returning to newspapers as their trusted source of news and propaganda. So the company is logically positioning itself to have sizable video losses to offset expected massive gains in newspaper profitability."

capable of losing a large, exciting amount of money. On the other hand, YouTube has been a gigantic black hole for Google, so the opportunity to join forces and achieve scale at losing money together was just incredibly compelling." He added, "Plus, you have to remember, Rupert's heart is really in newspapers. He continues to think this whole Internet thing is a fad that will eventually blow over, with people returning to newspapers as their trusted source of news and propaganda. So the company is logically positioning itself to have sizable video losses to offset expected massive gains in newspaper profitability."Meanwhile, in a meeting with employees, Hulu CEO Jason Kilar reportedly sought to put a positive spin on the merger. Employees who have Twittered the meeting say that to pump up employee enthusiasm he re-told stories of how much fun it was to originally come up with the name 'Hulu,' reportedly saying, "Look how much mileage we got of one ridiculous-sounding made-up name, just imagine the branding possibilities of the even more-ridiculous sounding names YouLu or HuTube..." Negotiations are already underway with the Chinese portal and domain parking company that own the respective URLs.

The merger left many industry analysts scratching their heads. Representative of their reaction, VideoNuze's Will Richmond said, "Geez, I never thought we'd see a more nonsensical media merger than the one between Time Warner and AOL, but I think this YouLu/HuTube thing might just be it. Let's hope it's not for real, and is just some kind of April Fool's Day joke cooked up by an industry analyst to provide some once-per-year, cheap laughs."

Categories: Aggregators, Deals & Financings

Topics: FOX, Hulu, NBCU, YouTube

-

NBCU's Zucker: "We're at digital dimes now"

NBCU CEO Jeff Zucker provided the opening keynote interview at the Media Summit in NYC this morning with Businessweek Executive Editor Ellen Pollock. I've seen him speak a number of times and true to form he was pragmatic, quite candid and humorous. Highlights below:

"We're at digital dimes now" - Zucker of course famously worried aloud about the risk of "exchanging analog dollars for digital pennies," the notion that half-baked online delivery models would only serve to cannibalize traditional profitability. Zucker sees progress, saying Hulu is "well ahead of plan" and is yes, is now making money. Zucker repeatedly praised the success of the company's wide-ranging digital initiatives, but also noted often there is still a lot of work to do. He also wondered aloud whether digital would ever be a 1 to 1 revenue substitute for traditional revenue streams, but that further cost rationalization would help drive profitability.

"We're in process of finding new economic models" - On the above point, Zucker was candid in saying that the work to be done on new economic models is still experimental and that "a lot of success is often accidental." He readily concedes that nobody has all the answers, and that a key challenge is bridging from the traditional business models to new ones, balancing the interests of older audiences comfortable with the status quo with younger ones that are aggressively embracing the new. Describing his own kids' media activity, which focuses on Hulu, generating their own content and being interactive must give Zucker ample perspective.

"Technology is unbelievably exciting" - Zucker has always emphasized the importance of technology on NBCU's various businesses and today was no exception. He noted that technology is increasing access to TV programs and movies in unprecedented ways, which is a good thing. However he also candidly observed that it has fundamentally changed the broadcast business, primarily through consumers' use of DVRs and online delivery. All of that, plus NBC's lagging primetime performance, has caused it to completely re-think the broadcast model. He observed that newspapers' current woes can be traced to them not being willing to quetion the fundamentals of their model and the role of technology. Like other video providers, he seems determined to confront realities and avoid repeating this mistake.

"NBCU is first and foremost a cable programming company" - Zucker has often highlighted the benefits of the two revenue stream cable programming model (affiliate fees and advertising), but this was the first time I've heard him so clearly position the company as being mainly in the cable business. NBCU's stable of channels, USA, SciFi, Oxygen, MSNBC, Bravo, etc. contributed 60% of NBCU's operating profit last year. The networks' ability to "outperform the market, especially in women's programming and news" is key to NBCU's overall success. Zucker noted that USA is increasingly a "must buy" for advertisers, and with its mass appeal, should justifiably be considered the 5th broadcast network.

"We're hopeful we'll resolve TV.com-Hulu issues soon" - Zucker only briefly touched on Hulu's recent decision to pull its programming from TV.com, which is fast emerging as a Hulu competitor. As has been previously reported, Hulu's attorneys obviously believe TV.com compromised its Hulu distribution agreement as part of its new configuration subsequent to CBS's acquisition of CNET. With a battle looming between aggregators especially in the down economy, I think it remains to be seen whether a settlement can be found.

Categories: Advertising, Aggregators, Broadcasters

Topics: NBCU

-

Learning from Jeff Zucker's Example

The corporate seismograph measuring activity coming out of NBCU lately has shot off the charts.

NBCU's tectonic moves have included: the "mini-merger" of NBC Entertainment and Universal Media Studios, together with the ouster of Katherine Pope, UMS's president and others; ongoing job cuts as part of its previously-stated plan to reduce its workforce by 3% or 500 positions, a move that itself was part of a larger $500M expense reduction program; and the planned shift of Jay Leno to the 10pm slot, the first-time ever a "stripped" program has moved to prime-time. And one can bet the changes are far from over.

The moves indicate that NBCU's president and CEO Jeff Zucker has concluded not just that the traditional rules of the media game are over for good, but that nothing short of a radical transformation of NBCU's business will ensure its future survival.

I don't know Zucker or the executives he's shuffling around so I'm not in a position to say whether the

personnel actions he's taking are the right ones specifically. But what I can say fairly is this: Zucker's unvarnished realism and willingness to make wrenching organizational changes should be viewed as a model for other industry CEOs to follow.

personnel actions he's taking are the right ones specifically. But what I can say fairly is this: Zucker's unvarnished realism and willingness to make wrenching organizational changes should be viewed as a model for other industry CEOs to follow. I was impressed with Zucker back in January '08, upon listening to his keynote at NATPE. I wrote in "Zucker Preparing NBC for Broadband Era" that I appreciated him saying "technology is transforming every part of our business" and that the "historic economic model supporting broadcast TV is wounded." Most famously, he said that the "number one challenge for everyone in this industry is...not trading analog dollars for digital pennies." I concluded that Zucker "got it."

While I am very sympathetic to those being affected by the change underway throughout the NBCU empire, I am thrilled to see Zucker acting as a leader. One would assume that when an individual has ascended to the highest ranks of their organization, they must actually be a real leader. However, the sad truth is that real leadership has been in desperately short supply throughout corporate and federal America in recent times. In fact, if we'd had more real leaders over the last 30-odd years we wouldn't have a crippled U.S. auto industry, an avaricious, self-destructive financial services sector, a tragically warming planet or a country bloated by a large and ever-growing debt burden.

In short, leaders see the world as it is. Not as it used to be. Not as they wish it could be. And not as they manufacture it to be so that in the short term they can maximize their financial reward. Zucker's ability to be a clear-eyed realist, and his willingness to take the actions required for future success, are critical to tens of thousands of NBCU employees and their families, the vast web of suppliers reliant on the company's continued good health and myriad investors whose confidence is the lifeblood of NBCU's parent company GE.

From my parochial position, broadband is at the top of the list of the company's challenges. Broadband and on-demand digital distribution, together with DVRs and fragmenting consumer behaviors strike at the core of the broadcast industry's longstanding success formula. The recent economic crisis and accompanying ad spending slowdown have simply accelerated their importance.

On the broadband front, so far NBC has responded admirably. By co-founding Hulu as its broadband spear tip, hiring top-notch executives for it, funding it generously and providing it ample autonomy, NBC has given Hulu the room to get off to a strong start. Though I have my concerns with how Hulu's monetizing its streams and worry about its affect on NBC's P&L, I'm hopeful that the Hulu team understands the big picture. In '09 I expect there will be a shakeout among the online aggregators of premium-quality video but I'm confident Hulu will be among those left standing.

In the meantime, I don't envy Jeff Zucker, or any of the other big media CEOs who are tasked with navigating their proud organizations into an unfamiliar and deeply unsettling new era. Personally I wouldn't have the stomach for it. But, based on what I've seen to date, if I were an NBCU stakeholder, I'd be glad that Zucker is at the helm.

What do you think? Post a comment now.

Categories: Broadcasters

Topics: NBCU

-

Digital Media and Broadband Video Executives Play Musical Chairs

It's been hard not to notice the recently growing roster of digital media/broadband video executives who are either leaving their jobs or jumping to other companies.

Among the many recent changes:

- Bill Day (moved to CEO, ScanScout from Chief Media Officer, Marchex)

- Ned Desmond (leaving as President, Time, Inc Interactive)

- Tony Fadell (leaving as SVP, iPod Division, Apple)

- Karin Gilford (moved to SVP, Fancast/Comcast from VP/GM, Yahoo Entertainment)

- Bob Greene (left as EVP, Advanced Services, Starz)

- Kevin Johnson (moved to CEO, Juniper Networks from President, Platforms & Services Division, Microsoft)

- George Kliavkoff (leaving as Chief Digital Officer, NBCU)

- Michael Mathieu (moved to CEO, YuMe from President, Freedom Communications Internet Division)

- Scott Moore (leaving as SVP, Media Group, Yahoo)

- Herb Scannell (moved from CEO to Executive Chairman, Next New Networks)

- David Verklin (moved to CEO, Canoe Ventures from CEO, Aegis Media Americas)

Of course there are many more as well.

There's no blanket explanation for all of this movement. Senior executives - particularly those with strong track records in unchartered territory like digital media and broadband video - are always in demand by competitors. And established companies who can't execute or who are losing altitude in their core businesses become fertile ground for executive recruiters. Then there are always personal reasons for causing executive change (family matters, geographic restrictions, etc.).

The whole digital media and broadband space is extremely dynamic. Major incumbents continue to struggle with defining their strategies and how to organize themselves properly to execute. The financial meltdown has caused huge profit pressure, prompting operational streamlining.

Still, I'm hoping that all this executive movement doesn't slow broadband's growth. In particular, prematurely folding a digital operation into an incumbent product area can limit innovation as executives who are primarily focused on the core business and who lack detailed domain knowledge will inevitably shy away from riskier or more complex digital initiatives. I've seen this myself first hand. Broadband is still early in its evolution; hopefully executive change will foster, not hinder, its continued progress.

What do you think? Post a comment now.

Categories: People

Topics: Aegis, Apple, Canoe, Comcast, Juniper, Marchex, Microsoft, NBCU, Next New Networks, ScanScout, Starz, Time, Yahoo, YuMe

-

At Last, Google Flexes YouTube's Strategic Muscles

In the two years since Google acquired YouTube, I've often wondered about two things: (1) was there really a strategic rationale behind the deal? and, (2) if there was indeed a strategic rationale, when might we see it borne out in actual business initiatives?

For sure YouTube's organic growth has continued unabated during these two years and from a traffic

perspective, it is more dominant now than ever. Yet the dearth of initiatives that are tangibly strategic (or meaningfully revenue-producing for that matter) to Google, or that even minimally strengthen either company's underlying value proposition, has led me to conclude that the deal had more to do with the Google guys wanting to acquire YouTube for its "coolness" factor - simply because they could - than anything else.

perspective, it is more dominant now than ever. Yet the dearth of initiatives that are tangibly strategic (or meaningfully revenue-producing for that matter) to Google, or that even minimally strengthen either company's underlying value proposition, has led me to conclude that the deal had more to do with the Google guys wanting to acquire YouTube for its "coolness" factor - simply because they could - than anything else. I don't mean to sound unfair to the YouTubers who work diligently to make YouTube an incredible experience, which of course it truly is. Yet it is hard to deny the obvious: exactly what has YouTube done differently during the last two years that it couldn't have done had it remained independent (and saying "afforded its monthly CDN bills" doesn't count!), and how exactly have either YouTube or Google benefited from being together during this time?

However, I think things are finally changing. In fact, with little fanfare or proactive PR, Google at last seems to be strategically flexing YouTube's muscles. While some of what they're doing is experimental, other moves have significant market potential and could be highly disruptive to other broadband oriented media and technology companies.

At the top of my "highest potential" list is Google Content Network, especially as it's envisioned as "spokes" tied to YouTube's "hub." I wrote at length about GCN a month ago in "Google Content Network Has Lots of Potential, Implications" so I won't rehash my arguments here. But note yesterday's news about "Poptub" as the second video series to get the GCN/YouTube treatment; I expect a steady drumbeat of these types of deals in the months to come. GCN has the potential to become a key driver of the Syndicated Video Economy.

Another high-potential activity is YouTube's plan to start streaming full episodes. The first deal with CBS is no doubt a signal of many more to come. Full episode streaming is strategic on a number of levels. It enhances YouTube's and Google's access to big brands' ad dollars. While Google has thrived in the self-service, "long tail of advertising" world, it needs more cred among big brands, especially as it pursues its Google TV initiative (see latest deal with NBCU) and other eventual broadband-to-the-TV activities. Full episodes are also a winner from a user standpoint: a unified video experience across premium, indie, long tail and UGC video is very compelling and also squeezes competitors with narrower offerings.

Yet another high-potential activity is the implementation of search ads on YouTube. When the deal was originally done, my first reaction was to think it was a no-brainer to simply start displaying ads against every YouTube search (example - you search for "West Wing" in YouTube and the results page shows an ad to buy the DVD set). If there's one thing Google knows cold, it's the search ad business. YouTube searches represent billions of incremental opportunities each year to extend its core franchise.

Lastly - and this is admittedly more of a "Will Richmond thing" than anything Google or YouTube are yet pursuing: I think it's practically inevitable that the company will start investing in independent broadband video companies at some point. I touched on this in yesterday's piece about NBCU-60Frames and MSN-Stage 9. As time marches on and some of the above activities bear fruit, it's going to become very tempting for Google/YouTube to lever its strengths more directly into content ownership. I know what Google's always maintained about being a technology company, committed to neutrality in way that even Switzerland would appreciate. But as Google's ad business matures and it inevitably is pressured for growth, content is going to be a very alluring opportunity.

Lastly - and this is admittedly more of a "Will Richmond thing" than anything Google or YouTube are yet pursuing: I think it's practically inevitable that the company will start investing in independent broadband video companies at some point. I touched on this in yesterday's piece about NBCU-60Frames and MSN-Stage 9. As time marches on and some of the above activities bear fruit, it's going to become very tempting for Google/YouTube to lever its strengths more directly into content ownership. I know what Google's always maintained about being a technology company, committed to neutrality in way that even Switzerland would appreciate. But as Google's ad business matures and it inevitably is pressured for growth, content is going to be a very alluring opportunity. Regardless of what happens on this last point, YouTube now seems to have a full plate of strategic activities underway. It's great to finally see this happening.

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Broadcasters, Indie Video, Syndicated Video Economy

Topics: 60Frames, CBS, Disney, Google, Google Content Network, MSN, NBCU, YouTube

-

Lessons from Two Recent Deals: NBCU-60Frames and Microsoft/MSN Video-Disney/Stage 9

I always hesitate to conclude too much from just a couple data points, but two deals in the last week - between NBCU and 60Frames and between Microsoft/MSN Video and Disney/Stage 9 - feel to me like leading indicators of more deals of this kind to come.

In case you missed the news, last Tuesday, NBCU and 60Frames, an independent broadband-only studio I've written about, announced a comprehensive content development and ad sales deal. Critically, NBCU will take original broadband-only shows from 60Frames to brands/agencies with which it has relationships to pursue both upfront sponsorships and possible brand integration.

Then this past Monday, Disney and Microsoft announced at MIPCOM that Stage 9, Disney's in-house broadband-only studio which I've also written about, would begin syndicating its shows to MSN Video for European viewers. While smaller in scope, the Disney-MS deal is no less noteworthy.

I see at least three underlying threads to these deals that suggest broader market implications. First, the

deals are further evidence that the broadband-only video model is still nascent and in need of market validation and financial support. If these deals are in fact harbingers, this support will come from established players like NBCU and Microsoft who have significant reach and access to ad dollars. Somewhat ironically these are also companies that have financial stakes (either through direct ownership of or important customer/strategic relationships with) the very incumbent media properties that the broadband-only crowd is trying to grab eyeballs away from.

deals are further evidence that the broadband-only video model is still nascent and in need of market validation and financial support. If these deals are in fact harbingers, this support will come from established players like NBCU and Microsoft who have significant reach and access to ad dollars. Somewhat ironically these are also companies that have financial stakes (either through direct ownership of or important customer/strategic relationships with) the very incumbent media properties that the broadband-only crowd is trying to grab eyeballs away from.Second, the down economy is a catalyst for more of these types of deals. Last week, in "5 Conclusions About the Bad Economy's Effect on Broadband Video," I asserted that the broadband-only studios would tighten their belts a bit to conserve resources in this uncertain climate. One way to mitigate their financial risk and uncertainty is through these linkups with deep pocketed partners. NBCU's backing of the 60Frames slate appears to be the most extensive of these types of deals to date. That Stage 9 - owned by well-funded Disney - is also hunting down big distribution partners which have brand relationships is still further evidence that risk mitigation is a key priority.

Third, the deals point to an acceleration of the trend toward broadband video syndication. In a presentation I give periodically to industry executives, I have a slide titled "Syndicated Video Economy Accelerates" which lists the reasons as: (1) Ongoing video explosion causes heightened need to break through to audiences, (2) Device proliferation causes even more audience fragmentation, (3) Ad model firms up, improving ROI for free, widely distributed video and (4) Social media use means surging user-driven syndication. That slide needs to be updated for a new #1 reason motivating syndication: "In a down economy, syndication could mean the difference between success and failure for broadband-only studios and even big media backed broadband initiatives."

Third, the deals point to an acceleration of the trend toward broadband video syndication. In a presentation I give periodically to industry executives, I have a slide titled "Syndicated Video Economy Accelerates" which lists the reasons as: (1) Ongoing video explosion causes heightened need to break through to audiences, (2) Device proliferation causes even more audience fragmentation, (3) Ad model firms up, improving ROI for free, widely distributed video and (4) Social media use means surging user-driven syndication. That slide needs to be updated for a new #1 reason motivating syndication: "In a down economy, syndication could mean the difference between success and failure for broadband-only studios and even big media backed broadband initiatives."Here's something else to consider: what role might YouTube, the market's undisputed 800 pound gorilla, play as an emerging distributor and financial backer of broadband-only video? Despite its much-avowed

disinterest in being a content provider, YouTube, with Google's abundant balance sheet, is in a Warren Buffet-like position to become the go-to resource for financial backing and key distribution. (Readers who are cable industry veterans will also see a potential parallel to the M.O. of TCI back in the 1980's and 90's.) Couple Google's billions with YouTube's massive reach, desire to move up the quality ladder from its UGC roots, pursuit of new ad models and commerce models and its budding GCN initiative, and the company really is superbly positioned to play a role in the development of broadband-only programming.

disinterest in being a content provider, YouTube, with Google's abundant balance sheet, is in a Warren Buffet-like position to become the go-to resource for financial backing and key distribution. (Readers who are cable industry veterans will also see a potential parallel to the M.O. of TCI back in the 1980's and 90's.) Couple Google's billions with YouTube's massive reach, desire to move up the quality ladder from its UGC roots, pursuit of new ad models and commerce models and its budding GCN initiative, and the company really is superbly positioned to play a role in the development of broadband-only programming. Anyway, I digress. For now, it's fair to say that these two deals do not yet make a trend. But still, I think it's extremely likely that we'll see many more of these kinds of linkups in the months to come. We're living in a hunker down time, when starry-eyed creatives enticed by broadband's no-rules freedom will be tempered by business executives' no-nonsense pursuit of financial viability.

What do you think? Post a comment now.

(Btw, for a deeper dive into how broadband-only studios ride out the economic storm, join me for the Broadband Video Leadership Breakfast Panel in Boston on Nov 10th. One of our panelists will be Fred Seibert, creative director and co-founder of Next New Networks, arguably the granddaddy of the broadband-only crowd, having raised over $23 million to date. Early bird pricing ends on Friday.)

Categories: Advertising, Aggregators, Broadcasters, International, Portals, Syndicated Video Economy

Topics: 60Frames, Disney, Google, Microsoft, MSN Video, NBCU, Stage 9, YouTube

-

Does Broadband Video Help or Hurt Broadcast TV Networks?

Yesterday's article in the NY Times, "In the Age of TiVo and Web Video, What is Prime Time?" was the latest of many about the changing landscape of broadcast network TV. An underlying question that receives a lot of attention, yet little in the way of clear-cut conclusions: Does broadband video help or hurt broadcast TV networks?

The jumble of conflicting data and opinions on this topic (as well as the related topic of DVRs' impact on the networks) is causing plenty of speculation during this important upfront week of when billions of dollars of networks' ads are bought and sold.

Here's a synopsis of how I think proponents of each would defend their answer:

Broadband video helps: The world is changing - consumers are more empowered than ever and it's pointless to resist. Broadband is a great way to catch up on episodes missed, conveniently sample programs, engender interactivity, transform viewers into viral promoters, etc. More exposure will translate into more on-air viewership. Plus as broadband audience size builds ad revenue will as well. Network programming is and always will be the most watched, most valued source of video entertainment and with broadband opening up all kinds of new revenue opportunities, there's ample reason to be optimistic.

Broadband video hurts: Broadband kills networks' success formula, driving profitable on-air viewership to profitless broadband viewership. It's pie-in-the-sky thinking to believe that broadband revenues will ever catch up. Since only a limited amount of ads can be included in online broadcasts, even the higher CPMs received per ad deliver nowhere close to the revenue per episode per viewer as the on-air model does. All the interactivity and engagement in the world will never offset this shortfall. As more programs move online and viewers can eventually watch these right on their TVs, the shift from on-air to online consumption will only accelerate, causing permanent erosion to the traditional economic formula.

So which is it - are networks helped or hurt by broadband? I think the answer is short-term it helps, but long-term it hurts. In the short-term, there is evidence that broadband expands audiences. For example, The Office's premiere last fall 9.7 million people tuned in, but another 2.7 million watched online.

Expanding viewership is great, but what happens to networks' revenues if next fall 7.7 million watch on-air and 4.7 million online? And 3 years from now, 5.7 million on-air and 6.7 million online? You can count on viewers to gravitate to the optimal viewing experience, and if online further improves, expect more eyeballs to shift. Again, since there are fewer ads online, the only way for total network revenues to keep pace are to show more ads online (see ABC's plan on that front), dramatically raise CPMs and/or dramatically raise viewership. My guess is that even the most optimal mix of these three will not deliver enough to offset on-air's revenue decline.

Broadband offers lots of complementary benefits to broadcasters to be sure. But NBCU's Jeff Zucker is absolutely right that the industry's number one challenge is the risk of turning "analog dollars into digital pennies." I can't say I see how that's to be avoided, unless networks go cold turkey, following CW, which recently pulled down streaming episodes of "Gossip Girl" to enhance on-air viewership. But I don't see that happening. Instead I think broadcast networks are going to have to adjust to fundamentally different economics in the future.

What do you think? Does broadband video help or hurt broadcasters? Post a comment!

Categories: Advertising, Broadcasters

-

Zucker Preparing NBC for Broadband Era

Jeff Zucker, NBCU's president and CEO gave a stirring, candid keynote at the NATPE show yesterday, in which he essentially said that all the rules that the broadcast TV industry has lived by for six decades have now changed. It was a pretty blunt assessment, given in terms not often heard from PR-cautious CEOs.

I thought Zucker nailed it on the head when he said that "technology is transforming every part of our business," suggesting that to succeed in the future the company must re-engineer itself from top to bottom.

The technology drivers - DVRs, broadband distribution, VOD, mobile and inexpensive production equipment are all leading to fundamental changes in distribution, advertising sales, marketing and content development.

The technology drivers - DVRs, broadband distribution, VOD, mobile and inexpensive production equipment are all leading to fundamental changes in distribution, advertising sales, marketing and content development. Zucker said that the "historic economic model supporting broadcast TV is wounded." This is well exemplified in the broadband space, where networks have eagerly pushed their hit programs online. Yet in referring to its broadband initiatives, Zucker acknowledged, "Our challenge with all these ventures is to effectively monetize them so that we do not end up trading analog dollars for digital pennies," noting "This is the Number 1 challenge for everyone in this industry today."

I believe many of the steps Zucker's taking will help surmount this challenge. They include: Improving the allocation of resources and efficiency of the pilot process to help NBC maximize the opportunity that the mass-scale broadcast business still provides. Expanding the marketing of its programs beyond traditional influencers to help tap into the water coolers of the digital age. Broadening the role of its stations encompassing all local media opportunities instead of just selling TV ad space to enhance their competitiveness. Setting up digital studios to produce content geared for the broadband and mobile to tap new audiences.

Listening to Zucker, I felt myself being optimistic about his leadership and the likelihood that his game plan will ultimately lead to a successful transformation of the business. It won't come without plenty of bumps in the road, but it did strike me as clear-headed thinking which was sensitive to the network's traditions, but not obsequious to them. Throughout his keynote, he repeatedly reminded the audience that great storytelling and content is what all matters. The story of how NBC and the other networks will learn to succeed in the broadband era is definitely one worth following.

Categories: Broadcasters

Topics: NBCU

-

Here Comes the Video "Experience Era"

OK, one last post related to CES, and then I promise to shut up about the show.

Observing the goings-on this week, it is evident that both content and consumer electronics firms have come to the same basic conclusion: each industry's success is inextricably tied to the other's. Each recognizes that the business dynamics of the future requires a new way of differentiating their products than they are accustomed. That means, for example, that TV makers can no longer just boast about better pictures. And that content companies can no longer bank on bigger stars or funnier sitcoms to deliver audiences and profits.

Rather, both industries recognize that we are moving into what I would call the "experience era" for video. That's to say, success with consumers is going to rest more on these industries' ability to deliver superior experiences which integrate content and technology in new and compelling ways. Rather than oohing and ahhing about their new TV's picture quality or how hilarious a certain episode was, going forward consumers will increasingly cite "how cool" something is.

"How cool" are code words for "how compelling is the experience". The new currency of video hipness will require that when I invite friends to my house and want to show off, I need to have more than just a honking-big screen or a digital collection of old programs - those will be commonplace. Instead, the experiences are what will matter. Things like seamlessly accessing broadband content on my TV, interacting with it -- along with other viewers -- from my couch, and moving it around my house for playback anywhere, in a snap. Delivering these types of experiences (and more) is the new competitive bar that content and technology firms should be aiming for.

My sense is these industry executives know this, and the partnerships we saw unveiled -- and those yet to come -- demonstrate this recognition. Listen to what Bob Scaglione, Sharp's SVP Marketing said in this NY Times piece: "We already all have beautiful HD televisions. How do you differentiate? One way to provide some really unique differentiation is to provide new content. That's why we're fighting to find the right content providers."

And then what Beth Comstock, president of NBC Universal Integrated Media said: "You can't talk about consumer electronics without talking about content.....We try every new technology that comes along."

Executives across the content and technology spectrum must understand the experience era is now upon us. Steve Jobs and Apple's iPod ushered in the experience era in the music business. We now wait to see which companies in the video industry will do the same and reach for Apple's success. In a hyper competitive world, those who deliver strongly against consumers' needs and desires will be the ultimate winners in the experience battle now underway.

Agree or disagree? Post a comment and let us all know!

Categories: Broadcasters, Devices, Strategy

Topics: Apple, iPod, NBCU, Sharp