-

VideoNuze Report Podcast #40 - November 13, 2009

Daisy Whitney and I are pleased to present the 40th edition (whoo-hoo!) of the VideoNuze Report podcast, for November 13, 2009.

This week Daisy first shares observations on her recent interview with Gary Vaynerchuk, who is best known as the host of Wine Library TV/The Thunder Show. Gary has a new book out called "Crush It!" part of a 10-book deal he did with HarperStudio. The book focuses on how you can build your personal brand using all of the Internet's various communications tools. Vaynerchuk has a lot of credibility as he's built up a huge following for Wine Library TV. Now with the books, he's showing how online popularity can be leveraged into the print world. For a good example of the show, check out this episode featuring Wayne Gretzky.

We then shift to my post from earlier this week, "Sony Gets It Wrong with 'Meatballs' Promotion." I took Sony Electronics to task for a new promotion they're starting which provides a free 24 hour rental of the movie "Cloudy With a Chance of Meatballs" to buyers of connected Sony Bravia TVs and Blu-ray disc players. It's also available as a $24.95 rental for current owners of these devices. I explain more about why I think this promotion falls way short and does little to advance the agenda of delivering movies via broadband.

Click here to listen to the podcast (14 minutes, 12 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: FIlms, Indie Video, Podcasts, Studios

Topics: Sony, Wine Library TV

-

Mobile Video Continues to Gain Traction

I continue to be impressed with how the mobile video market is gaining traction. It seems like rarely a day goes by now where there isn't an announcement by a technology vendor, content provider or service provider related to mobile video. Though it's still well behind online video's adoption, all of the pieces continue to fall into place for mobile video's continued growth.

From a consumer usage standpoint, the iPhone has of course been the key driver. Whenever I'm with an iPhone owner, I'm struck by how deeply they've integrated video into their mobile experience. It's not just that they've downloaded TV shows and movies to watch on planes and so forth, but rather how natural it is for them to start playing a video and then pass their phone around so others can watch also. The iPhone has turbocharged the whole concept of shared, out-of-home video experiences.

And though the iPhone's 30 million estimated units sold represents a huge footprint of new mobile video users (in turn generating a large ecosystem of app developers), from a device standpoint, new entrants are poised to grow the market even further. Devices powered by the Android mobile operating system are continuing to come to market, with the most recent, high-profile example being Motorola's Droid, offered by Verizon Wireless. Verizon is putting a huge marketing push behind the Droid, contributing to a growing sense of awareness by consumers of the appeal of smartphones and their video capabilities in particular. Not surprisingly given its Google parentage, YouTube has also weighed in on the benefits of Android in allowing easier uploading at higher video quality.

In addition the iPhone and Android, among business users, Blackberry continues to dominate and internationally, Nokia has the largest smartphone position. This all suggests there will be vigorous competition among these 4 platforms, leading to lots consumer-facing promotion and rapid innovation. In a recent AdAge piece, IDC estimated that 6% of U.S. cell phone users, or 18 million people, will watch video on their cell phones this year, rising to 27 million in 2013.

Content providers have taken notice of these dynamics and have been aggressively creating video-rich mobile apps, initially for the iPhone, but now also for Android, Nokia and Blackberry smartphones. In a recent conversation I had with Ujjal Kohli, CEO of Rhythm NewMedia, which specializes in "mobilizing and monetizing" broadcast and cable networks' TV shows, he explained how clients continue to bulk up their teams devoted solely to mobile video initiatives. An example of this is Warner Bros, which is among a number of film studios now pursuing mobile initiatives. In addition to building mobile video apps, Rhythm is also creating a mobile video ad network, like Transpera (which I last covered here). As mobile video usage surges, advertising will grow right alongside it. Mobile advertising in general received major validation earlier this week as Google acquired mobile video ad display network AdMob for $750 million.

With all this mobile video activity, technology providers are increasingly their attention to serving their content customers. Just yesterday, Kyte, a video platform company that focused early on mobile, announced that it has launched "application frameworks" for Android and Nokia, following on previous frameworks for iPhone and Blackberry. As Gannon Hall, Kyte's COO told me, its content customers have pushed Kyte for other platforms. Now with native support for all four platforms, Kyte's customers can quickly and cost-effectively adapt existing apps, incorporating full social and monetization functions. While Gannon believes Kyte has taken the lead among OVPs in offering mobile capabilities beyond just APIs, he envisions others ramping up as well. Some evidence of this is today's partnership announcement by VMIX and Qik, to integrate mobile live streaming into VMIX's platform. More will surely follow.

There are plenty of other examples of how the ecosystem supporting mobile video is being built out, such as Clearwire announcing this week $1.5 billion in additional capital raised for its 4G WiMax network, Verizon leading a group of venture investors in a $1.3 billion "LTE" 4G opportunity fund, Adobe releasing Flash Player 10.1 targeted for mobile devices, AT&T accelerating deployment of "HSPA 7.2" technology in 6 cities to boost 3G speeds and Akamai launching its "Akamai HD" network, which among other things supports HD video streaming to the iPhone. These and many other examples form the foundation for ever more robust mobile video experiences in the future.

One of my predictions for 2009 was that after many fits and starts, mobile video finally seemed poised to take off. Nearly 11 months into the year, I think we're seeing ample evidence of this happening. I expect only continued growth going forward.

What do you think? Post a comment now.

Categories: Advertising, Mobile Video, Telcos

Topics: AdMob, Apple, BlackBerry, Clearwir, Droid, Google, iPhone, Kyte, Motorola, Nokia, Qik, Rhythm NewMedia, Transpera, VMIX, YouTube

-

Sony Gets It Wrong with "Meatballs" Promotion

On Monday, Sony Electronics announced a holiday promotion in which buyers of select Internet-connected Sony Bravia TVs and Blu-ray players would receive a free 24 hour rental of the Columbia/Sony Pictures film

"Cloudy with a Chance of Meatballs." In addition, current owners of these devices would be able to rent the film for $24.95. For all of these consumers, the film would be available from Dec. 8th to Jan 4th, the month leading up to the film's DVD release.

"Cloudy with a Chance of Meatballs." In addition, current owners of these devices would be able to rent the film for $24.95. For all of these consumers, the film would be available from Dec. 8th to Jan 4th, the month leading up to the film's DVD release. Ordinarily I would applaud any move by Hollywood to modify its rigid release "windows" to benefit broadband delivery of films. Yet in this case I think Sony's promotion is ill-conceived and is extremely unlikely to contribute any real momentum to studios' future broadband delivery plans. In fact, it may actually have the opposite effect and further stunt the broadband medium's emergence. Here's why:

The release window is too tight - Release windows allow Hollywood studios to mine new value from the same content given each successive distribution medium's unique attributes and audience. But by trying to squeeze in this promotional window, Sony is exacerbating an already very tight windowing plan for "Meatballs" that called for DVD release less than 2 months following its theatrical run. Remarkably, even as Sony is trumpeting this new promotion, the film is actually still playing in theaters nationwide. Given it's already only 27 days until Dec 8th, there will be virtually no gap between theatrical and promotional windows. That undermines the theatrical value proposition, in turn ticking off exhibitors who are threatening to pull the film early, according to The Hollywood Reporter.

Theatrical to DVD windows have been getting progressively tighter as studios have sought to bolster sagging DVD sales. The problem is that like a good wine, lengthy windows allow a film to age and increase in value for both those consumers who saw the movie and those who did not. With this promotion, Sony is giving consumers an in-home opportunity to see the film immediately adjacent to the DVD's availability. That can do nothing but also hurt the DVD's sales.

The promotional offer isn't strong enough - For Sony Electronics, trying to differentiate its devices in a brutally competitive landscape is key. But do the marketing pros at Sony really believe that giving away a 24 hour rental is going to have a big impact? Personally I doubt it. The prices of the Sony TVs in the promotion are in the $1,000-$2,000 range, so a $25 incentive is easily swamped by the rampant deep discounts found in Sunday circulars (not to mention even deeper online deals). Further, I don't see any retailer incentives included in the promotion that would influence the sales process.

The "Meatballs" offer might have a stronger effect on sales of Sony's Blu-ray players, though here too, it's unlikely to be profound. With Blu-ray player sales lagging, manufacturers and retailers have largely decided that hitching their wagons to Netflix's Watch Instantly streaming is the best way to bump up sales. But with sub-$100 Netflix-capable Blu-ray players now available, a "Meatballs" rental valued at $25 on a $200-250 Sony player will have a hard time breaking through. Last but not least, it's important to remember, Sony's promotion is for a 24 hour rental. Not offering consumers ownership of "Meatballs" makes the promotional value ephemeral. And with Walmart, Target and Amazon now offering top DVDs for just $10 apiece, a 24 hour rental valued at $25 is underwhelming, not to mention somewhat specious, given it is Sony that's setting the "price." Given all of this, I suspect Sony would have done better by just offering a free "Meatballs" DVD with purchase.

Device audience too small to prove broadband delivery's appeal - Looked at differently, the small base of connected Sony Bravia and connected Blu-ray players, plus the new device sales over the promotional period, is unlikely to generate a large volume of "Meatballs" streaming anyway. That means that the promotion will do little to encourage Sony or other studios to more strongly embrace broadband delivery of their films. In fact, when the weak results of the promotion come in (as I expect they will), "Meatballs" could become future industry shorthand for "broadband delivery isn't ready for prime-time." That would be a shame, because I believe consumers very much want on-demand access to films in their homes. Netflix's success with Watch Instantly certainly proves that, as does the success VOD is having.

From my perspective, rather than setting up half-baked promotions like this one, studios should take a step back and think through how to do broadband delivery (for both rental and download-to-own) correctly. There are a lot of moving pieces, but clearly addressing what to do about the DVD window is critical. Studios are rightfully worried about killing off this cash cow. But compressing the DVD window and then trying to insert a new broadband delivery window isn't going to be the answer. Rather than seeing more "Meatballs" like promotions, I'd prefer to see a cohesive strategy out of Hollywood for how it can fully tap into broadband delivery's potential.

What do you think? Post a comment now.

Categories: Devices, FIlms, Studios

-

Comcast's Digital Transformation Continues

A year ago, in "Comcast: A Company Transformed," I asserted that in the past 10 years Comcast has dramatically evolved from a traditional, plain vanilla cable TV operator to a digital TV, broadband Internet access and voice powerhouse. Comcast's Q3 '09 earnings, released last week, offered more proof that the company continues its transformation, capitalizing on consumers' shift to digital lifestyles.

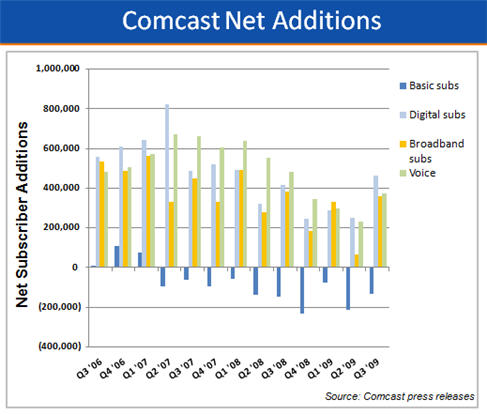

As the chart below shows, Comcast's Q3 results were once again powered by higher digital TV penetration in its cable TV subscriber base, and additional broadband and voice subscribers.

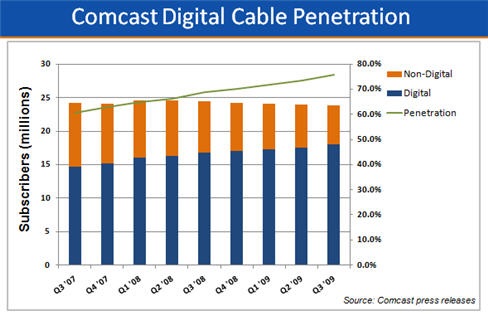

These gains offset the steady erosion in Comcast's total number of cable subs, which at the end of Q3 stood at approximately 23.8 million. Comcast has lost cable subs for 10 straight quarters (totaling 1.25 million) as competition from satellite and new telco video entrants takes its toll. Still, the company has been able to drive revenue per video subscriber steadily higher, to $116.91/month in Q3 '09, reflecting the value of product bundling and success in its business services area. As I said last year, Comcast has effectively moved "up-market," targeting consumers who are willing and able to afford a $100-$200 monthly bill to enjoy the modern digital lifestyle.

Even as the company continues to turn in solid financial performance, Comcast's slowing growth in the core areas of digital TV, broadband and voice are evident in the chart below, which converts the net additions to each service, plus the contraction in basic video subs, into trend lines. With the exception of a few sporadic blips up, over the past 3 years, all 3 areas have shown a steady deceleration in growth. For example, in the most recent 4 quarters (Q4 '08 - Q3 '09), Comcast added 3.4 million digital TV, broadband and voice subs, but this was down 38% vs. the 5.5 million digital TV, broadband and voice subs it added in the year earlier 4 quarters (Q4 '07 - Q3 '08). In the most recent 4 quarters, Comcast also lost 657,000 cable subs, vs. 436,000 in the earlier 4 quarter period, a 51% increase.

Meanwhile, a big bright spot over the last 3 years for Comcast has been the strong progress it has made in converting its subscriber base to digital TV. As the chart below shows, digital TV penetration now stands at nearly 76% of cable subs, up from about 69% at the end of Q3 '08, and about 61% at the end of Q3 '07. Between bundling, new digital channels, HD, VOD, an improved channel guide and DVR availability, Comcast has strengthened the value proposition for subscribers to convert to a digital set-top box, bringing the company higher revenues and a larger universe to deliver new services to, not to mention a stronger defense against possible cord-cutting.

With the slowdown in net additions occurring, Comcast has clearly begun contemplating where new growth, as well as expense reduction, will come from. Given its negotiations for a controlling stake in NBCU, for now it looks like the company's main strategy is deepening its stake in the content business. Since Comcast hasn't even formally acknowledged the negotiations, much less revealed what the financial and strategic benefits any deal might offer, it's too early to weigh the deal's pros and cons.

Should the deal happen though, it will certainly absorb significant management resources. Given how important an effective rollout of TV Everywhere is to the company, anything that distracts from this task would be a setback. Further, as I recently speculated in "How TV Everywhere Could Turn Cable Operators and Telcos Into Over-the-Top's Biggest Players," Comcast must also keep an eye on competitive drivers that might require it to serve video outside of its traditional geographical footprint (note, Comcast executives say there are no such plans). Doing so would be a herculean management challenge. Last week's research revealing that potentially 54% of Netflix's 11.1 million subscribers now use the service to stream video each month was a reminder that powerful national competitors are steadily building their IP-based delivery businesses through a variety of connected CE devices. These kinds of "over-the-top" services are inevitably competitive to Comcast and other incumbent video providers.

As Comcast has transformed itself into a digital powerhouse it has positioned itself extremely well for continued market leadership. How it chooses to allocate its vast resources, and then how well it executes on its choices will determine how much of its significant potential is realized.

What do you think? Post a comment now.

Categories: Cable TV Operators

Topics: Comcast

-

New Forrester Report Evaluates 6 Online Video Platforms

On Friday, Forrester Research released an analysis of 6 online video platform vendors. As with other comparison reports that come out regularly, Forrester's will have value as a starting point in evaluating options, but should be considered far from definitive.

With only 6 vendors evaluated, the biggest shortcoming of the new report (parts of which I've seen) is its lack of comprehensiveness. Selecting the field is always a key issue in any comparison process. And when trying to evaluate a market like online video platforms, with dozens of competitors, there's a natural tension between comprehensiveness and quality/cost. The broader the field that Forrester chose to evaluate, the more time-consuming and costly the report would have been to produce.

The downside of choosing only 6 is that a lot of other high-quality competitors, along with their particular strengths, are left out. This clearly skews overall conclusions. In Forrester's case it's also not entirely clear why the 6 - Brightcove, Ooyala, Kaltura, VMIX, Fliqz and Twistage - were actually chosen. For example, the report indicates that vendors that primarily focus on the high end of the market such as thePlatform and Digitalsmiths were not included. Yet arguably, Brightcove has as much focus on premium content providers as either of these companies do. thePlatform is also the most established player in the market, so to not include it means missing a critical market benchmark.

Forrester used 37 criteria to evaluate the vendors, grouped into 3 categories, Current Offering, Strategy and Market Presence. The sources of the data it used to assign scores to each vendor for the criteria were vendor surveys, product demos and customer reference calls. All of this is very useful, but it appears that Forrester did not do any hands-on testing itself. Having seen so many demos myself, I've come to believe that the only way to truly get a sense of the vendor's work flow and specific capabilities is to use with the platform directly. By definition demos are orchestrated to shine the best light on a platform's work flow; it's only through using one day-to-day that a nitty-gritty understanding can be gained.

Lastly, Forrester's conclusion that Brightcove and Ooyala are "Leaders," Kaltura and VMIX are "Strong Performers," and Twistage and Fliqz are "Contenders" feels like it could be more rigorous. For example, if statements like "stay away from these guys, they're truly inferior" or "if x, y and z features are critical to you, look no further" had been used, the reader would gain more clarity on where Forrester stands. Instead each vendor seems to have its own strengths, while weaknesses such as "...lack strong capabilities in areas such as distribution and scalability..." seem too high level.

All of this said, for customers looking for a first-cut evaluation of a limited segment of the market (which is how Forrester itself seems to be positioning the report), it is a useful tool. Whether it's worth the $1,749 asking price is another matter. I'd recommend also having a look at sources like VidCompare.com and the market snapshot from Marketing Mechanics.

What do you think? Post a comment now.

Categories: Technology

Topics: Forrester Research

-

4 Items Worth Noting for the Nov 2nd Week (Q3 earnings review, Blu-ray streaming, Apple lurks, "Anywhere" coming)

Following are 4 items worth noting for the Nov 2nd week:

1. Media company and service provider earnings underscore improvements in economy - This was earnings week for the bulk of the publicly-traded media companies and video service providers, and the general theme was modest increases in financial performance, due largely to the rebounding economy. The media companies reporting - CBS, News Corp, Time Warner. Discovery, Viacom and the Rainbow division of Cablevision - showed ongoing strength in their cable networks, with broadcast networks improving somewhat from earlier this year. For ad-supported online video sites, plus anyone else that's ad-supported, indications of a healthier ad climate are obviously very important.

Meanwhile the video service providers reporting - Comcast, Cablevision, Time Warner Cable and DirecTV all showed revenue gains, a clear reminder that even in recessionary times, the subscription TV business is quite resilient. Cable operators continued their trend of losing basic subscribers to emerging telco competitors (with evidence that DirecTV might now be as well), though they were able to offset these losses largely through rate increases. Though some people believe "cord-cutting" due to new over-the-top video services is real, this phenomenon hasn't shown up yet in any of the financial results. Nor do I expect it will for some time either, as numerous building blocks still need to fall into place (e.g. better OTT content, mass deployment of convergence devices, ease-of-use, etc.)

2. Blu-ray players could help drive broadband to the TV - Speaking of convergence devices, two articles this week highlighted the role that Blu-ray players are having in bringing broadband video to the living room. The WSJ and Video Business both noted that Blu-ray manufacturers see broadband connectivity as complementary to the disc value proposition, and are moving forward aggressively on integrating this feature. Blu-ray can use all the help it can get. According to statistics I recently pulled from the Digital Entertainment Group, in Q3 '09, DVD players continue to outsell Blu-ray players by an almost 5 to 1 ratio (15 million vs. 3.3 million). Cumulatively there are only 11.2 Blu-ray compatible U.S. homes, vs. 92 million DVD homes.

Still, aggressive price-cutting could change the equation. I recently noticed Best Buy promoting one of its private-label Insignia Blu-ray players, with Netflix Watch Instantly integrated, for just $99. That's a big price drop from even a year ago. Not surprisingly, Netflix's Chief Content Officer Ted Sarandros said "streaming apps are the killer apps for Blu-ray players." Of course, Netflix execs would likely say that streaming apps are also the killer apps for game devices, Internet-connected TVs and every other device it is integrating its Watch Instantly software into. I've been generally pessimistic about Blu-ray's prospects, but price cuts and streaming could finally move the sales needle in a bigger way.

3. Apple lurks, but how long will it stay quiet in video? - The week got off to a bang with a report that Apple is floating a $30/mo subscription idea by TV networks. While I think the price point is far too low for Apple to be able to offer anything close to the comprehensive content lineup current video service providers have, it was another reminder that Apple lurks as a major potential video disruptor. How long will it stay quiet is the key question.

While in my local Apple store yesterday (yes I'm preparing to finally ditch my PC and go Mac), I saw the new 27 inch iMac for the first time. It was a pretty stark reminder that Apple is just a hair's breadth away from making TVs itself. Have you seen this beast yet? It's Hummer-esque as a workstation for all but the creative set, but, stripped of some of its computing power to cost-reduce it, it would be a gorgeous smaller-size TV. Throw in iTunes, a remote, decent content, Apple's vaunted ease-of-use and of course its coolness cachet and the company could fast re-order the subscription TV industry, not to mention the TV OEM industry. The word on the street is that Apple's next big product launch is a "Kindle-killer" tablet/e-reader, so it's unlikely Steve Jobs would steal any of that product's thunder by near-simultaneously introducing a TV. If a TV's coming (and I'm betting it is), it's likely to be 2H '10 at the earliest.

4. Get ready for the "Anywhere" revolution - Yesterday I had the pleasure of listening to Emily Green, president and CEO of tech research firm Yankee Group, deliver a keynote in which she previewed themes and data from her forthcoming book, "Anywhere: How Global Connectivity is Revolutionizing the Way We Do Business." Emily is an old friend, and 15 years ago when she was a Forrester analyst and I was VP of Biz Dev at Continental Cablevision (then the 3rd largest cable operator), she was one of the few people I spoke to who got how important high-speed Internet access was, and how strategic it would become for the cable industry. 40 million U.S. cable broadband homes later (and 70 million overall) amply validates both points.

Emily's new book explores how the world will change when both wired and wireless connectivity are as pervasive as electricity is today. No question the Internet and cell phones have already dramatically changed the world, but Emily makes a very strong case that we ain't seen nothing yet. I couldn't help but think that TV Everywhere is arriving just in time for video service providers whose customers increasingly expect their video anywhere, anytime and on any device. "Anywhere" will be a must-read for anyone trying to make sense of how revolutionary pervasive connectivity is.

Enjoy your weekends!

Categories: Aggregators, Books, Broadcasters, Cable Networks, Cable TV Operators, Devices

Topics: Best Buy, Bl, Cablevision, CBS, Comcast, DirecTV, Netflix, News Corp, Rainbow, Time Warner Cable, Time Warner. Discovery, Viacom

-

VideoNuze Report Podcast #39 - November 6, 2009

Daisy Whitney and I are pleased to present the 39th edition of the VideoNuze Report podcast, for November 6, 2009.

This week Daisy and I first dig into the research I shared about Netflix's Watch Instantly users that I wrote about earlier this week. The research, by One Touch Intelligence and The Praxi Group, indicated that 62% of respondents have used the Watch Instantly streaming feature, with 54% saying they use it to watch at least 1 movie or TV show per month. Daisy and I discuss the significance of these and other data from the research. As a reminder the research is available as a complimentary download from VideoNuze.

Daisy is in NY this week attending Ad:Tech, and she then shares observations from a couple of sessions she's attended. In particular she passes on the advice that Sir Martin Sorrell, head of large agency holding company WPP, about where the advertising business is heading and how he's preparing WPP for the future.

Click here to listen to the podcast (14 minutes, 45 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, Aggregators, Podcasts

-

YouTube As the Ultimate Brand Engagement Platform

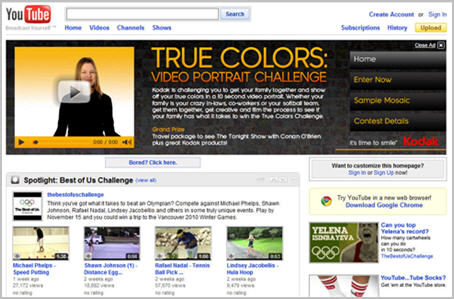

Surfing over to YouTube the other day, I was struck by how the site could well become the ultimate brand engagement platform. Below is a screen shot of what I found - nearly all the visible real estate showcased 2 different brand contests encouraging users to submit videos for a chance to win prizes.

The first contest, the "Kodak True Colors: Video Portrait Challenge," was just kicking off, and therefore had prominent positioning. The contest urges users to submit as many 10-second videos as they'd like in pursuit of a grand prize including 2 tickets to a taping of the "Conan O'Brien" show. The other contest, "The Best of Us Challenge," by the International Olympic Committee, shows athletes doing something outside their specialty (e.g. Michael Phelps doing speed putting, Lindsey Jacobellis doing the hula hoop) and asks user to emulate these or create their own challenge. The winner receives a trip for 2 to the 2010 Vancouver winter games. The contest was featured in YouTube's "Spotlight," a section on the home page populated by YouTube's editors based on user ratings.

These types of brand contest are not necessarily new, nor are their inclusion in YouTube. Over a year ago I suggested there was real opportunity in what I called "purpose-driven user-generated video" - the idea that with YouTube turning millions of people into amateur video producers, their enthusiasm and skills could be channeled to specific purposes. The success of campaigns like Doritos' $1 Million Super Bowl challenge has amply demonstrated that great creative and great buzz can be generated from a well-executed UGV campaign.

What YouTube's home page that day demonstrated to me is that as brands continue embracing online video and user participation, the go-to partner will be YouTube. There's simply no better way to reach a broad audience of likely contestants than by making a big splash on YouTube. While YouTube's monetization challenges have become one of the most-talked about industry topics this year, I'd argue there's been insufficient focus on the fact that since May '08, YouTube's share of overall video viewing has stayed right around 40%, at least according to comScore. In that time, YouTube's videos viewed per month have more than doubled, from 4.2 billion, to 10.4 billion in September '09.

Even as sites like Hulu and others have launched and promoted new and innovative sites, YouTube continues to retain its share of the fast-growing online video market. YouTube has also matured considerably, with its Content ID system largely sanitizing the site from pirated video and helping change its perception among copyright owners. (Note that on my recent visit to YouTube I searched in vain for a video of Johnny Damon's double steal in Game 4 and found nothing but "This video is no longer available due to a copyright claim by MLB Advanced Media." In the old days a video like that would have been available all over the site.)

While YouTube has made headway adding premium content partners, a significant part of its appeal remains users uploading and sharing videos. YouTube's combination of massive audience, ubiquitous brand, user interactivity and promotional flexibility make it an ideal partner for brands looking to engage their audiences through video.

Last summer I got plenty of flak for my post, "Does It Actually Matter How Much Money YouTube Loses?" in which I argued that YouTube's long-term strategic value (and Google's financial muscle to support the site's short-term losses) superseded the company's current losses. While I didn't mean to suggest in that post that a company can afford to lose money forever, I was trying to contend that YouTube, the dominant player in a fast-growing and highly disruptive market will eventually find its way to profitability and is well worth Google's continued investment.

YouTube is a rare example of a "winner take all" situation; there is no other video upload and sharing site even on the radar. As video becomes ever more strategic for all kinds of brands, they will increasingly recognize that YouTube is a must-have partner. If Google can't figure out how to make lemonade out of YouTube's lemons, then shame on them. I'm betting, however, that they will.

What do you think? Post a comment now.

Categories: Aggregators, Brand Marketing, UGC

Topics: Doritos, Google, IOC, Kodak, YouTube