-

Transpera Raises $8.25M Series B, Builds Out Mobile Video Services

Meanwhile, Transpera, which I wrote about previously here, is also announcing today an $8.25M Series B round, including new investor Labrador Ventures and existing investors Flybridge Capital Partners, Intel Capital and First Round Capital.

The mobile video space is earlier stage than broadband, but is coming on strong. At the recent Digital

Hollywood Fall, I ran into Transpera CEO/founder Frank Barbieri, who told me that the company's phones are ringing off the hook from content providers seeking a turnkey mobile video distribution and monetization platform (recall that Transpera is both a technology provider and a mobile ad network). He explained that for now, customers are focused on the basics: getting their video out there and getting paid for it. Other more interactive features are less important, at least for now.

Hollywood Fall, I ran into Transpera CEO/founder Frank Barbieri, who told me that the company's phones are ringing off the hook from content providers seeking a turnkey mobile video distribution and monetization platform (recall that Transpera is both a technology provider and a mobile ad network). He explained that for now, customers are focused on the basics: getting their video out there and getting paid for it. Other more interactive features are less important, at least for now.We touched on mobile video briefly at my two panels earlier this week. There's definite excitement, particularly in light of the iPhone's rapid acceptance. Wherever I go, people seem to accept as an inevitable that there's strong consumer appetite for mobile video. Transpera seems well-positioned to capitalize on this.

What do you think? Post a comment now.

Categories: Deals & Financings, Mobile Video

Topics: First Round Capital, Flybridge Capital Partners, Intel Capital, Labrador Ventures, Transpera

-

Reflections from Digital Hollywood

On Monday I wrote that a key mission of mine while attending the Digital Hollywood Fall conference in LA this week was to dig into what impact the economic crises is having on the broadband video industry. Specifically I was focused on three things: financing, staffing and customer spending effects.

I wasn't terribly surprised by what I heard; people are quite nervous. Most significantly they're nervous about financing. Many I spoke to cited the recent Sequoia Ventures presentation which offers a very harsh assessment of the landscape for financings and startups. I heard a lot of lukewarm responses like "we'll have to see what happens" from folks when asked about their ability to pursue future financings.

That said, some deals are still being done. One in particular is a new venture debt deal announced this morning by Clearleap. I caught up with their CEO Braxton Jarratt at DH, and one of my takeaways from that meeting was that venture investing may well be returning to its roots favoring technology-oriented companies that address well-understood industry pain points.

This shift would not bode well for content-oriented startups where investors are bet more on the startup's ability to create enterprise value from audience generation and ad revenue. Evidence of belt-tightening in the content world abounds, with the latest news of layoffs coming from 60Frames. All signs from DH suggest this is going to be one of the hardest hit sectors, as business models remain nascent and ROIs uncertain (one executive told me that every content startup has already eliminated at least 10-20% of their headcount, even if you haven't read about it publicly). While there's no shortage of interest in broadband content creation, the question is whether the dollars will be there to fund these ventures.

Closely tied to content's success is the video management/publishing platform space. I had a numerous conversations with folks about the large number of competitors and concern that both customer spending slowdowns and limited financing are going to force a shakeout. These companies are being advised to watch their cash carefully.

Lastly, there was lots of discussion, especially on panels, around ad spending in this climate. Optimists felt that the fundamentals of consumer behavior embracing broadband consumption would force advertisers to continue their spending in broadband. Conversely many pessimists said that friction, lack of clear ROIs, a flight to safety (i.e. a bias toward TV advertising) and the general slowdown would all conspire against broadband ad spending. It's hard to ignore the pessimists' arguments here; my hope is that any pullback is relatively shallow.

One thing that's certain: broadband is not exempt from the consequences of the financial meltdown. All businesses are assessing what they need to do to survive and succeed. Another major wrinkle has been introduced in the broadband video industry's evolution.

What do you think? Post a comment now.

(A postscript: thanks to the many of you who volunteered feedback on VideoNuze at the show. I really appreciate your comments and encourage all readers to let me know their thoughts. What can VideoNuze do differently or better to provide you more value?)

Categories: Advertising, Deals & Financings, Indie Video, Technology

Topics: 60Frames, Clearleap, Silicon Valley Bank

-

Looking for Economic Signals at Digital Hollywood This Week

This week I'll be at Digital Hollywood Fall in LA, the first big industry gathering I've attended since the economic crisis hit. I've been trying to keep my finger on the pulse of what the crisis means for the broadband video industry. Get-togethers like this, with lots of time for informal, off-the-record chats are great for getting a sense of what colleagues think is on the industry's horizon.

Here are 3 interrelated areas I'm most interested in learning about:

Financing

With the credit markets frozen and stock markets tumbling, the availability of financing is topic number one. This is especially relevant for the industry's many earlier stage companies, reliant on private financing from venture capitalists, angels and other private equity investors.

By my count we've seen at least 9 good-sized financings announced since around Labor Day, when the financial markets started coming unglued: Howcast ($2M), blip.tv (undisclosed), Booyah ($4.5M), BlackArrow ($20M), HealthiNation ($7.5M), Adap.tv ($13M), BitTorrent ($17M), Conviva ($20M), and Move Networks (Microsoft, undisclosed). The rumor mill tells me there are at least 2-3 additional financings underway currently. Really smart money (e.g. Warren Buffet) knows that downturns are exactly the time to invest. However, the reality can often be quite different. What's the experience of industry participants trying to raise money these days?

Staffing

In any downturn, the first expense to get cut is people. Headcount reductions are often done quietly, with word later leaking out to the public. Last week brought news of trimming at three indie video providers, Break (11 people), ManiaTV (20) and Heavy (12). More are sure to follow at other companies. As I've written before, the indies are among the most vulnerable in this environment, likely leading many to find bigger partners for both distribution and monetization. But whether layoffs will hit other industry sectors such as platforms, ad networks, CDNs, mobile video and big media is still to be determined by...

Customer spending

Central to the question of how deeply the financial crisis spirals is the interdependence of customer spending at all levels of the economy. Thinking you're safe because you're a B2B company is meaningless if your customers are B2C companies cutting back due to reductions in consumer spending. When consumers tighten their belts that leads to advertisers reducing their spending which leads to media companies scaling back which leads to technology vendors feeling the impact. The reality is we're all in this together.

In fact, the more I read about the economy's fragile condition, the clearer it is that the primary way out is rebuilding confidence and renewed spending at all levels. If a spending paralysis occurs, it could be long road ahead. While there's no reason to believe that consumers are going to slow their consumption of broadband media, the ability to monetize it and innovate around it would be dampened if spending hits a wall.

These are among the topics I'll be looking to discuss at Digital Hollywood this week. If you're attending, drop me a note so we can try to meet up and/or come by the session I'll be moderating on Wednesday at 12:30pm.

What do you think? Post a comment now!

Categories: Deals & Financings, Indie Video

Topics: Adap.TV, and Move Networks, BitTorrent, BlackArrow, blip.TV, Booyah, Conviva, HealthiNation, HowCast, Microsoft

-

Anystream and Voxant Merge, Making Big Bet on Syndicated Video Economy's Future

This morning Anystream, a leading digital media management and production company and Voxant, a content syndication network, have announced their merger. The deal marks an important milestone: it's the first M&A transaction that I'm aware of which is predicated on the Syndicated Video Economy dominating the future broadband video landscape.

NewCo's combined capabilities are noteworthy on many levels, one of which is its potential to disrupt the

competitive dynamics of the video content management and publishing space by providing fundamental new value to content producers. There has been a lot of capital invested in this space, and by my recent count at least 18 companies are playing in or around it. With the broadband gold rush underway, there's been enough business to go around. Competition for new business has mainly focused on features and pricing/business models.

competitive dynamics of the video content management and publishing space by providing fundamental new value to content producers. There has been a lot of capital invested in this space, and by my recent count at least 18 companies are playing in or around it. With the broadband gold rush underway, there's been enough business to go around. Competition for new business has mainly focused on features and pricing/business models. Anystream has traditionally (and somewhat quietly) focused on digital media transcoding and workflow for more than 700 companies around the world. It too has moved up the stack into content management and publishing, lately handling the video management for NBC's Olympics on-demand distribution, and prior to that announcing deals with Hearst-Argyle Television and others. On the other hand, Voxant has been a mid/long tail syndicator, having built out a distribution network with 30,000 publishers gaining rights-cleared content from 400+ providers. These publishers generate 35 million video views per month, making the Voxant network #15 in video views according to comScore.

NewCo's belief is that the bilateral syndication deals we've seen to date (e.g. CBS-Yahoo, ESPN-AOL, Next New Networks - Hulu, among many others) has whetted the market's appetite for this emerging business model, but that there is still far too much friction for syndication to really take off. That fits with what I hear from even the most aggressive content syndicators, one of whose CTOs said on a recent panel I moderated that his company is overwhelmed just trying to fully implement the handful of deals its already done.

NewCo's belief is that the bilateral syndication deals we've seen to date (e.g. CBS-Yahoo, ESPN-AOL, Next New Networks - Hulu, among many others) has whetted the market's appetite for this emerging business model, but that there is still far too much friction for syndication to really take off. That fits with what I hear from even the most aggressive content syndicators, one of whose CTOs said on a recent panel I moderated that his company is overwhelmed just trying to fully implement the handful of deals its already done.So, much as I've considered the Syndicated Video Economy solidly into its first phase of development, I've been sobered by the reality that the operational overhead of negotiating deals, implementing them through distributors' often heterogeneous sub-systems, and monitoring their performance requires so much human intervention that the whole syndication concept could end up collapsing under its own weight. (Side note, this is why the Google Content Network which I wrote about last week also has so much potential).

NewCo seeks to blend Anystream's and Voxant's capabilities, offering to content producers a seamless solution to manage, publish AND distribute clips and programs, at scale, to the Internet's widely dispersed audience. As I see it, NewCo is also a potential two-pronged market disrupter if - and for now this is still a big if - it can monetize premium video at scale through advertising.

First, these new revenues could put NewCo in a position to cross-subsidize its technology platform, thereby altering some of the fundamental economics in the platform space. This could trigger possible price-cutting by others solely dependent on platform revenue. Given the vast number of players in the space, and everyone's hunger for market share, this scenario isn't unreasonable to imagine. Second, NewCo could create steep switching barriers for its media customers. Upon getting a taste for turnkey NewCo-driven syndication revenues, content producers would almost certainly be less enticed by new platform-centric features that other competitors may offer. Combined, these disruptions would create a markedly new competitive dynamic.

Yet don't expect competitors to stand still; many of them are examining how to capitalize on their own distinct advantages to alter the dynamics still further. NewCo's abundantly strong management team must now execute on its vision and help its media customers realize syndication's real value. The Anystream-Voxant merger is a bold and possibly game-changing bet on the Syndicated Video Economy being fully realized over time. If that happens, NewCo will surely be among the industry's long-term winners.

What do you think? Click here to post a comment.

(Disclosures: Anystream is a VideoNuze sponsor and I also provided very brief "sounding-board" reactions to this merger prior to its closing.)

Categories: Advertising, Deals & Financings, Syndicated Video Economy, Technology

Topics: Anystream, Google, Voxant

-

Microsoft Invests in Move Networks, Jointly Power Democratic Convention Video

Move Networks will officially announce tomorrow morning that Microsoft has joined its Series C round as a strategic investor. The $46 million round was unveiled last April and was led by Benchmark Capital. The two companies also recently announced that Move would be integrated with Microsoft's Silverlight media player. The curtain on this first example of their integration is going up momentarily as the companies have also announced they're powering the video feed from the Democratic convention at http://www.demconvention.com/.

With the convention video, Microsoft continues the momentum Silverlight generated during the just-wrapped up '08 Summer Olympics. Meanwhile Move burnishes its reputation for high-quality delivery gained through deals with ABC, Discovery, Fox and others. These two are natural partners.

Categories: Deals & Financings, Partnerships, Technology

Topics: Microsoft, Move Networks

-

More on Heavy's Spinout of Husky Media

Late last week, news broke that Heavy Media, which operates Heavy.com, one of the leading destination sites for men 18-34 was spinning off its Husky Media unit as a standalone ad management and network company. I found the deal intriguing and followed up with David Carson, co-CEO to learn more and see how it plays into larger trends I've been tracking.

Broadband ad networks already compete vigorously with each other to build out their publisher networks and cultivate brands and agencies to obtain a share of their spending. The networks are continuously enhancing their technology and trying to optimize their various ad units to demonstrate the superiority of their approach. And as I recently wrote in "Tremor, Adap.tv Introduce New Ad Platforms," some firms are now enabling ad aggregation in an effort to improve their publishers' effective CPMs.

Broadband ad networks already compete vigorously with each other to build out their publisher networks and cultivate brands and agencies to obtain a share of their spending. The networks are continuously enhancing their technology and trying to optimize their various ad units to demonstrate the superiority of their approach. And as I recently wrote in "Tremor, Adap.tv Introduce New Ad Platforms," some firms are now enabling ad aggregation in an effort to improve their publishers' effective CPMs.With this context in mind, a key question is "does the world really need another video ad management and network?" David patiently explained that they've received a lot of outside interest in their units, namely the "barn doors" that are shown before the video plays, the subsequent skin that remains on the sides while the video plays, and the playlist-like queuing of video with ads judiciously interspersed (which Heavy calls its Video Guide). Heavy has avoided pre-rolls entirely. This interest spurred them to separate Husky.

David believes that each of these units offers superior value. As compared with pre-rolls, where David said "bounce" or early termination rates can be 50% (resulting in the actual content never being seen), with Husky's approach, there's a 90% completion rate, and particularly when users come through the Husky "Video Guide", the number of videos consumed can be 3-6 times greater. David also said they're seeing click-throughs averaging 1.6%, above industry norms.

So of course the next question is, if these units perform so well, what's to stop others from introducing them as well? In fact, David would encourage this, as he believes it would help educate the market and maybe help establish these as preferred units. As long as Husky continues to get its fair share that would be a win. Husky has patents on the skin, and how it works with various video players.

David said investor meetings are underway and he anticipates the company completing its own financing. Husky will have its own separate management team. Heavy also announced last week a syndication deal for its Burly Sports show to CBSSports.com, and, no surprise, Husky will be the ad platform. To the extent that Heavy can do other syndication deals where Husky gets included, that will help it gain market share.

Clearly there continues to be a huge amount of experimentation in the broadband video ad market. The Husky deal further shows that sometimes developing technology for your a site's own use can, if successful, end up creating larger financial value.

Categories: Advertising, Deals & Financings, Indie Video

Topics: Adap.TV, CBSSports.com, Heavy.com, Husky, Tremor

-

Entriq-DayPort Deal Broadens Product Offerings

Though I've been predicting a wave of consolidation among broadband vendors for a while, deals in the space have only been sporadic. I think that's been due to investors continuing to fund independent companies and a sufficient amount of business to go around for most everyone.

One deal that did close in the last few months was Entriq's acquisition of DayPort. I recently had a briefing with Guy Tennant, Entriq's COO and Cory Factor, DayPort's former CEO and now CTO of the combined entity to understand their joint strategy and a recently-expanded deal with Inergize Digital Media.

I've been familiar with Entriq for a while as it was primarily focused on enabling media companies to support paid business models. It specialized in things like rights management, DRM, security, business rules and the like. Yet as advertising as emerged as the business model of choice for many, Entriq has been on a bit of a roller-coaster; there has been some senior management turnover and also I've heard of layoffs.

I've been familiar with Entriq for a while as it was primarily focused on enabling media companies to support paid business models. It specialized in things like rights management, DRM, security, business rules and the like. Yet as advertising as emerged as the business model of choice for many, Entriq has been on a bit of a roller-coaster; there has been some senior management turnover and also I've heard of layoffs. By acquiring DayPort, which supports advertising, Entriq expands its capabilities, allowing it to serve customers regardless of business model choice. This would also include hybrid pay/ad-supported models, which I continue to hear more and more about. The combined company is focusing on verticals like broadcasting (where DayPort always had a presence), independent producers and long-form content, particularly sports. Syndication is another key focus of the combined companies, mirroring the trend that I've written about in the past.

The recently-expanded deal with Inergize builds on a prior relationship DayPort had with the company. Inergize itself provides online solutions to broadcasters and Entriq has now integrated its combined capabilities more deeply with Inergize to serve the market. The two companies are also trying to deeply tie in to existing broadcast work-flow and production operations. One joint customer Guy and Cory cited was Newport Television, which recently acquired the Clear Channel TV stations which as deployed the Inergize/Entriq products.

Entriq-DayPort is competing in the very crowded broadband video content management/publishing space, which I've described previously. Yet by combining, the two companies have certainly strengthened their hand. As the market continues to evolve, they'll be fighting for their share.

Categories: Broadcasters, Deals & Financings, Technology

Topics: DayPort, Entriq, Inergize Digital Media

-

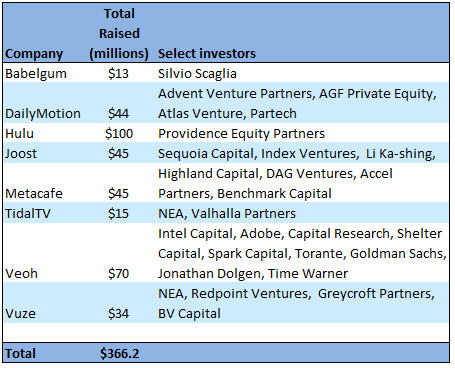

Video Aggregators Have Raised $366+ Million to Date

With this week's news that Veoh has garnered another $30 million in financing, by my count the total amount raised by the top broadband video aggregators now exceeds $366 million. The breakdown is below, according to publicly available data I've pulled together.

While definitions of who should be included in this category are admittedly fuzzy, I consider broadband aggregators to be companies that are providing a broad-based destination site that focuses mainly on professionally-created video. Often these sites include broadcast network and cable TV programming, but they don't have to. I'm sure plenty of readers have their own definitions and that I've overlooked some, so feel free to post a comment to add others to the list.

Savvy investors seem to have an enormous appetite for these kinds of companies. Veoh, with 28 million monthly unique visitors, and others have demonstrated their ability to attract lots of eyeballs. Yet all of these companies are solely reliant on advertising, and that of course makes begs the question how well these companies can convert their traffic to real revenue and therefore become profitable, sustainable businesses?

Since all of these companies are private it is hard to assess their momentum. Yet in a recent panel I moderated at Streaming Media East, Mike Henry, SVP of Ad Sales for Veoh explained the range of current challenges. Chief among them is getting traditional TV media buyers to clearly understand the broadband medium, how to buy into it and how to measure its performance. These are crucial matters since the biggest source of broadband ad dollars will no doubt come from brands shifting their TV spending to broadband.

Of course, to the extent that these companies can continue raising big money, they're buying themselves more runway. Complicating matters is that all of these sites live in the long shadow of YouTube, which alone still accounts for around 40% of all video views per month. Then there are big players like Yahoo, MSN and AOL and recent entrants like Adobe which are vying for their share of the video pie. But at some point these companies will have to show they can make money and survive.

With all these crosscurrents, it will be interesting to see how these companies' stories unfold.

Categories: Advertising, Aggregators, Deals & Financings

-

Yahoo Acquires Maven, First Hilmi Ozguc Interview

The rumor mill of the past 2 weeks proved correct, as Yahoo announced this morning that it has acquired

Maven Networks for $160M. By my count this is the biggest pure-play broadband video deal to date, and is an excellent validation of broadband video's growing importance in the media and technology landscape.

Maven Networks for $160M. By my count this is the biggest pure-play broadband video deal to date, and is an excellent validation of broadband video's growing importance in the media and technology landscape. Hilmi Ozguc, Maven's CEO and co-founder, provided me with an exclusive briefing about the deal, his first comments following the announcement this morning. (As a quick disclaimer, I did some business development and product strategy consulting work for Maven and Hilmi in the company's early days. I didn't have any current financial relationship with Maven.)

As Hilmi says below, and as I've said before (most recently in "My Rant About Super Bowl Ads"), broadband video is increasingly becoming the terrain of the big guys - the biggest brands, publishers, technology providers, networks, etc. As the broadband medium continues to mature, its ability to attract ad

dollars from incumbent media, particularly TV, is going to strengthen. This process will be accelerated by Yahoo as it seeks to drive Maven's capabilities into its customer and partner base.

dollars from incumbent media, particularly TV, is going to strengthen. This process will be accelerated by Yahoo as it seeks to drive Maven's capabilities into its customer and partner base. Following is a summary of my briefing with Hilmi:

Why did you sell the company?

Broadband video is increasingly going to be a game fought between titans because billions of dollars are at stake and the question is how do you get to the top 50 or 100 global media brands and advertisers? We've focused on building tools and technologies that these media companies need. The time to sell was excellent as was the return for our investors.

Can you describe the sale process?

We had several high profile bidders, although I can't identify them. It was gratifying to see multiple companies validate the product initiatives we put in motion 2 to 2 1/2 years ago. Yahoo has the resources to buy anyone. They took a deliberate approach and looked far and wide and concluded that Maven was the right company to buy. The whole process took several months from start to finish. The deal was for $160M, mostly in cash and it officially closed yesterday.

What group will Maven report into?

Maven will be integrated very quickly and deeply into Yahoo because video is so key to what Yahoo is doing in terms of advertising. This will not end up being a little business unit off to the side somewhere. Our engineering team will be part of Yahoo's engineering team. All Maven executives including me will be staying and have similar responsibilities to what we've been doing. A lot of work has already gone into the integration.

Who do you report into?

I'm not sure I'm at liberty to discuss that, as it would be a little too revealing of Yahoo's strategy, but I think it's in the right place to be within the company.

What does Yahoo bring to Maven?

Enormous reach, 500M visitors around the world per month. An incredible roster of advertisers and publishers who are already in their ecosystem. Interesting and complimentary engineering capabilities. A sheer ability to scale this massively. This deal is all about getting our stuff into the hands of the biggest media, publishing and advertising companies and having it exposed to a massive audience. We started as a media technology company, and evolved to mostly an advertising business. So combining with the leader in display advertising was very logical. Being plugged deeply into a company that sells close to $2B of advertising every 90 days is a huge opportunity for us. It's a massive advertising machine.

Does Yahoo-Maven portend more consolidation?

Absolutely. I just don't see how as a small startup you can have a significant enough piece of the pie when all the giants have now woken up and have video as front and center. Other big players are going to come in more aggressively.

What are the implications of Microsoft's takeover bid of Yahoo on Maven?

We need to stay focused at Maven, and as long as we do that I'm not concerned about any distractions. And I shouldn't really talk about the Microsoft deal either!

What are the 2-3 lessons you've learned about the broadband video market in 5 1/2 years since starting Maven?

When we started virtually nobody really believed in video being delivered on the Internet. We had a singular vision that said, look, once broadband is in enough homes, video is going to take off. So that was our first mission: delivery of bits, playback, HD-quality, etc. As the market evolved, the Akamais of the world solved a lot of the delivery problems, so we shifted our focus to publishing and content syndication, advertising and monetization. Basically, how does a media company generate revenue from broadband? So we evolved along with the market. We tried to stay focused on advertising, professional video and largest media companies.

This is your second successful startup - what lessons do you have for entrepreneurs?

1. Focus is the most important thing and ignoring the naysayers. It's natural to want to hedge, but you have to be bold enough to make decisions. Markets do take time to develop. We were early no question, but the market caught up and we were at right place at right time when it did. 2. Agility is also important and being analytical about what the market is saying. So the ability to shoot a direction and switch. And do it fearlessly. Trial and error is key. 3. Bet on the right people. The wrong people can steer you down the wrong path. So you essentially have to be the world's most capable talent scout, to build a team of people at all levels of the organization. A great team will figure it out.

Where's the broadband video market going from here?

Startups got this space going and created a lot of the core technology and innovation, but this is no longer a game of startups. Big media companies want to deal with big technology companies and networks. Big advertisers want to work with biggest publishers. To achieve this scale independently would be very difficult.

What are the key challenges for broadband video market?

I don't want to say the "R" word that everyone's talking about, but if it comes, I hope it's a mild one. As we know, advertisers cut back quickly in difficult economies. Though I don't think this will happen in broadband because it is so promising and it's still pretty small. Another challenge is getting ad agencies and advertisers to think of broadband as being interactive and capable of more than TV ads. You've talked about that a lot at VideoNuze. And finally the need to scale the technology and infrastructure so it's rock-solid and dependable. That's what Yahoo and Maven will focus tightly on. And I think we have all the tools between us to grab the undisputed leadership position in this, if we move fast enough.

So are you going to do startup #3?

My focus for now is on integration and marshalling all these terrific resources. Yahoo has a great team and has been chomping at the bit to have a competitive video offering to sit alongside their display offerings. They have a killer ad sales force, along with great relationships with the biggest publishers. They have mastered how to play on the media company side, and in being a partner to other media companies. We can't wait to get going.

Congrats again.

Categories: Deals & Financings, Portals, Technology

-

Microsoft, Yahoo and Broadband Video

Well, here I was waiting for news to officially cross the wire that Yahoo was acquiring Maven Networks for $150-$170 million (heavily rumored in the blogosphere yesterday and for weeks now) so that I could weigh in, when instead what emerged this morning was that Microsoft is making an unsolicited offer for Yahoo. Quite a day for Yahoo. (Note, I'll have more on Yahoo-Maven if and when that becomes official).

Today's big news is Microsoft's unsolicited $44.6B offer for Yahoo. Talks between the companies have been off and on for a long time, and it looks like Microsoft finally got fed up with the dithering at Yahoo and

decided to make a pre-emptive move. Steve Ballmer's letter to Yahoo's board and today's release is here.

decided to make a pre-emptive move. Steve Ballmer's letter to Yahoo's board and today's release is here. The deal is all about increasing scale to compete more effectively with Google in the online advertising space. Both Microsoft and Yahoo have lagged Google badly and have spent billions in the past year on ad infrastructure acquisitions. Yahoo immediately brings MSN lots of new traffic, which can be monetized with both search and display advertising.

Though Ballmer's letter also highlights "emerging user experiences" such as video, mobile, online commerce, social media and social platforms" down the list, as the fourth area of potential synergies, I would argue that

the upside in video is actually the most strategic benefit of the deal. Why?

the upside in video is actually the most strategic benefit of the deal. Why?The concept of scale, i.e. being able to both reach gigantic audiences and drive massive traffic from them, is absolutely essential for broadband video advertising to become core part of the marketing mix for big brands. Unlike search-based advertising, which has been driven by long-tail advertisers, broadband video advertising is going to be driven by big brands. That's because, notwithstanding the growth of overlays and other formats, pre-, mid- and post-roll ads are going to be with us for a while to come, and they are expensive to produce. The average garage-sized business isn't going to be making them.

Big brands spend tens of billions of dollars on TV ads. Shifting a meaningful part of this spending to broadband delivery is essential for broadband's growth. Brands spend on TV because that's been the only way for them to buy enough audience reach. Though they're beginning to trickle some spending over to broadband, the central obstacle to increasing their broadband spending is that there simply is not enough high quality, targeted video inventory for them to buy in order to achieve their reach objectives and therefore materially impact their businesses.

This is a theme I hear all the time, and just heard many times in the ad-related sessions I attended at NATPE earlier this week. Microsoft knows that to tap the long-term broadband ad opportunity in branded video advertising, it must offer advertisers greater reach, along with interactivity, reporting, social features, etc. This is all the more urgent because MSN and Yahoo are already playing catch-up to YouTube which still drive approximately 40% of all video views, a dominant market position.

MSN has worked hard to cross-promote MSN video in the rest of the site, and this has driven improved user experiences and impressive traffic gains. Yahoo, which has been mired down with a dysfunctional and bloated bureaucracy, has been far less coordinated and effective in video, leaving lots of room for MSN to make improvements.

You won't hear much about video as a key motivator for the deal because Wall Street, which is Microsoft's key audience to persuade, doesn't give a whit about long-term strategic positioning. It only cares about short-term financial metrics like dilution, earnings growth, cost-reductions and so forth. But behind the scenes, I'm giving credit to Microsoft. I think it is reading the tea leaves correctly about how the broadband video ad market is going to unfold and how to get MSN positioned properly for long-term success.

What do you think? Post a comment!

Categories: Advertising, Deals & Financings, Portals

-

Zipidee Buys TotalVid; Guns for Long Tail Video Dominance

This morning Zipidee, a company formed earlier this year, is announcing its acquisition of TotalVid from

Landmark Communications. With the deal Zipidee is gunning to become the king of the long tail, enthusiast video, using a strictly paid model. Yesterday I spoke with Zipidee CEO Henry Wong, and TotalVid President Karl Quist about the deal and the opportunity going forward.

Landmark Communications. With the deal Zipidee is gunning to become the king of the long tail, enthusiast video, using a strictly paid model. Yesterday I spoke with Zipidee CEO Henry Wong, and TotalVid President Karl Quist about the deal and the opportunity going forward.  Zipidee's strategy is to create a digital marketplace for video, audio and ebooks. As Henry puts it, we're "eBay meets iTunes", enabling content providers to set the business rules around how their content can be accessed. Like TotalVid, Zipidee's intent is to open up the broadband distribution market to the many smaller, independent producers who have traditionally relied on inefficient and hard-to-access DVD distribution channels.

Zipidee's strategy is to create a digital marketplace for video, audio and ebooks. As Henry puts it, we're "eBay meets iTunes", enabling content providers to set the business rules around how their content can be accessed. Like TotalVid, Zipidee's intent is to open up the broadband distribution market to the many smaller, independent producers who have traditionally relied on inefficient and hard-to-access DVD distribution channels. I am very familiar with TotalVid, having worked as a part-time biz dev consultant for them for a while, helping pull together a number of distribution deals. TotalVid started up in the relatively early days of broadband video, almost 4 years ago. Karl and his team did a fabulous job gaining access to specialty video in tons of categories such as action sports, martial arts, instruction, etc, eventually aggregating over 500 different content providers providing over 5,500 different titles. This library is very complimentary to Zipidee, which itself has done hundreds of content deals aggregating a library of over 5,000 titles. As Henry explained it, there is virtually zero duplication.

Henry resolutely believes that the paid approach for accessing this type of longer-form, specialty content is preferable to ad-supported. In general I agree with him - this kind of stuff isn't just random low-quality clips and consumers should expect that it won't come free.

However, as many VideoNuze readers know, I believe there are real challenges succeeding with the paid model right now. Chief among them is that the Internet is awash with free video, continuously raising the bar for how to get users to crack open their wallets and pay for anything, no matter how useful or sought after it might be. So this leads to a real marketing and customer acquisition challenge. Meanwhile DVD is a robust format and few people are yet familiar or comfortable with how a paid download works (e.g. is it portable? how does it get moved to other machines, can it be watched on TV?) So there's a big customer education challenge.

Nonetheless, I'm rooting for Zipidee. If they can surmount these and other challenges, they'll have created a hugely valuable digital distribution franchise.

Categories: Aggregators, Deals & Financings, Downloads, Startups

Topics: Landmark Communications, TotalVid, Zipidee

-

Discovery and Scripps Networks Are Blazing Ahead

The past two days have witnessed two very significant cable network-related transactions. First, Discovery announced its acquisition of HowStuffWorks for $250 million, its largest acquisition ever. And second, Scripps announced that it would separate itself into two companies, with its marquee networks, HGTV and Food Network, finally being pried free from the E. W. Scripps's traditional newspaper business.

The past two days have witnessed two very significant cable network-related transactions. First, Discovery announced its acquisition of HowStuffWorks for $250 million, its largest acquisition ever. And second, Scripps announced that it would separate itself into two companies, with its marquee networks, HGTV and Food Network, finally being pried free from the E. W. Scripps's traditional newspaper business.

I interpret these announcements as continued recognition by major cable networks that their futures lie squarely in the interactive and broadband video areas. These networks - and others - are laying the groundwork for an evolution from sole dependence on their traditional business model. That model has been a monster success over the years, built on ever-expanding distribution through cable and other multichannel platforms and annual increases in monthly affiliate fees.

With the advent of the Internet and broadband, the fragmentation of audiences, the proliferation of content startups and the strengthening of online advertising models, all cable networks realize that embracing interactive/broadband opportunities is critical to their future success.

Discovery's acquisition of HSW gives it a trove of broad and deep online content, some developed by HSW and some supplied by third parties, which will now be available to Discovery's multiple properties. In one fell swoop, Discovery gains scale and expertise, which must now be delicately integrated into its current on-air and online brands. If the integration of HSW's content is a success, it will become a template for other deals.

Meanwhile, the Scripps split up follows that of Belo, another lagging newspaper company. The standalone entity, Scripps Networks Interactive, will have a growth focus leveraging strong brands in some of the best lifestyle categories (food, home, luxury, etc.). With its own currency to do deals, I wouldn't be surprised to see Scripps ramp up its acquisition activity as it bolsters its position across all these categories (in fact CEO Ken Lowe said as much in the analyst call). Scripps has been a real leader among cable programmers in building out broadband extensions to its cable networks and I would expect to see that activity grow, accompanied by distribution deals with online distributors which have strong reach.

While the Discovery and Scripps deals are the latest evidence that the traditional cable programming world is undergoing significant change, I expect we'll see plenty more similar moves in the year ahead.

(Note while both Discovery and Scripps are clients, these are my opinions only and no confidential information has been relied upon)

Categories: Cable Networks, Deals & Financings

Topics: Discovery, Food Network, HGTV, HowStuffWorks, Scripps

-

Black Arrow Shoots for Multiplatform Ad Success

Black Arrow has an ambitious goal of managing and serving ads across broadband video, DVR and VOD platforms. With audience fragmentation causing chaos in the advertising world, such a solution, when fully implemented, would have enormous value to content companies and service providers (cable, satellite, telco).

Black Arrow has an ambitious goal of managing and serving ads across broadband video, DVR and VOD platforms. With audience fragmentation causing chaos in the advertising world, such a solution, when fully implemented, would have enormous value to content companies and service providers (cable, satellite, telco).Black Arrow has been around for a while but went under the radar for the past few months. Now it's re-emerging, with new CEO Dean Denhart installed about 6 months ago.

Dean briefed me last week on news the company announced today, which included closing a $12M B round from existing investors Comcast, Cisco, Intel, Mayfield and Polaris and officially launching their ad platform.

The company is trying to differentiate itself from many others serving ads in the broadband video space by tackling the thorny problem of also inserting in both the DVR and VOD environments. DVR insertion today is non-existent and for VOD it's not scalable. To succeed, the company will need to integrate its servers with the service providers, which is no easy feat. As many of you know, the rap on cable operators - and I've experienced this first-hand - is that selling into them wears out early-stage companies, using up precious time and capital in long drawn-out testing, selling and negotiation cycles.

If Black Arrow survives this process and proliferates its gear into headends, it will have a formidable competitive advantage against competitors. And on the encouraging side, in the cable world at least, a nascent set of standards dubbed "DVS 629" governing digital ad insertion is now being worked on. Black Arrow is following these closely. Dean explained that the company has proven in its technology and in 2008 it will be pursuing field trials and initial rollouts with major operators. Certainly having Comcast as a lead investor can't hurt its chances.

Black Arrow's real appeal to content companies will only begin when it has significant deployments. Dean explained that while the cable sell-in process continues to unfold, it will follow a parallel track of managing ads for broadband, with the longer-term value prop of multi-platform support. And it's taking a wait-and-see approach on which business model to use to fund the capex for proliferating its servers. An analogous and interesting approach is the one Akamai has mastered - i.e. not charging ISPs. Instead it positions its gear contributing to top-line growth and opex reductions. This strategy has been a massive success for Akamai, helping it achieve widespread deployments and a huge entry barrier for competitors.

I really like this company's vision; however achieving it in full is going to take tenacity, patient and deep-pocketed investors and a few good breaks.

Categories: Advertising, Cable TV Operators, Deals & Financings, Startups

Topics: Black Arrow, Cisco, Comcast, Intel, Mayfield, Polaris

-

Will eBay's Skype Write-down Hurt Joost and Other Video Players?

The news that eBay was going to write a portion of its Skype purchase did not really surprise many people, although its magnitude, $1.4B out of $2.6B paid still felt shocking. At the time of the deal, it seemed the only people who thought the deal made any sense were eBay's CEO Meg Whitman and her board. Whether they thought there was strategic sense to the deal or not, certainly Skype's founders Niklas Zennstrom and Janus Friis must have been grinning widely at the willingness of eBay to pay such a ridiculous premium for their company.This Times piece noted that:... revenue and earnings projections made by Skype executives before the sale to eBay turned out to be "a bit front-loaded" according to Mr. Zennstrom.

although its magnitude, $1.4B out of $2.6B paid still felt shocking. At the time of the deal, it seemed the only people who thought the deal made any sense were eBay's CEO Meg Whitman and her board. Whether they thought there was strategic sense to the deal or not, certainly Skype's founders Niklas Zennstrom and Janus Friis must have been grinning widely at the willingness of eBay to pay such a ridiculous premium for their company.This Times piece noted that:... revenue and earnings projections made by Skype executives before the sale to eBay turned out to be "a bit front-loaded" according to Mr. Zennstrom.Not to take anything away from the potential of Joost, the pair's much-heralded broadband video aggregator, but if you were considering making an investment in the company or any other in the video space, wouldn't this whole eBay-Skype affair make you cautious? Seeing such a gigantic writedown, and now the admission that the projections has to make prospective investors just a little more cautious about Joost, and all other video players as well.

I'm asked frequently, is there a bubble in the video space? I think the answer is that yes, investors are getting too enthusiastic, as they always do when they smell a transformative opportunity. The Skype writedown is a reminder to all investors in the space that being optimistic about broadband's potential is right, but keeping their sanity regarding valuations is critical. eBay just reminded all of us of the cost of not doing so.

Categories: Aggregators, Deals & Financings

-

WCSN: Succeeding With the Long Tail of Sports

Yesterday's news that World Championship Sports Network (WCSN) has sold a majority interest to Leo Hindery's InterMedia Partners shows that the company's success in aggregating the Long Tail of sports is succeeding. In addition, it shows there are slivers of success in paid subscription models. To be sure, WSCN also sells plenty of ads, but the core of the company's model is its $4.95/mo or $49.95/year subscriptions.

Yesterday's news that World Championship Sports Network (WCSN) has sold a majority interest to Leo Hindery's InterMedia Partners shows that the company's success in aggregating the Long Tail of sports is succeeding. In addition, it shows there are slivers of success in paid subscription models. To be sure, WSCN also sells plenty of ads, but the core of the company's model is its $4.95/mo or $49.95/year subscriptions. Hindery, who in his past life headed former #1 cable operator TCI, knows from TCI's old Liberty Media affiliate, as much as anyone about creating programming value, and this move should certainly be read as a major endorsement of WCSN's strategy. The company has come a long way quickly, I recall speaking to CEO Claude Ruibal about 18 months ago when he was first fleshing out his distribution strategy. Kudos to him and his team for doing deals with many of the majors (MSN, AOL, Yahoo, FoxSports, ESPN.com, etc.) and no doubt driving dramatic traffic gains.

For those not familiar with WCSN, their model has focused on aggregating exclusive Internet rights from key Olympics sports associations, whose sports are generally not well-covered on broadcast or cable TV.

WCSN has been remarkably successful in aggregating these rights. The site lists at least 20 association partners and says "WCSN’s sports coverage includes over 200 live annual events, offering more 2,000 hours of annual original event programming and more than 10,000 hours of archival programming..." One can only imagine the frequent flyer miles that have been racked up by WCSN executives getting these deals done.

WCSN’s sports coverage includes over 200 live annual events, offering more 2,000 hours of annual original event programming and more than 10,000 hours of archival programming..." One can only imagine the frequent flyer miles that have been racked up by WCSN executives getting these deals done.

A key lesson to WCSN's subscription success is the incredible allure of sports programming. No matter how niche, there seems to always an audience of rabid fans. And their willingness to pay for coverage is insatiable. Now it looks like WCSN is going to ramp up its ad sales as well. In doing the spade work to aggregate this long list broadband rights with clear monetization opportunities, WCSN has created substantial value. No doubt as the business continues to grow it will be an attractive acquisition candidate. If I had to bet, I'd expect an exit to ESPN, the sporting world's 800 pound gorilla, will be in the offing down the road.

Categories: Deals & Financings, Sports

Topics: InterMedia, WCSN

-

ScanScout Update and New TW Investment

On Friday I had a chance to meet with and get an update from Waikit Lau, COO/President and Co-Founder of ScanScout. They had given me a heads up earlier in the week about this morning's announcement of a strategic investment by Time Warner and new board member appointments, so I wanted to get a closer look.

ScanScout is among a group of companies that are trying to improve monetization of broadband video by using analysis techniques (e.g. audio, visual and metadata) to deliver highly contextual ads that go beyond conventional pre-roll ads. This group includes, to one extent or another, Digitalsmiths, Yume, Adap.tv, blinkx and Nexidia. ScanScout's format of choice is the "overlay", subject of much recent rabble following YouTube's decision to jump on this format's bandwagon.

Waikit explained that ScanScout sees its secret sauce in "extracting signals" (or descriptive data) from video streams, identifying semantics and correlations of like data and enabling "brand protection."

ScanScout first analyzes video content to characterize it so that scenes can become valuable in a way that today's keywords are. This is done though speech recognition, visual analysis and meta-data collection. Next, ScanScout technology is crawling the web each day to find all nouns and pronouns to determine how they relate to one another. By understanding these correlations and the underlying semantics, ScanScout's system becomes smarter, in turn enabling its advertisers to optimize their targeting. Finally, ScanScout's "brand protection" allows advertisers to de-select certain kinds of content and keywords so that their ads don't run in those offending videos.

The company is focusing on a network business model, so it's trying to sign up as many valuable publishers as possible to build its inventory, while also enticing advertisers and agencies to allocate some budget to its platform. Certainly having Time Warner in its corner will help the company gain access to the trove of TW content. However the company isn't focusing solely on big branded content. Waikit favors "torso" video (in Long Tail-speak, content between the head and UGC), that is monetization-challenged. And the company is focusing now on the entertainment vertical and on shorter form content, which Waikit sees as ideal for the overlay format.

It's a pretty cool model, but still needs time to be fully proven. Big brands love the CPMs they're getting for pre-rolls, so overlays are going to be less appealing for now. And for ScanScout and all its competitors, the proof of their wizzy technology will be tangibly improved targeting leading to higher user click-throughs and engagement. It's still too early to know whether the science leads to actual results. But with broadband content providers large and small scrambling for improved monetization, ScanScout and the others are playing in very fertile ground.

Categories: Advertising, Deals & Financings

Topics: ScanScout, Time Warner

-

DailyMotion Raises $34 Million, Is Category Over-Funded?

WSJ reported today that DailyMotion, the French video sharing site, has raised $34 million in a round led by Advent Venture Partners LLP of London and AGF Private Equity. This financing adds to a wave of capital that has poured into the overall ad-supported video sharing/video aggregator platform space in the last few months.

Companies that I think fit in this group that have recently raised big money are Joost ($45 million), Veoh ($26 million), Metacafe ($30 million) and blip.tv ($10 million). Hulu, the NBC-News Corp JV which raised $100 million could even be considered in this category. And thinking a little more broadly you could include sites like Heavy.com, Break, Vuguru, Next New Networks, DaveTV, Babelgum, BitTorrent and others which are creating and/or aggregating broadband programming.

To be fair, each of these companies has a slightly different approach to their content strategy (pure aggregation vs. original development vs. hybrids), market positioning and technology capabilities. However, as best I can tell, they're all trying to offer distinctive video content into broadband-only delivery networks and to one extent or another, surround this programming with interactive tools. The intended result is unique viewing experiences.

In the aggregator roles they play, they're muscling themselves into the market owned by traditional video distributors like cable and satellite operators, and more recently telcos. These new companies are all very interesting to watch because ultimately they must do at least 3 things to generate traffic and revenue: (1) differentiate themselves from each other, (2) add value to content providers/producers relative to CPs/producers relying solely on a direct-to-consumer approach and (3) shift viewing time from the traditional distributors' programming to their own.

Any one of these would be a pretty high hurdle to get over. Doing all three will be even tougher. Yet a lot of smart money keeps backing these companies, further demonstrating how hot this overall category is -- and how quickly it could become overfunded. But I don't expect things to cool down any time soon. We can expect further funding in this space as investors clamor to get a piece of the action in broadband video.

Categories: Advertising, Deals & Financings, UGC, Video Sharing

Topics: BitTorrent, DailyMotion, Hulu, MetaCafe, Next New Networks, Veoh, Vuguru, YouTube

-

5 Reasons Why Comcast Should Take Out Yahoo. Now.

Terry Semel's departure as CEO of Yahoo has again raised speculation that Yahoo is acquisition bait. Of course this rumor's been flying for ages. So here's my point of view: Comcast should acquire Yahoo. And they should do it now.

Some of you will recall that in my September, 2005 e-newsletter, "Why Comcast Should Acquire AOL" I laid out the case for Comcast to push aggressively into the online media business. At the time I thought an acquisition of AOL would be a bold stroke. While I had no inside knowledge of Comcast's plans, shortly afterwards it came to light that Comcast had indeed sniffed around AOL. Now, again, I have no knowledge of Comcast's possible interest in Yahoo, but it wouldn't surprise me if we saw something surface soon. It would be a very smart deal for Comcast. Following are my 5 key reasons. Judge for yourself.

1. The offensive case: Comcast needs more exposure to the online media business

Comcast is a company that urgently needs more long-term exposure to the online media business. In the last few years online usage and online advertising have exploded. A more recent category of burgeoning growth is of course, broadband-delivered video. I believe the trends around both online and broadband usage are only going to gain further momentum in the years ahead.

To see why, it is critical to understand the shift in media consumption patterns occurring among young people today. As one data point, JupiterResearch recently reported that online users under 35 spend more time online than watching TV. Meanwhile Magid just released figures showing that 80% of 18-24 year old males watch broadband video at least once a week, with 35% watching on a daily basis.

Today's young people live online. There is scarcely an aspect of their lives (except sleeping, eating, and other obvious activities) that they do not look to the Internet and mobile technologies to fulfill for them. All of this activity has also fueled their general product/service expectations. Accustomed to significant personalization, choice and price competition, this group is going to be the toughest customer base to please and the least tolerant of products/services that don't meet their specific needs. How does all this relate to cable? I believe that when many young people set up their own apartments, they will increasingly conclude that cable operators' basic programming tiers do not meet their personalized needs and will be looking online for programming alternatives.

Any company in the media or related industries that is not positioning itself squarely in the middle of the online media space, and broadband video in particular, is making a huge mistake. Some of you have heard me say this before: when companies get on the wrong side of fundamental changes in customer behavior, they are sure to meet with peril in the future. For just one example, consider the catastrophic state the U.S. auto industry now finds itself in because it failed to understand shifting consumer tastes 30 years ago (tastes which Japanese makers grasped and have mercilessly capitalized on).

To be fair, it's not as if Comcast has ignored online media and broadband video. It has acquired thePlatfom and Fandango, has started Ziddio and will soon be launching Fancast. And its Comcast.net portal gets strong traffic. However, I believe that even when all these activities are combined, they do not give Comcast enough exposure to online media.

A Yahoo deal is all about Comcast being positioned properly and with the right scale to exploit the inexorable shift to online and broadband usage. Alternatives that do not do so as quickly or forcefully are by definition sub-optimal.

2. The defensive case: Comcast must pre-empt another Yahoo acquirer

As important as the offensive case is for Comcast, the defensive one may be even stronger. Comcast simply cannot allow Yahoo to fall into either Microsoft's or (heaven forbid), Google's hands (though that prospect would face steep FTC objections).

To see why this is so important it is necessary to understand a fundamental change happening in the media business, which is that the economics of media are rapidly shifting away from consumer-paid models (i.e. subscriptions, a la carte purchases, etc.) toward ad-supported models.

There are at least two important and interrelated reasons for why this is happening. First, the efficiency and effectiveness of the advertising business are both improving dramatically. Online targeting technologies (search/keyword, contextual, behavioral and other mechanisms) enable marketers to get unprecedented returns on their spending. As marketers spend more online and compete with each other for limited high-quality ad inventory, publishers in turn are able to monetize their content better than ever. This dynamic is the backstory behind online advertising's resurgence. I believe it is not only going to continue, but quickly spread into the video business, which has, to date, been well-insulated from the Internet revolution.

The second and interrelated reason for the shift in media economics is that various technologies (digitization, storage, bandwidth) are all making it lower-cost (and in some cases, virtually no-cost) for companies to provide at least an introductory tier of their services for free. With costs so low, it is possible for providers to employ much more flexible business models and still generate adequate financial returns.

As a result, a genuine pattern is developing whereby traditionally premium services (i.e. those paid for by consumers) are becoming free, either with ads, or in some cases, without. The examples abound. Start with my favorite - online access to broadcast TV programs. Just over a year ago the only way to watch a broadcast program online was to buy it, likely at iTunes. Now over 40 hit broadcast programs are freely available - on an ad-supported basis - with more coming all the time. Broadcasters have quickly recognized that advertising is a far better business than paid downloads.

There are plenty of other examples. You can now make a 411 call without charge, courtesy of Jingle Networks and others, supported by ads. Or get an email account with unlimited storage for free, with ads. Or send receive a free fax. And the list goes on.

Given all of this, I believe that an important future competitive advantage in the media industry (in fact, quite possibly, the most important competitive advantage) will be expertise in content monetization through increasingly sophisticated advertising mechanisms. Companies that have this capability will be the media industry's ultimate winners. Of course, in search, that's the position that Google has expertly dominated to date, driving its lofty stock price. And by the way, Google and Microsoft have each just doubled-down on this advertising theme, recently spending a combined $9B to acquire DoubleClick and aQuantive respectively (which had combined revenues of less than $600 million in 2006).

So stop and consider a company like Comcast, which in 2006, generated about 60% ($15.1B) of its overall revenues from cable TV subscriptions. High speed Internet kicked in another 20% ($5B), voice 3.6% ($913M), programming networks (all TV-based) 4.2% ($1.05B) and local advertising 6.1% ($1.5B). By my calculations, Comcast's ratio of consumer subscription revenue (cable + Internet access + voice = $21B) to advertising revenue (programming + local advertising = $2.55B) is around 8:1 (note I didn't deduct affiliate fees its programming networks take in). That means that as cable TV networks inevitably offer more of their programming for free to consumers (which is already happening in the recent Joost deals) and more content choices are available through broadband , Comcast's cable TV subscription business becomes increasingly vulnerable and along with it, Comcast's overall financial health.

So if you buy my logic that content monetization through ads is critical, that Comcast doesn't have enough expertise in this area and that its current subscription TV business is vulnerable long-term, the question becomes how does Comcast re-position itself to compete properly down the road?

Could Comcast build out its own content monetization and advertising capability? Sure, anything's possible. But consider how long Yahoo itself (with its deep roots in Internet search) has been laboring over Panama (its next generation ad system) just to gain parity to Google and you get a sense of the enormity of the challenge. An alternative would be for Comcast to partner for this capability. That's possible too, but sub-optimal. If you believe that content monetization is going to be as critical in the future as I do, how could a company with Comcast's reach not have this as a core internal competency?

So here again, a Yahoo deal would not only give Comcast these crucial capabilities, but also preclude another company from gaining access to Yahoo's content monetization technologies and skills. This would remove the threat of that company competing more strongly against Comcast in the future.

3. Yahoo enables Comcast to become THE next generation video aggregation leader

Acquiring Yahoo would allow Comcast to take a leadership role as THE next-generation, cross-platform video aggregator. This is the most exciting reason for the acquisition. As content distribution continues to shift to broadband delivery, there are going to be innumerable new competitors to Comcast, each offering a different consumer value proposition. One thing is for certain - each and every one of them is going to be freely riding Comcast's (and other cable operators') broadband pipes into users' homes.

I have written about these "over-the-top" or "cable bypass" services in the past, and they represent a real long-term threat to Comcast and others. Sure, very few people are dropping their cable subscriptions today to cobble together broadband content in bits and pieces. However, I can tell you anecdotally, judging by the number of friends OUTSIDE the industry who have asked my opinion, there is significant consumer interest in dropping cable service and piecing together a more personalized lineup.

To defend itself, Comcast is in a unique position - able to both deliver standard and high definition digital TV signals to a set-top boxes and also IP-based, broadband video to over 10 million high-speed Internet subscribers today, and growing. There are very interesting bundling opportunities between these services, which will offer far greater value to Comcast subscribers, but at little additional cost to the company. In addition, there are unique ways for the company to use broadband to offer enhanced distribution to programmers eager to expand their share of Comcast's subscribers' viewership.

The key to defining this next-generation aggregation role is for Comcast to have a robust Internet suite of services and capabilities to build from and tie into. Succeeding in the video aggregation business in the future is going to be about far more than piping channels into consumers' homes. Rather, it's going to be about wrapping all kinds of related services, interactive/social networking capabilities and advanced advertising around the core video. So one capability that I described above that is needed is content monetization through ads. But there are many others, among which Yahoo has significant market shares. These include email, social networking, photos, travel, maps, jobs, personals and others. Marrying some or all of these to Comcast's current services, particularly at the local level, will create new and highly differentiated video offerings that "over-the-top" providers will be hard-pressed to match.

In short, Yahoo gives Comcast a whole new range of services to leverage in order to become THE leading next-generation video aggregator.

4. Yahoo gives Comcast a much-needed international presence

In the old days, a cable operator thought it was becoming international when it decided to add Telemundo or Univision to its channel lineup. (You think I'm joking!)

Today, being an international company means tapping into fast-developing economies all over the world. It is a simple fact that in developing economies, tens of millions of people are joining the middle class, bestowed with newfound spending power. This of course is why there are daily announcements from American companies trumpeting their new international ventures.

Yahoo and all the other major Internet companies have recognized this, operating essentially borderless businesses and offering their services in multiple languages. Yahoo has hundreds of millions of international users and in 2006 generated over $2B in international revenues. It provides its service in over 20 languages and has offices in over 20 markets around the world.

Comcast, on the other hand, offers its services only in America. It's tempting to say that's OK, since the markets in which Comcast operates are fundamentally local and have been mainly insulated from international competition. Yet, when you look at households across America, there are at least three concerns. First is that Comcast passes a defined number of them, so its addressable market is limited. Second is that there is real spending fatigue in many homes. Both of these diminish opportunities for top line revenue growth for services cable operators offer. Finally, with the spread of digital distribution technologies, Comcast faces new video competitors from all over the world vying to deliver video to homes within Comcast's footprint.

So sure, adoption of voice services is currently driving double-digit cash flow growth for Comcast and others, but how long will that last? These new revenues represent a market share shift from telcos, not new net market growth. They are nothing to sneeze at, but telcos are preparing their own market share assault on cable's video customers. And then of course there are wireless broadband services like WiMax, which will inevitably cut into Comcast's (and others') current market shares.

International exposure would provide Comcast with a whole new growth story. And Yahoo would provide this platform immediately. And by the way, there's another angle on international expansion. For anyone paying attention to the raging immigration debates here, our own American communities are becoming more and more ethnically mixed themselves. So for example, wouldn't it be cool for Comcast to have access to advertisers in China who want to insert their ads on Comcast's cable systems here in the U.S.? As the world becomes a global village, Comcast needs to fully participate in it.

5. Comcast needs more technology DNA, Yahoo provides it

Last but not least, Comcast needs more online and technology DNA in its culture and Yahoo can provide it. Mind you, I know many outstanding people at Comcast who are totally immersed in the online and broadband realms. However, they are an island in a sea of thousands of customer service reps, field technicians and operating executives steeped in the cable business. In fact, virtually all of Comcast's senior management team comes from within the cable industry, if not from within the company itself. To fully capitalize on its online and broadband opportunities, Comcast needs more people with more perspectives. People who aren't rooted in the core business and the traditional way of doing things. People who have more experiences operating within the very companies Comcast will increasingly be competing against.

As well, Yahoo would also bring Comcast access to the Silicon Valley ecosystem and culture of innovation. While there are plenty of other pockets of innovation around the U.S. and the world, the Valley is still the epicenter of the action and Yahoo's right in the middle of it. Becoming immersed in this culture would allow Comcast to learn first hand about the faster development cycles that characterize Web 2.0 initiatives and pull those talents into the company. This may seem like soft stuff, but building corporate cultures attuned to larger market circumstances is critical for all companies to succeed. Though Yahoo is already a Comcast partner, this relationship, no matter how strong, will never be sufficient to change Comcast's DNA.

Wrapping Up

OK, that was a mouthful. Obviously I think there are many compelling reasons for Comcast to go forward. Less clear is whether Yahoo would be interested. New CEO Jerry Yang obviously loves this company - he's not only a co-founder, he's stayed around all these years. So he'd likely be a reluctant seller. Susan Decker gets rave reviews and would likely want her turn to run the show. That said, shareholders are restive and their recent action clearly help stir the waters for Terry Semel's departure. So at the right price, shareholders would probably be motivated sellers.

So let's say Yahoo is willing. Could Comcast win this deal, particularly when there would likely be a spirited bidding war? Clearly Comcast would need to bring a full wallet to compete with the likes of Microsoft and others. Today Comcast's market capitalization is about $87B, while Yahoo's is currently around $37B. So say it takes a 30% premium to win the company. That's a deal worth around $50B. In short, a very big bite for Comcast, and very dilutive, given Yahoo's '06 revenues were a little over $6B (compared with Comcast's $25B). However, I'm a believer that Yahoo stock isn't going to get any cheaper. Despite its recent woes, Yahoo is a tremendous franchise that would be virtually impossible to replicate. If Comcast is going to make a move, it should do so now.

A key to success would be Comcast messaging the deal properly to the Street. Comcast did a disastrous job at this with its Disney bid in 2004, which not only failed, but cratered the stock for a long time after. Having the Street's support, in the form of a sturdy Comcast stock price, would be very important to Comcast's success.

Let's see how things play out.

Categories: Cable TV Operators, Deals & Financings, Portals

Topics: AOL, Comcast, Google, Microsoft, Yahoo

-

Quick Take: 2 Thumbs Up for Comcast-Fandango Deal

Comcast’s acquisition of Fandango is just off the wire, and my quick take is that it’s a winner for both companies.

From Comcast’s perspective, it looks like Fandango is going to anchor a new site named Fancast, which the company announced today as well, which will launch this summer. Comcast has been the sleeping the giant of the broadband video space. Though its Comcast.net traffic has grown strongly, the company has stood by while YouTube, MySpace, Apple, Amazon and others have pioneered new and important ground in delivering video over the open broadband Internet.

This paragraph from the press release was key:

“Fancast, which will launch this summer, will be a national entertainment site where people can search and discover television and movie content, while managing their viewing experience across multiple devices. With Fancast, consumers will be able to search for their favorite shows, movies, actors and actresses, or simply enjoy the video content on the site. Fancast will provide consumers with a place to discover when their favorite shows or movies are "on," and where they can view them via television, video-on-demand, online or on other device.”

My bet is that Fancast is a going to be a video-rich site that will also incorporate assets from E!, which is also a Comcast property. Everyone I speak to at the portals says that entertainment/celebrity-oriented material is their best-viewed video. Comcast has a great shot at defining a new entertainment portal that can also serve content to disparate devices. With Comcast (and other MSOs) now moving in the quad-play direction, thinking about video on screens other than just the TV, is critical. It’s great to see Comcast joining the action.

Categories: Cable TV Operators, Deals & Financings

-

Mossberg Raves About AppleTV, But….

Pretty gushy review today from Walt Mossberg at the WSJ regarding his 10 day experience with AppleTV. I originally offered my opinions on AppleTV's prospects (then called "iTV") back in my December '06 newsletter ("7 Broadband Video Trends for 2007"). I thought AppleTV was likely a winner, but contingent on its content strategy. If it offered buyers access to iTunes content only then its appeal would be much more limited than if it opened up the box to all broadband video sources.

When Steve Jobs offered more details in his Macworld keynote I downgraded my enthusiasm, as they chose the former content strategy, precluding (for now) AppleTV's role as THE bridge between PC/broadband and TV. Walt reiterates this point ("Apple TV's most important limitation is that it can't stream much video or audio directly from the Internet -- yet.") but hints that this capability will be available in gen2 boxes.

I reiterate my opinion - for now AppleTV is ultracool, but will likely find only a limited audience to fork over $299 mainly to watch iTunes content on their TVs, plus manipulate music and photos. When AppleTV allows easy access to the rest of the world of broadband video, then it's going to be a big hit.

Categories: Deals & Financings

Posts for 'Deals & Financings'

Previous |