-

StudioNow Begins March into Video Platform Space with AMS Launch

StudioNow, which has built a nationwide network of thousands of creative professionals providing outsourced, on-location video shooting and editing, is announcing its Video Asset Management & Syndication Platform ("AMS") today. With the move, StudioNow looks poised to enter the crowded video publishing and management platform space, but from the angle of video production partner. Earlier this week I spoke to StudioNow's CEO and founder David Mason and its COO David Corts to learn more.

StudioNow's core business has been linking video professionals to its clients' projects (competitors in this space include TurnHere, Geobeats and others). There have been two primary types of customers; directories like CitySearch (which I wrote about here), who increasingly want to sell video ads to their local customers,

yet lack the means to fulfill orders themselves and content publishers who want to add video to their sites, but for a variety of reasons don't have the capability to do so solely on their own. A good example of the latter is Maxim magazine which hired StudioNow to shoot and edit video from 100 different locations around the world for its "Hometown Hottie" feature.

yet lack the means to fulfill orders themselves and content publishers who want to add video to their sites, but for a variety of reasons don't have the capability to do so solely on their own. A good example of the latter is Maxim magazine which hired StudioNow to shoot and edit video from 100 different locations around the world for its "Hometown Hottie" feature.These projects have been managed using the company's video creation platform, which allows all of a project's participants (videographers, editors, client project team, StudioNow producer, etc.) to gain access and manage the project's work flow through to completion. Given the geographic dispersion of project participants, the platform plays a crucial role in tracking projects and keeping them on schedule and on budget.

David explained that as StudioNow has produced these videos, a new problem has cropped up: how to manage them, especially as the quantity grows over time. Originally StudioNow would just FTP the videos to the client and they would manage them using in-house or 3rd party management platforms. But more recently, with clients asking StudioNow to get more involved, the company spotted a need to roll out a full service offering that manages, transcodes (in the cloud using Amazon's services) and syndicates the video to its intended destinations. AMS also enables metadata creation and management and next, analytics. StudioNow is announcing Simon & Schuster as its first AMS customer today.

Add in a player, a CDN offering, and integration with monetization options and it sounds a lot like another new competitor in the video platform space, right? Not exactly, or at least not yet anyway according to David. For now, StudioNow is positioning AMS as an intermediary stop, with video still getting pushed to third-party platforms like Brightcove, Ooyala, Delve, or others that its clients might use.

But from my standpoint, it seems inevitable that StudioNow will add features and become another full-fledged video platform competitor. Assuming it goes that route, its advantage is that it is already a trusted partner to customers on the video creation side. This could be a significant entry point, as more companies conclude they need to offer video to remain competitive. But lacking the capabilities to do so on their own, on-demand video creation services will likely become ever more popular, providing a strong toehold for StudioNow to leverage.

This is yet another example of how the video platform space is continuing to evolve, with newer players finding ways to differentiate themselves.

What do you think? Post a comment now.

Categories: Technology

Topics: CitySearch, GeoBeats, Simon & Schuster, StudioNow, TurnHere

-

thePlatform Adds Partners to Its Framework Program

thePlatform is announcing this morning that another 20 companies have joined its "Framework" partner program originally rolled out in Feb. '08. There are now over 80 companies participating.

In its release, thePlatform notes that its "role is to make online video publishing a seamless process for our customers...." That's a commonly-shared goal among video platform companies, yet I continue to hear from

various content providers that stitching together the various pieces they require into a total solution can be difficult. That's why these kinds of programs, where partner products are pre-integrated, add a lot of value for customers.

various content providers that stitching together the various pieces they require into a total solution can be difficult. That's why these kinds of programs, where partner products are pre-integrated, add a lot of value for customers.Among the many companies thePlatform cites as new partners are quite a few I've written about previously on VideoNuze (click to see each write-up): Aspera, Azuki Systems, BrightRoll, EveryZing, Transpera, Visible Measures, YuMe and others.

(Note: thePlatform is a VideoNuze sponsor)

Categories: Partnerships, Technology

Topics: Aspera, Azuki Systems, BrightRoll, EveryZing, thePlatform, Transpera, Visible Measures, YuMe

-

Early Bird Registration Now Open for Oct. 13th "VideoSchmooze" Event in NYC

I'm pleased to announce that early bird registration is now open for VideoNuze's next "VideoSchmooze" Broadband Video Leadership Evening, on Tuesday evening, October 13th in New York City. The event will start with a panel discussion I'll moderate, "Realizing Broadband Video's Potential" with an A+ group of industry executives:

- Dina Kaplan - COO and co-founder, blip.tv

- George Kliavkoff - EVP & Deputy Group Head, Hearst Entertainment & Syndication (and formerly Chief Digital Officer, NBCU)

- Perkins Miller - SVP, Digital Media and GM, NBCU Sports & Olympics

- Matt Strauss - SVP, New Media, Comcast

Click here to learn more and register for the early bird discount

Each of the panelists and their companies are playing a key role in broadband video's growth and evolution. Expect a rigorous discussion as we dig deep into the key technology, business model and strategy topics that I write about each day on VideoNuze. There will also be ample audience Q&A time. Attendees will benefit from a unique learning experience.

Following the discussion, from 7:45pm-9:00pm, we'll have networking and cocktails (note 1 drink plus hors' d'oeuvres are included with each ticket; cash bar to follow). This is a premier opportunity to meet the

panelists and expand your network, whether you're pursuing business or personal opportunities in the industry. As with past events, I expect a strong mix of established media and technology executives, along with interesting early stage companies, entrepreneurs and investors.

panelists and expand your network, whether you're pursuing business or personal opportunities in the industry. As with past events, I expect a strong mix of established media and technology executives, along with interesting early stage companies, entrepreneurs and investors.The event will be held at the gorgeous Hudson Theater, a historic gem on West 44th Street just off Times Square. I'm pleased to have NATPE, VideoNuze's partner since launch, on board for the event. And I'm extremely grateful to lead sponsor Microsoft Silverlight and supporting sponsors Akamai Technologies, Digitalsmiths, FAST Search & Transfer, FreeWheel, Horn Group and mPoint for making the evening possible.

At the last VideoSchmooze in March, we had 270+ attendees, so if you're interested in joining us, I encourage you to register early to secure a spot!

I've also created more deeply discounted "5-Pack" and "10-Pack" tickets for those of you who plan to come with colleagues. A reminder that VideoSchmooze is being held on the eve of the IP Media Expo, so if you're already planning to come into town for that show, please book your travel plan accordingly so you're able to join us too (I've arranged a discounted room block at the adjacent Millennium Broadway Hotel.)

Click here to learn more and register for the early bird discount

I look forward to seeing you on Oct. 13th!

Categories: Events

Topics: VideoSchmooze

-

YouTube Movie Rentals: An Intriguing But Dubious Idea

Last week the WSJ broke the news that YouTube is in talks with Lionsgate, Sony, MGM and Warner Bros. about launching streaming movie rentals. On the surface this is an intriguing proposition: the 800 pound gorilla of the online video world tantalizing Hollywood with its massive audience and promotional reach. However, when you dig a little deeper, I believe it's a dubious distraction for YouTube, which is still trying to prove that it can make its ad model work.

I appreciate all the possible reasons YouTube is eyeing movie rentals. To evolve from its UGC roots, the company has been anxious for more premium content to monetize. But with Hulu locking up exclusive access

to ABC, Fox and NBC shows for at least the next year and a half or longer, full-length broadcast TV shows are largely unavailable. And now TV Everywhere threatens to foreclose access to cable TV programs. All this makes movies even more attractive.

to ABC, Fox and NBC shows for at least the next year and a half or longer, full-length broadcast TV shows are largely unavailable. And now TV Everywhere threatens to foreclose access to cable TV programs. All this makes movies even more attractive. Then there's Google's uber mission to organize the world's information. YouTube executives are savvy enough to know that not all content can be delivered solely on an ad-supported basis - not yet nor possibly ever (for more about the challenges of effectively monetizing broadcast TV shows, let alone movies, see my prior posts on Hulu). To succeed in gaining access to certain content, offering a commerce model is ultimately essential. Since YouTube has already put in place some key commerce-oriented infrastructure pieces like download-to-own and click-to-buy, rolling out a rental option is less of a stretch. Lastly, YouTube can position itself to Hollywood as a more flexible partner and viable alternative to Apple's iTunes.

Regardless, YouTube movie rentals are still a dubious idea for at least 3 reasons: they're a distraction from YouTube's as yet unproven ad model, there are too many competitors and too little opportunity to differentiate itself and the revenue opportunity is relatively small.

Focus on getting the ad model working right - Given its market-leading 40% share of all online video streams, I've long believed that YouTube is the best-positioned company to make the online video ad model work. YouTube has made solid progress adding premium content to the site that it can monetize, but it still has a lot of work ahead to make its ads profitable. As I wrote in June, Google's own senior management cannot yet clearly articulate YouTube's financial performance, causing many in the industry to worry about YouTube's sustainability. Some might assert that YouTube can keep tweaking the ad model while also rolling out rentals but I disagree. With the ongoing ad spending depression, YouTube must stay laser-focused on making its ad model work, and also on communicating its success.

Too many competitors, too little differentiation - It's hard to believe the world really needs another online option for accessing movies, and mainly older ones at that. There's Hulu, iTunes, Netflix, Amazon, Xbox and soon cable, satellite and telcos rolling out movies on TV Everywhere, just to name a few. Maybe YouTube has some secret differentiator up its sleeve, but I doubt it. Rather, it will be just one more comparably-priced option for consumers. And in some ways it will actually be inferior. For example, unlike Netflix and Amazon, YouTube's browser-centric approach means watching movies on YouTube will remain a suboptimal, computer-based experience. Unless YouTube is willing to pay up big-time, there's also no reason to believe it will get Hollywood product any earlier than proven services like Netflix and iTunes.

Revenue upside is small - It's hard to estimate how many movie rentals YouTube could generate, but here's one swag, which shows how limited the revenue opportunity likely is. Let's say YouTube ramped up to .5% of its 120M+ monthly U.S. viewers (assuming it had U.S. rights only to start) renting 1 movie per week (not a trivial assumption considering virtually none of YouTube's users have ever spent a dime on the site and there are plenty of existing online movie alternatives). YouTube's revenue would be 600K rentals/week x $4/movie (assumed price) x 30% (YouTube's likely revenue share) = $720K/week. For the full year it would be $37.4M. With YouTube's 2009 revenue estimates in the $300M range, that's about 12% of revenue. Nothing to sneeze at, but not world-beating either, especially as compared to YouTube's massive advertising opportunity.

Given these considerations, I contend that YouTube would be far better off trying to become the dominant player in online video advertising, replicating Google's success in online advertising. Like all other companies, YouTube has finite resources and corporate attention - it should focus where it can become a true leader. There's enough quality content and brands willing to partner with YouTube on an ad-supported basis to keep the company plenty busy, and on the road to eventual financial success.

What do you think? Post a comment now.

Categories: Advertising, Aggregators, FIlms, Studios

Topics: Hulu, Lionsgate, MGM, Sony, Warner Bros., YouTube

-

4 Items Worth Noting from the Week of August 31st

Following are 4 news items worth noting from the week of August 31st:

1. Nielsen "Three Screen Report" shows no TV viewing erosion - I was intrigued by Nielsen's new data out this week that showed no erosion in TV viewership year over year. In Q2 '08 TV usage was 139 hours/mo. In Q2 '09 it actually ticked up a bit to 141 hours 3 minutes/mo. Nielsen shows an almost 50% increase in time spent watching video on the Internet, from 2 hours 12 minutes in Q2 '08 to 3 hours 11 minutes in Q2 '09 (it's worth noting that recently comScore pegged online video usage at a far higher level of 8.3 hours/mo raising the question of how to reconcile the two firms' methodologies).

I find it slightly amazing that we still aren't seeing any drop off in TV viewership. Are people really able to expand their media behavior to accommodate all this? Are they multi-tasking more? Is the data incorrect? Who knows. I for one believe that it's practically inevitable that TV viewership numbers are going to come down at some point. We'll see.

2. DivX acquires AnySource - Though relatively small at about $15M, this week's acquisition by DivX of AnySource Media is important and further proof of the jostling for position underway in the "broadband video-to-the-TV" convergence battle (see this week's "First Intel-Powered Convergence Device Being Unveiled in Europe" for more). I wrote about AnySource earlier this year, noting that its "Internet Video Navigator" looked like a content-friendly approach that would be highly beneficial to CE companies launching Internet-enabled TVs. I'm guessing that DivX will seek to license IVN to CE companies as part of a DivX bundle, moving AnySource away from its current ad-based model. With the IBC show starting late next week, I'm anticipating a number of convergence-oriented announcements.

3. iPhone usage swamps AT&T's wireless network - The NY Times carried a great story this week about the frustration some AT&T subscribers are experiencing these days, as data-centric iPhone usage crushes AT&T's network (video is no doubt the biggest culprit). This was entirely predictable and now AT&T is scrambling to upgrade its network to keep up with demand. But with upgrades not planned to be completed until next year, further pain can be expected. I've been enthusiastic about both live and on-demand video applications on the iPhone (and other smartphones as well), but I'm sobered by the reality that these mobile video apps will be for naught if the underlying networks can't handle them.

4. Another great Netflix streaming experience for me, this time in Quechee VT courtesy of Verizon Wireless - Speaking of taxing the network, I was a prime offender of Verizon's wireless network last weekend. While in Quechee, VT (a pretty remote town about 130 miles from Boston) for a friend's wedding, I tethered my Blackberry during downtime and streamed "The Shawshank Redemption" (the best movie ever made) to my PC using Netflix's Watch Instantly. I'm happy to report that it came through without a single hiccup. Beautiful full-screen video quality, audio and video in synch, and totally responsive fast-forwarding and rewinding. I've been very bullish on Netflix's Watch Instantly, and this experience made me even more so.

Per the AT&T issue above, it's quite possible that occupants of neighboring rooms in the inn who were trying to make calls on their Verizon phones while I was watching weren't able to do so. But hey, that was their problem, not mine!

Enjoy the weekend (especially if you're in the U.S. and have Monday off too)!

Categories: Aggregators, Deals & Financings, Devices, Mobile Video

Topics: AnySource, Apple, AT&T, comScore, DivX, Intel, iPhone, Netflix, Nielsen, Verizon Wireless

-

VideoNuze Report Podcast #30 - September 4, 2009

Daisy Whitney and I are pleased to present the 30th edition of the VideoNuze Report podcast, for September 4, 2009.

This week Daisy shares more detail from her most recent New Media Minute, concerning what broadcast networks are doing this Fall with online video extensions of their shows. For example, CW is launching an original series in conjunction with "Melrose Place." ABC is doing a 3rd season of an "Ugly Betty" web series and a tie-in for "Lost." CBS is launching its first web series, via TV.com, with Julie Alexandria, focused on recapping highlights from various shows. Daisy notes that these efforts are focused mainly on marquee shows and when advertisers are already on board.

In the 2nd part of the podcast we discuss my post from yesterday, "2009 is a Big Year for Sports and Broadband/Mobile Video." In that post I observed that many big-time sports, and the TV networks that have the rights to televise them have realized this year that broadband and mobile distribution are friend, not foe. As a result they've rolled out many different initiatives. We also touch on the various lessons other content providers can take away from what's happening with sports and broadband/mobile distribution.

Click here to listen to the podcast (13 minutes, 54 seconds)Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Broadcasters, Podcasts, Sports

Topics: ABC, CBS, CW, Podcast, TV.com

-

2009 is a Big Year for Sports and Broadband/Mobile Video

Pick your favorite sport - baseball, basketball, football, golf, tennis, auto racing, etc. and it's likely that in 2009 some part of the action has been available via broadband or mobile video. 2009 is looking like the year that sports executives - and the TV network honchos that pay dearly for sports' broadcast rights- concretely realized that broadband and mobile complement traditional sports broadcasting and that they should be embraced, not spurned.

In VideoNuze's News Roundup, I've been keeping track of all the broadband and mobile sports headlines this year. Here's just a partial list of what I've captured, along with links:

- PGATour.com to Offer Live Video Streams of Key Holes for Tour Playoffs (B&C)

- U.S. Open to Stream Almost All Matches Online (PaidContent)

- DirecTV Offers NFL Sunday Ticket via Internet in NY Trial (USA Today)

- "Live at Wimbledon" Streaming Coverage Announced by NBC (Sports Media News)

- Cablevision Subs Will Gain Access to In-Market Streaming of YES's Yankee Telecasts (Multichannel News)

- MLB.com Streams Live Baseball Games to the iPhone (NYTimes Bits)

- NBA Playoffs to Stream on Android App (Online Media Daily)

- Speedtv.com to Stream Part of Le Mans 24 Hours (Multichannel News)

- NHL to Launch Daily Stanley Cup Pre-game Web Series (Mediaweek - reg required)

- Follow the Masters on Your iPhone (Electronic House)

- March Madness! YouTube Gets Live Video via Silverlight (NewTeeVee)

In some cases the initiatives provide specially-produced video, while in other cases they offer streams that are already available on TV. The former type isn't that surprising as supplementary video can add a lot of value to the main event (the analog in entertainment are the popular "behind-the-scenes" extras that come with DVDs).

It's the latter type - where broadcast streams are delivered via broadband or mobile, either live or on-demand - that is much more intriguing as it represents a big step forward in sports and TV network executives' thinking about multi-platform distribution. Traditionally the approach has been to tell fans when the sporting event was on and on which network to find it. But with these broadband and mobile efforts, increasingly we're seeing executives scrap that model and replace it with a more fan-friendly approach that seeks to bring the action to fans, on-demand and wherever they might be.

In my view, this is a welcome change. Regrettably, big-time sports are now all about big-time money. To understand the stakes, I'm fond of reminding people to do the math on what just ESPN rakes in on just its U.S. monthly affiliate fee of approximately $3.75 from cable operators, satellite operators and telcos carrying the channel into 90 million + homes (your calculator may run out of zeros if you try). With that kind of money on the line, it's imperative that networks and sports themselves figure out how to harness new technologies to deliver more value. From the looks of 2009's initiatives, they appear to be well on their way.

What do you think? Post a comment now.

Categories: Broadcasters, Cable Networks, Sports

Topics: ESPN

-

First Intel-Powered Convergence Device Being Unveiled in Europe

Convergence devices that bring broadband video and Internet applications to the TV (e.g. Roku, Xbox, Apple TV, Vudu, etc.) are a white-hot area of interest as many industry participants - including me - believe their eventual mass adoption will provide a major catalyst to broadband video usage and prompt further disruption in the value chain.

Intel has eyed a big role in this emerging market for a while, becoming a strong public proponent of the "digital home" concept. Building momentum over the past year, Intel has made announcements with Yahoo (for the "Widget Channel" framework), Adobe (to port and optimize Flash for TV viewing) and with a number of large content providers (demonstrating enhanced viewer experiences).

At the heart of Intel's early initiatives is the company's much-heralded Media Processor CE3100, the first in a family of "system on a chip" convergence-oriented processors. Next week the first CE3100-powered device, the "Mediaconnect TV" will be shown at the IBC show in Amsterdam. The box is a collaboration between a Dutch company, Metrological Media Innovations and a British interactive services provider, Miniweb (a spinoff of BSkyB). This has been previewed recently and is sure to gain more visibility next week. To learn more about Intel's convergence vision, yesterday I spoke to Wilfred Martis, the GM of Connected AV Products for Intel's Digital Home Group.

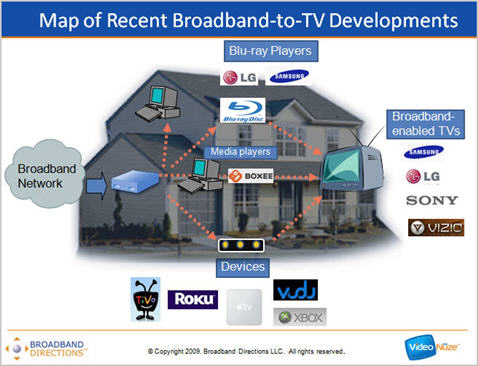

Intel sees 4 different types of home products that can be fitted with its media processor chips: set-top boxes, digital TVs, optical players (e.g. Blu-ray devices) and "connected AV" products, which are defined as standalone boxes that connect broadband to the TV, but without any guaranteed quality of service (QoS) for the video. This segmentation actually closely follows a slide I've been presenting lately which maps the various efforts for bringing broadband to the TV.

The connected AV devices are of course what "over-the-top" providers like Netflix, Amazon, iTunes, YouTube, etc. are counting on to deliver their services into the home over open broadband connections. On the one hand, Intel seems to be looking to empower these providers. As Wilfred says, Intel is trying to create a standard toolset and app environment akin to what we've seen on leading smartphones (mainly the iPhone) that helps drive creative new TV-based applications. Yet at the same time, as Wilfred notes, Intel wants to be a friend to incumbent video service providers, allowing them to deliver broadband content side-by-side with their walled-garden channels in their set-top boxes.

While Intel is clearly in this for the long haul, and has the resources to cultivate the market, other non-Intel devices continue to get a foothold. It's interesting to contrast, for example, the success that Roku is enjoying to date and ponder how the convergence device market will develop over the next several years. As I detailed a few weeks ago, Roku is successfully pursuing a classic "Crossing the Chasm" strategy, leveraging low pricing and loyalty to its content partners' brands to move lots of its product.

Still, integrating with Roku - and other current convergence devices - requires a one-off integration that assumes resources and prioritization (even when APIs exist). Some content providers will determine integrating is worthwhile, while others will not.

Intel's strategy is meant build on existing technologies and applications, making it more straightforward for content providers and applications developers to deploy on its devices (it's worth noting that Amazon, Blockbuster, Facebook and others plan to launch Widget Channel apps imminently). As Wilfred explains, when Intel's architecture is in convergence devices, incumbent software like browsers, plug-ins, drivers and the like are intended to work seamlessly. In addition, by providing abundant processing power, developers don't have to go through the arduous task of de-optimizing their apps for slower environments. And they get the performance headroom to continuously add updates.

The price for all this is of course, price. I don't know what the unit cost of the CE3100 is at volume, but my guess is that whatever it is would quickly sink any manufacturer's prospects of selling their box at anything close to a $99 price point, as Roku is. It's an age-old computing dilemma: beneficial as it is to have lots of processing power, there's a cost to it.

This raises the fundamental question of how the convergence device market will shape up over the next several years: will low-cost, "powerful-enough" devices continue to gain, or will boxes with robust processing render them obsolete at some point soon? My guess is that in the short term at least, low cost is going to lead the way. However, over the long term, it's hard to avoid the idea of significant computing power sitting next to the TV. However the business model for who pays to get it there remains in question.

What do you think? Post a comment now.

Categories: Devices, International

Topics: Adobe, Intel, Metrological Media Innovations, Miniweb, Roku, Yahoo