-

Magnify's New Social Features and Video's Role in Community-Building

Yesterday Magnify.net, a company I've previously written about, released its version 3.0, introducing new social features and also Pro and Enterprise versions. Magnify's CEO Steve Rosenbaum gave me an update.

Magnify is a platform that enables enthusiasts to assemble relevant video from sharing sites (YouTube, Metacafe, Dailymotion, others) into channels. One of the things I originally liked about the Magnify

approach is that it is a powerful avenue for would-be curators to simplify the morass of video now available at disparate locations into one easy-to-access area for others with similar interests. The concept has clearly proven popular: since I wrote the original post in October '07 the number of Magnify channels has roughly doubled from 17,500 to 33,000+ and page views have spiked to 18 million this month.

approach is that it is a powerful avenue for would-be curators to simplify the morass of video now available at disparate locations into one easy-to-access area for others with similar interests. The concept has clearly proven popular: since I wrote the original post in October '07 the number of Magnify channels has roughly doubled from 17,500 to 33,000+ and page views have spiked to 18 million this month.The social features Magnify is introducing in its 3.0 version are aimed at creating deeper community interaction within the channels and are a natural evolution for the company. Quite frankly, they're something I would have expected earlier (chalk it up to finite resources?). The social features allow members to create and view profiles, "friend" each other and to track and subscribe to other members' activities. There's also integration with Twitter, Mogulus and Flickr.

Reactions to Magnify's move have been mixed and raise interesting questions about the interplay of social media and broadband video. For example, if I understand TechCrunch writer Erick Schonfeld's perspective correctly, he just doesn't buy into the idea that video is a solid foundation for community building and that the existing social networks can and do incorporate video just fine, thereby obviating the need for community within Magnify's channel context. While he rightly identifies a potential logistical issue of Magnify not offering cross-channel profiles, and simmering social networking saturation, overall I think he's underestimating the potential of video as a catalyst for social interaction.

Using well-organized and curated video as a foundation for community development actually makes a ton of sense. In our media-saturated society, video is a common and defining thread for starting and sustaining our interactions. As one example, Steve pointed me to the "Native American Tube" channel at Magnify. Have a look, there are 388 members and counting, and see how active the back-and-forth commenting is? People have strong and passionate affiliations with particular videos, programs and even networks - and want to share their thoughts.

Meanwhile, for all the growth of Facebook, MySpace and Bebo, social media is far from a mature space. At last week's Media Summit, the integration of social media and video was among the hottest topics. The reality is that existing media brands (especially in the niches) and aspiring ones like those Magnify is powering have a strong ability and economic incentive to create community and interaction opportunities for their audiences. I expect we'll see no let up in their enthusiasm, and Magnify's social tools, as they further evolve, will become a key part of the company's success.

(Note: if you want to know more about this topic, yesterday there was a webinar sponsored by KickApps and Akamai. KickApps helps companies set up their own social networks and is getting significant traction in the media space.)

Categories: Events, Video Sharing

Topics: Akamai, KickApps, Magnify.net

-

Being "Constrained by Reality"

Back in the mid-to-late '90s when I was running business development for Continental Cablevision, then the 3rd largest cable operator in the US, I had the opportunity to meet with a lot startups that wanted to partner with us to gain access to our 5 million subscribers. Meeting these startups and hearing their ideas was almost always interesting but all too often our talks were inconclusive.

Why? Because frequently there was at least one or more completely unrealistic assumption in their business plans, which made us skeptical about the company's likeliness to succeed. I often found that otherwise intelligent and analytical executives had somehow convinced themselves of something that just wasn't realistic. I came up with a catchphrase that helped guide our evaluation of proposed deals: our go/no-go decisions would be "constrained by reality."

That principle has stuck with me, and has been reinforced through my own startup experiences, watching CEOs who also understood this principle and those who did not. Being "constrained by reality" especially means that the optimism that all entrepreneurs and startup executives radiate must be tempered by a careful analysis of what's actually happening in the market and what limitations the new product, feature, deal, etc. will meet up against. Not doing so can be a fatal mistake.

I bring this up because, as with early other immature markets, the nascent broadband video space has become a hotbed of entrepreneurial activity. Yet I continue to be exposed to ideas that are not aligned with market realities or key customer priorities. These companies are in for a rocky road ahead.

Conversely, I'm often impressed with CEOs who are no less confident, but do completely grasp the importance of being "constrained by reality." One technology CEO told me recently that his team spends an inordinate amount of time focused on "sequencing" or trying to model their customers' priorities. This informs their product development agenda and helps them stay aligned with recognizable opportunities. Similarly, a content executive told me that his company is very focused on production cost per minute because, having done an analysis of advertising CPMs, sell-out rates and splits, they have a solid grasp of what's required to be profitable. Another content executive acknowledged that while changing behaviors in his large company was critical, it was akin to "turning a barge" - something that needs to be done slowly and with care.

The above examples illustrate the subtle mix of optimism and pragmatism required for success in the broadband video space. I often try to explain that as exciting as broadband video is, it must be looked upon in evolutionary, not revolutionary terms. Feeling the constant pressure of being "constrained by reality" helps instill the kind of discipline that ultimately contributes to success.

Categories: Startups, Strategy

-

60Frames Pioneers "Broadband Studio" Model

Last week I had a chance to sit down with Brent Weinstein, CEO/founder of 60Frames, which is among a new group of companies I refer to as "broadband studios." This is a category that has generated a healthy amount of funding and activity recently, including, among others, Next New Networks ($23 million to date), Generate ($6 million), Revision3 ($9 million), Stage 9 (Disney/ABC's in-house unit), Vuguru (Michael Eisner's shop) and a slew of comedy-focused initiatives. 60Frames itself has raised $3.5 million from Tudor, Pilot Group and others.

The impetus for 60Frames came when Brent was heading up digital entertainment at UTA and observed that many clients wanted to create digital/broadband fare but wanted a partner for the same roles they've come to

expect studios to handle (e.g. financing, distribution, legal, creative, etc.). 60Frames aims to differentiate itself from the pack by being "artist-friendly" - allowing greater creative control and more significant ownership and by relying on strong relationships. With an existing staff of 11 and a goal of launching 50 programs by year end, the 60Frames team is no doubt going full tilt.

expect studios to handle (e.g. financing, distribution, legal, creative, etc.). 60Frames aims to differentiate itself from the pack by being "artist-friendly" - allowing greater creative control and more significant ownership and by relying on strong relationships. With an existing staff of 11 and a goal of launching 50 programs by year end, the 60Frames team is no doubt going full tilt.60Frames is following a traditional portfolio approach, working with great talent (Coen brothers, John August, Tom Fontana, others) but recognizing that results in this new medium will vary - there will be some winners and some losers. The goal is obviously to have the best ratio possible. Traditional studios improve their odds by using collective history and data about what types of projects succeed and which ones don't. But no such lengthy track record or data exists in broadband just yet, so it's a lot more speculative pursuit.

I asked Brent if there's any creative formula 60Frames is using to guide its decision-making. He was pretty emphatic that there's no "formula," but did concede 60Frames is focused on short-form (under 5 minutes), is biased toward comedy where episodes can stand alone more readily, and is mainly looking at niche audiences with a bulls-eye of 18-34 men, where consumption is highest.

Nurturing relationships and developing great content is only part of the equation for these budding studios' success. Distribution and monetization are also incredibly important, as broadband necessitates an entirely different model. Regarding distribution, I was encouraged to see 60Frames is solidly in the syndication camp to the point that it has not even set up destination sites for its 7 launched programs yet. 60Frames has a network of partners including Bebo, blip.tv, DailyMotion, iTunes, MySpace, YouTube and others. Gaining access to all the popular online destinations will accelerate success. Meanwhile advertising is being handled by partner SpotRunner, which has deep hooks in the space.

Broadband studios like 60Frames harken back to the original studio moguls in some ways - taking creative and financial risk to explore what works in a new medium. It's way too early to know if or to what extent they'll succeed, but if they do we can expect a gold rush of imitators.

Categories: Indie Video, Startups, Syndicated Video Economy

Topics: 60Frames, ABC, Bebo, blip.TV, DailyMotion, Disney, Generate, iTunes, MySpa, Next New Networks, Revision3, Stage 9, UTA, Vuguru

-

CBS Launches Local Ad Network; Local Space Heats Up

This morning CBS TV Stations is announcing the CBS Local Ad Network with a goal of widely syndicating CBS TV Stations' content into the maze of locally-focused web sites and blogs. A ground-breaking effort, it is the latest evidence that the local broadcast formula is being re-written by broadband's potential. I got an exclusive briefing on the CBS initiative last Friday from Jonathan Leess, President/GM of CBS TV Stations Digital Media and Aaron Radin, SVP, Ad Sales and Biz Dev.

As I wrote early last week in "CBS TV Stations Get Broadband," syndication is a key driver of video streaming growth for the company. Recognizing changing consumer behavior, the new Local Ad Network enables news "widgets" - small information badges carrying local headlines from CBS's 29 stations which can be easily selected and embedded by local sites and bloggers. When users click on a link in the widget they are carried back to the local CBS station site. See the right column in the below example:

Each widget carries ads which are sold by CBS, with a revenue share back to the local site. Radin is excited about the ad network because it has the potential for vastly expanded and targeted ad inventory, which can be sold to many different types of advertisers depending on their goals. For example for AT&T, a charter advertiser, the network provides a national player with enhanced local access. Additionally, the ad network can provide the local CBS station's digital sales team with more in-depth coverage for a local advertisers.

The significance of the CBS initiative is that it continues to show that broadband is opening up new opportunities for local stations to go well beyond their traditional broadcast models. The concept of local newscasts in the morning, evening and late night is increasingly irrelevant. Also gone is the concept of finite air-time. The CBS deal shows that the "shelf space" on which CBS local content sits doesn't even have to be owned by the station any longer. Now the shelf space could just as easily be a 15 year-old local kid's popular blog on local sports who wants to provide a customized feed of high-quality local video to his visitors. Think about how that expands a local station's business model.

The whole area of local content syndication is really heating up. In this deal, CBS has partnered with SyndiGo, a new unit of Seevast to build out the ad network's local web site and blog distribution network. For other local broadcasters seeking to pursue syndication there are other choices. For example, WorldNow (note: a VideoNuze sponsor), which now supports 260+ stations around the U.S. has also stepped up its syndication activity, in addition to technology provisioning. It recently launched Supernanny-related content into its lifestyle channel, enabling more choice and ad inventory.

WorldNow, like other 3rd parties, believe that, in these tumultuous times, local broadcasters should be focused on content, ad sales and distribution, not technology development. With technology and the market moving so fast, that logic makes a lot of sense. WorldNow and others present the classic "buy" vs. "build" option for stations. While CBS and others may "build," there's no question for many other who want to syndicate and drive new ad sales, they'll prefer to do it in a "buy" scenario. All of this activity will have the effect of spurring continued innovation in the space.

One thing's for certain, there are myriad new technology choices and go-to-market options facing local TV broadcasters in the "syndicated video economy." Broadband presents unprecedented challenges and opportunities to an industry that has long operated under a highly formulaic approach.

What do you think of the changes happening in the local broadcast business? Post a comment!

Categories: Broadcasters, Syndicated Video Economy, Technology

Topics: CBS, CBS TV Stations Digital Media Group, Seevast, WorldNow

-

My 3 Takeaways from 2008 Media Summit

I had 3 key takeaways from the 2008 Media Summit which just wrapped up in NYC. The event just keeps getting better - great keynotes, terrific informal hallway chit-chats/networking and tons of well-directed energy. Though the event's agenda is broad, I was focused on the video-related elements. Here are 3 takeaways:

1. Iger and Moonves Get Tech; Lots of Innovation/Growth Ahead

A clear highlight for all attendees was the 2 morning keynote interviews, day 1 with Disney CEO Bob Iger and day 2 with CBS CEO Leslie Moonves. Both were ably conducted by senior Businessweek editors. Until a couple years ago, big media was in a defensive crouch regarding technology's uninvited incursion into their businesses. No more. Iger and Moonves are obviously convinced that technology, the Internet and broadband video delivery are now their companies' friends. Iger in particular really pounded this theme home.

An example of how technology helps which Iger repeatedly touched on was how Disney will leverage the platform of Club Penguin, its recent acquisition, to build communities for other properties (e.g. "Cars", "Pirates," etc.). These moves are intended to engender ever-greater levels of engagement. By the way, if you're a parent of youngsters and you've ever bemoaned how Disney's gotten its hooks deeply into your kids, you ain't seen nothing yet!

Moonves was emphatic that the Internet extends the value of CBS properties. March Madness was an example he offered. Three years ago it generated $250K of broadband subscription revenue. Two years ago CBS converted to ad-support and generated $4M. Then last year it generated $10M and this year is projected for $23M. And as Moonves pointed out, other than bandwidth, it's all incremental profit for the company. Echoing another conference theme, he further added that "the Internet should not be used to just regurgitate TV," but rather for the medium's unique capabilities.

Iger's and Moonves's mantras are no doubt being sent down to the troops from the executive suite. That suggests we can all expect a whole lot of tech-based innovation springing from these media giants.

2. Engagement and Originality: Buzzwords or More?

Two touchstones in many sessions were "engagement" and "originality." Both reflect the evolving viewpoint that broadband video has its own unique capabilities and that breaking through requires going far beyond traditional, passive programming approaches. With respect to engagement, the concept of introducing "social media" opportunities was often cited as the key tactic. An amorphous term, social media refers to all manner of user participation: content sharing, interactivity, personalization, mashups, uploading, commenting, rating and so on. Basically it's anything that gets viewers to do more than just sit back and enjoy the show. (For those looking to learn more, note next week's webinar on social media, presented by VideoNuze sponsors KickApps and Akamai)

Regarding originality, this relates back to Moonves's comment about not using the medium for regurgitation of TV shows (though to be sure there's value to that). Many people echoed that theme, emphasizing broadband must be used for original programming. The proliferation of independent "broadband studios" is encouraging early evidence that the originality bar will keep rising, prompting established and startup players to harness broadband's limitless possibilities.

3. Missing in Action: Paid business models

It wasn't that long ago that discussions about broadband video business models focused evenly on paid and ad-supported. No more. The paid model was completely missing in action at the event. I think I can count on one hand the number of times the concept was raised in sessions. Also MIA was DRM, the paid model's enabler (or torturer, depending on your perspective).

I detect a broad consensus that the broadband video industry has hitched its wagon to free ad-supported video for the foreseeable future. Many of you know I've been a long-time and enthusiastic proponent of this approach and I'm extremely happy to see things unfold this way. Though the broadband video ad model is still immature, all macro trends point to a bright future. One in particular is video syndication, which I wrote about 2 days ago. Syndication was a dominant theme, as panel representatives from both large and small content providers enthusiastically embraced it. See my post earlier this week, "Welcome to the Syndicated Video Economy" for more on this.

Ok, there you have it. There's plenty more tidbits I took away from the summit, so feel free to ping me if you'd like. And if you attended, post a comment and share your takeaways as well!

Categories: Advertising, Broadcasters, Downloads, Syndicated Video Economy, UGC, Video Sharing

Topics: Akamai, CBS, Disney, KickApps

-

Hurray for TiVo-YouTube

Hurray for TiVo and YouTube, which yesterday announced a partnership to allow certain TiVo users to watch YouTube videos on their TVs. While the actual number of homes which have the right TiVo model

and have it connected to broadband numbers under a million, TiVo-YouTube shows there is still hope that the worlds of broadband video and TV will indeed converge.

and have it connected to broadband numbers under a million, TiVo-YouTube shows there is still hope that the worlds of broadband video and TV will indeed converge.Some of you will remember that in December '07 I wrote a post entitled "Broadband Video on TV is a Mirage" in which regrettably concluded that the mass availability of broadband video on TVs was nowhere on the horizon. In that post I wrote:

"The minority of consumers who will actually see broadband video on their TVs will either (1) shell out big bucks to buy a broadband appliance such as Vudu or Apple TV, (2) tackle the challenge of connecting their TVs via wireless networks (3) use a device built for another primary purpose, such as Xbox 360 or TiVo, to selectively augment their viewing with broadband-delivered choices or (4) use a service provider that has decided to throw in a few morsels of broadband video."

With the YouTube deal, TiVo continues to deliver on option 3, augmenting an already impressive array of broadband video available on select TiVo models. TiVo enhances its overall reputation for innovation

(although still absent resounding market success or profitability), with a particular focus on broadband video. TiVo has previously offered up Amazon Unbox, TiVoCast, Music Choice, Home Movies, etc. Providing access to YouTube, the world's most popular video site, is another notable accomplishment for TiVo.

(although still absent resounding market success or profitability), with a particular focus on broadband video. TiVo has previously offered up Amazon Unbox, TiVoCast, Music Choice, Home Movies, etc. Providing access to YouTube, the world's most popular video site, is another notable accomplishment for TiVo.I continue to believe that whichever company cracks the code on how to deliver wide open broadband video access to the TV - coupled with a strong user experience - is going to hit it big. At the risk of looking too far backward, at the end of 2006 I conjectured that Apple's then still-to-be-launched Apple TV product could be a resounding success if it got the content strategy right (i.e. offering open broadband access and even focusing particularly on easy YouTube access through the device). Instead Apple TV has turned into yet another walled garden and to date has been a market failure. Apple continues to miss the open broadband market opportunity which is sitting right in front of it with a big bulls-eye plainly visible.

The TiVo-YouTube partnership will hopefully have the effect of accelerating the wake up call to other market participants that this gigantic opportunity awaits. Broadband video to the TV is a natural. It simply extends the cable/satellite model of the last 30 years: offering ever more video choices right to the TV.

As I've often said, as amazing as the growth curve has been for broadband video consumption over the last 5 years, even more amazing is that virtually all of this consumption has happened on the computer - a completely parallel world to the traditional TV viewing platform. Nobody could have imagined this level of consumer adoption for a non-TV viewing platform. So then look forward and imagine the possibilities when broadband video and the TV are fused for the masses.

Categories: Devices, Partnerships

Topics: Apple, Apple TV, TiVo, YouTube

-

Welcome to the "Syndicated Video Economy"

I am ever mindful of the old adage about "missing the forest for the trees" as I try daily to understand the often minor feature differences between competing vendors or the nuances of startups' market positioning. As we all know, when you get too close to something, it's quite easy to lose the larger perspective. So periodically I think it's essential to take a huge step back to try to identify the larger patterns or trends that crystallize from the daily frenzy of deals and announcements.

As a result, I've come to believe that recent industry activity points to an emerging and significant trend: the early formation of what I would term the "syndicated video economy." By this I mean to suggest that I'm

seeing more and more industry participants' strategies - in both media and technology - start from the proposition that the broadband video industry will only succeed if video assets are widely dispersed and revenue creatively apportioned.

seeing more and more industry participants' strategies - in both media and technology - start from the proposition that the broadband video industry will only succeed if video assets are widely dispersed and revenue creatively apportioned. For content providers the notion of widespread video syndication big change in their business approach. In the past year I think we've observed content providers of all stripes transition from "aggregating eyeballs", to "accessing eyeballs," wherever they may live now or in the future: portals, social networks, portable devices, game consoles, etc. Underlying this shift is the realization that advertising-based revenues are going to fuel the broadband video industry for the foreseeable future. The ad model requires scale and syndication is the best way to deliver it.

This shift by content providers has been accompanied by a loosening of traditional tightly-controlled, scarcity-driven distribution strategies, an acknowledgement that fighting newly-empowered consumers is a futile exercise. The evidence of this shift abounds. Consider the broadcasters like CBS, NBC and Fox, which through their affiliates (Hulu, CBS Audience Network) are syndicating programming to many portals/aggregators (e.g. Yahoo, MSN, AOL, YouTube), social networks (e.g. Facebook, MySpace, Bebo) and others. And Disney's Stage 9 digital studio, which premiered with YouTube and explicitly plans to tap into broadband video hubs. And cable networks like MTV Networks, which is pursuing a plethora of distribution deals. And traditional news-gatherers like local TV stations, newspapers and news services (e.g. Reuters, AP) which have stepped up their activity to scatter their video clips to the Internet's nooks and crannies. And the list goes on and on.

Taking their cue from the media companies' strategy shift, technology entrepreneurs and investors have ramped up their focus on this market opportunity. The prospect of the syndicated video economy blossoming drives news/information distributors such as Voxant, ClipSyndicate, Mochilla, TheNewsMarket and RedLasso, an ad manager such as FreeWheel, and a content accelerator such as Signiant, plus many others. Then there are more established companies guiding areas of their product development process by the prospect of the syndicated video economy's growth: Google, WorldNow, Akamai, thePlatform, Anystream, Maven Networks, Brightcove, PermissionTV and plenty of others (apologies to those I've left out!)

All of this suggests that the eventual "value chain" of the broadband video industry will look quite different than the traditional one (for more on this, I've posted some my slides from late '07 here.) As with all economies, in the nascent syndicated video economy there is vast interdependence among the various players, not to mention shifting market positions and degrees of pricing power and negotiating leverage. It is far too early to gauge who will emerge as the syndicated video economy's winners and losers. But make no mistake, lots of energy and investment will be expended trying to nurture its growth and exploit its opportunities.

Do you see the syndicated video economy forming as well? Post a comment and let us all know!

Categories: Advertising, Aggregators, Broadcasters, Cable Networks, Newspapers, Portals, Startups, Syndicated Video Economy

Topics: Akamai, Anystream, ClipSyndicate, FreeWheel, Google, Mochilla, RedLasso, Signiant, TheNewsMarket, thePlatform, Voxant, WorldNow

-

CBS TV Stations Get Broadband Under Leess

(Note: This is the third in a series of posts with companies participating in the 2008 Media Summit, a premier industry event starting tomorrow in NYC. VideoNuze has partnered with Digital Hollywood, the Media Summit's producer, to provide select analysis and news coverage.)

A few months ago, in a post I wrote called "Broadcast TV Stations Most Threatened By Broadband/On-Demand," I asserted that broadband was bringing a perfect storm to the world of local TV stations.

These thoughts were in the background when I spoke last week with Jonathan Leess, President and GM of CBS TV Stations Digital Media Group. CBS owns 29 stations around the U.S. mostly in bigger markets. Leess has been in his role since April '04 and by all accounts has done an admirable job leading the CBS stations into the broadband era.

Most significant is the delicate balance he's tried to strike in centralizing certain online/broadband responsibilities while keeping others at the local level. This is no easy feat. Succeeding online requires scale and common technology platforms. Yet historically local stations enjoy wide autonomy in decision-making as long as they meet their numbers.

Leess explained that in broadband he's focused his corporate group on accessing and providing new non-local content, creating an internal syndication network for stations, developing technology and tools for all stations to use, focusing on national ad sales and training for local sales reps, and importantly generating new viewership by syndicating local stations' video to third parties.

A key part of executing the balancing act has been a relentless focus on work-flow and supporting technologies. Leess explained that the broadband activities at CBS TV Stations are a 24/7 operation involving hundreds of people around the country. Turning all of this into a well-oiled operation, particularly in the context of long-standing operational biases, has been an enormous operational challenge that Leess seems to have embraced.

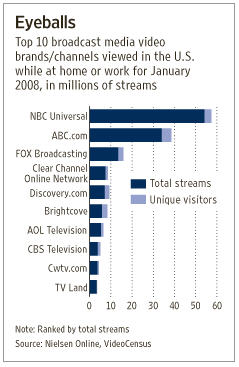

His efforts seem to be paying off. CBS TV Stations drove 89 million video views from their own sites in '07, an average of around 8 million video views/mo from their own sites, a 71% increase over '06. It's gaining an additional 10 million video views/mo through syndication partners. The primary current contributor to

syndication is Yahoo, with whom CBS TV Stations partnered in Oct '06. To put this in context, today's WSJ carried the adjacent graphic of select broadcasters' video views. Putting aside CBS TV Stations' 10 million monthly syndication streams, its '07 monthly average traffic would appear to rank it in the top 5, right around Discovery.com.

syndication is Yahoo, with whom CBS TV Stations partnered in Oct '06. To put this in context, today's WSJ carried the adjacent graphic of select broadcasters' video views. Putting aside CBS TV Stations' 10 million monthly syndication streams, its '07 monthly average traffic would appear to rank it in the top 5, right around Discovery.com. In addition, video clips are a big part of CBS TV Stations' success, as it is posting around 520/day and now offers a searchable library of 350K clips.

Meanwhile the Yahoo deal has been so successful that CBS TV Stations has clearly gotten syndication religion, with several significant announcements planned for the coming weeks. Leess explained how these syndication deals drive unprecedented consumption from out-of-market viewers while also creating valuable ad inventory. For pre-rolls, CBS is getting between $28-75 CPM, with banners fetching $8-18 CPM. Importantly, CBS TV Stations are aggressively bundling on-air/online/broadband packages, having sworn off broadband as a pure "value-add" some time ago.

While I stand by my assertion that local TV stations are most vulnerable to broadband's rise, it is also true that broadband offers stations fresh opportunities. CBS TV Stations' offensive approach shows that with the right leadership, strategy and operational plan, executing a successful transition to the broadband era is quite possible.

What do you think? Post a comment and let everyone know!

Categories: Broadcasters, Portals

Topics: CBS, CBS TV Stations Digital Media Group, Yahoo