-

Fueling Over-the-Top Broadband Video

Today I'm very pleased to introduce Michael Greeson as a contributor to VideoNuze. Michael is the founding partner and Principal Analyst at The Diffusion Group, a leading analytics and advisory firm helping

companies in the connected home and broadband media markets. VideoNuze has partnered with TDG to bring key highlights of its research and opinions to VideoNuze readers on a regular basis. I'm confident that you'll find them valuable and, as always, look forward to your feedback.A Simple Way to Fuel Diffusion of Over-the-Top Broadband Videoby Michael Greeson

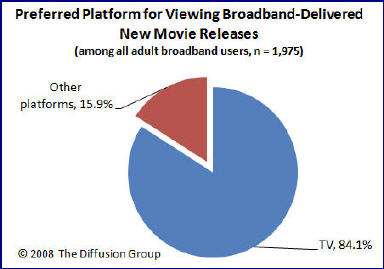

companies in the connected home and broadband media markets. VideoNuze has partnered with TDG to bring key highlights of its research and opinions to VideoNuze readers on a regular basis. I'm confident that you'll find them valuable and, as always, look forward to your feedback.A Simple Way to Fuel Diffusion of Over-the-Top Broadband Videoby Michael GreesonWith the web becoming more about media and entertainment, the rationale to get a broadband conduit into the living room is irrefutable - after all, that's where most consumers have their high-definition TV and their best sound system, it's the home's most comfortable media setting and remains the preferred platform for watching video. Not that a laptop PC in the den, a second TV and stereo in the master bedroom, or even an iPhone are not interesting as video consumption points; of course they are, but not as the primary or preferred setting. As noted below, when asked to choose between TVs, desktop PCs, notebook PCs, or mobile video platforms, close to nine in ten consumers prefer to watch movies on their living room TV.

Then why are those companies which are pushing a "three screen" video consumption strategy spending most of their energy and resources on the two "new" spaces (that is, PC-based or portable/mobile video consumption) and forgetting about the living room TV altogether? It seems as if open broadband to the TV is not sexy or cool enough for Silicon Valley; too mundane for such "cutting edge" companies.

Then why are those companies which are pushing a "three screen" video consumption strategy spending most of their energy and resources on the two "new" spaces (that is, PC-based or portable/mobile video consumption) and forgetting about the living room TV altogether? It seems as if open broadband to the TV is not sexy or cool enough for Silicon Valley; too mundane for such "cutting edge" companies.I've got news for them: watching video on the TV is not going away anytime soon, meaning that emerging new video models (the other two screens) will serve as supplements to the living room TV, not as replacements. Those pointing to TV's demise (a dubitable and specious position to hold) must know that, even if this happens, it will come about very, very slowly. The TV has proven an incredibly resilient and flexible viewing platform, one whose primacy will be reinforced by new media, not compromised.

For these reasons, I advocate a very simple strategy to help push broadband connectivity into the living room and broadband video into its rightful place. Forget about earmarking Internet connectivity as a "premium" feature reserved only for high-end CE, game consoles, or novel "new media" platforms like Apple TV. Think beyond adding Internet connectivity to a TV (which has a replacement cycle of six to eight years) or a high-def DVD player (a higher-end platform seen as unnecessary to most consumers).

Instead, add Internet connectivity to mainstream consumer electronic devices that are widely diffused, dependable, and which enjoy a more rapid replacement cycle - devices such as low-to-mid-range DVD players. Yes, it would increase the cost of the DVD player, but only slightly, and if there is legitimate value in delivering web-based media to the living room, the cost increase will be seen as tolerable. In the end, there is no better way to accomplish widespread, rapid diffusion than to tie a compelling new application to a trusted (existing) platform that's several hundred dollars cheaper than similarly-enabled platforms.

The argument I've presented above is relatively commonsensical: it is inherently easier to enhance incrementally the features and capabilities of a stable, widely diffused, well-loved platform (like a DVD player) than to try to sell consumers a completely new "black box" that enables a specific set of benefits that, while convincing, may not by themselves be sufficiently compelling to generate a purchase. Moreover, "new media" can benefit immensely by serving "traditional environments." While it is interesting to envision a future where anytime/anywhere video consumption is possible, at this point simply enhancing the primary video experience may be the most practical for "three screen" broadband video players. While not as "hot" or "cool," it will likely prove the most lucrative.

Categories: Aggregators, Devices

Topics: The Diffusion Group

-

UGC and Brand Marketing, Part 2

Wrapping up the week, today I revisit a post from several weeks ago, "An Intersection of UGC and Brand Marketing?"

In that post I mused about the opportunity for brand marketers to harness the recent enthusiasm many consumers have for creating video, as evidenced by the popularity of sites like YouTube. The idea I floated concerned how brands might somehow incent consumers to produce informative videos about their favorite products, which in turn could be showcased by the brands to help prospective buyers were in research mode. It seemed to me there might be a happy marriage in there somewhere.

It turns out I may have had my head in the clouds on this one. Daphne Kwon, CEO of ExpoTV reached out to me to explain some of the realities that my idea would encounter. Daphne's in a good position to know, since ExpoTV runs a site offering users the opportunity to upload videos with their reviews/opinions about products. ExpoTV has aggregated over 200K of these "Videopinions" to date. ExpoTV isn't exactly the concept I had in mind to marry UGC and brands, but it's definitely in the same ballpark.

Daphne raised two issues which she believes constrains brands from pursuing the user-generated reviews idea I envision. First is the specter that these reviews will be biased in some way. There are multiple dimensions to this. Will the brand maintain a completely open environment so that even negative reviews would be posted? If so, what are the implications? If not, and only positive videos are exposed, then the area wouldn't feel authentic or trustworthy. Also, would reviewers bias toward saying positive things simply to ingratiate themselves with the brand for ulterior reasons, such as getting noticed to be in a future ad or obtain funding for a private project?

Further complicating this is Daphne's sense that when people upload videos they're doing so to be part of a community that is responsive and interactive. This has clearly been a big part of YouTube's success. So brands couldn't just offer a place to upload, but rather would need to hire staff to manage the area, interact with participants, figure out how the area should be policed or self-policed, etc. Daphne doesn't see brands biting all off all of this, as it's a lot of work and she doesn't see any corporate mandates for brands to actively participate in these kinds of community-building activities.

Second and possibly more problematic is that there may be legal liability for brands to provide such platform, as the brands might be held responsible for the truthfulness and accuracy of the user-submitted videos. This liability would be broad, ranging from the relatively small (e.g. "The product didn't work as explained") to the very significant (e.g. "I used the product this way and was injured."). Clearly, in the litigious society in which we live, deep-pocketed corporations could be exposing themselves to all kinds of financial risks. Then of course there is the risk of negative PR, which alone could be quite damaging. Tying back to issues above, if there isn't a clear mandate to pursue these activities, no astute corporate soldier is going to risk his/her career diving into such precarious waters.

Hearing these considerations makes me think that the optimal route for incenting user-created video reviews may just be the way ExpoTV is doing it. Provide a "well-lit" space with a mix of financial incentives and community recognition, and monetize traffic in a number of creative ways (affiliate deals, advertising, etc.). Importantly maintain a focus on the community-building tasks required for motivating active and continuous user participation.

All of this serves as another reminder that with broadband - as with technology in general - just because something is possible, doesn't necessarily make it advisable.

What do you think? Post a comment and let us all know!

Categories: Brand Marketing, UGC

Topics: ExpoTV

-

Heavy Plans Big Push for Husky Ad Platform

(Note: This is the second in a series of posts with companies participating in the 2008 Media Summit, a premier industry event which will be held next week in NYC. VideoNuze has partnered with Digital Hollywood, the Media Summit's organizer, to provide select analysis and news coverage.)

Heavy Corporation, which operates Heavy.com, one of the most popular independent broadband video destinations for 18-34 males, is poised to make a push into the ad platform/network business through its

Husky Media unit. I spoke to Eric Hadley, Heavy's chief marketing officer yesterday who filled me in on their plans.

Husky Media unit. I spoke to Eric Hadley, Heavy's chief marketing officer yesterday who filled me in on their plans.The Husky platform is currently used today by Heavy.com. If you go to the site, you'll see how it operates, showing just one ad with the video selected. As Eric explains, the video is wrapped in the advertiser's skin, so upon starting the video player exposes a big interstitial ad for 2 1/2 second that sort of feels like "barn doors" before opening to the video itself. Then when the video plays, display ads surround the content. Additional related content is queued up and automatically starts playing subsequently. This approach has resulted in a 270% lift in videos viewed as compared with the pre-queuing implementation. This of course means more video usage and more advertising exposure.

Eric believes that this video presentation/ad format is unique in the industry (I agree, I haven't seen anything else like it), and goes straight to the biggest question in the industry: how are people actually going to make money from their broadband video content, especially original creations. Husky aims to combine the best of pre/mid-roll ads with the best of display.

Eric believes that this video presentation/ad format is unique in the industry (I agree, I haven't seen anything else like it), and goes straight to the biggest question in the industry: how are people actually going to make money from their broadband video content, especially original creations. Husky aims to combine the best of pre/mid-roll ads with the best of display.Eric said that advertiser enthusiasm for the Husky presentation has prompted Heavy to now offer it to other publishers who target demos other than Heavy.com's 18-34 males. It's still early days, but Eric said that in the next few weeks several major publishers will be launching Husky implementations, as will small-to-medium sized sites. This will form the beginnings of an ad network Heavy can assemble and offer to advertisers. By evolving Husky's focus from internal-only use to external use as well, Heavy will be competing with broadband ad players such as Tremor, Broadband Enterprises and others. The Husky move shows how dynamic the broadband video ad space is, with multiple kinds of formats and implementations being tested and used by content providers seeking to maximize monetization.

Meanwhile Heavy is continuing to build out its Heavy.com destination site, which currently receives 17M+ visitors/mo. Key upcoming focuses are music/urban, cars and racing, sports and travel categories. These are all the purview of the Heavy's recently added head of programming, Jimmy Jellinek, former editor at Maxim. Content sourcing is varied, with Heavy.com producing some of its own, producing some for its advertisers and also some it obtaining some from others, such as Transworld. In the U.S. today, Heavy does not syndicate its programming to others sites, which is a somewhat contrarian position vs. other content providers who are syndicating widely.

Looking ahead to the Media Summit, Eric plans to explain more about the upcoming Husky push and how content providers and advertisers can benefit from it. He also sees the Media Summit as an ideal forum to learn from others what's making a difference in the industry and what's hot.

Categories: Advertising, Indie Video, Technology

Topics: Heavy, Husky Media

-

TidalTV: Another Well-Funded Aggregator Goes For It

(Note: This is the first of a series of posts with companies participating in the 2008 Media Summit, a premier industry event which will be held next week in NYC. VideoNuze has partnered with Digital Hollywood, the Media Summit's producer, to provide select news and analysis coverage.)

Investors continue to show lots of optimism about the broadband video aggregator category. The latest data point is TidalTV, a new entrant that announced last week it has raised $15 million from NEA and Valhalla Partners. This comes on top of a crowd of well-funded startups: Joost ($45M+), Veoh ($40M+ to date), Building B ($17.5M), Vuze ($32M+), Hulu ($100M) and many others who are attacking this space in one way or another.

To better understand how TidalTV will distinguish itself from the pack, yesterday I had a lengthy briefing with CEO Mollie Spilman. She provided her first extensive remarks about TidalTV's game plan since last week's announcement. (Thanks to my old friend Tom MacIsaac, former CEO of Lightningcast, for facilitating the introduction. Tom recently launched Cove Street Partners and is as smart a player in the broadband video ad space as anyone around.)

The first thing to know about TidalTV is that it is pursuing mainstream users, not early adopters. This targeting pervades all its decision-making: site design is clean and approachable (Mollie said Apple is their role model), content is professional/well-branded only (no UGC), user experience incorporates a traditional linear programming sensibility combined with full on-demand access and advertising mimics traditional pods, while also integrating new broadband-only formats.

In short, TidalTV's making a bet that given how nascent broadband video adoption is among mainstream users, there is ample room to become the brand/destination of choice by providing an experience that feels more similar to traditional TV than to online. Though Mollie says that Apple is TidalTV's heaviest influence, I see clear parallels to AOL from the mid-late '90s. Recall that AOL's pervasive consumer-friendly UI, content and marketing (the Steve Case mantra) enabled it to crush all the dial-up ISPs which had more techie, complicated orientations. Watching AOL's rise made me a big believer that consumer-friendliness can indeed be a meaningful competitive differentiator if executed really well.

AOL is an interesting point of comparison because TidalTV's founder Scott Ferber was a co-founder of Advertising.com, which was sold to AOL in 2004, albeit after the Case era ended at AOL. Mollie was at Ad.com for 6 years as well. Other TidalTV executives come from Ad.com, Joost and Fox. The Ad.com lineage helps explain why TidalTV has chosen to invest significantly in optimizing its advertising capabilities rather than building a lot of its own publishing or delivery features (note TidalTV is all Flash-based streaming with no downloads and no P2P).

TidalTV has some interesting challenges ahead. First is content. It sounds like the company has made substantial progress in deals to obtain content from the "top 50 brands" which includes not only broadcast and cable network fare, but also print, online publishers and others who produce professional video. Yet Mollie concedes that "90% of TidalTV's content at launch could probably be found somewhere on-air or online," as content providers increasingly pursue widespread syndication. TidalTV's opportunity is to pull the content together in a neat, intuitive manner that mainstream users appreciate.

TidalTV will do so by using a "faux linear" presentation, which entails it becoming a "digital programmer," assembling its partners' shows into their own channelized formats (e.g. "The CSI Channel"), with traditional linear air times. For example, if you come to the site at 4pm, you'd see "what's on now" on multiple channels. At launch Mollie anticipates offering 10-15 channels, all on a revenue share basis with providers. This presentation approach is meant to appeal to mainstream users by providing a tangible link to a TV-oriented experience. If a user clicks to start watching, a linear "feed" will start playing, including ad breaks. However, TidalTV will also offer all programs on a full, on-demand basis as well.

But to illustrate how complicated the content acquisition terrain is for 3rd parties like TidalTV, consider Hulu, the NBC/FOX JV. It has insisted that prospective syndication partners take the Hulu player if they're to gain access to popular shows like "Heroes" and "24." Doing so could break TidalTV's user-friendly design. Mollie acknowledged this challenge, but felt confident that in examples like these, there should be adequate incentives to work out an arrangement. Then there's ABC, which to date has not pursued syndication aggressively. If it maintains its ABC.com centric approach, simply not making its programs available to 3rd parties, that leaves aggregators with obvious holes in their offerings. This would be especially challenging for a site like TidalTV, which appeals directly to mainstream users. Speaking generically, Mollie said that TidalTV's neutral "Switzerland" approach (i.e. no investments from media companies) should help in all of its content negotiations.

Driving traffic is another key issue. With other players in the market already, they've had a chance to build their traffic, though not necessarily in TidalTV's core target audience. For instance, Veoh alone says it's getting 20M+ unique visitors per month. To jumpstart traffic, Mollie said that TidalTV is prepared to fund an aggressive marketing plan, testing direct marketing, search, offline ads, outdoor, SEO, viral, PR and other tactics.

TidalTV expects to offer a geo-based limited beta in the Maryland, Virginia and DC area in late March, expanding to a national beta in mid-April. I'll be getting a peek at the beta product next week, so I'll have more to say then. Though it's still far too early to make a definitive assessment of TidalTV's chances of success, I like the fact that Mollie repeatedly uses the word "experimental" in her comments. That's a recognition of how early-stage this market space is and suggests TidalTV will stay flexible and open to all approaches to find success.

What do you think of TidalTV's chances? Post a comment and let everyone know!

Categories: Aggregators, Startups

Topics: ABC, AOL, Building B, FOX, Joost, NBC, New Enterprise Associates, TidalTV, Valhalla Partners, Veoh

-

FastCompany.TV Launches, Scoble at Helm

Yesterday Fast Company magazine officially launched its previously announced FastCompany.TV initiative as "a new kind of business video network." It is another indicator of how broadband is raising the competitive bar in the today's video business.

FC hired Robert Scoble, who ran Scobleizer, an extremely popular technology blog, to be the venture's managing editor. The first programs announced yesterday were "Scobleizer TV," mainly interviews with technology and innovation leaders shot in HD, and "Fast Company Live," which is being shot with a cell phone (yes, a cell phone) and presented in a rough-and-raw, "you're in the front row" experimental style.

FC.TV's launch follows many other magazines' forays into broadband video. I've often said, including in last week's webinar, that print publishers (newspapers and magazines) could well become the most formidable new source of video programming in the coming broadband era. About a year ago, I synthesized some of these thoughts in a report entitled "The Top 40 U.S. Magazines: Learning to Thrive in a Multi-Platform World," in which I asserted that "broadband video offered magazines a once-in-a-generation strategic growth opportunity to leverage their incumbent audiences, trusted brands, editorial expertise and advertising relationships in this new medium." I spoke to Robert yesterday and he concurred with this assessment, offering that "magazines do well in a niche world by understanding targeted audiences, how to serve them and make money at it." He has some previous experience at a 100K circulation title which used a combination of subscriptions, advertising and events to build a very healthy business. Robert believes these kinds of capabilities will serve magazines well in the broadband age.

I spoke to Robert yesterday and he concurred with this assessment, offering that "magazines do well in a niche world by understanding targeted audiences, how to serve them and make money at it." He has some previous experience at a 100K circulation title which used a combination of subscriptions, advertising and events to build a very healthy business. Robert believes these kinds of capabilities will serve magazines well in the broadband age.I asked Robert if he had considered aligning his brand to a broadcast or cable network instead of Fast Company. Though he said he had some conversations, he quickly realized that their approaches were not congruent with his. He saw that traditional networks produce very expensively, with multiple cameras, lights, sets, makeup, etc, all of which creates the lavish look we see on TV. Robert points out that all of this means networks spend a lot of money and time to create just a relatively small amount of actual video (he offered one example he knew of where it took 10 hours to create 2 minutes of video). All of this creates a culture in which executives have a hard time relating to his innovative, low overhead approach.

Conversely, he believes that broadband video must be shot economically, efficiently and creatively, with an eye toward maximizing the ratio of video shot to video aired. As he put it, in a "Google-powered trillion channel world, where each channel may only have 50 or 500 or 5,000 viewers, building media at a low-enough cost enables you to do very well. And the Internet offers the chance to present video that never would have been made in the traditional world."

These sentiments perfectly capture what I see as broadband video's ultimate impact: providing a different consumer experience unencumbered by traditional yardsticks and technologies, with the results being a proliferation of consumer choices and real competition to incumbent players.

Another interesting aspect of FC.TV is that it uses Twistage, a relatively new video publishing and management platform. I had spoken to their CEO David Wadler a couple of weeks ago, and he explained that Twistage is a highly flexible, API-rich platform that he believes is much cheaper than competitors. Robert said he likes Twistage's turnkey ASP approach, which allows FC.TV to outsource just about everything, eliminating a lot of what he called the "drudge work." Wadler told me there are other media customers to be announced soon, so Twistage looks to be an emerging player in this already quite crowded space.

Taken together, FastCompany.TV shows how aggressive magazines can use broadband video to significantly expand the scope of the businesses.

What do you think? Post a comment and let everyone know!

Categories: Magazines

Topics: Fast Company, FastCompany.tv, Robert Scoble, Twistage

-

FreeWheel: Helping Monetize the Syndicated Video Economy

Readers of VideoNuze know that for a long time I've been a big proponent of syndication as a key building block for broadband video success. In last week's webinar I explained that I see this trend only accelerating as content providers increasingly shift from aggregating the most eyeballs to accessing the most eyeballs. That means syndicating video far and wide through social networks, portals, broadband aggregators and others is fast-becoming a key success factor.

Yet aggressive syndication presents a complex set of issues around how to control and optimize the advertising to all those dispersed viewers. Absent the right set of tools to administer each deal's terms, there's a bias toward simplicity and hence, under-optimization. For example, I continually hear that all the broadcasters' syndication deals are 90-10 ad revenue splits. In some cases a plain vanilla approach like this may be fine. More likely though, to have a biz dev person's hands tied to very limited deal terms because of a lack of technology solutions significantly constrains the ecosystem.

FreeWheel is a new company aimed at unlocking these constraints with its "Monetization Rights Management" or MRM technology platform. MRM is a full ASP platform that empowers content providers'

biz dev teams to cut creative revenue/inventory sharing with syndication partners and then have ad sales teams follow through with far more intelligence about how to implement these deals and sell inventory. The result is revenue optimization for all parties. I caught up with CEO Doug Knopper, co-CEO and co-founder of FreeWheel last week to learn more.

biz dev teams to cut creative revenue/inventory sharing with syndication partners and then have ad sales teams follow through with far more intelligence about how to implement these deals and sell inventory. The result is revenue optimization for all parties. I caught up with CEO Doug Knopper, co-CEO and co-founder of FreeWheel last week to learn more. FreeWheel sits on top of existing ad management systems, as a sort of cross between a digital traffic cop and a green eyeshade - dynamically managing and allocating ad inventory, while keeping track of all ads and revenue across the content provider's syndicated network. MRM interfaces to a content provider's and partner's content management system through FreeWheel's API, allowing MRM to implement its predetermined business rules alongside the content being sent to partners. Clearly there's a huge network affect opportunity for FreeWheel - the more partners its early content provider customers get to implement MRM, the easier FreeWheel's sale will be to subsequent content providers.

FreeWheel reminds me a lot of Signiant, which I wrote about recently. Signiant is more focused on content distribution in a syndicated economy, while FreeWheel is focused on ad management. But both companies share a common purpose of greasing the skids for both content providers and distributors to play ball with each other with the intention of driving more video views and advertising revenue.

FreeWheel has signed up Next New Networks, Joost and Jumpstart Automotive Media as initial clients. The company was founded by three former DoubleClick executives, has 40 employees and has raised 2 rounds from Battery Ventures, though the total is undisclosed.

Categories: Advertising, Startups, Technology

Topics: FreeWheel, Joost, Jumpstart Automotive Media, Next New Networks, Signiant

-

Three Broadband Video Themes from February `08

At the end of each month I plan to step back and recap a few key themes from recent VideoNuze posts. Here are three from February '08:

Brand marketers embrace broadband video

One clear theme from the past 4 weeks has been brand marketers' accelerating moves into the broadband video space. This was on full display by select Super Bowl and Oscar advertisers. We are witnessing an unprecedented commitment by brands to create their own entertainment/information video content and also to induce consumers to create brand-related video through user-generated contests. As I detailed in yesterday's webinar, examples in the former category include Kraft/Tassimo, J&J, CIT Financial and GoDaddy.com, while examples in the latter category include TideToGo/MyTalkingStain.com, Heinz/Top This, Dove Cream Oil Body Wash and T-Mobile/Current TV.

Through VideoNuze I track all brands' broadband video initiatives, and it is clear that their involvement in this new medium is intensifying. Faced with splintering audiences, ad-skipping DVRs and changing media consumption habits - particularly by younger demos - brands have no choice but to get into broadband video. This results in an entirely different awareness/engagement paradigm than we're accustomed to from the world of interruptive TV advertising. Brands today increasingly recognize that a key way to create loyalty (and generate sales!) is by engaging the audience on its terms, using broadband and other technologies to accomplish this.

Monetization is the #1 challenge

Another key theme of the past month was the ongoing quest for broadband video monetization. As I also mentioned in yesterday's webinar, this is the number 1 business challenge for all broadband video industry participants - both content and technology providers. Two companies I wrote about this month, EveryZing and Veveo, are focused on improving content discovery, which leads to more consumption and revenue-generating opportunities. I also wrote about Jake Sasseville, a young entertainer who is pioneering multi-platform initiatives to forge a new revenue model.

Innovation is key in this space. Next week I'll be writing about Freewheel, an innovative startup that's just surfaced, which is providing a new approach to managing broadband video advertising. And yesterday, Magnify.net, one of my favorite early-stage companies, which focuses on enabling video content distribution, announced that it has raised an additional $1 of financing.

In addition, the big dogs of the technology and media landscape are in hot pursuit of improved video monetization as well. This month alone brought news of Yahoo's acquisition of Maven Networks, an ad-centric video platform, Google's beta rollout of AdSense for video, and the hostile bid by Microsoft for Yahoo, a deal that has vast longer-term implications for online and broadband video advertising. In short, monetization is a key focus for all large and small industry participants - cracking this nut is crucial to the long-term health of the industry.

Net neutrality re-surfaces

Lastly, this month also brought a lot of news on the regulatory front. Twice I wrote about "net neutrality," a regulatory concept its proponents believe will keep the Internet free from discrimination by broadband ISPs. While I don't agree with their viewpoint, what is clearly true is that net neutrality is being spurred by the massive adoption of broadband video, which places an unprecedented load on broadband ISPs' networks.

So that's it for this leap year month. Three themes you'll be hearing much more about going forward: brand marketers' broadband video initiatives, video monetization and net neutrality. See you on Monday for the start of a new month!

Categories: Advertising, Brand Marketing, Broadband ISPs, Regulation

Topics: EveryZing, FreeWheel, Google, Magnify.net, Maven Networks, Microsoft, Net Neutrality, Veveo, Yahoo

-

Disney/ABC's Stage 9 Launches, With YouTube

Disney/ABC Television Group's official announcement this morning of Stage 9 Digital Media, an experimental new media content studio, is another key milestone in the fast-moving broadband video industry.

I got a short briefing about Stage 9 late yesterday from Disney/ABC because it asked me to provide some analyst context to the LA Times' Dawn Chmielewski, who's done a great piece here. Stage 9 is Disney/ABC's key initiative to reach the coveted 18-34 audience in synch with this audience's unique media consumption patterns. Programming will be short, funny, well-produced, episodic, and widely distributed through popular broadband sites, social networks, mobile and download services.

I interpret Disney/ABC's move, when coupled with recent initiatives by other big media companies into original broadband video production, as further evidence of two key trends: that broadband video has come of age as a key priority for the largest media companies and that it is impossible to appeal to today's younger audiences simply by hewing to the traditional rules of the media game.

Also of significance is that Disney/ABC announced that "Squeegees," which is Stage 9's first release, will be co-exclusively premiered on ABC.com and YouTube starting today and sponsored by Toyota. Yes, you read that right. YouTube! The scruffy user-generated phenom that big media was threatening to sue out existence not so long ago, and which of course is now owned by Google, big media's most anxiety-inducing "frenemy," has been elevated to launch partner status for Stage 9's first program.

The "Squeegees" co-premiere is quite an accomplishment for YouTube. It shows that YouTube's methodical efforts to gain legitimacy (and a business model!) by establishing partner channels with media companies are beginning to pay off. David Eun, Google's VP of Content Partnerships has repeatedly explained this game plan to me, and others over the last year. The Stage 9 launch partnership should certainly be regarded as a major win for the young company. It is also another data point I'd use to support my contention that in the broadband age, traditional conceptions about copyright monetization need to be radically re-thought (Viacom, are you listening?).

I'm enthusiastic about the Stage 9 initiative, as I believe it holds lots of potential for Disney/ABC. It gives the company inroads to the elusive 18-34 set, offers the prospect of innumerable and invaluable insights about how to effectively program in the broadband age, provides a whole new internal breeding ground for developing new on-air programming (a possible double win, as this might help fix the broken and expensive traditional pilot process, though my enthusiasm on this point is tempered by news today of Quarterlife's NBC ratings fiasco) and creates new and exciting multi-platform sponsorship opportunities.

In short, the strategy is sound and the upside significant. Now for the hard part: Stage 9 needs to execute and actually deliver on all this potential.

What do you think? Post a comment now!

Categories: Broadcasters, Indie Video, UGC

Topics: ABC, Disney, Stage 9, Toyota, Viacom, YouTube