-

Unraveling comScore's Monthly Viewership Data for Online Video Ad Networks

A monthly reminder that online video remains a work in progress is comScore's viewership data for online video ad networks. Even as someone who follows the industry closely, I find these reports confusing. The press

releases often distributed by various online video ad networks touting their progress only adds to the confusion. I touched on this last month, and to clear away some of the fog, last week I spoke to Tania Yuki, comScore's product manager for its Video Metrix measurement service.

releases often distributed by various online video ad networks touting their progress only adds to the confusion. I touched on this last month, and to clear away some of the fog, last week I spoke to Tania Yuki, comScore's product manager for its Video Metrix measurement service. comScore's traffic reports are extremely important for the online video industry's growth because they are a key source of data for advertisers, media buyers, agencies and others looking to tap into this new medium. Ad networks in particular are an important part of the online video ecosystem because they provide significant reach, targeting and delivery technology, all of which are required by prospective advertisers.

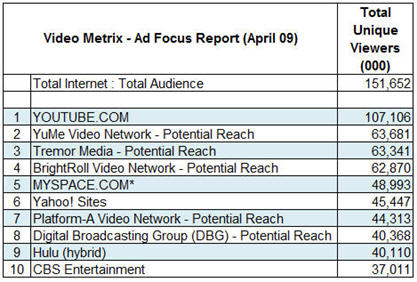

A key part of the current confusion is that each month comScore's Video Metrix Ad Focus report - which details the total audience of unique viewers for online properties and ad networks - combines both the actual audience of destination properties with the potential reach of video ad networks. For example, here's the top 10 for April:

As you can see, 5 of the top 10 listed are ad networks, whose measurement is potential, while the other 5 are actuals. "Potential" is supposed to represent the aggregate number of viewers of all the sites that the ad network has the right to place ads on. However even the validity of this number is amorphous, because networks are only required to provide comScore proof of their relationships if the site accounts for more than 2% of all streaming or web activity.

Recognizing the need to provide more clarity, comScore has recently made available the option for networks to participate in a "hybrid" measurement approach, meant to track networks' actual viewership. To participate, networks need to place a 1x1 pixel, or "beacon" inside any video player where their ads appear. comScore takes the data reported by the beacons and combines it with its 2 million member panel of users whose behavior it tracks. It reconciles differences between the two through a "scaling" process that looks at the intensity of users' non-video behaviors.

To give a sense of the difference between potential and actual, comScore reports BrightRoll - which along with Nabbr are the only video ad networks to have implemented the beacons by April - as having 26M actual viewers vs. the 62M potential reported.

comScore's hybrid approach, which fits with its recently-announced "Media Metrix 360" service, is an important step forward in providing more clarity on how video ad networks are actually performing. Still, as Tania explained, even the hybrid approach has its own idiosyncrasies. For example, some publishers resist having a network's beacon incorporated into their video player, because they want to receive traffic credit themselves. Further, it is a voluntary program. Tania said that in addition to BrightRoll and Nabbr, other networks like BBE, YuMe and Tremor are all working through the implementation currently.

The actual numbers are important for buyers, so that ad networks' viewership can be assessed on an "apple to apples" basis with online properties, as well as non-video options. Tania said that media buyers tell comScore they value both potential and actual numbers. Though that sounds right to me, I think that for the online video medium to mature, buyers are going to put increasing emphasis on actual performance, particularly as it relates to existing media. That's why recent efforts from YuMe and Tremor to translate online video's impact into TV's gross rating points (GRP) paradigm are also important.

In short, comScore seems to be doing its part to improve reporting clarity. However, this isn't going to resolve itself overnight; the market will continue to experience reporting confusion for some time to come.

What do you think? Post a comment now.

Categories: Advertising

Topics: BBE, BrightRoll, comScore, Nabbr, Tremor Media, YuMe

-

comScore Data Shows Tremor Media, Others Gaining in Premium Reach

Amid the steady stream of sneak peek press releases I'm sent each day, one I received late Tuesday from Tremor Media, the video ad network and monetization platform, caught my eye.

The release cited March data from comScore indicating that Tremor's network now had potential reach of 137M unique users and 57M unique video viewers (both unduplicated). The former number is from comScore's Media Metrix Ad Focus report and the latter from its Video Metrix Ad Focus report.

In particular, the latter number stuck out because I recalled comScore numbers from just 2 weeks ago that revealed the viewership for the top 10 video sites. Google (YouTube) was #1 with about 100M viewers, and Fox Interactive (mainly MySpace) was #2 with about half the amount, 55M.

comScore's new data meant that Tremor's potential reach was second only to YouTube's actual reach. And if you make the argument that much of YouTube's viewership is still UGC, while Tremor's network focuses

solely on premium publishers, Tremor would be #1 in potential reach against premium video, a key point of the release. It's also worth noting that 2 other video ad networks focused on premium publishers also show up in comScore's top 10 for potential unique viewers- BrightRoll with 56M and YuMe with 41M.

solely on premium publishers, Tremor would be #1 in potential reach against premium video, a key point of the release. It's also worth noting that 2 other video ad networks focused on premium publishers also show up in comScore's top 10 for potential unique viewers- BrightRoll with 56M and YuMe with 41M. Tremor's VP of Marketing Shane Steele and market research manager Ryan Van Fleet walked me through the data further yesterday.

First, it's important to read these numbers carefully, as there's a little bit of apples vs. oranges going on. The Video Metrix Ad Focus report combines actual viewership by the destination sites (e.g. YouTube, MySpace, Yahoo, Hulu, etc.) with potential viewership by the ad networks. The report clearly denotes what's considered "potential." If I understand it correctly then, the comScore numbers for ad networks should be read as "here's the total potential audience of viewers you have access to." However, what percentage of this accessible audience actually gets an ad served by the ad network is only known by the ad network itself.

VideoNuze readers will recall there's been a lot of sensitivity around these comScore numbers, since last summer a minor kerfuffle broke out over comScore's ranking of YuMe's traffic. Initially it attributed MSN's full audience to YuMe, but later revised YuMe's ranking down by only included pages against which YuMe ads could be served. comScore also stated that on an ongoing basis it would report "potential" reach for ad networks based on documented agreements and "actual" reach for those networks that included certain tags. The new Tremor numbers reflect this potential reach measurement.

It's also important to remember that comScore filters its data to arrive at unduplicated reach. As I understand it that means that if for example Tremor had USAToday.com and Fox.com in its network (note Tremor doesn't disclose its publishers except to its advertisers) and a single user watched video at both sites, the user would only be counted once in Tremor's potential reach. I don't know how exactly comScore de-duplicates viewership, but let's assume it's accurate.

The extent of Tremor's reach (along with BrightRoll's and YuMe's), particularly against premium video is an encouraging sign. I've written in the past that key inhibitors of TV ad dollars moving over to online video are both scale and various friction points in the ad buying process. The comScore data demonstrates that a cluster of ad networks is emerging that can deliver against TV ad buyer's reach expectations, while adding new targeting and reporting capabilities unavailable in TV. There have also been recent enhancements to these companies' reporting/analytics (particularly around GRPs) to synch up with TV ad buyers' expectations.

The online video ad model continues to grow and evolve in spite of the current recession. This is particularly important for expensively-produced premium video where effective online monetization is crucial.

Chime in here with a comment if you think the comScore data or its implications needs further clarification.

Categories: Advertising

Topics: BrightRoll, comScore, Tremor Media, YuMe

-

April '09 Recap - Innovation is Alive and Well in the Broadband Video Space

Looking over last month's posts with an eye for 2-3 themes to extract for my recap post today, I was instead struck by one overarching theme: innovation is alive and well in the broadband video space. Other sectors of the economy may have ground to a halt in the current recession, but whether it's new technologies, new service models or new approaches by traditional media companies, the pace of innovation in all things related to broadband video seems only to be accelerating.

Here are some of the examples from last month's posts:

New technologies

- SundaySky - a new approach to dynamically generate videos out of web site content

- HD Cloud - cloud-based encoding and transcoding plus 3rd party syndication

- Market7 - web-based platform for collaboratively creating and producing video

- FreeWheel - ad management/distribution company raises another $12M

New service models

- Sezmi - next-gen video service provider aiming to replace cable/satellite/telco

- TurnHere - distributed video production services for the corporate market

- Babelgum - premium-quality content destination for independent producers

- YuMe Mindshare iGRP - new measurement unit to compare on-air and online ad performance

- YouTube-Disney - short-form promotional deal

New approaches by traditional media companies

- Disney-Hulu - Exclusive 3rd party online distribution for established broadcast network

- Cable networks launching webisodes - online initiatives to attract and retain new online audiences

- New York magazine video re-launch - emphasis on curating best-of-the web videos with brand

- WWE Smashup - fan-submitted video mashup content driving awareness of on-air special

Now granted I have an eye out for broadband innovations so this list is somewhat self-serving. But remember that for every item above I was probably pitched on 2-3 others that I didn't write about due to time limitations. Some of these other items may have been picked up by other news outlets and captured in the news aggregation side of VideoNuze, while plenty of them likely received little attention.

My point is that throughout the whole broadband video ecosystem there is a vibrant sense of entrepreneurialism that is slowly but surely remaking the traditional video landscape. To be sure, not all of this stuff is going to work out; either business models will be faulty, technologies won't deliver as promised or consumers will reject what they're being offered. Nonetheless, from my vantage point, the wheels of innovation continue to spin faster. That makes it a very exciting time to be part of the industry.

What do you think? Post a comment now.

Categories: Aggregators, Broadcasters, Technology

Topics: Babelgum, Disney, FreeWheel, HD Cloud, Hulu, Market7, New York, SezMi, SundaySky, TurnHere, WWE, YouTube, YuMe

-

YuMe/Mindshare's iGRP is Another Important Building Block for Video Ads

This week's announcement by YuMe and Mindshare to introduce an "iGRP" calculation for online video ad campaigns is another important building block in the online video industry's maturation process. Under the plan, YuMe and Mindshare will offer a reach and frequency metric for ad campaigns running across YuMe's network, which will correlate to GRPs that media planners use for TV ads. I spoke to YuMe's president and co-founder Jayant Kadambi about the iGRP plan yesterday.

Jayant explained that as the online video medium has grown, YuMe's sales team has begun interacting with more and more TV ad buyers, in addition to online ad buyers it customarily dealt with. While a lot of the

spending for online video ads is still based on number of uniques and impressions, recently virtually all of the TV ad buyers YuMe deals with have been asking for a way to correlate and compare online video ad buys with TV buys. To address this need YuMe introduced the iGRP calculation a little while back and this week took the wraps off of it publicly. For those interested in understanding GRPs better, and the iGRP calculation, YuMe also released this useful white paper.

spending for online video ads is still based on number of uniques and impressions, recently virtually all of the TV ad buyers YuMe deals with have been asking for a way to correlate and compare online video ad buys with TV buys. To address this need YuMe introduced the iGRP calculation a little while back and this week took the wraps off of it publicly. For those interested in understanding GRPs better, and the iGRP calculation, YuMe also released this useful white paper.The white paper suggests that in addition to measuring reach and frequency, iGRPs can also capture an "interactivity factor" which would measure things like mouseovers, click-throughs and leads. YuMe and Mindshare plan to work with agencies and advertisers on various experiments testing the performance of different ad formats, durations, content types and targeting schemes.

I've believed for a while, as have others, that while there will be experimental ad dollars flowing into online video advertising, in order for the industry to truly scale, it is going to have to draw spending away from TV advertising. This is especially true in the down economy where advertisers are paring budgets, not increasing them. The $60 billion or so that's spent per year on TV ads is a rich pot of gold for online video to tap into. And given how reliant the online video industry is on advertising (vs. the paid model), the urgency to do so is quite high.

But actually making this happen is no easy feat. The TV ad industry is well-understood by all its

participants, and despite its shortcomings and recent pressures such as surging DVR usage, many in the industry have little incentive to change. As a result, I believe online video ad executives must address and resolve all the friction points in shifting ad spending. Learning to speak in the same language - GRPs in this case - that traditional TV buyers have used in building media plans and doing post-campaign analysis is essential for the online video industry's growth.

participants, and despite its shortcomings and recent pressures such as surging DVR usage, many in the industry have little incentive to change. As a result, I believe online video ad executives must address and resolve all the friction points in shifting ad spending. Learning to speak in the same language - GRPs in this case - that traditional TV buyers have used in building media plans and doing post-campaign analysis is essential for the online video industry's growth.YuMe's and Mindshare's GRP plan comes on the heels of Tremor Media's own GRP announcement with comScore from February. No doubt others will follow with their own approaches as well. This will make for a noisy period until the industry coalesces around standard ways of calculating GRPs and other metrics. Nonetheless, this awkward adolescence should be viewed as an expected part of the maturation process for an industry seeking to convert an already massive, and still rapidly growing amount of monthly eyeballs into meaningful ad revenues.

What do you think? Post a comment now.

Categories: Advertising, Analytics

Topics: comScore, Mindshare, Tremor Media, YuMe

-

Digital Media and Broadband Video Executives Play Musical Chairs

It's been hard not to notice the recently growing roster of digital media/broadband video executives who are either leaving their jobs or jumping to other companies.

Among the many recent changes:

- Bill Day (moved to CEO, ScanScout from Chief Media Officer, Marchex)

- Ned Desmond (leaving as President, Time, Inc Interactive)

- Tony Fadell (leaving as SVP, iPod Division, Apple)

- Karin Gilford (moved to SVP, Fancast/Comcast from VP/GM, Yahoo Entertainment)

- Bob Greene (left as EVP, Advanced Services, Starz)

- Kevin Johnson (moved to CEO, Juniper Networks from President, Platforms & Services Division, Microsoft)

- George Kliavkoff (leaving as Chief Digital Officer, NBCU)

- Michael Mathieu (moved to CEO, YuMe from President, Freedom Communications Internet Division)

- Scott Moore (leaving as SVP, Media Group, Yahoo)

- Herb Scannell (moved from CEO to Executive Chairman, Next New Networks)

- David Verklin (moved to CEO, Canoe Ventures from CEO, Aegis Media Americas)

Of course there are many more as well.

There's no blanket explanation for all of this movement. Senior executives - particularly those with strong track records in unchartered territory like digital media and broadband video - are always in demand by competitors. And established companies who can't execute or who are losing altitude in their core businesses become fertile ground for executive recruiters. Then there are always personal reasons for causing executive change (family matters, geographic restrictions, etc.).

The whole digital media and broadband space is extremely dynamic. Major incumbents continue to struggle with defining their strategies and how to organize themselves properly to execute. The financial meltdown has caused huge profit pressure, prompting operational streamlining.

Still, I'm hoping that all this executive movement doesn't slow broadband's growth. In particular, prematurely folding a digital operation into an incumbent product area can limit innovation as executives who are primarily focused on the core business and who lack detailed domain knowledge will inevitably shy away from riskier or more complex digital initiatives. I've seen this myself first hand. Broadband is still early in its evolution; hopefully executive change will foster, not hinder, its continued progress.

What do you think? Post a comment now.

Categories: People

Topics: Aegis, Apple, Canoe, Comcast, Juniper, Marchex, Microsoft, NBCU, Next New Networks, ScanScout, Starz, Time, Yahoo, YuMe

-

August '08 VideoNuze Recap - 3 Key Topics

Welcome to September. Before looking ahead, here's a quick recap of 3 key topics from August:

1. Advertising model remains in flux

Broadband video advertising was a key story line in August, as it seems to be every month. The industry is rightly focused on the ad model's continued evolution as more and more players in the value chain are increasingly dependent on it. This month, in "Pre-Roll Video Advertising Gets a Boost from 3 Research Studies," I noted how recent research is showing that user acceptance and engagement with the omnipresent pre-roll format is already high and is improving. However, as many readers correctly noted, research from industry participants must be discounted, and some of the metrics cited are not necessarily the best ones to use. I expect we'll see plenty more research - on both sides of pre-roll's efficacy - yet to come.

Meanwhile, comScore added to the confusion around the ad model by first highly ranking YuMe, a large ad network, very high in its reach statistics, only to then reverse itself by downgrading YuMe, before regrouping entirely by introducing a whole new metric for measuring reach. In this post, "comScore Gets Its Act Together on Ad Network Traffic Reporting," I tried to unravel some of this mini-saga. Needless to say, without trustworthy and universally accepted traffic reporting, broadband video is going to have a tough slog ahead.

2. Broadband Olympics are triumphant, but accomplishments are overshadowed

And speaking of a tough slog, the first "Broadband Olympics" were a huge triumph for both NBC and all of its technology partners, yet their accomplishments were overshadowed by a post-mortem revenue estimate by eMarketer suggesting NBC actually made very little money for its efforts. This appeared to knock broadband video advertising back on its heels, yet again, as outsiders pondered whether broadband is being overhyped.

The Olympics became a hobbyhorse of mine in the last 2 weeks as I tried to clarify things in 2 posts, "Why NBCOlympics.com's Video Ad Revenues Don't Matter" part 1 and part 2. These posts triggered a pretty interesting debate about whether technology/operational achievements are noteworthy, if substantial revenues are absent. My answer remains a resounding yes. But having exhausted all my arguments in these prior posts, I'll leave it to you to dig in there if you'd like to learn more about why I feel this way.

3. Broadband's impact is wide-ranging

VideoNuze readers know that another favorite topic of mine is how widespread broadband's impact is poised to become, and in fact already is. A number of August's posts illustrated how broadband's influence is already being felt across a diverse landscape.

Here's a brief sampling: "Vogue.TV's Model.Live: A Magazine Bets Big on Broadband" (magazines), "Tanglewood and BSO Pioneer Broadband Use for Arts/Cultural Organizations," (arts/culture), "American Political Conventions are Next Up to Get Broadband Video Treatment," (politics), "Citysearch Offering Local Merchants Video Enhancement," (local advertising) and "1Cast: A Legit Redlasso Has Tall Mountain to Climb" (local news).

I expect this trend will only accelerate, as more and more industries begin to recognize broadband video's potential benefits.

That's it for August and for the busy summer of '08. Lots more action to coming this fall!

Categories: Advertising, Analytics, Broadcasters, Magazines, Politics, Sports

Topics: 1Cast, CitySearch, comScore, eMarketer, NBC, RedLasso, Tanglewood, Vogue, YuMe

-

comScore Gets Its Act Together on Ad Network Traffic Reporting

I was pleased to see comScore announce on Tuesday that beginning this month it will report two sets of numbers for online ad networks: "potential reach" and "actual reach."

Potential reach will represent the unduplicated visitors to all sites that an ad network has under contract to

deliver ads to (based on written documentation), while actual reach will represent the number of ads actually served (based on a tagging mechanism that comScore will require the ad networks to implement to be counted). This is a welcome development, particularly in the intensely competitive video ad network space. In fact, it seems such an obvious move, one wonders why comScore has been so tardy in introducing it.

deliver ads to (based on written documentation), while actual reach will represent the number of ads actually served (based on a tagging mechanism that comScore will require the ad networks to implement to be counted). This is a welcome development, particularly in the intensely competitive video ad network space. In fact, it seems such an obvious move, one wonders why comScore has been so tardy in introducing it. Followers of VideoNuze and other industry blogs know that comScore's measurement deficiencies recently set off a tempest after comScore ranked YuMe, one of the large video ad networks, #8 in reach in its Ad Focus report. With YuMe trumpeting its ranking, other industry players challenged it by noting that the full audience of MSN (a site that YuMe serves ads to) had been counted. The confusion was caused by the fact that comScore had not been delineating "potential" from "actual" reach or providing apples-to-apples numbers for all networks. Chastened, comScore re-ranked YuMe, sending it plummeting in the rankings.

All of this of course only served to create more confusion for media buyers who are trying to cobble together media plans that achieve their broadband video reach and frequency goals within budget, while minimizing their time invested. Though I'm a huge advocate of the ad-supported model dominating the broadband video landscape well into the future, I'm cognizant that the friction media buyers currently encounter is the single biggest challenge the ad model currently faces in its bid to scale and redirect spending from traditional outlets.

So comScore's new reporting is a step forward after two recent steps back. Let's hope for more forward progress.

What do you think? Post a comment.

Categories: Advertising

-

comScore Revises YuMe Traffic Down

Back on July 22nd I passed on news from comScore that YuMe had broken into the top 10 ad networks, reaching almost 135 million unique visitors in June. Not so fast it turns out. As reported well by both

NewTeeVee and Online Media Daily over the few days, comScore has quietly revised YuMe's reach down to 59.2 million uniques, which would actually land it at number 32 on comScore's June Ad Focus report.

NewTeeVee and Online Media Daily over the few days, comScore has quietly revised YuMe's reach down to 59.2 million uniques, which would actually land it at number 32 on comScore's June Ad Focus report. The change results from re-assigning some traffic from major YuMe client MSN. comScore had given YuMe credit for all of MSN's page views, when in fact YuMe was only serving ads on certain sections of the portal. So comScore has decided it's more accurate to give YuMe credit solely for those pages.

Needless to say, YuMe is not happy about the change and is protesting the new numbers. Its argument is

that with comScore's revised approach, YuMe traffic is being counted differently than all other ad networks. For now it continues to prominently showcase the original comScore numbers on its home page. YuMe seems determined to see a revision to the revision, so we'll all have to see what comScore does next.

that with comScore's revised approach, YuMe traffic is being counted differently than all other ad networks. For now it continues to prominently showcase the original comScore numbers on its home page. YuMe seems determined to see a revision to the revision, so we'll all have to see what comScore does next. There are many posts on VideoNuze about the various ad networks and how they seek to differentiate from each other. Traffic is certainly one of the key battlegrounds, so it's no surprise this skirmish has broken out over the comScore numbers. One is tempted to feel some sympathy for media buyers...if the measurement firms haven't yet figured out how to accurately count the networks' relevant traffic, how are the agencies expected to buy on behalf of their clients?

Categories: Advertising

-

YuMe Ad Network Breaks Into comScore's Ad Focus Top 10

Another sign of video advertising's continued growth is that video ad network YuMe has broken into

comScore Media Metrix's Ad Focus top 10, reaching almost 135 million unique visitors in June. The full stats are in this comScore release. While obviously a big win for YuMe (which I've previously written about here), a larger point that I think is worth noting is that this demonstrates how pervasive broadband video is becoming for all publishers. Going forward I expect YuMe's reach to continue to rise, and also for other video ad networks to keep moving up comScore's list.

comScore Media Metrix's Ad Focus top 10, reaching almost 135 million unique visitors in June. The full stats are in this comScore release. While obviously a big win for YuMe (which I've previously written about here), a larger point that I think is worth noting is that this demonstrates how pervasive broadband video is becoming for all publishers. Going forward I expect YuMe's reach to continue to rise, and also for other video ad networks to keep moving up comScore's list. Categories: Advertising

-

Video Ad Networks Coverage Continued: SpotXchange, YuMe

As evidence of the market's bullishness on ad-supported video, video-focused ad networks continue to flourish. I recently spoke to CEO/co-founders of two of the larger ones, SpotXchange and YuMe to learn more about their respective differentiators.

SpotXchange CEO Mike Shehan explains that his company has focused on building a real-time auction model for publishers to offer inventory and advertisers/agencies to bid on it. The 2 main verticals

SpotXchange is pursuing are local and casual games. Providing an easy on-ramp to video advertising is the key goal. Advertisers can load their campaigns, enter the marketplace, target by channel and/or region and determine how much they're willing to pay.

SpotXchange is pursuing are local and casual games. Providing an easy on-ramp to video advertising is the key goal. Advertisers can load their campaigns, enter the marketplace, target by channel and/or region and determine how much they're willing to pay. Though it's a fully self-service model, SpotXchange offers client service model as well for larger brand advertisers. Michael says there are now 300 publishers in the networks, reaching 50 million unique visitors per month. The company grew out of Booyah Networks, a search and interactive agency which has fully-funded its development.

Meanwhile, Jayant Kadambi, CEO of YuMe explains that the company spent the first 2 1/2 years from its

founding in October '04 developing an ad-management platform that could handle various ad units and formats. In the absence of standards, Jayant believes this gives the company an edge in servicing advertisers and agencies that don't want to customize assets for various publisher sites' players. YuMe has built a network of 400+ publishers with 46 million uniques/month and a sweet spot of 750K-1 million video views/month and above (for a network total 150 million streams/mo).

founding in October '04 developing an ad-management platform that could handle various ad units and formats. In the absence of standards, Jayant believes this gives the company an edge in servicing advertisers and agencies that don't want to customize assets for various publisher sites' players. YuMe has built a network of 400+ publishers with 46 million uniques/month and a sweet spot of 750K-1 million video views/month and above (for a network total 150 million streams/mo). Jayant says he's been pleasantly surprised at how much video content is monetizable, though he's not suggesting user-generated video will be monetized any time soon. YuMe's CPMs are in the $10-30 range. The company is now in the mode of building scale, which could involve marrying its ad management platform to others' networks using its "Adaptive Campaign Engine." In fact, one recent partnership that was announced to do this was with SpotXchange. YuMe has raised $16M from investors including Khosla Ventures, Accel Partners, BV Capital and DAG Ventures.

I'll have more on other video ad networks and how they fit into the larger broadband industry in the coming weeks.

Categories: Advertising, Technology

Topics: SpotXchange, YuMe

-

blinkx Focuses on Network and Ads

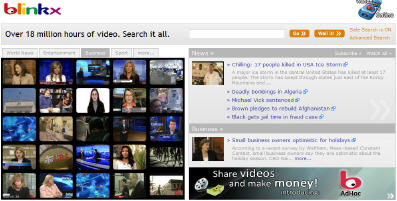

blinkx, which has been around as long as just about anyone in the video search space, is steadily building out its distribution network and advertising capabilities. I caught up with Suranga Chandratillake, CEO of blinkx, who's led the company since its spinoff from Autonomy, and successfully took the company public on London's AIM earlier this year.

Suranga said blinkx is now supporting 5 million searches/day and generating 50 million unique visitors/mo across its network. Network partners featuring a blinkx search box now include Ask.com, Real, Lycos, Infospace and scores of smaller sites that use blinkx's API. Suranga says blinkx can't distinguish between traffic coming from network partners vs. at blinkx.com itself. And the revenue splits in the business deals seem to vary widely, though typically they average out to 50-50. All deals are based on advertising, with the partner usually selling the inventory.

On the ad side, blinkx took a big step forward earlier this year, launching its "AdHoc" contextual ad program. Given the analysis blinkx is doing on video to drive search, it's a natural that the company now leverages this knowledge to improve targeting for ads. In fact, Suranga sees AdHoc as a sort of AdSense for video, dynamcially matching ads with relevant content.

With improved targeting of course comes improved CPMs. Suranga says they've seen CPMs as high as $66 through AdHoc. blinkx is relying on the scale of its 220+ content relationships and millions of impressions to make AdHoc work. Formats can vary but the one that has been most successful so far in a mid-roll banner with an invitation for user to click and engage. As I've written before, AdHoc plays in the same space as other contextual video ad companies such as ScanScout, Adap.tv, DigitalSmiths, AdBrite, YuMe and of course YouTube, plus others.

Both the contextual ad and video search spaces are growing increasingly crowded. Players recognize these are 3 interrelated Achilles heels of the current broadband video model: users finding desired content, content providers getting paid for their work and advertisers getting sufficient and well-targeted industry. blinkx seems well-positioned to address all three.

Categories: Advertising, Video Search

Topics: Adap.TV, AdBrite, Blinkx, Digitalsmiths, ScanScout, YouTube, YuMe

-

Adap.tv Improves Broadband Video Ad Targeting with CPC Approach

As the broadband video world continues to coalesce around advertising as its primary business model, there is a flurry of companies seeking to improve the monetization process. As I've written before, this is critical work, because at some point the bloom will be off the broadband video rose if participants can't earn an attractive ROI.

Enter Adap.tv, which is addressing the ad monetization challenge. The company was founded last year and is based in San Mateo, CA. It is backed by Redpoint and Gemini and now has 20 employees.

CEO/co-founder Amir Ashkenazi recently gave me a run-down on Adap.tv's approach and progress. Amir was the founder of Shopping.com, which was acquired by eBay and he has brought together many former colleagues for his experienced management team.

Like its competitors, the heart of Adap.tv's model is its ad targeting and relevance engine. Adap.tv uses a "multi-disciplinary approach": analysis of the video/audio (context, metadata, etc.), analysis of the ad (keyword submission, etc.) and analysis of the user (demographics, location, etc.). This data is then fed to a matching engine to pair ads with the most relevant video. Over time the system optimizes based on actual click behavior.

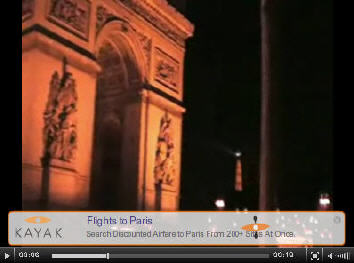

Adap.tv is highly focused on overlays (Amir believes this will be the "de-facto standard" soon), and provides a series of customizable templates for advertisers (see below Kayak overlay). It is also positioning itself as a cost-per-click model, so there's no fixed cost to advertisers. In fact, advertisers can power Adap.tv ads using the same keyword feeds they use for their keyword campaigns.

So far publishers have been responsive to the CPC model because they see overlays as opening up a lot of untapped inventory. Obviously implementing overlays needs to be done judiciously or the viewer experience will become cluttered and broken. Amir believes the whole broadband video ad model will move to CPC over time as advertisers become more sophisticated and focused on performance. This Google-like model would be very good news for advertisers, but would be a brave new world for traditional broadcast and cable networks long accustomed to CPM approaches in their traditional businesses.

While I think a more performance-based broadband ad environment would be welcome, I continue to believe a CPC/overlay approaches will ultimately co-exist with CPM/pre-rolls. There's a lot of interest in overlays, yet there are too many great 15 and 30 second TV spots not be re-used online and the CPMs are way too rich for big branded content providers to walk away from.

Other companies that are in the contextual analysis and/or overlay space include: ScanScout, Digitalsmiths (note: a VideoNuze sponsor), YuMe, blinkx, VideoEgg, YouTube, Brightcove, AdBrite, Viddler (which TechCrunch just wrote about yesterday) and others I'm sure I'm missing or are yet to surface.

Categories: Advertising, Startups, Technology

Topics: Adap.TV, AdBrite, Blinkx, Brightcove, Digitalsmiths, ScanScout, Viddler, VideoEgg, YouTube, YuMe

-

Broadband Video Contextual Ad Space Heats Up, Digitalsmiths Lands Series A Round of $6M

Tomorrow Digitalsmiths, an entrant in the budding broadband video contextual advertising space, will announce a $6M Series A round from The Aurora Funds, Chrysalis Ventures and individual investors. I got a briefing from Digitalsmiths's CEO Ben Weinberger and CTO Matt Berry along with the new investors. The company's new Videosense product builds off of their existing automated video indexing and search product known as InScene which Hollywood studios have been using for years to index and search stock footage.Videosense introduces a contextual ad matching process that matches ads to the content of videos based on an index of metadata that was extracted from the audio track and visual cues (scenery, characters, props, etc.). This matching and metadata gathering process is the company's secret sauce. As with all contextual approaches, the intention is to insert the appropriate ad at just the right moment. So say, for example, you're watching ‘24' online, when Jack Bauer pulls out his smartphone, a discreet ad for Treo pops up. The company can support all types of ads (video, text, banners, etc.) Digitalsmiths can do this across multiple video formats (Flash, WMV, Real, etc.) and plans to serve multiple devices as well.While they haven't announced any customers yet, Weinberger said they're in multiple live customer trials and should be announcing something soon. There's been lots of energy and top tier VC funding in the contextual video ad serving space recently. Other companies that we're aware of in this space include ScanScout, YuMe, Adap.TV, and Gotuit (which has been more focused on indexing than ads), along with blinkx, which just announced its "AdHoc" product today.Over the past year, vendors' efforts to improve upon today's vibrant, yet much maligned, pre-roll format have intensified. There are many different initiatives out there, such as new formats, interactivity, targeting, etc. Improvements in contextual targeting are part of this mix of innovation. All this activity isn't surprising as broadband video content providers have embraced advertising as their business model of choice.Since pre-rolls are still the lifeblood of the broadband video industry and will be for a while, smart vendors will seek to build on its momentum, while gracefully introducing new formats. And since much of the pre-roll delivery infrastructure is now in place, it's also essential for the new crop of contextual vendors to integrate seamlessly with existing ad networks. Digitalsmiths seems to be adhering to this game plan, and so their development is worth keeping an eye on.

Tomorrow Digitalsmiths, an entrant in the budding broadband video contextual advertising space, will announce a $6M Series A round from The Aurora Funds, Chrysalis Ventures and individual investors. I got a briefing from Digitalsmiths's CEO Ben Weinberger and CTO Matt Berry along with the new investors. The company's new Videosense product builds off of their existing automated video indexing and search product known as InScene which Hollywood studios have been using for years to index and search stock footage.Videosense introduces a contextual ad matching process that matches ads to the content of videos based on an index of metadata that was extracted from the audio track and visual cues (scenery, characters, props, etc.). This matching and metadata gathering process is the company's secret sauce. As with all contextual approaches, the intention is to insert the appropriate ad at just the right moment. So say, for example, you're watching ‘24' online, when Jack Bauer pulls out his smartphone, a discreet ad for Treo pops up. The company can support all types of ads (video, text, banners, etc.) Digitalsmiths can do this across multiple video formats (Flash, WMV, Real, etc.) and plans to serve multiple devices as well.While they haven't announced any customers yet, Weinberger said they're in multiple live customer trials and should be announcing something soon. There's been lots of energy and top tier VC funding in the contextual video ad serving space recently. Other companies that we're aware of in this space include ScanScout, YuMe, Adap.TV, and Gotuit (which has been more focused on indexing than ads), along with blinkx, which just announced its "AdHoc" product today.Over the past year, vendors' efforts to improve upon today's vibrant, yet much maligned, pre-roll format have intensified. There are many different initiatives out there, such as new formats, interactivity, targeting, etc. Improvements in contextual targeting are part of this mix of innovation. All this activity isn't surprising as broadband video content providers have embraced advertising as their business model of choice.Since pre-rolls are still the lifeblood of the broadband video industry and will be for a while, smart vendors will seek to build on its momentum, while gracefully introducing new formats. And since much of the pre-roll delivery infrastructure is now in place, it's also essential for the new crop of contextual vendors to integrate seamlessly with existing ad networks. Digitalsmiths seems to be adhering to this game plan, and so their development is worth keeping an eye on.Categories: Advertising, Startups

Topics: Adap.TV, Blinkx, Digitalsmiths, Gotuit, ScanScout, YuMe

Posts for 'YuMe'

Previous |