-

Tremor Media Acquires ScanScout, Creating Video Ad Network Giant

More consolidation among video ad networks, as market leader Tremor Media has acquired ScanScout, creating a new dominant player. comScore reported in its Sept. 2010 online video rankings that Tremor on its own was the #2 video ad network with over 525 million video ads served and reach to over 26% of the U.S. population. For its part ScanScout says it reaches 140 million unique viewers per month. Tremor most recently raised a $40 million round in April, bringing its total funding to $82 million, while ScanScout last raised another $8.5 million Oct. '09.

Categories: Advertising, Deals & Financings

Topics: ScanScout, Tremor Media

-

For Mobile Video, Primetime Continues to be Most of the Time

Rhythm New Media's Q2 '10 mobile video advertising report, which is being released this morning, continues to show how mobile video consumption is spread throughout the day. Unlike online video or traditional TV, where there's a large difference in viewership between the 8pm-11pm primetime daypart vs. other dayparts, the Rhythm data (see below) shows a more even distribution. Rhythms data is based on about 1 billion content views and 75 ad campaigns run during the quarter. Adam Wright reported similar findings in Rhythm's Q1 '10 report.

Categories: Advertising, Mobile Video

Topics: Android, iPhone, Rhythm New Media, ScanScout

-

Complimentary Webinar on Monday, April 8th: "Demystifying Free vs. Paid Online Video"

Please join Colin Dixon, senior partner at The Diffusion Group and me for a complimentary webinar on Thursday, April 8th at 11 am PT/2pm ET titled "Demystifying Free vs. Paid Online Video." We will be joined by two special guests, Chris Wagner, EVP, Marketplace Strategy of NeuLion, a leading provider of technology and services to content owners and aggregators, and Jason Krebs, EVP of ScanScout, a leading video ad network.

Learn more and register now for this complimentary webinar

In this webinar we will examine all sides of the debate including the effectiveness of online subscription models, how well online video advertising is taking advantage of the Internet's unique interactivity/engagement, the pending influence of "TV Everywhere" rollouts and much more. Chris and Jason will share best practices and insights based on their companies' experiences. Colin and I will ask them questions and then open up the webinar for plenty of audience Q&A. If you're trying to get your head around online video business models, then this webinar will be a high-impact educational opportunity.

The webinar will also be a terrific lead-in session for many of the issues we will drill into 2 1/2 weeks later at the "VideoSchmooze" Broadband Video Leadership Evening in NYC on Monday, April 26th. The title for the panel at VideoSchmooze is "Money Talks: Is Online Video Shifting to a Paid Model?" Early bird discounted tickets are now available and I hope you'll be able to join us for both the webinar and VideoSchmooze.

This webinar is the 2nd of 6 in the "Demystifying" series that TDG and VideoNuze are presenting in 2010, sponsored exclusively by ActiveVideo Networks.

Categories: Events

Topics: NeuLion, ScanScout, TDG, VideoSchmooze, Webinar

-

Video Ads Become More Engaging as Industry Grows

Making video ads more engaging has become a key initiative for many online video ad companies. They're responding to agencies and advertisers searching for additional ways to generate an ROI from their online video ad campaigns and further flexibility in how they deliver their messages. The moves come amid strong growth across the industry. Companies that have introduced enhanced interactivity include:

YuMe - introducing today the new "Triple Play" ad unit, which allows the advertiser to insert up to 3 calls to action (e.g. sign up for more info, watch more videos, etc.) after the video ends. YuMe's co-founder and president Jayant Kadambi told me that increasing choice for advertisers and agencies is a key goal. Separately, YuMe reported delivering 2.5 billion ads in Q4 '09, its strongest quarter to date, including an average of 30 million ads/day in Dec '09.

Jivox - introducing today custom interactivity allowing advertisers and agencies the ability to add their own Flash and HTML applets so users can interact within the player itself (example here, roll over the "Experience BMW" to see the interactive options). Diaz Nesamoney, Jivox's President, CEO and founder also explained to me last week that while the company continues operating its own ad network, its fastest-growing segment in '09 was licensing its platform to media companies (e.g. Gannett, McClatchy, Meredith, etc.) who want to sell their own video ads. Revenues were up 600% in '09 with 3,000 new advertisers.

Tremor Media - last week Tremor rolled out six new ad formats for enhanced interaction and engagement: Pre-roll Plus Overlay, vChoice Select, vChoice Rotator, Data Feed, Sequencer and In-Stream Live. The formats, which all use the company's Acudeo ad management platform, build on last June's introduction of its vChoice format. According to comScore's most recent Nov '09 numbers, Tremor was the largest video ad network with potential reach of 85 million viewers or 49.8% of the total U.S. viewing audience and actual reach of 20% of viewers.

Innovid - launched the iRoll, interactive pre-roll ad unit, in '09, which can embed a mini-web site in the video ad itself. Innovid originally pursued product placement through the insertion of Flash objects, but CEO and co-founder Zvika Netter told me recently that, based on agency feedback, it has decided to focus on enhancing interactivity. Innovid is still early stage, but its profile is growing. For example, Netter was recently selected as one of Time magazine's eight "Tech Pioneers Who Will Change Your Life."

ScanScout - Last but not least, in Oct '09 ScanScout unveiled its "Super Pre-Roll" unit, which also enhances interactivity within the ad itself (the Vaseline demo for a great example). Waikit Lau, ScanScout's co-founder and president told me that advertisers are drawn to the unit's superior click-through rates, which are up to 4.5 times higher than typical pre-roll ads.

All of these moves show that in-stream video ads are continuing to evolve to provide more value and a better ROI to advertisers, while also delivering an improved experience to users. No doubt this contributed to the strong '09 that many online video ad executives have reported to me. With the ad climate improving and further engagement opportunities inevitable, there is plenty of reason to believe that spending in the medium will continue to grow.

Note - if there are other initiatives you're aware of that I've missed, please leave a comment.

What do you think? Post a comment now (no sign-in required)

Categories: Advertising

Topics: Innovid, Jivox, ScanScout, Tremor Media, YuMe

-

4 Items Worth Noting for the Dec 14th Week (New pre-roll ad data, Paramount movie clips, Thwapr mobile, next week's preview)

Following are 4 items worth noting for the Dec 14th week:

1. New pre-roll data shows format's strength - Though many in the industry still scorn the pre-roll ad, this week 2 ad networks, ScanScout and YuMe, released data showing its continued prevalence as well as innovation that's improving its performance. ScanScout said its "Super Pre-roll" unit, which allows for integrating overlay graphics on the video that viewers can engage with, is driving 350% higher click-through rates compared with typical pre-rolls. In this example for Unilever's Vaseline, note how the creative nicely reinforces the messaging. The enhanced interactivity feels like the start of a new trend; another pre-roll that offers something similar is Innovid's iRoll unit. ScanScout separately announced this week a host of new premium publishers have joined its network.

Meanwhile YuMe released its Video Advertising Metrics Report for Jan-Nov '09, which showed that, at least within YuMe's network, 90%+ of all ads served were pre-rolls, with 30 second spots generating a 1.8% overall click-through rate, a 50% higher rate than the 1.2% that 15 second spots achieved. The volume of 30 second ads also grew 50% faster than 15 second volume in Q3 '09. Kids age 6-14 achieved a 3.7% click-through rate, the highest of any group, which YuMe's Jayant Kadambi told me could be explained by the more engaging nature of child-focused ads (e.g. click to play games, etc.). Jayant believes the sizable amount of existing creative for TV ads that can be easily repurposed for online is a key reason pre-rolls continue to dominate.

2. Paramount clipping site powered by Digitalsmiths is slick - I was impressed with a demo of Paramount Pictures' newly launched ParamountClips.com site that I got this week. The site is only open to Paramount's business partners, allowing them to either choose from an existing stock of clips from over 80 different Paramount movies, or to easily create their own. Desired clips are moved into a shopping cart and released for download, per previously determined licensing terms.

The site is powered by Digitalsmiths, which indexed all of the scenes from the movies using their proprietary recognition process, and then generated meta-data for each, which makes searching a snap. The new self-service site replaces the laborious previous process of a Paramount staffer working with each partner to extract jus the scene they want. As a result, a new highly-scalable licensing opportunity has been created. Paramount is taking advantage of Digitalsmiths VideoSense 2.5 release announced last week that is focused on clip generation, for both on demand and live streams, improved asset management and more integrated reporting.

3. Thwapr launches beta of mobile-to-mobile video sharing - Continuing the buildout of the mobile video ecosystem, Thwapr, a new mobile-to-mobile content sharing platform, launched its beta this week. Duncan Kennedy, Thwapr's COO told me that although there's been a proliferation of video capable smartphones, there's currently no easy, fool-proof way of sharing videos from one device to another (e.g. from an iPhone to a BlackBerry). Enter Thwapr, which lets the user upload videos to Thwapr and then have them shared with their contacts. Thwapr identifies the receiving phone's "user agent" so that it can dynamically decide the optimal format the video should be viewed in. The user simply clicks on a link and the video plays. I can attest that it worked beautifully on my BlackBerry Pearl.

Thwapr's raised about $3 million from angels and has a very strong team, including Duncan and others who worked on Apple's QuickTime. I'm a fan of how video, social/sharing and mobile intersect to create new opportunities, though there are business model unknowns. For now Thwapr is focused on a free ad-supported model, with a particular emphasis on geo-tagging videos to make advertising especially appealing for local merchants. Still, YouTube has illustrated how difficult it is to monetize user-generated content. Thwapr also envisions a business-grade option for real estate, travel, dating type applications which sound promising. I wonder too about whether a freemium model should be explored, though Duncan said Thwapr's analysis suggested this would be a relatively small opportunity. We'll see how things shape up.

4. Next week is 2009 wrap-up week on VideoNuze - Keep an eye on VideoNuze next week, as I'll be summarizing Q4 '09 venture capital investments and deals in the broadband/mobile video space, reviewing my 2009 predictions and looking ahead to what to expect in 2010. It's been an incredibly active year and based on the pre-CES briefings I've been doing, there's lots more to look forward to next year.

Enjoy your weekend!

Categories: Advertising, FIlms, Mobile Video, Predictions, Startups, Studios, Technology

Topics: Digitalsmiths, Paramount, ScanScout, Thwapr, YuMe

-

First Look at comScore's July '09 Video Ad Networks' Rankings

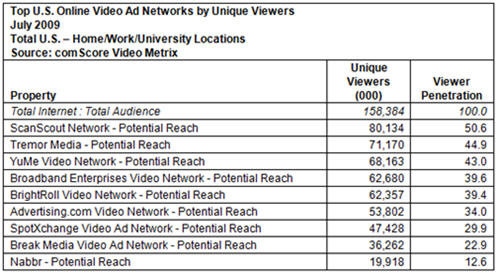

Below is a first look at comScore's rankings for video ad networks' "potential" reach for July '09. The rankings, which have not yet been publicly shared, reveal a relatively tight clustering of 5 video ad networks - ScanScout, Tremor Media, YuMe, Broadband Enterprises and BrightRoll - with ScanScout capturing the number 1 spot in its first month being fully measured by comScore.

The "potential reach" aspect of these rankings is important to understand. As I explained in June in "Unraveling comScore's Monthly Viewership Data for Online Video Ad Networks," the potential reach numbers account for the aggregate number of viewers of all the sites that the ad network has the right to place ads on. However, as I discussed with Tania Yuki, comScore's director of product management, it's not a perfect measure, though comScore is continually trying to improve it.

The rankings are determined through a combination of the ad networks' self-reported publisher list and comScore's own tracking. If a video network reports that any one publisher accounts for 2% or more of its viewers, comScore requires a letter proving the business relationship. There is also a self-policing mechanism as comScore provides a "dictionary" of all publishers that each ad network reports. Competitors can review the dictionary and appeal to comScore if something appears amiss. Still, there's some looseness in the methodology, and having spoken to a number of industry executives, also a fair amount of concern that it is accurately portraying the industry's true performance.

comScore recognizes the limitations of the potential reach approach and that it is just one way of understanding a video ad network's value. Actual monthly performance is equally important, and comScore has been working with ad networks to implement this reporting as well. As I wrote in June, the "hybrid" approach requires ad networks to insert a 1x1 beacon in their video players. Though this approach also has its limitations, many of the biggest video ad networks are now implementing the beacon, and soon comScore will likely begin reporting actual as well as potential reach.

Video ad networks are a very important part of the online video ecosystem, responsible for placing millions of dollars of ads each month. Importantly they allow a level of targeting and reach that brands seek, but are often unable to attain on their own with a handful of direct site relationships. With the online video medium still relatively new, buyers require data helping them understand their options. However, the comScore data is just a first filter, diligent buyers still must dig in to understand how each network, or individual site meets their needs.

What do you think? Post a comment now.

Categories: Advertising

Topics: BrightRoll, Broadband Enterprises, ScanScout, Tremor Media, YuMe

-

Video Companies Raised $64M in Q2 '09, Notching Another Stellar Quarter

In Q2 '09, 9 broadband and mobile video-oriented companies raised at least $64M, notching another stellar quarter. Here's what I tracked for the quarter (if I missed anything, please drop me a note). I've identified when new investors participated:

- TubeMogul (3M) 4/1 - Trinity Ventures

- ScanScout ($5.1M) 4/13

- FreeWheel ($12M) 4/30 - Foundation Capital

- Azuki Systems ($6M) 5/5

- EveryZing ($8.25M) 5/11 - Peacock Equity

- Grab Networks ($12M) 6/2

- beeTV ($8M) 6/3 - Innogest

-

YuMe ($2.9M) 6/12

-

Nokeena Networks ($6.5M) 6/25 - Mayfield

(Note that I've included beeTV, which offers a cross-platform TV recommendation system, so isn't a pure broadband or mobile video company. On the other hand, one might argue that Sugar's $16M round should also be included, since the company simultaneously announced the acquisition of video-oriented Shopflick.com and launch of Sugar Digital Entertainment. However, I haven't counted it since Sugar's more of a pure blog network.)

Excluding Sugar, the $64M comes on the heels of approximately $75M raised in Q1 '09 and over $80M raised in Q4 '08. That means over the last 3 quarters - arguably the heart of the current recession - at least 26 companies have raised a total of $219M. To be sure, everyone I've spoken to has told me these rounds have been hard work to raise, but these companies' successes demonstrate the appeal of the broadband video sector to investors and their anticipation for continued rapid growth.

One thing worth noting is that of the 26 companies, not a single one is a video producer itself, or even an aggregator of video. There has been a significant shift in investor sentiment away from content and towards the platforms and tools required to power video. While that's lamentable, it's also completely understandable. The bruising advertising environment, combined with ongoing business model uncertainty and the death of certain independent producers (e.g. 60Frames, Ripe Digital, etc.) has frozen new content investments. Aggregators aren't faring much better. Just today it was reported that Joost CEO Mike Volpi is stepping aside, as the company tries to relaunch itself as a technology provider. Veoh also restructured during the quarter, shedding half its staff and replacing CEO Steve Mitgang (in addition, just yesterday a VideoNuze reader emailed me saying he can't seem to find a working phone number for the company).

Couple all this with the rise of Hulu, the dominance of YouTube, the entry of cable operators and networks with TV Everywhere, and it's clear that on the content side at least, incumbents and earlier market entrants are ascendant, while more recent entrants and startups are having a tough time surviving the downturn. I anticipate this will continue to be the trend, at least until the economy rebounds.

What do you think? Post a comment now.

Categories: Deals & Financings

Topics: Azuki, beeTV, EveryZing, FreeWheel, Grab Networks, Nokeena, ScanScout, TubeMogul, YuMe

-

thePlatform Targets SMB Customers with New Cost-Savings Initiatives

Here's another sign of the times: thePlatform is announcing this morning that it has launched three new initiatives aimed at reducing small-to-medium (SMB) sized content providers' total cost of running their broadband video operations. In the context of the woeful economy, it's a savvy move.

In effect thePlatform (note, a VideoNuze sponsor) is using its scale to create a buyer's cooperative to save

money on three services (CDN, storage and others), thereby enabling its SMB customers to receive pricing comparable to what big customers can negotiate themselves. With thePlatform's customers driving 440 million video views in December '08, (3rd place after Google's site and Fox Interactive Media) according to comScore, the company is in a strong position to use its size on behalf of its SMB customers. I talked to Marty Roberts, thePlatform's VP Marketing, who explained the specifics of how the savings would work.

money on three services (CDN, storage and others), thereby enabling its SMB customers to receive pricing comparable to what big customers can negotiate themselves. With thePlatform's customers driving 440 million video views in December '08, (3rd place after Google's site and Fox Interactive Media) according to comScore, the company is in a strong position to use its size on behalf of its SMB customers. I talked to Marty Roberts, thePlatform's VP Marketing, who explained the specifics of how the savings would work. thePlatform's initiatives are based on an analysis it conducted of its SMB customers' key cost elements. No surprise, the cost of delivery was the biggest chunk, coming in at 78% of total. This was calculated using a set of assumptions including $.55/GB for delivery. For its new "mpsManage CDN" service, thePlatform has partnered with EdgeCast to resell its service for $.35/GB, resulting in a 36% savings on delivery costs. It will also be available on a utility basis, meaning no monthly commitments. Marty said that thePlatform will continue to work with its other 15 CDN partners, but I would guess that this new program is going to gain a lot of attention among its SMB customer base.

Delivery costs have always been a central issue for making the broadband P&L work. Having done many business cases for various content providers over the years, I'm well-acquainted with how quickly CDN costs can gobble up potential profitability even though the cost/GB delivered has plunged over the years. Yet there is a raft of CDNs out there to choose from, and the key is finding the right one for your needs at the moment and your budget. Still delivery costs persist as a major flashpoint: some of you may have read Mark Cuban's post just 2 weeks ago "The Great Internet Video Lie" in which he basically asserted that large CDNs and their pricing are the real gatekeepers to a truly open broadband distribution model (for the record, I think some of his points are valid, but long-term his logic is flawed).

The other programs thePlatform is rolling out are important, though not as impactful as the delivery option, simply because their percentage of underlying total costs is so much smaller in size. thePlatform is offering a new storage program which slashes the cost of storage from $8/GB on average, to $2/GB. Though a big cut, thePlatform calculates storage only accounts for 5% of total costs today.

Lastly, through its new Advantage program it's tapping into a select group of its ecosystem partners to find another 10% or more cost reduction on services like advertising, reporting and analytics and online community creation. Advantage program participants include Panache, BlackArrow, TubeMogul, Live Rail, ScanScout, Gloto and Visible Measures.

Add it all up and thePlatform believes it can offer a 32% reduction in "total cost of ownership" for SMB video content providers. These new services create a new revenue stream for the company, as the reduced prices include a margin for thePlatform as well. And as Marty pointed out the SMB space is quite vibrant and these programs will allow thePlatform to be more competitive in winning deals by giving them another negotiating lever.

thePlatform's moves are also smart from a positioning standpoint; in this troubled economy I think providers who overtly message that they are doing what they can to save customers money generate valuable notoriety. In good times everyone's focused on top-line growth and wants more features and flexibility. In bad times those goals are still valued, but saving money - which can often make the difference in merely surviving - is prized over everything else (Ben Franklin said it best: "a penny saved is a penny earned"). As a result, I suspect we'll see more companies unveiling messages of this kind in the months to come.

What do you think? Post a comment now.

Categories: CDNs, Technology

Topics: BlackArrow, EdgeCast, Gloto, Live Rail, Panache, ScanScout, thePlatform, TubeMogul, Visible Measures

-

Digital Media and Broadband Video Executives Play Musical Chairs

It's been hard not to notice the recently growing roster of digital media/broadband video executives who are either leaving their jobs or jumping to other companies.

Among the many recent changes:

- Bill Day (moved to CEO, ScanScout from Chief Media Officer, Marchex)

- Ned Desmond (leaving as President, Time, Inc Interactive)

- Tony Fadell (leaving as SVP, iPod Division, Apple)

- Karin Gilford (moved to SVP, Fancast/Comcast from VP/GM, Yahoo Entertainment)

- Bob Greene (left as EVP, Advanced Services, Starz)

- Kevin Johnson (moved to CEO, Juniper Networks from President, Platforms & Services Division, Microsoft)

- George Kliavkoff (leaving as Chief Digital Officer, NBCU)

- Michael Mathieu (moved to CEO, YuMe from President, Freedom Communications Internet Division)

- Scott Moore (leaving as SVP, Media Group, Yahoo)

- Herb Scannell (moved from CEO to Executive Chairman, Next New Networks)

- David Verklin (moved to CEO, Canoe Ventures from CEO, Aegis Media Americas)

Of course there are many more as well.

There's no blanket explanation for all of this movement. Senior executives - particularly those with strong track records in unchartered territory like digital media and broadband video - are always in demand by competitors. And established companies who can't execute or who are losing altitude in their core businesses become fertile ground for executive recruiters. Then there are always personal reasons for causing executive change (family matters, geographic restrictions, etc.).

The whole digital media and broadband space is extremely dynamic. Major incumbents continue to struggle with defining their strategies and how to organize themselves properly to execute. The financial meltdown has caused huge profit pressure, prompting operational streamlining.

Still, I'm hoping that all this executive movement doesn't slow broadband's growth. In particular, prematurely folding a digital operation into an incumbent product area can limit innovation as executives who are primarily focused on the core business and who lack detailed domain knowledge will inevitably shy away from riskier or more complex digital initiatives. I've seen this myself first hand. Broadband is still early in its evolution; hopefully executive change will foster, not hinder, its continued progress.

What do you think? Post a comment now.

Categories: People

Topics: Aegis, Apple, Canoe, Comcast, Juniper, Marchex, Microsoft, NBCU, Next New Networks, ScanScout, Starz, Time, Yahoo, YuMe

-

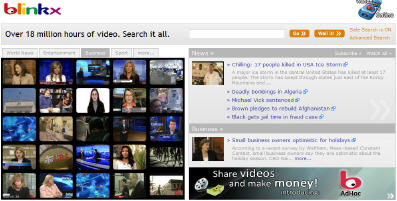

blinkx Focuses on Network and Ads

blinkx, which has been around as long as just about anyone in the video search space, is steadily building out its distribution network and advertising capabilities. I caught up with Suranga Chandratillake, CEO of blinkx, who's led the company since its spinoff from Autonomy, and successfully took the company public on London's AIM earlier this year.

Suranga said blinkx is now supporting 5 million searches/day and generating 50 million unique visitors/mo across its network. Network partners featuring a blinkx search box now include Ask.com, Real, Lycos, Infospace and scores of smaller sites that use blinkx's API. Suranga says blinkx can't distinguish between traffic coming from network partners vs. at blinkx.com itself. And the revenue splits in the business deals seem to vary widely, though typically they average out to 50-50. All deals are based on advertising, with the partner usually selling the inventory.

On the ad side, blinkx took a big step forward earlier this year, launching its "AdHoc" contextual ad program. Given the analysis blinkx is doing on video to drive search, it's a natural that the company now leverages this knowledge to improve targeting for ads. In fact, Suranga sees AdHoc as a sort of AdSense for video, dynamcially matching ads with relevant content.

With improved targeting of course comes improved CPMs. Suranga says they've seen CPMs as high as $66 through AdHoc. blinkx is relying on the scale of its 220+ content relationships and millions of impressions to make AdHoc work. Formats can vary but the one that has been most successful so far in a mid-roll banner with an invitation for user to click and engage. As I've written before, AdHoc plays in the same space as other contextual video ad companies such as ScanScout, Adap.tv, DigitalSmiths, AdBrite, YuMe and of course YouTube, plus others.

Both the contextual ad and video search spaces are growing increasingly crowded. Players recognize these are 3 interrelated Achilles heels of the current broadband video model: users finding desired content, content providers getting paid for their work and advertisers getting sufficient and well-targeted industry. blinkx seems well-positioned to address all three.

Categories: Advertising, Video Search

Topics: Adap.TV, AdBrite, Blinkx, Digitalsmiths, ScanScout, YouTube, YuMe

-

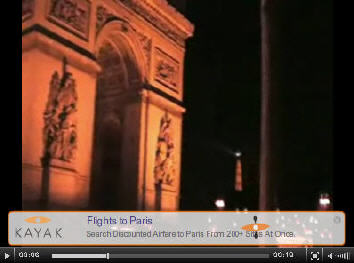

Adap.tv Improves Broadband Video Ad Targeting with CPC Approach

As the broadband video world continues to coalesce around advertising as its primary business model, there is a flurry of companies seeking to improve the monetization process. As I've written before, this is critical work, because at some point the bloom will be off the broadband video rose if participants can't earn an attractive ROI.

Enter Adap.tv, which is addressing the ad monetization challenge. The company was founded last year and is based in San Mateo, CA. It is backed by Redpoint and Gemini and now has 20 employees.

CEO/co-founder Amir Ashkenazi recently gave me a run-down on Adap.tv's approach and progress. Amir was the founder of Shopping.com, which was acquired by eBay and he has brought together many former colleagues for his experienced management team.

Like its competitors, the heart of Adap.tv's model is its ad targeting and relevance engine. Adap.tv uses a "multi-disciplinary approach": analysis of the video/audio (context, metadata, etc.), analysis of the ad (keyword submission, etc.) and analysis of the user (demographics, location, etc.). This data is then fed to a matching engine to pair ads with the most relevant video. Over time the system optimizes based on actual click behavior.

Adap.tv is highly focused on overlays (Amir believes this will be the "de-facto standard" soon), and provides a series of customizable templates for advertisers (see below Kayak overlay). It is also positioning itself as a cost-per-click model, so there's no fixed cost to advertisers. In fact, advertisers can power Adap.tv ads using the same keyword feeds they use for their keyword campaigns.

So far publishers have been responsive to the CPC model because they see overlays as opening up a lot of untapped inventory. Obviously implementing overlays needs to be done judiciously or the viewer experience will become cluttered and broken. Amir believes the whole broadband video ad model will move to CPC over time as advertisers become more sophisticated and focused on performance. This Google-like model would be very good news for advertisers, but would be a brave new world for traditional broadcast and cable networks long accustomed to CPM approaches in their traditional businesses.

While I think a more performance-based broadband ad environment would be welcome, I continue to believe a CPC/overlay approaches will ultimately co-exist with CPM/pre-rolls. There's a lot of interest in overlays, yet there are too many great 15 and 30 second TV spots not be re-used online and the CPMs are way too rich for big branded content providers to walk away from.

Other companies that are in the contextual analysis and/or overlay space include: ScanScout, Digitalsmiths (note: a VideoNuze sponsor), YuMe, blinkx, VideoEgg, YouTube, Brightcove, AdBrite, Viddler (which TechCrunch just wrote about yesterday) and others I'm sure I'm missing or are yet to surface.

Categories: Advertising, Startups, Technology

Topics: Adap.TV, AdBrite, Blinkx, Brightcove, Digitalsmiths, ScanScout, Viddler, VideoEgg, YouTube, YuMe

-

UGC Video Ads Becoming More Viable

Announcements from both ScanScout and Digitalsmiths continue to show that ads against UGC video may become more viable. There has been much skepticism about whether the vast trove of UGC video will be monetizable. Concerns about UGC monetization have been partly behind the recent emphasis by traditionally UGC-centric sites like YouTube, Metacafe, Veoh and others to move up the video quality food chain by offering branded or independent video.

Last week ScanScout announced trademark approval for its "Brand Protector" technology which is aimed at

allowing advertisers to have their messages accompany only content that is deemed appropriate. And today Digitalsmiths (disclaimer: VideoNuze sponsor) has announced "AdSafe", which has the same basic intent and may also functional at a more granular levels of acceptability. Both of these initiatives are should be read as good news in helping the UGC ad market get its footing. Brands looking to harness the power and popularity of UGC video should definitely be investigating these kinds of solutions.

allowing advertisers to have their messages accompany only content that is deemed appropriate. And today Digitalsmiths (disclaimer: VideoNuze sponsor) has announced "AdSafe", which has the same basic intent and may also functional at a more granular levels of acceptability. Both of these initiatives are should be read as good news in helping the UGC ad market get its footing. Brands looking to harness the power and popularity of UGC video should definitely be investigating these kinds of solutions.

Today Digitalsmiths also introduced "AdIQ", which brings the concept of "conquest ads" to the broadband video advertising world. For those unfamiliar with conquest ads, this is when a brand in the same category as a competitor buys inventory where a competitor is somehow mentioned or identified in the content itself. Here's a pretty good explanation from iMedia.

So for example, say Reebok is mentioned or identified in a video scene and say Nike wants to buy an overlay ad to play at that moment. Conversely, AdIQ allows Nike to ensure that its ad never runs against Reebok (or other competitors') content mentions. This is pretty cool stuff. But how about the media buyer who gets the responsibility to administer all this? I haven't seen the implementation, but I hope Digitalsmiths has made it simple to set up and monitor these campaigns!

Categories: Advertising, Technology, UGC

Topics: Digitalsmiths, ScanScout

-

ScanScout Update and New TW Investment

On Friday I had a chance to meet with and get an update from Waikit Lau, COO/President and Co-Founder of ScanScout. They had given me a heads up earlier in the week about this morning's announcement of a strategic investment by Time Warner and new board member appointments, so I wanted to get a closer look.

ScanScout is among a group of companies that are trying to improve monetization of broadband video by using analysis techniques (e.g. audio, visual and metadata) to deliver highly contextual ads that go beyond conventional pre-roll ads. This group includes, to one extent or another, Digitalsmiths, Yume, Adap.tv, blinkx and Nexidia. ScanScout's format of choice is the "overlay", subject of much recent rabble following YouTube's decision to jump on this format's bandwagon.

Waikit explained that ScanScout sees its secret sauce in "extracting signals" (or descriptive data) from video streams, identifying semantics and correlations of like data and enabling "brand protection."

ScanScout first analyzes video content to characterize it so that scenes can become valuable in a way that today's keywords are. This is done though speech recognition, visual analysis and meta-data collection. Next, ScanScout technology is crawling the web each day to find all nouns and pronouns to determine how they relate to one another. By understanding these correlations and the underlying semantics, ScanScout's system becomes smarter, in turn enabling its advertisers to optimize their targeting. Finally, ScanScout's "brand protection" allows advertisers to de-select certain kinds of content and keywords so that their ads don't run in those offending videos.

The company is focusing on a network business model, so it's trying to sign up as many valuable publishers as possible to build its inventory, while also enticing advertisers and agencies to allocate some budget to its platform. Certainly having Time Warner in its corner will help the company gain access to the trove of TW content. However the company isn't focusing solely on big branded content. Waikit favors "torso" video (in Long Tail-speak, content between the head and UGC), that is monetization-challenged. And the company is focusing now on the entertainment vertical and on shorter form content, which Waikit sees as ideal for the overlay format.

It's a pretty cool model, but still needs time to be fully proven. Big brands love the CPMs they're getting for pre-rolls, so overlays are going to be less appealing for now. And for ScanScout and all its competitors, the proof of their wizzy technology will be tangibly improved targeting leading to higher user click-throughs and engagement. It's still too early to know whether the science leads to actual results. But with broadband content providers large and small scrambling for improved monetization, ScanScout and the others are playing in very fertile ground.

Categories: Advertising, Deals & Financings

Topics: ScanScout, Time Warner

-

Broadband Video Contextual Ad Space Heats Up, Digitalsmiths Lands Series A Round of $6M

Tomorrow Digitalsmiths, an entrant in the budding broadband video contextual advertising space, will announce a $6M Series A round from The Aurora Funds, Chrysalis Ventures and individual investors. I got a briefing from Digitalsmiths's CEO Ben Weinberger and CTO Matt Berry along with the new investors. The company's new Videosense product builds off of their existing automated video indexing and search product known as InScene which Hollywood studios have been using for years to index and search stock footage.Videosense introduces a contextual ad matching process that matches ads to the content of videos based on an index of metadata that was extracted from the audio track and visual cues (scenery, characters, props, etc.). This matching and metadata gathering process is the company's secret sauce. As with all contextual approaches, the intention is to insert the appropriate ad at just the right moment. So say, for example, you're watching ‘24' online, when Jack Bauer pulls out his smartphone, a discreet ad for Treo pops up. The company can support all types of ads (video, text, banners, etc.) Digitalsmiths can do this across multiple video formats (Flash, WMV, Real, etc.) and plans to serve multiple devices as well.While they haven't announced any customers yet, Weinberger said they're in multiple live customer trials and should be announcing something soon. There's been lots of energy and top tier VC funding in the contextual video ad serving space recently. Other companies that we're aware of in this space include ScanScout, YuMe, Adap.TV, and Gotuit (which has been more focused on indexing than ads), along with blinkx, which just announced its "AdHoc" product today.Over the past year, vendors' efforts to improve upon today's vibrant, yet much maligned, pre-roll format have intensified. There are many different initiatives out there, such as new formats, interactivity, targeting, etc. Improvements in contextual targeting are part of this mix of innovation. All this activity isn't surprising as broadband video content providers have embraced advertising as their business model of choice.Since pre-rolls are still the lifeblood of the broadband video industry and will be for a while, smart vendors will seek to build on its momentum, while gracefully introducing new formats. And since much of the pre-roll delivery infrastructure is now in place, it's also essential for the new crop of contextual vendors to integrate seamlessly with existing ad networks. Digitalsmiths seems to be adhering to this game plan, and so their development is worth keeping an eye on.

Tomorrow Digitalsmiths, an entrant in the budding broadband video contextual advertising space, will announce a $6M Series A round from The Aurora Funds, Chrysalis Ventures and individual investors. I got a briefing from Digitalsmiths's CEO Ben Weinberger and CTO Matt Berry along with the new investors. The company's new Videosense product builds off of their existing automated video indexing and search product known as InScene which Hollywood studios have been using for years to index and search stock footage.Videosense introduces a contextual ad matching process that matches ads to the content of videos based on an index of metadata that was extracted from the audio track and visual cues (scenery, characters, props, etc.). This matching and metadata gathering process is the company's secret sauce. As with all contextual approaches, the intention is to insert the appropriate ad at just the right moment. So say, for example, you're watching ‘24' online, when Jack Bauer pulls out his smartphone, a discreet ad for Treo pops up. The company can support all types of ads (video, text, banners, etc.) Digitalsmiths can do this across multiple video formats (Flash, WMV, Real, etc.) and plans to serve multiple devices as well.While they haven't announced any customers yet, Weinberger said they're in multiple live customer trials and should be announcing something soon. There's been lots of energy and top tier VC funding in the contextual video ad serving space recently. Other companies that we're aware of in this space include ScanScout, YuMe, Adap.TV, and Gotuit (which has been more focused on indexing than ads), along with blinkx, which just announced its "AdHoc" product today.Over the past year, vendors' efforts to improve upon today's vibrant, yet much maligned, pre-roll format have intensified. There are many different initiatives out there, such as new formats, interactivity, targeting, etc. Improvements in contextual targeting are part of this mix of innovation. All this activity isn't surprising as broadband video content providers have embraced advertising as their business model of choice.Since pre-rolls are still the lifeblood of the broadband video industry and will be for a while, smart vendors will seek to build on its momentum, while gracefully introducing new formats. And since much of the pre-roll delivery infrastructure is now in place, it's also essential for the new crop of contextual vendors to integrate seamlessly with existing ad networks. Digitalsmiths seems to be adhering to this game plan, and so their development is worth keeping an eye on.Categories: Advertising, Startups

Topics: Adap.TV, Blinkx, Digitalsmiths, Gotuit, ScanScout, YuMe

Posts for 'ScanScout'

|