-

Spotlight is on Video as Mobile World Congress Begins

As the biggest annual mobile conference - the Mobile World Congress - gets underway today in Barcelona, new initiatives from some of the biggest names in technology underscore the growing importance of smartphones and of mobile video specifically. Among the most important headlines:

- Microsoft's CEO Steve Ballmer is unveiling Windows Phone 7 which includes Xbox LIVE games, Zune video and audio, plus enhanced sharing. With Phone 7 Microsoft is continuing to vie for position in a crowded smartphone operating system landscape.

- Sony Ericsson is launching "Creations" allowing users to create and publish video, audio and images from their mobile phones in collaboration with professional developers.

- AT&T and 11 other mobile service providers, which together have about 2 billion subscribers, are introducing a new applications store designed to appeal to developers and compete head-on with Apple's App Store.

- Symbian is taking the wraps off its new Symbian 3 open source release, which includes support for HDMI, so that users can connect their Symbian phones to their TVs and watch 1080p video, in effect creating a Blu-ray player in your pocket.

- Intel and Nokia are merging their respective Moblin and Maemo software platforms to create MeeGo, a unified Linux platform to run across multiple devices.

- Adobe is providing an update that by mid-2010, its AIR runtime for building rich applications will be available for Android and that Flash 10.1 will be generally available for various mobile platforms, including Android. In addition, Adobe is announcing that Omniture, which Adobe recently acquired, will add mobile video measurement within its SiteCatalyst product.

While each announcement, plus countless others, have their own significance in the burgeoning mobile ecosystem, the one that's most relevant to mobile video specifically is the coming availability of Flash 10.1, especially for Android. Mobile video has been hampered to date with the lack of Flash player support on iPhones, so its pending launch on Android phones threatens to scramble the relative appeal of these devices for users eager to watch video from sites like Hulu on their smartphones.

Late last week I got a glimpse of how significant Flash on smartphones is from Jeff Whatcott, SVP of Marketing at Brightcove, which today is announcing an optimized version of its platform for Flash 10.1, to be released in the middle of 2010. Adobe has made the beta of Flash 10.1 available to content providers, and Jeff has a video showing how it works with Brightcove for its customers like NYTimes.com and The Weinstein Company.

Brightcove has done 3 things - optimized its template for mobile devices (so navigation and interactivity is seamless on the small screen), enabled auto-detect of mobile devices (so the correct Brightcove template is served) and leveraged cloud-based transcoding (so a mobile-ready H.264 encoded video is streamed). The goal is for Brightcove's customers to be able to deliver an optimized mobile and Flash experience identical to their online experiences, with minimal additional work flow. Brightcove provides the appropriate logic for mobile templates to its customers which they embed in their pages. When a user visits from a mobile device and clicks to watch video, the right Brightcove-powered experience is delivered.

All of the above activity is happening in the shadow of the now-dominant iPhone (and coming release of the iPad) which do not support Flash. As non-iPhone devices - and content providers - progressively incorporate Flash this year, it seems like the smartphone market is poised for another new turn. Flash is the dominant video player and as users look to replicate their online experiences on their smartphones, the void of Flash on iPhones will become even more pronounced. I don't underestimate Steve Jobs or Apple's ability to compete, but this will be one place where it feels like the iPhone will be at a real disadvantage. Apple is keen to prevent Flash from extending its online hegemony to mobile as well, so it will be interesting to see how it chooses to play this.

What do you think? Post a comment now (no sign-in required).

Categories: Mobile Video, Technology

Topics: Adobe, AT&T, Brightcove, Intel, Microsoft, Nokia, Sony Ericsson, Symbian

-

Google's Fiber-to-the-Home Experiment Could Cost $750 Million or More

I hope for Google's sake that it understands the cost to build its 1 gigabit/second ultra high-speed fiber network experiment announced today could be $750 million or more. Even for Google that's a very big number, especially considering the company has said it has no intention of actually pursuing this as a business. Of course, we don't know exactly what Google is forecasting its project costs to be, but using Verizon's FiOS numbers wouldn't be a bad starting point to do the math. So here goes.

Google said it would offer the gigabit service to between 50,000 and 500,000 people. Let's start at the high end of that range. Verizon has disclosed that it will spend $18 billion to pass approximately 18 million homes in its footprint with its FiOS fiber-to-the-home network. It's not fair to do a straight average and assume that Verizon is still paying $1,000/home passed given that its costs have no doubt declined over the years.

However, in Google's case, since it has approximately zero experience laying fiber in neighborhoods, and won't get the same level of vendor discounts that Verizon enjoys, it is probably fair to assume Google will spend at least $1,000 per home passed. So if it goes all the way to 500,000 homes, that's $500 million in neighborhood build-out costs.

However, in Google's case, since it has approximately zero experience laying fiber in neighborhoods, and won't get the same level of vendor discounts that Verizon enjoys, it is probably fair to assume Google will spend at least $1,000 per home passed. So if it goes all the way to 500,000 homes, that's $500 million in neighborhood build-out costs. But that's only to wire the neighborhoods, then the service has to be deployed in the homes themselves. That means in-home wiring, on-premise equipment, labor, trucks, insurance, overhead, etc. Estimates for Verizon's per home cost vary, but $500 is in the range often cited. In Verizon's case they're also deploying a set-top box to deliver TV, which Google hasn't announced plans to do (more on that below), so that cost should be deducted. But on the flip side, once again, because Google has never wired a consumer's home (that I'm aware of anyway) it has a steep learning curve ahead of it, meaning its costs could be much higher than Verizon's.

But to make things easy, let's just use the $500 per installed home. So 500,000 homes at $500 apiece, another $250 million for the project. Add it to the $500 million for the neighborhood build-outs and the total is $750 million. This assumes Google decides to go all the way to 500,000. Obviously if it stopped at 50,000, the costs would be a lot lower.

However, there's another big caveat that could drive Google's costs far higher: passing 500,000 homes does not equal having 500,000 customers. It's impossible to predict what percentage of a community's residents would take the Google experimental service. One way of thinking about it is that around 65% of American homes currently subscribe to broadband Internet service. What percentage of those will Google lure? Say it's around 15%. So in a community with 100,000 residents for example, Google may get only get 9,750 people to take its gigabit service (100,000*.65*.15). That means Google may need to pass fiber by 10 homes for every one it gets as a participant in its experiment. Put another way, the $500 million homes passed budget could increase by a factor of 10x. (In case you're wondering, by comparison, Google's 2009 net income was $6.5 billion.) Each subscriber's home would have cost Google approximately $10,750 to connect.

Executives at cable operators and telcos - who build and operate residential networks for a living - are very familiar with modeling network deployment costs. But I wonder, how familiar do you think Google is? Does it know what it has bitten off here? And for what benefit exactly - to test next-generation apps? Hmm. Everyone knows video is the biggest bandwidth hog; an expensive experiment isn't going to change that. And also remember, Google only plans to sell broadband Internet access, not a full bundle with TV or voice. It says it will do this at competitive prices, which means around $50-$100/mo. At these revenue levels and with operating costs that I haven't even mentioned, it's inconceivable to me that there's a positive business case for Google's gigabit experiment.

I'm all for innovation and for pushing competitors along. But Google's experiment really has me scratching my head. No doubt the folks at Verizon, Comcast and other big broadband ISPs are wondering as well. It's one thing for Google to throw $2.5-$3 million at a 52-second Super Bowl ad, but quite another to be contemplating a $750 million experiment with ambiguous goals. What am I missing?

What do you think? Post a comment now (no sign-in required).

Categories: Broadband ISPs, Technology

Topics: Comcast, Google, Verizon

-

Paltalk Releases SuperIM URLs for Clientless Video Chatting

Paltalk, the long-time video chat technology provider, is announcing its Paltalk 9.9 beta release today, which includes a feature called SuperIM URLs, which allow users to initiate 1-click, in-browser video conferences without any client download. It's a clever feature that promises to drive higher adoption of personal video conferencing. Paltalk's CEO Jason Katz walked me through a demo yesterday.

SuperIM URLs work like this: say I'm a registered Paltalk user (either free or paid) so I've already downloaded the Paltalk software. I then select a personalized SuperIM address, for example http://www.wrichmond.superim.me. Then I begin publicizing the URL to friends, say through tagging my email signature, Facebook page or business card. People who see the URL simply click on it and, as long as they have a webcam, are instantly connected via video chat with me. Just so I don't have people barging in on me on a bad hair day, I can set privacy controls to always require accept/decline. I can also password-protect the link so I only hear from people I want to. I can also set it so only audio comes on first and I have to manually start the webcam.

I can have up to 10 people in a video chat and display the participants in different mosaics. The most obvious competition for SuperIM URLs is Skype, which I use for video calls. Jason agreed that while Skype does a lot of things really well, Paltalk SuperIM's big differentiator is that it does not require the caller to have downloaded any software to participate.

With SuperIM, the caller simply clicks on the URL provided and is connected. In effect, the conferencing capability is brought to users instead of the other way around. The goal is to make it so easy that anyone's "grandmother can use it" as Jason put it. Even though Paltalk has had its client downloaded some 70 million times, Jason acknowledged that it's a "busy Internet," and it's getting harder and harder to induce people to download any new software.

Another differentiator is Paltalk's multi-party capability, which Skype doesn't offer. This means that a Paltalk user could set up a multi-party video chat around a specific event simply by sending out the SuperIM URL to friends, asking them to click-through at a certain time (think "virtual Super Bowl party").

Going forward, Jason said Paltalk plans to eliminate the step of even having the initial user download the Paltalk software. Paltalk wants to become ubiquitous for mobile users and other portable devices like the iPad. Jason also makes an interesting point that with the spread of $300 Internet-connected netbooks with built-in webcams, personal video conferencing has become more accessible than ever. Paltalk is also aiming for tighter integration with Facebook, so users can initiate video chats to their friends.

I vividly remember that George Jetson's video phone was just about the coolest thing I'd ever seen when I was a kid. SuperIM URLs are yet another indication that the Jetsons' world is upon us.

What do you think? Post a comment now (no sign-in required).

Filckr image via writetechnology

Categories: Technology

-

VideoNuze Report Podcast #48 - February 5, 2010

Daisy Whitney and I are pleased to present the 48th edition of the VideoNuze Report podcast, for February 5, 2010.

This week we get started with me reviewing yesterday's post about FreeWheel now serving close to 2 billion video ads per month and signing up MLB Advanced Media as their newest customer. FreeWheel's Doug Knopper told me that it is benefitting from both its new customers and also from year-over-year increases in ads served for existing customers. FreeWheel is also in the middle of the "syndicated video economy" that I've written before, having integrated with big third parties such as YouTube, AOL, MSN, Fancast and others.

Then Daisy describes her interview from last week's NATPE show with Chloe Sladden, director of media partnership for Twitter. The company is planning to launch its Media Developer's Platform later this year, along with new measurement tools. Daisy shares what she learned.

Click here to listen to the podcast (12 minutes, 38 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

Categories: Advertising, Podcasts, Technology

Topics: FreeWheel, MLB, Podcast, Turner, Twitter, VEVO

-

KickApps Lands NBCU for Social Video Sites

KickApps and NBCU are announcing a licensing deal this morning which includes KickApps' App Studio and Premium Social Video Platform. The deal enables all of NBCU's entertainment properties to use KickApps' social software solution, expanding upon a prior relationship between the companies which has primarily focused on NBC's local media properties.

As Marc Siry, NBCU's SVP, Digital Products and Services explained to me, KickApps's key differentiator was its self-service App Studio which allows NBCU's brands to quickly create customized, socially-oriented sites and video players using drag-and-drop tools. Marc said that the self-service aspect to the App Studio was

particularly important as each NBCU property has its own customization requirements. With resources tight, it was key to be able to have each property be somewhat self-sufficient. Marc said that social wrapping is essential to all media today, and that no other online video platform that NBCU evaluated offered the same capabilities.

particularly important as each NBCU property has its own customization requirements. With resources tight, it was key to be able to have each property be somewhat self-sufficient. Marc said that social wrapping is essential to all media today, and that no other online video platform that NBCU evaluated offered the same capabilities. (As a side note, I have always thought of KickApps as a social platform first and foremost, which also offered video functionality. As a result it's not really a pure OVP, though with its NBC win, KickApps is showing that for some customers, it is a bona fide OVP competitor.)

NBC has strongly pursued social interaction on its local sites, encouraging users to submit comments, video, and other engagement opportunities. With local media impacted by audience fragmentation, efforts to re-invent how to connect with audiences have been crucial. Looking ahead - though unable to get too specific for now - Marc told me that NBCU already has several projects in the works that will leverage KickApps: a fan site from Telemundo, a new video portal emphasizing "secondary" non-TV program content with rabid fan interest, and a celebrity-oriented user-generated site. Parent company GE is even planning to use KickApps as an enterprise solution for video sharing among internal units.

Marc said that one other appealing aspect of KickApps was its embrace of Adobe's Open Source Media Framework ("OSMF"). For those not familiar with OSMF (formerly known as "Strobe") it is a public, pre-release initiative aimed at allowing developers to use pluggable components to create rich Flash-based playback experiences. It is still early days for OSMF and it represents something of a challenge to many online video platforms which offer similar integrations as part of their product or through professional services.

But as Marc explained, OSMF is valuable to NBCU because it is seeing more and more requirements from its brands and advertisers to do custom creative and OSMF gives it a baseline of functionality on which to build. Prior to KickApps, NBCU properties relied mainly on homegrown software for video applications, which Marc said had limited flexibility.

KickApps's NBCU win is yet another example of how dynamic the market for video solutions is today. I am continually hearing about how specific content providers each have their own unique requirements, so an individual video platform provider can be a perfect fit in one situation, but be less than optimal in another. While some requirements are converging, I anticipate a level of individuality will persist for some time to come, sustaining the OVP fragmentation we've seen to date.

What do you think? Post a comment now (no sign-in required).

Categories: Broadcasters, Technology

-

thePlatform Unveils New "mpx" Beta and mpx Dev Kit

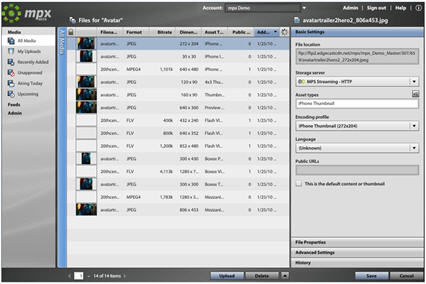

This morning, thePlatform is marking its 10th anniversary by unveiling a new version of its video management and publishing system, dubbed 'mpx" (the prior version was called "mps" for Media Publishing System) and mpx Dev Kit, a complete set of APIs and documentation. Last week Marty Roberts, thePlatform's VP of Marketing, gave me an overview of mpx and a short demo.

thePlatform had 3 primary customer goals in mind with mpx: (1) to provide more efficient management of large content libraries, (2) to enable personalized work flow options and (3) to re-orient the publishing process so

the beginning point is the outlet or "publishing profile." As Marty explained, over the course of the 10 years that thePlatform has been in business, the world of online video has become far more complex, with longer viewing durations, more distribution options, bigger content libraries, and more money at stake. Since thePlatform works primarily with big content providers and distributors, improving the ingest process to accept multiple simultaneous files, and then the navigation of existing files, was a key focus of mpx's development.

the beginning point is the outlet or "publishing profile." As Marty explained, over the course of the 10 years that thePlatform has been in business, the world of online video has become far more complex, with longer viewing durations, more distribution options, bigger content libraries, and more money at stake. Since thePlatform works primarily with big content providers and distributors, improving the ingest process to accept multiple simultaneous files, and then the navigation of existing files, was a key focus of mpx's development.In addition, having done lots of research on how its users interacted with mps, thePlatform found that they each used it in somewhat different ways and that ease-of-use remained a pain point. This led thePlatform to devote substantial resources to enabling users to create their own work flows, personalized depending on their specific role in the video management and publishing process. In the demo, Marty showed how different people, tasked with different assignments, could configure their own views of mpx's 3-pane publishing console, so that just those things they cared about were visible and accessible. Multiple views can be created and then saved, so the user can quickly return to and cycle through their various tasks.

Most interesting though, is mpx's re-orientation to start the publishing process by creating a "publishing profile" such as a pre-configured video player, or a mobile device, or a third-party syndication partner. In each case, the user first configures the outlet and then specifies exactly what types of assets are required, including encoding specs, formats, sizes, etc. Then, as video is ingested and marked for its destination, the system takes over and automatically runs the various required processes in order to deliver the required files to their destination. The same occurs for assets already in the system; the user finds what's required, associates a publishing profile and prompts the system to run the processes. It's a pretty slick approach, and no doubt will be a real time-saver for users.

Marty explained that thePlatform dedicated 70% of its engineering team to mpx's development for the last 2 years. Scale and reliability have also been key goals, as the company's large customers, especially service providers, have "5 9's" or 99.999% availability requirements. While thePlaftorm is cognizant of the range of online video platform competitors, the company believes the lessons learned over the years, which help it operate at huge scale, are a real differentiator.

Interestingly, Marty echoed what I continue to hear - that homegrown systems are still the most significant competition. However, the advent of TV Everywhere and the rise of paid media appear to be tipping these holdouts toward third-party platforms. With the online and mobile video worlds getting more complex by the day, this can be expected to continue.

What do you think? Post a comment now (no sign-in required).Note- thePlatform is a VideoNuze sponsor.Categories: Technology

Topics: thePlatform

-

Kyte Launches Console 2.0, Emphasis on Ease-of-Use

More online video platform product news today, as Kyte is unveiling its Console 2.0 product. Last week, COO Gannon Hall gave me a rundown of the new features, which include enhanced work flows, playlist creation, channel and player management and show scheduling among others.

It's no news that OVPs are in an intense feature war, and it is increasingly important for each player to find points of differentiation. Three things that Kyte has focused on to separate itself from the pack are support

for user generated content, mobile devices and social/video sharing. Gannon sees the UGC functionality as particularly important as Kyte is seeing customer demand growing for user engagement opportunities. Two customer examples he cited were ESPN's "Talk of the Terrace" live studio show in the U.K., which actively solicits user contributions (pictures, video and text), and McGraw-Hill's "Professor for a Day" initiative, which encourages students to upload a short video of themselves delivering a lecture on a subject of their choosing.

for user generated content, mobile devices and social/video sharing. Gannon sees the UGC functionality as particularly important as Kyte is seeing customer demand growing for user engagement opportunities. Two customer examples he cited were ESPN's "Talk of the Terrace" live studio show in the U.K., which actively solicits user contributions (pictures, video and text), and McGraw-Hill's "Professor for a Day" initiative, which encourages students to upload a short video of themselves delivering a lecture on a subject of their choosing. In these and other UGC examples, it's critical to be able to quickly moderate submissions and approve them for publishing. In the case of ESPN, Gannon noted that they had a multi-step approval process through compliance and copyright officers, which Kyte enabled. The proliferation of video capturing devices like smartphones and personal video cameras, plus the intense desire by brands to engage their audience, suggests that UGC support will become a more important OVP feature. As far as I'm aware, the only other OVP that has really emphasized UGC moderation is VMIX, a situation that is likely to change.

Mobile is another area where Kyte is trying to differentiate itself. Though its app frameworks for iPhone and Blackberry, and soon Nokia and Android, customers are able to quickly build apps for these mobile devices and then, using Kyte's Mobile Producer feature, can manage and publish video to their channels. Gannon said that for example, Fox News now routinely has field reporters capturing video with iPhones and then uploading it for audience viewing. Kyte was also involved in quickly turning around an iPhone app for last Friday's "Hope for Haiti" digital telethon.

I continue to believe that the world is getting more and more complicated for content producers. That's a theme that I've heard repeatedly at the NATPE conference in Las Vegas, where I am now. In the old days content people focused on producing great content, and then others worried about distribution and audience development. What's changing in the digital era is that content producers need to be just as focused on distribution in order to generate an ROI. In this respect OVPs are playing a more important role, providing the work flow, distribution and engagement functionality. Making all of this ever easier and more effective will continue to be a primary success factor for OVPs.

What do you think? Post a comment now (no sign-in required).

Categories: Technology

Topics: Kyte

-

Brightcove Makes Its First Move Into TV Everywhere

This morning Brightcove is making its first TV Everywhere ("TVE") related announcement, introducing its "TV Everywhere Solution Pack" (TVE-SP), which is the Brightcove 4 enterprise edition augmented with new components and services to support TVE rollouts. It is also unveiling a strategic alliance with Ping Identity to integrate its PingFederate security software with TVE-SP, to enable user authentication and authorization. Lastly, Brightcove has promoted Eric Elia from VP of Professional Services to VP of TV Solutions, charged with leading the company's TVE initiatives. Brightcove's CEO and founder Jeremy Allaire briefed me last week.

To understand how TVE-SP fits in, it is important to quickly review the TVE model. To date, most discussion of TVE has focused on multichannel video programming distributors ("MVPDs") providing their subscribers with online access to TV programming through

their own portals or services, for no extra charge (e.g. Comcast's Fancast Xfinity TV). Receiving less attention so far is that the programmers who agree to participate in MVPD portals will likely require they are also able to offer their same programs on their own sites, which are an increasingly important part of their brand identity and direct-to-consumer focus.

their own portals or services, for no extra charge (e.g. Comcast's Fancast Xfinity TV). Receiving less attention so far is that the programmers who agree to participate in MVPD portals will likely require they are also able to offer their same programs on their own sites, which are an increasingly important part of their brand identity and direct-to-consumer focus. Something else that hasn't received a lot of attention to date is that not all MVPDs will follow Comcast's model of managing, hosting and delivering the online programs themselves. Rather, some MVPDs will prefer to provide just the barebones online navigation, with TV programmers providing an embeddable video player and also delivering all the programming. Less-resourced MVPDs could end of relying heavily on programmers to power their TVE offerings. Where programmers already have online video platforms such as Brightcove in place, these OVPs are in a position to influence how TVE operates. (As a sidenote, I've heard multiple times that Comcast itself is also offering a white labeled version of its FXTV portal to other MVPDs).

All of this means there's likely to be plenty of heterogeneity in TV Everywhere rollouts. Recognizing this, a key part of Brightcove's product strategy is aligning with Ping to use PingFederate and the SAML 2.0 standard for user authentication and authorization. SMAL is used to exchange data between domains (e.g. between a TV programmer, whose web site visitor is trying to access a certain program and an MVPD which holds that user's subscription profile). This type of secure exchange will be essential for TV programmers to offer their own programs on their own sites in a TVE world.

SAML has been widely used in the SaaS business applications and Ping itself lists Comcast, Cox, Bell Canada and Discovery, among others, as customers. However, I suspect these are likely on the enterprise side, not the consumer-facing side. As a result, Brightcove's approach will require significant testing before it will be deemed acceptable by MVPDs. In fact, Brightcove's new white paper indicates that additional standards are required and that some of this is underway at CableLabs, the cable industry's development lab.

It's also worth noting that thePlatform (owned by Comcast) has 4 of the top 5 U.S. cable operators, plus Rogers in Canada, as customers, and ExtendMedia has the major U.S. telcos, plus Bell Canada, as customers. With Brightcove powering video at 60+ TV programmer websites, there are no doubt some interesting dynamics ahead as these OVPs' customers negotiate their TVE relationships and influence the interoperability of their respective technology providers. For its part, thePlatform, which also supports many content providers' video, introduced last November an "Authentication Adaptor" as part of its media publishing system to smooth the authentication and authorization process for programmers offering TVE shows on their own sites.

Confused yet? This is pretty dense stuff, and illustrates some of the hurdles ahead for TVE's widespread rollout. Meanwhile, lurking over TVE's shoulder are the raft of over-the-top alternatives (e.g. Netflix, Boxee, Apple, Xbox, YouTube, etc.) that are sure to gain additional traction with consumers (as a sidenote, yesterday's Best Buy Sunday circular promoted no fewer than 5 Blu-ray players as Netflix compatible, with each showcasing the Netflix logo).

As the TVE story unfolds, Brightcove is sure to be in the middle of the action given its market presence and technical capabilities. But how it all shakes out remains to be seen.

What do you think? Post a comment now (no sign-in required).

(Note - Brightcove, thePlatform and ExtendMedia are VideoNuze sponsors)

Categories: Technology

Topics: Brightcove, Comcast, ExtendMedia, Ping Identity, thePlatform

-

Fox Switches from Move to Flash; ABC Plans Transition Too

Fox.com has quietly switched from Move Networks' player to Flash for its online video, with Brightcove powering content management and publishing. Separately, a Disney-ABC spokesperson told me that ABC.com will also be transitioning from Move to Flash in the coming weeks, though both will be used temporarily.

Neither of the changes will surprise Move. Earlier this week I spoke with Move's Marcus Liassides, who

explained that the company is continuing its own transition, evolving from a technology provider to content owners to an end-to-end broadband delivery platform for powering next-generation multichannel video services. Marcus said that Move has been working closely with its content customers to support their respective swap-outs.

explained that the company is continuing its own transition, evolving from a technology provider to content owners to an end-to-end broadband delivery platform for powering next-generation multichannel video services. Marcus said that Move has been working closely with its content customers to support their respective swap-outs. Move was an early leader in adaptive bit rate streaming and gained a ton of visibility for raising close to $70 million, including a whopping $46 million round in April '08. Move gained notice for showing people that the Internet could indeed delivery crystal-clear, high-quality video that could credibly compete with TV viewing. For many, Move's player was very tangible evidence of how far the online video experience had changed since the pioneering days of RealNetworks' RealPlayer just 10+ years earlier.

Unfortunately the company encountered a perfect storm. First, as CDN prices fell, content providers considered Move an increasingly expensive-looking solution. Then, since Move's customers used a free, ad-supported model, as the recession crimped ad spending their ability to afford a luxury video player deteriorated. Meanwhile, both Microsoft (with Smooth Streaming) and Adobe (with FMS 3.5) both launched their own adaptive bit rate alternatives. Between their ultra-competitive pricing and large embedded customer bases, Move was squeezed from all sides. Compounding matters, Move also conveyed mixed messages about its strategy and rumors about its disjointed product development process were widespread.

Last June, Marcus provided me with an extensive overview of Move's revamped game plan, which blends Move's underlying delivery system with "virtual set-top box" technology acquired from Inuk Networks. The goal is to provide telcos, broadband ISPs and others with a platform to deliver an end-to-end multichannel linear, live, on-demand and DVR service, all through broadband.

More recently, Move hired Roxanne Austin, a former DirecTV president and COO as its new CEO, who in turn has brought in new executives to run operations, strategy and business affairs. Last September, Move announced that Cable & Wireless has partnered with it to roll out IP-based TV services. Marcus said that additional customer announcements are forthcoming soon.

Move has been on a roller-coaster ride since its inception. It is now in the delicate process of shedding existing customers as it migrates to its new model. With innumerable companies vying for a piece of the video market, Move finds itself in the middle the action once again. It will be interesting to see how the company's second act plays out.

Thursday morning update - Move has announced this morning that Eddy Hartenstein and Sol Trujillo have joined its board of directors. Hartenstein was the founder and CEO/Chairman of DirecTV and is currently the Publisher and CEO of the LA Times. Trujillo was the President/CEO of US West and of Telstra, Australia's largest telecom company. No doubt both bring significant Rolodexes to Move, helping it open doors to large telcos, ISPs and others.

What do you think? Post a comment now (no sign-in required)

Categories: Broadcasters, Technology

Topics: Move Networks

-

4 Items Worth Noting for the Jan 11th Week (Real's Rob Glaser, ESPN Mobile, Broadband's impact, Vail goes 360)

1. Goodbye to RealNetworks' Rob Glaser - For broadband veterans like myself, this week's news that RealNetworks' founder and CEO Rob Glaser is stepping down from the CEO role after 16 years brought to mind how far the online video and audio worlds have come, in a relatively short time. Having done a fair amount of work with Real back in my Continental Cablevision days, some of my first memories of seeing video delivered through the Internet were with the RealPlayer.

There is no question Rob was one of the pioneers of the online video industry, and everyone working in the industry today owes him and Real a debt of gratitude. In the Internet's first wave, Real was out ahead of everyone in audio and video. Unfortunately for the company, Microsoft's decision to roll out its own media player (and to bundle WMP with Windows) scrambled Real's future and set off years of antitrust litigation. Over the years Real has tried many things, some of which worked and some of which were serious head-scratchers (Ryan Lawler recounts 5 of the company dumbest moves here).

Personally, it's been a while since any video I wanted to watch required the RealPlayer download. And the last time I did download it, I was so incessantly bombarded with offers that I uninstalled it and swore I'd never download it again. Nonetheless, Real remains one of the largest digital media and technology companies, with $140 million in Q3 '09 revenues and almost $400 million in cash and short term investments. The new CEO will inherit all this, plus the challenge of how to make Real a more significant player in a broadband-dominated world that Rob envisioned so many years ago.

2. ESPN: "Mobile will be bigger than the web" - I'm always on the lookout for insights from content executives charged with building their company's mobile initiatives (and mobile video more specifically) and so I found MocoNews.net's interview with John Zehr, ESPN's SVP and GM of Mobile a worthwhile read. ESPN has made a ton of progress in mobile since its MVNO was shut down and the post provides growth stats on some of ESPN mobile's most successful efforts.

Reflecting the key shift in mobile away from "on-deck" carrier-focused distribution deals to a more open Internet-like environment, Zehr said ESPN's mobile revenue model is built on payments from aggregators like FLO TV and MobiTV, advertising and app sales. That sounds a lot like the traditional cable model of affiliate fees, advertising and ancillary revenues like commerce. And just like in cable ad sales, ESPN sells all of its mobile ads itself, avoiding third-party ad networks that it believes would commoditize the ESPN brand. ESPN is clearly bullish on mobile, with Zehr saying "Not too far in the future, mobile will be bigger than the web." With the Apple vs. Google mobile war getting underway there's a lot of momentum building. Still, to keep things in perspective, we're a long way from mobile eclipsing the web.

3. Does broadband help the economy or not? - I was intrigued by this piece in Network World, reviewing a new study, "Does Broadband Boost Economic Development?" which makes the case that where broadband connectivity is available, it helps local economies, though it doesn't necessarily help the individuals who live there. I'll admit, this is pretty wonky stuff, but as broadband becomes ever more central to our economy and to video in particular, it's important to understand broadband's impact. This is true all the more so as we have a major net neutrality debate looming this year, which could have far-reaching consequences for both content providers and network operators.

4. Vail introduces 360 degree video, it's almost like being there - Finally, on a lighter note, if you've been itching for that ski trip to Colorado this winter, or just want to escape the daily grind for a few minutes of pleasure, check out Vail's new virtual video clips, shot in 360 degree splendor with partner Immersive Media. The company's Dodeca spherical camera system captures video from 11 different sensors, allowing the viewer to click on the controls to switch angles.

Immersive caught my attention recently with music concerts they've captured and plus their work with brands like Red Bull, Armani and Mercedes. The company offers a full suite of capture, production and distribution services. In Vail's case, you get to experience some of the mountain's best runs alongside other skiers. It's great marketing for Vail and though it's no substitute for actually being there, your legs won't hurt afterwards either!

Enjoy the weekend!

(Note - The VideoNuze Report podcast with Daisy Whitney will resume next week)

Categories: Cable Networks, Mobile Video, People, Technology

Topics: ESPN, Immersive Media, RealNetworks, Vail

-

Encoding.com Moves to The Rackspace Cloud; Video Encoding Service Evolves

Encoding.com, one of the earliest companies to offer video encoding/transcoding as a service, announced yesterday that it would now be using The Rackspace Cloud as its primary cloud computing environment, a switch from Amazon's EC2. The move is significant as it is another indicator of how the still nascent video encoding as a service is evolving to fit into the overall encoding landscape. Jeff Malkin, Encoding.com's COO and Chandler Vaughn, The Rackspace Cloud's director of product development, gave me an update yesterday.

Media companies have traditionally done their encoding and transcoding in-house, using software from companies like Anystream, Telestream, Digital Rapids, Rhozet and others. As I originally wrote last April, companies like Encoding.com, mPoint and HD Cloud have begun offering alternatives that allow these processes to occur in the "cloud." The idea is that media companies can essentially rent encoding/transcoding capabilities as needed for a fee from companies who do their processes on a third party's infrastructure such as The Rackspace Cloud or Amazon's EC2. For media companies, the new encoding/transcoding service providers' primary value propositions are lower overall cost (both opex and capex), elimination of on-site responsibility for hardware and software, and flexibility.

Jeff reported that Encoding.com is now serving 400 customers, with user-generated content sites like StreetFire still a meaningful part of its business. The company has encoded 3.5 million videos to date and is

now encoding 30K source videos/day. Jeff said that established companies like MTV and Brightcove are using Encoding.com's services, but noted that larger media companies are still just dipping their toe into encoding as a service. In particular Jeff said that given turnaround times, the ability to do encodes for full-length HD-quality files on a service basis is not yet practical.

now encoding 30K source videos/day. Jeff said that established companies like MTV and Brightcove are using Encoding.com's services, but noted that larger media companies are still just dipping their toe into encoding as a service. In particular Jeff said that given turnaround times, the ability to do encodes for full-length HD-quality files on a service basis is not yet practical. This echoes what an executive at a large encoding software company told me recently - that for the biggest media companies, which have large files that need to be turned around quickly, encoding in the cloud doesn't yet make sense. Another issue is the reluctance to move source files outside the media company's firewall.

Encoding.com's move to Rackspace begins to address some of these issues. Jeff highlighted 3 primary reasons for the switch - Rackspace's CPU bursting capability, which can offer 2x the processing performance of EC2 (The Bitsource just posted a performance comparison analysis); closer proximity to customer's files, as Rackspace is the managed hosting provider for thousands of web sites; and Rackspace's customer support, which improves Encoding.com's ability to deliver on its service level guarantees.

With the volume of online and mobile video exploding, this will be a key part of the market to watch. It is still early days for encoding as a service, but as Encoding.com and others continue to strengthen their operations and maintain attractive pricing, it seems likely that they will eventually gain attention from additional media companies.

What do you think? Post a comment now.

Categories: Technology

Topics: Encoding.com, HD Cloud, mPOINT, The Rackspace Cloud

-

Ooyala Expands Into Japan with NTT Partnership

Online video platform provider Ooyala unveiled a partnership yesterday with NTT SMARTCONNECT that expands the company into Japan. Under the non-exclusive deal, the two companies will collaborate to create a localized and co-branded version of Ooyala's Backlot platform. Marketing and sales are set to begin in February.

As part of the announcement Ooyala also provided some 2009 updates: contracted customers grew from 30

to 300, self-serve customers grew five-fold, the Ooyala player now delivers hundreds of millions of streams/mo to 50 million unique users/mo, it transcodes 60K hours of video/mo and the company now has 70+ employees.

to 300, self-serve customers grew five-fold, the Ooyala player now delivers hundreds of millions of streams/mo to 50 million unique users/mo, it transcodes 60K hours of video/mo and the company now has 70+ employees. Ooyala also said that 50% of its customers are marketers, and outside of the traditional media space. The company cited Electronic Arts, for which it powers video on 30 different properties, General Mills and Cerner. The non-media focus parallels what Brightcove recently told me, that over half its business now comes from non-media customers (e.g. business, government and education).

As I wrote recently, despite all the growth in the online video platform space, it's still relatively early days. To be in the top tier as the market matures will require providers to scale their operations, including international expansion and serving customers outside the core media market. It looks like Ooyala understands this as well.

What do you think? Post a comment now.

Categories: International, Partnerships, Technology

Topics: NTT SMARTCONNECT, Ooyala

-

Brightcove Appoints David Mendels President and COO

Brightcove has appointed David Mendels as president and COO, a new executive position at the company.

Mendels has been on Brightcove's board of directors since late 2008 and for the last several months has been its acting head of sales. He was most recently the EVP and GM of Adobe's $1 billion enterprise software and business productivity division which includes Acrobat, Connect, LiveCycle and Flex. Prior, he was an early employee and spent many years at Macromedia, where he helped the company expand internationally, ran business development and alliances and managed a number of the company's key products.

Mendels and Jeremy Allaire, Brightcove's founder, Chairman and CEO, briefed me over the holidays on the appointment. The two worked together following Macromedia's acquisition of Allaire back in 2001. From Jeremy's perspective, bringing on Mendels won't prompt any radical changes. Rather, the goal is to

strengthen the company operationally and help it scale to capture opportunities both see in its 3 target markets: core media, non-media (i.e. business, government and education, which Jeremy said already account for over half the company's revenues) and small organizations (which Brightcove is pursuing with its recently launched Express product). Both also envision Mendels further globalizing Brightcove's business and also building out its channel sales efforts.

strengthen the company operationally and help it scale to capture opportunities both see in its 3 target markets: core media, non-media (i.e. business, government and education, which Jeremy said already account for over half the company's revenues) and small organizations (which Brightcove is pursuing with its recently launched Express product). Both also envision Mendels further globalizing Brightcove's business and also building out its channel sales efforts.For his part, Mendels thinks of Brightcove as being comparable to Macromedia back in 1993 when he joined it - still relatively small but profitable, with a strong management team in place and operating in a product area with huge mainstream opportunities ahead, yet where no single company or larger enterprise has established a dominant position. Mendels said he's not coming to Brightcove with a big agenda for change, but instead to help drive execution, create efficiencies and further penetrate newer market segments. One important area of emphasis is building out a developer program to help proliferate video applications based on Brightcove's APIs. As part of Mendels' transition, Brightcove is also searching for a head of North American sales and a head of Asia Pacific sales (Japan excluded).

The two believe that a continuing preference by many organizations to build vs. buy is Brightcove's biggest source of competition, though they see this starting to soften as video becomes more integral to customers' overall operations. Both are also very mindful of the plethora of other online video platforms in the market, as well as new startups that continue to spring up. As Jeremy and other Brightcove executive have told me in the past, the company believes it distinguishes itself from others not only on the basis of its platform, but also by its breadth of offerings, international presence and simultaneous pursuit of numerous market segments.

Brightcove is indeed well-positioned, though as I pointed out recently, I don't foresee there being any single, truly dominant provider in the video platform market any time soon. It is still relatively early days in the industry and there will be lots of competitors. I continue to believe that the best way for prospective customers to determine which provider meets their own particular requirements is to intensively demo various products and see how they each perform.

However, as the market inevitably matures, requirements converge and video becomes more mission critical, video platform providers' ability to effectively scale all aspects of their operations is going to become an increasingly important differentiator. In this respect, Mendels' Macromedia and Adobe experience is going to be extremely valuable to Brightcove's ongoing success.

What do you think? Post a comment now.

(note: Brightcove is a VideoNuze sponsor)

Categories: People, Technology

Topics: Adobe, Brightcove, Macromedia

-

4 Items Worth Noting for the Dec 14th Week (New pre-roll ad data, Paramount movie clips, Thwapr mobile, next week's preview)

Following are 4 items worth noting for the Dec 14th week:

1. New pre-roll data shows format's strength - Though many in the industry still scorn the pre-roll ad, this week 2 ad networks, ScanScout and YuMe, released data showing its continued prevalence as well as innovation that's improving its performance. ScanScout said its "Super Pre-roll" unit, which allows for integrating overlay graphics on the video that viewers can engage with, is driving 350% higher click-through rates compared with typical pre-rolls. In this example for Unilever's Vaseline, note how the creative nicely reinforces the messaging. The enhanced interactivity feels like the start of a new trend; another pre-roll that offers something similar is Innovid's iRoll unit. ScanScout separately announced this week a host of new premium publishers have joined its network.

Meanwhile YuMe released its Video Advertising Metrics Report for Jan-Nov '09, which showed that, at least within YuMe's network, 90%+ of all ads served were pre-rolls, with 30 second spots generating a 1.8% overall click-through rate, a 50% higher rate than the 1.2% that 15 second spots achieved. The volume of 30 second ads also grew 50% faster than 15 second volume in Q3 '09. Kids age 6-14 achieved a 3.7% click-through rate, the highest of any group, which YuMe's Jayant Kadambi told me could be explained by the more engaging nature of child-focused ads (e.g. click to play games, etc.). Jayant believes the sizable amount of existing creative for TV ads that can be easily repurposed for online is a key reason pre-rolls continue to dominate.

2. Paramount clipping site powered by Digitalsmiths is slick - I was impressed with a demo of Paramount Pictures' newly launched ParamountClips.com site that I got this week. The site is only open to Paramount's business partners, allowing them to either choose from an existing stock of clips from over 80 different Paramount movies, or to easily create their own. Desired clips are moved into a shopping cart and released for download, per previously determined licensing terms.

The site is powered by Digitalsmiths, which indexed all of the scenes from the movies using their proprietary recognition process, and then generated meta-data for each, which makes searching a snap. The new self-service site replaces the laborious previous process of a Paramount staffer working with each partner to extract jus the scene they want. As a result, a new highly-scalable licensing opportunity has been created. Paramount is taking advantage of Digitalsmiths VideoSense 2.5 release announced last week that is focused on clip generation, for both on demand and live streams, improved asset management and more integrated reporting.

3. Thwapr launches beta of mobile-to-mobile video sharing - Continuing the buildout of the mobile video ecosystem, Thwapr, a new mobile-to-mobile content sharing platform, launched its beta this week. Duncan Kennedy, Thwapr's COO told me that although there's been a proliferation of video capable smartphones, there's currently no easy, fool-proof way of sharing videos from one device to another (e.g. from an iPhone to a BlackBerry). Enter Thwapr, which lets the user upload videos to Thwapr and then have them shared with their contacts. Thwapr identifies the receiving phone's "user agent" so that it can dynamically decide the optimal format the video should be viewed in. The user simply clicks on a link and the video plays. I can attest that it worked beautifully on my BlackBerry Pearl.

Thwapr's raised about $3 million from angels and has a very strong team, including Duncan and others who worked on Apple's QuickTime. I'm a fan of how video, social/sharing and mobile intersect to create new opportunities, though there are business model unknowns. For now Thwapr is focused on a free ad-supported model, with a particular emphasis on geo-tagging videos to make advertising especially appealing for local merchants. Still, YouTube has illustrated how difficult it is to monetize user-generated content. Thwapr also envisions a business-grade option for real estate, travel, dating type applications which sound promising. I wonder too about whether a freemium model should be explored, though Duncan said Thwapr's analysis suggested this would be a relatively small opportunity. We'll see how things shape up.

4. Next week is 2009 wrap-up week on VideoNuze - Keep an eye on VideoNuze next week, as I'll be summarizing Q4 '09 venture capital investments and deals in the broadband/mobile video space, reviewing my 2009 predictions and looking ahead to what to expect in 2010. It's been an incredibly active year and based on the pre-CES briefings I've been doing, there's lots more to look forward to next year.

Enjoy your weekend!

Categories: Advertising, FIlms, Mobile Video, Predictions, Startups, Studios, Technology

Topics: Digitalsmiths, Paramount, ScanScout, Thwapr, YuMe

-

4 Items Worth Noting for the Dec 7th Week (boxee's box, AT&T's iPhone woes, Nielsen data, 3D is coming)

Following are 4 items worth noting for the Dec 7th week:

1. Boxee's new box with D-Link - It was hard to miss the news from boxee this week that it will be launching its first box, in partnership with D-Link, in early 2010. Boxee has gained a rabid early adopter following, but the high hurdle requirement of downloading and configuring its software onto a 3rd party device meant it was unlikely to gain mainstream appeal. Strategically, the new box is the right move for the company.

For other standalone box makers such as Roku, boxee's box, with its open source ability to easily offer lots of content, is a new challenge (though note, still no Hulu programming and little cable programming will be available on the boxee box). The indicated price point of $200 is on the high side, particularly as broadband-enabled Blu-ray players are already sub-$150 and falling. Roku has set a high standard for out-of-the-box usability whereas D-Link's media adaptors have never been considered ease-of-use standouts. Boxee's snazzy, but very unconventional sunken-cube design for the D-Link box is also risky. While eye-catching, it introduces complexity for users already challenged by how to squeeze another component onto their shelves. If boxee only succeeds in getting its current early adopters to buy the box it will have gained little. This one will be interesting to watch unfold.

2. AT&T tries to solve its iPhone data usage problem - In the "be careful what you ask for, you might just get it" category, AT&T Wireless head Ralph de la Vega revealed an interesting factoid this week at the UBS media conference: 3% of its smartphone (i.e. iPhone) users consume 40% of its network's capacity. Of course video and audio capabilities were one of the big ideas behind the iPhone, so AT&T should hardly be surprised by this result. AT&T, which has been hammered by Verizon (not to mention its users) over network quality, thinks the solution to its problem is giving heavy users unspecified "incentives" to reduce their activity. No word on what that means exactly.

Mobile video has become very hot this year, largely due to the iPhone's success. But the best smartphones in the world can't compensate for lack of network capacity. While AT&T is adding more 3G availability, it's questionable whether they'll ever catch up to user demand. That could mean the only way to manage this problem is to throttle demand through higher data usage pricing. That would be unfortunate and surely stunt the iPhone's video growth. Verizon, with its line of Android-powered phones, could be a key beneficiary.

3. Q3 '09 Nielsen data shows TV's supremacy remains, though early slippage found - Nielsen released its latest A2/M2 Three Screen Report this week, offering yet another reminder that despite online video's incredible growth, TV viewing still reigns supreme. Nielsen found that TV viewing accounted for 129 hours, 16 minutes in Q3. While that amount is more than 40 times greater than the 3 hours, 24 minutes spent on online video viewing, it is actually down a slight .4% from Q3 '08 of 129 hours 45 minutes.

How much weight should we give that drop of 29 minutes a month (which equates to just less than a minute/day)? Not a lot until we see a sustained trend over time. There are plenty of other video options causing competition for consumers' attention, but good old fashioned TV is going to dominate for a long time to come. This is one of the key motivators behind Comcast's acquisition of NBCU.

4. 3D poised for major visibility - In my Oct. 30th "4 Items" post I mentioned being impressed with a demo from 3D TV technology company HDLogix I saw while in Denver for the CTAM Summit. This Sunday the company will do a major public demonstration, broadcasting the Cowboys-Chargers in 3D on the Cowboys Stadium's 160 foot by 72 foot HDTV display. HDLogix touts its ImageIQ 3D as the most cost-effective method for generating 3D video, as it upconverts existing 2D streams in real-time, meaning no additional production costs are incurred.

Obviously those watching from home won't be able to see the 3D streaming, but it will surely be a sight to see the 80,000 attendees sporting their 3D glasses oohing and aahing. Between this and James Cameron's 3D "Avatar" releasing next week, 3D is poised for a lot of exposure.

Enjoy the weekend!

Categories: Devices, Mobile Video, Sports, Technology, Telcos

Topics: AT&T, Boxee, D-Link, HDLogix, iPhone, Nielsen, Roku

-

LiveRail Lands PBS for Video Ad Management

LiveRail, a video ad management company, notched a high-profile customer win yesterday, announcing that PBS will use the company's platform to deliver sponsor messages on its recently launched PBS.org video

portal and its 356 member stations' online video outlets. PBS is making an aggressive play in online video and has gained many positive reviews of its portal, which provides access to all of its full-length programs and more.

portal and its 356 member stations' online video outlets. PBS is making an aggressive play in online video and has gained many positive reviews of its portal, which provides access to all of its full-length programs and more.LiveRail's CEO Mark Trefgarne and EVP Nic Pantucci explained to me yesterday that they're building a suite of tools that equally addresses all 3 constituencies in the ecosystem - publishers, advertisers and ad networks. The company is focused on the following 3 differentiators to separate itself in a pretty crowded video ad management space:

- Enhanced optimization that allows simultaneous querying of multiple ad sources to determine the highest effective CPM ad to serve (Mark and Nic said that using LiveRail one customer saw an jump in their ad fill rate from 40% to 90%)

- More flexibility in distributing and customizing ads to affiliates, based on a sub-account authorization system (this was particularly valuable for PBS with its hundreds of member stations and multitude of sponsor messages)

- Integration with the broadest set of 3rd party ad networks, using an extensive series of open APIs (this helps with time to market and reducing cost of integrations)

Of course, the real way to validate these benefits and compare LiveRail to others is by getting hands-on and trying the platform out. I've offered similar advice in the past when assessing the variety of online video platforms.

LiveRail was started in 2007, has 15 employees and has raised $1.5 million to date, though it sounds like there may be financing news upcoming. The video ad management space includes others like FreeWheel, Adap.tv, Tremor Media (with its Acudeo product), Auditude and others.

What do you think? Post a comment now.

Categories: Advertising, Technology

-

thePlatform Enables TV Everywhere for TV Networks, Lands New Customers

TV Everywhere is getting another shot of momentum this morning as thePlatform, one of the leading online video platform companies (and a subsidiary of Comcast) is rolling out new features aimed at giving TV networks greater control of their programs in the coming TV Everywhere world.

The key new feature is what thePlatform calls an "Authentication Adaptor," which is a mechanism for networks that want to offer their programs on their own web sites to authenticate users as current paying video subscribers of a multichannel video provider (recall that under current TVE plans it is a requirement to be a multichannel video subscriber in order to access programs online). The authentication adaptor works by instantly checking with appropriate multichannel providers' billing systems and returning a yes/no authentication response for that user.

If the user is authenticated, then the adaptor verifies that the specific program is available for viewing to that user, depending on what tier of service the user subscribes to. thePlatform does this by mapping each

individual show to specific channels that each have an ID. The channel IDs are in turn mapped to the multichannel provider's subscription packages. For example if you were to try watching "Entourage" on HBO.com, but you didn't subscribe to HBO the linear channel via your service provider (e.g. Comcast, Time Warner Cable, etc.), your request would be denied. As one can imagine, with the endless permutations of shows, networks, subscription packages and multichannel providers, linking all of this together and delivering fast response times to the user is quite a challenge.

individual show to specific channels that each have an ID. The channel IDs are in turn mapped to the multichannel provider's subscription packages. For example if you were to try watching "Entourage" on HBO.com, but you didn't subscribe to HBO the linear channel via your service provider (e.g. Comcast, Time Warner Cable, etc.), your request would be denied. As one can imagine, with the endless permutations of shows, networks, subscription packages and multichannel providers, linking all of this together and delivering fast response times to the user is quite a challenge. What's also interesting here is that if indeed a request has been denied, a marketing opportunity has been created for both the TV network and the multichannel provider. In the Entourage example above, the denial message could be accompanied by offers to watch now on a pay-per-view basis or to instantly become a subscriber to HBO via Comcast, or to buy the DVD, etc. Or maybe the offer is just to watch free clips to improve sampling. thePlatform supports the creation of these types of rules and integration to appropriate 3rd parties. This is a great example of how TV Everywhere also opens up the instant-gratification online economy to networks and video providers.

The new features gain in importance as thePlatform is also announcing this morning more than 20 TV networks have recently become customers including Fox Sports Networks, E!, G4, Style, Comcast Sports Group (a group of regional sports networks), Travel Channel, Big Ten Network and others yet to be named. As TV Everywhere rolls out next year, TV networks will become increasingly interested in offering their programs themselves, in addition to offering access on their distributors' web sites.

Separate, thePlatform is also announcing today that it is working with Rogers, which is Canada's leading multichannel video provider, on an online video initiative. Though details aren't provided, Rogers recently disclosed that is also pursuing TV Everywhere, so it's probably logical to put two and two together. thePlatform also provides video management services to large American operators Cablevision, Cox, Time Warner Cable, in addition to parent company Comcast. Between the video provider deals and the TV networks deals, thePlatform finds itself squarely in the middle of the TV Everywhere action.

What do you think? Post a comment now.

Categories: Cable Networks, Cable TV Operators, Technology

Topics: Comcast, Rogers, thePlatform

-

EveryZing Becomes RAMP, Focuses on "Content Optimization"

EveryZing is changing its name to RAMP, and positioning itself around "Content Optimization." Ordinarily a name change signals a change in strategic or product direction, but in this case, as CEO Tom Wilde explained to me last week, the re-naming is neither. The change to RAMP unifies the company name with its platform name (plus descriptive extensions), and completes the evolution of the company as a consumer destination originally named PodZinger.

I've been bullish on RAMP since my original post on the company in February '08, in which I detailed how RAMP married online video to the ubiquitous consumer search experience, addressing the chronic need for

improved video discoverability. RAMP did this by using core technology to extract metadata for any type of video, audio, text and image and then organizing related content onto search engine-friendly topic pages that grouped related content.

improved video discoverability. RAMP did this by using core technology to extract metadata for any type of video, audio, text and image and then organizing related content onto search engine-friendly topic pages that grouped related content. RAMP has continued to build out its platform since then, unveiling its "chromeless" MetaPlayer in Oct '08 that creates "virtual clips" so users can navigate to just the scene they're looking for, while content providers can maintain their existing business rules. Then earlier this year RAMP released "MediaCloud," which moved the metadata extraction process into the cloud, giving content providers the ability to manage the metadata themselves and deeply integrate it into their workflow and larger content publishing activities.

As metadata has become recognized as the currency underpinning content discovery and monetization, RAMP has added large customers, such as NBCU (also its lead investor), FOX, Meredith Publishing and others. RAMP's capabilities to handle all media types (video, audio, text and images) has become increasingly important as content providers realize that mixing and matching different assets is now required to provide audiences with the best experience. For the most advanced publishers, the days of siloing off video or audio are in the past.

In its new white paper, RAMP articulates well the fundamental shifts happening in the media business: the move away from "containers" (e.g. a magazine, album or newspaper) into content "objects" that users find, share and self-organize online; the trend toward syndication, where brand success is more about proliferating content everywhere on the web than attracting users to a specific destination site; the opportunity for content providers to enhance their monetization through dynamic contextual targeting rather than by simply selling eyeballs. Addressing these and other elements effectively is what RAMP calls content optimization.

Many of the themes RAMP espouses align with what I've been describing for a while now as the "Syndicated Video Economy." I only see these themes accelerating in importance as the supply of video escalates, devices proliferate and social media grows. With its flexible, SaaS platform that integrates well into other 3rd party content management and publishing platforms, I expect RAMP will continue to succeed as content providers become more sophisticated about how to operate online.

What do you think? Post a comment now.

Categories: Syndicated Video Economy, Technology

-

Brightcove 4 Launches With More Features; New Low-Priced "Express" Option Introduced

Brightcove is launching the fourth generation of its platform today and is also introducing a new low-priced "Express" option that complements its "Professional" and "Enterprise" editions. Brightcove's SVP of Marketing Jeff Whatcott recently walked me through the new features and Express strategy.

Brightcove is enhancing its customers' ability to publish across 3 screens by introducing, among other things, a "universal delivery service" option which allows the same video to be delivered via multi-bit rate

streaming and progressive download. When selected, this means that publishers' video can be uploaded once, but delivered more intelligently depending on the device being targeted and the bandwidth available. Brightcove is also introducing an SDK for iPhone publishing which streamlines the workflow for publishers targeting the iPhone. Brightcove is also broadening its appeal to non-media customers that require a behind-the-firewall solution, providing delivery only to approved IP addresses and helping manage assets stored on private CDN infrastructure.

streaming and progressive download. When selected, this means that publishers' video can be uploaded once, but delivered more intelligently depending on the device being targeted and the bandwidth available. Brightcove is also introducing an SDK for iPhone publishing which streamlines the workflow for publishers targeting the iPhone. Brightcove is also broadening its appeal to non-media customers that require a behind-the-firewall solution, providing delivery only to approved IP addresses and helping manage assets stored on private CDN infrastructure.Given how increasingly strategic video is for its media customers, Brightcove is also introducing live streaming (including ad insertion), improved video sharing (with a particular focus on Facebook's Live Stream Box Widget), better analytics and monetization and improvements in media sharing across multiple divisions within an organization.

Brightcove is also introducing a slew of under-the-hood improvements that streamline the workflow, improve integration with 3rd parties and enhance SEO. These include new player APIs allowing more customized experiences, ad rules APIs and integrations with other web applications.

Importantly, the company is also broadening its target customer base. Although Brightcove had recently started focusing more on non-media (e.g. government, education, business) customers, these were still typically larger entities with high willingness-to-pay. Jeff explained though that with Brightcove's well-known brand, it was receiving many daily inquiries from prospects looking for a low-cost, turnkey solution. Lacking one, Brightcove felt it was leaving business on the table.

Now with the Express product (with 3 monthly price points, $99, $199 and $499), the company is making its first concerted effort to satisfy those with smaller video libraries, less need for customization and simpler monetization strategies. Moving to the low-end of the market puts Brightcove into more direct competition with players like Fliqz, Delve and others, while creating another new option for those with modest needs that have used YouTube.

As I've written recently, the video platform space continues to be quite crowded, with new entrants continuing to crop up. While I suspect that will continue to be the case, Brightcove argues persuasively that its feature set is far beyond anything that newer players yet offer, and that its track record of delivering video globally, at scale, provides major content providers quality assurance that others cannot yet match.

While the video platform space continues to evolve, Brightcove always impresses me with the methodical approach it takes to its product roadmap. Having been in the business for so long and having wide breadth of customers, the company is unlikely to fall behind anyone else when it comes to new customer requirements. Even in instances when competitors get a jump on it by offering distinctive new features, Brightcove is quick to respond. Brightcove 4 positions the company to continue as one of market's key leaders.

What do you think? Post a comment now.

(Note: Brightcove is a VideoNuze sponsor)

Categories: Technology

Topics: Brightcove

-

New Forrester Report Evaluates 6 Online Video Platforms

On Friday, Forrester Research released an analysis of 6 online video platform vendors. As with other comparison reports that come out regularly, Forrester's will have value as a starting point in evaluating options, but should be considered far from definitive.

With only 6 vendors evaluated, the biggest shortcoming of the new report (parts of which I've seen) is its lack of comprehensiveness. Selecting the field is always a key issue in any comparison process. And when trying to evaluate a market like online video platforms, with dozens of competitors, there's a natural tension between comprehensiveness and quality/cost. The broader the field that Forrester chose to evaluate, the more time-consuming and costly the report would have been to produce.

The downside of choosing only 6 is that a lot of other high-quality competitors, along with their particular strengths, are left out. This clearly skews overall conclusions. In Forrester's case it's also not entirely clear why the 6 - Brightcove, Ooyala, Kaltura, VMIX, Fliqz and Twistage - were actually chosen. For example, the report indicates that vendors that primarily focus on the high end of the market such as thePlatform and Digitalsmiths were not included. Yet arguably, Brightcove has as much focus on premium content providers as either of these companies do. thePlatform is also the most established player in the market, so to not include it means missing a critical market benchmark.

Forrester used 37 criteria to evaluate the vendors, grouped into 3 categories, Current Offering, Strategy and Market Presence. The sources of the data it used to assign scores to each vendor for the criteria were vendor surveys, product demos and customer reference calls. All of this is very useful, but it appears that Forrester did not do any hands-on testing itself. Having seen so many demos myself, I've come to believe that the only way to truly get a sense of the vendor's work flow and specific capabilities is to use with the platform directly. By definition demos are orchestrated to shine the best light on a platform's work flow; it's only through using one day-to-day that a nitty-gritty understanding can be gained.

Lastly, Forrester's conclusion that Brightcove and Ooyala are "Leaders," Kaltura and VMIX are "Strong Performers," and Twistage and Fliqz are "Contenders" feels like it could be more rigorous. For example, if statements like "stay away from these guys, they're truly inferior" or "if x, y and z features are critical to you, look no further" had been used, the reader would gain more clarity on where Forrester stands. Instead each vendor seems to have its own strengths, while weaknesses such as "...lack strong capabilities in areas such as distribution and scalability..." seem too high level.

All of this said, for customers looking for a first-cut evaluation of a limited segment of the market (which is how Forrester itself seems to be positioning the report), it is a useful tool. Whether it's worth the $1,749 asking price is another matter. I'd recommend also having a look at sources like VidCompare.com and the market snapshot from Marketing Mechanics.

What do you think? Post a comment now.

Categories: Technology

Topics: Forrester Research