-

Bebo Pursues Distinctive Original Programming Model

Bebo, the social networking giant being acquired by AOL for $850 million, is pioneering a new programming model by mixing original online-only video series, community engagement and brand integration. While in

LA last week I attended an invite-only session in which Bebo VP of Marketing Ziv Navoth provided an overview of its approach and elaborated on its upcoming plans.

LA last week I attended an invite-only session in which Bebo VP of Marketing Ziv Navoth provided an overview of its approach and elaborated on its upcoming plans.Since its inception in 2005, Bebo has quickly mushroomed to 40 million+ members with a core audience of 16-24 year olds, concentrated in the U.K. While a distant third to Facebook and MySpace in size, the depth of Bebo's user engagement is significant.

I think Bebo has cleverly grasped the notion that by offering original online video series, it is providing valuable, relatively inexpensive fodder for its members to engage with. So valuable is this programming to serving Bebo's larger corporate mission that its "Open Media" model allows content partners to keep 100% of revenue generated.

Bebo's programming initiatives are gaining traction with its members. Its first series, "KateModern," the successor to "LonelyGirl15," the YouTube phenomenon, received 35 million views in its first season, and is currently averaging 1.5 million views per week, according to the company. Its next series, "Sofia's Diary," is getting half a million viewers per episode according to the company, and its broadcast rights were just acquired by FIVER, the UK broadcaster. Other programs launched or in the works include Vuguru's "The All-for-Nots", "Conquering Demons" (in association with Oakley, the sunglass company) and "The Gap Year."

When you look across all these programs, a key thread is that they all showcase young characters to whom Bebo's audience can easily relate and/or fantasize about being. Ziv repeatedly referenced that in Bebo's model, community and programming are inseparable. Bebo encourages members' feedback and involvement in the stories, and in some cases will bend the narrative to members' desires. Meanwhile Bebo offers a range of community tools to help shows gain promotion to its member base. Bebo's promotional capabilities, massive reach and member engagement are of course the main reasons why producers will seek out Bebo as a partner.

If there's one current weakness I perceive in Bebo's programming model it is monetization. Given its young, media-savvy audience, Bebo knows that advertising must be approached with care. To date Bebo has emphasized product placement, but in a way that "propels the story line forward" according to Ziv, and is believable, not gratuitous. This of course necessitates a lot of custom, one-off selling, which not a model that is scalable across dozens of eventual programs. My guess is that traditional pre-rolls and even possibly overlays will have to play a bigger part if AOL wants to fully monetize Bebo's viewership. If done with proper targeting and capping this could be acceptable to its audience.

What I like about Bebo's programming approach is that it is clearly indigenous to the online medium. As such, it is distinct from models like Hulu, which though also valuable, are primarily new conduits for existing broadcast programming. To the extent Bebo succeeds, it will become a model for how new programming that is exclusively tailored for the online medium will work.

What do you think of Bebo's programming model? Post a comment and let everyone know!

Categories: Indie Video, Video Sharing

-

Does Broadband Video Help or Hurt Broadcast TV Networks?

Yesterday's article in the NY Times, "In the Age of TiVo and Web Video, What is Prime Time?" was the latest of many about the changing landscape of broadcast network TV. An underlying question that receives a lot of attention, yet little in the way of clear-cut conclusions: Does broadband video help or hurt broadcast TV networks?

The jumble of conflicting data and opinions on this topic (as well as the related topic of DVRs' impact on the networks) is causing plenty of speculation during this important upfront week of when billions of dollars of networks' ads are bought and sold.

Here's a synopsis of how I think proponents of each would defend their answer:

Broadband video helps: The world is changing - consumers are more empowered than ever and it's pointless to resist. Broadband is a great way to catch up on episodes missed, conveniently sample programs, engender interactivity, transform viewers into viral promoters, etc. More exposure will translate into more on-air viewership. Plus as broadband audience size builds ad revenue will as well. Network programming is and always will be the most watched, most valued source of video entertainment and with broadband opening up all kinds of new revenue opportunities, there's ample reason to be optimistic.

Broadband video hurts: Broadband kills networks' success formula, driving profitable on-air viewership to profitless broadband viewership. It's pie-in-the-sky thinking to believe that broadband revenues will ever catch up. Since only a limited amount of ads can be included in online broadcasts, even the higher CPMs received per ad deliver nowhere close to the revenue per episode per viewer as the on-air model does. All the interactivity and engagement in the world will never offset this shortfall. As more programs move online and viewers can eventually watch these right on their TVs, the shift from on-air to online consumption will only accelerate, causing permanent erosion to the traditional economic formula.

So which is it - are networks helped or hurt by broadband? I think the answer is short-term it helps, but long-term it hurts. In the short-term, there is evidence that broadband expands audiences. For example, The Office's premiere last fall 9.7 million people tuned in, but another 2.7 million watched online.

Expanding viewership is great, but what happens to networks' revenues if next fall 7.7 million watch on-air and 4.7 million online? And 3 years from now, 5.7 million on-air and 6.7 million online? You can count on viewers to gravitate to the optimal viewing experience, and if online further improves, expect more eyeballs to shift. Again, since there are fewer ads online, the only way for total network revenues to keep pace are to show more ads online (see ABC's plan on that front), dramatically raise CPMs and/or dramatically raise viewership. My guess is that even the most optimal mix of these three will not deliver enough to offset on-air's revenue decline.

Broadband offers lots of complementary benefits to broadcasters to be sure. But NBCU's Jeff Zucker is absolutely right that the industry's number one challenge is the risk of turning "analog dollars into digital pennies." I can't say I see how that's to be avoided, unless networks go cold turkey, following CW, which recently pulled down streaming episodes of "Gossip Girl" to enhance on-air viewership. But I don't see that happening. Instead I think broadcast networks are going to have to adjust to fundamentally different economics in the future.

What do you think? Does broadband video help or hurt broadcasters? Post a comment!

Categories: Advertising, Broadcasters

-

Tremor, Adap.tv Introduce New Ad Platforms

The video ad management and networks space

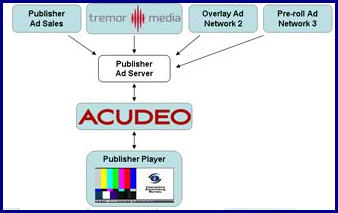

, marked by competition among a group of privately-held companies, continues to evolve. In the last few weeks two key players, Tremor Media and Adap.tv have announced new solutions giving content providers more flexibility to optimally monetize their video inventory by easily accessing multiple ad sources. Given how essential the ad business is to broadband video's ultimate success, both products are welcome.Ad networks play an important role for content providers which either don't have their own ad sales team or as an augment for those that do. For the latter, ad networks help monetize their unsold inventory, particularly important during unexpected spikes in viewership. Traditionally content providers had two basic choices, each of which had disadvantages:

First, they could select one ad management/network partner. This kept things simple, but didn't necessarily optimize the inventory, because it was dependent on how well that one network's advertisers were matched to available inventory (resulting in either the inventory going unsold or users seeing the same irrelevant ad over and over again).

The second was to go with multiple ad networks. This improved optimization, but created multiple operational challenges trying to work with different ad managers, formats and reporting.

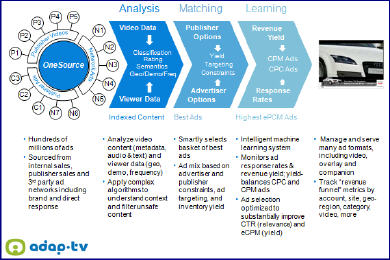

Both Tremor's new "Acudeo" platform, and Adap.tv's "OneSource" seek to resolve these problems by providing one management platform capable of handling multiple ad sources/ad networks across all ad inventory.

Jason Glickman, Tremor's CEO, explained to me that he's positioning Acudeo to do for video advertising what DoubleClick's DART did for banner advertising. Content providers can easily enable all kinds of complex ad rules around their inventory - the type of ad format to be used, their frequency and contextual targeting (with partner Digitalsmiths), their cueing and lastly, standardized reporting, so that ongoing campaign adjustments can be made. Acudeo aims to support all third party ad networks. Tremor prices Acudeo flexibly depending on whether the content provider also uses Tremor's ad network.

Adap.tv's recently introduced OneSource platform has the same goal of improving ad optimization with lower complexity. Amir Ashkenazi, Adap.tv's says OneSource differentiates itself by using Adap.tv's contextual advertising capabilities to optimize which third-party's ads to run. It does this by understanding the video content itself and then matching the optimal ads, factoring in the ad rules the content provider has preset. Amir believes that by doing so, it can raise the effective CPM delivered by 65%, from which OneSource's fee is deducted. OneSource has 40 third party ad networks currently integrated and also aims to support all ad sources.

Acudeo's and OneSource's potential is to bring more spending into the video category, which obviously would be extremely valuable. Last week, I expressed concern that with so many video content providers relying on advertising, a short-term squeeze is a real risk. Both Acudeo and OneSource are encouraging signs that the ad management and network businesses are continuing to mature, which will benefit everyone.

What do you think? Post a comment and let everyone know!

(Note: Both Tremor Media and Adap.tv are VideoNuze sponsors)

Categories: Advertising, Technology

Topics: Acudeo, Adap.TV, OneSource, Tremor Media

-

blinkx's New Advanced Media Platform for On-Site Video Search, Discovery, Monetization

blinkx, which has been steadily expanding its portfolio beyond its core video search product, this week announced Advanced Media Platform or "AMP" (not to be confused with Adobe Media Player/AMP or Yahoo's Advertising Management Platform/AMP). I spoke with Suranga Chandratillake, blinkx's founder/CEO last week to learn more.

blinkx is addressing a problem that I hear about often - how can content providers which have increasingly large volumes of video on their sites make it more discoverable, helping drive usage and therefore ad

revenues. Just this week on a panel at Digital Hollywood, Andy Forssell, Hulu's SVP, Content and Distribution, highlighted this problem, saying "we believe great content is significantly underwatched."

revenues. Just this week on a panel at Digital Hollywood, Andy Forssell, Hulu's SVP, Content and Distribution, highlighted this problem, saying "we believe great content is significantly underwatched."With AMP, blinkx has packaged up various offerings previously available web-wide into an enterprise product. These include its core video search/indexing technology, plus an SEO module and AdHoc, its contextual advertising platform for targeted monetization. blinkx is positioning AMP as a comprehensive approach that content providers can implement quickly on their sites. AMP is available in both licensing and ASP models. In the ASP model, AMP is available for a fee, or through ad revenue sharing. Suranga believes the ad sharing approach will likely end up being most popular.

blinkx announced 3 new AMP customers, Conde Nast's Portfolio.com, WallSt.net and Kiplinger.com. blinkx's AMP reminds me most of EveryZing, which I wrote about here. EveryZing's ezSearch and ezSEO take a similar approach to wringing value out of video assets. Pixsy is another company offering white label video search. Earlier this week it announced National Lampoon's network of sites as a new customer.

As content providers shift their focus from just getting their video online to actually monetizing and earning an ROI on it, discovery becomes critical. Therefore, I expect lots more activity in this space yet to come.

Categories: Video Search

Topics: Blinkx, EveryZing, Pixsy

-

More Questions than Answers at Digital Hollywood Spring

I'm just back from a couple days at Digital Hollywood Spring, one of the broadband industry's leading conferences. A key takeaway for me is that there are still many more outstanding questions about the broadband video industry's future - and their implications for other players in related industries - than there are concrete answers.

Here are 3 big ones worth considering:

What role will current video distributors play in an increasingly broadband-centric world?

The subscription video business, dominated by cable and satellite operators, generates approximately $80 billion/year, depending on whose data you use. The model is well-understood, and is a huge part of funding the value chain of cable networks, rights-holders and TV program producers. Bundling ever more channels (50,70,100+) into digital tiers and charging ever-higher prices for them has been a core industry revenue driver.

Yet data continues to show that out of all those channels, the average household still only watches 5-10 at the most. Couple that with the migration to broadband, DVR and on-demand consumption and one is left with the feeling that there is a significant disconnect between the way video is packaged and priced today with growing consumer expectations and behaviors. Is the current approach sustainable long term or are new players (e.g. Sezmi) going to successfully disrupt the formula? Any major disruption would have significant ripple effects.

Is the ad-supported business model for broadband video going to deliver for all the content providers relying on it?

I've been a big supporter of the ad-supported approach for a while and believe in it strongly in the long-term. Yet as I see more and more content providers, aggregators, social networks and others look to it as their primary business model, I'm growing concerned that in the short-term there isn't going to be enough money to go around to support everyone. To be sure, current growth rates are strong, yet at DH many of advertising's big hurdles to reach long-term success were mulled over: achieving scale, standardizing formats, understanding performance metrics, converting media buyers, targeting, proving interactivity's value and so on.

The efficacy of the broadband ad model online is particularly pressing for broadcasters. Though some research indicates on-air viewership is benefited from online program availability, long-term there can be no question that a substitution effect will take place as viewers decide "do I watch on-air OR online?"

Jeff Zucker, NBCU's CEO tersely captured the threat this poses in his now often-repeated question "are we trading analog dollars for digital pennies?" In other words, if someone watching an NBC show like The Office on Hulu currently brings NBC far less revenue than if they were watching it on-air, is the migration to broadband viewership actually causing a permanent down-sizing of broadcasters' ad revenue per minute viewed? A scary thought to contemplate.

What does all this mean for Hollywood?

Surely less subscription or ad revenue eventually means less money for everyone including the whole Hollywood apparatus that has been funded out of the traditional models. But how, when and to what extent does this play out?

Further, is the very nature of what's expected of Hollywood changing? Herb Scannell, CEO/founder of Next New Networks asserted in his panel that the current generation of 'auteurs' - multi-skilled and motivated people who can write, direct, produce, act and promote implies a far different role for how Hollywood creates value for itself in the future. In fact, Herb believes that technology-empowered talent is the biggest disruptive force to the traditional Hollywood equation.

The point was brought home to me in a offsite function I attended in which Bebo, the massive youth-oriented social network (recently sold to AOL for $850 million), outlined its big push into original entertainment (e.g. "KateModern," "Sofia's Diary," etc.). Their expectations of what they, creators and users will be doing to create value are starkly different from the Hollywood model.

And the questions continue. There are ample reasons to be enthusiastic about broadband video, still, we are living through transformational times impacting every corner of the traditional video value chain. For now many questions loom. Hopefully more answers will be forthcoming soon.

Do you have any answers? Post a comment and let everyone know!

Categories: Broadcasters, Cable Networks, Cable TV Operators, Devices

Topics: Bebo, Digital Hollywood, Next New Networks

-

2009 Super Bowl Ads to Hit $3 Million, Broadband's Role Must Grow

The Wall Street Journal reported yesterday that NBC will announce next week that the starting price for a 30 second ad during the 2009 Super Bowl will cost $3 million, a 10% increase over 2008. For sure one thing this

means to me: broadband video's role must grow in order to earn Super Bowl advertisers a return on these outsized rates.

means to me: broadband video's role must grow in order to earn Super Bowl advertisers a return on these outsized rates.As some of you know I've been writing about this topic for the last few years, even preceding the launch of VideoNuze. In Jan '06, in "The $10 Million Super Bowl Ad?" I argued that Super Bowl ad prices were heading nowhere but up given the historic opportunity to fuse the best of brand advertising with the best of online advertising.

I thought the linchpin would be brands recognizing that broadband video elements (e.g. larger campaign narratives, user contests, etc.) should precede and/or follow the game ad, creating a far larger engagement and ROI scenario. With more potential benefits, Super Bowl ad buying would be far less risky and therefore more advertisers would be compelled to buy, thus driving prices up.

While prices have risen, it's been more because audiences have continued fragmenting, making the Super Bowl truly a once-a-year advertising opportunity. NBC's willingness to raise prices by 10% over '08, in the face of a difficult U.S. economy is further testament to the big game's luster.

Back in '06 I forecasted that creative lightbulbs would be going off on Madison Avenue for how to capitalize on broadband's potential to add value. Sadly in the last 2 years this hasn't materialized. In Jan '08, in "My Rant About Super Bowl Ads" I lamented the fact that of the 52 game ads, only 5 (later revised to 6) ads had a broadband component. While the ads themselves were viewed for weeks after in online galleries, the stark reality was that tens of millions of dollars of client ad spending was being dramatically sub-optimized by not incorporating any broadband video elements.

It may be unfair of me to say, but I place the disproportionate share of the blame for this on the agencies behind the Super Bowl ads. They seem oblivious to how their clients' ad strategies must change to reflect broadband and online's importance.

So here's my message to brands considering a Super Bowl '09 ad buy: with 8 full months until game day, if your agency is not presenting you now with at least a half dozen compelling ideas for how to incorporate broadband elements into your Super Bowl ads, switch agencies now. I mean it. They are under-serving you. Find an agency that gets it, not one that is stuck in a time warp. The brands that will really score in the '09 game will have ads that reflect today's broadband realities.

Categories: Advertising, Brand Marketing, Sports

Topics: Super Bowl

-

Sunday Morning Talk Shows Need Broadband Refresh

In the heat of the Democratic primary, the five major Sunday morning talk shows have recently taken on greater prominence. For political junkies like me, even after a week's worth of endless campaign coverage, it is great sport to watch the candidates and their surrogates put the best face on the week's events, while eagerly trying to tee up issues for the coming week's news cycle.

The Sunday shows are also perfect fodder for broadband video consumption. On-air they are neatly segmented by guests and topics, their archives offer a vivid research opportunity for both editorial and user-driven curation, and the audiences that tune in are upscale and appealing to advertisers.

With all this going for them, I decided to investigate the online presence of the five Sunday morning shows, ABC's "This Week with George Stephanopoulos," CBS's "Face the Nation with Bob Schieffer," FOX's "Fox News Sunday with Chris Wallace," NBC's "Meet the Press with Tim Russert" and CNN's "Late Edition with Wolf Blitzer."

Though all of the sites had their strengths, as a group I found them to be surprisingly average initiatives, especially in comparison to the superb efforts these same networks have mounted for their online entertainment programming. (Note that all I found for "Late Edition" was a brochure page)

"FTN" would have to rank at the top of my list, primarily because it segments the show by its guests and topics and displays them in the user-friendliest manner. This allows the user to quickly zero in on desired segments. "This Week" and "MTP" do some of this as well, though I found their presentation not as straightforward. What's missing from all are related clips across episodes curated in a meaningful way. Presentation is very episode-centric.

While all the sites rely heavily on pre-roll ads, "FTN" gets credit for using some frequency capping. "This Week," seems to ignore the best practices that ABC.com follows in presenting its shows with limited interruptions. Not only does it not frequency cap, it also ran the same 2 ads - one for Intel and one for Verizon Wireless - over and over. Needless to say this became tiresome after clicking to watch several segments.

Meanwhile, navigation and available content on these sites are all over the board. "MTP" offers a link to watch the whole program with limited interruptions, while "FNS" offers a text transcript of the most recent program, but not a video of the whole program. "This Week's" main text navigation has links to pure text stories, text stories with embedded video clips, and video clips alone, but no way to sort the list by media type. Search on each site also yields highly diverse results - some video, some not. One missed opportunity is that none offer any user editing features. Putting together your own highlights reel to be embedded on a blog or social networking site would likely be great fun for many hard-core viewers.

The Sunday talk shows offer dynamite content, highly leverageable for broadband consumption. Hopefully as the political season rolls on we'll see the networks recognize this and continue to invest in new features and improved usability.

What do you think? Post a comment and let us all know!

Categories: Broadcasters, Cable Networks

Topics: ABC, CBS, CNN, FOX, NBC

-

iTunes Film Deals Not a Game-Changer

In the last few days there's been a lot of attention paid to Apple's deals with Disney, Fox, Warner Bros, Paramount, Universal, Sony, Lionsgate, Imagine and First Look Studios giving iTunes day-and-date access to these studios' current films.

As an advocate of the broadband medium, naturally I'm delighted to see studios put broadband distribution

on a par with DVD release. The deals should rightly be interpreted as another step in the maturation of the broadband medium.

on a par with DVD release. The deals should rightly be interpreted as another step in the maturation of the broadband medium. However, these deals, in and of themselves, do not constitute a game-changing event for paid downloads of feature films. That's because until there's mass connectivity between PCs and TVs and much-improved portability, consumers' willingness to buy is going to be significantly muted. Consumers' inability to easily watch a feature film on their widescreen TV or easily grab-these- movies-to-go (as with DVDs) are a huge drag on the download value proposition, easily swamping its new convenience benefits.

I believe that lack of mass connectivity between PCs and TVs is the last major hurdle to unlocking broadband video's ultimate potential. It is also the firewall that's preserving a lot of incumbents' business models (cable operators, broadcasters, etc.). No question, Apple and iTunes are powerful marketing partners for the studios, and their download revenue will certainly increase from its current modest base. But not even Apple's mighty brand (and certainly not its anemic AppleTV device) is enough to compensate for broadband's current deficiency.

The good news is that there's a frenzy of energy directed at solving the PC-to-TV connectivity issue. Though no approach has yet broken through, I'm still betting it's only a matter of time until one does. When that happens, studios will reap the major benefits. Until then, these deals represent progress, but not game-changing events.

Categories: Aggregators, Downloads, FIlms, Studios

Topics: Apple, Disney, FOX, iTunes, Lionsgate, New Line, Paramount, Sony Pictures, Universal, Warner Bros.