-

Despite Hurdles, Made-for-Broadband Video Projects Proliferate

If you thought the recession and resulting ad spending crunch had dimmed the enthusiasm around independently-produced, made-for broadband video, think again. The market seems to keep chugging along with all kinds of companies and creative talent involved. Here's a sample of the headlines I've noticed in just the last couple of months (some links now require registration):

Jason Priestly Tapped for Online Series

Reveille to Bow Welches Web Series

Crackle Pops with Porn Star Mom

Break Launches Guy Lifestyle Site MadeMan.com

Web Series Expands Beyond Lexus Promotion

DeVito Serves Up Blood on the Web

Xbox Live Slating New Original Video Series

Alloy Launch "Private" Online Series

More Teams With Candace Bushnell for Web Series

Candor, Shariff Hasan Get "Skinny"

The list of projects demonstrates both the breadth of participants and concepts coming to market. Some involve established backers like Microsoft or AOL. Others rely on starpower like Lisa Kudrow, Candace Bushnell or Jason Priestly. Some have ties to existing offline franchises like Alloy's "Private" or Meredith's "More" magazine, while others, like DiVide and Generate are in search of brand involvement. Clearly there's no shortage of experimentation in the made-for-broadband space.

Still, discipline is the key to success. That was my takeaway from a conversation I had yesterday with Michael Wayne, co-founder and CEO of DECA, an online-only entertainment company whose properties include Smosh, Momversation, Good Bite and others. Michael notes DECA's success stems from being very analytical about which projects to greenlight. Key success criteria include how large the targeted audience is, how engaged they are (measured by things like blogging, Twittering, commenting), whether other media properties have succeeded with the audience and if there's demonstrated advertiser interest.

Importantly, DECA looks hard for pre-existing online communities or "tribes" along with "tribal leaders" as Michael puts it - people who have emerged from the online rabble to become recognized leading voices in their vertical space. DECA tries to partner with these tribal leaders to build properties that have video at their core, but capitalize on all the publishing and interactive capabilities the web has to offer. Michael notes the need for all of this to be done on very lean, non-Hollywood budgets.

Meanwhile, I've been a believer that the coming convergence era, where broadband is increasingly connected to users' TVs, will further level the playing field for made-for-broadband projects. At some point it could be as easy to watch one of the above offerings as it is to watch "Heroes" or "Lost." Lastly, recent infrastructure and distribution progress, epitomized by last week's news from YouTube and blip.tv, provide further support for these independent producers.

So while the flameouts this year of 60Frames, ManiaTV, Ripe Digital and Blowtorch are reminders that the made-for-broadband space remains plenty precarious, it also continues to be fascinating to watch evolve.

What do you think? Post a comment now.

Categories: Indie Video

Topics: 60Frames, Blowtorch, DECA, ManiaTV, Ripe Digital

-

Netflix's ABC Deal Shows Streaming Progress and Importance of Broadcast TV Networks

Yesterday's announcement by Netflix that it will be adding to its Watch Instantly library past seasons ABC's "Lost," "Desperate Housewives," "Grey's Anatomy" and "Legend of the Seeker" is another step forward for Netflix in strengthening its online competitiveness.

At a broader level though, I think it's also further evidence that the near-term success of Watch Instantly and other "over-the-top" broadband video services is going to be tied largely to deals with broadcast TV networks, rather than film studios, cable TV networks or independently-produced video sources.

Key fault lines are beginning to develop in how premium programming will be distributed in the broadband era. Content providers who have traditionally been paid by consumers or distributors in one way or another are redoubling their determination to preserve these models. Examples abound: the TV Everywhere initiative Comcast/Time Warner are espousing that now has 20+ other networks involved; Epix, the new premium movie service backed by Viacom, Lionsgate and MGM; new distribution deals by the premium online service ESPN360.com, bringing its reach to 41 million homes; MLB's MLB.TV and At Bat subscription offerings; and Disney's planned subscription services. As I wrote last week in "Subscription Overload is On the Horizon," I expect these trends will only accelerate (though whether they'll succeed is another question).

On the other hand, broadcast TV networks, who have traditionally relied on advertising, continue mainly to do so in the broadband world, whether through aggregators like Hulu, or through their own web sites. However, ABC's deal with Netflix, coming on top of its prior deals with CBS and NBC, shows that broadcast networks are both motivated and flexible to mine new opportunites with those willing to pay.

That's a good thing, because as Netflix tries to build out its Watch Instantly library beyond the current 12,000 titles, it is bumping up against two powerful forces. First, in the film business, well-defined "windows"

significantly curtail distribution of new films to outlets trying to elbow their way in. And second, in the cable business, well-entrenched business relationships exist that disincent cable networks from offering programs outside the traditional linear channel affiliate model to new players like Netflix. These disincentives are poised to strengthen with the advent of TV Everywhere.

significantly curtail distribution of new films to outlets trying to elbow their way in. And second, in the cable business, well-entrenched business relationships exist that disincent cable networks from offering programs outside the traditional linear channel affiliate model to new players like Netflix. These disincentives are poised to strengthen with the advent of TV Everywhere.In this context, broadcast networks represent Netflix's best opportunity to grow and differentiate Watch Instantly. Last November in "Netflix Should be Aggressively Pursuing Broadcast Networks for Watch Instantly Service," I outlined all the reasons why. The ABC deal announced yesterday gives Netflix a library of past seasons' episodes, which is great. But it doesn't address where Netflix could create the most value for itself: as commercial-free subscription option for next-day (or even "next-hour") viewing of all prime-time broadcast programs. That is the end-state Netflix should be striving for.

I'm not suggesting for a moment that this will be easy to accomplish. But if it could, Netflix would really enhance the competitiveness of Watch Instantly and its underlying subscription services. It would obviate the need for Netflix subscribers to record broadcast programs, making their lives simpler and freeing up room on their DVRs. It would be jab at both traditional VOD services and new "network DVR" service from Cablevision. It would also be a strong competitor to sites like Hulu, where comparable broadcast programs are available, but only with commercial interruptions. And Hulu still has limited options for viewing on TVs, whereas Netflix's Watch Instantly options for viewing on TVs includes Roku, Xbox, Blu-ray players, etc. Last but not least, it would also be a powerful marketing hook for Netflix to use to bulk up its underlying subscription base that it intends to transition to online-only in the future.

Beyond next-day or next-hour availability, Netflix could also offer things like higher-quality full HD delivery or download options for offline consumption. Broadcasters, who continue to be pinched on the ad side, should be plenty open to all of the above, assuming Netflix is willing to pay.

I continue to believe Netflix is one of the strongest positions to create a compelling over-the-top service offering. But with numerous barriers in its way to gain online distribution rights to films and cable programs, broadcast networks remain its key source of premium content. So keep an eye for more deals like the one announced with ABC yesterday, hopefully including fast availability of current, in-season episodes.

What do you think? Post a comment now.

Categories: Aggregators, Broadcasters, Cable Networks, Cable TV Operators, FIlms

Topics: ABC, Cablevision, CBS, Comcast, EPIX, ESPN360, MLB, NBC, Netflix, Time Warner

-

ExtendMedia Looks to Support TV Everywhere Initiatives with OpenCase Publisher Launch

With momentum growing for "TV Everywhere" type services, it's to be expected that technology vendors will begin offering products that meet the evolving range of requirements video service providers will

encounter. One example is ExtendMedia, which today is introducing OpenCase "Publisher." With TV Everywhere type services still so new, even labeling the various capabilities video service providers will require to succeed is still a work in process. In a meeting last week, Extend's executives helped me understand what will be needed and what the Publisher product provides.

encounter. One example is ExtendMedia, which today is introducing OpenCase "Publisher." With TV Everywhere type services still so new, even labeling the various capabilities video service providers will require to succeed is still a work in process. In a meeting last week, Extend's executives helped me understand what will be needed and what the Publisher product provides. To date, much attention around TV Everywhere has focused on "authentication" - how a service provider would implement credentials (e.g. logins and passwords) so only authorized users could access its online video catalog. This gatekeeping step has rightly received a lot of focus, because leakage of any premium video must be prevented. Authentication is tricky though, as users must be verified as being who they say they (e.g. passwords haven't been improperly shared). But assuming for a moment that tight authentication processes are implemented, other challenges and opportunities remain.

For example, once authenticated, service providers need to be able to expose only those parts of their overall catalog each specific user is entitled to view (e.g. if I'm not an HBO subscriber, I shouldn't get access to HBO programs online). This notion of "service management and provisioning" means service providers need to create different bundles online, just as they have done offline. And the bundles need to be easy to change: a service provider may want to change a channel lineup and/or a subscriber may want to add a new channel.

Service management and provisioning itself requires that there's a scalable content management system in place. The service provider will need to be able to ingest lots of premium video from many different sources while also and accepting and assigning specific rules to each program as needed (e.g. one program may be available immediately and indefinitely, while another will be available just for a week, but starting at a specified future time). In addition, metadata must be assigned so programs can be tracked, and searched by users.

The above requirements are further complicated because TV Everywhere services are envisioned to work across multiple devices as well. That means that authentication must also work on smartphones, gaming consoles, portable media players, etc. The devices themselves must be registered and recognized so they can be linked to users' accounts. In some cases license terms will further restrict how specific parts of services are accessible, and under what addition terms (in turn possibly requiring DRM).

Last but not least is monetization. Given current plans not to charge extra for TV Everywhere, advertising from online viewing is the main new revenue-generating opportunity. So integrations with ad servers already used by content providers, along with the ability to measure and report on usage, is another crucial capability. Separate, a totally new monetization opportunity will be trying to upsell online subscribers on new services. For instance, HBO might run a promotion offering a sneak peek of a "True Blood" premiere to all TV Everywhere users. The service provider needs to not only support the promotion, but also offer one-click upsell subscription to HBO, and dynamic provisioning of the whole HBO catalog to the new subscriber.

As I've written previously, TV Everywhere is an exciting step forward for both the broadband industry and video service providers. Yet it is a very new world where things get complicated very fast. Vendors like Extend - and other leaders like thePlatform and Irdeto to name two - which have traditionally focused on cross-platform support for video service providers are increasingly going to be called on to turn executives' visions into reality.

What do you think? Post a comment now.

(Note - ExtendMedia and thePlatform are VideoNuze sponsors)

Categories: Technology

Topics: ExtendMedia, Irdeto, thePlatform

-

4 News Items Worth Noting from the Week of July 27th

Following are 4 news items worth noting from the week of July 27th:

New Pew research confirms online video's growth - Pew was the latest to offer statistics confirming that online video usage continues to soar. Among the noteworthy findings: Long-form consumption is growing as 35% of respondents say they have viewed a TV show or movie online (up from 16% in '07); watching video is widely popular, draw more people (62%) than social networking (46%), downloading a podcast (19%) or using Twitter (11%); usage is up across all age groups, but still skews young with 90% of 18-29 year olds reporting they watch online vs. 27% of 65+ year olds; and convergence is happening with 23% of people who have watched online reporting they have connected their computers to their TVs.

FreeWheel has a very good week - FreeWheel, the syndicated video ad management company I most recently wrote about here, had a very good week. On Monday, AdAge reported that YouTube has begun a test allowing select premium partners to bring their own ads into YouTube, served by FreeWheel. Then on Wednesday, blip.tv announced that it too had integrated with FreeWheel, so ads could be served for blip's producers across their entire syndication network. I caught up with FreeWheel's co-CEO Doug Knopper yesterday who added that more deals, especially with major content producers, are on the way. FreeWheel is riding the syndication wave in a big way.

Plenty of action with CDNs - CDNs were in the news this week, as Vusion (formerly Jittr Networks) bit the dust, after going through $11 million in VC money. Elsewhere CDN Velocix (formerly CacheLogic) was acquired by Alcatel-Lucent. ALU positioned the deal as fitting with its "Application Enablement" strategy, supporting customers' needs in a "video-centric world." Limelight announced its LimelightREACH and LimelightADS services for mobile media delivery and monetization (both are based on Kiptronic, which it acquired recently). Last but not least, bellwether Akamai reported Q2 '09 earnings, that while up 5% vs. year ago, were down sequentially from Q1. Coupled with a cautious Q3 outlook, the company's stock dropped 20%.

IAC is making big moves into online video - IAC is making no bones about its interest in online video. Last week the company unveiled Notional, a spin-out of CollegeHumor.com, to be headed by that site's former editor-in-chief Ricky Van Veen. Then this week it announced another new video venture, with NBCU's former co-entertainment head Ben Silverman. IAC chief Barry Diller seems determined to push the edge of the envelope, as IAC talks up things like multi-platform distribution and brand integration. With convergence and mobile consumption starting to take hold, the timing may finally be right for these sorts of plays. At a minimum IAC will keep things interesting for industry watchers like me.

Click here to see an aggregation of all of the week's broadband video news

Categories: Advertising, CDNs, Indie Video, Syndicated Video Economy

Topics: Akamai, Alcatel-Lucent, blip.TV, FreeWheel, IAC, Limelight, Pew, Velocix, Vusion, YouTube

-

VideoNuze Report Podcast #25 - July 31, 2009

Daisy Whitney and I are pleased to present the 25th edition of the VideoNuze Report podcast, for July 31, 2009.

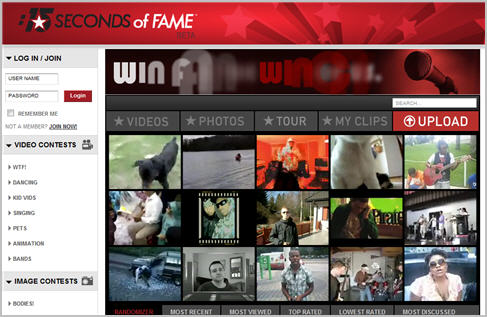

This week I provide some additional thoughts on the new web site 15 Seconds of Fame (http://15sof.com/), which I posted about yesterday. The site is a broadband, social media-based version of "American Idol," offering multiple online contests. Users pay $1 to enter their 15 second (max) video, which then funds the prizes ranging from $25-$100. It's a great example of what I call "purpose-driven" user generated video, meant to appeal to people who have talent and already have experience uploading video to YouTube and other video sharing sites.

Speaking of YouTube, Daisy picks up on her post about its latest sensation, the "JK Wedding Entrance Dance" which has gained over 12 million views. The video shows a wedding party proceeding down the aisle dancing to Chris Brown's "Forever." The video is a blast to watch, but more importantly, YouTube is highlighting on its blog that the video has also become a big money-maker for its rights-holders. By using YouTube's content management tools and "Click-to-Buy" links, there are now overlay ads to buy the song at Amazon and iTunes. YouTube reports that the click-through rate is 2x the average and helped drive the song to #3 on iTunes and #4 on Amazon. It's a nice win for everyone. Think the bride and groom (interviewed here on NBC's Today Show) are getting a cut?

Click here to listen to the podcast (12 minutes, 58 seconds)

Click here for previous podcasts

The VideoNuze Report is available in iTunes...subscribe today!

-

15 Seconds of Fame (15sof.com): A Broadband, Social Media-Based Version of "American Idol"

Andy Warhol's famous quote that "everyone gets their 15 seconds of fame" is the inspiration behind a new web site called 15sof.com that is like a broadband, social media-based version of the hit show "American Idol," but created and promoted at a fraction of the cost.

15sof.com is meant to capitalize on the growing subculture of society (that tends to skew younger) who are either seeking fame and fortune or want to influence the process of who attains it. These motivations have been the key forces behind the explosion of reality-based contest shows now running and arguably drive many of the most outlandish stunts seen on YouTube.

15sof.com's founder/CEO John Bonaccorso explained to me that the site offers aspiring contestants a simple but novel proposition: pay $1 to submit your 15 second (max) video to one of the myriad contests running at any one time on 15sof.com. The community then votes on the submissions and moves a handful of contestants on to subsequent rounds where lengthier videos are accepted. The prize money is funded from the contestants' fees. Contestants can enter as often as they'd like, but precautions are in place to prevent voting fraud. 15sof uses a white-label social media platform from Reality Digital, which I last wrote about here.

With current top prizes in the $25-$100 range, nobody's going to get rich, but they will gain visibility and of course psychic gratification. As John explained, particularly for the high school and college-aged drama crowd, 15sof.com offers them an opportunity to show their stuff, which is plenty enough.

15sof.com is itself a pure social media creation: John said the site hasn't spent any money yet on conventional marketing. Instead it has built awareness and participation solely through Facebook, MySpace, Twitter and other social media platforms. In the world of 15sof.com - and many other social sites and apps launching today - there's no need for tune-in ads, billboards or other expensive marketing tactics. Sites like 15sof.com grow out of the burgeoning social community, dominated by the young. John wouldn't disclose numbers, but said the site beat its first month traffic goal in the first 3 weeks. That's no indication of future success, but it's a good start.

For me, there are 2 other noteworthy aspects of 15sof.com. First, the site reflects yet another example of "purpose-driven" user-generated video, a concept I've explored in the past in connection with Unigo, a start-up trying to use student-created videos to disrupt the college guidebook industry. The "purpose-driven" video idea is to get the multitudes of amateurs whom YouTube introduced to video to turn their newfound skills and passion toward something more remunerative and possibly productive. Purpose-driven video concepts are proliferating. Most notable are the myriad brand-sponsored consumer video contests and also the many sites featuring user-created how-to videos. I continue to believe there will be many bona fide business opportunities based on purpose-driven video.

Second, 15sof.com also illustrates the evolving interplay between online and on-air programming. We are starting to see how programs born in one of the mediums can create a variation in the other, or where a concept can migrate from one medium to the other. For example, John's vision is that 15sof.com - the spawn of American Idol - could itself eventually become a TV show. Another example of this phenomenon is Scripps Networks' Food2, where new talent being showcased could eventually graduate to programs on the Food Network itself. I suspect some of this multi-platform thinking is behind Ben Silverman's new venture with IAC. My point is that broadband is giving programmers a lot of new flexibility in how they bring their creative concepts to market.

Meanwhile, if you're expecting to find yours truly belting out a song on 15sof.com, you'll have to keep waiting. I'll be here hiding behind my keyboard.

What do you think? Post a comment now.

Topics: 15sof.com, Food2, Reality Digital, YouTube

-

Blip.TV's New Deals Give Broadband Producers a Boost

Broadband-only producers got a boost yesterday as blip.tv, which provides technology, ad sales and

distribution for thousands of online shows, announced a variety of new deals as well as product improvements. The deals offer blip's producers new distribution, new monetization and new access to TVs. In order:

distribution for thousands of online shows, announced a variety of new deals as well as product improvements. The deals offer blip's producers new distribution, new monetization and new access to TVs. In order:Distribution: blip's new deal with YouTube means that producers using blip can deliver their episodes directly to their YouTube accounts, eliminating the two step process. With YouTube's massive traffic, getting in front of this audience is critical to any independent producer. Since my first conversation with blip's co-founder Mike Hudack several years ago, the company's mantra has been widespread syndication. Blip already distributed its producers' shows to iTunes, AOL Video, MSN Video, Facebook, Twitter, and others. Vimeo is another new distribution partner announced yesterday.

Monetization: A new integration with FreeWheel means that ads blip sells can follow the programs it distributes wherever they may be viewed. I've written about FreeWheel in the past, which offers essential monetization capability for the Syndicated Video Economy. With the blip deal, FreeWheel delivered ads can be inserted on YouTube. This follows news earlier this week that YouTube and FreeWheel had struck an agreement which allows content providers that use FreeWheel and distribute their video on YouTube can have FreeWheel insert their ads on YouTube (slowly but surely YouTube is opening itself up to 3rd parties).

Access to TVs - Last but not least is blip's integration with the Roku player which will help bring blip's shows directly to TVs (adding to deals blip already had with TiVo, Sony Bravia, Verizon FiOS, Boxee and Apple TV). While Roku's footprint is still modest, it is positioned for major growth given current deals with Netflix and Amazon, and others no doubt pending. At $100, Roku is an inexpensive and easy-to-operate convergence device that is a great option for consumers trying to gain broadband access on their TVs. Gaining parity access to TV audiences for its broadband producers is a key value proposition for blip.

In addition to the above, blip also redesigned its dashboard and work flow, making it easier for producers to manage their shows along with their distribution and monetization. An additional deal with TubeMogul announced yesterday allows second by second viewer tracking, providing more insight on engagement.

Taken together the new deals help blip further realize its vision of being a "next generation TV network" and provide much-needed services to broadband-only producers. This group has taken a hit this year, given the tough ad sales and funding environments, so they need every advantage they can get.

What do you think? Post a comment now.

Categories: Advertising, Aggregators, Analytics, Devices, Indie Video, Syndicated Video Economy

Topics: blip.TV, FreeWheel, Roku, TubeMogul, Vimeo, YouTube

-

Subscription Overload is on the Horizon

One might think that the depths of the worst economic recession in decades would be a lousy time to begin asking penny-pinching consumers for additional payments to access content. Yet this is exactly what many video providers plan to do, as a variety of broadband-delivered video subscription plans are beginning to take shape. Based on conversations I've been having with industry executives and what I've been reading, various subscription plans are now underway. This leads me to think that "subscription overload" is on the horizon.

Interest in getting consumers to pay has several sources. Many executives have concluded that advertising alone is an insufficient model, even as the cost of delivering broadband video is actually plummeting. Some of this concern relates to the widespread advertising slowdown, where even established players like the big broadcast networks are being forced to accept rate cuts. These declines cannot be made up with greater ad quantity as there's prevailing worry about just how many ads can be loaded into a broadband-delivered program before the viewer gets turned off.

There is also significant fear of not learning from the demise of the U.S. newspaper industry, which largely adopted an ad-only online business model that hasn't worked (causing some like the NY Times to now consider reinstituting subscription services). Newspapers' woes have become a touchstone in practically every conversation I've participated in recently. Last, but not least, there's no small amount of envy toward cable networks, whose dual subscription/advertising revenue model has allowed them to weather the recession better than most.

Subscription plans seek some combination of differentiators: offering premium video in better windows, at better-quality, with deeper selection, across multiple devices and with some degree of exclusivity. The thinking is that these enhancements will allow subscription services to be distinguished from and co-exist with free ad-supported services. The implicit bet is that these differences will be understood and valued by consumers.

Subscription plans are beginning to leak out, as happened last week in remarks by Disney CEO Bob Iger. Many in the industry (including me) anticipate that Hulu will launch a subscription service soon, particularly as it seeks to become a part of cable operators' TV Everywhere initiatives (which themselves seek to enhance the value of current cable subscriptions).

Other plans are on the drawing board. When I read yesterday, for example, about NBC's Ben Silverman jumping to IAC to form a new video venture, I suspect it's almost a given that the venture will consider some type of premium model. The growth of mobile video is another factor fueling subscriptions. This is what MLB is doing with its new At Bat 2009 subscription app for the iPhone, which builds on its highly successful MLB.TV broadband subscription service.

With so many subscription services underway, it's inevitable that many of them won't get traction. I mean, is it likely that consumers will pay extra so they can see a program online just hours after it airs, instead of a day later? Or so they can receive 1080-equivalent HD quality online, when 720-equivalent HD is available for free? I'm skeptical, even before factoring in the recession-driven belt-tightening many consumers have adopted. The bar for a subscription service to succeed is very high.

Still, with broadband allowing video providers direct access to their target audiences, their well-known brands as powerful enablers, and the crummy advertising climate showing no letup, it is no surprise that the pendulum is swinging heavily toward subscriptions.

What do you think? Post a comment now.

Categories: Advertising, Newspapers, Sports