-

Nexidia Brings Phonetics to Video Search Space

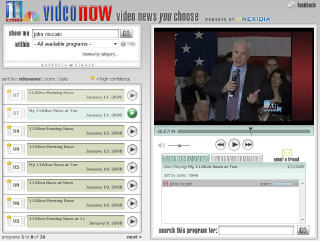

Innovation in the video search space just keeps on coming. The latest is from a company named Nexidia, which already operates in other verticals and is now targeting the media space as well. I caught up with Drew Lanham, SVP of Media for an update on their approach and how it differs from others in the market today.

Nexidia creates a searchable phonetic representation of the audio track, which it calls a "Phonetic Audio Track" or PAT file. These PAT files are then indexed, and queries are matched against them. The company believes the advantages of phonetics over traditional speech-to-text and metadata-based approaches are better accuracy (particularly against unrecognized phrases), faster indexing and lower-cost scaling. For example, Drew said that an hour of video can be indexed automatically by Nexidia in 15 seconds, while he believes that speech-to-text would be a 1:1 relationship, so an hour to index an hour of video.

Obviously there are real speed-to-market opportunities for content providers, so this would be a solid competitive advantage. Nexidia owns its own phonetics technology, which gives it flexibility in further developing it to meet customers' specific needs. Drew said metadata is also used to augment the phonetics-based approach.

Nexidia search results are the full long-form segment containing the search phrase, not just clips. Hash marks denote where the search term is spoken. This approach means that content providers no longer have to worry about creating and managing clips, thereby reducing their costs. It also means users get the full context of the program, if desired.

The company already has substantial operations in homeland security, call centers, legal and enterprise search, and has recently begun targeting the media vertical. One live example can be found at http://www.11alive.com/, which is the web site of WXIA in Atlanta. I played around with it a bit and found the results to be impressive, though I thought the interface needed some improvements. Drew showed me the next generation interface, which is stronger and offers new features like clipping, exploring tag-related content and syndication.

Drew said the company is getting a lot of traction in the media editing space (Avid, etc.), and is re-starting discussion with the top 20-30 media properties. It envisions being an "ingredient brand" and not having a consumer-facing portal. Nexidia again shows that content providers are going to be able mine lots of new value from their video archives. These troves of video are also going to yield unprecedented new targeted advertising opportunities.

Categories: Video Search

Topics: 11Alive.com, Nexidia

-

Netflix-Apple Battle is Illusory

Netflix announced this morning that it was removing the usage cap on its "Instant Watching" feature for unlimited plan subscribers. This feature allows subscribers to choose from 6,000 titles (and growing) to stream and view on their PCs. Up until now subscribers received an allocation of streaming hours based on their monthly subscription level (e.g. 17 hours if subscribing at $17/mo). Now the hours will be unlimited. It's a smart move for Netflix and a great value proposition for Netflix subscribers.

AP first reported the change yesterday and is depicting it as a preemptive move against Apple, which is anticipated to announce tomorrow that movie rental downloads will be available in iTunes. The price point is expected to be $3.99/download. This is a major departure for Apple's iTunes, which has, of course, stuck religiously to its purchase download model for both music and videos.

Others have also depicted Apple's move as a direct strike at Netflix, but I think this battle is illusory. Rather, I view Apple's introduction of rentals as clear competition for the likes of Movielink, CinemaNow, Amazon

Unbox, XBox LIVE and other rental stores, but not a blow to Netflix. The value propositions are very different. That's because Netflix very wisely has made the Instant Watching feature a value add for its subscribers, not an incremental fee.

Unbox, XBox LIVE and other rental stores, but not a blow to Netflix. The value propositions are very different. That's because Netflix very wisely has made the Instant Watching feature a value add for its subscribers, not an incremental fee. As a $16.99/mo subscriber myself, I love the fact that Netflix is unmetering Instant Watching, and am hard-pressed to see why anyone would drop their subscription in favor of Apple's rental model, unless they envision consuming a lot of movies on their iPods (now there's a slim segment of the population!).

From an economic standpoint alone, the breakeven is only 4+ movies, which is likely well below the monthly consumption of most of Netflix's full unlimited subscribers. And with Apple's rental model, users are still subjected to all the same online movie limitations all the other services have suffered from: no easy playback on TVs, lack of portability, viewing window limits, etc. Granted iTunes downloads enable watching on-the-go (vs. Netflix's streams), but I don't see that as a big differentiator. With Netflix you get the best of DVDs' advantages and now unlimited online delivery.

Now, if Apple were to pursue subscriptions, that would be a direct attack on Netflix. Yet even this approach might not be that successful. The fact is, Netflix has spent heavily on marketing over the years, and its strong brand awareness and 7 million subscriber base are quite meaningful advantages.

Online movie delivery, whether rental or owned, still has a long way to go to achieve mainstream success. Apple will certainly nudge the category forward, but not dramatically. Still, Netflix needs to remain aggressively on offensive to retain its leadership mantle. This is a category with lots of moves yet to be made.

Am I missing something? Post a comment and let everyone know!

Categories: Aggregators, Devices, FIlms

-

NATPE Conference in 2 Weeks

The annual NATPE conference in Las Vegas is coming up in 2 weeks, beginning on January 28th. If you're involved in content deal-making, whether on traditional or broadband platforms, NATPE promises once again to be a must-attend show. The agenda and registration are here.

I'll be there, hosting a new "Digital Briefing" day-long track on Tuesday, in which a series of broadband innovators will be presenting, including Joost, Vuze, PermissionTV, Digital Fountain and others. It promises to be an extremely informative day, with lots of time for Q&A.

The show will feature a ton of high-profile industry executives in panel discussions, keynotes and one-on-ones. The list includes: Jeff Zucker (NBC), Bob Pittman (Pilot Group), Greg Clayman (MTV), Jason Kilar (Hulu), Matt Strauss (Comcast), Mike Hudack (blip), Shelly Lazarus (Oglivy), Gary Gannaway (WorldNow), Jordan Hoffner (YouTube), Tim Armstrong (Google), Michael Eisner (Torante), Peter Levinsohn (FIM) and many others.

I'll be around the whole time, if you're coming drop me a line if you'd like to meet!

Categories: Events

Topics: NATPE

-

Here Comes the Video "Experience Era"

OK, one last post related to CES, and then I promise to shut up about the show.

Observing the goings-on this week, it is evident that both content and consumer electronics firms have come to the same basic conclusion: each industry's success is inextricably tied to the other's. Each recognizes that the business dynamics of the future requires a new way of differentiating their products than they are accustomed. That means, for example, that TV makers can no longer just boast about better pictures. And that content companies can no longer bank on bigger stars or funnier sitcoms to deliver audiences and profits.

Rather, both industries recognize that we are moving into what I would call the "experience era" for video. That's to say, success with consumers is going to rest more on these industries' ability to deliver superior experiences which integrate content and technology in new and compelling ways. Rather than oohing and ahhing about their new TV's picture quality or how hilarious a certain episode was, going forward consumers will increasingly cite "how cool" something is.

"How cool" are code words for "how compelling is the experience". The new currency of video hipness will require that when I invite friends to my house and want to show off, I need to have more than just a honking-big screen or a digital collection of old programs - those will be commonplace. Instead, the experiences are what will matter. Things like seamlessly accessing broadband content on my TV, interacting with it -- along with other viewers -- from my couch, and moving it around my house for playback anywhere, in a snap. Delivering these types of experiences (and more) is the new competitive bar that content and technology firms should be aiming for.

My sense is these industry executives know this, and the partnerships we saw unveiled -- and those yet to come -- demonstrate this recognition. Listen to what Bob Scaglione, Sharp's SVP Marketing said in this NY Times piece: "We already all have beautiful HD televisions. How do you differentiate? One way to provide some really unique differentiation is to provide new content. That's why we're fighting to find the right content providers."

And then what Beth Comstock, president of NBC Universal Integrated Media said: "You can't talk about consumer electronics without talking about content.....We try every new technology that comes along."

Executives across the content and technology spectrum must understand the experience era is now upon us. Steve Jobs and Apple's iPod ushered in the experience era in the music business. We now wait to see which companies in the video industry will do the same and reach for Apple's success. In a hyper competitive world, those who deliver strongly against consumers' needs and desires will be the ultimate winners in the experience battle now underway.

Agree or disagree? Post a comment and let us all know!

Categories: Broadcasters, Devices, Strategy

Topics: Apple, iPod, NBCU, Sharp

-

CES Broadband Video News Wrap-up and VideoNuze Overview

With CES finishing up, today I've attempted to assemble all of the show's broadband video-related press releases and non-overlapping news coverage. I've been following the announcements pretty closely, and I think as far as news filtered specifically for broadband (i.e. excluding things like Blu-ray, gaming, auto/navigation, etc.), this is an extremely comprehensive list. Apologies if I've missed anything -- just email to me and I'll add.

Click here to go straight to the CES broadband news wrap-up.

This CES broadband news wrap-up serves as a great reminder for VideoNuze readers and visitors that VideoNuze really consists of 2 parts: first, my daily analyses, and second, a roundup/aggregation of broadband video-related news from around the web. I've received tons of great feedback on the value of the analyses, but sense that fewer people understand the news roundup side of VideoNuze. News items are listed in the right column of both the daily email and on the web site, and are also available as an RSS feed.

News aggregation is a key function in VideoNuze, as it allows broadband video decision-makers each day to easily stay abreast of news from 50+ sources (mainstream media, trade pubs, blogs, etc.). In fact, one of the key motivations for me to start VideoNuze was my frustration at having to cobble together -- from various newsletters, feeds and sites -- all the news I felt was relevant. Yet even after undertaking this task, I always felt I'd missed something (and inevitably had!).

VideoNuze's News roundup allows broadband decision-makers to rest easy, as everything they need to stay up-to-date and in-the-know is collected in one place, with easy links to underlying sources.

Beyond staying current, VideoNuze is great for deep vertical research on broadband video. Say you're a product management/marketing/biz dev exec, planning your product's ad strategy and want to know who's been doing what, and also what Will's take is. Simple click on VideoNuze's "Advertising" category for News and you'll see hundreds of informative pieces and insights.

Or you're a busy sales exec, planning a key customer meeting, with say, MTV. Just type "MTV" into the VideoNuze search box and you'll get dozens of analyses and news items related specifically to MTV's broadband activities. In fact, there are already 1,000+ broadband-specific news items in VideoNuze, with the list growing each day!

Hopefully this overview has given you a better sense of the news roundup side of VideoNuze. My goal, as always, is to have VideoNuze be the best possible resource for broadband video decision-makers. If you have suggestions for improvements, just let me know!

Categories: Events, Miscellaneous

-

CES 2008 Broadband Video-Related News Wrap-up

CES 2008 broadband video-related news wrap-up:

Panasonic and Comcast Announce Products With tru2way™ Technology

Panasonic And Comcast Debut AnyPlay™ Portable DVR

NETGEAR® Joins BitTorrent™ Device PartnersD-Link Joins BitTorrent™ Device Partners

Vudu Expand High Definition Content Available Through On-Demand Service

Sling Media Unveils Top-of-Line Slingbox PRO-HD

Open Internet Television: A Letter to the Consumer Electronics Industry

Paid downloads a thing of the past

Samsung, Vongo Partner To Offer Movie Downloads For P2 Portable Player

Comcast Interactive Media Launches Fancast.com

New Year Brings Hot New Shows and Longtime Favorites to FLO TV

P2Ps and ISPs team to tame file-sharing traffic

ClipBlast Releases OpenSocial API

Categories: Advertising, Aggregators, Broadband ISPs, Broadcasters, Cable Networks, Cable TV Operators, Devices, Downloads, FIlms, Games, HD, Mobile Video, P2P, Partnerships, Sports, Technology, UGC, Video Search, Video Sharing

Topics: ABC, BitTorrent, BT, Comcast, D-Link, Disney, Google, HP, Microsoft, NBC, Netgear, Panasonic, Samsung, Sony, TiVo, XBox, YouTube

-

Highlighting 3 Partnerships Announced at CES

Among the many partnership announcements at CES this week, there are a number worth highlighting. Today I focus on the following three:

Viacom syndication - Viacom announced syndication deals for MTV Networks' stable of content with five leading broadband video sites: Dailymotion, GoFish, Imeem, MeeVee and Veoh. As those of you who have been following my previous posts know, I believe syndication is a critical engine in driving the advertising business model, which itself is the key to broadband video succeeding. As a result, I follow these syndication deals closely.

I've previously been critical of MTVN which appeared reluctant about syndicating its content when it launched its DailyShow.com destination site. However, with its recent deal with AOL, and now these five deals, it appears that MTVN does in fact believe syndication is the way to go. As one of the biggest cable network groups, MTVN is a key barometer for other networks' moves, so I view this as a real positive for the market.

Panasonic/Google - In this deal, Google and Matsushita announced that YouTube videos and Picasa photos would be directly accessible on new model Panasonic HDTVs launching in Q2 '08. Ordinarily I wouldn't be

too excited about a deal like this, a permutation of which we've seen with other TV makers such as Sony.

too excited about a deal like this, a permutation of which we've seen with other TV makers such as Sony. Yet this one rises in potential importance because YouTube is not just the most popular video site - with 40% of all video traffic - but because Google is determined to turn YouTube into a platform for legitimate content distribution. This was underscored by the Sony mini-sode deal also announced this week, and the

many partnerships YouTube has already struck with premium content providers. If successful (and there are many if's to be sure), YouTube would be far more than a scraggly collection of UGC. So, marry a broad-based premium video aggregator to HDTVs and you could see a new device/content model emerge.

many partnerships YouTube has already struck with premium content providers. If successful (and there are many if's to be sure), YouTube would be far more than a scraggly collection of UGC. So, marry a broad-based premium video aggregator to HDTVs and you could see a new device/content model emerge.BitTorrent device deals Netgear and D-Link - In a less publicized move, BitTorrent announced expanded deals with Netgear and D-Link covering a range of home networking products, with an emphasis on HD distribution. BitTorrent, which has been steadily legitimizing itself from its P2P file-sharing roots, has launched an aggressive SDK program called BitTorrent Device Partners, intended to permeate the market with its client software. BitTorrent also integrates easy access to its digital download store with these partners as well.

While I'm not very bullish about the market potential of bridge devices from companies like Netgear and D-Link, I do believe that P2P distribution has a real role to play in content distribution, especially for heavy HD files. I continue to see P2P as more of a "peer assist" play. To the extent that BitTorrent can continue getting its software into multiple devices, it gains validation and strengthens its potential to be a meaningful partner in the larger content distribution ecosystem.

Share your thoughts on these deals, and suggest others you think are noteworthy from CES!

Categories: Cable Networks, Devices, HD, Indie Video, P2P, Partnerships, UGC

Topics: BitTorrent, D-Link, DailyMotion, GoFish, Google, Imeem, MeeVee, MTVN, Netgear, Panasonic, Veoh, YouTube

-

Comcast Announces Moves at CES; Still Missing Key Strategic Piece

In his CES keynote today, Comcast CEO Brian Roberts will outline several Comcast's initiatives (under the umbrella "Project Infinity") to stay competitive in the fast-changing video arena.

These include:

"Wideband"- New "wideband" broadband technology which allows much faster downloads (this is impressive, though was previously displayed at '07 National Cable Show). Wideband is aimed at blunting criticism that telcos' fiber networks have more capacity and faster speeds.

HD expansion - Plans for a 10-fold increase in the number of HD movies available in its VOD library to 3,000, with at least 6,000 total titles, including SD programming, eventually available. This is all meant to offset the widely held view that satellite and telco have surpassed cable in current HD offerings, a key value prop to millions of Americans now bringing home shiny new HD TV sets.

Fancast - Comcast's video portal will include 3,000 hours of streaming TV content, from NBC, Fox, CBS and others. These moves will help bring Fancast to parity with other syndicated partners of the networks which are themselves trying to proliferate their programs everywhere. Fancast will also allows remote scheduling of DVRs (both Comcast's and TiVo's), a feature that has been widely available at sites like TiVo.com and Yahoo for years now.

All of these actions are intended to help restore Comcast's reputation as the leading provider of entertainment programming, amid the swirl of changes that have enveloped the company. Despite its formidable size, Comcast is fighting competitive fires on virtually every front: fierce multichannel competition from satellite and telcos, rising expectations of HD content, consumer behavior shifts to broadband video consumption (premium and UGC) and place-shifting/time-shifting/device-shifting. The list goes on. Amid these changes, and with a slowing of the American economy, Wall Street has punished Comcast's stock price, cutting it in half in the last year.

While I applaud today's announcements, there is still one big strategic piece missing which Comcast has yet to comprehensively address: what are its plans to allow subscribers using its digital set-top boxes to seamlessly watch broadband video content as they do broadcast and cable programs?

As many of you know, I have been on a "broadband-to-the-TV" jag recently (see here, here and here) analyzing different options and their potential, or lack thereof. I continue to maintain that incumbents with boxes already in the home - mainly cable, satellite, telcos - are best-positioned to bridge the current divide between broadband and TV.

A breakthrough value proposition for Comcast would be allowing its subscribers to gain easy access on their TVs to YouTube, Break.com, Metacafe, NYTimes.com and all the others broadband sites that have surged in popularity. In theory, Comcast and other cable operators have always been about providing more video choices to subscribers. But the caveat has been those choices are only offered when Comcast makes a deal to carry these new channels. With broadband it's a wide open world. Any video provider - deal or no deal would gain access. This "openness" is a fundamental paradigm change for Comcast and other "walled garden" loyalists.

Surmounting this change to its business and cultural model are in fact Comcast's #1 strategic challenge. How to effectively respond to customers' broadband desires, while maintaining a robust economic and competitive model? When Brian Roberts, and others in the cable industry are finally ready to address the question of how they'll integrate broadband into their TV-based user experience, that will be a keynote well worth watching.

Categories: Broadcasters, Cable Networks, HD, Portals, Telcos

Topics: Comcast